Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TARONIS TECHNOLOGIES, INC. | v469215_8k.htm |

Exhibit 99.1

MagneGas Corporation Investor Presentation NASDAQ:MNGA Scott Mahoney, CFA Chief Financial Officer

Safe Harbor NASDAQ:MNGA 2 This presentation may contain “forward - looking statements” that are made pursuant to the “safe harbor” provisions as defined within the Private Securities Litigation Reform Act of 1995. Forward - looking statements may be identified by words including “anticipates,” “believes,” “intends,” “estimates,” and similar expressions. These statements are based upon management’s current expectations as of the date of this presentation. Such forward - looking statements may include statements regarding the Company’s future financial performance or results of operations, including expected revenue growth, cash flow growth, future expenses and other future or expected performances. The Company cautions readers there may be events in the future that the Company is not able to accurately predict or control and the information contained in the forward - looking statements is inherently uncertain and subject to a number of risks that could cause actual results to differ materially from those indicated in the forward - looking statements. Further information on these and other potential factors that could affect the Company’s financial results is included in the Company’s filings with the SEC under the “Risk Factors” sections and elsewhere in those filings.

Investment Highlights » Only submerged, plasma arc gasification system in commercial use today; significant intellectual property barriers to entry for competition » Disruptive technology applications across multiple industry verticals including metal fabrication, agriculture, water sanitation and energy utility markets » Awarded $432,000 commercialization grant from the USDA for sterilization technology » Near term ability to rapidly scale and improve margins; existing business projected to grow at 50%+ CAGR from 2014 - 2017 » Closed $25.0 million milestone financing intended to fund accelerating growth » Focused on EBITDA positive business model in 2017 - 2018 through organic and acquired revenue growth NASDAQ:MNGA 3

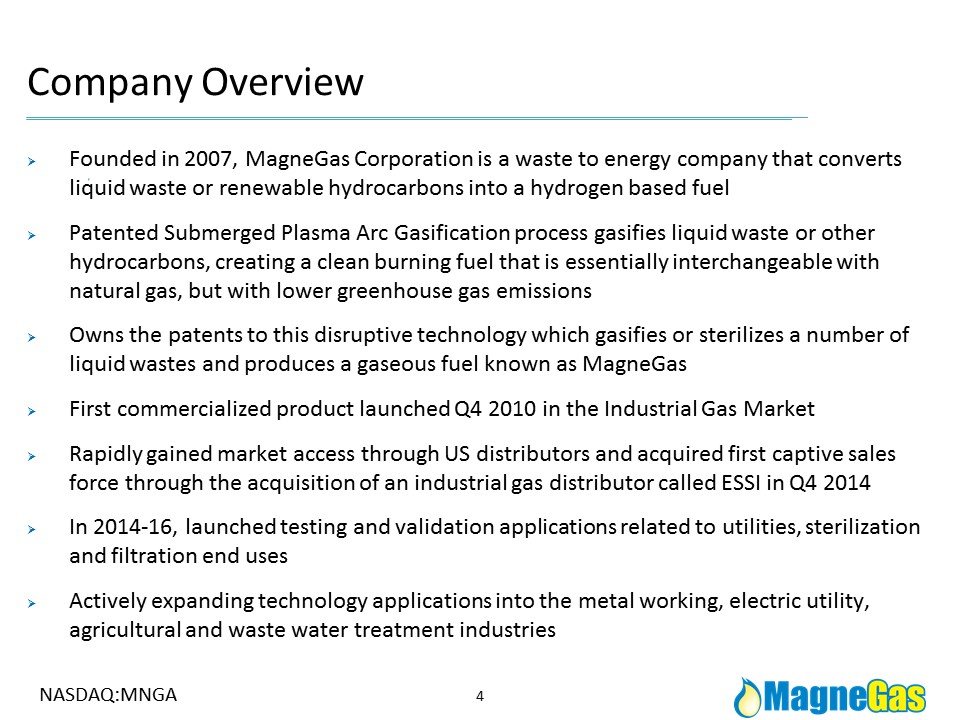

Company Overview » Founded in 2007, MagneGas Corporation is a waste to energy company that converts liquid waste or renewable hydrocarbons into a hydrogen based fuel » Patented Submerged Plasma Arc Gasification process gasifies liquid waste or other hydrocarbons, creating a clean burning fuel that is essentially interchangeable with natural gas, but with lower greenhouse gas emissions » Owns the patents to this disruptive technology which gasifies or sterilizes a number of liquid wastes and produces a gaseous fuel known as MagneGas » First commercialized product launched Q4 2010 in the Industrial Gas Market » Rapidly gained market access through US distributors and acquired first captive sales force through the acquisition of an industrial gas distributor called ESSI in Q4 2014 » In 2014 - 16, launched testing and validation applications related to utilities, sterilization and filtration end uses » Actively expanding technology applications into the metal working, electric utility, agricultural and waste water treatment industries NASDAQ:MNGA 4

Technology Overview NASDAQ:MNGA 5 *Certain liquids require dilution or further testing *

Submerged Plasma Arc Benefits Submerged gasification technology provides operating advantages: » More efficient production » Gas product immediately ready for use » Production inputs are readily available anywhere globally » Production units are very scalable to meet output needs » Units are equally flexible for all applications NASDAQ:MNGA 6 Units are readily customized, can be scaled down to a mobile unit on a flatbed or large enough to produce enough gas to power Fortune 500 manufacturing facilities

Business Overview NASDAQ:MNGA 7 » Sterilization confirmed & validated with agriculture partner – 2015 » Meets EPA Requirements for sewage, sludge and manures. Working to clear regulatory barriers » Target agriculture and waste water markets Welding Supply Waste & Water Treatment » Launched distributor sales - 2010 » Acquired 1st welding supply company - 2014 » First gas plant sold - 2016 » Inroads with Fortune 500 consumers – 2016 » Rapid scalability across all three areas - 2017 Electric Utilities » Two independent verifications in process » US verification partner is a leader in the US utility sector, household name » Highly disruptive potential applications in heavy industry, utilities

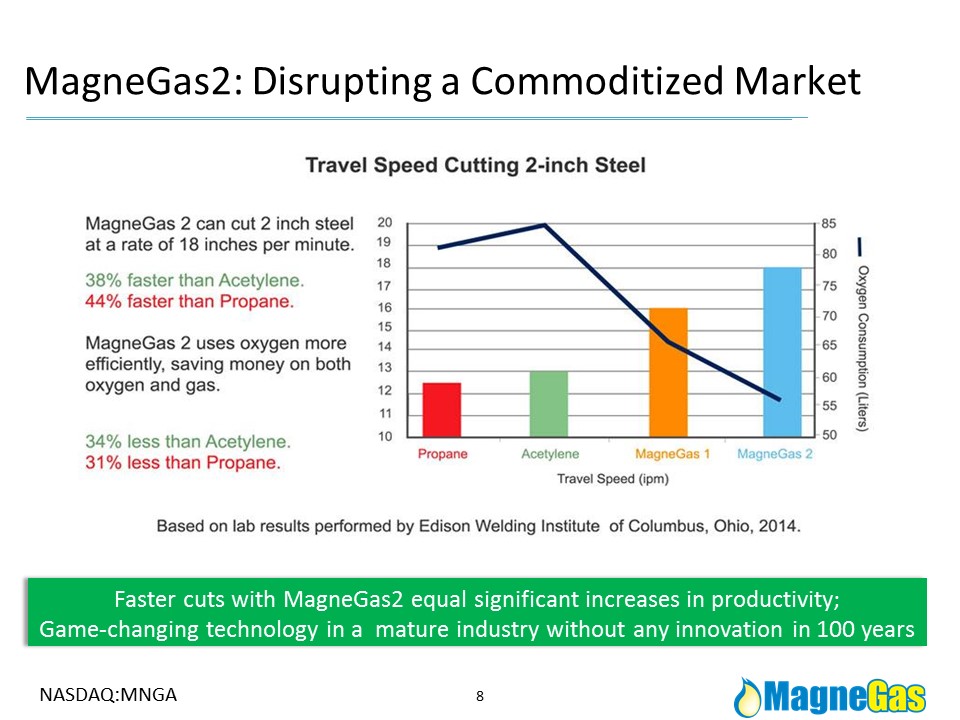

MagneGas2: Disrupting a Commoditized Market Faster cuts with MagneGas2 equal significant increases in productivity; Game - changing technology in a mature industry without any innovation in 100 years NASDAQ:MNGA 8

MagneGas2 Versus Acetylene Technical welders adopt our product for its superior performance: » Cuts 40% faster » Cleaner cut, less clean up time » 10 - 25% cheaper Corporate clients value the added benefits of MagneGas: » Safer, more stable material » Green, renewable product » Meaningful cost savings NASDAQ:MNGA 9 Why Clients Adopt MagneGas2 MagneGas - Acetylene Comparison MagneGas2 captive sales force model for 2+ years: 95%+ adoption rate and little client turnover Attribute Acetylene MagneGas2 Flame Temperature 5,600F / 3,100C 10,500F / 5,800C Slag Significant Little to None Top Edge Rollover Significant None Soot Significant Limited Noxious/Harmful Fumes Significant Hazard Minimal (Yields 12% Oxygen) Pooling if Leaked Significant Hazard None (Lighter than Air) Heat Affected Zone Wide Narrow Useable Gas in Cylinder 80% 100%

$0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 2014 2015 2016 2017P Annual Revenues (MM) Captive Sales Model Success NASDAQ:MNGA 10 » Launched captive sales model through acquisition 2014 in Florida » MagneGas2 is a key wedge product » 95%+ client adoption of MagneGas2 » Rapid new client growth » Accelerates distributor adoption » Overall growth generates production equipment sales Captive sales model drives 33% CAGR in welding supplies 58% Projected CAGR in welding and equipment sales Overall industry is only growing 2 - 3%

MagneGas: Wedge Product for Strong Cross - Sales Leverage 11 2% MagneGas 3% 7% 2% 36% 1% 2% 1% 7% 20% 19% Industrial Gas & Welding Supply Revenue Composition Propane MagneGas HighPressure Gas Low Pressure Gas Materials Liquids Bulk Machine Reairs Cylinder Rent Other Equipment » The acetylene market is heavily commoditized with little innovation in 100+ years » MagneGas is a demonstrated wedge product with high adoption rates » Proven client satisfaction through low attrition rates over 2+ years » MagneGas sales open the door for the client to bring their full welding supply needs to us » In our established markets, organic growth and new client adoption rates are accelerating For every dollar of MagneGas we sell, we are now gaining $31 in additional sales. NASDAQ:MNGA

2017 US Growth Strategy NASDAQ:MNGA 12 FLORIDA » Entered FL market in Q4 2014 » Grown revenues more than 100% » Opened 3 new location in LTM » Multiple acquisition opportunities CALIFORNIA » Very strong existing sales of MagneGas. » Identified multiple successful independent welding supply targets for acquisition » Intend to make CA a priority market for captive sales model Market Description Existing captive sales Existing Distributors Relationships Target market for acquisitions INDIANA » Strong distributor penetrated market for MagneGas » Brought a Big 3 Auto manufacturer that adopted MagneGas for two plants » Launched organic expansion in late Q2 2017. » Acquisition targets identified TEXAS » 1 st Distributor to purchase a production plant – 2016 TENNESSEE » Major regional distribution added in late 2016 » Key driver for market penetration in 7 SE states

Industrial Gas & Welding Supply Opportunity NASDAQ:MNGA 13 » MagneGas has a proven, disruptive product that competes well within a massive, established market » Our proprietary product is a highly effective wedge product, enabling MagneGas to take market share at an accelerated rate » MagneGas is currently tracking to a 50%+CAGR from 2014 - 2017, and we have made significant progress in identifying promising new markets via acquisitions » The industry is still target rich, with 2,000+ independent operators available for acquisition at reasonable valuations

Electric Utilities and Co - Combustion » MagneGas fuel has a very high combustion flame temperature of 10,500 F or 5,800 C » The higher the temperature, the more complete the combustion of the fuel and the cleaner the emissions » Ability to inject MagneGas into any form of fossil fuel as a catalyst to improve combustion* » Independent verification underway from two reference organizations in coal power NASDAQ:MNGA 14 The high flame temperature of MagneGas burns existing fuels cleaner through co - combustion Value Proposition *Results based on internal testing, independent verification underway

MagneGas Co - Combustion NASDAQ:MNGA 15 Advantages* Value Proposition Significant Market Waste Emissions Energy Fuel Power Plant » CO 2 is reduced » Heat is increased » Nox & CO reduced » Particulates almost eliminated » Potential to dramatically reduce waste emissions material » Reduces the replacement and maintenance of existing filtration and purification systems » Significant cost savings to the operator » Estimated $4 million of annual revenue per coal fired plant converted to MagneGas 1 » Mgmt estimates a total market of 547 coal fired power plants in US, 1000s worldwide *Based on internal testing, independent verification underway

Sterilization & Filtration Emerging Solution for Agriculture and Waste Water Industries » High volume of liquid sterilized in Sterilization Mode » Complete elimination of small quantity liquid in Gasification Mode » Space savings over existing methods of treatment » A versatile syngas and sterilized water are the results of the gasification process » Potential for meaningful cost savings, production adoption across two of the largest non - cyclical global industries NASDAQ:MNGA 16 MagneGas’ first business line uses heat from the plasma arc system to gasify or sterilize liquid wastes

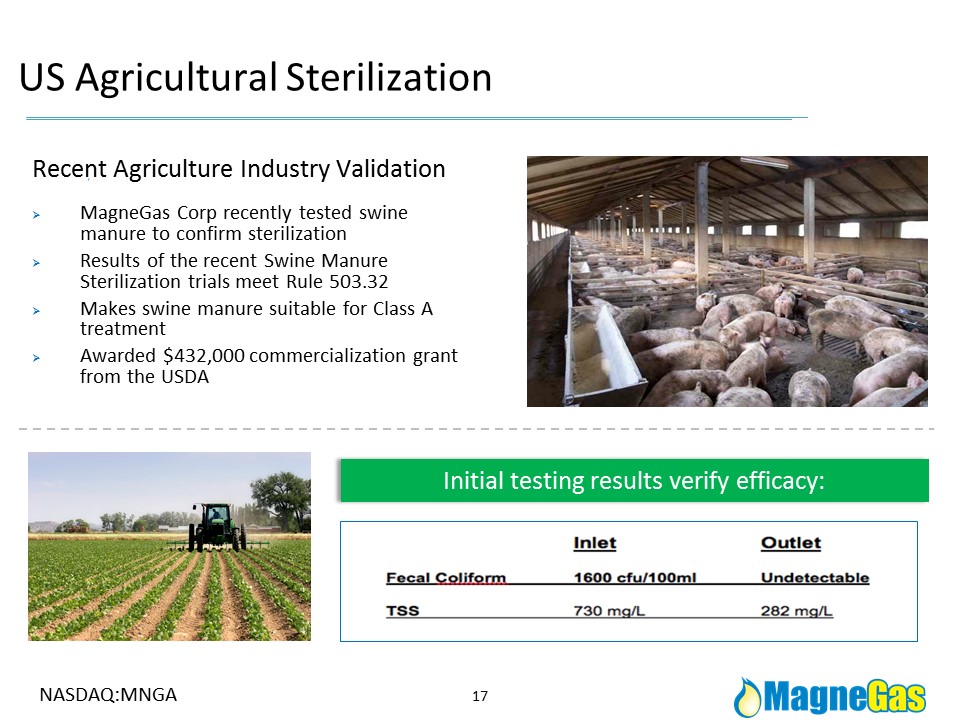

US Agricultural Sterilization Recent Agriculture Industry Validation » MagneGas Corp recently tested swine manure to confirm sterilization » Results of the recent Swine Manure Sterilization trials meet Rule 503.32 » Makes swine manure suitable for Class A treatment » Awarded $432,000 commercialization grant from the USDA NASDAQ:MNGA 17 Initial testing results verify efficacy:

Sterilization & Filtration JV Opportunities NASDAQ:MNGA 18 Prospective Partner is US Leader in Filtration & Remediation Solutions » In discussions with a 30+ year industry leader in environmental solutions for water and air filtration and remediation » Deep client relationships in heavy industry, utilities, fuel, manufacturing and other verticals Potential to Accelerate Client Adoption » Options to partner with or acquire filtration solutions business » Highly scalable solutions with low cost to expand, accelerate growth » Deep client base with immediate needs across western US » Strong synergies with our sterilization and filtration solutions

Experienced Management Team Ermanno P. Santilli, Chief Executive Officer, President Mr. Santilli has invested over 15 years with Fortune 500 brands such as Club Car, Bobcat, Thermo King, and Trane at Ingersoll Rand Company. He successfully stewarded global and international businesses with diverse teams of sales, marketing, engineering, sourcing, finance, and distribution. After graduating with a Bachelors of Science Degree from the prestigious Boston College Carroll School of Management, Mr. Santilli obtained a Masters of Business Administration from the Indiana University Kelley School of Management. More recently, Mr. Santilli founded MagneGas Europe where he became an expert in the MagneGas technology and business model and its various applications. Scott Mahoney, Chief Financial Officer and Secretary Mr. Mahoney has almost 20 years of finance and executive management experience and has held positions at several public and privately held companies in the banking, energy and recycling industries. Prior to joining MagneGas, Mr. Mahoney served as Chief Financial Officer of a leading national recycling company in the automotive space which he grew through various acquisitions. He has also served as Chief Financial Officer of several oil and gas companies and as Vice - President of JP Morgan Chase. Mr. Mahoney is a Certified Financial Analyst (CFA) and obtained his Bachelor Degree from the University of New Hampshire and his Master in Business Administration from the Thunderbird School of International Management. Jack Armstrong, President, MagneGas Welding Supply Mr. Armstrong has over 20 years of experience in the capital markets. He was a Managing Director at Piper Jaffray, Head of Trading at ThinkEquity Partners and recently the Senior Vice President of the Corporate Client Group at Northland Capital Markets assisting companies in strategy and capital raises. Over his career, Mr. Armstrong has worked with senior level management at several of the largest investment companies through the process of raising an estimated $5 billion of funds over his career. Mr. Armstrong received a Bachelors of Administration in Economics from Arizona State University. NASDAQ:MNGA 19

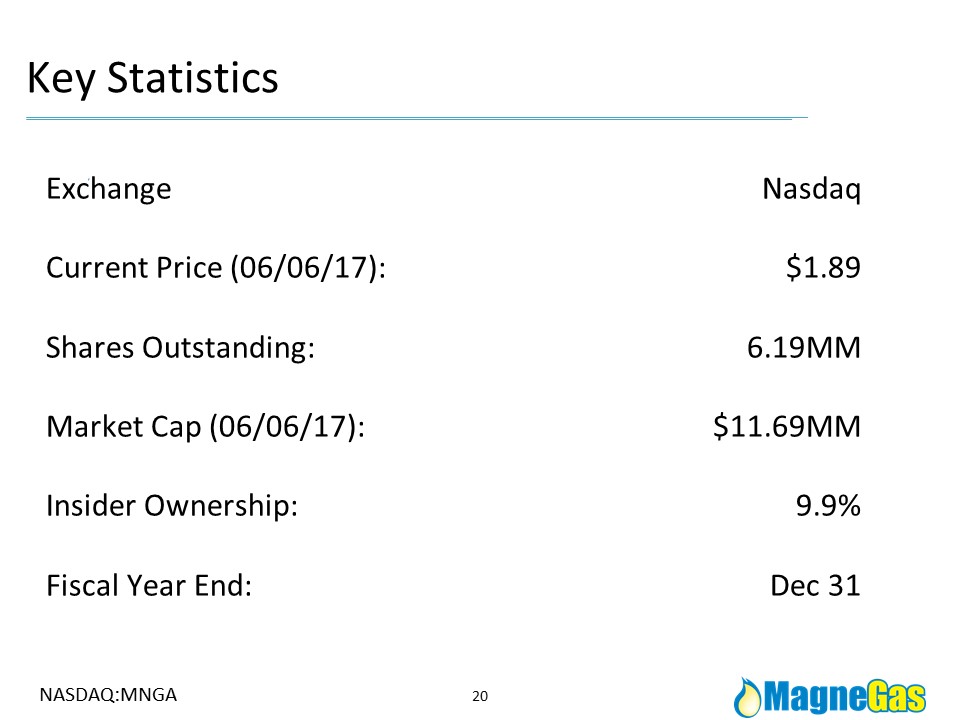

Key Statistics Exchange Nasdaq Current Price (06/06/17): $1.89 Shares Outstanding: 6.19MM Market Cap (06/06/17): $11.69MM Insider Ownership: 9.9% Fiscal Year End: Dec 31 NASDAQ:MNGA 20

11885 44 th Street N. Clearwater, FL 33762 www.MagneGas.com P. 727 - 934 - 3448 F. 727 - 934 - 6260 E. Info@magnegas.com Thank You Company Contact: