Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Macquarie Leasing Pty Ltd | d387635d8k.htm |

Exhibit 99.1

|

Australia and New Zealand Banking Group Limited

ABN 11 005 357 522

Half Year

31 March 2017

Consolidated Financial Report

Dividend Announcement

and Appendix 4D

|

|

The Consolidated Financial Report and Dividend Announcement contains information required by Appendix 4D of the Australian Securities Exchange (ASX) Listing Rules. It should be read in conjunction with ANZ’s 2016 Annual Report, and is lodged with the ASX under listing rule 4.2A.

|

| RESULTS FOR ANNOUNCEMENT TO THE MARKET | APPENDIX 4D |

| Name of Company: | Australia and New Zealand Banking Group Limited | |

| ABN 11 005 357 522 |

|

Report for the half year ended 31 March 2017

|

||||||||||

| Operating Results1 | AUD million | |||||||||

| Operating income |

ò | -3% | to | 9,996 | ||||||

| Net statutory profit attributable to shareholders |

ñ | 6% | to | 2,911 | ||||||

| Cash profit2 |

ñ | 23% | to | 3,411 | ||||||

| Dividends3 | Cents

per

share |

Franked

amount4

per share |

||||||||

| Proposed interim dividend |

80 | 100% | ||||||||

| Record date for determining entitlements to the proposed 2017 interim dividend |

9 May 2017 | |||||||||

| Payment date for the proposed 2017 interim dividend

|

|

3 July 2017

|

| |||||||

Dividend Reinvestment Plan and Bonus Option Plan

Australia and New Zealand Banking Group Limited (ANZ) has a Dividend Reinvestment Plan (DRP) and a Bonus Option Plan (BOP) that will operate in respect of the proposed 2017 interim dividend. For the 2017 interim dividend, ANZ intends to neutralise shares issued under the DRP by acquiring an equivalent number of shares on market (as approved by APRA). The ‘Acquisition Price’ to be used in determining the number of shares to be provided under the DRP and BOP will be calculated by reference to the arithmetic average of the daily volume weighted average sale price of all fully paid ANZ ordinary shares sold in the ordinary course of trading on the ASX during the ten trading days commencing on 12 May 2017, and then rounded to the nearest whole cent. Shares provided under the DRP and BOP will rank equally in all respects with existing fully paid ANZ ordinary shares. Election notices from shareholders wanting to commence, cease or vary their participation in the DRP or BOP for the 2017 interim dividend must be received by ANZ’s Share Registrar by 5.00pm (Australian Eastern Standard Time) on 10 May 2017. Subject to receiving effective contrary instructions from the shareholder, dividends payable to shareholders with a registered address in the United Kingdom (including the Channel Islands and the Isle of Man) or New Zealand will be converted to Pounds Sterling or New Zealand Dollars respectively at an exchange rate calculated on 12 May 2017.

| 1 | Unless otherwise noted, all comparisons are to the half year ended 31 March 2016. |

| 2 | Cash profit excludes non-core items included in statutory profit and is provided to assist readers in understanding the result of the ongoing business activities of the Group. The non-core items are calculated consistently period on period so as not to discriminate between positive and negative adjustments and fall into one of the three categories: gains or losses included in earnings arising from changes in tax, legal or accounting legislation or other non-core items not associated with the ongoing operations of the Group; treasury shares, revaluation of policy liabilities, economic hedging and similar accounting items that represent timing differences that will reverse through earnings in the future; and accounting reclassifications between individual line items that do not impact reported results, such as policyholders tax gross up. Cash profit is not a measure of cash flow or profit determined on a cash basis. The net after tax adjustment was an addition to statutory profit of $500 million made up of several items. Refer pages 67 to 71 for further details. |

| 3 | There is no conduit foreign income attributed to the dividends. |

| 4 | It is proposed that the interim dividend will be fully franked for Australian tax purposes (30% tax rate) and carry New Zealand imputation credits of NZD 9 cents per ordinary share. |

2

| AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED | ABN 11 005 357 522 |

CONSOLIDATED FINANCIAL REPORT, DIVIDEND ANNOUNCEMENT AND APPENDIX 4D

Half year ended 31 March 2017

|

CONTENTS

|

PAGE | |||

| Disclosure Summary |

5 | |||

| Summary |

7 | |||

| Group Results |

17 | |||

| Divisional Results |

43 | |||

| Profit Reconciliation |

67 | |||

| Condensed Consolidated Financial Statements |

73 | |||

| Supplementary Information |

105 | |||

| Definitions |

117 | |||

| ASX Appendix 4D Cross Reference Index |

120 | |||

| Alphabetical Index |

121 | |||

|

|

||||

This Consolidated Financial Report, Dividend Announcement and Appendix 4D has been prepared for Australia and New Zealand Banking Group Limited (the “Company” or “Parent Entity”) together with its subsidiaries which are variously described as “ANZ”, “Group”, “ANZ Group”, “the consolidated entity”, “the Bank”, “us”, “we” or “our”.

All amounts are in Australian dollars unless otherwise stated. The information on which the Condensed Consolidated Financial Statements are based have been reviewed by the Group’s auditors, KPMG. The Company has a formally constituted Audit Committee of the Board of Directors. The signing of the Condensed Consolidated Financial Statements was approved by resolution of a Committee of the Board of Directors on 1 May 2017.

When used in this Results Announcement the words “estimate”, “project”, “intend”, “anticipate”, “believe”, “expect”, “should” and similar expressions, as they relate to ANZ and its management, are intended to identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. ANZ does not undertake any obligation to publicly release the result of any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

3

| AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED | ABN 11 005 357 522 |

This page has been left blank intentionally

4

DISCLOSURE SUMMARY

SUMMARY OF 2017 HALF YEAR RESULTS AND ASSOCIATED DISCLOSURE MATERIALS

The following disclosure items were lodged separately with the ASX and NZX and can be accessed via the ANZ Shareholder Centre on the Group website http://www.shareholder.anz.com/ within the disclosures for 2017 Half Year Financial Results.

| • | Consolidated Financial Report, Dividend Announcement & Appendix 4D |

| • | Results Presentation Pack |

| • | Investor Discussion Pack |

| • | News Release |

| • | APS 330 Pillar III Disclosure at 31 March 2017 |

| • | Key Financial Data Summary |

| • | UK DTR Submission |

5

DISCLOSURE SUMMARY

This page has been left blank intentionally

6

SUMMARY

CONTENTS

Summary

Statutory Profit Results

Cash Profit Results

Key Balance Sheet Metrics

Cash Profit Results – FX Adjusted

Cash Profit Results – Adjusted Pro-forma

Full Time Equivalent Staff

Other Non-financial Information

7

SUMMARY

Statutory Profit Results

| Half Year | Movement | |||||||||||||||||||||||||||

|

Mar 17 $M |

Sep 16 $M |

Mar 16 $M |

Mar 17 v. Sep 16 |

Mar 17 v. Mar 16 |

||||||||||||||||||||||||

| Net interest income |

7,416 | 7,527 | 7,568 | -1% | -2% | |||||||||||||||||||||||

| Other operating income1

|

2,580 | 2,745 | 2,706 | -6% | -5% | |||||||||||||||||||||||

| Operating income |

9,996 | 10,272 | 10,274 | -3% | -3% | |||||||||||||||||||||||

| Operating expenses1

|

(4,731) | (4,951) | (5,488) | -4% | -14% | |||||||||||||||||||||||

| Profit before credit impairment and income tax |

5,265 | 5,321 | 4,786 | -1% | 10% | |||||||||||||||||||||||

| Credit impairment charge

|

(719) | (1,025) | (904) | -30% | -20% | |||||||||||||||||||||||

| Profit before income tax |

4,546 | 4,296 | 3,882 | 6% | 17% | |||||||||||||||||||||||

| Income tax expense |

(1,627) | (1,318) | (1,140) | 23% | 43% | |||||||||||||||||||||||

| Non-controlling interests

|

(8) | (7) | (4) | 14% | 100% | |||||||||||||||||||||||

| Profit attributable to shareholders of the Company

|

2,911 | 2,971 | 2,738 | -2% | 6% | |||||||||||||||||||||||

| Earnings Per Ordinary Share (cents) | Half Year | Movement | ||||||||||||||||||||||||||

|

Reference Page |

Mar 17

|

Sep 16

|

Mar 16

|

Mar 17 v. Sep 16 |

Mar 17 v. Mar 16 |

|||||||||||||||||||||||

| Basic

|

86 | 100.2 | 102.6 | 94.8 | -2% | 6% | ||||||||||||||||||||||

| Diluted

|

86 | 96.7 | 98.3 | 89.7 | -2% | 8% | ||||||||||||||||||||||

| Half Year | ||||||||||||||||||||

| Reference Page |

Mar 17 | Sep 16 | Mar 16 | |||||||||||||||||

| Ordinary Share Dividends (cents) |

||||||||||||||||||||

| Interim - 100% franked2 |

85 | 80 | - | 80 | ||||||||||||||||

| Final - 100% franked2

|

85 | - | 80 | - | ||||||||||||||||

| Total - 100% franked2 |

85 | 80 | 80 | 80 | ||||||||||||||||

| Ordinary share dividend payout ratio3 |

85 | 80.7% | 78.8% | 85.2% | ||||||||||||||||

| Profitability Ratios |

||||||||||||||||||||

| Return on average ordinary shareholders’ equity4 |

10.1% | 10.5% | 9.5% | |||||||||||||||||

| Return on average assets5 |

0.64% | 0.65% | 0.61% | |||||||||||||||||

| Net interest margin5,6

|

20 | 2.00% | 2.06% | 2.07% | ||||||||||||||||

| Efficiency Ratios |

||||||||||||||||||||

| Operating expenses to operating income1 |

47.3% | 48.2% | 53.4% | |||||||||||||||||

| Operating expenses to average assets1,5

|

1.03% | 1.08% | 1.22% | |||||||||||||||||

| Credit Impairment Charge/(Release) |

||||||||||||||||||||

| Individual credit impairment charge ($M) |

786 | 1,034 | 878 | |||||||||||||||||

| Collective credit impairment charge/(release) ($M)

|

(67) | (9) | 26 | |||||||||||||||||

| Total credit impairment charge ($M) |

89 | 719 | 1,025 | 904 | ||||||||||||||||

| Individual credit impairment charge as a % of average gross loans and advances5 |

0.27% | 0.36% | 0.31% | |||||||||||||||||

| Total credit impairment charge as a % of average gross loans and advances5

|

0.25% | 0.36% | 0.31% | |||||||||||||||||

| 1. | In the March 2017 half, a change was made to the classification of certain fees payable. These items have been reclassified from other operating income to other operating expenses to more accurately reflect the nature of these items. Comparatives have been restated accordingly (Sep 16 half: $8 million; Mar 16 half: $9 million). |

| 2. | Fully franked for Australian tax purposes and carry New Zealand imputation credits of NZD 9 cents per ordinary share for the proposed 2017 interim dividend (2016 final dividend: NZD 9 cents; 2016 interim dividend: NZD 10 cents). |

| 3. | Dividend payout ratio is calculated using the proposed 2017 interim, 2016 final, and 2016 interim dividends. |

| 4. | Average ordinary shareholders’ equity excludes non-controlling interests. |

| 5. | Loans and advances and average assets as at 31 March 2017 include assets held for sale. |

| 6. | In the March 2017 half, the Group changed its calculation of net interest margin to net home loan deposit offset balances against total interest earning assets. Refer to page 20 for further details. |

8

SUMMARY

Cash Profit Results1

| Half Year

|

Movement

|

|||||||||||||||||||||||

|

Mar 17 $M |

Sep 16 $M |

Mar 16 $M |

Mar 17 v. Sep 16 |

Mar 17 v. Mar 16 |

||||||||||||||||||||

| Net interest income |

|

7,416 |

|

|

7,527 |

|

|

7,568 |

|

|

|

-1% |

|

|

-2% |

| ||||||||

|

Other operating income2

|

2,887 | 2,742 | 2,757 | 5% | 5% | |||||||||||||||||||

| Operating income2 |

10,303 | 10,269 | 10,325 | 0% | 0% | |||||||||||||||||||

| Operating expenses

|

(4,731) | (4,951) | (5,488) | -4% | -14% | |||||||||||||||||||

| Profit before credit impairment and income tax |

5,572 | 5,318 | 4,837 | 5% | 15% | |||||||||||||||||||

| Credit impairment charge

|

(720) | (1,038) | (918) | -31% | -22% | |||||||||||||||||||

| Profit before income tax |

4,852 | 4,280 | 3,919 | 13% | 24% | |||||||||||||||||||

| Income tax expense |

(1,433) | (1,166) | (1,133) | 23% | 26% | |||||||||||||||||||

| Non-controlling interests

|

(8) | (7) | (4) | 14% | 100% | |||||||||||||||||||

| Cash profit

|

3,411 | 3,107 | 2,782 | 10% | 23% | |||||||||||||||||||

| Earnings Per Ordinary Share (cents) | Half Year

|

Movement

|

||||||||||||||||||||||||

|

Reference Page |

Mar 17 | Sep 16 | Mar 16 | Mar 17 v. Sep 16 |

Mar 17 v. Mar 16 |

|||||||||||||||||||||

| Basic |

33

|

|

116.7

|

|

|

106.7

|

|

|

95.9

|

|

|

9%

|

|

|

22%

|

| ||||||||||

|

Diluted

|

33 | 111.9 | 102.0 | 90.7 | 10% | 23% | ||||||||||||||||||||

| Half Year

|

||||||||||||||

|

Reference Page |

Mar 17 | Sep 16 | Mar 16 | |||||||||||

| Ordinary Share Dividends |

||||||||||||||

| Ordinary share dividend payout ratio3

|

34 | 68.9% | 75.4% | 83.9% | ||||||||||

| Profitability Ratios |

||||||||||||||

| Return on average ordinary shareholders’ equity4 |

11.8% | 10.9% | 9.7% | |||||||||||

| Return on average assets5 |

0.75% | 0.68% | 0.62% | |||||||||||

| Net interest margin5,6

|

20 | 2.00% | 2.06% | 2.07% | ||||||||||

| Efficiency Ratios |

||||||||||||||

| Operating expenses to operating income2 |

45.9% | 48.2% | 53.2% | |||||||||||

| Operating expenses to average assets2,5

|

1.03% | 1.08% | 1.22% | |||||||||||

| Credit Impairment Charge/(Release) |

||||||||||||||

| Individual credit impairment charge ($M) |

27 | 787 | 1,047 | 892 | ||||||||||

| Collective credit impairment charge/(release) ($M)

|

27 | (67) | (9) | 26 | ||||||||||

| Total credit impairment charge ($M) |

27 | 720 | 1,038 | 918 | ||||||||||

| Individual credit impairment charge as a % of average gross loans and advances5 |

0.27% | 0.36% | 0.31% | |||||||||||

| Total credit impairment charge as a % of average gross loans and advances5

|

0.25% | 0.36% | 0.32% | |||||||||||

| Cash Profit/(Loss) By Division | Half Year

|

Movement

|

||||||||||||||||||||||

| Mar 17 $M |

Sep 16 $M |

Mar 16 $M |

Mar 17 v. Sep 16 |

Mar 17 v. Mar 16 |

||||||||||||||||||||

| Australia |

1,798 | 1,778 | 1,769 | 1% | 2% | |||||||||||||||||||

| Institutional |

1,021 | 408 | 633 | large | 61% | |||||||||||||||||||

| New Zealand |

677 | 622 | 646 | 9% | 5% | |||||||||||||||||||

| Wealth Australia |

123 | 157 | 167 | -22% | -26% | |||||||||||||||||||

| Asia Retail & Pacific |

(217) | 99 | 60 | large | large | |||||||||||||||||||

| TSO and Group Centre

|

9 | 43 | (493) | -79% | large | |||||||||||||||||||

| Cash profit by division

|

3,411 | 3,107 | 2,782 | 10% | 23% | |||||||||||||||||||

| 1. | Cash profit excludes non-core items included in statutory profit and is provided to assist readers in understanding the results of the ongoing business activities of the Group. Refer to pages 67 to 71 for the reconciliation between statutory and cash profit. |

| 2. | In the March 2017 half, a change was made to the classification of certain fees payable. These items have been reclassified from other operating income to other operating expenses to more accurately reflect the nature of these items. Comparatives have been restated accordingly (Sep 16 half: $8 million; Mar 16 half: $9 million). |

| 3. | Dividend payout ratio is calculated using the proposed 2017 interim, 2016 final and 2016 interim dividends. |

| 4. | Average ordinary shareholders’ equity excludes non-controlling interests. |

| 5. | Loans and advances and average assets as at 31 March 2017 include assets held for sale. |

| 6. | In the March 2017 half, the Group changed its calculation of net interest margin to net home loan deposit offset balances against total interest earning assets. Refer to page 20 for further details. |

9

SUMMARY

Key Balance Sheet Metrics1

| As at

|

Movement

| |||||||||||||||

|

Reference |

Mar 17 | Sep 16 | Mar 16 | Mar 17 v. Sep 16 |

Mar 17 v. Mar 16 | |||||||||||

| Capital Management |

||||||||||||||||

|

Common Equity Tier 1 |

||||||||||||||||

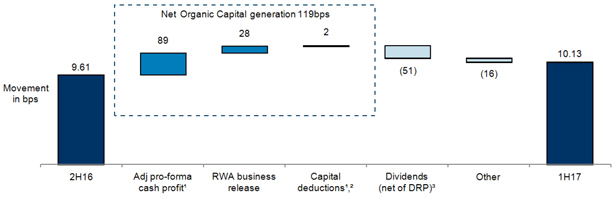

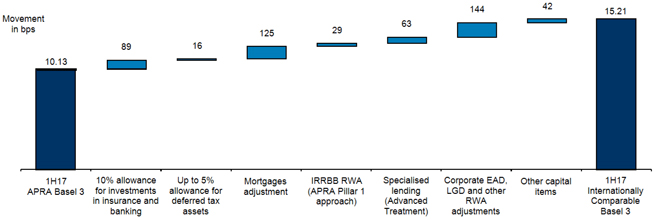

| - APRA Basel 3 |

38 | 10.1% | 9.6% | 9.8% | ||||||||||||

| - Internationally Comparable Basel 32 |

38 | 15.2% | 14.5% | 14.0% | ||||||||||||

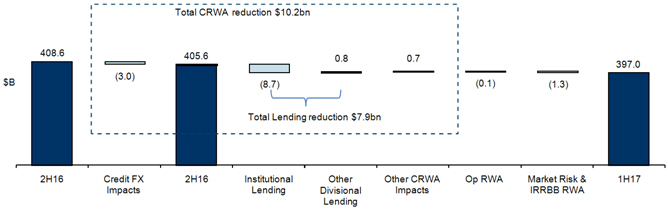

| Credit risk weighted assets ($B)3 |

108 | 341.8 | 352.0 | 334.3 | -3% | 2% | ||||||||||

| Total risk weighted assets ($B)3 |

38 | 397.0 | 408.6 | 388.3 | -3% | 2% | ||||||||||

| Leverage Ratio

|

|

40

|

|

5.3%

|

5.3%

|

5.1%

|

||||||||||

| Balance Sheet: Key Items |

||||||||||||||||

|

Gross loans and advances ($B) |

580.4 | 580.0 | 565.9 | 0% | 3% | |||||||||||

| Net loans and advances ($B) |

576.3 | 575.9 | 561.8 | 0% | 3% | |||||||||||

| Total assets ($B) |

896.5 | 914.9 | 895.3 | -2% | 0% | |||||||||||

| Customer deposits ($B) |

468.2 | 449.6 | 446.8 | 4% | 5% | |||||||||||

| Total equity ($B)

|

57.9

|

57.9

|

56.5

|

0%

|

2%

| |||||||||||

| Half Year Average

|

Movement

| |||||||||||||||

| Liquidity Risk |

Reference |

Mar 17 | Sep 16 | Mar 16 | Mar 17 v. Sep 16 |

Mar 17 v. Mar 16 | ||||||||||

|

Liquidity Coverage Ratio

|

|

36

|

|

135%

|

125%

|

126%

|

10%

|

9%

| ||||||||

| As at

|

Movement

| |||||||||||||||

|

Reference |

Mar 17 | Mar 17 | ||||||||||||||

| Page | Mar 17 | Sep 16 | Mar 16 | v. Sep 16 | v. Mar 16 | |||||||||||

|

Impaired Assets |

||||||||||||||||

|

Gross impaired assets ($M) |

29 | 2,940 | 3,173 | 2,883 | -7% | 2% | ||||||||||

| Gross impaired assets as a % of gross loans and advances |

0.51% | 0.55% | 0.51% | |||||||||||||

| Net impaired assets ($M) |

29 | 1,671 | 1,866 | 1,645 | -10% | 2% | ||||||||||

| Net impaired assets as a % of shareholders’ equity |

2.9% | 3.2% | 2.9% | |||||||||||||

| Individual provision ($M) |

28 | 1,269 | 1,307 | 1,238 | -3% | 3% | ||||||||||

| Individual provision as a % of gross impaired assets |

43.2% | 41.2% | 42.9% | |||||||||||||

| Collective provision ($M) |

28 | 2,785 | 2,876 | 2,862 | -3% | -3% | ||||||||||

| Collective provision as a % of credit risk weighted assets

|

0.81%

|

0.82%

|

0.86%

|

|||||||||||||

| Net Assets |

||||||||||||||||

|

Net tangible assets attributable to ordinary shareholders ($B) |

50.6 | 50.1 | 48.8 | 1% | 4% | |||||||||||

| Net tangible assets per ordinary share ($)

|

17.24

|

17.13

|

16.72

|

1%

|

3%

| |||||||||||

| As at

|

Movement

| |||||||||||

|

Mar 17 |

Sep 16 | Mar 16 | Mar 17 | Mar 17 | ||||||||

| Net Loans And Advances By Division | $B | $B | $B | v. Sep 16 | v. Mar 16 | |||||||

|

Australia |

336.7 | 327.1 | 321.4 | 3% | 5% | |||||||

| Institutional |

120.8 | 125.9 | 125.6 | -4% | -4% | |||||||

| New Zealand |

104.9 | 107.9 | 99.2 | -3% | 6% | |||||||

| Wealth Australia |

1.8 | 2.0 | 1.9 | -10% | -5% | |||||||

| Asia Retail & Pacific |

12.5 | 13.4 | 13.9 | -7% | -10% | |||||||

| TSO and Group Centre

|

(0.4)

|

(0.4)

|

(0.2)

|

0%

|

100%

| |||||||

|

Net loans and advances by division

|

576.3

|

575.9

|

561.8

|

0%

|

3%

| |||||||

| 1. | Balance Sheet amounts and metrics include assets and liabilities held for sale. |

| 2. | See page 38 for further details regarding the differences between APRA Basel 3 and Internationally Comparable Basel 3 standards. |

| 3. | Includes $25.9 billion increase in credit risk weighted assets associated with increased capital requirements for Australian residential mortgages introduced in July 2016. |

10

SUMMARY

Cash Profit Results – FX Adjusted

The following tables present the Group’s cash profit results neutralised for the impact of foreign currency translation. Comparative data has been adjusted to remove the translation impact of foreign exchange movements by retranslating prior period comparatives at current period foreign exchange rates. Refer to page 31 for further details on the impact of exchange rate movements.

Cash Profit - March 2017 Half Year vs March 2016 Half Year

| Half Year | Movement | |||||||||||||||

| Actual | FX unadjusted |

FX impact |

FX adjusted |

FX unadjusted |

FX impact |

FX adjusted | ||||||||||

|

Mar 17 |

Mar 16 | Mar 16 | Mar 16 | Mar 17 | Mar 17 | Mar 17 | ||||||||||

| $M | $M | $M | $M | v. Mar 16 | v. Mar 16 | v. Mar 16 | ||||||||||

|

Net interest income |

7,416 |

7,568 |

(12) |

7,556 |

-2% |

0% |

-2% | |||||||||

| Other operating income

|

2,887 | 2,757 | (35) | 2,722 | 5% | -1% | 6% | |||||||||

| Operating income |

10,303 | 10,325 | (47) | 10,278 | 0% | 0% | 0% | |||||||||

| Operating expenses

|

(4,731) | (5,488) | 45 | (5,443) | -14% | -1% | -13% | |||||||||

| Profit before credit impairment and income tax |

5,572 | 4,837 | (2) | 4,835 | 15% | 0% | 15% | |||||||||

| Credit impairment charge

|

(720) | (918) | 8 | (910) | -22% | -1% | -21% | |||||||||

| Profit before income tax |

4,852 | 3,919 | 6 | 3,925 | 24% | 0% | 24% | |||||||||

| Income tax expense |

(1,433) | (1,133) | (10) | (1,143) | 26% | 1% | 25% | |||||||||

| Non-controlling interests

|

(8) | (4) | 1 | (3) | 100% | large | large | |||||||||

| Cash profit

|

3,411 | 2,782 | (3) | 2,779 | 23% | 0% | 23% | |||||||||

| Cash Profit - March 2017 Half Year vs September 2016 Half Year | ||||||||||||||||

| Half Year | Movement | |||||||||||||||

| Actual | FX unadjusted |

FX impact |

FX adjusted |

FX unadjusted |

FX impact |

FX adjusted | ||||||||||

|

Mar 17 |

Sep 16 | Sep 16 | Sep 16 | Mar 17 | Mar 17 | Mar 17 | ||||||||||

| $M | $M | $M | $M | v. Sep 16 | v. Sep 16 | v. Sep 16 | ||||||||||

|

Net interest income |

7,416 |

7,527 |

- |

7,527 |

-1% |

0% |

-1% | |||||||||

| Other operating income

|

2,887 | 2,742 | 2 | 2,744 | 5% | 0% | 5% | |||||||||

| Operating income |

10,303 | 10,269 | 2 | 10,271 | 0% | 0% | 0% | |||||||||

| Operating expenses

|

(4,731) | (4,951) | 6 | (4,945) | -4% | 0% | -4% | |||||||||

| Profit before credit impairment and income tax |

5,572 | 5,318 | 8 | 5,326 | 5% | 0% | 5% | |||||||||

| Credit impairment charge

|

(720) | (1,038) | 2 | (1,036) | -31% | 0% | -31% | |||||||||

| Profit before income tax |

4,852 | 4,280 | 10 | 4,290 | 13% | 0% | 13% | |||||||||

| Income tax expense |

(1,433) | (1,166) | (5) | (1,171) | 23% | 1% | 22% | |||||||||

| Non-controlling interests

|

(8) | (7) | - | (7) | 14% | 0% | 14% | |||||||||

| Cash profit

|

3,411 | 3,107 | 5 | 3,112 | 10% | 0% | 10% | |||||||||

11

SUMMARY

Cash Profit Results – Adjusted Pro-forma

The Group recognised the impact of a number of items collectively referred to as ‘specified items’ which form part of the Group’s cash profit. The tables on the following pages present the Group’s cash profit adjusted for these items to assist readers to understand the estimated growth rates of the ongoing business performance of the Group. The “Cash Profit Results - Adjusted Pro-forma” is not subject to review or audit by the external auditor. The numbers shown on pages 12 and 13 are on a pre-tax basis.

| • | Asian minority investments adjustments |

Pro-forma

| • | On 30 March 2016, Bank of Tianjin (BoT), an equity accounted investment, completed a capital raising and listing on the Hong Kong Stock Exchange through an Initial Public Offering (IPO). As the Group did not participate in the capital raising, its ownership interest decreased from 14% to 12%. As a consequence, the Group ceased equity accounting for the investment in BoT and commenced accounting for it as an available for sale asset. |

| • | On 3 January 2017, the Group announced that it had agreed to sell its 20% stake in Shanghai Rural Commercial Bank (SRCB) to China COSCO Shipping Corporation Limited and Shanghai Sino-Poland Enterprise Management Development Corporation Limited. The agreement states COSCO and Sino-Poland Enterprise will each acquire 10% of SRCB. The sale is subject to customary closing conditions and regulatory approvals and is expected to be completed in the September 2017 half. As a consequence, the Group ceased equity accounting for the investment in SRCB and commenced accounting for it as an asset held for sale. |

Pro-forma results have been prepared on the assumption that the cessation of equity accounting for the above mentioned Asia minority investments took effect from 1 October 2015, effectively restating the Group’s cash profit for the March 2016, September 2016 and March 2017 half years.

Valuation adjustments

| • | During the March 2016 half year, the Group recognised a $260 million impairment to its equity accounted investment in AMMB Holdings Berhad (AmBank) bringing the carrying value in line with its value-in-use calculation (refer Note 1 (iv) of the Condensed Consolidated Financial Statements). |

| • | On cessation of equity accounting for BoT on 30 March 2016, a net gain of $29 million was recognised in relation to the remeasurement of the investment to fair value and recycling the associated equity accounted reserves. |

| Pro-forma | Valuation adjustments | |||||||||||||

|

BoT |

SRCB | AmBank | BoT | |||||||||||

| $M | $M | Total | $M | $M | Total | |||||||||

|

Mar-16 |

(86) |

(137) |

(223) |

260 |

(29) |

231 | ||||||||

| Sep-16 |

- | (122) | (122) | - | - | - | ||||||||

| Mar-17 |

- | (58) | (58) | - | - | - | ||||||||

| • | Reclassification of Asia Retail and Wealth to held for sale |

On 31 October 2016, the Group announced it had agreed to sell its Retail and Wealth businesses in Singapore, Hong Kong, China, Taiwan and Indonesia to Singapore’s DBS Bank. Subject to regulatory approval, the Group expects the sale to be completed in stages in 2017 and early 2018. As a result of the sale agreement, the Group recognised $324 million of charges to impair software, goodwill and fixed assets as well as providing for redundancies (detailed in Note 11 of the Condensed Consolidated Financial Statements). This business is part of the Asia Retail & Pacific division. There are no pro-forma adjustments as the business was held throughout the March 2017 half.

| • | Software capitalisation changes |

During the March 2016 half, the Group amended the application of the Group’s software capitalisation policy by increasing the threshold for capitalisation of software development costs to $20 million, reflecting the increasingly shorter useful life of smaller items of software, and directly expensing more project related costs. For software assets at 1 October 2015 with an original cost below the revised threshold, the carrying values were expensed through an accelerated amortisation charge of $556 million in the March 2016 half (recognised in TSO and Group Centre). In 2016 reporting, the Group also recognised a $183 million amortisation benefit offset by $370 million of increased operating expenses due to the application of the software capitalisation policy change. These items are not referred to as a specified item in 2017 reporting as they are treated consistently across 2016 and 2017 financial years.

| • | Restructuring |

The Group accelerated the process of reshaping its workforce in 2016 to build a simpler, more agile bank. A restructuring expense of $278 million was recognised as a specified item in the September 2016 full year. Restructuring expenses of $36 million in the half year ended March 2017 have not been classified as a specified item.

12

SUMMARY

| Half Year

| ||||

|

Sep 16 |

Mar 16 | |||

| Restructuring expense by division | $M | $M | ||

| Australia |

45 | 24 | ||

| Institutional |

39 | 53 | ||

| New Zealand |

18 | 3 | ||

| Wealth Australia |

7 | 13 | ||

| Asia Retail & Pacific |

1 | 12 | ||

| TSO and Group Centre

|

30 | 33 | ||

|

Total

|

140 | 138 | ||

| • | Esanda Dealer Finance divestment and pro-forma |

On 1 November 2015, the Group sold the Esanda Dealer Finance portfolio with the majority of the business transferred by 31 December 2015. The gain on sale of the Esanda Dealer divestment was $66 million, which was recognised in the March 2016 half. Pro-forma results have been prepared on the assumption that the sale took effect from 1 October 2015, effectively restating the Group’s cash profit for the March and September 2016 half years.

| • | Derivative CVA methodology change |

In determining the fair value of a derivative, the Group recognises a derivative credit valuation adjustment (CVA) to reflect the probability that the counterparty may default and the Group may not receive the full market value of outstanding transactions. It represents an estimate of the credit adjustment a market participant would include when deriving a purchase price to acquire the exposure. During the September 2016 half, the Group revised its methodology for determining the derivative credit valuation adjustment to make greater use of market information and enhanced modelling, and to align with leading market practice. The impact to cash profit before income tax associated with this methodology change was an incremental derivative credit valuation adjustment charge of $237 million.

13

SUMMARY

Cash Profit Results - Adjusted Pro-forma

| March 2017 Half Year | March 2016 Half Year | Mar 17 v. Mar 16 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash profit |

Asian minority pro-forma |

Reclassific- ation of |

Total specified items |

Adjusted pro-forma |

Cash profit |

Software capital- isation changes |

Asian minority pro-forma |

Asian minority valuation adjustments |

Restruct- uring |

Esanda Dealer Finance divestment and pro-forma |

Derivative CVA methodo- logy change |

Total specified items |

Adjusted pro-forma |

Movement | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 7,416 | - | - | - | 7,416 | 7,568 | - | - | - | - | (31) | - | (31) | 7,537 | -2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other operating income

|

2,887 | (58) | 324 | 266 | 3,153 | 2,757 | - | (223) | 231 | - | (78) | - | (70) | 2,687 | 17% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Operating income | 10,303 | (58) | 324 | 266 | 10,569 | 10,325 | - | (223) | 231 | - | (109) | - | (101) | 10,224 | 3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Operating expenses

|

(4,731) | - | - | - | (4,731) | (5,488) | 556 | - | - | 138 | 11 | - | 705 | (4,783) | -1% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Profit before credit impairment and income tax | 5,572 | (58) | 324 | 266 | 5,838 | 4,837 | 556 | (223) | 231 | 138 | (98) | - | 604 | 5,441 | 7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Credit impairment charge

|

(720) | - | - | - | (720) | (918) | - | - | - | - | 13 | - | 13 | (905) | -20% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Profit before income tax | 4,852 | (58) | 324 | 266 | 5,118 | 3,919 | 556 | (223) | 231 | 138 | (85) | - | 617 | 4,536 | 13% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | (1,433) | - | (40) | (40) | (1,473) | (1,133) | (167) | - | - | (37) | 29 | - | (175) | (1,308) | 13% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-controlling interests

|

(8) | - | - | - | (8) | (4) | - | - | - | - | - | - | - | (4) | 100% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Cash profit

|

3,411 | (58) | 284 | 226 | 3,637 | 2,782 | 389 | (223) | 231 | 101 | (56) | - | 442 | 3,224 | 13% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| March 2017 Half Year | March 2016 Half Year | Mar 17 v. Mar 16 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash profit |

Asian minority pro-forma |

Reclassific- ation of Asia Retail |

Total specified items |

Adjusted pro-forma |

Cash profit |

Software capital- isation changes |

Asian minority pro-forma |

Asian minority valuation adjustments |

Restruct- uring |

Esanda Dealer Finance divestment and pro-forma |

Derivative CVA methodo- logy change |

Total specified items |

Adjusted pro-forma |

Movement | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Profit before income tax by division | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Australia | 2,570 | - | - | - | 2,570 | 2,529 | - | - | - | 24 | (19) | - | 5 | 2,534 | 1% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Institutional | 1,441 | - | - | - | 1,441 | 879 | - | - | - | 53 | - | - | 53 | 932 | 55% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Zealand | 940 | - | - | - | 940 | 889 | - | - | - | 3 | - | - | 3 | 892 | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wealth Australia | 174 | - | - | - | 174 | 235 | - | - | - | 13 | - | - | 13 | 248 | -30% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asia Retail & Pacific | (236) | - | 324 | 324 | 88 | 75 | - | - | - | 12 | - | - | 12 | 87 | 1% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| TSO and Group Centre

|

(37) | (58) | - | (58) | (95) | (688) | 556 | (223) | 231 | 33 | (66) | - | 531 | (157) | -39% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Profit before income tax | 4,852 | (58) | 324 | 266 | 5,118 | 3,919 | 556 | (223) | 231 | 138 | (85) | - | 617 | 4,536 | 13% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense & non-controlling interests

|

(1,441) | - | (40) | (40) | (1,481) | (1,137) | (167) | - | - | (37) | 29 | - | (175) | (1,312) | 13% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Cash profit

|

3,411 | (58) | 284 | 226 | 3,637 | 2,782 | 389 | (223) | 231 | 101 | (56) | - | 442 | 3,224 | 13% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

14

SUMMARY

Cash Profit Results - Adjusted Pro-forma

| March 2017 Half Year | September 2016 Half Year | Mar 17 v. Sep 16 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash profit | Asian minority pro-forma |

Reclassific- ation of Asia Retail & Wealth to held for sale |

Total specified items |

Adjusted pro-forma |

Cash profit | Software capital- isation changes |

Asian minority pro-forma |

Asian minority valuation adjustments |

Restruct- uring |

Esanda |

Derivative CVA methodo- logy change |

Total specified items |

Adjusted pro-forma |

Movement | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 7,416 | - | - | - | 7,416 | 7,527 | - | - | - | - | - | - | - | 7,527 | -1% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other operating income

|

2,887 | (58) | 324 | 266 | 3,153 | 2,742 | - | (122) | - | - | - | 237 | 115 | 2,857 | 10% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Operating income | 10,303 | (58) | 324 | 266 | 10,569 | 10,269 | - | (122) | - | - | - | 237 | 115 | 10,384 | 2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Operating expenses

|

(4,731) | - | - | - | (4,731) | (4,951) | - | - | - | 140 | 6 | - | 146 | (4,805) | -2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Profit before credit impairment and income tax | 5,572 | (58) | 324 | 266 | 5,838 | 5,318 | - | (122) | - | 140 | 6 | 237 | 261 | 5,579 | 5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Credit impairment charge

|

(720) | - | - | - | (720) | (1,038) | - | - | - | - | 10 | - | 10 | (1,028) | -30% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Profit before income tax | 4,852 | (58) | 324 | 266 | 5,118 | 4,280 | - | (122) | - | 140 | 16 | 237 | 271 | 4,551 | 12% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | (1,433) | - | (40) | (40) | (1,473) | (1,166) | - | - | - | (40) | (5) | (69) | (114) | (1,280) | 15% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-controlling interests

|

(8) | - | - | - | (8) | (7) | - | - | - | - | - | - | - | (7) | 14% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Cash profit

|

3,411 | (58) | 284 | 226 | 3,637 | 3,107 | - | (122) | - | 100 | 11 | 168 | 157 | 3,264 | 11% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| March 2017 Half Year | September 2016 Half Year | Mar 17 v. Sep 16 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash profit | Asian minority pro-forma |

Reclassific- ation of Asia Retail & Wealth to held for sale |

Total specified items |

Adjusted pro-forma |

Cash profit | Software capital- isation changes |

Asian minority pro-forma |

Asian minority valuation adjustments |

Restruct- uring |

Esanda |

Derivative CVA methodo- logy change |

Total specified items |

Adjusted pro-forma |

Movement | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Profit before income tax by division | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Australia | 2,570 | - | - | - | 2,570 | 2,533 | - | - | - | 45 | 16 | - | 61 | 2,594 | -1% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Institutional | 1,441 | - | - | - | 1,441 | 600 | - | - | - | 39 | - | 237 | 276 | 876 | 64% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Zealand | 940 | - | - | - | 940 | 858 | - | - | - | 18 | - | - | 18 | 876 | 7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wealth Australia | 174 | - | - | - | 174 | 219 | - | - | - | 7 | - | - | 7 | 226 | -23% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asia Retail & Pacific | (236) | - | 324 | 324 | 88 | 121 | - | - | - | 1 | - | - | 1 | 122 | -28% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| TSO and Group Centre

|

(37) | (58) | - | (58) | (95) | (51) | - | (122) | - | 30 | - | - | (92) | (143) | -34% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Profit before income tax | 4,852 | (58) | 324 | 266 | 5,118 | 4,280 | - | (122) | - | 140 | 16 | 237 | 271 | 4,551 | 12% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense & non-controlling interests

|

(1,441) | - | (40) | (40) | (1,481) | (1,173) | - | - | - | (40) | (5) | (69) | (114) | (1,287) | 15% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Cash profit

|

3,411 | (58) | 284 | 226 | 3,637 | 3,107 | - | (122) | - | 100 | 11 | 168 | 157 | 3,264 | 11% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

15

SUMMARY

Full time equivalent staff 1

As at 31 March 2017, ANZ employed 46,046 people worldwide (Sep 16: 46,554; Mar 16: 48,896) on a full-time equivalent basis (“FTEs”).

| Division | As at

|

Movement

| ||||||||||||

| Mar 17 | Sep 16 | Mar 16 |

Mar

17 |

Mar 17 v. Mar 16 | ||||||||||

|

Australia |

11,518 | 11,639 | 12,094 | -1% | -5% | |||||||||

| Institutional |

4,899 | 5,112 | 5,601 | -4% | -13% | |||||||||

| New Zealand |

6,250 | 6,317 | 6,401 | -1% | -2% | |||||||||

| Wealth Australia |

2,043 | 2,098 | 2,158 | -3% | -5% | |||||||||

| Asia Retail & Pacific |

4,719 | 4,894 | 5,440 | -4% | -13% | |||||||||

| TSO and Group Centre

|

16,617

|

16,494

|

17,202

|

1%

|

-3%

| |||||||||

|

Total

|

46,046

|

46,554

|

48,896

|

-1%

|

-6%

| |||||||||

|

Average FTE

|

46,462

|

47,489

|

49,777

|

-2%

|

-7%

| |||||||||

| Geography | As at

|

Movement

| ||||||||||||

| Mar 17 | Sep 16 | Mar 16 |

Mar 17 v. Sep 16 |

Mar 17 v. Mar 16 | ||||||||||

|

Australia |

19,722 | 19,957 | 20,808 | -1% | -5% | |||||||||

| Asia Pacific, Europe & America |

18,563 | 18,728 | 20,025 | -1% | -7% | |||||||||

| New Zealand

|

7,761 | 7,869 | 8,063 | -1% | -4% | |||||||||

|

Total

|

46,046

|

46,554

|

48,896

|

-1%

|

-6%

| |||||||||

| 1. | Full time equivalent staff have been restated to reflect organisational changes. The net impact of these organisational changes was a decrease in TSO and Group Centre of 8,012 FTE as at September 2016 (March 16: 8,327 FTE), offset by an FTE increase across other divisions. Nil impact to total Group FTE. Refer to page 44 for further details. |

Other Non-financial Information

| Half Year

|

Movement

| |||||||||||||

| Shareholder value - ordinary shares | Mar 17 | Sep 16 | Mar 16 |

Mar

17 |

Mar 17 v. Mar 16 | |||||||||

|

Share price ($) |

||||||||||||||

| - high |

32.44 | 27.85 | 29.17 | 16% | 11% | |||||||||

| - low |

25.78 | 22.06 | 21.86 | 17% | 18% | |||||||||

| - closing |

31.82 | 27.63 | 23.46 | 15% | 36% | |||||||||

| Closing market capitalisation of ordinary shares ($B) |

93.4 | 80.9 | 68.4 | 15% | 37% | |||||||||

| Total shareholder returns (TSR)

|

22.4%

|

21.6%

|

-10.2%

|

4%

|

large

| |||||||||

| As at Mar 17

| ||||||

|

| ||||||

| Credit Ratings | Short-Term | Long-Term | Outlook | |||

| Moody’s Investor Services |

P-1 | Aa2 | Negative | |||

| Standard & Poor’s |

A-1+ | AA- | Negative | |||

| Fitch Ratings

|

F1+

|

AA-

|

Stable

| |||

16

GROUP RESULTS

CONTENTS

Group Results

Cash Profit

Net interest income

Other operating income

Operating expenses

Technology infrastructure spend

Software capitalisation

Credit risk

Income tax expense

Impact of foreign currency translation

Earnings related hedges

Earnings per share

Dividends

Economic profit

Condensed balance sheet

Liquidity risk

Funding

Capital management

Leverage ratio

Other regulatory developments

17

GROUP RESULTS

Non-IFRS information

The Group provides additional measures of performance in the Consolidated Financial Report & Dividend Announcement which are prepared on a basis other than in accordance with accounting standards. The guidance provided in Australian Securities and Investments Commission (ASIC) Regulatory Guide 230 has been followed when presenting this information.

Cash profit

Cash profit represents ANZ’s preferred measure of the result of the ongoing business activities of the Group, enabling readers to assess Group and Divisional performance against prior periods and against peer institutions. To calculate cash profit, the Group excludes non-core items from statutory profit (refer to Definitions for further details). The adjustments made in arriving at cash profit are included in statutory profit which is subject to review within the context of the external auditor’s review of the Condensed Consolidated Financial Statements. Cash profit is not subject to review or audit by the external auditor. The external auditor has informed the Audit Committee that recurring adjustments have been determined on a consistent basis across each period presented, and the additional adjustment for the reclassification of Shanghai Rural Commercial Bank to held for sale in the March 2017 half is appropriate.

The Group Results section is reported on a cash profit basis.

| Half Year

|

Movement

| |||||||||||||||||||

| Mar 17 | Sep 16 | Mar 16 | Mar 17 | Mar 17 | ||||||||||||||||

| $M | $M | $M | v. Sep 16 | v. Mar 16 | ||||||||||||||||

|

Statutory profit attributable to shareholders of the Company |

|

2,911 |

|

|

2,971 |

|

2,738 |

|

-2% |

|

6% | |||||||||

| Adjustments between statutory profit and cash profit1 |

||||||||||||||||||||

|

Treasury shares adjustment |

76 | 73 | (29) | 4% | large | |||||||||||||||

| Revaluation of policy liabilities |

36 | (40) | (14) | large | large | |||||||||||||||

| Economic hedges |

178 | (26) | 128 | large | 39% | |||||||||||||||

| Revenue hedges |

(105) | 131 | (39) | large | large | |||||||||||||||

| Structured credit intermediation trades |

(1) | (2) | (2) | -50% | -50% | |||||||||||||||

| Reclassification of SRCB to held for sale

|

|

316

|

|

|

-

|

|

-

|

|

n/a

|

|

n/a

| |||||||||

| Total adjustments between statutory profit and cash profit

|

|

500

|

|

|

136

|

|

44

|

|

large

|

|

large

| |||||||||

| Cash Profit

|

|

3,411

|

|

|

3,107

|

|

2,782

|

|

10%

|

|

23%

| |||||||||

|

1. Refer to pages 67 to 71 for analysis of the adjustments between statutory profit and cash profit. |

||||||||||||||||||||

|

Group Performance |

Half Year

|

Movement

| ||||||||||||||||||

| Mar 17 | Sep 16 | Mar 16 | Mar 17 | Mar 17 | ||||||||||||||||

| $M | $M | $M | v. Sep 16 | v. Mar 16 | ||||||||||||||||

|

Net interest income |

7,416 | 7,527 | 7,568 | -1% | -2% | |||||||||||||||

| Other operating income

|

|

2,887

|

|

|

2,742

|

|

2,757

|

|

5%

|

|

5%

| |||||||||

|

Operating income |

10,303 | 10,269 | 10,325 | 0% | 0% | |||||||||||||||

| Operating expenses

|

|

(4,731)

|

|

|

(4,951)

|

|

(5,488)

|

|

-4%

|

|

-14%

| |||||||||

|

Profit before credit impairment and income tax |

5,572 | 5,318 | 4,837 | 5% | 15% | |||||||||||||||

| Credit impairment charge

|

|

(720)

|

|

|

(1,038)

|

|

(918)

|

|

-31%

|

|

-22%

| |||||||||

|

Profit before income tax |

4,852 | 4,280 | 3,919 | 13% | 24% | |||||||||||||||

| Income tax expense |

(1,433) | (1,166) | (1,133) | 23% | 26% | |||||||||||||||

| Non-controlling interests

|

|

(8)

|

|

|

(7)

|

|

(4)

|

|

14%

|

|

100%

| |||||||||

| Cash profit

|

|

3,411

|

|

|

3,107

|

|

2,782

|

|

10%

|

|

23%

| |||||||||

|

Half Year

|

Movement

| |||||||||||||||||||

| Mar 17 | Sep 16 | Mar 16 | Mar 17 | Mar 17 | ||||||||||||||||

| Cash Profit/(Loss) By Division | $M | $M | $M | v. Sep 16 | v. Mar 16 | |||||||||||||||

|

Australia |

1,798 | 1,778 | 1,769 | 1% | 2% | |||||||||||||||

| Institutional |

1,021 | 408 | 633 | large | 61% | |||||||||||||||

| New Zealand |

677 | 622 | 646 | 9% | 5% | |||||||||||||||

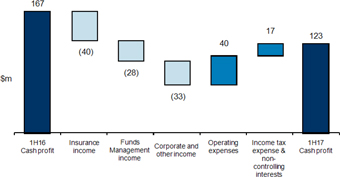

| Wealth Australia |

123 | 157 | 167 | -22% | -26% | |||||||||||||||

| Asia Retail & Pacific |

(217) | 99 | 60 | large | large | |||||||||||||||

| TSO and Group Centre

|

|

9

|

|

|

43

|

|

(493)

|

|

-79%

|

|

large

| |||||||||

| Cash profit

|

|

3,411

|

|

|

3,107

|

|

2,782

|

|

10%

|

|

23%

| |||||||||

18

GROUP RESULTS

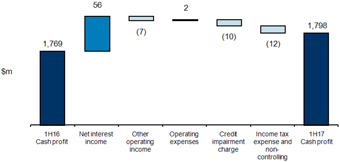

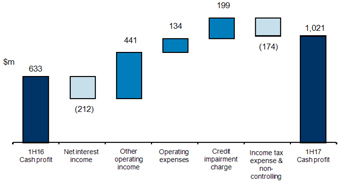

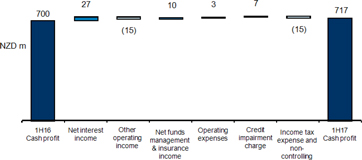

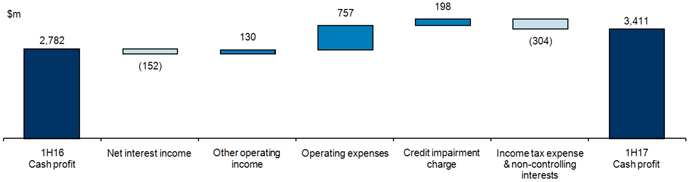

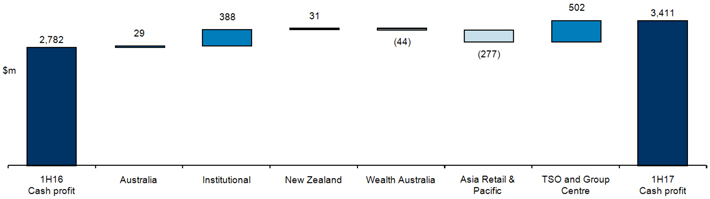

Group Cash Profit – March 2017 Half Year v March 2016 Half Year

| • | March 2017 v March 2016 |

Cash profit increased 23% partly reflecting a number of specified items taken in the March 2016 half. Excluding specified items, cash profit increased 13%.

| • | Net interest income decreased $152 million (-2%) as the result of a 7 basis point decrease in net interest margin, partially offset by 2% growth in average interest earning assets. The net interest margin decline was due to higher average funding costs, deposit competition, growth in the liquidity portfolio and lower capital earnings due to the lower interest rate environment. These impacts were partially offset by repricing in Home Loans. Average interest earning assets growth reflected ANZ’s strategic focus with growth in Home Loans in Australia and New Zealand, partially offset by a reduction in Institutional lending due to portfolio rebalancing. |

| • | Other operating income increased $130 million (+5%) benefiting from a significant improvement in Markets other operating income of $485 million, the $114 million gain on sale of 100 Queen Street, Melbourne, and the $260 million impairment of the investment in AmBank in the March 2016 half. A number of sales related transactions had an unfavourable impact including a $324 million charge related to the sale of Retail and Wealth businesses in Asia, a $177 million loss of earnings from SRCB, BoT and Esanda Dealer Finance, and the $66 million gain on sale of the Esanda Dealer Finance divestment in the March 2016 half. This was additional to a $103 million reduction in funds management and insurance income in Wealth Australia and a $59 million decrease in net fee and commission income. |

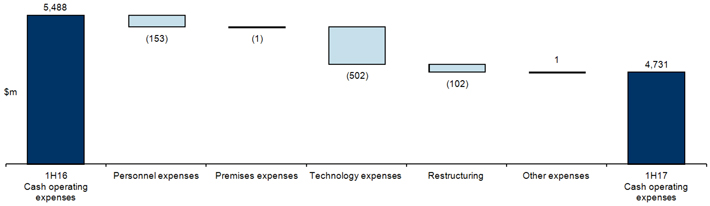

| • | Operating expenses decreased $757 million (-14%), driven by a $556 million charge for software capitalisation policy changes in the March 2016 half, a $153 million (-5%) reduction in personnel expenses reflecting a 7% reduction in average FTE, and a reduction in restructuring expenses of $102 million (-74%). Excluding the impact of software capitalisation policy changes, Technology expenses increased $54 million (+7%) due to higher amortisation from software. |

| • | Credit impairment charges decreased $198 million (-22%). Individual credit impairment charges decreased by $105 million (-12%) primarily due to a reduction in resource related exposures in the Institutional division. Collective impairment charges decreased by $93 million due to an improvement in the Group’s overall risk profile, portfolio rebalancing particularly in Institutional and migration from collective to individual provisions, this was partially offset by a management adjustment for the Queensland cyclone. |

| • | March 2017 v September 2016 |

Cash profit increased 10% compared with the September 2016 half. Excluding specified items, cash profit increased 11%.

| • | Net interest income decreased $111 million (-1%) as the result of a 6 basis point decrease in net interest margin, partially offset by 2% growth in average interest earning assets. The net interest margin decline was due to growth in the liquidity portfolio, lower capital earnings as the result of the lower interest rate environment, higher average funding costs and deposit competition, partially offset by repricing in Home Loans. Average interest earning assets growth was driven by Home Loan growth in Australia and New Zealand. |

| • | Other operating income increased $145 million (+5%) benefiting from a significant improvement in Markets other operating income of $284 million, the $114 million gain on sale of 100 Queen Street, Melbourne, and the $237 million derivative CVA methodology charge recognised in the September 2016 half. Two sales related transactions had an unfavourable impact, the $324 million charge related to the sale of Retail and Wealth businesses in Asia and the $64 million loss of earnings from SRCB. This was additional to a $79 million reduction in funds management and insurance income. |

| • | Operating expenses decreased $220 million (-4%) driven by a $104 million (-74%) reduction in restructuring expenses and a $92 million (-3%) reduction in personnel expenses reflecting a 2% reduction in average FTE. |

| • | Credit impairment charges decreased $318 million (-31%). Individual credit impairment charges decreased by $260 million (-25%) due to a $226 million decrease in the Institutional division. Collective impairment charges decreased $58 million due to an improvement in the Group’s overall risk profile, portfolio rebalancing particularly in Institutional and migration from collective to individual provisions, which was partially offset by a management adjustment for the Queensland cyclone. |

19

GROUP RESULTS

Net interest income

In the March 2017 half, the Group changed its calculation of net interest margin to net home loan deposit offset balances against total interest earning assets. The revised calculation is in line with other major banks. Originally reported net interest margin (Sept 16 half: 2.00%; Mar 16 half: 2.01%) and total average interest earning assets (Sept 16 half: $753,928 million; Mar 16 half: $754,391 million) have been restated accordingly in March 2017 half year reporting.

| Half Year

|

Movement

| |||||||||||||||||

|

Mar 17 |

Sep 16 | Mar 16 | Mar 17 | Mar 17 | ||||||||||||||

| Group | $M | $M | $M | v. Sep 16 | v. Mar 16 | |||||||||||||

|

Cash net interest income1 |

7,416 | 7,527 | 7,568 | -1% | -2% | |||||||||||||

| Average interest earning assets2,3 |

743,906 | 730,275 | 731,395 | 2% | 2% | |||||||||||||

| Average deposits and other borrowings3 |

597,337 | 585,672 | 587,235 | 2% | 2% | |||||||||||||

| Net interest margin (%) - cash2

|

|

2.00

|

|

|

2.06

|

|

2.07

|

-6 bps

|

-7 bps

| |||||||||

| Group (excluding Markets) |

||||||||||||||||||

|

Cash net interest income1 |

6,938 | 7,055 | 7,008 | -2% | -1% | |||||||||||||

| Average interest earning assets2,3 |

538,598 | 533,782 | 533,111 | 1% | 1% | |||||||||||||

| Average deposits and other borrowings3 |

452,671 | 453,424 | 453,136 | 0% | 0% | |||||||||||||

| Net interest margin (%) - cash2

|

|

2.58

|

|

|

2.64

|

|

2.63

|

-6 bps

|

-5 bps

| |||||||||

| Half Year

|

Movement

| |||||||||||||||||

|

Mar 17 |

Sep 16 | Mar 16 | Mar 17 | Mar 17 | ||||||||||||||

| Cash net interest margin by major division | $M | $M | $M | v. Sep 16 | v. Mar 16 | |||||||||||||

|

Australia1 |

||||||||||||||||||

| Net interest margin (%)2 |

2.69 | 2.74 | 2.75 | -5 bps | -6 bps | |||||||||||||

| Average interest earning assets2 |

308,391 | 301,516 | 296,012 | 2% | 4% | |||||||||||||

| Average deposits and other borrowings |

193,671 | 185,274 | 181,118 | 5% | 7% | |||||||||||||

| Institutional |

||||||||||||||||||

| Net interest margin (%) |

1.05 | 1.11 | 1.15 | -6 bps | -10 bps | |||||||||||||

| Average interest earning assets |

302,578 | 297,889 | 313,003 | 2% | -3% | |||||||||||||

| Average deposits and other borrowings |

242,402 | 232,143 | 233,775 | 4% | 4% | |||||||||||||

| New Zealand1 |

||||||||||||||||||

| Net interest margin (%) |

2.30 | 2.35 | 2.40 | -5 bps | -10 bps | |||||||||||||

| Average interest earning assets3 |

109,664 | 105,659 | 100,674 | 4% | 9% | |||||||||||||

| Average deposits and other borrowings3

|

|

79,190

|

|

|

77,661

|

|

73,175

|

2%

|

8%

| |||||||||

| 1. | Cash net interest income includes income relating to assets held for sale and income earned on assets prior to divestment. |

| 2. | In the March 2017 half, the Group changed its calculation of net interest margin to net home loan deposit offset balances against total interest earning assets. Average home loan deposit offset balances for the March 2017 half for the Australia division were $24,979 million (Sep 16 half: $23,653 million; Mar 16 half: $22,996 million). |

| 3. | Balance Sheet amounts as at 31 March 2017 include assets and liabilities held for sale. |

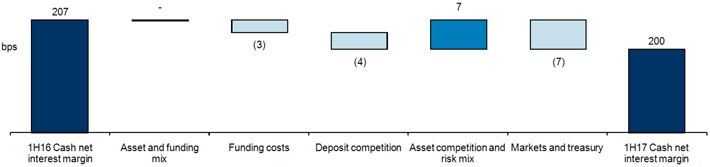

Group net interest margin – March 2017 Half Year v March 2016 Half Year

20

GROUP RESULTS

| • | March 2017 v March 2016 |

Net interest margin (-7 bps)

| • | Asset mix and funding mix (0 bps): favourable mix impact from a higher proportion of capital and run-off of lower margin lending products in Institutional, offset by the adverse mix impact from the Esanda Dealer Finance divestment and improved funding mix. |

| • | Funding costs (-3 bps): adverse impact due to increased wholesale funding costs. |

| • | Deposit competition (-4 bps): lower margin from increased competition in Australia and New Zealand, partially offset by improved margins in Asia. |

| • | Asset competition and risk mix (+7 bps): increase driven by Home Loans repricing. |

| • | Markets and treasury (-7 bps): adverse impact to earnings on capital as the result of lower interest rates, growth in the liquidity portfolio and lower earnings from markets activities. |

Average interest earning assets (+$12.5 billion or +2%)

| • | Average gross loans and advances (+$5.2 billion or +1%): increase driven by growth in Home Loans, partially offset by a decline in Institutional lending due to portfolio rebalancing. |

| • | Average trading and available for sale assets (+$5.7 billion or +6%): increase driven by growth in the liquidity portfolio. |

| • | Average cash (+$2.2 billion or +4%): increase as the result of management of liquidity requirements. |

Average deposits and other borrowings (+$10.1 billion or +2%)

| • | Average deposits and other borrowings (+$10.1 billion or +2%): increase driven by growth in customer deposits across Australia, Institutional and New Zealand divisions, offset by a decline in Treasury (commercial paper). |

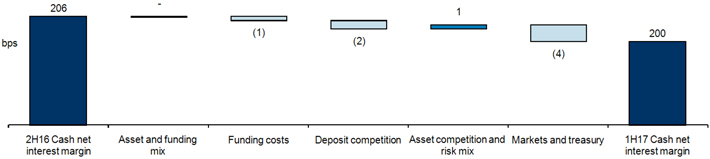

Group net interest margin – March 2017 Half Year v September 2016 Half Year

| • | March 2017 v September 2016 |

Net interest margin (-6 bps)

| • | Asset mix and funding mix (0 bps): favourable mix impact from a higher proportion of capital and run-off of lower margin loan products in Institutional, offset by adverse mix impact from lower growth in Cards in the Australia division and improved funding mix. |

| • | Funding costs (-1 bps): adverse impact due to increased wholesale funding costs. |

| • | Deposit competition (-2 bps): lower margin from increased competition in Australia and New Zealand, partially offset by improved margins in Asia. |

| • | Asset competition and risk mix (+1 bps): driven by Home Loan repricing, partially offset by lower Institutional and Commercial lending margins. |

| • | Markets and treasury (-4 bps): adverse impact to earnings on capital as the result of lower interest rates, growth in the liquidity portfolio and lower earnings from markets activities. |

Average interest earning assets (+$13.6 billion or +2%)

| • | Average gross loans and advances (+$4.8 billion or +1%): increase driven by growth in Home Loans, partially offset by a decline in Institutional lending due to portfolio rebalancing. |

| • | Average trading and available for sale assets (+$4.1 billion or +4%): increase driven by growth in the liquidity portfolio. |

| • | Average cash (+7.2 billion or +16%): increase as the result of management of liquidity requirements. |

Average deposits and other borrowings (+$11.7 billion or +2%)

| • | Average deposits and other borrowings (+$11.7 billion or +2%): increase driven by growth in customer deposits across Australia, New Zealand and Institutional divisions, offset by a decline in Treasury (commercial paper). |

21

GROUP RESULTS

Other operating income

| Half Year

|

Movement

| |||||||||||||||||||

|

|

Mar 17 |

|

Sep 16 | Mar 16 | Mar 17 | Mar 17 | ||||||||||||||

| $M | $M | $M | v. Sep 16 | v. Mar 16 | ||||||||||||||||

| Net fee and commission income1 |

1,177 | 1,201 | 1,236 | -2% | -5% | |||||||||||||||

| Net funds management and insurance income1 |

668 | 747 | 771 | -11% | -13% | |||||||||||||||

| Markets other operating income2 |

886 | 365 | 401 | large | large | |||||||||||||||

| Share of associates’ profit1 |

173 | 243 | 301 | -29% | -43% | |||||||||||||||

| Net foreign exchange earnings1 |

157 | 149 | 141 | 5% | 11% | |||||||||||||||

| Other1,3

|

|

(174)

|

|

|

37

|

|

(93)

|

|

large

|

|

-87%

| |||||||||

| Cash other operating income

|

2,887 | 2,742 | 2,757 | 5% | 5% | |||||||||||||||

| Half Year

|

Movement

| |||||||||||||||||||

| Mar 17 | Sep 16 | Mar 16 | Mar 17 | Mar 17 | ||||||||||||||||

| Markets income |

$M | $M | $M | v. Sep 16 | v. Mar 16 | |||||||||||||||

|

Net interest income |

478 | 472 | 560 | 1% | -15% | |||||||||||||||

| Other operating income2

|

|

886

|

|

|

365

|

|

401

|

|

large

|

|

large

| |||||||||

| Cash Markets income

|

1,364 | 837 | 961 | 63% | 42% | |||||||||||||||

| Half Year

|

Movement

| |||||||||||||||||||

| Mar 17 | Sep 16 | Mar 16 | Mar 17 | Mar 17 | ||||||||||||||||

| Other operating income by division |

$M | $M | $M | v. Sep 16 | v. Mar 16 | |||||||||||||||

| Australia |

602 | 597 | 609 | 1% | -1% | |||||||||||||||

| Institutional2 |

1,357 | 817 | 916 | 66% | 48% | |||||||||||||||

| New Zealand |

317 | 329 | 315 | -4% | 1% | |||||||||||||||

| Wealth Australia |

539 | 605 | 639 | -11% | -16% | |||||||||||||||

| Asia Retail & Pacific |

(139) | 235 | 243 | large | large | |||||||||||||||

| TSO and Group Centre3

|

|

211

|

|

|

159

|

|

35

|

|

33%

|

|

large

| |||||||||

| Cash other operating income

|

2,887 | 2,742 | 2,757 | 5% | 5% | |||||||||||||||

| 1. | Excluding Markets. |

| 2. | Markets other operating income for the September 2016 half includes a charge of $237 million related to the derivative CVA methodology change. |

| 3. | Other income for the March 2017 half includes the $324 million charge related to the sale of Retail & Wealth businesses in Asia, and the $114 million gain on sale of 100 Queen Street, Melbourne. The March 2016 half includes the $260 million impairment of the investment in AmBank, the $29 million gain on cessation of equity accounting of BoT, and the $66 million gain on the Esanda Dealer Finance divestment. |

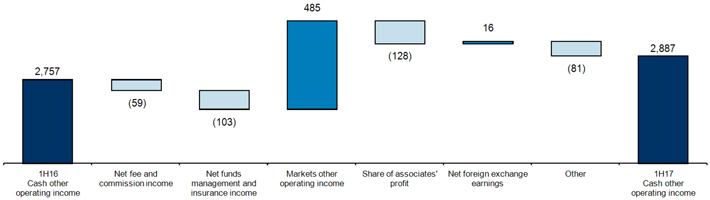

Other operating income – March 2017 Half Year v March 2016 Half Year

22

GROUP RESULTS

| • | March 2017 v March 2016 |

Other operating income increased by $130 million (+5%). Key drivers:

Net fee and commission income (-$59 million or -5%)

| • | $37 million decrease as the result of lower performance in Asia Retail & Pacific. |

| • | $22 million decrease in Institutional primarily due to portfolio rebalancing. |

Net funds management and insurance income (-$103 million or -13%)

| • | $104 million decrease in Wealth Australia primarily due to adverse disability claims, partially offset by favourable Lenders Mortgage Insurance experience, reduced fee income as expected from ongoing rationalisation of legacy investment platforms to SmartChoice and lower income from invested capital. |

Cash Markets income (+$403 million or +42%)

| • | $258 million increase in Franchise Trading as the result of favourable trading conditions arising from a strengthening USD and rising yield curves. Tighter credit spreads, combined with the impact of foreign exchange and interest rate movements resulted in an increase of $197 million from derivative credit and funding valuation adjustments, net of associated hedges. |

| • | $204 million increase in Balance Sheet Trading reflecting growth in the liquidity portfolio and tighter bond spreads. |

| • | $59 million decrease in Franchise Sales due to reduced client hedging activity as a result of low FX volatility and the low interest rate environment. |

Share of associates’ profit (-$128 million or -43%)

| • | $165 million decrease due to the cessation of equity accounting for BoT from March 2016 and SRCB from January 2017. |

| • | $33 million increase due to P.T. Bank Pan Indonesia. |

Other (-$81 million or -87%)

| • | $324 million decrease as a result of the sale of Retail and Wealth businesses in Asia. |

| • | $66 million decrease due to the Esanda Dealer Finance gain on divestment taken in the March 2016 half. |

| • | $29 million decrease due to a valuation gain on cessation of equity accounting for BoT in the March 2016 half. |

| • | $260 million increase due to the impairment of the investment in AmBank in the March 2016 half. |

| • | $114 million gain on sale of 100 Queen Street, Melbourne. |

| • | March 2017 v September 2016 |

Other operating income increased by $145 million (+5%). Key drivers:

Net fee and commission income (-$24 million or -2%)

| • | $35 million decrease as the result of lower performance in Asia Retail & Pacific. |

Net funds management and insurance income (-$79 million or -11%)

| • | $66 million decrease in Wealth Australia primarily due to adverse disability and lump sum claims, partially offset by favourable Lenders Mortgage Insurance experience, reduced fee income as expected from ongoing rationalisation of legacy investment platforms to SmartChoice and lower returns from the guaranteed business and invested capital. |

Cash Markets income (+$527 million or +63%)

| • | Excluding the $237 million charge relating to the derivative CVA methodology change in the September 2016 half, Markets income increased $290 million. |

| • | $231 million increase in Franchise Trading primarily attributed to valuation adjustments net of associated hedges as a result of tighter credit spreads combined with the impact of foreign exchange and interest rate movements. |

| • | $118 million increase in Balance Sheet Trading due to tighter bond spreads. |

| • | $59 million decrease in Franchise Sales due to lower client flows as a result of reduced volumes of debt issuances in Asia and New Zealand. |

Share of associates’ profit (-$70 million or -29%)

| • | $64 million loss of income due to the cessation of equity accounting for SRCB from January 2017. |

Other (-$211 million)

| • | $324 million charge as the result of the sale of Retail and Wealth businesses in Asia. |

| • | $114 million gain on sale of 100 Queen Street, Melbourne. |

23

GROUP RESULTS

Operating Expenses

| Half Year

|

Movement

| |||||||||||||||||||

| Mar 17 | Sep 16 | Mar 16 | Mar 17 | Mar 17 | ||||||||||||||||

| $M | $M | $M | v. Sep 16 | v. Mar 16 | ||||||||||||||||

| Personnel expenses |

2,648 | 2,740 | 2,801 | -3% | -5% | |||||||||||||||

| Premises expenses |

457 | 470 | 458 | -3% | 0% | |||||||||||||||

| Technology expenses1 |

831 | 834 | 1,333 | 0% | -38% | |||||||||||||||

| Restructuring expenses |

36 | 140 | 138 | -74% | -74% | |||||||||||||||

| Other expenses

|

|

759

|

|

|

767

|

|

758

|

|

-1%

|

|

0%

| |||||||||

| Total cash operating expenses

|

|

4,731

|

|

|

4,951

|

|

5,488

|

|

-4%

|

|

-14%

| |||||||||

| Full time equivalent staff (FTE) |

46,046 | 46,554 | 48,896 | -1% | -6% | |||||||||||||||

| Average full time equivalent staff (FTE)

|

|

46,462

|

|

|

47,489

|

|

49,777

|

|

-2%

|

|

-7%

| |||||||||

| 1. | Technology expenses include a $556 million charge associated with accelerated amortisation from the software capitalisation policy changes in the March 2016 half. Refer to page 12 for further details. |

| Half Year

|

Movement

| |||||||||||||||||||

| Mar 17 | Sep 16 | Mar 16 | Mar 17 | Mar 17 | ||||||||||||||||

| Expenses by division |

$M | $M | $M | v. Sep 16 | v. Mar 16 | |||||||||||||||

| Australia |

1,693 | 1,731 | 1,695 | -2% | 0% | |||||||||||||||

| Institutional |

1,379 | 1,445 | 1,513 | -5% | -9% | |||||||||||||||

| New Zealand |

600 | 635 | 590 | -6% | 2% | |||||||||||||||

| Wealth Australia |

370 | 391 | 410 | -5% | -10% | |||||||||||||||

| Asia Retail & Pacific |

353 | 379 | 429 | -7% | -18% | |||||||||||||||

| TSO and Group Centre

|

|

336

|

|

|

370

|

|

851

|

|

-9%

|

|

-61%

| |||||||||

| Total cash operating expenses

|

|

4,731

|

|

|

4,951

|

|

5,488

|

|

-4%

|

|

-14%

| |||||||||

Operating expenses – March 2017 Half Year v March 2016 Half Year

| • | March 2017 v March 2016 |

Operating expenses decreased 14% reflecting a number of specified items taken in the March 2016 half. Excluding specified items, operating expenses were down 1%.

| • | Personnel expenses decreased $153 million (-5%) due to a 7% reduction in average FTE, partially offset by wage inflation. |

| • | Technology expenses decreased $502 million (-38%) primarily as the result of software capitalisation policy charges of $556 million in the March 2016 half. Excluding this, Technology expenses increased $54 million (+7%) due to higher amortisation from software. |

| • | Restructuring expenses decreased $102 million (-74%) with larger investment in 2016 at the reset of the Group’s strategy. |

| • | March 2017 v September 2016 |

Operating expenses decreased 4%. Excluding specified items, operating expenses decreased 2%.

| • | Personnel expenses decreased $92 million (-3%) due to a 2% reduction in average FTE, partially offset by wage inflation. |

| • | Restructuring expenses decreased $104 million (-74%) with larger investment in 2016 at the reset of the Group’s strategy. |

24

GROUP RESULTS

Technology infrastructure spend

Technology infrastructure spend includes expenditure that develops and enhances the Group’s technology infrastructure to meet business and strategic objectives and to improve capability and efficiency. The analysis below aggregates all projects over $1 million. Spend on projects less than $1 million was $84 million in the March 2017 half (Sep 16 half: $92 million; Mar 16 half $83 million).

| Half Year

|

Movement

| |||||||||||||||||||

| Mar 17 | Sep 16 | Mar 16 | Mar 17 | Mar 17 | ||||||||||||||||

| $M | $M | $M | v. Sep 16 | v. Mar 16 | ||||||||||||||||

| Expensed investment spend |

225 | 254 | 272 | -11% | -17% | |||||||||||||||

| Capitalised investment spend |

160 | 203 | 197 | -21% | -19% | |||||||||||||||

| Technology infrastructure spend

|

|

385

|

|

|

457

|

|

469

|

|

-16%

|

|

-18%

| |||||||||

| Comprising | Half Year

|

Movement

| ||||||||||||||||||

| Mar 17 | Sep 16 | Mar 16 | Mar 17 | Mar 17 | ||||||||||||||||

| $M | $M | $M | v. Sep 16 | v. Mar 16 | ||||||||||||||||

| Growth |

122 | 147 | 186 | -17% | -34% | |||||||||||||||

| Productivity |

83 | 84 | 87 | -1% | -5% | |||||||||||||||

| Risk and compliance |

101 | 114 | 115 | -11% | -12% | |||||||||||||||

| Infrastructure and other |

79 | 112 | 81 | -29% | -2% | |||||||||||||||

| Technology infrastructure spend

|

|

385

|

|

|

457

|

|

469

|

|

-16%

|

|

-18%

| |||||||||

| Technology infrastructure spend breakdown: | Mar-17 $M

| |||

| • | March 2017 v March 2016: The reduced investment in the March 2017 half reflects lower investment in Wealth Australia and Institutional as well as productivity initiatives to reduce costs of project delivery. |

| ||

| • | March 2017 v September 2016: The reduced investment in the March 2017 half reflects the recalibration of investment spend for a simpler and less complex organisation. Project delivery initiatives delivered savings across all divisions and expenditure on productivity initiatives was maintained. | |||

| Technology infrastructure spend by division

|

Half Year

|

Movement

| ||||||||||||||||||

| Mar 17 | Sep 16 | Mar 16 | Mar 17 | Mar 17 | ||||||||||||||||

| $M | $M | $M | v. Sep 16 | v. Mar 16 | ||||||||||||||||

| Australia |

130 | 131 | 143 | -1% | -9% | |||||||||||||||

| Institutional |

60 | 79 | 96 | -24% | -38% | |||||||||||||||

| New Zealand |

31 | 38 | 37 | -18% | -16% | |||||||||||||||

| Asia Retail & Pacific |

1 | 3 | 4 | -67% | -75% | |||||||||||||||

| Wealth Australia |

25 | 24 | 45 | 4% | -44% | |||||||||||||||

| TSO and Group Centre |

138 | 182 | 144 | -24% | -4% | |||||||||||||||

| Technology infrastructure spend

|

|

385

|

|

|

457

|

|

469

|

|