Attached files

| file | filename |

|---|---|

| EX-99.1 - EX - 99.1 - DUPONT E I DE NEMOURS & CO | a63017enr.htm |

| 8-K - 8-K - DUPONT E I DE NEMOURS & CO | a630178kenr.htm |

0

DuPont First Quarter 2017 Earnings

CONFERENCE CALL

APRIL 25TH, 2017

DuPont Second-Quarter 2017 Earnings

CONFERENCE CALL

JULY 25TH, 2017

1

Regulation G

This document includes information that does not conform to U.S. generally accepted accounting principles (GAAP) and are considered non-GAAP measures. These

measures include the company’s consolidated results and earnings per share on an operating earnings basis, which excludes significant items and non-operating

pension and other post employment benefit costs (operating earnings and operating EPS), total segment pre-tax operating earnings, operating costs and corporate

expenses on an operating earnings basis. Management uses these measures internally for planning, forecasting and evaluating the performance of the Company’s

segments, including allocating resources and evaluating incentive compensation. Management believes that these non-GAAP measurements are meaningful to

investors as they provide insight with respect to ongoing operating results of the company and provide a more useful comparison of year-over-year results. From a

liquidity perspective, management uses free cash flow which is defined as cash provided by/used for operating activities less purchases of property, plant and

equipment. Free cash flow is useful to investors and management to evaluate the company’s cash flow and financial performance, and is an integral financial

measure used in the company’s financial planning process. These non-GAAP measurements supplement our GAAP disclosures and should not be viewed as an

alternative to GAAP measures of performance. This data should be read in conjunction with previously published company reports on Forms 10-K, 10-Q, and 8-K.

These reports, along with reconciliations of non-GAAP measures to GAAP are available on the Investor Center of www.dupont.com under Filings and Reports –

Reconciliations and Other Data. Reconciliations of non-GAAP measures to GAAP are also included with this presentation.

Forward-Looking Statements

On December 11, 2015, DuPont and The Dow Chemical Company (“Dow”) announced entry into an Agreement and Plan of Merger, as amended on March 31, 2017

and as may be amended from time to time in accordance with its terms, (the “Merger Agreement”) under which the companies will combine in an all-stock merger (the

“Merger Transaction”), subject to satisfaction of closing conditions, including receipt of regulatory approval. Dow and DuPont have obtained conditional approval for

the Merger Transaction from the antitrust regulatory authorities in the United States, Brazil, Canada and China, among others. The conditional approvals were

granted based on the companies fulfilling their commitments to divest certain assets, among other conditions, (the “Conditional Commitments”). In connection with the

Conditional Commitments, DuPont entered into a definitive agreement (the “FMC Transaction Agreement”) with FMC Corporation (FMC). Under the FMC Transaction

Agreement subject to the closing of the Merger Transaction in addition to customary closing conditions, including regulatory approval, FMC will acquire certain Crop

Protection business and R&D assets from DuPont and DuPont has agreed to acquire certain assets relating to FMC’s Health and Nutrition segment, (collectively, the

“FMC Transactions”). The combined company will be DowDuPont Inc. DuPont and Dow intend, following consummation of the Merger Transaction, that DowDuPont

Inc. will pursue, subject to the receipt of approval by the board of directors of DowDuPont, the separation of the combined company’s agriculture business, specialty

products business, and materials science business through a series of tax-efficient transactions (collectively, the “Intended Business Separations”). For more

information, please see DuPont’s latest annual, quarterly and current reports on Forms 10-K, 10-Q and 8-K, as well as the joint proxy/prospectus included in the

DowDuPont Registration Statement on Form S-4 filed in connection with the Merger Transaction.

This document contains forward-looking statements which may be identified by their use of words like “plans,” “expects,” “will,” “believes,” “intends,” “estimates,”

“anticipates” or other words of similar meaning. All statements that address expectations or projections about the future, including statements about the company’s

strategy for growth, product development, regulatory approval, market position, anticipated benefits of recent acquisitions, timing of anticipated benefits from

restructuring actions, outcome of contingencies, such as litigation and environmental matters, expenditures, financial results and timing of, as well as expected

benefits, including synergies, from proposed merger with Dow and the Intended Business Separations , are forward-looking statements. These and other forward-

looking statements, including the failure to consummate the Merger Transaction, the Intended Business Separations, the FMC Transactions or the Conditional

Commitments, to make or take any filing or other action required to consummate such transactions in a timely manner or at all, are not guarantees of future results

and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements.

Forward-looking statements are not guarantees of future performance and are based on certain assumptions and expectations of future events which may not be

realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond the company’s control.

2

Forward-Looking Statements, Continued

Some of the important factors that could cause the company’s actual results to differ materially from those projected in any such forward-looking statements are:

fluctuations in energy and raw material prices; failure to develop and market new products and optimally manage product life cycles; ability to respond to market

acceptance, rules, regulations and policies affecting products based on biotechnology and, in general, for products for the agriculture industry; outcome of significant

litigation and environmental matters, including realization of associated indemnification assets, if any; failure to appropriately manage process safety and product

stewardship issues; changes in laws and regulations or political conditions; global economic and capital markets conditions, such as inflation, interest and currency

exchange rates; business or supply disruptions; security threats, such as acts of sabotage, terrorism or war, natural disasters and weather events and patterns which

could affect demand as well as availability of products for the agriculture industry; ability to protect and enforce the company’s intellectual property rights; successful

integration of acquired businesses and separation of underperforming or non-strategic assets or businesses; and risks related to the Merger Transaction, Intended

Business Separations the FMC Transactions and the Conditional Commitments. These risks, as well as other risks associated with the Merger Transaction, the

Intended Business Separations, the FMC Transactions and the Conditional Commitments, are or will be more fully discussed in (1) DuPont’s most recently filed Form

10-K, 10-Q and 8-K reports, (2) DuPont’s subsequently filed Form 10-K and 10-Q reports and (3) the joint proxy statement/prospectus included in the Registration

Statement filed with the SEC about the Merger Transaction. Unlisted factors may present significant additional obstacles to the realization of forward-looking

statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things,

business disruption, operational problems, monetary loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on DuPont’s

consolidated financial condition, results of operations, credit rating or liquidity. The company assumes no obligation to publicly provide revisions or updates to any

forward-looking statements, whether because of new information, future developments or otherwise, should circumstances change, except as otherwise required by

securities and other applicable laws.

3

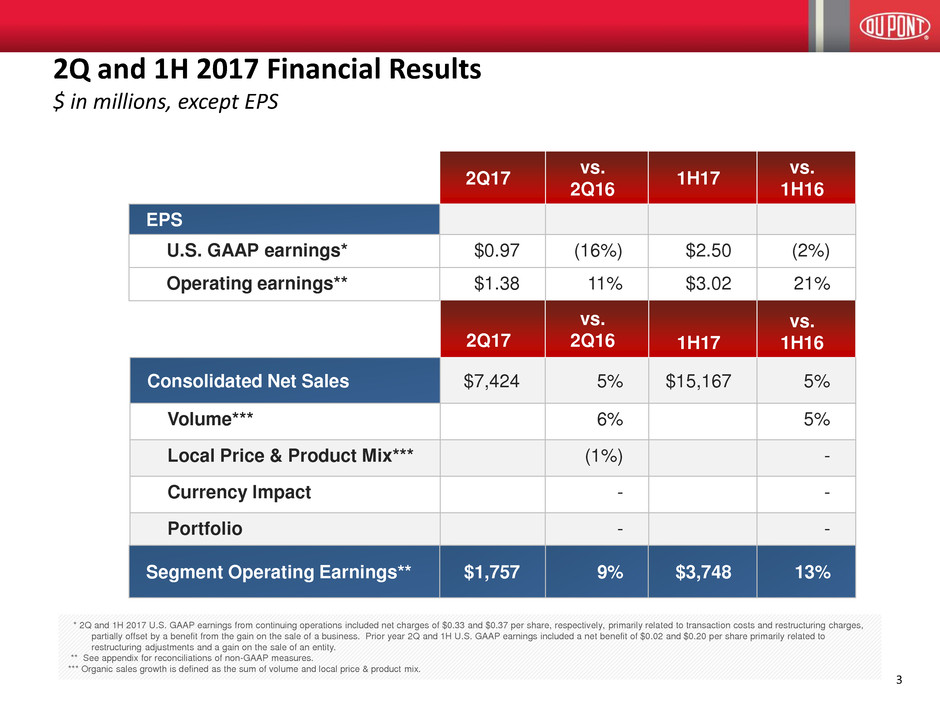

2Q and 1H 2017 Financial Results

$ in millions, except EPS

* 2Q and 1H 2017 U.S. GAAP earnings from continuing operations included net charges of $0.33 and $0.37 per share, respectively, primarily related to transaction costs and restructuring charges,

partially offset by a benefit from the gain on the sale of a business. Prior year 2Q and 1H U.S. GAAP earnings included a net benefit of $0.02 and $0.20 per share primarily related to

restructuring adjustments and a gain on the sale of an entity.

** See appendix for reconciliations of non-GAAP measures.

*** Organic sales growth is defined as the sum of volume and local price & product mix.

2Q17

vs.

2Q16

1H17

vs.

1H16

EPS

U.S. GAAP earnings* $0.97 (16%) $2.50 (2%)

Operating earnings** $1.38 11% $3.02 21%

2Q17

vs.

2Q16 1H17

vs.

1H16

Consolidated Net Sales $7,424 5% $15,167 5%

Volume*** 6% 5%

Local Price & Product Mix*** (1%) -

Currency Impact - -

Portfolio - -

Segment Operating Earnings** $1,757 9% $3,748 13%

4

Global Sales – Regional Highlights

Region %

Worldwide +5%

U.S. & Canada +3%

EMEA* +3%

Asia Pacific +11%

Latin America +6%

1H 2017 Sales YOY% Growth

* Europe, Middle East & Africa

Region %

Worldwide +5%

U.S. & Canada +6%

EMEA* +1%

Asia Pacific +10%

Latin America -3%

2Q 2017 Sales YOY% Growth

5

2Q 2017 EPS Variance

$0.13 $0.01 $0.02 ($0.02)

2Q16 Segment Results Corp Exp & Int AVG Shares Tax 2Q17

($0.08)

GAAP

EPS

$1.16

2Q16 Sig Items &

Non-Op

Pension*

($0.41)

GAAP

EPS

$0.97

2Q17Sig Items &

Non-Op

Pension*

Operating

EPS*

$1.24

Operating

EPS*

$1.38

➢ Segment results increased $0.13 per share primarily driven by volume growth. Segment results included a $0.01 per share

benefit from currency.

➢ A net decrease in corporate and interest expenses contributed $0.02 per share in the quarter. Corporate costs, as a

percentage of sales, declined about 50 basis points in the quarter.

➢ Lower average shares outstanding added $0.01 per share in the quarter.

➢ A higher base tax rate negatively impacted earnings by $0.02 per share, primarily reflecting the absence of a prior-year tax

benefit.

Key Factors

* See appendix for details of significant items and reconciliation of non-GAAP measures.

6

1H 2017 EPS Variance

$0.37

$0.04 $0.02$0.07 $0.03 ($0.01)

1H16 Segment Results EGL Corp Exp & Int Tax AVG Shares Noncontrolling

Interest

1H17

$0.05

GAAP

EPS

$2.55

1H16 Sig Items &

Non-Op

Pension*

($0.52)

GAAP

EPS

$2.50

1H17Sig Items &

Non-Op

Pension*

Operating

EPS*

$2.50

➢ Segment results increased $0.37 per share primarily driven by volume growth, including a $0.01 per share benefit from currency.

➢ Exchange gains/(losses) contributed $0.07 per share in the first half primarily due to the absence of currency devaluations versus

the prior year.

➢ A net decrease in corporate and interest expenses contributed $0.04 per share in the first half. Corporate costs, as a percentage

of sales, declined about 40 basis points in the first half.

➢ A lower base tax rate impacted earnings by $0.03 per share, primarily reflecting a benefit associated with the adoption of a recent

accounting pronouncement.

➢ Lower average shares outstanding added $0.02 per share in the first half.

Key Factors

* See appendix for details of significant items and reconciliation of non-GAAP measures.

Operating

EPS*

$3.02

7

*See appendix for details of significant items and reconciliation of non-GAAP measures

➢ Agriculture results improved on volume growth, partially offset by declines in local price and higher product costs. Volume growth was driven by increased

insecticide and fungicide sales, a benefit from the southern U.S. route-to-market change, and higher soybean sales in North America.

➢ Electronics & Communications increased as volume growth more than offset a decline in local price. Volume growth was due to increased demand in consumer

electronics and semiconductor markets, as well as stronger photovoltaic sales.

➢ Industrial Biosciences rose on volume growth and mix enrichment, partially offset by higher costs due to growth investments. Broad-based volume growth was

driven by increased demand for biomaterials in apparel and carpeting, bioactives in the grain processing market, and CleanTech.

➢ Nutrition & Health increased on volume growth. Increased demand in probiotics was partially offset by declines in systems and texturants and protein solutions.

➢ Performance Materials increased as volume growth, higher local price, and the absence of costs associated with a contractual claim were largely offset by higher

raw material costs and the planned turnaround of the ethylene cracker.

➢ Protection Solutions results increased as volume growth more than offset lower local price and product mix and higher costs due to growth investments. Volume

growth reflected improved demand for Tyvek® protective material in medical packaging and protective apparel and Nomex® thermal-resistant fiber in oil and gas

markets.

➢ Other changed due to higher costs associated with discontinued businesses, partially offset by higher income from the Consulting business.

Key Factors

$98

$23 $14 $5 $4

$3 ($3)

2Q16 Ag E&C IB N&H PM DPS Other 2Q17

$1,613

Segment

Operating

Earnings*

$1,757

Total

Segment

Operating

Earnings*

2Q 2017 Segment Operating Earnings Variance

($ in millions)

8

*See appendix for details of significant items and reconciliation of non-GAAP measures

➢ Agriculture results improved on growth in volume and local price. Volume growth was driven by a benefit from the change in timing of seed deliveries including

the southern U.S. route-to-market change, increased insecticide and fungicide sales, higher soybean sales in North America, and increased sunflower and corn

seed sales in Europe.

➢ Performance Materials increased driven by volume growth, cost savings, and the absence of costs associated with a contractual claim, partially offset by higher

raw material costs and the planned turnaround of the ethylene cracker. Volume growth was driven by increased demand for polymers in automotive markets and

high-performance parts in semiconductor and aerospace markets.

➢ Electronics & Communications increased on volume growth and the absence of a $16 million prior-year litigation expense, partially offset by lower local price.

Operating earnings included a gain on the sale of a business offset by costs associated with a legal matter.

➢ Industrial Biosciences rose on volume growth and mix enrichment, partially offset by higher costs due to growth investments. Volume growth was driven by

increased demand for biomaterials in apparel and carpeting and bioactives in the grain processing market.

➢ Nutrition & Health increased on plant productivity, mix enrichment and cost savings, partially offset by a $6 million negative impact from portfolio. Volume growth

in probiotics was offset by declines in systems and texturants and protein solutions.

➢ Protection Solutions results increased as volume growth was partially offset by lower local price and product mix and higher raw material costs. Volume growth

reflected increased demand for Nomex® in oil and gas markets, Kevlar® high-strength materials, and Tyvek® protective material.

➢ Other changed due to higher costs associated with discontinued businesses.

Key Factors

$233

$86

$53 $26

$22 $4

($6)

1H16 Ag PM E&C IB N&H DPS Other 1H17

$3,330

Segment

Operating

Earnings*

$3,748

Total

Segment

Operating

Earnings*

1H 2017 Segment Operating Earnings Variance

($ in millions)

9

Balance Sheet and Cash

June 30, 2017

Free Cash Flow*

• Reflects normal seasonal cash outflow and $2.8B

in higher pension contributions

• Year-over-year increase of about $200 million,

excluding additional pension contributions

Balance Sheet

• $7.3 billion in net debt**

• Increase from year-end due to normal seasonal

working capital requirements and increase in debt

to fund discretionary pension contribution

Expected Uses of Cash for 2017

• $1.3 billion for normal dividends***

• Capex spend in line with depreciation and

amortization

0

4

8

12

16

Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17

$

B

ill

io

n

s

Gross Debt Cash Net Debt**

Free Cash Flow*

Cash and Debt

* Free Cash Flow, a non-GAAP measure, is cash used for operating activities of ($4,055MM) and ($1,460MM) less purchases of plant, property and equipment of $524MM and

$507MM for the period ended June 30, 2017, and 2016, respectively.

** See appendix for reconciliation of non-GAAP measures.

*** Dividends on common stock after the proposed merger with Dow will be a decision of the DowDuPont Board of Directors.

-6

-5

-4

-3

-2

-1

0

1

2016 Pension Other Tax

Pmts

W/C Imp 2017

$

B

ill

io

n

s

10

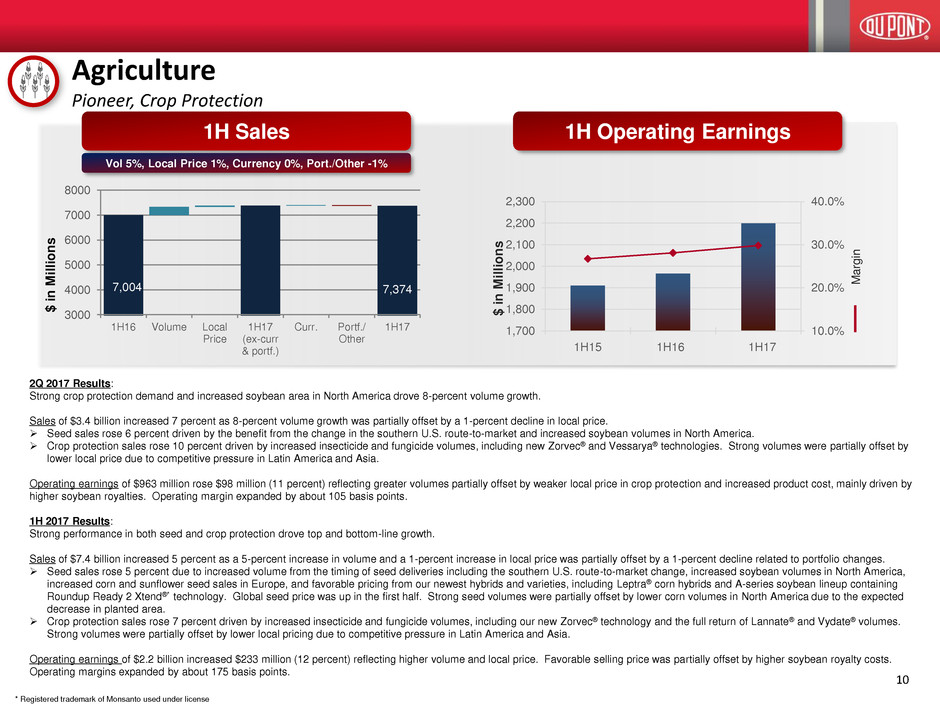

Agriculture

Pioneer, Crop Protection

1H15 1H16 1H17

10.0%

20.0%

30.0%

40.0%

1,700

1,800

1,900

2,000

2,100

2,200

2,300

M

a

rg

in

$

in

M

ill

io

n

s

1H Operating Earnings1H Sales

Vol 5%, Local Price 1%, Currency 0%, Port./Other -1%

3000

4000

5000

6000

7000

8000

1H16 Volume Local

Price

1H17

(ex-curr

& portf.)

Curr. Portf./

Other

1H17

7,004

$

in

M

ill

io

n

s

7,374

2Q 2017 Results:

Strong crop protection demand and increased soybean area in North America drove 8-percent volume growth.

Sales of $3.4 billion increased 7 percent as 8-percent volume growth was partially offset by a 1-percent decline in local price.

➢ Seed sales rose 6 percent driven by the benefit from the change in the southern U.S. route-to-market and increased soybean volumes in North America.

➢ Crop protection sales rose 10 percent driven by increased insecticide and fungicide volumes, including new Zorvec® and Vessarya® technologies. Strong volumes were partially offset by

lower local price due to competitive pressure in Latin America and Asia.

Operating earnings of $963 million rose $98 million (11 percent) reflecting greater volumes partially offset by weaker local price in crop protection and increased product cost, mainly driven by

higher soybean royalties. Operating margin expanded by about 105 basis points.

1H 2017 Results:

Strong performance in both seed and crop protection drove top and bottom-line growth.

Sales of $7.4 billion increased 5 percent as a 5-percent increase in volume and a 1-percent increase in local price was partially offset by a 1-percent decline related to portfolio changes.

➢ Seed sales rose 5 percent due to increased volume from the timing of seed deliveries including the southern U.S. route-to-market change, increased soybean volumes in North America,

increased corn and sunflower seed sales in Europe, and favorable pricing from our newest hybrids and varieties, including Leptra® corn hybrids and A-series soybean lineup containing

Roundup Ready 2 Xtend®* technology. Global seed price was up in the first half. Strong seed volumes were partially offset by lower corn volumes in North America due to the expected

decrease in planted area.

➢ Crop protection sales rose 7 percent driven by increased insecticide and fungicide volumes, including our new Zorvec® technology and the full return of Lannate® and Vydate® volumes.

Strong volumes were partially offset by lower local pricing due to competitive pressure in Latin America and Asia.

Operating earnings of $2.2 billion increased $233 million (12 percent) reflecting higher volume and local price. Favorable selling price was partially offset by higher soybean royalty costs.

Operating margins expanded by about 175 basis points.

* Registered trademark of Monsanto used under license

11

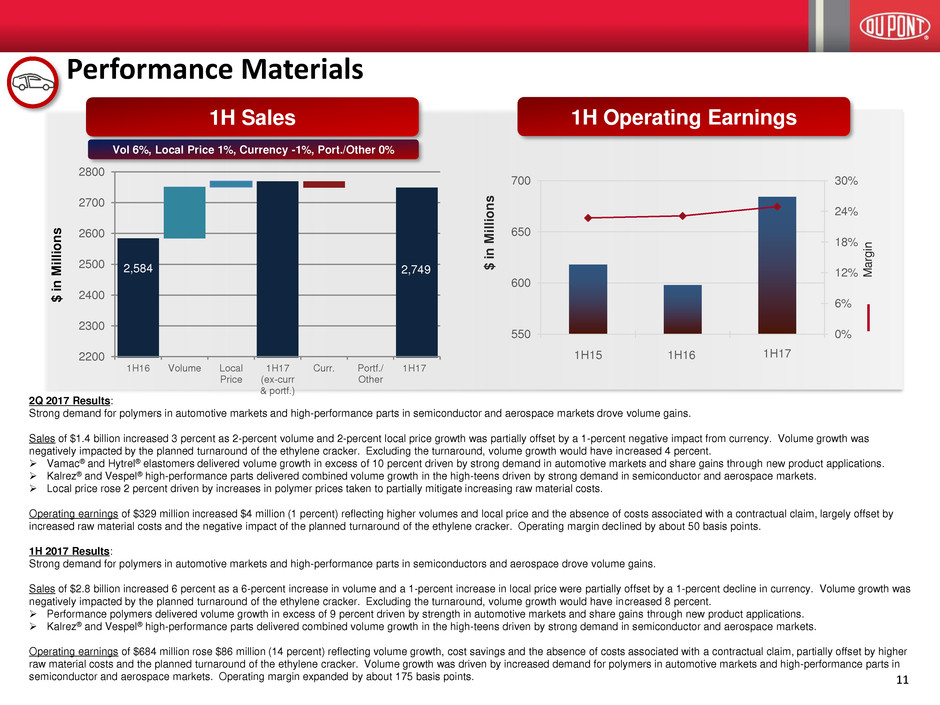

Performance Materials

1H15 1H16 1H17

0%

6%

12%

18%

24%

30%

550

600

650

700

M

a

rg

in

$

in

M

ill

io

n

s

1H Operating Earnings1H Sales

Vol 6%, Local Price 1%, Currency -1%, Port./Other 0%

$

in

M

ill

io

n

s

2,584

2200

2300

2400

2500

2600

2700

2800

1H16 Volume Local

Price

1H17

(ex-curr

& portf.)

Curr. Portf./

Other

1H17

2,749

2Q 2017 Results:

Strong demand for polymers in automotive markets and high-performance parts in semiconductor and aerospace markets drove volume gains.

Sales of $1.4 billion increased 3 percent as 2-percent volume and 2-percent local price growth was partially offset by a 1-percent negative impact from currency. Volume growth was

negatively impacted by the planned turnaround of the ethylene cracker. Excluding the turnaround, volume growth would have increased 4 percent.

➢ Vamac® and Hytrel® elastomers delivered volume growth in excess of 10 percent driven by strong demand in automotive markets and share gains through new product applications.

➢ Kalrez® and Vespel® high-performance parts delivered combined volume growth in the high-teens driven by strong demand in semiconductor and aerospace markets.

➢ Local price rose 2 percent driven by increases in polymer prices taken to partially mitigate increasing raw material costs.

Operating earnings of $329 million increased $4 million (1 percent) reflecting higher volumes and local price and the absence of costs associated with a contractual claim, largely offset by

increased raw material costs and the negative impact of the planned turnaround of the ethylene cracker. Operating margin declined by about 50 basis points.

1H 2017 Results:

Strong demand for polymers in automotive markets and high-performance parts in semiconductors and aerospace drove volume gains.

Sales of $2.8 billion increased 6 percent as a 6-percent increase in volume and a 1-percent increase in local price were partially offset by a 1-percent decline in currency. Volume growth was

negatively impacted by the planned turnaround of the ethylene cracker. Excluding the turnaround, volume growth would have increased 8 percent.

➢ Performance polymers delivered volume growth in excess of 9 percent driven by strength in automotive markets and share gains through new product applications.

➢ Kalrez® and Vespel® high-performance parts delivered combined volume growth in the high-teens driven by strong demand in semiconductor and aerospace markets.

Operating earnings of $684 million rose $86 million (14 percent) reflecting volume growth, cost savings and the absence of costs associated with a contractual claim, partially offset by higher

raw material costs and the planned turnaround of the ethylene cracker. Volume growth was driven by increased demand for polymers in automotive markets and high-performance parts in

semiconductor and aerospace markets. Operating margin expanded by about 175 basis points.

12

Electronics & Communications

1H15 1H16 1H17

0%

5%

10%

15%

20%

25%

0

30

60

90

120

150

180

210

240

M

a

rg

in

$

in

M

ill

io

n

s

1H Operating Earnings1H Sales

Vol 14%, Local Price -1%, Currency -1%, Port./Other 0%

946

600

700

800

900

1000

1100

1200

1H16 Volume Local

Price

1H17

(ex-curr

& portf.)

Curr. Portf./

Other

1H17

$

i

n

M

il

li

o

n

s

1,056

2Q 2017 Results:

Sales of $546 million increased 11 percent as 13-percent volume growth was partially offset by lower local price and a negative impact from currency.

➢ Significant volume growth was driven by improved demand in consumer electronics, semiconductor, and photovoltaic markets.

➢ Demand for polyimide films and laminates and semiconductor materials was driven by growth of smartphones, Internet of Things applications and automotive

electronics.

➢ Tedlar® film sales were supported by continued strong growth in photovoltaics.

Operating earnings of $116 million increased $23 million, or 25 percent, as volume growth more than offset lower local price. Operating margins expanded by

about 240 basis points.

1H 2017 Results:

Sales of $1.1 billion increased 12 percent as 14-percent volume growth was partially offset by lower local price and a negative impact from currency.

➢ Consumer electronics, semiconductor and photovoltaic markets have driven significant volume growth through the first half. Market demand in consumer

electronics was relatively weak in first half 2016.

Operating earnings of $205 million increased $53 million, or 35 percent, on volume growth and the absence of a $16 million prior year litigation expense, partially

offset by lower local price. Operating earnings included a gain on the sale of a business offset by costs associated with a legal matter. Operating margins

expanded by 335 basis points.

13

Industrial Biosciences

2Q 2017 Results:

Sales of $395 million increased 11 percent. Organic growth of 12 percent was driven by strong volume and local price gains in biomaterials, volume gains in

bioactives and growth in CleanTech.

➢ Biomaterials growth in the solid double digits was led by volume of Sorona® fiber apparel and volume and pricing of carpeting.

➢ Low-single-digit gains in bioactives reflected growth in grain processing as well as benefits from new product launches in household products and food.

➢ CleanTech sales grew by the low-teens percent due to stronger demand from refining performance and other markets.

Operating earnings of $76 million increased $14 million (23 percent), reflecting volume growth and mix enrichment, partly offset by higher costs due to growth

investments. Operating margins expanded by about 180 basis points.

1H 2017 Results:

Sales of $763 million increased 8 percent. Organic growth of 9 percent was driven by strong volume gains in biomaterials, growth in bioactives and benefits from

local price in biomaterials used for carpeting.

➢ Biomaterials growth of more than 40 percent was led by Sorona® apparel volume and carpeting volume and pricing.

➢ A low-single-digits percent gain in bioactives was led by grain processing as well as new product launches in household products and food. Sales in animal

nutrition declined.

➢ CleanTech sales were flat, with declines in the first quarter largely offset by growth in the second quarter in acid and refining markets.

Operating earnings of $151 million rose $26 million (21 percent) due to volume and mix enrichment gains, partially offset by higher costs due to growth

investments. Operating margins expanded by about 210 basis points.

1H15 1H16 1H17

0.0%

6.0%

12.0%

18.0%

24.0%

0

20

40

60

80

100

120

140

160

M

a

rg

in

$

in

M

ill

io

n

s

1H Operating Earnings1H Sales

Vol 7%, Local Price 2%, Currency -1%, Port./Other 0%

400

500

600

700

800

1H16 Volume Local

Price

1H17

(ex-curr

& portf.)

Curr. Portf./

Other

1H17

$

in

M

ill

io

n

s

707 763

14

Nutrition & Health

1H15 1H16 1H17

0%

6%

12%

18%

0

30

60

90

120

150

180

210

240

270

M

a

rg

in

$

in

M

ill

io

n

s

1H Operating Earnings1H Sales

Vol 0%, Local Price 0%, Currency -1%, Port./Other -1%

1200

1300

1400

1500

1600

1700

1H16 Volume Local

Price

1H17

(ex-curr

& portf.)

Curr. Portf./

Other

1H17

$

in

M

ill

io

n

s

1,636 1,607

2Q 2017 Results:

Sales of $818 million decreased 2 percent as volume growth was more than offset by negative impacts from local price, portfolio and currency.

➢ Organic growth was flat, as volume growth in probiotics was offset by lower demand and local price in systems and texturants and protein solutions, including

specific actions taken to exit certain low-margin markets.

➢ Probiotics volumes grew in the high-twenty-percent range, driven by demand in Asia Pacific and North America.

Operating earnings of $135 million increased $5 million, or 4 percent, on volume growth. Operating margin expanded by about 95 basis points year over year.

The segment has now delivered 16 consecutive quarters of margin expansion.

1H 2017 Results:

Sales of $1.6 billion decreased 2 percent due to negative impacts from portfolio and currency.

➢ Organic growth was flat, as volume growth in probiotics was offset by lower demand in systems and texturants and protein solutions.

➢ In protein solutions, volume declines resulted from business-specific actions to exit certain low margin markets coupled with inventory destocking in the U.S.

➢ Probiotics volumes grew in the high-twenty-percent range driven by demand in Asia Pacific and North America.

Operating earnings of $256 million increased $22 million, or 9 percent, on plant productivity, mix enrichment and cost savings, partially offset by a $6 million

negative impact from portfolio. Operating margin expanded by about 165 basis points year over year.

15

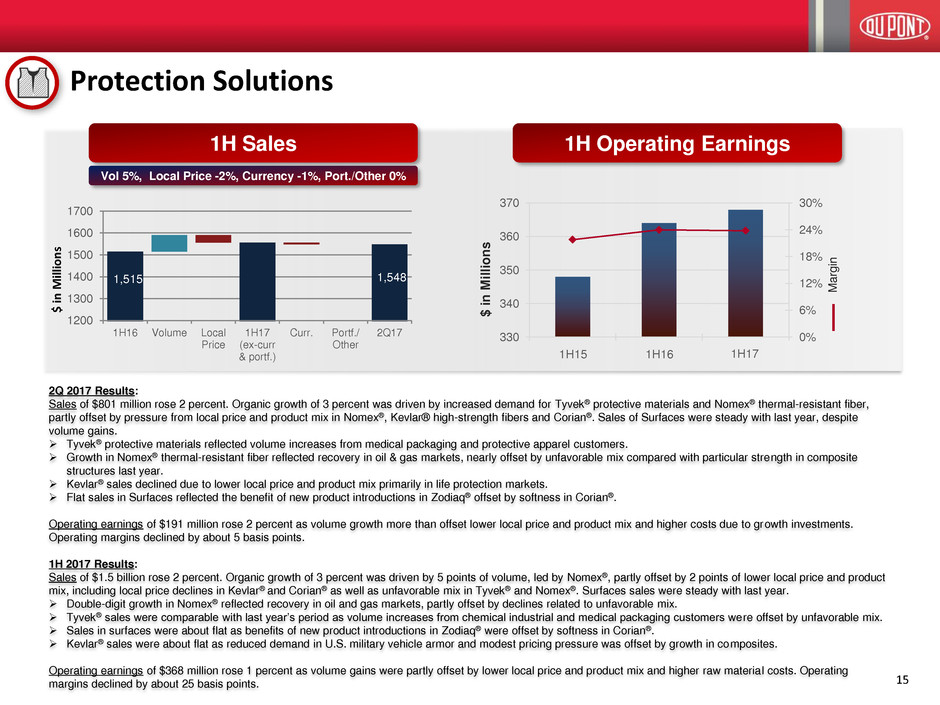

Protection Solutions

2Q 2017 Results:

Sales of $801 million rose 2 percent. Organic growth of 3 percent was driven by increased demand for Tyvek® protective materials and Nomex® thermal-resistant fiber,

partly offset by pressure from local price and product mix in Nomex®, Kevlar® high-strength fibers and Corian®. Sales of Surfaces were steady with last year, despite

volume gains.

➢ Tyvek® protective materials reflected volume increases from medical packaging and protective apparel customers.

➢ Growth in Nomex® thermal-resistant fiber reflected recovery in oil & gas markets, nearly offset by unfavorable mix compared with particular strength in composite

structures last year.

➢ Kevlar® sales declined due to lower local price and product mix primarily in life protection markets.

➢ Flat sales in Surfaces reflected the benefit of new product introductions in Zodiaq® offset by softness in Corian®.

Operating earnings of $191 million rose 2 percent as volume growth more than offset lower local price and product mix and higher costs due to growth investments.

Operating margins declined by about 5 basis points.

1H 2017 Results:

Sales of $1.5 billion rose 2 percent. Organic growth of 3 percent was driven by 5 points of volume, led by Nomex®, partly offset by 2 points of lower local price and product

mix, including local price declines in Kevlar® and Corian® as well as unfavorable mix in Tyvek® and Nomex®. Surfaces sales were steady with last year.

➢ Double-digit growth in Nomex® reflected recovery in oil and gas markets, partly offset by declines related to unfavorable mix.

➢ Tyvek® sales were comparable with last year’s period as volume increases from chemical industrial and medical packaging customers were offset by unfavorable mix.

➢ Sales in surfaces were about flat as benefits of new product introductions in Zodiaq® were offset by softness in Corian®.

➢ Kevlar® sales were about flat as reduced demand in U.S. military vehicle armor and modest pricing pressure was offset by growth in composites.

Operating earnings of $368 million rose 1 percent as volume gains were partly offset by lower local price and product mix and higher raw material costs. Operating

margins declined by about 25 basis points.

1H15 1H16 1H17

0%

6%

12%

18%

24%

30%

330

340

350

360

370

M

a

rg

in

$

in

M

ill

io

n

s

1H Operating Earnings1H Sales

Vol 5%, Local Price -2%, Currency -1%, Port./Other 0%

1200

1300

1400

1500

1600

1700

1H16 Volume Local

Price

1H17

(ex-curr

& portf.)

Curr. Portf./

Other

2Q17

1,515 1,548

$

in

M

ill

io

n

s

16

Second-Half 2017 Market Outlook By Segment

Agriculture

• Anticipate lower planted corn area in the Brazil summer season coming

off strong plantings and good yields in the previous summer season and

a sharp decline in domestic commodity prices. These dynamics are

causing farmers in Brazil to delay purchase decisions until closer to

planting as they closely scrutinize their cropping plans.

• North America farm-level income is expected to continue to be

pressured as commodity prices remain soft and current crop conditions

are less favorable than last year as the region progresses through a

critical stage in the growing season.

Electronics & Communications

• Expect continued moderate strength in key markets, primarily

consumer electronics, semiconductors and photovoltaics.

• Consumer electronics markets are likely to continue to improve versus

2016, but on slower year-over-year growth rates compared with

historical trends.

• Annual module installations in the photovoltaic market remain on

forecast to increase mid-single-digits percent year over year. Forecasted

growth rates are down from prior-year due to reduced government

subsidies and grid capacity constraints in China.

Industrial Biosciences

• Biomaterials: Favorable market trends for bio-based products expected

to continue. IHS forecasts and current futures indicate increases in

crude oil prices with benefits from OPEC production agreements partly

offset by higher production of shale gas in North America.

• Grain processing: Corn prices are expected to be influenced by weather,

NA yields and acres planted.

• Bioactives: Consumer demand for clean labels, healthy eating, low-temp

cleaning and replacing petro-chemical ingredients is likely to continue.

Nutrition & Health

• Consumer demand for healthier products expected to result in

continued probiotics growth, led by the U.S and Asia Pacific.

• Soft market conditions in global packaged foods expected to

continue, particularly in challenging markets such as the Middle

East and Latin America due to continued economic instability.

• Continued portfolio impact due to the sale of the Diagnostics

business in 1Q.

Performance Materials

• Per IHS, global autobuild growth in the second half is expected to

slow and is forecasted at 1-percent growth versus the 3-percent

growth that was reported in the first half.

• Key raw material feedstock costs including butadiene, benzene, and

ethane, are expected to continue to be elevated versus the prior

year.

• Ethylene spot prices are forecast to be down in the high teens with

the majority of the decline impacting the third quarter.

Protection Solutions

• IHS forecasts and current futures indicate increases in crude oil

prices with benefits from OPEC production agreements partly offset

by higher production of shale gas in North America.

• Single-family housing starts are expected to be positive in the

second half, according to IHS DataInsight.

• Expect military tenders to remain unsteady, reflecting tender award

delays and political uncertainty.

17

Appendix:

Supplemental Quarterly Information and Reconciliations of Non-

GAAP Measures

INDEX PAGE

SELECTED OPERATING RESULTS 19

SELECTED INCOME STATEMENT DATA 20

SEGMENT NET SALES 21

SEGMENT OPERATING EARNINGS 22

SIGNIFICANT ITEMS BY SEGMENT - PRETAX OPERATING INCOME; DEPRECIATION AND AMORTIZATION BY SEGMENT 23

RECONCILIATION OF NON-GAAP MEASURES 24-27

RECONCILIATION OF BASE INCOME TAX RATE TO EFFECTIVE INCOME TAX RATE 28

Note: Management believes that an analysis of operating earnings (as defined on page 19), a "non-GAAP" measure, is meaningful to investors because it provides insight with respect to ongoing operating results

of the company. Such measurements are not recognized in accordance with generally accepted accounting principles (GAAP) and should not be viewed as an alternative to GAAP measures of performance.

E. I. DU PONT DE NEMOURS AND COMPANY AND CONSOLIDATED SUBSIDIARIES

QUARTERLY SUPPLEMENTAL FINANCIAL DATA AND NON-GAAP RECONCILIATIONS

(UNAUDITED)

June 30, 2017

E. I. DU PONT DE NEMOURS AND COMPANY AND CONSOLIDATED SUBSIDIARIES

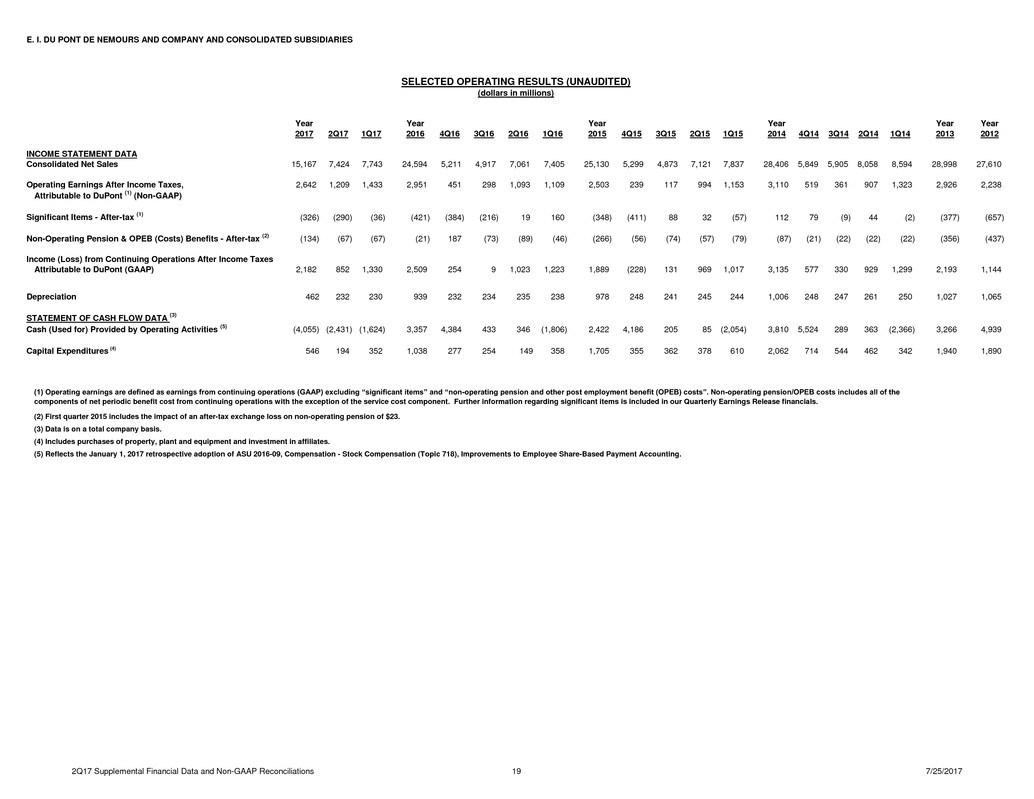

Year Year Year Year Year Year

2017 2Q17 1Q17 2016 4Q16 3Q16 2Q16 1Q16 2015 4Q15 3Q15 2Q15 1Q15 2014 4Q14 3Q14 2Q14 1Q14 2013 2012

INCOME STATEMENT DATA

Consolidated Net Sales 15,167 7,424 7,743 24,594 5,211 4,917 7,061 7,405 25,130 5,299 4,873 7,121 7,837 28,406 5,849 5,905 8,058 8,594 28,998 27,610

Operating Earnings After Income Taxes, 2,642 1,209 1,433 2,951 451 298 1,093 1,109 2,503 239 117 994 1,153 3,110 519 361 907 1,323 2,926 2,238

Attributable to DuPont

(1)

(Non-GAAP)

Significant Items - After-tax

(1)

(326) (290) (36) (421) (384) (216) 19 160 (348) (411) 88 32 (57) 112 79 (9) 44 (2) (377) (657)

Non-Operating Pension & OPEB (Costs) Benefits - After-tax

(2)

(134) (67) (67) (21) 187 (73) (89) (46) (266) (56) (74) (57) (79) (87) (21) (22) (22) (22) (356) (437)

Income (Loss) from Continuing Operations After Income Taxes

Attributable to DuPont (GAAP) 2,182 852 1,330 2,509 254 9 1,023 1,223 1,889 (228) 131 969 1,017 3,135 577 330 929 1,299 2,193 1,144

Depreciation 462 232 230 939 232 234 235 238 978 248 241 245 244 1,006 248 247 261 250 1,027 1,065

STATEMENT OF CASH FLOW DATA

(3)

Cash (Used for) Provided by Operating Activities

(5)

(4,055) (2,431) (1,624) 3,357 4,384 433 346 (1,806) 2,422 4,186 205 85 (2,054) 3,810 5,524 289 363 (2,366) 3,266 4,939

Capital Expenditures

(4) 546 194 352 1,038 277 254 149 358 1,705 355 362 378 610 2,062 714 544 462 342 1,940 1,890

(3) Data is on a total company basis.

(4) Includes purchases of property, plant and equipment and investment in affiliates.

SELECTED OPERATING RESULTS (UNAUDITED)

(dollars in millions)

(1) Operating earnings are defined as earnings from continuing operations (GAAP) excluding “significant items” and “non-operating pension and other post employment benefit (OPEB) costs”. Non-operating pension/OPEB costs includes all of the

components of net periodic benefit cost from continuing operations with the exception of the service cost component. Further information regarding significant items is included in our Quarterly Earnings Release financials.

(2) First quarter 2015 includes the impact of an after-tax exchange loss on non-operating pension of $23.

(5) Reflects the January 1, 2017 retrospective adoption of ASU 2016-09, Compensation - Stock Compensation (Topic 718), Improvements to Employee Share-Based Payment Accounting.

2Q17 Supplemental Financial Data and Non-GAAP Reconciliations 19 7/25/2017

E. I. DU PONT DE NEMOURS AND COMPANY AND CONSOLIDATED SUBSIDIARIES

Year Year Year Year Year Year

2017 2Q17 1Q17 2016 4Q16 3Q16 2Q16 1Q16 2015 4Q15 3Q15 2Q15 1Q15 2014 4Q14 3Q14 2Q14 1Q14 2013 2012

Consolidated Net Sales 15,167 7,424 7,743 24,594 5,211 4,917 7,061 7,405 25,130 5,299 4,873 7,121 7,837 28,406 5,849 5,905 8,058 8,594 28,998 27,610

Total Segment Operating Earnings

(1)

3,748 1,757 1,991 4,640 703 607 1,613 1,717 4,243 553 433 1,447 1,810 5,032 788 686 1,516 2,042 4,906 4,389

Adjusted EBIT (Operating Earnings)

(1) (2)

3,414 1,559 1,855 4,182 723 444 1,511 1,504 3,757 372 286 1,305 1,794 4,599 806 768 1,283 1,742 4,019 3,311

Adjusted EBITDA (Operating Earnings)

(1) (2)

3,984 1,848 2,136 5,440 1,002 724 1,850 1,864 5,095 675 577 1,666 2,177 5,965 1,122 1,064 1,663 2,116 5,360 4,680

Operating Earnings Before Income Taxes

(1)

3,246 1,467 1,779 3,824 629 355 1,422 1,418 3,441 287 204 1,236 1,714 4,232 719 676 1,192 1,645 3,584 2,871

Operating Earnings Per Share

(1) (3)

3.02 1.38 1.64 3.35 0.51 0.34 1.24 1.26 2.77 0.27 0.13 1.09 1.26 3.36 0.57 0.39 0.98 1.42 3.12 2.36

(1) See Reconciliation of Non-GAAP Measures.

(2) Adjusted EBIT from operating earnings is operating earnings (as defined on page 19) before income taxes, net income attributable to noncontrolling interests and interest expense.

Adjusted EBITDA from operating earnings is adjusted EBIT from operating earnings before depreciation and amortization of intangible assets.

(3) Earnings per share for the year may not equal the sum of quarterly earnings per share due to changes in average share calculations.

SELECTED INCOME STATEMENT DATA

OPERATING EARNINGS (UNAUDITED)

(dollars in millions, except per share)

2Q17 Supplemental Financial Data and Non-GAAP Reconciliations 20 7/25/2017

E. I. DU PONT DE NEMOURS AND COMPANY AND CONSOLIDATED SUBSIDIARIES

Year Year Year Year Year Year

2017 2Q17 1Q17 2016 4Q16 3Q16 2Q16 1Q16 2015 4Q15 3Q15 2Q15 1Q15 2014 4Q14 3Q14 2Q14 1Q14 2013 2012

Agriculture 7,374 3,446 3,928 9,516 1,393 1,119 3,218 3,786 9,798 1,550 1,093 3,218 3,937 11,296 1,732 1,563 3,610 4,391 11,728 10,421

Electronics & Communications 1,056 546 510 1,960 521 493 494 452 2,070 493 532 528 517 2,381 571 620 613 577 2,534 2,684

Industrial Biosciences 763 395 368 1,500 401 392 355 352 1,478 397 374 357 350 1,624 418 407 404 395 1,631 1,604

Nutrition & Health 1,607 818 789 3,268 809 823 835 801 3,256 807 810 826 813 3,529 843 899 926 861 3,473 3,422

Performance Materials 2,749 1,381 1,368 5,249 1,331 1,334 1,335 1,249 5,305 1,284 1,302 1,338 1,381 6,059 1,441 1,531 1,567 1,520 6,166 6,095

Protection Solutions 1,548 801 747 2,954 717 722 786 729 3,039 720 723 806 790 3,304 784 834 885 801 3,229 3,122

Other 70 37 33 147 39 34 38 36 184 48 39 48 49 213 60 51 53 49 237 262

CONSOLIDATED NET SALES 15,167 7,424 7,743 24,594 5,211 4,917 7,061 7,405 25,130 5,299 4,873 7,121 7,837 28,406 5,849 5,905 8,058 8,594 28,998 27,610

SEGMENT NET SALES

SEGMENT NET SALES (UNAUDITED)

(dollars in millions)

2Q17 Supplemental Financial Data and Non-GAAP Reconciliations 21 7/25/2017

E. I. DU PONT DE NEMOURS AND COMPANY AND CONSOLIDATED SUBSIDIARIES

Year Year Year Year Year Year

2017 2Q17 1Q17 2016 4Q16 3Q16 2Q16 1Q16 2015 4Q15 3Q15 2Q15 1Q15 2014 4Q14 3Q14 2Q14 1Q14 2013 2012

Agriculture 2,199 963 1,236 1,758 (19) (189) 865 1,101 1,646 (54) (210) 772 1,138 2,352 134 (56) 835 1,439 2,480 2,129

Electronics & Communications 205 116 89 358 98 108 93 59 359 87 104 89 79 336 92 90 84 70 314 237

Industrial Biosciences 151 76 75 270 67 78 62 63 243 78 61 50 54 269 69 58 71 71 232 228

Nutrition & Health 256 135 121 504 135 135 130 104 373 85 102 100 86 369 79 99 103 88 286 305

Performance Materials 684 329 355 1,297 328 371 325 273 1,216 281 317 301 317 1,267 326 366 293 282 1,249 1,140

Protection Solutions 368 191 177 668 142 162 188 176 641 147 146 181 167 672 169 174 181 148 553 475

Other (115) (53) (62) (215) (48) (58) (50) (59) (235) (71) (87) (46) (31) (233) (81) (45) (51) (56) (208) (125)

TOTAL SEGMENT OPERATING EARNINGS 3,748 1,757 1,991 4,640 703 607 1,613 1,717 4,243 553 433 1,447 1,810 5,032 788 686 1,516 2,042 4,906 4,389

Corporate Expenses (120) (51) (69) (340) (88) (83) (83) (86) (573) (160) (111) (148) (154) (677) (134) (167) (174) (202) (773) (842)

Interest Expense (183) (99) (84) (370) (92) (93) (93) (92) (322) (82) (82) (74) (84) (377) (87) (93) (94) (103) (448) (464)

3,445 1,607 1,838 3,930 523 431 1,437 1,539 3,348 311 240 1,225 1,572 3,978 567 426 1,248 1,737 3,685 3,083

(780) (376) (404) (845) (50) (101) (323) (371) (712) (7) (91) (268) (346) (692) (13) (56) (279) (344) (680) (685)

Net After-tax Exchange Gains (Losses)

(1)

(8) (15) 7 (122) (24) (28) (17) (53) (127) (68) (32) 42 (69) (166) (35) (8) (59) (64) (66) (136)

Less: Net Income Attr. to Noncontrolling Interests 15 7 8 12 (2) 4 4 6 6 (3) - 5 4 10 - 1 3 6 13 24

OPERATING EARNINGS (Non-GAAP) 2,642 1,209 1,433 2,951 451 298 1,093 1,109 2,503 239 117 994 1,153 3,110 519 361 907 1,323 2,926 2,238

Net Income (Loss) Attributable to Noncontrolling Interests 15 7 8 12 (2) 4 4 6 6 (3) - 5 4 10 - 1 3 6 13 24

Non-Operating Pension & OPEB (Costs) Benefits - After-tax

(1)

(134) (67) (67) (21) 187 (73) (89) (46) (266) (56) (74) (57) (79) (87) (21) (22) (22) (22) (356) (437)

Significant Items - After-tax (326) (290) (36) (421) (384) (216) 19 160 (348) (411) 88 32 (57) 112 79 (9) 44 (2) (377) (657)

INCOME (LOSS) FROM CONTINUING OPERATIONS

AFTER INCOME TAXES (GAAP) 2,197 859 1,338 2,521 252 13 1,027 1,229 1,895 (231) 131 974 1,021 3,145 577 331 932 1,305 2,206 1,168

(1)

OPERATING EARNINGS (UNAUDITED)

(dollars in millions)

In the first quarter 2015, the impact of an after-tax exchange loss on non-operating pension of $23 is excluded from Net After-tax Exchange Losses and is included within Non-Operating Pension & OPEB Costs-After tax above.

OPERATING EARNINGS BEFORE INCOME TAXES

AND EXCHANGE GAINS (LOSSES) (Non-GAAP)

Provision For Income Taxes on Operating Earnings,

Excluding Taxes on Exchange Gains (Losses)

SEGMENT OPERATING EARNINGS

2Q17 Supplemental Financial Data and Non-GAAP Reconciliations 22 7/25/2017

E. I. DU PONT DE NEMOURS AND COMPANY AND CONSOLIDATED SUBSIDIARIES

SEGMENT PRETAX IMPACT OF Year Year Year Year Year Year

SIGNIFICANT ITEMS 2017 2Q17 1Q17 2016 4Q16 3Q16 2Q16 1Q16 2015 4Q15 3Q15 2Q15 1Q15 2014 4Q14 3Q14 2Q14 1Q14 2013 2012

Agriculture - - - (37) 14 (13) 35 (73) 148 (30) 147 (4) 35 316 363 - (47) - (351) (469)

Electronics & Communications (6) (1) (5) 4 (9) (2) 8 7 (78) (89) - 11 - (84) (16) - (68) - (131) (37)

Industrial Biosciences (6) - (6) (152) 2 (158) 3 1 (61) (60) - (1) - (20) (16) - (4) - (1) (10)

Nutrition & Health 160 - 160 9 (3) (1) 12 1 (50) (46) - (4) - (15) (7) - (8) - 6 (49)

Performance Materials (13) (2) (11) 5 (2) 2 9 (4) (62) (60) - (2) - 292 (70) - 362 - (16) (104)

Protection Solutions (281) (157) (124) 14 4 - 7 3 105 (8) - 113 - (45) (17) - (28) - 6 (51)

Other - - - (11) (8) - - (3) (40) - - (3) (37) (10) (7) - (3) - 1 (137)

TOTAL SIGNIFICANT ITEMS

BY SEGMENT - PRETAX (146) (160) 14 (168) (2) (172) 74 (68) (38) (293) 147 110 (2) 434 230 - 204 - (486) (857)

DEPRECIATION AND Year Year Year Year Year Year

AMORTIZATION 2017 2Q17 1Q17 2016 4Q16 3Q16 2Q16 1Q16 2015 4Q15 3Q15 2Q15 1Q15 2014 4Q14 3Q14 2Q14 1Q14 2013 2012

Agriculture 160 82 78 417 74 72 126 145 453 79 74 139 161 436 97 78 121 140 358 337

Electronics & Communications 43 22 21 87 21 22 22 22 100 30 23 24 23 97 23 25 23 26 105 113

Industrial Biosciences 50 25 25 100 25 24 25 26 101 25 26 24 26 102 25 26 26 25 98 106

Nutrition & Health 105 53 52 223 53 55 57 58 236 58 58 58 62 264 64 66 68 66 271 288

Performance Materials 66 34 32 130 33 32 34 31 125 33 30 31 31 139 33 35 35 36 162 171

Protection Solutions 71 35 36 146 36 37 35 38 156 38 40 39 39 168 41 41 43 43 178 166

Other 4 1 3 10 3 3 1 3 6 2 - 3 1 8 1 2 2 3 9 10

TOTAL DEPRECIATION AND

AMORTIZATION BY SEGMENT 499 252 247 1,113 245 245 300 323 1,177 265 251 318 343 1,214 284 273 318 339 1,181 1,191

SIGNIFICANT ITEMS BY SEGMENT - PRETAX OPERATING INCOME (UNAUDITED)

(dollars in millions)

DEPRECIATION AND AMORTIZATION BY SEGMENT

(dollars in millions)

2Q17 Supplemental Financial Data and Non-GAAP Reconciliations 23 7/25/2017

E. I. DU PONT DE NEMOURS AND COMPANY AND CONSOLIDATED SUBSIDIARIES

Year Year Year Year Year Year

2017 2Q17 1Q17 2016 4Q16 3Q16 2Q16 1Q16 2015 4Q15 3Q15 2Q15 1Q15 2014 4Q14 3Q14 2Q14 1Q14 2013 2012

RECONCILIATION OF DILUTED EARNINGS PER SHARE (EPS)

(1)

EPS from continuing operations (GAAP) 2.50 0.97 1.52 2.85 0.29 0.01 1.16 1.39 2.09 (0.26) 0.14 1.06 1.11 3.39 0.63 0.36 1.00 1.39 2.34 1.20

Non-Operating Pension & OPEB Costs (Benefits)

(2)

0.15 0.08 0.08 0.02 (0.22) 0.08 0.10 0.05 0.29 0.06 0.09 0.07 0.09 0.09 0.03 0.02 0.03 0.03 0.38 0.46

Significant Items 0.37 0.33 0.04 0.48 0.44 0.25 (0.02) (0.18) 0.39 0.47 (0.10) (0.04) 0.06 (0.12) (0.09) 0.01 (0.05) - 0.40 0.70

Operating EPS (Non-GAAP) 3.02 1.38 1.64 3.35 0.51 0.34 1.24 1.26 2.77 0.27 0.13 1.09 1.26 3.36 0.57 0.39 0.98 1.42 3.12 2.36

RECONCILIATION OF ADJUSTED EBIT / ADJUSTED EBITDA TO CONSOLIDATED INCOME STATEMENTS

Income (Loss) From Continuing Operations After Income Taxes (GAAP) 2,197 859 1,338 2,521 252 13 1,027 1,229 1,895 (231) 131 974 1,021 3,145 577 331 932 1,305 2,206 1,168

Add: Provision for (Benefit from) income taxes on continuing operations 352 128 224 744 101 (69) 306 406 696 (190) 96 260 530 1,168 247 303 313 305 360 122

Income (Loss) From Continuing Operations Before Income Taxes 2,549 987 1,562 3,265 353 (56) 1,333 1,635 2,591 (421) 227 1,234 1,551 4,313 824 634 1,245 1,610 2,566 1,290

Add: Significant Items - Pretax - Charge / (Benefit) 489 376 113 519 557 297 (44) (291) 453 622 (138) (85) 54 (209) (137) 10 (85) 3 485 930

Add: Non-Operating Pension & OPEB Costs (Benefits) - Pretax

(2)

208 104 104 40 (281) 114 133 74 397 86 115 87 109 128 32 32 32 32 533 651

Operating Earnings Before Income Taxes (Non-GAAP) 3,246 1,467 1,779 3,824 629 355 1,422 1,418 3,441 287 204 1,236 1,714 4,232 719 676 1,192 1,645 3,584 2,871

Less: Net Income (Loss) Attributable to Noncontrolling Interests 15 7 8 12 (2) 4 4 6 6 (3) - 5 4 10 - 1 3 6 13 24

Add: Interest Expense 183 99 84 370 92 93 93 92 322 82 82 74 84 377 87 93 94 103 448 464

Adjusted EBIT (Operating Earnings) (Non-GAAP) 3,414 1,559 1,855 4,182 723 444 1,511 1,504 3,757 372 286 1,305 1,794 4,599 806 768 1,283 1,742 4,019 3,311

Add: Depreciation and Amortization 570 289 281 1,258 279 280 339 360 1,338 303 291 361 383 1,366 316 296 380 374 1,341 1,369

Adjusted EBITDA (Operating Earnings) (Non-GAAP) 3,984 1,848 2,136 5,440 1,002 724 1,850 1,864 5,095 675 577 1,666 2,177 5,965 1,122 1,064 1,663 2,116 5,360 4,680

(1) Earnings per share for the year may not equal the sum of quarterly earnings per share due to changes in average share calculations.

(2)

RECONCILIATION OF NON-GAAP MEASURES (UNAUDITED)

(dollars in millions, except per share)

First quarter 2015 includes the impact of an exchange loss on non-operating pension of $23.

2Q17 Supplemental Financial Data and Non-GAAP Reconciliations 24 7/25/2017

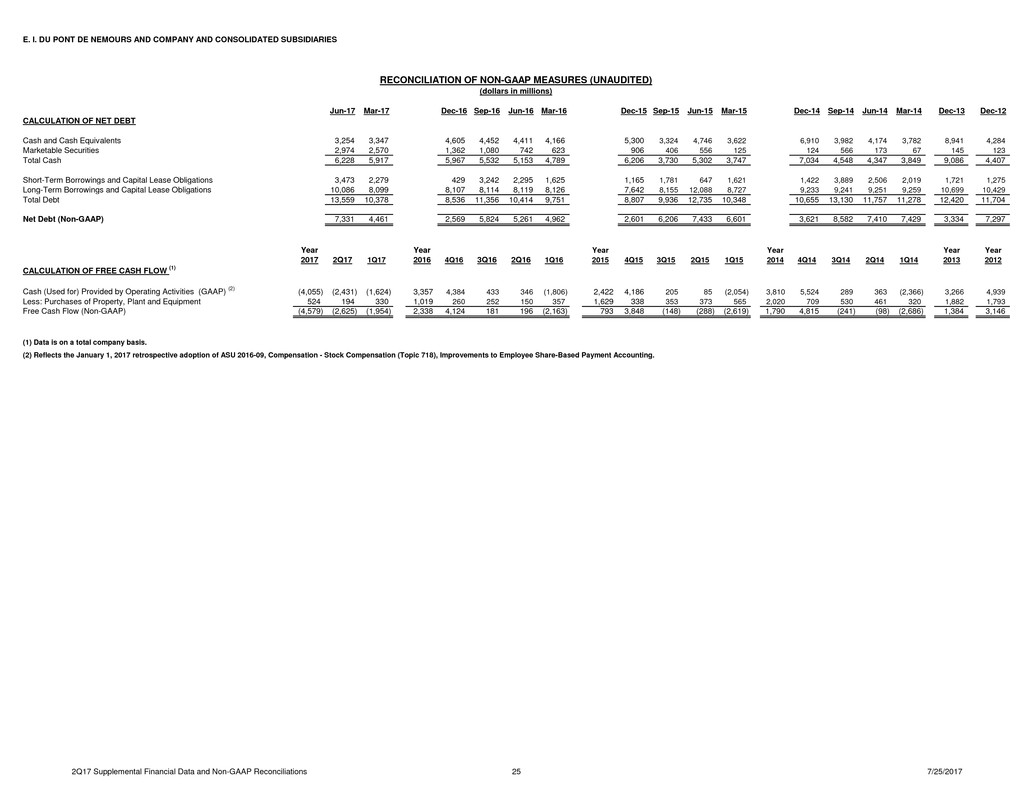

E. I. DU PONT DE NEMOURS AND COMPANY AND CONSOLIDATED SUBSIDIARIES

Jun-17 Mar-17 Dec-16 Sep-16 Jun-16 Mar-16 Dec-15 Sep-15 Jun-15 Mar-15 Dec-14 Sep-14 Jun-14 Mar-14 Dec-13 Dec-12

CALCULATION OF NET DEBT

Cash and Cash Equivalents 3,254 3,347 4,605 4,452 4,411 4,166 5,300 3,324 4,746 3,622 6,910 3,982 4,174 3,782 8,941 4,284

Marketable Securities 2,974 2,570 1,362 1,080 742 623 906 406 556 125 124 566 173 67 145 123

Total Cash 6,228 5,917 5,967 5,532 5,153 4,789 6,206 3,730 5,302 3,747 7,034 4,548 4,347 3,849 9,086 4,407

Short-Term Borrowings and Capital Lease Obligations 3,473 2,279 429 3,242 2,295 1,625 1,165 1,781 647 1,621 1,422 3,889 2,506 2,019 1,721 1,275

Long-Term Borrowings and Capital Lease Obligations 10,086 8,099 8,107 8,114 8,119 8,126 7,642 8,155 12,088 8,727 9,233 9,241 9,251 9,259 10,699 10,429

Total Debt 13,559 10,378 8,536 11,356 10,414 9,751 8,807 9,936 12,735 10,348 10,655 13,130 11,757 11,278 12,420 11,704

Net Debt (Non-GAAP) 7,331 4,461 2,569 5,824 5,261 4,962 2,601 6,206 7,433 6,601 3,621 8,582 7,410 7,429 3,334 7,297

Year Year Year Year Year Year

2017 2Q17 1Q17 2016 4Q16 3Q16 2Q16 1Q16 2015 4Q15 3Q15 2Q15 1Q15 2014 4Q14 3Q14 2Q14 1Q14 2013 2012

CALCULATION OF FREE CASH FLOW

(1)

Cash (Used for) Provided by Operating Activities (GAAP)

(2)

(4,055) (2,431) (1,624) 3,357 4,384 433 346 (1,806) 2,422 4,186 205 85 (2,054) 3,810 5,524 289 363 (2,366) 3,266 4,939

Less: Purchases of Property, Plant and Equipment 524 194 330 1,019 260 252 150 357 1,629 338 353 373 565 2,020 709 530 461 320 1,882 1,793

Free Cash Flow (Non-GAAP) (4,579) (2,625) (1,954) 2,338 4,124 181 196 (2,163) 793 3,848 (148) (288) (2,619) 1,790 4,815 (241) (98) (2,686) 1,384 3,146

(1) Data is on a total company basis.

RECONCILIATION OF NON-GAAP MEASURES (UNAUDITED)

(dollars in millions)

(2) Reflects the January 1, 2017 retrospective adoption of ASU 2016-09, Compensation - Stock Compensation (Topic 718), Improvements to Employee Share-Based Payment Accounting.

2Q17 Supplemental Financial Data and Non-GAAP Reconciliations 25 7/25/2017

E. I. DU PONT DE NEMOURS AND COMPANY AND CONSOLIDATED SUBSIDIARIES

SEGMENT OPERATING EARNINGS MARGIN % Year Year Year Year Year Year

(Segment Operating Earnings / Segment Net Sales)

(1)

2017 2Q17 1Q17 2016 4Q16 3Q16 2Q16 1Q16 2015 4Q15 3Q15 2Q15 1Q15 2014 4Q14 3Q14 2Q14 1Q14 2013 2012

Agriculture 29.8% 27.9% 31.5% 18.5% -1.4% -16.9% 26.9% 29.1% 16.8% -3.5% -19.2% 24.0% 28.9% 20.8% 7.7% -3.6% 23.1% 32.8% 21.1% 20.4%

Electronics & Communications 19.4% 21.2% 17.5% 18.3% 18.8% 21.9% 18.8% 13.1% 17.3% 17.6% 19.5% 16.9% 15.3% 14.1% 16.1% 14.5% 13.7% 12.1% 12.4% 8.8%

Industrial Biosciences 19.8% 19.2% 20.4% 18.0% 16.7% 19.9% 17.5% 17.9% 16.4% 19.6% 16.3% 14.0% 15.4% 16.6% 16.5% 14.3% 17.6% 18.0% 14.2% 14.2%

Nutrition & Health 15.9% 16.5% 15.3% 15.4% 16.7% 16.4% 15.6% 13.0% 11.5% 10.5% 12.6% 12.1% 10.6% 10.5% 9.4% 11.0% 11.1% 10.2% 8.2% 8.9%

Performance Materials 24.9% 23.8% 26.0% 24.7% 24.6% 27.8% 24.3% 21.9% 22.9% 21.9% 24.3% 22.5% 23.0% 20.9% 22.6% 23.9% 18.7% 18.6% 20.3% 18.7%

Protection Solutions 23.8% 23.8% 23.7% 22.6% 19.8% 22.4% 23.9% 24.1% 21.1% 20.4% 20.2% 22.5% 21.1% 20.3% 21.6% 20.9% 20.5% 18.5% 17.1% 15.2%

24.7% 23.7% 25.7% 18.9% 13.5% 12.3% 22.8% 23.2% 16.9% 10.4% 8.9% 20.3% 23.1% 17.7% 13.5% 11.6% 18.8% 23.8% 16.9% 15.9%

TOTAL SEGMENT OPERATING EARNINGS MARGIN %

RECONCILIATION OF NON-GAAP MEASURES (UNAUDITED)

(1) Segment Operating Earnings margin %'s for Other (which includes consulting solutions, pre-commercial programs, pharmaceuticals, and non-aligned businesses) are not presented separately above as they are not meaningful; however, the results are

included in the Total margin %'s above.

2Q17 Supplemental Financial Data and Non-GAAP Reconciliations 26 7/25/2017

E. I. DU PONT DE NEMOURS AND COMPANY AND CONSOLIDATED SUBSIDIARIES

As Reported

(GAAP)

Less:

Significant

Items

Less: Non-

Operating

Pension/OPEB

Costs (Non-GAAP)

As

Reported

(GAAP)

Less:

Significant

Items

Less: Non-

Operating

Pension/OPEB

Costs (Non-GAAP)

Other operating charges 176$ -$ -$ 176$ 143$ (30)$ -$ 173$

Selling, general and administrative expenses 1,348 216 31 1,101 1,211 76 53 1,082

Research and development expense 441 - 16 425 432 - 20 412

Total 1,965$ 216$ 47$ 1,702$ 1,786$ 46$ 73$ 1,667$

As Reported

(GAAP)

Less:

Significant

Items

Less: Non-

Operating

Pension/OPEB

Costs (Non-GAAP)

As

Reported

(GAAP)

Less:

Significant

Items

Less: Non-

Operating

Pension/OPEB

Costs (Non-GAAP)

Other operating charges 380$ -$ -$ 380$ 328$ (53)$ -$ 381$

Selling, general and administrative expenses 2,608 386 62 2,160 2,339 100 83 2,156

Research and development expense 857 - 32 825 850 - 31 819

Total 3,845$ 386$ 94$ 3,365$ 3,517$ 47$ 114$ 3,356$

2017 2016 2017 2016

Corporate expenses (income) (GAAP) 267$ 113$ 463$ (160)$

Less: Significant items charge (benefit) 216 30 343 (329)

Corporate expenses (Non-GAAP) 51$ 83$ 120$ 169$

Coporate expenses

The reconciliation below reflects GAAP corporate expenses (income) excluding significant items.

Three Months Ended

June 30,

RECONCILIATION OF NON-GAAP MEASURES (UNAUDITED)

(dollars in millions)

Three Months Ended June 30, 2017 Three Months Ended June 30, 2016

Reconciliation of Operating Costs to Consolidated Income Statement Line Items

GAAP operating costs is defined as other operating charges, selling, general and administrative expenses, and research and development costs. The reconciliation below

reflects operating costs excluding significant items and non-operating pension/OPEB (benefits) costs.

Six months ended June 30, 2017 Six months ended June 30, 2016

Six Months Ended

June 30,

2Q17 Supplemental Financial Data and Non-GAAP Reconciliations 27 7/25/2017

E. I. DU PONT DE NEMOURS AND COMPANY AND CONSOLIDATED SUBSIDIARIES

2017 2016 2017 2016

Effective income tax rate (GAAP) 13.0% 23.0% 13.8% 24.0%

Significant items effect and non-operating pension/OPEB costs effect 4.1% (0.1%) 4.3% (1.9%)

Tax rate, from continuing operations, before significant items and non-operating pension/OPEB costs 17.1% 22.9% 18.1% 22.1%

Exchange gains (losses) effect 6.3% (0.4%) 4.5% 1.2%

Base income tax rate from continuing operations (Non-GAAP) 23.4% 22.5% 22.6% 23.3%

Three Months Ended

June 30,

RECONCILIATION OF BASE INCOME TAX RATE TO EFFECTIVE INCOME TAX RATE (UNAUDITED)

Base income tax rate is defined as the effective income tax rate less the effect of exchange gains (losses), significant items and non-operating pension/OPEB costs.

Six Months Ended

June 30,

2Q17 Supplemental Financial Data and Non-GAAP Reconciliations 28 7/25/2017

18

Copyright © 2017 DuPont. All rights reserved.

The DuPont Oval Logo, DuPontTM, The miracles of scienceTM, and

all products, unless otherwise noted, denoted with ® or TM are

trademarks or registered trademarks of E. I. du Pont de Nemours and

Company.

+Images reproduced by E. I. du Pont de Nemours and Company under

license from the National Geographic Society.