Attached files

| file | filename |

|---|---|

| EX-32.2 - DUO WORLD INC | ex32-2.htm |

| EX-32.1 - DUO WORLD INC | ex32-1.htm |

| EX-31.2 - DUO WORLD INC | ex31-2.htm |

| EX-31.1 - DUO WORLD INC | ex31-1.htm |

| EX-21 - DUO WORLD INC | ex21.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2017

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ___________

Commission File Number 000-55698

DUO WORLD, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 35-2517572 | |

| (State of Incorporation) | (I.R.S. Employer Identification No.) |

c/o Duo Software (Pvt.) Ltd., No. 403 Galle Road, Colombo 03, Sri Lanka

(Address of principal executive offices)

Registrant’s telephone number, including area code: (870) 505-6540

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Title of Each Class

Common Stock, $.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant: (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that he registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Sec. 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit or post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the Registrant’s most recently completed second fiscal quarter (September 30, 2016) was approximately $-0- Not applicable as common stock was not trading on such date.

As of June 26, 2017, there were 38,567,467 shares of our common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

TABLE OF CONTENTS

| 2 |

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Annual Report”), in particular the Management’s Discussion and Analysis of Financial Condition and Results of Operations appearing in Item 7 herein (“MD&A”) contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements give expectations or forecasts of future events. The reader can identify these forward-looking statements by the fact that they do not relate strictly to historical or current facts. They use words such as “believe(s),” “goal(s),” “target(s),” “estimate(s),” “anticipate(s),” “forecast(s),” “project(s),” plan(s),” “intend(s),” “expect(s),” “might,” may” and other words and terms of similar meaning in connection with a discussion of future operations, financial performance or financial condition. Forward-looking statements, in particular, include statements relating to future actions, prospective services or products, future performance or results of current and anticipated services or products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, trends of operations and financial results.

Any or all forward-looking statements may turn out to be wrong, and, accordingly, readers are cautioned not to place undue reliance on such statements, which speak only as of the date of this Annual Report. These statements are based on current expectations and the current economic environment. They involve a number of risks and uncertainties that are difficult to predict. These statements are not guarantees of future performance. Actual results could differ materially from those expressed or implied in the forward-looking statements. Forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Many such factors will be important in determining the Company’s actual results and financial condition. The reader should consider the following list of general factors that could affect the Company’s future results and financial condition.

Among the general factors that could cause actual results and financial condition to differ materially from estimated results and financial condition are:

| ● | the success or failure of management’s efforts to implement their business strategy; | |

| ● | the ability of the Company to raise sufficient capital to meet operating requirements; | |

| ● | the uncertainty of consumer demand for our products and services; | |

| ● | the ability of the Company to compete with major established companies; | |

| ● | heightened competition, including, with respect to pricing, entry of new competitors and the development of new products or services by new and existing competitors; | |

| ● | absolute and relative performance of our products or services; | |

| ● | the effect of changing economic conditions; | |

| ● | the ability of the Company to attract and retain quality employees and management; and | |

| ● | other risks which may be described in our future filings with the U.S. Securities and Exchange Commission (“SEC”). |

No assurances can be given that the results contemplated in any forward-looking statements will be achieved or will be achieved in any particular timetable. We assume no obligation to publicly correct or update any forward-looking statements as a result of events or developments subsequent to the date of this Annual Report. The reader is advised, however, to consult any further disclosures we make on related subjects in our filings with the SEC.

| 3 |

BUSINESS DEVELOPMENT

BACKGROUND

Duo World, Inc. (“we,” the “Company” or “Duo World”) is an information technology and software solutions company, focused on bringing value to its clients through customer interactions.

Duo World has its registered office in Nevada, United States, and its development center in Colombo, Sri Lanka. Duo World specializes in the space of Customer Life Cycle Management & Contact Center solutions and Subscriber Management System and Billing for Pay-TV operators in the Asia Pacific Region. Driven by innovation, Duo World, has served the enterprises in many ways, including efficiency, cost reduction, revenue optimization and continuous value addition to their product or service offerings.

Duo World’s Customer Life Cycle and Contact Center solution has been used by some of the largest banks, largest retail chains, largest financial conglomerates, and largest taxi hailing startups in Sri Lanka. India’s largest digital cable TV operator and Indonesia’s growing DTH operators largely benefit by implementing Duo World’s Subscriber Management and Billing System for the operation.

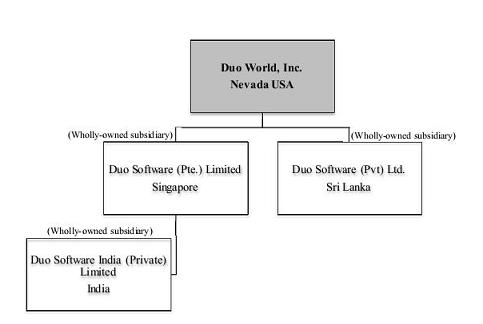

Duo World, Inc. was formed as a Nevada corporation in 2014 for the purpose of acquiring three operating entities: (i) Duo Software (Pvt.) Limited, a Sri Lankan company (“Duo Software Sri Lanka”), from Mr. Muhunthan Canagasooryam, Duo World’s President and founder, in exchange for 28,000,000 shares of our common stock and 5,000,000 shares of our Series A Preferred Stock; (ii) Duo Software (Pte.) Limited, a Singaporean company (“Duo Software Singapore”), from Ms. Koshala Nishaharan, in exchange for 2,000,000 shares of our common stock; and (iii) Duo Software India (Private) Limited, an Indian company (“Duo Software India”). Duo Software India is a wholly-owned subsidiary of Duo Software Singapore. These acquisitions were accomplished as of December 3, 2014.

Duo Software Sri Lanka was incorporated on September 22, 2004 in the Democratic Socialist Republic of Sri Lanka, as a limited liability company under the Sri Lanka Companies Act No. 17 of 1982, and was subsequently reregistered under the Sri Lanka Companies Act No. 7 of 2007, in compliance with the New Companies Act, which came into effect in 2007.

Duo Software Singapore was incorporated on June 5, 2007 in the Republic of Singapore under the Companies Act (Cap 50. 1994 Rev. Ed).

Duo Software India was incorporated on August 30, 2007, under the Companies Act of 1956 in the Republic of India and became a wholly-owned subsidiary of Duo Software Singapore.

| 4 |

Duo World maintains an internet website at www.duoworld.com. Information about us is available on the website, free of charge. We are a publicly held company and are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (“Exchange Act”). We have available on our website our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, which will be posted or linked on our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (“SEC”). The Company’s website and the information contained therein are not considered as being incorporated into this Annual Report.

Duo World has a Code of Business Conduct and Ethics that applies to all employees, as well as our Board of Directors and officers. The Code of Business Conduct and Ethics is posted on our website at www.duoworld.com. We will post on our website any amendments to, or waivers of, the Code of Business Conduct and Ethics.

Our Business and Products

Duo World is a software product development company focused on providing enterprise solutions simplified through our cloud offering and by use of cutting edge technology.

The experience and market insight gained by Duo World through its more than a decade of existence in the software industry caused us to think globally and futuristically to focus on new product development to cater to ever evolving and growing business needs.

Eventually, our Customer Life Cycle Management and Contact Center solution transformed into a futuristic cloud Communication and Collaboration Platform. Our Subscription Management and Billing System, which was primarily catering to the large digital Pay-TV operators, transformed into an API driven cloud Subscription Management and Billing System.

“FaceTone” is a cloud communications and collaborations platform which is being offered through public/private cloud and on site implementations as per business preferences.

Our FaceTone enterprise version was launched in October 2016 and the product has already gained momentum in the market by acquiring the largest home grown taxi hailing start up, the largest private bank, one of the largest financial conglomerate which became the most profitable listed company in 2017, and the largest private telecommunication service provider in Sri Lanka to its client portfolio.

| 5 |

FaceTone has also been implemented at some of the existing clients of Duo World, which include the largest government bank, some of the medium size private banks, the largest fixed telecommunication providers and the largest retail chain in Sri Lanka.

FaceTone showcased its excellence by winning the Gold Award under the “Communications Applications” category in The National Best Quality ICT Awards 2016 (NBQSA), an annual event organized by the BCS, The Chartered Institute for IT Sri Lanka, qualifying to participate in Asia Pacific ICT Awards (APICTA) hosted by Asia Pacific ICT Alliance Awards 2016 held in Taipei, Taiwan where FaceTone won a merit award in reinforcing itself as an innovative solution once again.

“CloudCharge” is an API driven Cloud Subscription Management and Billing System that caters to any business that operates in the space of subscription economy. CloudCharge is to be commercially launched by the second quarter of fiscal year 2017-2018.

Duo World commercially launched the enterprise version of DigIn in June 2017, and has ambitions plans of bringing many customers on board during the coming months. The SaaS version of DigIn is to be launched during the third quarter of fiscal year 2017-2018.

Other ancillary product of Duo World that is in completion, and to be launched is, Smoothflow. We plan to launch Smoothflow in January 2018.

All of the products are initially launched in Sri Lanka (as a test bed) and then taken to other countries.

Most of our product development, research and development, global support center, project management, business process and implementation, finance and treasury and human resource management functions are conducted and managed through Duo Software Sri Lanka.

Duo Software Singapore was established primarily for the purpose of marketing of our enterprise versions DuoSubscribe and DuoCLM when they were launched in 2008. Duo Software Singapore has been highly instrumental in generating successful sales leads through its presence at trade exhibitions and in following up sales leads.

Duo Software India was established for the purposes of having a dedicated team in India to promote and support the enterprise versions of DuoSubscribe and DuoCLM when it was launched in 2008. India is the world’s second most populated country and has a large number of Pay TV operators in the subscription economy in India.

Duo Software India has been successful in penetrating the Pay TV industry, and enterprise versions of DuoSubscribe and DuoCLM are being employed as the operation platform by some of the dominant Pay TV operators in New Delhi, and Kolkata, India, such as DEN Networks Limited, India’s largest cable TV distribution company serving 13 million homes in over 200 cities.

At present, Duo Software India has curtailed promoting DuoSubscribe and DuoCLM, and is at the verge of launching FaceTone in India, primarily to the Telecommunication industry.

Industry and Market

While Duo World initially developed its software for use by clients as an enterprise or on premises model, the information technology climate is changing in dramatic fashion as a result of cloud based, SaaS solutions and technology. Duo World fully grasps these changing dynamics and market forces, and intends to use its technical expertise, technology and other resources to exploit cloud based, SaaS solutions in order to compete within our industry.

The communication and collaboration software is where the solution facilitates hosted applications via private/public clouds or through an on premise implementation model.

| 6 |

While Duo World would primarily focus on the cloud model to acquire the market influencers and startups where the revenue will be on a monthly/annually subscription model, the on premise solution will be made available for brick and mortar companies, who have their own infrastructure to implement the system in house. For the on premise version, our pricing would be based on either a one-time investment pricing with annual support fee or a monthly/annual user license subscription basis as preferred by the customer.

Communication and Collaboration will facilitate running a comprehensive modern age customer support system featuring omni-channel delivery. It provides sales teams the convenience of contacting their customers from anywhere and any device, add their own task and manage a customer’s profile. FaceTone would also enable efficient internal communication between teams through its voice, messaging and collaboration platform.

FaceTone proves to be a solution for any industry and organization to uplift their communication with external stakeholders such as clients and internal communication within teams; hence, the market size promises to be significantly large and unfolds bigger opportunities for Duo World to achieve market leadership with the right product at the right time.

The subscription based software industry is an industry where software applications are hosted on a public or private cloud platform and services are provided on a monthly subscription model known as “Software as a Service” or “SaaS.” SaaS is a software licensing and delivery model in which software is licensed on a subscription basis and is centrally hosted on the cloud by independent software vendors or application service providers. Unlike traditional software applications which are conventionally sold as a perpetual license with an up-front fee and an annual fee charged for support, SaaS providers price their applications using a subscription fee, payable monthly or on a transaction basis. The subscription model allows organizations to access the applications without having to pay a large upfront fee, thereby increasing the potential user base.

The subscription industry has recently experienced phenomenal growth and is forecasted to continue to grow in the future. Subscriptions are no longer limited to cable TV, newspapers and magazines. During the past ten years, there has been a dramatic shift in the way both consumers and companies do business and more companies are using the subscription model to offer everything from music, movies and textbooks to even automobiles for a monthly fee. Many traditional organizations are joining the subscription economy in response to changing consumer habits, as many consumers today value the convenience and flexibility of subscribing for services or access to products more than having to purchase products or services.

DuoWorld Platform

Duo World has developed a platform to accommodate cloud based solutions. The Duo World cloud based platform is being used by the company for all research and development activities and new product development.

Our Products and Our Transformation to Cloud Based, SaaS Solutions

In response to the changing dynamics discussed under “Industry and Market,” above, we have been diligently transforming our business model by developing new products and enhancing our current products for the cloud based, Software-as-a-Service (“SaaS”) market.

Our DuoCLM product was designed to manage the entire customer life cycle from the initial contact point with a customer to after sales support. DuoCLM was offered as an enterprise or on premises solution to large organizations that have dedicated customer support/call centers to maintain their customer relationships.

We launched FaceTone in October 2016 to offer a significantly enhanced model of DuoCLM. The On Premise and Partner versions were launched in 2016, and we hope to launch the FaceTone cloud version in the second quarter of fiscal year 2017-2018.

| 7 |

Our DuoSubscribe product specializes in invoicing customers on a monthly/recurring basis and managing the services of the customer. DuoSubscribe is currently offered as an enterprise or on premises solution.

We have developed a significantly enhanced version of our DuoSubscribe product, called CloudCharge, as a cloud based, SaaS solution. CloudCharge will have a much wider scope and many new features that can serve many more industries than DuoSubscribe. CloudCharge can be used to manage and set up recurring bills (such as Pay TV, news subscriptions, car rentals) to subscribers. The client’s customer details can be stored in the system and used to send bills to their emails or phones. Discounts and promotions can be scheduled and activated using CloudCharge. CouldCharge will be launched in the second quarter of fiscal year 2017-2018.

“DigIn” is a business intelligence and data visualization tool that is offered through public/private cloud and on premise implementations. DigIn will make data analytics simplified for small and medium organizations. Our DigIn enterprise version was launched in June 2017, and the cloud version is to be launched by third quarter in fiscal year 2017-2018.

“SmoothFlow” is a cloud based workflow designing and execution tool that is meant for developers. This tool would also provide a back end as service where the app development would be made simple via a drag and drop service designer. SmoothFlow would be launched by primarily integrating with JIRA and made available on Atlassian market place providing access to the users of over 75,000 organizations using Atlassian tools.

“Veery” will be offered as a downloadable open source communication platform free of charge. However, we would charge customers for any required support on a case by case basis.

With Duo World transforming its business toward cloud based, SaaS, product deployments, we are employing a strategic market approach focused on creating and distributing valuable, relevant and consistent content to attract new and retain a clearly defined clientele with the goal of ultimately driving profitable customer action via content marketing.

While we move toward cloud based solutions, Duo World will continue to cater all of our products to the profitable enterprise segments, as well. And is the case of most of our products, the enterprise version will be launched first in Sri Lanka and the region (as a test bed), prior to being launched in other countries and as a SaaS.

In addition, our cloud based solutions will reduce implementation and change request costs, while improving product profitability. Duo World will focus more on product innovation than on deploying our resources and efforts on solving customer specific issues and accepting additional development requests from individual customers.

Instead of catering our products to limited industries in a particular region or country, our new products will allow us to cater to a more diversified audience that can be reached through our cloud presence, which can be accessed by any user via the internet, regardless of where they are located. We believe that our transformation from on premises/enterprise solutions to cloud-based, SaaS solutions will expose us to a greater number of potential customers and reduce our reliance on a few large enterprise customers.

Our transformation to a cloud-based, SaaS business is not without some small degree of risk, as we could lose some of the personal interaction with our customers, as all of our services will be offered via digital communications (e.g., email, blogs, service tickets and telephone), which could impact customer loyalty. In order to overcome this risk, we are investing in improving our global support operation and ensuring that proper attention and very professional services are provided to our customers as and when the need arises to provide additional customer support. However, our management does not believe that such risk is material.

Due to the increased dynamic conditions of the markets, we are now going to offer our other products without the Duo World platform.

| 8 |

CloudCharge

CloudCharge offers a range of features that would help organizations improve their operations and maximize their revenues. CloudCharge’s key features are:

| ● | customer profiling and portfolio management | |

| ● | order taking and provisioning | |

| ● | invoicing and payment processing | |

| ● | subscription management and billing | |

| ● | social media integration | |

| ● | marketing campaign and sales lead management | |

| ● | payment gateway integration | |

| ● | notifications and payment reminders | |

| ● | easy to use interface | |

| ● | open application program interface (“API”) for third party integration |

CloudCharge can also be used for one time billing by supermarkets, gas stations, etc. where bills will be generated one time for one or more products and services. CloudCharge also provides tools to manage inventory and multiple stores or sales outlets.

CloudCharge will be targeted toward small (including sole proprietors) and medium-sized businesses.

DigIn

DigIn is an end-to-end data visualization and analytics platform that allows the user to analyze structured and unstructured data in one place.

DigIn also has three business models, Cloud based, partner model and on premise model. DigIn supports Social Media Analytics, real time dashboard, data modeling, forecasting, and “what if” analysis, which is a highly valued feature in the present industries. The analysis can be made for several data sources and attributes, such as determining the products that experienced highest sales in a particular season or selling period. This data can be used to predict future sales of the products during specific seasons or time periods. By using Social Media Analytics, a company can analyze its reach in social media and review the comments received about its products, both positive and negative.

FaceTone

FaceTone is a communication and collaboration platform that provides capability of operating on premise or cloud based PABX, IVR or a contact/call center, efficiently. A PABX is a private automatic branch exchange and automatic telephone switching system. An IVR is an interactive voice response system that interacts with callers, gathers information and routes calls to the appropriate recipients. FaceTone is an enhanced version of Duo CLM.

| 9 |

FaceTone for PABX provides advanced features such as call conferencing, call parking, call forwarding, voicemail and more. FaceTone for Call Centers provides the capability to run a fully functional contact center with added features such as call routing and chat based collaboration like Facebook, Viber and Skype. FaceTone for Developers is for developers who wish to build communication related systems. This option will be available once FaceTone is well established in market.

SmoothFlow

SmoothFlow is a workflow designing tool that allows the user to create, edit, save and publish workflows, and is similar to Microsoft Workflow Designer, which we previously used to build workflows. If a user needs to build a web based system (e.g., Online POS), then the user can design the processes of the system using SmoothFlow and integrate them with the interface the user has already designed.

SmoothFlow is targeted toward developers who require a workflow designing tool for their development. SmoothFlow’s simple and intuitive drag and drop interface can be used by both new and experienced users with ease.

Veery

Veery is an open source development platform that can be used to build communication related systems. Users can download the Veery platform to their local computers to start working. Users can customize/develop communication related applications using Veery and sell them under their brand name. For example, a developer can develop a telephone application on top of the Veery platform using the calling services available in Veery to make and receive calls.

Developers will be allowed to download Veery free of charge and start using it for their development purpose, as it is an open source application.

New Product Marketing

We intend to take our message to as many of the prospective customers as possible by conducting a robust marketing campaign for our new products. Having products that our potential customers would be excited about and willing to pay for, we will pursue a mixed approach of digital and traditional marketing channel to lure customers.

We intend to market our new products in various ways and through various channels, including press releases in international online and print media about product development, release dates for new and updated versions of our software and products, new personnel hiring and other news about our company, our achievements and our products.

We also intend to advertise via entrepreneur magazines and Gartner publications, and product placement with other leading products. Gartner, Inc., based in Stanford, CT, in the United States, is one of the world’s leading information technology and advisory companies.

We also intend to actively market our products via online/social media marketing, such as content marketing via Google and LinkedIn, blogs, forums and video tutorials.

We have attended and participated in tradeshows and exhibitions in the past and we intend to participate in the Gartner Business Intelligence & Analytics Summit, and developer conferences, as a sponsor and exhibitor.

Duo World will conduct promotion activities jointly with the partners who would be reselling the on premise model of the products and these promotions will be localized based on the country and target market.

| 10 |

Dependence on One or a Few Major Customers

The Company does business with a few major customers. Major customers are defined as those customers whose annual revenue contributions to the Company are greater to or equal to 10% of the Company’s annual revenue. Net sales for the fiscal years ended March 31, 2017 and 2016, include sales to the following major customers:

| Sales | ||||||||||||||||

| Year Ended March 31, | ||||||||||||||||

| Customer | 2017 | % | 2016 | % | ||||||||||||

| Customer A | $ | 398,783 | 36 | $ | 445,120 | 32 | ||||||||||

| Customer B | $ | 376,626 | 34 | $ | 366,709 | 27 | ||||||||||

| Customer C | $ | 83,138 | 7 | $ | 193,721 | 14 | ||||||||||

| Customer D | $ | 80,757 | 7 | $ | 29,022 | 2 | ||||||||||

| Total Sales to Customers A-D | $ | 939,304 | 84 | $ | 1,034,572 | 75 | ||||||||||

Our Intellectual Property

We have no patents. Our trademarks are registered in Sri Lanka and will be registered in the United States shortly. Our trade secrets, copyrights and our other intellectual property rights are important assets for us. We enter into confidentiality agreements with our employees and consultants and we generally control access to and distribution of proprietary information. These agreements generally provide that any confidential information developed by us or on our behalf be kept confidential. Further, we require all employees to execute written agreements assigning to us all rights in all inventions, developments, technologies and other intellectual property created by our employees.

There are events that are outside of our control that pose a threat to our intellectual property rights. For example, effective intellectual property protection may not be available in every country in which our services are made available through the Internet. Also, the efforts we have taken to protect our propriety rights may not be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to compete. Also, protecting our intellectual property rights could be expensive and time consuming.

We have two wholly-owned subsidiaries: Duo Software (Pvt.) Limited, a Sri Lankan company, and Duo Software (Pte.) Limited, a Singaporean company. We also indirectly own Duo Software India (Private) Limited, an Indian company, which is the wholly-owned subsidiary of Duo Software (Pte.) Limited (Singapore).

Employees

The Company currently has approximately 100 employees. We have employment agreements with our employees, but not with our directors or officers. We do not anticipate any of our employees being union members.

Legal Proceedings

We are not involved in any legal proceedings.

| 11 |

Competitive Conditions

The subscription management and billing and customer lifecycle management businesses are intensely competitive. We have numerous competitors in the United States and abroad, many of whom have greater financial and human resources than we have. If we are unable to compete effectively and efficiently with our competitors, then we may not generate sufficient revenues and profits to stay in business, in which case investors in our common stock could lose part or all of their investments in the Company.

Business and Legal Developments Regarding Climate Change

We do not believe our business will be affected by business and legal developments regarding climate change.

Where You Can Find Us

Our principal executive offices in the United States are located at 170 S. Green Valley Parkway, Suite 300, Henderson, Nevada 89012. Our U.S. telephone number is (870) 505-6540. Our primary overseas offices are located at c/o Duo Software (Pvt.) Ltd., No. 403 Galle Road, Colombo 03, Sri Lanka. Our overseas telephone number is + (94) 112 375 000.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 or “JOBS Act.” We will remain an emerging growth company until the earlier of (1) March 31, 2022 (2) the last day of the fiscal year in which we have total annual gross revenue of at least $1.0 billion, (3) the last day of the fiscal year in which we are deemed to be a “large accelerated filer,” as defined in the Securities Exchange Act of 1934, and (4) the date on which we have issued more than $1.0 billion in nonconvertible debt during the prior three-year period.

As an emerging growth company, we may take advantage of reduced or “scaled” disclosure requirements that are otherwise applicable to public companies. These reduced or scaled disclosure requirements include, but are not limited to:

| 1. | being permitted to present only two years of audited financial statements and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report; | |

| 2. | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended; | |

| 3. | being able to take advantage of the reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and | |

| 4. | being exempt from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We have elected to take advantage of certain of the reduced disclosure obligations in this Annual Report and may elect to take advantage of other reduced reporting requirements in our future filings with the SEC. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies that are not emerging growth companies.

The JOBS Act also provides that an emerging growth company may take advantage of an extended transition period for complying with new or revised accounting standards. We have irrevocably elected to not avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

| 12 |

Compliance after Termination of Emerging Growth Company Status

After our emerging growth company status is terminated, we will not be able to take advantage of the reduced or scaled disclosure requirements described in subparagraphs 1. and 4., above. However, in the event we are a “smaller reporting company,” as that term is defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended, after our emerging growth company status has terminated, we will still be able to take advantage of the reduced or scaled disclosure requirements described in subparagraphs 2. and 3., above, for as long as we continue to have smaller reporting company status.

An investment in our Common Stock involves a high degree of risk. Prospective investors should carefully consider the following risk factors and the other information in this Annual Report and in our other filings with the SEC before investing in our Common Stock. Our business and results of operations could be seriously harmed by any of the following risks. You should carefully consider the risks described below, the other information in this Annual Report and the documents incorporated by reference herein when evaluating our Company and our business. If any of the following risks actually occurs, our business could be harmed. In such case, the trading price of our Common Stock could decline and investors could lose all or a part of the money paid for our Common Stock.

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. IF ANY OF THE FOLLOWING RISKS ACTUALLY MATERIALIZES, OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS WOULD SUFFER AND OUR SHAREHOLDERS COULD LOSE ALL OR PART OF THEIR INVESTMENT IN OUR SHARES.

Risks Related to Our Business

| We do not have an independent audit or compensation committee, the absence of which could lead to conflicts of interest of our officers and directors and work as a detriment to our shareholders. |

We do not have an independent audit or compensation committee. The absence of an independent audit and compensation committee could lead to conflicts of interest of our officers and directors, which could work as a detriment to our shareholders.

| The markets in which we operate include a large number of service providers and are highly competitive. |

Many of our competitors are expanding the services they offer in an attempt to gain additional business. In addition, new competitors, alliances among competitors or competitors’ mergers could result in significant market share gain. Some of our competitors may have or develop a lower cost structure, adopt more aggressive pricing policies or provide services that gain greater market acceptance than the services that we offer or develop. Large and well-capitalized competitors may be able to better respond to the need for technological changes faster, price their services more aggressively, compete for skilled professionals, finance acquisitions, fund internal growth and compete for market share. Our clients routinely negotiate for better pricing, and in order to respond to increased competition and pricing pressure, we may be required to lower our pricing structure, which would have an adverse effect on our revenues and profit margin.

| We are an emerging growth company and the reduced disclosure requirements applicable to emerging growth companies could make our common stock less attractive to investors. |

We are an “emerging growth company,” as defined in the JOBS Act. Under the JOBS Act, emerging growth companies can delay adopting new or revised financial accounting standards until such time as those standards apply to private companies. However, we have irrevocably elected not to avail ourselves of this extended transition period and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

| 13 |

For as long as we continue to be an emerging growth company, we may also take advantage of other exemptions from certain reporting requirements that are applicable to other public companies, including not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, exemption from any rules that may be adopted by the PCAOB requiring mandatory audit firm rotations or a supplement to the auditor’s report on financial statements, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved, and reduced financial reporting requirements. Investors may find our common stock less attractive if we rely on these exemptions, which could result in a less active market for our common stock, increased price fluctuations and a decrease in the trading price of our common stock.

| Our ability to achieve significant revenue will depend on our ability to establish effective sales and marketing capabilities. |

Our success is dependent upon our ability to effectively and profitably market and sell our services. If we fail to establish sufficient marketing and sales forces, our ability to enter new or existing markets will be impaired. Our inability to effectively enter these markets would materially and adversely affect our ability to generate significant revenues.

| If we are unable to hire or retain qualified personnel in certain areas of our business, then our ability to execute our business plans in those areas could be impaired and revenues could decrease. |

We employ approximately 100 employees worldwide. At times, we have experienced difficulties in hiring personnel with the desired levels of training and experience. We have been outsourcing certain non-core activities to third party suppliers. Additionally, quality service depends on our ability to retain employees and control personnel turnover. Any increase in the employee turnover rate could increase recruiting and training costs and could decrease operating effectiveness and productivity. We may not be able to continue to hire, train and retain a significant number of qualified personnel to adequately staff new client projects or expand existing ones.

| We depend heavily on our management team and the loss of any of our executive officers could significantly weaken our management expertise and ability to run our business. |

Our business strategy and success is dependent on the skills and knowledge of our management team and consultants. As of the date of this Annual Report, Muhunthan Canagasooryam is our President and Chief Executive Officer, Suzannah Jennifer Samuel Perera is our Chief Financial Officer and Riad Ameen is our Legal Director. The loss of services of Muhunthan Canagasooryam, Suzannah Jennifer Samuel Perera or Riad Ameen could weaken significantly our management expertise and our ability to efficiently run our business. We do not maintain key man life insurance policies on any of our officers.

| Because our President and Chief Executive Officer also works for another organization, our business could suffer if he is unable to devote sufficient time to our Company’s business. |

Muhunthan Canagasooryam, our President and Chief Executive Officer, devotes two days a week to our business and is contractually obligated to work three days a week as the Managing Director and Chief Executive Officer of the Information Communication Technology Agency (“ICTA”) in Sri Lanka. In the event that he is unable to devote sufficient time and effort to carry out his role and perform his responsibilities as President, Chief Executive Officer and Director of Duo World, our business could suffer and our investors could be harmed if our stock price declines as a result of Mr. Canagasooryam’s unavailability or lack of attention to the management and oversight of our business.

| 14 |

| Because our officers and directors reside outside of the United States, it may be difficult for an investor to enforce any right based on United States Federal Securities Laws or state securities laws against the Company and/or any of our officers or directors, or to enforce a judgment rendered by a court in the United States against the Company or any of our officers or directors. |

None of our officers or directors is a resident of the United States. Therefore, it may be difficult for our United States shareholders to (i) enforce any right or claim based on United States federal securities laws or state securities laws against the Company and/or any of our officers or directors, (ii) effect service of process on any of our officers or directors in the United States or in foreign countries in which we maintain assets and/or in which any of our officers or directors reside or may be found, (iii) enforce any judgment rendered by a court in the United States against the Company or any of our officers or directors; or (iv) bring an original action in foreign courts such as India, Singapore and Sri Lanka, where our assets, officers and directors are located, to enforce liabilities based on the United States or state securities laws against the Company or any of our officers or directors. As a result, it may be difficult or impossible for an investor to bring an action against our officers or directors in the event that an investor believes that such investor’s rights have been infringed upon under the securities laws of the United States or under any state securities laws, or otherwise. Even if an investor is successful in bringing an action of this kind, the courts of other countries may rule that the investor is unable to enforce a judgment against the assets of the Company located outside the territorial limits of the United States or the assets of the officers or directors located outside the territorial limits of the United States. As a result, our shareholders may have more difficulty in protecting their interests and investments in the Company through actions against our management, directors or officers, compared to shareholders of a corporation doing business in, and a corporation and its officers and directors maintaining assets in, and residing in the United States.

| Any United States or foreign judgment that may be obtained against us may be difficult or impossible to enforce in the United States, India, Singapore or Sri Lanka. |

Although we are a Nevada corporation, subject to suit in the United States and other courts in the United States, most of our assets are located in India, Singapore and Sri Lanka and our officers and directors and their assets are located outside the United States. Judgments obtained in the United States or in other foreign courts, including those with respect to United States federal or state securities laws claims, may not be enforceable in India, Singapore, Sri Lanka or any other country in which we or our officers or directors maintain assets. Therefore, it may be difficult or impossible to enforce any U.S. or other foreign judgment obtained against us or our officers or directors or any of our operating subsidiaries in India, Singapore, Sri Lanka or any other country in which we maintain assets.

| If our clients are not successful, or the trend towards outsourcing does not continue, the amount of business that our clients outsource and the prices that they are willing to pay for such services may diminish and could adversely affect our business. |

Our revenues depend on the success of our clients. If our clients or their specific programs are not successful, then the amount of business that they outsource may be diminished. There can be no assurance that the level of revenues generated by such clients will meet expectations. A reduction in the amount of business we receive from our clients could result in stranded capacity and costs. In addition, we may face pricing pressure from our clients, which could negatively affect our operating results.

Growth of our revenues depends, in large part, on the trend toward outsourcing. Outsourcing involves companies contracting with a third party, such as Duo World, to provide customer management services, customer lifecycle management solutions and subscription management and billing solutions rather than performing such services in-house. There can be no assurance that this trend will continue, as organizations may elect to perform such services in-house. A significant change in this trend could have a material adverse effect on our financial condition and results of operations.

| 15 |

| A large portion of our revenue is generated from a limited number of clients, and the loss of significant work from one or more of our clients could adversely affect our business. |

Our four (4) largest clients collectively represented 84% of our revenues for the fiscal year ended March 31, 2017 and our four (4) largest clients represented 75% of our revenues for the fiscal year ended March 31, 2016. While we typically have multiple work orders and/or contracts with our largest customers, which would not all terminate at the same time, the loss of one or more of the larger work orders or contracts with one of our largest customers could adversely affect our business, results of operations and financial condition, if the lost revenues were not replaced with profitable revenues from that client or other clients.

| We process, transmit and store personally identifiable information and unauthorized access to, or the unintended release of, this information could result in a claim for damages or loss of business and create unfavorable publicity. |

We process, transmit and store personally identifiable information, both in our role as a service provider and as an employer. This information may include social security numbers or other foreign tax identification numbers, financial and health information, as well as personal information. As a result, we are subject to certain contractual terms, as well as federal, state and foreign laws and regulations designed to protect personally identifiable information. While we take measures to protect the security and privacy of this information and to prevent unauthorized access, it is possible that our security controls over personal data and other practices we follow may not prevent the improper access to or disclosure of personally identifiable information. If any person, including any of our employees, negligently disregards or intentionally breaches our established controls with respect to such data or otherwise mismanages or misappropriates that data, we could be subject to monetary damages, fines and/or criminal prosecution.

| Interruption of our data centers and contact centers could have a materially adverse effect on our business. |

In the event that we experience a temporary or permanent interruption at one or more of our data centers or contact centers or to cloud storage where we also store data and codes, through natural disaster, casualty, operating malfunction, cyber-attack, sabotage or other causes, we may be unable to provide the data services we are contractually obligated to deliver. This could result in us being required to pay contractual damages to some clients or to allow some clients to terminate or renegotiate their contracts. Notwithstanding disaster recovery and business continuity plans and precautions instituted to protect our clients and us from events that could interrupt delivery of services (including property and business interruption insurance that we may maintain or procure in the future), there is no guarantee that such interruptions would not result in a prolonged interruption in our ability to provide support services to our clients or that such precautions would adequately compensate us for any losses we may incur as a result of such interruptions.

| Our ability to deliver our services is at risk if the technology and network equipment we rely upon is not maintained or upgraded on a timely basis. |

Technology is a critical foundation in our service delivery. We utilize and deploy internally developed and third party software solutions across various hardware environments. We operate an extensive internal voice and data network that links our global sites together in a multi-hub model that enables the rerouting of traffic. Also, we rely on multiple public communication channels for connectivity to our clients. Our clients are highly dependent upon the high availability and uncompromised security of our systems. These systems are subject to risk of an extended interruption or outage due to many factors, such as system failures, acts of nature and intentional unauthorized attacks from third parties. Accordingly, maintenance of, and investment in, these foundational components are critical to our success. If the reliability of our technology or network operations falls below required service levels, or a systemic fault affects the organization broadly, we may be obligated to pay performance penalties to our clients, and our business from existing and potential clients may be jeopardized and cause our revenue and cash flow to decrease.

| 16 |

| We may not be able to predict our future tax liabilities. If we become subject to increased levels of taxation or if tax contingencies are resolved adversely, our results of operations and financial condition could be adversely affected. |

Due to the international nature of our operations, we are subject to the complex and varying tax laws and rules of several foreign jurisdictions. We may not be able to predict the amount of future tax liabilities to which we may become subject due to some of these complexities if our positions are challenged by local tax authorities. Any increase in the amount of taxation incurred as a result of challenges to our tax filing positions or due to legislative or regulatory changes could result in a material adverse effect on our business, results of operations and financial condition. We are subject to tax audits, including issues related to transfer pricing, in the United States and other jurisdictions. We have material tax-related contingent liabilities that are difficult to predict or quantify. While we believe that our current tax provisions are reasonable and appropriate, we cannot be assured that these items will be settled for the amounts accrued or that additional exposures will not be identified in the future or that additional tax reserves will not be provided for any such exposure.

| Our business performance and growth plans may be negatively affected if we are unable to effectively manage changes in the application and use of our technology. |

The use of technology in our industry has and will continue to rapidly increase. Our future success depends, in part, upon our ability to develop and implement technology solutions that anticipate and keep pace with continuing changes in technology, industry standards and client preferences. We may not be successful in anticipating or responding to these developments on a timely and cost-effective basis, and our ideas may not be accepted in the marketplace. Additionally, the effort to gain technological expertise and develop new technologies in our business requires us to incur significant expenses. If we cannot offer new technologies as quickly as our competitors or if our competitors develop more cost-effective technologies, it could have a material adverse effect on our ability to obtain and complete customer engagements. Also, if customer preferences for technology disproportionately outpace other interaction preferences, it could have a material adverse impact on our revenue profile and growth plans.

| Defects or errors with our software could adversely affect our business. |

Design defects or software errors may delay software introductions or reduce the satisfaction level of clients and may have a materially adverse effect on our business and results of operations. Our software is highly complex and may, from time to time, contain design defects or software errors that may be difficult to detect and/or correct. Because both our clients and we use our software to perform critical business functions, design defects, software errors or other potential problems within or outside of our control may arise from the use of our software. It may also result in financial or other damages to our clients, for which we may be held responsible. Although our license and other agreements with our clients may often contain provisions designed to limit our exposure to potential claims and liabilities arising from client problems, these provisions may not effectively protect us against such claims in all cases and in all jurisdictions. Claims and liabilities arising from client problems could result in monetary damages to us and could cause damage to our reputation, adversely affecting our business, results of operations and financial condition.

| If we do not effectively manage our capacity, our results of operations could be adversely affected. |

Our ability to profit from the global trend toward outsourcing depends largely on how effectively we manage our contact center capacity. In order to create the additional capacity necessary to accommodate new or expanded outsourcing projects, we may need to open new contact centers. The opening or expansion of a contact center may result, at least in the short-term, in idle capacity until we fully implement the new or expanded program. We may also experience short-term and/or long-term fluctuations in client demand for services performed in one or more of our contact centers. Short-term downward fluctuations may result in less than optimal site utilization for a period of time. Longer-term downward fluctuations may result in site closures. As a result, we may not achieve or maintain targeted site utilization levels, or site utilization levels may decrease over certain periods and our revenues and profitability may suffer.

| 17 |

| Client consolidation could result in a loss of clients and adversely affect our business. |

We serve clients in industries that have experienced a significant level of consolidation. We cannot assure investors that additional consolidations will not incur in which our clients acquire additional businesses or are acquired themselves. Such consolidations may result in the termination of an existing client contract, which could have an adverse effect on our business, results of operations and financial condition.

| If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud. As a result, current and potential shareholders could lose confidence in our financial reporting, which could harm our business and the trading price of our common stock. |

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. If we cannot provide reliable financial reports or prevent fraud, our brand and operating results could be harmed. We will strive to adopt and implement effective internal controls and maintain the effectiveness of our internal controls in the future; however, we cannot guarantee that our internal controls will be effective. As a result, current and potential shareholders could lose confidence in our financial reporting, which could harm our business and the trading price of our common stock.

| Our intellectual property rights are valuable and any inability to protect them could reduce the value of our brand and our business. |

Our trade secrets, copyrights and our other intellectual property rights are important assets for us. There are events that are outside of our control that pose a threat to our intellectual property rights. Also, the efforts we have taken to protect our propriety rights may not be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to compete. Also, protecting our intellectual property rights could be expensive and time consuming.

| Our shareholders may be diluted significantly through our efforts to obtain financing, fund our operations and satisfy our obligations through issuance of additional shares of our common stock. |

We have no committed source of financing. We will likely have to issue additional shares of our common stock to fund our operations and to implement our plan of operation. Wherever possible, our board of directors will attempt to use non-cash consideration to satisfy obligations. Our board of directors has authority, without action or vote of the shareholders, to issue all or part of the 51,432,533 authorized, but unissued, shares of our common stock. Future issuances of shares of our common stock will result in dilution of the ownership interests of existing shareholders, may further dilute common stock book value and that dilution may be material.

| The marketability and profitability of our services is subject to unknown economic conditions, which could significantly impact our business, financial condition, the marketability of our services and our profitability. |

The marketability and profitability of our services may be adversely affected by local, regional, national and international economic conditions beyond our control and/or the control of our management, which could significantly impact our business, financial condition, the marketability of our services and our ability to earn a profit. Favorable changes may not necessarily enhance the marketability of our services or our profitability.

| 18 |

| Fluctuations in currency exchange rates could materially adversely affect our financial condition and results of operations. |

Our operations are primarily international and we earn our revenues and incur our expenses in multiple currencies. Doing business in different foreign currencies exposes us to foreign currency risks, including risks related to revenues and receivables, compensation of personnel, purchases and capital expenditures. The majority of our revenues are in U.S. dollars and Sri Lankan rupees. However, some of our expenses are denominated in Singapore dollars, Indian rupees and other local currencies. To the extent that we increase our business and revenues which are denominated in currencies other than U.S. dollars and Sri Lankan rupees, we will also increase our receivables denominated in those other currencies and, therefore, also increase our exposure to fluctuations in their exchange rates against the U.S. dollar (our reporting currency) or the Sri Lankan rupee. Similarly, any capital expenditures, such as for computer equipment, which are payable in the local currencies of the countries in which we operate, but are imported to such countries, and any deposits we hold in local currencies, can be materially affected by depreciation of the local currencies against the U.S. dollar or Sri Lankan rupee, and the effect of such depreciation on the local economy. Certain foreign currency exposures, to some extent, are naturally offset on a consolidated basis. However, if our international operations continue to grow, fluctuations in foreign currency exchange rates could materially impact our results of operations and financial condition.

Risks Related to an Investment in Our Securities

| Because one of our shareholders owns 28,000,000 shares of our common stock and 5,000,000 shares of our Series “A” Preferred Stock, he will be able to exert significant influence over corporate decisions that may be disadvantageous to our minority shareholders. |

Our President and Chief Executive Officer, Muhunthan Canagasooryam, currently owns 28,000,000 shares of our common stock and 5,000,000 shares of our Series “A” Preferred Stock, which allows him to cast controlling votes on any and all matters submitted to our shareholders for a vote. As a result of his ownership position, Mr. Canagasooryam will be able to elect all of our directors and control the vote on any matter brought before a meeting of our shareholders. Such control by Mr. Canagasooryam could be disadvantageous to our minority shareholders, who would have little say in the election of our directors and in any acquisition or merger transaction in which we may become involved.

| Our compliance with changing laws and rules regarding corporate governance and public disclosure may result in additional expenses to us which, in turn, may adversely affect our ability to continue our operations. |

Keeping abreast of, and in compliance with, changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002, new SEC regulations and, in the event we are ever approved for listing on either an automated quotation system or a registered exchange, any system or stock exchange rules, will require an increased amount of management attention and external resources. We intend to continue to invest all reasonably necessary resources to comply with evolving standards, which may result in increased general and administrative expenses estimated to be between $60,000 and $75,000 per year and a diversion of management time and attention from revenue-generating activities to compliance and disclosure activities. This could have an adverse impact on our operations.

| 19 |

| Trading in our securities could be subject to extreme price fluctuations that could adversely affect your investment. |

Historically speaking, the market prices for securities of small publicly traded companies have been highly volatile. Publicized events and announcements may have a significant impact on the market price of our common stock.

In addition, the stock market from time to time experiences extreme price and volume fluctuations that particularly affect the market prices for small publicly traded companies and which are often unrelated to the operating performance of the affected companies.

| We do not expect to pay dividends for the foreseeable future. |

We will use any earnings generated from our operations to finance our business and will not pay any cash dividends to our shareholders in the foreseeable future.

| We may be exposed to potential risks resulting from new requirements under Section 404 of the Sarbanes-Oxley Act of 2002. |

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, we will be required, beginning with our second Annual Report on Form 10-K (that will be due on or about June 29, 2018), to include in our annual report our assessment of the effectiveness of our internal control over financial reporting as of the end of such fiscal years.

We do not have a sufficient number of employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees. We have not yet begun our assessment of the effectiveness of our internal control over financial reporting and expect to incur additional expenses and diversion of management’s time as a result of performing the system and process evaluation, testing and remediation required in order to comply with the management certification and auditor attestation requirements. Further, implementing any appropriate changes to our internal controls may distract our officers and employees, entail substantial costs to modify our existing processes and take a significant amount of time to complete. Also, during the course of our testing, we may identify other deficiencies that we may not be able to remediate in time to meet the deadline imposed by the Sarbanes-Oxley Act for compliance with the requirements of Section 404.

In addition, if we fail to achieve and maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to insure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Moreover, effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to help prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information and the trading price of our common stock, if a market ever develops, could drop significantly.

| 20 |

| Our amended articles of incorporation provide for indemnification of officers and directors at our expense and limit their liability, which may result in a major cost to us and hurt the interests of our shareholders because corporate resources may be expended for the benefits of officers and/or directors. |

Our articles of incorporation and applicable Nevada laws provide for the indemnification of our directors, officers, employees and agents under certain circumstances, against attorney’s fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities on our behalf. We will also bear the expenses of such litigation for any of our directors, officers, employees or agents, upon such person’s written promise to repay us, therefore, even if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us that we may be unable to recoup.

We have been advised that, in the opinion of the Securities and Exchange Commission, indemnification for liabilities arising under federal securities laws is against public policy and is, therefore, unenforceable. In the event that a claim for indemnification for liabilities arising under federal securities laws, other than the payment by us of expenses incurred or paid by a director, officer or controlling person in the successful defense of any action, suit or proceeding, is asserted by a director, officer or controlling person in connection with the securities being registered, we will (unless in the opinion of our counsel, the matter has been settled by controlling precedent) submit to a court of appropriate jurisdiction, the question of whether indemnification by us is against public policy as expressed by the Securities and Exchange Commission and will be governed by the final adjudication of such issue. The legal process relating to this matter, if it were to occur, is likely to be very costly and may result is us receiving negative publicity, either of which factors is likely to materially reduce the market price for our shares, if such a market ever develops.

| There are risks associated with forward-looking statements |

This annual report contains certain forward-looking statements regarding management’s plans and objectives for future operations including plans and objectives relating to our planned marketing efforts and future economic performance. The forward-looking statements and associated risks set forth in this annual report include or relate to, among other things, (a) our projected sales and profitability, (b) our growth strategies, (c) anticipated trends in our industry, (d) our ability to obtain and retain sufficient capital for future operations and (e) our anticipated needs for working capital. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Description of Business,” in this annual report, as well as in this annual report, generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this annual report, generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this annual report will, in fact, occur.

For all of the foregoing reasons and other reasons set forth herein, an investment in our securities in any market that may develop in the future will involve a high degree of risk.

| 21 |

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties and other factors that may cause Duo World’s or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by the forward- looking statements.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. We are under no duty to update any of the forward-looking statements after the date of this annual report to confirm our prior statements to actual results.

Further, this annual report contains forward-looking statements that involve substantial risks and uncertainties. Such statements include, without limitation, all statements as to expectation or belief and statements as to our future results of operations, the progress of any product development, the need for, and timing of, additional capital and capital expenditures, partnering prospects, the protection of and the need for additional intellectual property rights, effects of regulations, the need for additional facilities and potential market opportunities.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not applicable.

Description of Property

Duo World Inc. is currently using office facilities at the Regus Centre in Nevada and is located at 170 S Green Valley Parkway, Suite 300, Henderson, NV 89012.

The subsidiary in Sri Lanka is located at No. 403, Galle Road, 00300, Colombo 03, Sri Lanka on a rented office property. The company occupies three floors, with 3,800 square feet on each floor (total of 11,400 square feet) at a monthly rental of U.S. $4,988 per month.

Duo Software India (Private) Limited uses the Regus Centre in New Delhi for all its office facility requirements. The address is 15/F, Eros Corporate Tower, Nehru Place, New Delhi.

Our board of directors must approve any rental arrangement and ensure that it is fair to the Company.

We are not subject to any other pending or threatened litigation.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

| 22 |

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

During the fiscal year ended March 31, 2017, the Company’s Common Stock was not traded.

During February 2017, the Company’s Common Stock started being quoted on the Over-the-Counter Bulletin Board under the symbol “DUUO.OB.” However, no shares of our Common Stock were sold in February or March 2017. The market for the Company’s Common Stock is limited, volatile and sporadic and the price of the Company’s Common Stock could be subject to wide fluctuations in response to quarterly variations in operating results, news announcements, trading volume, sales of Common Stock by officers, directors and principal shareholders of the Company, general market trends, changes in the supply and demand for the Company’s shares, and other factors. The following table sets forth the high and low sales prices for each quarter relating to the Company’s Common Stock for the last two fiscal years. These quotations reflect inter-dealer prices without retail mark-up, markdown, or commissions, and may not reflect actual transactions.

| Fiscal 2017 | High | Low | ||||||

| First Quarter(1) | $ | 0.000 | $ | 0.000 | ||||

| Second Quarter (1) | $ | 0.000 | $ | 0.000 | ||||

| Third Quarter(1) | $ | 0.000 | $ | 0.000 | ||||

| Fourth Quarter (1) | $ | 5.000 | $ | 0.01 | ||||

| Fiscal 2016 | High | Low | ||||||

| First Quarter(1) | $ | 0.000 | $ | 0.000 | ||||

| Second Quarter(1) | $ | 0.000 | $ | 0.000 | ||||

| Third Quarter(1) | $ | 0.000 | $ | 0.000 | ||||

| Fourth Quarter (1) | $ | 0.000 | $ | 0.000 |

| (1) | This represents the closing bid information for the stock on the OTC Bulletin Board. The bid and ask quotations represent prices between dealers and do not include retail markup, markdown or commission. They do not represent actual transactions and have not been adjusted for stock dividends or splits. |