Attached files

EXHIBIT 10.12

Freddie Mac Loan Number: 708855423

Property Name: Belmar Villas

GUARANTY

MULTISTATE

(Revised 5-5-2017)

THIS GUARANTY (“Guaranty”) is entered into to be effective as of July 21, 2017, by STEADFAST APARTMENT REIT III, INC., a Maryland corporation (“Guarantor”, collectively if more than one), for the benefit of BERKELEY POINT CAPITAL LLC, a Delaware limited liability company (“Lender”).

RECITALS

A. | Pursuant to the terms of a Multifamily Loan and Security Agreement dated the same date as this Guaranty (as amended, modified or supplemented from time to time, the “Loan Agreement”), STAR III BELMAR, LLC, a Delaware limited liability company (“Borrower”) has requested that Lender make a loan to Borrower in the amount of $47,112,000.00 (“Loan”). The Loan will be evidenced by one or more Multifamily Note(s) from Borrower to Lender dated effective as of the effective date of this Guaranty (as amended, modified or supplemented from time to time, and collectively if applicable, the “Note”). The Note will be secured by a Multifamily Mortgage, Deed of Trust, or Deed to Secure Debt dated effective as of the effective date of the Note (as amended, modified or supplemented from time to time, the “Security Instrument”), encumbering the Mortgaged Property described in the Loan Agreement. |

B. | As a condition to making the Loan to Borrower, Lender requires that Guarantor execute this Guaranty. |

C. | Guarantor has a direct or indirect ownership or other financial interest in Borrower and/or will otherwise derive a material benefit from the making of the Loan. |

AGREEMENT

NOW, THEREFORE, in order to induce Lender to make the Loan to Borrower, and in consideration thereof and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Guarantor agrees as follows:

Guaranty - Multistate | Page 1 | |

1. | Defined Terms. The terms “Indebtedness,” “Loan Documents,” and “Property Jurisdiction,” and other capitalized terms used but not defined in this Guaranty, will have the meanings assigned to them in the Loan Agreement. |

2. | Scope of Guaranty. |

(a) | Guarantor hereby absolutely, unconditionally and irrevocably guarantees to Lender each of the following: |

(i) | Guarantor guarantees the full and prompt payment when due, whether at the Maturity Date or earlier, by reason of acceleration or otherwise, and at all times thereafter, of each of the following: |

(A) | Guarantor guarantees a portion of the Indebtedness (including interest at the Note rate) equal to 0% of the original principal balance of the Note (“Base Guaranty”). |

(B) | In addition to the Base Guaranty, Guarantor guarantees all other amounts for which Borrower is personally liable under Sections 9(c), 9(d) and 9(f) of the Note (provided, however, that Guarantor will have no liability for failure of Borrower or SPE Equity Owner to comply with (I) Section 6.13(a)(xviii) of the Loan Agreement, and (II) the requirement in Section 6.13(a)(x)(B) of the Loan Agreement as to payment of trade payables within 60 days of the date incurred). |

(C) | Guarantor guarantees all costs and expenses, including reasonable Attorneys’ Fees and Costs incurred by Lender in enforcing its rights under this Guaranty. |

(ii) | Guarantor guarantees the full and prompt payment and performance of, and compliance with, all of Borrower’s obligations under Sections 6.12, 10.02(b) and 10.02(d) of the Loan Agreement when due and the accuracy of Borrower’s representations and warranties under Section 5.05 of the Loan Agreement. |

(iii) | Guarantor guarantees the full and prompt payment and performance of, and compliance with, Borrower’s obligations under Section 6.09(e)(v) of the Loan Agreement to the extent Property Improvement Alterations have commenced and remain uncompleted. |

(iv) through (vi) | Reserved |

Guaranty - Multistate | Page 2 | |

(b) | If the Base Guaranty stated in Section 2(a)(i)(A) is 100% of the original principal balance of the Note, then the following will be applicable: |

(i) | The Base Guaranty will mean and include, and Guarantor hereby absolutely, unconditionally and irrevocably guarantees to Lender, the full and complete prompt payment of the entire Indebtedness, the performance of and/or compliance with all of Borrower’s obligations under the Loan Documents when due, and the accuracy of Borrower’s representations and warranties contained in the Loan Documents. |

(ii) | For so long as the Base Guaranty remains in effect (there being no limit to the duration of the Base Guaranty unless otherwise expressly provided in this Guaranty), the obligations guaranteed pursuant to Sections 2(a)(i)(B) and 2(a)(i)(C) will be part of, and not in addition to or in limitation of, the Base Guaranty. |

(c) | If the Base Guaranty stated in Section 2(a)(i)(A) is less than 100% of the original principal balance of the Note, then Section 2(b) will be completely inapplicable. |

(d) | If Guarantor is not liable for the entire Indebtedness, then all payments made by Borrower with respect to the Indebtedness and all amounts received by Lender from the enforcement of its rights under the Loan Agreement and the other Loan Documents (except this Guaranty) will be applied first to the portion of the Indebtedness for which neither Borrower nor Guarantor has personal liability. |

3. Additional Guaranty Relating to Bankruptcy.

(a) | Notwithstanding any limitation on liability provided for elsewhere in this Guaranty, Guarantor hereby absolutely, unconditionally and irrevocably guarantees to Lender the full and prompt payment when due, whether at the Maturity Date or earlier, by reason of acceleration or otherwise, and at all times thereafter, the entire Indebtedness, in the event that: |

(i) | Borrower or any SPE Equity Owner voluntarily files for bankruptcy protection under the Bankruptcy Code. |

(ii) | Borrower or any SPE Equity Owner voluntarily becomes subject to any reorganization, receivership, insolvency proceeding, or other similar proceeding pursuant to any other federal or state law affecting debtor and creditor rights. |

(iii) | The Mortgaged Property or any part of the Mortgaged Property becomes an asset in a voluntary bankruptcy or becomes subject to any voluntary reorganization, receivership, insolvency proceeding, or other similar voluntary proceeding pursuant to any other federal or state law affecting debtor and creditor rights. |

Guaranty - Multistate | Page 3 | |

(iv) | An order of relief is entered against Borrower or any SPE Equity Owner pursuant to the Bankruptcy Code or other federal or state law affecting debtor and creditor rights in any involuntary bankruptcy proceeding initiated or joined in by a Related Party. |

(v) | An involuntary bankruptcy or other involuntary insolvency proceeding is commenced against Borrower or any SPE Equity Owner (by a party other than Lender) but only if Borrower or such SPE Equity Owner has failed to use commercially reasonable efforts to dismiss such proceeding or has consented to such proceeding. “Commercially reasonable efforts” will not require any direct or indirect interest holders in Borrower or any SPE Equity Owner to contribute or cause the contribution of additional capital to Borrower or any SPE Equity Owner. |

(b) | For purposes of Section 3(a) the term “Related Party” will include all of the following: |

(i) | Borrower, any Guarantor or any SPE Equity Owner. |

(ii) | Any Person that holds, directly or indirectly, any ownership interest (including any shareholder, member or partner) in Borrower, any Guarantor or any SPE Equity Owner or any Person that has a right to manage Borrower, any Guarantor or any SPE Equity Owner. |

(iii) | Any Person in which Borrower, any Guarantor or any SPE Equity Owner has any ownership interest (direct or indirect) or right to manage. |

(iv) | Any Person in which any partner, shareholder or member of Borrower, any Guarantor or any SPE Equity Owner has an ownership interest or right to manage. |

(v) | Any Person in which any Person holding an interest in Borrower, any Guarantor or any SPE Equity Owner also has any ownership interest. |

(vi) | Any creditor (as defined in the Bankruptcy Code) of Borrower that is related by blood, marriage or adoption to Borrower, any Guarantor or any SPE Equity Owner. |

(vii) | Any creditor (as defined in the Bankruptcy Code) of Borrower that is related to any partner, shareholder or member of, or any other Person holding an interest in, Borrower, any Guarantor or any SPE Equity Owner. |

(c) | If Borrower, any Guarantor, any SPE Equity Owner or any Related Party has solicited creditors to initiate or participate in any proceeding referred to in Section 3(a), regardless of whether any of the creditors solicited actually initiates or participates in the proceeding, then such proceeding will be considered as having been initiated by a Related Party. |

Guaranty - Multistate | Page 4 | |

4. | Guarantor’s Obligations Survive Foreclosure. The obligations of Guarantor under this Guaranty will survive any foreclosure proceeding, any foreclosure sale, any delivery of any deed in lieu of foreclosure, and any release of record of the Security Instrument, and, in addition, the obligations of Guarantor relating to Borrower’s representations and warranties under Section 5.05 of the Loan Agreement, and Borrower’s obligations under Sections 6.12 and 10.02(b) of the Loan Agreement will survive any repayment or discharge of the Indebtedness. Notwithstanding the foregoing, if Lender has never been a mortgagee-in-possession of or held title to the Mortgaged Property, Guarantor will have no obligation under this Guaranty relating to Borrower’s representations and warranties under Section 5.05 of the Loan Agreement or Borrower’s obligations relating to environmental matters under Sections 6.12 and 10.02(b) of the Loan Agreement after the date of the release of record of the lien of the Security Instrument as a result of the payment in full of the Indebtedness on the Maturity Date or by voluntary prepayment in full. |

5. | Guaranty of Payment and Performance. Guarantor’s obligations under this Guaranty constitute an unconditional guaranty of payment and performance and not merely a guaranty of collection. |

6. | No Demand by Lender Necessary; Waivers by Guarantor. The obligations of Guarantor under this Guaranty must be performed without demand by Lender and will be unconditional regardless of the genuineness, validity, regularity or enforceability of the Note, the Loan Agreement, or any other Loan Document, and without regard to any other circumstance which might otherwise constitute a legal or equitable discharge of a surety, a guarantor, a borrower or a mortgagor. Guarantor hereby waives, to the fullest extent permitted by applicable law, all of the following: |

(a) | The benefit of all principles or provisions of law, statutory or otherwise, which are or might be in conflict with the terms of this Guaranty and agrees that Guarantor’s obligations will not be affected by any circumstances, whether or not referred to in this Guaranty, which might otherwise constitute a legal or equitable discharge of a surety, a guarantor, a borrower or a mortgagor. |

(b) | The benefits of any right of discharge under any and all statutes or other laws relating to a guarantor, a surety, a borrower or a mortgagor, and any other rights of a surety, a guarantor, a borrower or a mortgagor under such statutes or laws. |

(c) | Diligence in collecting the Indebtedness, presentment, demand for payment, protest, all notices with respect to the Note and this Guaranty which may be required by statute, rule of law or otherwise to preserve Lender’s rights against Guarantor under this Guaranty, including notice of acceptance, notice of any amendment of the Loan Documents, notice of the occurrence of any default or Event of Default, notice of intent to accelerate, notice of acceleration, notice of dishonor, notice of foreclosure, notice of protest, and notice of the incurring by Borrower of any obligation or indebtedness. |

Guaranty - Multistate | Page 5 | |

(d) | All rights to cause a marshalling of the Borrower’s assets or to require Lender to do any of the following: |

(i) | Proceed against Borrower or any other guarantor of Borrower’s payment or performance under the Loan Documents (an “Other Guarantor”). |

(ii) | Proceed against any general partner of Borrower or any Other Guarantor if Borrower or any Other Guarantor is a partnership. |

(iii) | Proceed against or exhaust any collateral held by Lender to secure the repayment of the Indebtedness. |

(iv) | Pursue any other remedy it may now or hereafter have against Borrower, or, if Borrower is a partnership, any general partner of Borrower. |

(e) | Any right to object to the timing, manner or conduct of Lender’s enforcement of its rights under any of the Loan Documents. |

(f) | Any right to revoke this Guaranty as to any future advances by Lender under the terms of the Loan Agreement to protect Lender’s interest in the Mortgaged Property. |

7. | Modification of Loan Documents. At any time or from time to time and any number of times, without notice to Guarantor and without affecting the liability of Guarantor, all of the following will apply: |

(a) | Lender may extend the time for payment of the principal of or interest on the Indebtedness or renew the Indebtedness in whole or in part. |

(b) | Lender may extend the time for Borrower’s performance of or compliance with any covenant or agreement contained in the Note, the Loan Agreement or any other Loan Document, whether presently existing or entered into after the date of this Guaranty, or waive such performance or compliance. |

(c) | Lender may accelerate the Maturity Date of the Indebtedness as provided in the Note, the Loan Agreement, or any other Loan Document. |

(d) | Lender and Borrower may modify or amend the Note, the Loan Agreement, or any other Loan Document in any respect, including an increase in the principal amount. |

(e) | Lender may modify, exchange, surrender or otherwise deal with any security for the Indebtedness or accept additional security that is pledged or mortgaged for the Indebtedness. |

8. | Joint and Several Liability. The obligations of Guarantor (and each party named as a Guarantor in this Guaranty) and any Other Guarantor will be joint and several. Lender, in its sole and absolute discretion, may take any of the following actions: |

Guaranty - Multistate | Page 6 | |

(a) | Lender may bring suit against Guarantor, or any one or more of the parties named as a Guarantor in this Guaranty, and any Other Guarantor, jointly and severally, or against any one or more of them. |

(b) | Lender may compromise or settle with Guarantor, any one or more of the parties named as a Guarantor in this Guaranty, or any Other Guarantor, for such consideration as Lender may deem proper. |

(c) | Lender may release one or more of the parties named as a Guarantor in this Guaranty, or any Other Guarantor, from liability. |

(d) | Lender may otherwise deal with Guarantor and any Other Guarantor, or any one or more of them, in any manner. |

No action of Lender described in this Section 8 will affect or impair the rights of Lender to collect from any one or more of the parties named as a Guarantor under this Guaranty any amount guaranteed by Guarantor under this Guaranty.

9. | Limited Release of Guarantor Upon Transfer of Mortgaged Property. If Guarantor requests a release of its liability under this Guaranty in connection with a Transfer which Lender has approved pursuant to Section 7.05(a) of the Loan Agreement, and Borrower has provided a replacement Guarantor acceptable to Lender, then one of the following will apply: |

(a) | If Borrower delivers to Lender a Clean Site Assessment, then Lender will release Guarantor from all of Guarantor’s obligations except Guarantor’s obligation to guaranty Borrower’s liability under Section 6.12 (Environmental Hazards) or Section 10.02(b) (Environmental Indemnification) of the Loan Agreement with respect to any loss, liability, damage, claim, cost or expense which directly or indirectly arises from or relates to any Prohibited Activities or Conditions existing prior to the date of the Transfer. |

(b) | If Borrower does not deliver a Clean Site Assessment as described in Section 7.05(b)(i) of the Loan Agreement, then Lender will release Guarantor from all of Guarantor’s obligations except for Guarantor’s obligation to guaranty Borrower’s liability under Section 6.12 (Environmental Hazards) or Section 10.02(b) (Environmental Indemnification) of the Loan Agreement. |

10. | Subordination of Borrower’s Indebtedness to Guarantor. Any indebtedness of Borrower held by Guarantor now or in the future is and will be subordinated to the Indebtedness and Guarantor will collect, enforce and receive any such indebtedness of Borrower as trustee for Lender, but without reducing or affecting in any manner the liability of Guarantor under the other provisions of this Guaranty. |

Guaranty - Multistate | Page 7 | |

11. | Waiver of Subrogation. Guarantor will have no right of, and hereby waives any claim for, subrogation or reimbursement against Borrower or any general partner of Borrower by reason of any payment by Guarantor under this Guaranty, whether such right or claim arises at law or in equity or under any contract or statute, until the Indebtedness has been paid in full and there has expired the maximum possible period thereafter during which any payment made by Borrower to Lender with respect to the Indebtedness could be deemed a preference under the United States Bankruptcy Code. |

12. | Preference. If any payment by Borrower is held to constitute a preference under any applicable bankruptcy, insolvency, or similar laws, or if for any other reason Lender is required to refund any sums to Borrower, such refund will not constitute a release of any liability of Guarantor under this Guaranty. It is the intention of Lender and Guarantor that Guarantor’s obligations under this Guaranty will not be discharged except by Guarantor’s performance of such obligations and then only to the extent of such performance. |

13. | Financial Information and Litigation. Guarantor will deliver each of the following to Lender within 10 Business Days following a Notice from Lender requesting such information: |

(a) | Guarantor’s balance sheet and profit and loss statement as of the end of (A) the quarter that ended at least 30 days prior to the due date of the requested items, and/or (B) the fiscal year that ended at least 90 days prior to the due date of the requested items. |

(b) | Other Guarantor financial statements as Lender may reasonably require. |

(c) | Written updates on the status of all litigation proceedings that Guarantor disclosed or should have disclosed to Lender as of the date of this Guaranty. |

(d) | If an Event of Default has occurred and is continuing, copies of Guarantor’s most recent filed state and federal tax returns, including any current tax return extensions. |

14. | Assignment. Lender may assign its rights under this Guaranty in whole or in part and upon any such assignment, all the terms and provisions of this Guaranty will inure to the benefit of such assignee to the extent so assigned. The terms used to designate any of the parties in this Guaranty will be deemed to include the heirs, legal representatives, successors and assigns of such parties, and the term “Lender” will also include any lawful owner, holder or pledgee of the Note. |

Guaranty - Multistate | Page 8 | |

15. | Complete and Final Agreement. This Guaranty and the other Loan Documents represent the final agreement between the parties and may not be contradicted by evidence of prior, contemporaneous or subsequent oral agreements. There are no unwritten oral agreements between the parties. All prior or contemporaneous agreements, understandings, representations, and statements, oral or written, are merged into this Guaranty and the other Loan Documents. Guarantor acknowledges that Guarantor has received a copy of the Note and all other Loan Documents. Neither this Guaranty nor any of its provisions may be waived, modified, amended, discharged, or terminated except by a writing signed by the party against which the enforcement of the waiver, modification, amendment, discharge, or termination is sought, and then only to the extent set forth in that writing. |

16. | Governing Law. This Guaranty will be governed by and enforced in accordance with the laws of the Property Jurisdiction, without giving effect to the choice of law principles of the Property Jurisdiction that would require the application of the laws of a jurisdiction other than the Property Jurisdiction. |

17. | Jurisdiction; Venue. Guarantor agrees that any controversy arising under or in relation to this Guaranty may be litigated in the Property Jurisdiction, and that the state and federal courts and authorities with jurisdiction in the Property Jurisdiction will have jurisdiction over all controversies which may arise under or in relation to this Guaranty. Guarantor irrevocably consents to service, jurisdiction and venue of such courts for any such litigation and waives any other venue to which it might be entitled by virtue of domicile, habitual residence or otherwise. However, nothing in this Guaranty is intended to limit Lender’s right to bring any suit, action or proceeding relating to matters arising under this Guaranty against Guarantor or any of Guarantor’s assets in any court of any other jurisdiction. |

18. | Guarantor’s Interest in Borrower. Guarantor represents to Lender that Guarantor has a direct or indirect ownership or other financial interest in Borrower and/or will otherwise derive a material financial benefit from the making of the Loan. |

19. | Reserved. |

20. | Reserved. |

21. | Reserved. |

22. | Reserved. |

23. | Reserved. |

24. | Reserved. |

Guaranty - Multistate | Page 9 | |

25. | State-Specific Provisions. State-specific provisions, if any, are included on Schedule 1 to this Guaranty. |

26. | Community Property. If Guarantor (or any Guarantor, if more than one) is a married person, and the state of residence of Guarantor or his or her spouse (“Guarantor Spouse”) is a community property jurisdiction, then each of the following apply: |

(a) | Guarantor (or each such married Guarantor, if more than one) agrees that Lender may satisfy Guarantor’s obligations under this Guaranty to the extent of all of Guarantor’s separate property and against the marital community property of Guarantor and Guarantor Spouse. |

(b) | If Guarantor Spouse is not also a Guarantor of the Loan, Guarantor certifies that none of the assets shown on his or her financial statements submitted to Lender for purposes of underwriting the Loan were either (i) Guarantor Spouse’s individual property, or (ii) community property under the sole management, control, and disposition of Guarantor Spouse. |

(c) | If Guarantor or Guarantor Spouse resides in Alaska, Arizona, Idaho, Louisiana, Nevada, New Mexico, Washington or Wisconsin, Guarantor has caused Guarantor Spouse to acknowledge this Guaranty as required on the signature page of this Guaranty. |

Guaranty - Multistate | Page 10 | |

27. | WAIVER OF TRIAL BY JURY. |

(a) | GUARANTOR AND LENDER EACH COVENANTS AND AGREES NOT TO ELECT A TRIAL BY JURY WITH RESPECT TO ANY ISSUE ARISING OUT OF THIS GUARANTY OR THE RELATIONSHIP BETWEEN THE PARTIES AS GUARANTOR AND LENDER THAT IS TRIABLE OF RIGHT BY A JURY. |

(b) | GUARANTOR AND LENDER EACH WAIVES ANY RIGHT TO TRIAL BY JURY WITH RESPECT TO SUCH ISSUE TO THE EXTENT THAT ANY SUCH RIGHT EXISTS NOW OR IN THE FUTURE. THIS WAIVER OF RIGHT TO TRIAL BY JURY IS SEPARATELY GIVEN BY EACH PARTY, KNOWINGLY AND VOLUNTARILY WITH THE BENEFIT OF COMPETENT LEGAL COUNSEL. |

28. | Notices. All Notices required under this Guaranty will be provided in accordance with the requirements of Section 11.03 of the Loan Agreement. Guarantor’s address for Notices is as set forth on the signature page of this Guaranty unless changed in accordance with this Section 28. |

29. | Attached Schedules and Riders. The following Schedules and Riders, if marked with an “X” in the space provided, are attached to this Guaranty: |

|X| Schedule 1 – State Specific Provisions

|__| Material Adverse Change Rider

|X| Minimum Net Worth/Liquidity Rider

|X| Other: Term Of Existence of Guarantor Expiring Prior to Maturity Date

30. | Attached Exhibit. The following Exhibit, if marked with an “X” in the space provided, is attached to this Guaranty: |

|X| Exhibit A Modifications to Guaranty

(Remainder of page intentionally left blank; signature pages follow.)

Guaranty - Multistate | Page 11 | |

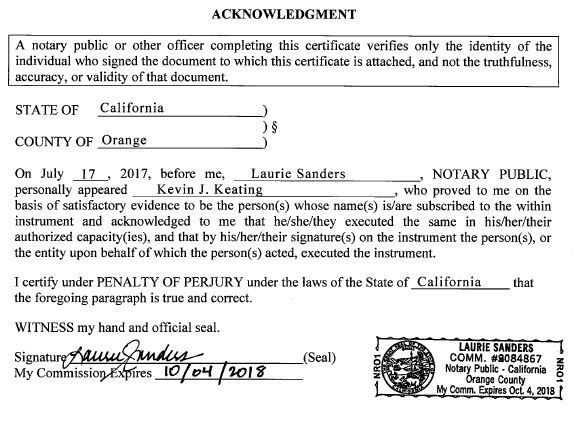

IN WITNESS WHEREOF, Guarantor has signed and delivered this Guaranty under seal or has caused this Guaranty to be signed and delivered under seal by its duly authorized representative. Where applicable law provides, Guarantor intends that this Guaranty will be deemed to be signed and delivered as a sealed instrument.

GUARANTOR:

STEADFAST APARTMENT REIT, INC.,

a Maryland corporation

By: | /s/ Kevin J. Keating (SEAL) |

Name: | Kevin J. Keating |

Title: | Treasurer |

Guaranty - Multistate | Page 1 | |

(a) | Guarantor's Notice Address: |

Name: | Steadfast Apartment REIT III, Inc. |

Adress: | c/o Steadfast Companies |

18100 Von Karman Avenue, Suite 500 | |

Irvine, California 92612 | |

Attention: Ana Marie del Rio, General Counsel | |

(b) | Guarantor represents and warrants that Guarantor is: |

[____] single

[____] married

[ X ] an entity

(c) | If Guarantor is married, then Guarantor represents and warrants that Guarantor’s state of residence is N/A and Guarantor Spouse’s state of residence is N/A. |

Note: If Guarantor is an entity or an unmarried person, insert “N/A” in each blank.

(d) | If Guarantor (i) is married, and (ii) Guarantor Spouse is not also a Guarantor of this Loan, and (iii) Guarantor or Guarantor Spouse’s state of residence is Alaska, Arizona, Idaho, Louisiana, Nevada, New Mexico, Washington, or Wisconsin, then Guarantor must cause Guarantor Spouse to sign below in accordance with Section 26 of this Guaranty. |

Any person signing this Guaranty solely as a Guarantor Spouse will bind only Guarantor Spouse’s marital community property and will not bind Guarantor Spouse’s separate property to the payment and performance of the Guarantor’s obligations under this Guaranty.

Note: If Guarantor is an entity or an unmarried person, insert “N/A” in each blank.

Guarantor Spouse’s Signature: N/A

Guarantor Spouse’s Printed Name: N/A

Guarantor Spouse’s Address: N/A

Guaranty - Multistate | Page 2 | |

SCHEDULE 1

STATE SPECIFIC PROVISIONS

Colorado | Guarantor waives the benefit of C.R.S. Sections 13‑50‑101 through 13‑50‑103, inclusive. |

Gauranty - Multistate | Schedule 1 - Page 1 | |

RIDER TO GUARANTY

MINIMUM NET WORTH/LIQUIDITY

(Revised 5-5-2017)

The following changes are made to the Guaranty which precedes this Rider:

A. Section 20 is deleted and replaced with the following:

20. Minimum Net Worth/Liquidity Requirements.

(a) | Guarantor must maintain a minimum net worth of $15,000,000 with liquid assets of at least $4,763,000 (collectively, “Minimum Net Worth Requirement”). |

(b) | In addition to the financial information that Guarantor is required to provide pursuant to Section 13 of this Guaranty, annually within 90 days after the end of each fiscal year of Guarantor (or at the end of each calendar year with respect to any Guarantor that is an individual), Guarantor must provide Lender with a written certification (“Guarantor Certification”) of the net worth and liquid assets of Guarantor, derived in accordance with customarily acceptable accounting practices. The Guarantor must certify the Guarantor Certification under penalty of perjury as true and complete. |

(c) | Within 30 45 days of receipt of Notice from Lender that Guarantor has failed to maintain the Minimum Net Worth Requirement, Guarantor must either: |

(i) | cause one or more natural persons or entities who individually or collectively, as applicable, meet the Minimum Net Worth Requirement and is/are acceptable to Lender, in its sole discretion, to execute and deliver to Lender a guaranty in the same form as this Guaranty, without any cost or expense to Lender; or |

(ii) | deliver to Lender a letter of credit or other collateral acceptable to Lender in its discretion meeting the following conditions, as applicable: |

Rider to Guaranty - Multistate | Page 1 | |

Minimum Net Worth/Liquidity | ||

(A) | If Guarantor supplies a letter of credit, the letter of credit must be in the form required by Lender and satisfy the requirements for Letters of Credit set forth in Section 11.15 of the Loan Agreement, except that an updated nonconsolidation opinion will not be required. |

(B) | The letter of credit or other collateral must be in an amount equal to the greatest of: |

(X) | the positive difference, if any, obtained by subtracting the net worth identified in the Guarantor Certification from the minimum net worth required under the Minimum Net Worth Requirement, |

(Y) | the positive difference, if any, obtained by subtracting the liquid assets identified in the Guarantor Certification from the minimum liquid assets required under the Minimum Net Worth Requirement, and |

(Z) $100,000.

(d) | Lender will hold the letter of credit or other collateral until one of the following occurs: |

(i) | Lender has a claim against the Guarantor, in which case Lender will be entitled to draw on the letter of credit and apply the proceeds or the other collateral to such claim(s), in Lender’s sole discretion. |

(ii) | Lender returns the letter of credit or other collateral to Guarantor pursuant to Section 20(e). |

(e) | Provided no Event of Default then exists, Guarantor will be entitled to request a return of the unused portion, if any, of the letter of credit or other collateral in the event it delivers to Lender evidence in form and substance reasonably satisfactory to Lender, including a Guarantor Certification, that Guarantor has satisfied the Minimum Net Worth Requirement. |

(f) | If there is more than one Guarantor, Lender will determine compliance with the Minimum Net Worth Requirement based on the aggregate net worth and liquid assets of all Guarantors of the Indebtedness. However, each Guarantor will otherwise satisfy all other requirements of this Section 20 on an individual basis at all times. |

Rider to Guaranty - Multistate | Page 2 | |

Minimum Net Worth/Liquidity | ||

RIDER TO GUARANTY

TERM OF EXISTENCE OF GUARANTOR EXPIRING PRIOR TO MATURITY DATE

(Revised 8-31-2015)

The following changes are made to the Guaranty which precedes this Rider:

A. Section 22 is deleted and replaced with the following:

22. | Term of Existence. |

(a) | At least 6 months prior to the expiration of its term of existence (“Term”) Guarantor must do one of the following (“Fund Expiration Alternatives”): |

(i) | Guarantor must extend its Term to a date that is no earlier than 6 months after the Maturity Date (“Extension”) and provide Lender with Notice of the Extension. |

(ii) | Guarantor must cause one or more natural persons or entities who individually or collectively, as applicable, is/are acceptable to Lender, in its sole discretion, to execute and deliver to Lender a guaranty in the same form as this Guaranty, without any cost or expense to Lender. If the replacement Guarantor is an entity other than a publicly-held REIT, the replacement Guaranty must be modified to include Freddie Mac’s standard form Minimum Net Worth/Liquidity Rider to Guaranty reflecting a minimum net worth requirement of $15,000,000 and a minimum required liquidity of $4,763,000. |

(iii) | Guarantor must deliver to Lender a letter of credit (“Term Extension Letter of Credit”) or other collateral acceptable to Lender, in its discretion, as collateral security for the Loan. If Guarantor delivers a letter of credit, the letter of credit must meet the following conditions: |

(A) | It must satisfy the requirements for Letters of Credit set forth in Section 11.15 of the Loan Agreement. |

(B) | It must be in the amount of $4,763,000. |

(b) | If Guarantor provides the Term Extension Letter of Credit, Guarantor must ensure that the Term Extension Letter of Credit remains in force and effect until the Maturity Date. Guarantor must continuously renew the Term Extension Letter of Credit not later than 30 days prior to the then expiration of the Term Extension Letter of Credit, or Lender may draw upon the Term Extension Letter of Credit as if an Event of Default had occurred. |

Rider to Guaranty - Multistate | Page 1 | |

Term Of Existence of Guarantor Expiring Prior to Maturity Date | ||

(c) | The Lender will hold the Term Extension Letter of Credit or the proceeds until (i) such time as there is a claim against the Guarantor in which case Lender will be entitled to draw on the Term Extension Letter of Credit and apply the proceeds to such claim, or (ii) the Loan is paid in full. The Term Extension Letter of Credit or other collateral delivered by Guarantor to Lender shall be drawn upon and the proceeds thereof applied only to satisfy Guarantor’s obligations under this Guaranty. |

(d) | The requirement to provide a Term Extension Letter of Credit is in addition to, and not in substitution for, any requirement to provide a letter of credit pursuant to the Minimum Net Worth/Liquidity Rider to Guaranty, if applicable. |

(e) | If Guarantor fails to exercise one of the Fund Expiration Alternatives at least 6 months prior to the expiration of the Term (“Term Expiration Date”), Guarantor must deliver to Lender monthly financial statements (each a “Guarantor Financial Statement”) in the form required under Section 6.07(f) of the Loan Agreement. |

(i) | Guarantor must begin delivering the Guarantor Financial Statement on the first day of the month which is 6 months prior to the Term Expiration Date and continue delivering the Guarantor Financial Statement on the first day of every month thereafter until Guarantor exercises one of the Fund Expiration Alternatives. The Guarantor Financial Statement must demonstrate a net worth and liquidity that are acceptable to Lender. |

(ii) | Guarantor must exercise one of the Fund Expiration Alternatives prior to the Term Expiration Date. However, if a Guarantor Financial Statement indicates that Guarantor’s net worth or liquidity is unacceptable to Lender, upon Notice from Lender, Guarantor must immediately exercise one of the Fund Expiration Alternatives. |

(iii) | The Guarantor’s requirements to deliver the Guarantor Financial Statements is in addition to any other requirements set forth in the Loan Documents requiring Guarantor to deliver any financial information (including the Guarantor’s requirements regarding financial covenants set forth in Section 20). |

Rider to Guaranty - Multistate | Page 2 | |

Term Of Existence of Guarantor Expiring Prior to Maturity Date | ||

EXHIBIT A

MODIFICATIONS TO GUARANTY

The following modifications are made to the text of the Guaranty that precedes this Exhibit:

None.

Guaranty - Multistate | Exhibit A - 1 | |