Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - VALLEY NATIONAL BANCORP | exhibit992mergerfinancing.htm |

| 8-K - 8-K - VALLEY NATIONAL BANCORP | vly-form8xkxmergeragreemen.htm |

© 2017 Valley National Bank®. Member FDIC. Equal Opportunity Lender. All Rights Reserved.

Valley National Bancorp to Acquire

USAmeriBancorp, Inc.

Enhancing Florida Franchise

EXHIBIT 99.1

Forward Looking Statements

The foregoing contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical

facts and include expressions about management’s confidence and strategies and management’s expectations about new and existing programs and products,

acquisitions, relationships, opportunities, taxation, technology, market conditions and economic expectations. These statements may be identified by such forward-

looking terminology as “should,” “expect,” “believe,” “view,” “opportunity,” “allow,” “continues,” “reflects,” “typically,” “usually,” “anticipate,” or similar statements

or variations of such terms. Such forward-looking statements involve certain risks and uncertainties. Actual results may differ materially from such forward-looking

statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to:

failure to obtain shareholder or regulatory approval for the merger of USAmeriBancorp, Inc. ("USAB") with Valley or to satisfy other conditions to the merger on the

proposed terms and within the proposed timeframe; delays in closing the merger; the inability to realize expected cost savings and synergies from the merger of

USAB with Valley in the amounts or in the timeframe anticipated; changes in the estimate of non-recurring charges; the diversion of management’s time on issues

relating to the merger; costs or difficulties relating to integration matters might be greater than expected; material adverse changes in Valley’s or USAB’s operations

or earnings; an increase or decrease in the stock price of Valley during the 30 day pricing period prior to the closing of the merger which could cause an adjustment

to the exchange ratio or give either Valley or USAB the right to terminate the merger agreement under certain circumstances; the inability to retain USAB’s

customers and employees; weakness or a decline in the economy, mainly in New Jersey, New York, Florida and Alabama, as well as an unexpected decline in

commercial real estate values within our market areas; less than expected cost reductions and revenue enhancement from Valley's cost reduction plans including its

earnings enhancement program called "LIFT"; damage verdicts or settlements or restrictions related to existing or potential litigations arising from claims of breach

of fiduciary responsibility, negligence, fraud, contractual claims, environmental laws, patent or trade mark infringement, employment related claims, and other

matters; the loss of or decrease in lower-cost funding sources within our deposit base may adversely impact our net interest income and net income; cyber attacks,

computer viruses or other malware that may breach the security of our websites or other systems to obtain unauthorized access to confidential information, destroy

data, disable or degrade service, or sabotage our systems; results of examinations by the OCC, the FRB, the CFPB and other regulatory authorities, including the

possibility that any such regulatory authority may, among other things, require us to increase our allowance for credit losses, write-down assets, require us to

reimburse customers, change the way we do business, or limit or eliminate certain other banking activities; changes in accounting policies or accounting standards,

including the new authoritative accounting guidance (known as the current expected credit loss (CECL) model) which may increase the required level of our

allowance for credit losses after adoption on January 1, 2020; higher or lower than expected income tax expense or tax rates, including increases or decreases

resulting from changes in tax laws, regulations and case law; our inability to pay dividends at current levels, or at all, because of inadequate future earnings,

regulatory restrictions or limitations, and changes in our capital requirements; higher than expected loan losses within one or more segments of our loan portfolio;

unanticipated loan delinquencies, loss of collateral, decreased service revenues, and other potential negative effects on our business caused by severe weather or

other external events; unexpected significant declines in the loan portfolio due to the lack of economic expansion, increased competition, large prepayments,

changes in regulatory lending guidance or other factors; and the failure of other financial institutions with whom we have trading, clearing, counterparty and other

financial relationship. A detailed discussion of factors that could affect our results is included in our SEC filings, including the “Risk Factors” section of our Annual

Report on Form 10-K for the year ended December 31, 2016. We undertake no duty to update any forward-looking statement to conform the statement to actual

results or changes in our expectations. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or achievements.

2

3

Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In

connection with the proposed merger, Valley intends to file a joint proxy statement/prospectus with the Securities and Exchange Commission. INVESTORS

AND SECURITY HOLDERS ARE ADVISED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, BECAUSE IT WILL CONTAIN

IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the registration statement (when available) and other documents

filed by Valley with the Commission at the Commission’s web site at www.sec.gov. These documents may be accessed and downloaded for free at Valley’s

web site at http://www.valleynationalbank.com/filings.html or by directing a request to Dianne M. Grenz, Executive Vice President, Valley National Bancorp,

at 1455 Valley Road, Wayne, New Jersey 07470, telephone (973) 305-3380.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security holder of Valley or USAB. However, Valley, USAB, their respective directors and

executive officers and other persons may be deemed to be participants in the solicitation of proxies from USAB’s shareholders in respect of the proposed

transaction. Information regarding the directors and executive officers of Valley may be found in its definitive proxy statement relating to its 2017 Annual

Meeting of Shareholders, which was filed with the Commission on March 17, 2017 and can be obtained free of charge from Valley’s website. Other

information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will

be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Preferred Stock Offering

This presentation shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the preferred stock in any state or

jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or

jurisdiction. Any offering of the preferred stock is being made only by means of a written prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended.

Strategic Focus to Achieve 2020 Vision

4

66.2%

61.2% 59.6%

<55.0%

2015 2016 2017 YTD Long-Term Goal

Efficiency Ratio1

12%

14%

13%

15% - 20%

2015 2016 2017 YTD Long-Term Goal

Non-Int Income / Total Revenue

13%

7%

6%

8% - 10%

2015 2016 2017

Annualized

Long-Term Goal

Loan Growth Exclusive of Whole Bank

Acquisitions

1Refer to the disclosure in the appendix regarding the calculation for the efficiency ratio

Enhance Non-Interest Revenue Grow Customer Base

Improve Operating Efficiency

Improve

Earnings

Performance

Improve Operating Efficiency

Overview of USAmeriBancorp, Inc.

5

Company Overview Financial Highlights ($ in Millions)

Management Team

USAB Deposit Franchise (3)

• Founded in 2007

• Headquartered in

Clearwater, FL

• Acquired Alexander

City, AL-based

Aliant Financial

Corporation in 2011

Market Market No. of Deposits

MSA Rank Share (%) Branches ($mm)

Tampa-St. Petersburg-Clearwater, FL 8 3.4% 14 $2,114

Montgomery, AL 7 5.7 6 441

Birmingham-Hoover, AL 14 0.9 5 321

Alexander City, AL 1 52.7 3 289

Auburn-Opelika, AL 13 1.9 1 47

Total: 29 $3,211

Name Title

Joseph V. Chillura President & CEO

Alfred T. Rogers, Jr. Executive VP and Chief Lending Officer

Amanda J. Stevens Executive VP & CFO

Loans (2) Deposits (2)

Non-Interest

Demand

25%

Savings, MMA

& O her

Checking

46%

Retail Time

6%

Jumbo Time

23%

Construction

12%

Residential

R.E.

14%

Commercial

R.E.

54%

Commercial &

Industrial

18%

Consumer &

Other

2%

(1) See Non-GAAP disclosures on slide 18

(2) As of June 30, 2017

(3) Per SNL Financial, as of June 30, 2016

2016Y 2017Q2

Net Interest Income $126.0 $35.5

Non Interest Income 14.3 5.2

Provision 6.0 (0.0)

Non Interest Expenses 75.9 21.2

Net Income 43.4 12.7

ROAA (%) 1.12% 1.19%

ROACE (%) 14.37 15.19

Net Interest Margin (%) 3.53 3.60

Efficiency Ratio (%) 54.1 52.2

Total Assets $4,153.3 $4,382.9

Gross Loans 3,373.6 3,585.7

Total Deposits 3,478.0 3,530.0

Total Equity 319.7 345.2

TCE / TA (%) (1) 7.2% 7.4%

Loans/ Deposits (%) 97 102

Leverage Ratio (%) 8.0 8.1

Tier 1 Ratio (%) 9.0 9.1

Total Capital Ratio (%) 11.7 12.1

Pr

of

ita

bi

lit

y

Ba

la

nc

e

Sh

ee

t

Ca

pi

ta

l

Ra

tio

s

In

co

m

e

St

at

em

en

t

$3,076

$3,632

$4,153

$4,383

$2,500

$3,000

$3,500

$4,000

$4,500

$5,000

2014 2015 2016 Q2 2017

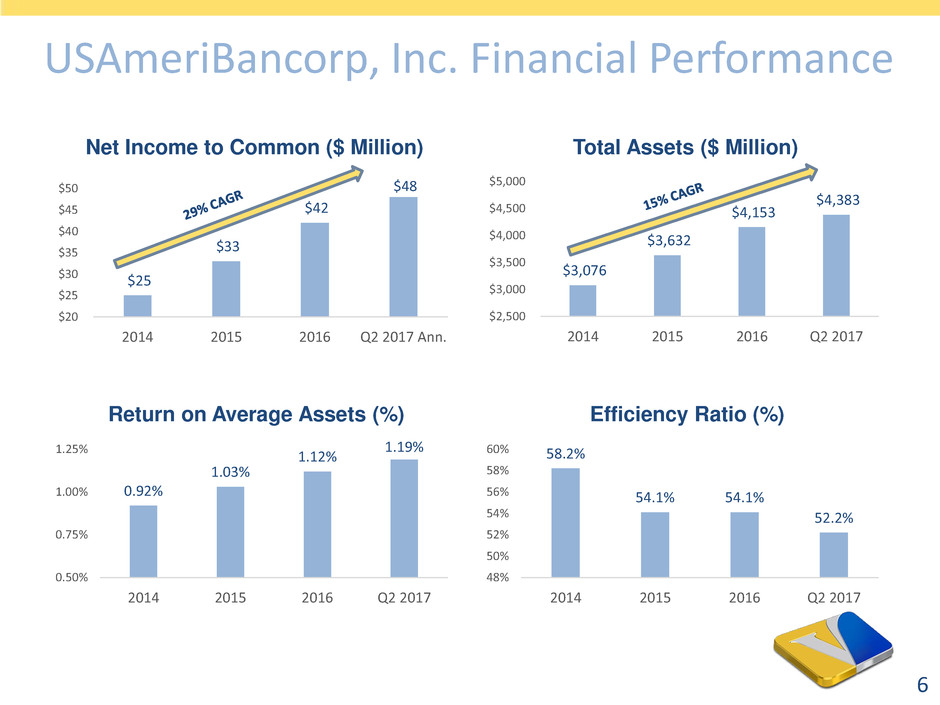

USAmeriBancorp, Inc. Financial Performance

$25

$33

$42

$48

$20

$25

$30

$35

$40

$45

$50

2014 2015 2016 Q2 2017 Ann.

6

Net Income to Common ($ Million) Total Assets ($ Million)

Return on Average Assets (%) Efficiency Ratio (%)

0.92%

1.03%

1.12%

1.19%

0.50%

0.75%

1.00%

1.25%

2014 2015 2016 Q2 2017

58.2%

54.1% 54.1%

52.2%

48%

50%

52%

54%

56%

58%

60%

2014 2015 2016 Q2 2017

Orlando

Branches 5

Loans $0.5B

Deposits $0.5B

Market Share 1.2%

Bolstering Valley’s Florida Franchise

7

Tampa (1)

Branches 18

Loans $3.1B

Deposits $2.5B

Market Share 3.6%

Southeast

Branches 13

Loans $0.9B

Deposits $1.3B

Market Share 0.6%

Penetrating Florida’s Most Dynamic Markets

(1) Pro Forma for USAB acquisition.

Pro Forma market share as of 6/30/2016, Source SNL Financial

Florida Total (1)

Branches 46

Loans $4.8B

Deposits $4.9B

CNLBank (2015)

1st United Bank (2014)

USAmeriBank (2018)

Florida Acquisitions

Southeast

Orlando Tampa

Other Florida Markets: Branches -10, Loans - $0.3B, Deposits - $0.6B

Professional &

Business

Services

18%

Education &

Health Services

15%

Leisure &

Hospitality

12%

Total

Government

12%

Retail Trade

12%

Finance &

Insurance

6%

Construction

6%

Other

19%

Tampa Market Highlights

8

Pro Forma VLY Florida Deposit Franchise (1) Tampa Highlights

Source: SNL Financial, Tampa Hillsborough Economic Development Corporation

(1) Deposit data as of June 30, 2016

MSA Pro Forma VLY / USAB

Deposits in % of FL Market

Market Deposits Market Share Deposits

MSA ($ bn) (%) Rank (%) Branches ($ mm)

Tampa-St. Petersburg-Clearwater 61 11.7 8 3.6 18 2,230

Miami-Fort Lauderdale-West Palm Beach 226 43.0 25 0.6 13 1,382

Orlando-Kissimmee-Sanford 45 8.5 13 1.2 5 523

Cape Coral-Fort Myers 15 2.9 19 1.2 3 186

Jacksonville 59 11.1 20 0.3 3 161

Naples-Immokalee-Marco Island 15 2.9 30 0.4 1 57

Sebastian-Vero Beach 4 0.8 16 0.6 1 26

Palm Bay-Melbourne-Titusville 8 1.6 16 0.3 1 21

North Port-Sarasota-Bradenton 19 3.7 37 0.1 1 16

• Tampa Bay is the second largest MSA in Florida and 18th

largest in the U.S. by population

‒ $61 billion of deposits

‒ Expected population growth of 6.5% by 2022

• 3.8% unemployment rate compares favorably to Florida

(4.0%) and national (4.1%) levels

• Home to over 112,000 businesses

• Key Industries include: Financial Services, Life Sciences,

Defense and Security, Manufacturing, Medical Devices, and

Technology

Tampa Employment by Sector Key Employers in Tampa

Alabama Franchise

9

Pro Forma VLY Alabama Deposit Franchise Alabama Highlights

Source: US Census, SNL Financial, Montgomery Chamber of Commerce, Birmingham Business Alliance, CNN Money

Deposit data as of June 30, 2016 and June 30, 2015, where applicable

• Franchise obtained through acquisition of Aliant Financial

Corporation

̶ Serves as low cost deposit generator within a growing

market

• 13% of non-farm employment in manufacturing sector

Montgomery and Birmingham

• Key Industries: Banking, Education, Technology, and Healthcare

• Key Employers: AT&T, Honda, Regions Financial, Hyundai Motors,

Baptist Health Systems, ALFA Insurance

Key Statistics – Montgomery and Birmingham

MSA Pro Forma VLY / USAB

Deposits in % of AL Market

Market Deposits Market Share Deposits

MSA ($ bn) (%) Rank (%) Branches ($ bn)

Montgomery, AL 8 8.0 7 5.7 6 441

Birmingham-Hoover, AL 37 38.6 14 0.9 5 321

Alexander City, AL 1 0.6 1 52.7 3 289

Auburn-Opelika, AL 2 2.5 13 1.9 1 47

Total Alabama 15 1,098

1,151

373

0

200

400

600

800

1,000

1,200

1,400

Birmingham Montgomery

Population

In thousands

46,569

15,237

0

10,000

20,000

30,000

40,000

50,000

60,000

Birmingham Mo tgo ery

$101

$34

Small Businesses

Sales in

billions

255

332 321

441

0

100

200

300

400

500

600

Birmingham Montgomery

USAB 2015 Deposits USAB 2016 Deposits

14

7

USAB 2016 DMS

Rank

$ in millions

USAB Deposit Growth

Transaction Rationale

Strong

Strategic Fit

• As the 5th largest community bank headquartered in Florida, USAmeriBank provides

significant scale to Valley’s Florida franchise, specifically in the Tampa Bay Market

• Increases Valley’s loan and deposit exposure in Florida by ~130% and 100%, respectively

• USAmeriBank has a history of consistent growth, strong profitability, and stable asset

quality

• Low-cost core funding base includes 25% non-interest bearing deposits

• Strong and experienced leadership team to drive future growth

Financially

Compelling

• Expected to be immediately accretive to EPS, excluding restructure charges

• Modest dilution to tangible book value per share with 4.7 year earnback

Conservative

Acquisition

• Comprehensive credit, business, financial, and legal due diligence

• Credit mark in excess of existing reserves

• Retention of key personnel

• Extensive integration experience

• Pricing protection to preserve financial outcomes

10 Note: Pricing metrics using VLY closing price of $12.40 as of 7/25/2017

Key Transaction Terms

Consideration

& Structure

Transaction Value: • $815.7 million

Structure: • 100% stock / 0% cash (1)

Exchange Ratio: • Fixed exchange ratio of 6.100x (2)

Pricing

Multiples

Price / Tangible Book Value: • 238% of USAB’s 6/30/2017 tangible book value

Price / LTM EPS: • 16.4x of USABs’s LTM net income

Price / 2018 EPS + Cost Savings (3): • 11.4x

Core Deposit Premium • 18.2%

Closing &

Other

Due Diligence:

• Comprehensive due diligence performed over 8 weeks

including thorough review of USAB’s loan portfolio

Approvals:

• Customary regulatory approvals & approval of both VLY

& USAB shareholders

Management Representation:

• VLY inherits USAB’s strong & seasoned Florida &

Alabama teams

Expected Closing: • Q1 2018

11

Note: Pricing metrics using VLY closing price of $12.40 as of 7/25/2017

(1) In certain circumstances outlined in Definitive Merger Agreement, Valley may choose to substitute some component of cash for stock

(2) Subject to cuffs and collars as outlined in Definitive Merger Agreement

(3) Using Valley’s projections of USAB earnings inclusive of fully phased-in cost savings

Key Transaction Assumptions

12

Expense Savings

• Estimated pre-tax expense savings of approximately $26 million (~28% of

USAB G&A expenses) phased in 75% in 2018, and excluding CDI amortization

Transaction

Expenses

• Expected to be approximately $32 million pre-tax

Capital Raise

• Preferred equity raise of approximately $75 million, launched concurrently

with announcement of USAB acquisition

Purchase

Accounting &

Other Adjustments

• Gross credit mark: $63 million, equal to 1.75% of USAB loans

• Core deposit intangible: 1.15% ($30 million)

• Additional purchase accounting adjustments: $6 million write-down to assets

• Estimated Durbin Amendment impact on USAB earnings: $400k

Note: Pricing metrics using VLY closing price of $12.40 as of 7/25/2017

Pro-Forma Impact Financial Summary

13

Note: Pro forma impacts presented inclusive of anticipated preferred stock capital raise

Note: Assumes pricing based on VLY closing price of $12.40 as of 7/25/2017

(1)Estimated financial impact is presented solely for illustrative purposes using mean analyst estimates. Includes purchase accounting marks and

cost savings, as well as approximately $75 million preferred stock capital raise

(2)See Non-GAAP disclosures on slide 19

Key Transaction Impacts to VLY (1)

2018E EPS Accretion ~3%

2019E EPS Accretion ~6%

Initial Tangible Book Value Dilution 5.5%

Tangible Book Value Earnback Period 4.7 years

As of June 30, 2017 Proforma (1)

VLY USAB

As of and for the year ended

December 31, 2017

Balance Sheet (S in Millions)

Total Assets $23,449 $4,383 $29,046

Gross Loans HFI 17,711 3,586 21,766

Deposits 17,250 3,530 21,286

Tangible Common Equity (2) 1,578 323 1,910

Capital Ratios

TCE/TA (2) 6.9% 7.4% 6.9%

Leverage Ratio 7.7% 8.1% 7.9%

Common Equity Tier I Ratio 9.2% 8.4% 9.0%

Tier I Ratio 9.8% 9.1% 10.0%

Total Risk-based Capital Ratio 12.0% 12.1% 12.2%

Loan Concentration Ratios

C&D / Tier 1 + ALLL 47% 108% 58%

CRE / Total Risk-based Capital 433% 367% 417%

Year Recent Bank Acquisitions

State

Asset Size

2017 USAmeriBank FL $4.4 billion

2015 CNLBank FL $1.4 billion

2014 1st United Bank FL $1.7 billion

2012 State Bank of Long Island

NY $1.6 billion

2010 The Park Avenue Bank (FDIC)

NY $0.5 billion

2010 LibertyPointe Bank (FDIC)

NY $0.2 billion

2008 Greater Community Bank

NJ $1.0 billion

2005 NorCrown Bank NJ $0.6 billion

2005 Shrewsbury State Bank NJ $0.4 billion

Keys to Execution Success

Proven Acquirer & Retention of Key Personnel

14

USAmeriBank

CNLBank

1st United Bank

• VLY has retention agreements with USAB President & CEO

Joseph V. Chillura, Chief Lending Officer Alfred T. Rogers, Jr.

and other key management

• USAB Chairman Jennifer W. Steans is expected to join VLY’s

board of directors

USAmeriBancorp Acquisition

Appendix

15

Due Diligence Process

Due Diligence Departments

Accounting Human Resources

AML/BSA Compliance Information Security

Appraisal Review Legal

Audit Loan Review

Commercial Lending Property Management

Consumer Lending Regulatory Compliance

Corporate Treasury Residential Mortgage

CRA Retail Banking

Credit Risk Management Risk Management

Deposit Operations Tax

Executive Technology

16

Due Diligence Scope

• Comprehensive on-site and off-site due diligence

conducted over an 8 week period

- Detailed evaluation of over 950 electronic documents

provided in virtual data room

- 22 departments participated in thorough review of

complementary functions:

Credit Due Diligence

• Targeted review over the course of three weeks covering:

- 75% of commercial balances including all criticized loans

with balances above $300,000

- 84% of construction portfolio

- 77% of residential real estate portfolio

- 72% of home equity balances

- 75% of consumer balances

Observations of Loan Portfolio

• Strong existing asset quality metrics:

- 0.76% NPAs / total assets as of June 30, 2017

• $63 million pre-tax credit mark equaling 1.75% of total

loans

• Existing allowance for loan losses of $41 million

Pro Forma Loan & Deposit Composition

17

Valley USAmeriBank Pro Forma

Loa

n

s

D

e

po

si

ts

Construction

5%

Residential

R.E.

15%

Commercial

R.E.

52%

Commercial

& Industrial

15%

Consumer &

Other

13%

Construction

12%

Residential

R.E.

14%

Commercial

R.E.

54%

Commercial

& Industrial

18%

Consumer &

Other

2%

Construction

6% Residential

R.E.

15%

Commercial

R.E.

53%

Commercial

& Industrial

15%

Consumer &

Other

11%

Non-Interest

Demand

30%

Savings,

NOW and

Money

Market

50%

Retail Time

9%

Jumbo Time

11%

Non-Interest

Demand

25%

Savings,

NOW and

Money

Market

46%

Retail Time

6%

Jumbo Time

23%

Non-Interest

Demand

29%

Savings,

NOW and

Money

Market

50%

Retail Time

8%

Jumbo Time

13%

Source: SNL Financial

Note: Loan and deposit data as of June 30, 2017

Total Loans: $17.7 billion Total Loans: $3.6 billion Total Loans: $21.3 billion

Total Deposits: $17.3 billion Total Deposits: $3.5 billion Total Deposits: $20.8 billion

Cost of Deposits: 0.53% Cost of Deposits: 0.59% Cost of Deposits: 0.54%

Non-GAAP Disclosure Reconciliations

USAB

18

(1) Pro Forma includes estimated purchase accounting adjustments

USAB USAB USAB

$ in millions 2015Y 2016Y 6/30/2017

Total Assets 3,632 4,153 4,383

Less: Goodwill & Other Intangibles (13) (13) (12)

Total Tangible Assets (TA) 3,619 4,141 4,371

Total Common Equity 270 310 335

Less: Goodwill & Other Intangibles (13) (13) (12)

Total Tangible Common Equity (TCE) 257 297 323

TCE / TA (%) 7.1% 7.2% 7.4%

© 2010 Valley National Bank. Member FDIC. Equal Opportunity Lender.

Non-GAAP Disclosure Reconciliations

6/30/2017

19

(1) Pro Forma includes estimated purchase accounting adjustments

$ in millions

VLY

6/30/2017

USAB

6/30/2017

Pro-Forma (1)

12/31/2017

Total Assets 23,449 4,383 29,046

Less: Goodwill & Other Intangibles (734) (12) (1,235)

Total Tangible Assets (TA) 22,715 4,371 27,811

Total Common Equity 2,312 335 3,145

Less: Goodwill & Other Intangibles (734) (12) (1,235)

Total Tangible Common Equity (TCE) 1,578 323 1,910

TCE / TA (%) 6.9% 7.4% 6.9%

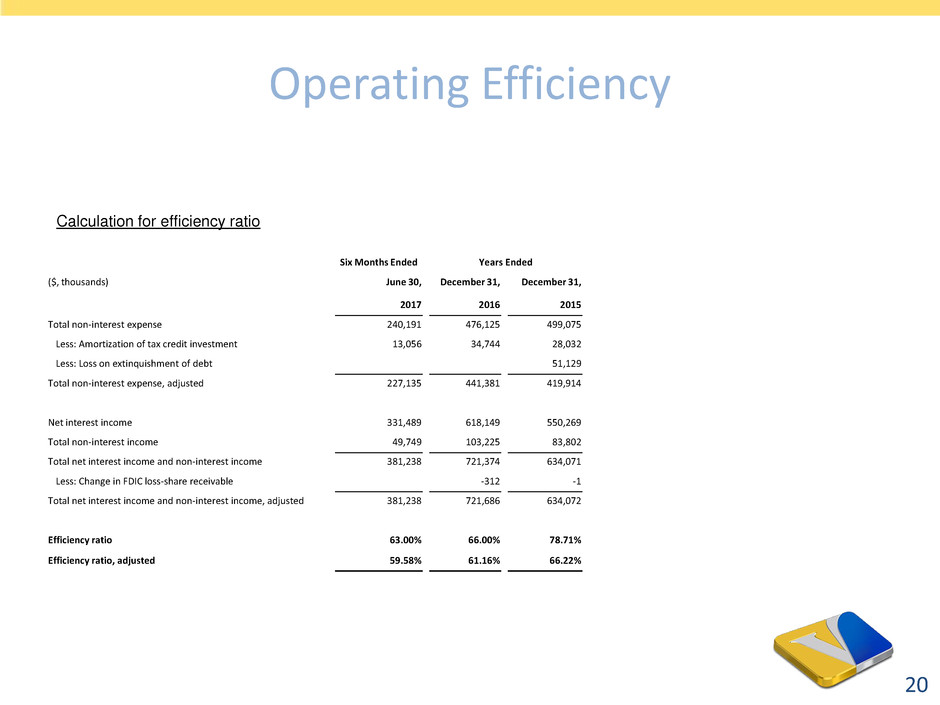

Operating Efficiency

Calculation for efficiency ratio

Six Months Ended Years Ended

($, thousands) June 30, December 31, December 31,

2017 2016 2015

Total non-interest expense 240,191 476,125 499,075

Less: Amortization of tax credit investment 13,056 34,744 28,032

Less: Loss on extinquishment of debt 51,129

Total non-interest expense, adjusted 227,135 441,381 419,914

Net interest income 331,489 618,149 550,269

Total non-interest income 49,749 103,225 83,802

Total net interest income and non-interest income 381,238 721,374 634,071

Less: Change in FDIC loss-share receivable -312 -1

Total net interest income and non-interest income, adjusted 381,238 721,686 634,072

Efficiency ratio 63.00% 66.00% 78.71%

Efficiency ratio, adjusted 59.58% 61.16% 66.22%

20