Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HEALTHCARE TRUST OF AMERICA, INC. | a2017070128-k.htm |

Baylor McKinney MOB, Duke

McKinney, TX

Estrella Medical Center, HTA

Phoenix, AZ

Healthcare Trust of America, Inc.

Largest Dedicated Owner of Medical Office for the Future of Healthcare

Annual Meeting– July 2017

670 Albany at Boston Medical Center, HTA

Boston, MA

NYSE: HTA www.htareit.com

Exhibit 99.1

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

2 www.htareit.com

FORWARD LOOKING STATEMENTS

This document contains both historical and forward‐looking statements. Forward‐looking statements are based on current expectations, plans, estimates,

assumptions and beliefs, including expectations, plans, estimates, assumptions and beliefs about our company, the real estate industry, pending acquisitions,

future medical office building performance and the debt and equity capital markets. All statements other than statements of historical fact are, or may be

deemed to be, forward‐looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended.

Forward‐looking statements include information concerning possible or assumed future results of operations of our Company. The forward‐looking statements

included in this document are subject to numerous risks and uncertainties that could cause actual results to differ materially from those expressed or implied in

the forward‐looking statements. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and

market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control.

Although we believe that the expectations reflected in such forward‐looking statements are based on reasonable assumptions, our actual results and

performance could differ materially from those set forth in the forward‐looking statements. Factors which could have a material adverse effect on our

operations and future prospects include, but are not limited to: changes in economic conditions affecting the healthcare property sector, the commercial real

estate market and the credit market; our ability to complete our pending acquisitions; competition for acquisition of medical office buildings and other facilities

that serve the healthcare industry; economic fluctuations in certain states in which our property investments are geographically concentrated; retention of our

senior management team; financial stability and solvency of our tenants; supply and demand for operating properties in the market areas in which we operate;

our ability to acquire properties, and to successfully operate those properties once acquired; changes in property taxes; legislative and regulatory changes,

including changes to laws governing the taxation of REITs and changes to laws governing the healthcare industry; fluctuations in reimbursements from third

party payors such as Medicare and Medicaid; changes in interest rates; the availability of capital and financing; restrictive covenants in our credit facilities;

changes in our credit ratings; our ability to remain qualified as a REIT; and the risk factors set forth in our 2016 Annual Report on Form 10‐K filed on February

21, 2017.

Forward‐looking statements speak only as of the date made. Except as otherwise required by the federal securities laws, we undertake no obligation to update

any forward‐looking statements to reflect the events or circumstances arising after the date as of which they are made. As a result of these risks and

uncertainties, readers are cautioned not to place undue reliance on the forward looking statements included in this document or that may be made elsewhere

from time to time by, or on behalf of, us.

For definitions of terms and reconciliations for certain financial measures disclosed herein, including, but not limited to, funds from operations (FFO),

normalized funds from operations (Normalized FFO), annualized base rents (ABR), net operating income (NOI), and on‐campus/aligned, please see our

Company’s earnings press release issued on April 26, 2017 and our Company’s Supplemental Financial Package for the quarter ended March 31, 2017, each

of which is available in the investor relations section of our Company’s website located at www.htareit.com.

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

3 www.htareit.com

LARGEST OWNER OF MEDICAL OFFICE IN THE U.S.

Approximately 24 million square feet of gross leasable area (1)

SEASONED, SKILLED MANAGEMENT TEAM

Decades of experience, acquiring, owning and operating commercial real estate

10-year track record of delivering consistent shareholder value

CORE, CRITICAL MEDICAL REAL ESTATE

On-campus and core community focus within high demand medical hubs for the future of

healthcare delivery

DISCIPLINED, ACCRETIVE GROWTH STRATEGY

Disciplined underwriting of MOB assets with record of strong NOI growth

Supported by HTA’s in‐house management and leasing platform

$6.8 billion invested over the past decade (1)

CRITICAL MASS IN ESTABLISHED GATEWAY MARKETS

Key Market Focus – 20-25 markets with growing economies and favorable demographic trends

Operational Scale achieved with 17 markets of ~500k SF creating operating synergies and

enhanced relationships that drive growth

FULL SERVICE, BEST-IN-CLASS PLATFORM

Property management and leasing platform leads to consistent same store growth

Development team adds strategic growth capabilities for new and existing relationships

STRONG, INVESTMENT GRADE BALANCE SHEET

Management has track record of successful financial management

Low leverage balance sheet with investment grade ratings

(1) As of 6/30/17.

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

4 www.htareit.com

A DECADE OF VALUE CREATION

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

$413M

2.2 MSF

$543M

2.9 MSF

$456M

2.3 MSF

$802M

3.5 MSF

$68M

0.3 MSF

$295M

1.3 MSF

$398M

1.5 MSF

$440M

1.2 MSF

$272M

0.8 MSF

$701M

2.5 MSF

$2.6B (2)

6.3 MSF

2.2 GLA 5.2 GLA 7.4 GLA 10.9 GLA 11.2 GLA 12.6 GLA

14.1 GLA 14.8 GLA 15.5 GLA 17.7 GLA 24.0 GLA

Identified and Established

Pure Play MOB Strategy

2006–2011: Invested $2.3B, 11.2 MSF

• Cash Buyer During Great Recession

• Grew Portfolio with Limited Competition

• Attractive Cap Rates lead to Accretive Deals

• Strong Balance Sheet with Low Leverage

• Investment Grade Ratings from S&P/Moody’s~

Achieving Critical Mass in Key Cities

Building Operating Platform

2012–2016: Invested $2.1B, 7.2 MSF

• Shares Listed on NYSE – No Dilutive Equity

• In-House Asset Mgmt & Leasing Platform

• ~$1B Raised via Equity & Bond Offerings

• 1:2 Reverse Stock Split

• ~3% Same-Store Growth

Industry Leader

Positioned For Growth

2017 YTD: Invested $2.6B, 6.3 MSF

• Full Service Platform with Significant

Relationships

• Significant Operating Capabilities for

Continued Growth

• Significant Same Store Growth Potential

• Strong , Conservative Balance Sheet

Enters

Miami

Expands

Presence in

North Carolina

Expands

Presence in

New York &

North Carolina

Invested ~>$1B

Becomes Largest

MOB Owner in

New England

$2.6B MOBs

Development

Platform

Expands

Presence in

Texas & South

Florida

52 Properties

Midwest,

Southeast,

Florida,

Arizona,

Texas

Expands

Presence in

Boston &

Miami

Expands Presence

in Boston,

Charleston,

Indianapolis,

Raleigh

Enters Boston

Opens Atlanta

Regional

Office

Expands

Presence in

Indianapolis,

Dallas,

Houston &

Florida

Enters

Greenville

Expands

Presence in

Arizona

Cash Buyer During Downturn

Executes on

In-House Platform

Lists Shares

on NYSE

Significant Savings

In-House Platform

Largest MOB Owner & Operator

$1B Capital Allocation

1:2 Reverse Stock Split

TSR (1)

45%

TSR (1)

54%

TSR (1)

62%

TSR (1)

132%

TSR (1)

143%

TSR (1)

171%

TSR (1)

194%

(6/30/17)

(1) TSR (total shareholder returns) represents s tock appreciation plus the reinvestment of dividends. (2) Includes investments closed as of 6/30/2017

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

5 www.htareit.com

KEY ACCOMPLISHMENTS IN LAST YEAR

HTA has established itself as the premier Medical Office Building Owner in the United States with a full

service platform with capabilities and relationships to maintain strong, consistent performance. Key

achievements since 2016 include:

Internal Growth that Flows to the Bottom Line

• Same Store Growth of 3.0%+

• Continued Margin Expansion

• Successful Integration of acquisitions onto property management and leasing platform

Accretive External Growth that Strengthens Company’s Portfolio

• Investing over $3.5 Billion to become the largest MOB REIT

• Established critical mass in key markets, 92% in existing HTA markets - 17 markets now approximately 500k SF or greater

• Focused on high quality portfolios with 81% on-campus and 93% occupied in 2017

• Significant overlap creates opportunities for synergies while maintaining an efficient corporate infrastructure

Maintained and Strengthened Investment Grade Balance Sheet

• Raised over $2.0 Billion in common equity to maintain low leverage

• Lengthened debt maturities while locking in low interest rates

Full Service Operating and Development Platform

• Expanded property management and leasing platform to cover over 93% of the portfolio.

• Acquired the best in class development platform to provide strategic capabilities to healthcare providers

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

6 www.htareit.com

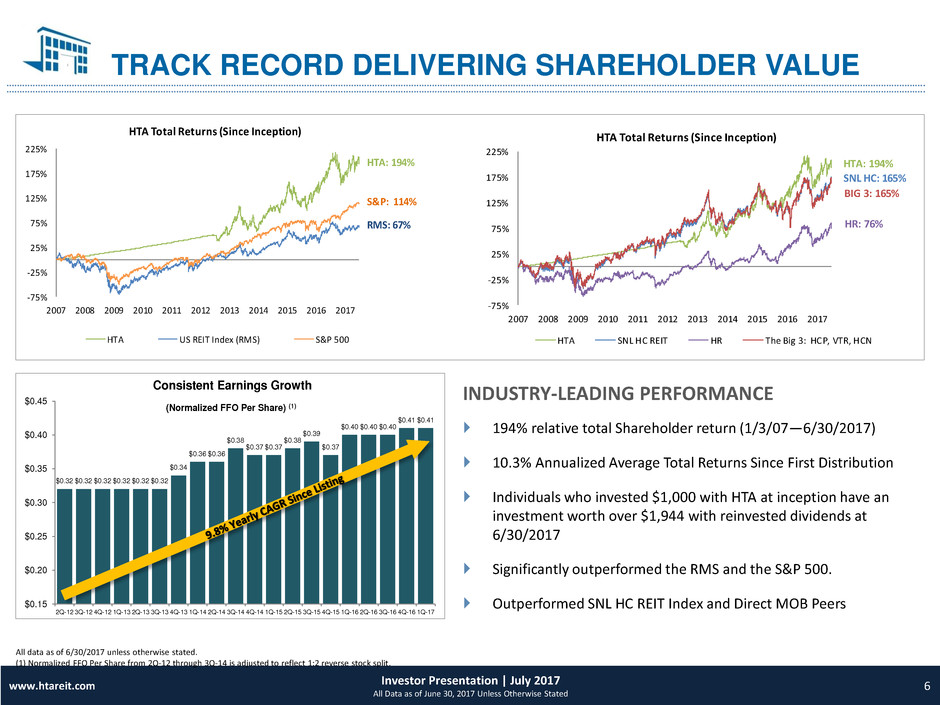

194% relative total Shareholder return (1/3/07—6/30/2017)

10.3% Annualized Average Total Returns Since First Distribution

Individuals who invested $1,000 with HTA at inception have an

investment worth over $1,944 with reinvested dividends at

6/30/2017

Significantly outperformed the RMS and the S&P 500.

Outperformed SNL HC REIT Index and Direct MOB Peers

INDUSTRY-LEADING PERFORMANCE

TRACK RECORD DELIVERING SHAREHOLDER VALUE

$0.32 $0.32 $0.32 $0.32 $0.32 $0.32

$0.34

$0.36 $0.36

$0.38

$0.37 $0.37

$0.38

$0.39

$0.37

$0.40 $0.40 $0.40

$0.41 $0.41

$0.15

$0.20

$0.25

$0.30

$0.35

$0.40

$0.45

2Q-12 3Q-12 4Q-12 1Q-13 2Q-13 3Q-13 4Q-13 1Q-14 2Q-14 3Q-14 4Q-14 1Q-15 2Q-15 3Q-15 4Q-15 1Q-16 2Q-16 3Q-16 4Q-16 1Q-17

Consistent Earnings Growth

(Normalized FFO Per Share) (1)

All data as of 6/30/2017 unless otherwise stated.

(1) Normalized FFO Per Share from 2Q‐12 through 3Q‐14 is adjusted to reflect 1:2 reverse stock split.

-75%

-2 %

25%

75%

12 %

175%

225%

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

HTA Total Returns (Since Inception)

HTA US REIT Index (RMS) S&P 500

HTA: 194%

S&P: 114%

RMS: 67%

-75%

-25%

25%

75%

125%

175%

225%

2007 2008 2009 201 2011 2012 2013 2014 2015 2016 2017

HTA Total R turns (Since Inception)

HTA SNL HC REIT HR The Big 3: HCP, VTR, HCN

HR: 76%

BIG 3: 165%

SNL HC: 165%

HTA: 194%

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

7 www.htareit.com

Source: American Hospital Association

MEDICAL OFFICE: HEALTHCARE TAILWINDS

Healthcare is Fastest Growing Sector of U.S.

Economy

Healthcare employment is growing 2x faster than

any other sector

10,000 people turning 65 every day (4x as many

physician visits as younger population)

Millennials are forming families which drives

healthcare utilization

Healthcare Expenditures Increasing to 20% of U.S.

GDP

Healthcare is Moving Outpatient

Focus on Cost-Effective Care – Private Insurers &

Government Providers

Outpatient Procedures are Cost Effective - Visits

are Increasing

Health Systems & Providers Focused on

Convenience – Serving Patients Where They Are

Medical Office is Primary Beneficiary of this trend

1,000

1,200

1,400

1,600

1,800

2,000

2,200

100

105

110

115

120

125

130

135

140

145

150

19

89

19

90

19

91

19

92

19

93

19

94

19

95

19

96

19

97

19

98

19

99

20

00

20

01

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

OUTPATIENT VISITS ARE INCREASING OVERTIME

Inpatient Admissions/1000 Persons Outpatient Visits/1000 Persons

INPATIENT OUTPATIENT

10%

12%

14%

16%

18%

20%

22%

$1

$2

$2

$3

$3

$4

$4

$5

$5

$6

$6

Total National Health Expenditures Spending as a % of GDP

Source: U.S. Centers for Medicare & Medicaid Services

HEALTHCARE SPENDING CONTINUES TO INCREASE

(National Healthcare Expenditures 2006 – 2025f)

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

8 www.htareit.com

MEDICAL OFFICE PROVIDES ATTRACTIVE RISK AND RETURNS

MOBs Hospitals

Skilled

Nursing

Sr. Housing

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

9 www.htareit.com

HTA VTR HCP HCN HR DOC

MOB GLA (MM SF) 22.8 19.8 18.2 17.2 13.3 11.3

MOBs On-Campus (%) 71% 72% 82% 58% 85% 45%

Top - 75 MSA's 93% 77% 76% 85% 82% 66%

Acquisitions

(Avg Annual $ since 2012) $785M $69M $140M $299M $182M $517M

NFFO/Sh - Annualized Growth

(since 1Q12) 9.5% 2.5% -5.3% 5.4% 3.4% 18.5%

Avg SS Growth (since 2012) 3.1% 2.0% 2.1% 2.3% 3.3% 2.4%

Development

(Avg $ Invested since 2012) $126M* $7M $58M $97M $16M --

Moody's / S&P Ratings Baa2 / BBB Baa1 / BBB+ Baa2 / BBB Baa1 / BBB+ Baa2 / BBB BB+

* Includes HTA - Development, formerly Duke Realty Healthcare which HTA acquired in 2Q17. HTA data includes all Duke properties under contract to close in the next 30 days.

Note: Competitor Data from Company Fil ings and HTA's property level analysis

THE LEADER IN THE MEDICAL OFFICE SECTOR

HTA is not only the largest MOB REIT, we also have a high quality portfolio and best in class platform that has delivered

results across the board for shareholders.

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

10 www.htareit.com

BEST-IN-CLASS PLATFORM DRIVES CONSISTENT GROWTH

ACQUISITIONS

Key Market Relationships and Disciplined Acumen Allows for Accretive Growth

National Leader in outpatient healthcare real estate – Approximately $7 billion invested

Achieved critical mass in established key gateway cities

Improved NAV; consistent and growing cash flows

Number One Development Platform Results in Strategic Dialogue with Providers and Growth Opportunities

Building Class A MOBs to expand HTA’s density within key gateway markets

HTA Development complements in-house operating platform

Maximize NOI growth driving higher same-store growth in the future

DEVELOPMENT

IN-HOUSE PROPERTY

MGMT & LEASING

PLATFORM

INVESTMENT GRADE

BALANCE SHEET

Specialized Asset Management Team Drives Same Store Performance in Key Markets

Market experts equipped to meet and exceed tenants’ changing demands

17 markets with approximate 500k SF or more creates operating synergies, cost savings and growth

opportunities

Drives sector leading same store growth

Strong Balance Sheet with Financial Flexibility

Raised more than $5.0 billion in debt and equity transactions since listing

Maintain low leverage with staggered debt maturities

Strong balance sheet allows for continued growth

On-Campus / Community Core Portfolio in Key Markets Provides Long Term Growth Trajectory

High Occupancies and Tenant Retention create dependable growth from consistent cash flows

Well-located MOBs drive demand from major healthcare systems and physician practices

Seasoned team of finance, real estate and accounting professionals

BEST-IN-CLASS

PORTFOLIO

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

11 www.htareit.com

HIGH QUALITY

REAL ESTATE

PORTFOLIO

Gross real estate investments ($ billions) $6.8

Total portfolio gross leasable area (GLA, millions) 24.3

Key Market and Top 75 MSA exposure (invested $) 93%

Leased rate (%) – As of 3/31/17 PF for 2Q Investments 92%

ASSET MGMT

DRIVES

PERFORMANCE

Properties managed by HTA’s in-house asset management 91%

Same-property tenant retention since listing (2012)

82%

Average same-store cash NOI growth since listing (2012) 3.1%

Average remaining lease term for all buildings (years)

5.2

STRONG

PERFORMANCE

Average annual portfolio growth from acquisitions since 2012

(as of 12/31/2016)

10.4%

Annualized NFFO/share growth since 2012 (CAGR)

(as of 3/31/2017)

10%

Total Annual Shareholder Returns Since Inception

194%

INVESTMENT

GRADE BALANCE

SHEET

Credit ratings by Moody’s and Standard & Poor’s Baa2 / BBB

Total Liquidity ($millions) $691

Total Debt / Total Market Capitalization 28.3%

Debt / Adjusted EBITDA 5.7X

71%

On-Campus/Adjacent

29%

COMPANY SNAPSHOT

3.6%

3.7%

3.8%

3.9%

3.9%

4.1%

4.8%

6.0%

6.3%

12.1%

Denver

Los Angeles

Tampa

Phoenix

Hartford

Indianapolis

Atlanta

Boston

Houston

Dallas|Ft. Worth

Core Community

Outpatient

Core-Critical Real Estate Portfolio

(Pro Forma % of GLA)

Premiere Gateway Cities – Top 10

(Pro Forma % of Invested $)

(as of 3/31/2017)

(as of 3/31/2017)

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

12 www.htareit.com

HTA

MARKETS

KEY MARKETS – STRONG MACRO ECONOMIC TRENDS

Median HHI Growth

30bps

Higher Growth

Unemployment

50bps

Lower

Unemployment

Bachelor’s Degree

130bps

More per Capita

Baby Boomer

Population Growth

50bps

Higher Growth 4.2%

Master’s Degree

130bps

More per Capita

Real GDP Growth

3.7%

4.4%

20.2%

8.8%

10.5%

210bps

Higher Growth

3.7%

3.4%

4.9%

18.9%

7.5%

8.4%

U.S.

AVG

Note: Data is not pro forma for Duke and Dignity portfolio transactions. Note: Pro forma portfolio composition.

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

13 www.htareit.com

ON-CAMPUS/ ADJACENT (71%)

Health system and academic campuses have significant investments in healthcare infrastructure that is difficult to

re-locate – long-term, steady demand

Aligned or located on campuses of nationally and regionally recognized healthcare systems

High energy campuses where hospitals/universities are expanding and recruiting physicians

Physician convenience - hospital utilization or teach/research at medical schools

Considerations:

Ground leases imposed by health systems can often restrict tenants in on-campus MOBs; hospital campuses not

always convenient for patients

More hospitals consolidating as more procedures move to outpatient settings

GREENVILLE, SC – $179M, ACQUIRED 2009 TUFTS & BOSTON UNIVERSITY, BOSTON, MA – $250M, ACQUIRED 2014-2015

Hospital Campus Academic Medical Center

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

14 www.htareit.com

COMMUNITY CORE – OUTPATIENT (29%)

More than 2/3 of all physicians practice “off-campus”

(source: Revista)

Off-Campus is the lowest cost location for healthcare

Physician synergies and referral patterns provide stable

leasing environment

Growth Drivers for Off-Campus

Medical technology advances allows for more care to be

done off-campus. (i.e. full hip replacements)

Providers focused on capturing patients – Accountable Care

Organizations, Population Health Management

Health Insurers focusing off-campus to lower cost; United

Healthcare is the largest employer of physicians (17k+) and

positions them off-campus

Core Off-Campus Performance Is Strong

Traditional Real Estate – Well positioned off-campus MOB’s

performs as well as good, on-campus MOBs: High Retention

and Rent Spreads

Community Core = (i) Medical Hubs Off-Campus, (ii) Affluent

Submarket, (iii) Highly Visible Locations, and (iv) Multi-

Tenanted

HTA’s Community Core Portfolio

(% of HTA’s Off-Campus Portfolio)

• 82% in Medical Hubs, cluster of medical

buildings away from campus

• 71% Multi-Tenanted Buildings

• 84% in High Visibility Locations, located

adjacent to a freeway or major arterial

roads

• 74% in Affluent Submarkets or

Commercial District locations

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

15 www.htareit.com

BEST-IN-CLASS OPERATIONS, LEASING & DEVELOPMENT

In-House Property Management and Leasing Platform totaling 22.4 million

square feet or 93% of the Total Portfolio

40 bps margin expansion in SS NOI growth in Q1-17 with ongoing synergies

Since 2013, HTA has reduced operating expenses by ~$3.6 million, or

approximately 2% per year, in each of the last two years.

Existing Reputable Development Platform Enhances Growth Potential &

Relationships with Key Tenants

Vertically integrated

Deep network of healthcare relationships

Track record of delivering projects on time and on budget

ASSET MANAGEMENT

25+ PROPERTY MANAGERS

25 ACCOUNTING PROFESSIONALS

Vendor management and contract

negotiation focused on operating

expense reduction

Operating expense benchmarking against

HTA’s national portfolio

Lease abstracting, receivables and

collections management and forecasting

ENGINEERING AND

CONSTRUSTION MGMT

70+ BUILDING ENGINEERS

Identification and coordination of all

capital improvements and preventative

maintenance

Daily inspections and supervision of all

contract maintenance

Monitoring and reducing costly

unexpected capital requirements

Supervision of life safety systems and

manage emergency on-call system

LEASING SERVICES

15+ LEASING PROFESSIONALS

Focus on building critical relationships

directly with physicians and health

systems

Strategic leasing to maximize tenant

synergy and retain tenants that are

expanding practices

Regional dedication and knowledge of

surrounding medical office buildings

leasing terms and tenancy

VERTICALLY INTEGRATED

DEVELOPMENT PLATFORM

~15 DEVELOPMENT PROFESSIONALS

Deep network of healthcare

relationships

Track record of delivering projects on

time and on budget

Average historical starts of $126 million

per year

HIGH-DEMAND

LOCATIONS

7 PROJECTS

470,000 SQUARE FEET

86% pre-leased, mitigating lease-up risk

On-campus assets affiliated with top

performing healthcare systems

Class A MOB assets for the future

delivery of healthcare

ACCRETIVE GROWTH

PROSPECTS

~$50 MILLION REMAINING SPEND

$10 MILLION - $11 MILLION STABILIZED NOI

Accretive development projects in

established key, gateway cities adds

another growth driver to HTA’s fully

integrated platform

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

16 www.htareit.com

2017 Investments Creates Medical Office Leader

Note: Includes $138 Million in properties related to the Duke transaction that will close in 3Q17.

(1) Includes 1 property valued at $66 million that may be closed within next 18 months

Less Other

ROFRs(1)

2Q

Investments

Invested $2.75 Billion <$495 Million> $391 Million $2.65 Billion

~5.0% In-Place/

~5.25% Stabilized

# Properties

65 Stabilized /

7 Development

11 24

78 Stabilized /

7 Development

GLA 6.6 Million SF 1.4 Million SF 1.3 Million SF 6.5 Million SF

% On-Campus (By GLA) 81% 92% 90% 80%

% MOBs (By GLA) 87.7% 100.0% 100.0% 91.1%

% Leased 94.3% 97.5% 88.6% 92.6%

% in HTA Existing

Markets

85% 100% 100% 91%

Duke Transaction

TOTAL 2Q

INVESTMENTS

Cap Rate (2 )

~4.75% In- Place/

~5.0% Stabilized

~4.7% ~6%

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

17 www.htareit.com

STRATEGIC RATIONALE

24.3 mm (2)

Combined Total GLA

74%

Leased to Major

Hospital Systems(3)

~91%

Assets Within HTA’s

Markets(2)

3.4%

Combined Pro Forma

SS NOI Growth(6)

Transformational Acquisition Creates Dominant Public Pure-Play MOB Platform

National Leader in outpatient healthcare real estate, an unconsolidated sector undergoing significant

change and macroeconomic growth trends

Pro forma enterprise value of ~$9.0 billion makes HTA the largest public MOB platform(1)

High-Quality Portfolio Focused On-Campus and in Community Core Locations

~80% located directly on or adjacent to health system campuses

Combined portfolios exhibit best-in-class same property NOI growth

Core critical assets with excellent visibility in prime position for healthcare delivery

92% leased with 9.6 weighted average lease term(4)

New construction with an average age of 8 years(5) and very limited capital needs

Significant Portfolio Overlap Creates Scale in Key Gateway Markets

Pro forma portfolio focused in 20 markets with strong growth characteristics

Increased market density allows for significant operating synergies and growth opportunities utilizing the

combined operating platform.

Pro forma – 17 markets with approximately 500k or more SF of GLA

Combined Full-Service Operating Platform with History of Performance and Execution

HTA’s operating platform has demonstrated significant growth maximizing acquired properties

Proven development platform allows for full-service relationship with new and existing healthcare

providers

Development assets are currently 86% pre-leased

(1) Excludes all properties with exercised ROFR/ROFOs. Includes $138MM in properties that remain to close (2) Based on Q1’17 ABR. (3) Based on GLA of 2Q Investments. (4) Weighted average lease term of Duke

portfolio, does not include Dignity assets. (5) Average age of Duke portfolio, does not include Dignity assets. (6) Same store growth weighted by GLA at 12/31/16 since 2012.

(2) Includes $391 million investments in 24 MOBs, aggregating 1.3 million square feet as of June 30, 2017.

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

18 www.htareit.com

100,000 Sq Ft.

1,000,000 Sq. Ft.

500,000 Sq. Ft.

Scale

Combined Portfolio by Square Feet

PROXIMITY TO EXISTING MARKETS DRIVES EFFICIENCIES

Uniquely positioned to create synergies across HTA’s existing markets

Proximity

HTA Duke + 1H Acquisitions Development

HTA has significant existing operating experience in all pro forma top markets

HTA manages 93% of the current portfolio through an In‐House Property Management and Leasing Platform, leading to better operating margins.

On a pro forma basis, HTA will be in 17 markets with each having approximately 500,000 or more SF of GLA

Proximity to

Closest HTA Asset

# of

Buildings

% of

Assets

Within 3 miles 7 6.9%

Within 5 miles 16 15.8%

Within 10 miles 45 44.6%

Within 20 miles 63 62.4%

Within 30 miles 72 71.3%

Within 50 miles 86 85.1%

100 Buildings

(94 Properties)

100%

Duke + 1H Acquisitions

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

19 www.htareit.com

Tenant Rating % of ABR

Baa2 4.6%

A1 4.1%

Aa2 2.6%

B2 2.4%

B1 2.4%

B2 2.3%

A1 2.3%

A2 1.7%

A1 1.3%

Baa2 1.3%

Total 25.0%

EXPANDED RELATIONSHIPS WITH TOP HC SYSTEMS

As the largest MOB platform with expanded capabilities, HTA will continue to be an increasingly

critical partner to the top hospital systems.

Pro forma HTA’s exposure to investment grade rated tenants and provides the company exposure to new hospital relationships.

HTA Pre-Transaction

(1) Moody’s credit rating. (2) S&P credit rating.

(1)

HTA Post-Transaction

(1) Tenant Rating % of ABR

Aa3 3.4%

Baa2 3.4%

A1 3.0%

B2 2.9%

Aa2 1.9%

B2 1.8%

B1 1.7%

A1 1.7%

Aa2 1.6%

Aa3 1.6%

Total 22.8%

Duke + 1H Acquisitions

(1)

(2)

Tenant Rating % of ABR

Aa3 11.9%

Aa2 5.7%

Aa3 5.5%

B2 4.4%

B2 4.3%

NR 3.7%

A3 3.5%

AAA 3.4%

A 3.1%

Aa3 3.0%

Total 48.6%

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

20 www.htareit.com

$0

$50

$100

$150

$200

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Millio

ns

NEW DEVELOPMENT CAPABILITIES ENHANCE GROWTH

Existing Reputable Development Platform Enhances Growth Potential & Relationships with Key Tenants

Vertically integrated platform that provides full offering of services from

construction, development, to property management

Deep network of healthcare relationships

Track record of delivering projects on time and on budget

Current development pipeline is 86% pre-leased / leased, minimizing

lease-up risk

Average historical development starts of $126 million per year

Main Line Bryn Mawr MOB

Philadelphia, PA | Main Line Health

Annual Development Starts(2)

86%

Pre-Leased

470,000

Square Feet

$10 - $11mm

Stabilized NOI(1)

~$50 mm

Remaining Cost to

Spend

7

Development

Projects

$126mm

Historical Avg.

(1) Actual results may differ materially from these estimates. Assumes development assets are leased to 100%.

(2) For the Duke portfolio only.

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

21 www.htareit.com

$2

$101

$406

$145

$304

$1,848

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

2017 2018 2019 2020 2021 Thereafter

M

ill

io

n

s

Credit Facility Secured Mortgages Term Loans Unsecured Notes Seller Financing

WELL CAPITALIZED, FLEXIBLE BALANCE SHEET

HTA has completed the financing of its 2Q Investments in a manner that maintains its strong, investment grade

balance sheet.

Debt Maturity Schedule

Well-Laddered Debt Capitalization

with Limited Near-Term Maturities

Equity Financing

Raised over $1.7 Billion in common equity through overnight and ATM transactions in Q2

Maintained low leverage profile despite significant investments

Locked in cost of capital for long term accretion

Debt Financing

Raised approximately $1.2 Billion in debt to complete the financing

$900 Million in public unsecured bonds at 3.4% average interest rate and 7.8 years average duration

$286 Million in seller financing at 4.0% maturing in 3 equal installments

Note: Reflects announced 2Q Capital Market transactions

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

22 www.htareit.com

HTA PROVEN HISTORY OF ACQUISITION SUCCESSES…

Disciplined Acquisition Underwriting

Play-offense history since inception - $4.4 billion of investments vs. $163 million of dispositions (through Q1 2017)

Duke MOB portfolio consists of complementary, high-quality assets similar to prior acquisitions

HTA’s management team has a proven track record of integrating assets onto the existing platform

($ in millions)

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

To-Date

Acquisitions Dispositions

$413

$543

$456

$802

$68

$295

$398

$440

$83

$440

$36 $39

$272

$701

$2.6B

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

23 www.htareit.com

EXPERIENCED MANAGEMENT TEAM

HTA’s Executive Leadership Team Has Decades of Experience

Scott Peters

Chairman, CEO, and President

Founded HTA in 2006

CEO of Grubb & Ellis (NYSE), ‘07‐’08

CEO of NNN Realty Advisors, ‘06‐’08

EVP, CFO, Triple Net Properties, Inc.,

‘04‐’06

Co‐Founder, CFO of Golf Trust of America,

Inc. (AMEX), ’97‐’07

EVP, Pacific Holding Company/LSR, ‘92‐’96

EVP, CFO, Castle & Cooke Properties, Inc.

(Dole Food Co.), ‘88‐’92

Robert Milligan, Chief Financial Officer

(With HTA Since 2011)

EVP Capital Markets, HTA, ‘11 – ‘16

Vice President, Bank of America Merrill Lynch, ‘07–’11

Senior Analyst / Financial Management Program, General Electric, ‘03 –’07

Amanda Houghton, EVP – Asset Management

(With HTA Since 2009)

Manager of Joint Ventures, Glenborough LLC, ‘06–’09

Senior Analyst, ING Clarion, ‘05 –’06

Senior Analyst, Weyerhauser Realty Investors, ‘04–’05

RSM EquiCo and Bernstein, Conklin, & Balcombe, ‘01‐’03

Keith Konkoli, EVP – Development

(28 years progressive development experience within the MOB space)

EVP - Healthcare, Duke realty, ‘14 – ‘17

SVP – Healthcare, Duke Realty ‘07 – ’14

SVP-Real Estate Operations, Duke Realty, ‘04 –’07

VP-Regional Asset Manager, Duke Realty, ’01 – ‘04

David Gershenson, Chief Accounting Officer

(With HTA Since 2012)

Director of Financial Planning & Analysis, HTA, ’14 – ’16

Assistant Controller, HTA ‘12 – ‘14

Senior Manager, BDO USA LLP, ’03 – ’12

Certified Public Accountant – California

Ann Atkinson, SVP – Acquisitions

(With HTA Since 2012)

Director of Acquisitions, HTA, ‘12 – ‘16

Real Estate Investment Specialist, JDM Partners, LLC, ’10 –’12

Medical Office Investment Broker, Cassidy Turley (f/k/a Grubb & Ellis), ‘04 –’10

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

24 www.htareit.com

LARGEST OWNER OF MEDICAL OFFICE IN THE U.S.

Approximately 24 million square feet of gross leasable area (1)

SEASONED, SKILLED MANAGEMENT TEAM

Decades of experience, acquiring, owning and operating commercial real estate

10-year track record of delivering consistent shareholder value

CORE, CRITICAL MEDICAL REAL ESTATE

On-campus and core community focus within high demand medical hubs for the future of

healthcare delivery

DISCIPLINED, ACCRETIVE GROWTH STRATEGY

Disciplined underwriting of MOB assets with record of strong NOI growth

Supported by HTA’s in‐house management and leasing platform

$7+ billion invested over the past decade (1)

CRITICAL MASS IN ESTABLISHED GATEWAY MARKETS

Key Market Focus – 20-25 markets with growing economies and favorable demographic trends

Operational Scale achieved with 17 markets over 500k SF creating operating synergies and

enhanced relationships that drive growth

FULL SERVICE, BEST-IN-CLASS PLATFORM

Property management and leasing platform leads to consistent same store growth

Development team adds strategic growth capabilities for new and existing relationships

STRONG, INVESTMENT GRADE BALANCE SHEET

Management has track record of successful financial management

Low leverage balance sheet with investment grade ratings

(1) Pro-forma for Duke and recent Q2-17 acquisitions.

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

25 www.htareit.com

Healthcare Trust of America, Inc.

Leading owner of Medical Office Buildings Investor Presentation | July 2017

All Data as of June 30, 2017 Unless Otherwise Stated

26 www.htareit.com

Core Locations & Performance

Core-Critical locations lead to long term demand

Stable Rental Performance Over All Cycles:

Occupancy and Rental Rates:

< 1% Defaults on MOBs in Downturn

Tenant Retention > 80% Industry Wide

Limited Re-tenanting Costs (10-12% of NOI) vs

Traditional Office (18 – 20+%)

Limited New Supply Given Core Locations (< 2% of

Inventory)

Medical Office is the “New” Office

MOBs outperformed traditional Office during

Downturn

Significant Private Capital Interest: Stable

Valuations, Additional Liquidity

Comparable Growth over Full Cycle with Lower

Volatility

Valuations Continue to be Compelling Relative to

Office: MOB REITs at 20-21x 2016 FAD vs Office

REITs at 25-26x 2016 FAD

Same Store Growth Over Time

Source: Green Street Advisors

10-Year CAGR Office 2.3% MOB: 2.4%

Nominal Cap Rates – Gap Remains

Source: Green Street Advisors