Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WESTAR ENERGY INC /KS | d423795d8k.htm |

| EX-99.2 - EX-99.2 - WESTAR ENERGY INC /KS | d423795dex992.htm |

| EX-2.1 - EX-2.1 - WESTAR ENERGY INC /KS | d423795dex21.htm |

WESTAR ENERGY AND GREAT PLAINS ENERGY ANNOUNCE MERGER OF EQUALS TO FORM LEADING MIDWEST ENERGY COMPANY July 10, 2017 Exhibit 99.1

FORWARD-LOOKING STATEMENTS Statements made in this presentation that are not based on historical facts are forward-looking, may involve risks and uncertainties, and are intended to be as of the date when made. Forward-looking statements include, but are not limited to, statements relating to the anticipated merger transaction of Great Plains Energy and Westar Energy, including those that relate to the expected financial and operational benefits of the merger to the companies and their shareholders (including cost savings, operational efficiencies and the impact of the transaction on earnings per share), the expected timing of closing, the outcome of regulatory proceedings, cost estimates of capital projects, redemption of Great Plains Energy debt and convertible preferred stock, dividend growth, share repurchases, balance sheet and credit ratings, rebates to customers, employee issues and other matters affecting future operations. In connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Great Plains Energy and Westar Energy are providing a number of important factors that could cause actual results to differ materially from the provided forward-looking information. These important factors include: future economic conditions in regional, national and international markets and their effects on sales, prices and costs; prices and availability of electricity in regional and national wholesale markets; market perception of the energy industry, Great Plains Energy and Westar Energy; changes in business strategy, operations or development plans; the outcome of contract negotiations for goods and services; effects of current or proposed state and federal legislative and regulatory actions or developments, including, but not limited to, deregulation, re-regulation and restructuring of the electric utility industry; decisions of regulators regarding rates the companies can charge for electricity; adverse changes in applicable laws, regulations, rules, principles or practices governing tax, accounting and environmental matters including, but not limited to, air and water quality; financial market conditions and performance including, but not limited to, changes in interest rates and credit spreads and in availability and cost of capital and the effects on derivatives and hedges, nuclear decommissioning trust and pension plan assets and costs; impairments of long-lived assets or goodwill; credit ratings; inflation rates; effectiveness of risk management policies and procedures and the ability of counterparties to satisfy their contractual commitments; impact of terrorist acts, including, but not limited to, cyber terrorism; ability to carry out marketing and sales plans; weather conditions including, but not limited to, weather-related damage and their effects on sales, prices and costs; cost, availability, quality and deliverability of fuel; the inherent uncertainties in estimating the effects of weather, economic conditions and other factors on customer consumption and financial results; ability to achieve generation goals and the occurrence and duration of planned and unplanned generation outages; delays in the anticipated in-service dates and cost increases of generation, transmission, distribution or other projects; Great Plains Energy’s and Westar Energy’s ability to successfully manage and integrate their respective transmission joint ventures; the inherent risks associated with the ownership and operation of a nuclear facility including, but not limited to, environmental, health, safety, regulatory and financial risks; workforce risks, including, but not limited to, increased costs of retirement, health care and other benefits; the ability of Great Plains Energy and Westar Energy to obtain the regulatory and shareholder approvals necessary to complete the anticipated merger or the imposition of adverse conditions or costs in connection with obtaining regulatory approvals; the risk that a condition to the closing of the anticipated merger may not be satisfied or that the anticipated merger may fail to close; the outcome of any legal proceedings, regulatory proceedings or enforcement matters that may be instituted relating to the anticipated merger; the costs incurred to consummate the anticipated merger; the possibility that the expected value creation from the anticipated merger will not be realized, or will not be realized within the expected time period; difficulties related to the integration of the two companies; the credit ratings of Great Plains Energy and Westar Energy following the anticipated merger; disruption from the anticipated merger making it more difficult to maintain relationships with customers, employees, regulators or suppliers; the diversion of management time and attention on the proposed transactions; and other risks and uncertainties. This list of factors is not all-inclusive because it is not possible to predict all factors. Additional risks and uncertainties will be discussed in the joint proxy statement/prospectus and other materials that Great Plains Energy, Westar Energy and Monarch Energy Holding, Inc. will file with the SEC in connection with the proposed transactions. Other risk factors are detailed from time to time in quarterly reports on Form 10-Q and annual reports on Form 10-K filed by Great Plains Energy, KCP&L and Westar Energy with the Securities and Exchange Commission. Each forward-looking statement speaks only as of the date of the particular statement. Monarch Energy Holding, Inc., Great Plains Energy, KCP&L and Westar Energy undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. JULY 2017 INVESTOR PRESENTATION

AGENDA TOPICS FOR TODAY’S DISCUSSION Transaction Overview and Rationale Financial Highlights Approvals and Timeline Q&A AGENDA JULY 2017 INVESTOR PRESENTATION

MERGER OF EQUALS CREATES A LEADING MIDWEST UTILITY Strong geographic fit, complementary operations with contiguous territories and existing shared assets Increased scale and jurisdictional diversity; enhanced platform to drive value for shareholders and customers Significant operating efficiencies; cost savings Highly experienced, complementary leadership team Long, successful history working together—years of joint ownership, a year planning integration COMPELLING STRATEGIC RATIONALE SUBSTANTIAL FINANCIAL BENEFITS Industrial logic consistent; but modified to address regulatory concerns JULY 2017 INVESTOR PRESENTATION Significantly accretive to both companies Immediately accretive to both companies in first full year Significantly accretive to Westar Energy in year 1 and to Great Plains Energy by year three Immediate, significant dividend increase for Westar Energy Expect to offer top tier value proposition: EPS growth 6% to 8%, 2016 to 20211 Dividend growth in line with EPS growth, targeting 60% to 70% payout ratio Maintains strong investment grade credit profile $1.25 billion of estimated cash at closing and strong balance sheet allow for post-close share repurchases to return excess cash to shareholders and maintain a balanced capital structure EPS growth based on Westar Energy 2016A EPS of $2.43.

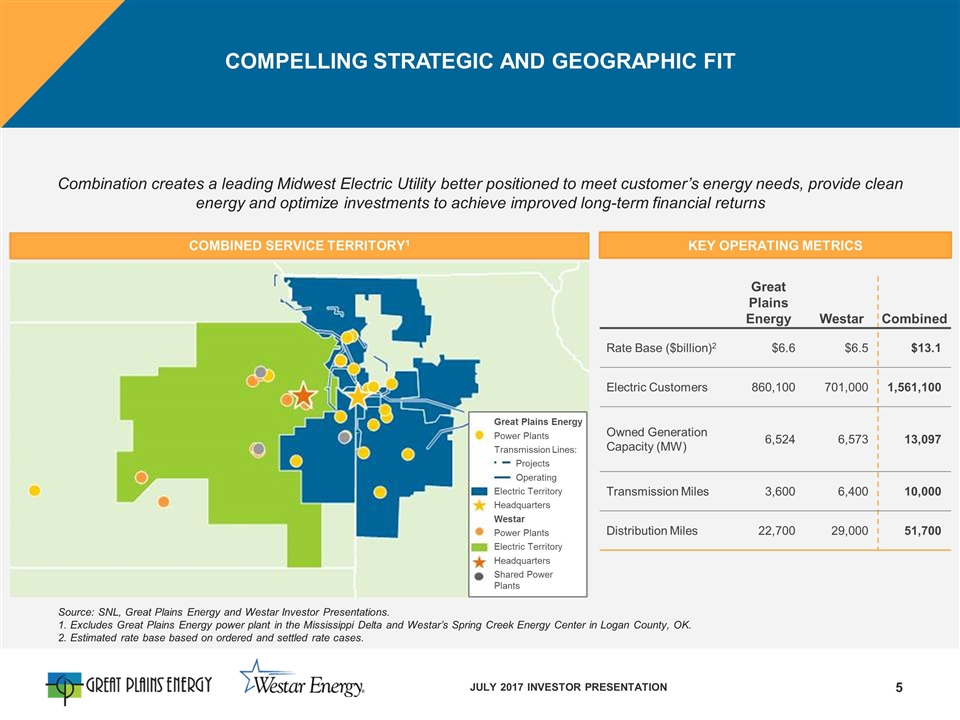

COMPELLING STRATEGIC AND GEOGRAPHIC FIT Great Plains Energy Power Plants Transmission Lines: Projects Operating Electric Territory Headquarters Westar Power Plants Electric Territory Headquarters Shared Power Plants COMBINED SERVICE TERRITORY1 KEY OPERATING METRICS Source: SNL, Great Plains Energy and Westar Investor Presentations. Excludes Great Plains Energy power plant in the Mississippi Delta and Westar’s Spring Creek Energy Center in Logan County, OK. Estimated rate base based on ordered and settled rate cases. Great Plains Energy Westar Combined Rate Base ($billion)2 $6.6 $6.5 $13.1 Electric Customers 860,100 701,000 1,561,100 Owned Generation Capacity (MW) 6,524 6,573 13,097 Transmission Miles 3,600 6,400 10,000 Distribution Miles 22,700 29,000 51,700 Combination creates a leading Midwest Electric Utility better positioned to meet customer’s energy needs, provide clean energy and optimize investments to achieve improved long-term financial returns JULY 2017 INVESTOR PRESENTATION

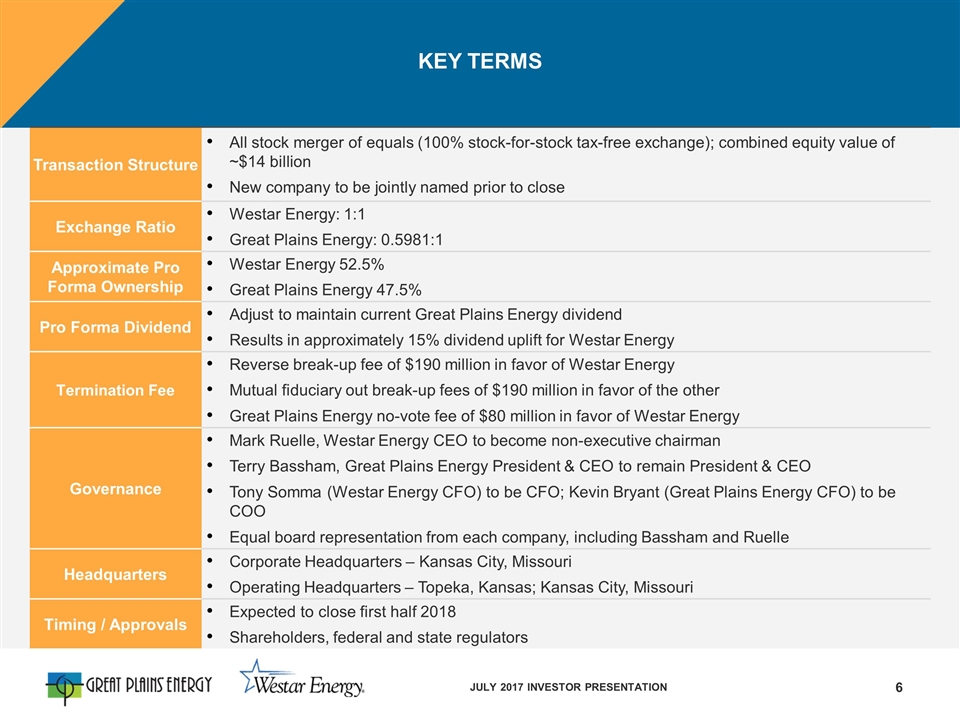

KEY TERMS Transaction Structure All stock merger of equals (100% stock-for-stock tax-free exchange); combined equity value of ~$14 billion New company to be jointly named prior to close Exchange Ratio Westar Energy: 1:1 Great Plains Energy: 0.5981:1 Approximate Pro Forma Ownership Westar Energy 52.5% Great Plains Energy 47.5% Pro Forma Dividend Adjust to maintain current Great Plains Energy dividend Results in approximately 15% dividend uplift for Westar Energy Termination Fee Reverse break-up fee of $190 million in favor of Westar Energy Mutual fiduciary out break-up fees of $190 million in favor of the other Great Plains Energy no-vote fee of $80 million in favor of Westar Energy Governance Mark Ruelle, Westar Energy CEO to become non-executive chairman Terry Bassham, Great Plains Energy President & CEO to remain President & CEO Tony Somma (Westar Energy CFO) to be CFO; Kevin Bryant (Great Plains Energy CFO) to be COO Equal board representation from each company, including Bassham and Ruelle Headquarters Corporate Headquarters – Kansas City, Missouri Operating Headquarters – Topeka, Kansas; Kansas City, Missouri Timing / Approvals Expected to close first half 2018 Shareholders, federal and state regulators JULY 2017 INVESTOR PRESENTATION

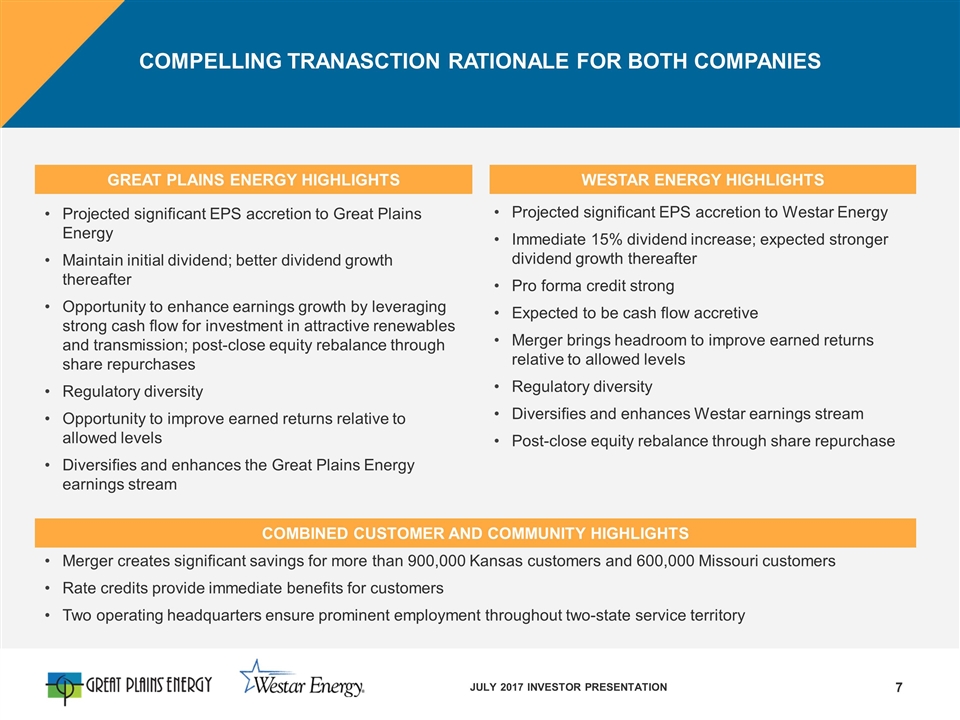

COMPELLING TRANASCTION RATIONALE FOR BOTH COMPANIES Projected significant EPS accretion to Great Plains Energy Maintain initial dividend; better dividend growth thereafter Opportunity to enhance earnings growth by leveraging strong cash flow for investment in attractive renewables and transmission; post-close equity rebalance through share repurchases Regulatory diversity Opportunity to improve earned returns relative to allowed levels Diversifies and enhances the Great Plains Energy earnings stream Projected significant EPS accretion to Westar Energy Immediate 15% dividend increase; expected stronger dividend growth thereafter Pro forma credit strong Expected to be cash flow accretive Merger brings headroom to improve earned returns relative to allowed levels Regulatory diversity Diversifies and enhances Westar earnings stream Post-close equity rebalance through share repurchase JULY 2017 INVESTOR PRESENTATION GREAT PLAINS ENERGY HIGHLIGHTS WESTAR ENERGY HIGHLIGHTS COMBINED CUSTOMER AND COMMUNITY HIGHLIGHTS Merger creates significant savings for more than 900,000 Kansas customers and 600,000 Missouri customers Rate credits provide immediate benefits for customers Two operating headquarters ensure prominent employment throughout two-state service territory

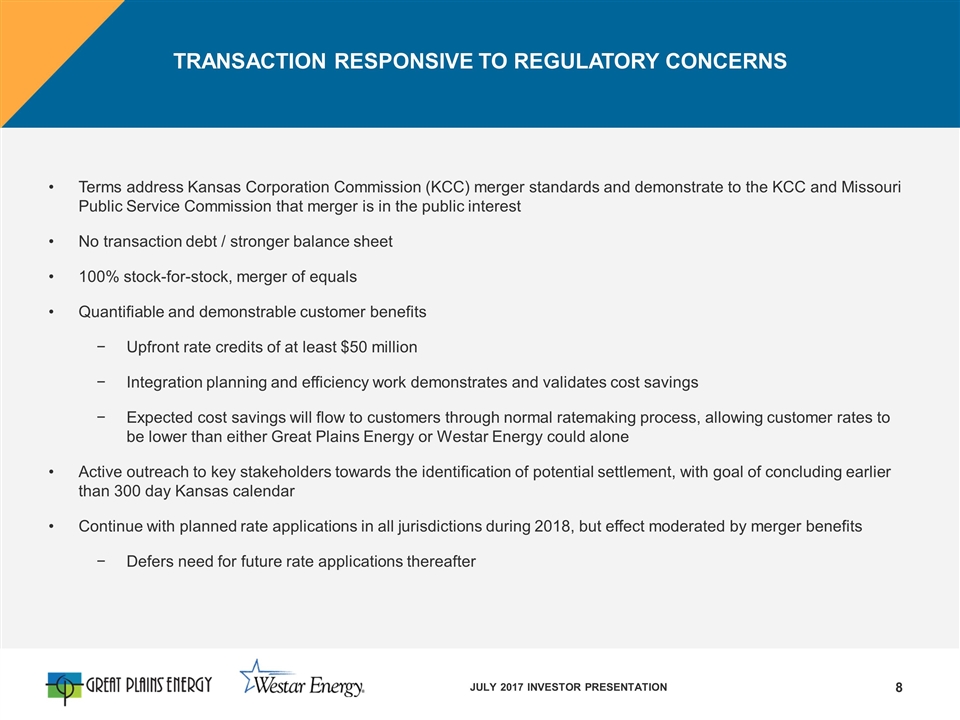

TRANSACTION RESPONSIVE TO REGULATORY CONCERNS Terms address Kansas Corporation Commission (KCC) merger standards and demonstrate to the KCC and Missouri Public Service Commission that merger is in the public interest No transaction debt / stronger balance sheet 100% stock-for-stock, merger of equals Quantifiable and demonstrable customer benefits Upfront rate credits of at least $50 million Integration planning and efficiency work demonstrates and validates cost savings Expected cost savings will flow to customers through normal ratemaking process, allowing customer rates to be lower than either Great Plains Energy or Westar Energy could alone Active outreach to key stakeholders towards the identification of potential settlement, with goal of concluding earlier than 300 day Kansas calendar Continue with planned rate applications in all jurisdictions during 2018, but effect moderated by merger benefits Defers need for future rate applications thereafter JULY 2017 INVESTOR PRESENTATION

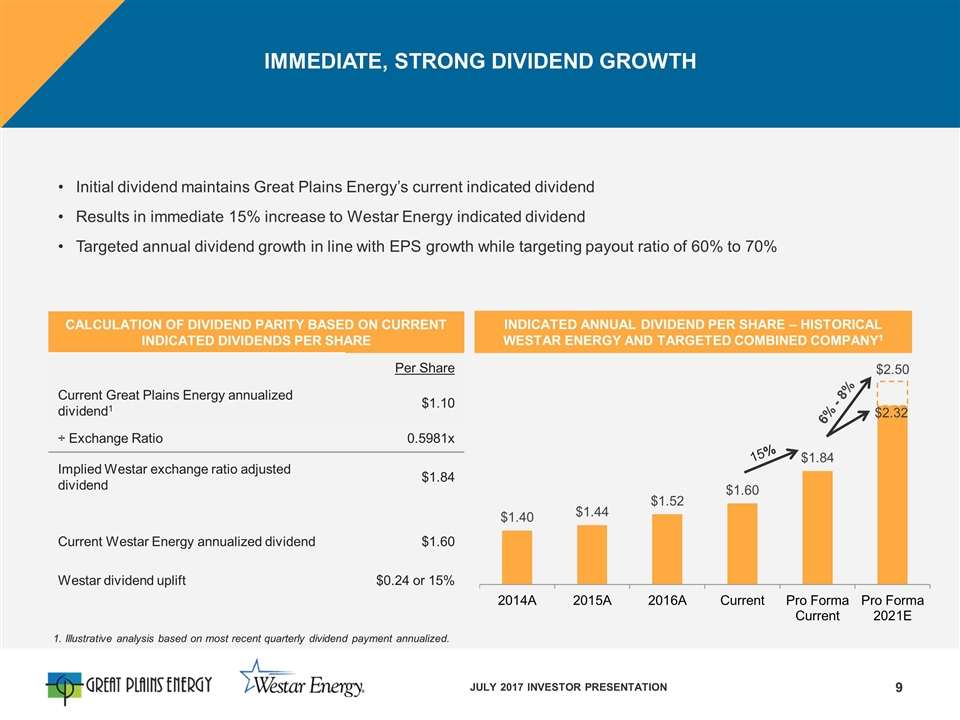

IMMEDIATE, STRONG DIVIDEND GROWTH Initial dividend maintains Great Plains Energy’s current indicated dividend Results in immediate 15% increase to Westar Energy indicated dividend Targeted annual dividend growth in line with EPS growth while targeting payout ratio of 60% to 70% INDICATED ANNUAL DIVIDEND PER SHARE – HISTORICAL WESTAR ENERGY AND TARGETED COMBINED COMPANY1 Illustrative analysis based on most recent quarterly dividend payment annualized. 15% CALCULATION OF DIVIDEND PARITY BASED ON CURRENT INDICATED DIVIDENDS PER SHARe Per Share Current Great Plains Energy annualized dividend1 $1.10 ÷ Exchange Ratio 0.5981x Implied Westar exchange ratio adjusted dividend $1.84 Current Westar Energy annualized dividend $1.60 Westar dividend uplift $0.24 or 15% JULY 2017 INVESTOR PRESENTATION 6% - 8%

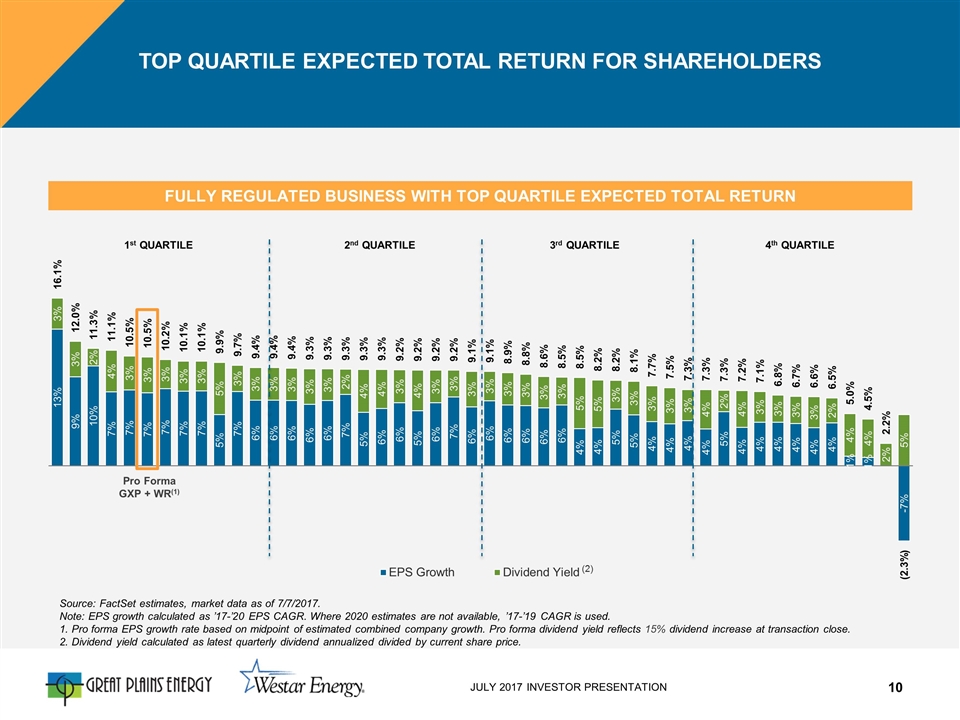

TOP QUARTILE EXPECTED TOTAL RETURN FOR SHAREHOLDERS FULLY regulated BUSINESS WITH TOP QUARTILE EXPECTED TOTAL RETURN 1st QUARTILE 2nd QUARTILE 3rd QUARTILE 4th QUARTILE Pro Forma GXP + WR(1) Source: FactSet estimates, market data as of 7/7/2017. Note: EPS growth calculated as ’17-’20 EPS CAGR. Where 2020 estimates are not available, ’17-’19 CAGR is used. Pro forma EPS growth rate based on midpoint of estimated combined company growth. Pro forma dividend yield reflects 15% dividend increase at transaction close. Dividend yield calculated as latest quarterly dividend annualized divided by current share price. (2) JULY 2017 INVESTOR PRESENTATION

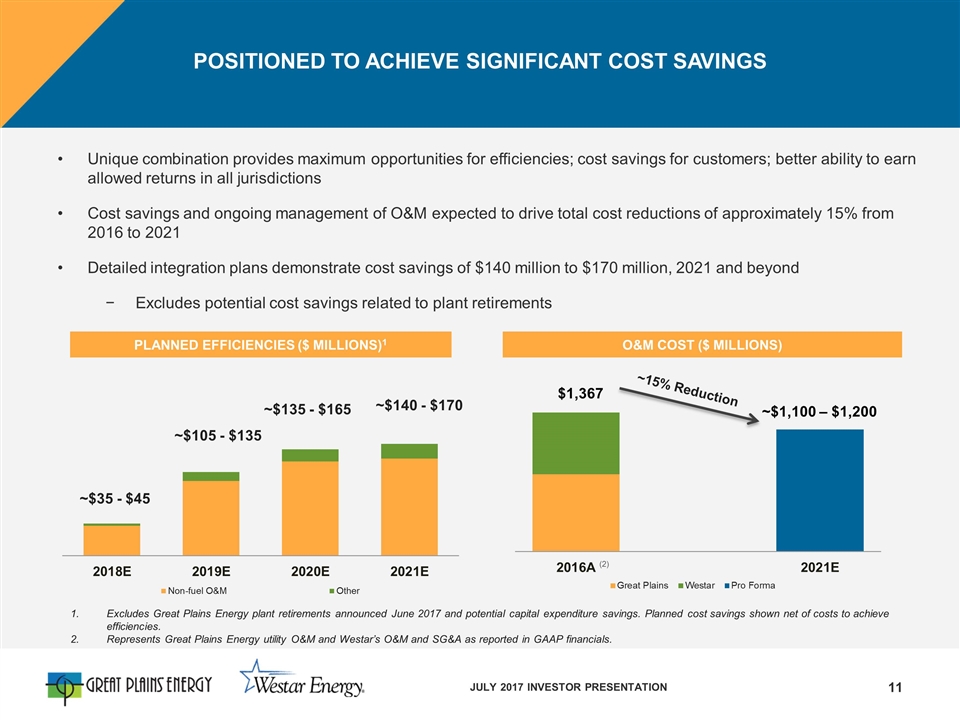

POSITIONED TO ACHIEVE SIGNIFICANT COST SAVINGS O&M COST ($ MILLIONS) Excludes Great Plains Energy plant retirements announced June 2017 and potential capital expenditure savings. Planned cost savings shown net of costs to achieve efficiencies. Represents Great Plains Energy utility O&M and Westar’s O&M and SG&A as reported in GAAP financials. PLANNED EFFICIENCIES ($ MILLIONS)1 Unique combination provides maximum opportunities for efficiencies; cost savings for customers; better ability to earn allowed returns in all jurisdictions Cost savings and ongoing management of O&M expected to drive total cost reductions of approximately 15% from 2016 to 2021 Detailed integration plans demonstrate cost savings of $140 million to $170 million, 2021 and beyond Excludes potential cost savings related to plant retirements ~15% Reduction (2) JULY 2017 INVESTOR PRESENTATION

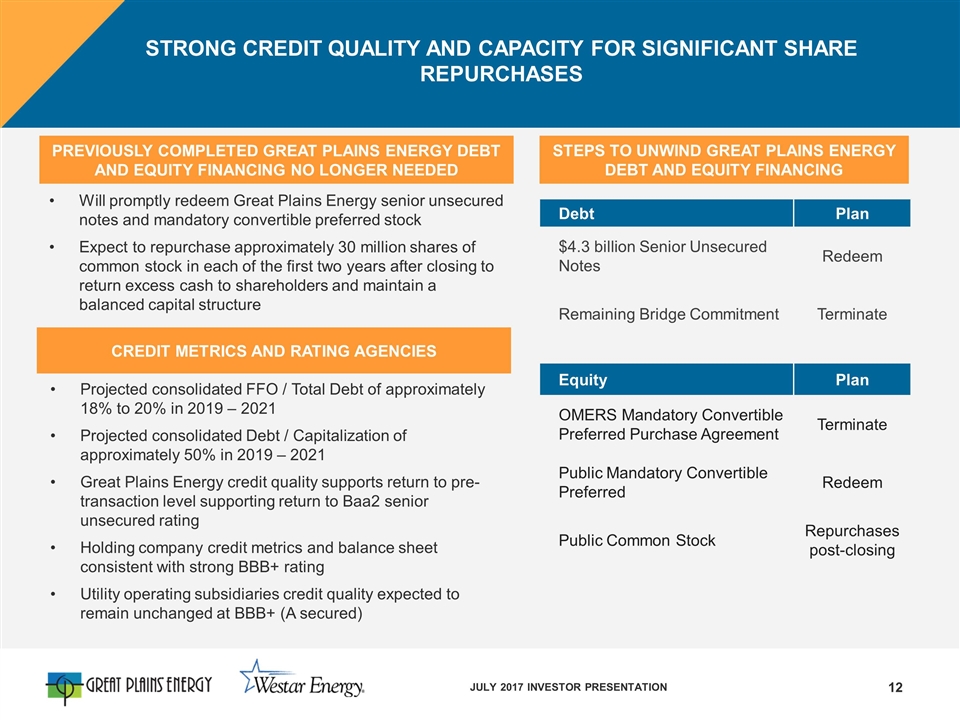

Will promptly redeem Great Plains Energy senior unsecured notes and mandatory convertible preferred stock Expect to repurchase approximately 30 million shares of common stock in each of the first two years after closing to return excess cash to shareholders and maintain a balanced capital structure Steps to unwind GREAT PlaIns energy DEBT and EQUITY financing Previously completed GREAT PlaInS energy debt AND EQUITY financing no longer needed Debt Plan $4.3 billion Senior Unsecured Notes Redeem Remaining Bridge Commitment Terminate Equity Plan OMERS Mandatory Convertible Preferred Purchase Agreement Terminate Public Mandatory Convertible Preferred Redeem Public Common Stock Repurchases post-closing JULY 2017 INVESTOR PRESENTATION CREDIT METRICS AND RATING AGENCIES Projected consolidated FFO / Total Debt of approximately 18% to 20% in 2019 – 2021 Projected consolidated Debt / Capitalization of approximately 50% in 2019 – 2021 Great Plains Energy credit quality supports return to pre-transaction level supporting return to Baa2 senior unsecured rating Holding company credit metrics and balance sheet consistent with strong BBB+ rating Utility operating subsidiaries credit quality expected to remain unchanged at BBB+ (A secured) STRONG CREDIT QUALITY AND CAPACITY FOR SIGNIFICANT SHARE REPURCHASES

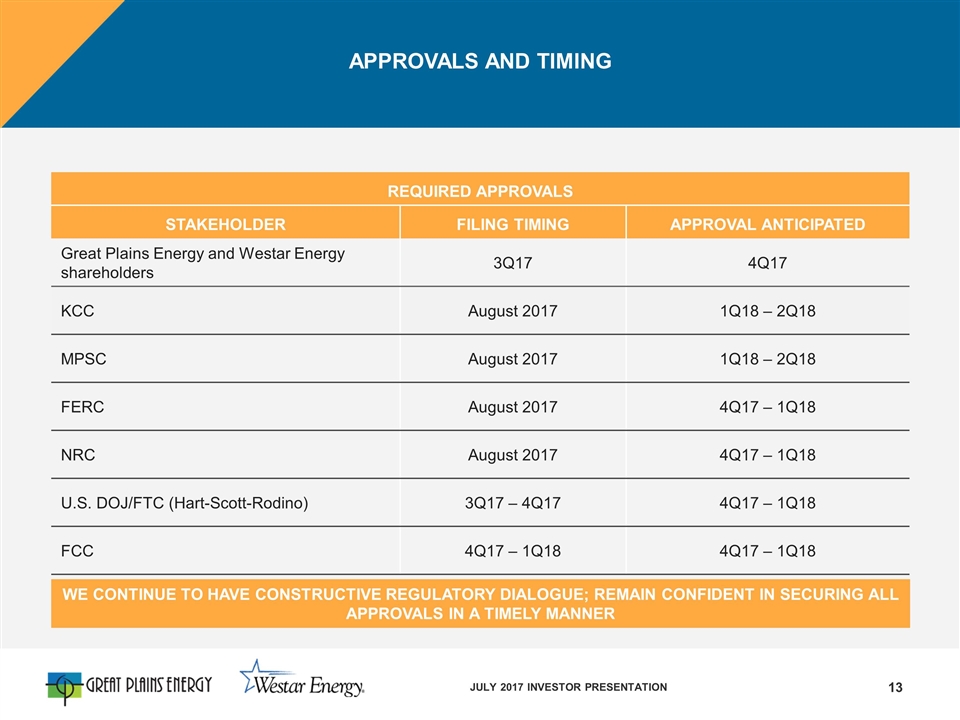

APPROVALS AND TIMING WE CONTINUE TO HAVE CONSTRUCTIVE REGULATORY DIALOGUE; REMAIN CONFIDENT IN SECURING ALL APPROVALS IN A TIMELY MANNER REQUIRED approvals Stakeholder filing timing APPROVAL ANTICIPATED Great Plains Energy and Westar Energy shareholders 3Q17 4Q17 KCC August 2017 1Q18 – 2Q18 MPSC August 2017 1Q18 – 2Q18 FERC August 2017 4Q17 – 1Q18 NRC August 2017 4Q17 – 1Q18 U.S. DOJ/FTC (Hart-Scott-Rodino) 3Q17 – 4Q17 4Q17 – 1Q18 FCC 4Q17 – 1Q18 4Q17 – 1Q18 JULY 2017 INVESTOR PRESENTATION

CONCLUSION Combination creates a leading Midwest Electric Utility with enhanced growth prospects Complementary footprint, operations and culture Expected EPS accretive for shareholders of each company Increased potential for earnings growth and stability creating a combined company with an industry leading total return profile and substantial flexibility for disciplined capital allocation Significant cost savings support customer rate credits and serve to defer future rate increases Commitment to jobs and communities Stock-for-stock, merger-of-equals structure addresses regulatory concerns and paves the way for timely closing Combination creates scale which drives value for shareholders and customers JULY 2017 INVESTOR PRESENTATION

AGENDA TOPICS FOR TODAY’S DISCUSSION APPENDIX JULY 2017 INVESTOR PRESENTATION

TRANSACTION BACKGROUND On May 29, 2016, Great Plains Energy and Westar Energy entered into an Agreement and Plan of Merger On April 19, 2017, the KCC found the transaction not to be in the public interest; denied the merger On May 4, 2017, companies filed a Petition for Reconsideration, requesting additional time to allow further discussions to resolve concerns identified in Commission’s April 19, 2017 Order On May 23, 2017, the KCC denied the Petition but encouraged the parties to continue working together to revise the transaction to resolve the KCC’s concerns and welcomed the filing of a new application Worked together to form a new transaction that met three key criteria: Presents meaningful improvement over each company’s respective standalone plan Creates long-term value for shareholders, customers, communities and other stakeholders Addresses the KCC’s concerns; creates maximum likelihood of success JULY 2017 INVESTOR PRESENTATION

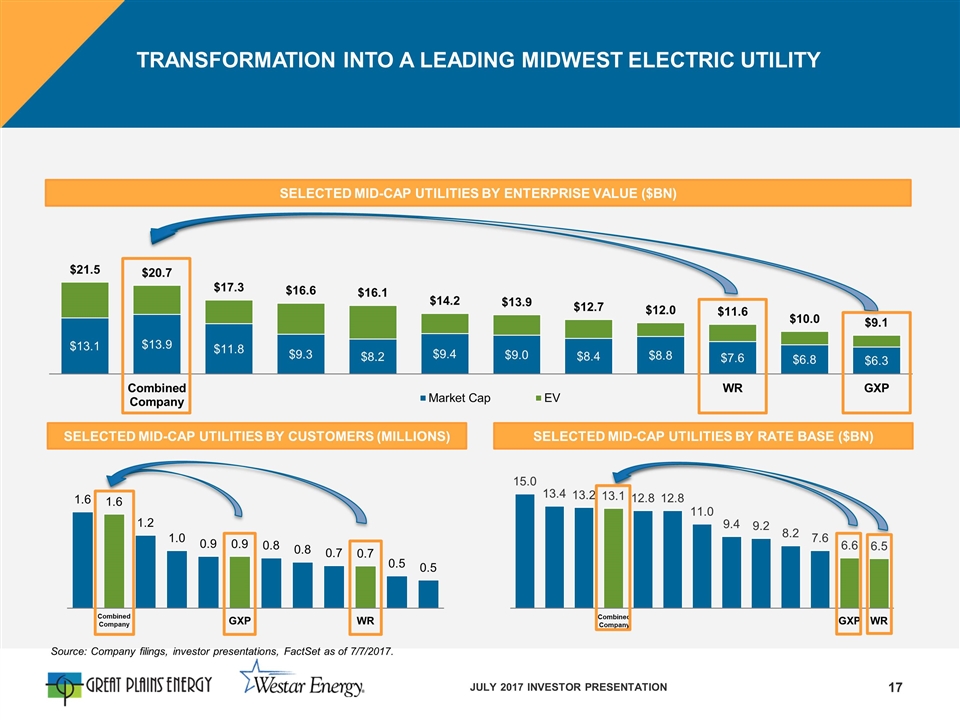

SELECTED MID-CAP UTILITIES BY ENTERPRISE VALUE ($BN) Source: Company filings, investor presentations, FactSet as of 7/7/2017. SELECTED MID-CAP UTILITIES BY CUSTOMERS (MILLIONS) SELECTED MID-CAP UTILITIES BY RATE BASE ($BN) Combined Company Combined Company JULY 2017 INVESTOR PRESENTATION TRANSFORMATION INTO A LEADING MIDWEST ELECTRIC UTILITY

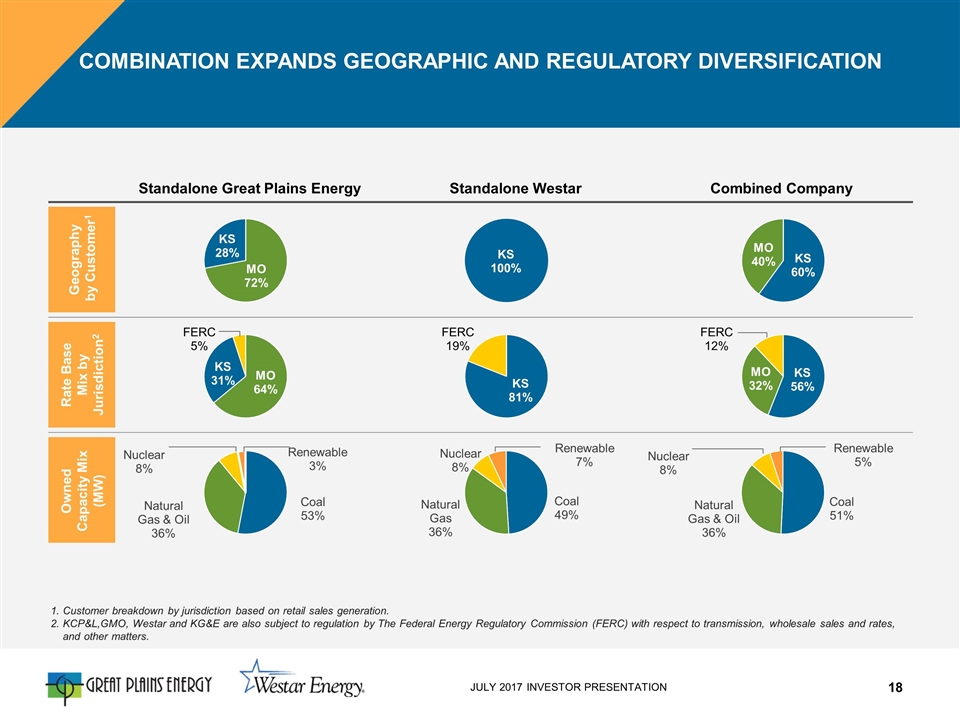

COMBINATION Expands Geographic and Regulatory Diversification Customer breakdown by jurisdiction based on retail sales generation. KCP&L,GMO, Westar and KG&E are also subject to regulation by The Federal Energy Regulatory Commission (FERC) with respect to transmission, wholesale sales and rates, and other matters. Standalone Great Plains Energy Standalone Westar Combined Company Geography by Customer1 Rate Base Mix by Jurisdiction2 Owned Capacity Mix (MW) JULY 2017 INVESTOR PRESENTATION

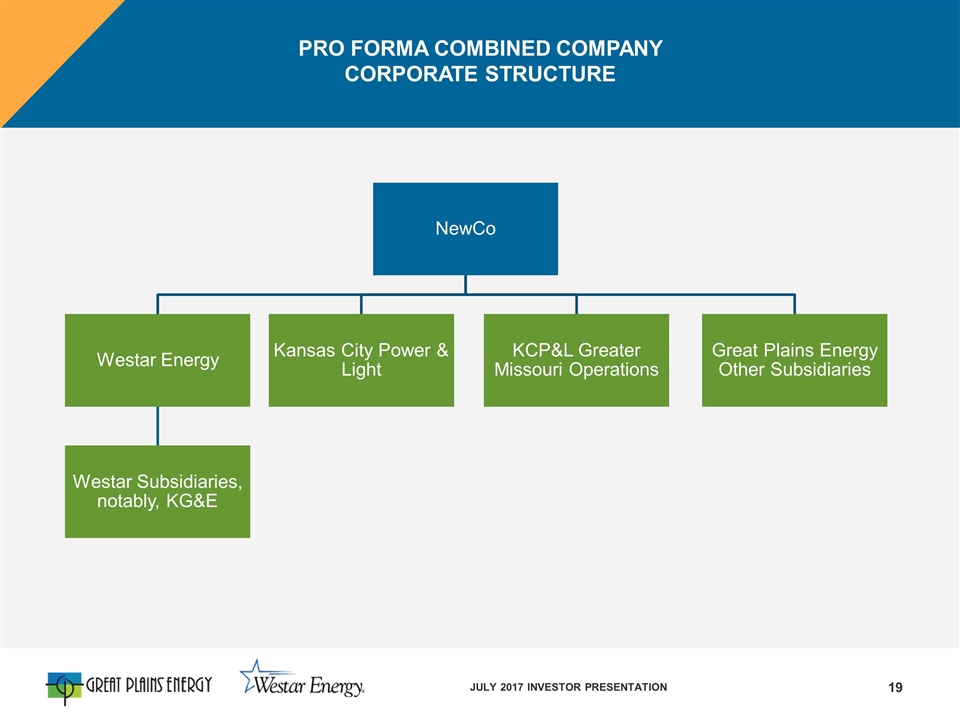

PRO FORMA COMBINED COMPANY corporate structure JULY 2017 INVESTOR PRESENTATION NewCo Kansas City Power & Light KCP&L Greater Missouri Operations Westar Energy Great Plains Energy Other Subsidiaries Westar Subsidiaries, notably, KG&E

ADDITIONAL INFORMATION Additional Information and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any proxy, vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In connection with the proposed transactions, Monarch Energy Holding, Inc. (Monarch) will file a Registration Statement on Form S-4, that includes a joint proxy statement of Great Plains Energy and Westar Energy, which also constitutes a prospectus of Monarch. WE URGE INVESTORS TO READ THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED BY MONARCH, GREAT PLAINS ENERGY AND WESTAR ENERGY WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT GREAT PLAINS ENERGY, WESTAR ENERGY, MONARCH AND THE PROPOSED TRANSACTION. Investors can obtain free copies of the Registration Statement and joint proxy statement/prospectus and other documents filed by Monarch, Great Plains Energy and Westar Energy with the SEC at http://www.sec.gov, the SEC’s website, or free of charge from Great Plains Energy’s website (http://www.greatplainsenergy.com) under the tab, “Investor Relations” and then under the heading “SEC Filings.” These documents are also available free of charge from Westar’s website (http://www.westarenergy.com) under the tab “Investors” and then under the heading “SEC Filings.” Participants in Proxy Solicitation Great Plains Energy, Westar Energy and their respective directors and certain of their executive officers and employees may be deemed, under SEC rules, to be participants in the solicitation of proxies from Great Plains Energy’s and Westar Energy’s shareholders with respect to the proposed transaction. Information regarding the officers and directors of Great Plains Energy is included in its definitive proxy statement for its 2017 annual meeting filed with SEC on March 23, 2017. Information regarding the officers and directors of Westar is included in an amendment to its Annual Report on Form 10-K for the fiscal year ended December 31, 2016, filed with the SEC on April 28, 2017. Additional information regarding the identity of potential participants, and their direct or indirect interests, by securities, holdings or otherwise, will be set forth in the Registration Statement and joint proxy statement/prospectus and other materials filed with SEC in connection with the proposed transaction. Free copies of these documents may be obtained as described in the paragraphs above. JULY 2017 INVESTOR PRESENTATION

Lori Wright Vice President – Corporate Planning, Investor Relations and Treasurer (816) 556-2506 lori.wright@kcpl.com Calvin Girard Senior Manager, Investor Relations (816) 654-1777 calvin.girard@kcpl.com NYSE: Great plains energy (GXP) INVESTOR RELATIONS INFORMATION JULY 2017 INVESTOR PRESENTATION Cody VandeVelde Director, Investor Relations (785) 575-8227 Cody.VandeVelde@westarenergy.com Nyse: Westar energy (wr)