Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CHART INDUSTRIES INC | gtls-2017731x8kinvestorpre.htm |

© 2017 Chart Industries, Inc. Confidential and Proprietary

Chart Industries, Inc.

Investor Presentation

Exhibit 99.1

© 2017 Chart Industries, Inc. Confidential and Proprietary 2

Disclosure

Forward-Looking Statements: This presentation contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs

and expectations of management of Chart Industries, Inc. (“Chart”) and are subject to significant risks and

uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that

could cause Chart’s actual results to differ materially from those described in the forward-looking

statements include those found in Chart’s Annual Report on Form 10-K for the year ended December 31,

2016, which has been filed with the Securities and Exchange Commission and is available on Chart’s

website (http://www.snl.com/IRW/CorporateProfile/4295886) and on the Securities and Exchange

Commission’s website (www.sec.gov), as well as risks and uncertainties related to the closing of the

acquisition of Hudson and subsequent integration of Hudson’s business with Chart’s. Chart does not

undertake to update the forward-looking statements to reflect the impact of circumstances or events that

may arise after the date of the forward-looking statements.

© 2017 Chart Industries, Inc. Confidential and Proprietary 3

Unique Business Portfolio

Distribution & Storage

(“D&S”)

BioMedical

Energy & Chemicals

(“E&C”)

Energy

Industrial

Healthcare

Life Sciences

In

d

u

st

rie

s

S

e

rv

e

d

FY

2016

Sales

$154.2M $497.1M $207.8M

© 2017 Chart Industries, Inc. Confidential and Proprietary 4

Driven By Technology

Chart is a recognized global brand for the design and manufacture of highly engineered

cryogenic equipment used from beginning to end in the liquid gas supply chain.

You may never use the products we make, but everyone uses the products we make possible.

Innovation

Experience

Performance We fulfill expectations with proven solutions to

meet customer needs.

Customers rely on our knowledge and products

because we are experts in our fields.

Core competencies in cryogenics, gas processing

and low temperature storage.

© 2017 Chart Industries, Inc. Confidential and Proprietary 5

Corporate Energy & Chemicals Distribution & Storage BioMedical

North America

Strategically Located Operations

Geographic diversification providing competitive advantage

Europe Asia - Pacific

© 2017 Chart Industries, Inc. Confidential and Proprietary 6

Mission Critical Equipment Provider

Supplier of Brazed Aluminum Heat Exchangers (BAHX), Air Cooled Heat

Exchangers (ACHX) and Cold Boxes

Provider of integrated systems and aftermarket services for gas processing,

LNG and petrochemical applications

Technology leader for over 50 years

Highly engineered equipment and systems used in the separation, liquefaction and purification of

hydrocarbon and industrial gases for natural gas processing, LNG and industrial gas applications

Energy & Chemicals

© 2017 Chart Industries, Inc. Confidential and Proprietary 7

$123M

Backlog at 6/30/17

51%

16%

23%

10%

7%

25%

68%

Industry

Serving Energy Markets Globally

18%

of Total Chart Sales

17%

Gross Margin

Region

LNG

Industrial

Gas

Natural Gas

Processing/

Petrochemical

United

States

Asia

ROW

Energy & Chemicals

E&C FY 2016 Sales of $154.2M 1st Half 2017 Highlights

Middle

East

© 2017 Chart Industries, Inc. Confidential and Proprietary 8

Leading Cryogenic Equipment Provider

Designer, manufacturer and service provider of cryogenic solutions for the storage and

delivery of cryogenic liquids used in industrial gas and LNG applications

Complete portfolio of cryogenic distribution and storage equipment

Leading innovator in cryogenic packaged gas and MicroBulk systems

Over 20 years of experience in LNG applications

Distribution & Storage

© 2017 Chart Industries, Inc. Confidential and Proprietary 9

Diversified Product Portfolio

57%

of Total Chart Sales

$225M

Backlog at 6/30/17

59%

22%

7%

5%

7%

53%

18%

22%

7%

D&S FY 2016 Sales of $497.1M

26%

Gross Margin

LNG

Manufacturing/

Fabrication

Asia

Europe

ROW

United

States

Industry Region

Food/

Beverage

Electronics

Healthcare

1st Half 2017 Highlights

Distribution & Storage

© 2017 Chart Industries, Inc. Confidential and Proprietary 10

Innovative Solution Provider

Healthcare, life science and environmental product lines built around our core

competencies in cryogenics and gas processing, but with a focus on the users of

cryogenic liquids and gases

End to end provider of respiratory therapy equipment

Set the standard for storage of biological materials at low temperatures

Reliable, high quality solutions for environmental market applications

BioMedical

© 2017 Chart Industries, Inc. Confidential and Proprietary 11

Serving Growing Global End Markets

25%

of Total Chart Sales

57%

34%

9%

41%

17%

34%

8%

BioMed FY 2016 Sales of $207.8M

$19M

Backlog at 6/30/17

35%

Gross Margin

Asia

Europe

ROW

United

States

Environmental

Life

Sciences

Healthcare

Industry Region

1st Half 2017 Highlights

BioMedical

© 2017 Chart Industries, Inc. Confidential and Proprietary 12

$204.1

$238.2

1Q 2017 2Q 2017

$209.7

$252.6

1Q 2017 2Q 2017

2Q 2017 Update

Orders Sales

20.5%

Increase

Orders increased sequentially (versus prior quarter) in every segment in both 1Q

and 2Q 2017

Revenues in all three segments grew sequentially from 1Q 2017

Backlog is $367.2M, up from $348.6M in 1Q 2017

Gross Margin was $63.2M (26.5% of revenue) compared to $55.7M (27.3% of

revenue) in 1Q 2017

($USD Million)

16.7%

Increase

© 2017 Chart Industries, Inc. Confidential and Proprietary

0

71

133

51

163

220

253

164

30

228

228

228

196

226

246

157

195

53

11

93

165

166

166

166

137

197

238

179

223

148

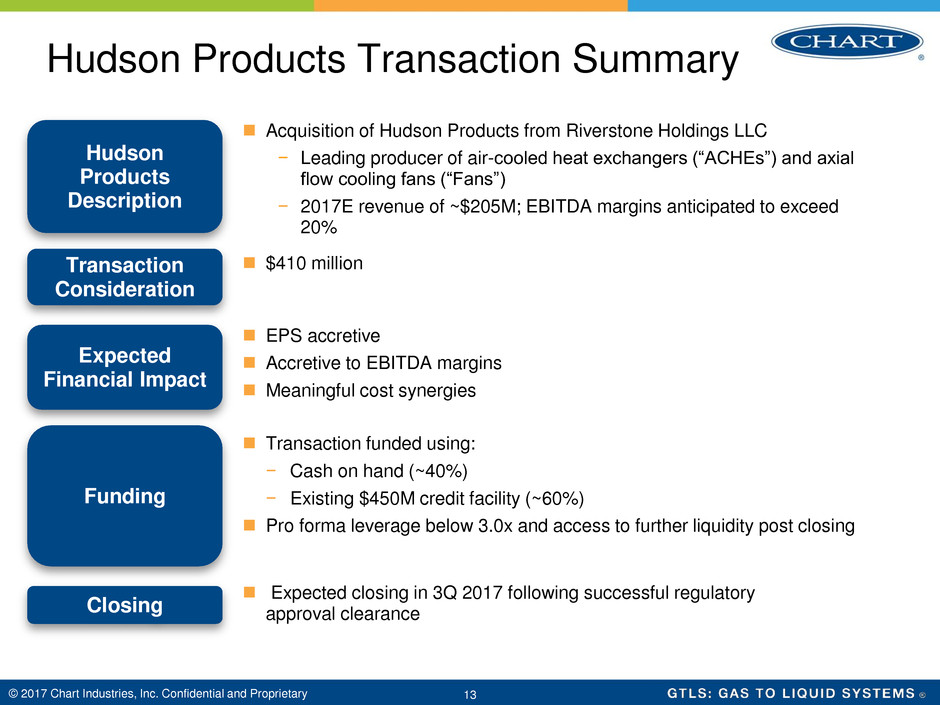

Hudson Products Transaction Summary

13

Hudson

Products

Description

Acquisition of Hudson Products from Riverstone Holdings LLC

− Leading producer of air-cooled heat exchangers (“ACHEs”) and axial

flow cooling fans (“Fans”)

− 2017E revenue of ~$205M; EBITDA margins anticipated to exceed

20%

Transaction

Consideration

$410 million

Expected

Financial Impact

EPS accretive

Accretive to EBITDA margins

Meaningful cost synergies

Closing

Expected closing in 3Q 2017 following successful regulatory

approval clearance

Funding

Transaction funded using:

− Cash on hand (~40%)

− Existing $450M credit facility (~60%)

Pro forma leverage below 3.0x and access to further liquidity post closing

© 2017 Chart Industries, Inc. Confidential and Proprietary

0

71

133

51

163

220

253

164

30

228

228

228

196

226

246

157

195

53

11

93

165

166

166

166

137

197

238

179

223

148

14

ACHEs

62%

Fans

38%

Global Leader in Heat Transfer Solutions

Adds highly complementary Fans

business

Strengthens aftermarket

presence

Consistent with core strategy to

enhance Air Cooled Heat

Exchanger (ACHE) business

Accretive to growth, margins and

EPS

Significant cost synergies

Efficient use of Chart’s favorable

balance sheet position

Product Split

Refining

20%

LNG

22%

Oil & Gas

19%

Power

10%

Industrial /

Other /

HVAC

23%

Chemical

6%

OEM

63%

End Market Split Aftermarket Split

Aftermarket

37%

© 2017 Chart Industries, Inc. Confidential and Proprietary

0

71

133

51

163

220

253

164

30

228

228

228

196

226

246

157

195

53

11

93

165

166

166

166

137

197

238

179

223

148

Enhances Position in Key E&C Business

15

Key

Products

Current Chart E&C Pro Forma

ACHEs

Brazed Aluminum

Heat Exchangers

Integrated Process

Systems

Axial Flow Fans

End Market Mix

Natural Gas Industrial Gas

LNG

Natural Gas Industrial Gas LNG

Power HVAC Refining

Oil & Gas Petrochemical

ACHEs

Brazed Aluminum

Heat Exchangers

Integrated Process

Systems

Expands Industrial Gas Offerings

Maximizes LNG Opportunity

© 2017 Chart Industries, Inc. Confidential and Proprietary 16

Profitable Growth Focus

Reduced global headcount by one-third since 2014

Continue facility consolidation efforts to create further operating

efficiencies and leverage support functions across the business

Focus on operational excellence and strategic goals for long-

term growth when market returns

Invest in additional capacity at our brazed aluminum heat

exchanger facility

Pursue acquisition targets in our core technologies and

adjacencies

© 2017 Chart Industries, Inc. Confidential and Proprietary 17

$234M

Cash at 6/30/2017

$450M

Revolving Credit

Facility

Well Positioned For Continued Growth

2.64x

Current Ratio*

Significant Liquidity Solid Balance Sheet

25%

Debt / Capital %**

** Total Debt (ST + LT Debt) / Total Capital (Common Equity + Noncontrolling Interests + Total Debt) as of 6/30/2017

* Total Current Assets / Total Current Liabilities as of 6/30/2017

Future Growth

© 2017 Chart Industries, Inc. Confidential and Proprietary 18

Why Invest In Chart?

Stable Industrial Gas

business

Growing BioMedical

opportunities

Long-term growth

opportunities through

build out of LNG

Selling to a wide range of

global industries

Well Diversified

Business

Proven Track Record

Investing for

Continued Growth

Strategic goals to

expand current platform

and increase profitability

Pursuing organic and

inorganic growth

opportunities

Market leadership

through quality and

innovation

Flexible cost structure to

accommodate cyclic

portions of the business

Strong cash flow

generation

Conclusion

© 2017 Chart Industries, Inc. Confidential and Proprietary

www.ChartIndustries.com

19