Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BOK FINANCIAL CORP | a20170630bokfconferencecal.htm |

1

Second Quarter 2017

Earnings Conference Call

July 26, 2017

2

Forward-Looking Statements: This presentation contains statements that are based on management’s

beliefs, assumptions, current expectations, estimates, and projections about BOK Financial Corporation, the

financial services industry, and the economy generally. These remarks constitute forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipates”,

“believes”, “estimates”, “expects”, “forecasts”, “plans”, “projects”, variations of such words, and similar

expressions are intended to identify such forward-looking statements. Management judgments relating to,

and discussion of the provision and allowance for credit losses involve judgments as to future events and are

inherently forward-looking statements. Assessments that BOK Financial’s acquisitions and other growth

endeavors will be profitable are necessary statements of belief as to the outcome of future events, based in

part on information provided by others which BOKF has not independently verified. These statements are not

guarantees of future performance and involve certain risks, uncertainties, and assumptions which are difficult

to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and

outcomes may materially differ from what is expressed, implied or forecasted in such forward-looking

statements. Internal and external factors that might cause such a difference include, but are not limited to,

changes in interest rates and interest rate relationships, demand for products and services, the degree of

competition by traditional and non-traditional competitors, changes in banking regulations, tax laws, prices,

levies, and assessments, the impact of technological advances, and trends in customer behavior as well as

their ability to repay loans. For a discussion of risk factors that may cause actual results to differ from

expectations, please refer to BOK Financial Corporation’s most recent annual and quarterly reports. BOK

Financial Corporation and its affiliates undertake no obligation to update, amend, or clarify forward-looking

statements, whether as a result of new information, future events, or otherwise.

Non-GAAP Financial Measures: This presentation may refer to non-GAAP financial measures. Additional

information on these financial measures is available in BOK Financial’s 10-Q and 10-K filings with the

Securities and Exchange Commission which can be accessed at www.BOKF.com.

All data is presented as of June 30, 2017 unless otherwise noted.

3

Steven G. Bradshaw

Chief Executive Officer

4

Second Quarter Summary:

• Noteworthy items impacting Q2 profitability:

• Strong net interest margin and net interest revenue growth from full benefit from March 2017 Fed

rate hike and continued asset sensitivity of balance sheet in early part of rate cycle

• Fee income driven by strong performance from Fiduciary and Asset Management, Transaction

Card, and seasonal strength in mortgage banking

• Continued careful expense management, including $5.1 million refund from FDIC

• $5.7 million gain on the sale of a merchant banking investment

• Benign credit environment – no provision for loan losses in the quarter.

Q2 2017 Q1 2017 Q2 2016

Diluted EPS $1.35 $1.35 $1.00

Net income before

taxes ($M)

$136.6 $126.8 $96.8

Net income

attributable to BOKF

shareholders ($M)

$88.1 $88.4 $65.8

$65.8

$74.3

$50.0

$88.4 $88.1

$1.00

$1.13

$0.76

$1.35 $1.35

2Q16 3Q16 4Q16 1Q17 Q217

Net Income

Net income attributable to shareholders

Net income per share - diluted

5

Additional Details

($B)

Q2 2017

Quarterly

Growth

Annualized

Quarterly

Growth

Year over Year

Growth

Period-End Loans $17.2 1.1% 4.5% 4.7%

Average Loans $17.1 -% -% 5.3%

Fiduciary Assets $44.5 0.2% 0.8% 11.3%

Assets Under Management

or in Custody

$77.8 0.5% 2.0% 6.6%

• Mid single digit annualized loan growth in Q2 2017, driven by momentum in energy banking

• Modest AUM growth driven by market factors

6

Steven Nell

Chief Financial Officer

Financial Overview

7

Net Interest Revenue

Net Interest Margin

($mil)

Q2

2017

Q1

2017

Q4

2016

Q3

2016

Q2

2016

Net Interest Revenue $205.2 $201.2 $194.2 $187.8 $182.6

Provision For Credit Losses $ -- $ -- $ -- $ 10.0 $ 20.0

Net Interest Revenue After Provision $205.2 $201.2 $194.2 $177.8 $162.6

Net Interest Margin 2.89% 2.81% 2.69% 2.64% 2.63%

Add Back: Dilution due to FHLB/Fed Trade 0.13% 0.13% 0.12% 0.12% 0.12%

Normalized Net Interest Margin 3.02% 2.94% 2.81% 2.76% 2.75%

• Due to low deposit betas and low deposit pricing pressure, balance sheet continues to behave very asset

sensitive in the current interest rate cycle

• Net Interest Margin up 8 basis points sequentially due to:

• Full impact of March 2017 Fed rate hike

• Yield on AFS securities up 6 basis points

• Loan yields up 15 basis points

• Deposit costs up 5 basis points

• Normalized Net Interest Margin exceeds 3% for first time since Q3 2012

8

Fees and Commissions

Revenue, $mil Change:

Q2 17

Quarterly,

Sequential

Quarterly,

Year over Year

Trailing 12

Months

Brokerage and Trading $31.8 (5.5%) (19.6%) (1.4%)

Transaction Card 35.3 9.9% 1.0% 2.8%

Fiduciary and Asset Management 41.8 8.2% 20.1% 15.7%

Deposit Service Charges and Fees 23.4 1.4% 3.3% 2.0%

Mortgage Banking 30.3 20.2% (13.2%) 0.8%

Other Revenue 15.0 27.5% 12.2% 0.1%

Total Fees and Commissions $177.5 8.0% (1.5%) 3.8%

Fee and commission revenue drivers:

• Brokerage and trading: Soft quarter for fees due to impact of fiduciary rule implementation on retail brokerage

business, lower investment banking deal flow, and reduced institutional trading volume.

• Transaction card: Revenue momentum rebuilding due to strong sales activity in 1H2017. Year over year

comparison impacted by heavy contract buyout revenue in 2Q16.

• Fiduciary and asset management: Strong revenue growth from corporate trust and institutional wealth; zero fee

waivers this quarter compared to $1.8 million in 2Q16; and contribution from seasonal tax planning business.

• Mortgage banking: Strong sequential increase due to seasonality, higher retail gain on sale margins, and

improved pipeline hedge performance.

• NOTE: $1.6 million of revenue from repossessed oil wells included in “other revenue” line.

9

Expenses

($mil)

Q2 2017

Q1 2017

Q2 2016

%Incr.

Seq.

%Incr.

YOY

Personnel Expense $143.7 $136.4 $139.2 5.4% 3.3%

Other Operating Expense $107.1 $108.3 $112.2 (1.1)% (4.5)%

Total Operating Expense $250.9 $244.7 $251.4 2.5% (0.2)%

Personnel Expense:

• Increase due to full quarter’s impact of March merit increases, severance expense, and updated vesting assumptions on

equity incentive awards

Other Operating Expense:

• Business promotion expense up $1 million sequentially due to timing of advertising spend

• $5.1 million of FDIC expense rebates from prior quarters due to designation of BOKF as a custody bank.

• Expect FDIC expense run rate to be ~$1 million per quarter lower going forward

• Higher OREO expense due to $900,000 of operating costs, net of gain on partial property sales, associated with

repossessed oil wells (offsetting revenue of $1.6 million)

• Lower provision for recourse losses caused reduction in mortgage banking expense

10

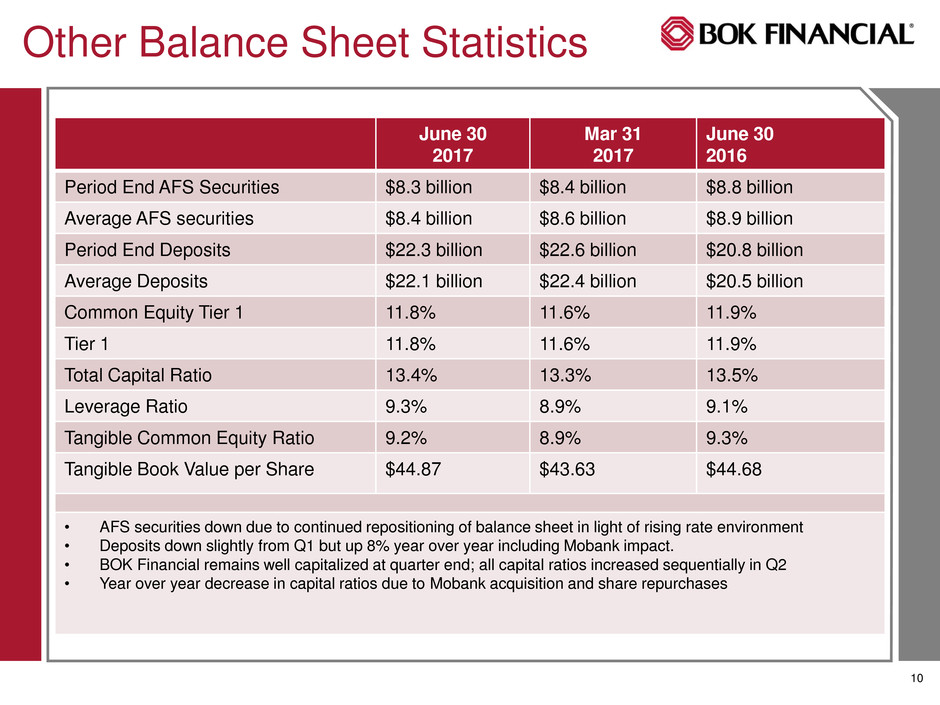

Other Balance Sheet Statistics

June 30

2017

Mar 31

2017

June 30

2016

Period End AFS Securities $8.3 billion $8.4 billion $8.8 billion

Average AFS securities $8.4 billion $8.6 billion $8.9 billion

Period End Deposits $22.3 billion $22.6 billion $20.8 billion

Average Deposits $22.1 billion $22.4 billion $20.5 billion

Common Equity Tier 1 11.8% 11.6% 11.9%

Tier 1 11.8% 11.6% 11.9%

Total Capital Ratio 13.4% 13.3% 13.5%

Leverage Ratio 9.3% 8.9% 9.1%

Tangible Common Equity Ratio 9.2% 8.9% 9.3%

Tangible Book Value per Share $44.87 $43.63 $44.68

• AFS securities down due to continued repositioning of balance sheet in light of rising rate environment

• Deposits down slightly from Q1 but up 8% year over year including Mobank impact.

• BOK Financial remains well capitalized at quarter end; all capital ratios increased sequentially in Q2

• Year over year decrease in capital ratios due to Mobank acquisition and share repurchases

11

2017 Assumptions

Mid-single-digit loan growth for the full year

Available-for-sale securities portfolio expected to be flat for balance of the year (*)

Stable to increasing net interest margin and modest sequential growth in net interest

income expected in Q3 and Q4

Loan loss provision of $0-$10 million for full year (*)

Low-single-digit revenue growth from fee-generating businesses on a trailing twelve

month basis

Expenses flat to slightly down compared to 2016

* Guidance changed from prior quarter

12

Stacy Kymes

EVP-Corporate Banking

13

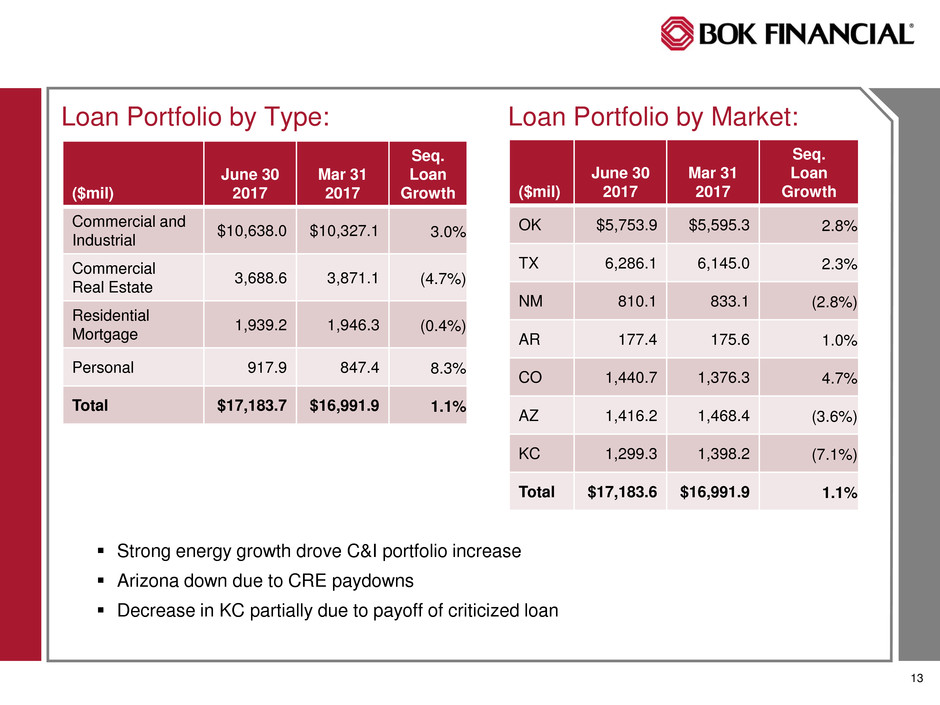

($mil)

June 30

2017

Mar 31

2017

Seq.

Loan

Growth

Commercial and

Industrial

$10,638.0 $10,327.1 3.0%

Commercial

Real Estate

3,688.6 3,871.1 (4.7%)

Residential

Mortgage

1,939.2 1,946.3 (0.4%)

Personal 917.9 847.4 8.3%

Total $17,183.7 $16,991.9 1.1%

Loan Portfolio by Type:

($mil)

June 30

2017

Mar 31

2017

Seq.

Loan

Growth

OK $5,753.9 $5,595.3 2.8%

TX 6,286.1 6,145.0 2.3%

NM 810.1 833.1 (2.8%)

AR 177.4 175.6 1.0%

CO 1,440.7 1,376.3 4.7%

AZ 1,416.2 1,468.4 (3.6%)

KC 1,299.3 1,398.2 (7.1%)

Total $17,183.6 $16,991.9 1.1%

Loan Portfolio by Market:

Strong energy growth drove C&I portfolio increase

Arizona down due to CRE paydowns

Decrease in KC partially due to payoff of criticized loan

14

($mil)

June 30

2017

Mar 31

2017

Seq.

Loan

Growth

Energy $2,847.2 $2,537.1 12.2%

Services 2,958.8 3,013.4 (1.8%)

Healthcare 2,221.5 2,265.6 (1.9%)

Wholesale/retail 1,543.7 1,506.2 2.5%

Manufacturing 546.2 543.4 0.5%

Other 520.6 461.4 12.8%

Total C&I $10,638.0 $10,327.1 3.0%

($mil)

June 30

2017

Mar 31

2017

Seq.

Loan

Growth

Retail $722.8 $745.0 (3.0%)

Multifamily 952.4 923.0 3.2%

Office 863.0 860.9 0.2%

Industrial 693.6 871.5 (20.4%)

Residential Const.

and Land Dev.

141.6 136.0 4.1%

Other CRE 315.2 334.7 (5.8%)

Total CRE $3,688.6 $3,871.1 (4.7%)

Commercial & Industrial: Commercial Real Estate

Energy loan growth of 12.2% was primary driver of overall C&I growth

Healthcare portfolio growth temporarily stalled due to uncertain political environment

CRE portfolio down due to internal concentration management efforts combined with

higher-than-expected paydown activity in Q2.

15

Key Credit Quality Metrics

$168.1

$143.0 $132.5

$110.4

$124.0

79.1

94.0

98.5

97.2

121.5

$247.2

$237.0

$231.0

$207.6

$245.4

$-

$50.0

$100.0

$150.0

$200.0

$250.0

2Q16 3Q16 4Q16 1Q17 2Q17

Energy Non-Accruals Other Non-Accruals

1.54%

1.56%

1.52%

1.52%

1.49%

1.40%

1.42%

1.44%

1.46%

1.48%

1.50%

1.52%

1.54%

1.56%

1.58%

2Q16 3Q16 4Q16 1Q17 2Q17

Combined Allowance for Credit Losses

to Period End Loans

0.18% 0.15%

-0.03%

-0.02%

0.04%

-0.50%

0.00%

0.50%

1.00%

1.50%

2Q16 3Q16 4Q16 1Q17 2Q17

Net charge offs (annualized)

to average loans

No material signs of stress in any loan

portfolio

Appropriately reserved for any potential

issues with a combined allowance of 1.49%,

which is at or near the top of the peer group

16

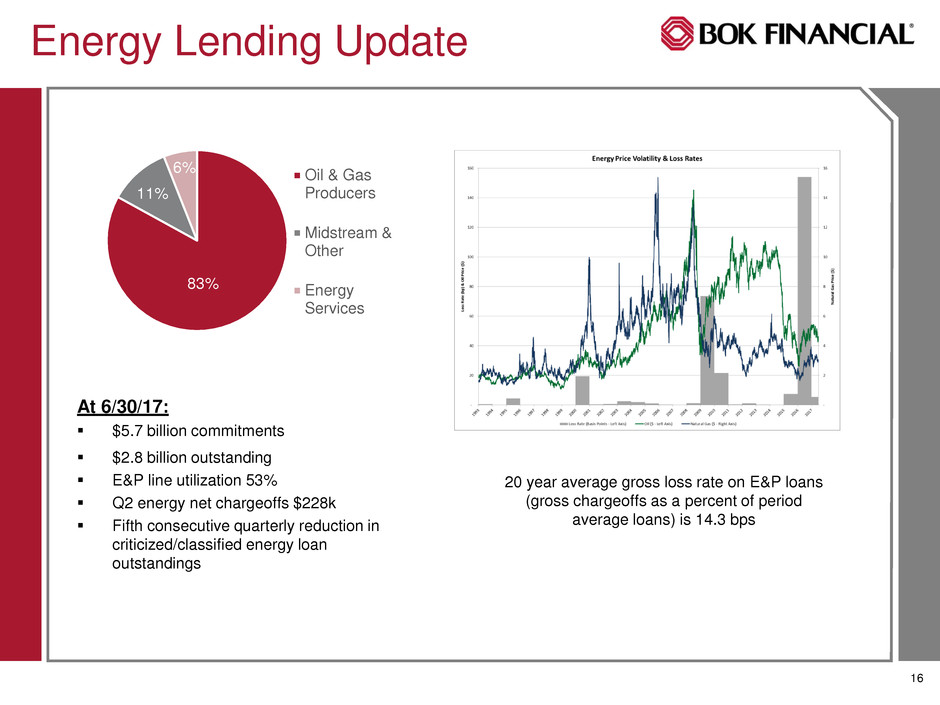

Energy Lending Update

At 6/30/17:

$5.7 billion commitments

$2.8 billion outstanding

E&P line utilization 53%

Q2 energy net chargeoffs $228k

Fifth consecutive quarterly reduction in

criticized/classified energy loan

outstandings

20 year average gross loss rate on E&P loans

(gross chargeoffs as a percent of period

average loans) is 14.3 bps

83%

11%

6% Oil & Gas

Producers

Midstream &

Other

Energy

Services

17

$723 million outstanding at 6/30/17

Only $2 million criticized loans – no change from 3/31/17

60% of portfolio considered service based and less susceptible to online

competition

Diversified portfolio:

Top ten “goods based” retail CRE exposures total $192 million. Goods based

determined by:

>50% of gross potential rent from the Moody’s retail industry classifications that are most

susceptible to e-commerce threats.

Or >35% of gross potential rent from any one goods-based retailer.

Highly diversified tenant base with no material exposure to any one tenant.

Top five tenant concentrations are as follows:

1. Investment grade retail pharmacy chain: 13 loans totaling $45MM

2. Investment grade retail pharmacy chain: 4 loans totaling $8MM

3. Investment grade “dollar store” chain: 9 loans totaling $7.9MM

4. Investment grade arts and crafts supply chain: 4 loans totaling $7.8MM

5. Investment grade “dollar store” chain: 5 loans totaling $4.1MM

Retail CRE Update

Top 5 tenants

only represent

$72.8 million or

10.1% of retail

CRE exposure

18

Total Retail/Wholesale category outstandings at 6/30: $1,543.7 million

Retailers total $652.6 million or 42% of this category

65% of retailer outstandings are service-based retailers (61% of commitments)

Criticized loans total $8.6 million (1.32%)

Retail C&I portfolio by type:

Retail C&I Update

Store Type

Outstanding at

6/30/17

Notes:

Convenience Stores $128.3

Grocers $45.2

Auto Dealers $49.5

Restaurants $158.7

Other $270.9 Over $100 million to a single investment-grade retailer

with low risk of online competition

TOTAL $652.6

19

Steven G. Bradshaw

Chief Executive Officer

Closing Remarks

20

Question and Answer Session