Attached files

| file | filename |

|---|---|

| EX-23.3 - EXHIBIT 23.3 - CANTALOUPE, INC. | ex23_3.htm |

| EX-23.1 - EXHIBIT 23.1 - CANTALOUPE, INC. | ex23_1.htm |

As filed with the Securities and Exchange Commission on July 7, 2017

REGISTRATION NO. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

USA TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

Pennsylvania

|

7359

|

23-2679963

|

|

(State or other jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer Identification No.)

|

100 Deerfield Lane, Suite 300

Malvern, Pennsylvania 19355

(610) 989-0340

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive officers)

Stephen P. Herbert

Chief Executive Officer

USA Technologies, Inc.

100 Deerfield Lane, Suite 300

Malvern, Pennsylvania 19355

(610) 989-0340

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

|

Douglas M. Lurio, Esquire

Shaila Prabhakar, Esquire

Lurio & Associates, P.C.

2005 Market Street, Suite 3120

Philadelphia, PA 19103-7015

(215) 665-9300

|

Justin P. Klein, Esquire

Gerald J. Guarcini, Esquire

Ballard Spahr LLP

1735 Market Street, 51st Floor

Philadelphia, PA 19103

(215) 665-8500

|

Michael D. Maline, Esquire

Goodwin Procter LLP

620 Eighth Avenue

New York, NY 10018

(212) 813-8966

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☒

|

|

Non-accelerated filer ☐

|

Smaller reporting company☐

|

|

(Do not check if a smaller reporting company)

|

|

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of each class of Securities to be Registered

|

Proposed Maximum

Aggregate Offering

Price (1)(2)

|

Amount of

Registration Fee

|

||||||

|

Common stock, no par value

|

$

|

40,000,000

|

$

|

$4,636.00

|

||||

| (1) |

Pursuant to Rule 416 under the Securities Act, the securities registered hereunder include such indeterminate number of securities as may be issuable with respect to the securities being registered hereunder as a result of stock splits, stock dividends or similar transactions. Includes shares of common stock which may be issued upon exercise of a 30-day option granted to the underwriters to cover overallotments, if any.

|

| (2) |

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities nor may offers to buy these securities be accepted until the registration statement filed with the Securities and Exchange Commission becomes effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject To Completion

Preliminary Prospectus Dated July 7, 2017

PROSPECTUS

Shares of Common Stock

USA TECHNOLOGIES, INC.

We are offering shares of our common stock. Our common stock is quoted on The NASDAQ Global Market under the symbol “USAT.” On July 6, 2017, the last reported sale price of our common stock was $5.10 per share.

Investing in our common stock involves risks. You should read the section entitled “Risk Factors,” beginning on page 8 of this prospectus, and all other information included in this prospectus in connection with an investment in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

|

Per Share

|

Total

|

|||||||

|

Public offering price

|

$ | $ | ||||||

|

Underwriting discounts and commissions (1)

|

$ | $ | ||||||

|

Proceeds to us, before expenses

|

$ | $ | ||||||

| (1) |

See the section entitled "Underwriting," beginning on page 82 of this prospectus, for additional information regarding underwriting compensation.

|

We have granted the underwriters an option to buy up to an additional shares of common stock to cover over-allotments. The underwriters may exercise this option at any time during the 30-day period from the date of this prospectus.

The underwriters are offering the shares of common stock for sale on a firm commitment basis. The underwriters expect to deliver the shares of common stock to the purchasers on or about , 2017.

William Blair

The date of this prospectus is , 2017

| 2 | |

| 8 | |

| 18 | |

| 19 | |

| 20 | |

| Dividend Policy | 21 |

| 22 | |

| 24 | |

| 26 | |

| 28 | |

| 49 | |

| 60 | |

| 63 | |

| 76 | |

| Certain Relationships and Related Transactions | 79 |

| 80 | |

| 82 | |

| 85 | |

| 85 | |

| 85 | |

| F-1 |

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. We have not, and the underwriters have not, authorized anyone to provide you with information that is different. We are offering to sell shares of our common stock, and seeking offers to buy shares of our common stock, only in jurisdictions where offers and sales are permitted. The information in this prospectus is complete and accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.

This prospectus and any related free writing prospectus, if any, do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus or any related free writing prospectus, if any, constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus, or any related free writing prospectus is accurate on any date subsequent to the date set forth on the front of the document, even though this prospectus or any related free writing prospectus is delivered or the applicable securities are sold on a later date.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “USA Technologies,” “USAT,” the “Company,” “we,” “us,” “our” and similar references refer to USA Technologies, Inc. USA Technologies® and our other logos and trademarks are the property of USA Technologies, Inc. All other trademarks, registered marks and trade names appearing in this prospectus are the property of their respective holders. Our use or display of other parties’ trademarks, trade dress or products in this prospectus does not imply that we have a relationship with, or the endorsement or sponsorship of, the trademark or trade dress owners.

This prospectus summary contains basic information about us and this offering. Because it is a summary, it does not contain all of the information that you should consider before deciding whether or not you should purchase shares of our common stock. Therefore, you should read the entire prospectus carefully, especially the sections entitled “Risk Factors,” “Selected Consolidated Financial Data and Other Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our common stock. The following summary is qualified in its entirety by reference to the detailed information appearing elsewhere in this registration statement.

Our Company

USA Technologies, Inc. (the “Company,” “we,” “USAT,” or “our”) provides wireless networking, cashless transactions, asset monitoring, and other value-added services principally to the small ticket, unattended Point of Sale (“POS”) market. Our ePort technology can be installed and/or embedded into everyday devices such as vending machines, a variety of kiosks, amusement games, and commercial laundry via either our ePort hardware or our Quick Connect solution. Our associated service, ePort Connect, is a Payment Card Industry Data Security Standard (PCI DSS)-compliant, comprehensive service that includes simplified credit card processing and support, consumer engagement services as well as telemetry, Internet of Things (“IoT”) and machine-to-machine (“M2M”) services, including the ability to remotely monitor, control, and report on the results of distributed assets containing our electronic payment solutions.

We are a leading provider in the small ticket, beverage and food vending industry and are expanding our solutions and services to other unattended market segments, such as amusement, commercial laundry, kiosk and others. Historically, these distributed assets have relied on cash for payment in the form of coins or bills, whereas, our systems allow them to accept cashless payments through the use of credit or debit cards or other emerging contactless forms, such as mobile payment.

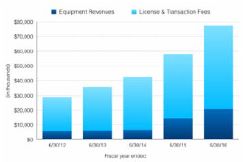

We generate revenue from the sale of equipment and from license and transaction fees. During the fiscal year ended June 30, 2016, we derived 73.0% of our revenues from recurring license and transaction fees related to our ePort Connect service and 27.0% of our revenue from equipment sales. Connections to our service stem from the sale or lease of our POS electronic payment devices or certified payment software or the servicing of similar third-party installed POS terminals. Connections to the ePort Connect service are the most significant driver of the our revenues, particularly the recurring revenues from license and transaction fees. We believe that our service-approach business model, including our value added services, could create a high-margin stream of recurring revenues that could create a foundation for long-term value and continued growth.

Our Industry

We operate primarily in the unattended POS market. Our solutions and services facilitate electronic payments in industries that have traditionally relied on cash transactions. We believe the following industry trends are driving growth in demand for electronic payment systems in general and more specifically within the markets we serve:

Shift toward electronic payment transactions and away from cash and checks. There has been an ongoing shift away from paper-based methods of payment, including cash and checks, towards electronic-based methods of payment. According to The Nilson Report, December 2015, paper-based methods of payment continued to decline in 2014, representing 28.07% of transaction dollars measured compared to 30.61% in 2013. The four card-based systems—credit, debit, prepaid, and electronic benefits transfer—generated $5.29 trillion in the United States in 2014, 57.34% of transaction dollars measured, compared to 42.3% in 2006. The Nilson Report projects that, by 2019, spending at merchants in the U.S. from the four card-based systems will grow to 67.03% of total transaction dollars measured.

Increase in Consumer Demand for Electronic Payments. The unattended, vending and kiosk POS market has historically been dominated by cash purchases. We believe electronic payment system providers such us that can meet consumers’ demand within the unattended market will be able to offer retailers, card associations, card issuers and payment processors and business owners an expanding value proposition at the POS.

Increase in Merchant/Operator Demand for Electronic Payments. We believe that, increasingly, merchants and operators of unattended payment locations (e.g., vending machines, laundry, tabletop games, etc.) are utilizing electronic payment alternatives as a means to improve business results. We work with our customers to help them drive increased revenue of their distributed assets through this expanded market opportunity. In addition, electronic payment systems can provide merchants and operators real-time sales and inventory data utilized for back-office reporting and forecasting, like our solutions and services, helping them to manage their business more efficiently.

Increase in Demand for Integrated Payment Solutions. We believe that merchant have come to value payment solutions that are integrated or bundled with other solutions and software. Offering an integrated solution allows us to provide a single source solution for our products and results in better customer retention, less focus on price and a better overall experience for our customers. We also view our integrated solutions as a significant competitive advantage as competitors will need fully integrated solutions to compete.

Increase in Demand for Networked Assets. Machine-to-machine (“M2M”) technology includes capturing value from wireless modules and electronic devices to improve business productivity and customer service. In addition, networked assets can provide valuable information regarding consumers’ purchasing patterns and payment preferences, allowing operators to more effectively tailor their offerings to consumers. Gartner, Inc. forecasts that 6.4 billion connected things will be in use worldwide in 2016, with 5.5 million new things getting connected every day, and will reach 20.8 billion by 2020.

POS Technology and NFC Equipped Mobile Phone Payment Improvements. Near Field Communication (“NFC”) is a short range wireless connectivity technology that uses electromagnetic radio fields to enable communication between devices when there is a physical touch, or when they are within close proximity to one another. We believe that POS contactless terminals that are enabled to accept NFC payments and digital wallet applications, such as Google Wallet, Chase Pay, Apple Pay, the recently introduced Android Pay, and others, stand to benefit from these evolving trends in mobile payment. Digital wallet is essentially a digital service, accessed via the web or a mobile phone application that serves as a substitute for the traditional credit or debit card. Providers can also market directly to targeted consumers with coupons and loyalty programs. With over 70% of our connections contactless enabled to accept NFC payments (in addition to magnetic stripe cards) as of June 30, 2016, we believe that we are well-positioned to benefit from this emerging space.

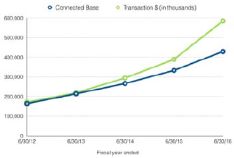

Our Connection Base

As of June 30, 2016 and March 31, 2017, we had 429,000 and 504,000 connections, respectively, to our ePort Connect service. These connections represented a 29% and 25.7% increase from connections as of June 30, 2015 and March 31, 2016, respectively. During the fiscal year ended June 30, 2016, we processed approximately 316 million cashless transactions totaling approximately $584 million in transaction dollars, representing a 46% increase in transaction volume and a 50% increase in dollars processed during the previous fiscal year ended June 30, 2015.

As of March 31, 2017, we had approximately 12,400 customers. Our customers range from global food service organizations to small businesses that operate primarily in the self-serve, small ticket retail markets including beverage and food vending, amusement and arcade machines, smartphones via our ePort Online solution, commercial laundry, tolls, and various other self-serve kiosk applications as well as equipment developers or manufacturers who incorporate our ePort Connect service into their product offerings.

Our customers can obtain POS electronic payment devices from us in the following ways:

| · |

Purchasing devices directly from our or one of our authorized resellers;

|

| · |

Financing devices under the Company’s QuickStart Program, which are non-cancellable sixty month sales-type leases, through an unrelated equipment financing company, if available, or directly from the Company; and

|

| · |

Renting devices under our JumpStart Program, which are cancellable month-to-month operating leases.

|

Our Solutions

Our solutions and services have been designed to simplify the transition to cashless for traditionally cash-only based businesses. As such, they are turn-key and include our comprehensive ePort Connect service and POS electronic payment devices or certified payment software, which are able to process traditional magnetic stripe credit and debit cards, contactless credit and debit cards and mobile payments. Standard services through ePort Connect are maintained on our proprietary operating systems and include merchant account setup on behalf of the customer, automatic processing and settlement, sales reporting and 24x7 customer support. Other value-added services that customers can choose from include things such as cashless deployment planning, cashless performance review and loyalty products and services. Our solutions also provide flexibility to execute a variety of payment applications on a single system, transaction security, connectivity options, compliance with certification standards, and centralized, accurate, real-time sales and inventory data to manage distributed assets (wireless telemetry and M2M).

Our ePort® Interactive is a cloud-based interactive media and content delivery management system that provides enhanced vendor management system (VMS) integration and consumer product information, including nutritional data. The technology is NFC enabled and compatible with mobile wallets including Apple Pay and Android Pay, and supports instant refunds, couponing, advertising and real-time consumer feedback to the owner and operator.

Our Competitive Strengths

We believe that we benefit from a number of advantages gained through our nearly twenty-five year history in our industry. They include:

| · |

One-Stop Shop, End-to-End Solution. We offer our customers one point of contact through a bundled cashless payment solution.

|

| · |

Trusted Brand Name. Our ePort Connect solution has a strong national reputation for quality, reliability, and innovation.

|

| · |

Market Leadership. With 504,000 connections to our network, we believe we have the largest installed base of unattended POS electronic payment systems in the unattended small ticket retail market for food and beverage and we are continuing to expand to other adjacent markets.

|

| · |

Attractive Value Proposition for Our Customers. We believe that our solutions provide our customers an attractive value proposition by reducing costs, improve operating efficiencies, and increasing the purchases of their consumers machines.

|

| · |

Increasing Scale and Financial Stability. During the 2016 fiscal year, 73% of our revenues came from licensing and processing fees which are recurring in nature.

|

| · |

Customer-Focused Research and Development. We have generated considerable intellectual property and know-how with 73 patents (US and International) as of June 30, 2017.

|

Our Growth Opportunity

Our primary objective is to continue to enhance our position as a leading provider of technology that enables electronic payment transactions and value-added services. We plan to execute this growth strategy organically and through strategic acquisitions. Key elements of our strategy are to:

| · |

Leverage and further penetrate our existing customers/partners

|

| · |

Expand distribution and sales reach

|

| · |

Further penetrate attractive adjacent markets

|

| · |

Capitalize on opportunities in international markets

|

| · |

Capitalize on the emerging NFC and growing mobile payments trends

|

| · |

Continuously enhance our solutions and services through innovation

|

| · |

Provide comprehensive service and support

|

| · |

Leverage intellectual property consisting of 73 U.S. and foreign patents

|

Our Acquisition Strategy

We have historically, and expect to continue to, drive growth in connections and expand the value of our services through strategic acquisitions of businesses, products, or technologies. We intend to pursue acquisitions of businesses that are accretive and complementary to our current product and service offerings by broadening our customer base, expanding our geographic footprint, and acquiring strategic technologies or otherwise complementing our current or future business.

Risk Factors Associated with our Business

Our business is subject to numerous risks and uncertainties, including those highlighted in the section captioned “Risk Factors” immediately following this prospectus summary. These risks include, among others, the following:

| · |

We have a history of losses since inception and if we continue to incur losses, the price of our shares can be expected to fall.

|

| · |

Our products may fail to gain substantial increased market acceptance. As a result, we may not generate sufficient revenues or profit margins to achieve our financial objectives or growth plans.

|

| · |

The loss of one or more of our key customers could significantly reduce our revenues, results of operations, and net income.

|

| · |

Competition from others could prevent us from increasing revenue and achieving our growth plans.

|

| · |

Substantially all of the network service contracts with our customers are terminable for any or no reason upon thirty to sixty days’ advance notice.

|

| · |

Our products and services may be vulnerable to security breach.

|

| · |

Failure to maintain effective systems of internal control over financial reporting and disclosure controls and procedures could cause a loss of confidence in our financial reporting and adversely affect the trading price of our common stock.

|

Corporate Information

We were incorporated in the Commonwealth of Pennsylvania in 1992. Our principal executive offices are located at 100 Deerfield Lane, Suite 300, Malvern, Pennsylvania 19355, and our phone number is (610) 989-0340. Additional information regarding our company, including our audited financial statements and description of our business, is contained in this prospectus. See “Where You Can Find More Information.” Our web site is www.usatech.com. Information on our website is not incorporated in this prospectus and is not a part of this prospectus.

|

Summary of This Offering

|

|

|

Securities Offered

|

shares of common stock (or shares of common stock if the underwriters exercise their over-allotment option in full).

|

|

Over-allotment option

|

The underwriters have an option for a period of 30 days after the date of this prospectus to purchase up to an additional shares of common stock, on the same terms and conditions as set forth above, to cover any over-allotments.

|

|

Shares Outstanding after

Completion of this

Offering

|

shares of our common stock will be outstanding ( shares if the underwriters exercise their option to purchase additional shares in full). These amounts exclude series A convertible preferred stock and outstanding options and warrants convertible into or exercisable for shares of common stock. |

|

Use of Proceeds

|

The proceeds from this offering, less fees and expenses incurred by us in connection with the offering, are intended to be used for general corporate purposes and working capital to support anticipated growth. These purposes may include, among other things, future acquisitions of businesses, products and technologies, or establishing strategic alliances that we believe will complement our current or future business. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering.

|

|

Risk Factors

|

You should read the “Risk Factors” section beginning on page 8 and other information included in this prospectus for a discussion of factors you should carefully consider before investing in our securities.

|

|

Trading Symbol

|

Our common stock is quoted on The NASDAQ Global Market under the symbol “USAT.”

|

The number of shares of common stock to be outstanding after this offering is based on 40,331,645 shares of common stock outstanding as of June 30, 2017, and excludes, in each case as of such date:

| · |

23,978 shares of common stock underlying warrants issued by the Company to our bank lender at an exercise price of $5.00 per share in connection with the loan agreement;

|

| · |

(i) 198,000 shares of common stock issuable upon the exercise of outstanding stock options issued under the 2015 Equity Incentive Plan, and (ii) 715,220 shares of common stock issuable upon the exercise of outstanding stock options issued under the 2014 Stock Option Incentive Plan;

|

| · |

(i) 1,052,000 shares of common stock reserved for issuance under the 2015 Equity Incentive Plan, (ii) 1,447 shares of common stock underlying stock options reserved for issuance under the 2014 Stock Option Incentive Plan, and (iii) 9,004 shares of common stock reserved for issuance under the Company’s 2013 Stock Incentive Plan;

|

| · |

100,333 shares issuable upon the conversion of outstanding preferred stock and cumulative preferred stock dividends; and

|

| · |

140,000 shares issuable to our former chief executive officer upon the occurrence of certain fundamental transactions involving the Company.

|

Summary Financial Data and Other Data

The following tables summarize our financial data and should be read together with the sections in this prospectus entitled “Selected Consolidated Financial Data and Other Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

We have derived the summary condensed consolidated statement of operations data for the years ended June 30, 2016 and 2015 from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the summary consolidated statement of operations data for the nine months ended March 31, 2017 and the summary condensed consolidated balance sheet data as of March 31, 2017 from our unaudited interim consolidated financial statements included elsewhere in this prospectus.

We have prepared the unaudited interim consolidated financial statements on the same basis as the audited consolidated financial statements and have included, in our opinion, all adjustments, consisting only of normal recurring adjustments, that we consider necessary for a fair statement of the financial information set forth in those statements. Our historical results are not necessarily indicative of the results that should be expected in the future, and interim results are not necessarily indicative of the results that should be expected for the full year or any other period.

|

Nine Months

Ended

March 31,

2017

|

As of and for the

Year ended June 30,

|

|||||||||||

|

($ in thousands, except per share data and as otherwise noted)

|

2016

|

2015

|

||||||||||

|

OPERATIONS DATA:

|

||||||||||||

|

Revenues

|

$

|

69,804

|

$

|

77,408

|

$

|

58,077

|

||||||

|

Operating income (loss)

|

$

|

(297

|

)

|

$

|

(1,467

|

)

|

$

|

(240

|

)

|

|||

|

Net Income (loss)

|

$

|

(2,095

|

)

|

$

|

(6,806

|

)

|

$

|

(1,089

|

)

|

|||

|

Cumulative preferred dividends

|

(668

|

)

|

(668

|

)

|

(668

|

)

|

||||||

|

Net income (loss) applicable to common shares

|

$

|

(2,763

|

)

|

$

|

(7,474

|

)

|

$

|

(1,757

|

)

|

|||

|

Net earnings (loss) per common share - basic and diluted (1)

|

$

|

(0.07

|

)

|

$

|

(0.21

|

)

|

$

|

(0.05

|

)

|

|||

|

Cash dividends per common share

|

-

|

-

|

-

|

|||||||||

|

BALANCE SHEET DATA:

|

||||||||||||

|

Total assets

|

$

|

88,992

|

$

|

84,833

|

$

|

75,134

|

||||||

|

Long-term debt

|

$

|

1,239

|

$

|

1,576

|

$

|

1,854

|

||||||

|

Shareholders’ equity

|

$

|

64,999

|

$

|

55,025

|

$

|

53,311

|

||||||

|

CASH FLOW DATA:

|

||||||||||||

|

Net cash provided by (used in) operating activities

|

$

|

(4,295

|

)

|

$

|

6,468

|

$

|

(1,698

|

)

|

||||

|

Net cash provided by (used in) investing activities

|

(2,713

|

)

|

(5,772

|

)

|

3,354

|

|||||||

|

Net cash provided by (used in) financing activities

|

5,516

|

7,202

|

646

|

|||||||||

|

Net increase (decrease) in cash and cash equivalents

|

(1,492

|

)

|

7,898

|

2,302

|

||||||||

|

Cash and cash equivalents at beginning of period

|

19,272

|

11,374

|

9,072

|

|||||||||

|

Cash and cash equivalents at end of period

|

$

|

17,780

|

$

|

19,272

|

$

|

11,374

|

||||||

|

CONNECTIONS AND TRANSACTION DATA (UNAUDITED):

|

||||||||||||

|

Net New Connections #

|

75,000

|

96,000

|

67,000

|

|||||||||

|

Total Connections #

|

504,000

|

429,000

|

333,000

|

|||||||||

|

New Customers Added #

|

1,350

|

1,450

|

2,300

|

|||||||||

|

Total Customers #

|

12,400

|

11,050

|

9,600

|

|||||||||

|

Total Number of Transactions (millions)

|

300.2

|

315.8

|

216.6

|

|||||||||

|

Transaction Volume (millions) #

|

577.3

|

584.4

|

388.9

|

|||||||||

|

(1)

|

See note 2 to our consolidated financial statements appearing elsewhere in this prospectus for a description of the method used to calculate basic and diluted net income (loss) per share of common stock.

|

Investing in our common stock involves risks. Before making an investment decision, please carefully review the risks described below, together with all other information in this prospectus, and in any free writing prospectus that we have authorized for use in connection with this offering. The occurrence of any of those risks could materially and adversely affect our business, prospects, financial condition, results of operations or cash flow. Other risks and uncertainties that we do not now consider to be material or of which we are not now aware may become important factors that affect us in the future. Any of these risks could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section entitled “Special Note Regarding Forward-Looking Statements.”

Risks Relating to Our Business

We have a history of losses since inception and if we continue to incur losses, the price of our shares can be expected to fall.

We experienced losses from inception through June 30, 2012, with net income for the years ended June 30, 2013 and June 30, 2014. However, we experienced losses for the fiscal years 2015 and 2016, and continued profitability is not assured. From our inception through June 30, 2016, our cumulative losses from operations are approximately $181 million. Until the Company’s products and services can generate sufficient annual revenues, the Company will be required to use its cash and cash equivalents on hand, its line of credit, and may raise capital to meet its cash flow requirements including the issuance of common stock or debt financing. For the years ended June 30, 2016 and 2015, we incurred a net loss of $6.8 million and $1.1 million, respectively. If we continue to incur losses in the future, the price of our common stock can be expected to fall.

The occurrence of material unanticipated expenses may require us to divert our cash resources from achieving our business plan, adversely affecting our financial performance and resulting in the decline of our stock price.

In the event we incur any material unanticipated expenses, we may be required to divert our cash resources from our operating activities in order to fund any such expenses. Any such occurrence may cause our anticipated connections, revenues, gross profits, and other financial metrics for the 2017 fiscal year and beyond to be materially adversely affected. In such event, the price of our common stock could be expected to fall.

The inability of our customers to utilize third party leasing companies under our QuickStart program would materially adversely affect our cash generated from operating activities and/or attaining our business plan.

The use of third party leasing companies by our customers under our QuickStart program positively affects our net cash provided by operating activities because we receive the purchase price from the leasing company at the time of the sale. There can be no assurance that we will be able to obtain such third party leasing companies. To the extent that third party leasing companies would not be available, we would lease the equipment directly to our customers. In such event, our net cash from operating activities would be adversely affected and we may be required to incur additional equity or debt financing to fund operations. In the alternative, we would not be able to attain our business plan, including anticipated connections and revenues.

We may require additional financing or find it necessary to raise capital to sustain our operations and without it we may not be able to achieve our business plan.

At March 31, 2017, we had net working capital of $11.9 million. We had net cash provided by operating activities of $6.5 million, $(1.7) million and $7.1 million for the fiscal years ended June 30, 2016, 2015 and 2014, respectively. Although we believe that we have adequate existing resources to provide for our funding requirements over the next 12 months, there can be no assurances that we will be able to continue to generate sufficient funds thereafter. Unless we maintain or grow our current level of operations, we may need additional funds to continue these operations. We may also need additional capital to update our technology or respond to unusual or unanticipated non-operational events. Should the financing that we require to sustain our working capital needs be unavailable or prohibitively expensive when we require it, the consequences could have a material adverse effect on our business, operating results, financial condition and prospects.

Our future operating results may fluctuate.

Our future operating results will depend significantly on our ability to continue to drive revenues from license and transaction fees and our ability to develop and commercialize new products and services. Our operating results may fluctuate based upon many factors, including:

| ● |

fluctuations in revenue generated by our business;

|

| ● |

fluctuations in operating expenses;

|

| ● |

our ability to establish or maintain effective relationships with significant partners and suppliers on acceptable terms;

|

| ● |

the amount of debit or credit card interchange rates that are charged by Visa and MasterCard;

|

| ● |

the fees that we charge our customers for processing services;

|

| ● |

the successful operation of our network;

|

| ● |

the commercial success of our customers, which could be affected by such factors as general economic conditions;

|

| ● |

the level of product and price competition;

|

| ● |

the timing and cost of, and our ability to develop and successfully commercialize, new or enhanced products and services;

|

| ● |

activities of, and acquisitions or announcements by, competitors;

|

| ● |

the impact from any impairment of inventory, goodwill, fixed assets or intangibles;

|

| ● |

the impact of any changes of valuation allowance on deferred tax assets;

|

| ● |

the ability to increase the number of customer connections to our network;

|

| ● |

marketing programs which delay realization by us of monthly service fees on our new connections;

|

| ● |

the material breach of security of any of the Company’s systems or third party systems utilized by the Company; and

|

| ● |

the anticipation of and response to technological changes.

|

Our products may fail to gain substantial increased market acceptance. As a result, we may not generate sufficient revenues or profit margins to achieve our financial objectives or growth plans.

There can be no assurances that demand for our products will be sufficient to enable us to generate sufficient revenue or become profitable on a sustainable basis. Likewise, no assurance can be given that we will be able to have a sufficient number of ePorts® connected to our network or sell or lease equipment utilizing our network to enough locations to achieve significant revenues. Alternatively, the locations which utilize the network may not be successful locations and our revenues would be adversely affected. We may lose locations utilizing our products to competitors, or may not be able to install our products at competitors’ locations, or may not obtain future locations which would be obtained by our competitors. In addition, there can be no assurance that our products could evolve or be improved to meet the future needs of the marketplace. In any such event, we may not be able to achieve our growth plans, including anticipated connections and revenue growth.

We may be required to incur further debt to meet future capital requirements of our business. Should we be required to incur additional debt, the restrictions imposed by the terms of such debt could adversely affect our financial condition and our ability to respond to changes in our business.

If we incur additional debt, we may be subject to the following risks:

| ● |

our vulnerability to adverse economic conditions and competitive pressures may be heightened;

|

| ● |

our flexibility in planning for, or reacting to, changes in our business and industry may be limited;

|

| ● |

our debt covenants may affect our flexibility in planning for, and reacting to, changes in the economy and in our industry;

|

| ● |

a high level of debt may place us at a competitive disadvantage compared to our competitors that are less leveraged and therefore, may be able to take advantage of opportunities that our indebtedness would prevent us from pursuing;

|

| ● |

the covenants contained in the agreements governing our outstanding indebtedness may limit our ability to borrow additional funds, dispose of assets and make certain investments;

|

|

●

|

a significant portion of our cash flows could be used to service our indebtedness;

|

| ● |

we may be sensitive to fluctuations in interest rates if any of our debt obligations are subject to variable interest rates; and

|

| ● |

our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions, general corporate purposes or other purposes may be impaired.

|

We cannot assure you that our leverage and such restrictions will not materially and adversely affect our ability to finance our future operations or capital needs or to engage in other business activities. In addition, we cannot assure you that additional financing will be available when required or, if available, will be on terms satisfactory to us.

Our bank borrowing agreement contains restrictions which may limit our flexibility in operating and growing our business.

Our bank borrowing agreement contains covenants regarding our maintenance of a minimum quarterly adjusted EBITDA as defined in our loan agreement and certain numbers of connections. Our loan agreement also includes covenants that limit our ability to engage in specified types of transactions, including among other things:

| · |

incur additional indebtedness or issue equity;

|

| · |

pay dividends on, repurchase or make distributions in respect of our common stock;

|

| · |

make certain investments (including acquisitions) and distributions;

|

| · |

sell certain assets;

|

| · |

create liens;

|

| · |

consolidate, merge, sell or otherwise dispose of all or substantially all of our assets;

|

| · |

enter into certain transactions with respect to our affiliates;

|

| · |

ability to enter into business combinations; and

|

| · |

certain other financial and non-financial covenants.

|

We were in compliance with these covenants as of March 31, 2017. Failure to be in compliance with these covenants could result in an event of default which, if not cured or waived, could result in the acceleration of all or a portion of our outstanding indebtedness, which would have a material adverse effect on our business, financial condition and results of operations.

The loss of one or more of our key customers could significantly reduce our revenues, results of operations, and net income.

We have derived, and believe we may continue to derive, a significant portion of our revenues from one large customer or a limited number of large customers. Customer concentrations for the years ended June 30, 2016, 2015 and 2014 were as follows:

|

2016

|

2015

|

2014

|

||||||||||

|

Trade account and finance receivables - one customer

|

18

|

%

|

35

|

%

|

22

|

%

|

||||||

|

License and transaction processing revenues - one customer

|

16

|

%

|

21

|

%

|

26

|

%

|

||||||

|

Equipment sales revenue - one customer

|

28

|

%

|

17

|

%

|

< 10

|

% | ||||||

Our customers may buy less of our products or services depending on their own technological developments, end-user demand for our products and internal budget cycles. A major customer in one year may not purchase any of our products or services in another year, which may negatively affect our financial performance. We have offered, and may in the future offer, discounts to our large customers to incentivize them to continue to utilize our products and services. If we are required to sell products to any of our large customers at reduced prices or unfavorable terms, our results of operations and revenue could be materially adversely affected. Further, there is no assurance that our customers will continue to utilize our transaction processing and related services as our customer agreements are generally cancelable by the customer on thirty to sixty days’ notice.

We depend on our key personnel and, if they leave us, our business could be adversely affected.

We are dependent on key management personnel, particularly the Chairman and Chief Executive Officer, Stephen P. Herbert. The loss of services of Mr. Herbert or other officers could dramatically affect our business prospects. Our executive officers and certain of our officers and employees are particularly valuable to us because:

| ● |

they have specialized knowledge about our company and operations;

|

| ● |

they have specialized skills that are important to our operations; or

|

| ● |

they would be particularly difficult to replace.

|

We have entered into an employment agreement with Mr. Herbert, which contains confidentiality and non-compete provisions. The agreement provided for an initial term continuing through January 1, 2013, which is automatically renewed for consecutive one year periods unless terminated by either Mr. Herbert or the Company upon at least 90 days’ notice prior to the end of the initial term or any one-year extension thereof.

We also may be unable to retain other existing senior management, sales personnel, and development and engineering personnel critical to our ability to execute our business plan, which could result in harm to key customer relationships, loss of key information, expertise or know-how and unanticipated recruitment and training costs.

Our dependence on proprietary technology and limited ability to protect our intellectual property may adversely affect our ability to compete.

Challenge to our ownership of our intellectual property could materially damage our business prospects. Our technology may infringe upon the proprietary rights of others. Our ability to execute our business plan is dependent, in part, on our ability to obtain patent protection for our proprietary products, maintain trade secret protection and operate without infringing the proprietary rights of others.

Through June 30, 2017, we had 14 pending United States and foreign patent applications, and will consider filing applications for additional patents covering aspects of our future developments, although there can be no assurance that we will do so. In addition, there can be no assurance that we will maintain or prosecute these applications. The United States Government and other countries have granted us 95 patents as of June 30, 2017. There can be no assurance that:

| ● |

any of the remaining patent applications will be granted to us;

|

| ● |

we will develop additional products that are patentable or do not infringe the patents of others;

|

| ● |

any patents issued to us will provide us with any competitive advantages or adequate protection for our products;

|

| ● |

any patents issued to us will not be challenged, invalidated or circumvented by others; or

|

| ● |

any of our products would not infringe the patents of others.

|

If any of our products or services is found to have infringed any patent, there can be no assurance that we will be able to obtain licenses to continue to manufacture, use, sell, and license such product or service or that we will not have to pay damages and/or be enjoined as a result of such infringement. Even if a patent application is granted for any of our products, there can be no assurance that the patented technology will be a commercial success or result in any profits to us.

If we are unable to adequately protect our proprietary technology or fail to enforce or prosecute our patents against others, third parties may be able to compete more effectively against us, which could result in the loss of customers and our business being adversely affected. Patent and proprietary rights litigation entails substantial legal and other costs, and diverts Company resources as well as the attention of our management. There can be no assurance we will have the necessary financial resources to appropriately defend or prosecute our intellectual property rights in connection with any such litigation.

Competition from others could prevent the Company from increasing revenue and achieving its growth plans.

While we are a leading provider and believe we have the largest installed base of unattended POS electronic payment systems in the small ticket, beverage and food vending industry, our competitors are increasingly and actively marketing products and services that compete with our products and services in this vending space. The competition includes manufacturers who may include in their new vending machines their own (or another third party’s) cashless payment systems and services other than our systems and services. While we believe our products and services are superior to our competitors, many of our competitors are much larger enterprises and have substantially greater revenues. In addition to these competitors, there are also numerous credit card processors that offer card processing services to traditional retail establishments that could decide to offer similar services to the industries that we serve. Competition from other companies, including those that are well established and have substantially greater resources, may reduce our profitability or reduce our business opportunities. Competition may result in lower profit margins on our products or may reduce potential profits or result in a loss of some or all of our customer base. To the extent that our competitors are able to offer more attractive technology, our ability to compete could be adversely affected.

The termination of any of our relationships with third parties upon whom we rely for supplies and services that are critical to our products could adversely affect our business and delay achievement of our business plan.

We depend on arrangements with third parties for a variety of component parts used in our products. We have contracted with various suppliers to assist us to develop and manufacture our ePort® products. For other components, we do not have supply contracts with any of our third-party suppliers and we purchase components as needed from time to time. We have contracted with a third-party data system recovery vendor to host our network in a secure, 24/7 environment to ensure the reliability of our network services. We also have contracted with multiple land-based telecommunications providers to ensure the reliability of our land-based network. If these business relationships are terminated, the implementation of our business plan may be delayed until an alternative supplier or service provider can be retained. If we are unable to find another source or one that is comparable, the content and quality of our products could suffer and our business, operating results and financial condition could be harmed.

A disruption in the manufacturing capabilities of our third-party manufacturers, suppliers or distributors would negatively impact our ability to meet customer requirements.

We depend upon third-party manufacturers, suppliers and distributors to deliver components free from defects, competitive in functionality and cost, and in compliance with our specifications and delivery schedules. Since we generally do not maintain large inventories of our products or components, any termination of, or significant disruption in, our manufacturing capability or our relationship with our third-party manufacturers or suppliers may prevent us from filling customer orders in a timely manner.

We have occasionally experienced, and may in the future experience, delays in delivery of products and delivery of products of inferior quality from third-party manufacturers. Although alternate manufacturers and suppliers are generally available to produce our products and product components, the number of manufacturers or suppliers of some of our products and components is limited, and a qualified replacement manufacturer or supplier could take several months. In addition, our use of third-party manufacturers reduces our direct control over product quality, manufacturing timing, yields and costs. Disruption of the manufacture or supply of our products and components, or a third-party manufacturer’s or supplier’s failure to remain competitive in functionality, quality or price, could delay or interrupt our ability to manufacture or deliver our products to customers on a timely basis, which would have a material adverse effect on our business and financial performance.

Substantially all of the network service contracts with our customers are terminable for any or no reason upon thirty to sixty days’ advance notice.

Substantially all of our customers may terminate their network service contracts with us for any or no reason upon providing us with thirty or sixty days’ advance notice. Accordingly, consistent demand for and satisfaction with our products by our customers is critical to our financial condition and future success. Problems, defects, or dissatisfaction with our products or services or competition in the marketplace could cause us to lose a substantial number of our customers with minimal notice. If a substantial number of our customers were to exercise their termination rights, it would result in a material adverse effect to our business, operating results, and financial condition.

Our reliance on our wireless telecommunication service provider exposes us to a number of risks over which we have no control, including risks with respect to increased prices and termination of essential services.

The operation of our wireless networked devices depends upon the capacity, reliability and security of services provided to us by our wireless telecommunication services providers, AT&T Mobility and Verizon Wireless. We have no control over the operation, quality or maintenance of these services or whether the vendor will improve or reduce its services or continue to provide services that are essential to our business. In addition, subject to our existing contracts with them, our wireless telecommunication services providers may increase their prices, which would increase our costs. If our wireless telecommunication services providers were to cease to provide essential services or to significantly increase prices, we could be required to find alternative vendors for these services. With a limited number of vendors, we could experience significant delays in obtaining new or replacement services, which could lead to slowdowns or failures of our network. In addition, we may have to replace our existing ePort® devices that are already installed in the marketplace and which are utilizing the existing vendor’s services. This could significantly harm our reputation and could cause us to lose customers and revenues.

We may not be able to adapt to changing technology and our customers’ technology needs.

We face rapidly changing technology and frequent new service offerings that can render existing services obsolete or unmarketable. Our future depends, in part, on our ability to enhance existing services and to develop, introduce and market, on a timely and cost effective basis, new services that keep pace with technological developments and customer requirements. Developing new products and technologies is a complex, uncertain process requiring innovation and accurate anticipation of technological and market trends. When changes to the product line are announced, we will be challenged to manage possible shortened life cycles for existing products and continue to sell existing products. Our inability to respond effectively to any of these challenges may have a material adverse effect on our business and financial success.

Security is vital to our customers and therefore breaches in the security of transactions involving our products or services could adversely affect our reputation and results of operations.

Protection against fraud is of key importance to purchasers and end-users of our products. We incorporate security features, such as encryption software and secure hardware, into our products to protect against fraud in electronic payment transactions and to ensure the privacy and integrity of consumer data. We design and test our products to industry security standards and our products and methodologies are under periodic review and improvement. Our products and services and third party products and services that are utilized by us may be vulnerable to breaches in security due to defects in our security mechanisms, the operating system and applications in our hardware platform. Security vulnerabilities could jeopardize the security of information transmitted or stored using our products. If the security of the information in our products is compromised, our reputation and marketplace acceptance of our products will be adversely affected, which would adversely affect our results of operations, and subject us to potential liability. If our security applications are breached and sensitive data is lost or stolen, we could incur significant costs to not only assess and repair any damage to our systems, but also to reimburse customers for losses that occur from the fraudulent use of the data. We may also be subject to fines and penalties from the credit card associations in the event of the loss of confidential card information.

Our products and services may be vulnerable to security breach.

Credit card issuers have promulgated credit card security guidelines as part of their ongoing efforts to battle identity theft and credit card fraud. We continue to work with credit card issuers to assure that our products and services comply with these rules. There can be no assurances, however, that our products and services or third party products and services utilized by us are invulnerable to unauthorized access or hacking. When there is unauthorized access to credit card data that results in financial loss, there is the potential that parties could seek damages from us, and our business reputation and results of operations would be materially adversely affected.

If we fail to adhere to the standards of the Visa and MasterCard credit card associations, our registrations with these associations could be terminated and we could be required to stop providing payment processing services for Visa and MasterCard.

Substantially all of the transactions handled by our network involve Visa or MasterCard. If we fail to comply with the applicable requirements of the Visa and MasterCard credit card associations, Visa or MasterCard could suspend or terminate our registration with them. The termination of our registration with them or any changes in the Visa or MasterCard rules that would impair our registration with them could require us to stop providing payment processing services through our network. In such event, our business plan and/or competitive advantages in the market place would be materially adversely affected.

We rely on other card payment processors; if they fail or no longer agree to provide their services, our customer relationships could be adversely affected and we could lose business.

We rely on agreements with other large payment processing organizations, primarily Chase Paymentech, to enable us to provide card authorization, data capture, settlement and merchant accounting services and access to various reporting tools for the customers we serve. The termination by our card processing providers of their arrangements with us or their failure to perform their services efficiently and effectively may adversely affect our relationships with the customers whose accounts we serve and may cause those customers to terminate their processing agreements with us.

We are subject to laws and regulations that affect the products, services and markets in which we operate. Failure by us to comply with these laws or regulations would have an adverse effect on our business, financial condition, or results of operations.

We are, among other things, subject to banking regulations and credit card association regulations. Failure to comply with these regulations may result in the suspension of our business, the limitation, suspension or termination of service, and/or the imposition of fines that could have an adverse effect on our financial condition. Additionally, changes to legal rules and regulations, or interpretation or enforcement thereof, could have a negative financial effect on us or our product offerings. To the extent this occurs, we could be subject to additional technical, contractual or other requirements as a condition of our continuing to conduct our payment processing business. These requirements could cause us to incur additional costs, which could be significant, or to lose revenues to the extent we do not comply with these requirements.

New legislation could be enacted regulating the basis upon which interchange rates are charged for debit or credit card transactions, which could increase the debit or credit card interchange fees charged by bankcard networks. An example of such legislation is the so-called “Durbin Amendment,” to the Dodd Frank Wall Street Reform and Consumer Protection Act of 2010. The Durbin Amendment regulates the basis upon which interchange rates for debit card transactions are made to ensure that interchange rates are “reasonable and proportionate to costs.” Pursuant to regulations that were promulgated by the Federal Reserve, Visa and MasterCard have significantly increased their interchange fees for small ticket debit card transactions.

As of November 14, 2014, we entered into a three-year agreement with Visa U.S.A. Inc. (“Visa”), pursuant to which Visa has agreed to continue to make available to the Company certain promotional interchange reimbursement fees for small ticket debit and credit card transactions. Similarly, MasterCard International Incorporated ("MasterCard") has agreed to make available to us reduced interchange rates for small ticket debit card transactions pursuant to a three-year MasterCard Acceptance Agreement dated January 12, 2015, as amended by a First Amendment thereto dated April 27, 2015. If the foregoing agreements with Visa and MasterCard are not extended, our financial results would be materially adversely affected unless we are able to pass these significant additional charges to our customers.

Increases in card association and debit network interchange fees could increase our operating costs or otherwise adversely affect our operations. If we do not pass along to our customers any future increases in credit or debit card interchange fees, assessments and transaction fees, our gross profits would be reduced.

We are obligated to pay interchange fees and other network fees set by the bankcard networks to the card issuing bank and the bankcard networks for each transaction we process through our network. From time to time, card associations and debit networks increase the organization and/or processing fees, known as interchange fees that they charge. Under our processing agreements with our customers, we are permitted to pass along these fee increases to our customers through corresponding increases in our processing fees. Passing along such increases could result in some of our customers canceling their contracts with us. Consequently, it is possible that competitive pressures will result in our Company absorbing some or all of the increases in the future, which would increase our operating costs, reduce our gross profit and adversely affect our business.

During the term of the Visa Agreement, the Company does not anticipate accepting any debit cards with interchange fees that are higher than the rates provided under the Visa Agreement. The Company will continue to accept Visa- and MasterCard- branded debit cards in addition to all major credit cards, including Visa, MasterCard, Discover and American Express at its current processing rates. If the Visa or MasterCard Agreements are not extended, our financial results would be materially adversely affected unless we are able to pass these significant additional charges to our customers.

The ability to recruit, retain and develop qualified personnel is critical to the Company’s success and growth.

For the Company to successfully compete and grow, it must retain, recruit and develop the necessary personnel who can provide the needed expertise required in its business. In addition, the Company must develop its personnel to provide succession plans capable of maintaining continuity in the midst of the inevitable unpredictability of human capital. However, the market for qualified personnel is competitive and the Company may not succeed in recruiting additional personnel or may fail to effectively replace current personnel who depart with qualified or effective successors. The Company’s effort to retain and develop personnel may also result in significant additional expenses. The Company cannot assure that key personnel, including executive officers, will continue to be employed or that it will be able to attract and retain qualified personnel in the future. Failure to retain or attract key personnel could have a material adverse effect on the Company.

We incur chargeback liability when our customers refuse or cannot reimburse chargebacks resolved in favor of consumers. Any increase in chargebacks not paid by our customers may adversely affect our results of operations, financial condition and cash flows.

In the event a dispute between a cardholder and a customer is not resolved in favor of the customer, the transaction is normally charged back to the customer and the purchase price is credited or otherwise refunded to the cardholder. If we are unable to collect such amounts from the customer's account, or if the customer refuses or is unable, due to closure, bankruptcy or other reasons, to reimburse us for a chargeback, we bear the loss for the amount of the refund paid to the cardholder. We may experience significant losses from chargebacks in the future. Any increase in chargebacks not paid by our customers could have a material adverse effect on our business, financial condition, results of operations and cash flows. We have policies to manage customer-related credit risk and attempt to mitigate such risk by monitoring transaction activity. Notwithstanding our programs and policies for managing credit risk, it is possible that a default on such obligations by one or more of our customers could have a material adverse effect on our business.

Failure to maintain effective systems of internal control over financial reporting and disclosure controls and procedures could cause a loss of confidence in our financial reporting and adversely affect the trading price of our common stock.

Effective internal control over financial reporting is necessary for us to provide accurate financial information. Section 404 of the Sarbanes-Oxley Act requires us to evaluate the effectiveness of our internal control over financial reporting as of the end of each fiscal year and to include a management report assessing the effectiveness of our internal control over financial reporting in our Annual Report on Form 10-K. We identified a material weakness in our internal controls over financial reporting as of June 30, 2016 and June 30, 2015. There can be no assurance that the remediation of the control deficiencies that gave rise to the material weakness will be effective or successful. If we fail to maintain the adequacy of our internal control, we may not be able to conclude and report that we have effective internal control over financial reporting. If we are unable to adequately maintain our internal control over financial reporting, we may not be able to accurately report our financial results, which could cause investors to lose confidence in our reported financial information, negatively affecting the trading price of our common stock, or our ability to access the capital markets.

Risks Relating to Our Common Stock

We do not expect to pay cash dividends in the foreseeable future and therefore investors should not anticipate cash dividends on their investment.

The holders of our common stock and series A convertible preferred stock are entitled to receive dividends when, and if, declared by our board of directors. Our Board of Directors does not intend to pay cash dividends in the foreseeable future, but instead intends to retain any and all earnings to finance the growth of the business. To date, we have not paid any cash dividends on our common stock or our series A convertible preferred stock and there can be no assurance that cash dividends will ever be paid on our common stock.

Our articles of incorporation prohibit the declaration of any dividends on our common stock unless and until all unpaid and accumulated dividends on the series A convertible preferred stock have been declared and paid. In addition, our loan agreement with our bank prohibits us from paying dividends without the prior consent of our bank. Through July 5, 2017, the unpaid and cumulative dividends on the series A convertible preferred stock are $14.03 million. As of July 5, 2017, each share of series A convertible preferred stock was convertible into 0.1940 of a share of common stock at the option of the holder and is subject to further adjustment as provided in our articles of incorporation. The unpaid and cumulative dividends on the series A convertible preferred stock are convertible into shares of our common stock at the rate of $1,000 per share at the option of the holder. During the year ended June 30, 2016, none of our series A convertible preferred stock and no cumulative preferred dividends were converted into shares of common stock.

Our articles of incorporation also provide that the preferred stock has a liquidation preference over the common stock in the amount of $10 per share plus accrued and unpaid dividends. As of March 31, 2017, the liquidation preference was $18.78 million.

Upon certain fundamental transactions involving the Company, such as a merger or sale of substantially all of our assets, we may be required to distribute the liquidation preference then due to the holders of our series A preferred stock which would reduce the amount of the distributions otherwise to be made to the holders of our common stock in connection with such transactions.

Our articles of incorporation provide that upon a merger or sale of substantially all of our assets or upon the disposition of more than 50% of our voting power, the holders of at least 60% of the preferred stock may elect to have such transaction treated as a liquidation and be entitled to receive their liquidation preference. Upon our liquidation, the holders of our preferred stock are entitled to receive a liquidation preference prior to any distribution to the holders of common stock which as of March 31, 2017 is equal to $18.78 million.

Our stock price may be volatile.

The trading price of our common stock is expected to be subject to significant fluctuations in response to various factors including, but not limited to, the following:

| ● |

variations in operating results and achievement of key business metrics;

|

| ● |

changes in earnings estimates by securities analysts, if any;

|

| ● |

any differences between reported results and securities analysts’ published or unpublished expectations;

|

|

●

|

announcements of new contracts, service offerings or technological innovations by us or our competitors;

|

|

●

|

market reaction to any acquisitions, joint ventures or strategic investments announced by us or our competitors;

|

| ● |

demand for our services and products;

|

| ● |

shares of common stock being sold pursuant to Rule 144 or upon exercise of warrants;

|

| ● |

regulatory matters;

|

| ● |

concerns about our financial position, operating results, litigation, government regulation, developments or disputes relating to agreements, patents or proprietary rights;

|

| ● |

potential dilutive effects of future sales of shares of common stock by shareholders and by the Company;

|

| ● |

the amount of average daily trading volume in our common stock;

|

| ● |

our ability to obtain working capital financing; and

|

| ● |

general economic or stock market conditions unrelated to our operating performance.

|

The securities market in recent years has from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations, as well as general economic conditions, may also materially and adversely affect the market price of our common stock.

Director and officer liability is limited.

As permitted by Pennsylvania law, our by-laws limit the liability of our directors for monetary damages for breach of a director’s fiduciary duty except for liability in certain instances. As a result of our by-law provisions and Pennsylvania law, shareholders may have limited rights to recover against directors for breach of fiduciary duty. In addition, our by-laws and indemnification agreements entered into by the Company with each of the officers and directors provide that we shall indemnify our directors and officers to the fullest extent permitted by law.

Our publicly-filed reports are reviewed by the SEC from time to time and any significant changes required as a result of any such review may result in material liability to us, and have a material adverse impact on the trading price of our common stock.

The reports of publicly-traded companies are subject to review by the SEC from time to time for the purpose of assisting companies in complying and to assess their compliance with applicable disclosure requirements and to enhance the overall effectiveness of companies’ public filings, and comprehensive reviews of such reports are now required at least every three years under the Sarbanes-Oxley Act of 2002. SEC reviews may be initiated at any time. While we believe that our previously filed SEC reports comply, and we intend that all future reports will comply in all material respects with the published SEC rules and regulations, we could be required to modify or reformulate information contained in prior filings as a result of an SEC review. Any modification or reformulation of information contained in such reports could be significant and result in material liability to us and have a material adverse impact on the trading price of our common stock.

Risks Relating to the Offering

Management will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.