Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - CASEYS GENERAL STORES INC | exhibit992rsuaward-nonxoff.htm |

| EX-99.1 - EXHIBIT 99.1 - CASEYS GENERAL STORES INC | exhibit991ltiaward-summary.htm |

| 8-K - 8-K - CASEYS GENERAL STORES INC | a8-kltincentiveprogramand2.htm |

INVESTOR DAY

JULY 20, 2017

Safe Harbor Statements

This presentation is dated as of July 19, 2017 and speaks as of that date.

Forward Looking Statements

This presentation contains statements that may constitute forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements include any statements relating to our possible or assumed future

results of operations, business strategies, growth opportunities, and performance improvements at our stores. There are a number of

known and unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from any future results

expressed or implied by those forward-looking statements, which are described in our most recent annual report on Form 10-K and

quarterly reports on Form 10-Q, as filed with the SEC and available on our website. Any forward-looking statements contained in this

presentation represent our current views as of the date of this presentation with respect to future events, and Casey's disclaims any

intention or obligation to update this presentation or revise any forward-looking statements attached in this presentation whether as a

result of new information, future events, or otherwise.

Use of Non-GAAP Measures

This presentation includes references to “EBITDA,” which we define as net income before net interest expense, depreciation and

amortization, and income taxes. EBITDA is not presented in accordance with accounting principles generally accepted in the United

States (“GAAP”). We believe EBITDA is useful to investors in evaluating our operating performance because securities analysts and

other interested parties use such calculations as a measure of financial performance and debt service capabilities, and it is regularly

used by management for internal purposes including our capital budgeting process, evaluating acquisition targets, and assessing

store performance. EBITDA is not a recognized term under GAAP and should not be considered as a substitute for net income, cash

flows from operating activities or other income or cash flow statement data. EBITDA has limitations as an analytical tool, and should

not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. We strongly encourage investors

to review our financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. Because

non-GAAP financial measures are not standardized, EBITDA, as defined by us, may not be comparable to similarly titled measures

reported by other companies. It therefore may not be possible to compare our use of this non-GAAP financial measure with those

used by other companies. A reconciliation of EBITDA to GAAP net income can be found in the recently filed Form 10-K for FYE

4/30/2017.

Agenda

Presentation

Terry Handley, President and CEO

Bill Walljasper, Senior Vice President and CFO

Q&A

Terry Handley, President and CEO

Bill Walljasper, Senior Vice President and CFO

Brian Johnson, Senior Vice President, Store Development

Jay Soupene, Senior Vice President, Operations

Distribution Center Tour

Store Tour & Product Sampling

Casey’s Mission

To provide quality products at competitive prices with

courteous service in clean stores at convenient

locations.

To provide a work environment where employees are

treated with respect, dignity and honesty and where

high performance is expected and rewarded.

To provide shareowners with a fair return on

investment.

Our Purpose

To make the daily lives of our

customers & communities better.

Our Vision

By 2030, proudly serve & satisfy

1.5 billion customers a year…one

customer at a time.

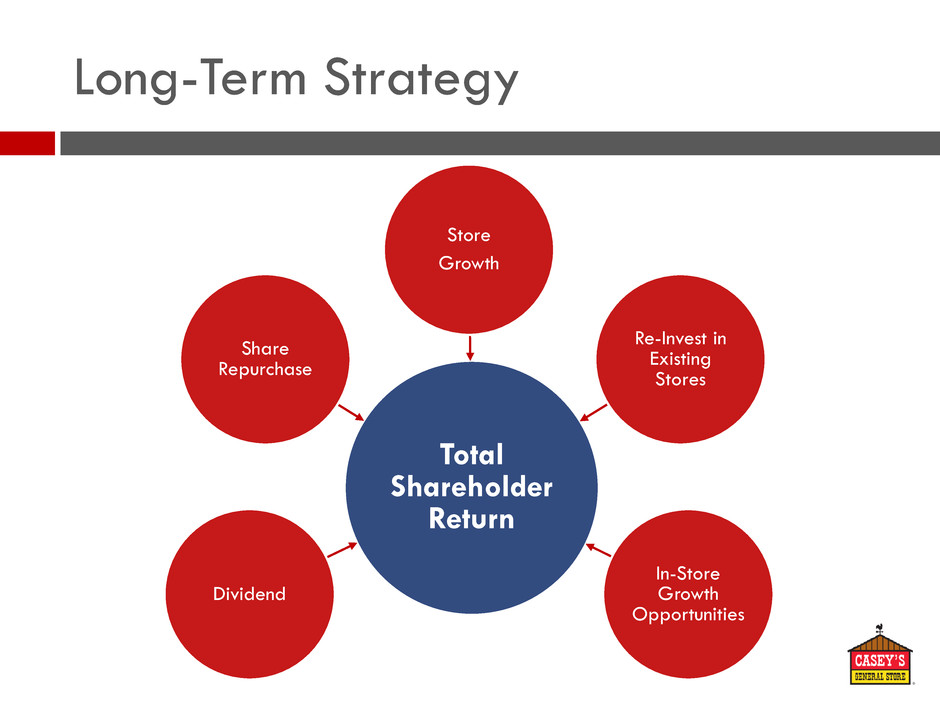

Long-Term Strategy

Total

Shareholder

Return

Store

Growth

Re-Invest in

Existing

Stores

In-Store

Growth

Opportunities

Share

Repurchase

Dividend

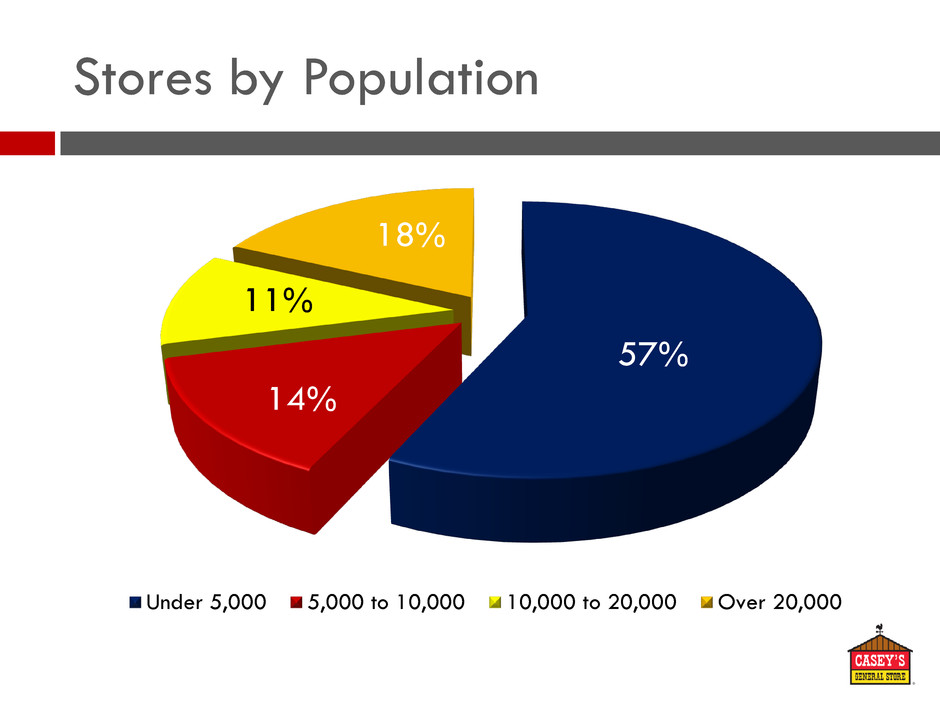

Stores by Population

57%

14%

11%

18%

Under 5,000 5,000 to 10,000 10,000 to 20,000 Over 20,000

Store Growth

1,749

1,808

1,878

1,931

1,978

2013 2014 2015 2016 2017

Fiscal Year

Fiscal Year New Builds

Acquired

Stores

2013 31 26

2014 44 28

2015 45 36

2016 51 5

2017 48 22

2018 Guidance: 80 to 120 Stores

Total Corporate Stores New Stores & Acquisitions

Type Sq Ft Land Building Equip.

Total

Invest.

Larger

Format

4,350 $0.7 $1.2 $1.4 $3.3

Smaller

Format

3,350 $0.5 $1.0 $1.2 $2.7

2017 New Store Average ($ in millions)

Core States Newer States(1)

State

FYE

2017

FYE

2012

5-Year

Growth

Iowa 518 477 41

Illinois 440 405 35

Missouri 326 309 17

Kansas 158 139 19

Minnesota 148 111 37

Nebraska 134 127 7

Indiana 91 75 16

S. Dakota 42 39 3

Wisconsin 18 10 8

Subtotal 1,875 1,692 183

State

FYE

2017

FYE

2012

5-Year

Growth

Arkansas 37 6 31

N. Dakota 26 0 26

Oklahoma 18 1 17

Kentucky 11 0 11

Tennessee 8 0 8

Ohio 3 0 3

Subtotal 103 7 96

All States 1,978 1,699 279

(1) States new to Casey’s within the last 10 years.

Store Growth

500-Mile Distribution Radius

42

26

148

18

440 91

518

134

158

18 37

326

11

8

3

1 - Ankeny, IA

2 - Terre Haute, IN

1

2

1,000 to 20,000 Population Communities

Core States Newer States(1)

State Total(2)

With

Casey’s

Without

Casey’s

Iowa 252 228 24

Illinois 547 299 248

Missouri 306 182 124

Kansas 172 99 73

Minnesota 300 96 204

Nebraska 96 58 38

Indiana 262 67 195

S. Dakota 59 24 35

Wisconsin 317 15 302

Subtotal 2,311 1,068 1,243

State Total(2)

With

Casey’s

Without

Casey’s

Arkansas 171 14 157

N. Dakota 45 8 37

Oklahoma 200 13 187

Kentucky 189 8 181

Tennessee 197 8 189

Ohio 447 3 444

Michigan 298 0 298

Subtotal 1,547 54 1,493

All States 3,858 1,122 2,736

(1) States new to Casey’s within the last 10 years plus Michigan.

(2) Source: http://factfinder.census.gov; Estimated 2016 Pop.

Re-Invest in Existing Stores

Fiscal

Year

Major

Remodels Replacements

2013 77 26

2014 25 20

2015 27 27

2016 102 11

2017 103 21

2018

Guidance

75 30

Type Sq Ft Building Equip.

Total

Investment

Major

Remodel

600 $0.35 $0.35 $0.7

2017 Remodel Average ($ in millions)

Generate Incremental Returns by

Adding Square Footage for Higher

Margin Products

Expanded Cooler Doors

Walk-in Beer Caves

Expanded Coffee and Fountain Bar

Made-to-Order Sub Sandwiches

In-Store Growth Opportunities

Fiscal

Year 24-Hours Delivery

2013 200 200

2014 130 80

2015 110 12

2016 110 110

2017 89 161

Since

Inception

1,000 580

2018

Guidance

75 100

Expanded Hours of

Operation

Delivery

In-Store Growth Opportunities

200

400

530

616

700

815

900

Q3

2016

Q4

2016

Q1

2017

Q2

2017

Q3

2017

Q4

2017

Current

Fiscal Quarter/Year

Mobile App Downloads (in thousands) Current

Digital Engagement

Mobile App

Online Ordering

~14% of All Pizza Sales

~20% Increase in Basket Size

Fuel Saver Programs

Future

Enhanced Digital Engagement

Customer Loyalty

Price Optimization

Fuel Saver Programs

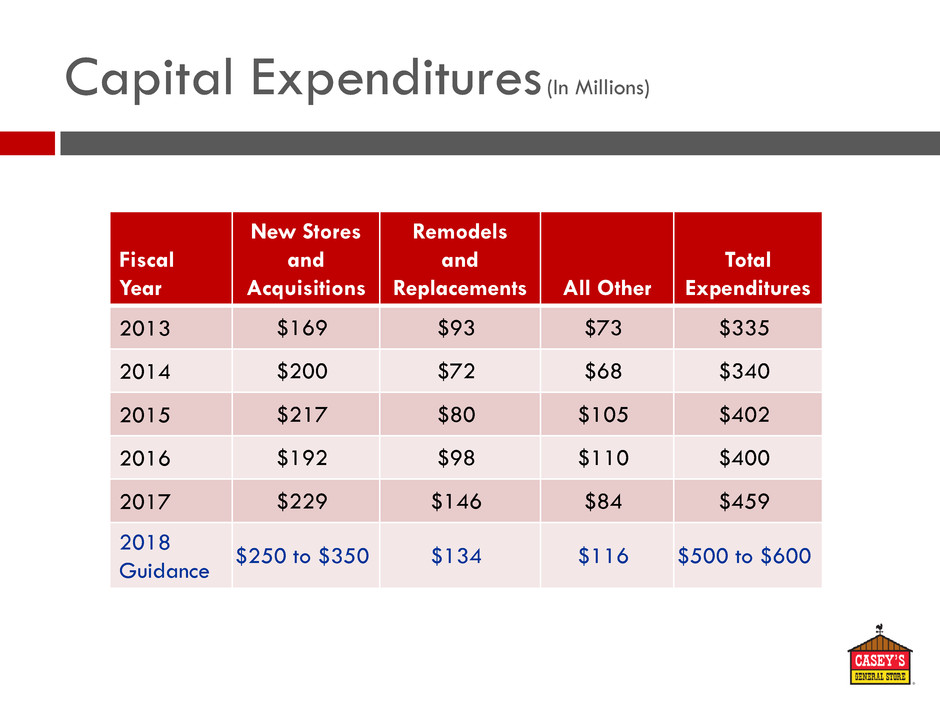

Capital Expenditures (In Millions)

Fiscal

Year

New Stores

and

Acquisitions

Remodels

and

Replacements All Other

Total

Expenditures

2013 $169 $93 $73 $335

2014 $200 $72 $68 $340

2015 $217 $80 $105 $402

2016 $192 $98 $110 $400

2017 $229 $146 $84 $459

2018

Guidance

$250 to $350 $134 $116 $500 to $600

Senior Note Summary

Issuance

Outstanding

Principal

(in Millions) Interest Rate Due

2006 (Series A) $22.5 5.72% September 30, 2019

2006 (Series B) $22.5 5.72% March 30, 2020

2010 $569 5.22% August 9, 2020

2013 (Series A) $150 3.67% June 15, 2028

2013 (Series B) $50 3.75% December 18, 2028

2016 (Series C) $50 3.65% May 2, 2031

2016 (Series D) $50 3.72% October 28, 2031

2017 (Series E) $150 3.51% June 13, 2025

2017 (Series F)* $250 3.77% August 22, 2028

* Expected to be issued August 22, 2017

Same-Store Sales and Margin

Same-Store Sales Gross Profit Margin

Fiscal Year

Fuel

Gallons

Grocery &

Other

Merchandise

Prepared

Food &

Fountain

2013 0.1% 0.8% 8.6%

2014 3.1% 7.4% 11.8%

2015 2.6% 7.8% 12.4%

2016 3.0% 7.1% 8.4%

2017 2.1% 2.9% 4.8%

2018

Guidance

1.0% -

2.0%

2.0% -

4.0%

5.0% -

7.0%

Fiscal Year

Fuel

(cents per

gallon)

Grocery &

Other

Merchandise

Prepared

Food &

Fountain

2013 14.4 32.6% 61.8%

2014 16.1 32.1% 61.1%

2015 19.3 32.1% 59.7%

2016 19.6 31.9% 62.5%

2017 18.4 31.5% 62.3%

2018

Guidance

18.0 -

20.0

31.0% -

32.0%

61.5% -

62.5%

Fuel Margin

10.6 10.5

9.8

11.1

9.6

10.9

10.1

10.7

11.5

10.4

13.9

12.9

13.9

15.2 15.1

14.4

16.1

19.3 19.6

18.4

8.0

12.0

16.0

20.0

C

e

nts

p

e

r

Ga

llo

n

Fiscal Year

Fuel

1,535

1,666

1,817

1,952

2,062

2013 2014 2015 2016 2017

Fiscal Year

Fuel Gallons Sold (in Millions) Gross Profit (in Millions)

$221

$268

$351

$382 $378

2013 2014 2015 2016 2017

Fiscal Year

Grocery & Other Merchandise

$1,419

$1,583

$1,795

$1,974

$2,087

2013 2014 2015 2016 2017

Fiscal Year

Revenue (in Millions) Gross Profit (in Millions)

$463

$508

$576

$629

$657

2013 2014 2015 2016 2017

Fiscal Year

Prepared Food & Fountain

$565

$659

$781

$881

$953

2013 2014 2015 2016 2017

Fiscal Year

Revenue (in Millions) Gross Profit (in Millions)

$349

$403

$466

$550

$594

2013 2014 2015 2016 2017

Fiscal Year

Financial Performance

$1,071

$1,222

$1,440

$1,614

$1,681

2013 2014 2015 2016 2017

Fiscal Year

Total Gross Profit (in Millions) EBITDA (in Millions)

$311

$365

$479

$560

$509

2013 2014 2015 2016 2017

Fiscal Year

Financial Performance

$104

$127

$181

$226

$177

2013 2014 2015 2016 2017

Fiscal Year

Net Income (in Millions) Diluted Earnings Per Share

$2.69

$3.26

$4.62

$5.73

$4.48

2013 2014 2015 2016 2017

Fiscal Year

Dividend

$0.66

$0.72

$0.80

$0.88

$0.96

2013 2014 2015 2016 2017

Fiscal Year

17 Consecutive Annual Dividend Increases

Share Repurchase

Authorized to repurchase up to an aggregate of

$300 million of the Company’s outstanding common

stock

Valid for a period of two years

Can be suspended or discontinued at any time

Period

Total Number of

Shares Purchased

(in thousands)

Average Price

Paid per Share

Maximum Dollar

Value of Shares Yet

to Be Purchased

(in Thousands)

March 9-31, 2017 215,900 $110.32 $276,182

April 1-30, 2017 227,900 $112.14 $250,626

As of April 30, 2017 443,800 $111.25 $250,626

Total Shareholder Return

$100 $104

$125

$151

$207 $209

$0

$50

$100

$150

$200

$250

2012 2013 2014 2015 2016 2017

In

ve

stme

nt

Fiscal Year

The graph assumes a $100 investment in the Company’s Common Stock on April 30, 2012 and reinvestment of all

dividends. The total shareholder return shown is not intended to be indicative of future returns.