Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - MALIBU BOATS, INC. | exhibit991.htm |

| EX-10.3 - EXHIBIT 10.3 - MALIBU BOATS, INC. | exhibit103-employmentagree.htm |

| EX-10.2 - EXHIBIT 10.2 - MALIBU BOATS, INC. | exhibit102-securityagreeme.htm |

| EX-10.1 - EXHIBIT 10.1 - MALIBU BOATS, INC. | exhibit101-creditagreement.htm |

| EX-2.1 - EXHIBIT 2.1 - MALIBU BOATS, INC. | exhibit21-unitpurchaseagre.htm |

| 8-K - 8-K - MALIBU BOATS, INC. | mbuu8-kjune2017.htm |

Malibu Boats, Inc.

Acquisition of Cobalt Boats, LLC

June 2017

Exhibit 99.2

Forward Looking Statements

This presentation includes forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995). Forward-looking statements

can be identified by such words and phrases as “believes,” “anticipates,” “expects,” “intends,” “estimates,” “may,” “will,” “should,” “continue” and similar expressions,

comparable terminology or the negative thereof, and includes the statements in this presentation regarding the expected timing for the closing of the transaction and

the expected financial and business impact of the transaction, including the expected impact on Malibu’s earnings per share for fiscal year 2018, tax benefits, de-

leveraging and cost and operational synergies and the timeline for achieving such synergies.

Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-

looking statements, including, but not limited to: the satisfaction of the closing conditions to the transaction and conditions for borrowing under the new second

amended and restated credit facility, our ability to efficiently integrate the operations and business of Cobalt upon completion of the transaction, general industry,

economic and business conditions, demand for our products, changes in consumer preferences, competition within our industry, our reliance on our network of

independent dealers, our ability to manage our manufacturing levels and our large fixed cost base, the successful introduction of our new products, and other factors

affecting us detailed from time to time in our filings with the Securities and Exchange Commission. Many of these risks and uncertainties are outside our control, and

there may be other risks and uncertainties which we do not currently anticipate because they relate to events and depend on circumstances that may or may not

occur in the future. Although we believe that the expectations reflected in any forward-looking statements are based on reasonable assumptions at the time made, we

can give no assurance that our expectations will be achieved. Undue reliance should not be placed on these forward-looking statements, which speak only as of the

date hereof. We undertake no obligation (and we expressly disclaim any obligation) to update or supplement any forward-looking statements that may become untrue

because of subsequent events, whether because of new information, future events, changes in assumptions or otherwise.

2

3

Agenda

• Transaction Overview and Rationale

• Cobalt Boats Overview

• Financial Summary

• Closing Comments

Transaction Overview and Rationale

5

Transaction Overview

• Acquiring Cobalt Boats, LLC (“Cobalt”); expect early July 2017 close

• Market leading manufacturer of premium water sport boats, cruisers,

bowriders and outboard boats

• ~$140 million in sales (LTM March 31, 2017)

• $130 million purchase price; including estimated $18 million NPV of future tax

benefits

• Accretive to EPS in FY2018, excluding purchase accounting/acquisition costs

• Synergies through operations, vertical integration and product management

• Cobalt to maintain existing operational footprint in Kansas

Addition of Another World Class Brand to MBUU

6

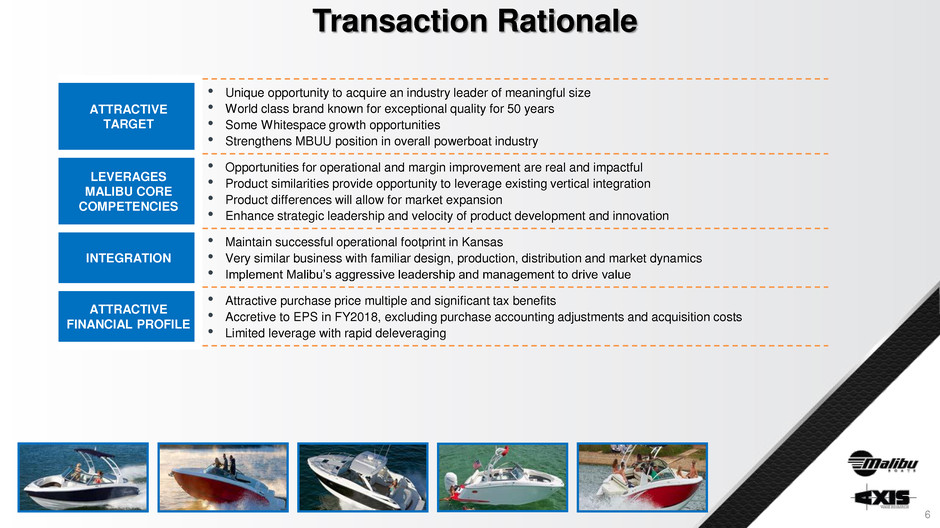

Transaction Rationale

ATTRACTIVE

TARGET

• Unique opportunity to acquire an industry leader of meaningful size

• World class brand known for exceptional quality for 50 years

• Some Whitespace growth opportunities

• Strengthens MBUU position in overall powerboat industry

LEVERAGES

MALIBU CORE

COMPETENCIES

• Opportunities for operational and margin improvement are real and impactful

• Product similarities provide opportunity to leverage existing vertical integration

• Product differences will allow for market expansion

• Enhance strategic leadership and velocity of product development and innovation

INTEGRATION

• Maintain successful operational footprint in Kansas

• Very similar business with familiar design, production, distribution and market dynamics

• Implement Malibu’s aggressive leadership and management to drive value

ATTRACTIVE

FINANCIAL PROFILE

• Attractive purchase price multiple and significant tax benefits

• Accretive to EPS in FY2018, excluding purchase accounting adjustments and acquisition costs

• Limited leverage with rapid deleveraging

7

Cobalt Boats Overview

8

Business Overview

Business Summary

• Founded in 1968 by the St. Clair family

• Comprehensive product portfolio

− Six series with 24 models ranging from 20’ – 40’

• Retail prices range from ~$50k to ~$700k

− ~$80k average price

• Dealer network with 132 locations

• ~600 employees

• Based in Neodesha, Kansas

Strategic Focus

• Culture of excellence focused on the customer

• Reputation for performance and quality

• Innovative new product pipeline, including wake

surf technology and outboard saltwater models

Sales by Series FY161

Net Sales: $135 million

1. Fiscal year ended September 30th

* Includes discontinued pontoon business.

Watersports

Outboard*

Premium

Sterndrive

Entry

Sterndrive

9

World Class Brand with Growth Potential

Entry Sterndrive

Premium Sterndrive

Outboard

Pontoon Series

Watersports

Significant Growth Opportunities Strong Core Business

10

Leading & Defensible Market Position with a

Globally Recognized Brand

• Cobalt is the market leader in large sterndrive boats with a market share of 29.5% in 24’-29’ length segment

• Top distribution with a large percentage of dealers with #1 or #2 market share

• Strong brand and market penetration in core segment provides opportunity in adjacent segments

− Expansion in offerings in varying price points and foot lengths present significant opportunity

− Expansion into outboard fiberglass is a logical brand extension

Source: Statistical Surveys, Inc. LTM as of 3/31/17.

29.5%

14.9%

13.3%

8.6%

8.6%

7.4%

17.7%

OTHERS

#1 U.S. 24’-29’ Sterndrive Market Share

11

Financial Summary

12

Financial Summary

PURCHASE PRICE

• $130 million purchase price, subject to certain adjustments

• Attractive purchase price multiple and significant estimated tax benefits

EARNINGS /

MARGINS AND

SYNERGIES

• Accretive to EPS in FY2018, excluding purchase accounting/acquisition costs

• Significant margin expansion opportunity

• Synergies of $7.5 million by the fourth year

TAXES • Asset basis step up in transaction provides estimated $18 million NPV of future tax benefits

FUNDING

• Funded through cash on hand and borrowing under amended and restated credit agreement

• Delayed draw term loan will be used to close acquisition in July

INTEGRATION

• Minimal risk anticipated

• Cobalt continues to operate in Kansas

• MBUU team to provide best practices to enhance operations

Closing Comments

14

Closing Comments

• Acquisition of significant scale and opportunity

• World class, market leading brand with significant growth opportunities

• Consistent with our stated strategic approach to acquisitions

• Enhanced diversity in distribution and product offering

• Similar business model allows us to use our well developed playbook

• Synergy through operations, vertical integration and product management

• Malibu has been preparing our team for this type of opportunity for years

• Accretive to EPS in FY2018, excluding purchase accounting/acquisition costs

Disciplined and patient acquisition approach has resulted in

a unique opportunity of scale to drive returns