Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - People's United Financial, Inc. | d428655d8k.htm |

| EX-99.1 - EX-99.1 - People's United Financial, Inc. | d428655dex991.htm |

Second Quarter 2017 Results July 20, 2017 NASDAQ: PBCT Exhibit 99.2

Forward-Looking Statement Certain statements contained in this presentation are forward-looking in nature. These include all statements about People's United Financial's plans, objectives, expectations and other statements that are not historical facts, and usually use words such as "expect," "anticipate," "believe," "should" and similar expressions. Such statements represent management's current beliefs, based upon information available at the time the statements are made, with regard to the matters addressed. All forward-looking statements are subject to risks and uncertainties that could cause People's United Financial's actual results or financial condition to differ materially from those expressed in or implied by such statements. Factors of particular importance to People’s United Financial include, but are not limited to: (1) changes in general, national or regional economic conditions; (2) changes in interest rates; (3) changes in loan default and charge-off rates; (4) changes in deposit levels; (5) changes in levels of income and expense in non-interest income and expense related activities; (6) changes in accounting and regulatory guidance applicable to banks; (7) price levels and conditions in the public securities markets generally; (8) competition and its effect on pricing, spending, third-party relationships and revenues; (9) the successful integration of acquisitions; and (10) changes in regulation resulting from or relating to financial reform legislation. People's United Financial does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

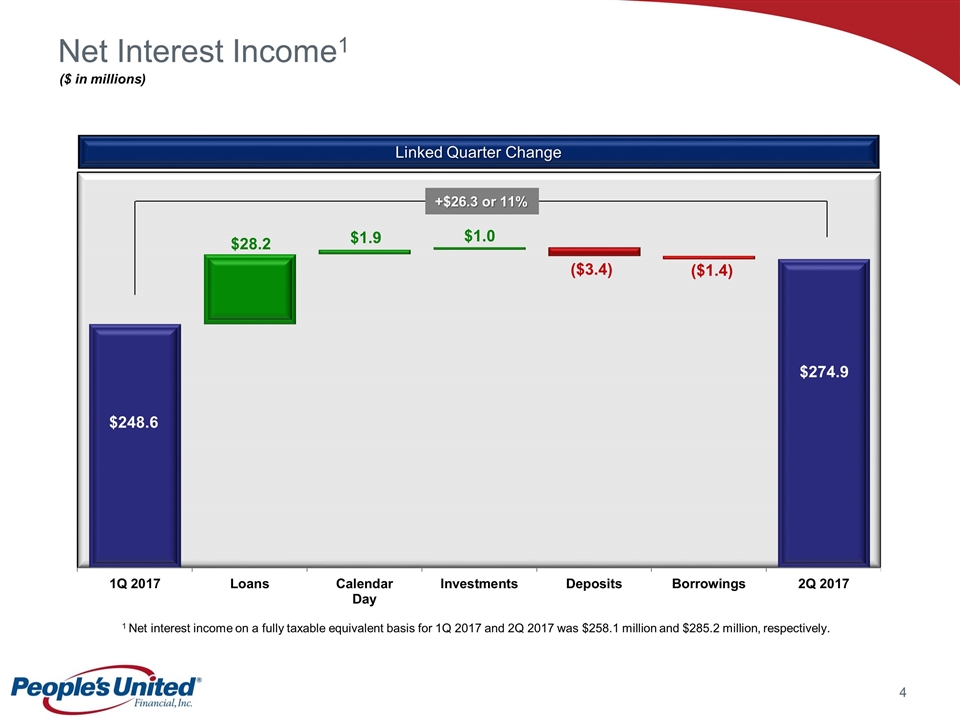

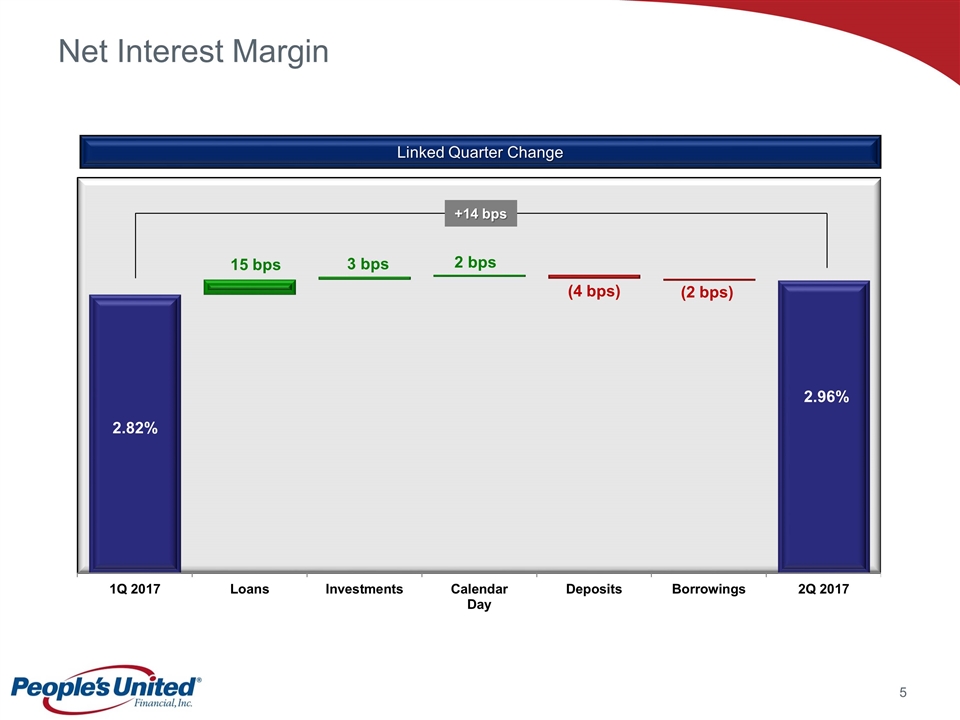

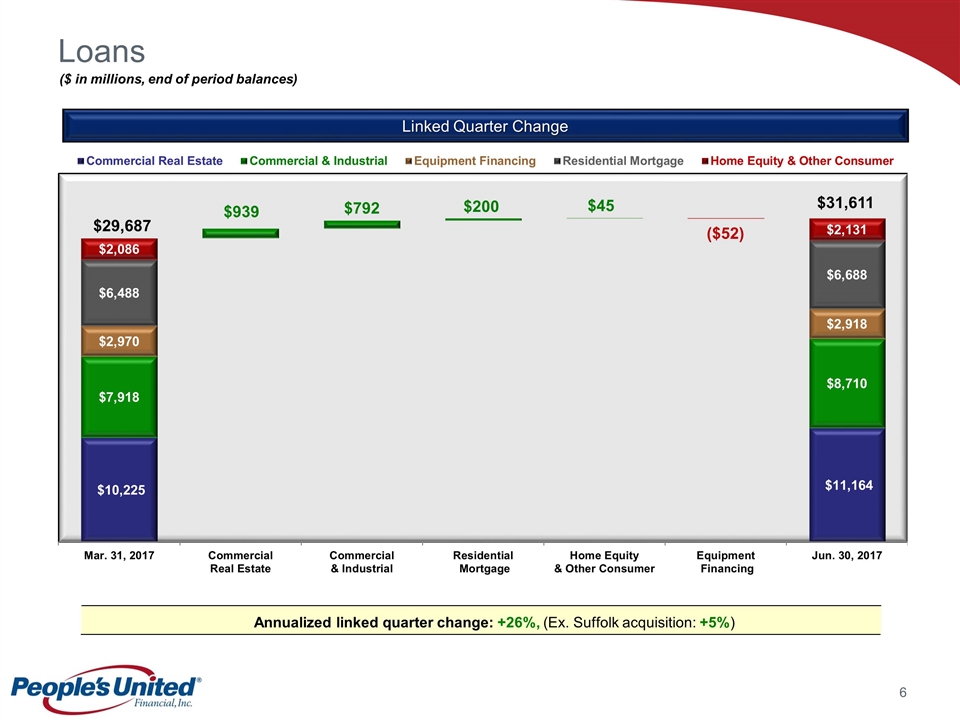

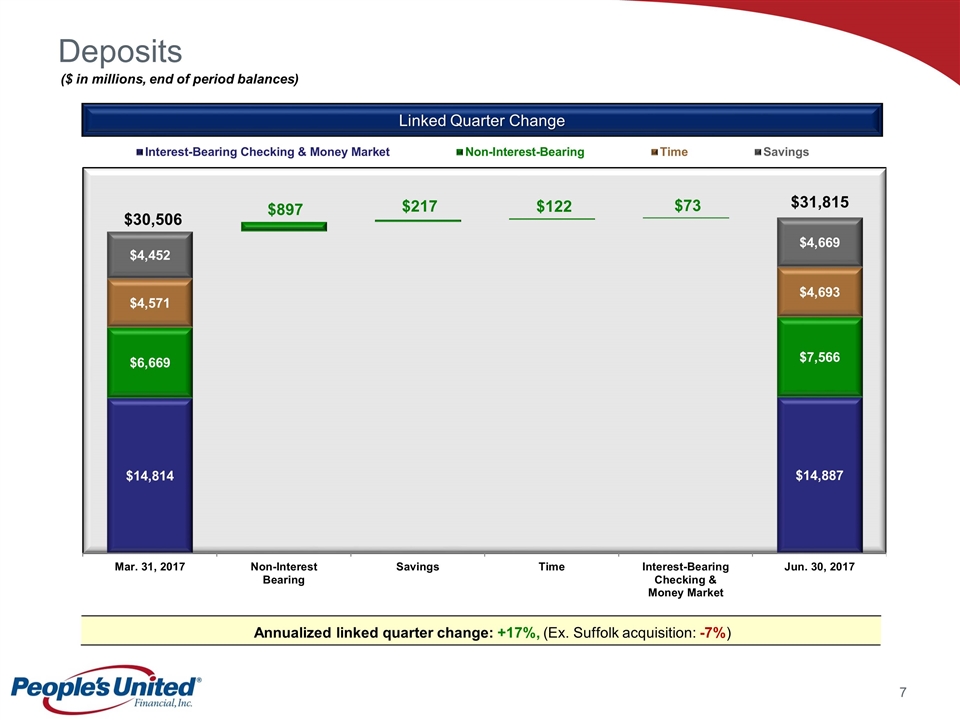

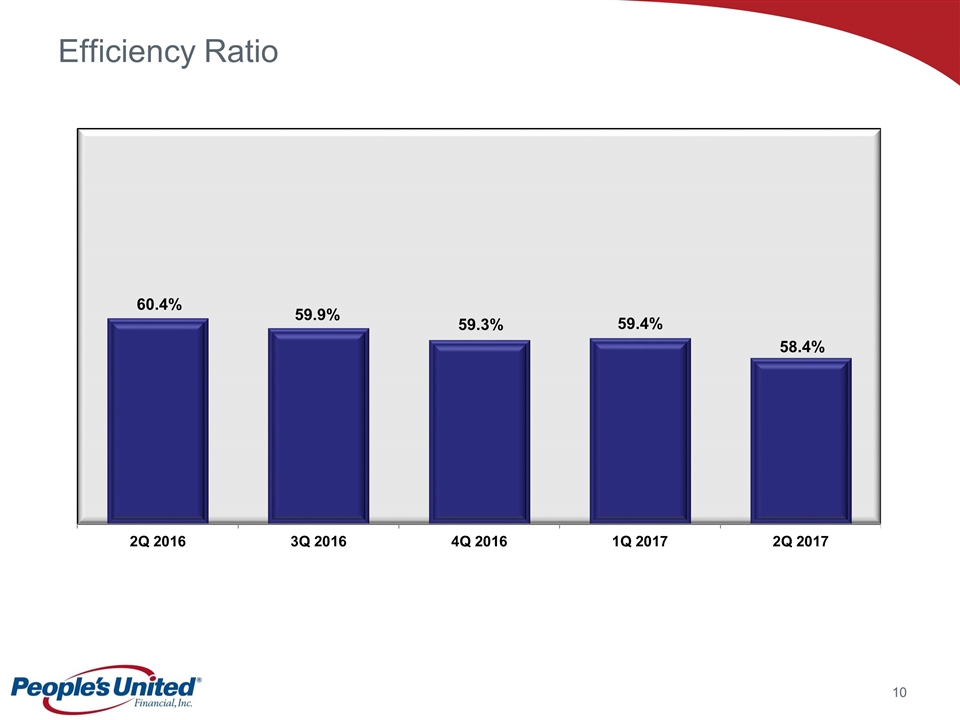

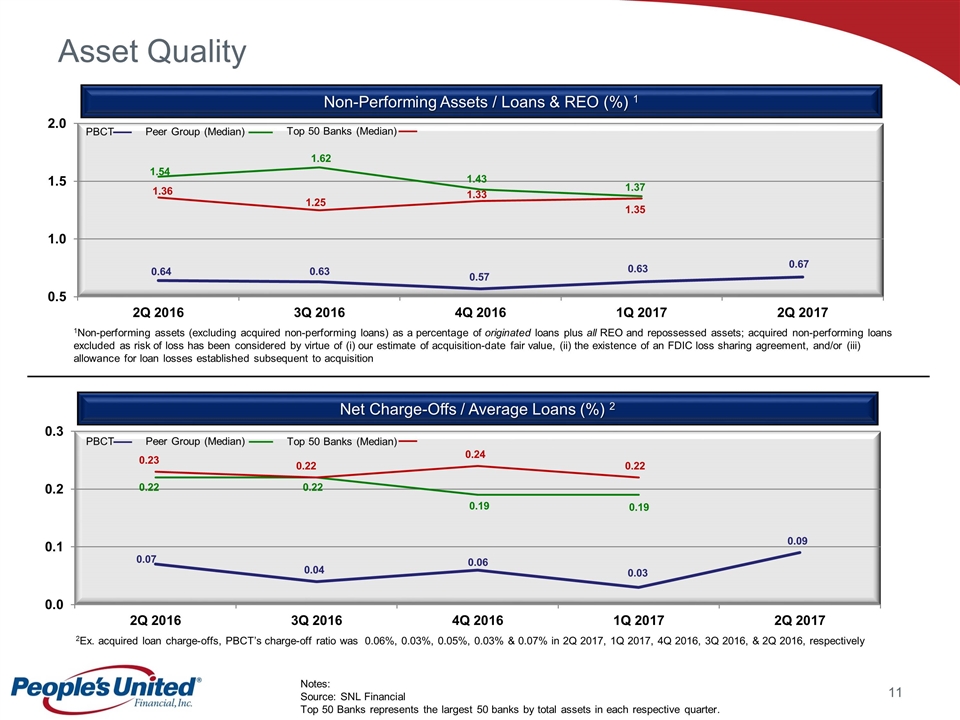

Net Income of $69.3 Million, or $0.19 Per Common Share Results include merger-related expenses of $24.8 million ($16.8 million after-tax) or $0.05 per common share Operating earnings of $82.6 million, an increase of 21% from both the 1st quarter and prior year quarter Operating earnings per common share of $0.24, increased $0.02 and $0.01, respectively, from the 1st quarter and prior year quarter Net interest income1 of $275 million, an increase of $26 million or 11% Net interest margin of 2.96%, an increase of 14 basis points Loan balances increased $1.9 billion, 26% annualized rate Deposit balances increased $1.3 billion,17% annualized rate Non-interest income of $92 million, an increase of $7 million or 8% Non-interest expense (ex. merger-related expenses) of $233 million, an increase of $8 million or 3% Efficiency ratio of 58.4%, an improvement of 100 basis points Net loan charge-offs of 0.09%, an increase of 6 basis points 1 Net interest income on a fully taxable equivalent basis was $285 million, an increase of 10%. (Comparisons versus first quarter 2017, unless noted otherwise) Second Quarter 2017 Overview

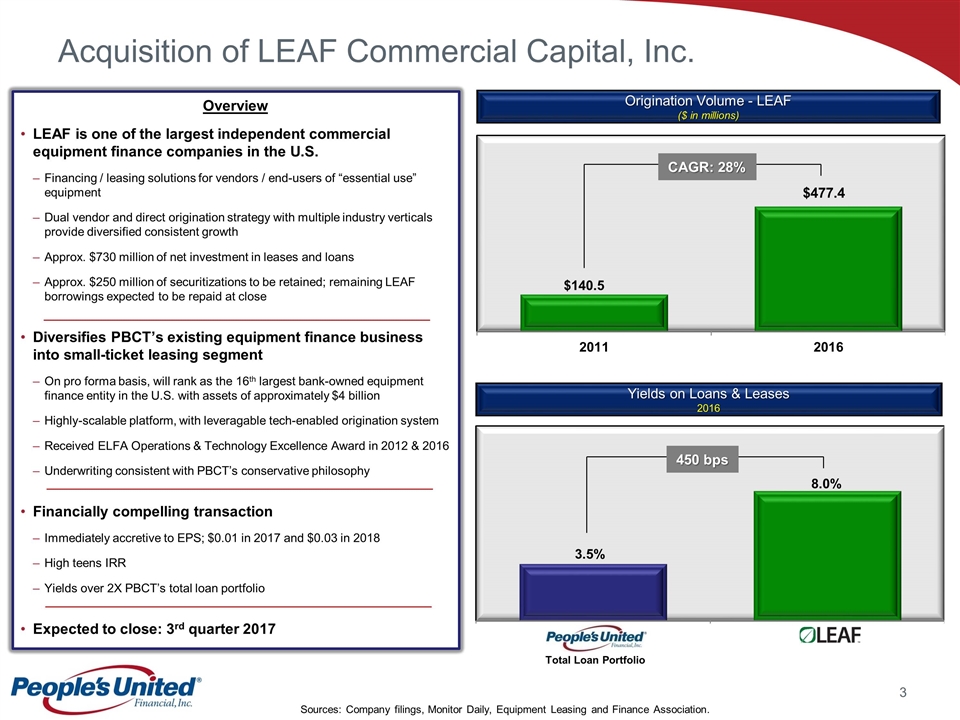

Acquisition of LEAF Commercial Capital, Inc. Overview LEAF is one of the largest independent commercial equipment finance companies in the U.S. Financing / leasing solutions for vendors / end-users of “essential use” equipment Dual vendor and direct origination strategy with multiple industry verticals provide diversified consistent growth Approx. $730 million of net investment in leases and loans Approx. $250 million of securitizations to be retained; remaining LEAF borrowings expected to be repaid at close Diversifies PBCT’s existing equipment finance business into small-ticket leasing segment On pro forma basis, will rank as the 16th largest bank-owned equipment finance entity in the U.S. with assets of approximately $4 billion Highly-scalable platform, with leveragable tech-enabled origination system Received ELFA Operations & Technology Excellence Award in 2012 & 2016 Underwriting consistent with PBCT’s conservative philosophy Financially compelling transaction Immediately accretive to EPS; $0.01 in 2017 and $0.03 in 2018 High teens IRR Yields over 2X PBCT’s total loan portfolio Expected to close: 3rd quarter 2017 Origination Volume - LEAF ($ in millions) Yields on Loans & Leases 2016 Sources: Company filings, Monitor Daily, Equipment Leasing and Finance Association. Total Loan Portfolio 450 bps CAGR: 28%

Net Interest Income1 ($ in millions) Linked Quarter Change $248.6 $274.9 1 Net interest income on a fully taxable equivalent basis for 1Q 2017 and 2Q 2017 was $258.1 million and $285.2 million, respectively. $28.2 ($3.4) +$26.3 or 11% $1.9 $1.0 ($1.4)

Net Interest Margin Linked Quarter Change 2.82% 2.96% 15 bps (4 bps) +14 bps (2 bps) 3 bps 2 bps

Loans $31,611 ($ in millions, end of period balances) $29,687 Annualized linked quarter change: +26%, (Ex. Suffolk acquisition: +5%) Linked Quarter Change $939 ($52) $792 $200 $45

Deposits Linked Quarter Change ($ in millions, end of period balances) $31,815 $897 $30,506 Annualized linked quarter change: +17%, (Ex. Suffolk acquisition: -7%) $217 $122 $73

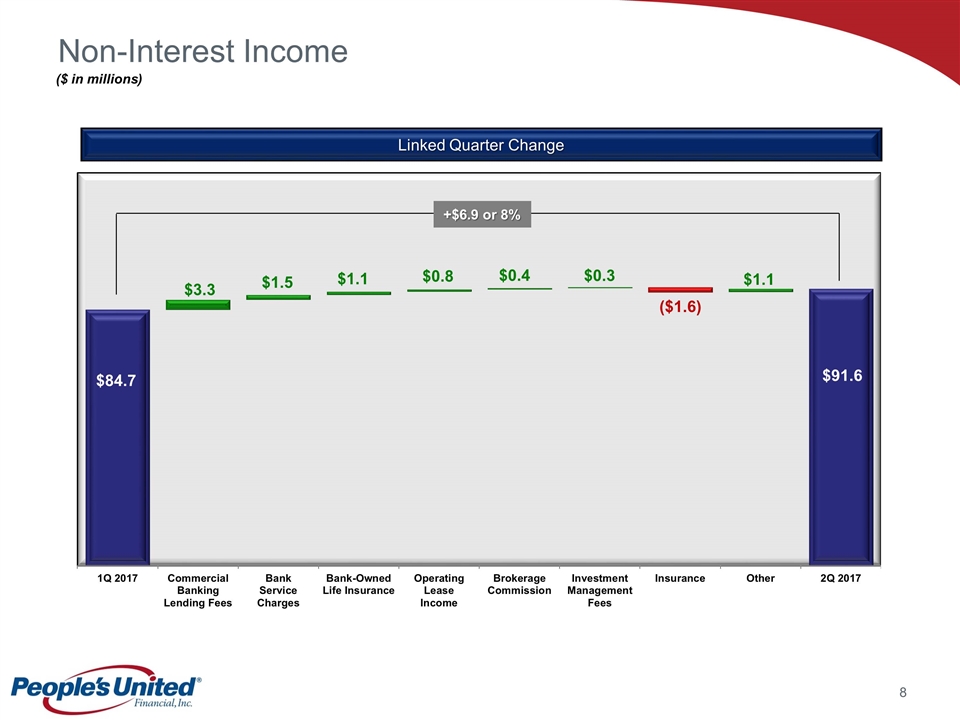

Non-Interest Income ($ in millions) $84.7 $91.6 Linked Quarter Change ($1.6) $3.3 +$6.9 or 8% $1.5 $1.1 $0.8 $0.4 $0.3 $1.1

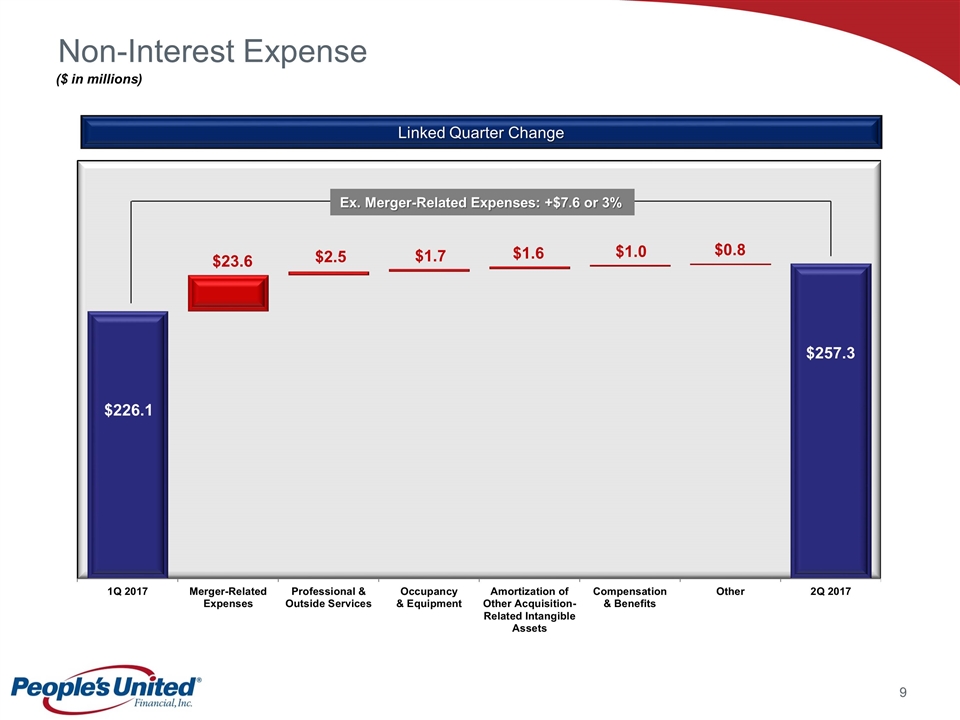

Non-Interest Expense ($ in millions) $257.3 $226.1 Linked Quarter Change $23.6 Ex. Merger-Related Expenses: +$7.6 or 3% $2.5 $1.7 $1.6 $1.0 $0.8

Efficiency Ratio

Asset Quality Non-Performing Assets / Loans & REO (%) 1 1Non-performing assets (excluding acquired non-performing loans) as a percentage of originated loans plus all REO and repossessed assets; acquired non-performing loans excluded as risk of loss has been considered by virtue of (i) our estimate of acquisition-date fair value, (ii) the existence of an FDIC loss sharing agreement, and/or (iii) allowance for loan losses established subsequent to acquisition Notes: Source: SNL Financial Top 50 Banks represents the largest 50 banks by total assets in each respective quarter. Net Charge-Offs / Average Loans (%) 2 2Ex. acquired loan charge-offs, PBCT’s charge-off ratio was 0.06%, 0.03%, 0.05%, 0.03% & 0.07% in 2Q 2017, 1Q 2017, 4Q 2016, 3Q 2016, & 2Q 2016, respectively PBCT Peer Group (Median) Top 50 Banks (Median) PBCT Peer Group (Median) Top 50 Banks (Median)

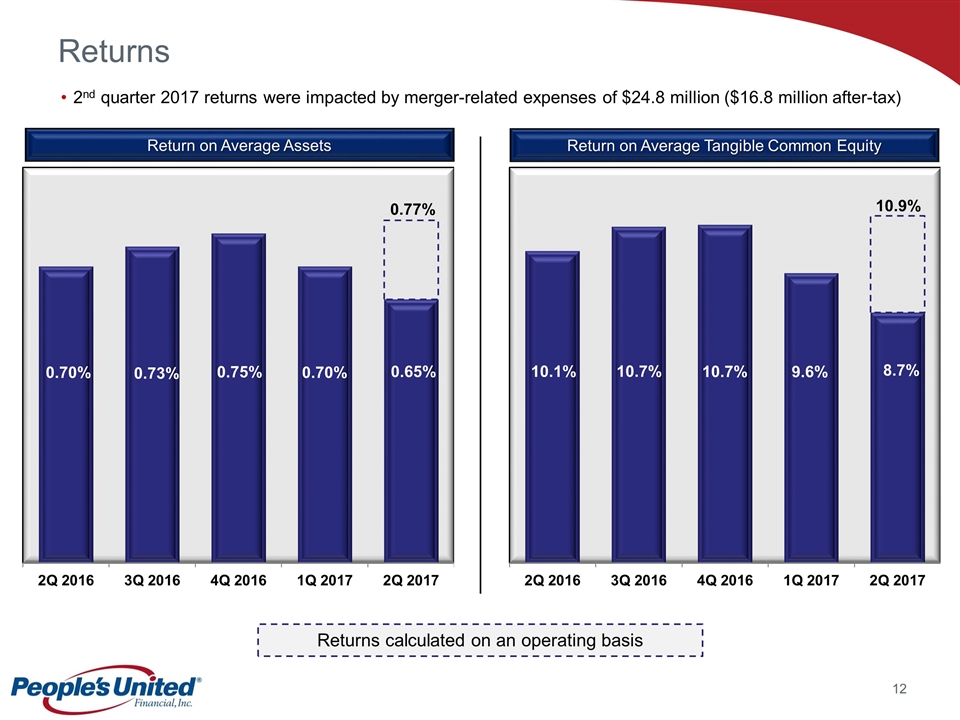

Returns Return on Average Assets Return on Average Tangible Common Equity 0.77% 10.9% Returns calculated on an operating basis 2nd quarter 2017 returns were impacted by merger-related expenses of $24.8 million ($16.8 million after-tax)

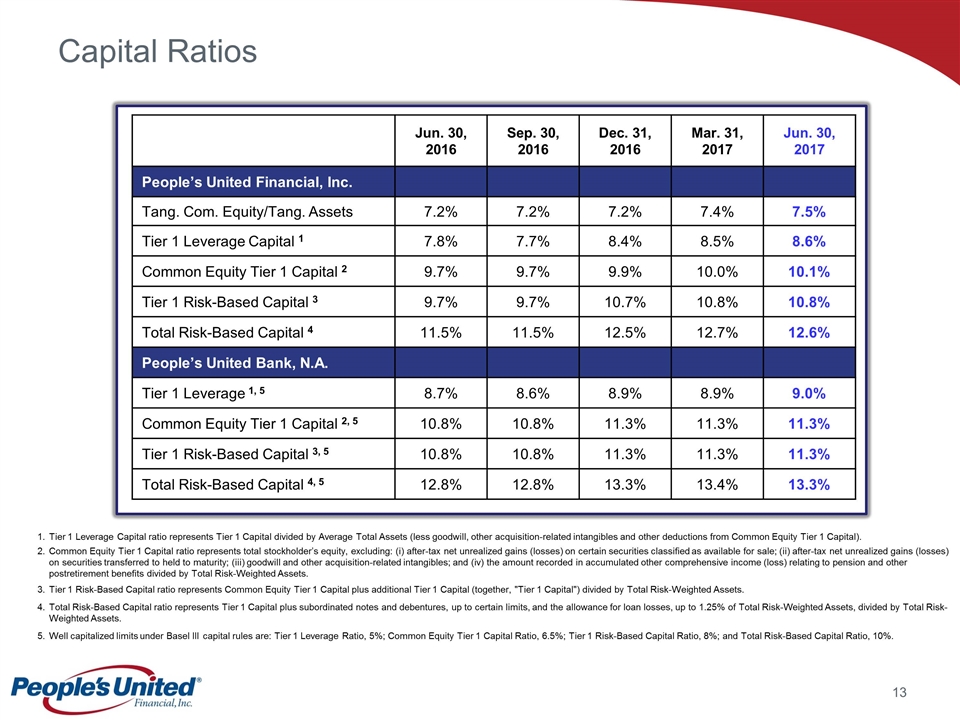

Capital Ratios Tier 1 Leverage Capital ratio represents Tier 1 Capital divided by Average Total Assets (less goodwill, other acquisition-related intangibles and other deductions from Common Equity Tier 1 Capital). Common Equity Tier 1 Capital ratio represents total stockholder’s equity, excluding: (i) after-tax net unrealized gains (losses) on certain securities classified as available for sale; (ii) after-tax net unrealized gains (losses) on securities transferred to held to maturity; (iii) goodwill and other acquisition-related intangibles; and (iv) the amount recorded in accumulated other comprehensive income (loss) relating to pension and other postretirement benefits divided by Total Risk-Weighted Assets. Tier 1 Risk-Based Capital ratio represents Common Equity Tier 1 Capital plus additional Tier 1 Capital (together, "Tier 1 Capital") divided by Total Risk-Weighted Assets. Total Risk-Based Capital ratio represents Tier 1 Capital plus subordinated notes and debentures, up to certain limits, and the allowance for loan losses, up to 1.25% of Total Risk-Weighted Assets, divided by Total Risk-Weighted Assets. Well capitalized limits under Basel III capital rules are: Tier 1 Leverage Ratio, 5%; Common Equity Tier 1 Capital Ratio, 6.5%; Tier 1 Risk-Based Capital Ratio, 8%; and Total Risk-Based Capital Ratio, 10%. Jun. 30, 2016 Sep. 30, 2016 Dec. 31, 2016 Mar. 31, 2017 Jun. 30, 2017 People’s United Financial, Inc. Tang. Com. Equity/Tang. Assets 7.2% 7.2% 7.2% 7.4% 7.5% Tier 1 Leverage Capital 1 7.8% 7.7% 8.4% 8.5% 8.6% Common Equity Tier 1 Capital 2 9.7% 9.7% 9.9% 10.0% 10.1% Tier 1 Risk-Based Capital 3 9.7% 9.7% 10.7% 10.8% 10.8% Total Risk-Based Capital 4 11.5% 11.5% 12.5% 12.7% 12.6% People’s United Bank, N.A. Tier 1 Leverage 1, 5 8.7% 8.6% 8.9% 8.9% 9.0% Common Equity Tier 1 Capital 2, 5 10.8% 10.8% 11.3% 11.3% 11.3% Tier 1 Risk-Based Capital 3, 5 10.8% 10.8% 11.3% 11.3% 11.3% Total Risk-Based Capital 4, 5 12.8% 12.8% 13.3% 13.4% 13.3%

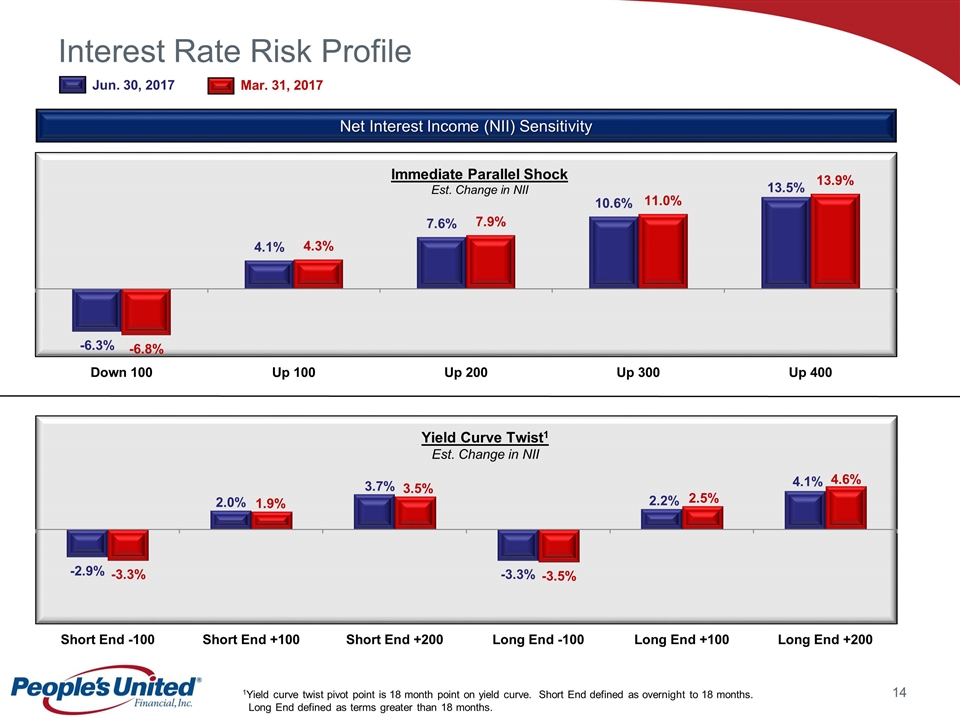

Interest Rate Risk Profile Net Interest Income (NII) Sensitivity 1Yield curve twist pivot point is 18 month point on yield curve. Short End defined as overnight to 18 months. Long End defined as terms greater than 18 months. Immediate Parallel Shock Est. Change in NII Yield Curve Twist1 Est. Change in NII Jun. 30, 2017 Mar. 31, 2017

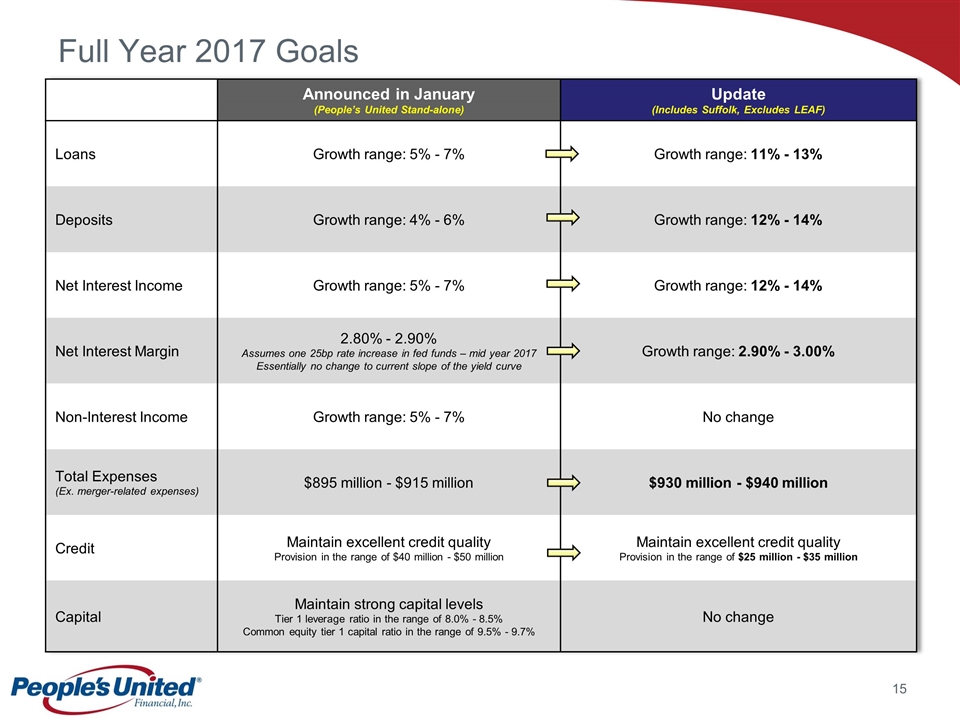

Full Year 2017 Goals Announced in January (People’s United Stand-alone) Update (Includes Suffolk, Excludes LEAF) Loans Growth range: 5% - 7% Growth range: 11% - 13% Deposits Growth range: 4% - 6% Growth range: 12% - 14% Net Interest Income Growth range: 5% - 7% Growth range: 12% - 14% Net Interest Margin 2.80% - 2.90% Assumes one 25bp rate increase in fed funds – mid year 2017 Essentially no change to current slope of the yield curve Growth range: 2.90% - 3.00% Non-Interest Income Growth range: 5% - 7% No change Total Expenses (Ex. merger-related expenses) $895 million - $915 million $930 million - $940 million Credit Maintain excellent credit quality Provision in the range of $40 million - $50 million Maintain excellent credit quality Provision in the range of $25 million - $35 million Capital Maintain strong capital levels Tier 1 leverage ratio in the range of 8.0% - 8.5% Common equity tier 1 capital ratio in the range of 9.5% - 9.7% No change

Appendix

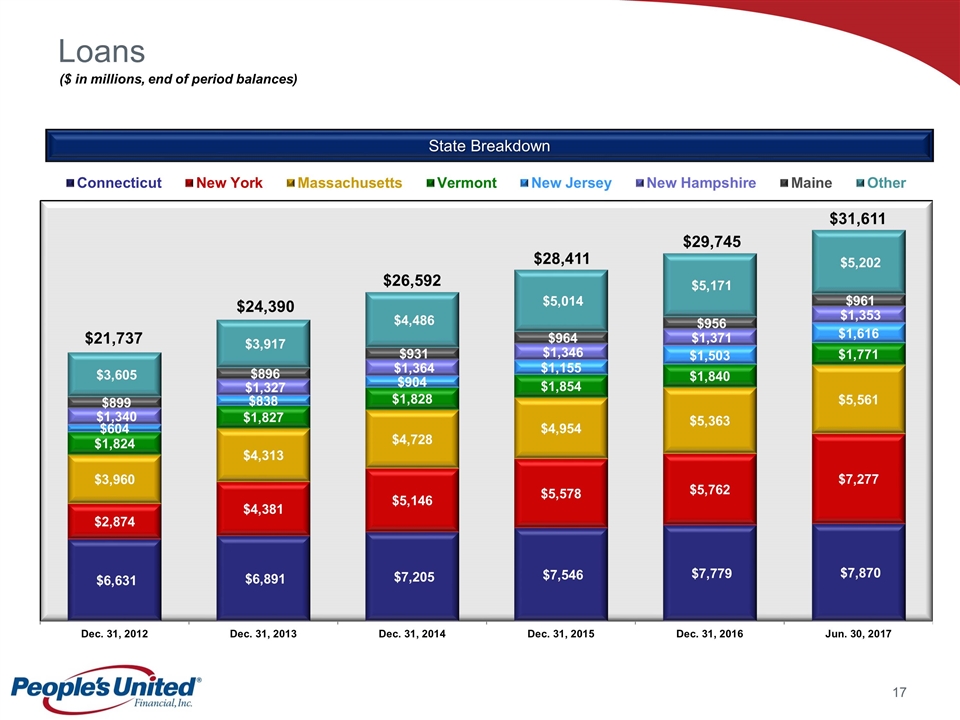

Loans ($ in millions, end of period balances) State Breakdown $21,737 $24,390 $26,592 $29,745 $31,611 $28,411

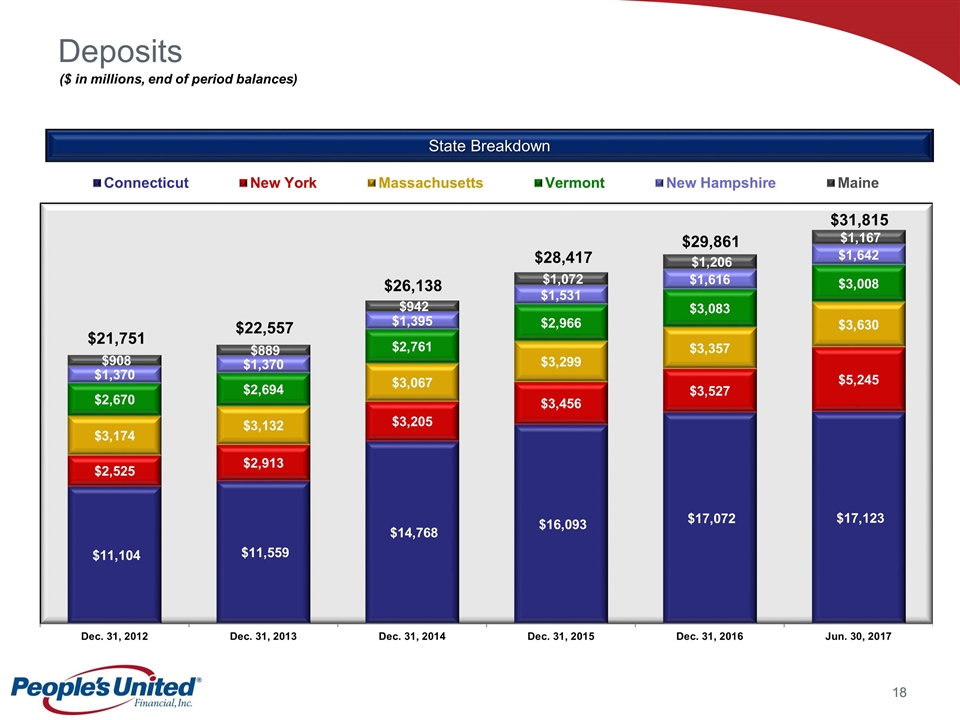

Deposits ($ in millions, end of period balances) State Breakdown $21,751 $22,557 $26,138 $29,861 $31,815 $28,417

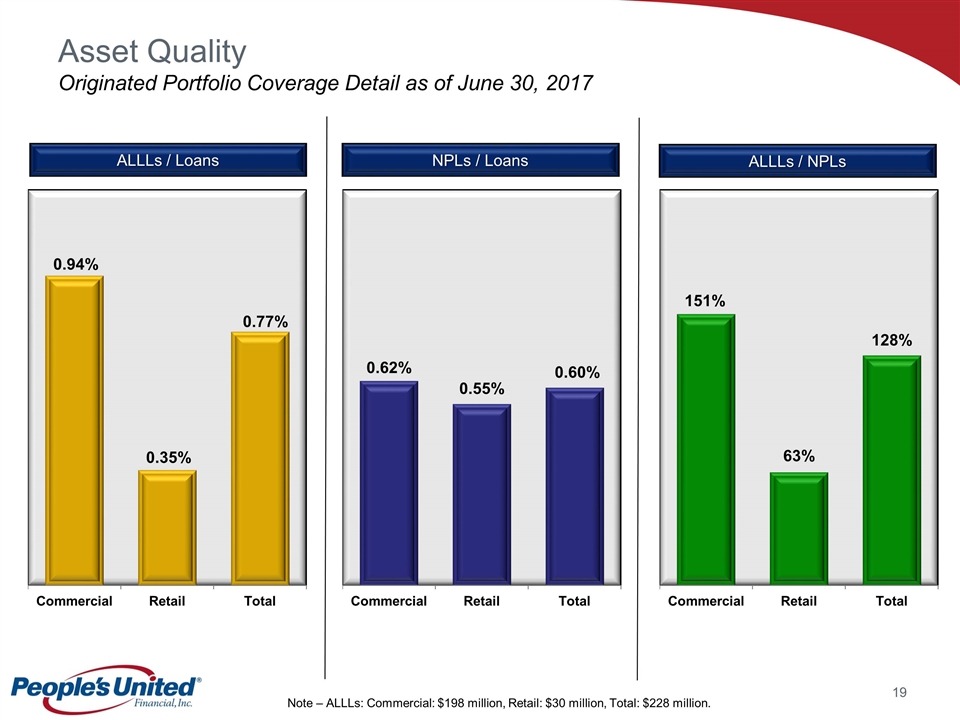

Asset Quality Originated Portfolio Coverage Detail as of June 30, 2017 ALLLs / Loans NPLs / Loans ALLLs / NPLs Note – ALLLs: Commercial: $198 million, Retail: $30 million, Total: $228 million.

Peer Group Firm Ticker City State 1 Associated ASB Green Bay WI 2 Citizens CFG Providence RI 3 Comerica CMA Dallas TX 4 Cullen/Frost CFR San Antonio TX 5 East West EWBC Pasadena CA 6 First Horizon FHN Memphis TN 7 Huntington HBAN Columbus OH 8 KeyCorp KEY Cleveland OH 9 M&T MTB Buffalo NY 10 New York Community NYCB Westbury NY 11 Signature SBNY New York NY 12 Synovus SNV Columbus GA 13 Umpqua UMPQ Portland OR 14 Webster WBS Waterbury CT 15 Zions ZION Salt Lake City UT

For more information, investors may contact: Andrew S. Hersom (203) 338-4581 andrew.hersom@ peoples.com NASDAQ: PBCT