Attached files

| file | filename |

|---|---|

| EX-10.1 - EX-10.1 - Franklin Financial Network Inc. | d423120dex101.htm |

| 8-K - FORM 8-K - Franklin Financial Network Inc. | d423120d8k.htm |

Exhibit 10.2

LEASE SUMMARY

Landlord:

| Name: | SS MCEWEN, LLC | |||

| Address: | c/o Southstar, LLC | |||

| 501 Corporate Centre Drive | ||||

| Suite 305 | ||||

| Franklin, TN 37067 | ||||

Tenant:

| Name: | FRANKLIN FINANCIAL NETWORK INC. | |||

| Address: | 722 Columbia Avenue | |||

| Franklin, TN 37064 | ||||

| Attn: Facilities Management | ||||

Project:

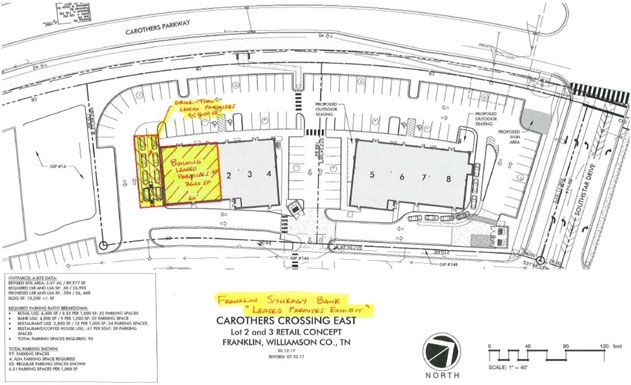

Carothers Crossing East Shopping Center, Franklin, Tennessee, as shown on Exhibit A, attached.

Premises and Approximate Square Footage:

Approximately 3,600 square feet, being Space Nos. 1, 2 and 3, located in the Project as shown on the plan attached hereto as Exhibit A, together with a drive thru window, with canopy, median, curbs, two concrete drive aisles, vacuum tubes and other improvements and equipment that serve such drive thru window as shown on Exhibit A (collectively, the “Drive Thru Window Improvements”).

Term of Lease:

One hundred twenty (120) months, commencing on the Commencement Date and continuing until the last day of the one hundred twentieth (120th) calendar month after the Commencement Date.

Commencement Date:

The earlier to occur of (i) the date that is one hundred twenty (120) days after Landlord delivers possession of the Premises to Tenant in a condition that Tenant can commence Tenant’s Work or (ii) the date Tenant opens for business on the Premises.

Minimum Annual Rent:

Minimum Annual Rent shall be payable in monthly installments as set forth in Section 4 of the Lease, in the following amounts:

| Months |

Minimum Annual Rent | Minimum Monthly Installment |

||||||

| 1-12 |

$ | 151,200.00 | $ | 12,600.00 | ||||

| 13-24 |

$ | 154,224.00 | $ | 12,852.00 | ||||

| 25-36 |

$ | 157,308.48 | $ | 13,109.04 | ||||

| 37-48 |

$ | 160,454.65 | $ | 13,371.22 | ||||

| 49-60 |

$ | 163,663.74 | $ | 13,638.65 | ||||

| 61-72 |

$ | 166,937.02 | $ | 13,911.42 | ||||

| 73-84 |

$ | 170,275.76 | $ | 14,189.65 | ||||

| 85-96 |

$ | 173,681.27 | $ | 14,473.44 | ||||

| 97-108 |

$ | 177,154.90 | $ | 14,762.91 | ||||

| 109-120 |

$ | 180,698.00 | $ | 15,058.17 | ||||

The foregoing represents an initial rent of $42.00 per rentable square foot commencing on the Commencement Date with an annual increase of two percent (2%) commencing in the 13th month after the Commencement Date and every 12 months thereafter.

Other Sums Payable:

Proportionate share of Taxes, Insurance and Common Area Charges (as such terms are defined in this Lease). The initial estimated annual payment for Taxes, Insurance, and Common Area Charges is $7.50 per square foot of the Premises per year, payable in equal monthly installments beginning on the Commencement Date.

Tenant shall pay the cost of all utilities serving the Premises in accordance with Section 13.

Tenant Tradename:

Franklin Synergy Bank

Permitted Use:

Operation of a bank branch

Security Deposit: None

INDEX OF LEASE ARTICLES

| Page | ||||||

| 1. |

PREMISES | 1 | ||||

| 2. |

TERM | 1 | ||||

| 3. |

PLANS AND SPECIFICATIONS | 1 | ||||

| 4. |

MINIMUM ANNUAL RENT | 3 | ||||

| 5. |

REAL ESTATE TAXES, INSURANCE, AND COMMON AREA CHARGES | 4 | ||||

| 6. |

USE | 6 | ||||

| 7. |

OPERATION OF BUSINESS | 6 | ||||

| 8. |

RADIUS | 6 | ||||

| 9. |

COMPLIANCE WITH LAW AND INSURANCE REQUIREMENTS | 7 | ||||

| 10. |

ALTERATIONS AND ADDITIONS | 7 | ||||

| 11. |

REPAIRS | 7 | ||||

| 12. |

UTILITIES | 8 | ||||

| 13. |

LIENS | 8 | ||||

| 14. |

ASSIGNMENT AND SUBLETTING | 9 | ||||

| 15. |

INDEMNITY | 9 | ||||

| 16. |

INSURANCE | 10 | ||||

| 17. |

PROPERTY TAXES | 12 | ||||

| 18. |

RULES AND REGULATIONS | 12 | ||||

| 19. |

PARKING | 12 | ||||

| 20. |

ENTRY BY LANDLORD | 12 | ||||

| 21. |

CASUALTY | 13 | ||||

| 22. |

EMINENT DOMAIN | 14 | ||||

| 23. |

EVENTS OF DEFAULT | 14 | ||||

| 24. |

REMEDIES IN DEFAULT | 15 | ||||

| 25. |

DAMAGES UPON TERMINATION | 17 | ||||

| 26. |

SECURITY DEPOSIT | 18 | ||||

| 27. |

ESTOPPEL CERTIFICATE | 18 | ||||

| 28. |

AUTHORITY OF PARTIES | 19 | ||||

| 29. |

LANDLORD’S LIABILITY | 19 | ||||

| 30. |

HAZARDOUS MATERIALS | 20 | ||||

| 31. |

EXTERIOR SIGNS | 20 | ||||

| 32. |

GENERAL PROVISIONS | 20 | ||||

- i -

LEASE AGREEMENT

This Lease Agreement (the “Lease”) is made and entered into as of the 25th day of July, 2017 (the “Effective Date”) between SS MCEWEN, LLC, a Tennessee limited liability company, (“Landlord”) and FRANKLIN FINANCIAL NETWORK INC., a Tennessee corporation (“Tenant”).

1. Premises.

| a. | Landlord leases to Tenant, and Tenant leases from Landlord those certain Premises as described on the Lease Summary. |

| b. | The “Project,” as used herein, shall mean the shopping center described on the Lease Summary. Exhibit A sets forth the general layout of the Project, but Landlord reserves the right to construct the Project in one or more phases, to enlarge or to decrease the size of the Project, to subdivide the Project, and to construct other buildings or improvements or to relocate or add any buildings, improvements, parking areas and other common areas in the Project, provided that the size and relative location of the Premises shall not be materially altered. |

| c. | Landlord reserves the use of the roof, exterior walls (excluding store fronts) and the area above and below the Premises, together with the right to install, maintain, use, repair and replace pipes, ducts, conduits, wires and structural elements running through the Premises that serve other parts of the Project. |

2. Term. The term of this Lease shall be as set forth in the Lease Summary

3. Plans and Specifications.

| a. | Landlord is to perform certain work on the Project and the Premises as set forth in Exhibit C, attached (the “Landlord’s Work”) and Landlord shall deliver possession of the Premises to Tenant when the Premises are in suitable condition for the commencement of construction of certain improvements as set forth in Exhibit D, attached (the “Tenant’s Work”) to be constructed in accordance with the Tenant Plans (as defined below). Landlord’s obligation with respect to construction on the Premises shall be limited to Landlord’s Work. Landlord shall endeavor to notify Tenant in writing not less than fifteen (15) days in advance of the date (the “Delivery Date”) that Tenant can commence Tenant’s Work; and Tenant shall commence such work within a reasonable period of time after receipt of such notice (although Landlord may not have completed Landlord’s Work on such date and may be in the Premises concurrently with Tenant, provided that Landlord’s presence does not materially interfere with Tenant’s ability to commence, continue or complete Tenant’s Work) (the “Delivery Date”). Except for incomplete work then in progress as of the date Tenant accepts delivery of the Premises for the purpose of commencing Tenant’s Work, Tenant shall be deemed to have accepted the Premises in the condition delivered by Landlord unless the Tenant delivers to Landlord a punchlist specifying any defects within ten (10) days of delivery. |

| b. | Landlord projects that the Delivery Date will occur on or about May 1, 2018, but Landlord shall have no liability to Tenant hereunder if the Delivery Date fails to occur by that date due to contractor delays, strike or other labor troubles, governmental restrictions, failure or shortage of utility service, national or local emergency, accident, flood, fire or other casualty, adverse weather condition, other act of God, inability to obtain a building permit or a certificate of occupancy, or any other cause beyond Landlord’s reasonable control. |

| c. | Within forty-five (45) days after the Effective Date, Tenant shall deliver to Landlord plans and specifications for the work that Tenant desires to perform to prepare the Premises for occupancy by Tenant (the “Tenant Plans”). The Tenant Plans shall comply with all of Landlord’s design criteria as established by Landlord for the Project from time to time and shall be consistent with Landlord’s Work. The Tenant Plans shall be reviewed by Landlord within ten (10) days of receipt. Landlord shall inform Tenant of any modifications it requires to the Tenant Plans within such ten (10) day period. Tenant shall thereafter have ten (10) days to revise the Tenant Plans and submit the same for Landlord’s final approval. After Landlord’s final approval of the Tenant Plans, any modification shall be subject to Landlord’s prior written approval, which shall not be unreasonably withheld. |

| d. | Tenant shall submit the Tenant Plans to the City of Franklin for approval not later than three (3) business days after the Landlord approves the Tenant Plans, and Tenant shall provide to Landlord evidence of such submission not later than three (3) business days after the Tenant Plans are submitted to the City of Franklin. Further, Tenant shall keep Landlord informed about the status of its submission and the estimated timing for issuance of a building permit. Tenant shall obtain a building permit and commence construction of Tenant’s Work not later than five (5) business days after the Tenant Plans are approved by the City of Franklin. |

| e. | Tenant shall complete Tenant’s Work in a good and workmanlike manner and in accordance with applicable legal requirements and the Tenant Plans as approved by Landlord. Tenant shall install all store and trade fixtures and equipment therein not later than the Commencement Date. Except for Tenant’s obligation to pay Minimum Annual Rent, Common Area Charges, Insurance and Taxes, which shall not commence until the Commencement Date, Tenant shall comply with all of the other terms and conditions of this Lease beginning on the Delivery Date, including the obligation to pay for utilities to the Premises. Tenant hereby releases Landlord and its contractors from any claim whatsoever for damages against Landlord or its contractors for any delay in the date on which the Premises shall be ready for delivery to Tenant or the date on which the Landlord’s Work is complete. |

- 2 -

| f. | Tenant shall hire a licensed general contractor, approved in writing by Landlord, to perform the Tenant’s Work not to be unreasonably withheld. Tenant shall place Landlord and Landlord’s general contractor as additional insureds on its Builder’s Risk and Liability Insurance Policies that cover the Tenant’s entire construction cost. Evidence of insurance shall be provided to Landlord prior to any construction commencement within or at the Premises. |

| g. | So long as Tenant is not then in default under the Lease, Landlord will reimburse Tenant up to One Hundred Twenty-Six Thousand and No/100 Dollars ($126,000.00) towards the cost of designing and completing the Tenant’s Work, including the Drive Through Window Improvements (the “Allowance”) following the occurrence of the last to occur of the following: (1) Tenant’s opening for business, (2) Tenant’s payment of the first full calendar month’s rent, (3) Tenant providing Landlord with proof of full lien releases from all contractors and materialmen performing work on or delivering supplies to the Premises on behalf of Tenant, (4) Tenant’s providing invoices confirming that Tenant has expended not less than the amount of the Allowance for hard costs of completing the Tenant’s Work, and (5) Tenant’s delivery of a final Certificate of Occupancy for the Premises. Any unused Allowance shall be forfeited if not drawn upon by the date that is ninety (90) days after Tenant opens for business in the Premises. |

4. Minimum Annual Rent.

| a. | The Minimum Annual Rent for the Premises shall be as set forth in the Lease Summary, and shall be payable in advance to Landlord, in equal monthly installments commencing on the Commencement Date and thereafter on the first (1st) day of each successive month. |

| b. | In the event the Commencement Date is on a day other than the first day of the month, the first rental payment shall be prorated for the period between the Commencement Date and the first day of the month following the Commencement Date. Rent for any period during the term hereof that is less than one (1) month shall be a prorated portion of the monthly installment of Rent set forth herein. |

| c. | As used herein, the term “rent” or “Rent” shall mean all sums payable by Tenant to Landlord under this Lease. |

| d. | All payments of Rent shall be made by Tenant without notice or demand at the office of Landlord or at such other place as Landlord may from time to time designate in writing, and without set-off, counterclaim, deduction or abatement except as otherwise expressly provided herein. Any payments of Rent not received by Landlord within five (5) days from the date when due shall be deemed delinquent and Tenant shall pay to Landlord on demand a late charge equal to five percent (5%) of the amount of such Rent. Tenant acknowledges that |

- 3 -

| such late charge is not a penalty, but is to compensate Landlord for the additional administrative expenses and other expenses incurred by Landlord in handling delinquent payments (which expenses are not readily ascertainable), and is in addition to, not in lieu of, interest on late payments as provided herein and any other remedies that Landlord may have by virtue of Tenant’s failure to make payments when due. Interest on any payment of Rent not received by Landlord on or before the date when due shall accrue from the date when due to and including the date such payment is received by Landlord at the average prime rate of interest published by the Federal Reserve from time to time, plus four percent (4%), but in no event in excess of the maximum interest rate permitted under applicable law from time to time (the “Default Rate”). |

5. Real Estate Taxes, Insurance, and Common Area Charges.

| a. | Tenant’s Proportionate Share. Tenant’s “Proportionate Share,” as used herein, shall be determined by multiplying the total amount of the expenses in question by a fraction, the numerator of which shall be the total square footage in the Premises as set forth in the Lease Summary and the denominator of which shall be the amount of leasable square footage in the Project. |

| b. | Tenant’s Share of Taxes. Tenant shall pay to Landlord Tenant’s Proportionate Share of all Taxes applicable to the Project. The term “Taxes” shall mean all taxes and assessments (special or otherwise), impact fees, and sewage charges levied or assessed against the use and/or occupancy of the Project, including any personalty used in connection therewith, imposed by federal, state or local authority or any other taxing authority having jurisdiction over the Project, and shall also include all costs and expenses, including reasonable attorney’s fees, incurred by Landlord during negotiations for or contests of the amount of Taxes. In the event a refund of Taxes is obtained, such refund will be credited against the Taxes. Taxes shall not include income, franchise, excise, estate or inheritance taxes personal in nature to Landlord. |

| c. | Tenant’s Share of Insurance Premiums. Tenant shall pay to Landlord Tenant’s Proportionate Share of premiums charged for insurance carried by Landlord with respect to the Project (the “Insurance”). |

| d. | Common Area Charges. Tenant shall pay to Landlord Tenant’s Proportionate Share of the Operating Costs for the Project (the “Common Area Charges”). “Common Areas” shall include but not be limited to all areas, space, facilities, parking lots, equipment, signs, and special services from time to time made available by Landlord for the common and joint use and benefit of Landlord, Tenant, other tenants and occupants of the Project, and their respective employees, agents, subtenants, concessionaires, licensees, customers and invitees. Landlord shall operate, manage, equip, light, and maintain the Common Areas in such a manner as Landlord may from time to time determine. Landlord, in its |

- 4 -

| sole discretion, may elect to employ security for the Common Areas; provided however, Landlord shall be under no obligation to do so, and Landlord’s election to employ security shall not be deemed an undertaking by Landlord to ensure the safety of the tenants or any of their agents, employees, contractors, customers or invitees or the property of any such parties. Tenant is hereby given a license (in common with all others to whom Landlord has or may hereafter grant rights) to use, during this Lease, the Common Areas of the Project, subject to reasonable rules and regulations established by Landlord. “Operating Costs” shall mean the total cost and expense incurred in owning, operating, maintaining, repairing and replacing the Common Areas, including, without limitation: the cost of police and fire protection equipment and services, if provided; gardening and landscaping; repairs and painting; decorating and redecorating the Common Areas; striping, sweeping and lighting (including the cost of electricity and maintenance and replacement of fixtures and bulbs); regulating traffic; rubbish, garbage and other refuse removal; ice and snow removal; machinery, equipment and supplies used in the operation, maintenance and repair of the Common Areas and facilities; depreciation of machinery and equipment used in the operation and maintenance of the Common Areas; replacement of paving, curbs and walkways; utility, drainage and water systems, impact fees and charges; and the cost to Landlord of personnel to implement and perform the operation, maintenance and repairs of the Common Areas as provided above (including worker’s compensation insurance, salaries and other benefits covering such personnel); owner’s association fees; management fees for the management of the Project; and administrative cost not to exceed ten percent (10%) of the total of such costs. |

| e. | Payment. In addition to the Minimum Annual Rent and all other payments due under this Lease, Tenant shall pay Tenant’s Proportionate Share of Taxes, Insurance, and Common Area Charges (the “Tenant’s Cost Allocation”) for each year, payable in advance in monthly installments based on Landlord’s estimates (the “Estimated Payment”), commencing on the Commencement Date. The estimated annual Tenant’s Cost Allocation shall initially be Twenty-Seven Thousand and 00/100 Dollars ($27,000.00) (i.e. $7.50 per square foot of the Premises). Within a reasonable period after the end of each calendar year, Landlord shall deliver to Tenant a statement (the “Statement”) setting forth Tenant’s Cost Allocation for such year. If Tenant’s Cost Allocation for such year exceeds the total of the Estimated Payment made by Tenant for each year, Tenant shall pay Landlord the amount of the deficiency within thirty (30) days of the receipt of the Statement. If the Estimated Payment made by Tenant exceeds Tenant’s Cost Allocation for such year, then Landlord shall credit against Tenant’s next ensuing Estimated Payment(s) an amount equal to the difference until the credit is exhausted. If a credit is due from Landlord after the expiration or termination of the Lease, Landlord shall pay Tenant the amount of the credit or refunded to Tenant if the excess collection is attributable to the last year of the term of this Lease unless renewed. The obligations of Tenant and Landlord to make payments required under this Section shall survive the expiration or termination of this Lease. |

- 5 -

6. Use. Tenant shall use the Premises for the purpose and under the tradename set forth in the Lease Summary, and shall not use or permit the Premises to be used for any other purpose without the prior written consent of Landlord, which may be withheld in Landlord’s sole discretion. Tenant shall not cause or permit the use, generation, storage or disposal in or about the Premises or the Project of any substances, materials or wastes subject to regulation under any federal or state or local laws from time to time in effect concerning hazardous, toxic or radioactive materials unless Tenant shall have received Landlord’s prior written consent, which Landlord may withhold or at any time revoke in its sole discretion. Tenant shall comply with all state and local laws in effect from time to time prohibiting discrimination or segregation by reason of race, color, creed, age, religion, sex or national origin. No auction, liquidation, going out of business, fire or bankruptcy sales may be conducted or advertised by sign or otherwise in the Premises. Tenant’s sales practices shall be in accord with standards and practices generally acceptable in comparable first-class retail projects. Tenant shall not offer any goods or services that Landlord determines, in its sole discretion, to be inconsistent with the image of projects of a similar nature, nor shall Tenant display or sell any goods containing portrayals that Landlord determines, in its sole discretion, to be lewd, graphically violent or pornographic. Tenant agrees that it will conduct its business in good faith, and will not do any act tending to injure the reputation of the Project as determined by Landlord. Tenant shall not sell or display any paraphernalia used in the preparation or consumption of controlled substances. In the event Landlord has approved Tenant’s remaining open for business after normal Project hours, then such approval shall be conditioned upon Tenant’s paying for all additional costs incurred by Landlord as a result thereof. Tenant shall not do or permit anything to be done in or about the Premises that will in any way obstruct or interfere with the rights of other tenants or occupants of the Project or injure or annoy them, or use or allow the Premises to be used for any improper, immoral, disreputable or objectionable purpose, nor shall Tenant cause, maintain or permit any nuisance or waste in, on or about the Premises. Tenant shall not use or permit the use of any portion of the Premises as sleeping quarters, lodging rooms, or for any unlawful purposes. Tenant shall not erect any aerial on the roof or exterior walls of any building within the Project. Landlord shall have the option to provide pest extermination services throughout the Project, in which event Tenant shall pay to Landlord Tenant’s Proportionate Share of the cost of such service.

7. Operation of Business. Tenant shall open for business not later than six (6) months after the Delivery Date and shall remain open for business and operate continuously, during customary banking hours, in all of the Premises for the entire term of this Lease, and shall conduct its business at all times in a first class and reputable manner, maintaining at all times a full staff of employees. Failure by Tenant so to be open for business and to operate shall entitle Landlord, in addition to other remedies provided in this Lease, to mandatory injunctive relief.

8. Radius. [INTENTIONALLY OMITTED].

- 6 -

9. Compliance with Law and Insurance Requirements. Tenant shall not use the Premises or permit anything to be done in or about the Premises that will in any way conflict with any law, statute, ordinance or governmental rule or regulation now in force or that may hereafter be enacted or promulgated. Tenant shall, at its sole cost and expense, promptly comply with all laws, statutes, ordinances and governmental rules, regulations or requirements now in force or that may hereafter be in force, and with the requirements of any board of fire insurance underwriters or other similar bodies now or hereafter constituted relating to or affecting the condition, use or occupancy of the Premises whether substantial or insubstantial, foreseen or unforeseen, or shall involve structural changes or improvements to the Premises. Tenant shall not do or permit anything to be done in or about the Premises or bring or keep anything on the Premises that will in any way increase the existing rate of or affect any fire or other insurance upon the Project or any of its contents, or cause cancellation of any insurance policy covering the Project or any part thereof or any of its contents. Tenant shall pay for any increase in insurance premiums on insurance carried by Landlord resulting from Tenant’s use or occupancy of the Premises or the Project within ten (10) days after notice from Landlord.

10. Alterations and Additions. Tenant shall not make or allow to be made any alterations, additions, or improvements to the Premises or any part thereof without the prior written consent of Landlord, which consent may not be unreasonably withheld, except for any exterior alterations, structural alterations or roof penetrations each of which shall require Landlord’s consent which may be granted or withheld in Landlord’s sole and absolute discretion. Any alterations, additions or improvements to the Premises, excepting movable furniture and trade fixtures, shall, on the expiration of this Lease, at Landlord’s option become a part of the realty and belong to the Landlord or shall be removed by Tenant. All such alterations and additions shall be made by Tenant at Tenant’s sole cost and expense, and any contractor or person selected by Tenant to make the same must first be approved in writing by the Landlord. Landlord’s roofing contractor must perform any roof penetrations, so as not to impair the roof warranty. If Tenant violates the provisions of this Section relating to roof penetrations or performs any other work that impairs the roof warranty, in addition to any other damages to which Landlord may be entitled, Tenant shall indemnify Landlord and shall pay for all repairs to the roof that would have been covered by Landlord’s roof warranty, and this indemnity shall survive the expiration or earlier termination of this Lease.

11. Repairs.

| a. | Tenant shall, at Tenant’s sole cost and expense, keep the Premises and every part thereof, including all of the Drive Thru Window Improvements and plumbing and heating and cooling equipment, in good condition and repair. Tenant shall keep a maintenance contract on the HVAC system to include at least monthly filter changes and inspections; and to perform preventative maintenance per manufacturer recommendations. Tenant shall retain and if asked provide copies of inspection reports to Landlord. Except as specifically provided in this Lease, Landlord shall have no obligation whatsoever to alter, remodel, improve, repair, decorate or paint the Premises or any part thereof and the parties hereto affirm that Landlord has made no representations to Tenant respecting the condition of |

- 7 -

| the Premises except as specifically provided herein. In the event Tenant shall fail to maintain or repair the Premises as required herein, Landlord shall have the right to enter the Premises and perform such maintenance or repair at Tenant’s expense. Tenant shall pay Landlord on demand all costs incurred by Landlord in performing such work, plus an administrative fee of ten percent (10%). |

| b. | Notwithstanding the provisions of subsection (a) above, Landlord shall repair and maintain the roof, foundation and structural portions of the Premises excluding the Drive Thru Window Improvements, unless such maintenance or repairs are caused in part or in whole by the act, neglect, fault or omission of any duty by the Tenant, its agents, servants, employees or invitees, in which case Tenant shall pay to Landlord the cost of such maintenance and repairs. Landlord shall not be liable for any failure to make any such repairs or to perform any maintenance required of Landlord hereunder unless such failure shall persist for any unreasonable time after written notice of the need of such repairs or maintenance is given to Landlord by Tenant. |

12. Utilities. Tenant shall, at Tenant’s sole cost and expense, pay all costs associated with setting utility meters and utility deposits unless specified as part of the Landlord’s Work. Tenant shall pay the cost of all utilities serving the Premises. No disruption or cessation of utility service to the Premises shall render Landlord liable for damages to either person or property, be construed as an eviction of Tenant, work an abatement of rent, or relieve Tenant from fulfillment of any covenant or agreement hereof. Tenant shall pay prior to delinquency all separately metered charges for electricity or any other utility consumed in the Premises by Tenant. Landlord may elect to furnish one or more other utility services to Tenant, and, in such event, Tenant shall purchase such services from Landlord and shall pay, as Additional Rent, the charges for such services provided by Landlord. Landlord may at any time discontinue furnishing any service without obligation, other than to connect the Premises to the appropriate public utility.

13. Liens. Landlord’s interest in the Premises shall not be subject to liens for improvements made by Tenant, and Tenant shall have no power or authority to create any lien or permit any lien to attach to the Premises or the present estate, reversion or other interest of Landlord in the Premises, the Project, or other improvements thereon as a result of improvements made by Tenant or by reason of any other work done on Tenant’s behalf or any other act or omission of Tenant. All materialmen, contractors, artists, mechanics and laborers and other persons contracting with Tenant with respect to the Premises or any part thereof, are hereby charged with notice that such liens are expressly prohibited and that they must look solely to Tenant to secure payment for any work done or material furnished for improvements made at the request of Tenant. Tenant agrees to provide notice to such effect to any such persons doing work or supplying materials to the Premises. Tenant shall indemnify Landlord against any loss or expenses incurred as a result of the assertion of any such lien, and Tenant covenants and agrees to remove such lien or transfer such lien to a bond or such other security, as may be permitted by applicable law, within ten (10) days of its assertion. In the event Tenant fails to have such lien removed as required hereunder, Landlord shall have the right to pay such lien and Tenant shall reimburse Landlord for such sum, plus an administrative fee of ten percent (10%) upon demand.

- 8 -

14. Assignment and Subletting. Tenant shall not, either voluntarily or by operation of law, mortgage, pledge, hypothecate or encumber this Lease, or any interest therein, or sublet the Premises nor assign this Lease or any part thereof, or any right or privilege appurtenant thereto, or suffer any other person to occupy or use the Premises, or any portion thereof (collectively, a “Transfer”), without Landlord’s prior written consent, which consent shall not be unreasonably withheld. A consent to one Transfer by another entity shall not be deemed to be a consent to any subsequent Transfer. Notwithstanding any such assignment or subletting, Tenant shall remain fully liable hereunder. Landlord may consent to Transfers or amendments or modifications to the Lease with assignees of Tenant without notifying Tenant, or any successor Tenant, and without obtaining its or their consent thereto, and any such actions shall not relieve Tenant of primary liability under this Lease. Any Transfer without the consent of Landlord as required hereunder shall be void. If Landlord consents or is deemed to have consented to allow the proposed Transfer, Tenant shall submit to Landlord a copy of the executed Transfer document, which must provide for the assumption of all of Tenant’s obligations under this Lease. At any time, Landlord may require that any rent or other sums paid by any sublessee be paid directly to Landlord. With regard to the foregoing, it shall be reasonable under this Lease and under any applicable Law for Landlord to withhold consent to any proposed Transfer where one or more of the following apply, without limitation as to other reasonable grounds for withholding consent: (a) the transferee is of a character or reputation or engaged in a business that is not consistent with the quality of the Project; (b) the transferee intends to use the Premises for purposes that are different than the Permitted Use; (c) the transferee intends to use the Premises for purposes that would result in a reduction of customer traffic; (d) the transferee is either a governmental agency or instrumentality thereof; (e) the transfer would likely result in significant increase in the use of the parking areas or Common Areas by the transferee’s employees or visitors; (f) the transferee is not consistent with Landlord’s desired tenant mix; (g) the transferee does not have has at least three (3) years of experience of operating the same or a similar business; (h) the transferee is not a party of reasonable financial worth or financial stability in light of the responsibilities involved under the Lease on the date consent is requested, as determined by Landlord; (i) the Transfer would cause a violation of another lease or any agreement to which Landlord is a party, or would give an occupant of the Project a right to cancel its lease; or (j) either the transferee or an affiliate of the transferee (i) occupies space in the Project at the time of the request for consent; (ii) is negotiating with Landlord to lease space in the Project at such time; or (iii) has negotiated with Landlord during the twelve (12)-month period immediately preceding Tenant’s notice of its intent to transfer this Lease or interest in Premises.

15. Indemnity.

| a. | Tenant shall indemnify and hold harmless Landlord from and against any and all claims arising from Tenant’s use of the Premises for the conduct of its business or from any activity, work or other things done, permitted or suffered by the Tenant in or about the Project, and shall further indemnify and hold harmless Landlord against and from any and all claims arising from any breach or default in the |

- 9 -

| performance of any obligations on Tenant’s part to be performed under the terms of this Lease, or arising from any act or negligence of the Tenant, or any officer, agent, employee, guest, contractor or invitee of Tenant, and from all and against all costs, attorneys’ fees, expenses, and liability incurred in or about any such claim or any claim or any action or proceeding brought thereon, and, in any case, if action or proceeding be brought against Landlord by reason of any such claim, Tenant upon notice from Landlord shall defend the same at Tenant’s expense by counsel reasonably satisfactory to Landlord. Tenant, as a material part of the consideration to Landlord, hereby assumes all risk of damage to property or injury to persons in, upon or about the Premises, from any cause other than Landlord’s gross negligence, and Tenant hereby waives all claims in respect thereof against Landlord. |

| b. | Landlord shall not be liable for any loss or damage to any property by theft or otherwise, nor for any injury to or damage to persons or property resulting from fire, explosion, falling plaster, steam, gas, electricity, water or rain, unless caused by or due to the gross negligence of Landlord, its agents, servants or employees. Landlord shall not be liable for any failure or interruption of utility services to the Premises and the same shall not be considered a constructive eviction of Tenant, nor shall the same entitle Tenant to an abatement of rent. Landlord shall not be liable for loss of business by Tenant. Except as expressly set forth in this Lease, Landlord shall not be liable for any defects in the Premises. Tenant shall give prompt notice to Landlord in case of fire or accident in the Premises or in the Project. |

| 16. | Insurance. |

| a. | Tenant shall, at its sole cost, maintain the following insurance at all times during this Lease and at all times thereafter when Tenant is in possession of the Premises: |

| i. | Commercial general liability insurance with a combined single limit for personal injury, loss of life and property damage of not less than Three Million and No/100 Dollars ($3,000,000.00) per occurrence, (with Tenant being permitted to provide liability coverage in excess of $1,000,000 via an umbrella policy). |

| ii. | Property insurance insuring Tenant’s leasehold improvements, furnishings, personal property, inventory, fixtures and equipment on an “all risk” basis written on a “special form” policy, or the equivalent, against loss by reason of fire, hazard or other casualty, with extended coverage, to the extent of at least eighty percent (80%) of the value thereof. |

- 10 -

| iii. | Plate glass insurance on all plate glass for the Premises insuring both Landlord and Tenant against loss or liability arising as a result thereof. |

| iv. | Workman’s compensation insurance as may be required by applicable law. |

| v. | In the event Tenant makes any improvements or alterations to the Premises, builders risk insurance written on a completed value (non-reporting) basis with Landlord being named as an additional insured. |

| b. | All insurance required of Tenant hereunder shall be carried with insurance companies and in form reasonably satisfactory to Landlord. Tenant shall deliver to Landlord prior to the Commencement Date original policies or certificates of all of such insurance, which shall provide that Landlord will be given not less than ten (10) days written notice prior to cancellation or expiration of the insurance evidenced thereby. Renewals of all of such insurance shall be delivered to Landlord at least ten (10) days prior to the expiration date of such insurance. |

| c. | All insurance required of Tenant hereunder shall be on a non-contributory basis and shall name Landlord, and at Landlord’s option, any mortgage lender on the Project, as an additional insured or insured mortgagee as the case may be. The limits of said insurance shall not, however, limit the liability of Tenant hereunder. Tenant may carry such insurance under a blanket policy; provided, however, such insurance by Tenant shall have a Landlord’s protective liability endorsement attached thereto. If Tenant shall fail to procure and maintain such insurance, Landlord may, but shall not be required to, procure and maintain the same, and Tenant shall reimburse Landlord for the cost thereof as Additional Rent, plus an administrative fee of ten percent (10%) upon demand. Landlord may require periodic increases in the amounts of Tenant’s insurance coverage in accordance with sound and prudent business practice. |

| d. | Tenant acknowledges and agrees that Landlord will not obtain or carry insurance on Tenant’s personal property, fixtures, equipment, inventory or Tenant’s leasehold improvements, and Tenant agrees that Tenant shall be responsible for obtaining and carrying insurance on the foregoing, at its sole cost and expense. |

| e. | Anything in this Lease to the contrary notwithstanding, Landlord and Tenant each hereby waives any and all rights of recovery, claim, action or cause of action against the other for any loss or damage that may occur to the Premises or any improvements thereto, the Project or any personal property of Landlord or Tenant, arising from any cause that (i) would be insured against under the terms of any property insurance required to be carried hereunder; or (ii) is insured against under the terms of any property insurance actually carried, regardless of whether the same is required hereunder. The foregoing waiver shall apply regardless of the cause or origin of such claim, including but not limited to the negligence of a party, or such party’s agents, officers, employees or contractors. The foregoing waiver shall not apply if it would have the effect, but only to the extent of such effect, of invalidating any insurance coverage of Landlord or Tenant. The foregoing waiver shall also apply to any deductible, as if the same were a part of the insurance recovery. |

- 11 -

17. Property Taxes. Tenant shall pay or cause to be paid before delinquency, any and all taxes levied or assessed that become payable during the term hereof upon all Tenant’s leasehold improvements, equipment, furniture, fixtures and personal property located in the Premises. In the event of any or all of the Tenant’s leasehold improvements, equipment, furniture, fixtures and personal property shall be assessed and taxed with the Project, Tenant shall pay to Landlord its share of such taxes within ten (10) days after delivery to Tenant by Landlord of a statement in writing setting forth the amount of such taxes applicable to Tenant’s property.

18. Rules and Regulations. Tenant shall faithfully observe and comply with all rules and regulations of general applicability that Landlord may from time to time promulgate for the Project. Landlord reserves the right from time to time to make all reasonable modifications to such rules. The additions and modifications to those rules shall be binding upon Tenant upon delivery of a copy to Tenant. Landlord shall not be responsible to Tenant for the noncompliance with any rules by another tenant or occupant, but Landlord will use reasonable efforts to uniformly enforce all rules and regulations in a nondiscriminatory manner.

19. Parking. Tenant shall use its best efforts to cause its employees to park in the parking spaces designated as “employee parking” on the site plan attached hereto as Exhibit B and incorporated herein by this reference. Tenant shall supply Landlord with lists of the license plate numbers of the cars of Tenant’s employees within five (5) days’ of request. Tenant hereby acknowledges that Landlord may tow away or cause to be towed away from the Project any employee vehicles not parking in the area designated for employee parking, and to attach violation stickers or notices to such cars.

20. Entry by Landlord. Landlord reserves and shall at any and all times have the right to enter the Premises, upon reasonable notice to Tenant, except in those circumstances or emergencies when the giving of such notice is not practicable, and inspect the same, to show the Premises to prospective purchasers or tenants, to post notices of non-responsibility, and to alter, improve or repair the Premises and any portion of the Project that Landlord may deem necessary or desirable, without abatement of rent, and may for that purpose erect scaffolding and other necessary structures where required by the character of the work to be performed, always providing that the entrance to the Premises shall not be blocked thereby, and further providing that the business of the Tenant shall not be interfered with unreasonably. During the six (6) months prior to the expiration of the Lease term, Landlord may exhibit the Premises to prospective tenants or purchasers, and place upon the Premises the usual notices “For Lease” or “For Sale,” which notices Tenant shall permit to remain thereon without molestation. Tenant hereby waives any claim for damages or for any injury or inconvenience to or interference with Tenant’s business, any loss of occupancy or quiet enjoyment of the Premises, and any other loss occasioned thereby. For each of aforesaid purposes, Landlord shall at all times have and retain a

- 12 -

key to all doors in, upon and about the Premises, excluding Tenant’s vaults, safes and files, and Landlord shall have the right to use any and all means that Landlord may deem proper to gain access to the Premises in an emergency, without liability to Tenant except for any failure to exercise due care for Tenant’s property. Landlord’s entry on the Premises shall not under any circumstances be construed or deemed to be a forcible or unlawful entry into, or a detainer of, the Premises, or a constructive eviction of Tenant from the Premises or any portion thereof.

21. Casualty.

| a. | Subject to the other provisions of this Section, in the event the Premises or the Project are damaged, this Lease shall remain in full force and effect. If Landlord does not terminate this Lease, then Landlord shall forthwith repair the Premises to a state ready for restoration by Tenant of Tenant’s improvements. |

| b. | Notwithstanding the foregoing, Landlord shall not have any obligation whatsoever to repair, reconstruct or restore the Premises, and Landlord may terminate this Lease by written notice to Tenant, when (i) the damage resulting from any casualty covered under this Section occurs during the last two (2) years of the term of this Lease, (ii) the Premises are damaged to the extent of thirty percent (30%) or more thereof, (iii) thirty percent (30%) or more of the Project is damaged, (iv) the insurance available to Landlord is not sufficient to cover the cost of such repair, reconstruction or restoration; or (v) the holder of any deed of trust or mortgage encumbering the Project does not permit use of such insurance proceeds for reconstruction. |

| c. | The provisions of this Section with respect to repair by Landlord shall be limited to such repair as is necessary to place the Premises in the condition specified for Landlord’s Work herein and when placed in such condition the Premises shall be deemed restored and rendered tenantable upon Tenant’s completion of restoration of its leasehold improvements. Promptly following Landlord’s restoration work Tenant, at Tenant’s expense, shall perform the work required to place the Premises in the condition specified for Tenant’s Work herein, and Tenant shall also repair or replace its stock in trade, fixtures, personal property, furniture, furnishings, floor coverings and equipment, and if Tenant has closed, Tenant shall promptly reopen for business. |

| d. | Landlord shall not be required to repair any injury or damage by fire or other cause, or to make any repairs or replacement of any improvements, or any other property installed in or located on the Premises by Tenant. |

| e. | Tenant shall be entitled to an abatement in Minimum Annual Rent in proportion to the portion of the Premises that is rendered untenantable by such damage; provided, however, if the damage is due to the acts or omissions of Tenant or its employees, and the same is not covered by any rent loss insurance carried by Landlord, there shall be no abatement of rent. Such abatement shall commence as of the date of such damage and shall terminate on the earlier to occur of thirty (30) days after the date Landlord delivers the Premises to Tenant for restoration of Tenant’s improvements or the date Tenant re-opens for business. |

- 13 -

22. Eminent Domain. If such a portion of the Premises is taken under the power of eminent domain or appropriation by any public or quasi-public authority, or Landlord delivers a deed-in-lieu of such a taking (a “Taking”), with the result that the operation of Tenant’s business is no longer economically feasible, either party hereto shall have the right, at its option, to terminate this Lease as of the date of such Taking, upon notice within thirty (30) days following the date of said taking. If the Taking results in thirty percent (30%) or more of the Project other than the Premises being taken, or a sufficient portion of the Project other than the Premises being taken so that it is no longer, in Landlord’s sole discretion, an economically viable entity, Landlord shall have the option to terminate this Lease upon notice within thirty (30) days following the date of such Taking, effective as of the date of such notice. In all events, Landlord shall be entitled to the entire award that may be paid in connection with such Taking, and Tenant shall have no claim against Landlord for the value of the unexpired term of this Lease or any extension or renewal term. Tenant may make a separate claim against the taking authority for damages to Tenant’s fixtures and for moving expenses. In the event neither party terminates this Lease as herein provided, the Minimum Annual Rent and other sums payable hereunder based on square footage shall be proportionately reduced.

23. Events of Default. This Lease is made upon the condition that Tenant shall punctually and faithfully perform all of the covenants, conditions and agreements by it to be performed as in this Lease set forth. The following shall each be deemed to be an event of default (each of which is sometimes referred to as an “Event of Default” in this Lease):

| a. | the failure by the Tenant to pay the Minimum Annual Rent or any other sums within five (5) days of when due; |

| b. | the failure of Tenant to open its business to the public in the Premises as required by this Lease, or the failure to remain open and operate as required by this Lease, or if Tenant vacates or abandons the Premises; |

| c. | the failure of Tenant to observe or perform any of the other covenants, terms or conditions set forth in this Lease where said failure continues for a period of thirty (30) days after written notice thereof from Landlord to Tenant (unless such failure is curable, but cannot reasonably be cured within thirty (30) days and Tenant shall have commenced to cure said failure within thirty (30) days and continues diligently to pursue the curing of such failure until completed); |

- 14 -

| d. | the filing of a proceeding in bankruptcy or arrangement or reorganization with respect to Tenant or any guarantor of this Lease pursuant to the United States Bankruptcy Code or any similar law, federal or state, including but not limited to: |

| i. | Tenant or any guarantor of this Lease shall file a voluntary petition in bankruptcy or shall be adjudicated a bankrupt or insolvent, or shall file any petition or answer seeking or acquiescing in any reorganization, arrangement, composition, readjustment, liquidation, dissolution or similar relief for itself under any present or future federal, state, or other statute, law or regulation relating to bankruptcy, insolvency or other relief for debtors, or shall seek or consent to or acquiesce in the appointment of any trustee, receiver or liquidator of Tenant or any such guarantor, or shall make any general assignment for the benefit of creditors, or shall admit in writing its inability to pay or shall fail to pay its debts generally as they become due; or |

| ii. | A court of competent jurisdiction shall enter an order, judgment or decree approving a petition filed against Tenant or any such guarantor seeking any reorganization, dissolution or similar relief under any present or future federal, state, or other statute, law or regulation relating to bankruptcy, insolvency or other relief for debtors or Tenant or any such guarantor shall be the subject of an order for relief entered by such a court, and such order, judgment or decree shall remain unvacated and unstayed for an aggregate of sixty (60) days (whether or not consecutive) from the first date of entry thereof, or any trustee, receiver, custodian or liquidator of Tenant or any such guarantor shall be appointed without the consent or acquiescence of Tenant or any such guarantor and such appointment shall remain unvacated and unstayed for an aggregate of sixty (60) days (whether or not consecutive); |

| e. | repetition or continuation of any failure to timely pay any Minimum Annual Rent, or other sums due hereunder, where such failure shall continue or be repeated for two (2) consecutive months, or for a total of four (4) months in any period of twelve (12) consecutive months; and |

| f. | repetition of any failure to observe or perform any of the other covenants, terms or conditions hereof more than six (6) times, in the aggregate, in any period of twelve (12) consecutive months. |

24. Remedies in Default. If an Event of Default occurs, Landlord may:

| a. | Terminate this Lease, in which event Tenant shall immediately surrender possession of the Premises to Landlord. |

| b. | Terminate Tenant’s right to possession of the Premises without terminating this Lease, in which event this Lease will continue in effect and Landlord shall have the right to collect Rent when due. Landlord may relet the Premises for the benefit of Tenant, and Tenant shall be liable immediately to Landlord for all costs Landlord incurs in reletting the Premises, including without limitation, reasonable |

- 15 -

| attorneys fees, brokers’ commissions, expenses of remodeling the Premises and like costs. Reletting can be for a period shorter or longer than the remaining Lease term. Tenant shall pay to Landlord the Rent under this Lease on the dates the same is due, less any Rent the Landlord receives from any reletting. Tenant shall have no right to any rent received by Landlord from such reletting in excess of the Rent hereunder. No act by Landlord with respect to the Premises shall terminate this Lease, including but not limited to acceptance of the keys, institution of an action for detainer or other dispossessory proceedings; it being understood that this Lease may only be terminated by express written notice from Landlord to Tenant, and any reletting of the Premises shall be presumed to be for and on behalf of Tenant, and not Landlord, unless Landlord expressly provides otherwise in writing to Tenant. |

| c. | In addition to Landlord’s rights of self-help set forth elsewhere in this Lease, if Tenant at any time fails to perform any of its obligations under this Lease in a manner reasonably satisfactory to Landlord, Landlord shall have the right, but not the obligation, to perform such obligations on behalf of and for the account of Tenant and to take all such action to perform such obligations. In such event, Landlord’s costs and expenses incurred therein shall be paid for by Tenant forthwith as additional rent, upon demand therefor, with interest thereon from the date Landlord performs such work at the lesser of eighteen percent (18%) per annum or highest lawful rate (the “Interest Rate”). |

| d. | In any action to enforce its rights hereunder or in any litigation concerning this Lease, Landlord shall be entitled to collect court costs, reasonable attorney’s fees and all costs of collection, including but not limited to costs of depositions and expert witnesses. |

| e. | Tenant hereby expressly waives any and all rights of redemption granted by or under any present or future laws in the event of Tenant being evicted or dispossessed for any cause, or in the event of Landlord obtaining possession of the Premises by reason of the violation by Tenant of any of the terms, covenants or obligations of this Lease, or otherwise. |

| f. | A termination of this Lease by Landlord or the recovery of possession of the Premises by Landlord or any voluntary or other surrender of this Lease by Tenant or a mutual cancellation thereof, shall not work a merger and shall at the option of Landlord, terminate all or any existing franchises or concessions, licenses, permits, subleases, subtenancies or the like between Tenant and any third party with respect to the Premises, or may, at the option of Landlord, operate as an assignment to Landlord of Tenant’s interest in same. |

| g. | The rights given to Landlord in this Section are cumulative and shall be in addition and supplemental to all other rights or remedies that Landlord may have under this Lease, under laws then in force or in equity. |

- 16 -

| h. | All demands for rent and all other demands, notices and entries, whether provided for under common law or otherwise, that are not expressly required by the terms hereof, are hereby waived by Tenant. |

| i. | In order to secure payment of all Rent becoming due hereunder from Tenant, and to secure payment of any damages or loss that Landlord may suffer by reason of the breach of Tenant of any covenant, or condition contained herein, Tenant hereby grants Landlord a security interest upon all goods, wares, equipment, fixtures (including trade fixtures), furniture, improvements, and other personal property of Tenant presently or hereafter situated in the Premises (the “Collateral”), and all proceeds from the sale or lease thereof, and such property shall not be removed from the Premises without the consent of Landlord, except in the ordinary course of business, until Tenant has paid all arrearages in Rent hereunder and complied with all the agreements and conditions hereof. This Lease is intended as and constitutes a security agreement within the meaning of the Uniform Commercial Code of the state in which the Premises are located (the “UCC”). If an Event of Default occurs, Landlord may, in addition to all other remedies provided herein or by law, enter upon the Premises and take possession of any and all of the Collateral and sell the Collateral pursuant to the UCC. Commercially reasonable notice shall be deemed to be at least ten (10) days’ notice prior to any foreclosure sale of the Collateral. The Collateral shall be sold on the Premises or at such other location as may be selected by Landlord in Landlord’s sole discretion. Landlord or its assigns may purchase at a public sale, and unless prohibited by law, at a private sale. The proceeds from any disposition pursuant to this subsection, less all expenses connected with the taking of possession and foreclosure, including reasonable attorney’s fees and legal expenses, shall be applied as a credit against Tenant’s indebtedness to Landlord. Any surplus shall be paid to Tenant or as otherwise required by law. Landlord shall have the right to file a financing statement in form sufficient to perfect the security interest granted herein. Any statutory lien for rent is not hereby waived, the express contractual lien herein granted being in addition and supplementary hereto. |

25. Damages upon Termination.

| a. | If Landlord elects to terminate this Lease under the provisions of the preceding Section, Landlord may recover from Tenant damages computed in accordance with the following formula in addition to Landlord’s other remedies: |

| i. | the worth at the time of judgment of any unpaid Rent which has been earned at the time of such termination; plus |

| ii. | the worth at the time of judgment of the amount by which the unpaid Rent which would have been earned after termination until the time of judgment exceeds the amount of such rental loss Tenant proves could have been reasonably avoided; plus |

- 17 -

| iii. | the worth at the time of judgment of the amount by which the unpaid Rent for the balance of the Term after the time of judgment exceeds the amount of such rental loss that Tenant proves could have been reasonably avoided; plus |

| iv. | any other amount necessary to compensate Landlord for all the detriment proximately caused by Tenant’s failure to perform its obligations under this Lease or which in the ordinary course of things would likely to result therefrom including but not limited to, the cost of recovering possession of the Premises, expenses of reletting, including necessary renovation and alteration of the Premises, reasonable attorneys’ fees, and the unamortized portion of (A) real estate commissions paid by Landlord in connection with this Lease, (B) all costs incurred by Landlord to improve the Premises, and (C) any additional amount furnished in the nature of an allowance (all of such amortization to be based on the assumption that such costs and expenses are amortized on a straight line basis over the initial lease term); plus |

| v. | at Landlord’s election, such other amounts in addition to or in lieu of the foregoing as may be permitted from time to time by applicable state law. Damages shall be due and payable from the date of termination. |

| b. | As used in subsections (a)(i) and (ii), the phrase “worth at the time of judgment” shall be computed by adding interest on all such sums from the date when originally due at the Interest Rate. As used in subsection (a)(iii), the phrase “worth at the time of judgment” is computed by discounting the sum in question at the Federal Reserve rate promulgated by the Federal Reserve office for the district in which the Project is located. For the purposes of this Section, “Rent” for each year of the unexpired Term shall be the Minimum Annual Rent payable under this Lease, together with any other continuously accruing expenses payable hereunder. |

26. Security Deposit. [INTENTIONALLY OMITTED].

27. Estoppel Certificate. Tenant shall at any time and from time to time within ten (10) days of written notice from Landlord execute, acknowledge and deliver to Landlord or its designees a statement in writing (a) certifying that this Lease is unmodified and in full force and effect (or, if modified, stating the nature of such modification and certifying that this Lease as so modified is in full force and effect) and the date to which the rental and other charges are paid in advance, if any; (b) acknowledging that there are not, to the Tenant’s knowledge, any uncured defaults on the part of the Landlord hereunder, or specifying such defaults if any are claimed; (c) certifying the amount of rent then due and whether Tenant has made any payments

- 18 -

of rent more than thirty (30) days in advance; (d) certifying that Landlord has satisfied all of its obligations and paid all allowances due with respect to the construction of the Project and Tenant’s leasehold improvements; (e) confirming the amount of Tenant’s Security Deposit, if any, and (f) certifying or acknowledging such other matters as Landlord or its designees may reasonably require. Any such statement may be relied upon by a prospective purchaser or encumbrancer of all or any portion of the Project. If Tenant fails to deliver such certificate as required herein, Tenant shall be deemed to have conclusively agreed to and be bound by all matters set forth in the certificate as submitted by Landlord. In addition to all other remedies to which Landlord may be entitled on account of Tenant’s failure to deliver the certificate as required herein, Landlord shall be entitled to collect and amount equal to $25.00 per day for each day after the initial ten (10) day period that Tenant’s failure to deliver the certificate continues.

28. Authority of Parties. If Tenant is a trust, corporation, partnership or limited liability company, each individual executing this Lease on behalf of said entity represents and warrants that said entity is in good standing under the laws of the state of its formation and is qualified to do business in the state in which the Project is located, and that such individual is authorized to execute and deliver this Lease on behalf of said entity, in accordance with the terms of the trust, a duly adopted resolution of the board of directors, the by-laws, or the partnership or operating agreement, as appropriate, and that this Lease is binding upon said entity in accordance with its terms. Tenant agrees to supply, upon request of Landlord, such evidence of authority as Landlord may reasonably request.

29. Landlord’s Liability. In no event shall Landlord be in default hereunder unless it has failed to cure such default within thirty (30) days after written notice (or if more than thirty (30) days shall be required because of the nature of the default, if Landlord shall fail to proceed diligently to cure such default after written notice). It is expressly understood and agreed that any money judgment resulting from any default or other claim arising under this Lease shall be satisfied only out of Landlord’s interest in the Project, and no other real, personal or mixed property of Landlord (the term “Landlord” for purposes of this Section only shall mean any and all partners, both general and/or limited, officers, directors, shareholders, members and beneficiaries, if any, who comprise Landlord), wherever situated, shall be subject to levy on any judgment obtained against Landlord. Tenant hereby waives, to the extent waivable under law, any right to satisfy a money judgment against Landlord except from Landlord’s interest in the Project. If such interest is not sufficient for the payment of such judgment, Tenant will not institute any further action, suit, claim or demand, in law or in equity, against Landlord for or on the account of such deficiency. Notwithstanding anything herein contained to the contrary, Tenant hereby waives, to the extent waivable under law, any right to specific performance in the event of Landlord’s default referred to herein, and Tenant expressly agrees that except as provided in the immediately following sentence, Tenant’s remedy shall be limited to the monetary damages referred to in this Section. Notwithstanding the foregoing, in the event of failure by Landlord to give any consent, as provided in this Lease, Tenant’s sole remedy shall be an action for specific performance at law, but in no event shall Landlord be responsible in monetary damages for failure to give such consent.

- 19 -

30. Hazardous Materials. Tenant shall not cause or permit the use, generation, storage or disposal in or about the Premises of any substances, materials or wastes subject to regulation under any federal, state or local law from time to time in effect concerning hazardous, toxic or radioactive materials (hereinafter “Hazardous Materials”) unless Tenant shall have received Landlord’s prior written consent, which consent Landlord may withhold or at any time revoke at its sole discretion. If Tenant uses, generates, stores or disposes of any Hazardous Materials in or about the Premises, Tenant shall obtain all necessary permits and comply with all statutes, regulations and rules applicable to such activity. Furthermore, Landlord shall have the right to require that Tenant deliver periodic environmental audits of the Premises evidencing that no violations have occurred. Tenant shall indemnify and hold Landlord harmless from and against all liability, cost, claim, penalty, expense and fees (including court costs and attorney’s fees) arising from Tenant’s use, generation, storage, or disposal of Hazardous Materials in or about the Premises. This Section shall survive the expiration or earlier termination of this Lease.

31. Exterior Signs. Tenant shall place no signs, awnings, canopies, advertising manner or other thing of any kind on any exterior door, wall or window, or upon the roof of the Premises except with the prior written consent of Landlord, which shall not be unreasonably withheld Any and all signs placed on the Premises by Tenant shall be maintained in compliance with all governmental ordinances, rules and regulations governing such signs, and Tenant shall be responsible to Landlord for any damage caused by the installation, use, removal or maintenance of the same or violation of any ordinance, rule or regulation with regard thereto, including complete restoration of the brick storefront, if any. All such signs, awnings, canopies, advertising matter or other thing of any kind shall be removed by Tenant prior to the expiration or termination of this Lease, and upon such removal Tenant shall simultaneously repair all damage incidental to such removal. All pylon and monument signs serving the Premises shall be deemed to be part of the land, shall not be removed by Tenant and shall be surrendered to Landlord as part of the Premises at the expiration of this Lease. Landlord may, in its discretion, install a monument or pylon sign for the Project. Although Tenant shall not be entitled to a panel or other identification on such sign, Landlord agrees that no Tenant occupying less space than Tenant may have such panel or identification unless Tenant has the right to install a comparable panel or identification.

32. General Provisions.

| a. | Holding Over. If Tenant holds over after the expiration of this Lease, Tenant shall be holding merely as a tenant-at-will, and Landlord shall have no obligation to notify Tenant of any termination of Tenant’s possession. If Tenant so holds over, Tenant shall pay to Landlord upon demand rent for each day of Tenant’s possession of the Premises after termination of this Lease in an amount equal to the monthly Rent applicable upon termination divided by thirty (30) and multiplied by two hundred percent (200%). Tenant shall indemnify and hold Landlord harmless from all loss or liability, including any claim made by any successor tenant founded upon Tenant’s failure to surrender the Premises on a timely basis. |

- 20 -

| b. | Attachments. Addendums, exhibits, clauses and riders, if any, signed by the Landlord and the Tenant and endorsed on or affixed to this Lease are a part hereof. |

| c. | Waiver. The waiver by Landlord of any term, covenant or condition herein contained shall not be deemed to be a waiver of such term, covenant or condition on any subsequent breach of the same or any other term, covenant or condition herein contained. No receipt of money by the Landlord from or on behalf of the Tenant after a default, nor the application by Landlord of any security for the obligations of Tenant after default shall (i) reinstate, continue, or extend the term of this Lease, if the same has been terminated; (ii) affect any notice given to the Tenant; (iii) operate as a waiver of the right of the Landlord to enforce the payment of Rent then due or falling due thereafter; or (iv) operate as a waiver of the right of the Landlord to recover possession of the Premises by proper suit, action, proceeding, or a waiver of any other remedy to which Landlord may be entitled on account of such default. The acceptance of Rent hereunder by Landlord shall not be deemed to be a waiver of any breach by Tenant of any term, covenant or condition of this Lease. |

| d. | Notice. All rents and other sums payable by Tenant to Landlord shall be paid to Landlord at the address set forth on the Lease Summary, or such other place as Landlord may specify in writing to Tenant. All notices, consents, approvals and demands that may or are required or permitted to be given by either party to the other hereunder shall be in writing. All notices, consents, approvals and other communications that may be or are required to be given under this Lease shall be properly given only if sent by (i) hand delivery to the intended address; (ii) first class, United States Mail, postage prepaid, certified, with return receipt requested, (iii) facsimile or electronic transfer during normal business hours followed by a confirmatory letter sent in another manner permitted hereunder; or (iv) a nationally recognized overnight delivery service (such as Federal Express, UPS Next Day Air, Purolator Courier or Airborne Express), with all delivery charges paid by the sender and sent to the address set forth on the Lease Summary, or at such other address as either party each may request in writing. Such notices shall be deemed received (A) if delivered by hand or overnight delivery service, on the date of delivery; (B) if sent by United States mail, on the date of deposit; and (C) if sent by electronic transfer, on the date of transmission. The refusal to accept delivery shall constitute acceptance. |

| e. | Joint Obligation. If there be more than one Tenant or guarantor, the obligations of Tenant hereunder shall be joint and several among them. |

| f. | Marginal Headings. The marginal headings and Section titles to the Sections in this Lease are not a part of this Lease and shall have no effect upon the construction or interpretation of any part hereof. |

- 21 -

| g. | Time. Time is of the essence of this Lease and each and all of its provisions in which performance is a factor. |

| h. | Successors and Assigns. The covenants and conditions herein contained, subject to the provisions as to assignment, apply to and bind the heirs, successors, executors, administrators and assigns of the parties hereto. |

| i. | Recordation. This Lease shall not be recorded. Upon written request by Landlord or Tenant, the other party shall execute a memorandum of this Lease, which the requesting party may record at its own expense. |

| j. | Quiet Possession. Upon Tenant paying the Rent reserved hereunder and observing and performing all of the covenants, conditions and provisions of Tenant’s part to be observed and performed hereunder, Tenant shall have quiet possession of the Premises for the entire term hereof, subject to all the provisions of this Lease and the provisions of any mortgage, deed of trust, ground lease or other encumbrance affecting the Project or any portion thereof. |

| k. | Late Charges. In the event that Tenant shall fail to pay the Landlord in full within five (5) days of the date when due any payment owing to Landlord pursuant to the terms of this Lease, said late payment shall bear interest, at the option of the Landlord, from the date when due at the Interest Rate, until the same shall have been fully paid. Following two consecutive late payments of rent or other sums due hereunder on a monthly basis, Landlord shall have the option to require that beginning with the next payment due, rent shall no longer be paid in monthly installments but shall be payable three (3) months in advance. |

The foregoing shall be in addition to, but not in limitation of, any other remedies available to Landlord on account of a default by Tenant.

| l. | Prior Agreements. The submission of this Lease for examination and negotiation does not constitute an offer to lease, or a reservation of, or option for, the Premises. This Lease shall become effective and binding only upon execution and delivery hereof by Tenant and by Landlord (or, when duly authorized, by Landlord’s agent or employee). No act or omission of any agent of Landlord or of Landlord’s broker shall alter, change or modify any of the provisions hereof. This Lease constitutes the entire agreement between the parties and all prior negotiations shall be deemed incorporated herein. Landlord has made no promises, representations, warranties or covenants, except as expressly provided herein. This Lease may only be modified by an instrument in writing signed by both parties. |

- 22 -

| m. | Force Majeure. Whenever a day is appointed herein on which, or a period of time is appointed within which, either party hereto is required to do or complete any act, matter or thing, the time for the doing or completion thereof shall be extended by a period of time equal to the number of days on or during which such party is prevented from, or is interfered with, the doing or completion of such act, matter or thing because of strikes, lock-outs, embargoes, unavailability of labor or materials, wars, insurrections, rebellions, civil disorder, declaration of national emergencies, acts of God, or other causes beyond such party’s reasonable control (financial reasons excepted); provided however, nothing contained in this Section shall excuse Tenant from (i) the prompt payment of any Rent except as may be expressly provided elsewhere in this Lease, or (ii) Tenant’s obligation to open for business not later than the Commencement Date. |

| n. | Sale by Landlord. In the event of any sale of the Project or any part thereof, Landlord shall be and is hereby entirely freed and relieved of all liability under any and all of its covenants and obligations contained in or derived from this Lease arising out of any act, occurrence or omission occurring on or after the consummation of such sale, and the purchaser at such sale or any subsequent sale shall be deemed, without any further agreement between the parties or their successors in interest or between the parties and any such purchaser, to have assumed and agreed to carry out any and all of the covenants and obligations of the Landlord under this Lease from and after the date of such Sale. |

| o. | Subordination, Attornment. |

| i. | This Lease is subject and subordinate to all ground or master leases, mortgages, deeds of trust and other financing liens or security interests, which now affect the Premises or the Project, and to all renewals, modifications, consolidations, replacements, and extensions thereof. If the lessor under any such lease or the holder or holders of any such mortgage or deed of trust shall advise Landlord that they desire or require this Lease to be prior and superior thereto, upon written notice to Tenant, this Lease shall automatically be superior thereto, and Tenant agrees promptly to execute, acknowledge and deliver any and all documents or instruments which Landlord or such lessor, holder, or holders reasonably may require for purposes of confirming such priority. Notwithstanding the foregoing, and without requiring any reversal of priorities with this Lease as aforesaid, at the option of the lessor under any such lease or the holder or holders of any such mortgage or deed of trust to which this Lease is subject and subordinate as aforesaid, Tenant shall be deemed to attorn, and hereby agrees to attorn to any party so purchasing or otherwise acquiring the Project or the Premises at any foreclosure sale (or by deed in lieu of foreclosure) or pursuant to the exercise of any other rights, powers or remedies under such mortgages, deeds of trust, ground or master leases, as if such party had been named as Landlord herein; it being intended hereby that even if this Lease would otherwise be terminated, cut off or defeated by reason of any act or actions by the lessor under any such senior lease or the holder or holders of any such senior mortgage or deed of trust, by |

- 23 -

virtue of Tenant’s agreement herein to attorn the party so purchasing or otherwise succeeding Landlord as the owner of the Project or the Premises shall be presumed to have accepted the Premises subject to this Lease remaining in full force and effect absent written notice to Tenant to the contrary from such party within ninety (90) days after such change in ownership.