Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Celanese Corp | june1820178-kdoc.htm |

| EX-99.5 - EXHIBIT 99.5 - Celanese Corp | june1820178-kex995.htm |

| EX-99.4 - EXHIBIT 99.4 - Celanese Corp | june1820178-kex994.htm |

| EX-99.2 - EXHIBIT 99.2 - Celanese Corp | june1820178-kex992.htm |

| EX-99.1 - EXHIBIT 99.1 - Celanese Corp | june1820178-kex991.htm |

Celanese and Blackstone

to Form Joint Venture in

Acetate Tow

J U N E 1 8 , 2 0 1 7

Combines complementary tow portfolios to

drive innovation and enhance cost competitiveness

Proceeds from transaction to be deployed

in high-growth businesses at Celanese

2A C E T A T E T O W J V – J U N E 2 0 1 7

Disclosures

Forward-Looking Statements

This presentation contains “forward-looking statements,” which include information concerning the Company’s plans, objectives, goals, strategies, future revenues, synergies,

or performance, financing needs and other information that is not historical information. All forward-looking statements are based upon current expectations and beliefs and

various assumptions, including the announced joint venture transaction. There can be no assurance that the Company will realize these expectations or that these beliefs will

prove correct. There are a number of risks and uncertainties that could cause actual results to differ materially from the results expressed or implied in the forward-looking

statements contained in this presentation, including with respect to the joint venture. These risks and uncertainties include, among other things: changes in general economic,

business, political and regulatory conditions in the countries or regions in which we operate; the length and depth of product and industry business cycles, particularly in the

automotive, electrical, textiles, electronics and construction industries; changes in the price and availability of raw materials, particularly changes in the demand for, supply of,

and market prices of ethylene, methanol, natural gas, wood pulp and fuel oil and the prices for electricity and other energy sources; the ability to pass increases in raw material

prices on to customers or otherwise improve margins through price increases; the ability to maintain plant utilization rates and to implement planned capacity additions and

expansions; the ability to reduce or maintain current levels of production costs and to improve productivity by implementing technological improvements to existing plants;

increased price competition and the introduction of competing products by other companies; changes in the degree of intellectual property and other legal protection afforded

to our products or technologies, or the theft of such intellectual property; compliance and other costs and potential disruption or interruption of production or operations due

to accidents, interruptions in sources of raw materials, cyber security incidents, terrorism or political unrest or other unforeseen events or delays in construction or operation

of facilities, including as a result of geopolitical conditions, the occurrence of acts of war or terrorist incidents or as a result of weather or natural disasters; potential liability for

remedial actions and increased costs under existing or future environmental regulations, including those relating to climate change; potential liability resulting from pending or

future litigation, or from changes in the laws, regulations or policies of governments or other governmental activities in the countries in which we operate; changes in currency

exchange rates and interest rates; our level of indebtedness, which could diminish our ability to raise additional capital to fund operations or limit our ability to react to changes

in the economy or the chemicals industry; and various other factors discussed from time to time in the Company’s filings with the Securities and Exchange Commission. In

addition to the risks and uncertainties identified above, the following risks and uncertainties, among others, could cause the Company’s actual results of operations regarding

the joint venture to differ materially from the results expressed or implied in this presentation: the timing or ultimate completion of the transaction as the transaction is subject

to closing conditions, including antitrust clearance; the benefits of the transaction may not materialize as expected; ability to successfully implement the integration strategy for

the joint venture; and the ability to ensure continued performance or market growth of the combined tow businesses. Any forward-looking statement speaks only as of the date

on which it is made, and the Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which it is made

or to reflect the occurrence of anticipated or unanticipated events or circumstances.

Results Unaudited

The results in this document, together with the adjustments made to present the results on a comparable basis, have not been audited and are based on internal financial data

furnished to management. Quarterly results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year.

Presentation

This document presents the Company’s business segments in two subtotals, reflecting our two cores, the Acetyl Chain and Materials Solutions, based on similarities among

customers, business models and technical processes. As described in the Company’s annual report on Form 10-K and quarterly reports on Form 10-Q, the Acetyl Chain

includes the Company’s Acetyl Intermediates segment and the Industrial Specialties segment. Materials Solutions includes the Company’s Advanced Engineered Materials

segment and the Consumer Specialties segment. The Consumer Specialties segment includes the Company’s Cellulose Derivatives business.

Non-GAAP Financial Measures

This presentation, and statements made in connection with this presentation, refer to non-GAAP financial measures. For more information on the non-GAAP financial measures

used by the Company, including the most directly comparable GAAP financial measure for each non-GAAP financial measures used, including definitions and reconciliations

of the differences between such non-GAAP financial measures and the comparable GAAP financial measures, please refer to the Non-US GAAP Financial Measures and

Supplemental Information documents available on our website, www.celanese.com, under Investor Relations/Financial Information/Non-GAAP Financial Measures.

3A C E T A T E T O W J V – J U N E 2 0 1 7

Agenda

> Value creation at Celanese

> Tow transaction de-risks portfolio

and unlocks tremendous value

> Clear path to accelerate growth

4A C E T A T E T O W J V – J U N E 2 0 1 7

…drives value creation at Celanese

Structural and commercial uniqueness...

Competitive

Advantages

Differentiated

Business

Models

LEADERSHIP

POSITIONS

MANAGING

COMPLEXITY

GLOBAL

PRESENCE

BROAD PRODUCT

PORTFOLIO

FLEXIBLE

MANUFACTURING

& SUPPLY CHAIN

ADVANTAGED

COST

POSITIONS

WINNING

CULTURE &

MINDSET

+

MARKET

PLACE

PRESENCE

GLOBAL

ASSETS &

RESOURCES

BROADEST

MATERIALS

PORTFOLIO

DIFFERENTIATOR

CAPABILITIES

PRODUCTIVITY UNPARALLELED

CHOICES

EXPANDED

FLEXIBILITY

EXCEPTIONAL

EXECUTION

COMPETITIVE ADVANTAGES

DIFFERENTIAL ACTIONS

DIFFERENTIAL MARGIN PERFORMANCE

ACETYL CHAIN

#1 OR #2

IN OUR

MARKETS

LOW-COST

OPERATIONS

ADVANTAGED

TECHNOLOGY

HIGHLY

INTEGRATED

VALUE CHAIN

BEST PIPELINE MANAGEMENT SYSTEM

COMPLETE PACKAGECUSTOMER

ROBUST OPPORTUNITY PIPELINE

ADVANCED ENGINEERED MATERIALS (AEM)

+

CUSTOMER NEEDS

C

US

TOMER

M

ATERIAL

PART

PIPELINE

AGGREGATION

& EXECUTION

MACHINE

Customer

Engagement to Map

Project Options

Translation

of Wins

Real-time

Screening Process

Programming

of Resources

Prioritized Solution

Development

Identification of

Customer Trends

5A C E T A T E T O W J V – J U N E 2 0 1 71. 2015 free cash flow excludes payment of $177 million related to the termination of an existing supplier agreement

2. 2016 free cash flow excludes voluntary payment of $300 million for pension deleveraging

…supported by strong commercial and operational fundamentals

A track record of robust growth...

2012 2013 2014 2015 2016 2017F

$4.07

$4.50

$5.67

$6.02

$6.61

~8-11%

GROWTH

2012 2013 2014 2015 2016 2017F

$361 $392

$548

$7331

$9232

~$850

13%

CAGR

2012-16

26%

CAGR

2012-16

2012 2013 2014 2015 2016

17.5%

16.2%

17.8%

18.6%

19.4%

$88

$247

$394

$594

$701

18%

2012 2013 2014 2015 2016

CELANESE

AVG. ADJUSTED

ROIC

11%

PEER

MEAN ROIC

China

Eastman

Celanese

Daicel

Solvay

Other

2016 Acetate Tow Capacity

ADJUSTED EPS FREE CASH FLOW

I N M I L L I O N S

6A C E T A T E T O W J V – J U N E 2 0 1 7

Growth reinforced by capital stewardship...

1. ROIC for proxy peers is defined as Net Operating Profit After Tax divided by the average Invested Capital at the beginning and ending of each measurement period.

ROIC for proxy peers is per Bloomberg. ROIC for Celanese is per Celanese non-GAAP disclosure

Proxy peers include ALB, APD, ASH, ECL, EMN, FMC, HUN, MON, PPG, PX, RPM, VAL

2. Cumulative change in market cap through end of Q1 2017

3. Bloomberg total shareholder return from start of 2012 through end of Q1 2017

…has generated total shareholder return of ~120%3

2012 2013 2014 2015 2016 2017F

$4.07

$4.50

$5.67

$6.02

$6.61

~8-11%

GROWTH

2012 2013 2014 2015 2016 2017F

$361 $392

$548

$7331

$9232

~$850

13%

CAGR

2012-16

26%

CAGR

2012-16

2012 2013 2014 2015 2016

17.5%

16.2%

17.8%

18.6%

19.4%

$88

$247

$394

$594

$701

18%

2012 2013 2014 2015 2016

CELANESE

AVG. ADJUSTED

ROIC

11%

PEER

MEAN ROIC

China

Eastman

Celanese

Daicel

Solvay

Other

2016 Acetate Tow Capacity

$0.09

$0.9

$2.4

$2.7

$3.2

$5.1

-$0.2

$0.3

$0.7

$1.3

$2.0

2012 2013 4 2015 2016 2017F2

ADJUSTED ROIC1

2 0 1 2 - 2 0 1 6

MARKET CAP AND CASH RETURN

I N B I L L I O N S

A rigor in capital deployment that

delivers outsized returns…

…and growing market cap and

returning cash to shareholders

CUMULATIVE CHANGE IN AVERAGE

MARKET CAP SINCE 2011

CUMULATIVE DIVIDENDS

CUMULATIVE SHARE REPURCHASES

7A C E T A T E T O W J V – J U N E 2 0 1 7

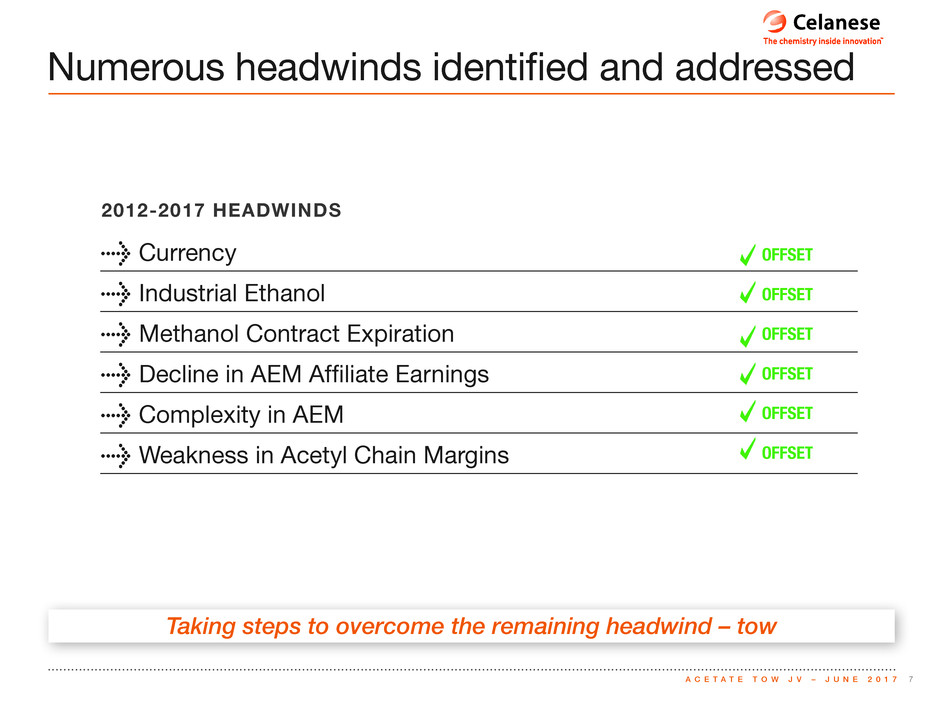

Numerous headwinds identified and addressed

Taking steps to overcome the remaining headwind – tow

> Currency

> Industrial Ethanol

> Methanol Contract Expiration

> Decline in AEM Affiliate Earnings

> Complexity in AEM

> Weakness in Acetyl Chain Margins

OFFSET

OFFSET

OFFSET

OFFSET

OFFSET

OFFSET

2012-2017 HEADWINDS

8A C E T A T E T O W J V – J U N E 2 0 1 71. Celanese estimates

2. Rhodia Acetow assets recently acquired by Blackstone

...and has delivered high levels of cash and earnings growth

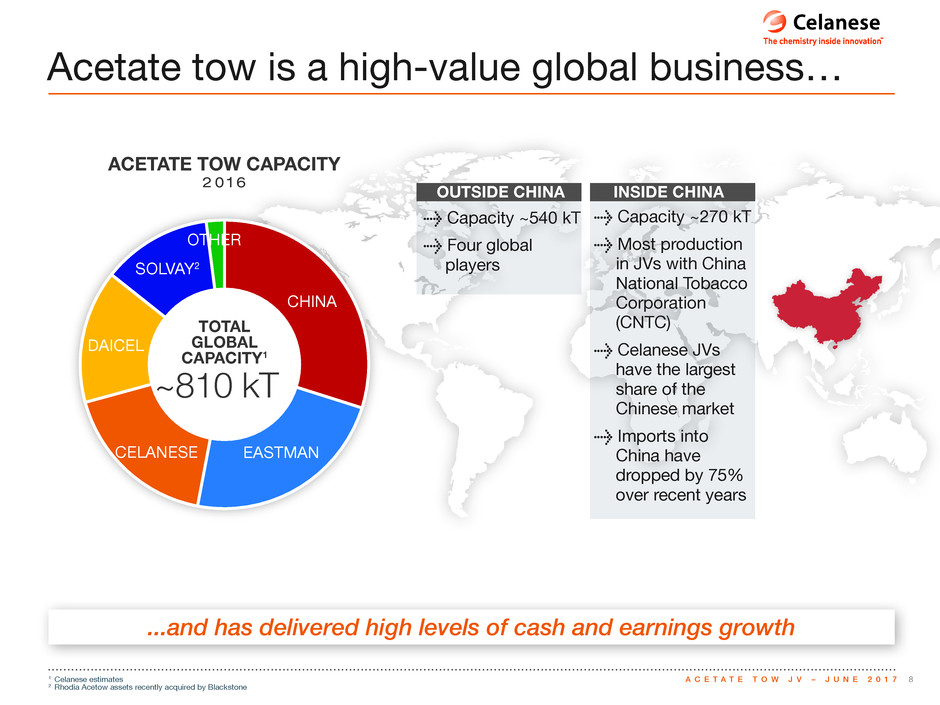

Acetate tow is a high-value global business…

> Capacity ~270 kT

> Most production

in JVs with China

National Tobacco

Corporation

(CNTC)

> Celanese JVs

have the largest

share of the

Chinese market

> Imports into

China have

dropped by 75%

over recent years

> Capacity ~540 kT

> Four global

players

INSIDE CHINAOUTSIDE CHINA

ACETATE TOW CAPACITY

2 0 1 6

2012 2013 2014 2015 2016 2017F

$4.07

$4.50

$5.67

$6.02

$6.61

~8-11%

GROWTH

2012 2013 2014 2015 2016 2017F

$361 $392

$548

$7331

$9232

~$850

13%

CAGR

2012-16

26%

CAGR

2012-16

2012 2013 2014 2015 2016

17.5%

16.2%

17.8%

18.6%

19.4%

$88

$247

$394

$594

$701

18%

2012 2013 2014 2015 2016

CELANESE

AVG. ADJUSTED

ROIC

11%

PEER

MEAN ROIC

China

Eastman

Celanese

Daicel

Solvay

Other

2016 Acetate Tow Capacity

~810 kT

TOTAL

GLOBAL

CAPACITY1

CHINA

EASTMANCELANESE

DAICEL

SOLVAY2

OTHER

9A C E T A T E T O W J V – J U N E 2 0 1 71. GAMA data, Euromonitor, Celanese estimates

2. Stick Equivalent

Recent shifts in Chinese demand pattern…

2011-2014 2014-2020E

CHINA CIGARETTES CHINA IMPORT VOLUME (KT)ROW CIGARETTES IMPORT % OF CHINESE TOW DEMAND

CAGR CAGR

-0.7% -1.5%

2012 2013 2014 2015 2016E 2017E 2018E 2019E 2020E

6.3 6.3 6.26.2 5.9 5.9 5.8 5.7 5.6 5.6

2011 2012

I

M

P

O

R

T

%

I

M

P

O

R

T

V

O

L

U

M

E

(

K

T

)

2013 2014 2015 2016E 2017E 2018E2011

200

160

120

80

40

0

50%

40%

30%

20%

10%

0%

I

M

P

O

R

T

%

I

M

P

O

R

T

V

O

L

U

M

E

(

K

T

)

200

160

120

80

40

0

50%

40%

30%

20%

10%

0%

43% 43%

36%

32%

19%

15%

9%

5%

43% 43%

36%

32%

19%

15%

9%

5%

2012 2013 2014 2015 2016E 2017E 2018E 2019E 2020E

6.3 6.3 6.26.2 6.0 5.9 5.8 5.7 5.6 5.6

2011 2012 2013 2014 2015 2016E 2017E 2018E2011

CU

M

U

L

AT

I

V

E

CA

SH

GE

NE

R

AT

I

O

N

2011

2016 2017 2018 2019 2020

$x

$x

C

U

M

U

L

A

T

I

V

E

C

A

S

H

G

E

N

E

R

A

T

I

O

N

V

A

L

U

E

S

C

A

L

E

HIGHEST

2016 2017 2018 2019 2020

$6.0B

$4.2B

$2.5B

C

U

M

U

L

A

T

I

V

E

C

A

S

H

G

E

N

E

R

A

T

I

O

N

20161 2017F 2018F 2019F 2020F

$6.2B

$4.6B

H

I G

H

E

S

T

V

A

L

U

E

H

I

G

H

E

S

T

V

A

L

U

E

$1.8

$0.9 1

2016: $0.9

2017F: $1.8

2018F: Orange: $2.7; Silver: $1.6

2019F: Orange: $3.6; Silver: $1.6

2020F: Orange: $4.6; Silver: $1.6

$1.6

$4.2B

I

M

P

O

R

T

%

I

M

P

O

R

T

V

O

L

U

M

E

(

K

T

)

200

160

120

80

40

0

50%

40%

30%

20%

10%

0%

43% 43%

36%

32%

19%

15%

9%

5%

2012 2013 2014 2015 2016E 2017E 2018E2011

120

80

40

0

43% 43%

36%

32%

19%

15%

9%

5%

2012 2013 2014 2015 2016E 2017E 2018E2011

...have lowered industry tow utilization rates

GLOBAL CIGARETTE DEMAND1

T R I L L I O N S E 2

CHINA TOW IMPORTS

Demand for cigarettes in China

hit an inflection point in 2015

China’s shift to self-sufficiency resulted

in sharp decline in tow imports

10A C E T A T E T O W J V – J U N E 2 0 1 71. Subject to regulatory approval

2. Combined 2017 pro forma estimates

Addresses concerns about tow and positions the JV for growth

Timely transaction creates leading tow supplier

REVENUE2 EBITDA MARGIN2 OWNERSHIP

$1.3 BILLION >40% 70% CELANESE

Celanese and Blackstone combine1 resources to deliver strategic benefits to all stakeholders

> Enhanced innovation driven by combined technology to

support evolving consumer trends

> Improved reliability from global production footprint

> Enhanced technical expertise to support customers

> Improved efficiency from combined supply chain

> Attractive growth opportunities

> Cash unlocked from monetization

> Enhanced earnings potential

CONSUMERS

CUSTOMERS

EMPLOYEES

SHAREHOLDERS

11A C E T A T E T O W J V – J U N E 2 0 1 7

Amsterdam, Netherlands (New Company HQ)

Freiburg, Germany

Lanaken, Belgium

Celanese-CNTC JV

Zhuhai, China (30%)

Narrows, VA

Santo Andre, Brazil

Ocotlan, Mexico

Celanese-CNTC JV

Kunming, China (30%)

Celanese-CNTC JV

Nantong, China (31%)

Serpukhov, Russia

Roussillon, France

Kingsport, TN

1. Combined 2016 pro forma revenue

…enhances efficiency of the supply chain and reliability for customers

Combined assets expand global footprint...

CELANESE BLACKSTONE

Americas ~16% Europe ~49% Asia ~31%

NEW COMPANY PRO FORMA REVENUE MIX1

ROW ~4%

12A C E T A T E T O W J V – J U N E 2 0 1 7

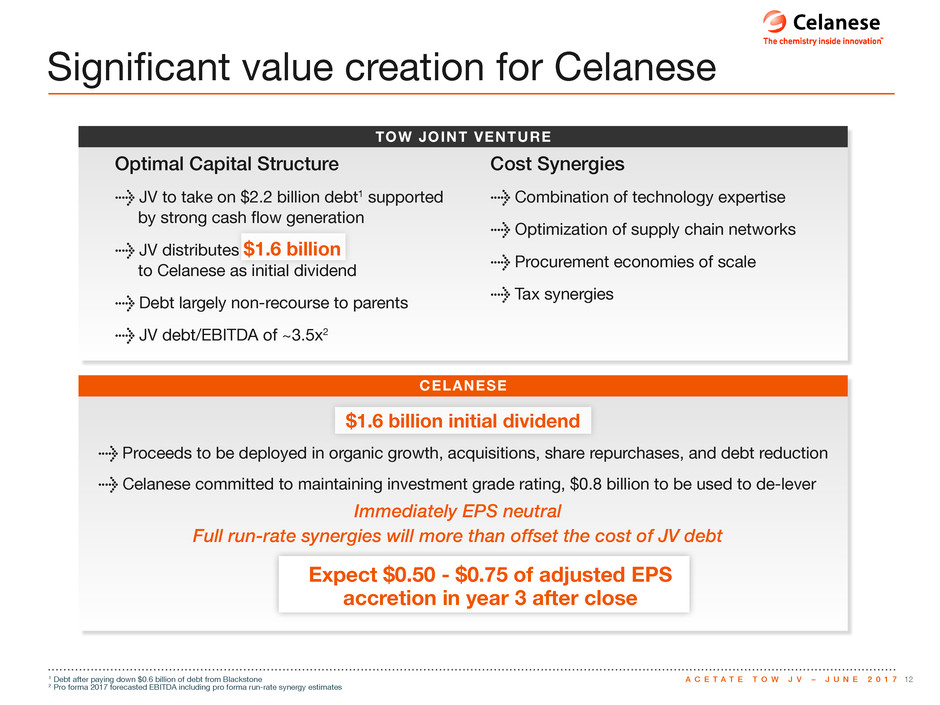

Significant value creation for Celanese

TOW JOINT VENTURE

Immediately EPS neutral

Full run-rate synergies will more than offset the cost of JV debt

Expect $0.50 - $0.75 of adjusted EPS

accretion in year 3 after close

1. Debt after paying down $0.6 billion of debt from Blackstone

2. Pro forma 2017 forecasted EBITDA including pro forma run-rate synergy estimates

Cost Synergies

> Combination of technology expertise

> Optimization of supply chain networks

> Procurement economies of scale

> Tax synergies

CELANESE

Optimal Capital Structure

> JV to take on $2.2 billion debt1 supported

by strong cash flow generation

> JV distributes $1.6 billion

to Celanese as initial dividend

> Debt largely non-recourse to parents

> JV debt/EBITDA of ~3.5x2

$1.6 billion initial dividend

> Proceeds to be deployed in organic growth, acquisitions, share repurchases, and debt reduction

> Celanese committed to maintaining investment grade rating, $0.8 billion to be used to de-lever

13A C E T A T E T O W J V – J U N E 2 0 1 7

Tow transaction advances significant growth options for Celanese

Multi-faceted successes

> $1.6 billion initial monetization of Cellulose Derivatives

> Opportunity to create value uplift through reallocation

of capital to higher-growth businesses

> Enhanced cost competitiveness

> Improved value proposition

> Enhanced long-term strategic options

> End of tow earnings decline

DE-RISK

MONETIZE

REALLOCATE

14A C E T A T E T O W J V – J U N E 2 0 1 7

...supported by robust cash flow generation from acetyls and tow

Clear set of growth opportunities at Celanese...

Robust Cash Generation

Acetate Tow JV

> Tow JV will enable earnings enhancement

> Initial monetization to unlock cash

Acetyl Chain

> Outsized share of industry growth

> Engagement in activities that improve global landscape

Explosive Growth

AEM

> Turbocharge the existing customer project

pipeline engagement model

> Bolt-on M&A

> Larger transactions offer step change options

DI

SC

IPL

INE

D CA

PITAL EARNINGS

AE

M

AEMD

EP

LO

YME

NT GROW

TH

A c e t y l C h a i n & To w J V

CASH F LOW

E X PANDING

VALUE

UPLIFT

CYCLE

15A C E T A T E T O W J V – J U N E 2 0 1 71. Celanese estimates of industry utilization at 1Q of each year

Differentiated performance overcomes weak industry dynamics

Acetyl Chain model delivers strong results

12%

10%

10%

16%

14%

13%

64%

61%

63%

70%

65%64%

Q1

2012

Q1

2013

Q1

2014

Q1

2015

Q1

2016

Q1

2017

8-10%

OLD

RANGE

12-16%

NEW

RANGE

ADJUSTED EBIT MARGIN

ACETIC ACID INDUSTRY UTILIZATION1

LTM ADJ. EBIT MARGIN

PRODUCTIVITY UNPARALLELED

CHOICES

EXPANDED

FLEXIBILITY

EXCEPTIONAL

EXECUTION

COMPETITIVE ADVANTAGES

DIFFERENTIAL ACTIONS

DIFFERENTIAL MARGIN PERFORMANCE

#1 OR #2

IN OUR

MARKETS

LOW-COST

OPERATIONS

ADVANTAGED

TECHNOLOGY

HIGHLY

INTEGRATED

VALUE CHAIN

16A C E T A T E T O W J V – J U N E 2 0 1 7

Acetyl Chain positioned for growth in excess of GDP

Multiple growth layers in Acetyl Chain

> Leadership positions and advantaged cost footprint allow the

Acetyl Chain to capture disproportionate share of industry growth

> Dynamic optimization of commercial model delivers margin capture

> Environmental regulations in China creating pressure on coal gasification

> Access more molecules through co-supply options and various

partnerships

> Explore smart M&A opportunities along the chain

> Drive innovation in downstream derivatives

> Enhance productivity and conversion technology

OUTSIZED

SHARE OF

INDUSTRY

GROWTH

CHAIN

EXTENSION

INNOVATION

17A C E T A T E T O W J V – J U N E 2 0 1 71. Engineered materials: AEM excluding affiliates

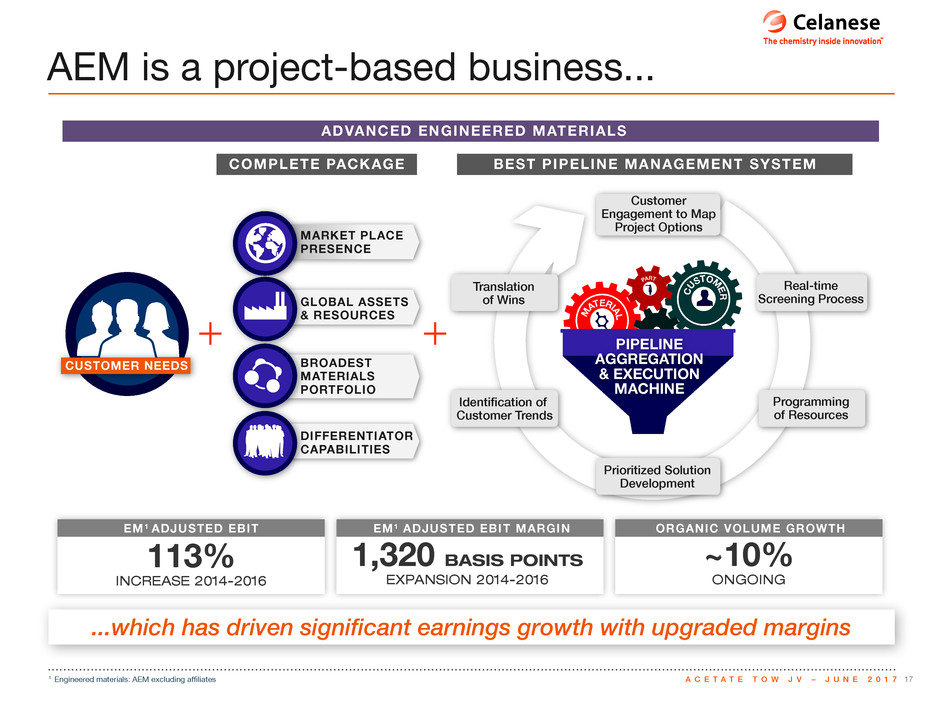

...which has driven significant earnings growth with upgraded margins

AEM is a project-based business...

GLOBAL ASSETS

& RESOURCES

MARKET PLACE

PRESENCE

DIFFERENTIATOR

CAPABILITIES

BROADEST

MATERIALS

PORTFOLIO

C

US

TOMER

M

ATERIAL

PART

PIPELINE

AGGREGATION

& EXECUTION

MACHINE

MILLION

+ + =

SOLID

EARNINGS

GROWTH

CUSTOMER NEEDS

~$175

Customer

Engagement to Map

Project Options

Translation

of Wins

Real-time

Screening Process

Programming

of Resources

Prioritized Solution

Development

Identification of

Customer Trends

COMPLETE PACKAGE BEST PIPELINE MANAGEMENT S YSTEM

EM1 AD JUSTED EBIT EM1 AD JUSTED EBIT MARGIN ORGANIC VOLUME GROWTH

113%

INCREASE 2014-2016

1,320 BASIS POINTS

EXPANSION 2014-2016

~10%

ONGOING

ADVANCED ENGINEERED MATERIALS

18A C E T A T E T O W J V – J U N E 2 0 1 71. Launches refers to projects commercialized (received initial Purchase Order for) in the year through the AEM pipeline

…delivering high single-digit organic volume growth each year

AEM has a long runway for profitable growth…

NEXT PROJECT

SYSTEM

STEP-UPINORGANIC

PLATFORM

EXPANSION

(SO.F.TER., NILIT

PLASTICS)

PROGRAMS

REALIGNED TO

REVEALED

MARKET PULLORGANIC PLATFORM

EXPANSION

ORGANIC

PLATFORM

EXTENSIONS

> Additional M&A

> Evolve project management

system to improve win rate

> Accelerate growth in medical

applications

> Drive increased value through

JVs

> Leverage portfolio to accelerate

translation

> Supercharged customer project

options engagement model

2015 1 ,000 LAUNCHES 1

DIFFERENTIATED

MODEL

IMPLEMENTATION

APRIL 2015

2016 1 ,385 LAUNCHES

2017F 1 ,900+ LAUNCHES

MANY MORE STEPS

6

5

4

3

2

1

A PERPETUAL

SET OF

IMPROVEMENT

OPPORTUNITIES

SIGNIFICANT ENTERPRISE VALUE CREATION

THROUGH A DIFFERENTIATED MODEL

25% IMPROVEMENT IN WIN RATE

2015–2017

19A C E T A T E T O W J V – J U N E 2 0 1 7

AEM poised for step change in value delivery

> Find the most

projects

> Screen projects

for winners

> Remove complexity

from the customers

> Continuously

improve win rates

> One of the broadest

polymer portfolios in

the industry

> Deep customer

relations

> Abundance of

solution options

to meet customer

challenges

> Expand to new

solution capabilities

and polymer

platforms

> Price for

package value

> Immediately

accretive

> Successful

integration

> Recent success

with SO.F.TER.

and Nilit Plastics

ORGANIC

GROWTH

INORGANIC

GROWTH

INORGANIC

GROWTH

PROVEN

MODEL

+

FOCUSED CORE

COMPETENCIES

+

UNLOCKED

CAPITAL

Numerous high-return opportunities available in growth businesses

INDUSTRY-LEADING

PACKAGE

PERFECTING

THE MODEL

EXTENSION THROUGH

ACQUISITION

STEP CHANGE IN

GROWTH OPTIONS

20A C E T A T E T O W J V – J U N E 2 0 1 7

C

U

M

U

L

A

T

I

V

E

C

A

S

H

G

E

N

E

R

A

T

I

O

N

20161 2017F 2018F 2019F 2020F

$6.2B

$4.6B

H

I G

H

E

S

T

V

A

L

U

E

$2.5B

1. 2016 free cash flow excludes voluntary payment of $300 million for pension deleveraging

2. Including estimated ongoing cash flow available to CE from new acetate tow JV

3. Includes voluntary payment of $300 million in 2016 for pension deleveraging. Excludes any deleveraging at the new acetate tow JV

$6.2B of cash generation to be deployed to enhance growth

Value uplift via thoughtful capital allocation

HIGH ROIC PROJECTS

RETURNING CASH TO SHAREHOLDERS

ANTICIPATED $1.6B INITIAL DIVIDEND

FROM NEW ACETATE TOW JV

COMMITMENT TO MAINTAIN INVESTMENT GRADECELANESE CASH GENERATION

FROM OPERATIONS2

SOURCES OF CASH

2 0 1 6 - 2 0 2 0

I N B I L L I O N S

USES OF CASH

2 0 1 6 - 2 0 2 0

I N B I L L I O N S

~$1.3

~$2.0

~$1.8

~$1.13

DELEVERAGING

ORGANIC

GROWTH

AND

M&A

DIVIDENDS

SHARE REPURCHASES

NO EXCESS CASH ON

BALANCE SHEET