Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Calyxt, Inc. | d370817dex231.htm |

| EX-5.1 - EX-5.1 - Calyxt, Inc. | d370817dex51.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 10, 2017

Registration No. 333-218924

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CALYXT, INC.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| Delaware | 2870 | 27-1967997 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

600 County Road D West

Suite 8

New Brighton, MN 55112

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Calyxt, Inc.

600 County Road D West

Suite 8

New Brighton, MN 55112

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||||

| Richard D. Truesdell, Jr. Derek J. Dostal Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Shayne Kennedy Brian Cuneo Brett Urig Latham & Watkins LLP 650 Town Center Drive, 20th Floor Costa Mesa, California 92626 (714) 540-1235 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has not elected to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title Of Each Class Of Securities To Be Registered |

Amount To Be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate |

Amount Of Registration Fee(3) | ||||

| Common stock, par value $0.0001 per share |

6,969,697 | $18.00 | $125,454,546 | $8,746 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes the offering price of shares of common stock that may be sold if the option to purchase additional shares of common stock granted to the underwriters is exercised. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(a) under the Securities Act of 1933. |

| (3) | Filing fees in the amount of $5,795 were previously paid. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not offer these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 10, 2017

PRELIMINARY PROSPECTUS

6,060,606 Shares

Calyxt, Inc.

Common Stock

This is our initial public offering. We are offering 6,060,606 shares of our common stock.

Prior to this offering, there has been no public market for our common stock. We have applied to list the common stock on the NASDAQ Global Market (the “NASDAQ”) under the symbol “CLXT.” We anticipate that the initial public offering price will be between $15.00 and $18.00 per share of common stock.

We are an “emerging growth company” as that term is defined in the Jumpstart Our Business Startups Act of 2012 and, as such, will be subject to certain reduced public company reporting requirements. See “Summary—Implications of Being an Emerging Growth Company.”

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 13.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts(1) |

$ | $ | ||||||

| Proceeds to us before expenses(1) |

$ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain FINRA-related expenses. See “Underwriting.” |

Our parent company, Cellectis S.A., has reserved the option to potentially purchase up to $20.0 million of our common stock in the offering at a price per share equal to the initial public offering price. The shares would be purchased directly from Calyxt and not through the underwriters and there would be no payment of any underwriting discount.

The underwriters have the option to purchase up to 909,091 additional shares of common stock from us at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2017 through the book-entry facilities of The Depository Trust Company.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Citigroup | Jefferies | Wells Fargo Securities |

| BMO Capital Markets | Ladenburg Thalmann |

The date of this prospectus is , 2017

Table of Contents

Table of Contents

| PAGE | ||||

| 1 | ||||

| 9 | ||||

| 11 | ||||

| 13 | ||||

| Special Note Regarding Forward-Looking Statements and Industry Data |

47 | |||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 53 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

55 | |||

| 69 | ||||

| 100 | ||||

| 106 | ||||

| 119 | ||||

| 121 | ||||

| 126 | ||||

| 132 | ||||

| Material U.S. Federal Tax Considerations for Non-U.S. Holders |

134 | |||

| 137 | ||||

| 146 | ||||

| 146 | ||||

| 146 | ||||

| F-1 | ||||

We, Cellectis S.A. and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We, Cellectis S.A. and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide you. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the shares of common stock.

For investors outside the United States: Neither we nor any of the underwriters have taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

Unless the context requires otherwise: (a) references to “Calyxt,” the “Company,” our “company,” “we,” “us” or “our” refer to Calyxt, Inc., a Delaware corporation (formerly known as Cellectis Plant Sciences, Inc.) and (b) references to “Cellectis” refer to Cellectis S.A., a French corporation, and its subsidiaries other than Calyxt and its subsidiaries. Unless the context requires otherwise, statements relating to our history in this prospectus describe the history of Cellectis’ plant products business. See “Certain Relationships and Related Party Transactions—Relationship with Cellectis.”

i

Table of Contents

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

Currency amounts in this prospectus are stated in U.S. dollars, unless otherwise indicated.

This prospectus includes industry and market data that we obtained from periodic industry publications, third-party studies and surveys, filings of public companies in our industry and internal company surveys. These sources include government and industry sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this prospectus, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. We do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein. Assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

The name and trademark, Cellectis, and other trademarks, trade names and service marks of Cellectis appearing in this prospectus are the property of Cellectis. Prior to the completion of this offering, Calyxt and other trademarks, trade names and service marks of Calyxt appearing in this prospectus are the property of Cellectis, and after the completion of this offering, they will be the property of, or licensed to, Calyxt. This prospectus also contains additional trade names, trademarks and service marks belonging to Cellectis and to other companies. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

ii

Table of Contents

This summary highlights information included elsewhere in this prospectus and does not contain all of the information you should consider in making an investment decision. You should read this entire prospectus carefully, including the sections entitled “Risk Factors,” “Special Note Regarding Forward-Looking Statements,” “Selected Historical Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the notes thereto before making an investment decision regarding our common stock.

Our Company

Overview

We are a consumer-centric, food- and agriculture-focused company. By combining our leading gene-editing technology and technical expertise with our innovative commercial strategy, we are pioneering a paradigm shift to deliver healthier specialty food ingredients, such as healthier oils and high fiber wheat, for consumers and agriculturally advantageous crop traits, such as herbicide tolerance, to farmers. While the traits that enable these characteristics may occur naturally and randomly through evolution—or under a controlled environment through traditional agricultural technologies—those processes are imprecise and take many years, if not decades. Our technology enables us to precisely and specifically edit a plant genome to elicit the desired traits and characteristics, resulting in a final product that has no foreign DNA. We believe the precision, specificity, cost effectiveness and development speed of our gene-editing technologies will enable us to provide meaningful disruption to the food and agriculture industries.

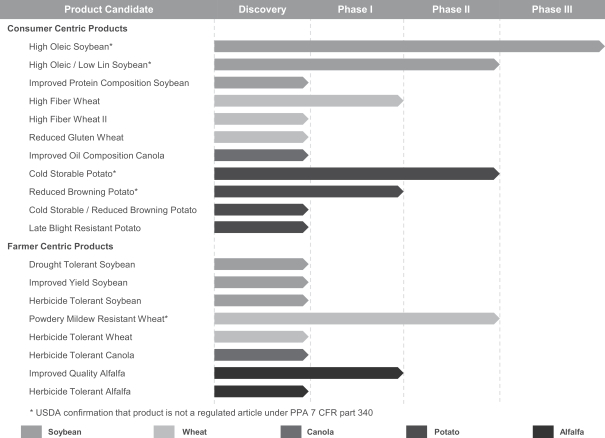

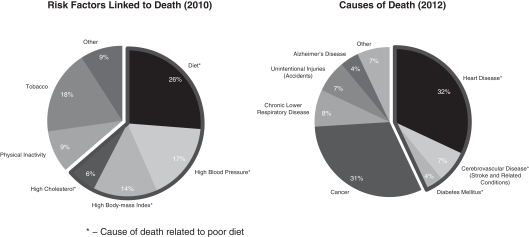

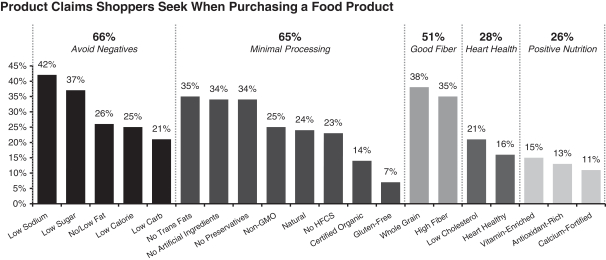

Food-related issues including obesity and diabetes are some of the most prevalent health issues today and continue to grow rapidly. As awareness of these diet-related health issues grows, consumers are emphasizing a healthier lifestyle and a desire for nutritionally rich foods that are more nutritious, better tasting, less processed and more convenient. This trend is leading to an increase in the demand for higher valued, premium segments of the food industry, such as higher fiber, reduced gluten and reduced fat products. As a result of these trends, food companies are looking for specialty ingredients and solutions that can help them satisfy their customers’ evolving needs and drive growth in market share and new value-added products.

While food companies are focused on these trends, we believe the legacy agriculture companies have overlooked society’s food-related issues and are not properly equipped to address health-driven consumer food trends. These legacy agriculture companies have historically focused on increasing yields, profit margins and market share. They have been burdened by high research and development costs and a high degree of commoditization in their deep, farmer-focused supply chains.

We have developed a robust product pipeline with our proprietary technology. Our first product candidate, which we expect to be commercialized by the end of 2018, is a high oleic soybean designed to produce a healthier oil that has zero trans fats and reduced saturated fats. We are also developing a high fiber wheat to create flour with up to three times more dietary fiber than standard white flour while maintaining the same flavor and convenience of use. Another product candidate we are developing is a herbicide tolerant wheat designed to provide farmers with better weed control options to increase yields and profitability. We believe each of these product candidates addresses a potential multi-billion dollar market opportunity.

We believe that our proprietary gene-editing technologies and innovative commercial strategy will allow us to bridge the divide between evolving consumer preferences and the historical approach by the large legacy companies in the agriculture supply chain.

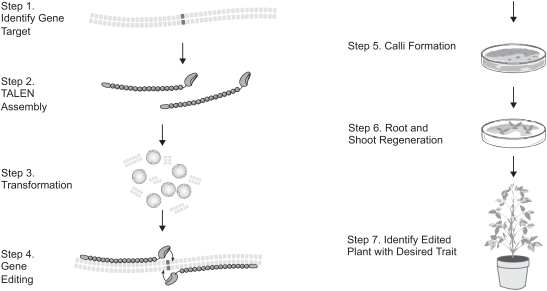

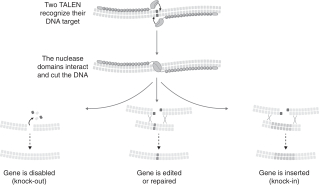

Using our proprietary technologies and expertise, we edit the genome of food crops by using our “molecular scissors” to precisely cut DNA in a single plant cell, use the plant’s natural repair machinery to make our desired

1

Table of Contents

edit and finally regenerate the single cell into a full plant. We believe we are able to develop targeted traits—some of which would be nearly impossible to develop using traditional trait-development methods—quicker, more efficiently and more cost effectively than traditional trait-development methods. Our technology positions us to assess the probability of success early on in the research and development process, potentially eliminating expensive late stage failures and allowing for a larger breadth of products to be developed. We have a strong track record with respect to our technologies and expertise as we have successfully edited more than 20 unique genes in 6 plant species since our inception in 2010.

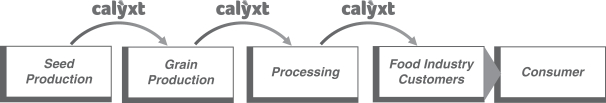

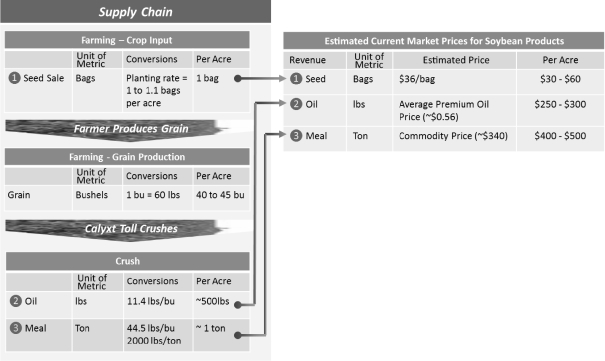

Our commercial strategy is centered on two core elements: developing healthier specialty food ingredients, such as healthier oils and high fiber wheat, to enable the food industry to address evolving consumer trends and developing agriculturally advantageous traits, such as herbicide tolerance, for farmers. This will involve developing and leveraging our supply chain to effectively bring our consumer- and farmer-centric products to the marketplace. For our consumer-centric products we intend to repurpose and leverage existing supply chain capacity by contracting, tolling or partnering with players in the existing supply chain, such as seed production companies, farmers, crushers, refiners or millers, which we expect will allow us to apply our resources to maximizing innovation and product development while minimizing our capital expenditures and overhead. For our farmer-centric products, we intend to broadly out-license our products to the seed industry.

Our Competitive Strengths

We believe that we are strategically well-positioned to develop high-value and innovative products. Our competitive strengths include:

| • | Proprietary technologies creating a powerful platform to design and develop new products. Since our founding, we have been at the forefront of the research, development and application of plant-based gene-editing technologies. Our capabilities enable us to precisely edit specific genes from a target food crop to improve the nutritional composition or provide agricultural benefits to farmers. Three examples of our technological innovation include: |

| • | High Oleic Soybean: We deactivated key genes associated with fatty acid biosynthesis to achieve a healthier soybean oil. |

| • | High Fiber Wheat: We simultaneously deactivated all six copies of a gene within a single wheat plant with the purpose of increasing fiber content. |

| • | Herbicide Tolerance: We believe we can develop crop varieties that will be tolerant to certain herbicides by identifying and making a subtle base substitution that we believe will be sufficient to confer herbicide tolerance. We expect to be able to replicate this process in various crops. |

| • | Innovative portfolio of product candidates with an accelerated path to market. We are currently developing a diversified portfolio spanning across five core crops—soybean, wheat, canola, potato and alfalfa—and a multitude of product candidates. These include innovative consumer-centric product candidates like our high-fiber wheat that is designed to produce flour with up to three times the fiber content of standard white flour, as well as innovative, farmer-centric solutions like herbicide tolerant wheat and products with valuable supply chain benefits like cold storable potatoes that are designed to store longer and produce much less acrylamide in the frying process, a human health concern that has been linked to cancer. We believe our portfolio of product candidates, coupled with our ability to quickly develop future product candidates, affords us the opportunity to disrupt the food industry. |

| • | Significant barriers to entry through our first-mover advantage and strong intellectual property. We command a first-mover advantage in the editing of genes in plants. As a pioneer in gene-editing technologies, we are building on more than two decades of hands-on experience and process |

2

Table of Contents

| optimization which we believe cannot be easily replicated by competitors. Our proprietary technologies and product candidates benefit from the licensing of a portfolio of 81 issued patents and 170 pending patent applications. |

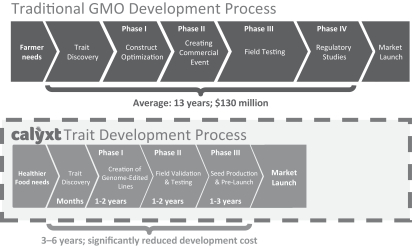

| • | Faster, cheaper and innovative product development process focused on end user needs. Genetic modification has traditionally taken an average of 13 years and over $130 million to develop a commercially viable product. By contrast, a key advantage of our gene-editing technology platform is that we believe we can develop products from concept to commercialization in three to six years and at a fraction of the cost. For example, we created our high oleic soybean product candidate by generating fewer than 20 independent plants that were edited with TALEN. This contrasts with traditional genetic modification methods which we believe require thousands of plants to achieve the same result. We developed our high oleic soybean from concept to field in under four years and expect to commercialize this product by the end of 2018. We believe we will continue to be able to react quickly to consumer and farmer needs that we identify. |

| • | Supply chain flexibility enabling us to capture significant downstream value. We plan to develop consumer traits and leverage existing supply chain capacity and our existing relationships to provide differentiated specialty ingredients to food companies. By doing so, we believe that we will be able to capture significant value as our innovative products move from “field to fork.” Our supply chain is flexible, enabling us to layer on new products to our existing ones and capture additional value. By stacking additional characteristics on the same seeds, we believe we can create additional value without necessarily increasing acreage, volumes of grain produced or the amount of oil commercialized, but rather by aiming to increase the value of our products on a per unit basis. For example, we believe this value creation could be implemented in our high oleic soybean product candidate if we were to stack a trait that improves the protein composition of the meal, a trait that further improves the soybean oil fatty acid profile or a farmer-focused trait such as herbicide tolerance. |

| • | A world-class management team with deep industry expertise. Our executive team has more than 120 years of collective experience in the agriculture and gene-editing fields. This includes over 95 years of collective experience in agricultural supply chain, product development and commercial operations, during which several members of our executive team have managed billions of dollars of revenue and cost at large multinational corporations. Several members of our executive team previously worked at well-known technology and agri-business companies, such as Monsanto, Syngenta, Stine Seed Company and Cargill. As pioneers in plant-based gene editing, members of our management team invented TALEN, one of the premier gene-editing tools. Dr. Daniel Voytas, our Chief Science Officer, is a Professor of Genetics, Cell Biology and Development at the University of Minnesota and Director of the Beckman Center for Genome Engineering. He is best known for his pioneering work to develop methods for precisely editing DNA sequences in living plant cells. |

Our Growth Strategy

We believe that there are significant opportunities to grow our business both domestically and internationally by executing on the following key elements of our strategy:

| • | Commercialize our current product candidates in North America. Our near-term focus is to launch our product candidates in North America where we believe the markets for healthier specialty food ingredients for consumers and unique, plant-trait solutions for farmers are significant and the existing supply chain enables us to accelerate growth. |

| • | Identify new opportunities through our consumer- and farmer-centric approaches. We intend to continue to elicit desired traits and to include additional crops in our product pipeline. We continuously evaluate the evolving needs of the consumer and the farmer and seek to apply our technologies and |

3

Table of Contents

| expertise to provide better solutions to meet their demands. We also expect to be able create additional opportunities from our existing product candidates once they are commercialized through combining traits, which may allow us to create products with additional benefits without adding significant cost. |

| • | Accelerate our R&D productivity with enhanced automation and high throughput capabilities. We consistently strive to optimize our product development processes. Through our planned facility expansion, we are combining gene-editing automation with food science capabilities to enable us to rapidly identify new growth opportunities. We believe that this automation and our high-throughput platform will allow for greater standardization in our processes. We expect this standardization to increase our research and development productivity significantly and add a greater number of projects to our product pipeline. |

| • | Expand through R&D agreements and acquisitions. We plan to selectively partner, in-license or acquire key enabling technologies and businesses across the value chain. This may include acquiring complementary technologies and intellectual property or fully developed products. In each case, we plan to look for R&D partners and acquisitions that give us a significant presence in the health focused specialty food ingredient markets where we will be able to accelerate the launch and commercialization of our innovative products. |

| • | Leverage our North American market presence to globalize our products. While we believe the North American market opportunity remains attractive and extensive, in the future we plan to explore the possibility of expanding our business globally. This may involve exporting our products to international markets or establishing new supply chains in other attractive markets. |

4

Table of Contents

Our Product Pipeline

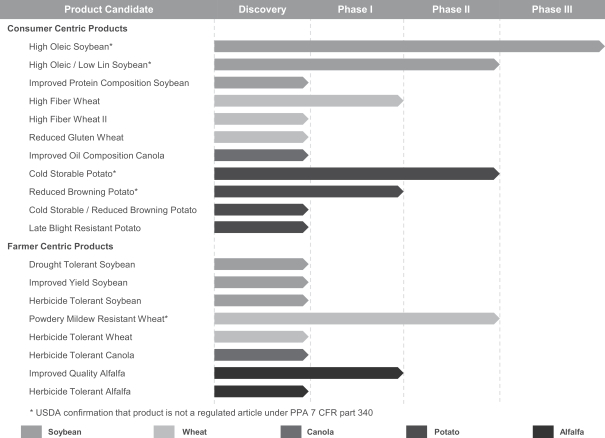

We have several products under development including: high oleic soybeans, powdery mildew resistant wheat, cold storable potato, high fiber wheat, reduced browning potato and herbicide tolerant wheat. Our current product candidates are depicted in the figure below:

We categorize our stages of pre-commercial development from Phase I to Phase III. Prior to entering Phase I, in Discovery, we identify genes of interest. In Phase I, we edit the identified genes of interest, target edits we desire to make, and produce an initial seed that contains the desired edit. Phase II is trait validation, where we perform small-scale and large-scale tests to confirm phenotype and ingredient functionality. In this phase we also perform replicated, multi-location field testing, after confirming that the product is not a regulated article by the USDA. In Phase III, we develop the first commercial-scale pilot production, begin to build out the supply chain and inventory and perform customer testing prior to commercialization.

High Oleic Soybean (Consumer Trait)

Soybean oil has historically been partially hydrogenated to enhance its oxidative stability in order to increase shelf life and improve frying characteristics. This process, however, creates trans-unsaturated fatty acids, or trans fats, which have been demonstrated to raise low-density lipoprotein (LDL) cholesterol levels and lower high-density lipoprotein (HDL), both of which contribute to cardiovascular disease.

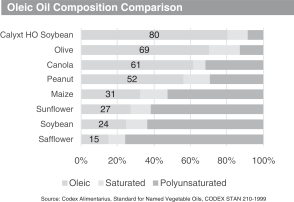

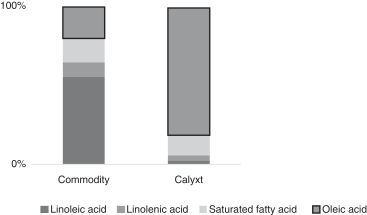

We developed a soybean trait that has produced oils with a fatty acid profile that contains 80% oleic acid, 20% less saturated fatty acids compared to commodity soybean oil and zero trans fats. Our high oleic soybean oil

5

Table of Contents

enhances oxidative stability more than fivefold when compared to commodity oil and also offers a threefold increase in fry-life. Our high oleic soybean was created using our TALEN gene-editing technology. We designed TALEN to specifically target two fatty acid desaturase genes (designated FAD2A and FAD2B). By key measures, including yield, our high oleic soybean variety performs comparably to its unedited counterpart. Our soybean product candidate is in Phase III of our development process. We are currently completing our commercialization plan and anticipate commercialization by the end of 2018.

High Fiber Wheat (Consumer Trait)

Research has shown that fiber may play a large role in maintaining bowel health, lowering cholesterol, stabilizing blood glucose levels and controlling weight gain. In recent years, the awareness of the health benefits of high fiber diets has increased. This has translated to a strong growth in demand for high fiber food products, with 35% of grocery shoppers now seeking high fiber foods. By 2018, the global market for high-fiber bread is expected to be $36 billion, a 25% jump from 2013.

We are developing high fiber wheat traits that could be used to produce white flour with up to three times more dietary fiber than standard white flour. We anticipate that by altering the proportion of certain slower digested carbohydrates in the wheat grain, we will increase dietary fiber. We believe our high fiber wheat flour will be incorporated into many food products—from pasta to bread. The product candidate is currently in Phase I of our development process.

Herbicide Tolerant Wheat (Farmer Trait)

With the constant need to increase yields, herbicides are an important component of commercial food production. Herbicide tolerance traits in crops can provide additional crop protection chemistry alternatives to control weeds and increase crop yields.

We are pioneering the development of herbicide tolerant traits in wheat without the use of foreign DNA. Herbicides act by inhibiting the activity of certain plant-encoded proteins that promote growth. We aim to achieve herbicide tolerance by specifically making a subtle repair to prevent herbicides from being able to recognize and block functions of these proteins, such that the edited plant survives the application of the herbicide. Our product will contain no foreign DNA. We believe this solution, if successfully developed and commercialized, will have the potential to increase the farmer’s yield and revenue. The product candidate is currently in the Discovery phase of our development process.

Other Products in Our Development Pipeline

Our extensive product pipeline includes a variety of consumer centric and farmer centric traits for soybean, wheat, canola, alfalfa and potato. We will conduct further development programs to build upon our current pipeline which currently includes improved oil composition canola, herbicide tolerant canola, improved quality alfalfa and herbicide tolerant alfalfa, late blight resistant potato, cold storable / reduced browning potato, improved protein composition soybean, drought tolerant soybean, herbicide tolerant soybean and improved yield soybean. In the future, we anticipate expanding our product pipeline to include other food crops.

We plan to develop gene-editing automation processes that will enable us to implement a high throughput discovery platform to identify new growth opportunities. This high-throughput platform is intended to allow us to discover more gene traits and make more complex edits, enabling us to drive innovation at a significantly faster rate. We believe all of these steps will enable us to remain at the forefront of food and agriculture innovation.

6

Table of Contents

Relationship with Cellectis

Prior to the completion of this offering, we were a wholly owned subsidiary of Cellectis, and all of our outstanding shares of common stock were owned by Cellectis. Immediately prior to the completion of this offering, we and Cellectis intend to enter into, or will have entered into, certain agreements that will provide a framework for our ongoing relationship with Cellectis. For a description of these agreements, see “Certain Relationships and Related Party Transactions—Relationship with Cellectis.”

Risk Factors

There are a number of risks that you should understand before making an investment decision regarding this offering. These risks are discussed more fully in the section entitled “Risk Factors” following this prospectus summary. These risks include, but are not limited to:

| • | Our limited operating history; |

| • | Our incurrence of significant losses since our inception and likelihood that we will continue to incur significant losses for the foreseeable future; |

| • | Our product development efforts use complex integrated technology platforms and require substantial time and resources; |

| • | Our crops are new, and producers may require instruction to successfully establish, grow and harvest our crops; |

| • | Our ability to produce high-quality plants and seeds cost-effectively on a large scale and to accurately forecast demand for our products; |

| • | Significant competition in plant biotechnology and the substantially greater financial, technical and other resources of our competitors; |

| • | Challenges from public perceptions of genetically engineered products and ethical, legal, environmental and social concerns and the potential future government regulation of our products; |

| • | Our ability to adequately protect our proprietary rights; |

| • | Our success in obtaining or maintaining necessary rights to product components and processes for our development pipeline through acquisitions and in-licenses; |

| • | Our ability to retain and attract senior management and key employees; |

| • | Our independent registered public accounting firm has identified a material weakness relating to our lack of a control in place to review forward purchase derivative contracts entered into by us, and this will require remediation; |

| • | The influence of Cellectis over us after this offering, including its contractual right to nominate a majority of our directors and other contractual rights; and |

| • | Our being a “controlled company” and, as a result, qualifying for, and intending to rely on, exemptions from certain corporate governance requirements. |

Corporate Information

We were incorporated in Delaware on January 8, 2010. The address of our principal executive offices is currently 600 County Road D West, Suite 8, New Brighton, MN 55112. Our website is currently www.calyxt.com. Information on, or accessible through, our website is not part of this prospectus.

7

Table of Contents

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of certain reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; |

| • | only two years of audited financial statements are required in addition to any required interim financial statements, and correspondingly reduced disclosure in management’s discussion and analysis of financial condition and results of operations; and |

| • | (i) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and (ii) exemptions from the requirements of holding a non-binding advisory vote on executive compensation, including golden parachute compensation. |

We may take advantage of these provisions for up to five years or until such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earliest to occur of (1) the last day of the fiscal year in which we have more than $1.07 billion in annual revenue; (2) the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities; (3) the issuance, in any three-year period, by us of more than $1.07 billion in non-convertible debt securities held by non-affiliates; and (4) the last day of the fiscal year ending after the fifth anniversary of our initial public offering.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”) for complying with new or revised accounting standards. This permits an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We intend to take advantage of the exemptions discussed above. Accordingly, the information contained herein may be different than the information you receive from other public companies.

8

Table of Contents

| Share of common stock offered by us |

6,060,606 shares |

| Total shares of common stock to be outstanding after this offering |

25,660,606 shares (26,569,697 shares if the underwriters exercise their option in full) |

| Underwriters’ option to purchase additional shares |

The underwriters have a 30-day option to purchase up to 909,091 additional shares of common stock from us as described under the heading “Underwriting.” |

| Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $90.9 million, or approximately $104.8 million if the underwriters exercise in full their option to purchase additional shares of our common stock, assuming an initial public offering price of $16.50 per share (the midpoint of the range set forth on the cover page of this prospectus), after deducting estimated underwriting discounts and commissions and estimated offering expenses. |

| We intend to use the net proceeds of this offering to fund research and development, to build out commercial capabilities and for working capital and general corporate purposes, as described in greater detail under “Use of Proceeds.” |

| Voting rights |

Holders of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholder. |

| See “Description of Capital Stock—Common Stock” for a description of the material terms of our common stock. |

| Directed share program |

At our request, the underwriters have reserved for sale, at the initial public offering price, up to 3.0% of the shares offered by this prospectus for sale to some of our or Cellectis’ directors, consultants and employees and their families. Any purchases of reserved shares by these persons would reduce the number of shares available for sale to the general public. Any reserved shares that are not so purchased will be offered by the underwriters to the general public on the same terms as the other shares offered by this prospectus. |

| NASDAQ symbol |

We have applied to list the common stock on the NASDAQ under the symbol “CLXT.” |

The number of shares outstanding after this offering is based on 19,600,000 shares outstanding as of June 30, 2017 and excludes:

| • | 1,909,775 shares of common stock issuable upon the exercise of outstanding stock options under the Calyxt, Inc. Equity Incentive Plan (the “Existing Plan”) and 2,119,699 shares of common stock issuable upon the exercise of outstanding stock options under the new equity compensation plan that we adopted in connection with this offering (the “Omnibus Plan”) at a blended weighted-average exercise price of $9.09 per share; |

9

Table of Contents

| • | 1,452,333 shares of common stock deliverable upon the vesting and settlement of outstanding restricted stock units under the Omnibus Plan; |

| • | 127,400 shares of common stock reserved for future grants or for sale under the Existing Plan; and |

| • | 1,327,969 shares of common stock reserved for future grants or for sale under the Omnibus Plan. |

Unless we specifically state otherwise or the context otherwise requires, the information in this prospectus (i) reflects the 100-for-1 stock split completed on June 14, 2017 as described in note 15 to our unaudited condensed financial statements included elsewhere in this prospectus and (ii) assumes:

| • | except in our historical financial statements included in this prospectus, the consummation of another stock split immediately prior to and contingent on closing of this offering pursuant to which each share of common stock held of record by the holder thereof will be reclassified into 2.45 shares; |

| • | no exercise of the outstanding options described above; |

| • | no purchases by our directors, officers or their affiliates pursuant to the directed share program or by Cellectis; and |

| • | the underwriters’ option to purchase up to an additional 909,091 shares of common stock from us is not exercised. |

10

Table of Contents

SUMMARY HISTORICAL FINANCIAL DATA

The summary financial information appearing below for the years ended December 31, 2016 and 2015 has been derived from our audited financial statements, included elsewhere in this prospectus with the exception of the basic and diluted net loss per share and the weighted average shares outstanding—basic and diluted, which reflect the consummation of a stock split immediately prior to and contingent on closing of this offering pursuant to which each share held of record by the holder thereof will be reclassified into 2.45 shares. The summary financial information appearing below as of March 31, 2017 and for the three months ended March 31, 2017 and 2016 has been derived from our unaudited condensed financial statements, included elsewhere in this prospectus. The unaudited condensed financial statements have been prepared on the same basis as our audited financial statements and include all normal recurring adjustments that we consider necessary for a fair statement of our financial position and operating results as of the dates and for the periods presented. The summary financial data below should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in conjunction with the financial statements, related notes and other information included elsewhere in this prospectus.

Our historical results are not necessarily indicative of our future results and our interim results are not necessarily reflective of the results to be expected for the full year. The summary financial information below does not contain all the information included in our financial statements.

Statements of Operations

| (unaudited) | ||||||||||||||||

| Three Months Ended March 31, | Year Ended December 31, | |||||||||||||||

| 2017 | 2016 | 2016 | 2015 | |||||||||||||

| (in thousands, except per share data) | ||||||||||||||||

| Revenue |

$ | 55 | $ | 106 | $ | 399 | $ | 1,272 | ||||||||

| Operating expenses: |

||||||||||||||||

| Cost of revenue |

— | 100 | 200 | 751 | ||||||||||||

| Research and development |

1,266 | 1,370 | 5,638 | 2,766 | ||||||||||||

| Sales, general, and administrative |

1,578 | 1,197 | 6,670 | 3,569 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

2,844 | 2,667 | 12,508 | 7,086 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(2,789 | ) | (2,561 | ) | (12,109 | ) | (5,814 | ) | ||||||||

| Interest expense |

(14 | ) | (4 | ) | (5 | ) | (261 | ) | ||||||||

| Foreign currency transaction gains (losses) |

(29 | ) | (4 | ) | 28 | 186 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss before income taxes |

(2,832 | ) | (2,569 | ) | (12,086 | ) | (5,889 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income tax benefit |

— | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (2,832 | ) | $ | (2,569 | ) | $ | (12,086 | ) | $ | (5,889 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic and diluted net loss per share(1) |

$ | (0.14 | ) | $ | (0.13 | ) | $ | (0.62 | ) | $ | (0.88 | ) | ||||

| Weighted average shares outstanding—basic and diluted |

19,600,000 | 19,600,000 | 19,600,000 | 6,725,740 | ||||||||||||

11

Table of Contents

Balance Sheet Data:

| (unaudited) | ||||||||

| As at March 31, 2017 | ||||||||

| Actual | As Adjusted(2) | |||||||

| (in thousands) | ||||||||

| Cash and cash equivalents |

$ | 3,007 | $ | 93,873 | ||||

| Total assets |

15,092 | 105,958 | ||||||

| Accumulated deficit |

(31,400 | ) | (31,400 | ) | ||||

| Total stockholder’s equity |

10,421 | 101,287 | ||||||

| Total liabilities and stockholder’s equity |

15,092 | 105,958 | ||||||

| (1) | See note 8 to our audited financial statements and note 7 to our unaudited condensed financial statements, included elsewhere in this prospectus, for an explanation of the method used to calculate basic and diluted net loss per share. |

| (2) | As adjusted to give effect to the issuance and sale of 6,060,606 shares of common stock in this offering, assuming an initial public offering price of $16.50 per share (the midpoint of the range set forth on the cover page of this prospectus), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

A $1.00 increase (decrease) in the assumed initial public offering price of $16.50 per share would increase (decrease) each of as adjusted cash and cash equivalents, total assets total stockholder’s equity and total liabilities and stockholder’s equity by $5.6 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting the underwriting discount and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. Each increase (decrease) of 1,000,000 in the number of shares offered by us would increase (decrease) as adjusted cash and cash equivalents, total stockholder’s equity and liabilities and stockholder’s equity by $15.3 million, assuming an initial public offering price of $16.50 per share, after deducting the underwriting discount and estimated offering expenses payable by us.

12

Table of Contents

Investing in our common stock involves a high degree of risk. You should consider carefully the following risks, together with all the other information in this prospectus, including our financial statements and notes thereto, before you invest in our common stock. If any of the following risks actually materializes, our operating results, financial condition and liquidity could be materially adversely affected. As a result, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks Related to Our Business and Industry

We have a limited operating history, which makes it difficult to evaluate our current business and future prospects and may increase the risk of your investment.

We are an early-stage gene-editing company with a limited operating history that to date has been focused primarily on research and development, conducting field trials and building our management team. Investment in agricultural biotechnology product development is a highly speculative endeavor. It entails substantial upfront research and development investment and there is significant risk that we will not be able to edit the genes in a particular plant to express a desired trait, or, once edited, we will not be able to replicate that trait across entire crops in order to commercialize the product candidate. Moreover, the regulatory pathway for some of our product candidates can be uncertain and could add significant additional cost and time to development. We have not yet generated any revenue from sales of these products.

Our limited operating history may make it difficult to evaluate our current business and our future prospects. We have encountered, and will continue to encounter, risks and difficulties frequently experienced by growing companies in rapidly developing and changing industries, such as the agricultural biotechnology industry, including challenges in forecasting accuracy, determining appropriate investments of our limited resources, gaining market acceptance of the products created using our gene-editing platform, managing a complex regulatory landscape and developing new product candidates. We may also face challenges in scaling our supply chain in a cost-effective manner, as we will rely on contracting with seed production companies, farmers, crushers, refiners, logistics and transportation providers and/or millers, in order to get our various products to market. Our current operating model may require changes in order for us to scale our operations efficiently. We may not be able to fully implement or execute on our business strategy or realize, in whole or in part within our expected time frames, the anticipated benefits of our growth strategies. You should consider our business and prospects in light of the risks and difficulties we face as an early-stage company focused on developing products in the field of agricultural biotechnology.

We have incurred significant losses since our inception, have no commercial products and anticipate that we will continue to incur significant losses for the foreseeable future.

Our net loss for the three months ended March 31, 2017 and for the years ended December 31, 2016 and 2015 was $2.8 million, $12.1 million and $5.9 million, respectively. As of March 31, 2017, we had an accumulated deficit of $31.4 million. The amount of our future net losses will depend, in part, on the pace and amount of our future expenditures and our ability to obtain funding through equity or debt financings, funding provided by Cellectis, and on additional grants or tax credits. We currently have no commercial products and do not expect to have sales until the end of the 2018 at the earliest for our high oleic soybean product candidate, and we do not expect potential commercial launch of our high fiber wheat product candidate until 2020 at the earliest. Even then, our sales will be limited to a single product. As a result, we expect to continue to incur significant expenses and operating losses for the foreseeable future. We anticipate that such expenses will increase substantially if and as we:

| • | establish a sales, marketing and distribution infrastructure, including relationships across our supply chain, to commercialize any products that have completed the development process; |

| • | conduct additional field trials of our current and future product candidates; |

13

Table of Contents

| • | secure manufacturing arrangements for commercial production; |

| • | continue to advance the research and development of our current and future product candidates; |

| • | seek to identify and validate additional product candidates; |

| • | acquire or in-license other product candidates, technologies, germplasm or other biological material; |

| • | are required to seek regulatory and marketing approvals for our product candidates; |

| • | make royalty and other payments under any in-license agreements; |

| • | maintain, protect, expand and defend our intellectual property portfolio; |

| • | seek to attract and retain new and existing skilled personnel; and |

| • | experience any delays or encounter issues with any of the above. |

The net losses we incur may fluctuate significantly from year-to-year and quarter-to-quarter, such that a period-to-period comparison of our results of operations may not be a good indication of our future performance. In any particular period or periods, our operating results could be below the expectations of securities analysts or investors, which could cause the price of our common stock to decline.

We have never commercialized a product candidate and we may lack the necessary expertise, personnel and resources to successfully commercialize any of our product candidates.

We have never commercialized a product candidate. Our products are still in development, and there is no established market for them. Completion of product development could be protracted, and any products may not be ready for commercial launch for several years, if ever. If we are not able to commercialize our existing or future product candidates on a significant scale, then we may not be successful in building a sustainable or profitable business. Moreover, we expect to price our products based on our assessment of the value that we believe they will provide to food manufacturers or farmers, rather than on the cost of production. If food manufacturers or farmers attribute a lower value to our products than we do, they may not be willing to pay the premium prices that we expect to charge. Pricing levels may also be negatively affected if our products are unsuccessful in producing the yields or traits we expect. Food manufacturers or farmers may also be cautious in their adoption of new products and technologies, with conservative initial purchases and proof of product required prior to widespread deployment. It may take several growing seasons for food manufacturers or farmers to adopt our products on a large scale.

To achieve commercial success of our product candidates, we will have to develop our own sales, marketing and supply capabilities by outsourcing these activities to third parties. Factors that may affect our ability to commercialize our product candidates on our own include recruiting and retaining adequate numbers of effective sales and marketing personnel, obtaining access to or persuading adequate numbers of food manufacturers or farmers to purchase and use our product candidates and other unforeseen costs associated with creating an independent sales and marketing organization. Developing and maintaining a sales and marketing organization requires significant investment, is time-consuming and could delay the launch of our product candidates. We may not be able to build or maintain an effective sales and marketing organization in North America or other key global markets. If we are unable to find suitable partners for the commercialization of our product candidates, we may have difficulties generating revenue from them.

We will rely on contractual counterparties and they may fail to perform adequately.

Our commercial strategy depends on our ability to contract with counterparties that provide, and in the future may provide, a variety of seed production companies, farmers, crushers, refiners, millers, transportation and logistics companies and lab equipment service providers. We plan to rely on these third parties to provide services along our supply chain and in our research and development functions. The failure of these

14

Table of Contents

counterparties to fulfill the terms of our agreements could cause disruptions in our supply chains, research efforts, commercialization efforts, and otherwise inhibit our ability to bring our products to market at the times and in the quantities as planned. For example, if our crushers and refiners fail to process our crops at the times and at the quantities as agreed, we may be unable to meet the demands of food manufacturers who we have contracted with to purchase our products, leading to lower sales and potential reputational damage and contractual liabilities. While we may have certain indemnification rights in our contracts with such counterparties, there is no assurance that such indemnification rights will be sufficient to cover any damage to us that would result from a failure of such a counterparty in their contractual arrangements with us.

We face significant competition and many of our competitors have substantially greater financial, technical and other resources than we do.

The market for agricultural biotechnology products is highly competitive, and we face significant direct and indirect competition in several aspects of our business. Competition for improving plant genetics comes from conventional and advanced plant breeding techniques, as well as from the development of advanced biotechnology traits. Other potentially competitive sources of improvement in crop yields include improvements in crop protection chemicals, fertilizer formulations, farm mechanization, other biotechnology, and information management. Programs to improve genetics and crop protection chemicals are generally concentrated within a relatively small number of large companies, while non-genetic approaches are underway with broader set of companies. Mergers and acquisitions in the plant science, specialty food ingredient and agricultural biotechnology, seed and chemical industries may result in even more resources being concentrated among a smaller number of our competitors. Additionally, competition for providing more nutritious ingredients for food companies come from chemical-based ingredients, additives and substitutes, which are developed by various companies. The majority of these competitors have substantially greater financial, technical, marketing, sales, distribution and other resources than we do, such as larger research and development staff, more experienced marketing and manufacturing organizations and more well-established sales forces. As a result, we may be unable to compete successfully against our current or future competitors, which may result in price reductions, reduced margins and the inability to achieve market acceptance for our products. We expect to continue to face significant competition in the markets in which we intend to commercialize our products.

Many of our competitors engage in ongoing research and development, and technological developments by our competitors could render our products less competitive, resulting in reduced sales compared to our expectations. Our ability to compete effectively and to achieve commercial success depends, in part, on our ability to: control manufacturing and marketing costs; effectively price and market our products; successfully develop an effective marketing program and an efficient supply chain; develop new products with properties attractive to food manufacturers or farmers; and commercialize our products quickly without incurring major regulatory costs. We may not be successful in achieving these factors and any such failure may adversely affect our business, results of operations and financial condition.

We also anticipate increased competition in the future as new companies enter the market and new technologies become available, particularly in the area of gene editing. Our technology may be rendered obsolete or uneconomical by technological advances or entirely different approaches developed by one or more of our competitors, which will prevent or limit our ability to generate revenue from the commercialization of our products. At the same time, the expiration of patents covering existing products reduces the barriers to entry for competitors.

The successful commercialization of our products may face challenges from public perceptions of genetically engineered products and ethical, legal, environmental, health and social concerns.

The successful commercialization of our product candidates depends, in part, on public acceptance of genetically engineered agricultural products. Any increase in negative perceptions of gene editing or more restrictive government regulations in response thereto, would have a negative effect on our business and may delay or impair the development and commercialization of our products.

15

Table of Contents

The commercial success of our products may be adversely affected by claims that biotechnology plant products are unsafe for consumption or use, pose risks of damage to the environment, or create legal, social and ethical dilemmas.

If we are not able to overcome these concerns, our products may not achieve market acceptance. Any of the risks discussed below could result in expenses, delays or other impediments to our development programs or the market acceptance and commercialization of our products:

| • | public attitudes about the safety and environmental hazards of, and ethical concerns over, genetic research and biotechnology plant products, which could influence public acceptance of our technologies and products; |

| • | public attitudes regarding, and potential changes to laws governing, ownership of genetic material, which could weaken our intellectual property rights with respect to our genetic material and discourage R&D partners from supporting, developing or commercializing our products and technologies; and |

| • | failure to maintain or secure consumer confidence in, or to maintain or receive governmental approvals for, our products. |

Any future labeling requirements could heighten these concerns and make consumers less likely to purchase food products containing gene-edited ingredients.

Regulatory requirements for genetically engineered products are uncertain and evolving. Changes in the current application of these laws would have a significant adverse impact on our ability to develop and commercialize our products.

Changes in applicable regulatory requirements could result in a substantial increase in the time and costs associated with developing our products and negatively impact our operating results. In the United States, the United States Department of Agriculture, or USDA, regulates, among other things, the introduction (including the importation, interstate movement, or release into the environment such as field testing) of organisms and products altered or produced through genetic engineering that are plant pests or that there is reason to believe are plant pests. Such organisms and products are considered “regulated articles.” However, a petitioner may submit a request for a determination by the USDA of “nonregulated status” for a particular article. A petition for determination of nonregulated status must include detailed information, including relevant experimental data and publications, and a description of the genotypic differences between the regulated article and the nonmodified recipient organism, among other things. We previously submitted a request for a determination of “nonregulated status” to the USDA for our potato product candidates, our high oleic and low linolineic soybean product candidates and our powdery mildew-resistant wheat product candidate. The USDA confirmed in writing that each of these product candidates is not deemed to be a “regulated article” under the Plant Protection Act because it does not contain genetic material from plant pests. In the event any of our product candidates are found to contain inserted genetic material or otherwise differ from the descriptions we have provided to the USDA, the USDA could determine that such product candidates are regulated articles, which would require us to comply with the permit and notification requirements of the Plant Protection Act. While we believe that the USDA’s reasoning will continue to extend to our other product candidates, we have not obtained a determination from the USDA that any of our other product candidates are not “regulated articles” under these regulations. USDA’s regulations also require that companies obtain a permit or file a notification before engaging in the introduction (including the importation, interstate movement, or release into the environment such as field testing) of “regulated articles.” We cannot predict whether the USDA or advocacy groups will challenge our interpretation, or whether the USDA will alter the manner in which it interprets its own regulations or institutes new regulations, or otherwise modifies regulations in a way that will subject our products to more burdensome standards, thereby substantially increasing the time and costs associated with developing our product candidates. Moreover, we cannot assure you that the USDA will apply this same analysis to any of our other product candidates in development. Complying with USDA’s plant pest regulations, including permitting requirements, is a costly, time-consuming process and could substantially delay or prevent the commercialization of our products.

16

Table of Contents

Our products may also be subject to extensive FDA food product regulations. Under sections 201(s) and 409 of the Federal Food, Drug, and Cosmetic Act, or FDCA, any substance that is reasonably expected to become a component of food added to food is a food additive, and is therefore subject to FDA premarket review and approval, unless the substance is generally recognized, among qualified experts, as having been adequately shown to be safe under the conditions of its intended use (generally recognized as safe, or GRAS), or unless the use of the substance is otherwise excluded from the definition of a food additive, and any food that contains an unsafe food additive is considered adulterated under section 402(a)(2)(C) of the FDCA. The FDA may classify some or all of our product candidates as containing a food additive that is not GRAS or otherwise determine that our products contain significant compositional differences from existing plant products that require further review. Such classification would cause these product candidates to require pre-market approval, which could delay the commercialization of these products. In addition, the FDA is currently evaluating its approach to the regulation of gene-edited plants. For example, on January 18, 2017, the FDA announced a Request for Comments, or RFC, seeking public input to help inform its regulatory approach to human and animal foods derived from plants produced using gene editing. Among other things, the RFC asks for data and information in response to questions about the safety of foods from gene-edited plants, such as whether categories of gene-edited plants present food safety risks different from other plants produced through traditional plant breeding. If the FDA enacts new regulations or policies with respect to gene-edited plants, such policies could result in additional compliance costs and/or delay the commercialization of our product candidates, which could negatively affect our profitability. Any delay in the regulatory consultation process, or a determination that our products do not meet regulatory approval, by the FDA could cause a delay in the commercialization of our products, which may lead to reduced acceptance by food manufacturers, farmers or the public and an increase in competitor products that may directly compete with ours.

The regulatory environment outside the United States varies greatly from region to region and is less developed than in the United States.

The regulatory environment around gene editing in plants for food ingredients is greatly uncertain outside of the United States and varies greatly from jurisdiction to jurisdiction. Each jurisdiction may have its own regulatory framework regarding genetically modified foods, which may include restrictions and regulations on planting and growing genetically modified plants and in the consumption and labeling of genetically modified foods, and which may encapsulate our products. The two leading jurisdictions, the United States and the European Union, or the EU, do, and may continue to in the future, have distinctly different regulatory regimes with different rules and requirements. We cannot predict how the global regulatory landscape regarding gene editing in plants for food ingredients will evolve and may incur increased regulatory costs as regulations in the jurisdictions in which we operate change.

In the EU, genetically modified foods can only be allowed on the market once they have been authorized subject to rigorous safety assessments. The procedures for evaluation and authorization of genetically modified foods are governed by Regulation (EC) 1829/2003 on genetically modified food and feed and Directive 2001/18/EC on the release of genetically modified organisms, or GMOs, into the environment. If the GMO is not to be used in food or feed, then an application must be made under Directive 2001/18/EC. If the GMO is to be used in food or feed (but it is not grown in the EU) then a single application for both food and feed purposes under Regulation 1829/2003 should be made. If the GMO is used in feed or food and it is also grown in the EU, an application for both cultivation and food/feed purposes needs to be carried out under Regulation (EC) 1829/2003. A different EU regulation, Regulation (EC) 1830/2003, regulates the labeling of products that contain GMOs that are placed on the EU market. There are currently legislative proposals in the EU that would allow EU Member States to restrict or prohibit growing GMOs in their territory, on a range of environmental grounds, even if such crops were previously authorized at EU level. Should these proposals become law, growing GMOs may become more difficult in individual EU Member States.

We cannot predict whether or when any jurisdiction will change its regulations with respect to our products. Advocacy groups have engaged in publicity campaigns and filed lawsuits in various countries against companies

17

Table of Contents

and regulatory authorities, seeking to halt regulatory approval activities or influence public opinion against genetically engineered products. In addition, governmental reaction to negative publicity concerning our products could result in greater regulation of genetic research and derivative products or regulatory costs that render our products cost prohibitive.

The scale of the commodity food industry may make it difficult to monitor and control the distribution of our products. As a result, our products may be sold inadvertently within jurisdictions where they are not approved for distribution. Such sales may lead to regulatory challenges or lawsuits against us, which could result in significant expenses and management attention.

Government policies and regulations, particularly those affecting the agricultural sector and related industries, could adversely affect our operations and profitability.

Agricultural production and trade flows are subject to government policies and regulations. Governmental policies and approvals of technologies affecting the agricultural industry, such as taxes, tariffs, duties, subsidies, incentives and import and export restrictions on agricultural commodities and commodity products can influence the planting of certain crops, the location and size of crop production, and the volume and types of imports and exports. Future government policies in the United States or in other countries may discourage food manufacturers or farmers from using our products or encourage the use of products more advantageous to our competitors, which would put us at a commercial disadvantage and could negatively impact our future revenues and results of operations.

The overall agricultural industry is susceptible to commodity price changes and we, along with our food manufacturing customers and farmer customers, are exposed to market risks from changes in commodity prices.

Changes in the prices of certain commodity products could result in higher overall cost along the agricultural supply chain, which may negatively affect our ability to commercialize our products. We will be susceptible to changes in costs in the agricultural industry as a result of factors beyond our control, such as general economic conditions, seasonal fluctuations, weather conditions, demand, food safety concerns, product recalls and government regulations. As a result, we may not be able to anticipate or react to changing costs by adjusting our practices, which could cause our operating results to deteriorate. We do not engage in hedging or speculative financial transactions nor do we hold or issue financial instruments for trading purposes.

Our product development efforts use complex integrated technology platforms and require substantial time and resources; these efforts may not be successful, or the rate of product improvement may be slower than expected.

Development of successful agricultural products using complex technology platforms such as gene-editing technologies requires significant levels of investment in research and development, including laboratory, greenhouse and field testing, to demonstrate their effectiveness and can take several years or more. For the three months ended March 31, 2017 and for the years ended December 31, 2016 and 2015, we spent $1.3 million, $5.6 million and $2.8 million, respectively, on research and development expenses. We intend to continue to invest in research and development, including additional and expanded field testing, to validate our product candidates in real world conditions. Our investment in research and development may not result in significant product revenue over the next several years, if ever. Moreover, the successful application of gene-editing technologies can be unpredictable, and may prove to be unsuccessful when attempting to achieve desired traits in different crops and plants. For example, our gene-editing techniques may prove to be unsuccessful very early on during the discovery phase of new crop development based on technology limitations. Alternatively, even though we successfully implemented gene edits during the discovery phase, that trait may not ultimately appear in crops during field testing or crops may also exhibit other undesirable traits that adversely affect their commercial value.

18

Table of Contents

Development of new or improved agricultural products involves risks of failure inherent in the development of products based on innovative and complex technologies. These risks include the possibility that:

| • | our products will fail to perform as expected in the field; |

| • | our products will not receive necessary regulatory permits and governmental clearances in the markets in which we intend to sell them; |

| • | our products may have adverse effects on consumers; |

| • | consumer preferences, which are unpredictable and can vary greatly, may change quickly, making our products no longer desirable; |

| • | our competitors develop new products that taste better or have other more appealing characteristics than our products; |

| • | our products will be viewed as too expensive by food companies or farmers as compared to competitive products; |

| • | our products will be difficult to produce on a large scale or will not be economical to grow; |

| • | intellectual property and other proprietary rights of third parties will prevent us, our R&D partners, or our licensees from marketing and selling our products; |

| • | we may be unable to patent or otherwise obtain intellectual property protection for our discoveries in the necessary jurisdictions; |

| • | we or the food manufacturers that we sell our ingredients to may be unable to fully develop or commercialize products containing our products in a timely manner or at all; and |

| • | third parties may develop superior or equivalent products. |

Lastly, the field of gene editing, particularly in the area of plants, is still in its infancy, and no products using this technology have reached the market. Negative developments in the field of gene editing, including with respect to adverse side effects, could harm the reputation of the industry and negatively impact our business.

We are currently reliant on certain gene-editing technologies that may become obsolete in the future.

We currently rely on our proprietary TALEN technology in the development of our product candidates. There are several other gene-editing technologies currently available, including CRISPR/Cas9, meganucleases and zinc finger nucleases. If our competitors are able to refine existing gene-editing technologies—or develop new ones—that allow them to develop products faster, with lower research costs or with more desirable traits than we can, we may face a decline in the demand for our products. Our technologies may be rendered obsolete or uneconomical by technological advances or entirely different approaches developed by one or more of our competitors, which will prevent or limit our ability to generate revenues from the commercialization of our products.

We may need to raise additional funding, which may not be available on acceptable terms or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations.

The process of developing and commercializing product candidates is expensive, lengthy and risky. We expect our research and development expenses to increase substantially as we continue to develop our existing product candidates and identify new product candidates for development. We are beginning to prepare for the commercialization of our first product candidate, high-oleic soybean oil, which we expect to occur by the end of 2018. As a result, our selling, general and administrative expense will also increase significantly.

19

Table of Contents