Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BARINGTON/HILCO ACQUISITION CORP. | s106752_8k.htm |

Exhibit 99.1

CORPORATE PRESENTATION July 2017 O O M B A G A M E W O R K S THE ULTIMATE PLATFORM FOR EVENTS, RANKINGS & STATS THE LARGEST CHAIN OF ESPORTS STADIUMS ACROSS AMERICA

2 SAFE HARBOR & SEC CAUTIONARY NOTE FORWARD LOOKING STATEMENTS Forward-Looking Statements This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, among others, statements regarding the expected benefits of the potential combinations of Barington/Hilco Acquisition Corp. (“Barington/Hilco”) and Oomba, Inc. (“Oomba”) pursuant to a merger agreement dated May 12, 2017 and of Oomba and GameWorks Entertainment, LLC (“GameWorks”) pursuant to an asset purchase agreement dated May 12, 2017 and expectations about future business plans, prospective performance (including estimated combined pro forma financial performance) and opportunities; and the expected timing of the completion of the transaction and the obtaining of required approval by Barington/Hilco’s and Oomba shareholders. These forward-looking statements may be identified by the use of words such as “expect,” “anticipate,” “believe,” “estimate,” “potential,” “should”, “will” or similar words intended to identify information that is not historical in nature. These forward-looking statements are based on current expectations and assumptions of management of Oomba and GameWorks and are subject to risks, uncertainty and changes in circumstances that could cause the actual events and results in future periods to differ materially from the current expectations of Barington/Hilco, Oomba and GameWorks and those expressed or implied by these forward-looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. These risks, uncertainties and changes in circumstances include, among others, (a) the possibility that the merger does not close when expected or at all; (b) the ability and timing to obtain required shareholder approval, and to satisfy or waive other closing conditions; (c) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement or could otherwise cause the merger to fail to close; (d) the ability of Oomba and GameWorks to promptly and effectively integrate their respective businesses; (e) the outcome of any legal proceedings that may be instituted in connection with the transaction; (f) the receipt of an unsolicited offer from another party for an alternative business transaction that could interfere with the proposed merger; (g) the ability to retain key employees of Oomba and GameWorks; (h) that there may be a material adverse change affecting Oomba and GameWorks, or that the respective businesses of Oomba and GameWorks may suffer as a result of uncertainty surrounding the transaction; (i) the risk factors disclosed in Barington/Hilco’s filings with the Securities and Exchange Commission (the “SEC”), including its Annual Report on Form 10-K; (j) the inability to obtain or maintain the listing of the post-combination company’s common stock on NASDAQ following the business combination could disrupt current plans and operations as a result of the announcement and consummation of the transactions described herein; (k) the inability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, and the ability of the combined business to grow and manage growth profitability that Oomba and GameWorks may be adversely affected by other economic, business, political, and/or competitive factors. Forward-looking statements reflect Oomba’s and GameWorks’ management’s current analysis and expectations only as of the date of this presentation, and none of Barington/Hilco, Oomba or GameWorks undertakes to update or revise these statements, whether written or oral, to reflect subsequent developments, except as required under the federal securities laws. Readers are cautioned not to place undue reliance on any of these forward-looking statements. Additional Information and Where to Find It This presentation may be deemed to be solicitation material for the prospective shareholder vote with respect to the issuance of shares of Barington/Hilco common stock under the merger agreement. In connection with the merger agreement, Barington/Hilco intends to file relevant materials with the SEC, including a preliminary proxy statement and a definitive proxy statement. The definitive proxy statement will be mailed to Barington/Hilco’s shareholders. This presentation does not constitute a solicitation of any vote or proxy from any shareholder of Barington/Hilco or an offer to sell any securities. INVESTORS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS OR MATERIALS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE IN THE DEFINITIVE PROXY STATEMENT BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT OOMBA, GAMEWORKS AND BARINGTON/HILCO AND THE PROPOSED MERGER. Investors may obtain free copies of the definitive proxy statement, and other relevant materials and documents filed with the SEC (when they become available), without charge, at the SEC’s web site at www.sec.gov. In addition, investors may obtain free copies of the definitive proxy statement, and other relevant materials and documents filed with the SEC (when they become available) by directing a written request to Investor Relations, Barington/Hilco Acquisition Corp., 888 Seventh Avenue, 6th Floor, New York, NY 10019. Participants in Prospective Solicitation Oomba, GameWorks and Barington/Hilco and their respective directors, executive officers and certain other members of management and employees may be deemed to be “participants” in a prospective solicitation of proxies from shareholders of Barington/Hilco in connection with the proposed transaction and other matters set forth in the forthcoming proxy statement, including with respect to the issuance of shares of Barington/Hilco common stock under the merger agreement. Additional information regarding participants in such a proxy solicitation and a description of their interests in the proposed transaction will be contained in the proxy statement that Barington/Hilco will file with the SEC in connection with the proposed transaction and other relevant documents or materials to be filed with the SEC regarding the proposed transaction.

3 CONTENTS Executive Summary | Transaction Overview 4 Our Core Belief | eSports are Sports 7 Insight | If eSports are Sports, they must monetize like Sports 12 Opportunity #1 | Where are the Stadiums? 16 Opportunity #2 | How do we find Events? And where do we keep our Rankings and Stats? 22 Our Grand Strategy | Buy GameWorks, add eSports, go public! 31 The Nitty-Gritty | Company Overview 37 Deeper Dive | Selected Financial Data 46 Further Data | Appendix 57

EXECUTIVE SUMMARY Transaction Overview League pf Legends World Championship Staples Center Los Angeles =, CA USA

5 Oomba and GameWorks Oomba is the software platform; GameWorks is the location based eStadium + Founded in 2012, based in Irvine, CA, Oomba is a Founded in 1996 by Steven Spielberg in cloud-based tournament management platform. partnership with SEGA. Based in Playa Vista, CA with 9 locations in large metro areas around the Oomba is a revolutionary social media platform: US; GameWorks is a leading location based Specializing in event and tournament entertainment company. management Full service bar and restaurant A social network focused on stats, rankings, and Modern arcade, gaming, and event venue ratings In May 2017, Oomba entered into an Asset Purchase Agreement with GameWorks Entertainment, LLC; Oomba also signed a definitive merger agreement with Barington/Hilco Acquisition Corp. (NASDAQ: BHAC), a special purpose acquisition company. Upon closing under the merger agreement, the combined company will operate as Oomba GameWorks.

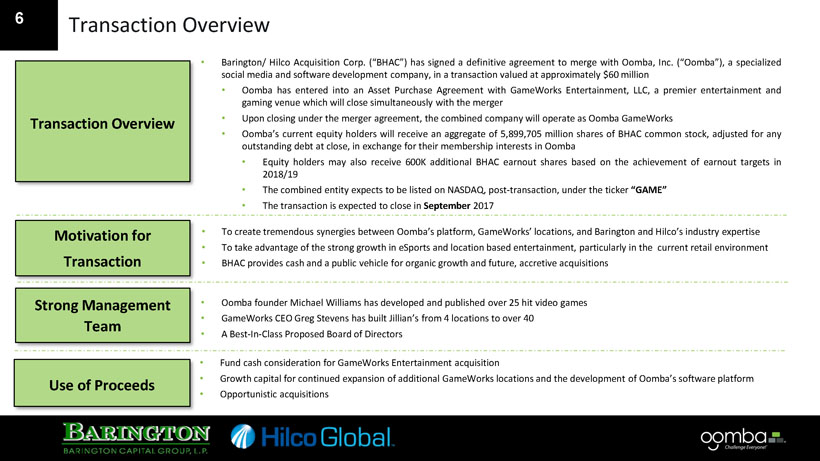

6 Transaction Overview Barington/ Hilco Acquisition Corp. (“BHAC”) has signed a definitive agreement to merge with Oomba, Inc. (“Oomba”), a specialized social media and software development company, in a transaction valued at approximately $60 million Oomba has entered into an Asset Purchase Agreement with GameWorks Entertainment, LLC, a premier entertainment and gaming venue which will close simultaneously with the merger Transaction Overview Upon closing under the merger agreement, the combined company will operate as Oomba GameWorks Oomba’s current equity holders will receive an aggregate of 5,899,705 million shares of BHAC common stock, adjusted for any outstanding debt at close, in exchange for their membership interests in Oomba Equity holders may also receive 600K additional BHAC earnout shares based on the achievement of earnout targets in 2018/19 The combined entity expects to be listed on NASDAQ, post-transaction, under the ticker “GAME” The transaction is expected to close in September 2017 Motivation for To create tremendous synergies between Oomba’s platform, GameWorks’ locations, and Barington and Hilco’s industry expertise To take advantage of the strong growth in eSports and location based entertainment, particularly in the current retail environment Transaction BHAC provides cash and a public vehicle for organic growth and future, accretive acquisitions Strong Management Oomba founder Michael Williams has developed and published over 25 hit video games GameWorks CEO Greg Stevens has built Jillian’s from 4 locations to over 40 Team A Best-In-Class Proposed Board of Directors Fund cash consideration for GameWorks Entertainment acquisition Growth capital for continued expansion of additional GameWorks locations and the development of Oomba’s software platform Use of Proceeds Opportunistic acquisitions

OUR CORE BELIEF eSports are Sports

8 The Numbers are Undeniable More people watch eSports than nearly all other sports. World Championships 27M 20M Forbes MAR 16, 2017 @ 09:02 AM 3,730 +46 Million Watched Live Esports Event NBA FINALS 15.5M WORLD SERIES 13.8M STANLEY CUP FINALS 5M

9 The eSports Market Will Double by 2019 eSports is a large and rapidly growing industry. NewZoo projects global revenue from rights, merchandise & tickets, online advertising, brand partnerships, and additional game publisher investment to reach: $1.072 billion in 2019 Deloitte Global predicts that eSports will generate global revenues of $500 million in 2016, up 25 percent from $400 million in 2015

10 The Audience is Large and Getting Larger In 2017, more people will watch eSports than play them. ESPORTS AUDIENCE GROWTH GLOBAL FOR 2015, 2016, 2017, 2020 Q1 2017

11 Why Didn’t You know? Viewership is mostly on new media, not television. 2017: “Where do you typically go to watch gaming-related video?” 1. 70% 2. 19% 3. 17% 4. 17% 5. 15% Source: Nielsen Reports “Games 360 U.S. Report 2017”

INSIGHT If eSports are Sports, they, must monetize like Sports

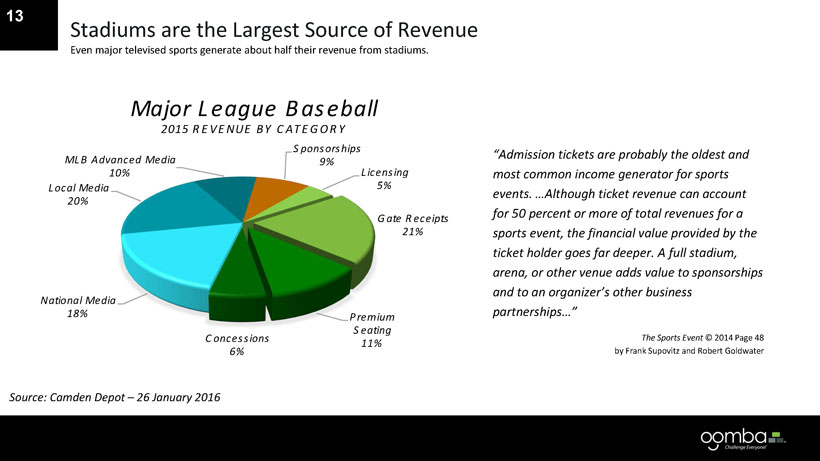

13 Stadiums are the Largest Source of Revenue Even major televised sports generate about half their revenue from stadiums. Major League Baseball 2015 REVENUE BY CATEGORY Sponsorships MLB Advanced Media “Admission tickets are probably the oldest and 9% 10% Licensing most common income generator for sports Local Media 5% events. …Although ticket revenue can account 20% Gate Receipts for 50 percent or more of total revenues for a 21% sports event, the financial value provided by the ticket holder goes far deeper. A full stadium, arena, or other venue adds value to sponsorships and to an organizer’s other business National Media 18% Premium partnerships…” Seating Concessions 11% The Sports Event © 2014 Page 48 6% by Frank Supovitz and Robert Goldwater Source: Camden Depot 26 January 2016

14 eSports is Watching not just Playing in Real Life This is not online gaming played at home. 42% of eSports fans noted a desire to: eSports related videos comprise ~10% of meet and socialize with one another YouTube’s top performing channels pick up pro tips for playing games meet or see eSports celebrities live

15 This is Not Online eSports events have sold out Madison Square Gardens and other major venues. Sang-am World Cup Stadium, Seoul Madison Square Garden League of Legends 2014 World Finals (45,000 Fans) League of Legends World Championship Semifinals (18,000+ Fans)

OPPORTUNITY #1 Where are the Stadiums?

17 GameWorks with its 9 Locations is positioned to be the Leader 30,000+ sq. ft. locations with full-service bars, food and beverage centers, and gaming. Mall of America Seattle Schaumburg Seattle, WA Ontario, CA1 San Francisco, CA San Francisco Opened May 1996 Opened July 1997 Opened April 1999 Schaumburg, IL Newport, KY Chesapeake, VA Chesapeake Ontario1 Las Vegas Denver Newport Opened June 1999 Opened March 2002 Opened May 2010 1The Ontario location is in the process of relocating. Mall of America, MN Las Vegas, NV Denver, CO Opened May 2011 Opened July 2014 Opened March 2016

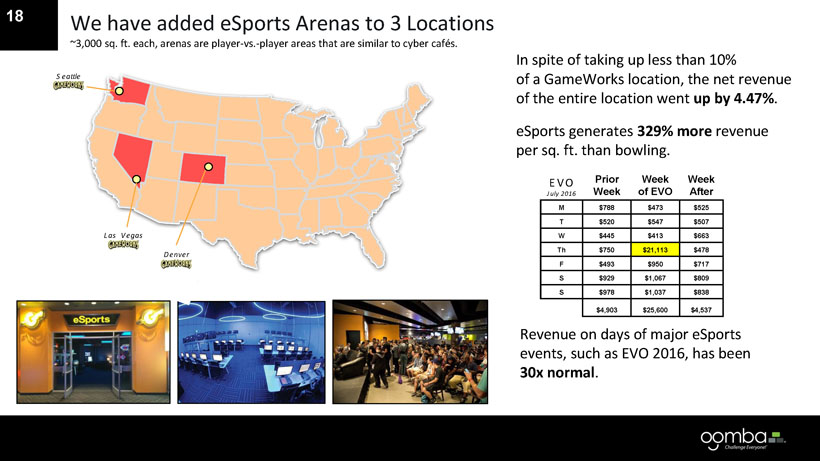

18 We have added eSports Arenas to 3 Locations ~3,000 sq. ft. each, arenas are player-vs.-player areas that are similar to cyber cafés. In spite of taking up less than 10% Seattle of a GameWorks location, the net revenue of the entire location went up by 4.47%. eSports generates 329% more revenue per sq. ft. than bowling. EVO Prior Week Week July 2016 Week of EVO After M $788 $473 $525 T $520 $547 $507 Las Vegas W $445 $413 $663 Th $750 $21,113 $478 Denver F $493 $950 $717 S $929 $1,067 $809 S $978 $1,037 $838 $4,903 $25,600 $4,537 Revenue on days of major eSports events, such as EVO 2016, has been 30x normal.

19 Natural Evolution to eSports Stadiums eSports Stadiums are basically theaters with a stage, monitors, and lighting. Assigned Seating VIP Rooms Food & Beverage Large Monitors Surround Sound Lighting Livestreaming Leaderboards Seats about 500 to 1,500 Adjoins GameWorks NOTE: Intended for concept illustration only

20 Partnerships with Pro eSports Teams We are inviting eSports teams to each make a location their official home GameWorks will be the home stadium to new and existing pro eSports teams. Pro teams are expected pay as much as $10 million to be the official team for League of Legends® or Overwatch® within each city to the game publishers. Teams are owned by famous basketball stars, NFL teams, and billionaires. Relationship with Oomba GameWorks includes appearances, merchandising, and performance rights with revenue share. This is very much like the NFL®, MLB®, NBA® or any other professional sport. Teams shown are copyright of Oomba and shown for illustrative purposes only

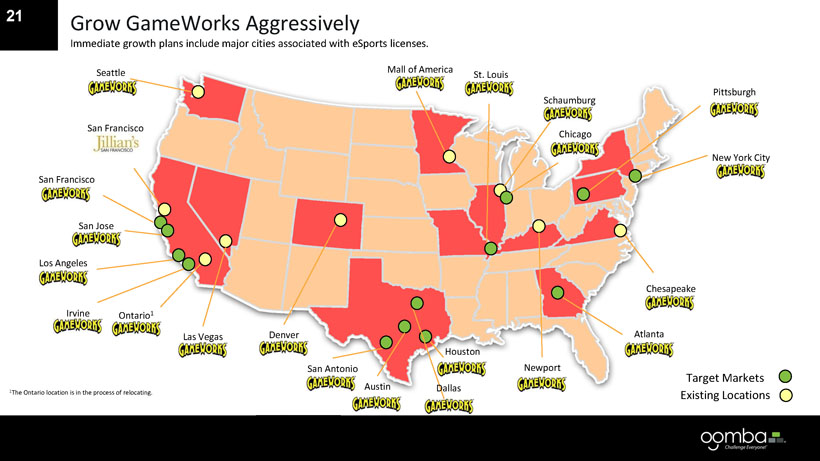

21 Grow GameWorks Aggressively Immediate growth plans include major cities associated with eSports licenses. Seattle Mall of America St. Louis Pittsburgh Schaumburg San Francisco Chicago New York City San Francisco San Jose Los Angeles Chesapeake Irvine Ontario1 Las Vegas Denver Atlanta Houston San Antonio Newport Target Markets Austin Dallas 1The Ontario location is in the process of relocating. Existing Locations

OPPORTUNITY #2 How do we find events? And where de we keep our rankings and stats?

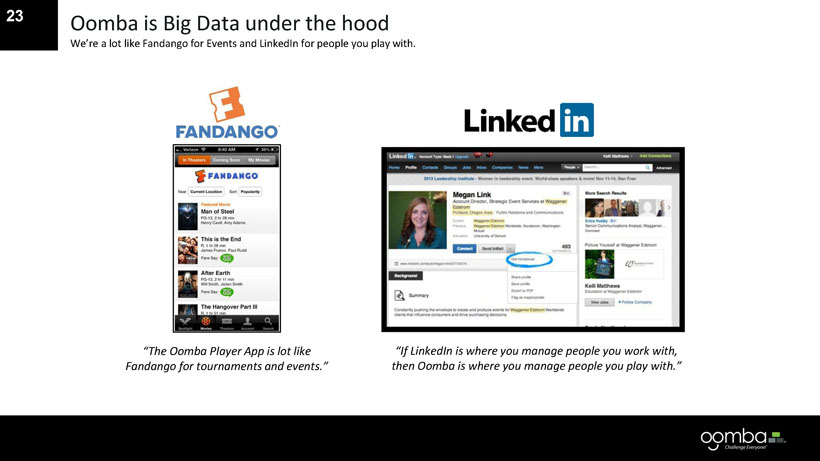

23 Oomba is Big Data under the hood We’re a lot like Fandango for Events and LinkedIn for people you play with. “The Oomba Player App is lot like “If LinkedIn is where you manage people you work with, Fandango for tournaments and events.” then Oomba is where you manage people you play with.”

24 The eSports Landscape The eSports marketplace is fragmented; there is currently only one large-scale, cloud-based community (see next slide).

25 100-Million User Communities The nine cloud-based communities with over 100-million users based in the US listed are: #1 Where we keep our pictures. 2.00 billion active users #2 How we send text messages. 1.2 billion active users #3 How we share pictures. 600 million active users #4 How we broadcast messages. 328 million active users One game, League of #5 Where we keep our videos. 212 million active users Legends®, has grown to 100 million active users, but eSports is #6 How we broadcast our videos. 161 million active users bigger than that and sports and games in #7 How we share our interests. 150 million active users general are even bigger. #8 Where we keep our résumés. 106 million active users #9 A particular eSports game. 100 million active users Source: Wikipedia.org as of June 25, 2017

26 Oomba is a Multi-sided Software Platform We bring together Players, Tournament Organizers, Sponsors and many, many other parties. Sponsors Apparel Companies Venues Players Tournament Organizers Teams Judges Equipment Coaches Manufacturers

27 Oomba brings Elegant Organization to Sports and Games We provide powerful online utilities to tournament organizers and players for no money upfront and a small percentage on the back end. Powerful Tournament Organization Tools Fandango-like Player App for finding Events Scorekeeping Apps for iPads and Tablets Leaderboards and Round Clocks for Venues Livestreaming and Curated Content for Sports Bars User-Generated Content with real time scores/stats Stat Casting and Commentary Feeds Large-scale first-party events with 100’s of Satellites, dozens of regionals and annual grand finalés. Third-party events at Microsoft Stores, eSports Arenas

28 First-party Events Oomba runs a set of major, year-long events. National tabletop tournament (board games) involving 6 publishers, 289 game stores and about 10,000 players. National, collegiate eSports tournament involving 128 colleges competing for scholarships ending in a grand final in Las Vegas. Tournament that is the aggregation of the finals of several skill-based events, such as cup-stacking and dodge ball. Oomba’s first-party events drive awareness and users. Oomba’s software has been used to managed thousands of third-party events.

29 Oomba captures and broadcasts Stats, Rankings and Ratings We capture the stats wherever they are created and transmit them to 1st- and 3rd-party services everywhere. OombaTV BoardGameGeek Events

30 An Evergreen Place for Your Ranking and Stats We all socialize around sports, eSports, games, and stats; Oomba offers the tools to do that. #1 Where we keep our pictures. 2.00 billion active users #2 Where we keep our videos. 212 million active users Where we keep our rankings and #3 150 million active users stats. #4 Where we keep our résumés. 106 million active users The vision for Oomba is to become the universal repository for all stats, rankings and ratings.

GROWTH STRATEGY Buy GameWorks, add eSports, go public!

32 Oomba is Buying GameWorks and Going Public We Will Build eSports Stadiums all Across the US and Grow to Be a 100-million+ User Community. Social Network Entertainment Major Live Events eSports Stadiums Livestreaming + Bar & Restaurant Special Purpose Acq. Corp. $35 million in Equity NASDAQ: BHAC

33 Oomba GameWorks Management Team MICHAEL A WILLIAMS THOMAS IWANSKI JAKE DORN STEVE BOOTH Chief Executive Officer & Founder Chief Financial Officer Chief Marketing Officer Chief Operating Officer, Oomba, Inc. Developed over 25 hit video games Former CFO of Energous “WATT” Global SVP & Chief Client Officer Ipsos (NASDAQ: IPS) Over 26 years in the Entertainment/Gaming Founder of Planetwide Media Officer or Director for 7 Public Co’s Industry Founder of Tremor Ent. Global VP J Walter Thompson (NASDAQ: WPP) VP of Licensing Midway Games Over 20 years of Executive Management Founder of CodeFire Experience Director of Business Affairs WorldWide Senior Director Marketing CollegeSports.com Entertainment Licensing (for Electronic Arts) Almost 10 years of Public Accounting Board Advisor and Investor in Director of Operations and VR/AR Project Experience with KPMG LLP mobile, AI and AR Management Emblematic Group Certified Public Accountant

34 Oomba Management Team ED HAR DYLAN HUNDLEY TOM VONDRAN MATT SCOTT Chief Financial Officer SVP Production, Founder SVP Strategy President/CTO, Oomba Cloud Controller W Hotels San Diego President of Buzzkill Over 25 years in the Technology Over 20 years of Corporate and Business Development Experience Founder UpperStrata CFO Steele Canyon Golf Course Co-Founder of Reality Gap Founder Game Machine Studios Former Investment Banker with D.A. Davidson Sr. Finance Dir. Paradigm Investment Group SVP of Friedland Capital Founder Little Orbit & Co (Franchisee of Hardee’s and Carl’s Jr.) Founder Pepper Branch Manager for 5 offices of Wells Fargo Featured on 2014 OC Metro’s Financial Hottest 25 CEO’s List

35 GameWorks Management Team GREG STEVENS PAUL LEBLANC MICHAEL BRAND Chief Executive Officer Chief Financial Officer SVP eSports Former CEO of JBC Entertainment, Inc. GameWorks Chief Financial Officer since Founder of the community-based Founder/Owner of S&G Mgmt. Group, LLC. December 2014 eSports arenas at GameWorks Operating Partner with Milestone Capital CFO of Jillian’s Entertainment, a $180 million President at October Financial Offering competitive events and tournaments multi-venue entertainment for PC, Console, SVP at Kane & Co. (BD) Managing Director, VP, Director of Operation and mobile titles for Can-Apple Investments. Certified Public Accountant (Inactive) VP of Finance of PepsiCo

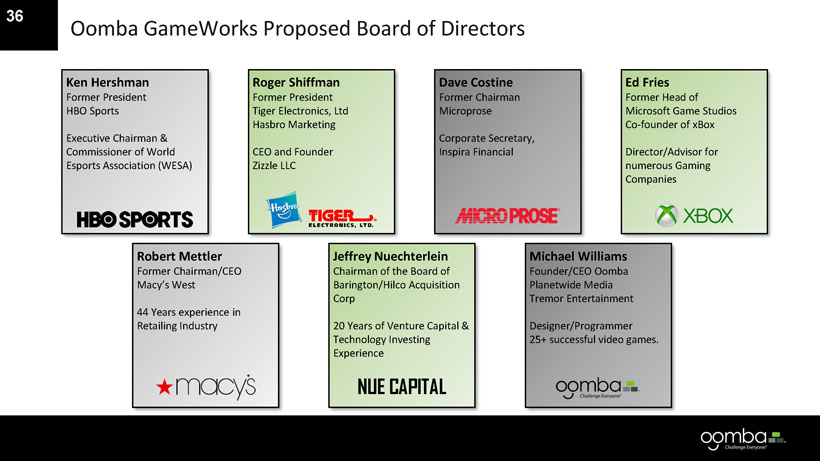

36 Oomba GameWorks Proposed Board of Directors Ken Hershman Roger Shiffman Dave Costine Ed Fries Former President Former President Former Chairman Former Head of HBO Sports Tiger Electronics, Ltd Microprose Microsoft Game Studios Hasbro Marketing Co-founder of xBox Executive Chairman & Corporate Secretary, Commissioner of World CEO and Founder Inspira Financial Director/Advisor for Esports Association (WESA) Zizzle LLC numerous Gaming Companies Robert Mettler Jeffrey Nuechterlein Michael Williams Former Chairman/CEO Chairman of the Board of Founder/CEO Oomba Macy’s West Barington/Hilco Acquisition Planetwide Media Corp Tremor Entertainment 44 Years experience in Retailing Industry 20 Years of Venture Capital & Designer/Programmer Technology Investing 25+ successful video games. Experience NUE CAPITAL

THE NITTY-GRITTY Company Overview

38 GameWorks Operations Target net cash investment of $1-2 million per location, calculated as $4.5 million of capital expenditures less $1.2 million of game package financing and $1-2 million of landlord TI allowance Target annual revenue of $6.0 million per entertainment center Target annual entertainment center level EBITDA contribution of $1.2 million (20% margin) Non-proforma targeted cash-on-cash returns of 36% reflects a 2.8-year payback period on invested capital, not including TI allowances GameWorks is projected to achieve pro forma revenue of over $31 million and center level EBITDA of over $4.5 million in 2017

39 Retail Distribution The Rise of the Mega Mall Complex. Malls built by developers in the 1960s, 1970s, and 1980s. Anchor tenants given favorable deals to open in shopping malls to draw foot traffic. In-Line tenants pay higher rents because Anchor stores draw foot traffic and they could limit spending on marketing

40 Retail Distribution creates Opportunities for Experiential Tenants Both In-Line and Anchor retailers are closing stores at a rapid pace. Store closure announcements have accelerated this year, with Credit Suisse estimating more than 8,600 in 2017, up from 2,056 in 2016. Mall-Based Retailers who have closed or announced store closings include: Macy’s, Sports Authority, The Gap, Aeropostale, BCBG, Limited, JCPenney, Sears/Kmart, Golfsmith, Gymboree and many more. Despite significant disruption, in 2016 online retail sales accounted for just 11.7% of total retail sales (excluding fuel and auto). GameWorks is uniquely positioned to fill these vacancies and attract a key demographic, millennials with disposable income, back to the malls.

41 GameWorks is Perfect Venue to Showcase Emerging Technologies Sponsorship & Partnership opportunities with leading brands for VR, AR, Drone Racing, and simulators. Showcase for Major Brands Room-Scale VR Drone Racing Competitive VR Events AR Mixed Reality Intended for concept illustration NOTE: Intended for concept illustration only

42 Growth Strategy and Milestones GameWorks location expansion with eSports-equipped facilities and grow Oomba user base 2017 Continue to develop new versions of Event Management Platform and Personalized Expand current eSports in the Seattle, Las Vegas, and Denver locations by eSports User Page. building similar eSports arenas in the remaining GameWorks locations at similar to historic costs per location. Augment B2C strategy with B2B initiatives. Market customized software Aggressively expand the number of locations by opening new units in class development capabilities to businesses in the gaming industry. A malls in premier markets throughout the United States; new locations will include eSports “stadiums” in addition to the eSports arenas. Complete Increase marketing opportunities to significantly expand the number of Oomba sourcing of 8 additional GameWorks locations. user accounts through joint marketing with GameWorks and other eSports ecosystem partners. Aggressively expand the marketing effort to further embed the Event Management Platform within the eSports Tournament Operator Community. 2018 Increase marketing opportunities to significantly expand the number of Oomba Open 8 more GameWorks locations. user accounts through joint marketing with GameWorks and other eSports ecosystem partners. Joint Venture with professional eSports teams with each claiming a GameWorks eSports Stadium as its home. Market customized software development capabilities to business in the gaming industry. Continue to expand B2B relationships. 2019 Increase marketing opportunities to significantly expand the number of Oomba Open 9 more GameWorks locations. user accounts through joint marketing with GameWorks and other eSports ecosystem partners.

43 Competitive Landscape Location Based Entertainment Vail Resorts, Inc. Oomba GameWorks Six Flags Entertainment Corp. competes with location- Cedar Fair, L.P. FULL YEAR 2017 PEER Churchill Downs Inc. based entertainment GROUP1 Dave & Buster's Entertainment, Inc. platforms for discretionary International Speedway Corp. consumer spending: 1COMPARABLE PEER ANALYSIS PERFORMED BY: ATLAS CONSULTING, PAY GOVERNANCE LLC, MERIDIAN COMPENSATION PARTNERS, LLC, AON HEWITT, FW COO; VIA PUBLIC COMPANY 14A FILINGS, GENERAL PEER ANALYSIS, ETC.

44 Competitive Landscape Oomba Advantages Oomba GameWorks’ competitive advantages: Vail Resorts, Inc. Six Flags Entertainment Corp. First mover advantage Cedar Fair, L.P. FULL YEAR 2017 PEER Churchill Downs Inc. Expansive scope of activities GROUP1 Dave & Buster's Entertainment, Inc. Large scale venues International Speedway Corp. Long term relationships Proven sales and marketing 1COMPARABLE PEER ANALYSIS PERFORMED BY: ATLAS CONSULTING, PAY GOVERNANCE LLC, MERIDIAN COMPENSATION PARTNERS, LLC, AON HEWITT, FW COO; VIA PUBLIC COMPANY 14A FILINGS, GENERAL PEER ANALYSIS, ETC.

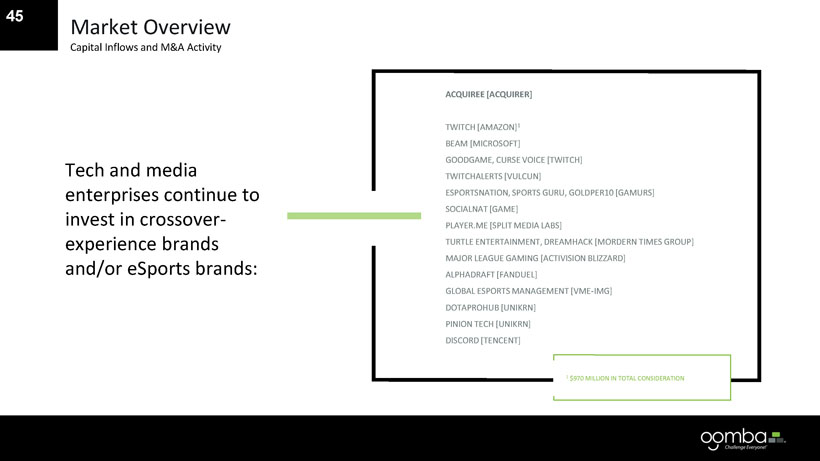

45 Market Overview Capital Inflows and M&A Activity ACQUIREE [ACQUIRER] TWITCH [AMAZON]1 BEAM [MICROSOFT] GOODGAME, CURSE VOICE [TWITCH] Tech and media TWITCHALERTS [VULCUN] enterprises continue to ESPORTSNATION, SPORTS GURU, GOLDPER10 [GAMURS] SOCIALNAT [GAME] invest in crossover- PLAYER.ME [SPLIT MEDIA LABS] experience brands TURTLE ENTERTAINMENT, DREAMHACK [MORDERN TIMES GROUP] MAJOR LEAGUE GAMING [ACTIVISION BLIZZARD] and/or eSports brands: ALPHADRAFT [FANDUEL] GLOBAL ESPORTS MANAGEMENT [VME-IMG] DOTAPROHUB [UNIKRN] PINION TECH [UNIKRN] DISCORD [TENCENT] 1 $970 MILLION IN TOTAL CONSIDERATION

DEEPER DIVE Selected Financial Data

47 Selected Financial Data: Consolidated Statement of Operations Adjusted Consolidated Actual Forecast Forecast Forecast FYE 2016 2017 2018 2019* (in $000's) Net Revenue 33,177 32,683 59,547 120 150 Cost of Goods Sold 5,843 8,761 12,663 Gross Profit 27,334 23,922 46,884 Operating Expenses 27,108 25,340 42,593 EBITDA 227 (1,418) 4,291 23 28 Note: adjusted for stock compensation and other non-cash items * Dollars in Millions

48 Selected Financial Data: GameWorks Statement of Operations Adjusted GameWorks Actual Forecast Forecast Forecast FYE 2016 2017 2018 2019* (in $000's) Net Revenue 32,664 31,131 51,636 100 120 Cost of Goods Sold 5,771 5,582 9,380 Gross Profit 26,893 25,549 42,256 Operating Expenses 24,401 23,206 35,541 EBITDA 2,493 2,343 6,715 17 20 Note: adjusted for stock compensation and other non-cash items * Dollars in Millions

49 Selected Financial Data: Oomba Statement of Operations Adjusted Oomba Actual Forecast Forecast Forecast FYE 2016 2017 2018 2019* (in $000's) Net Revenue 513 1,552 7,911 20 30 Cost of Goods Sold 72 3,179 3,283 Gross Profit 441 (1,627) 4,628 Operating Expenses 2,707 2,134 7,052 EBITDA (2,266) (3,761) (2,424) 6 8 Note: adjusted for stock compensation and other non-cash items * Dollars in Millions

50 Valuation and Comparable Analysis: 2017 PEER VALUATION COMPARISON12: EV AND MARKET CAP FIGURES IN MILLIONS PEER AVERAGE: 11.36 3.69 58.22 % GAME OOMBA GAMEWORKS, INC. 60.00 1.84 73.19 % GAME OOMBA GAMEWORKS, INC. 88.503 2.71 73.19 % 1All peer data are analyst estimates via I/B/E/S or standardized data. Standardized data are via I/B/E/S, Fundamentals, as well as public research reports. Standardized data has relatively fewer adjustments than GAAP/IFRS. Standardized data generally has adjustments for extraordinary and unusual expenses. Normalizing for such one-off events makes the data more comparable when comparing one company to another. Whenever reported numbers are restated, the restated numbers will be shown. 2As of June 9, 2017 3Assuming closing of SPAC merger

51 Valuation and Comparable Analysis: 2018 PEER VALUATION COMPARISON12: EV AND MARKET CAP FIGURES IN MILLIONS PEER AVERAGE: 10.85 3.57 56.42 % 6.23 % GAME OOMBA GAMEWORKS, INC. 60.00 13.98 1.01 78.73 % 82.20 % GAME OOMBA GAMEWORKS, INC. 88.503 20.62 1.49 78.73 % 82.20 % 1All peer data are analyst estimates via I/B/E/S or standardized data. Standardized data are via I/B/E/S, Fundamentals, as well as public research reports. Standardized data has relatively fewer adjustments than GAAP/IFRS. Standardized data generally has adjustments for extraordinary and unusual expenses. Normalizing for such one-off events makes the data more comparable when comparing one company to another. Whenever reported numbers are restated, the restated numbers will be shown. 2As of June 9, 2017 3Assuming closing of SPAC merger

52 Overview of Significant Terms Closing Consideration: An aggregate 5,899,705 BHAC shares will be issued to Oomba shareholders, adjusted for any outstanding debt at close, based on a pre-money enterprise valuation of Oomba equal to $60 million and a BHAC share Merger Consideration valuation of $10.17. Earnout Consideration: Assuming the achievement of the EBITDA thresholds or the BHAC common stock trading thresholds, BHAC would issue up to an additional 600,000 shares to the pre-closing Oomba shareholders as follows: 5% of the Merger Consideration (in the form of BHAC shares) will be placed in escrow for indemnification purposes. 18 Indemnification Escrow month survival. The parties agree to close as long as there is at least $23.5 million of cash available in BHAC trust fund, net of any amount Funds Required in BHAC raised in a preferred equity offering between signing and closing, down to a minimum of $5 million, net of transaction expenses. Trust Fund at Closing 7 members, 4 appointed by Oomba and 3 appointed by BHAC. Board of Directors

53 Transaction Valuation Valuation At Close(1)(2) Ownership at Close(1) At Closing Total Shares Outstanding 9,869,612 $ Per Share $10.17 Equity Value $100,373,953 Debt $0 Cash $11,833,707 Oomba Public Shares Enterprise Value $88,540,246 34.3% GameWorks Shares 53.1% Implied Multiples At Close Implied Multiples Revenue/EBITDA At Closing BHAC Sponsor 2017 EV/Revenue $32,683,000 2.7x Shares 2018 EV/Revenue $59,547,000 1.5x 12.6% 2019 EV/Revenue $135,000,000 0.7x 2018 EV/EBITDA $4,291,000 20.6x 1 Assumes 911,200 public common shares redeemed in connection with the February 2017 6-month extension approval 2019 EV/EBITDA $25,500,000 3.5x 2 Includes shares attributable to rights, does not include warrants

54 Illustrative Stock Price at Close $40.00 $37.37 $34.79 $32.20 $29.62 $30.00 $27.04 $24.45 $21.87 STOCK PRICE: $20.00 $10.00 $- 8.0x 9.0x 10.0x 11.0x 12.0x 13.0x 14.0x EBITDA MULTIPLE: (1) Assumptions: $25.5mm 2019 EBITDA

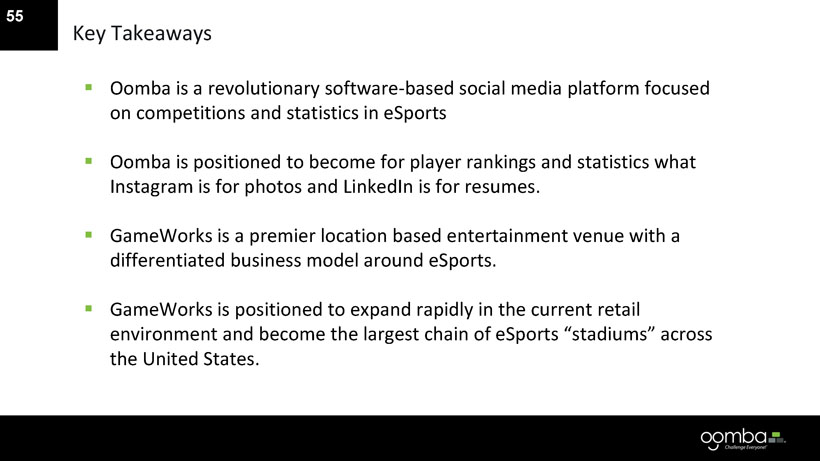

55 Key Takeaways Oomba is a revolutionary software-based social media platform focused on competitions and statistics in eSports Oomba is positioned to become for player rankings and statistics what Instagram is for photos and LinkedIn is for resumes. GameWorks is a premier location based entertainment venue with a differentiated business model around eSports. GameWorks is positioned to expand rapidly in the current retail environment and become the largest chain of eSports “stadiums” across the United States.

56 Contact Information OOMBA, INC. INVESTOR RELATIONS CONTACT ADDRESS: 9840 Irvine Center Dr. Ted Haberfield President CITY & STATE: Irvine, CA MZ North America PHONE: 949-825-6150 PHONE: 760-755-2716 WEBSITE: www.oomba.com EMAIL: thaberfield@mzgroup.us

FURTHER DATA Appendix

58 Target Market Overview Gamers: Young, Affluent, Mainstream 75% aged 18 to 35 133% purchasing power $76K average HH income $200 average spend per month 36% of US population by 2020 Forbes, CBS, Marketing Research

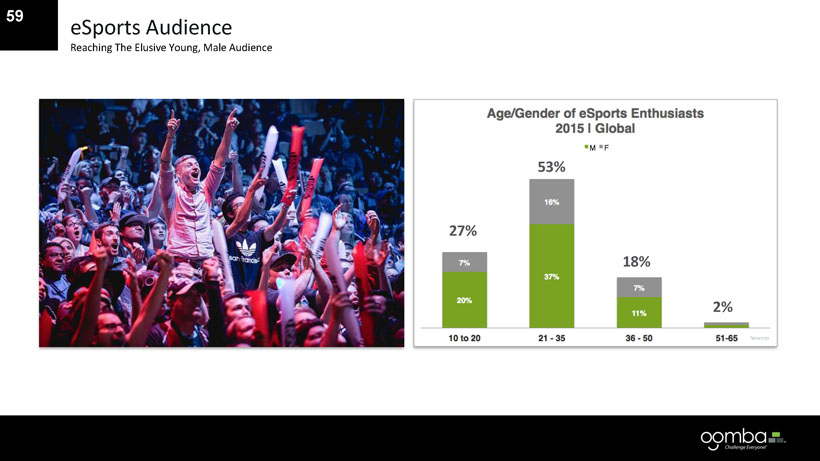

59 eSports Audience Reaching The Elusive Young, Male Audience 53% 27% 18% 2% Newzoo

60 eSports Audience Strong Purchasing Power eSports Audience HHI $90K+ 43% $75K-$89K Mindshare % eSports Audience Willing to Pay More For No Ads Mindshare

61 eSports Colleges Embracing eSports Programs, Engaging Math, Science and Technology Students in Sports Seven colleges fielded eSports programs as of July 2016 Currently 34 varsity eSports programs across the country Estimate of 50 to 60 schools will sponsor an eSports team by the next academic year Source: Sports Business Daily Global Journal

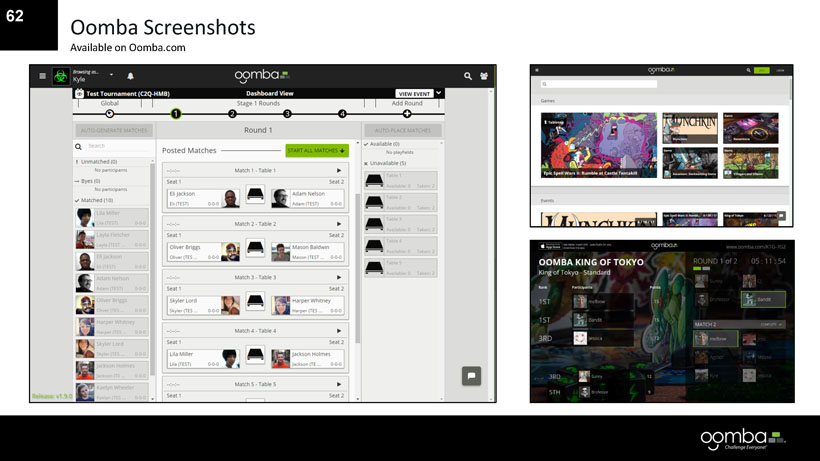

62 Oomba Screenshots Available on Oomba.com