Attached files

| file | filename |

|---|---|

| EX-99 - EXHIBIT 99 - FORD MOTOR CO | q22017earningsrelease.pdf |

| 8-K - 8-K - FORD MOTOR CO | earnings8-kdated07x26x2017.htm |

Ford Motor Company 2Q July 26, 2017

* See endnote on page 4.

For news releases, related materials and high-resolution photos and video, visit www.media.ford.com.

Follow at www.facebook.com/ford, www.twitter.com/fordir or www.youtube.com/fordvideo1

│ NEWS

www.facebook.com/ford www.twitter.com/ford

2Q 2017

B/(W) 2Q 2016

PRODUCT AND SERVICES HIGHLIGHTS

HIGHLIGHTS 2Q 2017*

2017 F-150 King Ranch

2017 Lincoln Continental

2017 Expedition

Ford SYNC 3

Ford Delivers Second Quarter Net Income of $2.0B;

$2.5B Adjusted Pre-Tax Profit;

Total Company Revenue of $39.9B

? Second quarter net income was $2.0B, total company revenue

was $39.9B; EPS was $0.51, all up year over year

? Total Company adjusted pre-tax profit of $2.5B and lower

tax rate drove adjusted EPS of $0.56, up $0.04 year over year

? Lower adjusted pre-tax profit due to higher commodity cost,

mainly steel, unfavorable exchange and non-repeat of last

year’s gain on the sale of majority stake in OEConnection LLC

? In the U.S.: Year-over-year average transaction prices rose

nearly five times the industry average in the quarter and

incentives declined as a percent of vehicle price, while the

industry increased

? Automotive profits driven by North America, with Europe and

Asia Pacific also profitable; outside North America, other

regions were about breakeven in total; Ford Credit pre-tax profit

was $619M, up 55 percent year over year

? Automotive operating cash flow was positive; continue to expect

full-year shareholder distributions of about $2.7B

? 2017: Expect full year adjusted EPS of $1.65 to $1.85 with

adjusted effective tax rate now expected to be about 15 percent

2 0 17 S E C O N D Q U A R T E R F I N A N C I A L R E S U LT S

“This quarter shows the underlying health

of our company with strong products like

F-Series and commercial vehicles around

the world, but we have opportunity to

deliver even more. The entire team is

focused on improving the fitness of the

business and smartly deploying our

capital to improve both the top and

bottom lines in the quarters ahead.”

Jim Hackett, President & CEO

Revenue Net Income Adjusted Pre-Tax Profit EPS Adjusted EPS Auto Segment Auto Segment Operating

(GAAP) (GAAP) (Non-GAAP) (GAAP) (Non-GAAP) Operating Margin (GAAP) Cash Flow (GAAP)

$39.9B $2.0B $2.5B $0.51 $0.56 5.9% $1.3B

$0.4B $0.1B $(0.5)B $0.02 $0.04 (1.8) ppts $(2.9)B

“We continue to maintain a strong

balance sheet with substantial cash

and liquidity. This provides the capital

needed to invest in and grow our

business, while also protecting against

a downturn.”

Bob Shanks

Executive Vice President & CFO

F-Series

In the U.S. F-Series had its

best second quarter sales

performance since 2001,

with a 7 percent gain

compared to last year.

Average transaction prices

of $45,400 per truck were

up $3,100 from a year ago

and led the segment.

Lincoln

Lincoln had strong 2Q sales

in both the U.S. and China,

selling more than 29,000

vehicles in the U.S. for the

brand’s best performance

in a decade. In China, the

brand capped its best ever

quarter with record June

sales, up 84 percent.

Quality

Ford earned the No. 2

ranking of all non-premium

brands in this year’s U.S.

J.D. Power Initial Quality

Study – the brand’s best

ranking in the report’s 31-

year history. Seven Ford and

Lincoln models were in the

top three of their segments.

Over-the-Air Updates

Ford offered its first

software update via Wi-Fi

with a SYNC 3 update that

brings support for Android

Auto and Apple CarPlay to

more than 800,000

model-year 2016 vehicles.

Ford Motor Company 2Q July 26, 2017

A U T O M O T I V E S E G M E N T R E S U LT S

North America

South America

Europe

Middle East & Africa

Asia Pacific

F O R D C R E D I T R E S U LT S

Ford Credit

Wholesales Revenue MarketShare

Operating

Margin

Pre-Tax

Results

2

? Wholesale volume was down 1 percent, revenue up

3 percent year over year, driven by continued strength of

series and vehicle mix and higher net pricing

? Market share improvement in truck and utilities was more

than offset by lower fleet sales

? For 2017: Continue to expect North America

operating margin and profit to be lower than 2016, mainly

due to higher commodity costs and increased engineering

expense, mainly for utilities and autonomous vehicles

2Q 2017 807K $24.5B 14.4% 9.0% $2.2B

B/(W)

2Q 2016 (8)K $0.7B (0.1) ppts (2.3) ppts $(0.5)B

? All key metrics improved for the third consecutive quarter

? Wholesales were up 12 percent; revenue up 18 percent,

reflecting higher volume and favorable pricing

? Market share improved due to performance of the Ka

? For 2017: Continue to expect loss to improve from

last year, as a result of favorable market factors as the

economy continues to recover

2Q 2017 93K $1.5B 9.2% (12.6)% $(185)M

B/(W)

2Q 2016 10K $0.2B 0.5 ppts 8.7 ppts $80M

? Ninth consecutive quarterly profit, but key metrics were

lower due to Brexit effects and launch of the all-new Fiesta

? Kuga, Ka and commercial vehicle share improved, while

overall share was down due to Fiesta launch

? For 2017: Continue to expect Europe to remain profitable,

although below 2016 levels, mainly due to Brexit effects

and higher commodity cost. Favorable market factors and

continued improvement in Russia will be a partial offset

2Q 2017 375K $7.1B 7.3% 1.2% $88M

B/(W)

2Q 2016 (55)K $(1.0)B (0.2) ppts (4.6) ppts $(379)M

? Pre-tax results improved due to favorable cost

performance, reflecting mainly lower material and freight

costs, and favorable exchange

? Other key metrics lower due to lower wholesale volume,

largely reflecting lower share and lower industry

? For 2017: Continue to expect results in the region to

improve compared to 2016 due to lower cost and favorable

exchange with lower volume a partial offset

2Q 2017 24K $0.6B 3.4% (9.7)% $(53)M

B/(W)

2Q 2016 (14)K $(0.4)B (1.2) ppts (2.5) ppts $12M

? Wholesale volume up 7 percent; revenue up 21 percent,

reflecting strength of full line up of SUVs and continued

growth of Lincoln in China

? Market share was up, due to higher share in China because

of strong JMC commercial vehicle gains and Lincoln

performance

? For 2017: Continue to expect pre-tax profits to improve

from 2016 due to favorable volume and mix, and lower cost

2Q 2017 352K $3.4B 3.7% 4.1% $143M

B/(W)

2Q 2016 24K $0.6B 0.1 ppts 4.4 ppts $151M

Wholesales Revenue(GAAP) Market Share

Operating Margin

(GAAP)

Pre-Tax Profit

(GAAP)

2Q 2017 1,651K $37.1B 7.4% 5.9% $2.2B

B/(W) 2Q 2016 (43)K $0.1B (0.1) ppts (1.8) ppts $(0.6)B

? Best quarterly pre-tax profit since 2011

? Continued receivables growth globally

? For 2017: Now expect full-year pre-tax profit higher

than $1.5B, reflecting an improved lease residual outlook,

along with higher volume, margin and a strong cost focus

Pre-Tax Results

2Q 2017 $619M

B/(W)

2Q 2016 $219M

Ford Motor Company 2Q July 26, 20173

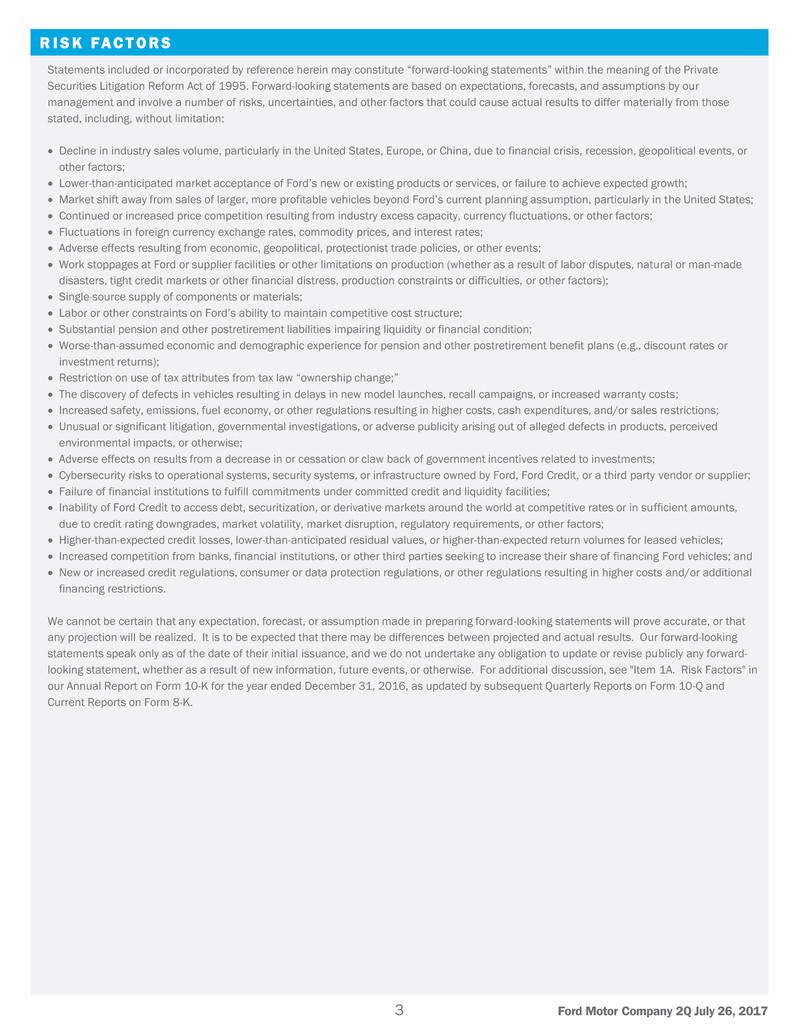

Statements included or incorporated by reference herein may constitute “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by our

management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those

stated, including, without limitation:

? Decline in industry sales volume, particularly in the United States, Europe, or China, due to financial crisis, recession, geopolitical events, or

other factors;

? Lower-than-anticipated market acceptance of Ford’s new or existing products or services, or failure to achieve expected growth;

? Market shift away from sales of larger, more profitable vehicles beyond Ford’s current planning assumption, particularly in the United States;

? Continued or increased price competition resulting from industry excess capacity, currency fluctuations, or other factors;

? Fluctuations in foreign currency exchange rates, commodity prices, and interest rates;

? Adverse effects resulting from economic, geopolitical, protectionist trade policies, or other events;

? Work stoppages at Ford or supplier facilities or other limitations on production (whether as a result of labor disputes, natural or man-made

disasters, tight credit markets or other financial distress, production constraints or difficulties, or other factors);

? Single-source supply of components or materials;

? Labor or other constraints on Ford’s ability to maintain competitive cost structure;

? Substantial pension and other postretirement liabilities impairing liquidity or financial condition;

? Worse-than-assumed economic and demographic experience for pension and other postretirement benefit plans (e.g., discount rates or

investment returns);

? Restriction on use of tax attributes from tax law “ownership change;”

? The discovery of defects in vehicles resulting in delays in new model launches, recall campaigns, or increased warranty costs;

? Increased safety, emissions, fuel economy, or other regulations resulting in higher costs, cash expenditures, and/or sales restrictions;

? Unusual or significant litigation, governmental investigations, or adverse publicity arising out of alleged defects in products, perceived

environmental impacts, or otherwise;

? Adverse effects on results from a decrease in or cessation or claw back of government incentives related to investments;

? Cybersecurity risks to operational systems, security systems, or infrastructure owned by Ford, Ford Credit, or a third party vendor or supplier;

? Failure of financial institutions to fulfill commitments under committed credit and liquidity facilities;

? Inability of Ford Credit to access debt, securitization, or derivative markets around the world at competitive rates or in sufficient amounts,

due to credit rating downgrades, market volatility, market disruption, regulatory requirements, or other factors;

? Higher-than-expected credit losses, lower-than-anticipated residual values, or higher-than-expected return volumes for leased vehicles;

? Increased competition from banks, financial institutions, or other third parties seeking to increase their share of financing Ford vehicles; and

? New or increased credit regulations, consumer or data protection regulations, or other regulations resulting in higher costs and/or additional

financing restrictions.

We cannot be certain that any expectation, forecast, or assumption made in preparing forward-looking statements will prove accurate, or that

any projection will be realized. It is to be expected that there may be differences between projected and actual results. Our forward-looking

statements speak only as of the date of their initial issuance, and we do not undertake any obligation to update or revise publicly any forward-

looking statement, whether as a result of new information, future events, or otherwise. For additional discussion, see "Item 1A. Risk Factors" in

our Annual Report on Form 10-K for the year ended December 31, 2016, as updated by subsequent Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K.

R I S K F A C T O R S

Ford Motor Company 2Q July 26, 20174

C O N F E R E N C E C A L L D E TA I L S

Ford Motor Company [NYSE:F] releases its 2017 second quarter financial results at 7:00 a.m. EDT today.

Following the release, Jim Hackett, Ford president and chief executive officer, and Bob Shanks, Ford executive vice president and chief

financial officer, will host a conference call at 9 a.m. EDT to discuss the results.

The presentation (listen-only) and supporting materials will be available at www.shareholder.ford.com. Representatives of the investment

community and the news media will have the opportunity to ask questions on the call.

Access Information - Wednesday, July 26, 2017

Ford Earnings Call: 9 a.m. EDT

Toll-Free: 1.877.870.8664

International: 1.970.297.2423

Passcode: Ford Earnings

REPLAY

(Available after 1:00 p.m. EDT the day of the event through Thursday, August 3, 2017)

www.shareholder.ford.com

Toll-Free: 1.855.859.2056

International: 1.404.537.3406

Passcode: 95413408

About Ford Motor Company

Ford Motor Company is a global company based in Dearborn, Michigan. The company designs, manufactures, markets and services a?full

line of Ford cars, trucks, SUVs, electrified vehicles and Lincoln luxury vehicles, provides financial services through Ford Motor Credit

Company and is pursuing leadership positions in electrification, autonomous vehicles and mobility solutions. Ford employs approximately

203,000 people worldwide. For more information regarding Ford, its products and Ford Motor Credit Company, please visit

??????????????????????.

* The following applies to the information throughout this release:

? See tables at the end of this release for the nature and amount of special items, and reconciliations of the non-GAAP financial

measures designated as “adjusted” to the most comparable financial measures calculated in accordance with U.S. generally

accepted accounting principles (“GAAP”).

? Wholesale unit sales and production volumes include Ford brand and Jiangling Motors Corporation (“JMC”) brand vehicles produced

and sold in China by our unconsolidated affiliates; revenue does not includes these sales. See materials supporting the July 26, 2017

conference call at www.shareholder.ford.com for further discussion of wholesale unit volumes.

? Automotive segment operating margin is defined as Automotive segment pre-tax profit divided by Automotive segment revenue.

? References to records related to Automotive segment pre-tax profit, Automotive segment operating cash flow, Automotive segment

operating margin and Automotive business unit results are since at least 2000.

Ford Motor Company 2Q July 26, 20175

C O N S O L I D AT E D I N C O M E S T AT E M E N T

FORD MOTOR COMPANY AND SUBSIDIARIES

CONSOLIDATED INCOME STATEMENT

(in millions, except per share amounts)

For the periods ended June 30,

2016 2017 2016 2017

Second Quarter First Half

(unaudited)

Revenues

Automotive $ 36,932 $ 37,113 $ 72,189 $ 73,588

Financial Services 2,553 2,738 5,014 5,407

Other — 2 — 4

Total revenues 39,485 39,853 77,203 78,999

Costs and expenses

Cost of sales 32,522 33,349 63,039 66,057

Selling, administrative, and other expenses 2,784 2,756 5,474 5,520

Financial Services interest, operating, and other expenses 2,258 2,217 4,318 4,449

Total costs and expenses 37,564 38,322 72,831 76,026

Interest expense on Automotive debt 212 277 412 556

Non-Financial Services other income/(loss), net 686 658 1,454 1,370

Financial Services other income/(loss), net 82 74 173 96

Equity in net income of affiliated companies 398 273 939 619

Income before income taxes 2,875 2,259 6,526 4,502

Provision for/(Benefit from) income taxes 903 209 2,099 858

Net income 1,972 2,050 4,427 3,644

Less: Income/(Loss) attributable to noncontrolling interests 2 8 5 15

Net income attributable to Ford Motor Company $ 1,970 $ 2,042 $ 4,422 $ 3,629

EARNINGS PER SHARE ATTRIBUTABLE TO FORD MOTOR COMPANY COMMON AND CLASS B STOCK

Basic income $ 0.50 $ 0.51 $ 1.11 $ 0.91

Diluted income 0.49 0.51 1.11 0.91

Cash dividends declared 0.15 0.15 0.55 0.35

Ford Motor Company 2Q July 26, 20176

C O N S O L I D AT E D B A L A N C E S H E E T

FORD MOTOR COMPANY AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

(in millions)

December 31, 2016

June 30,

2017

(unaudited)

ASSETS

Cash and cash equivalents $ 15,905 $ 16,223

Marketable securities 22,922 22,886

Financial Services finance receivables, net 46,266 49,888

Trade and other receivables, less allowances of $392 and $416 11,102 10,159

Inventories 8,898 11,092

Other assets 3,368 3,291

Total current assets 108,461 113,539

Financial Services finance receivables, net 49,924 51,551

Net investment in operating leases 28,829 28,597

Net property 32,072 33,794

Equity in net assets of affiliated companies 3,304 3,241

Deferred income taxes 9,705 10,145

Other assets 5,656 6,602

Total assets $ 237,951 $ 247,469

LIABILITIES

Payables $ 21,296 $ 23,568

Other liabilities and deferred revenue 19,316 19,958

Automotive debt payable within one year 2,685 2,911

Financial Services debt payable within one year 46,984 47,862

Total current liabilities 90,281 94,299

Other liabilities and deferred revenue 24,395 24,840

Automotive long-term debt 13,222 13,277

Financial Services long-term debt 80,079 81,959

Deferred income taxes 691 735

Total liabilities 208,668 215,110

Redeemable noncontrolling interest 96 97

EQUITY

Common Stock, par value $.01 per share (3,986 million shares issued of 6 billion authorized) 40 40

Class B Stock, par value $.01 per share (71 million shares issued of 530 million authorized) 1 1

Capital in excess of par value of stock 21,630 21,735

Retained earnings 15,634 18,437

Accumulated other comprehensive income/(loss) (7,013 ) (6,716 )

Treasury stock (1,122 ) (1,253 )

Total equity attributable to Ford Motor Company 29,170 32,244

Equity attributable to noncontrolling interests 17 18

Total equity 29,187 32,262

Total liabilities and equity $ 237,951 $ 247,469

Ford Motor Company 2Q July 26, 20177

C O N S O L I D AT E D S T AT E M E N T O F C A S H F L O W S

FORD MOTOR COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(in millions)

For the periods ended June 30,

2016 2017

First Half

(unaudited)

Cash flows from operating activities

Net cash provided by/(used in) operating activities $ 11,891 $ 9,951

Cash flows from investing activities

Capital spending (3,206) (3,264)

Acquisitions of finance receivables and operating leases (27,501) (27,379)

Collections of finance receivables and operating leases 19,732 21,636

Purchases of equity and debt securities (16,757) (16,931)

Sales and maturities of equity and debt securities 15,491 16,906

Settlements of derivatives 111 154

Other 21 16

Net cash provided by/(used in) investing activities (12,109) (8,862)

Cash flows from financing activities

Cash dividends (2,184) (1,392)

Purchases of common stock (145) (131)

Net changes in short-term debt 934 72

Proceeds from issuance of other debt 25,574 20,467

Principal payments on other debt (21,104) (19,952)

Other (87) (102)

Net cash provided by/(used in) financing activities 2,988 (1,038)

Effect of exchange rate changes on cash and cash equivalents 21 267

Net increase/(decrease) in cash and cash equivalents $ 2,791 $ 318

Cash and cash equivalents at January 1 $ 14,272 $ 15,905

Net increase/(decrease) in cash and cash equivalents 2,791 318

Cash and cash equivalents at June 30 $ 17,063 $ 16,223

Ford Motor Company 2Q July 26, 20178

S U P P L E M E N TA L F I N A N C I A L I N F O R M AT I O N

The tables below provide supplemental consolidating financial information. The data is presented by our reportable

segments, Automotive and Financial Services. All Other, Special Items, and Adjustments include our operating segments

that did not meet the quantitative threshold to qualify as a reportable segment, special items, eliminations of intersegment

transactions, and deferred tax netting.

Selected Income Statement Information. The following table provides supplemental income statement information, by

segment (in millions):

For the period ended June 30, 2017

Second Quarter

Automotive

Financial

Services

All Other,

Special Items,

& Adjustments Consolidated

Revenues $ 37,113 $ 2,738 $ 2 $ 39,853

Total costs and expenses 35,815 2,217 290 38,322

Interest expense on Automotive debt — — 277 277

Other income/(loss), net 627 74 31 732

Equity in net income of affiliated companies 266 8 (1 ) 273

Income/(loss) before income taxes 2,191 603 (535 ) 2,259

Provision for/(Benefit from) income taxes 181 174 (146 ) 209

Net income/(loss) 2,010 429 (389 ) 2,050

Less: Income/(Loss) attributable to noncontrolling interests 8 — — 8

Net income attributable to Ford Motor Company $ 2,002 $ 429 $ (389 ) $ 2,042

For the period ended June 30, 2017

First Half

Automotive

Financial

Services

All Other,

Special Items,

& Adjustments Consolidated

Revenues $ 73,588 $ 5,407 $ 4 $ 78,999

Total costs and expenses 71,295 4,449 282 76,026

Interest expense on Automotive debt — — 556 556

Other income/(loss), net 1,258 96 112 1,466

Equity in net income of affiliated companies 605 15 (1 ) 619

Income/(loss) before income taxes 4,156 1,069 (723 ) 4,502

Provision for/(Benefit from) income taxes 741 322 (205 ) 858

Net income/(loss) 3,415 747 (518 ) 3,644

Less: Income/(Loss) attributable to noncontrolling interests 15 — — 15

Net income attributable to Ford Motor Company $ 3,400 $ 747 $ (518 ) $ 3,629

Ford Motor Company 2Q July 26, 20179

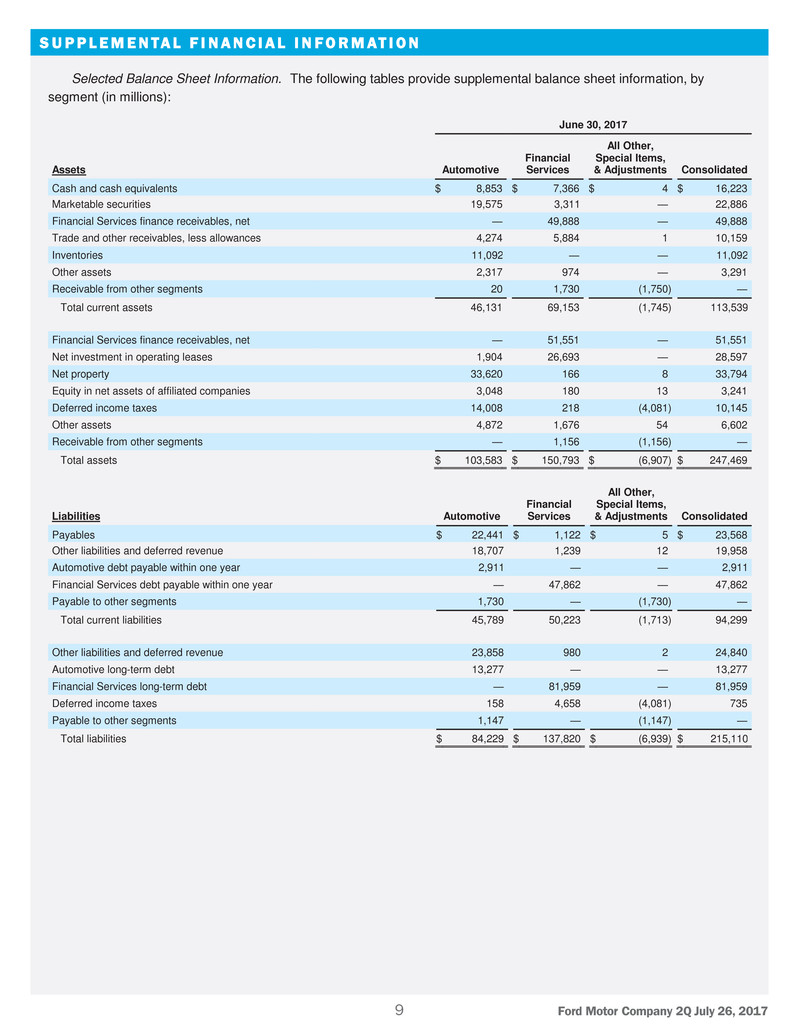

S U P P L E M E N TA L F I N A N C I A L I N F O R M AT I O N

Selected Balance Sheet Information. The following tables provide supplemental balance sheet information, by

segment (in millions):

June 30, 2017

Assets Automotive

Financial

Services

All Other,

Special Items,

& Adjustments Consolidated

Cash and cash equivalents $ 8,853 $ 7,366 $ 4 $ 16,223

Marketable securities 19,575 3,311 — 22,886

Financial Services finance receivables, net — 49,888 — 49,888

Trade and other receivables, less allowances 4,274 5,884 1 10,159

Inventories 11,092 — — 11,092

Other assets 2,317 974 — 3,291

Receivable from other segments 20 1,730 (1,750 ) —

Total current assets 46,131 69,153 (1,745 ) 113,539

Financial Services finance receivables, net — 51,551 — 51,551

Net investment in operating leases 1,904 26,693 — 28,597

Net property 33,620 166 8 33,794

Equity in net assets of affiliated companies 3,048 180 13 3,241

Deferred income taxes 14,008 218 (4,081 ) 10,145

Other assets 4,872 1,676 54 6,602

Receivable from other segments — 1,156 (1,156 ) —

Total assets $ 103,583 $ 150,793 $ (6,907 ) $ 247,469

Liabilities Automotive

Financial

Services

All Other,

Special Items,

& Adjustments Consolidated

Payables $ 22,441 $ 1,122 $ 5 $ 23,568

Other liabilities and deferred revenue 18,707 1,239 12 19,958

Automotive debt payable within one year 2,911 — — 2,911

Financial Services debt payable within one year — 47,862 — 47,862

Payable to other segments 1,730 — (1,730 ) —

Total current liabilities 45,789 50,223 (1,713 ) 94,299

Other liabilities and deferred revenue 23,858 980 2 24,840

Automotive long-term debt 13,277 — — 13,277

Financial Services long-term debt — 81,959 — 81,959

Deferred income taxes 158 4,658 (4,081 ) 735

Payable to other segments 1,147 — (1,147 ) —

Total liabilities $ 84,229 $ 137,820 $ (6,939 ) $ 215,110

Ford Motor Company 2Q July 26, 201710

S U P P L E M E N TA L F I N A N C I A L I N F O R M AT I O N

Selected Cash Flow Information. The following tables provide supplemental cash flow information, by segment

(in millions):

For the period ended June 30, 2017

First Half

Cash flows from operating activities Automotive

Financial

Services

All Other,

Special Items,

& Adjustments Consolidated

Net cash provided by/(used in) operating activities $ 5,748 $ 4,236 $ (33 ) $ 9,951

Reconciling Adjustments to Automotive Segment Operating Cash Flows*

Automotive capital spending (3,242 )

Net cash flows from non-designated derivatives 200

Funded pension contributions 456

Separation payments 59

Other 65

Automotive Segment Operating Cash Flows $ 3,286

_________

For the period ended June 30, 2017

First Half

Cash flows from investing activities Automotive

Financial

Services

All Other,

Special Items,

& Adjustments Consolidated

Capital spending $ (3,242 ) $ (22 ) $ — $ (3,264 )

Acquisitions of finance receivables and operating leases — (27,379 ) — (27,379 )

Collections of finance receivables and operating leases — 21,636 — 21,636

Purchases of equity and debt securities (13,578 ) (3,351 ) (2 ) (16,931 )

Sales and maturities of equity and debt securities 13,570 3,336 — 16,906

Settlements of derivatives 200 (46 ) — 154

Other 10 12 (6 ) 16

Investing activity (to)/from other segments (38 ) (11 ) 49 —

Net cash provided by/(used in) investing activities $ (3,078 ) $ (5,825 ) $ 41 $ (8,862 )

Cash flows from financing activities Automotive

Financial

Services

All Other,

Special Items,

& Adjustments Consolidated

Cash dividends $ (1,392 ) $ — $ — $ (1,392 )

Purchases of common stock (131 ) — — (131 )

Net changes in short-term debt 216 (144 ) — 72

Proceeds from issuance of other debt 507 19,960 — 20,467

Principal payments on other debt (881 ) (19,071 ) — (19,952 )

Other (50 ) (52 ) — (102 )

Financing activity to/(from) other segments — 12 (12 ) —

Net cash provided by/(used in) financing activities $ (1,731 ) $ 705 $ (12 ) $ (1,038 )

Effect of exchange rate changes on cash and cash equivalents $ 94 $ 173 $ — $ 267

* We measure and evaluate our Automotive segment operating cash flow on a different basis than Net cash provided by/(used in) operating activities in our

consolidated statement of cash flows. Automotive segment operating cash flow includes additional elements management considers to be related to our

Automotive operating activities, primarily capital spending and non-designated derivatives, and excludes outflows for funded pension contributions,

separation payments, and other items that are considered operating cash flows under U.S. GAAP. The table above quantifies the reconciling adjustments to

Net cash provided by/(used in) operating activities for the period ended June 30, 2017.

Ford Motor Company 2Q July 26, 201711

N O N - G A A P F I N A N C I A L M E A S U R E S T H AT S U P P L E M E N T G A A P M E A S U R E S

We use both GAAP and non-GAAP financial measures for operational and financial decision making, and to assess Company and segment

business performance. The non-GAAP measures listed below are intended to be considered by users as supplemental information to their

equivalent GAAP measures, to aid investors in better understanding our financial results. We believe that these non-GAAP measures provide

useful perspective on underlying business results and trends, and a means to assess our period-over-period results. These non-GAAP measures

should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. These

non-GAAP measures may not be the same as similarly titled measures used by other companies due to possible differences in method and in

items or events being adjusted.

Total Company Adjusted Pre-tax Profit (Most Comparable GAAP Measure: Net income attributable to Ford) – The non-GAAP measure is useful to

management and investors because it allows users to evaluate our pre-tax results excluding pre-tax special items. Pre-tax special items

consist of (i) pension and OPEB remeasurement gains and losses that are not reflective of our underlying business results, (ii) significant

restructuring actions related to our efforts to match production capacity and cost structure to market demand and changing model mix, and (iii)

other items that we do not necessarily consider to be indicative of earnings from ongoing operating activities. When we provide guidance for

adjusted pre-tax profit, we do not provide guidance on a net income basis because the GAAP measure will include potentially significant special

items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and OPEB

remeasurement gains and losses.

Adjusted Earnings Per Share (Most Comparable GAAP Measure: Earnings Per Share) – Measure of Company’s diluted net earnings per share

adjusted for impact of pre-tax special items (described above), and tax special items. The measure provides investors with useful information to

evaluate performance of our business excluding items not indicative of underlying run rate of our business. When we provide guidance for

adjusted earnings per share, we do not provide guidance on an earnings per share basis because the GAAP measure will include potentially

significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and

OPEB remeasurement gains and losses.

Adjusted Effective Tax Rate (Most Comparable GAAP Measure: Effective Tax Rate) – Measure of Company’s tax rate excluding pre-tax special

items (described above) and tax special items. The measure provides an ongoing effective rate which investors find useful for historical

comparisons and for forecasting. When we provide guidance for adjusted effective tax rate, we do not provide guidance on an effective tax rate

basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with

reasonable certainty prior to year-end, including pension and OPEB remeasurement gains and losses.

Ford Motor Company 2Q July 26, 201712

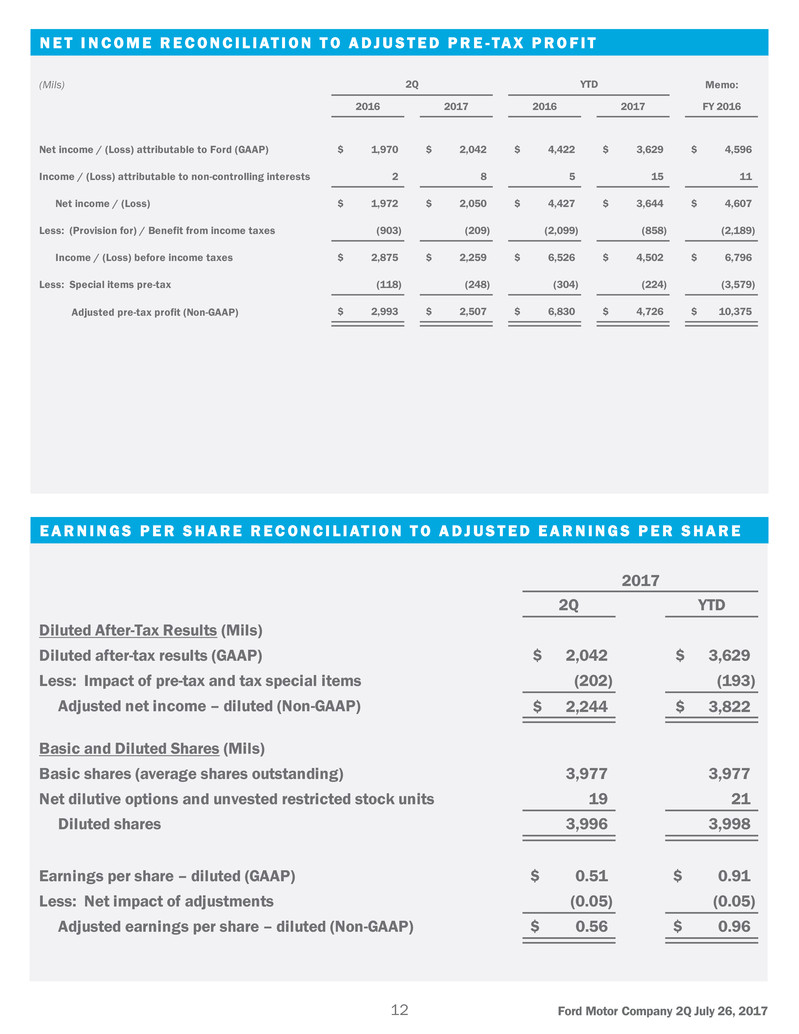

N E T I N C O M E R E C O N C I L I AT I O N T O A D J U S T E D P R E - TA X P R O F I T

E A R N I N G S P E R S H A R E R E C O N C I L I AT I O N T O A D J U S T E D E A R N I N G S P E R S H A R E

2017

2Q YTD

Diluted After-Tax Results (Mils)

Diluted after-tax results (GAAP) 2,042$ 3,629$

Less: Impact of pre-tax and tax special items (202) (193)

Adjusted net income – diluted (Non-GAAP) 2,244$ 3,822$

Basic and Diluted Shares (Mils)

Basic shares (average shares outstanding) 3,977 3,977

Net dilutive options and unvested restricted stock units 19 21

Diluted shares 3,996 3,998

Earnings per share – diluted (GAAP) 0.51$ 0.91$

Less: Net impact of adjustments (0.05) (0.05)

Adjusted earnings per share – diluted (Non-GAAP) 0.56$ 0.96$

(Mils) Memo:

2016 2017 2016 2017 FY 2016

Net income / (Loss) attributable to Ford (GAAP) 1,970$ 2,042$ 4,422$ 3,629$ 4,596$

Income / (Loss) attributable to non-controlling interests 2 8 5 15 11

Net income / (Loss) 1,972$ 2,050$ 4,427$ 3,644$ 4,607$

Less: (Provision for) / Benefit from income taxes (903) (209) (2,099) (858) (2,189)

Income / (Loss) before income taxes 2,875$ 2,259$ 6,526$ 4,502$ 6,796$

Less: Special items pre-tax (118) (248) (304) (224) (3,579)

Adjusted pre-tax profit (Non-GAAP) 2,993$ 2,507$ 6,830$ 4,726$ 10,375$

2Q YTD

Ford Motor Company 2Q July 26, 201713

E F F E C T I V E T A X R AT E R E C O N C I L I AT I O N T O A D J U S T E D E F F E C T I V E T A X R AT E

S P E C I A L I T E M S

2017 Memo:

2Q YTD FY 2016

Pre-Tax Results (Mils)

Income / (Loss) before income taxes (GAAP) 2,259$ 4,502$ 6,796$

Less: Impact of special items (248) (224) (3,579)

Adjusted pre-tax profit (Non-GAAP) 2,507$ 4,726$ 10,375$

Taxes (Mils)

(Provision for) / Benefit from income taxes (GAAP) (209)$ (858)$ (2,189)$

Less: Impact of special items 46 31 1,121

Adjusted (provision for) / benefit from income taxes (Non-GAAP) (255)$ (889)$ (3,310)$

Tax Rate (Pct)

Effective tax rate (GAAP) 9.3% 19.1% 32.2%

Adjusted effective tax rate (Non-GAAP) 10.2% 18.8% 31.9%

(Mils) Memo:

2016 2017 2016 2017 FY 2016

Pension and OPEB remeasurement gain / (loss) (11)$ -$ (11)$ -$ (2,996)$

Separation-related actions (102)$ (7)$ (276)$ (29)$ (304)$

Other Items

San Luis Potosi plant cancellation -$ 7$ -$ 53$ (199)$

Japan, Indonesia market closure (5) - (17) - (80)

Next-generation Focus footprint change - (248) - (248) -

Total other items (5)$ (241)$ (17)$ (195)$ (279)$

Total pre-tax special items (118)$ (248)$ (304)$ (224)$ (3,579)$

Tax special items (1)$ 46$ (67)$ 31$ 1,121$

Memo:

Special items impact on earnings per share* (0.03)$ (0.05)$ (0.09)$ (0.05)$ (0.61)$

2Q YTD

Ford Motor Company 2Q July 26, 201714

C O N S O L I D AT E D I N C O M E S T AT E M E N T – F O R D C R E D I T

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

CONSOLIDATED INCOME STATEMENT

(in millions)

For the periods ended June 30,

2016 2017 2016 2017

Second Quarter First Half

(unaudited)

Financing revenue

Operating leases $ 1,388 $ 1,381 $ 2,706 $ 2,747

Retail financing 757 825 1,493 1,627

Dealer financing 443 476 883 927

Other 7 17 19 34

Total financing revenue 2,595 2,699 5,101 5,335

Depreciation on vehicles subject to operating leases (1,075 ) (1,037 ) (2,089) (2,101 )

Interest expense (687 ) (769 ) (1,333) (1,498 )

Net financing margin 833 893 1,679 1,736

Other revenue

Insurance premiums earned 41 42 80 82

Fee based revenue and other — 61 — 116

Total financing margin and other revenue 874 996 1,759 1,934

Expenses

Operating expenses 310 302 604 606

Provision for credit losses 137 99 265 251

Insurance expenses 79 62 91 93

Total expenses 526 463 960 950

Other income, net 52 86 115 116

Income before income taxes 400 619 914 1,100

Provision for income taxes 104 173 260 321

Net income $ 296 $ 446 $ 654 $ 779

Ford Motor Company 2Q July 26, 201715

C O N S O L I D AT E D B A L A N C E S H E E T – F O R D C R E D I T

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

(in millions)

December 31,

2016

June 30,

2017

(unaudited)

ASSETS

Cash and cash equivalents $ 8,077 $ 7,366

Marketable securities 3,280 3,311

Finance receivables, net 102,981 108,300

Net investment in operating leases 27,209 26,693

Notes and accounts receivable from affiliated companies 811 986

Derivative financial instruments 909 979

Other assets 2,822 2,859

Total assets $ 146,089 $ 150,494

LIABILITIES

Accounts payable

Customer deposits, dealer reserves, and other $ 1,065 $ 1,138

Affiliated companies 336 513

Total accounts payable 1,401 1,651

Debt 126,492 129,268

Deferred income taxes 3,230 3,449

Derivative financial instruments 166 216

Other liabilities and deferred income 1,997 2,066

Total liabilities 133,286 136,650

SHAREHOLDER’S INTEREST

Shareholder’s interest 5,227 5,227

Accumulated other comprehensive income/(loss) (890 ) (609 )

Retained earnings 8,466 9,226

Total shareholder’s interest attributable to Ford Motor Credit Company 12,803 13,844

Shareholder’s interest attributable to noncontrolling interests — —

Total shareholder’s interest 12,803 13,844

Total liabilities and shareholder’s interest $ 146,089 $ 150,494

Ford Motor Company 2Q July 26, 201716

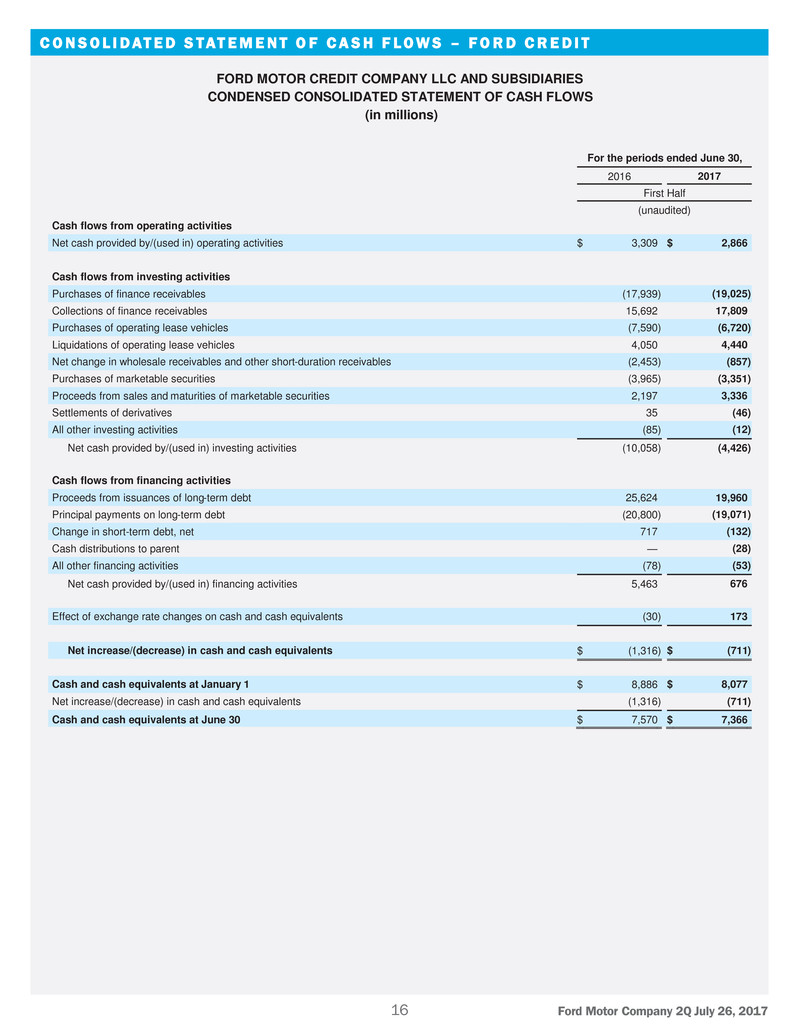

C O N S O L I D AT E D S T AT E M E N T O F C A S H F L O W S – F O R D C R E D I T

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(in millions)

For the periods ended June 30,

2016 2017

First Half

(unaudited)

Cash flows from operating activities

Net cash provided by/(used in) operating activities $ 3,309 $ 2,866

Cash flows from investing activities

Purchases of finance receivables (17,939 ) (19,025 )

Collections of finance receivables 15,692 17,809

Purchases of operating lease vehicles (7,590 ) (6,720 )

Liquidations of operating lease vehicles 4,050 4,440

Net change in wholesale receivables and other short-duration receivables (2,453 ) (857 )

Purchases of marketable securities (3,965 ) (3,351 )

Proceeds from sales and maturities of marketable securities 2,197 3,336

Settlements of derivatives 35 (46 )

All other investing activities (85 ) (12 )

Net cash provided by/(used in) investing activities (10,058 ) (4,426 )

Cash flows from financing activities

Proceeds from issuances of long-term debt 25,624 19,960

Principal payments on long-term debt (20,800 ) (19,071 )

Change in short-term debt, net 717 (132 )

Cash distributions to parent — (28 )

All other financing activities (78 ) (53 )

Net cash provided by/(used in) financing activities 5,463 676

Effect of exchange rate changes on cash and cash equivalents (30 ) 173

Net increase/(decrease) in cash and cash equivalents $ (1,316) $ (711)

Cash and cash equivalents at January 1 $ 8,886 $ 8,077

Net increase/(decrease) in cash and cash equivalents (1,316 ) (711 )

Cash and cash equivalents at June 30 $ 7,570 $ 7,366