Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Allison Transmission Holdings Inc | d425653dex991.htm |

| 8-K - FORM 8-K - Allison Transmission Holdings Inc | d425653d8k.htm |

Q2 2017 Earnings Release Published July 31, 2017 (Earnings Conference Call August 1, 2017) Lawrence Dewey, Chairman & Chief Executive Officer David Graziosi, President & Chief Financial Officer Exhibit 99.2

Safe Harbor Statement The following information contains, or may be deemed to contain, “forward-looking statements” (as defined in the U.S. Private Securities Litigation Reform Act of 1995). The words “believe,” “expect,” “anticipate,” “intend,” “estimate” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. You should not place undue reliance on these forward-looking statements. Although forward-looking statements reflect management’s good faith beliefs, reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements speak only as of the date the statements are made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise. These forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to: our participation in markets that are competitive; the highly cyclical industries in which certain of our end users operate; the failure of markets outside North America to increase adoption of fully-automatic transmissions; risks related to our substantial indebtedness; uncertainty in the global regulatory and business environments in which we operate; the concentration of our net sales in our top five customers and the loss of any one of these; future reductions or changes in government subsidies and other external factors impacting demand for hybrid vehicles; U.S. defense spending; general economic and industry conditions; the discovery of defects in our products, resulting in delays in new model launches, recall campaigns and/or increased warranty costs and reduction in future sales or damage to our brand and reputation; our ability to prepare for, respond to and successfully achieve our objectives relating to technological and market developments, competitive threats and changing customer needs; risks associated with our international operations; labor strikes, work stoppages or similar labor disputes, which could significantly disrupt our operations or those of our principal customers; and our intention to pay dividends and repurchase shares of our common stock. Allison Transmission cannot assure you that the assumptions made in preparing any of the forward- looking statements will prove accurate or that any long-term financial goals will be realized. All forward-looking statements included in this presentation speak only as of the date made, and Allison Transmission undertakes no obligation to update or revise publicly any such forward-looking statements, whether as a result of new information, future events, or otherwise. In particular, Allison Transmission cautions you not to place undue weight on certain forward-looking statements pertaining to potential growth opportunities, long-term financial goals or the value we currently ascribe to certain tax attributes set forth herein. Actual results may vary significantly from these statements. Allison Transmission’s business is subject to numerous risks and uncertainties, which may cause future results of operations to vary significantly from those presented herein. Important factors that could cause actual results to differ materially are discussed in Allison Transmission’s Annual Report on Form 10-K for the year ended December 31, 2016.

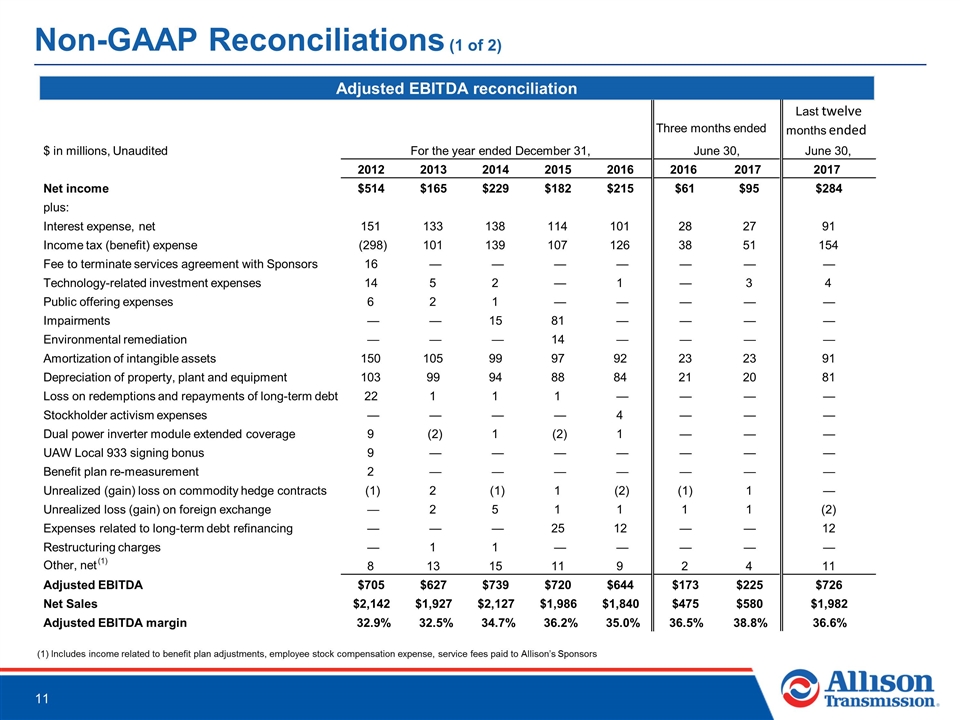

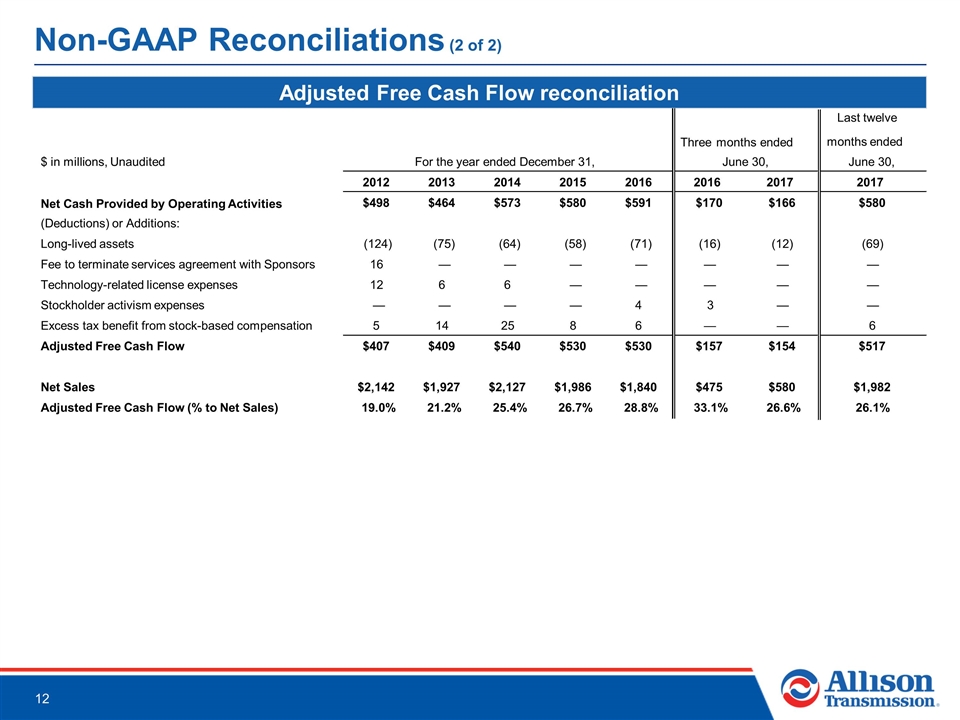

Non-GAAP Financial Information We use Adjusted EBITDA and Adjusted EBITDA margin to measure our operating profitability. We believe that Adjusted EBITDA and Adjusted EBITDA margin provide management, investors and creditors with useful measures of the operational results of our business and increase the period-to-period comparability of our operating profitability and comparability with other companies. Adjusted EBITDA margin is also used in the calculation of management’s incentive compensation program. The most directly comparable U.S. generally accepted accounting principles (“GAAP”) measure to Adjusted EBITDA is Net income. Adjusted EBITDA is calculated as the earnings before interest expense, income tax expense, amortization of intangible assets, depreciation of property, plant and equipment and other adjustments as defined by our debt agreement. Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by net sales. We use Adjusted free cash flow to evaluate the amount of cash generated by our business that, after the capital investment needed to maintain and grow our business and certain mandatory debt service requirements, can be used for repayment of debt, stockholder distributions and strategic opportunities, including investing in our business and strengthening our balance sheet. We believe that Adjusted free cash flow enhances the understanding of the cash flows of our business for management, investors and creditors. Adjusted free cash flow is also used in the calculation of management’s incentive compensation program. The most directly comparable GAAP measure to Adjusted free cash flow is Net cash provided by operating activities.

Call Agenda Q2 2017 Performance 2017 Guidance Update

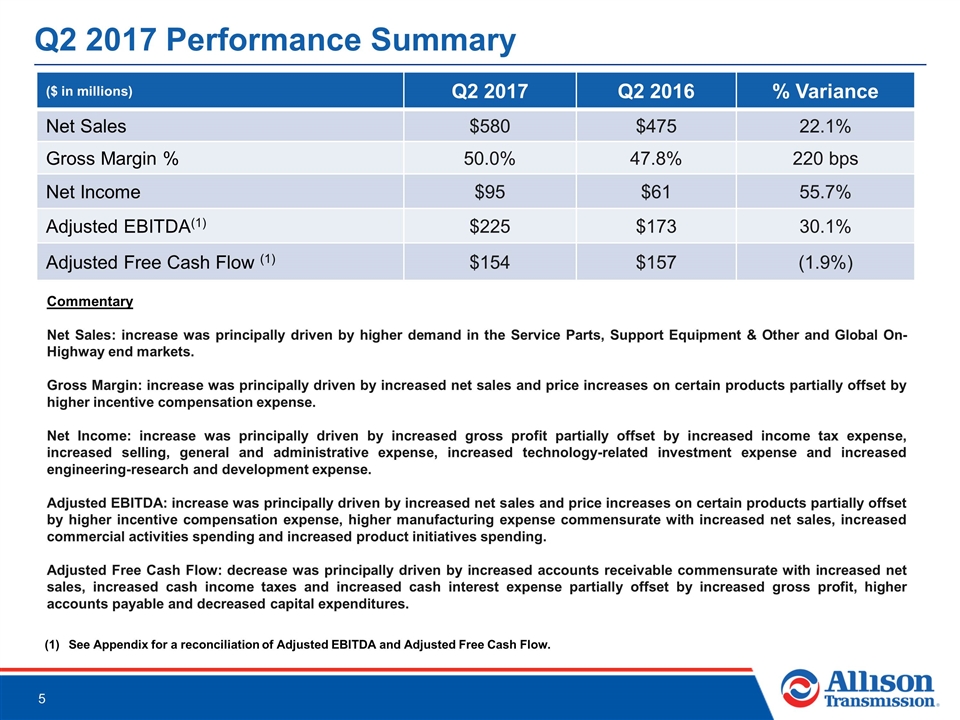

Q2 2017 Performance Summary ($ in millions) Q2 2017 Q2 2016 % Variance Net Sales $580 $475 22.1% Gross Margin % 50.0% 47.8% 220 bps Net Income $95 $61 55.7% Adjusted EBITDA(1) $225 $173 30.1% Adjusted Free Cash Flow (1) $154 $157 (1.9%) See Appendix for a reconciliation of Adjusted EBITDA and Adjusted Free Cash Flow. Commentary Net Sales: increase was principally driven by higher demand in the Service Parts, Support Equipment & Other and Global On-Highway end markets. Gross Margin: increase was principally driven by increased net sales and price increases on certain products partially offset by higher incentive compensation expense. Net Income: increase was principally driven by increased gross profit partially offset by increased income tax expense, increased selling, general and administrative expense, increased technology-related investment expense and increased engineering-research and development expense. Adjusted EBITDA: increase was principally driven by increased net sales and price increases on certain products partially offset by higher incentive compensation expense, higher manufacturing expense commensurate with increased net sales, increased commercial activities spending and increased product initiatives spending. Adjusted Free Cash Flow: decrease was principally driven by increased accounts receivable commensurate with increased net sales, increased cash income taxes and increased cash interest expense partially offset by increased gross profit, higher accounts payable and decreased capital expenditures.

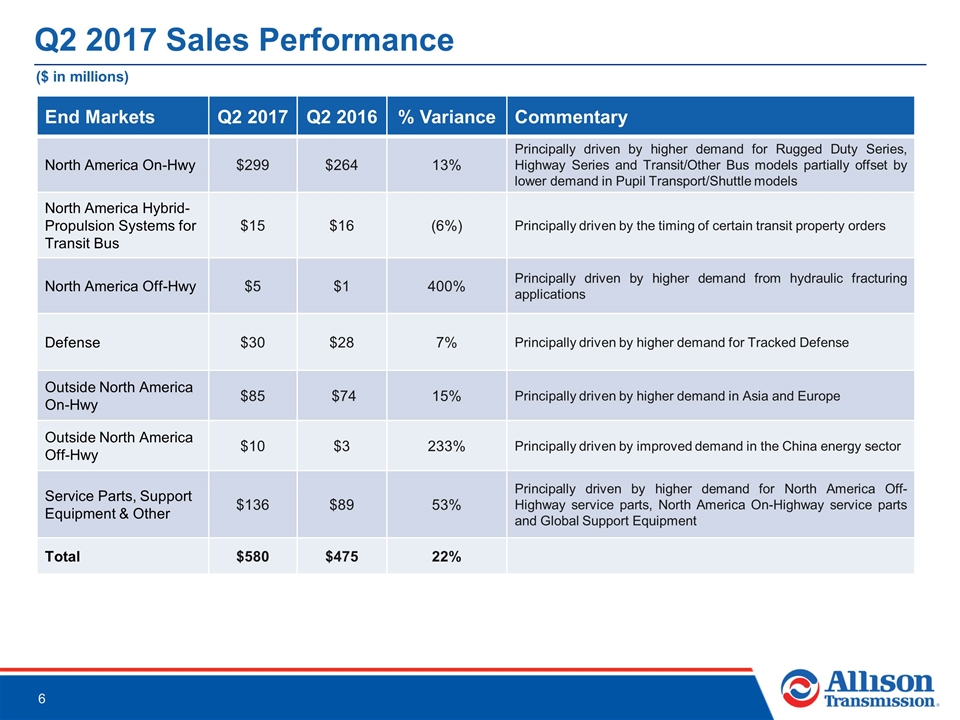

Q2 2017 Sales Performance ($ in millions) End Markets Q2 2017 Q2 2016 % Variance Commentary North America On-Hwy $299 $264 13% Principally driven by higher demand for Rugged Duty Series, Highway Series and Transit/Other Bus models partially offset by lower demand in Pupil Transport/Shuttle models North America Hybrid-Propulsion Systems for Transit Bus $15 $16 (6%) Principally driven by the timing of certain transit property orders North America Off-Hwy $5 $1 400% Principally driven by higher demand from hydraulic fracturing applications Defense $30 $28 7% Principally driven by higher demand for Tracked Defense Outside North America On-Hwy $85 $74 15% Principally driven by higher demand in Asia and Europe Outside North America Off-Hwy $10 $3 233% Principally driven by improved demand in the China energy sector Service Parts, Support Equipment & Other $136 $89 53% Principally driven by higher demand for North America Off-Highway service parts, North America On-Highway service parts and Global Support Equipment Total $580 $475 22%

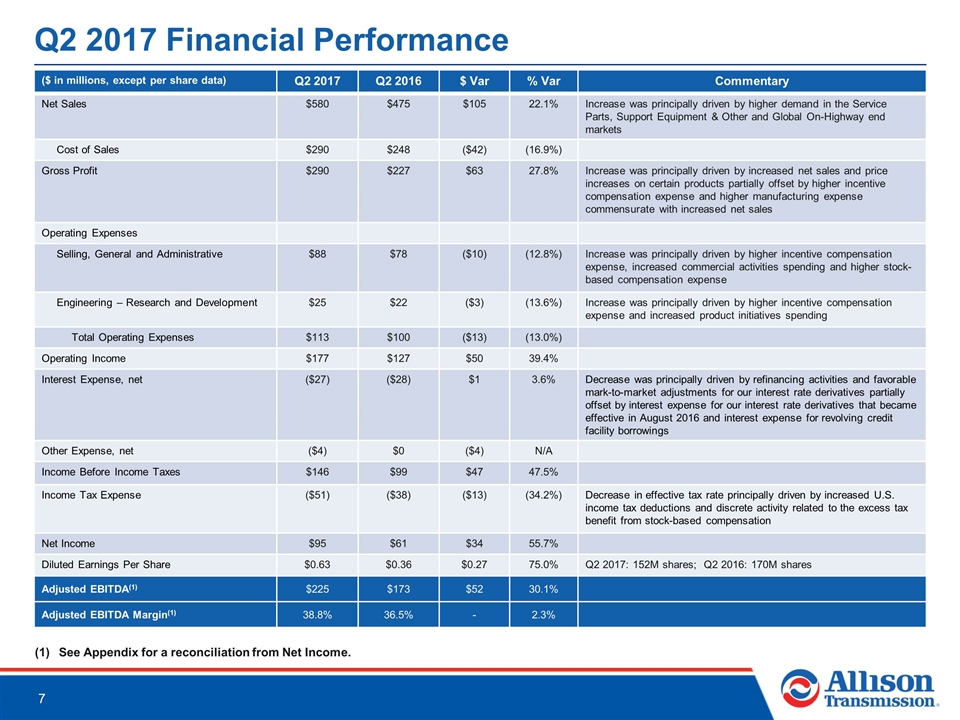

Q2 2017 Financial Performance ($ in millions, except per share data) Q2 2017 Q2 2016 $ Var % Var Commentary Net Sales $580 $475 $105 22.1% Increase was principally driven by higher demand in the Service Parts, Support Equipment & Other and Global On-Highway end markets Cost of Sales $290 $248 ($42) (16.9%) Gross Profit $290 $227 $63 27.8% Increase was principally driven by increased net sales and price increases on certain products partially offset by higher incentive compensation expense and higher manufacturing expense commensurate with increased net sales Operating Expenses Selling, General and Administrative $88 $78 ($10) (12.8%) Increase was principally driven by higher incentive compensation expense, increased commercial activities spending and higher stock-based compensation expense Engineering – Research and Development $25 $22 ($3) (13.6%) Increase was principally driven by higher incentive compensation expense and increased product initiatives spending Total Operating Expenses $113 $100 ($13) (13.0%) Operating Income $177 $127 $50 39.4% Interest Expense, net ($27) ($28) $1 3.6% Decrease was principally driven by refinancing activities and favorable mark-to-market adjustments for our interest rate derivatives partially offset by interest expense for our interest rate derivatives that became effective in August 2016 and interest expense for revolving credit facility borrowings Other Expense, net ($4) $0 ($4) N/A Income Before Income Taxes $146 $99 $47 47.5% Income Tax Expense ($51) ($38) ($13) (34.2%) Decrease in effective tax rate principally driven by increased U.S. income tax deductions and discrete activity related to the excess tax benefit from stock-based compensation Net Income $95 $61 $34 55.7% Diluted Earnings Per Share $0.63 $0.36 $0.27 75.0% Q2 2017: 152M shares; Q2 2016: 170M shares Adjusted EBITDA(1) $225 $173 $52 30.1% Adjusted EBITDA Margin(1) 38.8% 36.5% - 2.3% See Appendix for a reconciliation from Net Income.

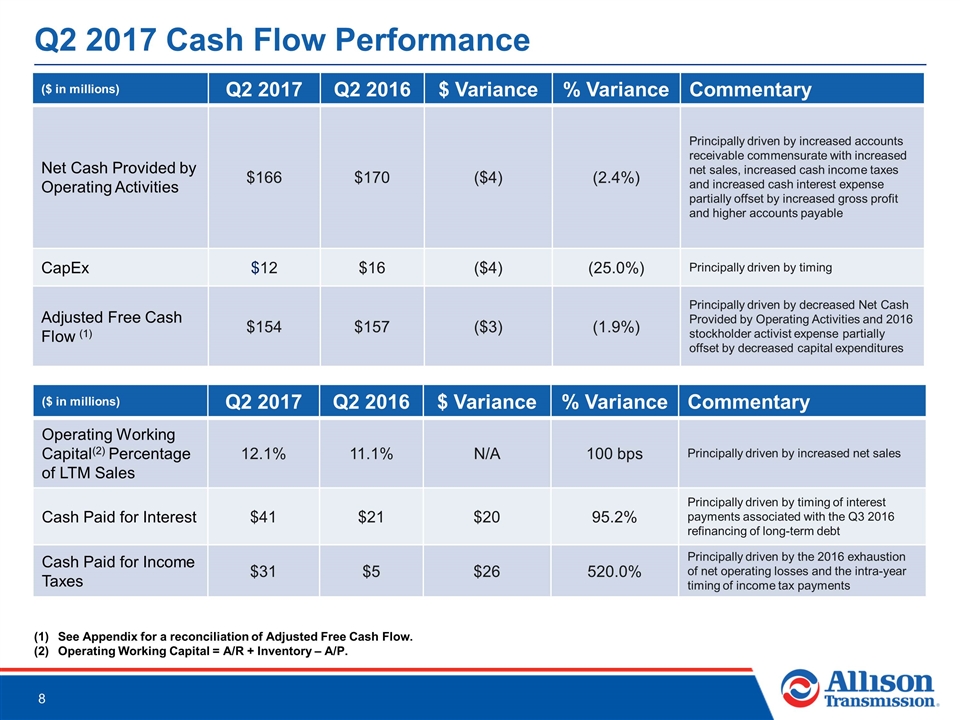

Q2 2017 Cash Flow Performance See Appendix for a reconciliation of Adjusted Free Cash Flow. Operating Working Capital = A/R + Inventory – A/P. ($ in millions) Q2 2017 Q2 2016 $ Variance % Variance Commentary Net Cash Provided by Operating Activities $166 $170 ($4) (2.4%) Principally driven by increased accounts receivable commensurate with increased net sales, increased cash income taxes and increased cash interest expense partially offset by increased gross profit and higher accounts payable CapEx $12 $16 ($4) (25.0%) Principally driven by timing Adjusted Free Cash Flow (1) $154 $157 ($3) (1.9%) Principally driven by decreased Net Cash Provided by Operating Activities and 2016 stockholder activist expense partially offset by decreased capital expenditures ($ in millions) Q2 2017 Q2 2016 $ Variance % Variance Commentary Operating Working Capital(2) Percentage of LTM Sales 12.1% 11.1% N/A 100 bps Principally driven by increased net sales Cash Paid for Interest $41 $21 $20 95.2% Principally driven by timing of interest payments associated with the Q3 2016 refinancing of long-term debt Cash Paid for Income Taxes $31 $5 $26 520.0% Principally driven by the 2016 exhaustion of net operating losses and the intra-year timing of income tax payments

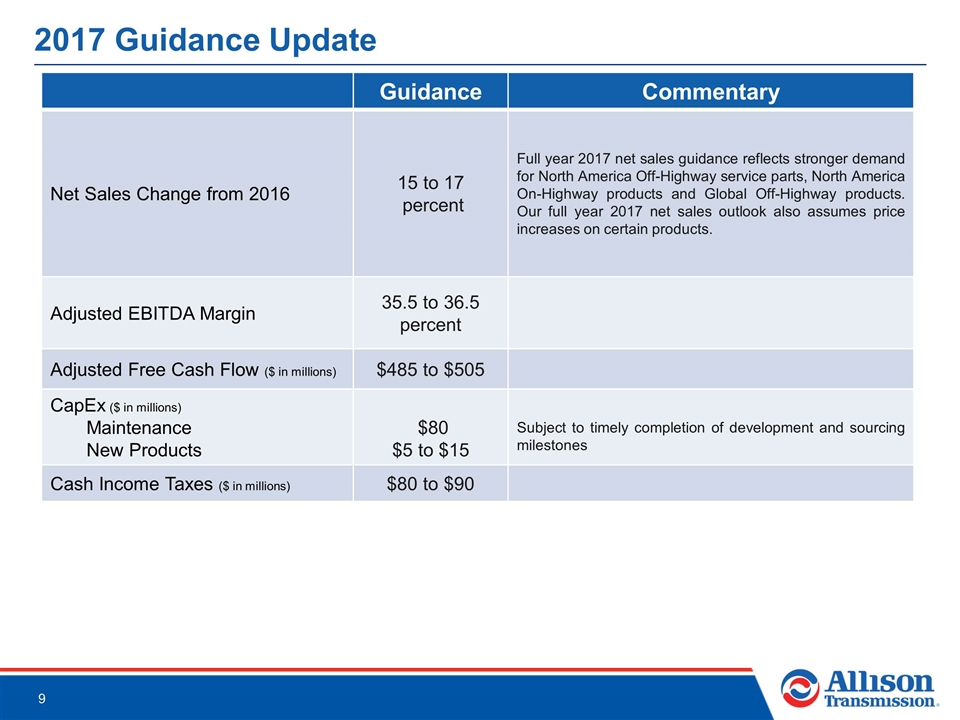

2017 Guidance Update Guidance Commentary Net Sales Change from 2016 15 to 17 percent Full year 2017 net sales guidance reflects stronger demand for North America Off-Highway service parts, North America On-Highway products and Global Off-Highway products. Our full year 2017 net sales outlook also assumes price increases on certain products. Adjusted EBITDA Margin 35.5 to 36.5 percent Adjusted Free Cash Flow ($ in millions) $485 to $505 CapEx ($ in millions) Maintenance New Products $80 $5 to $15 Subject to timely completion of development and sourcing milestones Cash Income Taxes ($ in millions) $80 to $90

APPENDIX Non-GAAP Financial Information

Non-GAAP Reconciliations (1 of 2) (1) Includes income related to benefit plan adjustments, employee stock compensation expense, service fees paid to Allison’s Sponsors Adjusted EBITDA reconciliation Last twelve months ended $ in millions, Unaudited June 30, 2012 2013 2014 2015 2016 2016 2017 2017 Net income $514 $165 $229 $182 $215 $61 $95 $284 plus: Interest expense, net 151 133 138 114 101 28 27 91 Income tax (benefit) expense (298) 101 139 107 126 38 51 154 Fee to terminate services agreement with Sponsors 16 — — — — — — — Technology-related investment expenses 14 5 2 — 1 — 3 4 Public offering expenses 6 2 1 — — — — — Impairments — — 15 81 — — — — Environmental remediation — — — 14 — — — — Amortization of intangible assets 150 105 99 97 92 23 23 91 Depreciation of property, plant and equipment 103 99 94 88 84 21 20 81 Loss on redemptions and repayments of long-term debt 22 1 1 1 — — — — Stockholder activism expenses — — — — 4 — — — Dual power inverter module extended coverage 9 (2) 1 (2) 1 — — — UAW Local 933 signing bonus 9 — — — — — — — Benefit plan re-measurement 2 — — — — — — — Unrealized (gain) loss on commodity hedge contracts (1) 2 (1) 1 (2) (1) 1 — Unrealized loss (gain) on foreign exchange — 2 5 1 1 1 1 (2) Expenses related to long-term debt refinancing — — — 25 12 — — 12 Restructuring charges — 1 1 — — — — — Other, net (1) 8 13 15 11 9 2 4 11 Adjusted EBITDA $705 $627 $739 $720 $644 $173 $225 $726 Net Sales $2,142 $1,927 $2,127 $1,986 $1,840 $475 $580 $1,982 Adjusted EBITDA margin 32.9% 32.5% 34.7% 36.2% 35.0% 36.5% 38.8% 36.6% Three months ended June 30, For the year ended December 31,

Non-GAAP Reconciliations (2 of 2) Adjusted Free Cash Flow reconciliation Last twelve months ended $ in millions, Unaudited June 30, 2012 2013 2014 2015 2016 2016 2017 2017 Net Cash Provided by Operating Activities $498 $464 $573 $580 $591 $170 $166 $580 (Deductions) or Additions: Long-lived assets (124) (75) (64) (58) (71) (16) (12) (69) Fee to terminate services agreement with Sponsors 16 — — — — — — — Technology-related license expenses 12 6 6 — — — — — Stockholder activism expenses — — — — 4 3 — — Excess tax benefit from stock-based compensation 5 14 25 8 6 — — 6 Adjusted Free Cash Flow $407 $409 $540 $530 $530 $157 $154 $517 Net Sales $2,142 $1,927 $2,127 $1,986 $1,840 $475 $580 $1,982 Adjusted Free Cash Flow (% to Net Sales) 19.0% 21.2% 25.4% 26.7% 28.8% 33.1% 26.6% 26.1% June 30, Three months ended For the year ended December 31,