Attached files

| file | filename |

|---|---|

| 8-K - PORTER BANCORP, INC. 8-K - LIMESTONE BANCORP, INC. | a51596332.htm |

Exhibit 99.1

Porter Bancorp, Inc. NASDAQ TICKER ‐PBIB July 26, 2017 1

Porter Bancorp, Inc. ‐ PBIB FORWARD LOOKING STATEMENTS: This presentation contains forward‐looking statements that involve risks and uncertainties. These forward‐looking statements are based on management’s current expectations. Porter Bancorp’s actual results in future periods may differ materially from those currently expected due to various factors, including those risk factors described in documents that the Company files with the Securities and Exchange Commission, including the Company’s most recent Annual Report on Form 10‐K and Quarterly Report on Form 10‐Q. The forward‐looking statements in this presentation are made as of the date of the presentation and Porter Bancorp does not assume any responsibility to update these statements. NON‐GAAP FINANCIAL MEASURES: These slides contain non‐GAAP financial measures. For purposes of Regulation G, a non‐GAAP financial measure is a numerical measure of the registrant’s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, Porter Bancorp, Inc. has provided reconciliations within the slides, as necessary, of the non‐GAAP financial measure to the most directly comparable GAAP financial measure. 2

Porter Bancorp is a Kentucky‐based bank holding company – (NASDAQ: PBIB) PBI Bank is the 14th largest bank domiciled in Kentucky based on total assets Corporate headquarters in Louisville, Ky. Approximately $954 million in assets and 221 associates (fte) at June 30, 2017 Broad scope of high‐quality retail and business banking products & services Management team assembled under leadership of John T. Taylor, President & CEO with extensive market knowledge and community relationships About Porter Bancorp and PBI Bank 3

John T. Taylor President & CEO, Porter Bancorp Chairman, President & CEO, PBI Bank Joined July 2012 Over 30 years in industry American Founders Bank – Lexington, KY PNC Bank, NA – President of Ohio & N. KY Region Phillip W. Barnhouse CFO, Porter Bancorp since January 2012 CFO & COO, PBI Bank Joined Ascencia Bank (Porter Subsidiary) in September 1998 Previous Experience: Arthur Andersen LLP – Chattanooga, TN Stephanie Renner Senior Vice President, General Counsel, PBI Bank Joined August 2012 Previous experience: American Founders Bank Stites & Harbison, PLLC – Lexington, KY Bryan Cave, LLP – Los Angeles, CA Management Team John R. Davis Executive Vice President, Chief Credit Officer, PBI Bank Joined August 2012 25 Years Previous Experience: American Founders Bank – Lexington, KY National City Bank – Louisville, KY and Dayton & Cleveland, OH Joseph C. Seiler Executive Vice President, Head of Commercial Banking, PBI Bank Joined April 2013 25 Years Previous Experience: PNC Bank, NA – Louisville, KY National City Bank – Louisville, KY Tom Swink Senior Vice President, Head of Community Banking, PBI Bank Joined June 2013 25 Years Previous Experience: Fifth Third Bank – Lexington, KY, Cincinnati, OH, and Charlotte, NC 4

W. Glenn Hogan Founder, CEO and President Hogan Real Estate Louisville, KY Director since 2006 Michael T. Levy President Muirfield Insurance LLC Lexington, KY Director since 2014 James M. Parsons Chief Financial Officer Ball Homes LLC Lexington, KY Director since 2015 Board of Directors Bradford T. Ray Retired CEO and Chairman Steel Technologies, Inc. Louisville, KY Director since 2014 W. Kirk Wycoff Managing Partner Patriot Financial Partners LP Philadelphia, PA Director since 2010 Dr. Edmond J. Seifried Principal Seifried & Brew LLC Bethlehem, PA Director since 2015 John T. Taylor President & CEO, Porter Bancorp Chairman, President & CEO, PBI Bank Louisville, KY Director since 2012 5

Talent acquisition – Board, management, and production team Nonperforming asset reduction Enterprise Risk Management system implementation Credit adjudication and centralized operations Regulatory relations Compliance management systems Quality loan production and initiation of deposit mix shift Financial transactions: Q2‐17: Completed $10 million senior borrowing and contributed $9.0 in new capital to PBI Bank Q2‐16: Issued 4 million shares of common stock raising $5.0 million in new capital for Bancorp Q3‐15: Converted $4 million of TRUPS to common equity at $2.6 million discount Q4‐14: Exited TARP program exchanging existing $35 million preferred equity acquired by investors in auction for common and newly issued preferred shares 6

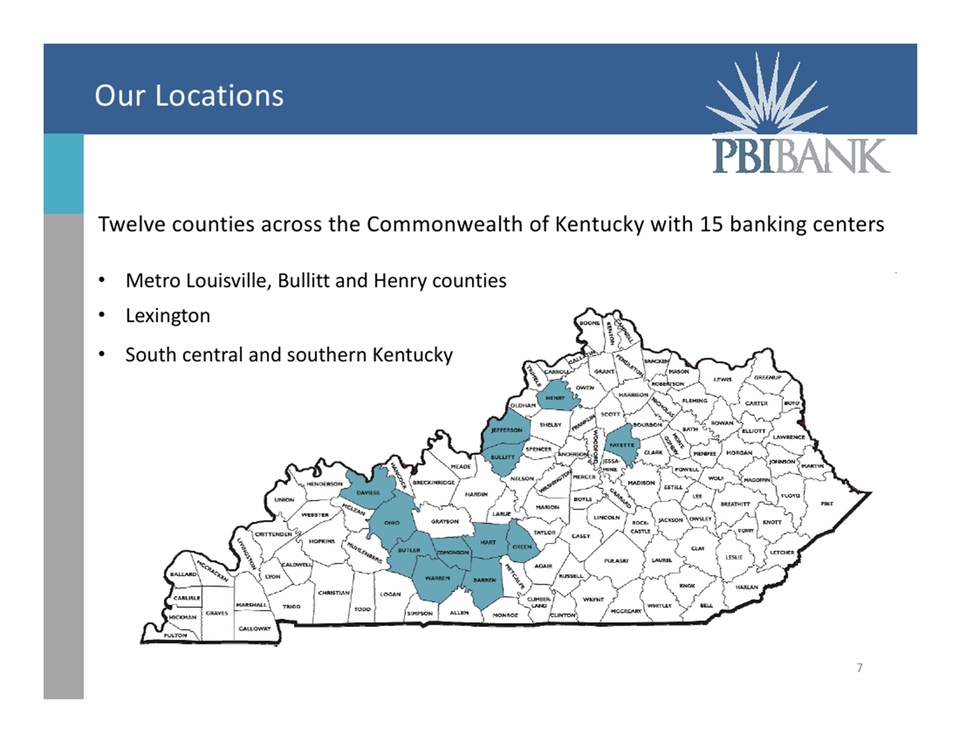

Twelve counties across the Commonwealth of Kentucky with 15 banking centers • Metro Louisville, Bullitt and Henry counties • Lexington • South central and southern Kentucky Our Locations 7

Metro Market Overview 8 Louisville Lexington Owensboro Bowling Green Corporate Headquarters: Brown‐Forman, Churchill Downs, Humana, Kindred Healthcare, Papa Johns, Texas Roadhouse, and Yum! Brands Corporate Headquarters: Fasig Tipton, Jif (peanut butter), Keeneland, Lexmark, and Tempur‐Pedic Corporate Headquarters: Owensboro Health Corporate Headquarters: Camping World, Fruit of the Loom, Houchens Industries, and the Medical Center at Bowling Green Other large employers: UPS, Ford Motor Company, GE Appliances, and Norton Healthcare Other large employers: Toyota, IBM, and Valvoline Other large employers: Kimberly‐Clark, US Bank Mortgage Processing, and Toyotetsu Other large employers: General Motors Corvette plant, Rafferty’s Restaurants Universities: University of Louisville and Bellarmine University Universities: University of Kentucky and Transylvania University Universities: Kentucky Wesleyan University and Brescia University Universities: Western Kentucky University Deposits in Market: $18.6 billion PBI market share 0.7% Note: Four largest cities in Kentucky Deposits in Market: $6.8 billion PBI market share 1.0% Deposits in Market: $3.2 billion PBI market share 1.2% Deposits in Market: $2.2 billion PBI market share 1.4%

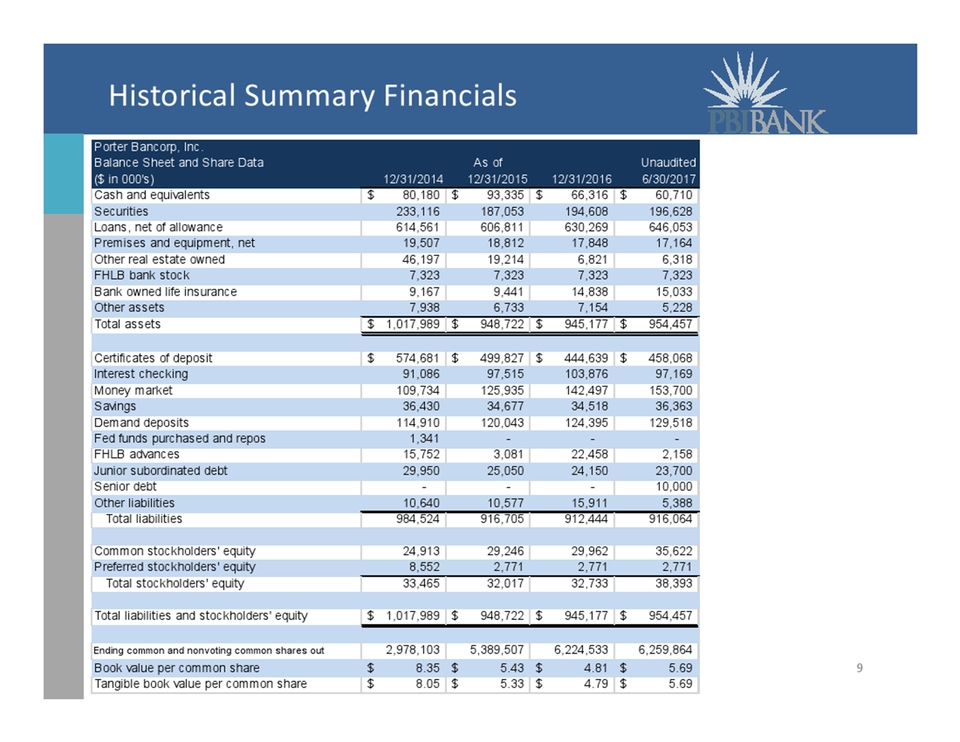

Historical Summary Financials 9 Porter Bancorp, Inc. Balance Sheet and Share Data As of Unaudited ($ in 000's) 12/31/2014 12/31/2015 12/31/2016 6/30/2017 Cash and equivalents $ 80,180 $ 93,335 $ 66,316 $ 60,710 Securities 233,116 187,053 194,608 196,628 Loans, net of allowance 614,561 606,811 630,269 646,053 Premises and equipment, net 19,507 18,812 17,848 17,164 Other real estate owned 46,197 19,214 6 ,821 6,318 FHLB bank stock 7 ,323 7,323 7,323 7,323 Bank owned life insurance 9 ,167 9,441 14,838 15,033 Other assets 7 ,938 6,733 7,154 5,228 Total assets $ 1 ,017,989 $ 948,722 $ 945,177 $ 954,457 Certificates of deposit $ 574,681 $ 499,827 $ 444,639 $ 458,068 Interest checking 91,086 97,515 103,876 97,169 Money market 109,734 125,935 142,497 153,700 Savings 36,430 34,677 34,518 36,363 Demand deposits 114,910 120,043 124,395 129,518 Fed funds purchased and repos 1 ,341 - - - FHLB advances 15,752 3 ,081 22,458 2 ,158 Junior subordinated debt 29,950 25,050 24,150 23,700 Senior debt - - - 10,000 Other liabilities 10,640 10,577 15,911 5 ,388 Total liabilities 984,524 916,705 912,444 916,064 Common stockholders' equity 24,913 29,246 29,962 35,622 Preferred stockholders' equity 8 ,552 2,771 2,771 2,771 Total stockholders' equity 33,465 32,017 32,733 38,393 Total liabilities and stockholders' equity $ 1 ,017,989 $ 948,722 $ 945,177 $ 954,457 Ending common and nonvoting common shares out 2,978,103 5,389,507 6,224,533 6,259,864 Book value per common share $ 8 .35 $ 5.43 $ 4.81 $ 5.69 Tangible book value per common share $ 8 .05 $ 5.33 $ 4.79 $ 5.69

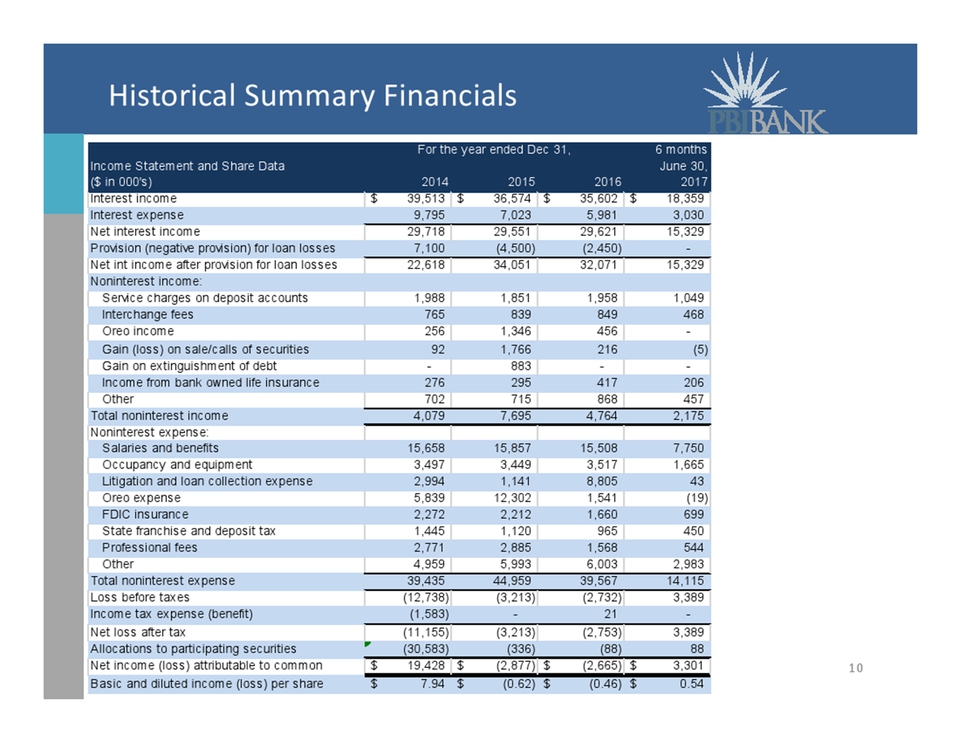

Historical Summary Financials 10 6 months Income Statement and Share Data June 30, ($ in 000's) 2014 2015 2016 2017 Interest income $ 39,513 $ 36,574 $ 35,602 $ 18,359 Interest expense 9 ,795 7,023 5,981 3 ,030 Net interest income 29,718 29,551 29,621 15,329 Provision (negative provision) for loan losses 7 ,100 (4,500) (2,450) - Net int income after provision for loan losses 22,618 34,051 32,071 15,329 Noninterest income: Service charges on deposit accounts 1 ,988 1,851 1,958 1 ,049 Interchange fees 765 839 849 468 Oreo income 256 1,346 456 - Gain (loss) on sale/calls of securities 92 1,766 216 (5) Gain on extinguishment of debt - 883 - - Income from bank owned life insurance 276 295 417 206 Other 702 715 868 457 Total noninterest income 4 ,079 7,695 4,764 2 ,175 Noninterest expense: Salaries and benefits 15,658 15,857 15,508 7 ,750 Occupancy and equipment 3 ,497 3,449 3,517 1 ,665 Litigation and loan collection expense 2 ,994 1,141 8,805 43 Oreo expense 5 ,839 12,302 1,541 (19) FDIC insurance 2 ,272 2,212 1,660 699 State franchise and deposit tax 1 ,445 1,120 965 450 Professional fees 2 ,771 2,885 1,568 544 Other 4 ,959 5,993 6,003 2 ,983 Total noninterest expense 39,435 44,959 39,567 14,115 Loss before taxes (12,738) ( 3,213) (2,732) 3 ,389 Income tax expense (benefit) ( 1,583) - 21 - Net loss after tax (11,155) ( 3,213) (2,753) 3 ,389 Allocations to participating securities (30,583) (336) (88) 88 Net income (loss) attributable to common $ 19,428 $ (2,877) $ (2,665) $ 3,301 Basic and diluted income (loss) per share $ 7 .94 $ (0.62) $ (0.46) $ 0 .54 For the year ended Dec 31,

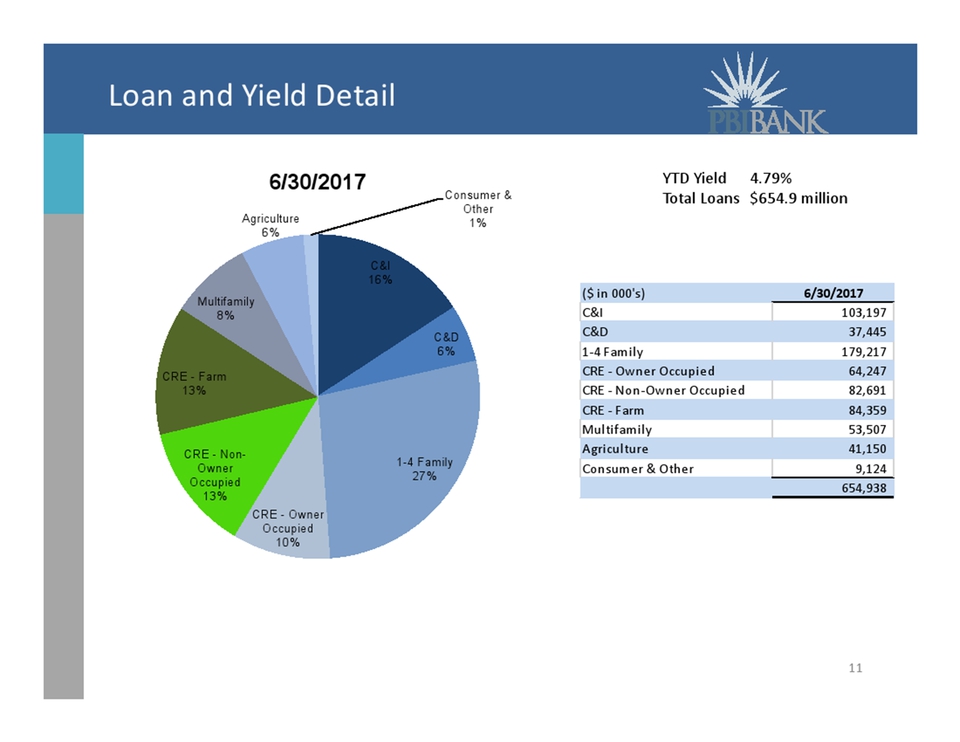

Loan and Yield Detail 11 YTD Yield 4.79% Total Loans $654.9 million ($ in 000's) 6/30/2017 C&I 103,197 C&D 37,445 1‐4 Family 179,217 CRE ‐ Owner Occupied 64,247 CRE ‐ Non‐Owner Occupied 82,691 CRE ‐ Farm 84,359 Multifamily 53,507 Agriculture 41,150 Consumer & Other 9,124 654,938 C&I 16% C&D 6% 1-4 Family 27% CRE – Owner Occupied 10% CRE - Non- Owner Occupied 13% CRE – Farm 13% Multifamily 8% Agriculture 6% Consumer & Other 1% 6/30/2017

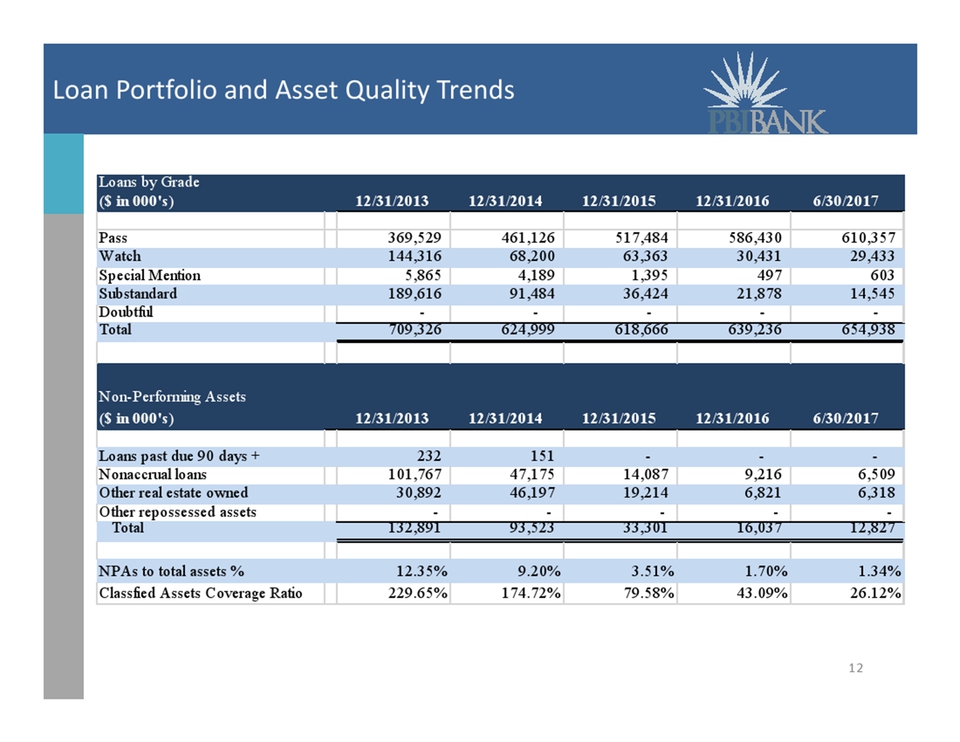

Loan Portfolio and Asset Quality Trends 12 Loans by Grade ($ in 000's) 12/31/2013 12/31/2014 12/31/2015 12/31/2016 6/30/2017 Pass 369,529 461,126 517,484 586,430 610,357 Watch 144,316 68,200 63,363 30,431 29,433 Special Mention 5,865 4,189 1,395 497 603 Substandard 189,616 91,484 36,424 21,878 14,545 Doubtful - - - - - Total 709,326 624,999 618,666 639,236 654,938 Non-Performing Assets ($ in 000's) 12/31/2013 12/31/2014 12/31/2015 12/31/2016 6/30/2017 Loans past due 90 days + 232 151 - - - Nonaccrual loans 101,767 47,175 14,087 9,216 6,509 Other real estate owned 30,892 46,197 19,214 6,821 6,318 Other repossessed assets - - - - - Total 132,891 93,523 33,301 16,037 12,827 NPAs to total assets % 12.35% 9.20% 3.51% 1.70% 1.34% Classfied Assets Coverage Ratio 229.65% 174.72% 79.58% 43.09% 26.12%

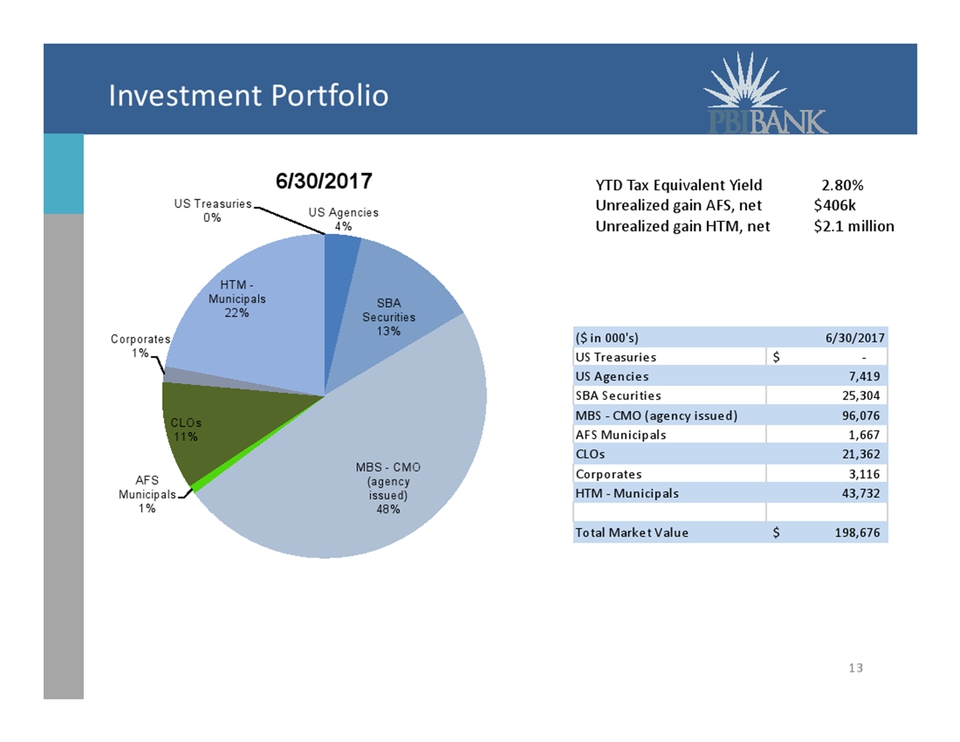

Investment Portfolio 13 YTD Tax Equivalent Yield 2.80% Unrealized gain AFS, net $406k Unrealized gain HTM, net $2.1 million ($ in 000's) 6/30/2017 US Treasuries $ ‐ US Agencies 7,419 SBA Securities 25,304 MBS ‐ CMO (agency issued) 96,076 AFS Municipals 1,667 CLOs 21,362 Corporates 3,116 HTM ‐ Municipals 43,732 Total Market Value $ 198,676 US Treasuries 0% US Agencies 4% SBA Securities 13% MBS – CMO (agency issued) 48% AFS Municipals 1% CLOs 11% Corporates 1% HTM – Municipals 22% 6/30/2017

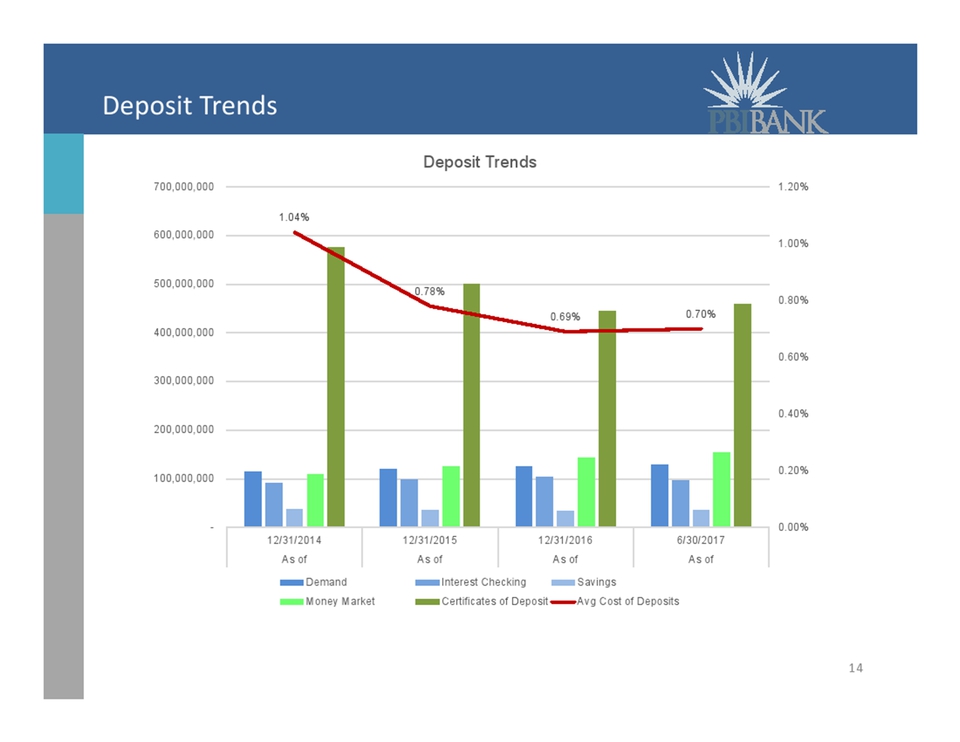

Deposit Trends 14 1.04% 0.78% 0.69% 0.70% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% - 100,000,000 200,000,000 300,000,000 400,000,000 500,000,000 600,000,000 700,000,000 12/31/2014 12/31/2015 12/31/2016 6/30/2017 As of As of As of As of Deposit Trends Demand Interest Checking Savings Money Market Certificates of Deposit Avg Cost of Deposits

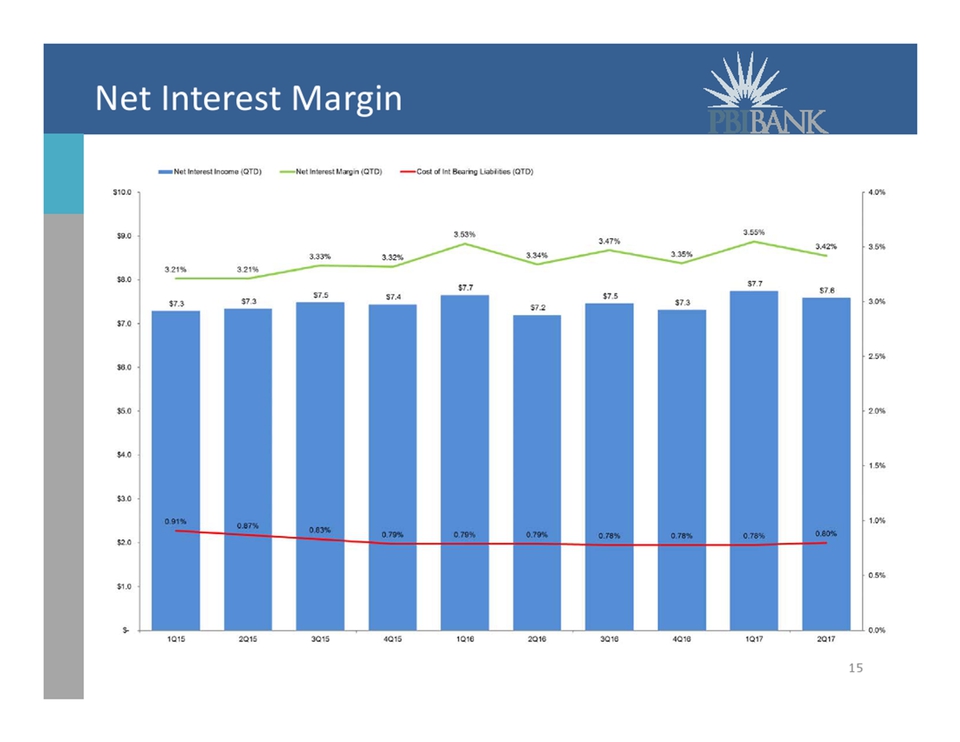

Net Interest Margin 15 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 $10.0 $9.0 $8.0 $7.0 $6.0 $5.0 $4.0 $3.0 $2.0 $1.0 $- 0.91% 0.87% 0.83% 0.79% 0.78% 0.80% $7.3 $7.5 $7.4 $7.7 $7.2 $7.3 $7.7 $7.6 3.21% 3.33% 3.32% 3.53% 3.34% 3.47% 3.35% 3.55% 3.42%

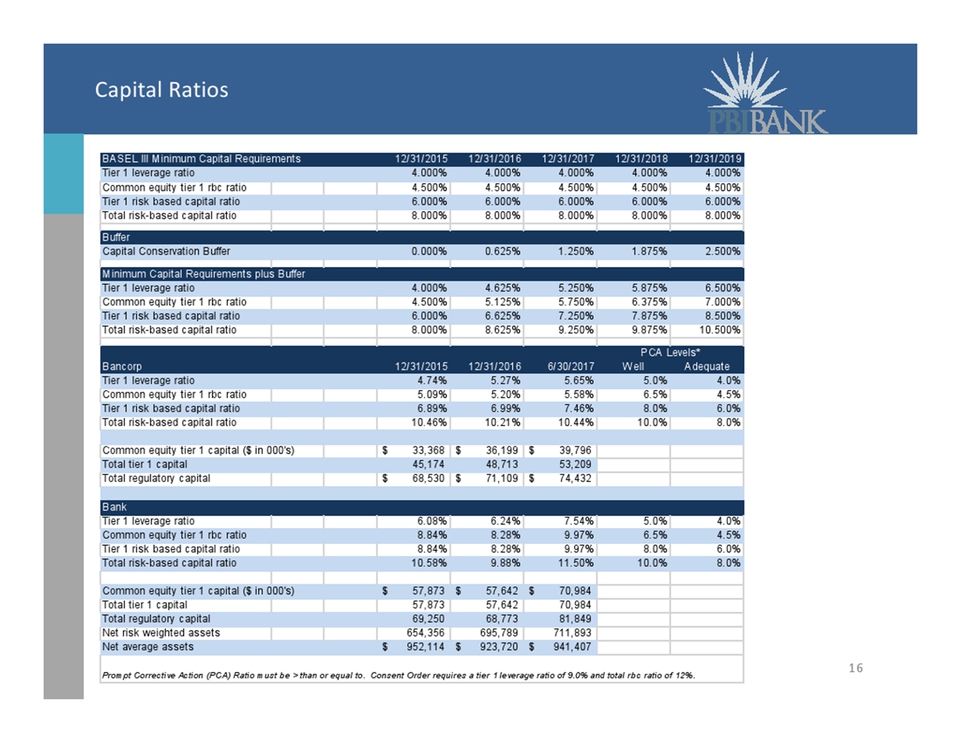

Capital Ratios 16 BASEL III Minimum Capital Requirements 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 Tier 1 leverage ratio 4.000% 4.000% 4.000% 4.000% 4.000% Common equity tier 1 rbc ratio 4.500% 4.500% 4.500% 4.500% 4.500% Tier 1 risk based capital ratio 6.000% 6.000% 6.000% 6.000% 6.000% Total risk-based capital ratio 8.000% 8.000% 8.000% 8.000% 8.000% Buffer Capital Conservation Buffer 0.000% 0.625% 1.250% 1.875% 2.500% Minimum Capital Requirements plus Buffer Tier 1 leverage ratio 4.000% 4.625% 5.250% 5.875% 6.500% Common equity tier 1 rbc ratio 4.500% 5.125% 5.750% 6.375% 7.000% Tier 1 risk based capital ratio 6.000% 6.625% 7.250% 7.875% 8.500% Total risk-based capital ratio 8.000% 8.625% 9.250% 9.875% 10.500% Bancorp 12/31/2015 12/31/2016 6/30/2017 Well Adequate Tier 1 leverage ratio 4.74% 5.27% 5.65% 5.0% 4.0% Common equity tier 1 rbc ratio 5.09% 5.20% 5.58% 6.5% 4.5% Tier 1 risk based capital ratio 6.89% 6.99% 7.46% 8.0% 6.0% Total risk-based capital ratio 10.46% 10.21% 10.44% 10.0% 8.0% Common equity tier 1 capital ($ in 000's) $ 33,368 $ 36,199 $ 39,796 Total tier 1 capital 45,174 48,713 53,209 Total regulatory capital $ 68,530 $ 71,109 $ 74,432 Bank Tier 1 leverage ratio 6.08% 6.24% 7.54% 5.0% 4.0% Common equity tier 1 rbc ratio 8.84% 8.28% 9.97% 6.5% 4.5% Tier 1 risk based capital ratio 8.84% 8.28% 9.97% 8.0% 6.0% Total risk-based capital ratio 10.58% 9.88% 11.50% 10.0% 8.0% Common equity tier 1 capital ($ in 000's) $ 57,873 $ 57,642 $ 70,984 Total tier 1 capital 57,873 57,642 70,984 Total regulatory capital 69,250 68,773 81,849 Net risk weighted assets 654,356 695,789 711,893 Net average assets $ 952,114 $ 923,720 $ 941,407 PCA Levels* Prompt Corrective Action (PCA) Ratio must be > than or equal to. Consent Order requires a tier 1 leverage ratio of 9.0% and total rbc ratio of 12%.

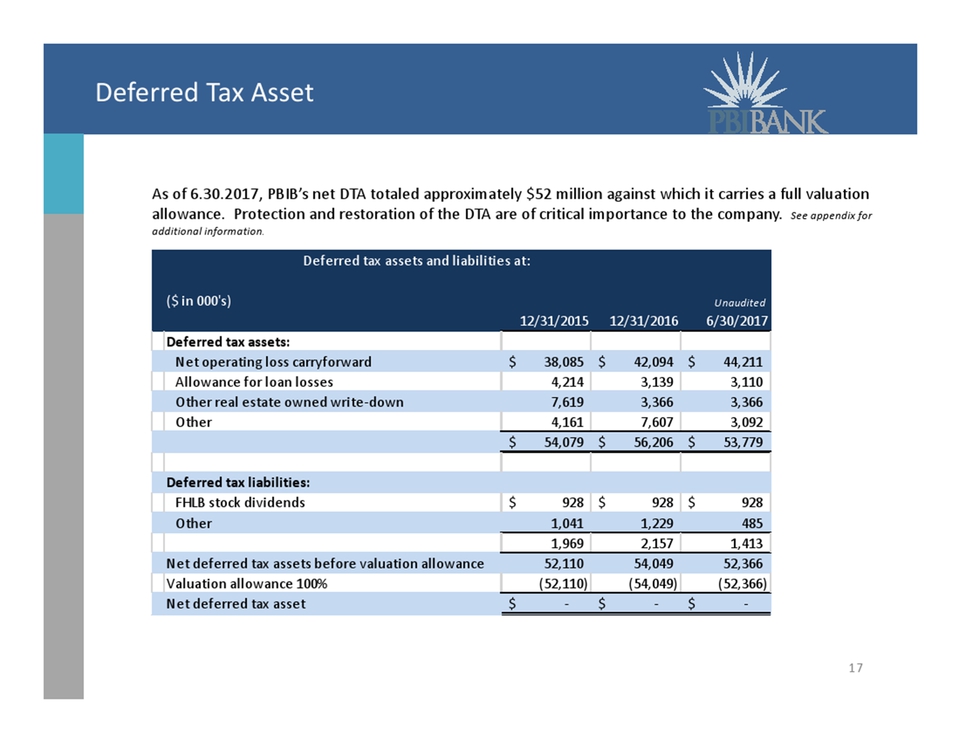

As of 6.30.2017, PBIB’s net DTA totaled approximately $52 million against which it carries a full valuation allowance. Protection and restoration of the DTA are of critical importance to the company. See appendix for additional information. Deferred Tax Asset 17 ($ in 000's) Unaudited 12/31/2015 12/31/2016 6/30/2017 Deferred tax assets: Net operating loss carryforward $ 38,085 $ 42,094 $ 44,211 Allowance for loan losses 4,214 3 ,139 3,110 Other real estate owned write‐down 7,619 3 ,366 3,366 Other 4,161 7 ,607 3,092 $ 54,079 $ 56,206 $ 53,779 Deferred tax liabilities: FHLB stock dividends $ 928 $ 928 $ 928 Other 1,041 1 ,229 485 1,969 2 ,157 1,413 Net deferred tax assets before valuation allowance 52,110 54,049 52,366 Valuation allowance 100% (52,110) ( 54,049) (52,366) Net deferred tax asset $ ‐ $ ‐ $ ‐ Deferred tax assets and liabilities at:

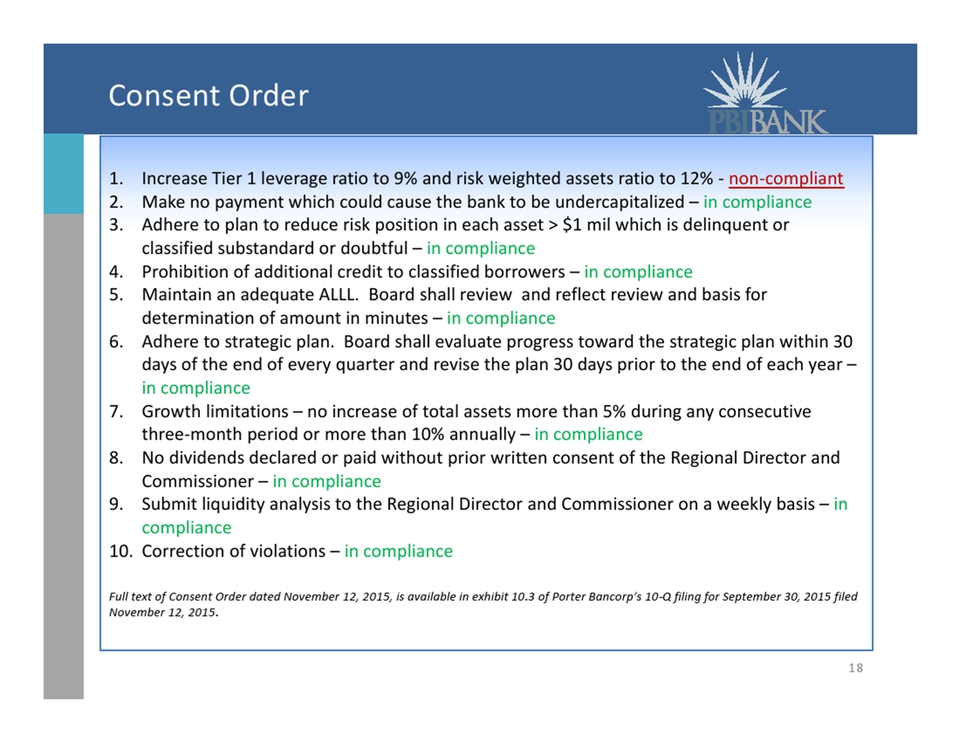

Consent Order 18 1. Increase Tier 1 leverage ratio to 9% and risk weighted assets ratio to 12% ‐ non‐compliant 2. Make no payment which could cause the bank to be undercapitalized – in compliance 3. Adhere to plan to reduce risk position in each asset > $1 mil which is delinquent or classified substandard or doubtful – in compliance 4. Prohibition of additional credit to classified borrowers – in compliance 5. Maintain an adequate ALLL. Board shall review and reflect review and basis for determination of amount in minutes – in compliance 6. Adhere to strategic plan. Board shall evaluate progress toward the strategic plan within 30 days of the end of every quarter and revise the plan 30 days prior to the end of each year – in compliance 7. Growth limitations – no increase of total assets more than 5% during any consecutive three‐month period or more than 10% annually – in compliance 8. No dividends declared or paid without prior written consent of the Regional Director and Commissioner – in compliance 9. Submit liquidity analysis to the Regional Director and Commissioner on a weekly basis – in compliance 10. Correction of violations – in compliance Full text of Consent Order dated November 12, 2015, is available in exhibit 10.3 of Porter Bancorp’s 10‐Q filing for September 30, 2015 filed November 12, 2015.

Appendix – Additional Information 19 • Shareholders and percentage ownership • Deferred tax asset analysis • Senior debt and Junior subordinated debt details (Trups) • Additional information is available in Porter Bancorp Inc.’s public filings on form 10‐K, 10Q, and 8‐K. Porter trades on the NASDAQ index under the ticker symbol PBIB. Our investor relations website is located at www.pbibank.com.

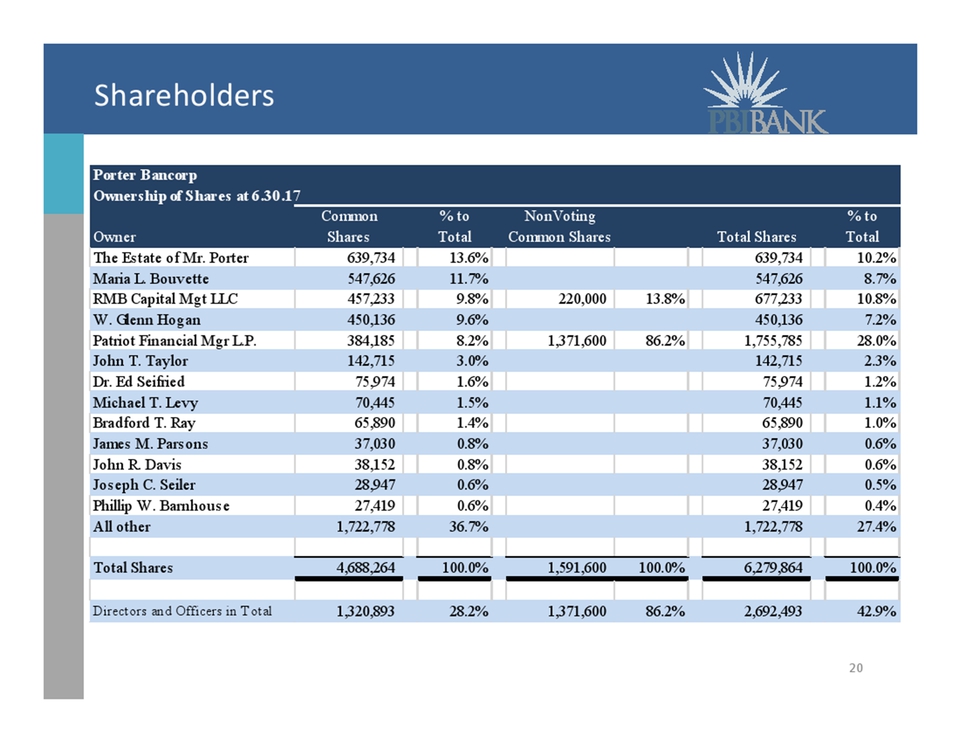

Shareholders 20 Porter Bancorp Ownership of Shares at 6.30.17 Common % to NonVoting % to Owner Shares Total Common Shares Total Shares Total The Estate of Mr. Porter 639,734 13.6% 639,734 10.2% Maria L. Bouvette 547,626 11.7% 547,626 8.7% RMB Capital Mgt LLC 457,233 9.8% 220,000 13.8% 677,233 10.8% W. Glenn Hogan 4 50,136 9.6% 450,136 7.2% Patriot Financial Mgr L.P. 384,185 8.2% 1,371,600 86.2% 1,755,785 28.0% John T. Taylor 1 42,715 3.0% 142,715 2.3% Dr. Ed Seifried 7 5,974 1.6% 75,974 1.2% Michael T. Levy 7 0,445 1.5% 70,445 1.1% Bradford T. Ray 6 5,890 1.4% 65,890 1.0% James M. Parsons 3 7,030 0.8% 37,030 0.6% John R. Davis 3 8,152 0.8% 38,152 0.6% Joseph C. Seiler 2 8,947 0.6% 28,947 0.5% Phillip W. Barnhouse 2 7,419 0.6% 27,419 0.4% All other 1,722,778 36.7% 1,722,778 27.4% Total Shares 4,688,264 100.0% 1,591,600 100.0% 6,279,864 100.0% Directors and Officers in Total 1,320,893 28.2% 1,371,600 86.2% 2,692,493 42.9%

Deferred Tax Asset (DTA) 21 As of 6.30.2017, PBIB’s net DTA totaled approximately $52.3 million against which it carries a full valuation allowance. • The valuation allowance can be reversed over time to offset future taxable income. • Currently, none of the deferred tax asset is included in regulatory capital. • DTA capital accretion presents an attractive upside potential and capital enhancement to new investors. • Section 382 of the Internal Revenue Code governs DTA impairment and “ownership change”. • An “ownership change” is defined as a more than 50% change in ownership – complex assessment . • 382 imposes an annual ceiling on future use of the Company’s NOLs, credit carry‐forwards and built‐in losses. • Tends to slow rate of NOL utilization (reducing present value of tax savings). • Some NOLs and other tax benefits could expire before utilization is allowed. • In June 2015, PBIB adopted a tax benefits preservation plan. • Under Section 382 of the IRS Code, a permanent impairment of a substantial portion of the DTA could be triggered if shareholders owning 5% or more of the Company increase their ownership by more than 50 percentage points over a defined period of time. • The tax benefits preservation plan is designed to reduce the likelihood of an “ownership change”. • Any shareholder or group that acquires ownership of 5% or more of the Company could be subject to significant dilution in its holdings if our Board does not approve such acquisition. • Existing shareholders of 5% or more are also subject to dilution if they increase their holdings without Board approval. • In September 2015, shareholders approved an amendment to the articles of incorporation to further protect the long‐term value of the Company’s NOLs. • The amendment provides a means to block transfers of our common shares that could result in an ownership change under Section 382.

Senior Debt 22 Loan amount: $10.0 million – Issued June 30, 2017 Term: 5 years Rate: Three month libor + 250% thereafter Repay terms: Interest only quarterly; principal in the amount of $250,000 per quarter beginning at end of quarter 13 through quarter 20 with all unpaid principal due at maturity. Prepayment: Pre‐payable without penalty Collateral: 100% of PBI Bank, Inc. common stock Use of proceeds: $9 million capital contribution to PBI Bank Other: $1.0 million retained by lender in pre‐paid interest escrow for interest service

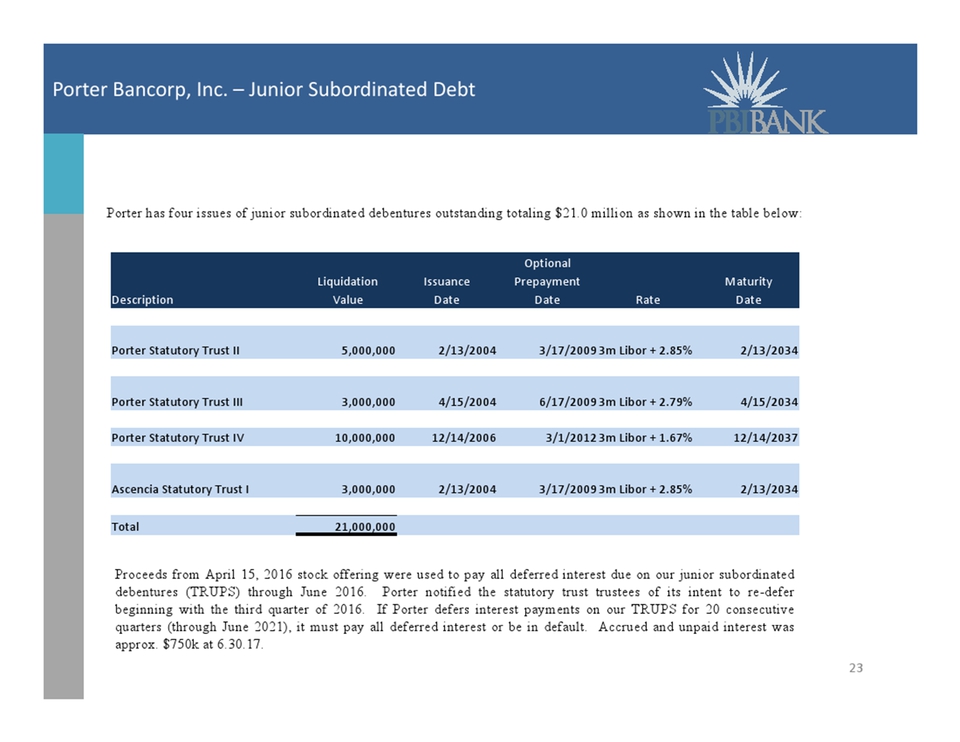

Porter Bancorp, Inc. – Junior Subordinated Debt Porter has four issues of junior subordinated debentures outstanding totaling $21.0 million as shown in the table below: 23 Proceeds from April 15, 2016 stock offering were used to pay all deferred interest due on our junior subordinated debentures (TRUPS) through June 2016. Porter notified the statutory trust trustees of its intent to re-defer beginning with the third quarter of 2016. If Porter defers interest payments on our TRUPS for 20 consecutive quarters (through June 2021), it must pay all deferred interest or be in default. Accrued and unpaid interest was approx. $750k at 6.30.17. Optional Liquidation Issuance Prepayment Maturity Description Value Date Date Rate Date Porter Statutory Trust II 5,000,000 2/13/2004 3/17/20093m Libor + 2.85% 2/13/2034 Porter Statutory Trust III 3,000,000 4/15/2004 6/17/20093m Libor + 2.79% 4/15/2034 Porter Statutory Trust IV 10,000,000 12/14/2006 3/1/20123m Libor + 1.67% 12/14/2037 Ascencia Statutory Trust I 3,000,000 2/13/2004 3/17/20093m Libor + 2.85% 2/13/2034 Total 21,000,000

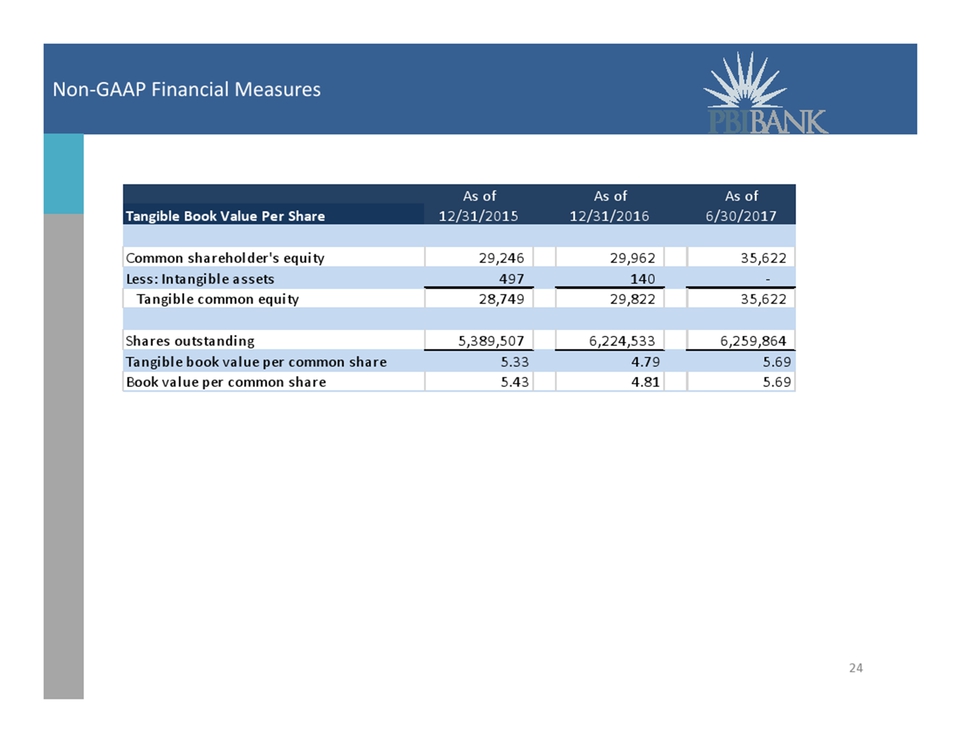

Non‐GAAP Financial Measures 24 As of As of As of Tangible Book Value Per Share 12/31/2015 12/31/2016 6/30/2017 Common shareholder's equity 29,246 29,962 35,622 Less: Intangible assets 497 140 ‐ Tangible common equity 28,749 29,822 35,622 Shares outstanding 5 ,389,507 6,224,533 6,259,864 Tangible book value per common share 5.33 4.79 5.69 Book value per common share 5.43