Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of

report (Date of earliest event reported): June 9,

2017

|

ENVIRONMENTAL PACKAGING TECHNOLOGIES HOLDINGS, INC.

|

|

(Exact

name of registrant as specified in its charter)

|

|

Nevada

|

|

333-182629

|

|

45-5634033

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File No.)

|

|

(IRS

Employer

Identification

No.)

|

|

6100 West by Northwest, Suite 110

Houston, Texas 77040 |

|

77040

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

(877) 824-4733

(Registrant’s

telephone number, including area code)

International Metals Streaming Corp.

12303 Airport Way, Suite 200

Broomfield, CO 80021

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2.

below):

☐

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

☐

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

☐

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

☐

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Current Report on Form 8-K contains certain “forward-looking

statements” within the meaning of the Private Securities

Litigation Reform Act of 1995, Section 27A of the Securities

Act of 1933, as amended (the “Securities Act”) and

Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange

Act”), which statements involve substantial risks and

uncertainties. In some cases, it is possible to identify

forward-looking statements because they contain words such as

“anticipates,” believes,”

“contemplates,” “continue,”

“could,” “estimates,”

“expects,” “future,” “intends,”

“likely,” “may,” “plans,”

“potential,” “predicts,”

“projects,” “seek,” “should,”

“target” or “will,” or the negative of

these words or other similar terms or expressions that concern our

expectations, strategy, plans or intentions. Many factors could

cause our actual operations or results to differ materially from

the operations and results anticipated in forward-looking

statements. These factors include, but are not limited

to:

●

our financial

performance, including our history of operating

losses;

●

our ability to

obtain additional funding to continue our operations;

●

our ability to

successfully develop and commercialize our products;

●

changes in the

regulatory environments of the United States and other countries in

which we intend to operate;

●

our ability to

attract and retain key management and marketing

personnel;

●

competition from

new market entrants;

●

our ability to

successfully transition from a research and development company to

a marketing, sales and distribution concern;

●

our ability to

identify and pursue development of additional products;

and

●

the other factors

contained in the section entitled “Risk Factors”

contained in this Current Report on Form 8-K.

We have

based the forward-looking statements contained in this Current

Report on Form 8-K primarily on our current expectations and

projections about future events and trends that we believe may

affect our business, financial condition, results of operations and

prospects. The outcome of the events described in these

forward-looking statements are subject to risks, uncertainties,

assumptions, and other factors including those described in the

section of this Current Report on Form 8-K entitled “Risk

Factors.” Moreover, we operate in a very competitive and

rapidly changing environment. New risks and uncertainties emerge

from time to time, and it is not possible for us to predict all

risks and uncertainties that could have an impact on the

forward-looking statements used herein.

You

should not rely on forward-looking statements as predictions of

future events. Except as required by law, neither we nor any other

person assumes responsibility for the accuracy and completeness of

the forward-looking statements, and we undertake no obligation to

update any forward-looking statements to reflect events or

circumstances after the date of such statements.

EXPLANATORY NOTE

As used

in this Current Report on Form 8-K (1) the terms the

“Company,” “we,” “us,” and

“our” refer to the combined enterprises of

Environmental Packaging Technologies Holdings, Inc., a Nevada

corporation, formerly named International Metals Streaming Corp.

(“IMST”), and Environmental

Packaging Technologies, Inc., a Delaware corporation

(“EPT”), after giving

effect to the Merger (defined below) and the related transactions

described herein, (2) the term IMST refers to the business of

International Metals Streaming Corp., prior to the Merger, and (3)

the term “EPT” refers to the business of Environmental

Packaging Technologies, Inc., prior to the Merger, in each case

unless otherwise specifically indicated or as is otherwise

contextually required. Although International Metals Streaming

Corp. changed its name to Environmental Packaging Technologies,

Inc. by filing a certificate of amendment with the Secretary of

State of Nevada on February 2, 2017, to avoid confusion and for

purposes of clarity, the historical pre-Merger operations of the

Company are referred to in this Current Report as

“IMST”.

This

Current Report on Form 8-K is being filed with the Securities and

Exchange Commission (the “SEC”) in connection with

a series of transactions consummated by us that relate to the

Merger between IMST and EPT, which transactions are described

herein, together with certain related actions taken by

us.

2

On June

12, 2017, we filed with the SEC a Current Report on Form 8-K (the

“6/12/2017

8-K”), to inform the

public that the Merger had been consummated and to provide certain

other information related thereto. Because prior to the Merger,

IMSC was a “shell company” (as defined in Rule 405 of

the Securities Act), the Company is required to file a Current

Report on Form 8-K containing such information that it would be

required to disclose if it were a registrant filing a general form

for registration of securities on Form 10 under the Exchange

Act (a “Super

8-K”). The 6/12/2017 8-K

did not constitute a Super 8-K. This Current Report on Form 8-K is

the Company’s Super 8-K.

Although this

Current Report on Form 8-K includes the audited financial

statements and accompanying footnotes and the related

Management’s Discussion and Analysis of Financial Condition

and Result of Operations (“MD&A”) of EPT for the 12

months ending December 31, 2016 and 2015, due to unanticipated and

unintended delays this Super 8-K does not include the financial

statements and footnotes thereto and related MD&A disclosure of

EPT for the three (3) months ending March 31, 2017 and 2016. We are

however, working diligently to finalize such items and intend to as

soon as reasonably possible file the same with the SEC in an

amendment to this Current Report on Form 8-K.

Because

IMST prior to the Merger and since approximately June 30, 2014 was

a “shell company”, the information included in

IMST’s financial statements filed with the SEC in quarterly

and annual reports of IMST prior to the Merger was in our

determination non-material, and as a result we have not included

any pro-forma financial information of IMST and EPT in this Current

Report on Form 8-K.

3

Item

1.01.

Entry

into a Material Definitive Agreement.

On or

about December 28, 2016, IMST entered into an Agreement and Plan of

Merger (the “Merger

Agreement”) with EPT Merger Inc., a Delaware

corporation and wholly owned subsidiary of IMST

(“Merger

Sub”), and EPT, pursuant to which the parties agreed

that on the Effective Date (as defined below), EPT would merge with

and into Merger Sub and EPT would be the surviving company thereof

and as a result would become a wholly-owned subsidiary of

IMST.

For a

description of the Merger and the material agreements entered into

in connection with the Merger, please see the disclosures set forth

in Item 2.01 of this Current Report on Form 8-K, which disclosures

are incorporated into this Item 1.01 by reference. Item 2.01 of

this Current Report on Form 8-K contains only a brief description

of the material terms of the Merger Agreement, and does not purport

to be a complete description of the rights and obligations of the

parties thereunder, and such description is qualified in their

entirety by reference to the Merger Agreement which was filed as an

exhibit to our 6/12/2017 8-K.

Item

2.01.

Completion

of Acquisition or Disposition of Assets.

The Merger and Related Transactions

On June

9, 2017 (the “Effective Date”),

pursuant to the Merger Agreement, Merger Sub and EPT consummated

the Merger, and as a result EPT became a wholly-owned subsidiary of

IMST.

Immediately

following the Effective Date, we had issued and outstanding the

following shares of our common stock (i) 40,000,000 shares issued

to former EPT stockholders in the Merger, (ii) 12,000,023

shares issued to our shareholders immediately prior to the

Effective Date, (iii) 565,000 shares issued to purchasers of EPT

common stock purchased in a private placement conducted by EPT

prior to the Effective Date (the “EPT Offering”), which EPT

shares were converted into such 5,650,000 shares of our common

stock in the Merger, (iv) 1,045,000 shares issued to holders of EPT

warrants which were exercised and converted into shares of our

common stock in the Merger, and (v) 2,066,000 shares held by prior

purchasers of $758,000 aggregate principal amount of EPT

convertible notes which EPT convertible notes were converted into

EPT common stock and thereafter converted into shares of our common

stock in the Merger. In addition we will issue 998 shares of our to

be created 6% Series B Preferred convertible preferred stock (the

“Series B

Preferred”), with each Series B Preferred having a

stated value of $1,000, is convertible into shares of our common

stock at a conversion price of $0.50 per share, accrues dividends

at a rate of 6% per annum (subject to increase), have customary

beneficial ownership blockers, various anti-dilution rights

including for sales and/or issuance of our common stock and/or

derivate securities with a sale price and/or conversion, exchange

or exercise price (as the case may be) below $0.50 per share and

will contain optional and mandatory conversion and mandatory

redemption provisions. Such 998 B Shares will be issued to holders

of 998 shares of substantially identical Series B Preferred stock

of EPT.

On the

Effective Date, Michael Hlavsa, our sole officer and director

resigned from such positions and David Skriloff, the EPT chief

executive officer was appointed as our sole director and our chief

executive officer and treasurer; and Shane Sims, EPT’s

president and chief operating officer was appointed as our

president, chief operating officer and secretary.

Pursuant

to the Merger Agreement we are obligated to pay to IMST’s

majority shareholder prior to the Merger $550,000 as a result of

its cancellation of 11,810,830 shares of our common stock pursuant

to the Merger Agreement.

EPT is

required to and will offer certain of its former shareholders

appraisal rights pursuant to the Delaware General Corporate Law

(the “DGCL”).

As

contemplated by the Merger Agreement, on February 1, 2017

IMST’s then sole director and IMST’s then majority

shareholder approved a name change of IMST from

“International Metals Streaming Corp.” to

“Environmental Packaging Technologies Holdings, Inc.,”

in February 2017, IMST’s sole director approved a forward

split of IMST’s outstanding and authorized common stock at a

ratio of 2.17079 to 1 and IMST requested that the Financial

Industry Regulatory Authority (“FINRA”) change the

trading symbol of our common stock from “IMST” to

“EPTI”. IMST submitted an issuer company-related action

notification form to FINRA requesting FINRA to approve the name

change, forward split and symbol change, which name change and

forward stock split FINRA approved on February 14, 2017 with an

effective date of February 16, 2017 and the symbol change was

effective as of February 28, 2017. As a result of the forward

split, our authorized common stock consists of 108,539,500 shares

of common stock, par value $0.001 per share.

4

The

foregoing description of the Merger Agreement is only a summary and

is qualified in its entirety by reference to the complete text of

the original Merger Agreement and the two amendments thereto. The

Merger Agreement was filed as Exhibit 2.1 to IMST’s Current

Report on Form 8-K filed with the SEC on December 29, 2016, the

first amendment to the Merger Agreement was filed as Exhibit 2.2 to

IMST’s Current Report on Form 8-K filed with the SEC on April

18, 2017 and the 2nd amendment to the

Merger Agreement was filed as Exhibit 2.3 to the 6/12/2017 8-K,

each of which is incorporated by reference herein.

Accounting Treatment

The

Merger is being treated as a reverse acquisition of IMST, a public

shell company, for financial accounting and reporting purposes. As

such, EPT is treated as the acquirer for accounting and financial

reporting purposes while IMST is treated as the acquired entity for

accounting and financial reporting purposes. Further, as a result,

the historical financial statements that will be reflected in the

Company’s future financial statements filed with the SEC will

be those of EPT, and the Company’s assets, liabilities and

results of operations will be consolidated with the assets,

liabilities and results of operations of EPT.

Smaller Reporting Company

Following

the consummation of the Merger, the Company will continue to be a

“smaller reporting company,” as defined in Regulation

S-K promulgated under the Exchange Act.

BUSINESS

Overview

Environmental

Packaging Technologies, Inc. (EPT, www.eptpac.com) was incorporated

in 2011 with headquarters in Houston, Texas, manufacturing

facilities in Zeeland, Michigan, as well as operations in the

Netherlands, Argentina, and South Korea, and sales in over

twenty-eight countries in the Americas, Europe, and Asia. In 2015,

EPT’s total revenue was approximately $16.2M with a $2M

operating loss. In 2016, EPT’s total revenue was over $17.3M

with a $1.4M operating profit.

EPT is

a pioneer in the field of flexitank

manufacturing, and it is the only company manufacturing flexitanks

in the United States. EPT’s flexitank is a soft sided single

use container enabling bulk shipment of non-hazardous liquids. EPT

believes it flexitanks are considered to be the least expensive and

most environmentally friendly way to ship bulk non-hazardous

liquids over long distances. One flexitank can hold up to 24,000

liters of liquids which in most instances is the weight limit for

such a container and therefore allows for the most possible amount

of liquid to be shipped in a single container.

Although

counterintuitive, one of the main reasons that a flexitank is the

least expensive transportation method is its one time use design.

This eliminates the cost of clean-out and also shipping empty

containers back to the original source of the product, as most are

really only a one-way product. For example, there is a lot of

orange juice shipped from Brazil to the rest of the world, but very

little orange juice is shipped back. Therefore, if a container was

not single use, empty containers would need to be returned to

Brazil for reuse. As everyone is trying to save money in shipping,

the use of a flexitank makes tremendous sense in this common

example.

This

value proposition continues when a shipper is using a dedicated

liquid tanker truck. These trucks are more expensive to operate and

harder to find than a traditional tractor trailer. As the flexitank

is transported by a traditional tractor trailer, it is materially

cheaper to ship the liquid with a Flexitank. This also does not

take into account that it is much easier for a traditional tractor

trailer to find a return load (and does not need a specific

clean-out) as compared to a dedicated liquid tanker truck

(“isotank”).

5

Within

the flexitank industry, EPT believes that it makes the highest

quality flexitank with the strongest materials, which altogether

have the lowest rates of leakage or breakage in the industry. EPT

also believes that it carries the highest amount of insurance in

case of leakage or breakage. EPT believes breakage has been an

issue with cheaper flexitanks manufactured by some of EPT’s

competitors. Any time there is a break, there is not only the cost

of the cleanup and the cost of the lost product that spilled, but

also a potentially substantial negate publicity. As an example, of

a flexitank on a train carrying diesel fuel, breaks on a bridge

over a river which causes the diesel fuel to spill into the river.

While the direct economic cleanup cost is not cheap, the indirect

costs of bad publicity can be even greater. By offering a solution

that is still substantially less expensive than any other method of

shipping yet one that does not break or have leakage issues, plus

has a large insurance policy, EPT believes it has created a strong

industry niche for itself, which EPT believes continues to

expand.

EPT

also believes it differentiates itself from competitors by making

its Flexitanks with a higher capability to handle temperature

extremes, than other competing products. All EPT Flexitanks are

made with materials that can withstand heated liquids as high as

180o

Fahrenheit. This has allowed EPT to win a major new customer

relationship with a producer of Bitumen in the tar sands of Canada.

Essentially, Bitumen is the petroleum part of asphalt. To ship

bitumen, it is generally heated to about 170oF in order to be

viscous enough to be pumped. This relationship alone is now

ramping, and is currently expected to become a substantial customer

over the next 12 months. EPT believes that it makes the only

Flexitank capable of handling this level of heat.

This

ability to withstand high heat also allows EPT’s products to

be used to ship products aseptically. In order for a

customer’s liquids to be shipped aseptically, all materials

that come in contact with the liquid being transported and the

outside air must be sterilized. EPT believes it has the only bag on

the market that can withstand this level of heat sterilization. A

product stored aseptically can withstand warmer temperatures

without spoiling, or the need for refrigeration such as juice or

milk boxes.

EPT has

three separate flexitanks – its Big Red Flexitank, its Big

Red Wine-Pac and its newest product Liquiride, launched in 2016.

EPT’s products have been used to ship hundreds of different

products including petroleum products, base oils, wine, juice,

milk, high-fructose corn syrup, additives, specialty chemicals like

liquid latex, and many other types of liquid products.

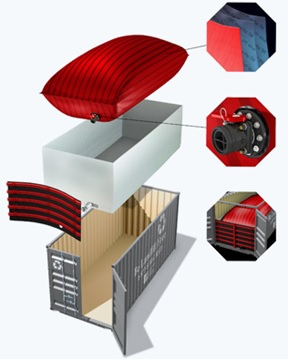

The Big

Red Flexitank, similar to the other flexitanks in the industry, is

a large single soft-sided composite plastic bag that fits within a

20’ shipping container and is secured by bulkheads. It has

certifications for shipping on most of the world’s railways,

roads and ships – a very difficult and time consuming

process. EPT believes that it has the premiere product as it has a

long history of the fewest leaks within the industry, with

substantially less than 0.1% of all tanks developing a problem. In

2016, EPT sold more than 24,000 Flexitanks and generated $17.3

million in revenues from those sales, including logistics services

associated with the shipments that use our products.

6

Diagram of a Big Red Flexitank within a 20’ Shipping

Container

EPT

believes that its biggest advantage comes from its newest

flexitanks product – its patent pending LiquirideTM.

The Liquiride is a smaller size Flexitank, which has multiple

competitive advantages, from which it is now beginning to open up

entire new flexitank markets for EPT, which previously have been

inaccessible to any other flexitank providers. Because of the

engineering physics of its unique design, as well as the high

quality of the bag itself, Liquiride has unique advantages that are

summarized as follows:

●

EPT believes that

LiquiRide is the only flexitank on the market that can be used

inside of 40-foot and 53-foot intermodal metal shipping containers

(as opposed to 20 foot containers for all other

flexitanks).

●

EPT believes that

LiquiRide is the only flexitank on the market that can be used

inside of a standard 40-foot intermodal refrigerated containers or

refrigerated tractor trailer (“REEFERs”).

Currently,

EPT believes that the other flexitank manufacturers are only making

bags that can be utilized in only 20-foot intermodal metal shipping

containers. All bags used in 20-footers are specifically designed

to fill up 70%-80% of the available space in those containers.

These regular flexitanks use the strong side-walls of the 20-foot

metal container to provide the primary structural support of the

bag and lock it in place. However in a 40-foot or 53-foot metal

container, regular flexitanks do not fill up as much space and are

nowhere near as snug, thereby creating an unacceptable transport

hazard (because the weight of the 20-foot size filled flexitank

that is no longer snug, throws around too much force). Because of

its uniquely designed and patent-pending engineering physics, the

smaller, flatter Liquiride is essentially a free-standing bag when

filled with product, which does not throw its weight around and

thereby does not materially impinge on the side-walls. This allows

it to be placed in the larger 40 & 53-foot metal containers,

without reliance on the side-walls to contain the bag. EPT believes

that to date, no other manufacturer has come up with a design that

can be efficiently and robustly manufactured, which actually works

on a free-standing basis, and does not rely on the walls of a

container to give it that needed support. This ability to be

free-standing is necessary for 40-foot REEFERS, where the side

walls are substantially thinner than in a traditional container,

and would otherwise deform such container if it were used for

substantial amounts of support.

7

This,

EPT believes, provides it with a critical advantage, because in the

past decade, 20-foot metal containers have reduced significantly as

a percentage of the manufactured intermodal market. They have been

increasingly replaced by 40-footers for rail and ocean-freight, and

53-footers for over-the-road transport. Therefore, the average

freight cost of these larger containers have become on average

cheaper than 20-foot containers, especially because they make up a

larger percentage of the overall available intermodal market at any

one time or location. By using 3 Liquirides per container, shippers

of bulk liquids can take advantage of these larger intermodal

options, and still ship close to or even more liquids, in a greater

percentage of the available freight market and creates a much

greater degree of flexibility for the shipper.

EPT

also believes that its Liquiride product is the only flexitank that

will work in a refrigerated shipping container

(“Refeer”) and therefore is the only product that can

be used with a liquid in which temperature control is important.

Consider the shipment of orange juice concentrate or fresh juice in

which the liquid needs to remain cold or will spoil. Historically,

these needed to be shipped using other methods. EPT believes that

the use of flexitanks as opposed to other methods of shipping

within a refrigerated container could save $2,500 to $3,000 per

container.

Picture of a LiquiRide within a 40’ refrigerated

container

In

addition to our two main products, the Big Red Wine-Pac is a

flexitank customized to meet the specific requirements of the wine

industry. The BIG Red Wine-Pac is constructed with a high strength

multi-layer tubing containing an effective gas barrier to protect

oxygen sensitive products such as wine or, for certain oils and

solvents, to provide a barrier that keeps the noxious odors from

escaping to the outside air.

8

EPT’s Wine Pac within a 20’ Shipping

Container

Strategic Relationships

EPT has

entered into several strategic relationships and joint ventures in

2016 that it believes will be a driver to our growth. One of those

relationships is an exclusive agreement with one of the

world’s largest shippers for the use of BIG Red

LIQUIRIDE™s in all of such shipper’s ocean going

refrigerated containers. The shipper has begun selling BIG Red

LIQUIRIDE™s as part of an overall refrigerated container sale

and has initially targeted the orange juice market. A number of

tests were run with some of the world’s largest orange juice

manufacturers with positive results and initial sales of BIG Red

LIQUIRIDE™s have recently commenced. EPT and the shipper have

also begun to market their combined offerings to producers of other

commodities that require temperature control such as milk, other

types of juices and certain chemicals.

In

addition, EPT established two other strategic relationships during

2016. It has created a joint venture with Synergie, Canada

(“Synergie”), a $30 million revenue logistics and

shipping company in Canada and with The Vedder Group

(“Vedders”), one of the largest Canadian logistics and

shipping company focusing exclusively on the shipping of liquids.

Both entities are now selling and installing EPT’s flexitanks

as part of their respective product offerings to their clients.

Through these three partnerships, EPT has been able to essentially

expand its products’ salesforce from its eight internal

salespeople to more than 100 sales personnel across the various

cooperating parties.

Restructuring

Beginning

in October 2015 through April, 2017, EPT went through a

restructuring. As part of this restructuring, OMB Acquisition

Corp., LLC, a limited liability company owned by certain then

minority shareholders of EPT including an entity of which David

Skriloff our CEO may be deemed an affiliate of OMB, purchased from EDP, LLC,

the then controlling shareholder of EPT approximately (i)

$13,960,000 of EPT’s subordinated debt, and (ii) $18,990,000

of EPT’s preferred stock. EDP also cancelled all shares of

EPT common stock owned by it. In addition, certain owners of the

OMB arranged for $3,875,000 of new EPT debt and used $1,800,000 of

such new indebtedness to retire all the then approximately

$12,600,000 of outstanding senior indebtedness of EPT and the

remaining $1,100,000 balance for EPT working capital and general

corporate purposes.

Such

EPT subordinated debt and preferred stock acquired by the OMB was

converted into approximately 2,890,000 EPT shares of common stock,

which converted into approximately 28,900,000 shares of our common

stock in the Merger.

As part

of the restructuring, a new EPT management team was installed

including Mr. Skriloff as chief executive officer, a new business

strategy was implemented which focused on revenue growth, as

opposed to cost control and a change in EPT’s sales strategy

focusing on strategic relationships within the shipping industry.

This change of strategy EPT believes, resulted in EPT establishing

the above mentioned strategic relationships with Synergie Canada,

The Vedder Group and a large international shipping company

pursuant to which, among other items, EPT’s flexitanks are

being offered for sale by such entities to their respective

customers. These 3 entities, EPT believes collectively have over

100 sales persons offering our flexitank products to

their respective customers. These entities began offering our

products toward the end of 2016 and the Company currently believes

that such relationships will generate substantial revenues to EPT

in 2017 and 2018.

9

Technical Focus

We are

actively engaged in research and development programs designed to

improve the manufacture, reliability and installation of our

existing flexitank products and to develop new flexitanks to better

serve our current and potential future customers. In its research

and development efforts, both internal development along with

outsourced engineering teams who report to EPT. We place particular

emphasis on the development of new products that are compatible

with, and build upon, our manufacturing and reliability

capabilities.

Certification

In

order to transport liquids through flexitanks, extensive

certifications and testing must to occur to obtain the required

governmental approvals. A number of the world’s highway and

train authorities require tests such as collision and drop tests to

attempt to ensure the flexitanks will not break or leak. In

addition, most of the larger transoceanic shippers require their

own tests prior to allowing flexitanks onto their ships. These

tests are expensive and time consuming but without them, it becomes

very difficult to transport on certain roads, rails and ships. EPT

also believes that such testing slows the time for a new entrant or

competing product to get to market and has spent considerable

resources obtaining such needed certifications.

The

following is a list of some of the certifications that EPT has

obtained for its flexitanks.

●

Passed Association

of American Railroad (AAR) Rail Impact Test, Pueblo,

CO.

●

Passed Association

of American Railroad (AAR) Rail Vibration Test (VTU), Pueblo,

CO

●

Passed Goerlitz

Flexitank Rail Impact Test, Brunel Railmotive, Goerlitz,

Germany

●

Passed Marine

Container Test Services DNV 2.7.1 Drop Test and EN 12079>

Vertical Impact Test, Liverpool, England

●

Received rail

certification from Bureas Veritas in Argentina

●

Authorized by the

Russian Railroad (RZD) for flexitank shipments

●

Passed China

Railroad Impact Test

●

Received Kosher

certification from Chicago Rabbinical Council (CRC)

●

HALAL

Certified

●

EU Food Grade

Certificate

●

FDA

Compliant

●

ISO 9001:2008

Certificate

●

Meets all COA Code

of Flexitank Requirements

Manufacturing

EPT

believes manufacturing is critical to the successful implementation

of its products in the marketplace. We assemble and manufacture

components used in our flexitanks through a contract manufacturer

based in Zeeland, Michigan. EPT has invested considerable resources

to develop our manufacturing process and has provided our contract

manufacturer with what we believe to be all of the specialized

equipment and knowledge necessary to manufacture our products in

efficient and reliable manner. We believe our current manufacturer

has the capability of expanding to meet our currently anticipated

growth.

10

Trends Shaping Our Markets

The

growth in the use of flexitanks in the shipping market we believe

is due to flexitanks offering significant savings when compared to

the movement of liquid products in drums, intermediate bulk

containers (IBCs), or tank containers. Flexitanks we believe are

attractive to shipping lines to facilitate the use of backhaul

cargoes from some parts of the world to avoid the costs of

repositioning empty boxes. According to a Grand View Research

report, global flexitank market demand was 800,000 units in 2014

and is expected to reach 3,135,791 units by 2022 growing at a CAGR

of 18.6% from 2015 to 2022. The UK P&I Club projects that

in 2015, approximately 15% to 20% of global flexitank loads

emanated from South America, with the movement of wine and

fruit juices being particularly prominent. EPT believes flexitanks

are ideally suited for this type of shipment as they:

●

Are a single use

product with little risk of cross contamination;

●

Have low

positioning costs; and

●

Exhibit a superior

cargo/load ratio

The

clients who we sell our flexitanks consists of: operators and

freight forwarding firms. Operators largely provide port to port

movement of material and in some cases a door to door delivery of

material. Freight forwarding firms offer to arrange door to door

transport of material for smaller businesses who are unable to or

do not wish to utilize operators. EPT currently sells to operators,

freight forwarding firms and directly to the end user. EPT

therefore operates primarily as a manufacturer and at times also as

a freight forwarding or logistics firm.

Growth

EPT is

seeing growth from both the Flexitank business and the BIG Red

LIQUIRIDE™ product. Growth is also occurring from additional

orders from existing customers, new customers and, most

importantly, new strategic relationships. Some of the larger

opportunities are outlined below:

●

Kumho Asiana Group – Kumho in

Korea is currently EPT’s largest customer generating sales of

approximately 1,000 Flexitanks per month. Although Kumho has

indicated to EPT a need to increase its orders.

●

Strategic relationship with large transoceanic

shipper – an exclusivity agreement has been reached

between EPT and a large shipper. The agreement provides for an

exclusive relationship for ocean-going reefer based freight. The

shipper has agreed to a minimum commitment of 18,000 BIG Red

LIQUIRIDE™s per year and we believe such relationship has the

potential to result in substantial future orders of BIG Red

LIQUIRIDE™ units to be ordered from such

shipper.

●

Synergie Canada LTD – is a

Canadian based freight forwarder and logistics company based in

Quebec. We have completed an agreement with Synergie in which it is

now exclusively selling our products as part of an overall sale of

its services. In this agreement, EPT will be receiving a portion of

shipping revenues in addition to sales of Flexitanks.

●

Vedders Transportation Group – is

a shipping and logistics company that specializes in shipping

liquids. Vedders has recently begun offering EPT’s flexitanks

to its customers as part of its over-all shipping

services.

Strategic Goals

●

Grow Revenues and Market Share through

Strategic Partnerships. We plan to attempt to increase sales

through strategic partnerships such as those currently in place.

These relationships provide EPT with substantially expanded reach

as our three partners combined have more than 100 sales people

selling our products world-wide compared to our internal sales

force of 8 salespeople. In addition, our relationship with Synergie

is one in which we share in both revenues from shipping and in

Flexitank sales. This is a model we would like to duplicate and are

working with others to create similar relationships.

●

Expand Our Organic Growth Initiatives.

EPT believes we have opportunities to further expand revenues with

our existing clients by marketing additional service offerings to

them, as well as by extending services to existing clients in new

geographies. We believe that some of our existing clients will have

a need for our new BIG Red LIQUIRIDE™ product and some

additional products, such as an aseptic product that we have begun

introducing in the first quarter of 2017.

11

●

Increase Operating Margins by Leveraging

Operating Efficiencies. We believe that increased volume

will improve our costs to manufacture via lower material costs and

increased buying power. In addition, we are at the early planning

stages to build another manufacturing facility off-shore. Such a

facility we believe would allow EPT to both lower costs and

increase production capacity and thus better compete

globally.

●

Invest in research and development. We

believe our future success is dependent in large part on the

investments we make in research and development, either internally

or through acquisitions, and that we should continually develop and

introduce innovative solutions, enhance existing solutions and

effectively stimulate customer demand for existing and future

products.

Our History

In

2011, Environmental Packaging Technologies, Inc. was created to

purchase certain assets of Environmental Packaging Technologies,

Ltd of Hong Kong (“Ltd”) which was y founded in 2007.

Since 2011, the founders of Ltd have no on-going role in EPT and

own less than 1.0% of our common stock issued and

outstanding.

In

2015, EPT completed a restructuring in which EDP, Ltd, its then

largest investor, debtor and shareholder decided to exit the

investment. In the restructuring EDP returned the Company all of

its shares of common stock to treasury, sold $18.9 million of our

preferred stock and $13.9 million of our subordinated debt held by

EDP to OMB Acquisition Corp., LLC (“OMB”). EDP also

assumed $8.2 million of guarantees of the Company’s senior

debt owed to Huntington Bank, and the Company paid the remaining

$1.8 million to Huntington Bank to retire that debt in full. OMB

subsequently converted all of such acquired debt and preferred

stock of EPT to common stock of EPT and provided its member holders

with such shares of common stock which were converted to shares of

our common stock in the Merger.

In

April 2017, EPT entered a revolving credit facility (the

“Revolving Facility”) of up to $7.5 million, subject to

borrowing base availability, pursuant to Loan and Security

Agreements with both ExWorks and the Export/Import Bank. Borrowing

for all overseas A/R and finished goods inventory intended for use

overseas is provided by the Export/Import bank and all other

borrowing is through ExWorks. As of May 31, 2017, EPT has

drawn down a total of $4.1 million.

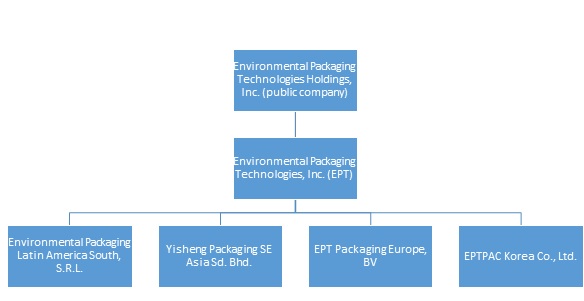

Our

current corporate structure is as follows:

12

Proprietary Rights and Technology

Our

ability to compete is dependent in part upon our proprietary rights

and technology. We rely on a combination of trademark, copyright,

trade secret and patent laws in the United States and globally as

well as confidentiality procedures and contractual provisions to

protect our proprietary technology and our brands and maintain

programs to protect and enforce our rights. These laws and

contractual provisions, however, provide only limited protection of

our proprietary rights and technology, which include confidential

information and trade secrets that we attempt to protect through

confidentiality and nondisclosure provisions in our agreements. We

typically seek to protect our confidential information and trade

secrets through these contractual provisions for the terms of the

applicable agreement and, to the extent permitted by applicable

law, for some negotiated period of time following termination of

the agreement. Listed below are the patents currently held by or

submitted by EPT:

|

Patent / Application

Number

|

Country

|

Title

|

Type

|

Filing Date

And Issue Date

|

|

12/616,825

|

U.S.

|

Shipping

Container Systems

|

Application

|

11/12/2009

|

|

CA

2686180

|

Canada

|

Shipping

Container Systems

|

Application

|

11/17/2009

|

|

12/576,684

|

U.S.

|

Methods,

Systems, and Kits for Shipping and/or Off-Loading Granular

Products

|

Application

|

10/09/2009

|

|

12/901,363

|

U.S.

|

Upright

Side Support Beam

System

for Shipping Containers Used with Bulk Liquid Cargo

|

Application

|

10/08/2010

|

Also,

EPT has filed a patent application (14/945,648) in the

U.S. The pending patent application covers systems and methods for

shipping liquid using multiple bladders placed on a non-slip mat

and oriented in a manner such that the seams of the bladders are

aligned parallel to the sides of the shipping container (for

example, the seams can be touching the sides of the container).

This pending patent application makes up the underlying technology

around our new BIG Red LIQUIRIDE™ container.

In

addition to patents, EPT has trademarks protecting the names of

many of its products. The trademarks include BIG Red

Flexitank®, EPT Wine-Pak, and BIG Red

LIQUIRIDE™.

Competition

We

expect to experience competition from two main areas: flexitank

manufacturers and shipping logistic companies. Various flexitank

manufacturers such as Qingdao LAF Packaging Co., LTD, BLT Flexitank

Industrial Co., LTD, and MY Flexitank Industries Sdn Bhd are active

in offering flexitank solutions to the shipping carrier market.

Multiple shipping logistic firms such as Trans Ocean, Braid and

Hoyer incorporate flexitank solutions into their door to door

service offering. We expect our proven track record for reliability

and capability to offer a more flexible and economic solution with

our Liquidride offering will provide us with an advantage over our

competition.

There

are various options available to companies when it comes to

transporting bulk products, including tanks, bins, and inflatable

storage tanks. However, we believe our products help companies

ensure hygiene and cargo security and reduce overall transportation

costs in a competitively sustainable manner.

Employment

As of

March 31, 2017 EPT currently has 24 employees, of whom 4 are

executives, 1 employee is engaged in product development,

engineering and research and development, 9 employees are engaged

in sales and marketing, 6 employees are engaged in administrative

and clerical services and 4 employees are engaged in customer

service.

None of

our employees are represented by labor organizations. We consider

our relationship with our employees to be excellent.

13

Our Corporate Information

Our

principal executive offices are located at 6100 West by Northwest,

Suite 110, Houston, TX 77040. Our telephone number is 877-824-4733.

Our website address is www.eptpac.com. These are textual

references only. We do not incorporate the information on, or

accessible through, any of our websites into this prospectus, and

you should not consider any information on, or that can be accessed

through, our websites as part of this prospectus.

Risk Factors

Risks Related to Our Business, Operations and Financial

Condition

We have a substantial accumulated deficit and a history of

recurring losses and we may never achieve and or sustain

profitability. In addition, we may be unable to continue as a going

concern.

We are

not profitable and have incurred losses since our inception in

2011, except for a one-time net gain in 2015 resulting from the

reorganization and forgiveness of debt. We continue to incur

research and development and general and administrative expenses

related to our operations.

We

incurred a net loss of $179,658 for the year ended December 31,

2016 and total liabilities of $ 23,948,067 from August 8, 2011

(date of inception) to December 31, 2016.

The

amount of future losses and when, if ever, we will achieve

profitability are uncertain. If our products do not achieve market

acceptance, we may never become profitable. Additionally, if we are

not successful in growing revenues and controlling costs, we will

not achieve profitability and even if we achieve profitability in

the future, we may not be able to sustain profitability in

subsequent periods.

Our recurring losses have raised substantial doubt regarding our

ability to continue as a going concern.

Our

recurring losses raise substantial doubt about our ability to

continue as a going concern. Our financial statements included

elsewhere in this prospectus include a note describing the

conditions which raise this substantial doubt. As a result, our

independent registered public accounting firm included an

explanatory paragraph in its report on our financial statements as

of and for the year ended December 31, 2016 referring to our

recurring losses and expressing substantial doubt in our ability to

continue as a going concern. Our financial statements do not

include any adjustments that might result from the outcome of this

uncertainty.

We may require substantial additional funding, which may not be

available to us on acceptable terms, or at all.

Our

cash balance at December 31, 2016 was $814,778 and in the first six

months of 2017 raised additional equity and debt capital. We

may require additional funding to fund and grow our operations and

continue developing certain products. There can be no assurance

that financing will be available in amounts or on terms acceptable

to us, if at all. In the event we required additional capital, the

inability to obtain additional capital will restrict our ability to

grow and may reduce our ability to continue to conduct business

operations. If we require and are unable to obtain additional

financing, we will likely be required to curtail our development

plans. In that event, current stockholders would likely experience

a loss of most or all of their investment. Additional funding that

we do obtain may be dilutive to the interests of existing

stockholders.

We primarily dependent on two products.

EPT

primarily has two products- the BIG Red Flexitank® and its

newest product, launched in 2016, BIG Red LIQUIRIDE™.

Therefore, the BIG Red Flexitank® and BIG Red LIQUIRIDE™

products account for a substantial portion of our revenues for the

foreseeable future. As a result, our future operating results are

dependent upon continued and further market acceptance of those

products. Factors adversely affecting the pricing of, demand for,

or market acceptance of such products, such as regulatory

complications, competition, or technological change, could have a

material adverse effect on our business, operating results, and

financial condition.

Our failure to effectively manage growth could impair our

business.

Our

business strategy contemplates a period of rapid growth which may

put a strain on our administrative and operational resources, and

our funding requirements. Our ability to effectively manage growth

will require us to successfully expand the capabilities of our

operational and management systems, and to attract, train, manage,

and retain qualified personnel during our initial product launch

and future launches of our other products. There can be no

assurance that we will be able to do so, particularly if losses

continue and we are unable to obtain sufficient financing. If we

are unable to appropriately manage growth, our business, prospects,

financial condition, and results of operations could be adversely

affected.

14

Although we have a substantial product liability insurance policy,

which we believe will protect us, we may be subject to product

liability claims, and may not have sufficient product liability

insurance to cover any such claims, which may expose us to

substantial liabilities.

We may

be exposed to product liability claims from consumers of our

products. It is possible that any product liability insurance

coverage we obtain will be insufficient to protect us from future

claims. Further, we may not be able to obtain or maintain insurance

on acceptable terms or such insurance may be insufficient to cover

any potential product liability claim or recall. Failure to obtain

or maintain sufficient insurance coverage could have a material

adverse effect on our business, prospects, and results of

operations if claims are made that exceed our

coverage.

Our costs will increase significantly as a result of operating as a

public company, and our management will be required to devote

substantial time to complying with public company

regulations.

Prior

to the closing of the Merger, EPT operated as a private company.

Following the closing of the Merger, the Company will be a publicly

traded company and will file various reports with the SEC including

annual reports on Form 10-K, quarterly reports on Form 10-Q and

current Reports on Form 8-K. As a result of such and other

obligations relating to us being a publicly traded issuer filing

reports with the SED, we will incur additional legal, accounting,

compliance and other expenses that EPT did not incur as a private

company.

We depend on third-party suppliers for materials and components for

our products.

We

depend on a limited number of third-party suppliers for the

materials and components required to manufacture our products and

certain of the materials and components required to produce our

products are single sourced. A delay or interruption by our

suppliers may harm our business, results of operations, and

financial condition, and could also adversely affect our future

profit margins, and/or force us to cease production altogether. In

addition, the lead time needed to establish a relationship with a

new supplier, should one exist, can be lengthy, and we may

experience significant delays in meeting demand in the event we

must change or add new suppliers, should one exist. Our dependence

on our suppliers exposes us to numerous risks, including but not

limited to the following: our suppliers may cease or reduce

production or deliveries, raise prices, or renegotiate terms; we

may be unable to locate a suitable replacement supplier on

acceptable terms or on a timely basis, or at all; and delays caused

by supply issues may harm our reputation, frustrate our customers,

and cause them to turn to our competitors for future

needs.

We may not be able to manage our strategic partners

effectively.

Our

growth strategy includes strategic partners to assist in the

selling of our products and to broaden our reach to potential

customers. The process to bring on, train and assist strategic

partners is time-consuming and costly. We expect to expend

significant resources to undertake business, financial and legal

due diligence on both existing and potential partners, and there is

no guarantee that these will be successful in ultimately increasing

our business.

Failure

to manage our partners effectively may affect our success in

executing our business plan and may adversely affect our business,

financial condition and results of operation. We may not realize

the anticipated benefits of any or all partnership, or may not

realize them in the time frame expected.

Our working capital requirements and cash flows are subject to

fluctuation, which could have an adverse effect on our financial

condition.

Our

working capital requirements and cash flows have historically been,

and are expected to continue to be, subject to quarterly and yearly

fluctuations, depending on a number of factors. Factors which could

result in cash flow fluctuations include:

●

the level of sales

and the related margins on those sales;

●

the collection of

receivables;

●

the timing and size

of purchases of inventory and related components; and

●

the timing of

payment on payables and accrued liabilities.

15

If we

are unable to manage fluctuations in cash flow, our business,

operating results and financial condition may be materially

adversely affected. For example, if we are unable to effectively

manage fluctuations in our cash flows, we may be unable to make

required payments on our indebtedness.

We operate in a highly competitive industry.

Our

industry is highly competitive, and we will face increased

competition from companies with strong positions in certain markets

we serve and in new markets and regions we may enter. These

companies offer new, disruptive or substitute products and services

that compete for the pool of available customer

demand.

Many of

these competitors have, and our potential competitors may have,

significantly greater financial and other resources than we do and

have spent, and may continue to spend, significant amounts of

resources to try to enter or expand their presence in the market.

Increased competition or other competitive pressures have and may

continue to result in price reductions, reduced margins or loss of

market share, any of which could have a material adverse effect on

our business, financial condition or results of

operations.

Some of

EPT’s customers are required to purchase equipment by

soliciting proposals from a number of sources and, in some cases,

are required to purchase from the lowest bidder. While we attempt

to price our products competitively based upon the relative

features they offer, our competitors’ prices and other

factors, we are often not the lowest bidder and may lose sales to

lower bidders.

Competitors

may be able to respond to new or emerging technologies and changes

in customer requirements more effectively and faster than we can or

devote greater resources to the development, promotion and sale of

products than we can. Current and potential competitors may

establish cooperative relationships among themselves or with third

parties, including through mergers or acquisitions, to increase the

ability of their products to address the needs of

customers.

EPT does not have its own manufacturing facilities and will be

dependent on third parties for product manufacture. EPT may be

unable to control the availability or cost of producing its

products.

EPT

does not have its own manufacturing facilities and has engaged a

third-party manufacturer to provide contract manufacturing

capabilities. There can be no assurance that EPT’s products

can be manufactured in sufficient commercial quantities, in

compliance with our requirements and at an acceptable cost.

Establishing a replacement source for any of EPT’s products

could require significant time and additional expense. Furthermore,

third party manufacturers may encounter manufacturing or quality

control problems. Any such failure could delay or prevent EPT from

shipping products and marketing its products. In the future EPT may

engage other contract manufacturing organizations in addition to

our current manufacturer or create its own capability.

Testing of potential products will be required and there is no

assurance of regulatory approval.

The

effect of government regulation and the need for approval may delay

marketing of new products for a considerable period of time, impose

costly procedures upon EPT’s activities and provide an

advantage to larger companies that compete with EPT. There can be

no assurance that regulatory approval for any products developed by

EPT will be granted on a timely basis or at all. Any such delay in

obtaining, or failure to obtain, such approvals would materially

and adversely affect the marketing of any contemplated products and

the ability to earn product revenue. Further, regulation of

manufacturing facilities by state, local, and other authorities is

subject to change. Any additional regulation could result in

limitations or restrictions on EPT’s ability to utilize any

of its technologies, thereby adversely affecting EPT’s

operations. Various federal and foreign statutes and regulations

also govern or influence the manufacturing, safety, labeling,

storage, record keeping and marketing of food products. The process

of obtaining these approvals and the subsequent compliance with

appropriate U.S. and foreign statutes and regulations are

time-consuming and require the expenditure of substantial

resources. In addition, these requirements and processes vary

widely from country to country.

16

Our suppliers may not be able to always supply components or

products to us on a timely basis and on favorable terms, and as a

result, our dependency on third party suppliers can adversely

affect our revenue.

We will

rely on our third-party suppliers for components and depend on

obtaining adequate supplies of quality components on a timely basis

with favorable terms to manufacture our products. Some of those

components that we sell are provided to us by a limited number of

suppliers. We will be subject to disruptions in our operations if

our sole or limited supply contract manufacturers decrease or stop

production of components or do not produce components and products

of sufficient quantity. Alternative sources for our components will

not always be available. Many of our components are manufactured

overseas, so they have long lead times, and events such as local

disruptions, natural disasters or political conflict may cause

unexpected interruptions to the supply of our products or

components.

To

prevent future overselling we have worked closely with our

suppliers to establish protocols to handle unexpected orders of key

products and components. In addition, it is our intention, as

mentioned in the use of proceeds, to allocate financial resources

to improve our inventory management, including establishing an

inventory buffer of components appropriate to our business.

However, we cannot assure that our attempt will be successful or

that product or component shortages will not occur in the future.

If we cannot supply products due to a lack of components, or are

unable to utilize other components in a timely manner, our business

will be significantly harmed. If inventory shortages continue, they

could be expected to have a material and adverse effect on our

future revenues and ability to effectively project future sales and

operating results.

We rely on highly skilled personnel, and, if we are unable to

attract, retain or motivate qualified personnel, we may not be able

to operate our business effectively.

Our

success depends in large part on continued employment of senior

management and key personnel who can effectively operate our

business, as well as our ability to attract and retain skilled

employees. Competition for highly skilled management, technical,

research and development and other employees is intense and we may

not be able to attract or retain highly qualified personnel in the

future. In addition, there is a limited quantity of qualified

personnel with experience in the flexitank market. In making

employment decisions, particularly in the job candidates often

consider the value of the equity awards they would receive in

connection with their employment. Our long-term incentive programs

may not be attractive enough or perform sufficiently to attract or

retain qualified personnel.

If any

of our employees leaves us, and we fail to effectively manage a

transition to new personnel, or if we fail to attract and retain

qualified and experienced professionals on acceptable terms, our

business, financial condition and results of operations could be

adversely affected.

Our

success also depends on our having highly trained financial,

technical, recruiting, sales and marketing personnel. We will need

to continue to hire additional personnel as our business grows. A

shortage in the number of people with these skills or our failure

to attract them to our company could impede our ability to increase

revenues from our existing products and services, ensure full

compliance with international and federal regulations, or launch

new product offerings and would have an adverse effect on our

business and financial results.

We may have difficulty in entering into and maintaining strategic

alliances with third parties.

EPT has

entered into, and we may continue to enter into, strategic

alliances with third parties to gain access to new and innovative

technologies and markets. These parties are often large,

established companies. Negotiating and performing under these

arrangements involves significant time and expense, and we may not

have sufficient resources to devote to our strategic alliances,

particularly those with companies that have significantly greater

financial and other resources than we do. The anticipated benefits

of these arrangements may never materialize, and performing under

these arrangements may adversely affect our results of

operations.

We may not be able to obtain patents or other intellectual property

rights necessary to protect our proprietary technology and

business.

We will

seek to patent concepts, components, processes, designs and

methods, and other inventions and technologies that we consider to

have commercial value or that will likely give us a technological

advantage. Despite devoting resources to the research and

development of proprietary technology, we may not be able to

develop technology that is patentable or protectable. Patents may

not be issued in connection with pending patent applications, and

claims allowed may not be sufficient to allow them to use the

inventions that they create exclusively. Furthermore, any patents

issued could be challenged, re-examined, held invalid or

unenforceable or circumvented and may not provide sufficient

protection or a competitive advantage. In addition, despite efforts

to protect and maintain patents, competitors and other third

parties may be able to design around their patents or develop

products similar to the EPT work products that are not within the

scope of their patents. Finally, patents provide certain statutory

protection only for a limited period of time that varies depending

on the jurisdiction and type of patent.

17

Prosecution

and protection of the rights sought in patent applications and

patents can be costly and uncertain, often involve complex legal

and factual issues and consume significant time and resources. In

addition, the breadth of claims allowed in our patents, their

enforceability and our ability to protect and maintain them cannot

be predicted with any certainty. The laws of certain countries may

not protect intellectual property rights to the same extent as the

laws of the United States. Even if our patents are held to be valid

and enforceable in a certain jurisdiction, any legal proceedings

that we may initiate against third parties to enforce such patents

will likely be expensive, take significant time and divert

management’s attention from other business matters. We cannot

assure that any of the issued patents or pending patent

applications of EPT provide any protectable, maintainable or

enforceable rights or competitive advantages to us.

In

addition to patents, we will rely on a combination of copyrights,

trademarks, trade secrets and other related laws and

confidentiality procedures and contractual provisions to protect,

maintain and enforce our proprietary technology and intellectual

property rights in the United States and other countries. However,

our ability to protect our brands by registering certain trademarks

may be limited. In addition, while we will generally enter into

confidentiality and nondisclosure agreements with our employees,

consultants, contract manufacturers, distributors and resellers and

with others to attempt to limit access to and distribution of our

proprietary and confidential information, it is possible

that:

●

misappropriation of

our proprietary and confidential information, including technology,

will nevertheless occur;

●

our confidentiality

agreements will not be honored or may be rendered

unenforceable;

●

third parties will

independently develop equivalent, superior or competitive

technology or products;

●

disputes will arise

with our current or future strategic licensees, customers or others

concerning the ownership, validity, enforceability, use,

patentability or registrability of intellectual property;

or

●

unauthorized

disclosure of our know-how, trade secrets or other proprietary or

confidential information will occur.

We

cannot assure that we will be successful in protecting, maintaining

or enforcing our intellectual property rights. If we are

unsuccessful in protecting, maintaining or enforcing our

intellectual property rights, then our business, operating results

and financial condition could be materially adversely affected,

which could

●

adversely affect

our reputation with customers;

●

be time-consuming

and expensive to evaluate and defend;

●

cause product

shipment delays or stoppages;

●

divert

management’s attention and resources;

●

subject us to

significant liabilities and damages;

●

require us to enter

into royalty or licensing agreements; or

●

require us to cease

certain activities, including the sale of products.

If it

is determined that we have infringed, violated or are infringing or

violating a patent or other intellectual property right of any

other person or if we are found liable in respect of any other

related claim, then, in addition to being liable for potentially

substantial damages, we may be prohibited from developing, using,

distributing, selling or commercializing certain of our

technologies unless we obtain a license from the holder of the

patent or other intellectual property right. We cannot assure that

we will be able to obtain any such license on a timely basis or on

commercially favorable terms, or that any such licenses will be

available, or that workarounds will be feasible and cost-efficient.

If we do not obtain such a license or find a cost-efficient

workaround, our business, operating results and financial condition

could be materially adversely affected and we could be required to

cease related business operations in some markets and restructure

our business to focus on our continuing operations in other

markets.

18

If we are unable to anticipate customer preferences and

successfully develop attractive products, we might not be able to

maintain or increase our revenue or achieve

profitability

Our

success depends on our ability to anticipate and react to the

demands and preferences of customers in a timely manner. If we are

unable to introduce new solutions or products in a timely manner or

our new offers are not accepted by our customers, our competitors

may introduce more attractive offers which would adversely impact

our competitive position. Failure to respond in a timely manner to

changing consumer preferences could lead to, among other things,

lower revenues and excess inventory positions of outdated

products.

We may be unable to keep pace with changes in technology as our

business and market strategy evolves.

We will

need to respond to technological advances in a cost-effective and

timely manner in order to remain competitive. The need to respond

to technological changes may require us to make substantial,

unanticipated expenditures. There can be no assurance that we will

be able to respond successfully to technological

change.

Risks Related to Our Common Stock

There is currently a limited public trading market for our common

stock and one may never develop. We voluntarily file reports with

the SEC.

Our

common stock currently is eligible for quotation on the OTC Pink

Marketplace. There currently is a limited trading market for our

shares of common stock, and no assurances can be given that any

public market will develop in the foreseeable future, or even if it

does, that an active trading market will develop or be sustained.

As a result, our investors may have limited or no ability to

liquidate their investments.

The OTC

Pink Marketplace is a less recognized market than the registered

securities exchanges and are often characterized by low trading

volume and significant price fluctuations. These and

other factors may further impair our stockholders’ ability to

sell their shares when they want to and/or could depress our stock

price. As a result, stockholders could find it difficult to dispose

of, or obtain accurate quotations of the price of our securities

because smaller quantities of shares could be bought and sold,

transactions could be delayed and security analyst and news

coverage of our Company may be limited. If a public

market for our common stock does develop, these factors could

result in lower prices and larger spreads in the bid and ask prices

for our shares of common stock. These factors could impact the

value of the Company and impair the value of our common

stock.

Because we were a “shell company,” Rule 144 is

unavailable until one year has elapsed from the date that we have

filed “Form 10 information” with the SEC, including

current financial statements.

Rule

144 provides, as indicated above, that sales of securities of a

former shell company may only be made once the applicable waiting

period has terminated and only if appropriate current information

is available by the company and that it has filed all relevant

periodic reports that it is required to file. Rule 144 will be

unavailable to holders of restricted securities until one year has

elapsed from the date that we filed “Form 10

information” (as defined in Rule 144) with the SEC along with

audited financial statements. Since, as indicated above, we have

not included unaudited financial statements for the three (3)

months ended March 31, 2017, Rule 144 will not be available and

holders of shares of our common stock that are deemed

“restricted securities” under the Securities Act will

not be able to sell such shares under Rule 144 until the date one

(1) year from the date we file an amendment to this Current Report

on Form 8-K which includes such unaudited financial statements.

Once we become current, no assurance can be made that the Company

will be able to remain current with its reports. In addition to the

above, because we voluntarily file SEC reports with the SEC,

following the one (1) year period discussed above, holders will not

be permitted to rely on Rule 144 for sales of our shares, unless

and until such time as we are mandatorily required under SEC laws,

rules and regulations to file periodic reports with the

SEC.

The market price of our common stock may be highly volatile and

such volatility could cause you to lose some or all of your

investment.

The

market price of our common stock may fluctuate significantly in

response to numerous factors, some of which are beyond our control,

such as:

●

the announcement of

new products or product enhancements by us or our

competitors;

●

developments

concerning intellectual property rights;

●

changes in legal,

regulatory, and enforcement frameworks impacting our

products;

19

●

variations in our

and our competitors’ results of operations;

●

fluctuations in

earnings estimates or recommendations by securities analysts, if

our common stock is covered by analysts;

●

the results of

product liability or intellectual property lawsuits;

●

future issuances of

common stock or other securities;

●

the addition or

departure of key personnel;

●

announcements by us

or our competitors of acquisitions, investments or strategic

alliances; and

●

general market

conditions and other factors, including factors unrelated to our

operating performance.

Further,

the general stock market has recently experienced price and volume

fluctuations. The volatility of our common stock could be further

exacerbated due to low trading volume. Continued market

fluctuations could result in extreme volatility in the price of our

common stock, which could cause a decline in the value of our

common stock and the loss of some or all of our investors’