Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LABORATORY CORP OF AMERICA HOLDINGS | form8-kerppt72617.htm |

8-K FILED JULY 26, 2017

SECOND QUARTER 2017

SUPPLEMENTAL FINANCIAL INFORMATION

1

FORWARD LOOKING STATEMENT

This presentation contains forward-looking statements which are subject to change

based on various important factors, including without limitation, competitive

actions in the marketplace, and adverse actions of governmental and other third-

party payers.

Actual results could differ materially from those suggested by these forward-

looking statements. Further information on potential factors that could affect the

operating and financial results of Laboratory Corporation of America Holdings (the

“Company”) is included in the Company’s Form 10-K for the year ended December

31, 2016, and subsequent Forms 10-Q, including in each case under the heading

risk factors, and in the Company’s other filings with the SEC. The Company has no

obligation to provide any updates to these forward-looking statements even if its

expectations change.

2

USE OF ADJUSTED MEASURES

The Company has provided in this presentation “adjusted” financial information

that has not been prepared in accordance with GAAP, including Adjusted EPS,

Adjusted Operating Income, Free Cash Flow, and certain segment information. The

Company believes these adjusted measures are useful to investors as a

supplement to, but not as a substitute for, GAAP measures, in evaluating the

Company’s operational performance. The Company further believes that the use of

these non-GAAP financial measures provides an additional tool for investors in

evaluating operating results and trends, and growth and shareholder returns, as

well as in comparing the Company’s financial results with the financial results of

other companies. However, the Company notes that these adjusted measures may

be different from and not directly comparable to the measures presented by other

companies. Reconciliations of these non-GAAP measures to the most comparable

GAAP measures are included in the tables accompanying this presentation.

3

LabCorp Diagnostics

The LabCorp Diagnostics segment includes historical LabCorp business units,

excluding its Clinical Trials operations (which are part of the Covance Drug

Development segment), and including the Nutritional Chemistry and Food Safety

operations acquired as part of the Covance acquisition.

Covance Drug Development

The Covance Drug Development segment includes historical Covance business

units, excluding its Nutritional Chemistry and Food Safety operations (which are

part of the LabCorp Diagnostics segment), and including the LabCorp Clinical Trials

operations.

OPERATING SEGMENT OVERVIEW

4

SECOND QUARTER CONSOLIDATED RESULTS

(DOLLARS IN MILLIONS, EXCEPT PER SHARE DATA)

(1) Adjusted Operating Income and Adjusted EPS exclude amortization, restructuring charges and special items

(2) See Reconciliation of non-GAAP Financial Measures on slides 15 – 18

2Q17 2Q16 % Change

Net Revenue $2,498.4 $2,382.0 4.9%

Adjusted Operating Income(1) (2) $437.3 $425.3 2.8%

Adjusted Operating Margin 17.5% 17.9% (40 bps)

Adjusted EPS(1) (2) $2.47 $2.36 4.7%

Operating Cash Flow $310.7 $349.5 (11.1%)

Less: Capital Expenditures ($69.3) ($67.0) (3.4%)

Free Cash Flow $241.4 $282.5 (14.5%)

5

YEAR-TO-DATE CONSOLIDATED RESULTS

(DOLLARS IN MILLIONS, EXCEPT PER SHARE DATA)

(1) Adjusted Operating Income and Adjusted EPS exclude amortization, restructuring charges and special items

(2) See Reconciliation of non-GAAP Financial Measures on slides 15 – 18

Six Months Six Months

Ended 6/30/17 Ended 6/30/16 % Change

Net Revenue $4,906.5 $4,675.6 4.9%

Adjusted Operating Income(1) (2) $828.6 $798.4 3.8%

Adjusted Operating Margin 16.9% 17.1% (20 bps)

Adjusted EPS(1) (2) $4.69 $4.41 6.3%

Operating Cash Flow $544.5 $477.1 14.1%

Less: Capital Expenditures ($141.5) ($138.4) (2.2%)

Free Cash Flow $403.0 $338.7 19.0%

6

SECOND QUARTER PRO FORMA SEGMENT RESULTS(1)

(DOLLARS IN MILLIONS)

(1) The consolidated net revenue and adjusted operating income are presented net of inter-segment transaction eliminations

(2) Covance Drug Development’s results exclude the impact from the wind-down of operations relating to a committed minimum volume

contract that expired on October 31, 2015

(3) Adjusted Operating Income excludes amortization, restructuring charges and special items

(4) See Reconciliation of non-GAAP Financial Measures on slides 15 – 18

2Q17 2Q16 % Change

Net Revenue

LabCorp Diagnostics $1,799.1 $1,659.7 8.4%

Covance Drug Development(2) $699.7 $722.4 (3.1%)

Total Net Revenue(2) $2,498.4 $2,382.0 4.9%

Adjusted Operating Income(3) (4)

LabCorp Diagnostics $375.0 $355.3 5.5%

Adjusted Operating Margin 20.8% 21.4% (60 bps)

Covance Drug Development $95.1 $107.6 (11.6%)

Adjusted Operating Margin 13.6% 14.9% (130 bps)

Unallocated Corporate Expense ($32.8) ($37.6) 12.8%

Total Adjusted Operating Income $437.3 $425.3 2.8%

Total Adjusted Operating Margin 17.5% 17.9% (40 bps)

7

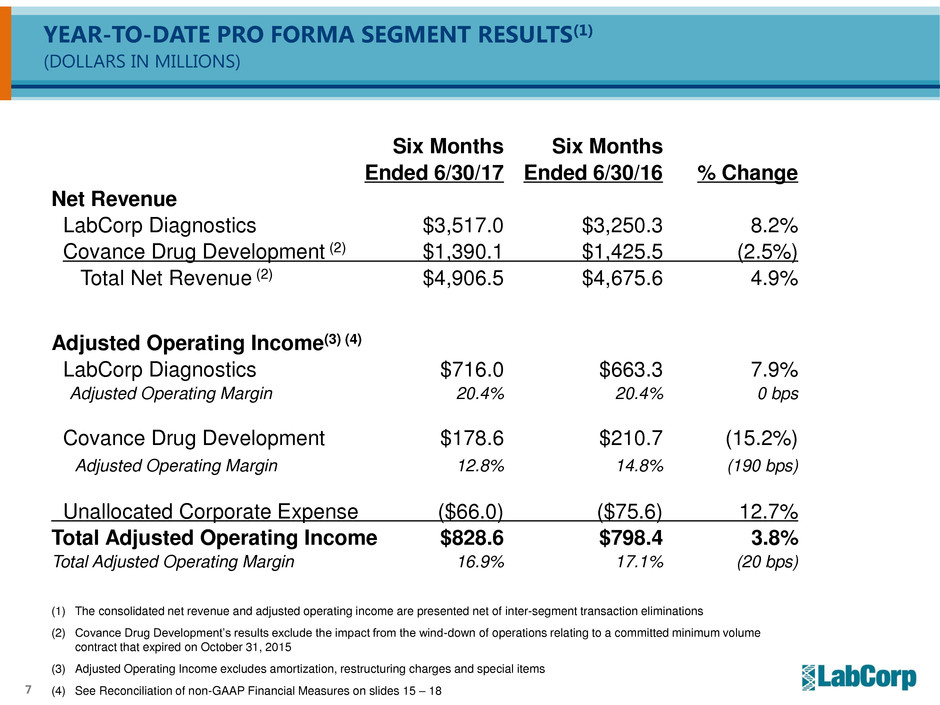

YEAR-TO-DATE PRO FORMA SEGMENT RESULTS(1)

(DOLLARS IN MILLIONS)

(1) The consolidated net revenue and adjusted operating income are presented net of inter-segment transaction eliminations

(2) Covance Drug Development’s results exclude the impact from the wind-down of operations relating to a committed minimum volume

contract that expired on October 31, 2015

(3) Adjusted Operating Income excludes amortization, restructuring charges and special items

(4) See Reconciliation of non-GAAP Financial Measures on slides 15 – 18

Six Months Six Months

Ended 6/30/17 Ended 6/30/16 % Change

Net Revenue

LabCorp Diagnostics $3,517.0 $3,250.3 8.2%

Covance Drug Development (2) $1,390.1 $1,425.5 (2.5%)

Total Net Revenue (2) $4,906.5 $4,675.6 4.9%

Adjusted Operating Income(3) (4)

LabCorp Diagnostics $716.0 $663.3 7.9%

Adjusted Operating Margin 20.4% 20.4% 0 bps

Covance Drug Development $178.6 $210.7 (15.2%)

Adjusted Operating Margin 12.8% 14.8% (190 bps)

Unallocated Corporate Expense ($66.0) ($75.6) 12.7%

Total Adjusted Operating Income $828.6 $798.4 3.8%

Total Adjusted Operating Margin 16.9% 17.1% (20 bps)

8

SELECT FINANCIAL METRICS

(DOLLARS IN MILLIONS)

2Q16 3Q16 4Q16 1Q17 2Q17

Total Depreciation $77.9 $77.9 $79.3 $78.4 $73.5

Total Amortization(1) $45.3 $41.1 $48.8 $47.6 $51.4

Total Adjusted EBITDA(2) $505.4 $485.0 $469.3 $472.2 $515.7

Total Debt to Last Twelve Months Adjusted EBITDA(2) 3.3x 3.3x 3.1x 3.1x 3.2x

Total Net Debt to Last Twelve Months Adjusted EBITDA(2) 2.9x 3.0x 2.9x 2.9x 3.0x

(1) Excludes amortization of deferred financing fees

(2) Adjusted EBITDA excludes restructuring charges and special items. See reconciliation on slide 14.

9

COVANCE DRUG DEVELOPMENT: SELECT FINANCIAL METRICS(1)

Trailing Twelve Month (TTM) Results

Net Orders Net Book-to-Bill

TTM Ending June 30, 2017 $3.44 billion 1.23x

TTM Ending March 31, 2017 $3.24 billion 1.15x

TTM Ending December 31, 2016 $3.15 billion 1.11x

Backlog

Estimated revenue expected to convert

from backlog in the next twelve months

As of June 30, 2017 $5.53 billion $2.1 billion

As of March 31, 2017 $5.19 billion $2.1 billion

As of December 31, 2016 $4.86 billion $2.0 billion

(1) Beginning with the fourth quarter of 2016, the Company began reporting net orders, net book-to-bill and backlog based upon fully-executed

contracted awards. The Company believes this methodology is a more conservative and objective practice, providing greater visibility into its

revenue conversion from the backlog. Results shown include the impact from cancellations and foreign currency translation.

10

(1) Revenues recognized in over 30 currencies; the largest foreign currency accounts for less than 10% of total net revenue

Segment Distribution

LabCorp

Diagnostics

72.0%

Covance

Drug Development

28.0%

USA

81.5%

Geographic Distribution

Rest of

World(1)

18.5%

SECOND QUARTER 2017 NET REVENUE DISTRIBUTION

11

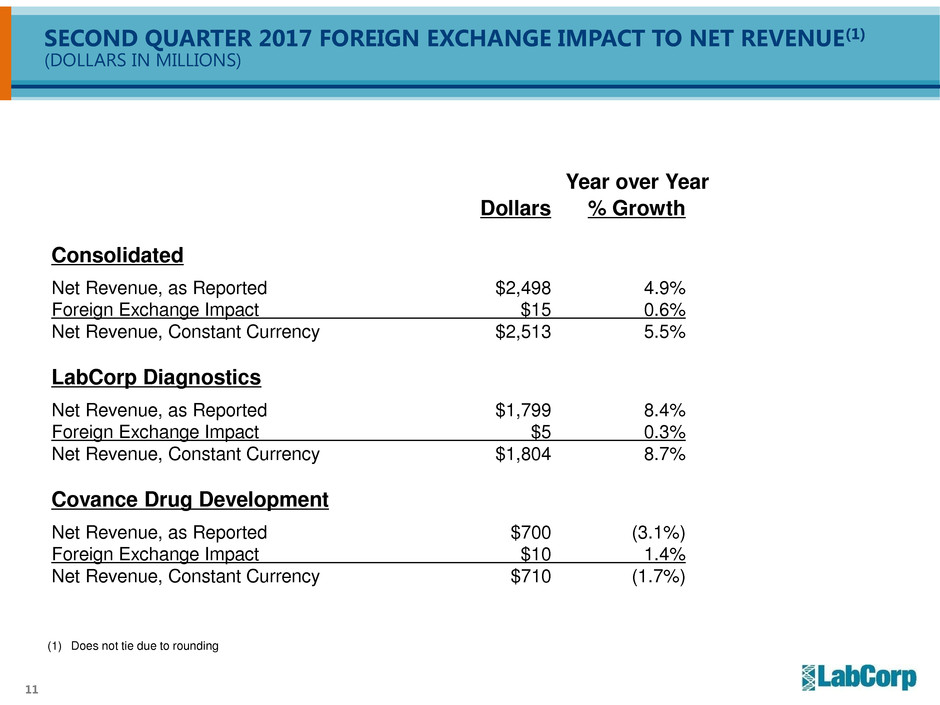

SECOND QUARTER 2017 FOREIGN EXCHANGE IMPACT TO NET REVENUE(1)

(DOLLARS IN MILLIONS)

Year over Year

Dollars % Growth

Consolidated

Net Revenue, as Reported $2,498 4.9%

Foreign Exchange Impact $15 0.6%

Net Revenue, Constant Currency $2,513 5.5%

LabCorp Diagnostics

Net Revenue, as Reported $1,799 8.4%

Foreign Exchange Impact $5 0.3%

Net Revenue, Constant Currency $1,804 8.7%

Covance Drug Development

Net Revenue, as Reported $700 (3.1%)

Foreign Exchange Impact $10 1.4%

Net Revenue, Constant Currency $710 (1.7%)

(1) Does not tie due to rounding

12

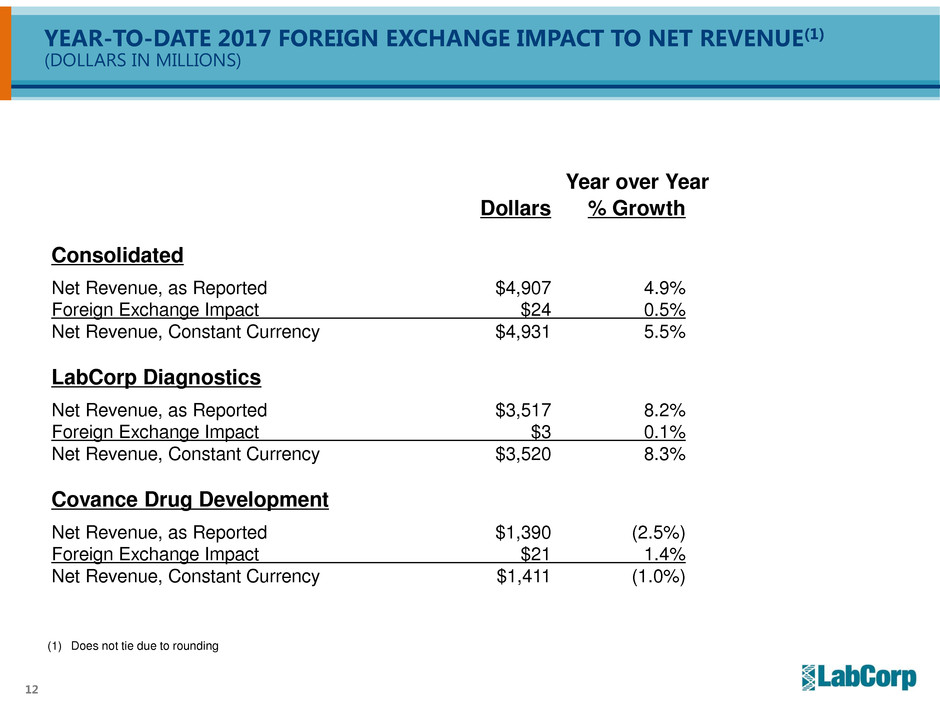

YEAR-TO-DATE 2017 FOREIGN EXCHANGE IMPACT TO NET REVENUE(1)

(DOLLARS IN MILLIONS)

Year over Year

Dollars % Growth

Consolidated

Net Revenue, as Reported $4,907 4.9%

Foreign Exchange Impact $24 0.5%

Net Revenue, Constant Currency $4,931 5.5%

LabCorp Diagnostics

Net Revenue, as Reported $3,517 8.2%

Foreign Exchange Impact $3 0.1%

Net Revenue, Constant Currency $3,520 8.3%

Covance Drug Development

Net Revenue, as Reported $1,390 (2.5%)

Foreign Exchange Impact $21 1.4%

Net Revenue, Constant Currency $1,411 (1.0%)

(1) Does not tie due to rounding

13

2017 FINANCIAL GUIDANCE

Prior Guidance

(assumes foreign exchange

rates effective as of

March 31, 2017)

Current Guidance

(assumes foreign exchange

rates effective as of

June 30, 2017)

Total net revenue growth: 3.5% – 5.5%(2) 5.0% – 6.5%(3)

LabCorp Diagnostics net revenue growth: 5.0% – 7.0%(4) 7.0% – 8.0%

Covance Drug Development net revenue growth: 0.0% – 2.0%(5) 1.0% – 3.0%(6)

Adjusted EPS (1): $9.20 – $9.60 $9.30 – $9.65

Free cash flow: $925 Million – $975 Million $925 Million – $975 Million

(1) Excludes the impact from amortization, restructuring charges and special items.

(2) Included the impact from approximately 40 basis points of negative currency.

(3) Includes the impact from approximately 10 basis points of negative currency.

(4) Included the impact from approximately 10 basis points of negative currency.

(5) Included the impact from approximately 130 basis points of negative currency.

(6) Includes the impact from approximately 20 basis points of negative currency.

14

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES – ADJUSTED EBITDA

(DOLLARS IN MILLIONS)

2Q16 3Q16 4Q16 1Q17 2Q17

LabCorp Operating Income $365.5 $324.0 $323.4 $332.7 $336.0

Add:

Restructuring and other special charges $6.6 $22.8 $9.8 $3.9 $39.1

Other special charges(1) $7.9 $16.1 $5.8 $7.1 $10.8

Depreciation $77.9 $77.9 $79.3 $78.4 $73.5

Amortization $45.3 $41.1 $48.8 $47.6 $51.4

Equity method income, net $1.9 $2.6 $2.0 $2.3 $4.5

Depreciation and amortization of equity method investments $0.3 $0.5 $0.2 $0.2 $0.4

Adjusted EBITDA $505.4 $485.0 $469.3 $472.2 $515.7

(1) Other special charges as disclosed by the Company in its quarterly earnings releases

15

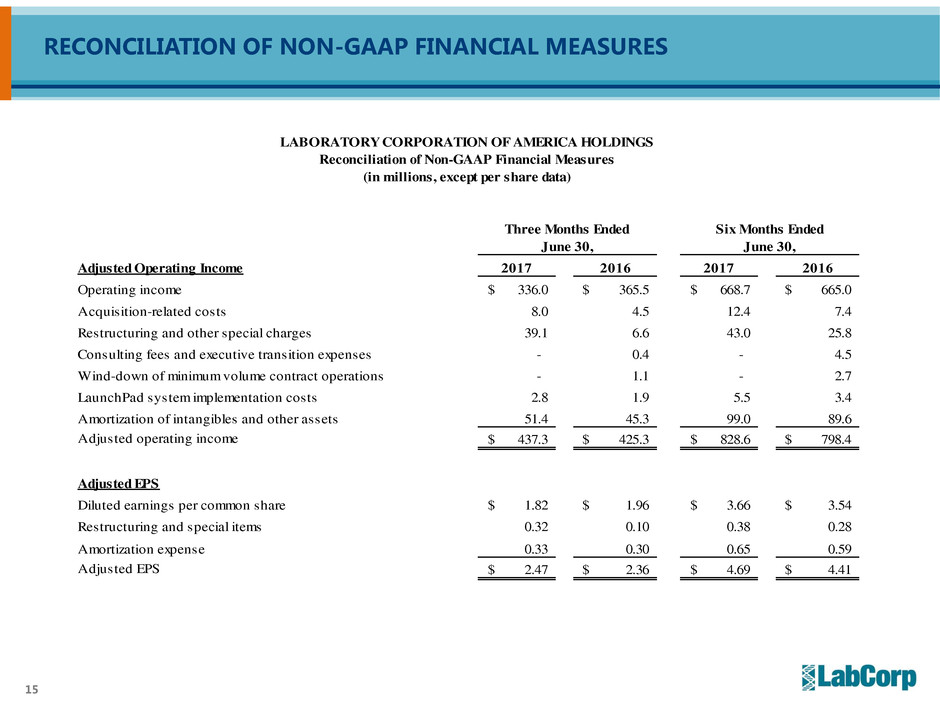

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Adjusted Operating Income 2017 2016 2017 2016

Operating income 336.0$ 365.5$ 668.7$ 665.0$

Acquisition-related costs 8.0 4.5 12.4 7.4

Restructuring and other special charges 39.1 6.6 43.0 25.8

Consulting fees and executive transition expenses - 0.4 - 4.5

Wind-down of minimum volume contract operations - 1.1 - 2.7

LaunchPad system implementation costs 2.8 1.9 5.5 3.4

Amortization of intangibles and other assets 51.4 45.3 99.0 89.6

Adjusted operating income 437.3$ 425.3$ 828.6$ 798.4$

Adjusted EPS

Diluted earnings per common share 1.82$ 1.96$ 3.66$ 3.54$

Restructuring and special items 0.32 0.10 0.38 0.28

Amortization expense 0.33 0.30 0.65 0.59

Adjusted EPS 2.47$ 2.36$ 4.69$ 4.41$

Free Cash Flow:

Net cash provided by operating activities 310.7$ 349.5$ 544.5$ 477.1$

Less: Capital expenditures (69.3) (67.0) (141.5) (138.4)

Free cash flow 241.4$ 282.5$ 403.0$ 338.7$

LABORATORY CORPORATION OF AMERICA HOLDINGS

Reconciliation of Non-GAAP Financial Measures

(in millions, except per share data)

Three Months Ended

June 30,

Six Months Ended

June 30,

16

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Free Cash Flow: 2017 2016 2017 2016

Net cash provided by operating activities 310.7$ 349.5$ 544.5$ 477.1$

Less: Capital expenditures (69.3) (67.0) (141.5) (138.4)

Free cash flow 241.4$ 282.5$ 403.0$ 338.7$

Free Cash Flow:

Net cash provided by operating activities 310.7$ 349.5$ 544.5$ 477.1$

Less: Capital expenditures (69.3) (67.0) (141.5) (138.4)

Free cash flow 241.4$ 282.5$ 403.0$ 338.7$

LABORATORY CORPORATION OF AMERICA HOLDINGS

Reconciliation of Non-GAAP Financial Measures

(in millions, except per share data)

Three Months Ended

June 30,

Six Months Ended

June 30,

17

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES - FOOTNOTES

1) During the second quarter of 2017, the Company recorded net restructuring and other special charges of $39.1 million. The charges included $19.9

million in severance and other personnel costs along with $4.2 million in costs associated with facility closures and general integration initiatives. The

Company reversed previously established reserves of $0.1 million in unused facility reserves. The Company also recognized an asset impairment loss of

$15.1 million related to the termination of a software development project.

The Company incurred legal and other costs of $5.7 million relating to recent acquisition activity. The Company also recorded $2.3 million in consulting

expenses relating to fees incurred as part of its Covance integration and compensation analysis. In addition, the Company incurred $2.8 million of non-

capitalized costs associated with the implementation of a major system as part of its LaunchPad business process improvement initiative (all recorded in

selling, general and administrative expenses).

The after tax impact of these charges decreased net earnings for the quarter ended June 30, 2017, by $32.9 million and diluted earnings per share by $0.32

($32.9 million divided by 103.7 million shares).

During the first quarter of 2017, the Company recorded net restructuring and other special charges of $3.9 million. The charges included $2.7 million in

severance and other personnel costs along with $1.6 million in costs associated with facility closures and general integration initiatives. The Company

reversed previously established reserves of $0.4 million in unused severance reserves.

The Company incurred legal and other costs of $0.9 million relating to recently completed acquisitions. The Company also recorded $2.6 million in

consulting expenses relating to fees incurred as part of its Covance integration and compensation analysis, along with $0.9 million in short-term equity

retention arrangements relating to the acquisition of Covance. In addition, the Company incurred $2.7 million of non-capitalized costs associated with the

implementation of a major system as part of LaunchPad (all recorded in selling, general and administrative expenses).

The after tax impact of these combined charges decreased net earnings for the six months ended June 30, 2017, by $39.8 million and diluted earnings per

share by $0.38 ($39.8 million divided by 104.0 million shares).

18

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES - FOOTNOTES

2) During the second quarter of 2016, the Company recorded net restructuring and special items of $6.6 million. The charges included $4.5 million in

severance and other personnel costs along with $4.6 million in facility-related costs associated with facility closures and general integration initiatives.

The Company reversed previously established reserves of $2.2 million in unused facility-related costs and $0.3 million in unused personnel costs.

The Company incurred additional legal and other costs of $1.1 million relating to the wind-down of its minimum volume contract operations. The

Company also recorded $4.0 million in consulting expenses relating to fees incurred as part of its Covance integration and compensation analysis,

along with $0.5 million in short-term equity retention arrangements relating to the acquisition of Covance, $0.4 million of accelerated equity

compensation relating to the retirement of a Company executive and $1.9 million of non-capitalized costs associated with the implementation of a major

system as part of LaunchPad (all recorded in selling, general and administrative expenses). In conjunction with certain international legal entity tax

structuring, the Company recorded a one-time tax liability of $1.1 million.

The after tax impact of these charges decreased net earnings for the quarter ended June 30, 2016, by $10.6 million and diluted earnings per share by

$0.10 ($10.6 million divided by 104.1 million shares).

During the first quarter of 2016, the Company recorded net restructuring and other special charges of $19.2 million. The charges included $4.5 million

in severance and other personnel costs along with $17.0 million in costs associated with facility closures and general integration initiatives. A

substantial portion of these costs relate to the planned closure of duplicative data center operations. The Company reversed previously established

reserves of $2.3 million in unused severance reserves primarily as the result of selling one of its minimum volume contract facilities to a third party. The

Company incurred additional legal and other costs of $1.6 million relating to the wind-down of its minimum volume contract operations. The Company

also recorded $1.7 million in consulting expenses relating to fees incurred as part of its Covance integration and compensation analysis, along with $1.2

million in short-term equity retention arrangements relating to the acquisition of Covance and $4.1 million of accelerated equity compensation relating to

the announced retirement of a Company executive (all recorded in selling, general and administrative expenses). In addition, the Company incurred

$1.5 million of non-capitalized costs associated with the implementation of a major system as part of LaunchPad.

The after tax impact of these charges decreased net earnings for the six months ended June 30, 2016, by $29.6 million and diluted earnings per share

by $0.28 ($29.6 million divided by 103.9 million shares).

3) The Company continues to grow the business through acquisitions and uses Adjusted EPS Excluding Amortization as a measure of operational

performance, growth and shareholder returns. The Company believes adjusting EPS for amortization provides investors with better insight into the

operating performance of the business. For the quarters ended June 30, 2017 and 2016, intangible amortization was $51.4 million and $45.3 million,

respectively ($34.8 million and $30.9 million net of tax, respectively) and decreased EPS by $0.33 ($34.8 million divided by 103.7 million shares) and

$0.30 ($30.9 million divided by 104.1 million shares), respectively. For the six months ended June 30, 2017 and 2016, intangible amortization was

$99.0 million and $89.6 million, respectively ($67.2 million and $61.0 million net of tax, respectively) and decreased EPS by $0.65 ($67.2 million divided

by 104.0 million shares) and $0.59 ($61.0 million divided by 103.9 million shares), respectively.