Attached files

| file | filename |

|---|---|

| EX-32 - SECTION 1350 CERTIFICATIONS - PRICE T ROWE GROUP INC | trow-ex32_q22017.htm |

| EX-31.2 - RULE 13A-14(A) CERTIFICATION OF PRINCIPAL FINANCIAL OFFICER - PRICE T ROWE GROUP INC | trow-ex31i2_q22017.htm |

| EX-31.1 - RULE 13A-14(A) CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER - PRICE T ROWE GROUP INC | trow-ex31i1_q22017.htm |

| EX-15 - LETTER FROM KPMG LLP - PRICE T ROWE GROUP INC | trow-ex15_q22017x10q.htm |

| 10-Q - 10-Q - PRICE T ROWE GROUP INC | a10q-q22017.htm |

1

NEWS RELEASE

T. ROWE PRICE GROUP REPORTS SECOND QUARTER 2017 RESULTS

Assets Under Management Increase to $903.6 Billion

BALTIMORE (July 25, 2017) - T. Rowe Price Group, Inc. (NASDAQ-GS: TROW) today reported its second

quarter of 2017 results, including net revenues of $1.2 billion, net income of $373.9 million, and diluted

earnings per common share of $1.50. On a comparable basis, net revenues were $1.0 billion, net income was

$203.3 million, and diluted earnings per common share was $.79 in the second quarter of 2016. The 2016

results included the nonrecurring operating charge of $166.2 million related to the Dell appraisal rights matter,

which reduced net income by $100.7 million, or $.39 in diluted earnings per common share. A summary of the

impact the matter has had on the firm's periodic financial results is summarized in a table at the back of this

release. Adjusted diluted earnings per share for the second quarter of 2017 is up 15.3% compared to the 2016

quarter.

Financial Highlights

The table below presents financial results on a U.S. GAAP basis as well as a non-GAAP basis that adjusts for

the impact of the Dell appraisal rights matter, the firm's consolidated sponsored investment portfolios, and

other non-operating income. The firm believes the non-GAAP financial measures below provide relevant and

meaningful information to investors about its core operating results.

Three months ended Six months ended

(in millions, except per-share data) 6/30/2016

(1)

6/30/2017

%

change 6/30/2016

(1)

6/30/2017

%

change

U.S. GAAP Basis

Investment advisory fees $ 920.6 $ 1,043.9 13.4 % $ 1,791.4 $ 2,035.0 13.6 %

Net revenues $ 1,044.7 $ 1,171.6 12.1 % $ 2,038.8 $ 2,285.2 12.1 %

Operating expenses $ 761.2 $ 664.0 (12.8 )% $ 1,344.4 $ 1,255.9 (6.6 )%

Net operating income $ 283.5 $ 507.6 79.0 % $ 694.4 $ 1,029.3 48.2 %

Non-operating income $ 41.5 $ 112.0 169.9 % $ 126.6 $ 227.0 79.3 %

Net income attributable to T. Rowe Price Group $ 203.3 $ 373.9 83.9 % $ 507.4 $ 759.8 49.7 %

Diluted earnings per common share $ .79 $ 1.50 89.9 % $ 1.97 $ 3.04 54.3 %

Weighted average common shares outstanding

assuming dilution 252.6

243.0

(3.8 )% 252.2

244.2

(3.2 )%

Adjusted(2)

Operating expenses $ 593.3

(3)

$ 662.3

(3)

11.6 % $ 1,175.2

(5)

$ 1,302.4

(5)

10.8 %

Net income attributable to T. Rowe Price Group $ 285.6 (4) $ 317.9 (4) 11.3 % $ 545.7 (6) $ 615.1 (6) 12.7 %

Diluted earnings per common share $ 1.11 $ 1.28 15.3 % $ 2.12 $ 2.46 16.0 %

Assets under Management (in billions)

Average assets under management $ 772.7 $ 885.9 14.6 % $ 750.4 $ 865.6 15.4 %

Ending assets under management $ 776.6 $ 903.6 16.4 % $ 776.6 $ 903.6 16.4 %

(1)Prior year amounts have been adjusted to reflect the impact of implementing new stock-based compensation accounting guidance in the third quarter of

2016.

(2) See the reconciliation to the comparable U.S. GAAP measures at the end of this earnings release.

2

Assets Under Management

Assets under management increased $42.0 billion in the second quarter of 2017 to $903.6 billion at June 30,

2017. The firm's net cash inflows were $3.7 billion in the second quarter of 2017. There were $7.6 billion of

client transfers from the mutual funds to other portfolios. The components of the change in assets under

management are shown in the table below.

Three months ended 6/30/2017 Six months ended 6/30/2017

(in billions)

Sponsored

U.S. mutual

funds

Other

investment

portfolios Total

Sponsored

U.S. mutual

funds

Other

investment

portfolios Total

Assets under management at

beginning of period $ 548.3

$ 313.3

$ 861.6

$ 514.2

$ 296.6

$ 810.8

Net cash flows before client

transfers 1.9

1.8

3.7

4.4

—

4.4

Client transfers from mutual funds

to other portfolios (7.6 ) 7.6

—

(7.9 ) 7.9

—

Net cash flows after client transfers (5.7 ) 9.4 3.7 (3.5 ) 7.9 4.4

Net market appreciation and

income, net of distributions not

reinvested 23.9

14.4

38.3

55.8

32.6

88.4

Change during the period 18.2 23.8 42.0 52.3 40.5 92.8

Assets under management at June

30, 2017 $ 566.5

$ 337.1

$ 903.6

$ 566.5

$ 337.1

$ 903.6

The firm's net cash flows were in the following asset classes:

(in billions)

Three months

ended 6/30/2017

Six months

ended 6/30/2017

Stock and blended asset $ (1.4 ) $ (5.3 )

Bond, money market, and stable value 5.1 9.7

Total net cash flows 3.7 4.4

Net cash flows into the firm's target date retirement portfolios were $3.1 billion in the second quarter of 2017

and $5.4 billion in the first half of 2017.

The firm's assets under management by asset class and in the firm's retirement date portfolios are as follows:

As of

(in billions) 12/31/2016 3/31/2017 6/30/2017

Equity $ 450.6 $ 482.9 $ 508.9

Fixed income 121.2 123.5 125.4

Asset allocation 239.0 255.2 269.3

Total assets under management $ 810.8 $ 861.6 $ 903.6

Target date retirement portfolios $ 189.2 $ 202.6 $ 213.8

Investors domiciled outside the United States accounted for about 5% of the firm's assets under management

at December 31, 2016, and June 30, 2017.

3

Capital Management

T. Rowe Price remains debt-free with ample liquidity, including cash and sponsored portfolio investment

holdings as follows:

(in millions) 12/31/2016 6/30/2017

Cash and cash equivalents $ 1,204.9 $ 1,542.2

Discretionary investments in sponsored investment portfolios 700.6 678.7

Total discretionary investments 1,905.5 2,220.9

Redeemable seed capital investments in sponsored investment portfolios 1,263.8 1,169.1

Investments in sponsored investment portfolios to hedge supplemental

savings plan liability —

172.3

Total cash and sponsored investment holdings $ 3,169.3 $ 3,562.3

The firm's common shares outstanding decreased since the end of 2016 as it expended $447.0 million during

the first half of 2017 to repurchase 6.5 million shares, or 2.6%, of its outstanding common shares, including

$130.7 million to repurchase 1.9 million shares during the second quarter of 2017. The firm invested

$82.6 million during the first half of 2017 in capitalized facilities and technology and expects capital

expenditures for 2017 to be up to $200 million, of which about two-thirds is planned for technology initiatives.

These expenditures are expected to continue to be funded from operating resources.

Investment Performance

The percentage of T. Rowe Price mutual funds (across share classes) that outperformed their comparable

Lipper averages on a total return basis and that are in the top Lipper quartile for the one-, three-, five-, and 10-

years ended June 30, 2017, were:

1 year 3 years 5 years 10 years

Outperformed Lipper averages

All funds 68% 81% 83% 85%

Asset allocation funds 90% 96% 95% 93%

Top Lipper quartile

All funds 44% 56% 58% 61%

Asset allocation funds 66% 67% 84% 79%

In addition, 88% of the rated Price Funds' assets under management ended the quarter with an overall rating

of four or five stars from Morningstar. The performance of the firm's institutional strategies against their

benchmarks remains very competitive especially over longer time periods.

4

Financial Results

Investment advisory revenues earned in the current quarter from the T. Rowe Price mutual funds distributed in

the U.S. were $754.3 million, an increase of 12.7% from the comparable 2016 quarter. Average U.S. mutual

fund assets under management increased 13.8% to $560.2 billion.

Investment advisory revenues earned in the current quarter from other investment portfolios were

$289.6 million, an increase of 15.1% from the comparable 2016 quarter. Average assets under management

for these portfolios increased 16.1% to $325.7 billion.

The firm has reduced the management fees of certain of its mutual funds and other investment portfolios since

mid-2016. These reductions were a factor in why investment advisory revenue grew slower than average

assets under management during 2017. The firm regularly assesses the competitiveness of its fees and will

continue to make adjustments as deemed appropriate.

Operating expenses were $664.0 million in the current quarter. Excluding the $166.2 million charge related to

the Dell matter recognized in the second quarter of 2016, operating expenses have increased 11.6% from the

2016 quarter. The firm currently expects that its operating expenses, excluding the impact of the Dell matter,

will grow about 10% in 2017 versus 2016. The firm could elect to modify the pace of spending on its planned

initiatives should markets rise or decline significantly.

Compensation and related costs were $403.8 million in the current quarter, an increase of 8.8% over the

second quarter of 2016, due primarily to additional headcount, an increase in the interim accrual of the annual

bonus, and higher benefits. Benefits expenses rose primarily due to increased market valuations on its

supplemental savings plan liability, which resulted in additional compensation expense. These increases were

offset in part by higher labor capitalization related to internally developed software as the firm continues to

invest in its technology capabilities. Average staff size increased by 6.8% from the second quarter of 2016, and

the firm employed 6,651 associates at June 30, 2017.

Advertising and promotion costs were $18.6 million in the current quarter, compared with $14.9 million in the

2016 quarter. The firm currently expects advertising and promotion costs for 2017 to grow up to 10% over

2016 as the firm executes on a number of strategic initiatives.

Occupancy and facility costs, together with depreciation expense, were $83.1 million in the current quarter, an

increase of 11.4% compared to the second quarter of 2016. The increase is due primarily to higher facility

costs as well as the added costs to update and enhance technology capabilities, including related maintenance

programs.

Other operating expenses were $122.1 million in the current quarter, an increase of 23.5% from the

comparable 2016 quarter, as operational and regulatory business demands continue to grow.

5

Net non-operating income was $112.0 million in the current quarter, an increase of $70.5 million from the

second quarter of 2016. The components and variances are included in the table below:

Three months ended

6/30/2016 6/30/2017 $ change

Net realized gains on dispositions of sponsored fund

investments $ —

$ 30.3

$ 30.3

Ordinary dividend distributions from sponsored fund investments 1.8 3.5 1.7

Unrealized gains on sponsored fund investments 7.5 32.0 24.5

Net investment income on consolidated sponsored investment

portfolios(1) 26.4

39.4

13.0

Other investment income 6.0 5.6 (.4 )

Other non-operating expenses, including foreign currency gains

and losses (.2 ) 1.2

1.4

Net non-operating income $ 41.5 $ 112.0 $ 70.5

(1) A table detailing the impact the consolidated sponsored investment portfolios have had on the firm's consolidated statements of income is included at the

end of this earnings release.

Nearly all of the $30.3 million in net realized gains and $23.6 million of the $32.0 million in unrealized gains on

sponsored funds recognized during the second quarter of 2017 resulted from the firm's decision to

economically hedge the market exposure associated with its supplemental savings plan liability.

The firm's effective tax rate for the second quarter of 2017 was 37.1%. The firm currently estimates its effective

tax rate for 2017 will be about 37.4%.

Management Commentary

William J. Stromberg, the company’s president and chief executive officer, commented: “U.S. stocks rose

broadly in the second quarter of 2017 with many major indexes reaching all-time highs. International stocks

outperformed U.S. shares, aided by strengthening currencies relative to the U.S. dollar. Fixed income returns

were also positive with healthy credit conditions in the U.S. and abroad.

"Our assets under management grew by five percent in the second quarter of 2017, boosted by strong market

returns, healthy alpha generation, and solid net inflows. Positive net flows continued into our international

equity, fixed income, and asset allocation strategies, partially offset by modest outflows from U.S. equity.

“Overall we are encouraged by increasing levels of client activity and by execution of our strategy. Our relative

investment performance remains strong, investor interest continues to grow globally, and we are making good

progress with our investments in product, distribution, and technology. Some highlights of activity that reflect

ways we are meeting the needs of our clients and distribution partners include:

• New Investment Products—Recently launched portfolios include the Retirement Income 2020 Fund (a

new managed-payout fund) and the U.S. High Yield Fund (stemming from the acquisition of the

6

Henderson High Yield Opportunities Fund). We have also filed preliminary registration statements for

the Multi-Strategy Total Return Fund and Capital Appreciation & Income Fund, both of which we

expect to launch later this year.

• Recent Vehicle Launches Gaining Traction—The T. Rowe Price ActivePlus Portfolios, retail separately

managed accounts, and model portfolios are each attracting clients and assets.

• Expanding Distribution Reach—Our mutual funds are now available on Fidelity Investments’

FundsNetwork® and their Institutional No Transaction Fee (iNTF) Program, further expanding their

availability to retail investors and advisors with no transaction fees. This agreement follows the recent

addition of our mutual funds to Charles Schwab’s Mutual Fund OneSource® service with no

transaction fee.

• Client Experience Enhancements—A new relationship management team servicing high-value

individual investors in our direct channel is bolstering client engagement, and helping attract and retain

assets. Likewise, our agile approach to innovating and developing improved client digital experiences

is also seeing initial success.

"With the progress we are making on our strategic priorities and the outstanding work of our associates, we

are confident we are on the right track to enhance our competitiveness and grow and diversify our business. In

this our 80th year, we remain committed to our guiding principle of always doing what is right for our clients.

Over time, we believe that this approach will enable us to remain a premier asset manager and create

attractive long-term value for our stockholders.”

Other Matters

The financial results presented in this release are unaudited. The firm expects that it will file its Form 10-Q

Quarterly Report for the second quarter of 2017 with the U.S. Securities and Exchange Commission later

today. The Form 10-Q will include additional information on the firm's unaudited financial results at June 30,

2017.

Certain statements in this earnings release may represent “forward-looking information,” including information

relating to anticipated changes in revenues, net income and earnings per common share, anticipated changes

in the amount and composition of assets under management, anticipated expense levels, estimated tax rates,

and expectations regarding financial results, future transactions, new products and services, investments,

capital expenditures, dividends, stock repurchases, and other market conditions. For a discussion concerning

risks and other factors that could affect future results, see the firm's 2016 Form 10-K and June 30, 2017 Form

10-Q filed later today.

7

Founded in 1937, Baltimore-based T. Rowe Price (troweprice.com) is a global investment management

organization that provides a broad array of mutual funds, subadvisory services, and separate account

management for individual and institutional investors, retirement plans, and financial intermediaries. The

organization also offers a variety of sophisticated investment planning and guidance tools. T. Rowe Price's

disciplined, risk-aware investment approach focuses on diversification, style consistency, and fundamental

research.

CONTACTS:

Public Relations

Brian Lewbart

410-345-2242

brian_lewbart@troweprice.com

Investor Relations

Teresa Whitaker

410-345-6586

teresa_whitaker@troweprice.com

8

Unaudited Consolidated Statements of Income

(in millions, except per share amounts)

Three months ended Six months ended

Revenues 6/30/2016 6/30/2017 6/30/2016 6/30/2017

Investment advisory fees $ 920.6 $ 1,043.9 $ 1,791.4 $ 2,035.0

Administrative fees 88.5 91.3 177.9 178.6

Distribution and servicing fees 35.6 36.4 69.5 71.6

Net revenues 1,044.7 1,171.6 2,038.8 2,285.2

Operating expenses

Compensation and related costs 371.0 403.8 726.2 801.2

Advertising and promotion 14.9 18.6 38.0 44.2

Distribution and servicing costs 35.6 36.4 69.5 71.6

Depreciation and amortization of property and equipment 33.8 36.3 66.0 71.9

Occupancy and facility costs 40.8 46.8 82.2 92.2

Other operating expenses 98.9 122.1 196.3 224.8

Nonrecurring charge (insurance recoveries) related to Dell appraisal rights

matter 166.2

—

166.2

(50.0 )

Total operating expenses 761.2 664.0 1,344.4 1,255.9

Net operating income 283.5 507.6 694.4 1,029.3

Non-operating income

Net investment income on investments 15.3 71.4 76.6 136.2

Net investment income on consolidated sponsored investment portfolios 26.4 39.4 50.2 88.3

Other income (.2 ) 1.2 (.2 ) 2.5

Total non-operating income 41.5 112.0 126.6 227.0

Income before income taxes 325.0 619.6 821.0 1,256.3

Provision for income taxes 113.8 229.6 296.5 465.9

Net income 211.2 390.0 524.5 790.4

Less: net income attributable to redeemable non-controlling interests 7.9 16.1 17.1 30.6

Net income attributable to T. Rowe Price Group 203.3 373.9 507.4 759.8

Less: net income allocated to outstanding restricted stock and stock unit

holders 4.0

8.5

9.8

17.2

Net income allocated to T. Rowe Price Group common stockholders $ 199.3 $ 365.4 $ 497.6 $ 742.6

Earnings per share on common stock of T. Rowe Price Group

Basic $ .81 $ 1.52 $ 2.02 $ 3.08

Diluted $ .79 $ 1.50 $ 1.97 $ 3.04

Weighted-average common shares

Outstanding 246.9 239.8 246.8 240.9

Outstanding assuming dilution 252.6 243.0 252.2 244.2

Dividends declared per share $ .54 $ .57 $ 1.08 $ 1.14

Impact of consolidated sponsored investment portfolios on consolidated

statements of income (in millions)

Three months ended Six months ended

6/30/2016 6/30/2017 6/30/2016 6/30/2017

Operating expenses reflected in net operating income $ (3.5 ) $ (2.7 ) $ (6.1 ) $ (5.3 )

Net investment income reflected in non-operating income 26.4 39.4 50.2 88.3

Impact on income before taxes $ 22.9 $ 36.7 $ 44.1 $ 83.0

Income attributable to T. Rowe Price Group's interest $ 15.0 $ 20.6 $ 17.1 $ 52.4

Income attributable to redeemable non-controlling interests 7.9 16.1 27.0 30.6

$ 22.9 $ 36.7 $ 44.1 $ 83.0

9

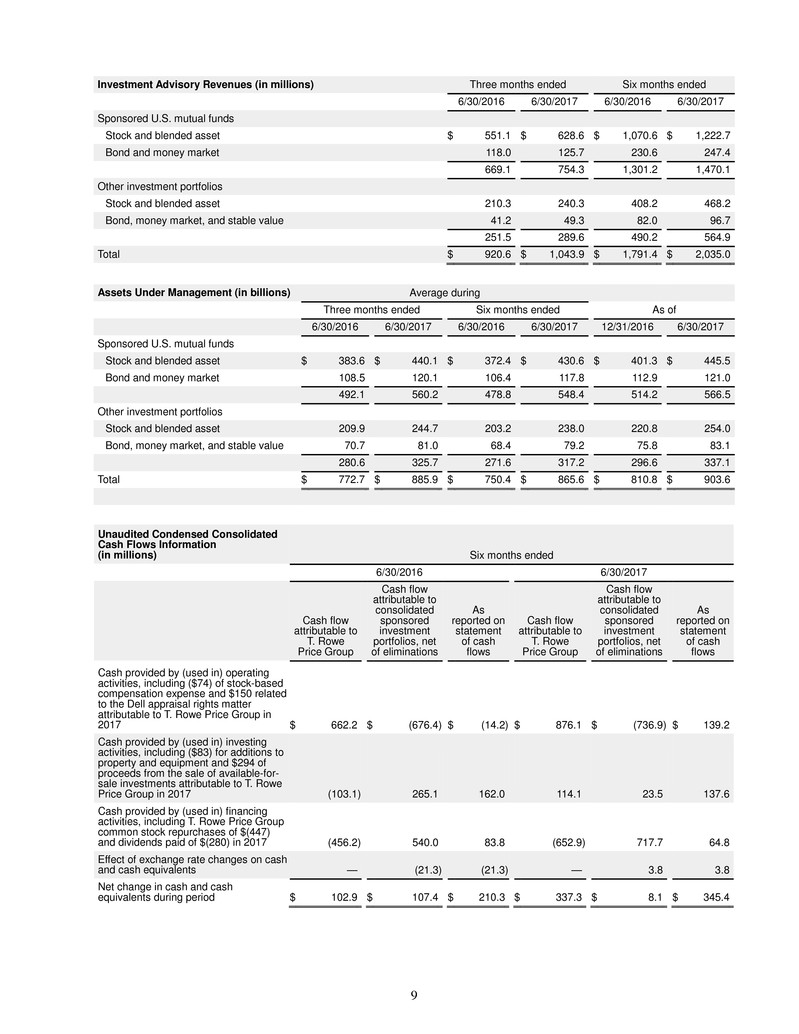

Investment Advisory Revenues (in millions) Three months ended Six months ended

6/30/2016 6/30/2017 6/30/2016 6/30/2017

Sponsored U.S. mutual funds

Stock and blended asset $ 551.1 $ 628.6 $ 1,070.6 $ 1,222.7

Bond and money market 118.0 125.7 230.6 247.4

669.1 754.3 1,301.2 1,470.1

Other investment portfolios

Stock and blended asset 210.3 240.3 408.2 468.2

Bond, money market, and stable value 41.2 49.3 82.0 96.7

251.5 289.6 490.2 564.9

Total $ 920.6 $ 1,043.9 $ 1,791.4 $ 2,035.0

Assets Under Management (in billions) Average during

Three months ended Six months ended As of

6/30/2016 6/30/2017 6/30/2016 6/30/2017 12/31/2016 6/30/2017

Sponsored U.S. mutual funds

Stock and blended asset $ 383.6 $ 440.1 $ 372.4 $ 430.6 $ 401.3 $ 445.5

Bond and money market 108.5 120.1 106.4 117.8 112.9 121.0

492.1 560.2 478.8 548.4 514.2 566.5

Other investment portfolios

Stock and blended asset 209.9 244.7 203.2 238.0 220.8 254.0

Bond, money market, and stable value 70.7 81.0 68.4 79.2 75.8 83.1

280.6 325.7 271.6 317.2 296.6 337.1

Total $ 772.7 $ 885.9 $ 750.4 $ 865.6 $ 810.8 $ 903.6

Unaudited Condensed Consolidated

Cash Flows Information

(in millions) Six months ended

6/30/2016 6/30/2017

Cash flow

attributable to

T. Rowe

Price Group

Cash flow

attributable to

consolidated

sponsored

investment

portfolios, net

of eliminations

As

reported on

statement

of cash

flows

Cash flow

attributable to

T. Rowe

Price Group

Cash flow

attributable to

consolidated

sponsored

investment

portfolios, net

of eliminations

As

reported on

statement

of cash

flows

Cash provided by (used in) operating

activities, including ($74) of stock-based

compensation expense and $150 related

to the Dell appraisal rights matter

attributable to T. Rowe Price Group in

2017 $ 662.2

$ (676.4 ) $ (14.2 ) $ 876.1

$ (736.9 ) $ 139.2

Cash provided by (used in) investing

activities, including ($83) for additions to

property and equipment and $294 of

proceeds from the sale of available-for-

sale investments attributable to T. Rowe

Price Group in 2017 (103.1 ) 265.1

162.0

114.1

23.5

137.6

Cash provided by (used in) financing

activities, including T. Rowe Price Group

common stock repurchases of $(447)

and dividends paid of $(280) in 2017 (456.2 ) 540.0

83.8

(652.9 ) 717.7

64.8

Effect of exchange rate changes on cash

and cash equivalents —

(21.3 ) (21.3 ) —

3.8

3.8

Net change in cash and cash

equivalents during period $ 102.9

$ 107.4

$ 210.3

$ 337.3

$ 8.1

$ 345.4

10

Unaudited Condensed Consolidated Balance Sheet Information (in millions) As of

12/31/2016 6/30/2017

Cash and cash equivalents $ 1,204.9 $ 1,542.2

Accounts receivable and accrued revenue 455.1 488.7

Investments 1,257.5 1,333.7

Assets of consolidated sponsored investment portfolios 1,680.5 1,604.0

Property and equipment, net 615.1 624.3

Goodwill 665.7 665.7

Other assets 346.2 274.0

Total assets 6,225.0 6,532.6

Total liabilities, includes $65.6 at December 31, 2016, and $55.4 at June 30, 2017, from consolidated

sponsored investment portfolios 529.2

736.4

Redeemable non-controlling interests 687.2 627.6

Stockholders' equity, 240.3 common shares outstanding at June 30, 2017, includes net unrealized

holding gains of $10.1 at June 30, 2017 $ 5,008.6

$ 5,168.6

Cash, Cash Equivalents, and Investments Information (in millions)

Interest Held by T. Rowe Price Group

Cash and

discretionary

investments

in sponsored

portfolios

Investments

in sponsored

portfolios to

hedge

supplemental

savings plan

Seed capital

investments

in sponsored

portfolios

Investment

in UTI and

other

investments Total

Redeemable

non-

controlling

interests

As reported

on

consolidated

balance

sheet

6/30/2017

Cash and cash

equivalents $ 1,542.2

$ —

$ —

$ —

$ 1,542.2

$ —

$ 1,542.2

Investments 675.6 172.3 251.2 234.6 1,333.7 — 1,333.7

Net assets of

consolidated sponsored

investment portfolios 3.1

—

917.9

—

921.0

627.6

1,548.6

$ 2,220.9 $ 172.3 $ 1,169.1 $ 234.6 $ 3,796.9 $ 627.6 $ 4,424.5

Quarterly Financial Impact of Dell Appraisal Rights Matter (in millions)

Three months ended

Pre-tax

operating

expense

Pre-tax

operating

cash flow

June 30, 2016 $ 166.2 $ (164.0 )

September 30, 2016 — (.9 )

December 31, 2016 (100.0 ) (1.3 )

Total - 2016 66.2 (166.2 )

March 31, 2017 (50.0 ) 140.0

June 30, 2017 — 10.0

Total impact of Dell appraisal rights matter $ 16.2 $ (16.2 )

11

Non-GAAP Information and Reconciliation

The firm believes the non-GAAP financial measures below provide relevant and meaningful information to investors

about its core operating results. These measures have been established in order to increase transparency for the

purpose of evaluating the firm's core business, for comparing current results with prior period results, and to enable

more appropriate comparison with industry peers. However, non-GAAP financial measures should not be considered

as a substitute for financial measures calculated in accordance with U.S. GAAP and may be calculated differently by

other companies. The following schedule (in millions, except for per-share amounts) reconciles U.S. GAAP financial

measures to non-GAAP measures for the three- and six-month period ended June 30, 2016 and 2017.

Three months ended Six months ended

6/30/2016 6/30/2017 6/30/2016 6/30/2017

Operating expenses, GAAP basis $ 761.2 $ 664.0 $ 1,344.4 $ 1,255.9

Non-GAAP adjustments:

Expenses of consolidated sponsored investment portfolios, net of

elimination of its related management fee(1) (1.7 ) (1.7 ) (3.0 ) (3.5 )

Insurance recoveries (nonrecurring charge) related to Dell appraisal

rights matter (3) (166.2 ) —

(166.2 ) 50.0

Adjusted operating expenses $ 593.3 $ 662.3 $ 1,175.2 $ 1,302.4

Net income attributable to T. Rowe Price Group, GAAP basis $ 203.3 $ 373.9 $ 507.4 $ 759.8

Non-GAAP adjustments:

Net income of consolidated sponsored investment portfolios, net of

redeemable non-controlling interests(1) (15.0 ) (20.6 ) (27.0 ) (52.4 )

Non-operating income, excluding impact of consolidated sponsored

investment portfolios(2) (15.1 ) (72.6 ) (76.4 ) (138.7 )

Nonrecurring charge (insurance recoveries) related to Dell appraisal

rights matter (3) 166.2

—

166.2

(50.0 )

Income tax impacts of non-GAAP adjustments (4) (53.8 ) 37.2 (24.5 ) 96.4

Adjusted net income attributable to T. Rowe Price Group $ 285.6 $ 317.9 $ 545.7 $ 615.1

Diluted earnings per common share, GAAP basis $ .79 $ 1.50 $ 1.97 $ 3.04

Non-GAAP adjustments:

Consolidated sponsored investment portfolios (1) (.04 ) (.05 ) (.07 ) (.13 )

Non-operating income, excluding impact of consolidated sponsored

investment portfolios(2) (.03 ) (.17 ) (.17 ) (.33 )

Nonrecurring charge (insurance recoveries) related to Dell appraisal

rights matter (3) .39

—

.39

(.12 )

Adjusted diluted earnings per common share(5) $ 1.11 $ 1.28 $ 2.12 $ 2.46

(1) The non-GAAP adjustments add back the management fees that the firm earns from the consolidated sponsored investment

portfolios and subtract the investment income and operating expenses of these portfolios that have been included in the firm's

U.S. GAAP consolidated statements of income. Management believes the consolidated sponsored investment portfolios may

impact the reader's ability to understand the firm's core operating results. The following table details the calculation of net income

of consolidated sponsored investment portfolios, net of redeemable non-controlling interests, for the three- and six-month period

ended June 30, 2016 and 2017:

12

Three months ended Six months ended

6/30/2016 6/30/2017 6/30/2016 6/30/2017

Net investment income of consolidated sponsored portfolios $ 26.4 $ 39.4 $ 50.2 $ 88.3

Operating expenses of consolidated sponsored portfolios (3.5 ) (2.7 ) (6.1 ) (5.3 )

Net income of consolidated sponsored portfolios 22.9 36.7 44.1 83.0

Less: net income attributable to redeemable non-controlling interests 7.9 16.1 17.1 30.6

T. Rowe Price's portion of net income $ 15.0 $ 20.6 $ 27.0 $ 52.4

(2) This non-GAAP adjustment removes the non-operating income that remains after backing out the portion related to the

consolidated sponsored investment portfolios. Management believes excluding non-operating income helps the reader's ability to

understand the firm's core operating results and increases comparability to prior years. Additionally, management does not

emphasize the impact of non-operating income when managing the firm and evaluating its performance. The following table

details the calculation of other non-operating income for the three- and six-month period ended June 30, 2016 and 2017:

Three months ended Six months ended

6/30/2016 6/30/2017 6/30/2016 6/30/2017

Total non-operating income $ 41.5 $ 112.0 $ 126.6 $ 227.0

Less: net investment income of consolidated sponsored portfolios 26.4 39.4 50.2 88.3

Total other non-operating income $ 15.1 $ 72.6 $ 76.4 $ 138.7

(3) In the second quarter of 2016, the firm recognized a nonrecurring charge of $166.2 million related to the firm's decision to

compensate certain clients in regard to the Dell appraisal rights matter. In the first quarter of 2017, the firm recognized insurance

recoveries of $50 million as a reduction in operating expenses from claims that were filed in relation to the matter. Management

believes it is useful to readers of the firm's consolidated statements of income to adjust for these non-recurring insurance

recoveries in arriving at adjusted operating expenses and net income attributable to T. Rowe Price Group, Inc. and diluted

earnings per share, as this will aid with comparability to prior periods and analyzing the firm's core business results.

(4) These were calculated using the effective tax rate applicable to the related items.

(5) This non-GAAP measure was calculated by applying the two-class method to adjusted net income attributable to T. Rowe Price

Group, Inc. divided by the weighted-average common shares outstanding assuming dilution.