Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - POPULAR, INC. | d429029d8k.htm |

Investor Presentation Second Quarter 2017 Exhibit 99.1

Cautionary Note Regarding Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the U.S Private Securities Litigation Reform Act of 1995. These forward-looking statements may relate to Popular, Inc’s (the “Corporation”, “we”, “us”, “our”) financial condition, results of operations, plans, objectives, future performance and business, including, but not limited to, statements with respect to the adequacy of the allowance for loan losses, delinquency trends, market risk and the impact of interest rate changes, capital market conditions, capital adequacy and liquidity, the anticipated impacts of our acquisition of certain assets and deposits and the effect of legal proceedings and new accounting standards on the Corporation’s financial condition and results of operations. All statements contained herein that are not clearly historical in nature are forward-looking, and the words “anticipate”, “believe”, “continues”, “expect”, “estimate”, “intend”, “project” and similar expressions and future or conditional verbs such as “will”, “would”, “should”, “could”, “might”, “can”, “may” or similar expressions are generally intended to identify forward-looking statements. Forward-looking statements are not guarantees of future performance are based on management’s current expectations and, by their nature, involve certain risks, uncertainties, estimates and assumptions by management that are difficult to predict. Various factors, some of which are beyond the Corporation’s control, could cause actual results to differ materially from those expressed in, or implied by, such forward-looking statements. Please refer to our Annual Report on Form 10-K for the year ended December 31, 2016, the Quarterly Report on Form 10-Q for the quarter ended March 31, 2017, and our other filings with the Securities and Exchange Commission for a discussion of some of the risks and important factors that could cause such differences and otherwise affect the Corporation’s future results and financial condition. Those filings are available on the Corporation’s website (www.popular.com) and on the Securities and Exchange Commission website (www.SEC.gov). The Corporation does not undertake to update or revise any forward-looking statement to reflect occurrences or unanticipated events or circumstances that may arise after the date of such statements.

2 NPLs decreased by $28 million QoQ; ratio at 2.4% NPL inflows, excluding consumer loans, down by $20 million QoQ NCO ratio increased to 1.01% from 0.63% in previous quarter Credit (excluding covered loans) Net income of $96.2 million Strong margins: Popular, Inc. 4.02%, BPPR 4.36% Earnings Robust capital; Common Equity Tier 1 Capital ratio of 16.7% Tangible book value per share of $44.71 Capital Q2 2017 Highlights Commercial loan growth QoQ: P.R. - $92 million, or 1.3% U.S. - $144 million, or 3.8% Deposit cost: P.R. - 0.33% compared to 0.35% in Q1 U.S. - 0.81% in line with prior quarter Gross revenues strong at $491 million, increasing $13 million QoQ Quarter Highlights

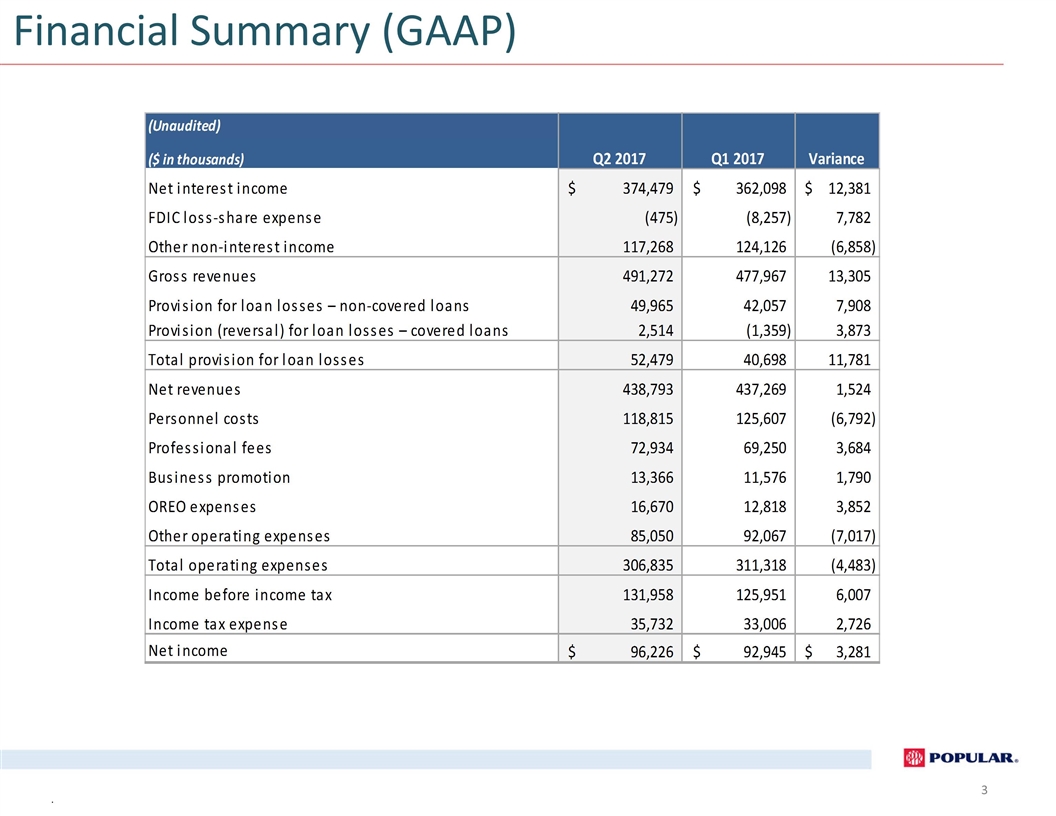

. Financial Summary (GAAP)

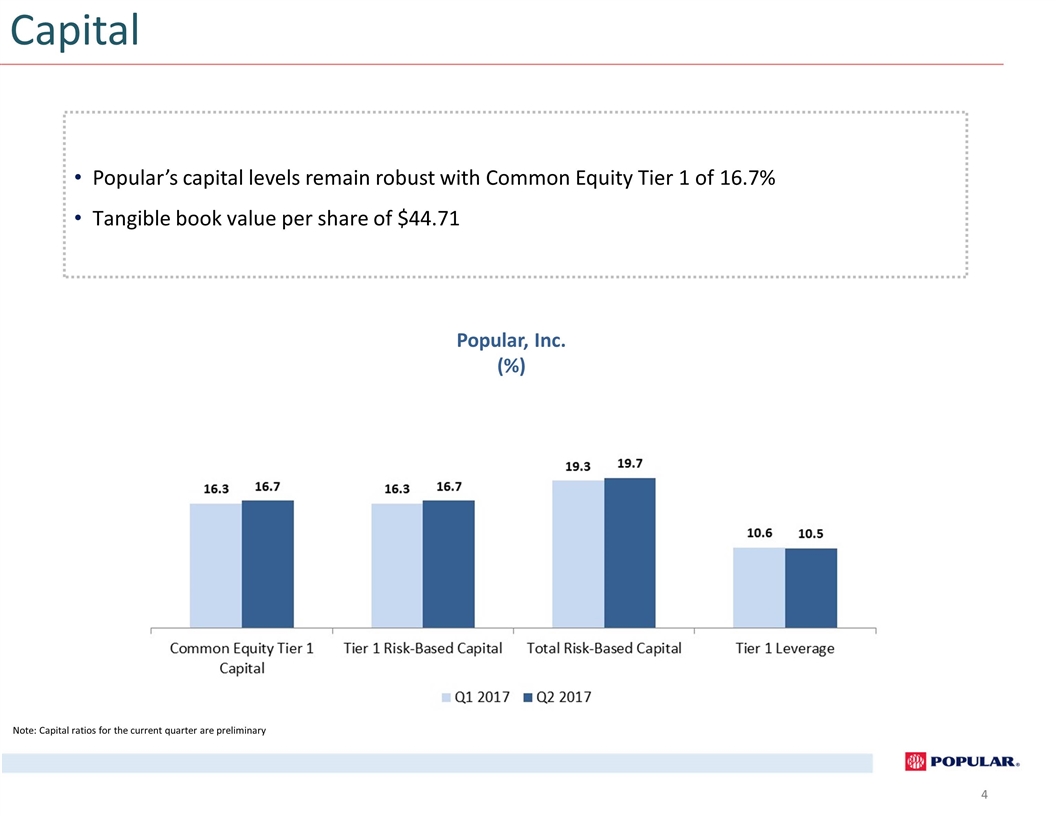

Capital Popular’s capital levels remain robust with Common Equity Tier 1 of 16.7% Tangible book value per share of $44.71 Popular, Inc. (%) Note: Capital ratios for the current quarter are preliminary

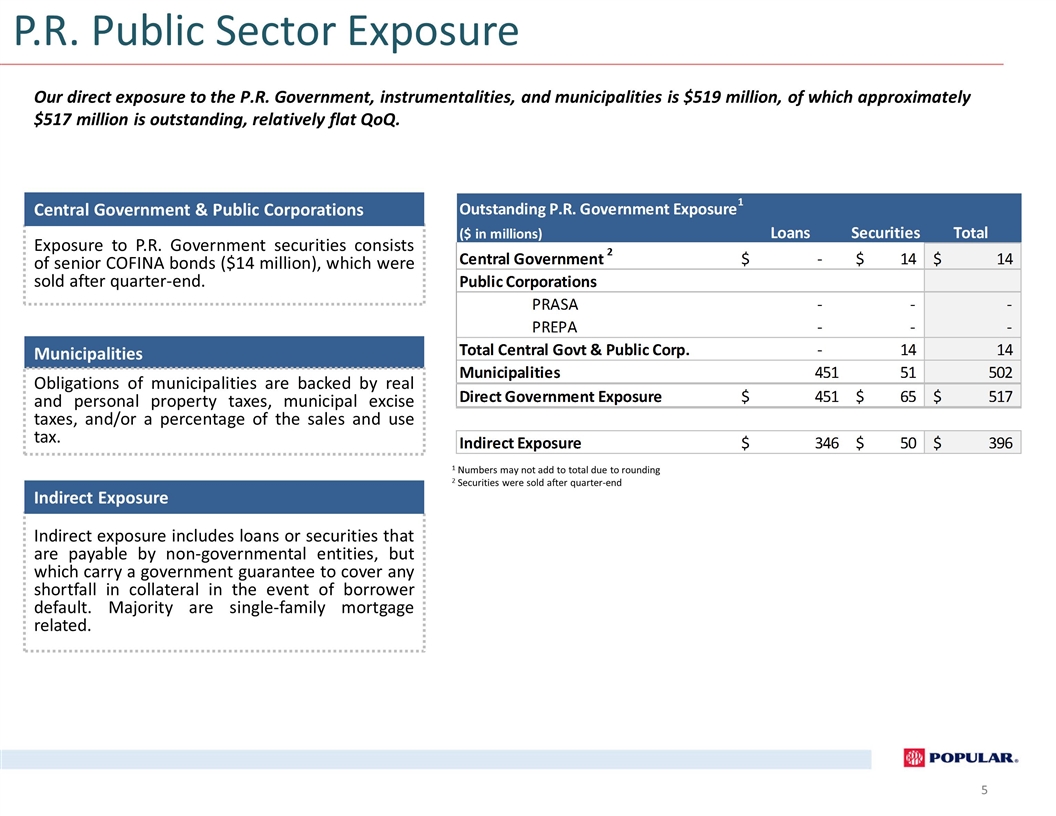

Our direct exposure to the P.R. Government, instrumentalities, and municipalities is $519 million, of which approximately $517 million is outstanding, relatively flat QoQ. Exposure to P.R. Government securities consists of senior COFINA bonds ($14 million), which were sold after quarter-end. Central Government & Public Corporations Municipalities Obligations of municipalities are backed by real and personal property taxes, municipal excise taxes, and/or a percentage of the sales and use tax. 5 Indirect exposure includes loans or securities that are payable by non-governmental entities, but which carry a government guarantee to cover any shortfall in collateral in the event of borrower default. Majority are single-family mortgage related. Indirect Exposure 1 Numbers may not add to total due to rounding 2 Securities were sold after quarter-end P.R. Public Sector Exposure

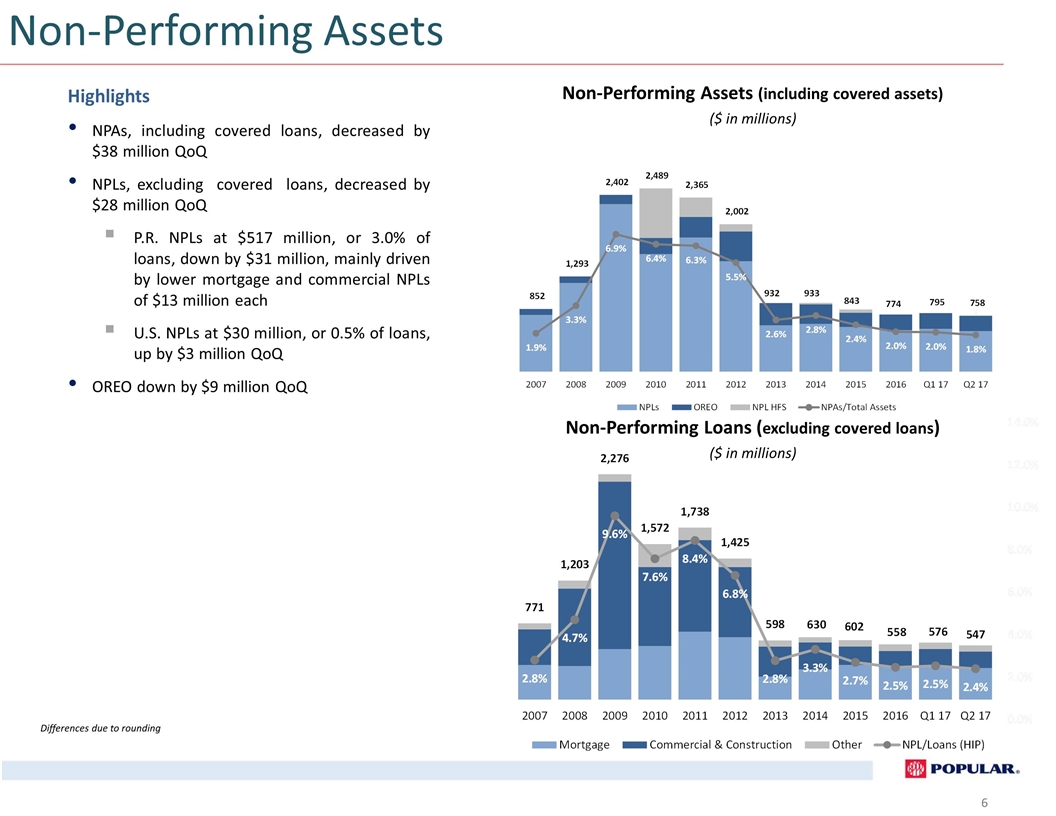

Non-Performing Assets Highlights NPAs, including covered loans, decreased by $38 million QoQ NPLs, excluding covered loans, decreased by $28 million QoQ P.R. NPLs at $517 million, or 3.0% of loans, down by $31 million, mainly driven by lower mortgage and commercial NPLs of $13 million each U.S. NPLs at $30 million, or 0.5% of loans, up by $3 million QoQ OREO down by $9 million QoQ Differences due to rounding 1 Non-Performing Assets (including covered assets) ($ in millions) Non-Performing Loans (excluding covered loans) ($ in millions)

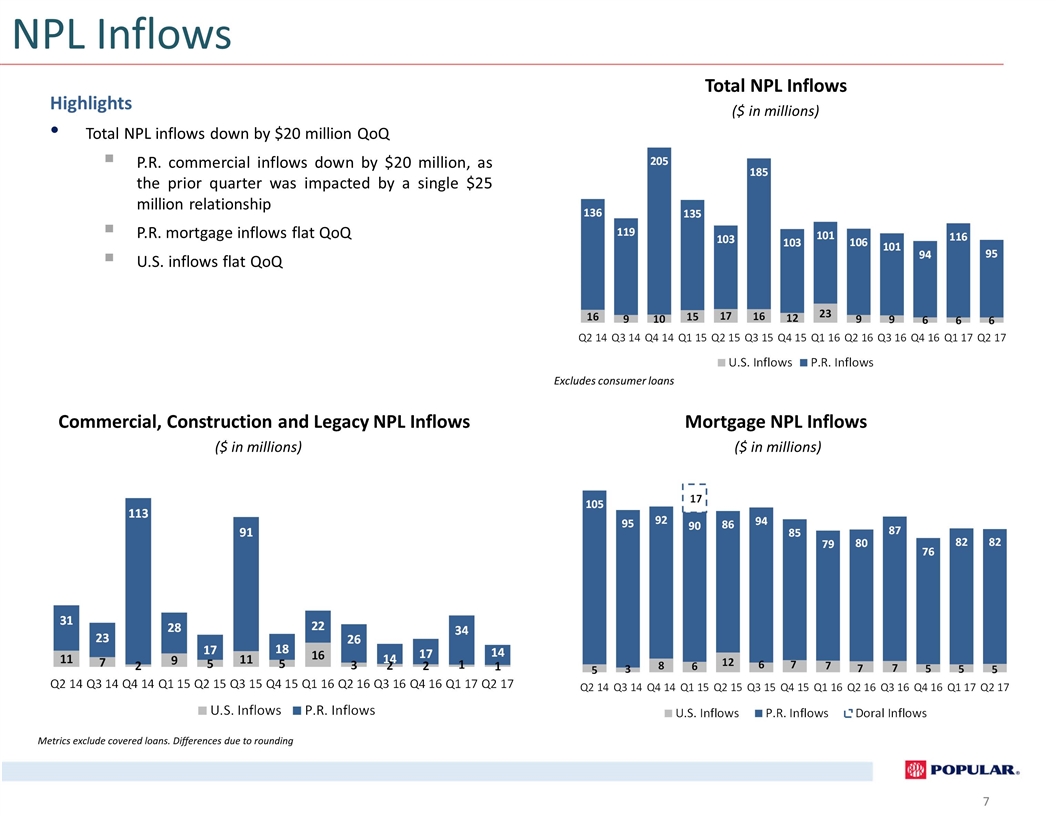

NPL Inflows Total NPL Inflows ($ in millions) Highlights Total NPL inflows down by $20 million QoQ P.R. commercial inflows down by $20 million, as the prior quarter was impacted by a single $25 million relationship P.R. mortgage inflows flat QoQ U.S. inflows flat QoQ Excludes consumer loans Mortgage NPL Inflows ($ in millions) Commercial, Construction and Legacy NPL Inflows ($ in millions) Metrics exclude covered loans. Differences due to rounding

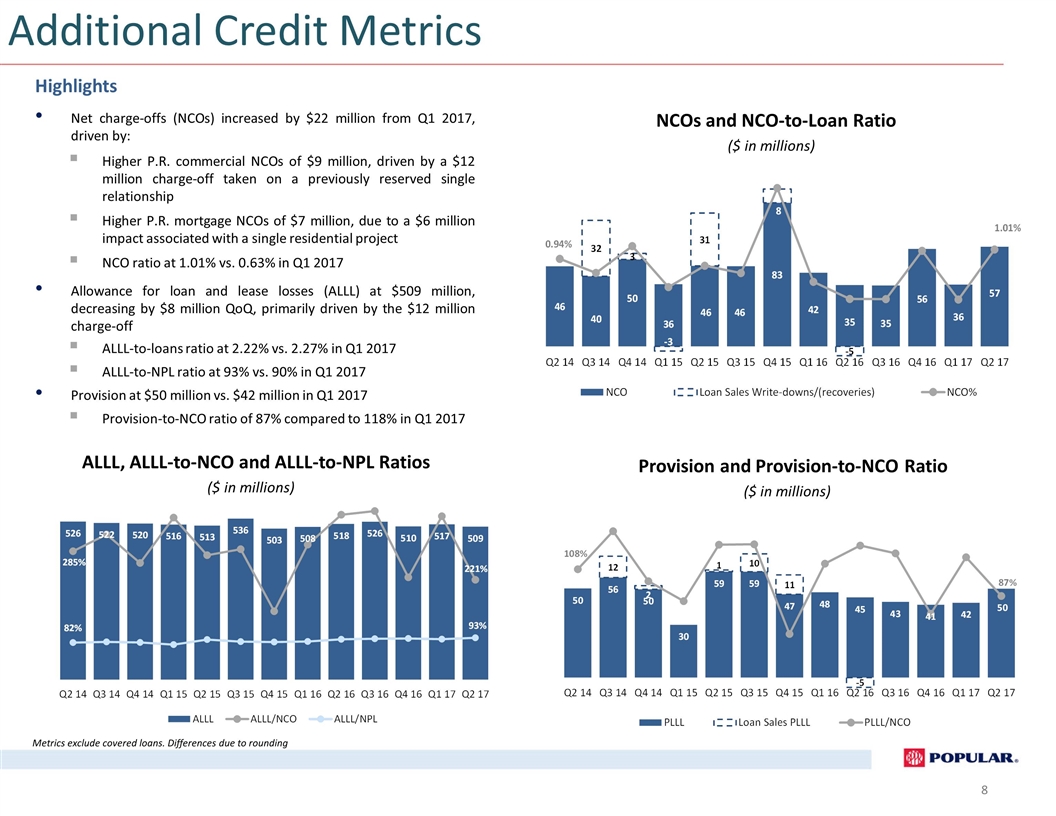

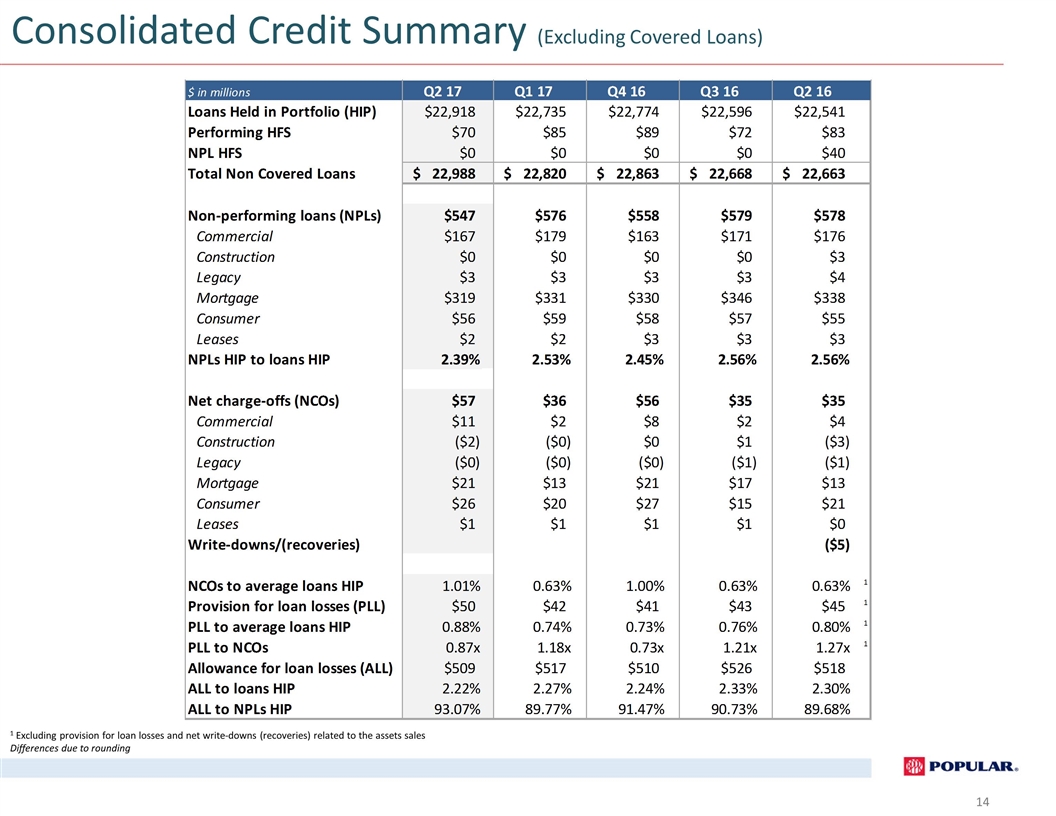

NCOs and NCO-to-Loan Ratio ($ in millions) Provision and Provision-to-NCO Ratio ($ in millions) Highlights Net charge-offs (NCOs) increased by $22 million from Q1 2017, driven by: Higher P.R. commercial NCOs of $9 million, driven by a $12 million charge-off taken on a previously reserved single relationship Higher P.R. mortgage NCOs of $7 million, due to a $6 million impact associated with a single residential project NCO ratio at 1.01% vs. 0.63% in Q1 2017 Allowance for loan and lease losses (ALLL) at $509 million, decreasing by $8 million QoQ, primarily driven by the $12 million charge-off ALLL-to-loans ratio at 2.22% vs. 2.27% in Q1 2017 ALLL-to-NPL ratio at 93% vs. 90% in Q1 2017 Provision at $50 million vs. $42 million in Q1 2017 Provision-to-NCO ratio of 87% compared to 118% in Q1 2017 Metrics exclude covered loans. Differences due to rounding 8 ALLL, ALLL-to-NCO and ALLL-to-NPL Ratios ($ in millions) Additional Credit Metrics

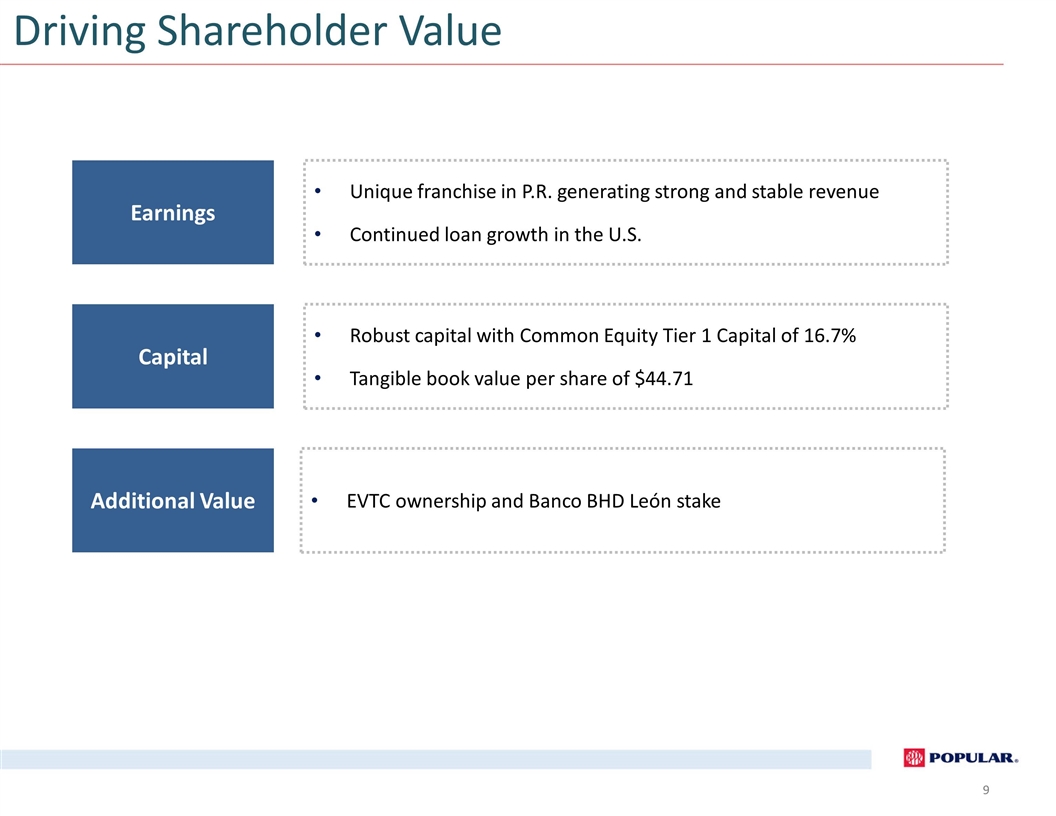

Capital Robust capital with Common Equity Tier 1 Capital of 16.7% Tangible book value per share of $44.71 Earnings Unique franchise in P.R. generating strong and stable revenue Continued loan growth in the U.S. Additional Value EVTC ownership and Banco BHD León stake Driving Shareholder Value

Investor Presentation Second Quarter 2017 Appendix

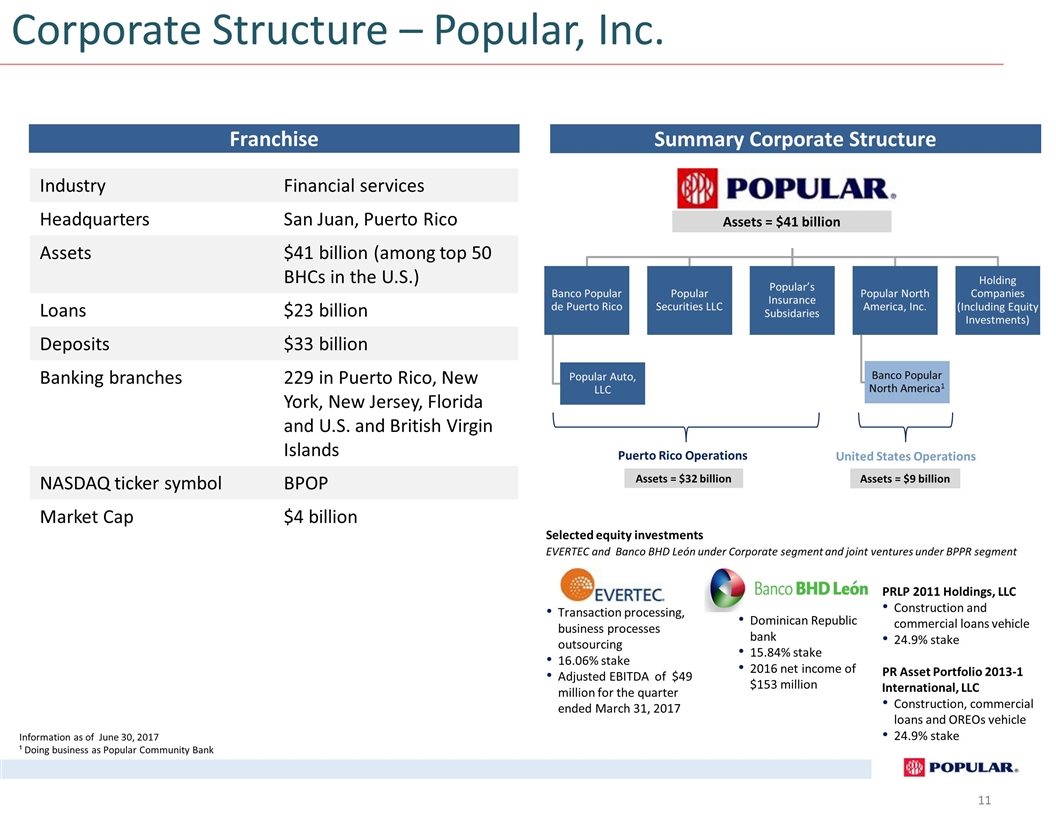

Who We Are – Popular, Inc. Franchise Summary Corporate Structure Assets = $41 billion Assets = $32 billion Assets = $9 billion Puerto Rico Operations United States Operations Selected equity investments EVERTEC and Banco BHD León under Corporate segment and joint ventures under BPPR segment Transaction processing, business processes outsourcing 16.06% stake Adjusted EBITDA of $49 million for the quarter ended March 31, 2017 Dominican Republic bank 15.84% stake 2016 net income of $153 million PRLP 2011 Holdings, LLC Construction and commercial loans vehicle 24.9% stake PR Asset Portfolio 2013-1 International, LLC Construction, commercial loans and OREOs vehicle 24.9% stake Corporate Structure – Popular, Inc. Industry Financial services Headquarters San Juan, Puerto Rico Assets $41 billion (among top 50 BHCs in the U.S.) Loans $23 billion Deposits $33 billion Banking branches 229 in Puerto Rico, New York, New Jersey, Florida and U.S. and British Virgin Islands NASDAQ ticker symbol BPOP Market Cap $4 billion Information as of June 30, 2017 ¹ Doing business as Popular Community Bank Banco Popular de Puerto Rico Popular’s Insurance Subsidaries Popular North America, Inc. Popular Securities LLC Holding Companies (Including Equity Investments) Banco Popular North America 1 Popular Auto, LLC

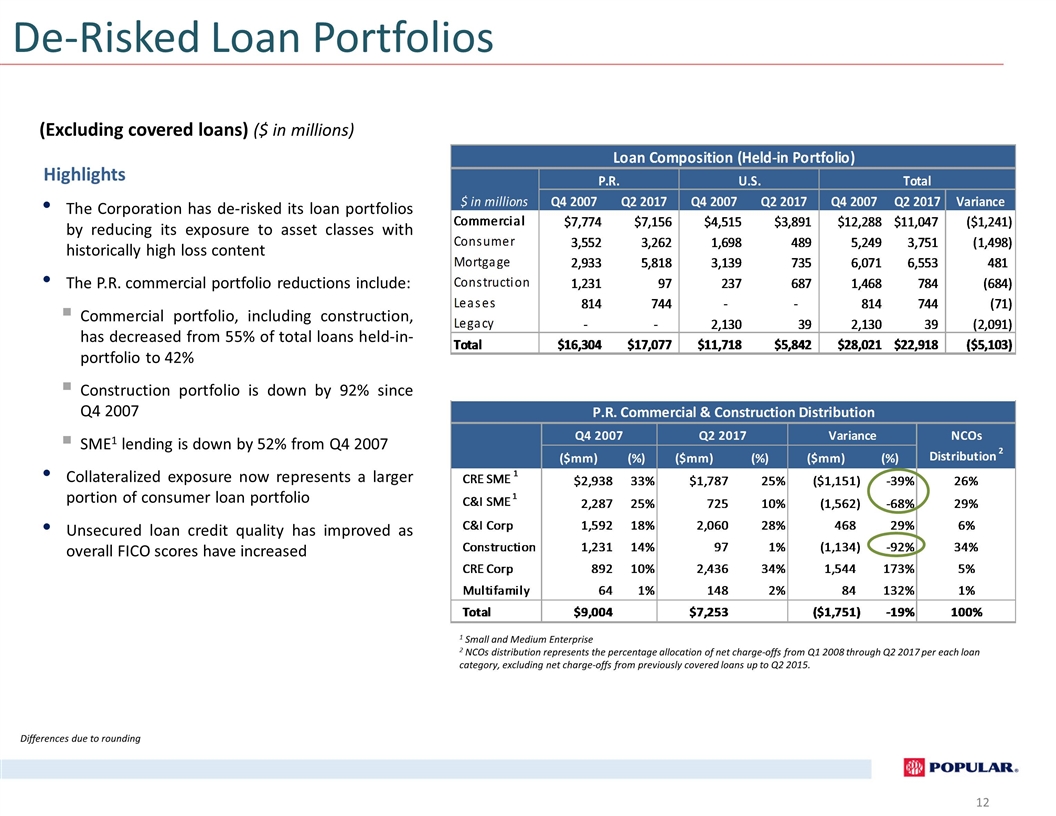

De-Risked Loan Portfolios The Corporation has de-risked its loan portfolios by reducing its exposure to asset classes with historically high loss content The P.R. commercial portfolio reductions include: Commercial portfolio, including construction, has decreased from 55% of total loans held-in-portfolio to 42% Construction portfolio is down by 92% since Q4 2007 SME1 lending is down by 52% from Q4 2007 Collateralized exposure now represents a larger portion of consumer loan portfolio Unsecured loan credit quality has improved as overall FICO scores have increased (Excluding covered loans) ($ in millions) Highlights 1 Small and Medium Enterprise 2 NCOs distribution represents the percentage allocation of net charge-offs from Q1 2008 through Q2 2017 per each loan category, excluding net charge-offs from previously covered loans up to Q2 2015. Differences due to rounding

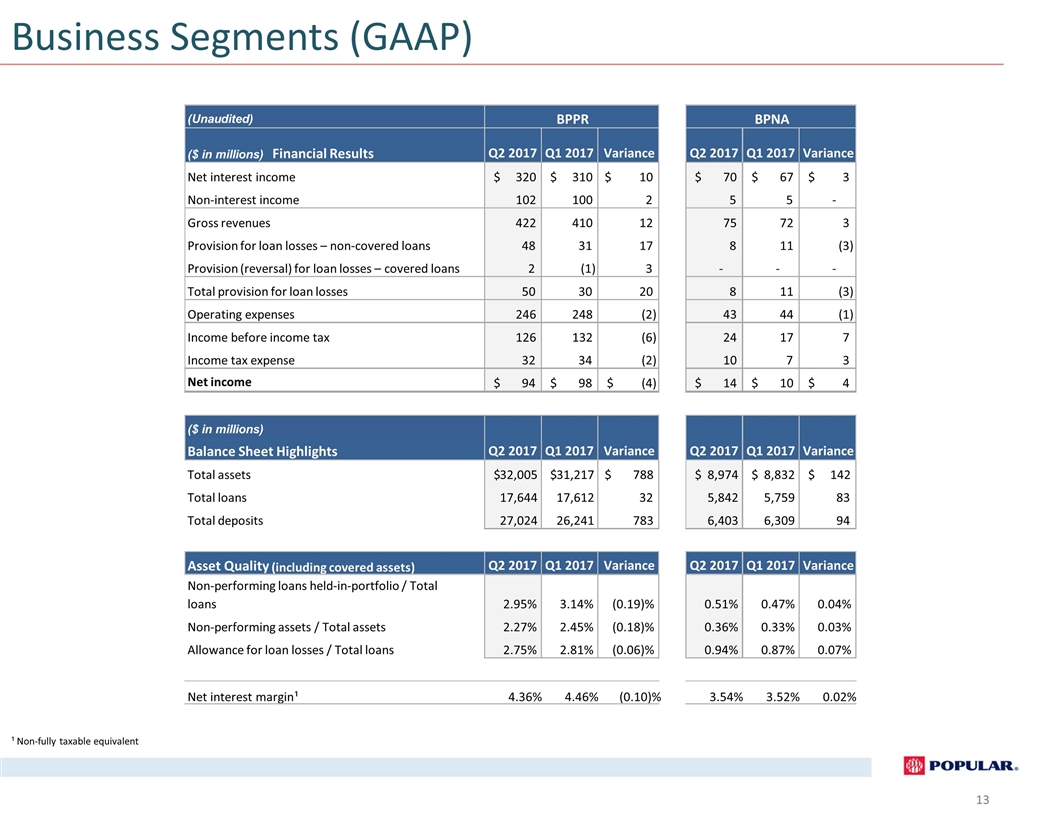

Business Segments (GAAP) ¹ Non-fully taxable equivalent (Unaudited) ($ in millions) Financial Results Q2 2017 Q1 2017 Variance Q2 2017 Q1 2017 Variance Net interest income 320 $ 310 $ 10 $ 70 $ 67 $ 3 $ Non-interest income 102 100 2 5 5 - Gross revenues 422 410 12 75 72 3 Provision for loan losses – non-covered loans 48 31 17 8 11 (3) Provision (reversal) for loan losses – covered loans 2 (1) 3 - - - Total provision for loan losses 50 30 20 8 11 (3) Operating expenses 246 248 (2) 43 44 (1) Income before income tax 126 132 (6) 24 17 7 Income tax expense 32 34 (2) 10 7 3 Net income 94 $ 98 $ (4) $ 14 $ 10 $ 4 $ ($ in millions) Balance Sheet Highlights Total assets 32,005 $ 31,217 $ 788 $ 8,974 $ 8,832 $ 142 $ Total loans 17,644 17,612 32 5,842 5,759 83 Total deposits 27,024 26,241 783 6,403 6,309 94 Asset Quality (including covered assets) Q2 2017 Q1 2017 Variance Q2 2017 Q1 2017 Variance Non-performing loans held-in-portfolio / Total loans 2.95% 3.14% (0.19)% 0.51% 0.47% 0.04% Non-performing assets / Total assets 2.27% 2.45% (0.18)% 0.36% 0.33% 0.03% Allowance for loan losses / Total loans 2.75% 2.81% (0.06)% 0.94% 0.87% 0.07% Net interest margin ¹ 4.36% 4.46% (0.10)% 3.54% 3.52% 0.02% BPPR BPNA Q2 2017 Q1 2017 Variance Q2 2017 Q1 2017 Variance

Consolidated Credit Summary (Excluding Covered Loans) 1 Excluding provision for loan losses and net write-downs (recoveries) related to the assets sales Differences due to rounding

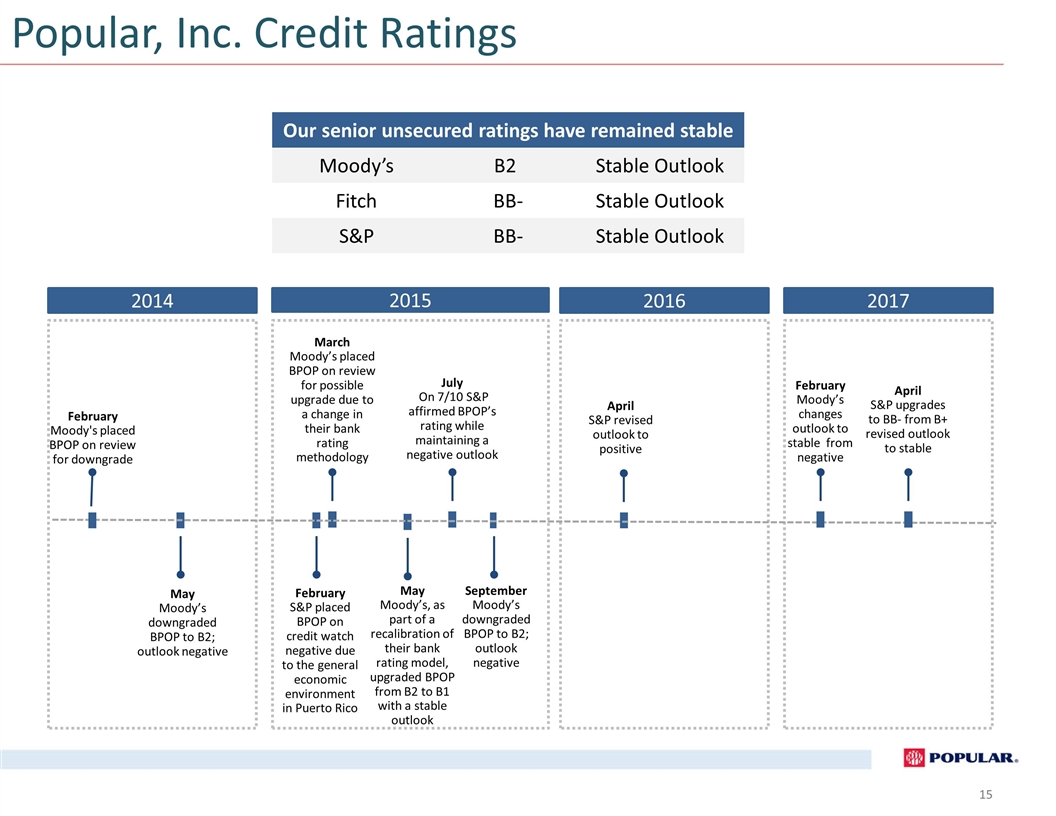

Popular, Inc. Credit Ratings Our senior unsecured ratings have remained stable Moody’s B2 Stable Outlook Fitch BB- Stable Outlook S&P BB- Stable Outlook February Moody’s changes outlook to stable from negative April S&P upgrades to BB- from B+ revised outlook to stable 2017 February S&P placed BPOP on credit watch negative due to the general economic environment in Puerto Rico February Moody's placed BPOP on review for downgrade May Moody’s downgraded BPOP to B2; outlook negative 2014 2015 May Moody’s, as part of a recalibration of their bank rating model, upgraded BPOP from B2 to B1 with a stable outlook July On 7/10 S&P affirmed BPOP’s rating while maintaining a negative outlook March Moody’s placed BPOP on review for possible upgrade due to a change in their bank rating methodology September Moody’s downgraded BPOP to B2; outlook negative 2016 April S&P revised outlook to positive

Investor Presentation Second Quarter 2017