Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CMTSU Liquidation, Inc. | form8-kxmormay.htm |

Page I of 14

UNITED STATES BANKRUPTCY COURT

DISTRICT OF DELAWARE

In re: CIDER, Loe., cl aL

Debtor

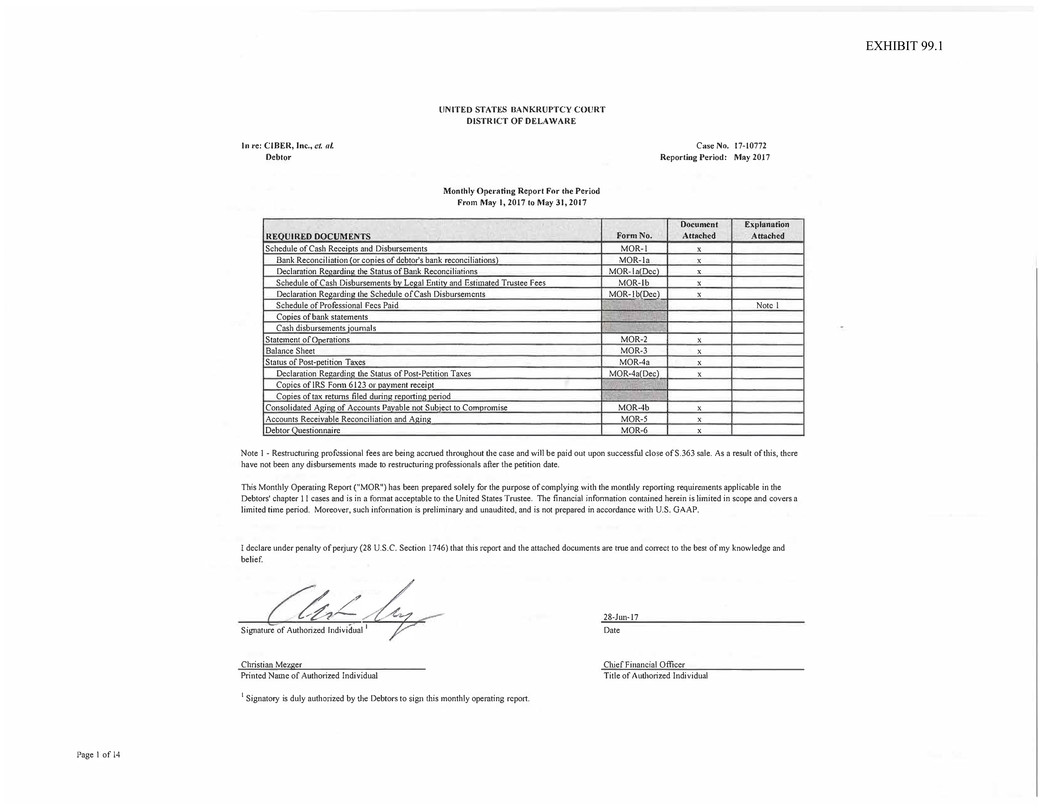

REQUCRED DOCUMENTS

Schedule of Cash Receiots and Disbursements

Monthly O(l<rating Report For the Period

From May I, 2017 to May 31, 2017

Bank Reconciliation /or conies of debtor's bank reconciliations)

Declaration Re11ardimz the Status of Bank Reconciliations

Schedule of Cash Disbursements bv Leo.al Entitv and Estimated Trustee Fees

Declaration Regardino. the Schedule of Cash Disbursements

Schedule of Professional Fees Paid

Cooies of bank statements

Cash disbursements journals

Statement ofOnerations

Balance Sheet

Starus of Post-oetition Taxes

Declaration Renardina the Status of Post-Petition Taxes

Cooies of IRS Fonn 6123 or oavment reee.iot

Cooies of tax rerums filed durina reoortino. oeriod

Consolidated Amna of Accounts Pavable not Subiect to Comoromise

Accounts Receivable Reconciliation and Allin2

Debtor Ouestionnaire

Form No.

MOR-I

MOR- la

MOR-lnlnec\

MOR-lb

Case No. 17-10772

Reporting Period: May 2017

Document Explanation

Attached Attached

X

X

X

X

MOR- lb(Dee) X

Note I

MOR-2 X

MOR-3 X

MOR-4a X

MOR-4a(Dec) X

MOR-4b X

MOR-5 X

MOR-6 X

Note I - Restructuring professional fees are being accrued throughout the case and will be paid out upon successful close ofS.363 sale. As a result oftl1is, tl1cre

have not been any disbursements made to restrucruring professionals after the petition date.

This Monthly Operating Report ("MOR") has been prepared solely for the purpose of complying with the montl1Jy reporting requirements applicable in the

Debtors' chapter 11 cases and is in a fonnat acceptable to the United States Trustee. The financial infonnation contained herein is Limited in scope and covers a

limited time period. Moreover, such infonnation is preliminary and unaudited, and is not prepared in accordance with U.S. GAAP.

I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and

belief.

4L 28-Jwi-17

Signarure of Authorized Individual

1 Date

Christian Mez.s.er Chief Financial Officer

Printed Name of Authorized Individual Title of Authorized Individual

1 Signatory is duly authorized by the Debtors to sign tliis monthly operating report.

EXHIBIT 99.1

Page 2 of 14

In re: CIBER, Inc., et. al.

Debtor

Debtor-hr-Possession Financial Statements

UNlTED STATES BANKRUPTCY COURT

D!STRJCT OF DELA WARE

General Notes

Case No. 17-10772

Reporting Period: May 2017

The financial statements and supplemental information contained herein are unaudited, preliminary, and may not comply with generally accepted accounting

principles in the United States of America ("U.S. GAAP") in all material respects.

Financial Accounting Standards Board Accountiog Standards Codification 852, (Reorganizations)(" ASC 852"), which is applicable to companies in chapter 11,

requires that financial statements for periods after the filing of a chapter 11 petition distinguish transactions and events that are directly associated with the

reorganization from the ongoing operations of the business. The financial statements have been prepared in accordance with ASC 852. The unaudited financial

statements have been derived from the books and records of the Debtors. This information, however, has not been subject to procedures that would typically be

applied to financial infonnation presented in accordance with U.S. GAAP, and upon application of such procedures, the Debtors believe that the financial

information could be subject to changes, and these changes could be material. The infonnation furnished in this report includes preliminary normal recurring

adjustments.

The results ofoperations contained herein are not necessarily indicative ofresults which may be expected from any other period or for the full year and may not

necessarily reflect the results of operations, financial position and cash flows of the Debtors in the future.

The information contained herein is provided to fulfill the requirements of the Office of the United States Trustee.

lntercompany Transactions

lntercornpany transactions between the Debtors and between the Debtors and non-Debtor affiliates have not been eliminated in the financial statements contained

herein. No conclusion as to the legal obligation related to these intercompany transactions is made by the presentation herein.

Liabilities Subject to Compromise

As a result of the chapter ll filings, the payment of prepetition indebtedness is subject to compromise or other treatment under a plan of reorganization. The

detennination of how liabilities will ultimately be serried or treated cannot be made until the Bankruptcy Court approves a chapter 11 plan ofreorganization.

Accordingly, the ultimate amountofsuch liabilities is not determinable at th is time. ASC 852 requires prepetition liabilities that are subject to compromise tobe

reported at the amounts expected to be allowed as claims, even if they may be settled for lesseramounts. The amounts currently classified as liabilities subject to

compromise are preliminary and may be subject to future adjustments depending on Court actions, further developments with respect to disputed claims,

determinations of the secured status of certain claims, the values of any collateral securing such claims, rejection of executory contracts, continued reconciliation

or other events.

Reorganization Items

ASC 852 requires expenses and income directly associated with the chapter 11 filings to be reported separately in the income statement as reorganization items.

Reorganization items includes expenses related to legal advisory and representation services, other professional consulting and advisory services, debtor-in

possession financing fees and changes in liabilities subject to compromise recognized as there are changes in amounts expected to be allowed as claims.

Page 3 of 14

In re: CIBER, Inc., et. al.

Debtor

Beginning cash balance· Note 1

Total cash receipts

Total cash disbursements

Debtors' net cash flow

From - Non-Debtors

(To) - Non-Debtors

Net cash flow

Borrow/(Pay-Down) - Wells Fargo Facility

Other

Ending cash balance (2)

Notes

MOR-I: Schedule of Cash Receipts and Disbursements

For the 1icriod 05101 through 05/31

(US Dollars in Thousands)

Case No. 17-10772

Reporting Period: May 2017

Period from May 01, 2017 -

MayJl,2017

3,099

27,261

(29,470)

(2,209)

107

(2,307)

(4,409)

8,041

16

6,747

(1) April MOR showed receipts and disbursements on an accrual basis utilizing beginning and ending cash per the book balance as opposed to the bank balance. As

cash basis is more appropriate, below is a reconciliation to bridge from April MOR ending balance to May MOR beginning balance.

Beginning Cash Balance Reconciliation:

Ending Book Cash Balance April (per GL)

Reconciling Items - GL

Reconciling Items - Bank

Ending Bank Cash Balance April (per Bank Statements)

3,141,786

(744,258)

701.476

3,099,004

(2) Sec below for a reconciliation from the ending cash bank balance (agrees to bank statements) to the ending cash book balance (agrees to the GL and Balance Sheet)

Ending Cash Balance Reconciliation:

Ending Bank Cash Balance May (per Bank Statements)

Reconciling Items· GL

Reconciling Items - Bank

Ending Book Cash Balance May (per GL)

6,747,469

44,196

(273, IJS)

6,518,549

In re: CJBER, Inc., et. al.

Debtor

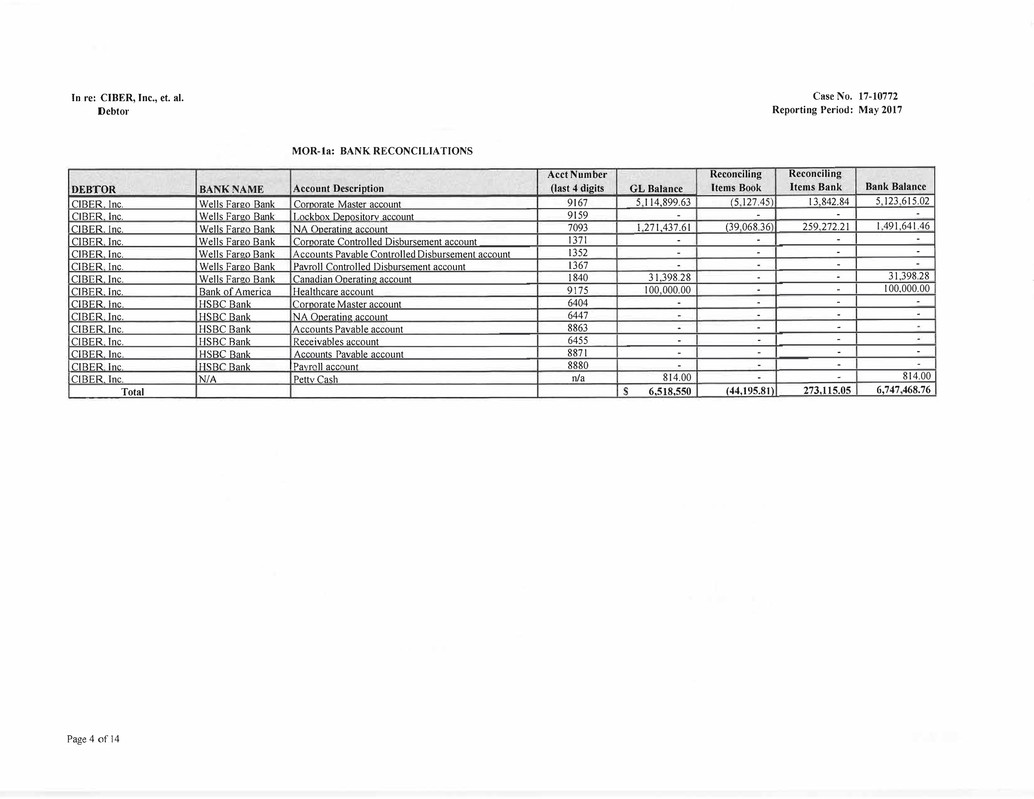

MOR-la: BANKRECONCILIATIONS

Acct Number

DEBTOR BANK NAME Account Description (last 4 digits

CIBER Inc. Wells Fawo Bank Cornorate Master account 9167

CJBER Inc. Wells Far"o Bank Lockbox Denositorv account 9159

CJBER Inc. Wells FarPo Bank NA nnpratine account 7093

CIBER Inc. Wells Fawo Bank Cornorate Controlled Disbursement account 1371

CIBER Inc. Wells FarPO Bank Accounts Pavable Controlled Disbursement account 1352

CIBER Inc. Wells Fawo Bank Pavroll Controlled Disbursement account 1367

CIBER Inc. Wells FarPo Bank Canadian Ooeratine account 1840

CJBER Inc. Bank of America Healthcare account 9175

CIBER Inc. HSBC Bank <:ornorate Master account 6404

CIBER Inc. HSBC Bank NA Oneratine account 6447

CJBER Inc. HSBC Bank Accounts Pavable account 8863

CIBER Inc. HSBC Bank Rece.ivables account 6455

CIBER Inc. mmc Bank Accounts Pavable account 8871

ICIBER Inc. I--J<::Br Bank I Pa"r" II acc,nunt 8880

CIBER Tnc. NIA Pettv Cash n/a

Total $

Page 4 of 14

GLBalance

5 114,899.63

-

I 271,437.61

-

-

-

31 398.28

100 000.00

-

-

-

-

-

-

814.00

6,518,550

Reconciling

Items Book

(5 127.45

-

(39 068.36

-

-

-

-

-

-

-

-

-

-

-

-

Case No. 17-10772

Reporting Period: May 2017

Reconciling

Items Bank Bank Balance

13 842.84 5 123 615.02

- -

259 272.21 1 491-641.46

- -

- -

- -

- 31,398.28

- 100,000.00

- -

- -

-

-

- -

- -

- 814.00

(44,195.81) 273115.05 6.747 468.76

Page 5 of 14

In re: CIBER, Inc., et. al.

Debtor

Case No. 17-10772

Reporting Period: May 2017

MOR 1 a(Dec): DECLARATION REGARDING THE STATUS OF BANK RECONCILIATIONS OF THE DEBTORS

Christian Mezger hereby declares under penalty of perjury:

I. I am the chief financial officer of Ciber, Inc. In that capacity I am familiar with the above-captioned debtors and

debtors-in-possession (collectively the "Debtors") day-to-day operations, business affairs and books and records. I

am authorized to submit this Declaration on behalf of the Debtors.

2. All statements in the Declaration are based on my personal knowledge, my review of the relevant documents, my

discussions with other employees of the Debtors, or my opinion based upon my experience and knowledge of the

Debtors' operations and financial condition. Ifl were called upon to testify, I could and would testify to each of the

facts set forth herein based on such personal knowledge, review of documents, discussions with other employees of

the Debtors or opinion.

3. To the best of my knowledge, all of the Debtors' bank balances as of May 31, 2017 have been reconciled in an

accurate and timely manner.

Dated: June 28, 2017 Respectfully submitted,

�/�.

By: Christian Mezger

Title: Chief Financial Officer

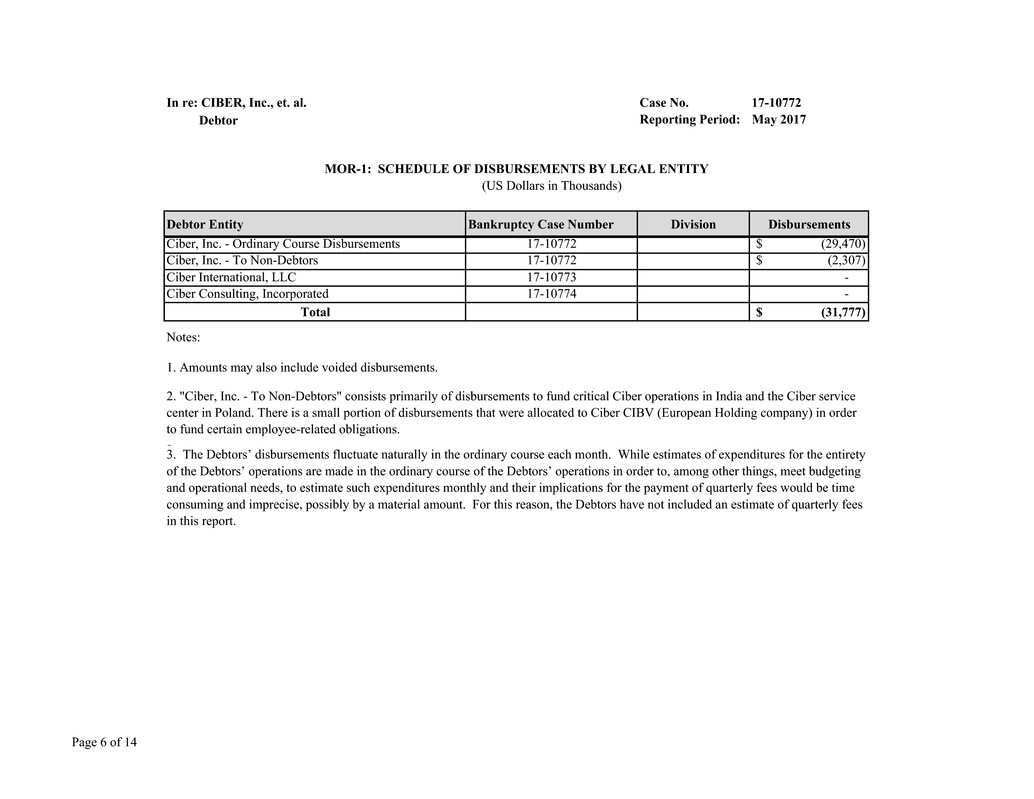

In re: CIBER, Inc., et. al. Case No. 17-10772

Debtor Reporting Period: May 2017

(US Dollars in Thousands)

Debtor Entity Bankruptcy Case Number Division Disbursements

Ciber, Inc. - Ordinary Course Disbursements 17-10772 (29,470)$

Ciber, Inc. - To Non-Debtors 17-10772 (2,307)$

Ciber International, LLC 17-10773 -

Ciber Consulting, Incorporated 17-10774 -

Total (31,777)$

Notes:

a

1. Amounts may also include voided disbursements.

MOR-1: SCHEDULE OF DISBURSEMENTS BY LEGAL ENTITY

3. The Debtors’ disbursements fluctuate naturally in the ordinary course each month. While estimates of expenditures for the entirety

of the Debtors’ operations are made in the ordinary course of the Debtors’ operations in order to, among other things, meet budgeting

and operational needs, to estimate such expenditures monthly and their implications for the payment of quarterly fees would be time

consuming and imprecise, possibly by a material amount. For this reason, the Debtors have not included an estimate of quarterly fees

in this report.

2. "Ciber, Inc. - To Non-Debtors" consists primarily of disbursements to fund critical Ciber operations in India and the Ciber service

center in Poland. There is a small portion of disbursements that were allocated to Ciber CIBV (European Holding company) in order

to fund certain employee-related obligations.

Page 6 of 14

Page 7 of 14

In re: CIBER, Inc., et. al.

Debtor

Case No. 17-10772

Reporting Period: May 2017

MOR Jb(Dec): DECLARATION REGARDlNG THE SClfEDULE OF DISBURSEMENTS

Christian Mezger hereby declares under penalty of perjury:

I. l am the chieffinancial officer ofCiber, Inc. In that capacity I am familiar with the above-captioned debtors and

debtors-in-possession (collectively the "Debtors") day-to-day operations, business affairs and books and records. I am

authorized to submit this Declaration on behalfofthe Debtors.

2. The Debtors submit the Declaration regarding cash disbursements in lieu of providing copies of the cash

disbursements schedules.

3. All statements in the Declaration are based on my personal knowledge, my review of the relevant documents, my

discussions with other employees of the Debtors, or my opinion based upon my experience and knowledge of the

Debtors' operations and financial condition. lfl were called upon to testify, I could and would testify to each of the

facts set forth herein based on such personal knowledge, review of documents, discussions with other employees of

the Debtors or opinion. I am authorized to submit this Declaration on behalf of the Debtors.

4. The Debtors have, on a timely basis, disbursed approximately $31.8 million for postpetition amounts and prepetition

amounts payable under one or more orders entered by the Bankruptcy Court for the period of May 1, 2017 through

May 31, 2017. Copies of the cash disbursement schedules are available for inspection upon request by the Office of

the United States Trustee.

Dated: June 28, 2017 Respectfully submitted,

By Chri�0� /4L-

Title: Chief Financial Officer

Page 8 of 14

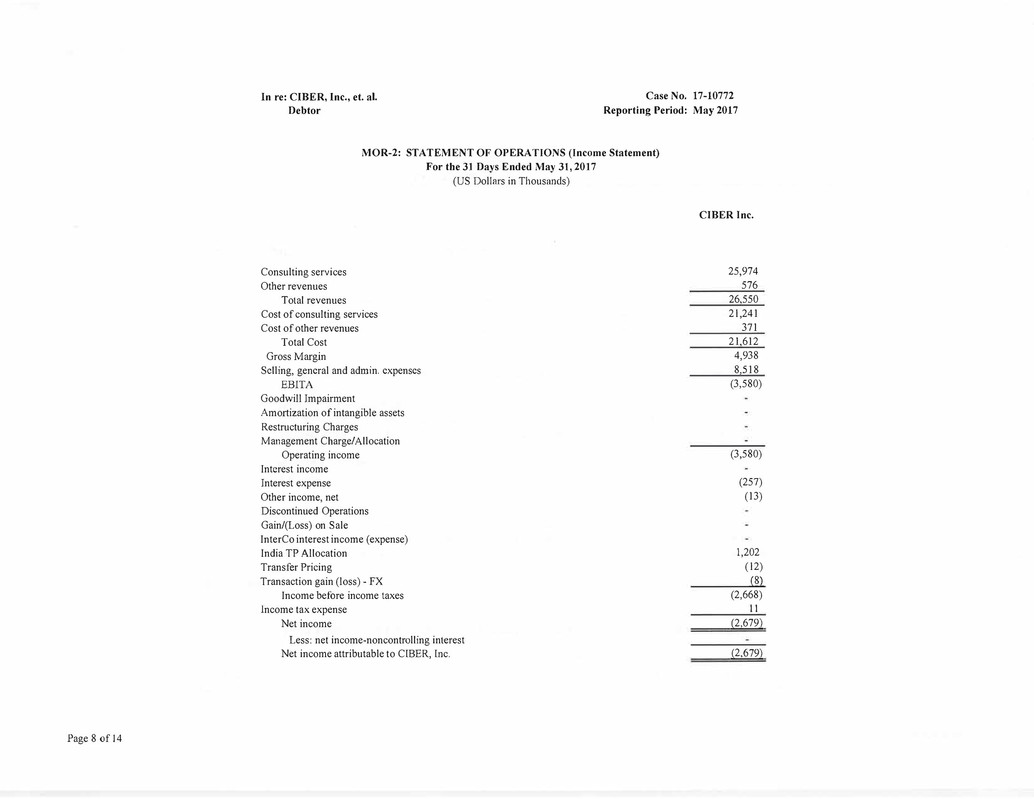

In re: CIBER, Inc., et. al. Case No. 17-10772

Debtor Reporting Period: May 2017

MOR-2: STATEMENT OF OPERATIONS (Income Statement)

For the 31 Days Ended May 31, 2017

Consulting services

Other revenues

Total revenues

Cost of consulting services

Cost of other revenues

Total Cost

Gross Margin

Selling, general and admin. expenses

EBITA

Goodwill Impairment

Amortization of intangible assets

Restructuring Charges

Management Charge/ Allocation

Operating income

Interest income

Interest expense

Other income, net

Discontinued Operations

Gain/(Loss) on Sale

InterCo interest income (expense)

India TP Allocation

Transfer Pricing

Transaction gain (loss) - FX

Income before income taxes

lncome tax expense

Net income

(US Dollars in Thousands)

Less: net income-noncontrolling interest

Net income attributable to CIBER, Inc.

CJBER Inc.

25,974

576

26,550

21,241

371

2li612

4,938

8,518

(3,580)

(3,580)

(257)

(13)

1,202

(12)

ill

(2,668)

11

(2,679)

(2,679)

Page 9 of 14

In re: CIBER, Inc., et. al.

Debtor

Assets

Current Assets

Cash

Accounts Receivable

Prepaid expenses

Other current assets

Total current assets

Net property and equipment

Goodwill

Other intangibles, net

Deferred income taxes

Other assets

Restricted Cash

Investment in NA subs

Investment in Dutch CV

Investment in India

Total assets

Liabilities and Shareholders' Equity

Current liabilities - Liabilities Subjecl To Compromise

Current liabilities - Not Subject To Compromise

Line of Credit

Lease coslS - Long Tenm

Other long term liabilities

Deferred tax liability L-T

Long-tenm debt

Total liabilities

Common stock, SO.OJ par value

Additional paid-in capital

Retained earnings

Foreign currency translation

Other - pension plan

Tax Effect - pension plan

RSU International Equity Reserve

Unrealized (loss)lgain on hedging activities

Treasury Stock

Total CIBER, Inc shareholders' equity

Noncontrolling Interest

Total Shareholders' equity

Total liabilities and shareholde(s equity

MOR-3: BALANCE SHEET

As at May 31, 2017

(US Dollars in Thousands)

CaseNo. 17-10772

Reporting Period: May 2017

ClBERlnc.

6,519

60,911

6,886

1,026

75,342

4,087

4,351

26,746

16,585

127.,_l_)_I

3,250

95,509

1,386

100,145

826

388,809

(356,134)

(6,653)

(1,307)

1,424

26,966

26,966

127,111

In re: CIBER, Inc., et. al.

Debtor

L

See attached rider at MOR - 4 Rider

Page IO of 14

MOR-4: STATUS OF POST-PETITION TAXES

Beginning

la.A. .LUIUllU.V

Amount

Withheld or

ft\;\:IUCU

Amount

.£411U

Date

.1.a1u

Case No. 17-10772

Reporting Period: May 2017

Check No.

UA .1:.1 . .1..' a

Ending

Tax

.......... .., ..... ,..

Pagellof l4

In re: CIBER, Inc., et. al.

Debtor

Case No. 17-10772

Reporting Period: May 2017

MOR 4(Dec): DECLARATION REGARDING THE STATUS OF POST-PETITION TAXES

Christian Mezger hereby declares under penalty of perjury:

1. I am the chief financial officer of Ciber, Tnc. In that capacity I am familiar with the above-captioned debtors and

debtors-in-possession (collectively the "Debtors") day-to-day operations, business affairs and books and records. I

am authorized to submit this Declaration on behalf of the Debtors.

2. All statements in the Declaration are based on my personal knowledge, my review of the relevant documents, my

discussions with other employees of the Debtors, or my opinion based upon my experience and knowledge of the

Debtors' operations and financial condition. Ifl were called upon to testify, I could and would testify to each of the

facts set forth herein based on such personal knowledge, review of documents, discussions with other employees of

the Debtors or opinion. I am authorized to submit this Declaration on behalf of the Debtors.

3. To the best of my knowledge and except as otherwise set forth in this Monthly Operating Report, all of the Debtors

have filed all necessary federal, state and local tax returns and have timely made ( or are in the process of remediating

any immaterial late filings or payments) all related required post-petition tax payments.

Dated: June 28, 20 I 7 Respectfully submitted,

acL��

By: Christian Mezger

Title: ChiefFinancial Officer

Page 12 of 14

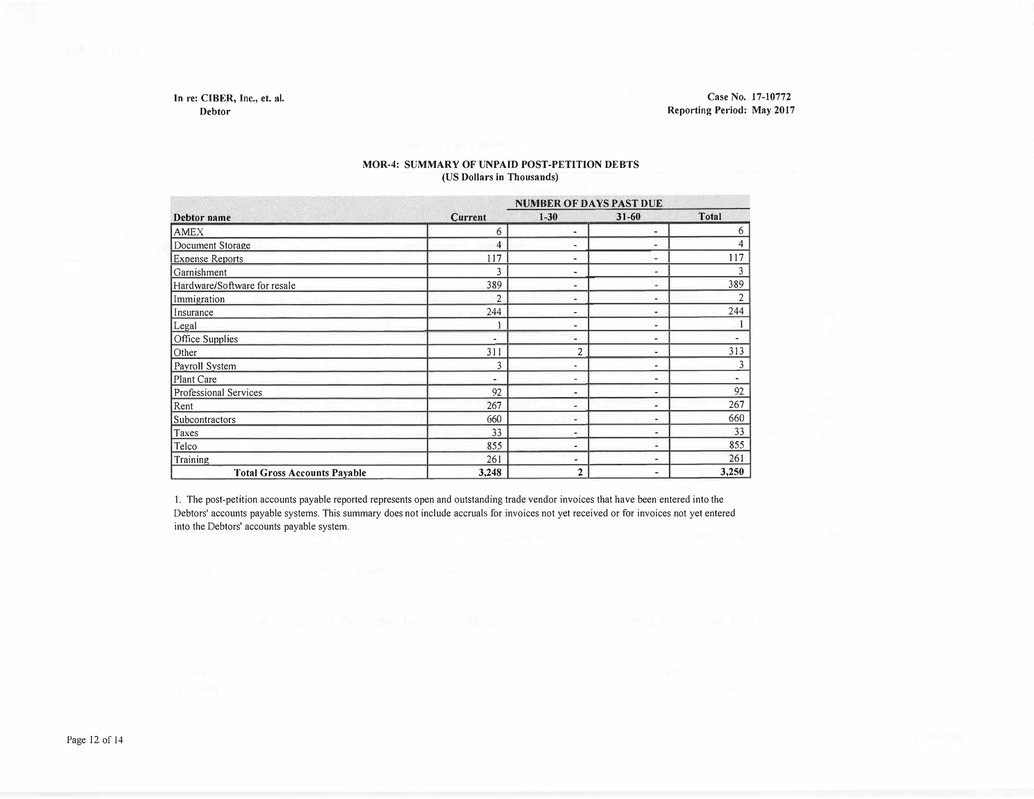

In re: CIBER, Inc., et. al.

Debtor

Debtor name

AMEX

Document Stora"e

Exoense Reoorts

Garnishment

Hardware/Software for resale

Immi11:ration

Insurance

Legal

Office Sunnlies

Other

Pavroll Svstem

Plant Care

Professional Services

Rent

Subcontractors

Taxes

Telco

Trainin"

MOR-4: SUMMARY OF UNPAID POST-PETITION DEBTS

(US Dollars in Thousands)

NUMBER OF DA)'8_ J>_A_8_T DUE

Current --· - ----

6

4

117

3

389

2

244

I

-

311

3

-

92

267

660

33

855

261

1-30 31-60

-

-

-

-

-

-

-

-

-

2

-

.

-

.

-

.

-

.

-

-

-

-

-

-

-

-

.

.

-

.

.

-

.

-

Total Gross Accounts Pavable 3,248 2 -

Case No. 17-10772

Reporting Period: May 2017

Total -··--

6

4

117

3

389

2

244

l

.

313

3

-

92

267

660

33

855

261

3,250

1. The post-petition accounts payable reported represents open and outstanding trade vendor invoices that have been entered into the

Debtors' accounts payable systems. This summary does not include accruals for invoices not yet received or for invoices not yet entered

into the Debtors' accounts payable system.

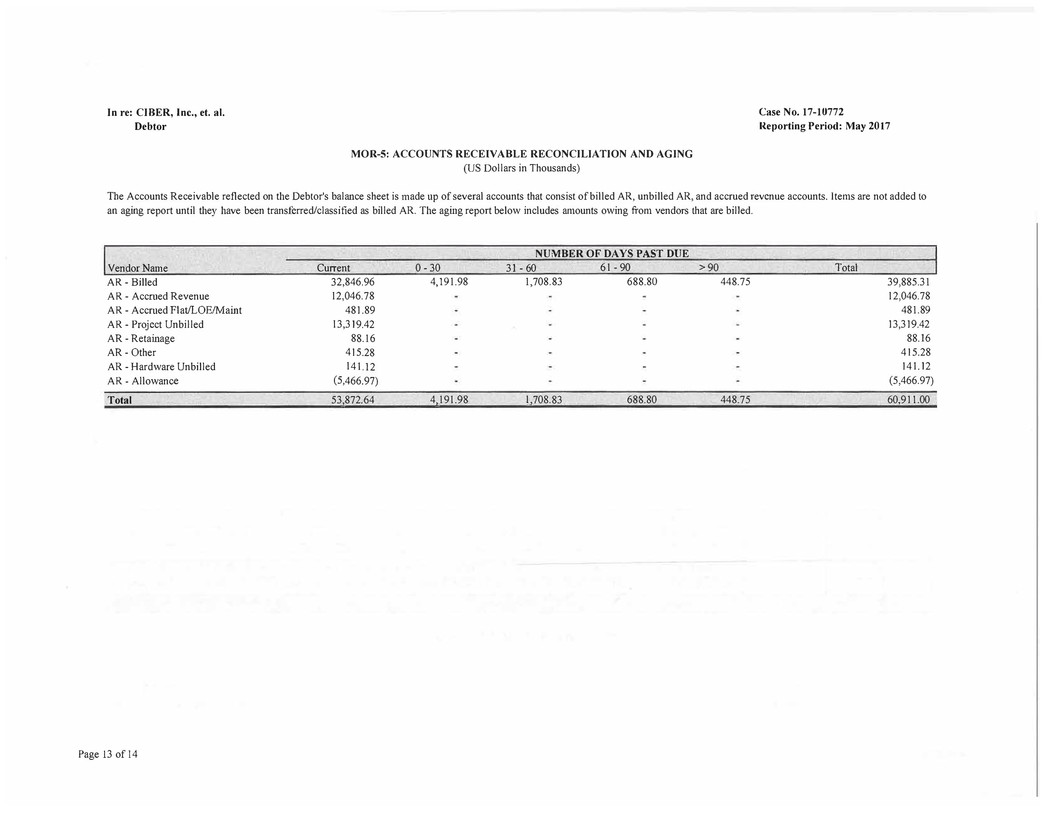

In re: CIBER, Inc., et. al.

Debtor

MOR-5: ACCOUNTS RECEIVABLE RECONCILIATION AND AGING

(US Dollars in Thousands)

Case No. 17-10772

Reporting Period: May 2017

The Accounts Receivable reflected on the Debtor's balance sheet is made up of several accounts that consist of billed AR, unbilled AR, and accrued revenue accounts. Items are not added to

an aging report until they have been transferred/classified as billed AR. The aging report below includes amounts owing from vendors that are billed.

Vendor N an1e

AR- Billed

AR - Accrned Revenue

AR - Accrued Flat/LOE/Maint

AR - Project Unbilled

AR - Retainage

AR- Other

AR - Hardware Unbilled

AR - Allowance

Total

Page 13 of 14

Current

32,846.96

12,046.78

481.89

13,319.42

88.16

415.28

141.12

(5,466.97)

532872.64

0- 30

4,191.98

4,191.98

NUMBER OF DAYS PAST DUE

31 - 60 61 - 90

1,708.83 688.80

1.708.83 688.80

>90 Total

448.75

448.75

39,885.31

12,046.78

481.89

13,319.42

88.16

415.28

141.12

(5,466.97)

60,91 J.00

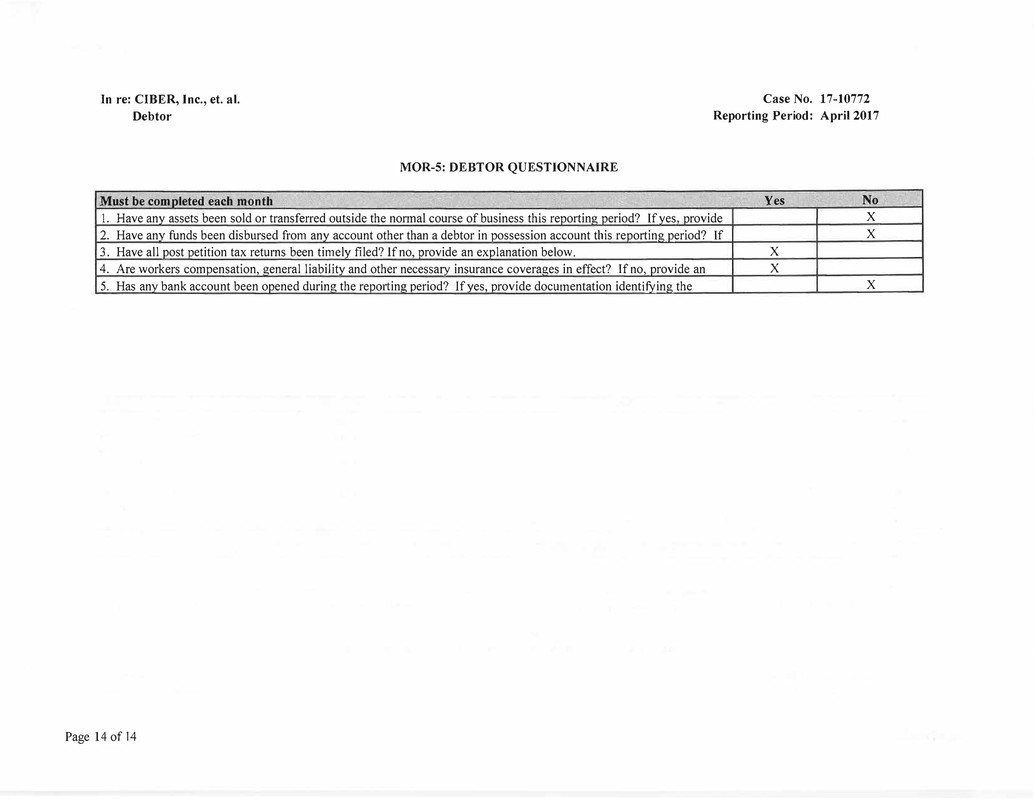

1n re: CIBER, Inc., et. al.

Debtor

Must be completed each month

MOR-5: DEBTOR QUESTIONNAIRE

Case No. 17-10772

Reporting Period: April 2017

Yes No

1. Have anv assets been sold or transferred outside the normal course of business this reporting period? If ves provide X

2. Have anv funds been disbursed from anv account other than a debtor in possession account this reoorting period? If X

3. Have all post petition tax returns been timelv filed? ffno, orovide an exolanation below. X

4. Are workers compensation, general liabilitv and other necessary insurance coveraE!es in effect? If no, provide an X

5. Has any bank account been opened durin!!. the rep01tin!!. oeriod? Ifves, orovide documentation identifying the X

Page 14 of 14