Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - US BANCORP \DE\ | d425751dex991.htm |

| 8-K - 8-K - US BANCORP \DE\ | d425751d8k.htm |

U.S. Bancorp 2Q17 Earnings Conference Call July 19, 2017 Exhibit 99.2

Forward-looking Statements and Additional Information The following information appears in accordance with the Private Securities Litigation Reform Act of 1995: Today’s presentation contains forward-looking statements about U.S. Bancorp. Statements that are not historical or current facts, including statements about beliefs and expectations, are forward-looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date hereof. These forward-looking statements cover, among other things, anticipated future revenue and expenses and the future plans and prospects of U.S. Bancorp. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. A reversal or slowing of the current economic recovery or another severe contraction could adversely affect U.S. Bancorp’s revenues and the values of its assets and liabilities. Global financial markets could experience a recurrence of significant turbulence, which could reduce the availability of funding to certain financial institutions and lead to a tightening of credit, a reduction of business activity, and increased market volatility. Stress in the commercial real estate markets, as well as a downturn in the residential real estate markets could cause credit losses and deterioration in asset values. In addition, changes to statutes, regulations, or regulatory policies or practices could affect U.S. Bancorp in substantial and unpredictable ways. U.S. Bancorp’s results could also be adversely affected by deterioration in general business and economic conditions; changes in interest rates; deterioration in the credit quality of its loan portfolios or in the value of the collateral securing those loans; deterioration in the value of securities held in its investment securities portfolio; legal and regulatory developments; litigation; increased competition from both banks and non-banks; changes in customer behavior and preferences; breaches in data security; effects of mergers and acquisitions and related integration; effects of critical accounting policies and judgments; and management’s ability to effectively manage credit risk, market risk, operational risk, compliance risk, strategic risk, interest rate risk, liquidity risk and reputational risk. For discussion of these and other risks that may cause actual results to differ from expectations, refer to U.S. Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2016, on file with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Corporate Risk Profile” contained in Exhibit 13, and all subsequent filings with the Securities and Exchange Commission under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934. However, factors other than these also could adversely affect U.S. Bancorp’s results, and the reader should not consider these factors to be a complete set of all potential risks or uncertainties. Forward-looking statements speak only as of the date hereof, and U.S. Bancorp undertakes no obligation to update them in light of new information or future events. This presentation includes non-GAAP financial measures to describe U.S. Bancorp’s performance. The calculations of these measures are provided in the Appendix. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

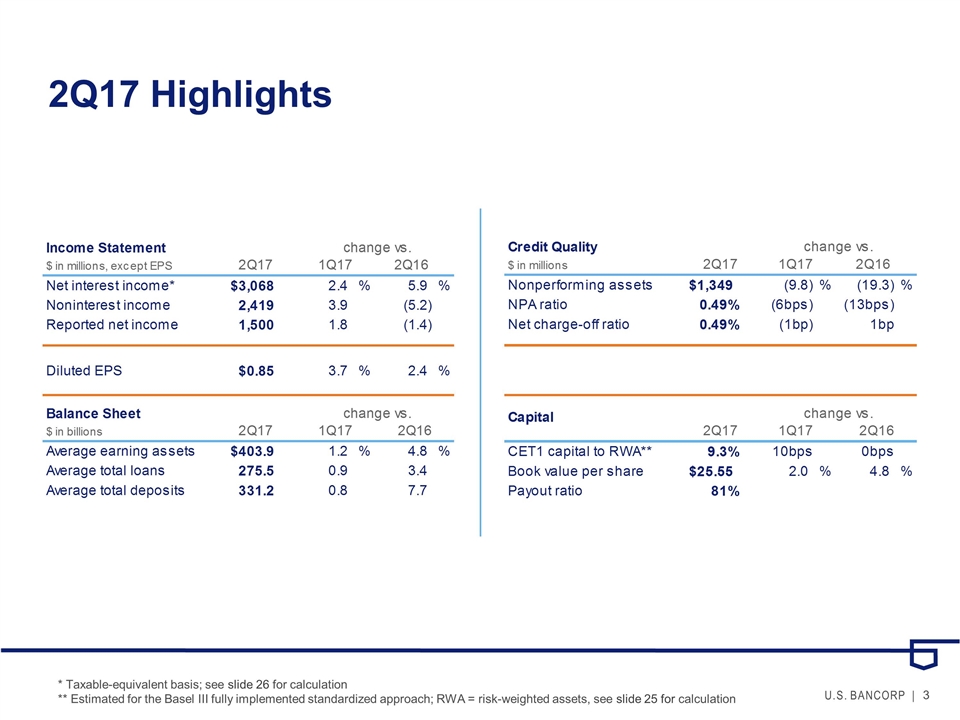

2Q17 Highlights * Taxable-equivalent basis; see slide 26 for calculation ** Estimated for the Basel III fully implemented standardized approach; RWA = risk-weighted assets, see slide 25 for calculation

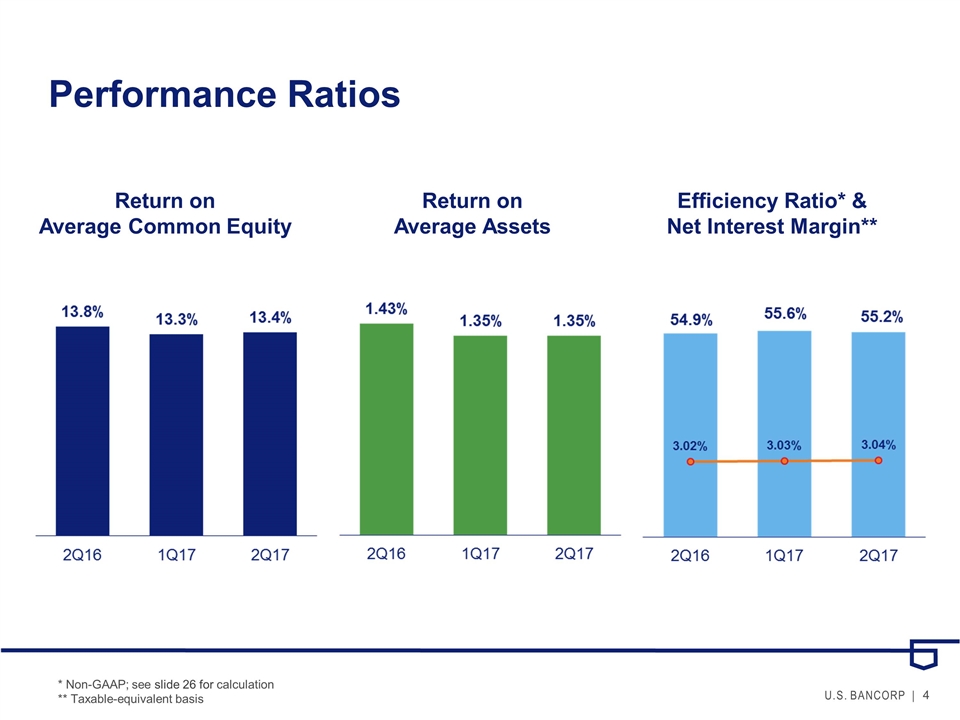

Performance Ratios Return on Average Common Equity Efficiency Ratio* & Net Interest Margin** * Non-GAAP; see slide 26 for calculation ** Taxable-equivalent basis Return on Average Assets

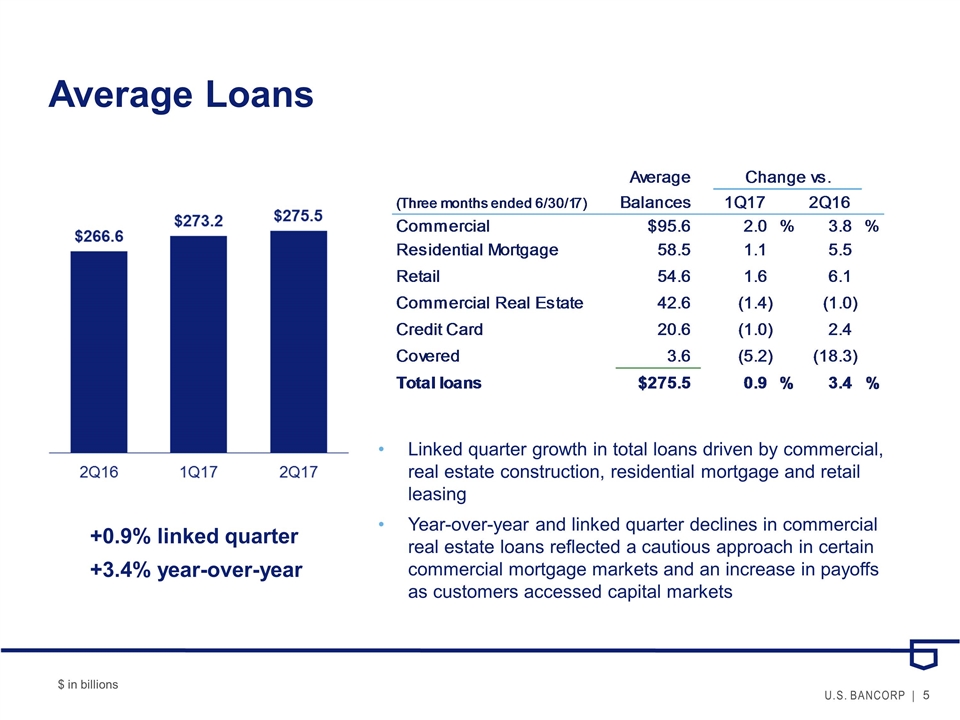

Average Loans +0.9% linked quarter +3.4% year-over-year Linked quarter growth in total loans driven by commercial, real estate construction, residential mortgage and retail leasing Year-over-year and linked quarter declines in commercial real estate loans reflected a cautious approach in certain commercial mortgage markets and an increase in payoffs as customers accessed capital markets $ in billions

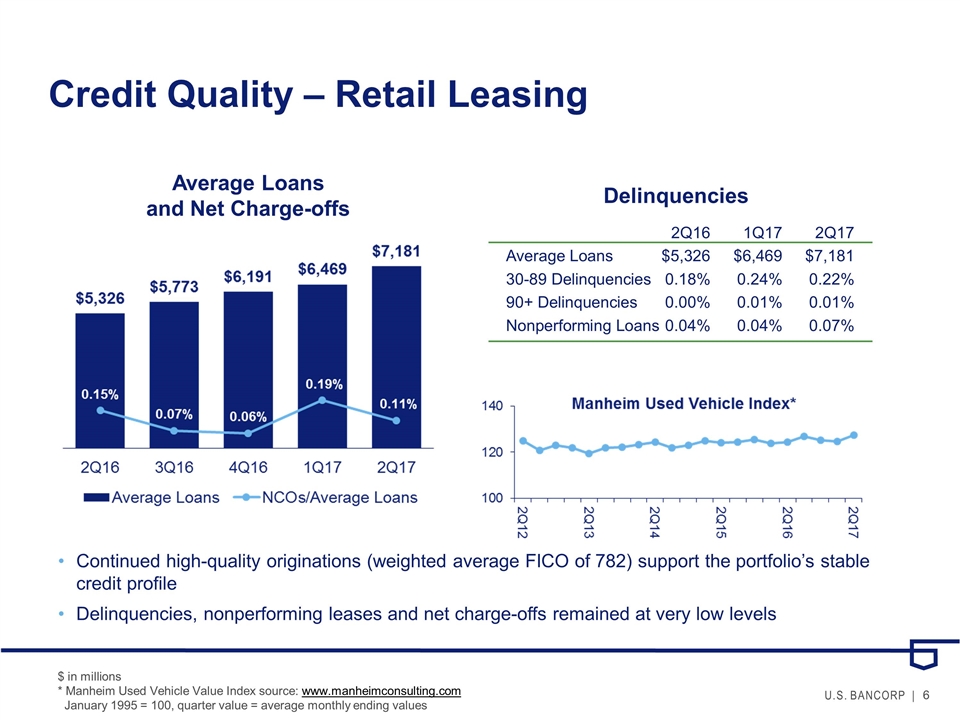

Credit Quality – Retail Leasing Average Loans and Net Charge-offs Delinquencies 2Q161Q172Q17 Average Loans$5,326$6,469$7,181 30-89 Delinquencies0.18%0.24%0.22% 90+ Delinquencies0.00%0.01%0.01% Nonperforming Loans0.04%0.04%0.07% $ in millions * Manheim Used Vehicle Value Index source: www.manheimconsulting.com January 1995 = 100, quarter value = average monthly ending values Continued high-quality originations (weighted average FICO of 782) support the portfolio’s stable credit profile Delinquencies, nonperforming leases and net charge-offs remained at very low levels

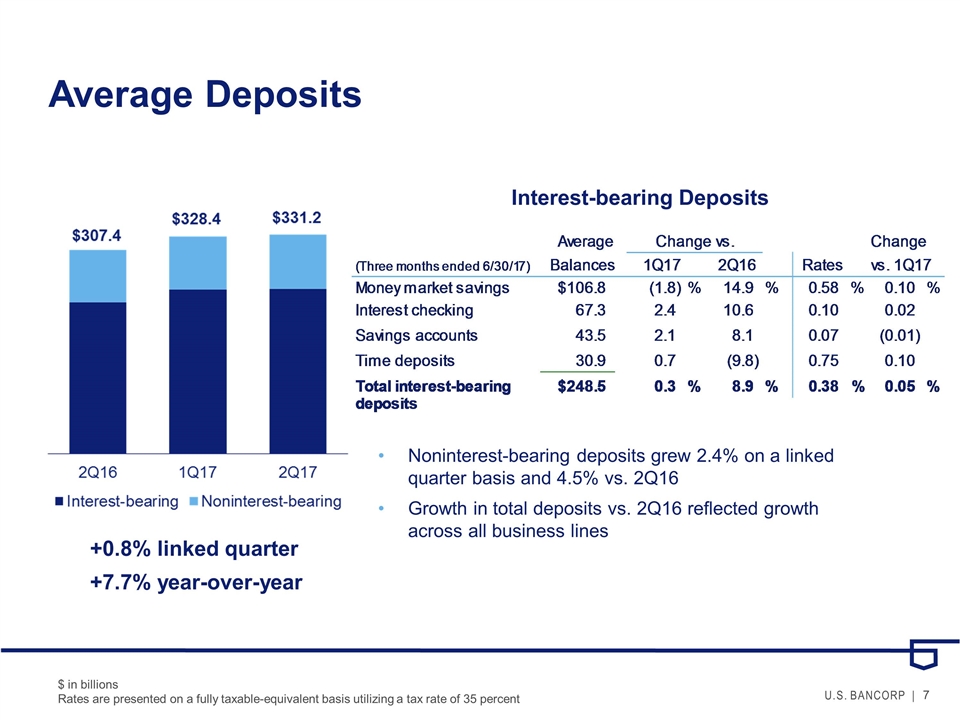

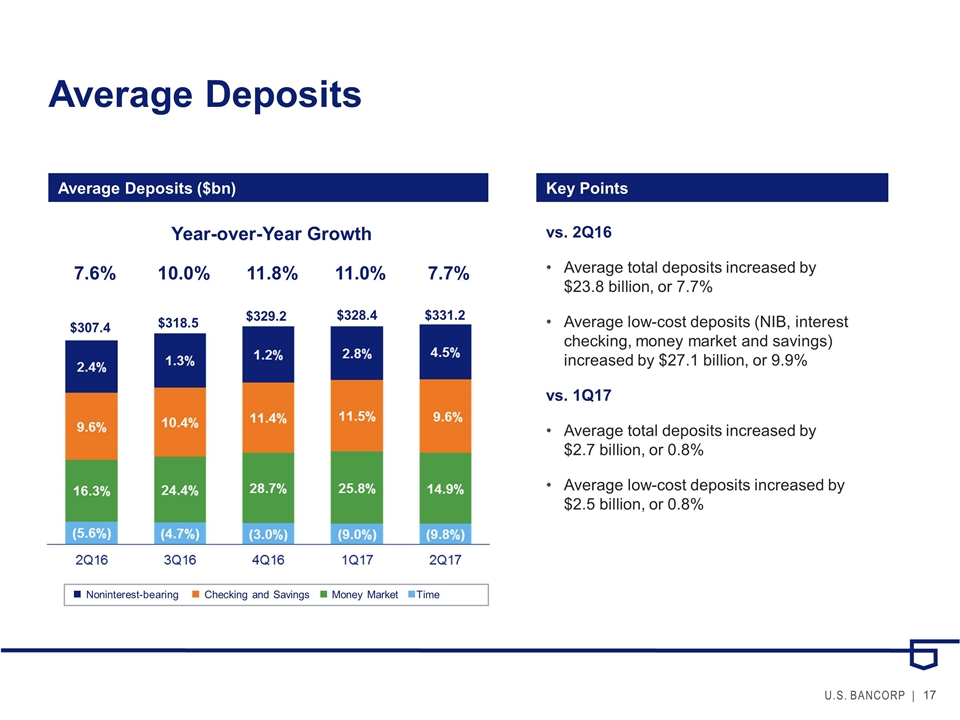

Average Deposits +0.8% linked quarter +7.7% year-over-year $ in billions Rates are presented on a fully taxable-equivalent basis utilizing a tax rate of 35 percent Interest-bearing Deposits Noninterest-bearing deposits grew 2.4% on a linked quarter basis and 4.5% vs. 2Q16 Growth in total deposits vs. 2Q16 reflected growth across all business lines

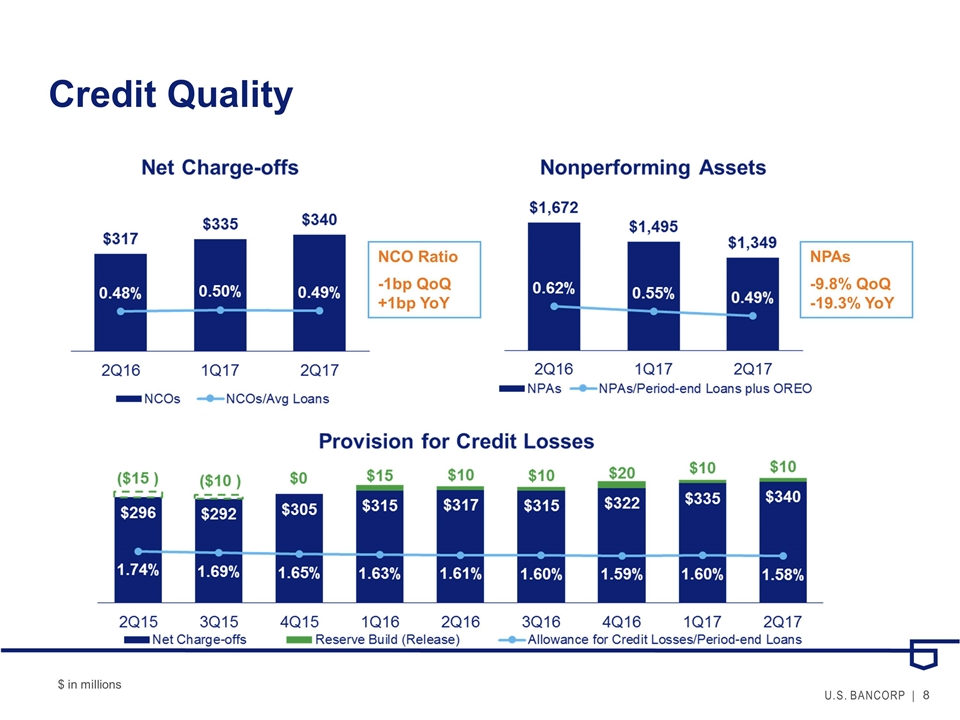

Credit Quality NCO Ratio -1bp QoQ +1bp YoY NPAs -9.8% QoQ -19.3% YoY $ in millions

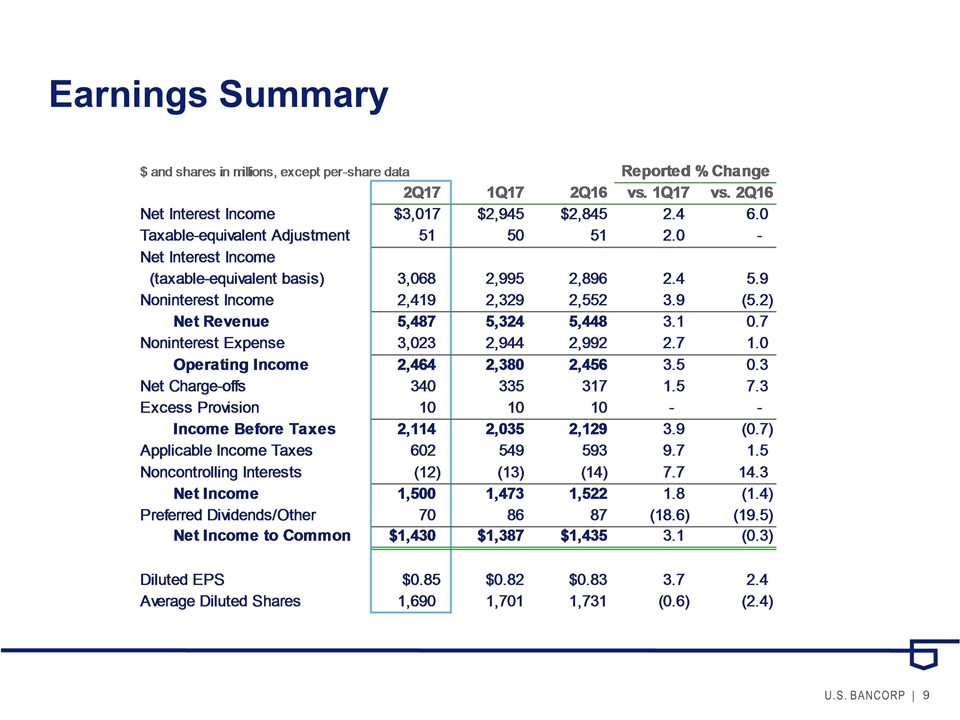

Earnings Summary

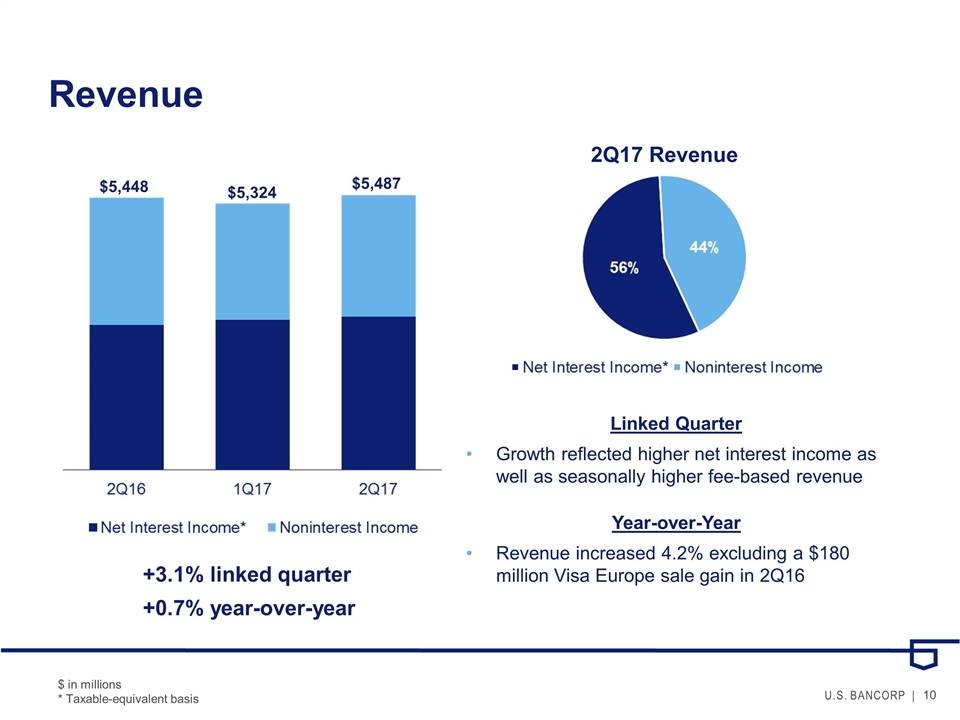

Revenue $5,487 $5,324 $5,448 Linked Quarter Growth reflected higher net interest income as well as seasonally higher fee-based revenue Year-over-Year Revenue increased 4.2% excluding a $180 million Visa Europe sale gain in 2Q16 $ in millions * Taxable-equivalent basis +3.1% linked quarter +0.7% year-over-year 2Q17 Revenue

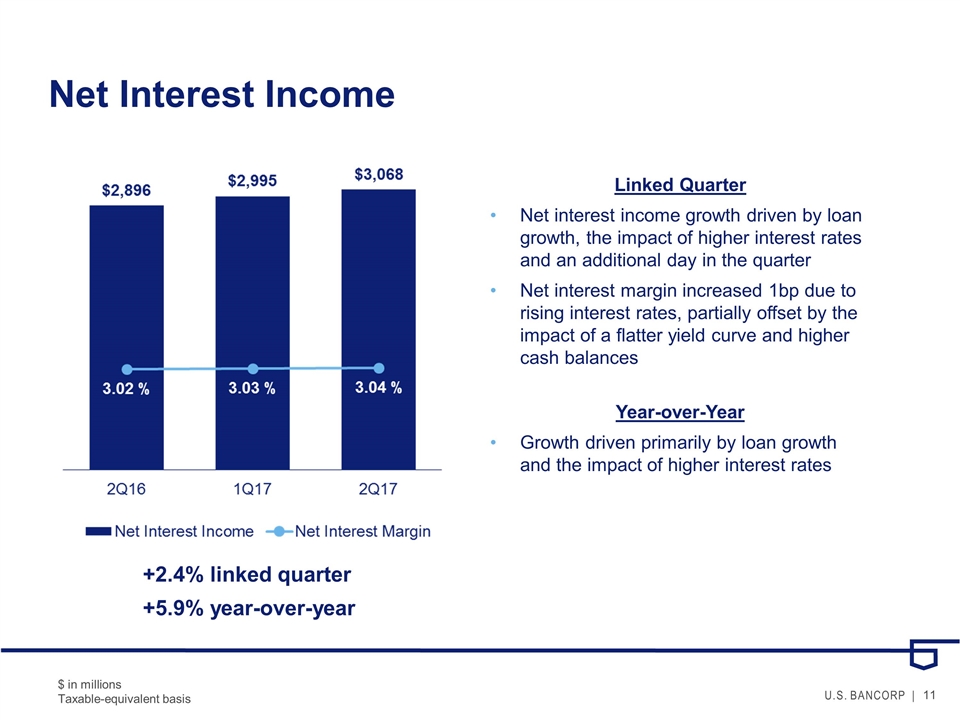

Net Interest Income Linked Quarter Net interest income growth driven by loan growth, the impact of higher interest rates and an additional day in the quarter Net interest margin increased 1bp due to rising interest rates, partially offset by the impact of a flatter yield curve and higher cash balances Year-over-Year Growth driven primarily by loan growth and the impact of higher interest rates $ in millions Taxable-equivalent basis +2.4% linked quarter +5.9% year-over-year

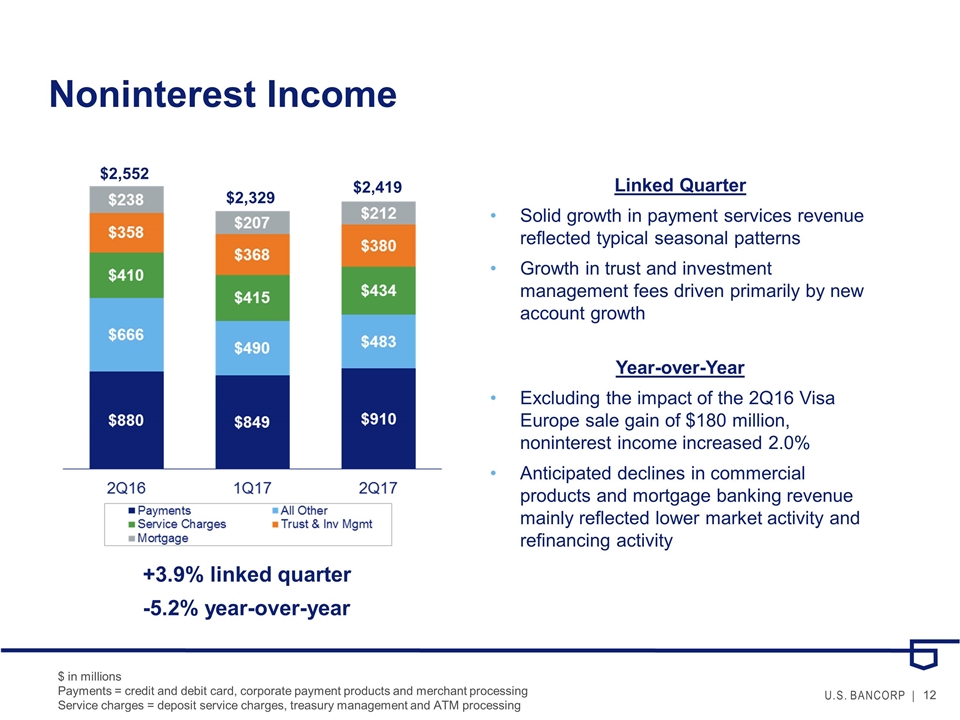

Noninterest Income $ in millions Payments = credit and debit card, corporate payment products and merchant processing Service charges = deposit service charges, treasury management and ATM processing $2,552 $2,329 $2,419 Linked Quarter Solid growth in payment services revenue reflected typical seasonal patterns Growth in trust and investment management fees driven primarily by new account growth Year-over-Year Excluding the impact of the 2Q16 Visa Europe sale gain of $180 million, noninterest income increased 2.0% Anticipated declines in commercial products and mortgage banking revenue mainly reflected lower market activity and refinancing activity +3.9% linked quarter -5.2% year-over-year

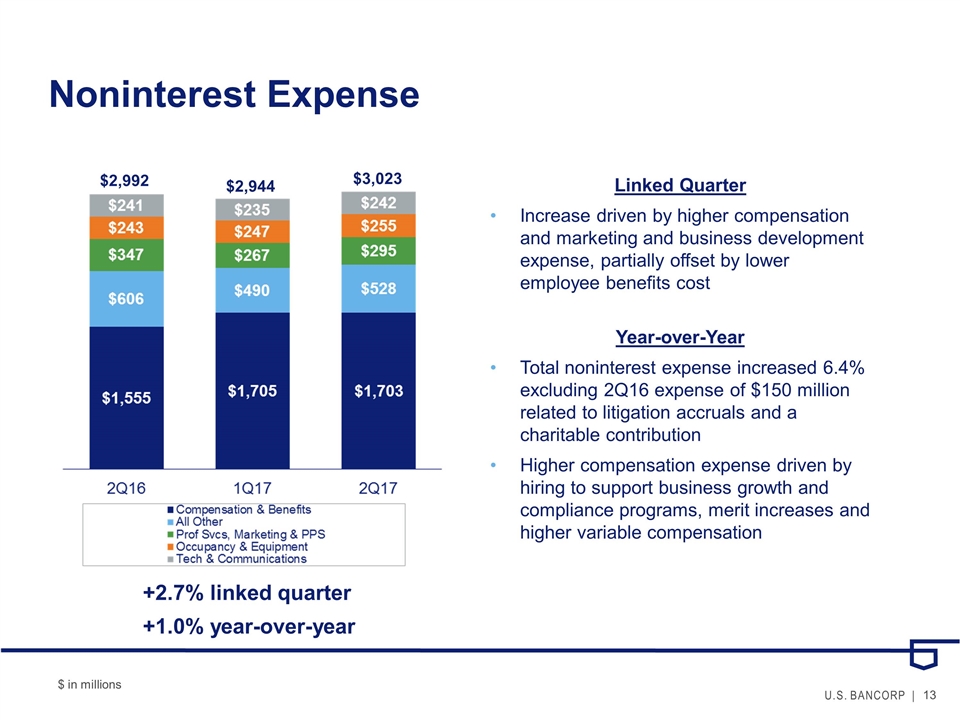

Noninterest Expense $2,992 $2,944 $3,023 Linked Quarter Increase driven by higher compensation and marketing and business development expense, partially offset by lower employee benefits cost Year-over-Year Total noninterest expense increased 6.4% excluding 2Q16 expense of $150 million related to litigation accruals and a charitable contribution Higher compensation expense driven by hiring to support business growth and compliance programs, merit increases and higher variable compensation $ in millions +2.7% linked quarter +1.0% year-over-year

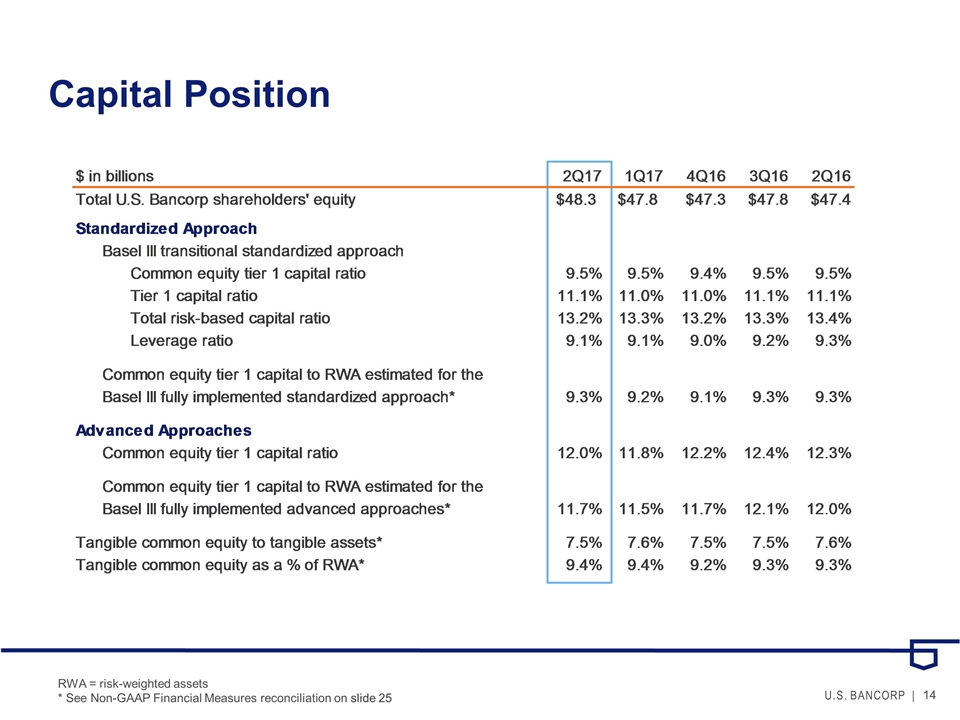

Capital Position RWA = risk-weighted assets * See Non-GAAP Financial Measures reconciliation on slide 25

Appendix

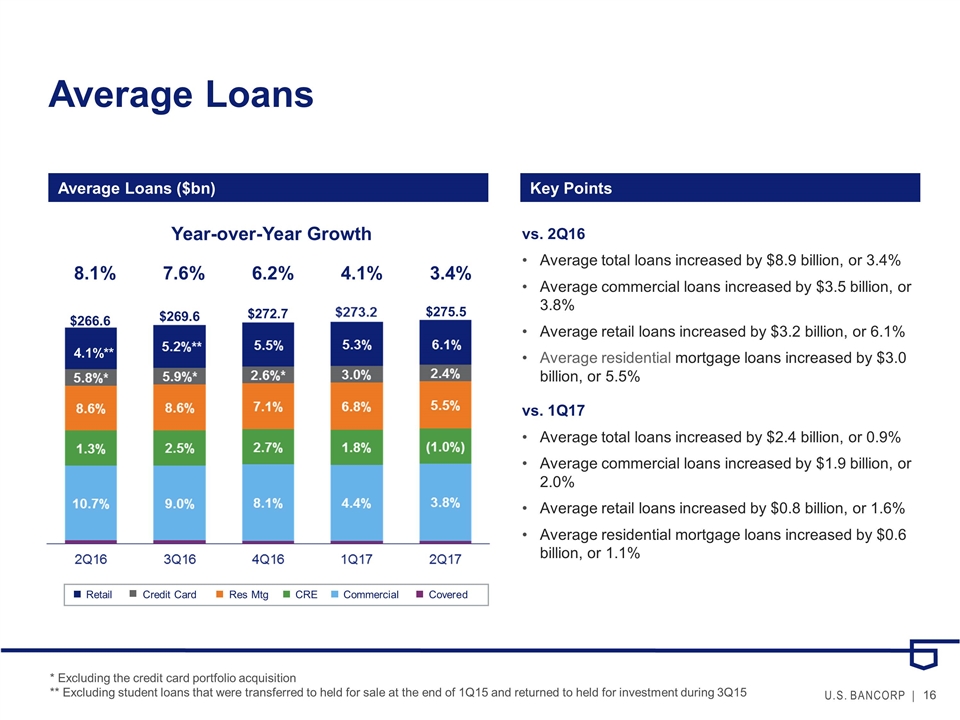

Average Loans vs. 2Q16 Average total loans increased by $8.9 billion, or 3.4% Average commercial loans increased by $3.5 billion, or 3.8% Average retail loans increased by $3.2 billion, or 6.1% Average residential mortgage loans increased by $3.0 billion, or 5.5% vs. 1Q17 Average total loans increased by $2.4 billion, or 0.9% Average commercial loans increased by $1.9 billion, or 2.0% Average retail loans increased by $0.8 billion, or 1.6% Average residential mortgage loans increased by $0.6 billion, or 1.1% * Excluding the credit card portfolio acquisition ** Excluding student loans that were transferred to held for sale at the end of 1Q15 and returned to held for investment during 3Q15 Key Points Year-over-Year Growth 8.1% 7.6% 6.2% 4.1% 3.4% Covered Commercial CRE Res Mtg Retail Credit Card $272.7 $266.6 $269.6 4.1%** $275.5 Average Loans ($bn)

Average Deposits Key Points vs. 2Q16 Average total deposits increased by $23.8 billion, or 7.7% Average low-cost deposits (NIB, interest checking, money market and savings) increased by $27.1 billion, or 9.9% vs. 1Q17 Average total deposits increased by $2.7 billion, or 0.8% Average low-cost deposits increased by $2.5 billion, or 0.8% Average Deposits ($bn) Year-over-Year Growth 7.6% 10.0% 11.8% 11.0% 7.7% Time Money Market Checking and Savings Noninterest-bearing $329.2 $307.4 $318.5 $328.4 $331.2

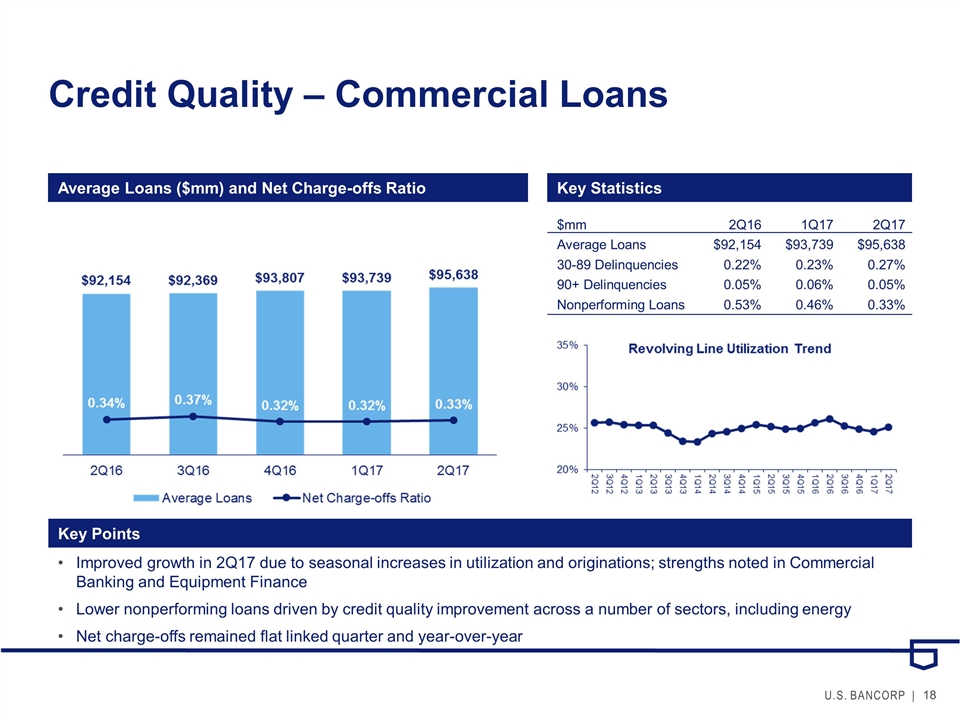

Credit Quality – Commercial Loans Average Loans ($mm) and Net Charge-offs Ratio Key Statistics Key Points $mm2Q161Q172Q17 Average Loans$92,154$93,739$95,638 30-89 Delinquencies0.22%0.23%0.27% 90+ Delinquencies0.05%0.06%0.05% Nonperforming Loans0.53%0.46%0.33% Improved growth in 2Q17 due to seasonal increases in utilization and originations; strengths noted in Commercial Banking and Equipment Finance Lower nonperforming loans driven by credit quality improvement across a number of sectors, including energy Net charge-offs remained flat linked quarter and year-over-year

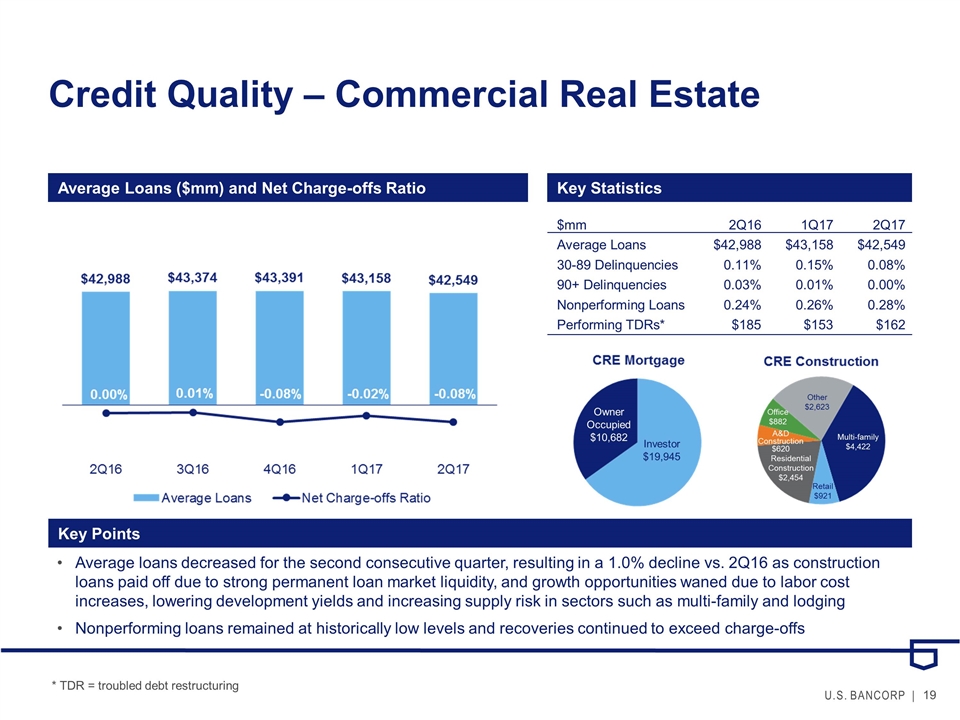

A&D Construction $620 Credit Quality – Commercial Real Estate Average Loans ($mm) and Net Charge-offs Ratio Key Statistics Key Points $mm2Q161Q172Q17 Average Loans$42,988$43,158$42,549 30-89 Delinquencies0.11%0.15%0.08% 90+ Delinquencies0.03%0.01%0.00% Nonperforming Loans0.24%0.26%0.28% Performing TDRs*$185$153$162 Investor $19,945 Owner Occupied $10,682 Multi-family $4,422 Retail $921 Residential Construction $2,454 Office $882 Other $2,623 * TDR = troubled debt restructuring Average loans decreased for the second consecutive quarter, resulting in a 1.0% decline vs. 2Q16 as construction loans paid off due to strong permanent loan market liquidity, and growth opportunities waned due to labor cost increases, lowering development yields and increasing supply risk in sectors such as multi-family and lodging Nonperforming loans remained at historically low levels and recoveries continued to exceed charge-offs

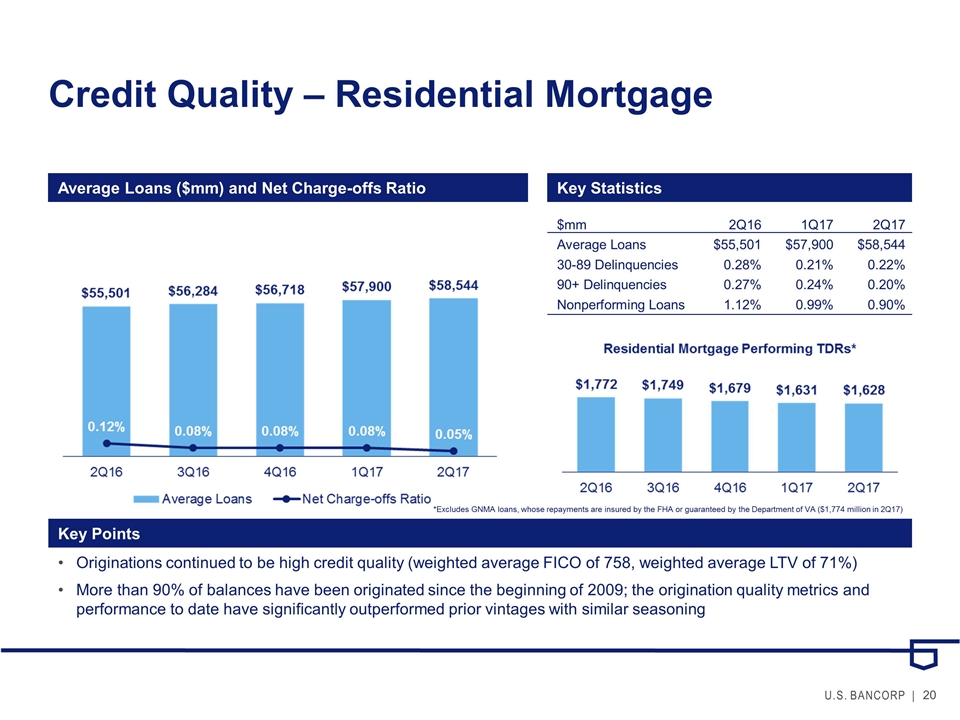

Credit Quality – Residential Mortgage Average Loans ($mm) and Net Charge-offs Ratio Key Statistics Key Points $mm2Q161Q172Q17 Average Loans$55,501$57,900$58,544 30-89 Delinquencies0.28%0.21%0.22% 90+ Delinquencies0.27%0.24%0.20% Nonperforming Loans1.12%0.99%0.90% *Excludes GNMA loans, whose repayments are insured by the FHA or guaranteed by the Department of VA ($1,774 million in 2Q17) Originations continued to be high credit quality (weighted average FICO of 758, weighted average LTV of 71%) More than 90% of balances have been originated since the beginning of 2009; the origination quality metrics and performance to date have significantly outperformed prior vintages with similar seasoning

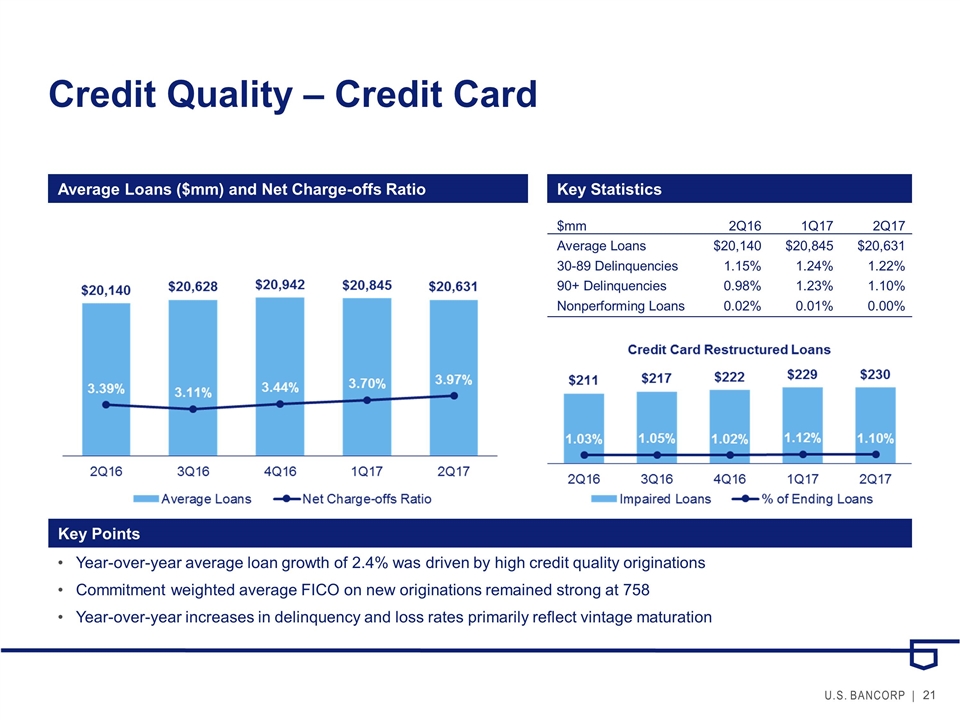

Credit Quality – Credit Card Average Loans ($mm) and Net Charge-offs Ratio Key Statistics Key Points Year-over-year average loan growth of 2.4% was driven by high credit quality originations Commitment weighted average FICO on new originations remained strong at 758 Year-over-year increases in delinquency and loss rates primarily reflect vintage maturation $mm2Q161Q172Q17 Average Loans$20,140$20,845$20,631 30-89 Delinquencies1.15%1.24%1.22% 90+ Delinquencies0.98%1.23%1.10% Nonperforming Loans0.02%0.01%0.00%

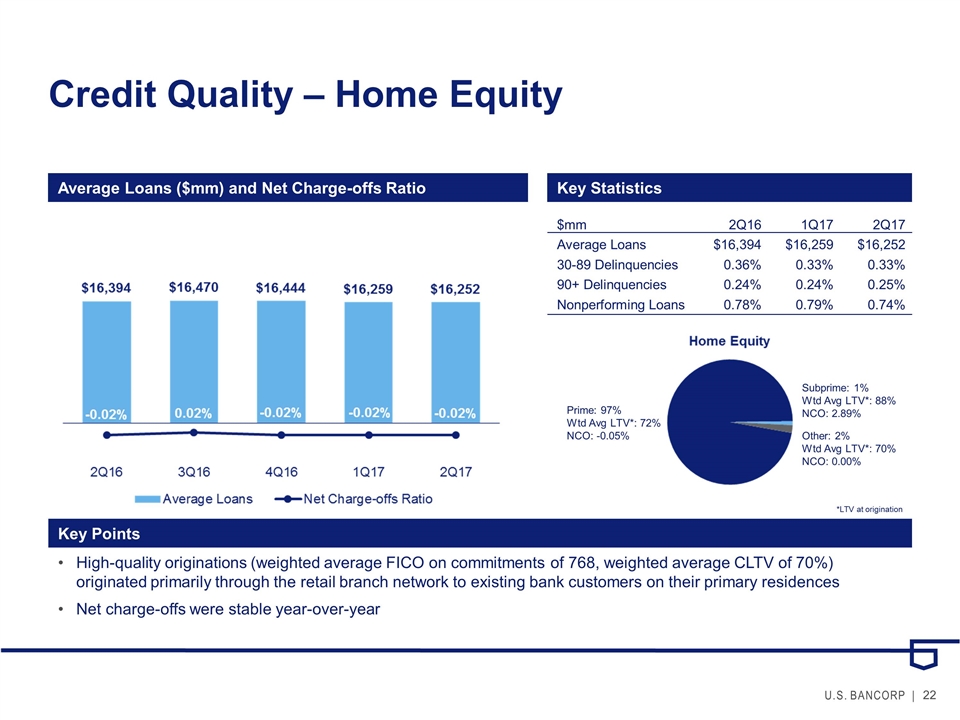

Credit Quality – Home Equity Average Loans ($mm) and Net Charge-offs Ratio Key Statistics Key Points $mm2Q161Q172Q17 Average Loans$16,394$16,259$16,252 30-89 Delinquencies0.36%0.33%0.33% 90+ Delinquencies0.24%0.24%0.25% Nonperforming Loans0.78%0.79%0.74% Subprime: 1% Wtd Avg LTV*: 88% NCO: 2.89% Prime: 97% Wtd Avg LTV*: 72% NCO: -0.05% Other: 2% Wtd Avg LTV*: 70% NCO: 0.00% *LTV at origination High-quality originations (weighted average FICO on commitments of 768, weighted average CLTV of 70%) originated primarily through the retail branch network to existing bank customers on their primary residences Net charge-offs were stable year-over-year

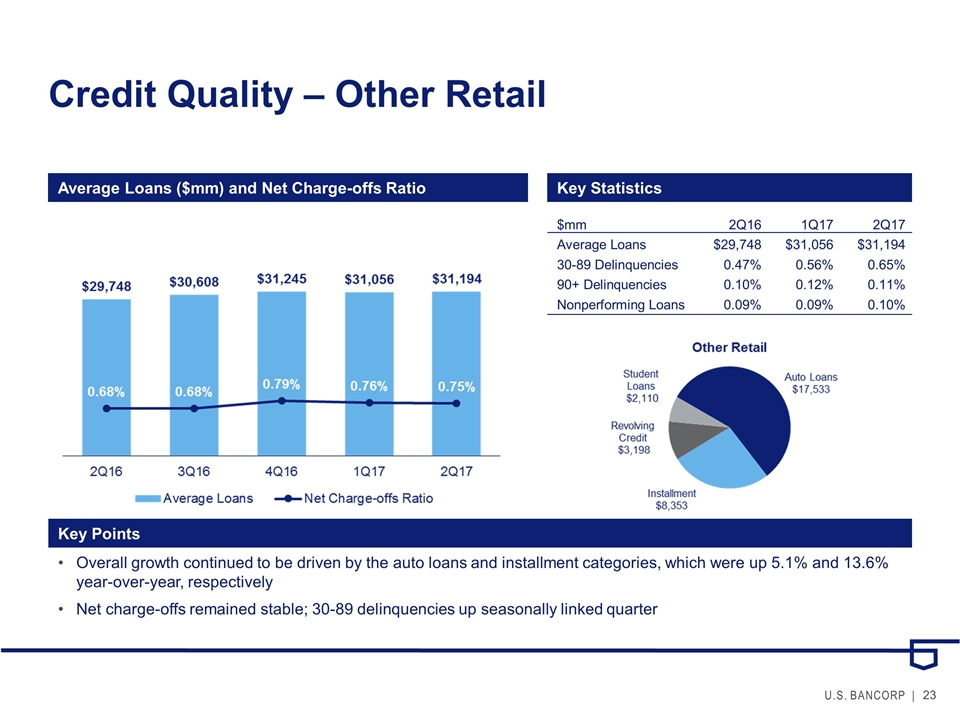

Credit Quality – Other Retail Average Loans ($mm) and Net Charge-offs Ratio Key Statistics Key Points $mm2Q161Q172Q17 Average Loans$29,748$31,056$31,194 30-89 Delinquencies0.47%0.56%0.65% 90+ Delinquencies0.10%0.12%0.11% Nonperforming Loans0.09%0.09%0.10% Overall growth continued to be driven by the auto loans and installment categories, which were up 5.1% and 13.6% year-over-year, respectively Net charge-offs remained stable; 30-89 delinquencies up seasonally linked quarter

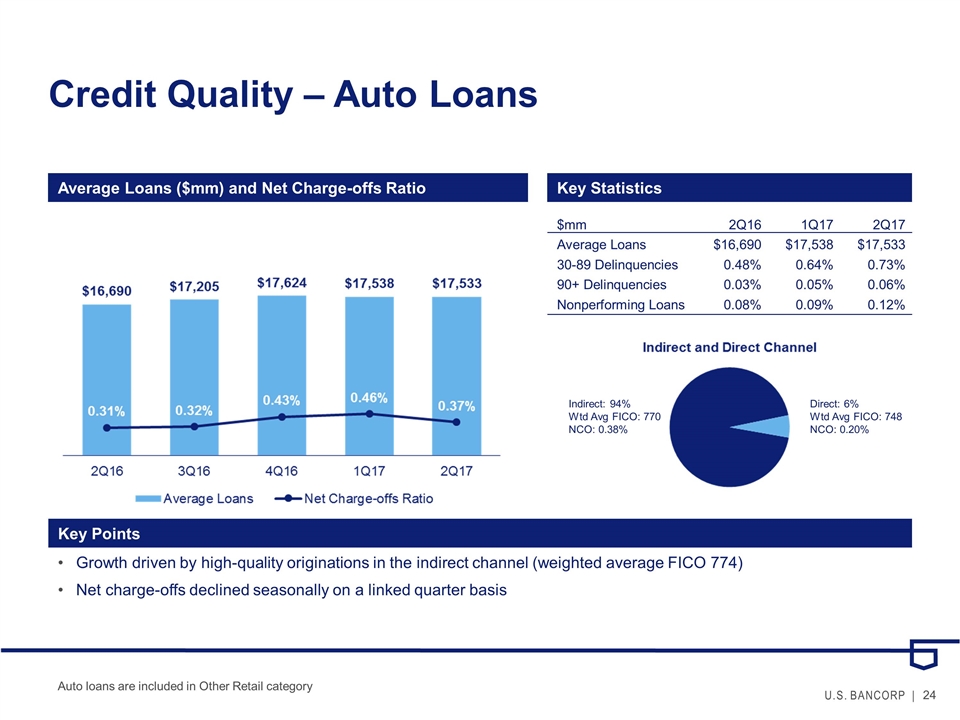

Credit Quality – Auto Loans Average Loans ($mm) and Net Charge-offs Ratio Key Statistics Key Points $mm2Q161Q172Q17 Average Loans$16,690$17,538$17,533 30-89 Delinquencies0.48%0.64%0.73% 90+ Delinquencies0.03%0.05%0.06% Nonperforming Loans0.08%0.09%0.12% Direct: 6% Wtd Avg FICO: 748 NCO: 0.20% Indirect: 94% Wtd Avg FICO: 770 NCO: 0.38% Auto loans are included in Other Retail category Growth driven by high-quality originations in the indirect channel (weighted average FICO 774) Net charge-offs declined seasonally on a linked quarter basis

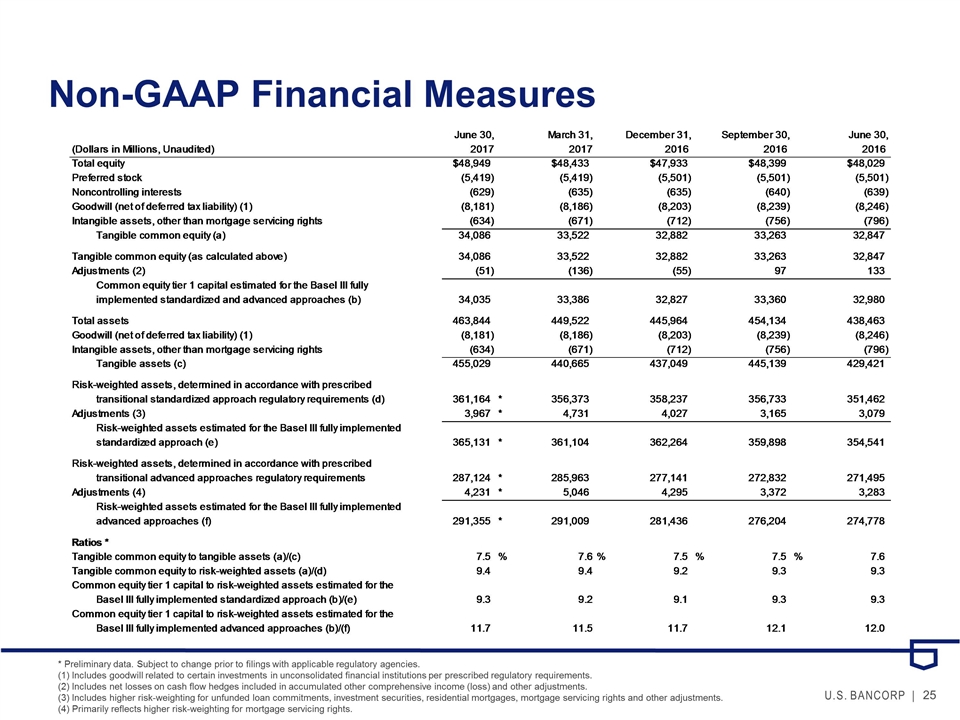

Non-GAAP Financial Measures * Preliminary data. Subject to change prior to filings with applicable regulatory agencies. (1) Includes goodwill related to certain investments in unconsolidated financial institutions per prescribed regulatory requirements. (2) Includes net losses on cash flow hedges included in accumulated other comprehensive income (loss) and other adjustments. (3) Includes higher risk-weighting for unfunded loan commitments, investment securities, residential mortgages, mortgage servicing rights and other adjustments. (4) Primarily reflects higher risk-weighting for mortgage servicing rights.

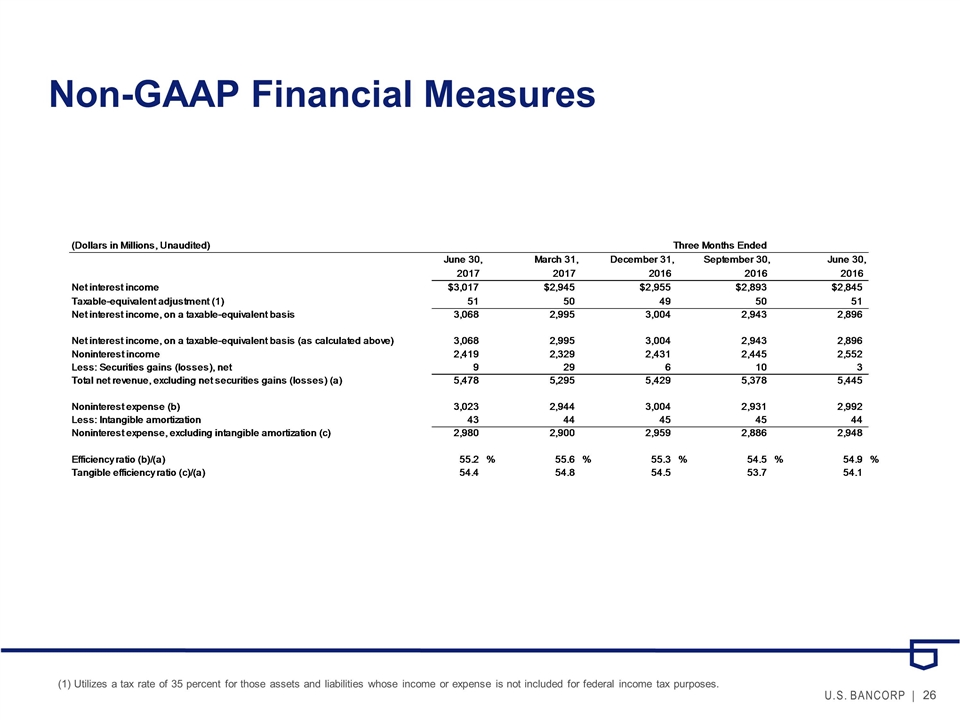

Non-GAAP Financial Measures (1) Utilizes a tax rate of 35 percent for those assets and liabilities whose income or expense is not included for federal income tax purposes.

U.S. Bancorp 2Q17 Earnings Conference Call July 19, 2017