Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Independent Bank Group, Inc. | form8-kibgpressrelease7x24.htm |

| EX-99.1 - EXHIBIT 99.1 - Independent Bank Group, Inc. | exhibit991q22017.htm |

Second Quarter 2017

Earnings Release Presentation

July 25, 2017

Exhibit 99.2

Safe Harbor Statement

From time to time, our comments and releases may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act

of 1995 (the “Act”). Forward-looking statements can be identified by words such as “believes,” “anticipates,” “expects,” “forecast,” “guidance,” “intends,”

“targeted,” “continue,” “remain,” “should,” “may,” “plans,” “estimates,” “will,” “will continue,” “will remain,” variations on such words or phrases, or

similar references to future occurrences or events in future periods; however, such words are not the exclusive means of identifying such statements.

Examples of forward-looking statements include, but are not limited to: (i) projections of revenues, expenses, income or loss, earnings or loss per share, and

other financial items; (ii) statements of plans, objectives, and expectations of Independent Bank Group or its management or Board of Directors; (iii)

statements of future economic performance; and (iv) statements of assumptions underlying such statements. Forward-looking statements are based on

Independent Bank Group’s current expectations and assumptions regarding its business, the economy, and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Independent Bank

Group’s actual results may differ materially from those contemplated by the forward-looking statements, which are neither statements of historical fact nor

guarantees or assurances of future performance. Factors that could cause actual results to differ from those discussed in the forward-looking statements

include, but are not limited to: (1) local, regional, national, and international economic conditions and the impact they may have on us and our customers and

our assessment of that impact; (2) volatility and disruption in national and international financial markets; (3) government intervention in the U.S. financial

system, whether through changes in the discount rate or money supply or otherwise; (4) changes in the level of non-performing assets and charge-offs; (5)

changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; (6)

adverse conditions in the securities markets that lead to impairment in the value of securities in our investment portfolio; (7) inflation, deflation, changes in

market interest rates, developments in the securities market, and monetary fluctuations; (8) the timely development and acceptance of new products and

services and perceived overall value of these products and services by customers; (9) changes in consumer spending, borrowings, and savings habits; (10)

technological changes; (11) the ability to increase market share and control expenses; (12) changes in the competitive environment among banks, bank

holding companies, and other financial service providers; (13) the effect of changes in laws and regulations (including laws and regulations concerning taxes,

banking, securities, and insurance) with which we and our subsidiaries must comply; (14) the effect of changes in accounting policies and practices, as may

be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board, and other

accounting standard setters; (15) the costs and effects of legal and regulatory developments including the resolution of legal proceedings; and (16) our

success at managing the risks involved in the foregoing items and (17) the other factors that are described in the Company’s Annual Report on Form 10-K

filed on March 8, 2017, under the heading “Risk Factors”, and other reports and statements filed by the Company with the SEC. Any forward-looking

statement made by the Company in this release speaks only as of the date on which it is made. Factors or events that could cause the Company’s actual

results to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company undertakes no obligation to

publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

2

Today's Presenters

David R. Brooks

Chairman of the Board, CEO and President, Director

• 37 years in the financial services industry; 29 years at Independent Bank

• Active in community banking since the early 1980s - led the investor group that

acquired Independent Bank in 1988

Michelle S. Hickox

Executive Vice President, Chief Financial Officer

• 27 years in the financial services industry; 5 years at Independent Bank

• Formerly a Financial Services Audit Partner at RSM US LLP

• Certified Public Accountant

3

Second Quarter Key Highlights

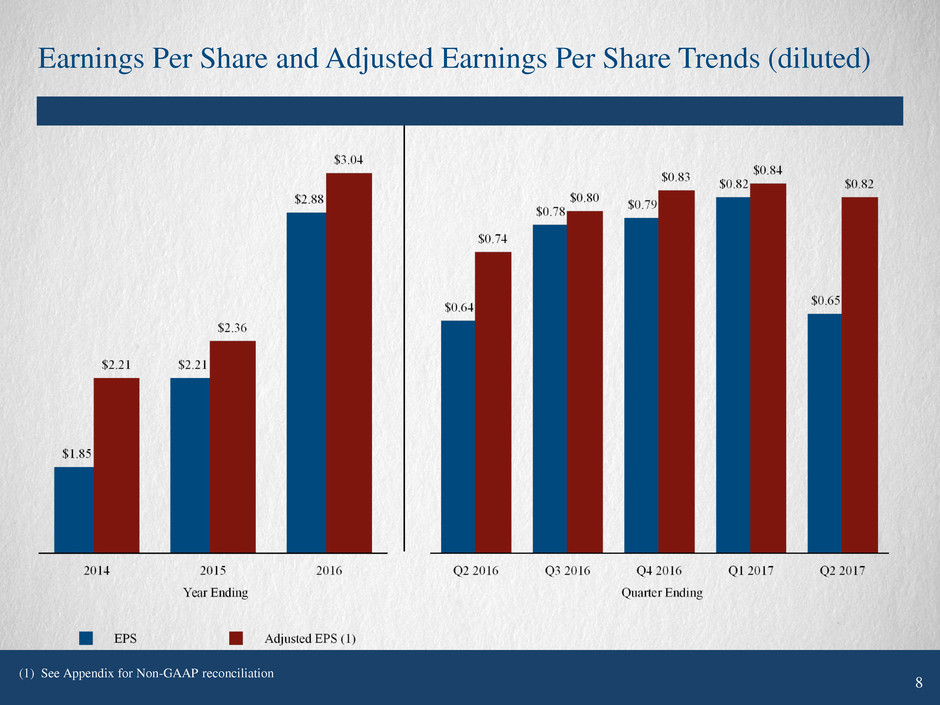

• Adjusted (non-gaap) net income was $22.7 million, or $0.82 per

diluted share, compared to $16.0 million, or $0.84 per diluted

share, for first quarter 2017

• Total assets increased to $8.6 billion, reflecting continued organic

growth and growth from the completion of the Carlile Bancshares

acquisition on April 1, 2017

• Annualized organic loan growth of 11.4% for the quarter and

11.6% year to date

• Positive increase in net interest margin to 3.81%, up from 3.67%

for first quarter 2017

• Continued strong credit quality metrics

4

Second Quarter Selected Financial Data

($ in thousands except per share data) As of and for the Quarter Ended

Balance Sheet Data June 30, 2017 March 31, 2017 June 30, 2016

Linked Quarter

Change Annual Change

Total assets $ 8,593,979 $ 6,022,614 $ 5,446,797 42.7 57.8

Loans held for investment (gross, excluding warehouse

lines) 6,119,305 4,702,511 4,251,457 30.1 43.9

Warehouse Lines 120,217 — — 100.0 100.0

Total deposits 6,669,288 4,722,203 4,208,405 41.2 58.5

Total borrowings (excluding trust preferred securities) 584,349 568,115 578,169 2.9 1.1

Total capital 1,259,592 688,469 629,628 83.0 100.1

Earnings and Profitability Data

Net interest income $ 69,500 $ 47,867 $ 45,883 45.2 % 51.5 %

Net interest margin 3.81 % 3.67 % 3.96 % 3.8 % (3.8 )%

Non-interest income $ 10,995 $ 4,583 $ 4,929 139.9 % 123.1 %

Non-interest expense 51,328 28,028 31,023 83.1 % 65.5 %

Net income 18,134 15,671 11,809 15.7 % 53.6 %

Basic EPS $ 0.65 $ 0.83 $ 0.64 (21.7 )% 1.6 %

Diluted EPS $ 0.65 $ 0.82 $ 0.64 (20.7 )% 1.6 %

Adjusted net interest margin (2) 3.78 % 3.66 % 3.94 % 3.3 % (4.1 )%

Adjusted net income (1) $ 22,746 $ 15,990 $ 13,764 42.3 % 65.3 %

Adjusted basic EPS (1) $ 0.82 $ 0.85 $ 0.75 (3.5 )% 9.3 %

Adjusted diluted EPS (1) $ 0.82 $ 0.84 $ 0.74 (2.4 )% 10.8 %

5

(1) See Appendix for Non-GAAP reconciliation

(2) Non-GAAP financial measure. Excludes income recognized on acquired loans of $572, $123 and $265, respectively.

(1) See Appendix for Non-GAAP reconciliation

6

Net Income Growth

$ in Millions

Interest Income Growth

7

Interest Income, Net Interest Income and NIM Trends

Core EPS (1)

Earnings Per Share and Adjusted Earnings Per Share Trends (diluted)

(1) See Appendix for Non-GAAP reconciliation

8

Adjusted Efficiency Ratio

Adjusted Efficiency Ratio Trends (1)

(1) See Appendix for non-GAAP Reconciliation

9

Total Loans by Year and Current Annual Trend ($ in billions)(1)

Loan Portfolio Growth

(1) Includes loans held for sale.

10

Loan Portfolio Composition

Loan Composition at 06/30/2017 CRE Loan Composition at 06/30/2017

Loans by Region at 06/30/2017

11

CRE Concentrations

12

NPLs / Loans NCOs / Average Loans

Note: Financial data as of and for quarter ended March 31, 2017 for peer data and June 30, 2017 for IBTX. Interim quarterly chargeoff data annualized.

Source: U.S. and Texas Commercial Bank numbers from SNL Financial.

Historically Strong Credit Culture

13

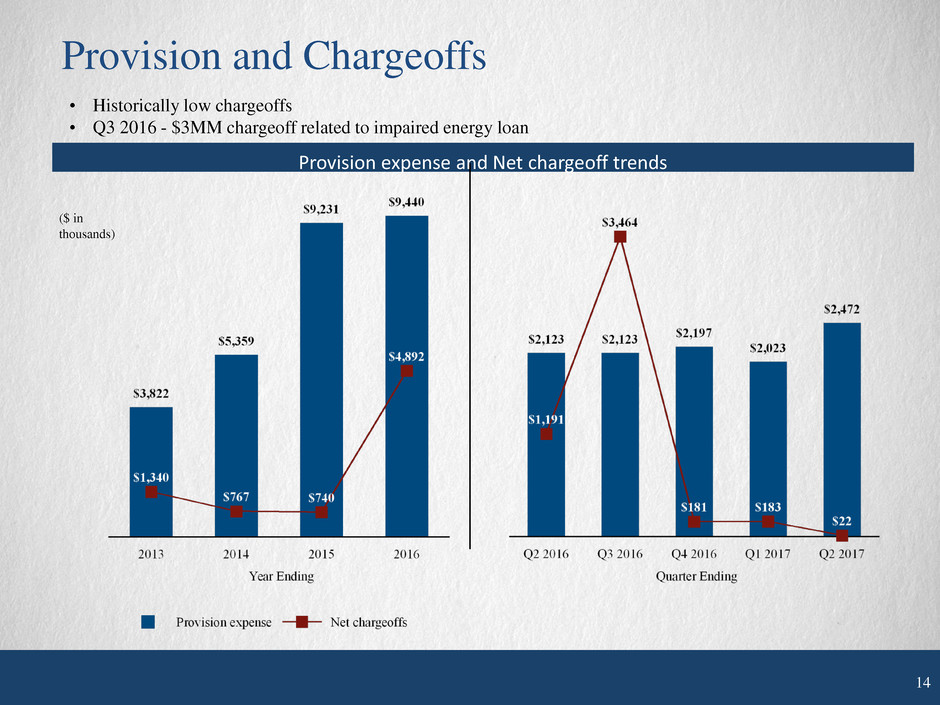

Provision expense and Net chargeoff trends

Provision and Chargeoffs

• Historically low chargeoffs

• Q3 2016 - $3MM chargeoff related to impaired energy loan

14

($ in

thousands)

Energy Lending

(in millions)

15

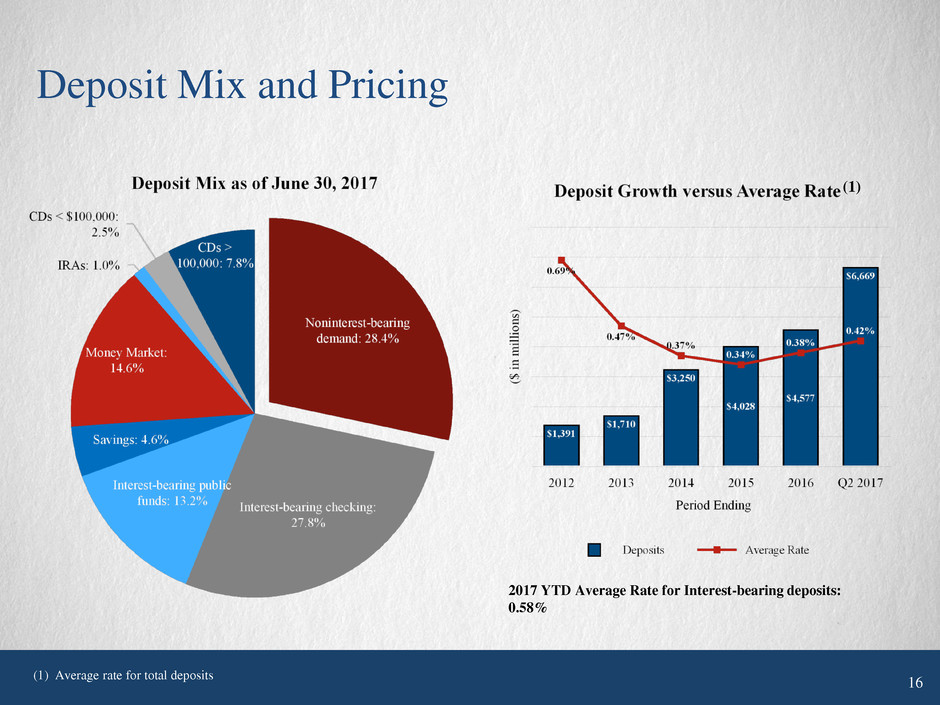

Deposit Mix and Pricing

(1)

(1) Average rate for total deposits

2017 YTD Average Rate for Interest-bearing deposits:

0.58%

16

Total Capital , Tier 1 and TCE/TA Ratios (1)

Capital

(1) See Appendix for non-GAAP Reconciliation 17

($ in thousands except per share data)

June 30, 2017 March 31, 2017 December 31, 2016 September 30, 2016 June 30, 2016

Net Interest Income - Reported (a) 69,500 47,867 46,526 45,737 45,883

Income recognized on acquired loans (572 ) (123 ) (51 ) (116 ) (265 )

Adjusted Net Interest Income (b) 68,928 47,744 46,475 45,621 45,618

Provision Expense - Reported (c) 2,472 2,023 2,197 2,123 2,123

Noninterest Income - Reported (d) 10,995 4,583 5,224 4,932 4,929

Gain on sale of loans (13 ) — — — —

Loss on sale of branch — — — 43 —

(Gain) loss on sale of premises and equipment

26 — — (4 ) (10 )

Gain on sale of securities (52 ) — — — (4 )

Loss / (Gain) on sale of PP&E (1 ) (5 ) — 9 (3 )

Recoveries on charged off loans acquired (123 ) — — — —

Adjusted Noninterest Income (e) 10,832 4,578 5,224 4,980 4,912

Noninterest Expense - Reported (f) 51,328 28,028 27,361 26,887 31,023

Senior leadership restructuring — — — — (2,575 )

OREO impairment (120 ) — — (51 ) —

IPO related stock grant and bonus expense (127 ) (125 ) (127 ) (104 ) (156 )

Acquisition expense (7,278 ) (459 ) (1,075 ) (384 ) (475 )

Adjusted Noninterest Expense (g) 43,803 27,444 26,159 26,348 27,817

Adjusted Net Income (2) (b) - (c) + (e) - (g) = (h) 22,746 15,990 15,541 14,819 13,764

Average shares for basic EPS (i) 27,782,584 18,908,679 18,613,975 18,478,289 18,469,182

Average shares for diluted EPS (j) 27,887,485 19,015,810 18,716,614 18,568,622 18,547,074

Adjusted Basic EPS (h) / (i) $ 0.82 $ 0.85 $ 0.83 $ 0.80 $ 0.75

Adjusted Diluted EPS (h) / (j) $ 0.82 $ 0.84 $ 0.83 $ 0.80 $ 0.74

EFFICIENCY RATIO

Amortization of core deposit intangibles (k) $ 1,410 $ 492 $ 492 $ 492 $ 492

Reported Efficiency Ratio (f - k) / (a + d) 62.01 % 52.50 % 51.92 % 52.09 % 55.91 %

Adjusted Efficiency Ratio (g - k) / (b + e) 53.15 % 51.51 % 49.65 % 51.10 % 54.67 %

Supplemental Information - Non-GAAP Financial Measures (unaudited)

Reconciliation of Adjusted Net Income, Adjusted Efficiency Ratio and Adjusted EPS--Quarterly Periods

APPENDIX

(1) Calculated using adjusted net income

(1) Assumes actual effective tax rate of 32.1%, 30.0%, 33.4%, 33.0% and 33.2%, for the quarters ended June 30, 2017, March 31, 2017, December 31, 2016, September 30, 2016 and June 30, 2016, respectively.

(3) Excludes average balance of goodwill and net core deposit intangibles.

18

($ in thousands except per share data)

2016 2015 2014

Net Interest Income - Reported (a) $ 183,806 $ 154,098 $ 124,145

Income recognized on acquired loans (1,765 ) (1,272 ) (1,960 )

Adjusted Net Interest Income (b) $ 182,041 $ 152,826 $ 122,185

Provision Expense - Reported (c) 9,440 9,231 5,359

Noninterest Income - Reported (d) 19,555 16,128 13,624

Gain on sale of loans — (116 ) (1,078 )

Loss on sale of branch 43 — —

Gain on sale of OREO/repossessed assets (62 ) (290 ) (71 )

Gain on sale of securities (4 ) (134 ) (362 )

(Gain) loss on sale of premises and equipment

(32 ) 358 22

Adjusted Noninterest Income (e) 19,500 15,946 12,135

Noninterest Expense - Reported (f) 113,790 103,198 88,512

Senior leadership restructuring (2,575 ) — —

Adriatica expenses — — (23 )

OREO impairment (106 ) (35 ) (22 )

IPO related stock grant and bonus expense (543 ) (624 ) (630 )

Registration statements — — (619 )

Core system conversion — — (265 )

Acquisition expense (3,121 ) (3,954 ) (9,237 )

Adjusted Noninterest Expense (g) 107,445 98,585 77,716

Adjusted Net Income (2) (b) - (c) + (e) - (g) = (h) $ 56,563 $ 41,056 $ 34,427

Average shares for basic EPS (i) 18,501,663 17,321,513 15,458,666

Average shares for diluted EPS (j) 18,588,309 17,406,108 15,557,120

Adjusted Basic EPS (h) / (i) $ 3.06 $ 2.37 $ 2.23

Adjusted Diluted EPS (h) / (j) $ 3.04 $ 2.36 $ 2.21

EFFICIENCY RATIO

Amortization of core deposit intangibles (k) $ 1,964 $ 1,555 $ 1,281

Reported Efficiency Ratio (f - k) / (a + d) 55.95 % 60.62 % 64.25 %

Adjusted Efficiency Ratio (g - k) / (b + e) 53.31 % 58.41 % 57.86 %

Supplemental Information - Non-GAAP Financial Measures (unaudited)

Reconciliation of Adjusted Net Income, Adjusted Efficiency Ratio and Adjusted EPS--Annual Periods

APPENDIX

(1) Assumes actual effective tax rate of 33.2%, 32.6% and 32.8% for the years ended December 31, 2016, 2015, and 2014, respectively.

19

Supplemental Information - Non-GAAP Financial Measures (unaudited)

Reconciliation of Tangible Common Equity to Tangible Assets

APPENDIX

Tangible Common Equity To Tangible Assets 6/30/17 3/31/17 12/31/16 12/31/2015 12/31/14 12/31/13

($ in thousands)

Tangible Common Equity

Total common stockholders' equity $ 1,259,592 $ 688,469 $ 672,365 $ 603,371 $ 516,913 $ 233,772

Adjustments:

Goodwill (607,263 ) (258,319 ) (258,319 ) (258,643 ) (229,457 ) (34,704 )

Core deposit intangibles, net (48,992 ) (13,685 ) (14,177 ) (16,357 ) (12,455 ) (3,148 )

Tangible Common Equity $ 603,337 $ 416,465 $ 399,869 $ 328,371 $ 275,001 $ 195,920

Tangible Assets

Total Assets $ 8,593,979 $ 6,022,614 $ 5,852,801 $ 5,055,000 $ 4,132,639 $ 2,163,984

Adjustments:

Goodwill (607,263 ) (258,319 ) (258,319 ) (258,643 ) (229,457 ) (34,704 )

Core deposit intangibles (48,992 ) (13,685 ) (14,177 ) (16,357 ) (12,455 ) (3,148 )

Tangible Assets $ 7,937,724 $ 5,750,610 $ 5,580,305 $ 4,780,000 $ 3,890,727 $ 2,126,132

Tangible Common Equity To Tangible Assets 7.60 % 7.24 % 7.17 % 6.87 % 7.07 % 9.21 %

20