Attached files

| file | filename |

|---|---|

| EX-99.4 - EXHIBIT 99.4 - Orion Group Holdings Inc | exhibit994proformanotes.htm |

| EX-99.2 - EXHIBIT 99.2 - Orion Group Holdings Inc | exhibit99233117tonybagli.htm |

| EX-99.1 - EXHIBIT 99.1 - Orion Group Holdings Inc | exhibit991123116tonybagl.htm |

| EX-23.1 - EXHIBIT 23.1 - Orion Group Holdings Inc | exhibit231oriongrouphold.htm |

| 8-K/A - 8-K/A - Orion Group Holdings Inc | tbc8-kaamendment.htm |

Exhibit 99.3

ASSETS Orion Group Holdings T.B.C. Combined Historical Pro Forma Adjustments Combined Pro Forma

Current assets:

Cash and cash equivalents 1,550$ 181$ 1,731$ (181)$ (1) 1,550$

Accounts receivable:

Trade, net of allowance of $0 and $0, respectively 77,628 3,144 80,772 - 80,772

Retainage 36,490 1,973 38,463 - 38,463

Other current 3,467 9 3,476 - 3,476

Income taxes receivable 99 - 99 - 99

Inventory 5,527 - 5,527 - 5,527

Costs and estimated earnings in excess of billings on uncompleted contracts 46,294 5 46,299 - 46,299

Assets held for sale 6,375 - 6,375 - 6,375

Prepaid expenses and other 3,733 - 3,733 - 3,733

Total current assets 181,163 5,312 186,475 (181) 186,294

Property and equipment, net 153,916 1,732 155,648 366 (2) 156,014

Accounts receivable, non-current 1,748 - 1,748 - 1,748

Inventory, non-current 3,989 - 3,989 - 3,989

Deferred tax asset, non-current 2,013 - 2,013 - 2,013

Goodwill 66,351 - 66,351 2,420 (3) 68,771

Intangible assets, net of amortization 20,763 - 20,763 1,114 (4) 21,877

Other noncurrent 1,495 - 1,495 - 1,495

Total assets 431,438 7,044 438,482 3,719 442,201

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Current debt, net of debt issuance costs 13,712 936 14,648 5,064 (5)&(6) 19,712

Accounts payable:

Trade 50,656 1,856 52,512 - 52,512

Retainage 758 - 758 - 758

Accrued liabilities 15,615 67 15,682 - 15,682

Taxes payable 269 17 286 - 286

Billings in excess of costs and estimated earnings on uncompleted contracts 24,564 1,184 25,748 - 25,748

Total current liabilities 105,574 4,060 109,634 5,064 114,698

Long-term debt, net of debt issuance costs 78,822 715 79,537 (715) (5) 78,822

Other long-term liabilities 2,841 - 2,841 465 (7) 3,306

Deferred income taxes 17,767 - 17,767 1,174 (8) 18,941

Interest rate swap liability 186 - 186 - 186

Total liabilities 205,190 4,775 209,965 5,988 215,953

Stockholders’ equity:

284 10 294 (10) (9) 284

(6,540) - (6,540) - (6,540)

Accumulated other comprehensive loss (186) - (186) - (186)

Additional paid-in capital 172,051 33 172,084 (33) (9) 172,051

Retained earnings 60,639 2,226 62,865 (2,226) (9) 60,639

Total stockholders’ equity 226,248 2,269 228,517 (2,269) 226,248

Total liabilities and stockholders’ equity 431,438$ 7,044$ 438,482$ 3,719$ 442,201$

** See accompany notes to the Unaudited Pro Forma Combined Consolidated Financial Information

(1) Reflects the decrease of cash as a result of the terms of the purchase agreement

(2) Reflects the fair value adjustment to the acquired property and equipment

(3) Reflects the preliminary estimate of goodwill, which represents the excess of the purchase price over the fair value of the acquireee's assets acquired and liabilities assumed

(4) Reflects the fair value adjustment for intangible assets

(5) Represents the debt extinguished under the terms of the acquisition

(6)

(7)

(8) Deferred income tax related to long-lived intangible assets and fixed assets acquired

(9) Reflects the reduction of the acquiree's membership interests

UNAUDITED PRO FORMA COMBINED BALANCE SHEET

March 31, 2017

Common stock

Treasury stock

Reflects total contingent consideration calculated based on purchase agreement

The purchase of TBC was a cash purchase by Orion. At the purchase date Orion had enough cash on hand to make the $6 million purchase. At March 31, 2017, Orion had less than the total purchase price in cash, if the

acquisition had been made at this date Orion would have borrowed from the Company's existing revolving line of credit and made payments once cash on hand had increased. As such, in the pro forma calculation the $6

million purchase price was applied to current debt to represent a draw on the existing LOC.

Exhibit 99.3

Orion Group Holdings T.B.C. Combined Historical Pro Forma Adjustments Combined Pro Forma

Contract revenues 138,757$ 5,177$ 143,934$ -$ 143,934$

Costs of contract revenues 125,772 5,172 130,944 - 130,944

Gross profit 12,985 5 12,990 - 12,990

Selling, general and administrative expenses 14,979 266 15,245 34 (3) 15,279

(Gain) loss on sale of assets, net (512) - (512) - (512)

Operating loss from operations (1,482) (261) (1,743) (34) (1,777)

Other (expense) income

Other income 10 2 12 - 12

Interest income - - - - -

Interest expense (1,355) (8) (1,363) 8 (2) (1,355)

Other expense, net (1,345) (6) (1,351) 8 (1,343)

Loss before income taxes (2,827) (267) (3,094) (26) (3,120)

Income tax benefit (1,019) - (1,019) (103) (1) (1,122)

Net loss (1,808)$ (267)$ (2,075)$ 76$ (1,999)$

Earnings per common share:

Basic loss per share (0.07) (0.07) (0.07)

Diluted loss per share (0.07) (0.07) (0.07)

Shares used to compute loss per share

Basic 27,786,087 27,786,087 27,786,087

Diluted 27,786,087 27,786,087 27,786,087

** See accompany notes to the Unaudited Pro Forma Combined Consolidated Financial Information

(1) Annual taxes for TBC adjusted for pro forma calculated at the statutory tax rate of 35%

(2) Interest on loans extinguished during purchase by Orion

(3) Intangible amortization on intangibles identified during acquisition

UNAUDITED PRO FORMA COMBINED CONSOLIDATED STATEMENTS OF INCOME

For the Three Month Period Ended March 31, 2017

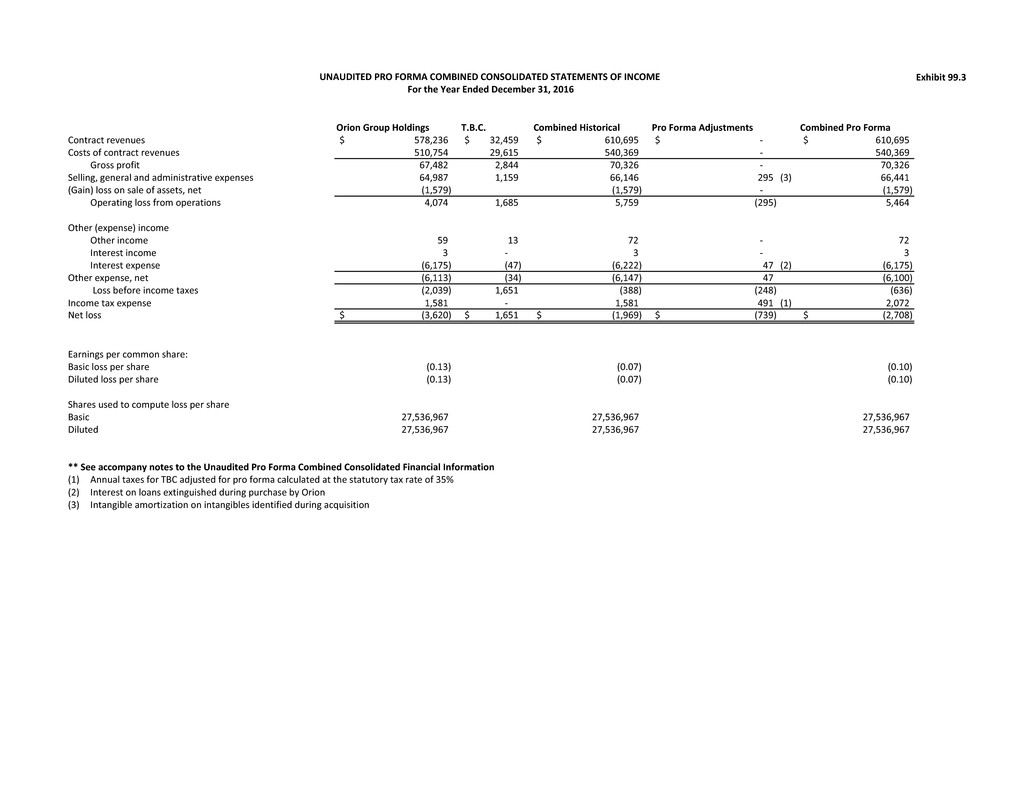

Exhibit 99.3

Orion Group Holdings T.B.C. Combined Historical Pro Forma Adjustments Combined Pro Forma

Contract revenues 578,236$ 32,459$ 610,695$ -$ 610,695$

Costs of contract revenues 510,754 29,615 540,369 - 540,369

Gross profit 67,482 2,844 70,326 - 70,326

Selling, general and administrative expenses 64,987 1,159 66,146 295 (3) 66,441

(Gain) loss on sale of assets, net (1,579) (1,579) - (1,579)

Operating loss from operations 4,074 1,685 5,759 (295) 5,464

Other (expense) income

Other income 59 13 72 - 72

Interest income 3 - 3 - 3

Interest expense (6,175) (47) (6,222) 47 (2) (6,175)

Other expense, net (6,113) (34) (6,147) 47 (6,100)

Loss before income taxes (2,039) 1,651 (388) (248) (636)

Income tax expense 1,581 - 1,581 491 (1) 2,072

Net loss (3,620)$ 1,651$ (1,969)$ (739)$ (2,708)$

Earnings per common share:

Basic loss per share (0.13) (0.07) (0.10)

Diluted loss per share (0.13) (0.07) (0.10)

Shares used to compute loss per share

Basic 27,536,967 27,536,967 27,536,967

Diluted 27,536,967 27,536,967 27,536,967

** See accompany notes to the Unaudited Pro Forma Combined Consolidated Financial Information

(1) Annual taxes for TBC adjusted for pro forma calculated at the statutory tax rate of 35%

(2) Interest on loans extinguished during purchase by Orion

(3) Intangible amortization on intangibles identified during acquisition

UNAUDITED PRO FORMA COMBINED CONSOLIDATED STATEMENTS OF INCOME

For the Year Ended December 31, 2016