Attached files

Table of Contents

Index to Financial Statements

As filed with the Securities and Exchange Commission on July 14, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BJ Services, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 1389 | 30-0976566 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

11211 FM 2920

Tomball, Texas 77375

(281) 408-2361

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Warren M. Zemlak

Chief Executive Officer

11211 FM 2920

Tomball, Texas 77375

(281) 408-2361

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Sean T. Wheeler Ryan J. Maierson Latham & Watkins LLP 811 Main Street, Suite 3700 Houston, Texas 77002 (713) 546-5400 |

Matthew R. Pacey Justin F. Hoffman Kirkland & Ellis LLP 600 Travis Street, Suite 3300 Houston, Texas 77002 (713) 835-3600 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | Emerging growth company | ☒ | |||||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Aggregate |

Amount of Registration Fee | ||

| Class A Common Stock, par value $0.001 per share |

$100,000,000 | $11,590 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. Includes shares issuable upon exercise of the underwriters’ option to purchase additional shares. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Index to Financial Statements

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 14, 2017

PROSPECTUS

Shares

BJ Services, Inc.

Class A Common Stock

This is an initial public offering of the Class A common stock of BJ Services, Inc. We are offering shares of our Class A common stock, par value $0.001 per share.

Prior to this offering, there has been no public market for our Class A common stock. It is currently estimated that the initial public offering price of shares of our Class A common stock will be between $ and $ per share. We have applied to list our Class A common stock on the New York Stock Exchange (the “NYSE”) under the symbol “BJS.” We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and will be subject to reduced public company reporting requirements.

You should consider the risks we have described in “Risk Factors” beginning on page 22.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of the prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | Please read “Underwriting” for a description of all underwriting compensation payable in connection with this offering. |

The underwriters have the option, exercisable for 30 days from the date of this prospectus, to purchase up to an additional shares of Class A common stock from us at the public offering price, less the underwriting discounts.

Delivery of shares of Class A common stock is expected to be made on or about , 2017 through the book-entry facilities of The Depository Trust Company.

| Goldman Sachs & Co. LLC | Morgan Stanley | Credit Suisse |

The date of this prospectus is , 2017.

Table of Contents

Index to Financial Statements

| Page | ||||

| 1 | ||||

| 16 | ||||

| SUMMARY HISTORICAL CONSOLIDATED AND PRO FORMA FINANCIAL DATA |

19 | |||

| 22 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| SELECTED HISTORICAL CONSOLIDATED AND PRO FORMA FINANCIAL DATA |

53 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

55 | |||

| 77 | ||||

| 83 | ||||

| 102 | ||||

| 109 | ||||

| 117 | ||||

| 121 | ||||

| 123 | ||||

| 132 | ||||

| 135 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS |

138 | |||

| 143 | ||||

| 150 | ||||

| 150 | ||||

| 150 | ||||

| 152 | ||||

| F-1 | ||||

| A-1 | ||||

Table of Contents

Index to Financial Statements

You should rely only on the information contained in this prospectus or in any free writing prospectus prepared by us or on behalf of us or to which we have referred you. Neither we nor the underwriters have authorized any other person to provide you with information different from that contained in this prospectus and any free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the underwriters are making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our Class A common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Please read “Risk Factors” and “Forward-Looking Statements.”

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and does not imply, a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and trade names.

Unless the context otherwise requires, the information in this prospectus (other than in the historical financial statements) assumes that the underwriters will not exercise their option to purchase additional shares of our Class A common stock.

References in this prospectus to North America include both the United States and Canada, unless otherwise specified or the context otherwise requires.

The data included in this prospectus regarding the industry in which we operate, including descriptions of trends in the market and our position and the position of our competitors within our industry, is based on a variety of sources, including independent publications, government publications, information obtained from clients, distributors, suppliers, trade and business organizations and publicly available information, as well as our good faith estimates, which have been derived from management’s knowledge and experience in the industry in which we operate. Specifically, much of the industry information set forth in this prospectus is derived from (i) Spears & Associates’ “Hydraulic Fracturing Market 2005-2017” published in the fourth quarter 2016, “Hydraulic Fracturing Market 2006-2018” published in the first quarter 2017 and “Cementing” published in the second quarter of 2016, (ii) Coras Oilfield Research’s fourth quarter 2016 data pack and “January 2017 Oilfield Trends” report and (iii) with respect to historical rig count information, Baker Hughes North America Rig Count as of June 30, 2017. We believe that these third-party sources are reliable and that the third-party information included in this prospectus and in our estimates is accurate and complete; however, we have not independently verified such information.

ii

Table of Contents

Index to Financial Statements

CERTAIN TERMS USED IN THIS PROSPECTUS

Unless the context otherwise requires, references in this prospectus to:

| • | “ABL credit facility” are to our $400.0 million senior secured asset-based loan facility that BJS LLC entered into on May 30, 2017, which we expect to join as a co-borrower in connection with the completion of this offering; |

| • | “Allied Asset Acquisition” are to the acquisition by Allied Energy Services of certain pressure pumping assets from Bayou Well Services, LLC on July 29, 2016; |

| • | “Allied Energy Services” are to Allied Energy Services, LLC, an entity controlled by CSL; |

| • | “Allied Completions Holdings” are to Allied Completions Holdings, LLC; |

| • | “Allied OFS” are to the business and operating assets of Allied Oil & Gas Holdings, LLC, a privately held services company providing cementing services throughout the United States, subsequent to its acquisition by Allied OFS, LLC; |

| • | “Allied Oil and Gas” are to the business of Allied Oil and Gas Holdings, LLC, acquired by CSL Allied Holdings, LLC, which subsequently transferred the assets to Allied OFS, LLC, on April 28, 2016; |

| • | “ALTCem” are to ALTCem, LLC, an entity controlled by CSL; |

| • | “Baker Hughes North America Land Pressure Pumping Business” or “BH N.A. PP” are to BHOO’s hydraulic fracturing and cementing services in North America, including personnel, expertise, technology, infrastructure and equipment; |

| • | “BHGE” are to (i) Baker Hughes Incorporated when used in reference to periods prior to the combination of such entity with General Electric Company’s oil and gas business on July 3, 2017 and (ii) Baker Hughes, a GE company, LLC when used in reference to periods following such combination. General Electric Company and Baker Hughes, a GE company (NYSE: BHGE), hold an approximately 62.5% and 37.5% economic interest, respectively, in Baker Hughes, a GE company, LLC; |

| • | “BHOO” are to Baker Hughes Oilfield Operations LLC and Baker Hughes International Holding LLC, wholly owned subsidiaries of BHGE through which BHGE owns its interest in us, collectively; |

| • | “BJS LLC Agreement” are to the Third Amended and Restated Limited Liability Company Agreement of BJS LLC to be entered into in connection with the completion of this offering; |

| • | “Class A shares” are to shares of Class A common stock, par value $0.001 per share, of the Company; |

| • | “Class B shares” are to shares of Class B common stock, par value $0.001 per share, of the Company; |

| • | “CSL” are to CSL Capital Management, LLC, an investment firm specializing in oilfield services, equipment and technology investments, and its affiliated funds; |

| • | “Company,” “we,” “us” and “our” are to (i) BJ Services, LLC (“BJS LLC”) and its subsidiaries when used in a historical context and (ii) BJ Services, Inc. and its subsidiaries when used in the present tense or prospectively; |

| • | “Existing Owners” are to the Joint Venture, our Sponsors, certain affiliates of BHGE and Management Holdings; |

| • | “Goldman Sachs Affiliated Funds” are to certain investment funds affiliated with Goldman Sachs & Co. LLC and managed by MBD; |

| • | “Joint Venture” is to Allied Energy JV Contribution, LLC, a joint venture among our Sponsors; |

iii

Table of Contents

Index to Financial Statements

| • | “LLC Unit Holders” are to the Existing Owners in their capacity as holders of units representing membership interests in BJS LLC (“LLC Units”) following this offering; |

| • | “Management Holdings” are to BJ Services Management Holdings, LLC, an entity owned by certain members of our management team; |

| • | “MBD” are to the Merchant Banking Division of Goldman Sachs & Co. LLC; |

| • | “Predecessor” are to (A) ALTCem from ALTCem’s inception on January 27, 2015 until the acquisition by Allied OFS, LLC of Allied Oil and Gas on April 28, 2016, (B) ALTCem and Allied OFS on a combined basis from the acquisition by Allied OFS, LLC of Allied Oil and Gas on April 28, 2016 until the Allied Asset Acquisition and (C) ALTCem, Allied OFS and the assets acquired in connection with the Allied Asset Acquisition on a combined basis following the completion of the Allied Asset Acquisition; and |

| • | “Sponsors” are to CSL and Goldman Sachs Affiliated Funds. |

iv

Table of Contents

Index to Financial Statements

This summary provides a brief overview of information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our Class A shares. You should read the entire prospectus carefully, including the financial statements and the notes to those financial statements included in this prospectus. Unless indicated otherwise, the information presented in this prospectus assumes an initial public offering price of $ per Class A share (the midpoint of the price range on the cover page of this prospectus) and that the underwriters do not exercise their option to purchase additional Class A shares. You should read “Risk Factors” for more information about important risks that you should consider carefully before buying our Class A shares.

For a definition of certain terms used in this prospectus, please read “Certain Terms Used in this Prospectus” beginning on page (iii). In addition, we have provided definitions for some of the commonly used terms in the oil and natural gas industry used in this prospectus in the “Glossary of Oil and Natural Gas Terms” beginning on page A-1 of this prospectus.

BJ Services, Inc.

Our Mission: “Perfecting Operational Execution in the Oilfield”

We are the largest North American-focused, pure-play pressure pumping services provider. Our people, equipment and leading-edge technologies provide innovative solutions for exploration and production (“E&P”) clients in North America. Our management team and members of our Board of Directors have an extensive history of providing reliable, safe and efficient solutions for clients across all major North American shale plays. In December 2016, we combined a select set of assets, including certain well-maintained, land-based hydraulic fracturing and cementing equipment, premier facilities and an extensive intellectual property portfolio licensed from Baker Hughes, a GE company, LLC, with the hydraulic fracturing and cementing businesses of Allied Completions Holdings to form our company. Since our formation, we have rapidly and efficiently redeployed a significant portion of our fleets throughout North America.

BJ Services is one of the oilfield services industry’s oldest continuously operating brands, with a 145-year history. The BJ Services brand is recognized globally for its reliability, high-quality equipment and facilities and history of innovation. We are building on this legacy by developing tailored completion and cementing solutions for our clients through a vertically integrated, technology-driven approach that is centered around our flagship technology center in Tomball, Texas, network of regional laboratories and in-house equipment support facilities and access to an intellectual property portfolio containing approximately 500 active patents. Our reputation, commitment to reliability and tailored solutions enable us to provide services to some of North America’s most active and well-capitalized E&P companies.

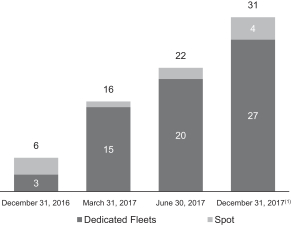

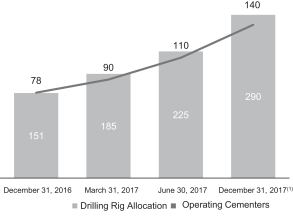

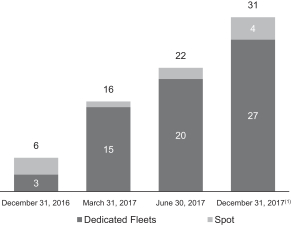

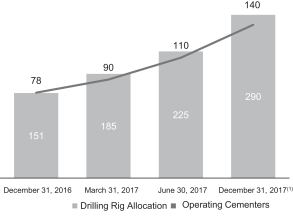

We currently own 43 hydraulic fracturing fleets with an aggregate capacity of 2.2 million hydraulic horsepower (“HHP”), as well as 241 cementers, making us one of the largest hydraulic fracturing and cementing service providers in North America. We calculate our number of fleets by assuming an average HHP per fleet in excess of 50,000 HHP. As of June 30, 2017, we had 22 hydraulic fracturing fleets and 110 cementers operating across all major North American resource plays. We are also engaged in discussions and negotiations with clients or potential clients relating to the redeployment of an additional 9 fracturing fleets by December 2017. Based on our recent redeployment experience, ongoing contract negotiations and discussions with our existing clients, we expect to increase our operating fleet count to 31 hydraulic fracturing fleets and 140 cementers by December 2017.

1

Table of Contents

Index to Financial Statements

We believe the significant historical investment in, and the relatively young age of, our hydraulic fracturing and cementing equipment, will allow us to redeploy our equipment rapidly with an attractive level of expenditures for equipment reactivation. Between 2011 and 2016, BHGE invested approximately $3.5 billion in capital expenditures and repair and maintenance expenses for the hydraulic fracturing and cementing equipment that it contributed to BJS LLC. As a result of historically invested capital and past strategic events which resulted in lower asset utilization, our hydraulic fracturing fleets have an average engine run time since manufacturing, a measure of the relative age and condition of our equipment, of only 2.75 years as of December 31, 2016, based on an assumed 3,600 hours of engine run time per year for a fleet deployed on continuous operations.

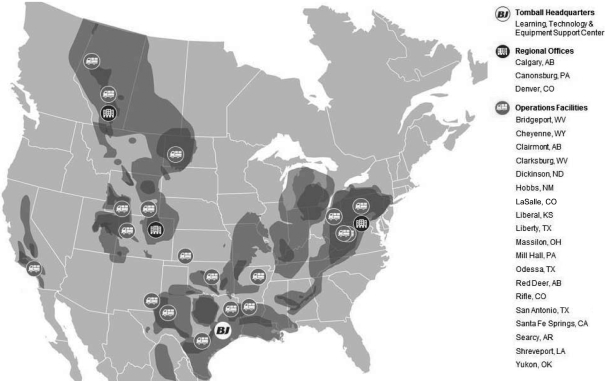

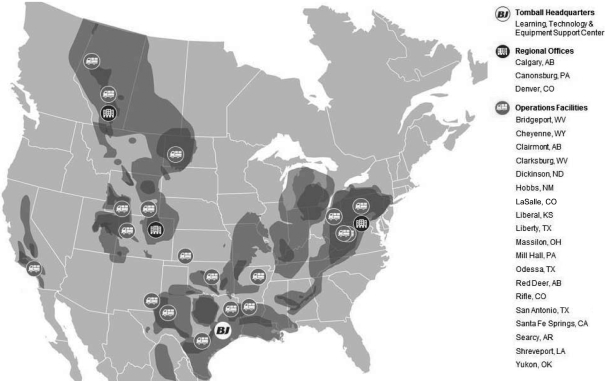

In addition to rapidly redeploying our fleets, we have streamlined the combined legacy footprint of BHGE’s and Allied Completions Holdings’ hydraulic fracturing and onshore cementing businesses from 55 field facilities to 14 owned and 9 leased operating locations that are strategically located within leading resource plays in North America.

The following map represents our facilities and areas of operation as of June 30, 2017:

Our Products and Solutions

Hydraulic Fracturing and Cementing

Hydraulic fracturing. In general, hydraulic fracture treatments are used to increase the productivity of a producing well by pumping fluids at high pressure down a wellbore, creating fractures in the rock formation to stimulate the flow of hydrocarbons. The majority of our tailored hydraulic

2

Table of Contents

Index to Financial Statements

fracturing services are performed in low permeability, damaged reservoirs or horizontal wells. Without successful hydraulic fracturing services, these resources would be uneconomical for our clients.

We own 43 hydraulic fracturing fleets with an aggregate capacity of 2.2 million HHP. We have increased our operating fleet count from six fleets as of December 31, 2016 to 22 fleets as of June 30, 2017, comprising approximately 1,100,000 operating HHP, 20 of which are dedicated to specific clients and operate on a continuous, 24-hour per day basis. We believe we can redeploy and upgrade all 43 of our hydraulic fracturing fleets for an aggregate cost of approximately $197.0 million by leveraging our in-house refurbishment capabilities that will allow us to control the timing and cost of fleet redeployment. As part of our fleet reactivation, we are deploying our proprietary Gorilla pumps, which we believe are among the highest specification mobile pressure pumping units currently in operation. Included in our equipment reactivation is the implementation of proprietary modifications to our equipment that enable us to reduce ongoing repair and maintenance (“R&M”) expense, reduce our total cost of ownership and minimize non-operational time for our clients.

Cementing. We also offer cementing services, which provide zonal isolation between the casing and the open hole, restricting fluid movement between formations or sensitive water aquifers and bond, support and protect the casing from corrosion.

We own 241 cementers, making us one of the largest providers of cementing services to E&P companies in North America. As of June 30, 2017, 110 of our 241 cementers were operating across all major North American resource plays, providing services to approximately 225 land drilling rigs in North America, representing approximately 20% of the land drilling rigs currently in operation. We intend to redeploy our idle cement pumping capacity, which we believe can be fully reactivated with approximately $25.0 million of capital expenditures. As the demand for cementing technologies increases, we expect to increase the number of operating cementers to 140 by December 2017. As trends in the drilling industry evolve, so does the demand for cementing technology solutions that can withstand the challenges associated with longer and deeper horizontal laterals and cyclical stresses across cemented casing strings during advanced completion techniques. We believe we are well-positioned to address that demand with a modernized fleet of cement pumps and premier cement additive technologies that increase job reliability and well integrity during the life of the well. Our standardized fleet is comprised primarily of our proprietary Falcon cementers, which, based on our operating experience, we believe are among the most reliable cementing pumps in the industry by incorporating our Pacemaker fluid pump and standardized control and automation packages.

3

Table of Contents

Index to Financial Statements

Rapid Redeployment of Hydraulic Fracturing and Cementing Fleet. The rapid growth in our operating fleet count has been driven by a number of factors, including our efforts to quickly and efficiently redeploy and upgrade our hydraulic fracturing capacity in response to increasing client demand and our proven ability to gain client share from other hydraulic fracturing service providers. Based on our experience redeploying 16 hydraulic fracturing fleets and 32 cementers since December 31, 2016, as well as contractual commitments, discussions with our existing clients and active negotiations with potential new clients, we expect to further increase the number of our hydraulic fracturing fleets and cementers operating in the field as follows:

| Operating Hydraulic Fracturing Fleets | Operating Cementers and Drilling Rig Allocations | |

|

| |

| (1) | Amounts presented represent estimates based on our recent redeployment experience, contractual commitments, ongoing contract negotiations and discussions with our existing and potential new clients, and there can be no guarantee that the anticipated increase in operating fleets will occur on the timeline indicated, or at all. Please read “Risk Factors—Risks Inherent in Our Business—We may not be able to reactivate and achieve the expansion and deployment of our fleets on our anticipated timeline, or at all.” |

Additional Technological Solutions

In addition to our hydraulic fracturing and cementing services, our flagship technology center and in-house technological expertise enable us to partner with our clients in the design, testing and implementation of hydraulic fracturing and cementing solutions. North American unconventional resource plays have been made economically viable not only by innovative technologies but also by decreasing the operating cost base realized through applying advances in technical and operational processes which improve operating efficiencies. We believe that we are well positioned to take advantage of our North American focused solution offerings, which include cementing systems, hydraulic fracturing systems, equipment design, performance monitoring, completion design and analysis, and integrated proprietary workflows. We believe our tailored, in-house hydraulic fracturing and cementing products are a key differentiator from competitors who may source such products from third parties, as we are able to customize the products we procure and develop for the specific needs of each client. We are also expanding our extensive intellectual property portfolio by developing additional patents for our well-specific fluid design technology, which we believe is at the forefront of fluid products designed to optimize proppant volumes while reducing pumping times and hydraulic horsepower required.

4

Table of Contents

Index to Financial Statements

Our Technology

We couple our industry expertise and premier products and services with innovative technology to develop tailored solutions for our clients. The BJ Services brand embodies 145 years of leadership in technological innovation that has helped position us as the hydraulic fracturing and cementing service provider of choice for a wide range of active E&P clients in North America. We believe there are several aspects of our technology solutions that differentiate us from our competitors:

| • | Flagship technology center. We own an industry-leading technology center spanning over 80 acres in Tomball, Texas, where our team of experts, including chemists, mechanical engineers, software engineers, geoscientists and reservoir engineers, develop, sustain and support technology to keep us at the forefront of hydraulic fracturing and cementing applications. Our flagship technology center represents a significant historical capital investment for equipment and new laboratory facilities used to develop and enhance hydraulic fracturing and cementing products and perform geomechanical, conductivity and fluid analyses. Our flagship technology center also houses a training center, an equipment support center, a high pressure treating iron repair center and equipment testing facilities. |

| • | Extensive intellectual property portfolio. We have access to a portfolio of approximately 500 active patents related to pressure pumping assets and techniques and non-exclusive licenses with BHGE to continue using these patents for an unlimited term, and we are in the process of filing for six new patents. In addition, we have filed trademarks for 14 product lines that differentiate our hydraulic fracturing and cementing service offerings. |

| • | Reservoir modeling. We believe our evolving reservoir expertise, which includes petrophysics, completions engineering, geosciences, geomechanics and reservoir engineering, will ensure our clients have access to a broad range of services to continually drive completion optimization as our industry evolves. |

| • | Tailored solutions. We have developed custom hydraulic fracturing and cementing designs for leading E&P companies across all major oil and natural gas resource plays in North America. Additionally, we have developed over 180 unique fluid systems tailored to particular reservoir properties and integrated with specific job-design requirements. |

| • | Big data analytics to optimize our equipment and wellsite performance. We continuously collect and analyze data from the performance of our equipment and operations to optimize asset deployment decisions and continually improve our predictive and preventative maintenance processes. For example, this capability has led to significant modifications to our equipment that have more than doubled the run life of most of our critical components, including extending the run life of our fluid ends by approximately 150%, improving uptime across our fleet, reducing our total cost of ownership and improving the safety and reliability of our services and equipment. |

Market Opportunity

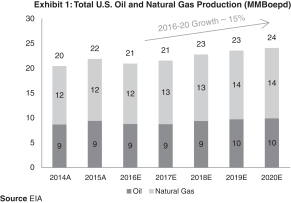

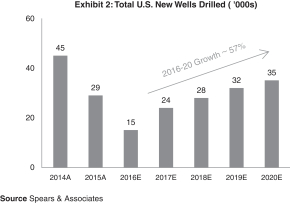

North America has multiple hydrocarbon-rich basins with well-known geologic attributes and large, exploitable resource bases that deliver attractive economics to E&P companies at prevailing oil and natural gas prices. Since reaching a cyclical low in May 2016, the North American land rig count has grown 165% from 416 rigs to 1,103 rigs as of June 30, 2017 according to BHGE. We operate in all of the major North American basins, which provides us with an opportunity to develop our business as industry conditions improve. We believe there are several key drivers of demand for our products and services which will likely lead to tightening pressure pumping supply and demand fundamentals and

5

Table of Contents

Index to Financial Statements

continued pricing improvement for our services. In addition, an ongoing shift to larger, more complex well completions and an increased need to achieve drilling efficiencies to manage capital programs have significantly increased demand for the sophisticated hydraulic fracturing, cementing and other completion solutions we provide.

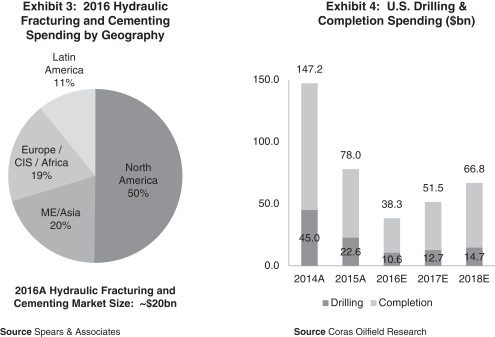

| • | Increasing capital expenditures by E&P companies with an emphasis on completions. In response to the improvement in hydrocarbon prices in the latter half of 2016, E&P companies have increased their capital spending on drilling and completion services, resulting in increased demand for oilfield services activities. According to Coras Oilfield Research, the industry is projected to spend $52 billion on drilling and completions activity in 2017 in the United States, as compared to $38 billion in 2016. Additionally, service intensity has increased the portion of total well costs E&P companies are expected to spend on completions to 75% in 2017 from 66% in 2013. |

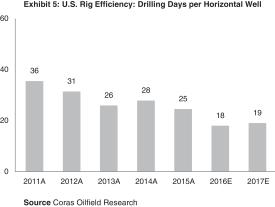

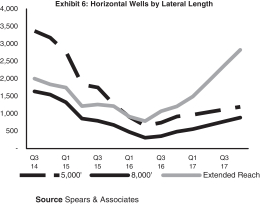

| • | Increasing overall drilling activity, rig efficiency and lateral lengths. While rig counts are increasing, according to Coras Oilfield Research, drilling activity is also increasing due to the reduction in average drilling days per well in the United States from 28 days in 2014 to 21 days in 2016, leading to more wells drilled per rig per year. In addition to rig efficiency, lateral lengths have grown from an average of 6,284 feet in 2014 to an average of more than 7,496 feet in the United States in 2016 per Spears & Associates. |

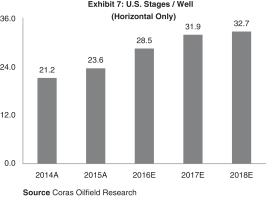

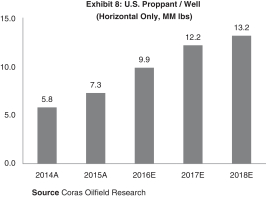

| • | Increasing frac stages per lateral and increasing service intensity of completions. According to Coras Oilfield Research, frac stages per well in the United States have increased from an average of 21 in 2014 to an average of approximately 29 stages per well completed in 2016. Increased stages and service intensity are also expected to result in an increase in proppant usage per well from an average of six million pounds per well in 2014 to an average of approximately ten million pounds per well in 2016 in the United States. |

The aggregate effect of increased demand for greater recovery and completions intensity, as well as increased spending on North American drilling, is driving a trend towards E&P companies seeking partnerships with oilfield service providers that have the technology and facilities to provide complex, engineered hydraulic fracturing and cementing solutions. For more information on industry trends and our market opportunity, see “Industry Trends and Outlook.”

Our Competitive Strengths

Our primary business objectives are to create value for our shareholders and to serve as a strategic partner for our clients by continuing to provide reliable, high-quality, technology-driven solutions for the long-term development of their unconventional resources. We believe that the following strengths differentiate us from our peers and uniquely position us to execute on this strategy:

| • | An iconic oilfield services brand with a rich 145-year history. The BJ Services brand is recognized globally for its reliability, high-quality equipment and history of innovation. We are building on this legacy by developing tailored completion and cementing solutions for our clients through a vertically integrated, technology-driven approach that is centered around our flagship technology center in Tomball, Texas, network of regional laboratories and in-house equipment support facilities and access to an intellectual property portfolio containing approximately 500 active patents. Our reputation, commitment to reliability and tailored solutions enable us to partner with some of North America’s most active and well-capitalized E&P companies. |

| • | A lean, scalable platform with an active presence in every major North American oil and natural gas resource play. We are the largest North American focused, pure-play pressure |

6

Table of Contents

Index to Financial Statements

| pumping services provider, with leading hydraulic fracturing and cementing businesses. As of June 30, 2017, our platform comprised of 43 hydraulic fracturing fleets (of which 22 are operating) providing an aggregate of 2.2 million HHP (approximately 1,100,000 of which represent operating HHP) and 241 cementers (of which 110 are operating). We have aligned our operating infrastructure with key resource plays by streamlining the combined legacy footprint of BHGE’s and Allied Completions Holdings’ hydraulic fracturing and onshore cementing businesses from 55 field sites to 14 owned and 9 leased operating locations. We have also overhauled the legacy BJ Services supply chain and network of facilities to minimize overhead and redundant support services while driving “last-mile” logistics efficiencies across our platform. We believe that our lean, scalable, asset-light infrastructure footprint allows us to serve growing client demand for our services across North America while keeping our operating expenses and overhead at an optimal level. |

| • | Modern, high-quality equipment requiring minimal capital for reactivation and a low cost of ownership. Our hydraulic fracturing fleets and cementers are designed to reduce our operational footprint while maximizing the effectiveness, reliability and longevity of our equipment in the field. |

| • | Differentiated assets. We believe our hydraulic fracturing equipment is among the most standardized and highest-quality equipment in the industry and succeeds in maximizing horsepower and reliability while minimizing its footprint. Our proprietary Gorilla mobile fracturing pumps incorporate the latest high-pressure technology and provide up to 3,000 brake-horsepower. Their advanced capabilities enable us to design and pump jobs that were not previously possible and allow our clients to extract a better rate of return from wells. Our cementing platform is primarily comprised of Falcon cementers, which, based on our operating experience, we believe are among the most reliable cementing pump systems in the industry. Our cementers utilize higher horsepower cement pumps leading spacer and cement additive technology to reduce equipment needs and allow for more efficient operations on longer, higher volume jobs. Our equipment is engineered with the latest control and monitoring systems for precise control of job parameters, real-time job data acquisition and post-job analysis. Our proprietary designed assets enable us to reduce our operational footprint on location and provide better value to our clients. |

| • | Minimal expenditure for reactivation. The average age of our frac pumps is 6.3 years; however, we believe these assets have significant remaining operational life and will require only modest R&M due to past strategic events which resulted in low utilization. This lower utilization of our fleet resulted in having an average engine run time of approximately 9,900 hours or the equivalent of approximately 2.75 years of average engine run time as of December 31, 2016, based on an assumed 3,600 hours of engine run time per year for a fleet deployed on continuous operations, since construction. We also believe that our well-maintained, modern hydraulic fracturing fleets can be effectively upgraded with our proprietary modifications and redeployed for approximately $197.0 million, or approximately $4.6 million per hydraulic fracturing fleet, based on the average cost of reactivating and upgrading the 16 hydraulic fracturing fleets we have reactivated since December 31, 2016 and our knowledge of the costs required to activate the remaining fleets. At $4.6 million per hydraulic fracturing fleet, we believe our reactivation cost is significantly lower than the cost of building a new comparably equipped fleet, which we estimate would cost approximately $50.0 million, based on the experience of our management. Additionally, we expect the cost of redeploying our idle cementers will be approximately $25.0 million or approximately $150,000 per cementer, compared to approximately $1.4 million to build a comparable new cementer. The relative age of our equipment combined with our robust and proprietary maintenance program and vertically |

7

Table of Contents

Index to Financial Statements

| integrated, in-house refurbishment capabilities allows us to activate equipment at a significant cost advantage and efficient timing that is within our control. |

| • | Low overall cost of ownership. We provide vertically integrated client solutions and maintain state-of-the-art equipment support facilities, which are located in close proximity to the major resource plays we service. Our standardized fleets share common equipment and design, which reduces inventory costs and allows us to utilize our technicians across our entire fleet. Additionally, we have further reengineered certain of our equipment to extend the run life and reduce R&M costs of key components. For example, our proprietary modifications to major equipment have more than doubled the run life of most of our critical components, including extending the run life of our fluid ends by approximately 150%, and have reduced our total cost of ownership. We monitor and analyze data using a preventive maintenance model to assure equipment performance, safety and reliability throughout its lifetime. |

| • | Industry-leading technology innovation supported by high-quality research and development capabilities. We own a flagship technology center spanning over 80 acres in Tomball, Texas staffed with chemists, mechanical engineers, software engineers, geoscientists, completions and reservoir engineers who design, develop, sustain and support technology to keep us at the forefront of hydraulic fracturing and cementing applications. Our technology assets and intellectual property portfolio represent a significant historical capital investment to build new laboratory facilities for developing hydraulic fracturing and cementing products and engaging in geomechanical, conductivity and fluid analyses. Our Tomball headquarters also houses a training center, an equipment support center, high pressure treating iron repair center and equipment testing facilities. We also have access to a portfolio of approximately 500 active patents related to pressure pumping assets and techniques and non-exclusive licenses with BHGE to continue using these patents for an unlimited term, and we are in the process of filing for six new patents. In addition, we have filed trademarks for 14 product lines that differentiate our hydraulic fracturing and cementing service offerings. |

| • | Operations designed for a high reliability organization (“HRO”). Our HRO philosophy is designed to maximize returns by integrating our supply chain, sales, technical and operational workflows. The backbone of this system is our ability to collect and analyze “big data,” enhancing our ability to adjust operational parameters to create synergies across sales, supply chain and field operations within our organization. Additionally, our careful monitoring and analysis of our operating equipment has led to engineered solutions that reduce both our and our clients’ costs. We believe we have established a unique and proven management and team performance system that focuses on perfecting execution in the field. |

| • | Experienced executive team and field managers supported by world-class leadership. Our Board of Directors includes former chief executives from the world’s leading oilfield services companies and our senior management has extensive experience leading oilfield services operations. We believe our leadership team’s knowledge of the oilfield services industry is a key competitive advantage. In addition, our field managers have expertise in the resource plays in which they operate and understand the unique challenges that our clients face. We believe their knowledge of our industry and business lines enhances our ability to provide innovative, client-focused and basin-specific solutions, which we also believe strengthens our relationships with our clients. |

8

Table of Contents

Index to Financial Statements

Our Business Strategies

We intend to achieve our primary business objectives through the following business strategies:

| • | Focus on our mission of perfecting operational execution in the oilfield. We are a solutions-driven organization with a focus on maximizing returns and maintaining a low-cost operating model by leveraging our technology capabilities in chemistry, equipment design and reservoir engineering. We believe we have established a unique and proven management system for achieving optimal operational execution in the oilfield, which is based on the following organizational principles: |

| • | Repeatable execution. Our management systems have been designed to drive industry leading environmental, health and safety (“EH&S”) and quality standards. Our management systems also comply with API Q2 standards and are supported by our internally developed cloud-based reporting platform, which provides timely critical information to our operations and our clients. Our management team emphasizes our foundational focus on reliability, and we have established training and operational control procedures throughout the organization. We believe our organizational footprint, including training facilities and support structure, is scalable. Another aspect of our management systems includes an integrated process in which management, operations and supply chain work together to continuously synchronize our business requirements to meet our clients’ needs through sales and operations planning. Repeatable execution and focus on reliability have driven change in our organization as evidenced by improved safety and quality performance, as well as aligning all aspects of our organization to operate in an efficient, low-cost and consistent manner. |

| • | Responsible stewardship. We conduct ourselves at all times with the highest ethical standards. We respect the communities and environment in which we work, our clients and suppliers and all our stakeholders. We seek to safeguard our valuable assets through disciplined capital spending, prudent management of our balance sheet and diligent maintenance of our fleet. We also seek to maximize our returns and create efficiencies for our clients through an asset-light supply-chain and integrated sales, technical and operational workflows. We believe our physical infrastructure strategically targets key resource plays, our owned locations provide significant savings as compared to the rental cost of comparable facilities and our status as the largest North America-focused, pure-play pressure pumping service provider allows for scale and purchasing power to align key supplier strategies. In addition, we believe our centralized maintenance and asset-light distribution structure further drives efficiency, ensuring optimized returns on our investment. |

| • | Right team. We are committed to a learning culture with a focus on being an HRO. We seek to attract and retain the highest quality workforce. We have instituted a scalable infrastructure for learning and competency development. Our HRO philosophy begins with personnel who value our culture of reliability and safety, and at all levels we support their development through training programs and learning tools that make maintaining that culture and our policies and principles a continued focus within our organization. |

| • | Solutions driven. Our focus is to deliver high-quality client solutions through new technology and efficient cost-management. Our management team seeks to provide solutions tailored to the needs of our clients by focusing on our geographic footprint, the elimination of burdensome overhead costs and expenses and the implementation of proprietary engineering methods to reduce product and minimize ongoing R&M costs. We optimize the performance of our assets by incorporating data collection and analysis into our fleet operations and deployment, which provides us with continuous information on the |

9

Table of Contents

Index to Financial Statements

| performance of our assets to ensure we are providing efficient, high-quality services to our clients. These technologies result in less downtime, reduced equipment failure in demanding conditions, lower operating costs and improved safety and reliability. We believe the execution history of our personnel across multiple demand-markets, low overhead and propriety R&M model allow us to understand and respond to the needs of our clients with innovative, cost-effective and tailored solutions. Our experience and technological expertise allows us to meaningfully partner with and provide innovative solutions for our clients. For example, we have developed over 180 unique fluid systems tailored to the reservoir properties and integrated with specific job design requirements for our clients. We believe that the repeatable results we achieve deepen our relationships with our clients and allow us to grow as they expand their footprint both within and beyond their current operating regions. Additionally, we leverage our operational excellence and the knowledge we gain to win new clients and grow our operational footprint. |

| • | Deploying additional hydraulic fracturing horsepower. We expect to see a continued increase in demand for our hydraulic fracturing services based on trends in our industry and believe that we can continue to grow our base of operating assets by upgrading and redeploying our fleets. The average age of our frac pumps is 6.3 years; however, due to past strategic events which resulted in low utilization, our average engine run time is approximately 9,900 hours, or the equivalent of approximately 2.75 years of average engine run time as of December 31, 2016, based on an assumed 3,600 hours of engine run time per year for a fleet deployed on continuous operations, since manufacturing. As a result, we believe that these assets have significant remaining operational life and will require only modest R&M. By leveraging our in-house refurbishment capabilities that allow us to control the timing and cost of fleet redeployment, we also believe that all 43 of our hydraulic fracturing fleets can be effectively reactivated, upgraded with our proprietary modifications and redeployed for a cost of approximately $197.0 million, or approximately $4.6 million per hydraulic fracturing fleet, based on the average cost of reactivating and upgrading the 16 hydraulic fracturing fleets we have reactivated since December 31, 2016 and our knowledge of the costs required to activate the remaining fleets. Based on our experience with recent redeployments, the quality of our equipment and discussions with our clients, we expect to increase our operating fleet count from 22 fleets to 31 operating fleets, comprising approximately 1.6 million operating HHP, by December 2017. |

| • | Increasing our operating cementers. Drilling rig efficiency, combined with longer laterals and “monobore” well designs, are drastically increasing the demand for efficient cementing solutions. We believe we are strategically positioned to provide these solutions by utilizing our high horsepower cement pumps and proprietary spacer and cement additive technology that reduces equipment needs and allows for more efficient operations on longer, higher volume jobs. As of June 30, 2017, we had 110 of our 241 cementers operating in the field across all major North American resource plays and expect to redeploy cementers from our inventory to meet growing demand from our clients. Our cementing fleet, comprised primarily of Falcon cementers, which, based on our operating experience, we believe are among the most reliable cementing pump systems in the industry, has been upgraded to incorporate the significant improvements in available technology in recent years, and we believe these cementers can be fully upgraded and redeployed at an estimated cost of approximately $25.0 million or approximately $150,000 per cementer. |

| • | Maintaining a prudent balance sheet while focusing on profitable operations. We carefully manage our liquidity by continuously monitoring cash flow, capital spending and debt capacity with a focus on profitability and related returns to evaluate our performance. Maintaining our |

10

Table of Contents

Index to Financial Statements

| financial strength and flexibility provides us with the ability to execute our strategy through commodity price cycles. We intend to maintain a conservative approach to managing our balance sheet to preserve operational and strategic flexibility. At June 30, 2017, we had $68.1 million in cash and cash equivalents on hand and ample liquidity, providing us with the means to fund deployment of fleets and cementers and grow our operations. We also expect to join the existing $400.0 million ABL credit facility as a co-borrower in connection with the completion of this offering. As of June 30, 2017, there was a $50.0 million balance outstanding under the ABL credit facility. |

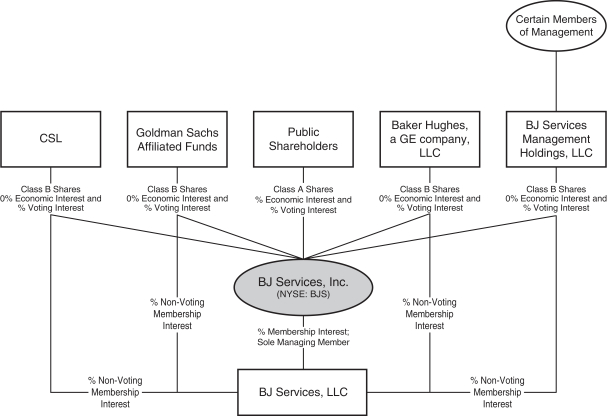

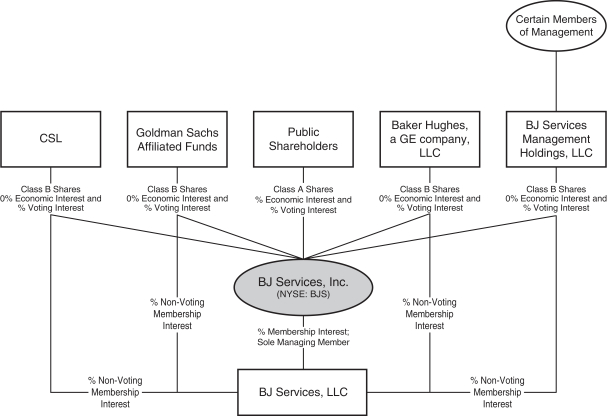

Our Sponsors and Existing Owners

Upon completion of this offering, the Existing Owners will initially own shares of Class A common stock, par value $0.001 per share, of the Company (“Class A shares”), representing approximately % of the voting power of BJ Services, Inc., units representing membership interests in BJ Services, LLC (“BJS LLC” and such units, the “LLC Units”) and shares of Class B common stock, par value $0.001 per share, of the Company (“Class B shares”), representing approximately % of the voting power of BJ Services, Inc. For more information on our reorganization and the ownership of our common stock by our principal shareholders, see “Corporate Reorganization” and “Principal Shareholders.”

CSL is an SEC-registered investment firm founded in early 2008 and headquartered in Houston that invests in energy services companies and entrepreneurs with a focus on oilfield services opportunities. Since its inception, CSL has raised in excess of $1.4 billion in equity capital and commitments across various investment vehicles, including startups, growth equity, recapitalizations and restructurings in energy services, consumables and equipment. Selected current and prior platform investments of CSL include Independence Oilfield Chemicals, a fracturing chemicals and solutions provider, Pyramax Ceramics, a ceramic proppant manufacturer, Mission Well Services, an Eagle Ford-focused fracturing company, and Ranger Energy Services, a production and completion services provider of high specification service rigs.

Founded in 1869, The Goldman Sachs Group, Inc., is a leading global investment banking, securities and investment management firm. Goldman Sachs’ Merchant Banking Division (“MBD”) is the primary center for the firm’s long-term principal investing activity. With nine offices across seven countries, MBD is one of the leading private capital investors in the world with equity and credit investments across corporate, real estate and infrastructure strategies. Since 1986, the group has invested over $170 billion of levered capital across a number of geographies, industries and transaction types.

Baker Hughes, a GE company, LLC (“BHGE”) is the world’s first and only fullstream provider of integrated oilfield products, services and digital solutions. BHGE’s employees today work in more than 120 countries.

Management Holdings is an entity owned and controlled by certain members of our management team and the entity through which such members hold their membership interests in BJS LLC. Management Holdings was formed in 2017.

BJS LLC is a privately owned company and a provider of hydraulic fracturing and cementing services in the oil and natural gas industry. BJS LLC was created in late 2016 pursuant to a Contribution Agreement (the “Contribution Agreement”) entered into among BJS LLC, BHOO, a wholly

11

Table of Contents

Index to Financial Statements

owned subsidiary of BHGE, Allied Completions Holdings and the Joint Venture. Under the terms of the Contribution Agreement, BHOO contributed to BJS LLC its hydraulic fracturing and cementing services in North America, including personnel, expertise, technology and infrastructure. Allied Completions Holdings contributed to BJS LLC cash and its pressure pumping business in the United States, including hydraulic fracturing and cementing services and other assets. Through the Joint Venture, CSL and Goldman Sachs Affiliated Funds contributed cash to BJS LLC in the amount of $325.0 million, of which $175.0 million was retained by BJS LLC and the remaining $150.0 million was paid to BHOO. Our Sponsors currently own approximately 53% of our company, and BHOO owns the remaining interest. Following the completion of this offering, CSL will own approximately % of our company, Goldman Sachs Affiliated Funds will own approximately % of our company, BHOO will own approximately % of our company and Management Holdings will own the remaining interest.

Corporate Reorganization

BJ Services, Inc. was incorporated by the Joint Venture as a Delaware corporation in March 2017. Following this offering and the transactions described below, BJ Services, Inc. will be a holding company whose sole material asset will consist of a membership interest in BJ Services, LLC (“BJS LLC”). BJS LLC owns, directly or indirectly, all of the outstanding equity interests in the operating subsidiaries through which we operate our assets. After the consummation of the transactions described below, BJ Services, Inc. will be the sole managing member of BJS LLC and will be responsible for all operational, management and administrative decisions relating to BJS LLC’s business and will consolidate the financial results of BJS LLC and its subsidiaries.

In connection with this offering, (a) all of the membership interests in BJS LLC held by the Existing Owners will be converted into a single class of units in BJS LLC (“LLC Units”) using an implied equity valuation for BJS LLC prior to the offering based on the initial public offering price for our Class A shares set forth on the cover page of this prospectus and the current relative levels of ownership in BJS LLC, (b) BJ Services, Inc. will contribute all of the net proceeds we receive from this offering to BJS LLC in exchange for LLC Units and (c) the Existing Owners (in their capacity as holders of LLC Units following this offering, the “LLC Unit Holders”) will purchase for par value a number of Class B shares equal to the number of LLC Units held by such Existing Owners following this offering. After giving effect to these transactions and the offering contemplated by this prospectus, BJ Services, Inc. will own an approximate % interest in BJS LLC (or % if the underwriters’ option to purchase additional Class A shares is exercised in full) and the Existing Owners will own an approximate % interest in BJS LLC (or % if the underwriters’ option to purchase additional Class A shares is exercised in full). Please see “Principal Shareholders.”

Each Class B share has no economic rights but entitles its holder to one vote on all matters to be voted on by shareholders generally. Holders of Class A shares and Class B shares will vote together as a single class on all matters presented to our shareholders for their vote or approval, except as otherwise required by applicable law or by our certificate of incorporation. We do not intend to list Class B shares on any stock exchange.

The Existing Owners will have the right to require BJS LLC to redeem (the “Redemption Right”) all or a portion of their LLC Units (together with a corresponding number of Class B shares) for Class A shares (or cash at our or BJS LLC’s election (the “Cash Option”)) on a one-for-one basis, as described under “Certain Relationships and Related Party Transactions—BJS LLC Agreement.” In addition, each of our Sponsors and BHGE will have the right, under certain circumstances, to cause us to register the offer and resale of their respective Class A shares as described under “Certain Relationships and Related Party Transactions—Registration Rights Agreement.”

12

Table of Contents

Index to Financial Statements

We will enter into a tax receivable agreement (the “Tax Receivable Agreement”) with BJS LLC and the Existing Owners. This agreement generally provides for the payment by us to an Existing Owner of 85% of the amount of tax benefits, if any, that we actually realize (or are deemed to realize in certain circumstances) in periods after this offering as a result of (a) increases in tax basis resulting from any redemptions of LLC Units described below under “—Redemption rights of holders of LLC Units” or in connection with this offering and (b) certain other tax benefits related to our entering into the Tax Receivable Agreement, including tax benefits attributable to payments under the Tax Receivable Agreement. BJ Services, Inc. will retain the benefit of the remaining 15% of these cash savings. We will be dependent on distributions from BJS LLC to make these payments under the Tax Receivable Agreement, and neither the timing nor the amount of any such distributions can be guaranteed. Payments under the Tax Receivable Agreement are not conditioned upon the Existing Owners maintaining a continued ownership interest in BJS LLC or us and, in the event that the Tax Receivable Agreement is not terminated, the payments under the Tax Receivable Agreement are anticipated to commence in the year following the first year that the Existing Owners redeem their units in a secondary offering and to continue for 15 years after the date of the last redemption or exchange of the LLC Units. See “Certain Relationships and Related Party Transactions—Tax Receivable Agreement.”

The following diagram indicates our simplified ownership structure immediately following this offering and the transactions related thereto (assuming that the underwriters’ option to purchase additional shares is not exercised):

13

Table of Contents

Index to Financial Statements

Controlled Company Status

Because the Existing Owners, together with their affiliates, will initially own LLC Units and shares of Class B common stock, representing approximately % of the voting power of the Company following the completion of this offering, we expect to be a controlled company as of the completion of the offering under Sarbanes-Oxley and NYSE corporate governance standards. A controlled company does not need its board of directors to have a majority of independent directors or to have an independent compensation or nominating and corporate governance committee comprised entirely of independent directors. As a controlled company, we will remain subject to listing rules of the NYSE that require us to have an audit committee composed entirely of independent directors. Under these rules, we must have at least one independent director on our audit committee by the date our Class A common stock is listed on the NYSE, at least two independent directors on our audit committee within 90 days of the listing date and at least three independent directors on our audit committee within one year of the listing date. We expect to have independent directors upon the closing of this offering.

If at any time we cease to be a controlled company, we will take all action necessary to comply with Sarbanes-Oxley and the listing rules of the NYSE, including by appointing a majority of independent directors to our Board of Directors and ensuring we have a compensation committee and a nominating and corporate governance committee, each composed entirely of independent directors, subject to a permitted “phase-in” period.

Risk Factors

Investing in our Class A shares involves risks. You should carefully read the section of this prospectus entitled “Risk Factors” beginning on page 22 and the other information in this prospectus for an explanation of these risks before investing in our Class A shares.

Principal Executive Offices and Internet Address

Our principal executive offices are located at 11211 FM 2920, Tomball, Texas, 77375, and our telephone number is (281) 408-2361. Following the closing of this offering, our website will be located at http://www.bjservices.com. We expect to make our periodic reports and other information filed with or furnished to the Securities and Exchange Commission (the “SEC”) available, free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus.

Our Emerging Growth Company Status

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we may, for up to five years, take advantage of specified exemptions from reporting and other regulatory requirements that are otherwise applicable generally to public companies. These exemptions include:

| • | the presentation of only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in this prospectus; |

14

Table of Contents

Index to Financial Statements

| • | deferral of the auditor attestation requirement on the effectiveness of our system of internal control over financial reporting; |

| • | exemption from the adoption of new or revised financial accounting standards until they would apply to private companies; |

| • | exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; and |

| • | reduced disclosure about executive compensation arrangements. |

We may take advantage of these provisions until we are no longer an emerging growth company, which will occur on the earliest of (i) the last day of the fiscal year following the fifth anniversary of this offering, (ii) the last day of the fiscal year in which we have more than $1.07 billion in annual revenue, (iii) the date on which we issue more than $1.07 billion of non-convertible debt over a three-year period and (iv) the date on which we are deemed to be a “large accelerated filer,” as defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

We have elected to take advantage of the applicable JOBS Act provisions, including the exemption that allows emerging growth companies to extend the transition period for complying with new or revised financial accounting standards. Accordingly, the information that we provide you may be different than what you may receive from other public companies in which you hold equity interests.

15

Table of Contents

Index to Financial Statements

| Issuer |

BJ Services, Inc. | |

| Class A shares offered by us |

Class A shares. | |

| Class A shares outstanding after this offering |

Class A shares (or Class A shares, if the underwriters exercise in full their option to purchase additional Class A shares). | |

| Option to purchase additional Class A shares |

We have granted the underwriters a 30-day option to purchase up to an aggregate of additional Class A shares. | |

| Class B shares outstanding after this offering |

Class B shares, or one Class B share for each LLC Unit held by the Existing Owners immediately following this offering. Class B shares are non-economic. When an LLC Unit is exchanged for a Class A share, a corresponding Class B share will be cancelled. | |

| Voting power of Class A shares after this offering |

% (or 100% if all outstanding LLC Units are exchanged by the Existing Owners, along with a corresponding number of our Class B shares, for newly-issued shares of Class A shares on a one-for-one basis). | |

| Voting power of Class B shares after this offering |

% (or 0% if all outstanding LLC Units are exchanged by the Existing Owners, along with a corresponding number of our Class B shares, for newly-issued shares of Class A shares on a one-for-one basis). | |

| Voting rights |

Each of our Class A shares entitles its holder to one vote on all matters to be voted on by shareholders generally. Each of our Class B shares entitles its holder to one vote on all matters to be voted on by shareholders generally. Holders of our Class A shares and Class B shares vote together as a single class on all matters presented to our shareholders for their vote or approval, except as otherwise required by applicable law or by our certificate of incorporation. See “Description of Capital Stock.” | |

| Use of proceeds |

We expect to receive approximately $ million of net proceeds from this offering (or $ million if the underwriters exercise in full their option to purchase additional Class A shares), based upon the assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus), after deducting underwriting | |

16

Table of Contents

Index to Financial Statements

| discounts and estimated offering expenses payable by us. | ||

| We intend to contribute all of the net proceeds we receive from this offering to BJS LLC, and we expect BJS LLC to use: approximately $ million of the proceeds for expanding its fleet, improving the reliability of its fleet by performing upgrades to extend component life, investing in facility improvements to optimize its fleet refurbishment program; approximately $ million of the proceeds for performing additional research and development; and the remainder of the proceeds for other general corporate purposes, including to repay borrowings outstanding under our ABL credit facility from time to time. Please read “Use of Proceeds.” | ||

| Dividend policy |

We do not anticipate paying any cash dividends on our Class A shares. In addition, our ABL credit facility places certain restrictions on our ability to pay cash dividends. Please read “Dividend Policy.” | |

| Redemption rights of holders of LLC Units |

The Existing Owners may from time to time at each of their options require BJS LLC to redeem all or a portion of their LLC Units in exchange for, at our election, newly-issued Class A shares on a one-for-one basis or, at our or BJS LLC’s option, the Cash Option; provided that, at our election, we may effect a direct exchange of such Class A shares or such cash, as applicable, for such LLC Units. The Existing Owners may exercise such Redemption Right for as long as their LLC Units remain outstanding. See “Certain Relationships and Related Party Transactions—BJS LLC Agreement.” Simultaneously with the payment of cash or Class A shares, as applicable, in connection with a redemption or exchange of LLC Units pursuant to the terms of the BJS LLC Agreement, a number of shares of our Class B shares registered in the name of the redeeming or exchanging Existing Owner will be cancelled for no consideration on a one-for-one basis with the number of LLC Units so redeemed or exchanged. | |

| Tax receivable agreement |

We will enter into a Tax Receivable Agreement with BJS LLC and the Existing Owners. This agreement generally provides for the payment by us to an Existing Owner of 85% of the amount of tax benefits, if any, that we actually realize (or are deemed to realize in certain circumstances) in periods after this offering as a result of (i) increases in tax basis resulting from any | |

17

Table of Contents

Index to Financial Statements

| redemptions of LLC Units described above under “—Redemption rights of holders of LLC Units” or in connection with this offering and (ii) certain | ||

| other tax benefits related to our entering into the Tax Receivable Agreement, including tax benefits attributable to payments under the Tax Receivable Agreement. BJ Services Company Inc. will retain the benefit of the remaining 15% of these cash savings. See “Certain Relationships and Related Party Transactions—Tax Receivable Agreement.” | ||

| Directed share program |

At our request, the underwriters have reserved up to % of the Class A shares being offered by this prospectus for sale, at the initial public offering price, to our directors, executive officers and employees. The sales will be made by the underwriters through a directed share program. We do not know if these persons will choose to purchase all or any portion of these reserved Class A shares, but any purchases they do make will reduce the number of Class A shares available to the general public. Please read “Underwriting—Directed Share Program.” | |

| Risk factors |

You should carefully read and consider the information set forth under the heading “Risk Factors” and all other information set forth in this prospectus before deciding to invest in our Class A shares. | |

| Listing and trading symbol |

We have applied to list our Class A shares on the New York Stock Exchange under the symbol “BJS.” | |

18

Table of Contents

Index to Financial Statements

SUMMARY HISTORICAL CONSOLIDATED AND PRO FORMA FINANCIAL DATA

The following table presents summary historical consolidated financial data of BJS LLC and our Predecessor as of the dates and for the periods indicated. Our Predecessor refers to (i) ALTCem from ALTCem’s inception on January 27, 2015 until the acquisition of Allied Oil and Gas, (ii) ALTCem and Allied OFS on a combined basis from the acquisition of Allied Oil and Gas until the Allied Asset Acquisition and (iii) ALTCem, Allied OFS and the assets acquired in connection with the Allied Asset Acquisition on a combined basis following the completion of the Allied Asset Acquisition. We conduct our business through two operating segments: hydraulic fracturing and cementing.

The summary historical consolidated financial data of BJS LLC presented in the following table for the three months ended March 31, 2017 and 2016 are derived from the unaudited condensed consolidated financial statements appearing elsewhere in this prospectus. The summary historical consolidated financial data of the Predecessor at December 31, 2016 and 2015 and for the year ended December 31, 2016 and the period from January 27, 2015 (Date of Inception) to December 31, 2015 are derived from the audited financial statements appearing elsewhere in this prospectus. The summary historical consolidated financial data presented below should be read in conjunction with “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes and other financial data included elsewhere in this prospectus.

The summary unaudited condensed pro forma financial data presented in the following table for the three months ended March 31, 2017 and the year ended December 31, 2016 are derived from the unaudited pro forma condensed financial statements included elsewhere in this prospectus. The summary unaudited pro forma condensed balance sheets as of March 31, 2017 assume the offering and the transactions described below occurred as of March 31, 2017 and the unaudited pro forma condensed statements of operations for the three months ended March 31, 2017, and the year ended December 31, 2016 assume the offering and the transactions described below occurred as of January 1, 2016. These transactions include, and the unaudited pro forma condensed financial statements give effect to, the following:

| • | with respect to the year ended December 31, 2016, our acquisition of Allied Oil and Gas; |

| • | with respect to the year ended December 31, 2016, the contribution by BHGE of its North American hydraulic fracturing and land cementing businesses to us; |

| • | the consummation of this offering and the completion of the transactions described under “—Corporate Reorganization”; and |

| • | the application of the net proceeds of this offering as described in “Use of Proceeds.” |

The following table also presents summary historical financial information of Allied Oil and Gas and Baker Hughes’s North American Pressure Pumping business (“BH N.A. PP”), two significant acquisitions that were completed during the year ended December 31, 2016 for the periods indicated. The summary historical financial information of Allied Oil and Gas for the period from January 1, 2016 to April 28, 2016 and for the years ended December 31, 2015 and 2014 have been derived from the historical financial statements included elsewhere in this prospectus, except for certain balance sheet data, which was derived from Allied Oil and Gas’ accounting records. The summary audited historical financial information of BH N.A. PP for the period from January 1, 2016 through December 30, 2016, and for the years ended December 31, 2015 and 2014 have been derived from the audited condensed abbreviated financial statements included elsewhere in this prospectus.

19

Table of Contents

Index to Financial Statements

| BH N.A. PP | Allied Oil and Gas | Predecessor | BJS LLC | Pro Forma | ||||||||||||||||||||||||||||||||||||||||||||

| (in millions, |

Years ended December 31, |

Period from January 1, 2016 to December 30, 2016 |

Years ended December 31, |

Period from January 1, 2016 to April 28, 2016 |

Period from January 27, 2015 (Date of Inception) to December 31, 2015 |

Year ended December 31, 2016 |

Three months ended March 31, |

Year ended December 31, 2016 |

Three months ended March 31, 2017 |

|||||||||||||||||||||||||||||||||||||||

| 2014 | 2015 | 2014 | 2015 | 2016 | 2017 | |||||||||||||||||||||||||||||||||||||||||||

| Statements of Operations Data: |

||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue |

$ | 4,296.1 | $ | 1,272.0 | $ | 231.0 | $ | 132.6 | $ | 52.7 | $ | 9.2 | $ | 1.2 | $ | 37.0 | $ | 1.0 | $ | 180.1 | ||||||||||||||||||||||||||||

| Revenues in Excess (Deficit) of Direct Operating expenses |

187.3 | (636.8 | ) | (283.9 | ) | N/A | N/A | N/A | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||||||||||||||

| Operating income (loss) |

N/A | N/A | N/A | 13.5 | (86.7 | )(a) | (9.6 | )(a) | (3.9 | ) | (2.0 | )(b) | (1.3 | ) | (64.4 | ) | ||||||||||||||||||||||||||||||||

| Net income (loss) |

N/A | N/A | N/A | 9.7 | (91.3 | ) | (11.1 | ) | (3.9 | ) | (2.3 | ) | (1.3 | ) | (63.4 | ) | ||||||||||||||||||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||||||||||||||||||||||||||

| Capital expenditures |

N/A | N/A | N/A | 32.8 | 0.8 | — | 10.4 | 90.5 | (c) | — | 42.6 | |||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA |

505.2 | (d) | (355.1 | )(d) | (220.8 | )(d) | 25.9 | (4.0 | ) | (7.4 | ) | (3.4 | ) | (20.0 | ) | (1.0 | ) | (30.9 | ) | |||||||||||||||||||||||||||||

| Per Share / Unit Data: |

||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss per share: |

||||||||||||||||||||||||||||||||||||||||||||||||