Attached files

| file | filename |

|---|---|

| EX-23.1 - US EXP Group Inc. | usexps1062317ex23_1.htm |

| EX-5.1 - JONES, HALEY MOTTERN, P.C. - US EXP Group Inc. | usexps1062317ex5_1.htm |

| EX-3.2 - US EXP Group Inc. | usexps1062317ex3_2.htm |

| EX-3.1 - US EXP Group Inc. | usexps1062317ex3_1.htm |

As filed with the United States Securities and Exchange Commission on June 30, 2017

Registration No. ____________

____________________________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

____________________________________________

US EXP GROUP INC.

(Exact name of Registrant as Specified in its Charter)

NEVADA (State or other jurisdiction of incorporation or organization) |

7370 (Primary Standard) Industrial Classification Code Number) |

81-4673824 (I.R.S. Employer Identification No.) |

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices, principal place of business and name, address and phone number of service agent)

____________________________________________

| COPIES TO: | DR. WENYI YU | COPIES TO: | RICHARD W. JONES |

| 160 KERNS AVENUE | JONES, & HALEY, P.C. | ||

| BUFFALO, NEW YORK 14211 | 115 PERIMETER CENTER PLACE | ||

| (716) 200-1162 | SUITE 170 | ||

| ATLANTA, GEORGIA 30346 | |||

| (770) 804-0500 |

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or combination basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. [x]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.[ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If the form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accredited filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-3 of the Exchange Act. (Check one):

[ ]Large accelerated filer [ ]Accelerated filer

[ ]Non-accelerated filer [x]Smaller reporting company

(Do not check if a smaller reporting company)

If an emerging growth company, indicate by check made if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standard to Section 7 (a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEE

____________________________________________________________________________________________

Title of Each Class of Securities To Be Registered |

Amount to Be Registered |

Proposed Maximum Offering Price Per Unit (1) |

Proposed Maximum Aggregate Offering Price |

Amount Of Registration Fee (2) | ||||

Common Stock $.0001 Par Value

|

3,327,414 Shares | 5.00 | $16,637,070 | $1,664 |

________________________________________________________________________________________________

(1) The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o) of the Securities Act. Our shares of common stock are not traded on any national exchange and in accordance with Rule 457(o) the offering price was determined by the price of the shares that were sold to some of our shareholders in a private placement. We intend to apply to have our shares of Common Stock quoted on the OTCBB. The price of $5.00 is a fixed price at which the selling shareholders may sell their shares until our shares of common stock are quoted on the OTCBB marketplace and thereafter at prevailing market prices or privately negotiated prices or in transactions that are not in the public market. Before our shares of Common Stock can be quoted on the OTCBB, the Financial Industry Regulatory Authority (“FINRA”) must approve a Form 211 application filed by a licensed market maker. There can be no assurance that: (1) a market maker will agree to file the Form 211 Application; (2) that FINRA will approve the Form 211 Application; or (3) that our application to be quoted on the OTCBB marketplace will be approved.

(2) Calculated under Section 6(b) of the Securities Act of 1933 as .00003930 of the aggregate offering price.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SUCH SECTION 8(a), MAY DETERMINE.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS Subject to completion, dated June 30, 2017.

Preliminary Prospectus dated June 30, 2017

US EXP GROUP INC.

3,327,414 Shares of Common Stock

US EXP GROUP INC., is registering an aggregate of 3,327,414 shares of our common stock to be sold, from time to time, by the Company or one or more of the selling shareholders. The selling shareholders are offering 3,059,500 shares of the Company’s common stock and the Company is offering 267,914 shares of its common stock. The shares may only be offered and sold, from time to time, using this prospectus in transactions at a fixed offering price of $5.00 per share until a trading market develops in our common stock, at which time the selling shareholders may sell shares at prevailing market prices, which may vary, or they may sell shares at privately negotiated prices. The proceeds from the sale of the selling shareholders' shares will go directly to the selling shareholders and will not be available to us, while the proceeds from the sale of shares by the Company will go directly to the Company.

The selling shareholders and any broker/dealer executing sell orders on behalf of the selling shareholders are "underwriters" within the meaning of the Securities Act of 1933, as amended.

Currently, no public market exists for our common stock. We will seek to have a market maker publish quotations for our common stock on the OTC Bulletin Board ("OTCBB"), which is maintained by the Financial Institutions National Regulatory Authority (“FINRA”). However, we have no agreement or understanding with any potential market maker to do so. We cannot assure you that a public market for our common stock will develop. Ownership of our common stock is likely to be an illiquid investment.

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. WE URGE YOU

TO READ THE "RISK FACTORS" BEGINNING ON PAGE 8.

Brokers or dealers effecting transactions in these shares should confirm that the shares are registered under the applicable state law or that an exemption from registration is available.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Our business, financial condition, results of operations and prospects may have changed since that date.

June 30, 2017

| Page | |

| Prospectus Summary | 5 |

| The Offering | 5 |

| Cautionary Statement Regarding Forward Looking Statements | 8 |

| Risk Factors | 8 |

| Tax Considerations | 23 |

| Use of Proceeds | 23 |

| Capitalization | 24 |

| Dilution | 24 |

| Determination of Offering Price | 25 |

| Selling Shareholders | 25 |

| Plan of Distribution | 27 |

| Description of Securities | 32 |

| Interests of Named Experts and Counsel | 34 |

| Description of Business | 35 |

| Description of Website | 50 |

| Description of Creative Work Management | 62 |

| Description of Events Plan | 63 |

| Legal Proceedings | 73 |

| Market for Common Equity | 73 |

| Related Shareholder Matters | 73 |

| Transfer Agent and Registrar | 74 |

| Management Discussion and Analysis of Financial Condition and Results of Operations | 74 |

| Directors, Executive Officers, Promoters and Control Persons | 103 |

| Executive Compensation | 105 |

| Transactions with Related Persons, Promoters, and Certain Control Persons | 106 |

| Security Ownership of Principal Stockholders | 106 |

| Disclosure of Commission Position on Indemnification of Securities Act Liabilities | 107 |

| Where You Can Find Additional Information | 107 |

| Information Not Required in the Prospectus | 108 |

| Exhibits and Financial Statement Schedules | 109 |

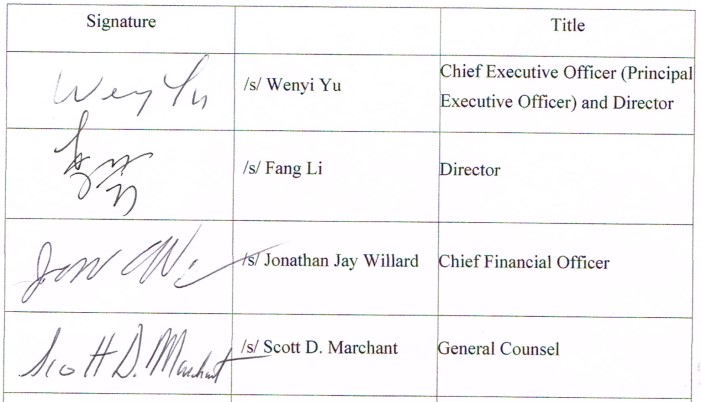

| Signatures | 112 |

US EXP GROUP INC.

PROSPECTUS

| PROSPECTUS |

We have agreed to bear the expenses relating to the registration of the shares of the selling shareholders.

We are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and as a result we are subject to reduced public company reporting requirements.

Investing in our Common Stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our Common Stock in “Risk Factors” beginning on page 8 of this prospectus.

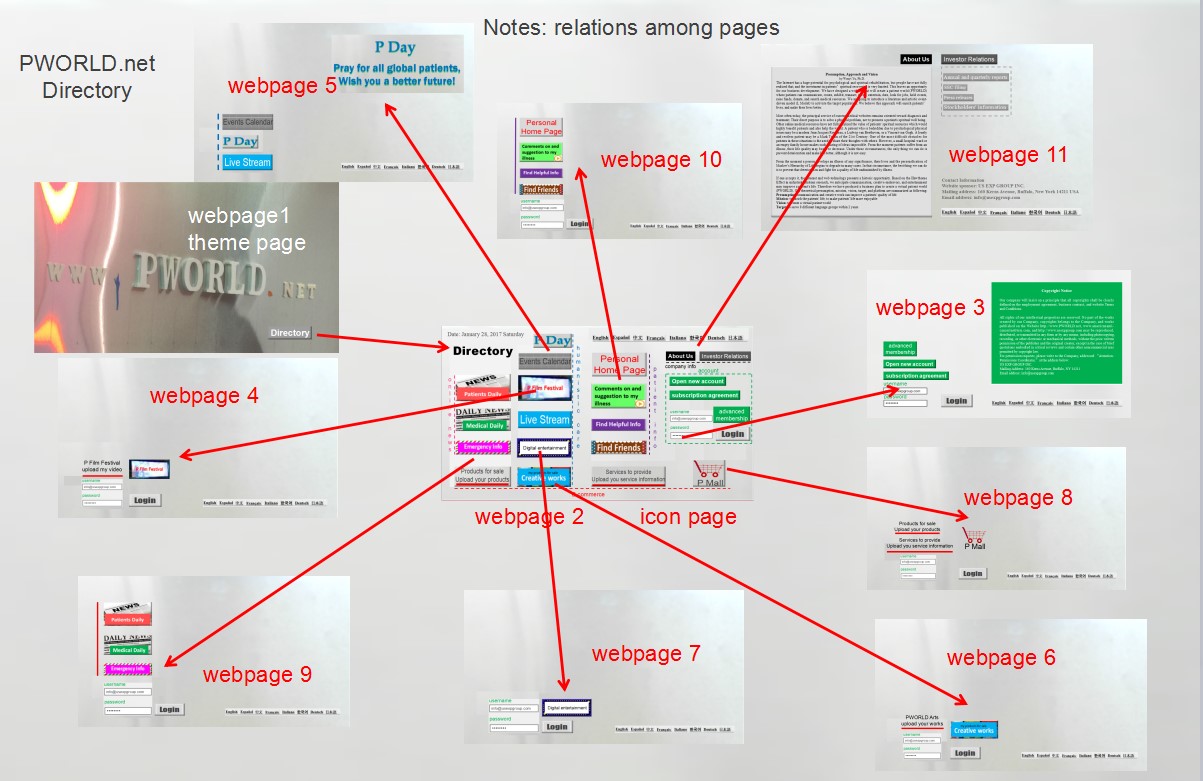

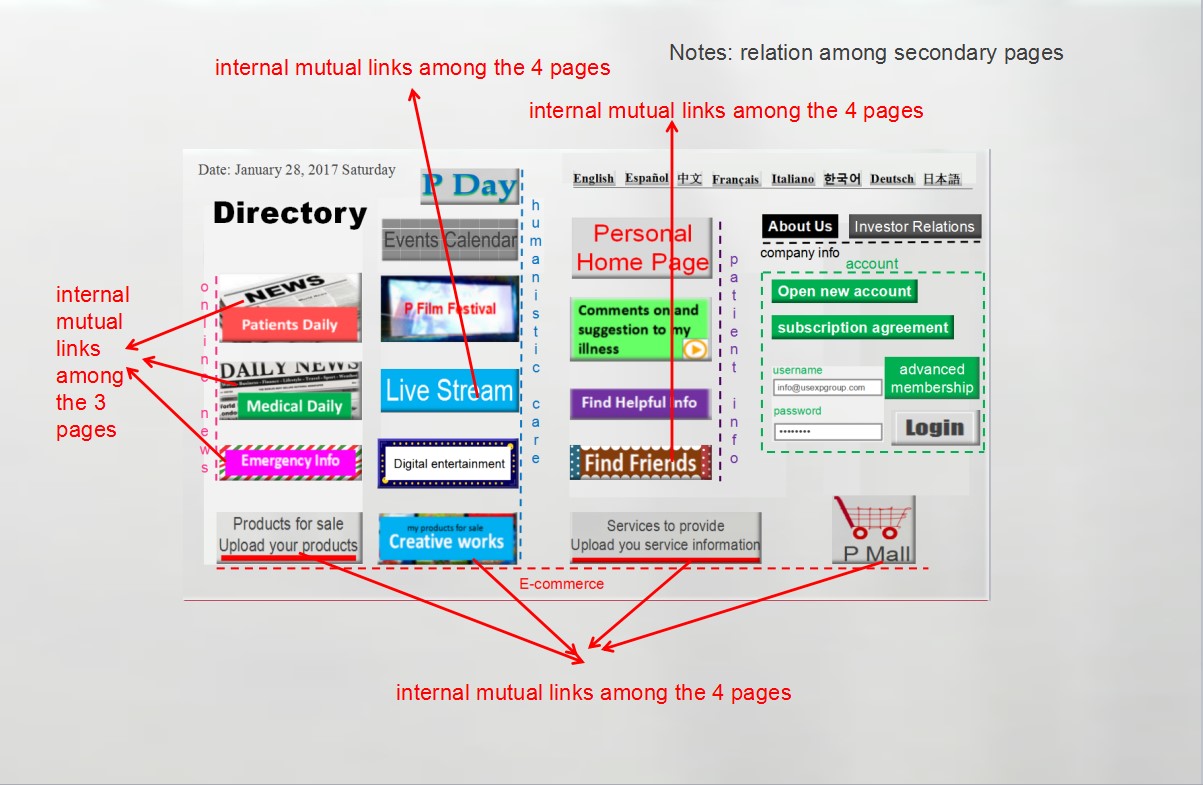

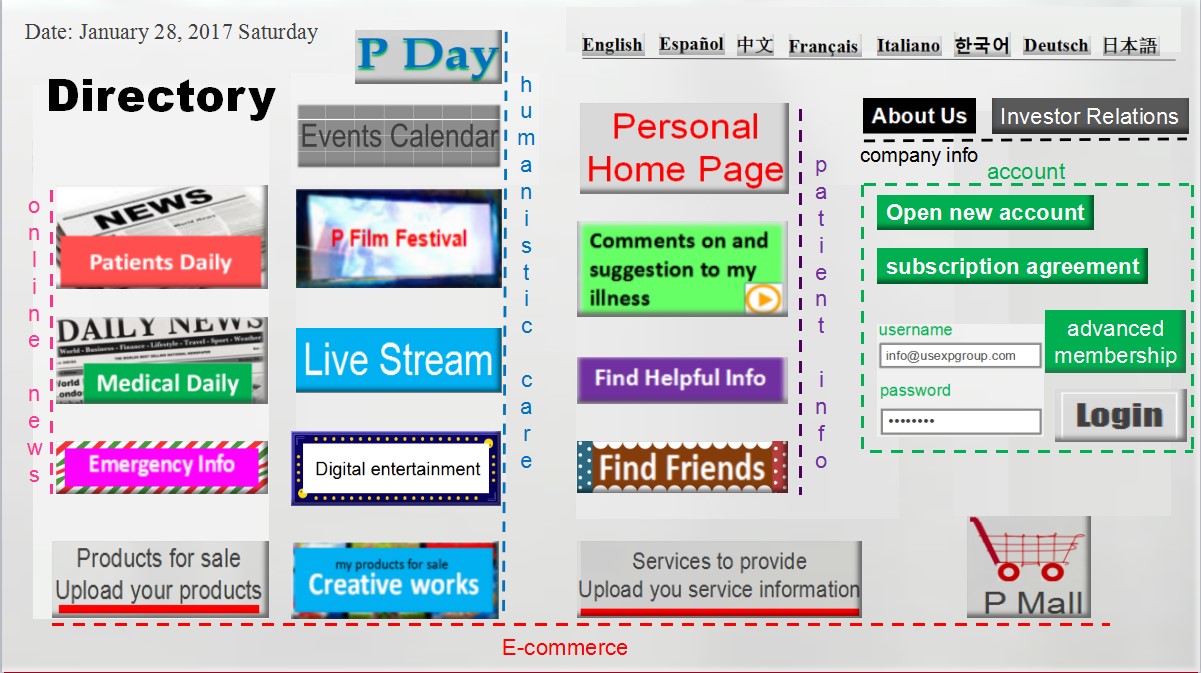

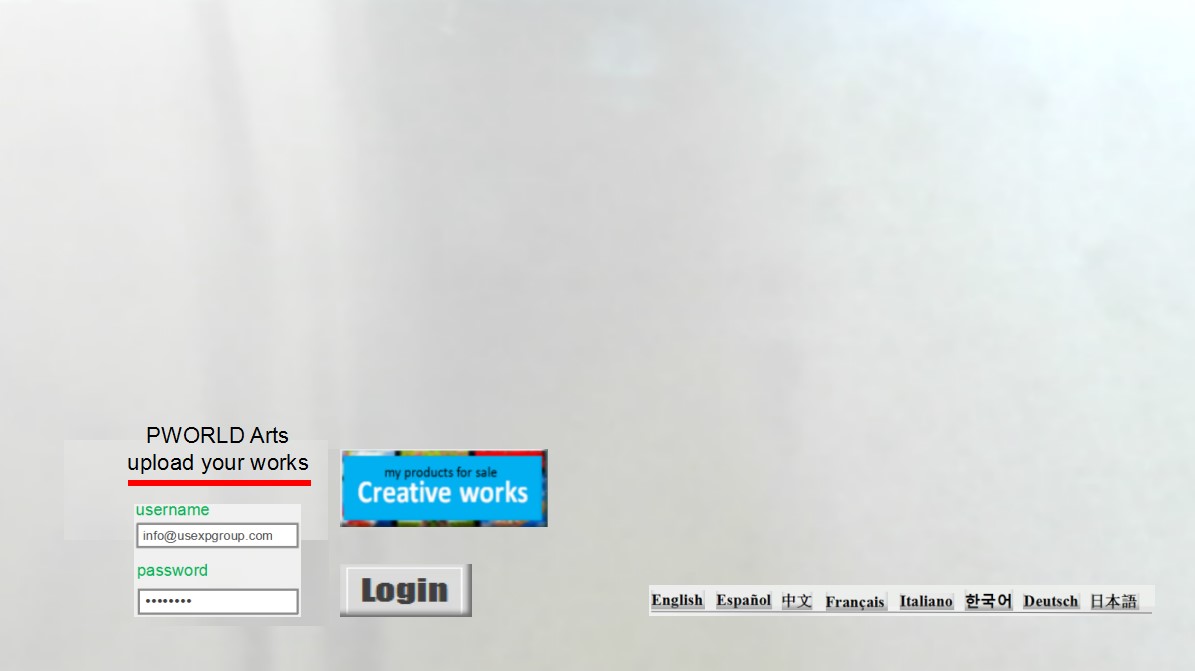

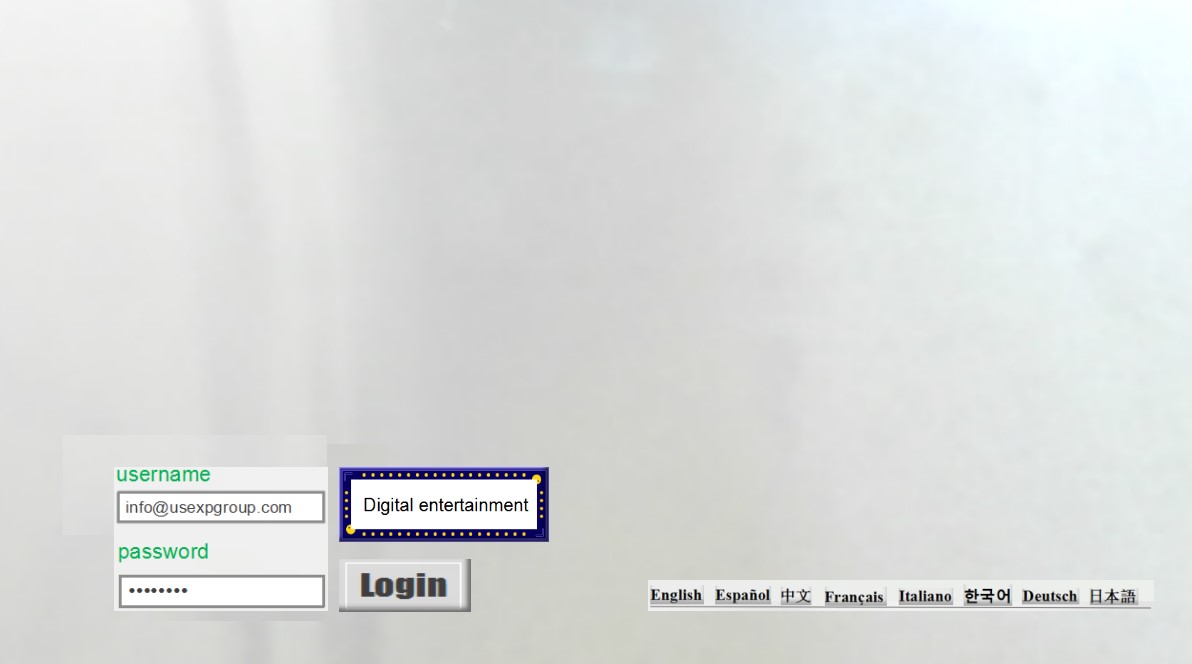

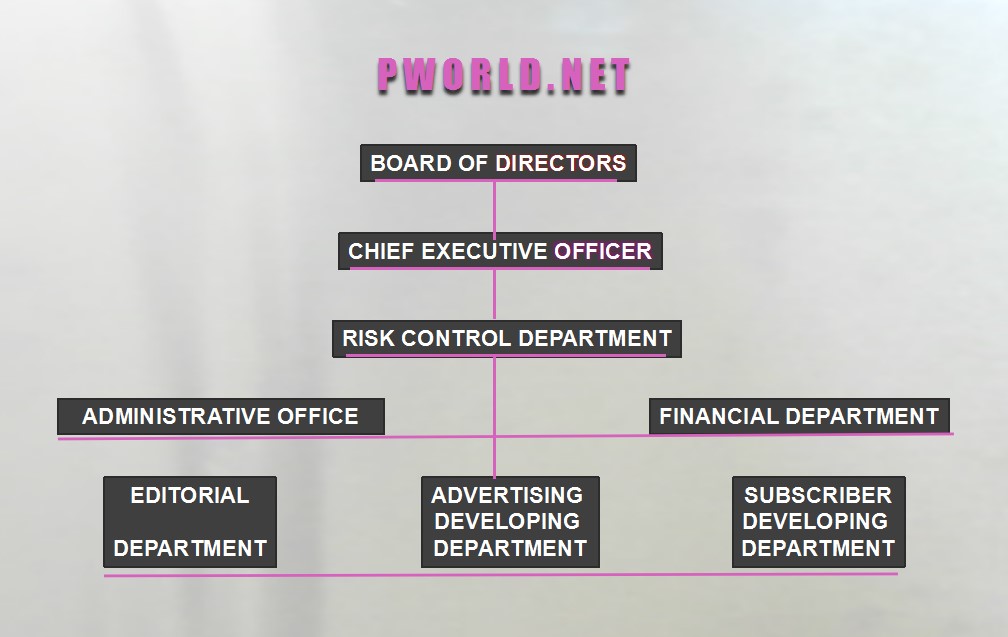

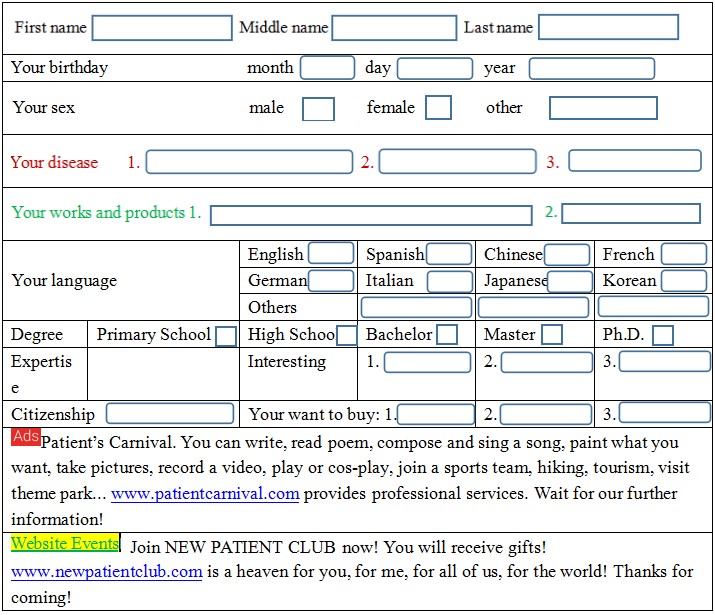

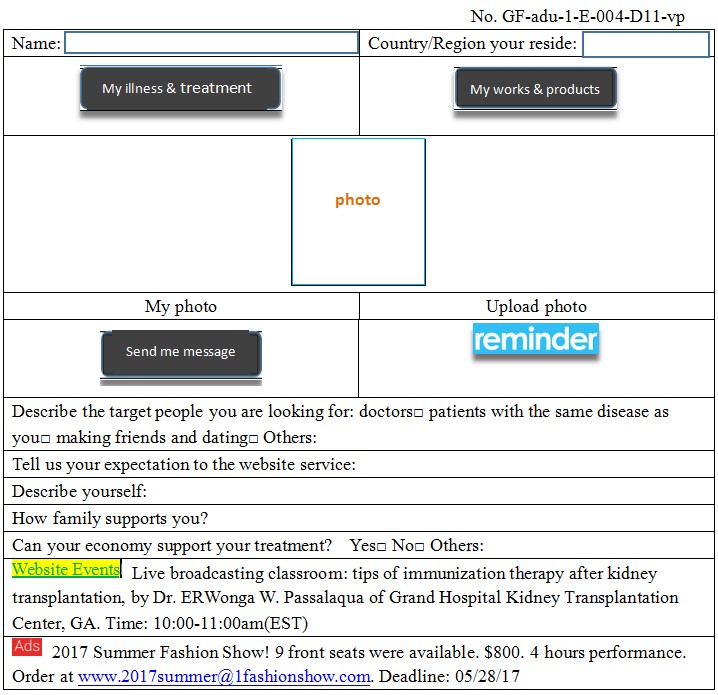

Below are some screen shots from our website at www.PWORLD.net

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the Common Stock. You should carefully read the entire prospectus, including “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements, and the accompanying notes to those financial statements before making an investment decision. In this Prospectus, the term “US EXP GROUP”, “the Company,” “we,” “us,” and “our” refer to US EXP GROUP INC. or any of its subsidiaries, unless the context otherwise requires. In addition, any references to "financial statements" are to our financial statements contained herein, except as the context otherwise requires and any references to "fiscal year" refers to our fiscal year ending December 31. Unless otherwise indicated, the terms "Common Stock," "common stock" and "shares" refer to shares of our $.001 par value, common stock.

Where You Can Find Us

Our principal executive office is located at 160 Kerns Avenue, Buffalo, New York, 14211. Our telephone number is (716) 200-1162.

| Securities Being Offered | 267,914 shares of Common Stock to be sold by the Company and 3,059,500 shares of Common Stock to be sold by selling shareholders. This 3,527,414 shares represent 16.4% of our current outstanding Common Stock, which is based on 20,278,400 shares of Common Stock outstanding as of March 31, 2017.

Common stock offered by the Company: 267,914 shares Common stock offered by the selling stockholders: 3,059,500 shares Common Stock Outstanding Before the Offering: 20,278,400 shares Common stock to be outstanding after this offering, assuming all the shares offered are sold: 20,546,314 shares

|

Initial Offering Price:

Use of proceeds:

|

The selling shareholders and the Company will sell their shares at $5.00 per share until the Company’s shares are quoted on the OTCBB and thereafter they will sell them at the prevailing market price. The five-dollar price was arbitrarily determined by our board of directors and may not be indicative of the real value of a share of our common stock.

The total proceeds are estimated to be $1,339,570 assuming all the shares offered are sold; the underwriting discount percentage is up to 7% ($93,770), costs related to this offer and OTCBB listing except underwriting discounts are $185,500, the total expense for this offering is estimated to be $279,270; the net proceeds are estimated to be $1,245,800; the budget for regular business administration and operation is estimated at $1,060,300 for the year 2017.

$1,060,300 of the proceeds of the offering will be used to create the website www.PWORLD.net, to maintain it, to implement events-driving plans, and for the general management of the Company and website promotion. The funds to be raised will cover all the costs for human capital, events and facilities, hardware, copyrights and website maintenance, office and daily administration. |

Termination of the Offering:

|

The offering will conclude upon the earliest of: (1) such time as all of the Common Stock has been sold pursuant to the registration statement of which this prospectus forms a part (the “Registration Statement”); or (2) such time as all of the Common Stock becomes eligible for resale without volume limitations pursuant to Rule 144 under the Securities Act, or any other rule of similar effect.

|

| Terms of the Offering: | The Company and the selling shareholders will determine when and how they will sell the Common Stock offered in this prospectus.

|

| Market for Our Common Stock: | There is currently no market for our Common Stock and we cannot assure you that a market will develop. We intend to apply to have our shares of Common Stock quoted on the OTCBB marketplace. Before our shares of Common Stock can be quoted on the OTCBB marketplace, FINRA will have to approve a Form 211 Application filed by a market maker. There can be no assurance that: (1) a market maker will agree to file the Form 211 Application; (2) that FINRA will approve the Form 211 Application; or (3) that our application to be quoted on the OTCBB marketplace will be approved by OTC Markets Group Inc. |

6 |

Risk Factors:

Business of the Company

|

The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. The risk may be derived from multiple sources such as user development, website promotion events, intellectual property, platform stability and web technology support, online advertising, creative works, digital entertainment, facility and property management, diversified employment pool, business model and ability to monetize our service, international development, et al. For more information, please see “Risk Factor” beginning on page 8.

US EXP GROUP INC. is in the business of providing humanistic and artistic care to patients and it does so primarily through its website PWORLD.net.

PWORLD.net is designed to create a virtual patient world. The purpose of this world is to enrich and improve the patient’s life. PWORLD.net will offer psychological and emotional support in order to reduce the fear the user will have to “go it alone”.

PWORLD.net will provide information and discussion on conditions, treatments, symptoms, research, financial considerations, legal con-siderations, fund-raising and the future of healthcare. Public and private discussion groups will facilitate communication between users, their families, friends, medical professionals, as well as all other interested parties. Our online newspaper “Patient Daily” will collect stories from our users, our “Medical Daily” will keep users up to date on all medical issues.

PWORLD.net will cater to the patient’s artistic side thereby improving their quality of life. Users will be able to share, sell and auction their videos, pictures, poems and short stories.

PWORLD.net will also have an e-commerce platform. Users will be able to sell their medical related items and artistic works in the P-Mall. Users will have the option to donate their proceeds to their favorite charity.

PWORLD.net will be a virtual worldwide community with a universal translator so users can communicate no matter their native language.

PWORLD.net’s target audience are patients, hospitals, clinics, physicians, pharmacies, medical equipment manufacturers, nutritionists, supplemental manufacturers, psychologists, insurance companies, advertisement agencies, artists, culture and artistic companies.

PWORLD.net will be designed to attract new users by offering special events and contests. It is anticipated that PWORLD.net’s principal cash flow will be from upgrading users to subscribers, ad revenue, digital entertainment, and fees from sales in the P-Mall.

|

Emerging Growth Company

The Jumpstart Our Business Strategy Act (“Jobs Act”) was enacted on April 5, 2012 in order to loosen the restrictions on small business. We qualify as an “emerging growth company” as that term is used in the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. For more details regarding emerging growth companies, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Nature of Operations and Summary of Significant Accounting Policies.”

CAUTIONARY STATEMENT REGARDING FORWARDLOOKING STATEMENTS

The information contained in this prospectus, including in the documents incorporated by reference into this prospectus, includes some statements that are not purely historical and that are “forwardlooking statements.” Such forwardlooking statements include, but are not limited to, statements regarding our Company and management’s expectations, hopes, beliefs, intentions or strategies regarding the future, including our financial condition, results of operations, and the expected impact of the offering on the parties’ individual and combined financial performance. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forwardlooking statements. The words “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” and similar expressions, or the negatives of such terms, may identify forwardlooking statements, but the absence of these words does not mean that a statement is not forwardlooking.

The forward looking statements contained in this prospectus are based on current expectations and beliefs concerning future developments and the potential effects on the parties and the transaction. There can be no assurance that future developments actually affecting us will be those anticipated. These forwardlooking statements involve a number of risks, uncertainties (some of which are beyond the parties’ control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forwardlooking statements.

RISK FACTORS

Please consider the following risk factors before deciding to invest. This offering and any investment in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below and all of the information contained in this prospectus before deciding whether or not to purchase our common stock. The risks and uncertainties described below are those that our management currently believes may significantly affect us. If any of the following risks actually occur, our business, financial condition and results of operations could be harmed and investors in our common stock could lose part or all of their investment in our shares.

RISKS RELATED TO THE NATURE OF OUR SERVICE

As a patient website aimed at promoting communication among patients, our success will be dependent upon two factors: 1. The user base (UB) 2. Average user's engagement level (AUEL). The subscription scale (SS), which is expressed as SS= {UB, AUEL...}if we cannot maintain an adequate SS level, we will not be successful.

THE DEVELOPMENT OF SUFFICIENT USERS/CLIENTS IS CRITICAL TO OUR SUCCESS. IF WE CAN’T ATTRACT SUFFICIENT USERS, QUITE SIMPLY OUR BUSINESS GROWTH MAY BE SIGNIFICANTLY LIMITED.

Users of our website will be able to stay connected with their family, friends, medical professionals, various products, and social resources. The concept User here refers only to subscribers to this website. Advertisers, medical suppliers and facilities, MD’s, pharmaceutical companies are also users of the site and provide a significant share of our revenue. The User base is aggregate subscribers of our website during a certain period. In general, the monthly active user base (MAUB) is a measure of the success of a website. As a new website, the ability to enroll subscribers must be proven, and the promotion of our website will be one of our singular goals. In theory, the MAUB growth rate is affected by:

1. Patient population;

2. Patient’s willingness to share public communication;

3. The convenience of our website;

4. The brand strength of our business;

5. The products we provide or advertisers have;

6. The contents subscribers post;

7. The competition among similar services;

8. The existing social media;

9. Our website promotional investments; and

10. The technical security of our website.

The negative result of any one of the above factors can adversely affect our revenue and our potential for success.

THE DEVELOPMENT OF USER’S ENGAGEMENT LEVEL IS CRITICAL TO OUR SUCCESS. IF WE CANNOT PROVIDE A SATISFACTORY EXPERIENCE TO USERS, OUR BUSINESS MAY NOT GROW.

Users can create contents and generate feedback, and the more they do, the better their engagement. User engagement level has a direct relation to the experience they have with a website, and their expectations. Of course, a consumer's expectations and experience is difficult to ascertain in advance. All websites are not successful, and we may not be successful in engaging a sufficient number of users. Theoretically, user engagement level is affected by:

1. The quality and diversification of products and services we provide;

2. Number of Users;

3. Efficient Internet displays of contents that Users present;

4. Fast updates and velocity of contents;

5. The level of communication among clients; and

6. The number of regular customers.

The negative result of any of the one above factors will adversely affect our revenues and potential for success.

WE ARE SUBJECT TO SEVERE COMPETITION TO ATTRACT ADVERTISING DOLLARS TO OUR WEBSITE

Advertisement here refers to advertisers posting their products and services onto our website, which includes but is not limited to online advertising, online marketing for other sites and apps, plus our website platform may deliver promotional messages to Users. As an online advertising site, we face substantial competition, including competition from websites with much more resources than we have. For example, people may use new technologies to block or obscure the display of our website’s ads and contents, which could result in site interruption or site corruption. Enrolling advertisers in an increasingly competitive market is very difficult and we may not be successful in doing so.

WE ANTICIPATE THAT OUR REVENUE WILL COME MOSTLY FROM ADVERTISING. THE LOSS OF ADVERTISERS, OR REDUCTION IN SPENDING BY ADVERTISERS, COULD SIGNIFICANTLY AFFECT OUR REVENUE

As a patient website which can meet the demands of multiple advertisers, our advertising revenue is mainly dependent on two factors: 1. Advertiser scale or quantity (AS) 2. Average investment per advertisement (AIPA). The advertisement revenue (AR) can be expressed as AR = {AS, AIPA...} If we cannot maintain a satisfactory AR level we will not be successful.

THE DEVELOPMENT OF ADVERTISING DOLLARS IN SUFFICIENT QUANTITY IS CRITICAL TO OUR SUCCESS. IF WE CANNOT ATTRACT SUFFICIENT ADVERTISERS, OUR BUSINESS GROWTH MAY BE ADVERSELY AFFECTED

Advertising quantity is the aggregate advertisers invest on our website during a certain period. As a new website, we will require a certain timespan to acquire and attract advertisers. In theory, advertiser quantity is affected by the following factors:

1. The macroscopic economic cycle;

2. The economic development of medical and pharmacology business;

3. The quantity of users as subscribers;

4. The experience our website provides to users;

5. Advertising revenue from our website;

6. Our website promotion and marketing;

7. The advertising resource management proficiency of our website, including ad inventory management which affects the number, size, and prominence of ads to be displayed;

8. The competitive strength among companies in the same industry; and

9. The balance between advertising effectiveness (Type, frequency, prominence, and size of ads) and other contents displayed.

The negative result of any one of the above noted factors will adversely affect earnings and our potential for success.

IF WE CAN'T PROVIDE A SATISFACTORY RETURN TO ADVERTISERS, AND IF WE CANNOT DEMONSTRATE THAT RETURN TO OUR ADVERTISERS OUR REVENUE MAY BE SIGNIFICANTLY HARMED

Average investment per advertisement is the advertising investment amount per advertiser by average during certain period. Advertisers emphasize web traffic, which is the amount of data sent and received by visitors to a web site. As a new site, since we have no traffic statistics, our preliminary advertisers may invest on our website tentatively. That investment may be short-term, for small amounts and irregular. Theoretically, the investment amount per advertiser is affected by the following factors:

1. The expected ROI of advertisers;

2. The macroscopic economic cycle;

3. Advertiser’s economic status and business strategy;

4. Our subscriber quantity;

5. The style, design, products, and services available on our website and related resources;

6. The promotional investment quantity of our website;

7. Our practices and ability to maximize the Website's advertising for value; and

8. The comparative advantages and weakness of our website among services of a similar nature, although our delivery of creativity should make us unique.

The negative result of any one of the above will adversely affect our earnings and our potential for success.

THERE ARE SEVERAL TYPES OF INTERNET ADVERTISING INCLUDING INTERACTIVE ADVERTISING, E-MAIL ADVERTISING, AND VIRAL MARKETING THAT ARE REGULATED BY MANY STATUTES, PARTICULARLY THOSE ADMINISTERED BY THE FEDERAL TRADE COMMISSION (FTC). IF THERE ARE VIOLATIONS, OUR ADVERTISEMENT SERVICES COULD BE NEGATIVELY IMPACTED.

The FTC monitors and enforces laws regarding online advertising, and has enforcement or administrative responsibilities under more than 70 statutes. Online advertising issues may be through false advertising, theft of intellectual property rights, privacy, contests and sweepstakes, and much more. FTC has issued “Guides Concerning the Use of Endorsements and Testimonials in Advertising”, which may require those giving testimonials to disclose their relationship with a Company if it benefits them directly. The best references are untouched by the advertisers, and many do this now, including even any and all negative referrals, which encourages potential buyers to trust them. For some of our advertising and promotional events, we may use patient’s names and photos and post them on our website, obviously with permission only. In Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003, it defines a commercial electronic mail message as “any electronic mail message, the primary purpose of which is the commercial advertisement or promotion of a commercial product or service.” (Including content on an Internet website operated for a commercial purpose) More importantly, it clearly points out the legitimate ways to use emails for normal commercial services. If we fail to comply with these requirements we could suffer damages.

RISKS RELATED TO THE DEVELOPMENT OF SUBSCRIBERS AND MARKETING

Investment is important to the development of subscribers. Developing clients is also an art and science, and the most successful websites have learned this. If we are unable to develop a reasonable subscriber base we might not be successful.

WEBSITE PROMOTION SKILL IS CRITICAL TO ENROLL SUBSCRIBERS. IF WE CANNOT MOTIVATE VISITORS TO ULTIMATELY SUBSCRIBE, WE WILL FAIL

To attract clients and medical professionals to use our website, there are many promotional skills to develop potential subscriber’s interest about our website. Some of the skills are listed below:

1. Integration and compromise between our business target and customer’s demands;

2. An efficient way to communicate with patients and medical professionals in a simple to understand way;

3. Critical editing, and the creation of unique stories, and a forum’s topic and original posts, great contents in all respects, including chat room conversations, etc.;

4. Convenience of graphics for audience and the plan of introducing pictures, info-graphic and graphic stories & contents, favicons, emoticons, and videos;

5. Display pleasing aesthetics through designs for primary and all pages plus graphics and videos, including ads. Appearances count, viewers will always return more to visually pleasing and easy to use sites;

6. The management talents of the content administrator and moderator in dealing with topics, threads, posts, private messages, chat discussions, and stopping any trolling or spamming.

7. Introducing new technologies as they become available to promote communications between the website and potential and existing users; To be a leader in the field by the rational allocation of our resources and continuously learning from competitors; and

8. The ability to design an aesthetically pleasing website.

A poor result of any one of the above noted factors will adversely affect our business.

THE DEVELOPMENT OF ADVANCED MEMBERS IS CRITICAL TO OUR SUCCESS. IF WE CAN’T ATTRACT SUFFICIENT ADVANCED MEMBERS, OUR BUSINESS GROWTH MAY BE ADVERSELY AFFECTED.

The development of unique applications will allow the Company to charge a monthly, quarterly, or annual fee for access to certain advanced applications and content. We anticipate that such advanced memberships will be an important source of revenue. We anticipate that our ability to attract such advanced memberships will be affected by the following factors, among others:

1. The quality of the Patient Daily to be delivered to advanced members;

2. The purchase discount we provide to advanced members;

3. The sophistication and attractiveness of events for advanced members; and

4. The aesthetic design, and the products and services of our website and related resources.

If we are unable to attract advanced members our revenue will be adversley affected.

WE MAY FACE LOSSES AS A WEBSITE CONTENT PROVIDER

The opinion of our users and members about the patient website may change dramatically when they are stimulated by internal and external factors. The patient's opinions on the quality, value or usefulness of our products will vary. This will be a challenge for our service. The web chat room's primary use is to share information via text between a group of people. Some users may post rumors and false information on occasion. An internet forum, blog, or message board, is an online discussion site where users can hold conversations in the form of posted messages. It can also be used for illegal purposes. As a content provider, we are exposed to claims related to defamation, violation of intellectual property rights, and privacy rights.

THE COMPANY FACES RISKS RELATED TO THE CONTENT POSTED BY USERS AND OUR EMPLOYEES

Third parties may attempt to coerce employees or users to disclose information in order to gain access to proprietary data or our user's personal data. Some platform developers may store information provided by our users through apps on the company platform or web sites integrated with the Company. If these third parties or platform developers fail to comply with security terms and policies, our user's data may be improperly disclosed and we could face liability for such disclosure.

LIABILITY FOR CONTENT NOT COVERED BY THE COMMUNICATION DECENCY ACT COULD NEGATIVELY IMPACY OUR BUSINESS.

The Communications Decency Act (CDA) of 1996 protects freedom of expression and innovation on the Internet and says that "No provider or user of an interactive computer service shall be treated as the publisher or speaker of any information provided by another information content provider." Regardless, the Company may still face the following liability related to content service in some situations:

1. Fraudulent information posted by users and our employees;

2. Deceptive advertising;

3. Illegal disclosure of patient's medical records and related information;

4. Intellectual Property infringement issues; and

5. Libel and false claims.

The negative impact of any one above items could adversely affect our earnings, and our potential for success.

FAILURE TO OBTAIN USEFUL INFORMATION ON OUR WEBSITE COULD RESULT IN LOSSES

Several of our competitor’s high traffic blogs or discussion groups will compete for users with the Company. A blog allows posting of text, images, audio, video, hyperlinks to other web pages and other related material. Readers may post comments in an interactive format. Any “thread” could become popular and see much activity. Our topic may overlap with our competitor’s blogs. We are not certain that our users will be satisfied with the content we present and consider the information useful and relevant to them. If the content is not the type users are looking for, the Company will have to invest more time and effort improving content, costing money and it will decreasing our earnings.

WE HAVE INSUFFICIENT KNOWLEDGE AND EXPERIENCE ON HOW TO DEAL WITH POTENTIAL THREATS SUCH AS DISCLOSURE OF CONFIDENTIAL INFORMATION, UNAUTHORIZED USE/INFRINGEMENT OF INTELLECTUAL PROPERTY, DEFAMATION, and FALSE ENDORSEMENTS

Some content may be very sensitive. We may be exposed to losses related to claims of libel, defamation of character, and breach of privacy. As a form of social media, we may have some content such as employee blogs, disclosure of trade secrets, disclosure of financial information, or information related to children, which could expose us to losses.

WE COULD BE LIABLE FOR EXPOSURE OF CONFIDENTIAL INFORMATION

The U.S. Department of Health and Human Service's HIPAA Privacy Rule requires doctors, nurses, pharmacies, hospitals, nursing homes, and other health care providers to protect the privacy of individual health information. If we allow such information to be disclosed we could face liability.

WE COULD BE LIABLE FOR THE ACTION OF HACKERS

E-Commerce faces a variety of challenges. The Company’s website will provide an online exhibition of products for sale by users. Users may create a Patient Shopping Mall (P-Mall). Our e-commerce platform may be attacked by hackers, viruses, worms, malware and possibly even company employees. Hacktivists may attack our platform for political cause; computer criminals may hack for profit or financial benefits, and cyberterrorists may damage the infrastructure of our website. Such articles could damage our website and could expose us to legal liability.

THE DEVELOPMENT OF E-COMMERCE IS CRITICAL TO OUR SUCCESS. IF WE CANNOT DEVELOP PATIENTS' PRODUCTS FOR SALE, OUR BUSINESS MAY BE ADVERSELY AFFECTED.

The E-commerce here refers to the exhibition and sale of users’ creative works, products and intellectual property on our e-commerce platform. Our Company will receive a percentage of the sale price as a commission on the sale of such products. ClickWrap technology will be used to record contracts with sellers. The Terms of Service will be amended as needed to address problems as the occur.

The revenue from E-commerce may be affected by the following factors:

1. The value of products exhibited and sold;

2. The quality, diversity, and price of the products offered for sale;

3. The actual sale price;

4. The ease of use of our e-Commerce service;

5. The commission paid by the seller for using our website;

6. The effectiveness of sales and marketing campaigns;

7. Returns and charge backs;

8. Delivery and logistics; and

The negative result of any one above factor will adversely affect our earnings and our potential for success.

THE DEVELOPMENT OF DIGITAL ENTERTAINMENT SERVICE IS CRITICAL TO OUR SUCCESS. IF THE SERVICE CAN'T REACH A BREAK-EVEN POINT, OUR BUSINESS GROWTH MAY BE ADVERSELY AFFECTED.

Our website will provide digital entertainment to patients in order to help them cope during difficult times. Content will include films, videos, animation, gaming and music. Content can be displayed on PCs, tablets or mobile devices. Authors may offer free content or may charge based on download. These charges will be a source of revenue to the Company and such revenues may be affected by the following factors:

1. The quality and popularity of the entertainment content provided;

2. The size the Patient Website user base;

3. The total cost to use the entertainment products including rates charge by the Website; and

4. The sales and marketing resources committed to expand the service.

Failure to achiever the factors listed above could negatively affect our business and our prospect for success.

CREDIT CARD PAYMENTS MAY CREATE CERTAIN RISKS TO THE COMPANY

Our services may also be impacted by issues related to money transmission, gift cards and other prepaid access instruments, electronic funds transfers, banking and lending. These electronic transfers could put the Company at risk of violations for charge backs as well as other legal violations such as money laundering, terrorist financing and gambling.

Charge backs and customer disputes may increase our costs and divert our management time with negotiation and/or arbitration. It is possible that illegal activities by users, developers, employees or third parties and these could create liabilities for the Company.

DIGITAL ENTERTAINMENT HAS ARTISTIC COPYRIGHTS. IF THERE IS VIOLATION OF COPYRIGHTS, OUR BUSINESS MAY BE ADVERSELY AFFECTED.

Copyright issues for film, television, animation, game and music are litigated frequently in the U.S. and the world. The digital entertainment services we provide could create risks associated with the following:

1. IP for written and artistic expression;

2. Patents for tangible items; and

3. Trademarks for brands and logos.

There are so many regulations governing digital entertainment such as USPTO and Trade-Related Aspects of Intellectual Property Rights, The Copyright Act of 1976, Rules of Practice in Trademark Cases; the Trademark Act of 1946, and Defend Trade Secrets Act of 2016. Copyrights created after January 1, 1978 have protection during the life of the author plus 70 years, and the Work-Made-For-Hire rule has 95 years term and 120 years term. While "fair use" allows limited use of a copyrighted works for those purposes such as teaching, criticism, reviews, news reporting, and research, sometimes only a court can decide what kind of use is "fair use". If we violate such laws or if we infringe on the intellectual property rights of others, the Company may be liable for economic compensation or other penalties.

SPECIAL EVENT MANAGEMENT IS IMPORTANT TO OUR SUCCESS. IF THE PLANNING, LIVE STREAMING, ARE NOT SUCCESSFUL, OUR BUSINESS PROSPECTS MAY BE ADVERSELY AFFECTED.

Special events are one of the most powerful keys to penetrate a target market and build the Website's brand. It functions to increase both subscriber sales, and advertiser revenues that generate cash flow. A clever Special Events marketing strategy will help the Website to increase sustainability. Factors related to special events management include:

1. A well-prepared events strategy, and both short-term and long-term plans;

2. A professional team to manage events efficiently;

3. Substantial sales and marketing budget;

4. Professional events promotion to maximize value;

5. Multiple media market advertising of events; and

6. Reliable technical support;

Failure to accomplish the factors noted above will adversely affect our revenues and our potential for success.

Failure to attract users to our events could degrade our revenues and revenue growth.

RISKS RELATED TO TECHNIQUE AND PLATFORM

The patient website will operate in an open environment. The physical server is provided by a hosting company. The subscribers will come from around the world and have diversified knowledge and skills. Today, network security remains a concern. We will rely on the hosting company that hosts our website to provide advanced security technology to protect our users from any viruses. We need a stable and online hosting platform with competent engineers. If our hosting company does not perform well or if we should have a security breach, we may incur heavy losses.

OUR TECHNICAL INFRASTRUCTURE IS THE FOUNDATION OF OUR SERVICE. IF THE HARDWARE AND SOFTWARE CAN'T BE MANAGED WELL TO MEET THE USER'S REQUIREMENTS, OUR BUSINESS GROWTH MAY BE ADVERSELY AFFECTED.

Our platform may contain software with undetected errors, bugs, or vulnerabilities. Any programming problem discovered in our code after release could result in damage to our service and could create losses due to legal liability issues.

A SUCCESSFUL PLATFORM MANAGEMENT STRATEGY IS EXTREMELY IMPORTANT TO OUR COMPANY. IF A PLATFORM STRATEGY IS FLAWED WE COULD INCURE LOSS.

Platform management is very important in the context of operating a website. Maintaining the reliability of the website is always an ongoing priority. Engineers will concentrate on hardware and software configuration, reliable technical support, mobile operation, all in conjunction with our web hosting company. Failure to attain successful platform management could damage our business model and business results.

WHEN HUMAN RESOURCE MANAGEMENT IS NOT OPTIMAL, BUSINESS WILL SUFFER.

We consider our human resource plan and implementation critical to the success of our business plan. If we do not have the right plan or if we do not have the right employees and partners to implement our plan our business will suffer.

RISKS RELATED TO FINANCE MANAGEMENT

INTERNATIONAL DEVELOPMENT IS IMPORTANT TO THE SUCCESS OF OUR BUSINESS AND IF WE FAIL IN OUR EFFORT OUR OVERALL DEVELOPMENT WILL BE HARMED

The following factors are key to the Company's international development: language, foreign currency, accounting and tax policies, human resource regulations and insurance, corporate culture, business promotion models, community relations, social environment, content censoring, and other local internet administrative regulations. As a patient website, we may also face additional risks. We are going to provide content in English the following languages: Chinese, French, German, Spanish, Japanese, Italian, and Korean. Multiple-language, multiple-nation and multiple-culture operation ask for experienced local managers. As a new company, we do not have experienced management like our competitors. Hence, we face the following risks:

1. We are not sure we can build up a harmonious local public relations to prevent risks by political, social, or economic instability;

2. we may not be able to protect our intellectual property rights from country to country;

3. Local media, our reputation, and brand will be affected differently in different countries;

4. Every country has its own laws and regulations to protect patients. Our business behavior may not comply with local laws and regulations concerned with clients and all other user's privacy, rights of publicity, data protection, content management, intellectual property, electronic contracts, transmission and distribution and

5. Raising funds in other countries could be challenging.

If we are unable to overcome these risks our business will suffer.

THERE IS PRESENTLY NO TRADING MARKET FOR OUR COMMON STOCK AND NO ASSURANCE CAN BE GIVEN THAT AN ACTIVE AND LIQUID TRADING MARKET WILL DEVELOP IN THE FUTURE. ACCORDINGLY, YOU MAY BE UNABLE TO LIQUIDATE YOUR SHARES QUICKLY

There is currently no market for our Common Stock and we cannot assure you that a market will develop. We intend to apply to have our shares of Common Stock quoted on the OTCBB, but there are no assurances that we will be successful in obtaining such a listing.

Once our Common Stock is listed or quoted on an active trading market, there may be periods of several days or more when trading activity in our shares is minimal or nonexistent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales. We cannot give you any assurance that an active public trading market for our shares of Common Stock will develop or be sustained. You may not be able to liquidate your shares quickly or at the market price if trading in our Common Stock is not active.

THE OFFERING PRICE OF THE COMMON STOCK WAS DETERMINED BASED ON THE PRICE OF THE SHARES THAT WERE SOLD TO SOME OF OUR SHAREHOLDERS IN A PRIVATE PLACEMENT, AND THEREFORE SHOULD NOT BE USED AS AN INDICATOR OF THE FUTURE MARKET PRICE OF THE SECURITIES.

The facts considered in determining the offering price were our financial condition and prospects, our limited operating history, the market capacity, and the general condition of the securities market. The offering price bears no relationship to the book value, assets or earnings of our company or any other recognized criteria of value. The offering price should not be regarded as an indicator of the future market price of the securities.

FUTURE ISSUANCE OF OUR COMMON STOCK COULD DILUTE THE INTERESTS OF EXISTING SHAREHOLDERS.

If we raise capital through the issuance of equity, the percentage ownership of our Company held by existing shareholders will be reduced and those shareholders may experience dilution. In addition, we may also have to issue securities that may have rights, preferences and privileges senior to our Common Stock. In the event we seek to raise additional capital through the issuance of debt or its equivalents, this will result in increased interest expense.

OUR COMMON STOCK MAY BE CONSIDERED A PENNY STOCK, WHICH MAY BE SUBJECT TO RESTRICTIONS ON MARKETABILITY.

We may be subject now and in the future to the SEC’s “penny stock” rules if our shares of Common Stock sell below $5.00 per share. Penny stocks generally are equity securities with a price of less than $5.00. The penny stock rules require broker dealers to deliver a standardized risk disclosure document prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The brokerdealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the brokerdealer and its salesperson, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the brokerdealer and salesperson compensation information must be given to the customer orally or in writing prior to completing the transaction and must be given to the customer in writing before or with the customer’s confirmation.

In addition, the penny stock rules require that prior to a transaction, the broker dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. The penny stock rules are burdensome and may reduce the purchases of any offerings and reduce the trading market for our shares. As long as our shares of Common Stock are subject to the penny stock rules, the holders of such shares of Common Stock may find it more difficult to sell their securities.

RISKS RELATED TO OUR BUSINESS

WE DO NOT HAVE AN INDEPENDENT AUDIT OR COMPENSATION COMMITTEE, THE ABSENCE OF WHICH COULD LEAD TO CONFLICTS OF INTEREST OF OUR OFFICERS AND DIRECTORS AND WORK AS A DETRIMENT TO OUR SHAREHOLDERS

We do not have an independent audit or compensation committee. The absence of an independent audit and compensation committee could lead to conflicts of interest of our officers and directors, which could work as a detriment to our shareholders.

WE HAVE A VERY LIMITED OPERATING HISTORY AND THERE IS NO ASSURANCE THAT OUR FUTURE OPERATIONS WILL RESULT IN REVENUES OR PROFITS. IF WE CANNOT GENERATE SUFFICIENT REVENUES TO OPERATE PROFITABLY, THEN WE MAY SUSPEND OR CEASE OUR OPERATIONS AND YOU COULD EVEN LOSE YOUR ENTIRE INVESTMENT IN OUR COMMON STOCK

We were incorporated on December 9, 2016 and generated zero revenues or profits through March 31, 2017. We also have very little operating history upon which an evaluation of our future success or failure can be made. As of March 31, 2017, we had incurred a net loss of approximately $20,838 since our inception. The success of our future operations is dependent upon our ability to carry out our planned activities, fund our operations and compete effectively with other similar businesses. Based on our current business plan, we expect to incur operating losses during the fiscal year ending December 31, 2017. We cannot guarantee that we will ever be successful in generating revenues sufficient to cover our operating costs and overhead or achieve profitability. Our failure to achieve profitability may cause us to suspend or cease our operations.

THERE MAY BE CONFLICTS OF INTEREST BETWEEN OUR MANAGEMENT AND OUR NON-MANAGEMENT STOCKHOLDERS

Conflicts of interest create the risk that management may have an incentive to act adversely to the interests of other investors. A conflict of interest may arise between our management's personal pecuniary interest and its fiduciary duty to our stockholders. Further, our management's own pecuniary interest may at some point compromise its fiduciary duty to our stockholders. In addition, our management is involved in other businesses and they may not devote their full attention to the business of the Company.

WE DEPEND HEAVILY ON OUR MANAGEMENT TEAM AND CONSULTANTS AND THE LOSS OF ANY OF OUR EXECUTIVE OFFICERS COULD SIGNIFICANTLY WEAKEN OUR MANAGEMENT EXPERTISE AND ABILITY TO RUN OUR BUSINESS

Our business strategy and success is dependent on the skills and knowledge of our management team and consultants. As of the date of this prospectus, Dr. Wenyi Yu is our President and Chief Executive Officer, and Mr. Jonathan Jay Willard is our Treasurer and Secretary. Both Dr. Wenyi Yu and Ms. Fang Li are directors. We have no other officers or directors and rely on third party consultants to assist with management and, therefore, have little backup capability for their activities. The loss of services of Dr. Wenyi Yu could weaken significantly our management expertise and our ability to efficiently run our business. We do not maintain key man life insurance policies on the life of Dr. Wenyi Yu.

TRADING IN OUR SECURITIES COULD BE SUBJECT TO EXTREME PRICE FLUCTUATIONS THAT COULD ADVERSELY AFFECT YOUR INVESTMENT

Historically speaking, the market prices for securities of small publicly traded companies have been highly volatile. Publicized events and announcements may have a significant impact on the market price of our common stock.

In addition, the stock market from time to time experiences extreme price and volume fluctuations that particularly affect the market prices for small publicly traded companies and which are often unrelated to the operating performance of the affected companies.

Following the effectiveness of this offering we plan to seek the listing of our common stock on the OTC Bulletin Board. However, we cannot assure you that following such a transaction, we will be able to meet the initial listing standards of the OTC Bulletin Board or any other stock exchange, or that we will be able to maintain a listing of our common stock on an exchange. In addition, we would be subject to an SEC rule that, if it failed to meet the criteria set forth in such rule, imposes various practice requirements on broker-dealers who sell securities governed by the rule to persons other than established customers and accredited investors. Consequently, such rule may deter broker-dealers from recommending or selling our common stock, which may further affect its liquidity. This would also make it more difficult for us to raise additional capital following a business combination.

SUBSTANTIAL SALES OF OUR COMMON STOCK MAY IMPACT THE MARKET PRICE OF OUR COMMON STOCK

Future sales of substantial amounts of our common stock, including shares that we may issue upon exercise of options and warrants, and the resale of shares by investors who may have registration rights, could adversely affect the market price of our common stock. Furthermore, if we raise additional funds through the issuance of common stock or securities convertible into our common stock, the percentage ownership of our shareholders will be reduced and the price of our common stock may fall.

WE DO NOT EXPECT TO PAY DIVIDENDS FOR THE FORESEEABLE FUTURE

We will use any earnings generated from our operations to finance our business and will not pay any cash dividends to our shareholders in the foreseeable future.

ISSUING PREFERRED STOCK WITH RIGHTS SENIOR TO THOSE OF OUR COMMON STOCK COULD ADVERSELY AFFECT HOLDERS OF COMMON STOCK

Our charter documents grant our board of directors the authority to issue various series of preferred stock without a vote or action by our shareholders. Our board also has the authority to determine the terms of preferred stock, including price, preferences and voting rights. The rights granted to holders of preferred stock may adversely affect the rights of holders of our common stock. For example, a series of preferred stock may be granted the right to receive a liquidation preference that would reduce the amount available for distribution to holders of our common stock. In addition, the issuance of preferred stock could make it more difficult for a third party to acquire a majority of our outstanding voting stock. As a result, common shareholders could be prevented from participating in transactions that would offer an optimal price for their shares.

WE WILL BE SUBJECT TO THE PERIODIC REPORTING REQUIREMENTS OF THE SECURITIES EXCHANGE ACT OF 1934 WHICH WILL REQUIRE US TO INCUR AUDIT FEES AND LEGAL FEES IN CONNECTION WITH THE PREPARATION OF SUCH REPORTS. THESE COSTS COULD REDUCE OR ELIMINATE OUR ABILITY TO EARN A PROFIT

We will be required to file periodic reports with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934 and the rules and regulations promulgated thereunder. In order to comply with these regulations, our independent registered public accounting firm must review our financial statements on a quarterly basis and audit our financial statements on an annual basis. Moreover, our legal counsel has to review and assist in the preparation of such reports. The costs charged by these professionals for their services cannot be accurately predicted at this time, because of factors such as the number and type of transactions that we engage in and the complexity of our reports. The issues cannot be determined at this time and will have a major effect on the amount of time to be spent by our auditors and attorneys and the fees they charge. The incurrence of such costs will obviously be an expense to our future operations and could have a negative effect on our profits.

SHAREHOLDERS MAY BE DILUTED SIGNIFICANTLY THROUGH OUR EFFORTS TO OBTAIN FINANCING AND SATISFY OBLIGATIONS THROUGH ISSUANCE OF ADDITIONAL SHARES OF OUR COMMON STOCK

We have no committed source of financing. Wherever possible, our board of directors will attempt to use non-cash consideration to satisfy obligations that have not. In many instances, we believe that the non-cash consideration will consist of restricted shares of our common stock. Our board of directors has authority, without action or vote of the shareholders, to issue all or part of our authorized, but unissued, shares of our common stock. Future issuances of shares of our common stock will result in dilution of the ownership interests of existing shareholders, may further dilute common stock book value and that dilution may be material.

OUR CERTIFICATE OF INCORPORATION PROVIDES FOR INDEMNIFICATION OF OFFICERS AND DIRECTORS AT OUR EXPENSE AND LIMIT THEIR LIABILITY, WHICH MAY RESULT IN A MAJOR COST TO US AND HURT THE INTERESTS OF OUR SHAREHOLDERS, BECAUSE CORPORATE RESOURCES MAY BE EXPENDED FOR THE BENEFITS OF OFFICERS AND/OR DIRECTORS

Our certificate of incorporation and applicable New York State laws provide for the indemnification of our directors, officers, employees and agents under certain circumstances, against attorney's fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities on our behalf. We will also bear the expenses of such litigation for any of our directors, officers, employees or agents, upon such person's written promise to repay us, if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us that we may be unable to recoup.

We have been advised that, in the opinion of the Securities and Exchange Commission, indemnification for liabilities arising under federal securities laws is against public policy and is, therefore, unenforceable. In the event that a claim for indemnification for liabilities arising under federal securities laws, other than the payment by us of expenses incurred or paid by a director, officer or controlling person in the successful defense of any action, suit or proceeding, is asserted by a director, officer or controlling person in connection with the securities being registered, we will (unless in the opinion of our counsel, the matter has been settled by controlling precedent) submit to a court of appropriate jurisdiction, the question of whether indemnification by us is against public policy as expressed by the Securities and Exchange Commission and will be governed by the final adjudication of such issue. The legal process relating to this matter, if it were to occur, is likely to be very costly and may result in us receiving negative publicity, either of which factors is likely to materially reduce the market price for our shares, if such a market ever develops.

OUR COMMON STOCK BEING REGISTERED WHICH MAY BE SOLD BY SELLING SHAREHOLDERS IS LIKELY TO DEPRESS THE MARKET FOR AND PRICE OF OUR SHARES IN ANY MARKET THAT MAY DEVELOP

Our common stock held by the selling shareholders that are being registered in this offering may be sold subsequent to the date of this prospectus, either at once or over a period of time. See also "Selling Shareholders" and "Plan of Distribution" elsewhere in this prospectus. The ability to sell these shares of common stock and/or the sale thereof reduces the likelihood of the establishment and/or maintenance of an orderly trading market for our shares at any time in the near future.

THERE ARE RISKS ASSOCIATED WITH FORWARD LOOKING STATEMENTS

This prospectus contains certain forward-looking statements regarding management's plans and objectives for future operations including plans and objectives relating to our planned marketing efforts and future economic performance. The forward-looking statements and associated risks set forth in this prospectus include or relate to, among other things, (a) our projected sales and profitability, (b) our growth strategies, (c) anticipated trends in our industry, (d) our ability to obtain and retain sufficient capital for future operations and (e) our anticipated needs for working capital. Actual events or results may differ materially from those discussed in forward looking statements as a result of various factors, including, without limitation, the risks outlined under "Risk Factors" and matters described in this prospectus, generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this prospectus will, in fact, occur.

WE WILL NEED ADDITIONAL CAPITAL FINANCING IN THE FUTURE

We have experienced losses from the inception of the Company. As a result, it is likely that we will be required to seek additional financing in the future to respond to increased expenses or shortfalls in anticipated revenues, respond to competitive pressures, develop new or enhanced products, or take advantage of unanticipated acquisition opportunities. We may not be able to find such additional financing on reasonable terms, or at all. If we are unable to obtain additional financing when needed, we could be required to modify our business plan in accordance with the extent of available financing.

INABILITY TO ATTRACT MARKET MAKERS

There is currently no public trading market for our Common Stock. The development of a public trading market depends not only the existence of willing buyers and sellers, but also on market makers. Following the completion of this offering it is contemplated that certain broker-dealers may become market makers for the Common Stock. Under these circumstances, the market bid and asked prices for our Common Stock may be significantly influenced by decisions of the market makers to buy or sell the Common Stock for their own account, which may be critical for the establishment and maintenance of a liquid public market in the Common Stock. Market makers are not required to maintain a continuous two-sided market and are free to withdraw firm quotations at any time. We currently have no market makers. We may not be able to obtain any market makers in the future, and the failure to obtain such market makers could have an adverse impact on the market price of the shares.

WE HAVE A LIMITED OPERATING HISTORY AND IF WE ARE NOT SUCCESSFUL IN CONTINUING TO GROW OUR BUSINESS, THEN WE MAY HAVE TO SCALE BACK OR EVEN CEASE OUR ONGOING BUSINESS OPERATIONS

We have a limited history of revenues from operations and limited tangible assets. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Our company has a limited operating history and must be considered in the development stage. Our company’s operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

ANY CHANGE TO GOVERNMENT REGULATION/ADMINISTRATIVE PRACTICES MAY HAVE A NEGATIVE IMPACT ON OUR ABILITY TO OPERATE AND OUR PROFITABILITY

The laws, regulations, policies or current administrative practices of any government body, organization of any applicable jurisdiction, may be changed, applied or interpreted in a manner which will fundamentally alter the ability of our Company to carry on our business.

The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate and/or our profitability.

OUR OFFICERS AND DIRECTORS HAVE OTHER TIME COMMITMENTS THAT WILL PREVENT THEM FROM DEVOTING FULL-TIME TO OUR OPERATIONS, WHICH MAY AFFECT OUR OPERATIONS

Our officers and directors do not devote their full working time to operation and management, and as a consequence the implementation of our business plans may be impeded. Our officers and directors have other obligations and time commitments, which may slow our operations and impact our financial results. Additionally, we may not be able to hire additional qualified personnel to replace our officers and directors in a timely manner. If our officers or directors should be unable to fulfill their duties, we may not be able to implement our business plan in a timely manner or at all.

FINANCIAL INDUSTRY REGULATORY AUTHORITY (FINRA) SALES PRACTICE REQUIREMENTS MAY LIMIT YOUR ABILITY TO BUY AND SELL OUR COMMON STOCK, WHICH COULD DEPRESS THE PRICE OF OUR SHARES

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

OUR SECURITY HOLDERS MAY FACE SIGNIFICANT RESTRICTIONS ON THE RESALE OF OUR SECURITIES DUE TO STATE “BLUE SKY” LAWS

Each state has its own securities laws, often called “blue sky” laws, which (i) limit sales of securities to a state’s residents unless the securities are registered in that state or qualify for an exemption from registration, and (ii) govern the reporting requirements for broker-dealers doing business directly or indirectly in the state. Before a security is sold in a state, there must be a registration in place to cover the transaction, or the transaction must be exempt from registration. The applicable broker must be registered in that state.

We do not know whether our securities will be registered or exempt from registration under the laws of any state. A determination regarding registration will be made by those broker-dealers, if any, who agree to serve as the market-makers for our common stock. There may be significant state blue sky law restrictions on the ability of investors to sell, and on purchasers to buy, our securities. You should therefore consider the resale market for our common stock to be limited, as you may be unable to resell your shares without the significant expense of state registration or qualification.

INVESTING IN THE COMPANY IS A HIGHLY SPECULATIVE INVESTMENT AND COULD RESULT IN THE LOSS OF YOUR ENTIRE INVESTMENT

A purchase of the offered shares is significantly speculative and involves significant risks. The offered shares should not be purchased by any person who cannot afford the loss of his or her entire purchase price. The business objectives of the Company are also speculative, and we may be unable to satisfy those objectives. The stockholders of the Company may be unable to realize a substantial return on their purchase of the offered shares, or any return whatsoever, and may lose their entire investment in the Company. For this reason, each prospective purchaser of the offered shares should read this prospectus and all of its exhibits carefully and consult with their attorney, business advisor and/or investment advisor prior to purchasing the share.

AS A PUBLIC COMPANY, WE WILL INCUR SUBSTANTIAL EXPENSES

Upon the effectiveness of the registration of our shares we will become subject to this the information and reporting requirements of the United States securities laws. The United States securities laws require, among other things, review, audit, and public reporting of our financial results, business activities, and other matters. SEC regulations, including regulations enacted as a result of the Sarbanes-Oxley Act of 2002, has also substantially increased the accounting, legal, and other costs related to becoming and remaining an SEC reporting company. If we do not have current information about our company available to market makers, they will not be able to trade our stock. The public company costs of preparing and filing annual and quarterly reports, and other information with the SEC and furnishing audited reports to stockholders, will cause our expenses to be higher than they would be if we were privately-held. In addition, we are incurring substantial expenses in connection with the preparation of this Registration Statement. These increased costs may be material and may include the hiring of additional advisors and professionals. Our failure to comply with the federal securities laws could result in private or governmental legal action against us and/or our officers and directors, which could have a detrimental effect on our business, on the value of our stock and on the ability of shareholders to resell the stock.

YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED OR INCORPORATED BY REFERENCE IN THIS PROSPECTUS AND IN ANY ACCOMPANYING PROSPECTUS SUPPLEMENT. NO ONE HAS BEEN AUTHORIZED TO PROVIDE YOU WITH DIFFERENT INFORMATION

THE SECURITIES ARE NOT BEING OFFERED IN ANY JURISDICTION WHERE THE OFFER IS NOT PERMITTED.

YOU SHOULD NOT ASSUME THAT THE INFORMATION IN THIS PROSPECTUS OR ANY PROSPECTUS SUPPLEMENT IS ACCURATE AS OF ANY DATE OTHER THAN THE DATE ON THE FRONT OF SUCH DOCUMENTS.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a registration statement on Form S-1 that we filed with the United States Securities and Exchange Commission with respect to the Shares of common stock offered by this prospectus. This prospectus does not contain all of the information set forth in the registration statement and the exhibits and schedule filed therewith. For further information about us and the Shares offered by this prospectus, reference is made to the registration statement and the accompanying exhibits and schedules. A copy of the registration statement and the associated exhibits and schedules may be inspected without charge at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549, and copies of all or any part of the registration statement may be obtained from such office upon the payment of the fees prescribed by the SEC.

Please call the SEC at 1-800-SEC-0330 for further information about its public reference room. The SEC maintains a World Wide Web site that contains reports, proxy and information statements and other information regarding registrants, including us, that file electronically with the SEC. The address of the website is http://www.sec.gov. Our registration statement and the exhibits and schedules we filed electronically with the SEC are available on this site.

We are not currently subject to the informational requirements of the Securities Exchange Act of 1934, as amended, however, we expect to be subject to those informational requirements following the effectiveness of this registration statement. At that time, we will we file reports and other information with the SEC. Such reports and other information can be inspected and/or obtained at the locations and website set forth above.

SELLING SHAREHOLDERS AND ANY PURCHASERS OF OUR SECURITIES SHOULD BE AWARE THAT THE MARKET IN OUR STOCK WILL BE SUBJECT TO THE PENNY STOCK RESTRICTIONS

CAUTIONARY STATEMENTS REGARDING FORWARD LOOKING STATEMENTS

This prospectus contains forward looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward looking statements by terminology such as "may," "will," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," or the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. We are under no duty to update any of the forward-looking statements after the date of this prospectus to confirm our prior statements to actual results.

Further, this prospectus contains forward looking statements that involve substantial risks and uncertainties. Such statements include, without limitation, all statements as to expectation or belief and statements as to our future results of operations, the progress of the development of our website, the need for, and timing of, additional capital and capital expenditures, partnering prospects, the protection of and the need for additional intellectual property rights, effects of regulations, the need for additional facilities and potential market opportunities.

TAX CONSIDERATIONS

We are not providing any tax advice as to the acquisition, holding or disposition of the common stock offered herein. In making an investment decision, investors are strongly encouraged to consult their own tax advisor to determine the U.S. federal, state and any applicable foreign tax consequences relating to their investment in our common stock.

USE OF PROCEEDS

Of the 3,327,414 shares of common stock being offered hereby 3,059,500 shares are being registered on behalf of the selling shareholders for an estimated sales price of $ 5.00. We will not receive any proceeds from the sale of common stock by the selling shareholders. The Company will sell 267,914 shares of common stock for its benefit, and the proceeds to us from this Offering, assuming the sale of all shares being offered hereby are estimated to be approximately $1,339,570. We expect to use such net proceeds as follows:

| Approximate | Approximate Percentage | |||||||

| Application of Proceeds | Dollar Amount | of Net Proceeds | ||||||

| Offering expenses | $ | 279,270 | 21 | % | ||||

| Personnel costs | $ | 600,000 | 45 | % | ||||

| Website development | $ | 308,300 | 23 | % | ||||

| Working Capital and General Corporate Purposes(1) | $ | 152,000 | 11 | % | ||||

| Total: | $ | 1,339,570 | 100 | % | ||||

(1) Represents amounts to be used for working capital and general corporate purposes, including corporate overhead, administration and ongoing professional fees.

The net proceeds from this offering, together with internally generated funds, are expected to be adequate to fund our working capital needs for the next 12 months. See "Plan of Operation". There can be no assurance that such funds will be sufficient to fund our operations for 12 months. If not, we could be forced to seek additional funding. There is no assurance we could obtain such funding. (See "Risk Factors".) Pending use of the proceeds from this offering as set forth above, we may invest all or a portion of such proceeds in marketable securities, short-term, interest-bearing securities, U.S. Government securities, money market investments and short-terms, interest-bearing deposits in banks.

CAPITALIZATION

The following table sets forth our capitalization at March 31, 2017, and as adjusted to show the sale of the Company shares at a public offering price of $5.00 per share, including the application of the net proceeds of such sale, as described in "Use of Proceeds" above.

| (Actual) | Proforma | |||||||

| 3/31/2017 | 3/31/2017 | |||||||

| Current Liabilities | 50,582 | 50,582 | ||||||

| Long term liabilities | — | — | ||||||

| Total Liabilities | $ | 50,582 | $ | 50,582 | ||||

| Common Stock $.0001 per value per Share; 500,000,000 shares | ||||||||

| authorized; 20,278,400 and 20,546,314 Shares issued and outstanding, | ||||||||

| respectively as adjusted (assuming the maximum number of Shares | ||||||||

| are sold) | ||||||||

| Par | 2,028 | 2,055 | ||||||

| APIC | 290,313 | 1,536,086 | ||||||

| Subscription receivable | (1 | ) | (1 | ) | ||||

| Accumulated Deficit | (25,508 | ) | (25,508 | ) | ||||

| Total Stockholders’ Equity | 266,832 | 1,512,632 | ||||||

| Total Liabilities and Stockholders’ Equity | $ | 317,414 | $ | 1,563,214 | ||||

| (1) | Assumes the sale of 267,914 shares, or the maximum number of shares offered by the Company. |

DILUTION