Attached files

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 20, 2017

NeuroOne

Medical Technologies Corporation

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation) |

000-54716 (Commission File |

27-0863354 (IRS Employer Identification No.) |

10006

Liatris Lane, Eden Prairie, MN 55347

(Address of principal executive offices, including zip code)

952-237-7412

(Registrant's telephone number, including area code)

Original

Source Entertainment, Inc.

24 Turnberry Dr.

Williamsville, New York 14221

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

TABLE OF CONTENTS

| i |

| Item 5.03 Amendments to Certificate of Incorporation or Bylaws; Change in Fiscal Year | 104 |

| Item 5.06 Change in Shell Company Status | 104 |

| Item 9.01 Financial Statements and Exhibits | 104 |

| ii |

Upon the completion of the transactions contemplated by the Agreement and Plan of Merger and Reorganization, or the Merger Agreement, NeuroOne Medical Technologies Corporation became the Parent Company of NeuroOne, Inc., as more fully described below (the “Acquisition”).

We were originally incorporated as Original Source Entertainment, Inc. under the laws of the State of Nevada on August 20, 2009. We were originally formed to license songs to the television and movie industry. From our inception and prior to the Acquisition, our operations have been primarily limited to organizational, start-up, and capital formation activities.

As previously disclosed, prior to the Closing of the Acquisition, we completed a series of steps contemplated by a Plan of Conversion pursuant to which we, among other things, changed our name to NeuroOne Medical Technologies Corporation, increased our authorized number of shares of common stock from 45,000,000 to 100,000,000, increased our authorized number of shares of preferred stock from 5,000,000 to 10,000,000 and reincorporated in Delaware. Upon the closing of the Acquisition, all of the outstanding capital stock, options and warrants to purchase shares of NeuroOne, Inc. were converted into 6,291,994 shares of our common stock, options to purchase 365,716 shares of our common stock and warrants to purchase shares of our common stock, as a result of which NeuroOne, Inc. became our wholly-owned subsidiary. In connection with the Acquisition, we also assumed the outstanding convertible promissory notes of NeuroOne, Inc., and our largest stockholder pre-Acquisition, Mr. Samad, tendered for cancellation 3,500,000 shares of our common stock held by him.

As a result of the Acquisition, we acquired the business of NeuroOne, Inc., an early-stage medical technology company developing comprehensive neuromodulation cEEG and sEEG monitoring, ablation, and brain stimulation solutions to diagnose and treat patients with epilepsy, Parkinson’s disease, dystonia, essential tremors, and other brain related disorders.

Unless otherwise indicated in this Current Report on Form 8-K, or this Report, all references herein to “we,” “us,” “our Company,” “our,” “NeuroOne,” the “Company,” or the “Registrant” refers to NeuroOne Medical Technologies Corporation and the business of our subsidiary, NeuroOne, Inc., after giving effect to the Acquisition. Unless otherwise indicated in this Report, all references in this Report to our board of directors refer to our board of directors as reconstituted upon the closing of the Acquisition. Our business following the Acquisition consists solely of that of our subsidiary, NeuroOne, Inc.

This Report contains summaries of material terms of various agreements executed in connection with the transactions described herein. The summaries of these agreements are subject to, and are qualified in their entirety by reference to these agreements, which are filed as exhibits hereto and incorporated herein by reference.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

This Report contains forward-looking statements that involve substantial risks and uncertainties. The forward-looking statements are contained principally in the sections entitled “Risk Factors,” “Management's Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” but are also contained elsewhere in this Report. In some cases, you can identify forward-looking statements by the words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “target,” “seek,” “contemplate,” “continue” and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Report, we caution you that these statements are based on a combination of facts and factors currently known by us and our expectations of the future, about which we cannot be certain. Forward-looking statements include statements about:

| · | our plans to develop and commercialize our cortical strip, grid and depth electrode technology; |

| 3 |

| · | our plans for and our expectations regarding the pre-clinical testing and clinical trials of our cortical strip, grid and depth electrode technology that will be required by the FDA or foreign regulatory bodies; |

| · | the timing and availability of data from pre-clinical tests or clinical trials; |

| · | the timing of our planned regulatory filings; |

| · | the timing of and our ability to obtain and maintain regulatory approval of our cortical strip, grid and depth electrode technology; |

| · | our expectations regarding international opportunities for commercializing our cortical strip, grid and depth electrode technology under development; |

| · | the clinical utility of our cortical strip, grid and depth electrode technology under development; |

| · | our ability to develop our cortical strip, grid and depth electrode technology with the benefits we hope to offer as compared to existing technology, or at all; |

| · | our ability to develop future generations of our cortical strip, grid and depth electrode technology; |

| · | our future development priorities; |

| · | our ability to obtain reimbursement coverage for our cortical strip, grid and depth electrode technology; |

| · | our expectations about the willingness of healthcare providers to recommend our cortical strip, grid and depth electrode technology to people with epilepsy, Parkinson’s disease, essential tremors, and other brain related disorders; |

| · | our future commercialization, marketing and manufacturing capabilities and strategy; |

| · | our ability to comply with applicable regulatory requirements; |

| · | our ability to maintain our intellectual property position; |

| · | our estimates regarding the size of, and future growth in, the market for our technology under development; and |

| · | our estimates regarding our future expenses and needs for additional financing. |

Forward-looking statements are based on management's current expectations, estimates, forecasts and projections about our business and the industry in which we operate, and management's beliefs and assumptions are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. You should refer to the “Risk Factors” section of this Report for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Report will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all.

These forward-looking statements speak only as of the date of this Report. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future. You should, however, review the factors and risks and other information we describe in the reports we will file from time to time with the SEC after the date of this Report.

Item 1.01 Entry into a Material Definitive Agreement.

The information contained in Item 2.01 below relating to the various agreements described therein is incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

Merger with NeuroOne, Inc.

On July 20, 2017, we entered into the Merger Agreement with NeuroOne, Inc. and OSOK Acquisition Company to acquire NeuroOne, Inc. The transactions contemplated by the Merger Agreement were consummated on July 20, 2017 and, pursuant to the terms of the Merger Agreement, (i) all outstanding shares of common stock of NeuroOne, Inc., par value $0.0001 per share, or the NeuroOne Shares, were exchanged for shares of our common stock, par value $0.001 per share, or the Company Shares, based on the Exchange Ratio of 17.0103706 Company Shares for every one NeuroOne Share, (ii) all NeuroOne Options were replaced with Company Options based on the Exchange Ratio, with corresponding adjustments to their respective exercise prices, (iii) all NeuroOne Warrants were replaced with Company Warrants and (iv) we assumed the outstanding convertible promissory notes, or the Notes, of NeuroOne, Inc. We refer herein to the transactions described in clauses (i), (ii), (iii) and (iv), collectively, as the Acquisition. Accordingly, we acquired 100% of NeuroOne, Inc. in exchange for the issuance of shares of our common stock and NeuroOne, Inc. became our wholly-owned subsidiary. Also at the Closing, Mr. Samad tendered for cancellation 3,500,000 Company Shares held by him as part of the conditions to Closing. The Merger Agreement is filed as an exhibit to this Report and is incorporated herein by reference.

| 4 |

Issuance and Exchange of Company Shares for NeuroOne Shares

At the Closing, each NeuroOne Share outstanding immediately prior to the Closing was converted into the right to receive 17.0103706 Company Shares, or the Exchange Ratio, with all fractional shares rounded down to the nearest whole share. Accordingly, we issued an aggregate of 6,291,994 Company Shares for all of the then-outstanding NeuroOne Shares.

Issuance and Exchange of Company Options and Company Warrants for NeuroOne Options and NeuroOne Warrants

At the Closing, we issued Company Options in exchange for NeuroOne Options. The Company Options cover a number of Company Shares equal to the product (rounded down to the next whole number of Company Shares) of the number of NeuroOne Shares underlying each NeuroOne Option immediately prior to the Closing multiplied by the Exchange Ratio, and have an exercise price per Company Share equal to the per share exercise price of such NeuroOne Option immediately prior to the Closing divided by the Exchange Ratio. The Company Options continue to vest and become exercisable on the same vesting schedule. We similarly issued Company Warrants in exchange for NeuroOne Warrants. We reserved 365,716 Company Shares for issuance upon the exercise of Company Options, or the Reserved Shares. For a description of the warrants and information about the number of shares of common stock for which they can be exercised, see “Form 10 Information—Management's Discussion And Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Capital Resources”.

The NeuroOne Options had been issued pursuant to the NeuroOne, Inc. 2016 Equity Incentive Plan, or the 2016 Plan. Pursuant to the Merger Agreement, we assumed the 2016 Plan upon the Closing.

Reincorporation and Name Change

Prior to the Acquisition, we completed a series of steps contemplated by a Plan of Conversion pursuant to which we, among other things, changed our name to NeuroOne Medical Technologies Corporation, increased our authorized number of shares of common stock from 45,000,000 to 100,000,000, increased our authorized number of shares of preferred stock from 5,000,000 to 10,000,000 and reincorporated in Delaware. Our Certificate of Incorporation is filed as an exhibit to this Report and is incorporated herein by reference.

Change in Directors and Officers of the Company

In connection with the Acquisition, Amer Samad, formerly our sole director and officer, appointed the person designated by NeuroOne, Inc. to our board of directors, resigned from all officer positions and resigned as a director, subject to the filing by us of a Schedule 14F-1 providing notice of a change in the majority of our board of directors, or the Schedule 14F-1, and waiting the requisite time pursuant to the rules thereunder. Our newly constituted board of directors immediately appointed the officers designated by NeuroOne, Inc. Identification of our directors and officers, including biographical information for each of them, is included elsewhere in the “Management” section of this Report.

| 5 |

Aggregate Beneficial Ownership of our Common Stock After the Acquisition

Prior to the Closing, the former NeuroOne, Inc. stockholders owned no shares of our common stock and there were no material relationships between the management of NeuroOne, Inc. and our management. After the Closing, and after giving effect to the issuance of the Company Shares and the reservation of the Reserved Shares, the number of shares of our common stock issued and outstanding was 7,864,994 and an additional 365,716 shares of common stock were reserved for issuance upon the exercise of options. Following the Acquisition, the former holders of securities in NeuroOne, Inc. own approximately 80.0% of our outstanding common stock and the stockholders owning all of our common stock immediately prior to the Closing (other than Amer Samad, whose shares of common stock were cancelled upon the Closing of the Acquisition) own approximately 20.0% of our outstanding common stock.

The foregoing description is a summary of the material terms of the Acquisition and the terms of the Merger Agreement are not intended to modify or supplement any factual disclosures about us or NeuroOne, Inc. in any public reports filed by us with the Securities and Exchange Commission, or the SEC. The representations, warranties, and covenants contained in the Merger Agreement were made only for purposes of the Merger Agreement as of the specified dates set forth therein, were solely for the benefit of the parties to the Merger Agreement, and are subject to limitations agreed upon by the parties to the Merger Agreement, including being qualified by disclosure schedules. These disclosure schedules contain information that modifies, qualifies and creates exceptions to the representations and warranties set forth in the Merger Agreement. Moreover, certain representations and warranties in the Merger Agreement have been made for the purposes of allocating risk between the parties to the Merger Agreement instead of establishing matters of fact. Accordingly, the representations and warranties in the Merger Agreement may not constitute the actual state of facts about us or NeuroOne, Inc. The representations and warranties set forth in the Merger Agreement may also be subject to a contractual standard of materiality different from the actual state of facts. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in our public filings with the SEC.

Corporate Overview of NeuroOne Medical Technologies Corporation

We were originally incorporated as Original Source Entertainment, Inc. under the laws of the State of Nevada on August 20, 2009. Prior to the Closing of the Acquisition, we completed a series of steps contemplated by a Plan of Conversion pursuant to which we, among other things, changed our name to NeuroOne Medical Technologies Corporation, increased our authorized number of shares of common stock from 45,000,000 to 100,000,000, increased our authorized number of shares of preferred stock from 5,000,000 to 10,000,000 and reincorporated in Delaware. On July 20, 2017, we closed the Acquisition and acquired NeuroOne, Inc. Immediately following the Closing, the business of NeuroOne, Inc. became our sole focus. Unless otherwise stated or unless the context otherwise requires, the description of our business set forth below is provided on a combined basis, taking into account our wholly-owned subsidiary, NeuroOne, Inc.

Corporate Overview and History of NeuroOne, Inc.

NeuroOne, Inc. was incorporated under the laws of the State of Delaware on October 7, 2016. Its predecessor entity, NeuroOne LLC, or the LLC, was formed on December 13, 2013 and operated as a limited liability company until it was merged with and into NeuroOne, Inc. on October 27, 2016 with NeuroOne, Inc. as the surviving entity (the “Merger”). As a result of the Merger, all of the properties, rights, privileges, powers and franchises of the LLC vested in NeuroOne, Inc., and all debts, liabilities and duties of the LLC became the debts, liabilities and duties of NeuroOne, Inc., except for the WARF License, which was not legally transferred until May 2017. The purpose of the Merger was to change the jurisdiction of incorporation from Minnesota to Delaware, change of ownership of the LLC’s underlying assets and to convert from a limited liability company to a corporation.

We are headquartered in Eden Prairie, Minnesota.

| 6 |

We are a medical technology company focused on the development and commercialization of thin film electrode technology for cEEG and sEEG recording, brain stimulation and ablation solutions for patients suffering from Epilepsy, Parkinson’s Disease, Dystonia, Essential Tremors and other related brain related disorders. Members of our management team have held senior leadership positions at a number of medical technology and biopharmaceutical companies, including Boston Scientific, St. Jude Medical, Stryker Instruments, C.R. Bard, A-Med Systems, Sunshine Heart, Empi, Don-Joy and PMT Corporation.

We are developing our cortical and sheet and depth electrode technology to provide solutions for diagnosis through continuous electroencephalogram (cEEG) recording and stereoelectroencephalography (sEEG) recording and treatment through brain stimulation and ablation, all in one product. A cEEG is a continuous recording of the electrical activity of the brain that identifies the location of irregular brain activity, which information is required for proper treatment. cEEG recording involves an invasive surgical procedure, referred to as a craniotomy. sEEG involves a less invasive procedure whereby doctors place electrodes in targeted brain areas through drilling small holes through the skull. Both methods of seizure diagnosis are used to identify areas of the brain where epileptic seizures originate in order to precisely locate the seizure source for therapeutic treatment if possible.

Deep brain stimulation, or DBS, therapies involve activating or inhibiting the brain with electricity that can be given directly by electrodes on the surface or implanted deeper in the brain via depth electrodes. Introduced in 1987, this procedure involves implanting a power source referred to as a neurostimulator, which sends electrical impulses through implanted depth electrodes, to specific targets in the brain for the treatment of disorders such as Parkinson's disease, essential tremor, dystonia, and chronic pain. Alzheimer’s is another indication evaluating the effects of DBS. Unlike ablative technologies, the effects of DBS are reversible.

RF ablation is a procedure that uses radiofrequency under the electrode contacts that is directed to the site of the brain tissue that is targeted for removal. The process involves delivering energy to the contacts, thereby heating them and destroying the brain tissue. The ablation does not remove the tissue. Rather, it is left in place and typically scar tissue forms in the place where the ablation occurs. This procedure is also known as brain lesioning as it causes irreversible lesions.

Our cortical sheet electrode and depth electrode technology has been tested over the years at both Wisconsin Alumni Research Foundation, or WARF, the owners of our licensed patents, and Mayo Clinic located in Rochester Minnesota, in both pre-clinical models as well as through an IRB approval at Mayo Clinic for clinical research. These pre-clinical tests have demonstrated that the technology is capable of recording, ablation and acute stimulation, although our technology remains in product development for all of the therapeutic modalities. In addition, a great deal of bench top, pre-clinical and clinical testing remains for all therapeutic modalities as well as for the diagnostic technologies for our technology. Once the research and development has been completed, these devices will have to undergo both acute and long term testing to ensure the product’s long term viability. Bench top, electrical, sterility, aging and biocompability testing are some of the tests that will have to be conducted. After that, we expect that we will have to conduct a clinical trial for long term stimulation to achieve regulatory approval in any jurisdiction. The size and endpoints of these trials will require additional dialogue with U.S. Food and Drug Administration, or FDA, and other regulatory bodies in any foreign jurisdiction in which we seek to commercialize our technology.

Our Market Opportunity

Epilepsy Market

We expect to initially target the diagnosis and treatment of epilepsy. Epilepsy can be caused by a variety of conditions that affect a person’s brain, some of which are: stroke, brain tumor, traumatic brain injury and central nervous system infections. According to the Centers for Disease Control and Prevention, or CDC, and Citizens United for Research in Epilepsy, or CURE, there are approximately 3 million patients annually suffering with epilepsy in the U.S., with an additional 200,000 diagnosed every year. They also estimate that epilepsy costs the United States $15.5 billion per year. We believe the European market is similar. Approximately 720,000 of these patients are not receptive to pharmaceutical treatment and therefore are appropriate for surgical treatment of this disorder. In addition to poor quality of life, epilepsy also is associated with fairly high mortality rates, especially in children. CURE reported that Sudden Unexpected Death in Epilepsy, or SUDEP, accounts for 34% of all deaths in children. Such deaths have increased by close to 100% from 2005 to 2015 according to the CDC. Despite the large market opportunity, it is estimated that there are only 16,000 craniotomies performed for epilepsy cases each year in the United States with 18,000 performed in Europe.1 These numbers represent an underpenetrated market due to the invasiveness of a full craniotomy required just to perform the diagnostic procedure. After the diagnostic procedure, a second therapeutic procedure is required and at times even a third surgery if the seizures persist. We believe patients are unwilling to proceed due to the long diagnostic times (1-4 weeks in the hospital with a craniotomy), infection rates and 50% rate of success in the diagnosis and treatment of the disorder. As detailed above, after the diagnosis is completed, if successful, the patient must undergo an additional procedure to have the affected area of brain tissue removed. The average cost for the diagnostic technology per procedure is $10,000, with ablation devices costing $15,000 and brain stimulation devices costing $25,000 to $30,000. We believe our technology, once developed, will offer an all in one solution with diagnostic and therapeutic capabilities.

1 American Association of Neurological Surgeons (AANS) National Neurosurgical Procedural Statistics 2012.

| 7 |

We believe that many leading neurologists believe that the limits of today’s current technologies are the reason the exact affected area of the brain causing epileptic seizures is not determinable. We expect our technology under development, which has been developed to date by physicians at WARF and Mayo Clinic, will provide a number of significant advantages over the current technologies, including the following:

| · | Our proprietary thin film technology under development has a smaller footprint with many more electrodes. |

| · | We expect our technology eventually will be able to be implanted using a minimally invasive procedure utilizing a dime sized burr hole versus a full craniotomy required to implant the current technology. Our physician advisors are providing critical support in this endeavor. |

| · | Limited clinical testing to date by Mayo Clinic suggests that our proprietary thin film technology under development can detect single neuron brain activity. This could allow for more rapid detection of irregular brain activity versus an average of two and a half weeks with the currently available technology, during which time the patient remains hospitalized. In limited clinical testing, Doctors at Mayo Clinic have documented pre-seizure activity (micro-seizures) during their clinical research with their patients using this technology. |

| · | We expect our technology can ablate through the electrodes as well as perform brain stimulation, allowing for diagnosis and treatment through the same product and in the same procedure. |

Parkinson’s Disease

The Parkinson’s Disease Foundation estimates that as many as one million patients live with Parkinson’s disease with an additional 60,000 patients diagnosed per year. Over 10,000,000 patients worldwide are living with Parkinson’s disease. There have not been any drugs introduced that have been effective at treating Parkinson’s disease. The average onset is over 60 years old but some people have been diagnosed as young as 40 years old. Parkinson’s is a disorder of the central nervous system caused by loss of brain cells throughout various regions of the brain. It is attributed to the loss of dopamine production in the brain, a messenger in the brain that allows for movement and coordination. There are no objective tests to diagnose Parkinson’s disease, and misdiagnosis rates are still very high. Doctors look to find two or more signs to make a diagnosis, including balance problems, rigidity and tremors that occur during rest. In 2011, the FDA approved the first imaging device called a DaTscan that can capture images of the dopamine system in the brain. By itself, these scans cannot diagnose Parkinson’s but can help confirm a doctor’s diagnosis. Parkinson’s disease is typically not fatal; however, complications caused by the symptoms of Parkinson’s, such as difficulty swallowing causing food to travel to the lungs resulting in pulmonary issues or falls related to loss of balance, can be fatal.

| 8 |

Today’s primary treatment for Parkinson’s disease involves medications that have not proven to resolve symptoms but rather ease symptoms. Years ago, surgical procedures such as thalamotomy and pallidotomy targeted certain parts of the brain and involved destroying the tissue. More recently, these procedures have been replaced with DBS. A doctor evaluates the patient by reviewing the patient’s symptoms and medications taken and administering detailed memory, thinking and imaging tests to determine if they are appropriate for DBS. According to the Michael J. Fox Parkinson’s Disease Research Foundation website, patients that seem to do best with DBS are those that have had the disease for at least four years and have benefited from taking medications prescribed to control the disease. In addition, DBS seems to help with reducing the issues with motor functions such as tremors, stiffness and slowness but not for balance issues. Doctors are evaluating treatment to other parts of the brain in an effort to address more symptoms to treat walking or balance issues. In addition, research is being conducted to provide stimulation when the symptoms return as opposed to all of the time. We expect our technology under development will improve doctors’ ability to diagnose and treat Parkinson’s assuming our technology has the ability to detect single neuron activity. According to Mayo Clinic, detecting brain activity down to a sub-millimeter scale and detecting “microseizure activity” may allow for detection and thus prevention of a seizure before it occurs.

Essential Tremors

Essential tremors are thought to be due to electrical irregularities in the brain that send abnormal signals to the muscles. It is a progressive condition that worsens over time and is linked to genetic disorders that typically appear over 40 years old. Essential tremors usually occur alone and without any other neurological symptoms or signs. The tremors usually occur when the hands are raised and primarily affect the hands. Muscles in the trunk, face and neck may also experience symptoms. Sometimes misdiagnosed as Parkinson’s disease, essential tremors are an involuntary rhythmic shaking of the hands that is not present at rest. It is apparent during activities such as drinking, writing and eating. Symptoms can worsen due to stress, anxiety, smoking, caffeine, fatigue, etc. Genetics Home Reference estimates that as many as ten million people in the United States are affected by the disease. Treatments for the disease include medical therapy, weighting the limbs and DBS. Patients need to eliminate any medications they are taking that cause tremors as this can exacerbate the symptoms. For some patients, using wrist weights may ease symptoms allowing the patient to function. Other patients may also use relaxation techniques as stress can increase symptoms. Medical therapy is also used to treat patient’s symptoms. Primidone is typically the first drug prescribed as it has had success in some situations for epilepsy. Botox is also used at times to control head tremors. When these fail, surgery is the next alternative. A surgical procedure used years ago created lesions in the ventral intermediate thalamus and was highly successful with treating essential tremors but is no longer commonly used due to increased risk of developing speech problems. The latest therapy is DBS, which, unlike other therapies, is reversible and programmable, helping to adjust the settings to maximize patient benefit. Similar to Parkinson’s disease, the ability to detect this irregular brain activity before it causes a tremor is highly desirable. We expect our technology will detect brain activity to a single neuron, which we believe would be highly desirable by both physicians diagnosing and treating patients with essential tremors.

Dystonia

Dystonia is a neurological condition recognized as a motion disorder that involves over activity of a variety of different muscles simultaneously that work against each other. It presents itself in a variety of symptoms but typically involves repetitive, patterned and often twisting involuntary muscle contractions resembling tremors. According to the Dystonia Medical Research Foundation, over 300,000 people are affected in the United States and Canada alone. Dystonia is the third most common problem seen in movement disorder clinics. Because it has many different manifestations, it is often misdiagnosed. In addition, similar to Parkinson’s Disease, there are no specific tests that can positively diagnose dystonia. A doctor typically will evaluate patient and family history, potentially do genetic testing, EEG testing, blood and urine tests. There are also many treatment options for patients but depend on the type of dystonia. Botox and certain medications may be helpful or DBS may be used. As was described in previous sections, if our technology under development is able to detect single neuron activity as we expect it will be, our technology could be helpful in preventing or even minimizing these involuntary muscle contractions.

Limitations of Currently Available Therapies

There are a limited number of currently available products for diagnosis and treatment for people with neurological disorders such as epilepsy. Although the currently available systems provide diagnosis and treatment for patients, they have certain inherent limitations and shortcomings that we believe limit their use and validate the need for improved technology in the market. These limitations include:

| · | Lengthy diagnostic times: Patients spend one to four weeks in the hospital waiting to have seizures that will allow doctors to determine where the seizures are occurring. |

| 9 |

| · | Inability of diagnostic technologies to identify seizure location or micro seizures: Current technology does not have the ability to detect brain activity down to a single neuron, or what has been referred to as micro seizure activity. In addition, the spacing requirements between electrodes increase the potential for missing data that may be critical in the removal of brain tissue causing the irregular activity. Micro seizure activity could be a major predictor of where a future seizure will occur. |

| · | Need to perform a full craniotomy (invasiveness): Currently available cortical electrode technology is placed through a craniotomy, which requires removing the top part of the cranium and is a very painful and invasive procedure. Procedural times for a craniotomy range from a minimum of 4 to 8 hours. A variety of complications can occur when a full craniotomy is performed, including but not limited to: stroke, bleeding, infection, seizures, swelling of the brain (which may require a second craniotomy), nerve damage, which may cause muscle paralysis or weakness, cerebrospinal fluid (CSF) leak, which may require repair, loss of mental functions and permanent brain damage with associated disabilities. The invasiveness, procedural times and possible surgical complications have limited the growth of surgical treatment of epilepsy. |

| · | Multiple technologies required for diagnosis and treatment: Currently, a patient undergoes a craniotomy for implantation of diagnostic film technologies. The patient then waits in the hospital for one to four weeks waiting to have seizures that will allow doctors to pinpoint where the seizures are occurring in the brain. After this is complete, a patient has to undergo another lengthy procedure to have the brain tissue removed or undergo permanent implantation of depth electrodes for chronic stimulation. There is a need for an all in one technology that can potentially allow for diagnosis and treatment concurrently and potentially offer real time treatment without the need for surgery. |

Our Solution

As a result of the inherent limitations and inconvenience of existing systems, we believe that there is a significant unmet need among people with neurological disorders for cortical strip, grid and depth electrodes that provide diagnostic capabilities through cEEG and sEEG recording in addition to therapeutic modalities, such as brain stimulation and ablation, offered as an all in one product. In comparison to currently available technologies, we are currently developing our strip, grid and depth electrodes with the goal of providing the following expected advantages:

| · | Reduced time for diagnosis: If we are successful in identifying brain activity more quickly, in offering a minimally invasive procedure and developing an all in one solution, we expect our technology will reduce overall procedural times. While our pre-clinical and clinical experience to date is very limited, our cortical grid technology under development has, in some cases, demonstrated the ability to provide hi fidelity recordings that have allowed physicians to identify the affected brain tissue causing seizures in hours versus weeks. This represents the potential for meaningful cost savings for hospitals and patients and improved quality of life for patients. |

| · | Improved accuracy of diagnostic technologies: Because we believe our thin film technology will be capable of recording at higher fidelity than current technologies, we believe our technology may be able to more precisely determine the brain tissue causing seizures. In the limited clinical tests performed by Mayo Clinic with five patients to date, our technology under development has identified what clinicians refer to as pre-seizure activity (made possible by the ability to detect brain activity down to a single neuron and populations of neurons). We believe our technology under development may be able to improve outcomes compared to using other therapeutic technologies regardless of whether we are able to offer an all in one diagnostic and therapeutic solution. |

| 10 |

| · | Possibility to implant via minimally invasive procedure with fewer post-procedure complications: We are currently developing an approach to deliver the cortical electrodes, including minimizing the invasiveness of the procedure. We expect that patients who have qualified for this therapy will be more accepting of a minimally-invasive procedure. Such a procedure would potentially reduce the patient’s pain, bleeding and other adverse events associated with a full craniotomy. Our technology is expected to also have fewer wires exiting the patient’s head, which can also reduce the potential for infections. Furthermore, the material we currently use in our cortical electrodes has shown in pre-clinical evaluations to cause less inflammation than current electrode substrates as it appears more compatible with brain tissue. As discussed under “Strategy” below, our technology under development, if approved, will be implanted via a full craniotomy until such time, if ever, as we are able to develop our minimally invasive procedure. |

| · | All-in-one diagnostic and therapeutic technology solution: Due to the expected high fidelity recording capabilities of our technology under development, we have received feedback from physicians that they will attempt to perform the diagnosis and treatment in a single procedure, thereby eliminating the need for a second surgical procedure, reducing the likelihood of patient infection and minimizing the diagnostic, procedural and hospital costs. As discussed in under “Strategy” below, our initial product offering will offer diagnostic-only capabilities while we advance the development of our all in one approach. |

Our Strategy

Our goal is to be the global leader in cEEG and sEEG recording, deep brain stimulation and ablation, owning the procedure from diagnosis through treatment. The key elements of our strategy include:

| · | Introduce cortical strip and grid electrodes for the diagnosis of epilepsy in U.S. – In the first quarter of 2018, we intend to complete the development, testing and 510(k) device submission to the FDA for our cortical and strip electrodes for temporary (less than 30 day) use with recording, monitoring, and acute stimulation equipment for the recording, monitoring and stimulation of electrical signals on the surface of the brain. Our initial product offering will be placed through traditional surgical means involving a craniotomy until such time, if any, that we launch our minimally invasive procedure. We believe, due to physician feedback, that our technology under development would represent a major improvement over existing devices for the diagnosis of epilepsy. We are initially targeting epilepsy as we believe this is a clinical area of great need and a market that is underpenetrated with the fastest path to commercialization. We believe the largest and quickest-to-market geography for our cortical strip and grid technology under development is in the United States for a number of reasons, including the following: (i) many industry sources believe there is a large underserved U.S. market, (ii) healthy procedural reimbursement for centers and physicians, (ii) robust average selling prices, (iii) physician enthusiasm for our technology under development and (iv) that we may seek additional intellectual property protection and will be required to seek additional regulatory approvals to commercialize outside the U.S. We expect to hire direct experienced sales representatives to market our technology, if approved, in the U.S. |

| · | Evaluate international opportunities and initiate approval processes in targeted geographies – We are currently considering international opportunities to market our technology under development. We believe there is a market for our technology in Europe, but we are evaluating epilepsy surgery rates, reimbursement and growth opportunities, the regulatory pathway and intellectual property rights in each jurisdiction. Once we have compiled all this data, we will determine whether to seek to commercialize in any foreign jurisdictions, for which we would seek additional intellectual property protection and be required to obtain additional regulatory approvals. |

| · | Launch depth electrodes for sEEG recording – Given the reluctance of patients to undergo epilepsy surgery due to its invasiveness, a number of epilepsy centers have adopted the use of depth electrodes, which are placed by drilling small holes into the patient’s cranium, thereby avoiding a craniotomy. We believe our technology will offer advantages to current depth electrode technology and will enable us to offer a therapeutic solution using this technology in the future. As we develop our technology, we plan to release further information about the expected advantages of our technology over currently available therapies. |

| 11 |

| · | Introduce minimally invasive delivery system for cortical electrodes – Cortical electrodes generally require a craniotomy, which is a very invasive procedure that can cause patient complications. Because of this, many patients have opted to not have epilepsy surgery, instead accepting the consequences and risks associated with epilepsy. We intend to develop a procedure that may include a delivery system placed through a small circular incision in the skull for implantation of the cortical grid and strip electrodes. We believe this will increase patient willingness to accept the surgery and increase market penetration. Until we are able to develop this procedure, if at all, our initial product offering will be placed through traditional surgical means involving a craniotomy and may be less likely to be adopted by physicians and patients due to unwillingness of patients to undergo epilepsy surgery. |

| · | Utilize these core technologies to develop all in one diagnostic and therapeutic solutions – Patients currently undergo one surgical procedure for diagnosis (either to have a cortical electrode placed via a craniotomy or depth electrodes placed via holes drilled into the skull) and, hopefully after the brain recordings successfully indicate where the affected brain tissue is located, a second procedure or surgery is then required to treat the patient. There is strong physician interest in being able to perform both the diagnostic and therapeutic procedure concurrently. We are developing our technology with the goal of being able to offer this benefit although there can be no assurance that we will be able to do so. We are pursuing cortical grid, strip and depth electrode technology that can record brain activity (diagnose), ablate brain tissue and also provide both acute and long term stimulation. The technology has demonstrated these functions in acute and short term animal models; however, additional development is required to offer a device that has long term therapeutic application. These therapeutic technologies are expected to require more robust regulatory approvals for the United States, ranging from a 510(k) with human clinical data to pre-market approvals (PMAs). We will engage the FDA at the proper time to determine the most efficient clinical path. |

| · | Gain approval for other brain or motor related disorders such as Parkinson’s with the therapeutic technologies developed for epilepsy – While we are developing our technology for the diagnosis and treatment of epilepsy, we believe that our technology has strong application and utilization for other brain or motor related disorders such as Parkinson’s disease, dystonia, essential tremors and facial pain as these diseases are currently treated with DBS if medications are not effective. As previously mentioned, we are planning to offer electrodes that can be implanted for long term stimulation applications, but such use will require that we pursue additional approvals from the FDA and any international regulatory bodies where we seek to commercialize our technology. |

| · | Explore partnerships with other companies that leverage our core technology – Given that our technology enables, complements and/or competes with a number of companies that are in the market or attempting to enter the market with diagnostic or therapeutic technologies to treat brain related disorders, we believe there may be opportunities to establish mutually beneficial relationships. In addition, our technology may have application in cardiovascular, orthopedic and pain related indications that could benefit from a hi-fidelity thin film electrode product that can provide stimulation and/or ablation therapies. |

Our Technology

Epilepsy Mapping and Monitoring

Epileptic seizures occur when the neurons in the brain miscommunicate. This miscommunication typically results in involuntary muscle seizure activities and/or periods of perceptual disconnect where the individual appears frozen. Modern medical science has advanced the treatment of epileptic seizures by mapping the electrical communication activity of neurons and understanding their special orientation in the brain. This mapping is accomplished by access to the cranium (through a craniotomy) and placing conductive contacts on the brain directly. The craniotomy procedure is very invasive, traumatic to the surrounding tissue, results in high patient down time, and increases the risk of infection.

| 12 |

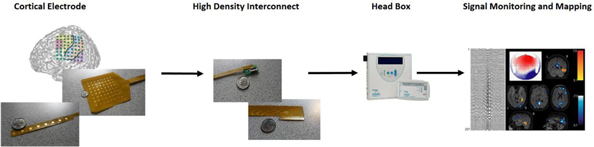

Our Technology

We seek to leverage scale-able technology and produce ultra-thin electrodes that allow for higher density contacts thus increasing the mapping resolution and signal acquisition. We also believe that the electrodes’ unique thinness and flexibility will afford a non-invasive approach to electrode placement to replace a craniotomy with placement and removal utilizing access via a small burr hole in the skull.

Our technology consists of three primary types of cortical electrodes: grid electrodes, strip electrodes and dual-sided electrodes. These electrodes have a patented design that utilizes proprietary processing and materials technology, which we believe will allow the electrodes to have improved features over the current industry standard recording electrodes.

What sets our technology apart from others is the integration of state of the art design leveraging the latest in flexible printed circuit technology. We believe our patented designs will provide the surgeon a higher tactile perspective on electrode placement allowing for ultra-precise neuron recording. We expect the benefits of our electrode designs to include the ability to detect better defined margins between healthy tissue and resect-able tissue, less immune-response from the brain and surrounding tissue, better signal acquisition due to superior conformability of the electrode over the brain, improved flexibility that physicians have been requested, which we expect will enable a minimally invasive approach and the electrodes unique thinness that is unmatched by current products being used.

The Future of Epilepsy Mapping with NeuroOne

We seek to develop superior “scale-able” technology for future product system iterations in higher density contact placement. This will open the doors to other brain related disease recording procedures by providing hi-fidelity, more accurate diagnostic capabilities and also the ability to provide an all in one therapy capable of diagnosis, ablation and/or stimulation. Beyond the brain, we believe our technology under development has applications in other neurological signal recording disease states related to voluntary or involuntary motor neuron abnormalities, understanding sensory neuro behavior (pain), limb prosthetics and degenerative muscle disease.

Clinical Development and Regulatory Pathway

Clinical Experience, Future Development and Clinical Trial Plans

Our technology under development has not been approved for commercialization by any U.S. or foreign regulatory body, and, prior to receiving such approval, our technology will need to undergo extensive pre-clinical testing and clinical trials. As disclosed in more detail below, our technology has been tested in very limited trials to date, and we have very limited clinical data to support our expectations regarding the performance of our technology, its safety, efficacy and anticipated benefits compared to currently available technology.

| 13 |

In parallel with the development and testing needed to launch our cortical strip and grid electrodes, we intend to expand our product offerings to include less invasive means and all in one solutions, thus providing both patients and physicians better options to treat epilepsy and other brain related disorders. While we expect to make modifications to this initial system, we believe that most of our future product development initiatives will involve unique and transformational next generation technology that should drive further appeal of our products with both physicians and patients.

We are utilizing a number of resources to develop these technologies. We license three critical patents from WARF that are the foundation of the technology we are developing and intend to commercialize and benefit from the thin film technology know-how of Mayo Clinic doctors through our license and development agreement. WARF and Mayo Clinic have been responsible for all pre-clinical studies of our technology under development to date. See “—WARF License” and “—The Mayo Foundation for Medical Education and Research License and Development Agreement” below.

Below we have summarized, for each component of our technology under development, the current stage of development, the pre-clinical testing done to date by WARF or Mayo Clinic on such component, if any, our plans for further testing or clinical trials and our expectations regarding the requirements for regulatory approval and timing of regulatory submissions:

| Technology |

Stage of Development and Pre-Clinical Testing to Date |

Expected Requirements for Regulatory Approval | |||

|

Cortical strip and grid electrodes for the diagnosis of epilepsy

|

Design freeze complete

Pre-clinical testing has been conducted on the versions used for clinical research by The Mayo Clinic and WARF (described below) |

In vitro bench top and pre-clinical (bio compatibility and sterilization) testing expected to be required prior to human use and scheduled to be completed in the fourth quarter of 2017

There may be continued clinical evaluation of the technology under a pre-existing IRB research protocol approved by Mayo’s institutional review board, which will provide us with additional clinical evidence that may assist with product acceptance and launch

Planned U.S. commercial launch in early 2018 upon FDA clearance, if received | |||

| Depth electrodes for diagnostic purposes |

In development

Have not been tested in clinical or pre-clinical studies to date, although made of the same material and electrical contacts as our cortical grid and strip electrodes |

In vitro bench top, biocompatibility and sterilization tests expected to be required

Design testing to be determined in the second half of 2017 and expected to be complete in the fourth quarter of 2017

Expect to file for FDA 510(k) clearance in the second quarter of 2018 | |||

| Minimally invasive cortical electrode delivery system |

In development

No clinical testing to date |

Future clinical testing requirements for regulatory clearance currently unknown

Currently researching predicate devices and procedures to support position to file with the FDA as a 510(k) submission and to determine required testing |

| 14 |

| Technology |

Stage of Development and Pre-Clinical Testing to Date |

Expected Requirements for Regulatory Approval | |||

| Cortical and depth electrode ablation devices |

In development

No clinical testing to date

|

Future clinical testing requirements for regulatory clearance/approval currently unknown

Expect to perform clinical study in 2019 and then submit such clinical study to the FDA

No FDA feedback has been sought or received by us to date on the clinical process that may be required for an ablation indication, but we expect regulatory clearance/approval will require a more robust clinical process, which could range from 510(k) clearance with human clinical data to a PMA, depending on proposed indications for use

In-vitro bench top, pre-clinical and safety (animal) studies and FDA-approved human clinical studies will most likely be required | |||

| Cortical and depth electrode chronic stimulation devices |

In development

No clinical testing to date

|

Future clinical testing requirements for regulatory clearance/approval currently unknown

Expect to conduct clinical testing in 2019

No FDA feedback has been sought or received by us to date on the clinical process that will be required for chronic stimulation, but we expect regulatory clearance/approval for chronic stimulation may require a more robust clinical process, which could range from 510(k) clearance with human clinical data to a PMA

In-vitro bench-top, pre-clinical and safety (animal) studies and FDA-approved human clinical studies will most likely be required |

Our cortical technology for the diagnosis of epilepsy has been tested by doctors at Mayo Clinic in multiple pre-clinical tests conducted from 2012 to 2017. In pre-clinical models, doctors examined the biological impact on mammalian brains. Polyimide substrate electrodes (NeuroOne technology) were implanted on the pig’s brain for one week alongside standard competitive electrodes. The tissue underneath the two types of electrodes was removed, fixed, stained, and examined for immunological responses. Electrophysiological (brain neuron activity) properties were examined by recordings in pigs and from tissue to be removed in five patients undergoing surgery. Doctors examined the changes in local field potential activity of the brain with thin film electrodes (NeuroOne technology) and then compared to competitive electrodes. Intra-operative brain activity recordings were obtained and evaluated in a pig seizure model and in five human subjects undergoing surgery for drug resistant epilepsy.

The results of a histological (evaluation of brain tissue under a microscope) analysis showed reduced immunological reaction to prolonged polyimide substrate implants (NeuroOne technology) compared to standard silicone substrate competitive clinical electrodes. Electrophysiological recordings showed data obtained from polyimide electrodes showed feasibility of high fidelity multi-scale electrophysiology while also displaying easier deployment of polyimide electrodes (NeuroOne technology) through burr holes utilizing a minimally invasive approach.

Conclusions reached by the physicians at Mayo Clinic are that thin, flexible polyimide electrodes (NeuroOne technology) provide recordings similar to standard clinical electrodes with markedly reduced immunological response. In addition, the flexibility and reduced volume of polyimide electrodes should reduce pain and swelling associated with implantation of the device, and the single wire exiting the skull should reduce infection risk. Combined, these properties suggest that the replacement of current competitive silicone electrodes with polyimide substrate electrodes (NeuroOne technology) for recording brain activity for epilepsy could provide enhanced clinical value with reduced cost, reduced infection risk, and improved patient comfort.

| 15 |

In addition, our cortical implant technology has been tested by researchers at the University of Wisconsin-Madison in multiple pre-clinical studies conducted from 2006 to 2016. These studies, illustrated in a variety of pre-clinical animal models that included mice, rats and primates, have shown that thin film cortical implant technology can reliably record brain activity from different areas of the brain, can be implanted successfully in a minimally invasive fashion, can be safely implanted over long-time periods of up to five years, can electrically provide brain stimulation and tissue ablation, and has increased flexibility versus existing commercially available technology that allows the grids to conform to the brain surface.

Sales and Marketing

Based on the size and maturity of the U.S. market, our initial commercial focus, if our technology is approved for commercialization for the diagnosis of epilepsy in the U.S., will be to invest in developing a direct sales force and infrastructure to support the launch of the product in the United States and target what we estimate to be approximately 188 Level 4 epilepsy centers along with their respective epilepsy teams comprised of neurologists, neurosurgeons and technicians in the United States who are clinically active.

In parallel, we are evaluating the opportunity to commercialize our products in select European markets, which we would do through third-party distributors or country independent agents. We believe there is a market for our technology in Europe, but we are evaluating epilepsy surgery rates, reimbursement and growth opportunities, the regulatory pathway and intellectual property rights in each jurisdiction. If we plan to commercialize in foreign jurisdictions, we plan to initially target markets that have active epilepsy programs with adequate reimbursement for the procedures. Simultaneously, we have engaged European consultants to identify the requirements to gain acceptance in the European Union.

In addition, if our technology is approved for commercialization for the diagnosis of epilepsy in the U.S., we will look to educate neurologists, neurosurgeons and primary care physicians on the advantages to existing epilepsy approaches through a variety of targeted marketing tools and social media.

Reimbursement

Coverage in the United States

Reimbursement from private third-party healthcare payors and, to a lesser extent, Medicare will be an important element of our success. Although the Centers for Medicare and Medicaid, or CMS, and third-party payors have adopted coverage policies for our targeted indications, there is no guarantee this will continue at the same levels or at all in the future. Current Procedural Terminology, or CPT, is a medical code set that is used to report medical, surgical, and diagnostic procedures and services to entities such as physicians, health insurance companies and accreditation organizations.

Applicable diagnostic CPT codes for mapping (diagnosing) the brain for diagnostic procedures are as follows:

| · | 61531 Subdural implantation of strip electrodes through one or more burr or trephine (saw) hole(s) for long-term seizure monitoring |

| · | 61533 Craniotomy with elevation of bone flap: for subdural implantation of an electrode array, for long term seizure monitoring |

| · | 61535 Craniotomy with elevation of bone flap; for removal of epidural or subdural electrode array, without excision of cerebral tissue (separate procedure) |

| · | 61760 Stereotactic implantation of depth electrodes into the cerebrum for long term seizure monitoring |

| 16 |

Regarding ICD-10 codes, the International Classification of Diseases, Tenth Edition (ICD-10) is a clinical cataloging system that went into effect for the U.S. healthcare industry on Oct. 1, 2015, after a series of lengthy delays. Accounting for modern advances in clinical treatment and medical devices, ICD-10 codes offer many more classification options compared to those found in its predecessor, ICD-9. Within the healthcare industry, providers, coders, IT professionals, insurance carriers, government agencies and others use ICD codes to properly note diseases on health records, to track epidemiological trends and to assist in medical reimbursement decisions.

ICD-10 codes for epilepsy are as follows:

| · | G40.0 Localization-related (focal) (partial) idiopathic epilepsy and epileptic syndromes with seizures of localized onset |

| · | G40.1 Localization-related (focal) (partial) symptomatic epilepsy and epileptic syndromes with simple partial seizures |

| · | G40.2 Localization-related (focal) (partial) symptomatic epilepsy and epileptic syndromes with complex partial seizures |

| · | G40.3 Generalized idiopathic epilepsy and epileptic syndromes |

| · | G40.A Absence epileptic syndrome |

| · | G40.4 Other generalized epilepsy and epileptic syndromes |

| · | G40.50 Epileptic seizures related to external causes, not intractable |

| · | G40.80 Other epilepsy |

| · | G40.82 Epileptic spasms |

We believe that many of the indications we are pursuing with our technologies are currently reimbursed on a widespread basis by Medicare, Medicaid and private insurance companies.

Medicare, Medicaid, health maintenance organizations and other third-party payors are increasingly attempting to contain healthcare costs by limiting both coverage and the level of reimbursement of new medical devices, and, as a result, their coverage policies may be restrictive, or they may not cover or provide adequate payment for our products. In order to obtain reimbursement arrangements, we may have to agree to a net sales price lower than the net sales price we might charge in other sales channels. Our revenue may be limited by the continuing efforts of government and third-party payors to contain or reduce the costs of healthcare through various increasingly sophisticated means, such as requiring prospective reimbursement and second opinions, purchasing in groups, or redesigning benefits. Our future dependence on the commercial success of our technologies makes us particularly susceptible to any cost containment or reduction efforts. Accordingly, unless government and other third-party payors provide adequate coverage and reimbursement for our products and the related insertion and removal procedures, our financial performance may be limited.

Coverage Outside the United States

If we seek to commercialize in countries outside the United States, coverage for epilepsy surgical procedures are available from certain governmental authorities, private health insurance plans, and labor unions. Coverage systems in international markets vary significantly by country and, within some countries, by region. If we seek to commercialize our technology, if approved, outside the U.S., coverage approvals must be obtained on a country-by-country, region-by-region or, in some instances, a case-by case basis. Based on our ongoing evaluation, certain countries reimburse more highly than others.

| 17 |

Manufacturing, Supply and Quality Assurance

We currently outsource the supply and manufacture of all components of our prototypes of our technology under development. We plan to continue with an outsourced manufacturing arrangement for the foreseeable future. Our third-party manufacturers are recognized in their field for their competency to manufacture the respective portions of our system and have quality systems established that meet FDA requirements. We believe the manufacturers we currently utilize have sufficient capacity to meet our launch requirements if our technology under development is approved in the future and are able to scale up their capacity relatively quickly with minimal capital investment. We believe that, as we increase our demand in the future, our per unit costs will decrease materially. We have also identified capable second source manufacturers and suppliers in the event of disruption from any of our primary vendors.

Our suppliers meet the latest ISO 13485 certification, which includes design control requirements. As a medical device developer, the facilities of our sterilization and other critical suppliers are subject to periodic inspection by the FDA and corresponding state and foreign agencies. We believe that our quality systems and those of our suppliers are robust and achieve high product quality. We plan to audit our suppliers periodically to ensure conformity with the specifications, policies and procedures for our devices.

Research and Development

Our research and development team includes 10 employees and consultants who specialize in thin film technology, many of whom have considerable experience in brain related neurovascular technologies and related conditions. Our research and development team is focused on the development of thin film cortical grid and strip electrodes and depth electrodes for recording, ablation and chronic stimulation for brain related disorders. Our research and development expenses were $0 and $2,400 for the years ended December 31, 2016 and 2015, respectively, and $72,041 and $0 for the three months ended March 31, 2017 and 2016, respectively.

Competition

In the market for Epilepsy diagnosis, our cortical strip, sheet and depth electrode technology will likely compete with Integra Life Science’s Integra Epilepsy Strip, Grid and depth electrodes, which provide a similar function to our diagnostic technologies under development. These products are well established in the marketplace and Integra has greater resources than us, which could allow them to innovate faster. Ad-Tech Medical Instrument Corporation’s Epilepsy/LTM (subdural grid, strip and depth) electrodes, which have become the market leaders for diagnostic mapping in epilepsy, and PMT Corporation’s Cortac Strips and grid electrodes and Depthalon depth electrodes are used for recording brain activity similar to other competitive technologies. These technologies are very different from our thin film strip technology under development, which, if developed as expected and approved, would represent next generation recording technology that can be placed minimally invasively, allow for smaller footprints with increased number of electrodes, different shaped electrodes and much higher fidelity that may be able to detect microseizure activity, which would be helpful in improving clinical rates of eliminating seizure activity in patients. Today’s success rates for seizure free post-operative conditions remain at 50%, which has limited patient’s acceptance to undergo the currently highly invasive surgical procedure. We will also compete against other companies in early stages of development of thin film technologies.

In the neuro-ablation market, we expect to compete with Medtronic’s Visualase® guided-laser ablation technology and Monteris Medical’s NeuroBlate technology, which use MRI guided laser surgical ablation for use to ablate, necrotize or coagulate soft tissue through interstitial irradiation or thermal therapy in medicine and surgery in the discipline of neurosurgery with 1064 nm lasers. Their website claims it is used for ablation in the brain for soft tissue and tumors. We believe there are other laser based systems in development that will compete with these technologies.

In the neurostimulation market, we expect to compete with NeuroPace’s RNS system approved for epilepsy, Medtronic’s Activa system approved for Parkinson’s disease, Boston Scientific Vercise (indicated for Parkinson’s, Dystonia and Essential Tremors), Abbott/St. Jude Medical’s Infinity DBS system (approved for Parkinson’s disease and essential tremors), Liva Nova/Cyberonic’s VNS therapy intended for patient’s suffering with epilepsy. We believe there are additional companies pursuing this high growth space although none are expected to be commercially available in 2017 based on current reports.

| 18 |

Although we will face potential competition from many different sources, we believe that our technology, knowledge, experience and scientific resources will provide us with competitive advantages. We expect the key competitive factors affecting the success of our cortical strip and sheet electrodes under development, if successfully developed and approved, are likely to be: hi-fidelity recording that allows for detection of pre-seizure activity, ability to place the devices minimally invasively, deliverability of cortical grid, strip and depth electrode technology, ability to offer grid, strip and depth electrodes in various electrode shapes and sizes, potential reduction in infections and ability to record brain activity both on the surface using cortical grid and strip technology and deeper into the brain using depth electrodes concurrently.

Many of the companies against which we may compete in the future have significantly greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals and marketing approved products than we do. Mergers and acquisitions in the pharmaceutical, biotechnology and diagnostic industries may result in even more resources being concentrated among a smaller number of our competitors. Smaller or early stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical trial sites and subject registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our development.

WARF License

We have entered into an Exclusive Start-Up Company License Agreement with Wisconsin Alumni Research Foundation, or WARF, pursuant to which WARF has granted us an exclusive license, or the WARF License, to make, use and sell, in the United States only, products that employ certain licensed patents for a neural probe array or thin-film micro electrode array and method. In exchange for the license, we have agreed to pay WARF a one-time fee of $120,000 (representing a license fee and reimbursement for costs incurred by WARF in maintaining the licensed patents) upon the earliest to occur of certain events related to the Company raising a minimum amount of financing, a change of control or our revenue reaching a threshold amount. We have also agreed to pay WARF a royalty equal to a single-digit percentage of our product sales pursuant to the WARF License, with a minimum annual royalty payment of $50,000 for 2019, $100,000 for 2020 and $150,000 for 2021 and each calendar year thereafter that the WARF License is in effect. If we or any of our sublicenses contest the validity of any licensed patent, the royalty rate will be doubled during the pendency of such contest and, if the contested patent is found to be valid and would be infringed by us if not for the WARF License, the royalty rate will be tripled for the remaining term of the WARF License.

We have agreed to diligently develop, manufacture, market and sell products under the WARF License in the United States during the term of the agreement and, specifically, that we will submit a business plan to WARF by February 1, 2018 and file an application for 510(k) marketing clearance with the FDA by February 1, 2019. WARF may terminate this license in the event that we fail to meet these milestones on 30 days’ written notice, if we default on the payments of amounts due to WARF or fail to timely submit development reports, actively pursue our development plan or breach any other covenant in the WARF License and fail to remedy such default in 90 days or in the event of certain bankruptcy events involving us. WARF may also terminate this license (i) on 90 days’ notice if we fail to have commercial sales of one or more FDA-approved products under the WARF License by March 31, 2019 or (ii) if, after royalties earned on sales begin to be paid, such earned royalties cease for more than four calendar quarters. The WARF License otherwise expires by its terms on the date that no valid claims on the patents licensed thereunder remain. We expect the latest expiration of a licensed patent to occur in 2030.

In addition, WARF reserves the right to grant non-profit research institutions and government agencies non-exclusive licenses to practice and use the inventions of the licensed patents for non-commercial research purposes, and we grant WARF a non-exclusive, sub licensable, royalty-free right and license for non-commercial research purposes to use improvements to the licensed patents. In the event that we discontinue use or commercialization of the licensed patents or improvements thereon, we must grant WARF an option to obtain a non-exclusive, sub-licensable royalty-bearing license to use the improvements for commercial purposes.

| 19 |

See “Risk Factors—We depend on intellectual property licensed from Wisconsin Alumni Research Foundation for our cortical strip, grid electrode and depth electrode technology under development, and the termination of this license would harm our business” for additional information regarding the WARF License and our past breach thereof.

Mayo Foundation for Medical Education and Research License and Development Agreement

We have entered into a license and development agreement, or the Mayo Development Agreement, with Mayo Foundation for Medical Education and Research (referred to herein as Mayo) to license worldwide (i) certain know how for the development and commercialization of products, methods and processes related to flexible circuit thin film technology for the recording of tissue and (ii) the products developed therefrom, and to partner with Mayo to assist the Company in the investigation, research application, development and improvement of such technology. Mayo has agreed to assist us by providing access to certain individuals at Mayo, or the Mayo Principal Investigators, in developing our cortical thin film flexible circuit technology, including prototype development, animal testing, protocol development for human and animal use, abstract development and presentation and access to and license of any intellectual property that the Mayo Principal Investigators develop relating to the procedure.

Whether or not any such technology, product, method, process, device or delivery system is developed, we agreed, in consideration for Mayo’s efforts under the Mayo Development Agreement, to pay Mayo a cash payment of approximately $92,000 on the earlier of September 30, 2017 or the date we raise a minimum amount of financing, and on May 25, 2017, prior to the closing of the Acquisition, NeuroOne, Inc. issued Mayo 50,556 NeuroOne Shares pursuant to a Subscription Agreement. Finally, we have agreed to pay Mayo a royalty equal to a single-digit percentage of our product sales pursuant to the Mayo Development Agreement. Mayo may purchase any developed products licensed under the Mayo Development Agreement at the best price offered by us to the end user in the prior year. The Mayo Development Agreement generally will expire in October 2034, unless the Mayo know-how and improvements under the Mayo Development Agreement remain in use, and the Mayo Development Agreement may be terminated by Mayo for cause or under certain circumstances.

For additional information regarding the Mayo Development Agreement and our past breach thereof, see “Risk Factors—We depend on our partnership with Mayo Foundation for Medical Education and Research to license certain know how for the development and commercialization of our technology. Termination of this partnership would harm our business, and even if this partnership continues, it may not be successful.”

Intellectual Property

Protection of our intellectual property is a strategic priority for our business. We rely on a combination of patents, trademarks, copyrights, trade secrets as well as nondisclosure and assignment of invention agreements, material transfer agreements, confidentiality agreements and other measures to protect our intellectual property and other proprietary rights.

Patents