Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RITE AID CORP | v470707_8-k.htm |

Exhibit 99.1

Asset Sale Pro - Forma Information July 17, 2017 1

CAUTIONARY NOTE REGARDING PRO FORMA INFORMATION : The following presentation provides certain pro forma information regarding the impact of Rite Aid’s proposed sale of stores and assets to Walgreens Boots Alliance, Inc . on Rite Aid’s results of operations and capital structure . The pro forma information is for illustrative purposes only, was prepared by management in response to investor inquiries and is based upon a number of assumptions . Additional items that may require adjustments to the pro forma information may be identified and could result in material changes to the information contained herein . The information in this presentation is not necessarily indicative of what actual financial results of Rite Aid would have been had the sale occurred on the dates or for the periods indicated, nor does it purport to project the financial results of Rite Aid for any future periods or as of any date . Such pro forma information has not been prepared in conformity with Regulation S - X . Rite Aid’s independent auditors have not audited, reviewed, compiled or performed any procedures with respect to this preliminary financial information . Accordingly, they do not express an opinion or provide any form of assurance with respect thereto . The information in this presentation should not be viewed in replacement of results prepared in compliance with Generally Accepted Accounting Principles or any pro forma financial statements subsequently required by the rules and regulations of the Securities and Exchange Commission . Safe Harbor Statement 2

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS : Statements in this presentation that are not historical are forward - looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 . Such statements include, but are not limited to, statements regarding the expected timing of the closing of the sale of stores and assets to WBA ; the ability of the parties to complete the sale and related transactions considering the various closing conditions ; the outcome of legal and regulatory matters, including with respect to the outcome of discussions with the Federal Trade Commission and otherwise in connection with the sale of stores and assets of Rite Aid to WBA ; the expected benefits of the transaction such as improved operations, enhanced revenues and cash flow, growth potential, market profile and financial strength ; the competitive ability and position of Rite Aid following completion of the proposed transaction ; the ability of Rite Aid to implement new business strategies following the completion of the proposed transaction and any assumptions underlying any of the foregoing . Words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” the exact timing, series and amounts of Rite Aid's indebtedness to be repaid and the premiums associated with such repayments ; “ intend,” “may,” “plan,” “predict,” “project,” “should,” and “will” and variations of such words and similar expressions are intended to identify such forward - looking statements . These forward - looking statements are not guarantees of future performance and involve risks, assumptions and uncertainties, including, but not limited to, our high level of indebtedness and our ability to make interest and principal payments on our debt and satisfy the other covenants contained in our debt agreements ; general economic, industry, market, competitive, regulatory and political conditions ; our ability to improve the operating performance of our stores in accordance with our long term strategy ; the impact of private and public third - party payers continued reduction in prescription drug reimbursements and efforts to encourage mail order ; our ability to manage expenses and our investments in working capital ; outcomes of legal and regulatory matters ; changes in legislation or regulations, including healthcare reform ; our ability to achieve the benefits of our efforts to reduce the costs of our generic and other drugs ; risks related to the proposed transaction, including the possibility that the transaction may not close, including because a governmental entity (including the Federal Trade Commission) may prohibit, delay or refuse to grant approval for the consummation of the transaction, or may require conditions, limitations or restrictions in connection with such approvals ; the risk that there may be a material adverse change of Rite Aid, or the business of Rite Aid may suffer as a result of uncertainty surrounding the proposed transaction ; risks related to the ability to realize the anticipated benefits of the proposed transaction ; risks associated with the financing of the proposed transaction ; disruption from the proposed transaction making it more difficult to maintain business and operational relationships ; the effect of the pending sale on Rite Aid's business relationships (including, without limitation, customers and suppliers), operating results and business generally ; risks related to diverting management's or employees' attention from ongoing business operations ; the risk that Rite Aid's stock price may decline significantly if the proposed transaction is not completed ; significant transaction costs ; unknown liabilities ; the risk of litigation and/or regulatory actions related to the proposed transaction ; potential changes to our strategy in the event the proposed transaction does not close, which may include delaying or reducing capital or other expenditures, selling assets or other operations, attempting to restructure or refinance our debt, or seeking additional capital, and other business effects . These and other risks, assumptions and uncertainties are more fully described in Item 1 A (Risk Factors) of our most recent Annual Report on Form 10 - K, and in other documents that we file or furnish with the Securities and Exchange Commission, which you are encouraged to read . Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward - looking statements . Accordingly, you are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date they are made . Rite Aid expressly disclaims any current intention to update publicly any forward - looking statement after the distribution of this presentation, whether as a result of new information, future events, changes in assumptions or otherwise . Safe Harbor Statement 3

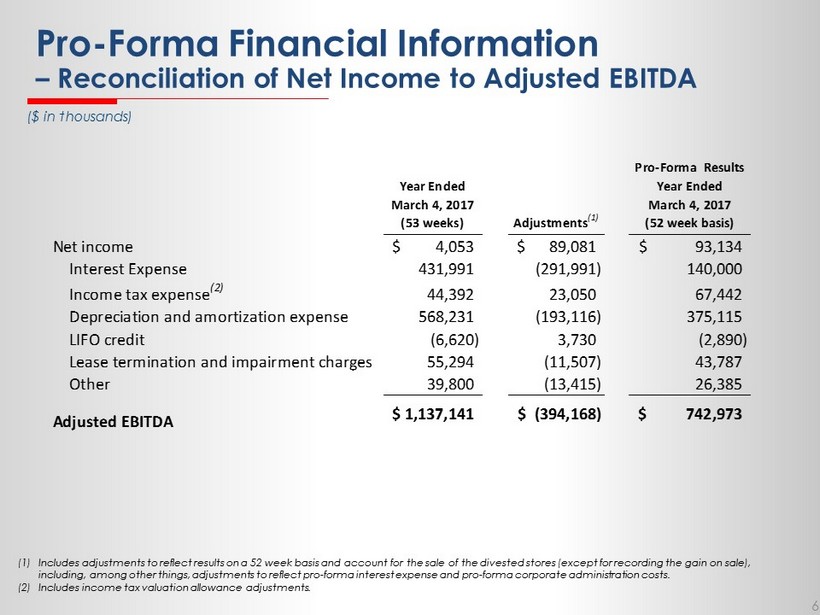

Non - GAAP Financial Measures The following presentation includes a non - GAAP financial measure, Adjusted EBITDA . Rite Aid defines Adjusted EBITDA as net income excluding the impact of income taxes, interest expense, depreciation and amortization, LIFO adjustments, charges or credits for facility closing and impairment, inventory write - downs related to store closings, debt retirements and other items (including stock - based compensation expense, merger and acquisition - related costs, severance and costs related to distribution center closures, gain or loss on sale of assets and revenue deferrals related to our customer loyalty program) . The presentation includes a reconciliation of Adjusted EBITDA to net income, which is the most directly comparable GAAP financial measure . 4

Asset Sale Pro - Forma Information – Key Assumptions • Fiscal 2017 data presented on a 52 - week basis instead of on a 53 - week basis, as reported for the fiscal year ended March 4, 2017 • Net proceeds of $4.9 billion used to pay down debt (refer to "Sources and Uses" slide) • Corporate administration costs are assumed to be reduced by $96 million and adjustments to pro - forma financial information contained herein include an allocation of corporate administration costs to the divested assets to reflect the right - sizing of our administrative function • Pro - forma adjustments do not include estimate’s for generic drug synergies or other purchasing dis - synergies that could occur after the asset sale is completed • Pro - forma interest expense assumes that our 6.125% notes due 2021, 7.7% notes due 2027 and 6.875% notes due 2028 remain outstanding following our expected pay down of debt • Pro - forma net income does not include the gain on sale of assets that will be recorded • The pro - forma information included in this presentation is presented as of and for the year ended March 4, 2017. It does not reflect the results of our most recently completed quarter ended June 3, 2017, and it is not intended to be a forward looking projection or guidance, which the company has not published 5

Pro - Forma Financial Information – Reconciliation of Net Income to Adjusted EBITDA 6 ($ in thousands) (1) Includes adjustments to reflect results on a 52 week basis and account for the sale of the divested stores (except for record ing the gain on sale), including, among other things, adjustments to reflect pro - forma interest expense and pro - forma corporate administration costs. (2) Includes income tax valuation allowance adjustments. Year Ended March 4, 2017 (53 weeks) Adjustments (1) Pro-Forma Results Year Ended March 4, 2017 (52 week basis) Net income 4,053$ 89,081$ 93,134$ Interest Expense 431,991 (291,991) 140,000 Income tax expense (2) 44,392 23,050 67,442 Depreciation and amortization expense 568,231 (193,116) 375,115 LIFO credit (6,620) 3,730 (2,890) Lease termination and impairment charges 55,294 (11,507) 43,787 Other 39,800 (13,415) 26,385 Adjusted EBITDA 1,137,141$ (394,168)$ 742,973$

Pro - Forma Sources and Uses 7 ($ in millions) Sources Estimated Purchase Price (1) 5,175$ Merger Termination Fee 325 Total Sources 5,500$ Uses Estimated Accrued Liabilities (Net of Retained Assets) (2) 369$ Estimated Restructuring Charges and Transaction Costs 100 Estimated Income Tax Expense on Sale of Assets (3) 111 Estimated Debt Repayments 4,920 Total Uses 5,500$ (1) Purchase price assumes that all 2,186 stores are sold. The final number and composition of stores sold could differ, which c oul d impact the final purchase price. (2) Based on net liability balances as of March 4, 2017. (3) Based on the expected ability as of the date hereof to use the company’s current federal and state tax net operating loss car ryf orwards, and assumes no change in control for purposes of Section 382 under the Internal Revenue Code occurs prior to the closing of the t ran saction.

Pro - Forma Store Metrics (as of and for the year ending March 4, 2017) 8 (1) Per store sales and script information is presented on a 52 week basis and is derived from Rite Aid’s internal data. (2) Includes impact of Rite Aid’s proposed sale of 2,186 stores and other assets to WBA. Current Rite Aid Pro-Forma Rite Aid Following Sale (2) Store Count Overview Store Count 4,522 2,336 Wellness Remodels 2,417 1,337 (% of Portfolio) 53% 57% Customer World Stores 422 297 (% of Portfolio) 9% 13% Average per Store (1) Front End Sales 1,814$ 1,975$ Pharmacy Sales 3,923 4,131 Total Sales 5,737$ 6,106$ Average Weekly Scripts 1,277 1,385 ($ in thousands)

9