Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Encompass Health Corp | brandingannouncementpressr.htm |

| 8-K - 8-K - Encompass Health Corp | brandingannouncement8-k.htm |

1

Corporate Name Change and Rebranding

Initiative Announcement

July 11, 2017

Supplemental Information

2

The information contained in this presentation includes certain estimates, projections and other forward-looking information that reflect

HealthSouth’s current outlook, views and plans with respect to future events, including strategy, expenditures, demographic trends, financial

performance, financial assumptions and business outlook. These estimates, projections and other forward-looking information are based on

assumptions HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and

actual events or results, and those differences may be material. There can be no assurance any estimates, projections or forward-looking

information will be realized.

All such estimates, projections and forward-looking information speak only as of the date hereof. HealthSouth undertakes no duty to

publicly update or revise the information contained herein.

You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as

they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors that may

cause actual events or results to differ materially from the views, beliefs and estimates expressed herein. Such factors include, but are not

limited to, any adverse outcome of various lawsuits, claims, and legal or regulatory proceedings that may be brought by or against the

Company; the impact of the rebranding initiative on patient admissions, referral source relationships and the Company’s stock price; the

ability to successfully integrate acquisitions; changes in the regulation of the healthcare industry broadly or the inpatient rehabilitation,

home health and hospice areas specifically at either or both of the federal and state levels; competitive pressures in the healthcare industry

broadly or the inpatient rehabilitation, home health and hospice areas specifically and the Company’s response thereto; the ability to

maintain proper local, state and federal licensing where the Company does business; potential disruptions, breaches, or other incidents

affecting the proper operation, availability, or security of the Company’s information systems, including the unauthorized access to or theft of

patient or other sensitive information; changes, delays in (including in connection with resolution of Medicare payment reviews or appeals),

or suspension of reimbursement for the Company’s services by governmental or private payors; general conditions in the economy and

capital markets; and other factors which may be identified from time to time in the Company’s SEC filings and other public announcements,

including its Form 10-K for the year ended December 31, 2016 and Form 10-Q for the quarter ended March 31, 2017.

Forward-Looking Statements

3

is becoming

• HealthSouth Corporation will change its name to Encompass Health Corporation

• Corporate name change and ticker symbol change (from “HLS” to “EHC”) effective January 2, 2018

• Both business segments (inpatient rehabilitation and home health and hospice) to transition to

Encompass Health branding (expected to be complete by year end 2019)

• Rebranding initiative reinforces strategic position as an integrated provider of inpatient and home-

based care

• Estimated rebranding investment of $25 million to $30 million to be incurred between 2017 and 2019

− Approximately $7 million to $10 million expected to be incurred in 2017 ($6 million to $8 million in

operating expenses; $1 million to $2 million in CAPEX)

− Only $1 million included in previously issued guidance

The name change and rebranding initiative reflect the Company’s expanding national

footprint and reinforce the strategy it is pursuing to deliver integrated high-quality,

cost-effective care across the post-acute continuum.

The decision to rebrand as Encompass Health Corporation resulted from a

yearlong, research-intensive project and is intended to raise awareness of the

Company’s strategy and value proposition.

4

New Brand Logo and Visual Identity Will Begin Rolling

Out in 2018

Sample applications

5

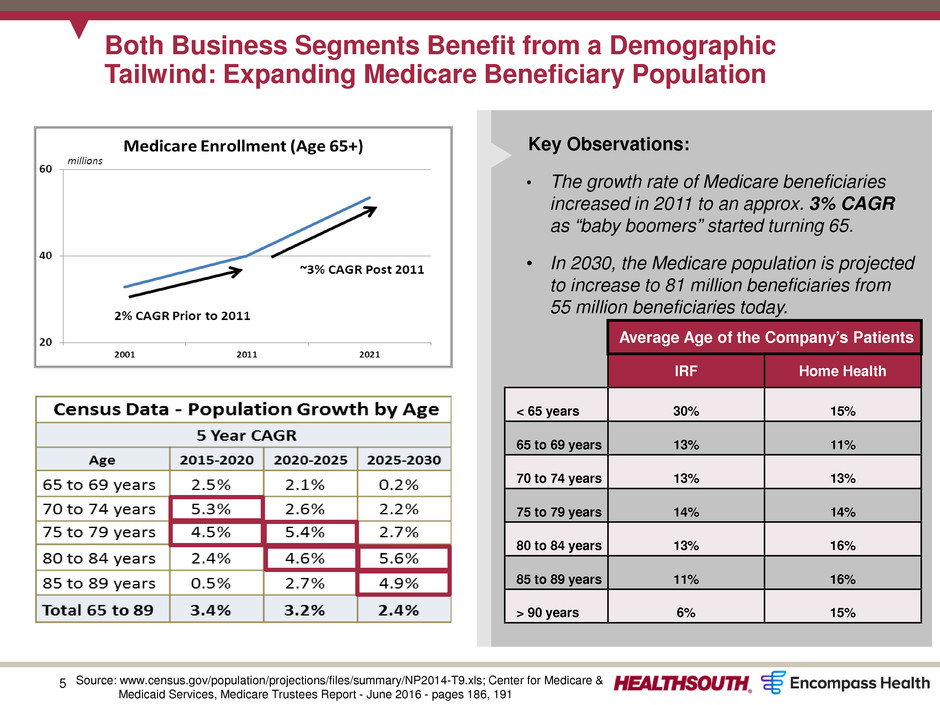

Both Business Segments Benefit from a Demographic

Tailwind: Expanding Medicare Beneficiary Population

Key Observations:

• The growth rate of Medicare beneficiaries

increased in 2011 to an approx. 3% CAGR

as “baby boomers” started turning 65.

• In 2030, the Medicare population is projected

to increase to 81 million beneficiaries from

55 million beneficiaries today.

Source: www.census.gov/population/projections/files/summary/NP2014-T9.xls; Center for Medicare &

Medicaid Services, Medicare Trustees Report - June 2016 - pages 186, 191

Average Age of the Company’s Patients

IRF Home Health

< 65 years 30% 15%

65 to 69 years 13% 11%

70 to 74 years 13% 13%

75 to 79 years 14% 14%

80 to 84 years 13% 16%

85 to 89 years 11% 16%

> 90 years 6% 15%

6

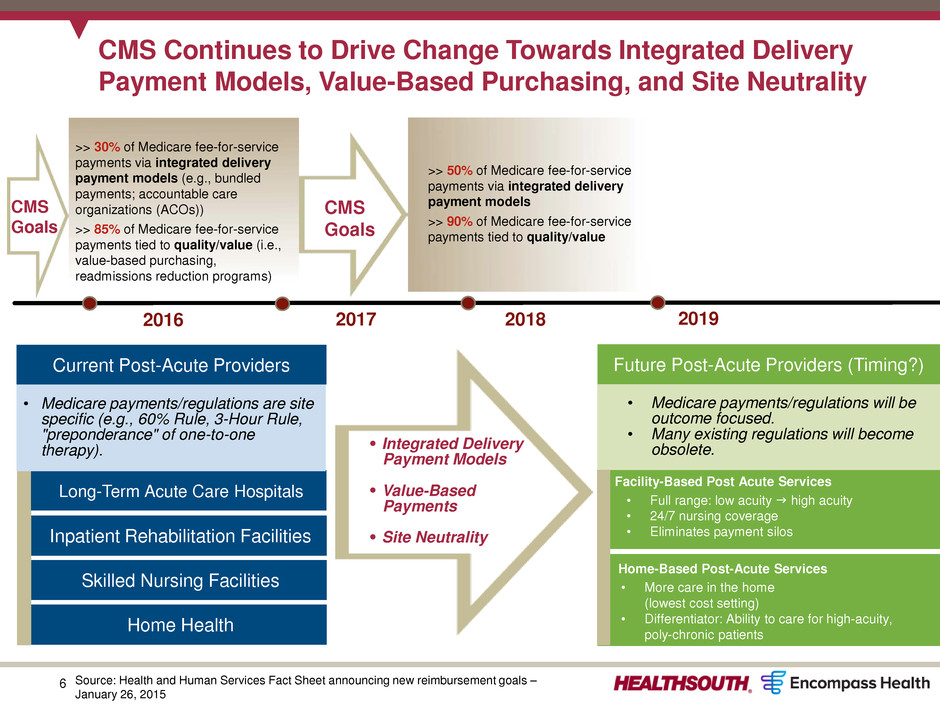

CMS Continues to Drive Change Towards Integrated Delivery

Payment Models, Value-Based Purchasing, and Site Neutrality

Future Post-Acute Providers (Timing?)

Inpatient Rehabilitation Facilities

• Full range: low acuity high acuity

• 24/7 nursing coverage

• Eliminates payment silos

Home-Based Post-Acute Services

• More care in the home

(lowest cost setting)

• Differentiator: Ability to care for high-acuity,

poly-chronic patients

>> 50% of Medicare fee-for-service

payments via integrated delivery

payment models

>> 90% of Medicare fee-for-service

payments tied to quality/value

Integrated Delivery

Payment Models

Value-Based

Payments

Site Neutrality

Current Post-Acute Providers

• Medicare payments/regulations will be

outcome focused.

• Many existing regulations will become

obsolete.

Facility-Based Post Acute Services

>> 30% of Medicare fee-for-service

payments via integrated delivery

payment models (e.g., bundled

payments; accountable care

organizations (ACOs))

>> 85% of Medicare fee-for-service

payments tied to quality/value (i.e.,

value-based purchasing,

readmissions reduction programs)

2017 2016

Source: Health and Human Services Fact Sheet announcing new reimbursement goals –

January 26, 2015

CMS

Goals

2018 2019

CMS

Goals

Skilled Nursing Facilities

Home Health

Long-Term Acute Care Hospitals

• Medicare payments/regulations are site

specific (e.g., 60% Rule, 3-Hour Rule,

"preponderance" of one-to-one

therapy).

7

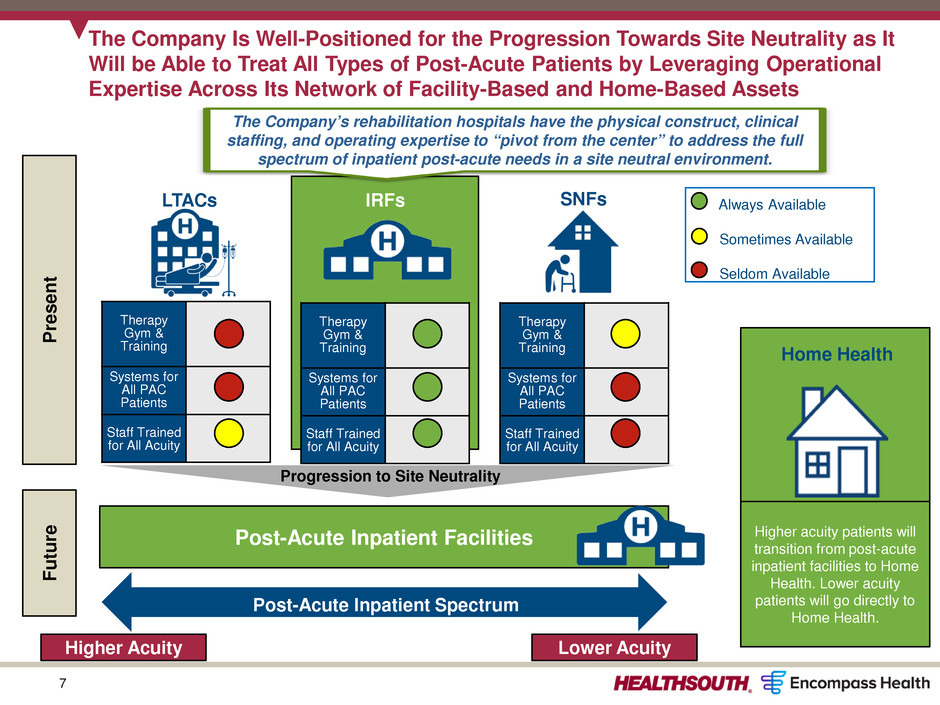

Always Available

Sometimes Available

Seldom Available

Therapy

Gym &

Training

Systems for

All PAC

Patients

Staff Trained

for All Acuity

Therapy

Gym &

Training

Systems for

All PAC

Patients

Staff Trained

for All Acuity

Therapy

Gym &

Training

Systems for

All PAC

Patients

Staff Trained

for All Acuity

LTACs IRFs SNFs

Home Health

The Company’s rehabilitation hospitals have the physical construct, clinical

staffing, and operating expertise to “pivot from the center” to address the full

spectrum of inpatient post-acute needs in a site neutral environment.

The Company Is Well-Positioned for the Progression Towards Site Neutrality as It

Will be Able to Treat All Types of Post-Acute Patients by Leveraging Operational

Expertise Across Its Network of Facility-Based and Home-Based Assets

Higher acuity patients will

transition from post-acute

inpatient facilities to Home

Health. Lower acuity

patients will go directly to

Home Health.

Post-Acute Inpatient Spectrum

Higher Acuity Lower Acuity

Progression to Site Neutrality

Post-Acute Inpatient Facilities

P

re

se

nt

Fu

tu

re

8

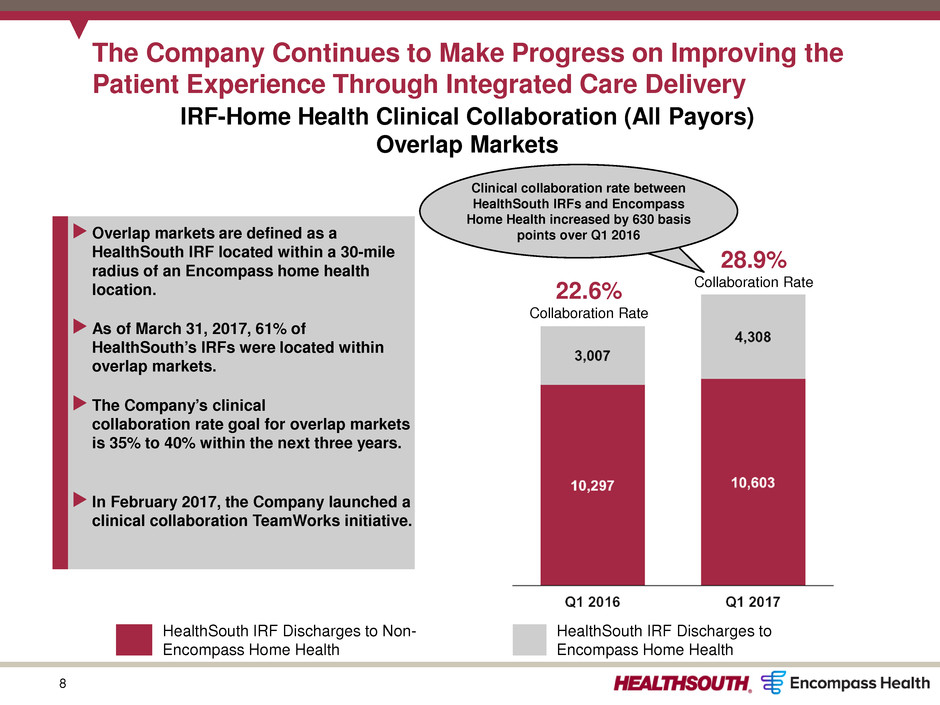

Clinical collaboration rate between

HealthSouth IRFs and Encompass

Home Health increased by 630 basis

points over Q1 2016

The Company Continues to Make Progress on Improving the

Patient Experience Through Integrated Care Delivery

22.6%

Collaboration Rate

28.9%

Collaboration Rate

HealthSouth IRF Discharges to Non-

Encompass Home Health

HealthSouth IRF Discharges to

Encompass Home Health

Overlap markets are defined as a

HealthSouth IRF located within a 30-mile

radius of an Encompass home health

location.

As of March 31, 2017, 61% of

HealthSouth’s IRFs were located within

overlap markets.

The Company’s clinical

collaboration rate goal for overlap markets

is 35% to 40% within the next three years.

In February 2017, the Company launched a

clinical collaboration TeamWorks initiative.

IRF-Home Health Clinical Collaboration (All Payors)

Overlap Markets