Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER - YBCC, Inc. | ybcc_10q-ex3101.htm |

| EX-32.2 - CERTIFICATION - YBCC, Inc. | ybcc_10q-ex3202.htm |

| EX-32.1 - CERTIFICATION - YBCC, Inc. | ybcc_10q-ex3201.htm |

| EX-31.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER - YBCC, Inc. | ybcc_10q-ex3102.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended March 31, 2017 or

o Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from _____________ to _____________

Commission file number 0-21384

YBCC, INC.

(Exact Name of Registrant as Specified in its Charter)

| Nevada | 13-3367421 | |

| (State or Other Jurisdiction of | (I.R.S. Employer | |

| Incorporation or Organization) | Identification No.) |

17800 Castleton Street, Suite 386, City of Industry, California

(Address of Principal Executive Offices)

91748

(Zip Code)

(626) 213-3945

(Registrant’s Telephone Number, Including Area Code)

___________________________________________

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large accelerated filer o | Accelerated filer o | |

| Non-accelerated filer o | Smaller reporting company x | |

| Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2 of the Exchange Act).

o Yes x No

The number of shares outstanding of the Issuer’s common stock as of June 15, 2017 was 9,894,214.

YBCC, Inc.

and Subsidiaries

FORM 10-Q for the Quarter Ended March 31, 2017

INDEX

| Page | ||||||

| PART I - FINANCIAL INFORMATION | ||||||

| Item 1. | Financial Statements | 3 | ||||

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 15 | ||||

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 18 | ||||

| Item 4. | Controls and Procedures | 18 | ||||

| PART II - OTHER INFORMATION | ||||||

| Item 1. | Legal Proceedings | 20 | ||||

| Item 2. | Unregistered Sale of Equity Securities and Use of Proceeds | 20 | ||||

| Item 3. | Defaults Upon Senior Securities | 20 | ||||

| Item 4. | Mine Safety Disclosures | 20 | ||||

| Item 5. | Other Information | 20 | ||||

| Item 6. | Exhibits | 21 | ||||

| Signatures | 22 | |||||

| 2 |

PART I - FINANCIAL INFORMATION

ybcc, Inc. and Subsidiaries

| March 31, | December 31, | |||||||

| 2017 | 2016 | |||||||

| (unaudited) | (restated) | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash | $ | 256,726 | $ | 339,147 | ||||

| Accounts receivable, net | 14,762 | 149,765 | ||||||

| Other receivable | 111,337 | 102,122 | ||||||

| Advance to suppliers | 154,038 | 94,799 | ||||||

| Prepaid expenses | 60,014 | 40,858 | ||||||

| Inventory, net | 248,968 | 149,844 | ||||||

| Total current assets | 845,845 | 876,535 | ||||||

| Property, plant and equipment, net | 2,494,901 | 2,518,243 | ||||||

| Intangible assets, net | 697,433 | 695,109 | ||||||

| Other assets | ||||||||

| Deferred costs | 21,508 | 14,792 | ||||||

| Deposits | 11,854 | 11,635 | ||||||

| Total other assets | 33,362 | 26,427 | ||||||

| Total assets | $ | 4,071,541 | $ | 4,116,314 | ||||

| Liabilities and Equity | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 62,639 | $ | 69,606 | ||||

| Accrued expenses | 86,303 | 71,395 | ||||||

| Customer deposits | 113,425 | 22,401 | ||||||

| Customer deposits-related party | – | 34,378 | ||||||

| Taxes payable | 70,558 | 60,963 | ||||||

| Other payable | 592,285 | 486,910 | ||||||

| Other payable- related party | 2,514,224 | 2,559,476 | ||||||

| Total current liabilities | 3,439,434 | 3,305,129 | ||||||

| Total liabilities | 3,439,434 | 3,305,129 | ||||||

| Equity | ||||||||

| Convertible preferred shares: $0.0001 par value, 50,000,000 shares authorized, 974,730 shares of series A issued and outstanding as of March 31, 2017 and December 31, 2016, respectively | 98 | 98 | ||||||

| Common stock: $0.001 par value, 900,000,000 shares authorized, 9,894,214 and 6,894,214 shares issued and outstanding as of March 31, 2017 and December 31, 2016, respectively | 9,894 | 6,894 | ||||||

| Additional paid-in capital | 1,162,328 | 865,328 | ||||||

| Subscription received in advance | – | 300,000 | ||||||

| Accumulated foreign currency exchange loss | (53,935 | ) | (56,689 | ) | ||||

| Accumulated deficit | (757,434 | ) | (608,739 | ) | ||||

| Total YBCC, Inc. stockholders' equity | 360,951 | 506,892 | ||||||

| Non-controlling interest | 271,156 | 304,293 | ||||||

| Total equity | 632,107 | 811,185 | ||||||

| Total liabilities and equity | $ | 4,071,541 | $ | 4,116,314 | ||||

See accompanying notes to these unaudited consolidated financial statements

| 3 |

ybcc, inc. and Subsidiaries

Consolidated Statements of Operations and Comprehensive Income

(Unaudited)

| For The Three Months Ended | ||||||||

| March 31, | ||||||||

| 2017 | 2016 | |||||||

| Sales revenue | $ | 280,430 | $ | 161,746 | ||||

| Cost of goods sold | 278,526 | 151,090 | ||||||

| Gross profit | 1,904 | 10,656 | ||||||

| Operating expenses | ||||||||

| Selling expenses | 7,996 | 5,330 | ||||||

| General and administrative expenses | 181,383 | 53,094 | ||||||

| Total operating expenses | 189,379 | 58,424 | ||||||

| Loss from operations | (187,475 | ) | (47,768 | ) | ||||

| Other income (expenses) | ||||||||

| Other income | 2,969 | 7,646 | ||||||

| Interest income (expense) | 29 | (22,318 | ) | |||||

| Total other income (expenses) | 2,998 | (14,672 | ) | |||||

| Loss before income taxes | (184,477 | ) | (62,440 | ) | ||||

| Provision for income taxes | – | – | ||||||

| Net loss | (184,477 | ) | (62,440 | ) | ||||

| Less: net loss attributable to non-controlling interest | (35,782 | ) | (30,595 | ) | ||||

| Net loss attributable to the Company | $ | (148,695 | ) | $ | (31,845 | ) | ||

| Net loss | $ | (184,477 | ) | $ | (62,440 | ) | ||

| Other comprehensive loss | ||||||||

| Foreign currency translation gain | 5,399 | 3,494 | ||||||

| Comprehensive loss | (179,078 | ) | (58,946 | ) | ||||

| Less: comprehensive gain attributable to non-controlling interest | 2,646 | 1,712 | ||||||

| Net comprehensive loss to the Company | $ | (181,724 | ) | $ | (60,658 | ) | ||

| Loss per weighted average share of common stock-basic and diluted | $ | (0.02 | ) | $ | (0.01 | ) | ||

| Weighted average shares outstanding - basic and diluted | 9,827,547 | 4,054,214 | ||||||

See accompanying notes to these unaudited consolidated financial statements

| 4 |

ybcc, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(Unaudited)

| For The Three Months Ended | ||||||||

| March 31, | March 31, | |||||||

| 2017 | 2016 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (184,477 | ) | $ | (62,440 | ) | ||

| Adjustments to reconcile net loss to net cash provided by operating activities: | ||||||||

| Depreciation expense | 48,914 | 50,631 | ||||||

| Amortization | 3,714 | 3,910 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 136,263 | 3,487 | ||||||

| Other receivable | (8,327 | ) | (28,355 | ) | ||||

| Advance to suppliers | (58,397 | ) | (16,485 | ) | ||||

| Prepaid expenses | (19,128 | ) | (1,448 | ) | ||||

| Inventory | (97,792 | ) | (8,068 | ) | ||||

| Deposits | (145 | ) | (1,590 | ) | ||||

| Accounts payable | (7,571 | ) | 3,442 | |||||

| Accrued expenses | 14,666 | 9,401 | ||||||

| Customer deposit | 90,802 | 28,521 | ||||||

| Customer deposit– related party | (34,666 | ) | – | |||||

| Tax payable | 9,064 | – | ||||||

| Other payable | 101,114 | 61,168 | ||||||

| Net cash provided by (used in) operating activities | (5,966 | ) | 42,174 | |||||

| Cash flows from investing activities: | ||||||||

| Deferred cost | (6,586 | ) | 167,776 | |||||

| Purchase of property and equipment | (3,751 | ) | (219,033 | ) | ||||

| Net cash used in investing activities | (10,337 | ) | (51,257 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Advance from (repayment to) related party | (66,376 | ) | 94,542 | |||||

| Net cash provided by (used in) financing activities | (66,376 | ) | 94,542 | |||||

| Effect of currency translation on cash | 258 | 1,312 | ||||||

| Net increase (decrease) in cash and cash equivalents | (82,421 | ) | 86,771 | |||||

| Cash and cash equivalents at beginning of period | 339,147 | 21,747 | ||||||

| Cash and cash equivalents at end of period | $ | 256,726 | $ | 108,518 | ||||

| Supplementary Disclosures of Cash Flow | ||||||||

| Cash paid during the period for: | ||||||||

| Interest | $ | – | $ | 22,318 | ||||

| Income taxes | $ | – | $ | – | ||||

| Non-cash investing and financing activities | ||||||||

| Issuance of common stock for subscription received previously | $ | 300,000 | $ | – | ||||

See accompanying notes to these unaudited consolidated financial statements

| 5 |

ybcc, Inc. and Subsidiaries

Notes to Unaudited Consolidated Financial Statements

NOTE 1 - ORGANIZATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization and Operations – YBCC, Inc., (The “Company” or “YBAO”), formerly known as International Packaging and Logistic Group, Inc., a Nevada corporation, was originally incorporated on June 2, 1986, in the state of Delaware. On April 17, 2008, the Company redomiciled form the State of Delaware to the State of Nevada.

On July 2, 2007, the Company through its wholly-owned subsidiary, YesRx.com (“YesRx”) acquired all the outstanding shares of H&H Glass, Inc. (“H&H Glass”), in exchange for 3,915,000 shares of its common stock in a reverse triangular merger.

On May 15, 2016, the Company and Xiuhua Song (the “Purchaser”) entered into a Stock Purchase Agreement (the “Purchase Agreement”), pursuant to which IPLO (the “Seller”) would sell to the Purchaser, and the Purchaser will purchase from the Seller, an aggregate of 3,915,000 newly issued shares of IPLO Common Stock (the “Shares”), which Shares represented 87% of the issued and outstanding shares of common stock. On July 1, 2016, this transaction was completed.

On July 1, 2016, Standard Resources Ltd. (“Standard”), previously IPLO’s majority stockholder, and IPLO entered into a share purchase agreement (“H&H Vend Out”) whereby Standard would cancel 3,915,000 shares of IPLO common stock held by it in exchange for all of the outstanding shares of H&H Glass. The H&H Glass Vend Out was completed on August 31, 2016.

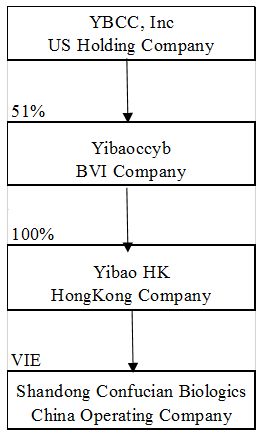

On July 1, 2016, the Company executed a Share Exchange Agreement (“Exchange Agreement”) by and among Yibaoccyb Limited, a British Virgin Islands limited liability company (“Yibaoccyb”), and the stockholders of 51% of Yibaoccyb’s common stock (the “Yibaoccyb Shareholders”), on the one hand, and the Company, on the other hand. Yibaoccyb owns 100% of YibaoConfucian Co., Ltd. (“YibaoHK”), a Hong Kong company. YibaoHK will own 100% of Shenzhen Confucian Biologics Co. Ltd. (yet to be formed, “Yibao”), which will be a wholly foreign-owned enterprise (“WFOE”) under the laws of the Peoples’ Republic of China (“PRC” or “China”). On August 31, 2016, YibaoHK entered into a series of contractual arrangements with Shandong Confucian Biologics Co., Ltd. (“Confucian”) which is a limited liability company headquartered in, and organized under the laws of, the PRC. The contractual arrangements are discussed below.

The Exchange Agreement was completed on August 31, 2016 concurrent with the H&H Vend Out. The Company issued 2,040,000 shares of the Company’s common stock (the “IPLO Shares”) to the Yibaoccyb Shareholders in exchange for 51% of the common stock of Yibaoccyb.

On December 22, 2016, the Company amended its Certificate of Incorporation (the “Amendment”). As a result of the Amendment, the Company’s corporate name was changed from International Packaging and Logistics Group, Inc. to YBCC, Inc.

Yibaoccyb is a limited liability company incorporated under the laws of the British Virgin Islands on May 30, 2016. Other than all the issued and outstanding shares of YibaoHK, Yibaoccyb has no other assets or operations.

YibaoHK is a limited liability company incorporated under the laws of the Hong Kong on June 15, 2016, which was formed by Yibaoccyb.

Confucian was founded on October 31, 2012. Confucian is in the Food Industrial Park inside the economic development Zone of JinXiang County, Jining City in the province of Shandong in China.

Confucian possesses manufacturing permits for food product, hygienic products, sanitary products, and health products. The Company's main business includes research and development of chondroitin and garlic oil; trading, cold storage, and pretreating of garlic, fruit, and vegetables products; trading of chemical products (excluding hazardous chemicals); import and export of goods and technology (excluding those restricted by China government); and, the manufacturing and sale of health products including powder, granules, tablets, hard capsule, soft capsule products.

| 6 |

Details of the Company’s structure as of March 31, 2017 is as follow:

Reverse Merger Accounting – Since YBCC and Yibaoccyb were entities under Mrs. Song’s common control prior to the share exchange, the transaction was accounted for as a restructuring transaction in accordance with generally accepted accounting principles in the United States ("GAAP"). YBCC has recast prior period unaudited consolidated financial statements to reflect the conveyance of Yibaoccyb’s common shares as if the restructuring transaction had occurred as of the earliest date of the unaudited consolidated financial statements.

Basis of Accounting and Presentation - The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America.

Principles of Consolidation - The accompanying unaudited consolidated financial statements are prepared in accordance with generally accepted accounting principles in the United States of America. Confucian’s functional currency is Chinese Yuan (CNY), however, the accompanying unaudited consolidated financial statements have been re-measured and presented in United States Dollars ($).

The unaudited consolidated financial statements include the accounts of YBCC and its subsidiaries. The Company’s subsidiaries include 51% of Yibaoccyb, YibaoHK and Confucian, of which 49% of Yibaoccyb’s consolidated operating results was shown in non-controlling interest on the consolidated balance sheets.

Intercompany accounts and transactions have been eliminated upon consolidation.

Use of Estimates - The preparation of unaudited consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimate and assumptions that affect certain reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates. The most significant estimates reflected in the consolidated financial statements include allowance for doubtful accounts, allowance for inventory, depreciation, useful lives of property and equipment, deferred income taxes, useful life of intangible assets, and contingencies. Estimates and assumptions are periodically reviewed and the effects of revisions are reflected in the unaudited consolidated financial statements in the period they are determined to be necessary.

Cash and Cash Equivalents – For purpose of the unaudited consolidated statements of cash flows, the Company considers all highly liquid debt instruments purchased with a maturity of 90 days or less to be cash equivalents.

Accounts Receivable - The Company extends credit to its customers. Accounts receivable was recorded at the contract amount after deduction of trade discounts and, allowances, if any, and do not bear interest. The allowance for doubtful accounts, when necessary, is the Company’s best estimate of the amount of probable credit losses from accounts receivable. The Company determines the allowance based on historical write-off experience, customer specific facts and economic conditions.

| 7 |

As of March 31, 2017 and December 31, 2016, accounts receivable was $14,762 and $149,765, respectively. The Company believes that its accounts receivables are fully collectable and determined that an allowance for doubtful accounts was not necessary.

Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. The Company does not have any off-balance-sheet credit exposure related to its customers.

Inventories - Inventory is valued at the lower of cost or market. Cost is determined using first-in, first-out method.

Inventory, comprised principally of finished goods, raw material and packaging material, are valued at the lower of cost or market.

| March 31, 2017 | December 31, 2016 | |||||||

| Finished goods | $ | 213,666 | $ | 7,098 | ||||

| Work in progress | – | 106,934 | ||||||

| Raw materials | 25,337 | 20,457 | ||||||

| Packaging material | 9,054 | 15,088 | ||||||

| Supplies | 911 | 267 | ||||||

| Total | $ | 248,968 | $ | 149,844 | ||||

The Company periodically estimates an inventory allowance for estimated unmarketable inventories. Inventory amounts are reported net of such allowances, if any. There were no allowances for inventory as of March 31, 2017 and December 31, 2016.

Property, Plant and Equipment – Property, plant, and equipment are stated at cost less accumulated depreciation. The costs of a constructed asset are accumulated in the account Construction-in-Progress until the asset is placed into service. When the asset is completed and placed into service, the account Construction-in-Progress will be credited for the accumulated costs of the asset and will be debited to the appropriate Property, Plant and Equipment account. Depreciation begins after the asset has been placed into service.

Expenditures for maintenance and repairs are charged to operations; major expenditures for renewals and betterments are capitalized. Assets that are still kept in service after reaching the end of their estimated useful lives are depreciated over the estimated useful life of their residual value. Gain or loss on disposal of property, plant, and equipment is recognized as non-operating income or expenses.

Depreciation is computed by applying the following methods and estimated lives:

| Category | Estimated Life | Method |

| Manufacturing equipment | 10 | Straight Line |

| Office equipment | 5 | Straight Line |

| Buildings | 20 | Straight Line |

Intangible Assets - Land use rights represent the exclusive right to occupy and use a piece of land in the PRC during the contractual term of the land use right. Land use rights are carried at cost and charged to expense on a straight-line basis over the respective periods of the rights of 50 years or the remaining period of the rights upon acquisition.

Non-Controlling Interest – The Company accounted for its non-controlling interest of 49% in Yibaoccyb as a separate component of equity. In addition, net loss, and components of other comprehensive income are attributed to both the Company and non-controlling interest.

Revenue Recognition - The Company recognizes product revenue in accordance with ASC 605. ASC 605 requires that four basic criteria must be met before revenue can be recognized: (i) persuasive evidence of an arrangement exists, (ii) delivery has occurred, (iii) the price paid by the customer is fixed or determinable and (iv) collection of the resulting account receivable is reasonably assured. The Company recognizes revenue for product sales upon transfer of title to the customer. Customer purchase orders and/or contracts are generally used to determine the existence of an arrangement. Shipping documents and terms and the completion of any customer acceptance requirements, when applicable, are used to verify product delivery. The Company assesses whether a price is fixed or determinable based upon the payment terms associated with the transaction and whether the sales price is subject to refund or adjustment. The Company has no product returns or sales discounts and allowances because goods delivered and accepted by customers are normally not returnable.

| 8 |

Cost of goods sold- Cost of goods sold includes cost of inventory sold during the period, net of discounts and inventory allowances, freight and shipping costs, warranty and rework costs, and sales tax.

Impairment of Long-Live Assets – The Company applies FASB ASC 360, “Property, Plant and Equipment,” which addresses the financial accounting and reporting for the recognition and measurement of impairment losses for long-lived assets. In accordance with ASC 360, long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The Company will recognize the impairment of long-lived assets in the event the net book value of such assets exceeds the future undiscounted cash flows attributable to those assets. There is no impairment of our long-lived assets for the three months ended March 31, 2017 and 2016.

Income Taxes – The Company adopts FASB ASC Topic 740, "Income Taxes,” which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the consolidated financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

In accordance with ASC Topic 740-10, “Accounting for Uncertainty in Income Taxes — An Interpretation of FASB ASC Topic 740”, which requires income tax positions to meet a more-likely-than-not recognition threshold to be recognized in the financial statements. Tax positions that previously failed to meet the more-likely-than-not threshold should be recognized in the first subsequent financial reporting period in which that threshold is met. Previously recognized tax positions that no longer meet the more-likely-than-not threshold should be derecognized in the first subsequent financial reporting period in which that threshold is no longer met. As of March 31, 2017, and December 31, 2016, management considered that the Company had no uncertain tax positions, and will continue to evaluate for uncertain positions in the future.

The application of tax laws and regulations is subject to legal and factual interpretation, judgment and uncertainty. Tax laws and regulations themselves are subject to change because of changes in fiscal policy, changes in legislation, the evolution of regulations and court rulings. Therefore, the actual liability may be materially different from our estimates, which could result in the need to record additional tax liabilities or potentially reverse previously recorded tax liabilities or deferred tax asset valuation allowance.

The Company has made a comprehensive review of its portfolio of tax positions in accordance with recognition standards established by ASC 740-10 and has not recognized any material uncertain tax positions.

In addition, companies in the PRC are required to pay an Enterprise Income Tax at 25%.

Foreign Currency Translation - The Company's functional currency is the Chinese Renminbi (RMB). The reporting currency is that of the US Dollar. Assets, liabilities and owners’ contribution are translated at the exchange rates as of the balance sheet date. Income and expenditures are translated at the average exchange rate of the year. The RMB is not freely convertible into foreign currency and all foreign currency exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into US dollar at the rates used in translation.

The exchange rates used to translate amounts in RMB into USD for the purposes of preparing the financial statements were as follows:

| Balance sheet | |

| Balance sheet as of March 31, 2017 | RMB 6.88 to US $1.00 |

| Balance sheet as of December 31, 2016 | RMB 6.94 to US $1.00 |

| Statement of operation and other comprehensive income | |

| Statement of operation and other comprehensive income for three months ended March 31, 2017 | RMB 6.89 to US $1.00 |

| Statement of operation and other comprehensive income for three months ended March 31, 2016 | RMB 6.54 to US $1.00 |

| 9 |

Fair Value of Financial Instruments – FASB ASC 820, “Fair Value Measurement” specifies a hierarchy of valuation techniques based upon whether the inputs to those valuation techniques reflect assumptions other market participants would use based upon market data obtained from independent sources (observable inputs). In accordance with ASC 820, the following summarizes the fair value hierarchy:

Level 1 Inputs— Unadjusted quoted market prices for identical assets and liabilities in an active market that the Company has the ability to access.

Level 2 Inputs— Inputs other than the quoted prices in active markets that are observable either directly or indirectly.

Level 3 Inputs— Inputs based on valuation techniques that are both unobservable and significant to the overall fair value measurements

ASC 820 requires the use of observable market data, when available, in making fair value measurements. When inputs used to measure, fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

The Company did not identify any assets or liabilities that are required to be presented at fair value on a recurring basis. Carrying values of non-derivative financial instruments, including cash and cash equivalents, accounts receivable, inventories, prepaid expenses, advances from customers, accounts payable, taxes payable, accrued liabilities and other payables, and loan from bank, approximated their fair values due to the short maturity of these financial instruments. There were no changes in methods or assumptions during the periods presented.

Net Earnings (Loss) Per Share – Earnings/(loss) per common share is computed on the weighted average number of common shares outstanding during each year. Basic earnings per share is computed as net loss applicable to common stockholders divided by the weighted average number of common shares outstanding for the period. Diluted earnings per share reflects the potential dilution that could occur from common shares issuable through convertible preferred shares, stock options, warrants and other convertible securities when the effect would be dilutive. In this case, the Preferred Shares would not be dilutive since the conversion price is $3.00 and the quoted price is significantly lower than the conversion price. Therefore, there were no dilutive securities for the three months ended March 31, 2017 and 2016, respectively.

Reclassifications – Certain classifications have been made to the prior year consolidated financial statements to conform to the current year presentation. The reclassification had no impact on previously reported net loss or accumulated deficit.

NOte 2 - going concern

The Company sustained net losses of $184,477 and $62,440 during the three months ended March 31, 2017 and 2016, respectively. The Company has accumulated deficit of $754,434 and $608,739 as of March 31, 2017 and December 31, 2016, respectively. The Company’s continuation as a going concern is dependent on its ability to generate sufficient cash flows from operations to meet its obligations and/or obtain additional financing, as may be required.

The accompanying unaudited consolidated financial statements have been prepared assuming the Company will continue as a going concern; however, the above condition raises substantial doubt about the Company’s ability to do so. The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result should the Company be unable to continue as a going concern.

Management’s Plan to Continue as a Going Concern

In order to continue as a going concern, the Company will need, among other things, additional capital resources. Management’s plans to obtain such resources for the Company include (1) obtaining capital from the sale of its equity securities, (2) sales of the Company’s products, (3) short-term and long-term borrowings from banks, and (4) short-term borrowings from stockholders or other related party(ies) when needed. However, management cannot provide any assurance that the Company will be successful in accomplishing any of its plans.

| 10 |

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plans described in the preceding paragraph and eventually to secure other sources of financing and attain profitable operations.

NOte 3 - concentration of credit risk

We maintain our cash balance in several banks in China and United States. The consolidated cash balances as of March 31, 2017 and December 31, 2016 were $256,726 and $339,147, respectively. The cash balances in China as of March 31, 2017 and December 31, 2016 were $46,000 and $29,156, respectively. The accounts in China were not insured which we believe were exposed to credit risks on cash. As of March 31, 2017, the balance of our US account was $210,726 which did not exceed the federal insured limit of $250,000. As of December 31, 2016, the balance was $309,991 which was in excess of federal insured limit of $250,000 by $59,991.

NOTe 4 - other receivable

Total other receivable consists of balances of VAT receivable of $111,337 and $102,122 as of March 31, 2017 and December 31, 2016, respectively.

NOTe 5 - prepaid expenses

Prepaid expenses were comprised of the following:

| March 31, 2017 | December 31, 2016 | |||||||

| Prepaid operating expenses | $ | 27,241 | $ | 2,497 | ||||

| Professional fees | 32,773 | 38,361 | ||||||

| Total | $ | 60,014 | $ | 40,858 | ||||

Note 6 - property, plant and equipment

Property, plant and equipment as of March 31, 2017 and December 31, 2016 are summarized as following:

| March 31, 2017 | December 31, 2016 | |||||||

| Buildings | $ | 1,754,895 | $ | 1,739,780 | ||||

| Vehicles | 11,259 | 11,162 | ||||||

| Manufacturing equipment | 991,893 | 982,511 | ||||||

| Office equipment | 88,662 | 85,061 | ||||||

| Property, plant, and equipment - total | 2,846,709 | 2,818,514 | ||||||

| Less: accumulated depreciation | (351,808 | ) | (300,271 | ) | ||||

| Fixed assets, net | $ | 2,494,901 | $ | 2,518,243 | ||||

For the three months ended March 31, 2017 and 2016, depreciation expense was $48,914 and $50,631, respectively.

note 7 - intangible assets -net

All land in the PRC is owned by the government and cannot be sold to any individual or entity. Instead, the government grants landholders a "land use right" after a purchase price for such "land use right" is paid to the government. The "land use right" allows the holder to use the land for 50 years and enjoys all the incidents of ownership of the land. As of March 31, 2017, and December 31, 2016, the land use rights net of accumulated amortization was $697,433 and $695,109, respectively. The use term was 50 years.

| 11 |

The summary of land use rights as of March 31, 2017 and December 31, 2016 are summarized as following:

| The land use right term | March 31, 2017 | December 31, 2016 | ||||||

| May, 2013 - Apr. 2063 | $ | 523,032 | $ | 518,528 | ||||

| Dec. 2015 - Sept. 2065 | 196,130 | 194,440 | ||||||

| Dec. 2015 – Sept. 2065 | 23,870 | 23,664 | ||||||

| Intangible assets- total | 743,032 | 736,632 | ||||||

| Less: accumulated amortization | (45,599 | ) | (41,523 | ) | ||||

| Intangible assets, net | $ | 697,433 | $ | 695,109 | ||||

For the three months ended March 31, 2017 and 2016, amortization expense was $3,714 and $3,910, respectively.

NOTE 8 - DEFERRED COSTS

As of March 31, 2017 and December 31, 2016, the Company had paid $21,508 and $14,792 as advances to vendors for equipment purchases, respectively. The Company recorded the advance payments for equipment as deferred costs as of March 31, 2017 and December 31, 2016.

NOTE 9 - COMMITMENTS AND CONTINGENCIES

The Company entered a lease for new office space in City of Industry, California. The lease period started October 1, 2016 and expired on September 1, 2018. On October 1, 2016, the Company started this lease at $2,802 per month from October 1, 2016 to September 1, 2017. From September 2, 2017 to August 31, 2018, the monthly lease will be $2,923, resulting in the following future commitments:

| Amount | ||||

| 2017 calendar year | $ | 25,702 | ||

| 2018 calendar year | 23,384 | |||

| Total | $ | 49,086 | ||

NOTE 10 - INCOME TAX

At March 31, 2017 and December 31, 2016, based on the weight of available evidence, management determined that it was unlikely that the Company's deferred tax assets would be realized and have provided for a full valuation allowance associated with the net deferred tax assets.

The Company periodically analyzes its tax positions taken and expected to be taken and has determined that since inception there has been no need to record a liability for uncertain tax positions. The Company classifies income tax penalties and interest, if any, as part of selling, general and administrative expenses in the accompanying statements of operations. There was no accrued interest or penalties as of March 31, 2017 and December 31, 2016.

The Company is neither under examination by any taxing authority, nor has it been notified of any impending examination.

Under the Law of People’s Republic of China on Enterprise Income Tax (“EIT Law”), which was effective from January 1, 2008, domestically-owned enterprises and foreign-invested enterprises are subject to a uniform tax rate of 25%. As of March 31, 2017, the Company had net operating losses carry forward of $754,434 that begin expiring in 2018. The potential benefit of the Company’s net operating losses has not been recognized in these financial statements because it is more likely-than-not the Company will not utilize the net operating losses carried forward as it does not expect to generate sufficient taxable income in future or the amount involved is not significant.

| March 31, 2017 | December 31, 2016 | |||||||

| Deferred Tax Assets and Liabilities: | ||||||||

| Net operating loss carry forwards | $ | 754,434 | $ | 608,739 | ||||

| Valuation allowance | (754,434 | ) | (608,739 | ) | ||||

| Net deferred tax assets | $ | – | $ | – | ||||

| 12 |

A reconciliation between the income tax computed at the U.S. statutory rate and the Company’s provision for income tax in the PRC is as follows:

| March 31, 2017 | December 31, 2016 | |||||||

| Tax expense at statutory rate-US | 34 % | 34 % | ||||||

| Foreign income not recognized in the US | (34)% | (34)% | ||||||

| PRC enterprise income tax rate | 25 % | 25 % | ||||||

| Loss not subject to income tax | (25)% | (25)% | ||||||

| Effective income tax rates | – | – | ||||||

note 11 - equity

Common Stock:

On July 1, 2016, the Company issued 3,915,000 shares of common stock to Ms. Song in connection with the change of control.

On August 31, 2016, the Company cancelled 3,915,000 shares of outstanding shares belonging to Standard.

On August 31, 2016, the Company issued 2,040,000 shares to Yibaoccyb Shareholders in exchange for 51% of the common stock of Yibaoccyb to complete the share exchange and restructuring of entities under common control.

On December 22, 2016, the Company issued 350,000 shares for legal counsel services valued at $35,000.

On December 23, 2016, the Company received cash payment of $300,000 in advance for issuance of 3,000,000 shares of common stock, or $0.10 per share. On January 3, 2017, 3,000,000 shares were issued to seven investors, none of which is a related-party to the Company.

Series A Preferred Shares:

The Series A Preferred shares are convertible into common shares on a 1:1 ratio at a fixed rate of $3 per share. Preferred shares have no voting rights, have no redemption rights and earn no dividends. Holders of Series A Convertible Preferred Stock are not permitted to convert their stock into common shares until the Company’s market capital reaches $15,000,000. Upon dissolution, liquidation or winding up of the Company, whether voluntary or involuntary, the holders of the then outstanding shares of Series A Convertible Preferred Stock shall be entitled to receive out of the assets of the Company the sum of $0.0001 per share (the “Liquidation Rate”) before any payment or distribution shall be made on any other class of capital stock of the Company ranking junior to the Series A Convertible Preferred Stock.

ASC Topic 480, “Distinguishing Liabilities from Equity,” establishes standards for how an issuer classifies and measures certain financial instruments with characteristics of both liabilities and equity.

A mandatorily redeemable financial instrument shall be classified as a liability unless the redemption is required to occur only upon the liquidation or termination of the reporting entity. A financial instrument issued in the form of shares is mandatorily redeemable if it embodies an unconditional obligation requiring the issuer to redeem the instrument by transferring its assets at a specified or determinable date (or dates) or upon an event certain to occur. A financial instrument that embodies a conditional obligation to redeem the instrument by transferring assets upon an event not certain to occur becomes mandatorily redeemable—and, therefore becomes a liability—if that event occurs, the condition is resolved, or the event becomes certain to occur.

The Company determined that the preferred shares are not mandatorily or conditionally redeemable and are properly classified as permanent equity in the accompanying unaudited consolidated financial statements.

Series B Preferred Shares

During the year ended December 31, 2015, the Company received the 400,000 shares of Series B Preferred Shares being returned to the Company. As a result, there were no shares of Series B Preferred Shares issued and outstanding as of March 31, 2017 and December 31, 2016.

| 13 |

NOTE 12 - NON-CONTROLLING INTEREST

On July 1, 2016, the Company executed the Exchange Agreement with Yibaoccyb and the Yibaoccyb Shareholders. From and after the Closing Date, Yibaoccyb became a 51% owned subsidiary of the Company. Yibaoccyb owns 100% of YibaoHK. YibaoHK will own 100% of Shenzhen Confucian Biologics Co. Ltd. (yet to be formed, “Yibao WFOE”), which will be wholly foreign-owned enterprise (“WFOE”) under the laws of the Peoples’ Republic of China (“PRC” or “China”). On August 31, 2016, YibaoHK entered into a series of contractual arrangements with Confucian and currently is 100% owner of Confucian.

Non-controlling interest consisted of the following:

| March 31, | December 31, | |||||||

| 2017 | 2016 | |||||||

| Beginning balance | $ | 304,293 | $ | 464,323 | ||||

| Net loss attributed to non-controlling interest | (35,782 | ) | (132,253 | ) | ||||

| Foreign currency translation gain (loss) attributable to non-controlling interest | 2,645 | (27,777 | ) | |||||

| Ending balance | $ | 271,156 | $ | 304,293 | ||||

note 13 - related party transactions

The Company has $0 and $34,677 deposits received from Shandong Yibao Biologics Co, Ltd, which is also a customer of Confucian as of March 31, 2017 and December 31, 2016, respectively. Sales to Shandong Yibao Biologics Co, Ltd for the three months ended March 31, 2017 and 2016 were $45,309 and $0, respectively. The purchases of raw material from Shandong Yibao Biologics Co, Ltd were $2,135 and $0 for the three months ended March 31, 2017 and 2016, respectively. The purchases from Shandong Yibao Biologics are mostly consisted of one raw material, and the sales to Shandong Yibao Biologics are all finished goods.

The Company has the following payables to related parties:

| March 31, 2017 | December 31, 2016 | |||||||

| To Xiuhua Song | $ | 2,245,870 | $ | 2,293,434 | ||||

| To Hengchun Zhang | 262,430 | 260,169 | ||||||

| To Quingbao Kong | 5,924 | 5,873 | ||||||

| Total due to related parties | $ | 2,514,224 | $ | 2,559,476 | ||||

NOTE 14 - MAJOR SUPPLIERS AND CUSTOMERS

The Company purchases majority of its inventory and packaging supplies from two suppliers which accounted for 49.38% and 12.77% of the total purchases for the three months ended March 31, 2017.

The Company had four major customers for the three months ended March 31, 2017: Nanjing Hejian Biologics accounted for 35.10%, Ping Xiang Import and Export Company accounted for 18.55% of revenue and Shandong Yibao Biologics for 16.23% of revenue for the three months ended March 31, 2017.

The Company purchases majority of its inventory and packaging supplies from four suppliers which accounted for 23.75%, 19.79%, 14.43% and 10.84% of the total purchases for the three months ended March 31, 2016.

The Company had one major customer for the year ended December 31, 2016: Ping Xiang Import and Export Company accounted for 100% of revenue for the three months ended March 31, 2016.

NOTE 15 - SUBSEQUENT EVENTS

Management has evaluated subsequent events through June 15, 2017, the date which the consolidated financial statements were available to be issued. All subsequent events requiring recognition as of March 31, 2017 have been incorporated into these consolidated financial statements and there are no subsequent events that require disclosure in accordance with FASB ASC Topic 855, “Subsequent Events.”

| 14 |

| ITEM 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this Form 10-Q is intended to update the information contained in our Annual Report on Form 10-K for the year ended December 31, 2016 and presumes that readers have access to, and will have read, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other information contained in such Form 10-K. The following discussion and analysis also should be read together with our financial statements and the notes to the financial statements included elsewhere in this Form 10-Q.

The following discussion contains certain statements that may be deemed “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements appear in a number of places in this Report, including, without limitation, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements are not guarantees of future performance and involve risks, uncertainties and requirements that are difficult to predict or are beyond our control. Forward-looking statements speak only as of the date of this quarterly report. You should not put undue reliance on any forward-looking statements. We strongly encourage investors to carefully read the factors described in our Annual Report on Form 10-K for the year ended December 31, 2016 in the section entitled “Risk Factors” for a description of certain risks that could, among other things, cause actual results to differ from these forward-looking statements. We assume no responsibility to update the forward-looking statements contained in this quarterly report on Form 10-Q. The following should also be read in conjunction with the unaudited consolidated Financial Statements and notes thereto that appear elsewhere in this report.

Overview

The Company is a manufacture and research based bio-science company. It has large capacity in manufacturing tablets, granule, oral liquid, powders, soft gels and capsules products. The Company distributes its products through its own network and white label products. It also has access to a member-based distribution system owned by its affiliated company.

The Company possesses manufacturing permits for food product, hygienic products, sanitary products, and health products. The Company's main business scope include technology study and transfer of Chondroitin and Garlic Oil; trading, cold storage, and pretreating of Garlic, fruit, and vegetables products; trading of Chemical products (excluding hazardous chemicals); Import and export of goods and technology (excluding those restricted by government); the manufacturing and sale of health products including powder, granules, tablets, hard capsule, soft capsule products.

Product Overview

The Company’s main products can be divided into two groups, one is health food products and the other is hygienic products

Health Food Products

| · | Phytocholesterol tabletting candy, |

Phytosterol has strong anti-inflammatory effects to the human body, which can inhibit the absorption of cholesterol for human and biochemical synthesis of cholesterol. Promote the degradation and metabolism of cholesterol. Phytosterol can be used for prevention & therapy of coronary atherosclerosis heart disease. In treating ulcers, skin squamous carcinoma and cervical cancer has obvious curative effect. Can promote wound healing, make muscle proliferation, enhance capillary circulation; also can be used as blocking agent of formation of gallstones.

| · | Polydextrose tabletting candy, |

Regulating blood lipid, reduce fat accumulation preventing the fat.

| · | Dunaliella salina haematococcus pluvialis tabletting candy, |

Replenishing the body's astaxanthin, Natural carotene and variety of minerals, have a great effect of antioxidant activity, protect skin, protect vision and improve immunity.

| · | Dunaliella salina Gum Base candy, |

Dunaliella salina is rich in antioxidant needed by the human body health, resistance to radiation and enhance human immunity of natural carotenoids and 70 kinds of minerals and trace elements.

| 15 |

| · | Haematococcus pluvialis Gum candy, |

The main components of Haematococcus Pluvialis is astaxanthin. It has six anti-aging effect: can be Anti-aging and protect the skin; Protect the eye health; helps to support the cardiovascular system, maintain a healthy joints and connective tissue; increases strength and endurance.

| · | Fish Oil Gum candy, |

Adjusting blood liquid, prevent blood clots, cerebral thrombosis, cerebral hemorrhage and stroke; prevent arthritis and alzheimer's disease, improve the memory and vision, control presbyopia.

| · | Earthworm Protein tabletting candy, |

Improve blood circulation, inhibiting platelet aggregation, reduce glucose concentrations, prevent blood clots, has the very good control efficiency for coronary heart disease, arteriosclerosis, and other hematologic disorders.

| · | Collagen Protein tabletting candy, |

It is rich in glycine, proline hydroxyproline and other amino acid needed for human body. Have a good health care effect for skin, hair, bones and muscles.

| · | Krill Oil Gum candy, |

It is rich in EPA and DHA. Enhancing health effects, including cardiovascular, nerve, bones, joints, vision, skin care, etc.

| · | Phosphatidylserine tabletting candy, |

Improve the function of brain; help to repair the injure of brain; promote the recovery of brainfag; protect central nervous system. Used for auxiliary treatment dementia and agedness memory loss.

| · | Milk Powder tabletting candy. |

Milk tablet is kind of leisure food. Supplement of the nutrition of human needed in specific environment.

Hygienic Products

The hygienic product line includes the following products:

| · | Gel for women, |

Anti-bacteria product. Auxiliary treatment bacterial, mould sex vaginitis.

| · | Skin comfortable liquid |

Anti-bacteria product. Used for sterilization, antibacterial of skin. Inhibit the bromhidrosis and relief beriberi itch

Confucian owns 100,000 stage purification workshops, advanced production lines and manufacturing equipment. The Company has a higher capacity for OEM processing of tablets, hard capsules, soft capsules, oral liquid, granules, and powders.

Plan of Operations

By following the Company motto of "being passionate for health industry, bringing together the world's resources, focusing on consumer demand, creating a “win-win situation", the Company is eager to develop businesses in the international health and pharmaceutical market.

The Company’s near term goal is to reach breakeven within a 6 month period time. In order to reach such goal, the Company is increasing its sales and production volume through arrangements and networking with its existing customers and its affiliated companies. Additionally, it plans to increase the size of its sales department to develop new customers.

| 16 |

The Company’s ultimate goal is to make the business profitable and competitive in the international health and pharmaceutical market. To achieve such goal, the Company needs to cooperate with other businesses having capital, market, technology, or products, recruit sufficient workforce and various talents to serve the company, and actively develop new technology and new product through research and development.

Results of Operations

Three Months Ending March 31, 2017 Compared to March 31, 2016

Revenue:

For the three months ended March 31, 2017 and 2016, revenues were $280,430 and $161,746 respectively with an increase of $118,684 over the same period in 2016. The increase is mainly due to the expanded customer base as well as the increase in demands from consumers for healthy products.

Cost of Goods Sold:

Cost of goods sold for the three months ended March 31, 2017 and 2016 were $278,526 and $151,090 respectively, for an increase of $127,436 over the same period in 2016. This increase is mainly due to increased labor in production line and depreciation cost.

Gross Profit:

Gross profits were $1,904 and $10,656 for the three months ended March 31, 2017 and 2016, a decrease of $8,752 over the same period in 2016. The gross profit margin as a percent of sales for the three months ending March 31, 2017 and 2016 was 1% and 7% respectively with a decrease of 6% mainly due to the increase in labor costs and in depreciation costs of newly added manufacturing related fixed assets for expanded production. The lower gross profit margin for the three months ending March 31, 2017 was also caused by reproduction costs of defective products for a sales order, which was identified by management as an isolated one-time event.

Operating Expenses:

Operating expenses for the three months ended March 31, 2017 and 2016 were $189,379 and $58,424 respectively for an increase of $130,955 or 224%. The major expenses for the three months ended March 31, 2017 and 2016 consist of payroll expenses, property taxes and professional fees. The increase of $130,955 was mainly due to the increase in payroll of $37,277 for increased numbers of newly recruited employees, increase of professional fee of $51,747 and the increase of $8,886 of property tax.

Other Income (Expense):

Other income (expense) consists of interest income and expenses and other non-operation related income and expenses. For the three months ended March 31, 2017 and 2016, the net other income (expenses) were $2,998 and $(14,672), respectively. The change was mainly due to $0 interest expenses for the three months ended March 2017 compared to $22,318 for the same period in 2016 for a short term loan which has been fully repaid by the Company in June 2016.

Liquidity and Capital Resources

The Company suffered recurring losses from operations and has an accumulated deficit of $754,434 at March 31, 2017. The Company has a cash balance of $256,726 and negative working capital of $2,593,589 as of March 31, 2017. The Company has incurred losses of $184,477 and $62,440 for the three months ended March 31, 2017 and 2016, respectively. The Company has not continually generated significant revenues. Unless our operations continue to generate significant revenues and cash flows from operating activities, our continued operations will depend on whether we are able to raise additional funds through various sources, such as equity and debt financing, other collaborative agreements and strategic alliances. Our management is actively engaged in seeking additional capital to fund our operations in the short to medium term. Such additional funds may not become available on acceptable terms and there can be no assurance that any additional funding that we do obtain will be sufficient to meet our needs in the long term.

Net cash used in operating activities for the three months ended March 31, 2017 amounted to $5,966, compared to $42,174 provided by operating activities for the three months ended March 31, 2016. The increase of $48,140 in the net cash used in our operating activities was primarily due to the increase in net loss of $122,037 from operations, increase in the change of net cash used in prepaid expenses of $17,680, increase in change of advance to suppliers at $41,912, increase in the change of inventory of $89,724, and decrease in the change of customer deposit-related of $34,666; partially offset by the decrease in the change of account receivable of $132,776, increase in the change of customer deposit of $62,281 and increase in the change of other payable of $39,946.

| 17 |

Net cash used in investing activities for the three months ended March 31, 2017 amounted to $10,337 compared to net cash used in investing activities of $51,257 in the three months ended March 31, 2016, resulting in a decrease of $40,920. The decrease was mainly due to reduction in fixed assets purchases during three months ended March 31, 2017 by $215,282; partially offset by decrease of deferred cost of equipment at $174,362.

Net cash used in financing activities for the three months ended March 31, 2017 amounted to $66,376, compared to net cash provided by financing activities of $94,542 in the three months ended March 31, 2016, resulting in a net decrease of $160,918. The decrease in net cash provided by financing activities was mainly due to the repayment of payable to related party.

Going Concern

The accompanying unaudited consolidated financial statements have been prepared assuming the Company will continue as a going concern; however, the above condition raises substantial doubt about the Company’s ability to do so. The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result should the Company be unable to continue as a going concern.

In order to continue as a going concern, the Company will need, among other things, additional capital resources. Management’s plans to obtain such resources for the Company include (1) obtaining capital from the sale of its equity securities, (2) sales of the Company’s products, (3) short-term and long-term borrowings from banks, and (4) short-term borrowings from stockholders or other related party(ies) when needed. However, management cannot provide any assurance that the Company will be successful in accomplishing any of its plans.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plans described in the preceding paragraph and eventually to secure other sources of financing and attain profitable operations.

Capital Resources

Over the next twelve months, management believes there will not be sufficient working capital obtained from operations due to the Company in its early development stage.

Off-Balance Sheet Arrangements

As of March 31, 2017, we did not have any off-balance sheet arrangements as defined in Item 303(a)(4)(ii) of Regulation S-K.

| ITEM 3. | Quantitative and Qualitative Disclosures about Mark Risk |

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide the information required by this Item

| ITEM 4. | Controls and Procedures. |

Evaluation of Disclosure Controls and Procedures:

As of March 31, 2017, we conducted an evaluation under the supervision and with the participation of the Company's Chief Executive Officer and the Chief Financial Officer, management has evaluated the effectiveness of the design and operation of the Company's disclosure controls and procedures. Based on that evaluation and because of the material weaknesses in our internal control over financial reporting described below, the Chief Executive Officer and the Chief Financial Officer have concluded that the Company's disclosure controls and procedures were not effective as of March 31, 2017.

Management identified the following control deficiencies that constitute material weaknesses that are not fully remediated as of the filing date of this report:

Our size has prevented us from being able to employ sufficient resources to enable us to have an adequate level of supervision and segregation of duties within our internal control system. There is mainly one person involved in processing of transactions. Therefore, it is difficult to effectively segregate accounting duties. We have hired an additional administrative person and retained an outside professional firm to assist in mitigating the separation of duties issues on an ongoing basis. The use of the outside firm has proven successful in assisting in the separation of duties. However, additional people are not needed to do the administrative work therefore segregation of duties will continue to be an ongoing weakness.

| 18 |

Similarly, the Shandong Confucian Biologic Co., Ltd. operation also has a material weakness due to lack of segregation of duties. Its size has prevented us from being able to employ sufficient resources to enable us to have an adequate level of supervision and segregation of duties within our internal control system. We have retained an outside professional firm to assist in the separation of duties on an ongoing basis. The use of the outside firm has proven successful in assisting in the separation of duties.

Limitations on the Effectiveness of Internal Controls

Disclosure controls and procedures, no matter how well designed and implemented, can provide only reasonable assurance of achieving an entity's disclosure objectives. The likelihood of achieving such objectives is affected by limitations inherent in disclosure controls and procedures. These include the fact that human judgment in decision-making can be faulty and that breakdowns in internal control can occur because of human failures such as simple errors or mistakes or intentional circumvention of the established process.

Changes in Internal Control over Financial Reporting

There were no changes in internal control over financial reporting that occurred during the current quarter covered by this report that have materially affected, or are reasonably likely to affect, the Company's internal control over financial reporting.

| 19 |

| ITEM 1. | Legal Proceedings |

None

| ITEM 1A. | Risk Factors |

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide the information required by this Item.

| ITEM 2. | Unregistered Sales of Equity Securities and Use of Proceeds |

On December 23, 2016, the Company received cash payment of $300,000 in advance for issuance of 3,000,000 shares of common stock, or $0.10 per share. On January 3, 2017, 3,000,000 shares were issued to seven investors, none of which is a related-party to the Company.

| ITEM 3. | Defaults Upon Senior Securities |

Not Applicable

| ITEM 4. | Mine Safety Disclosures |

None

| ITEM 5. | Other Information |

None

| 20 |

| ITEM 6. | Exhibits |

a) Exhibits

| 2.1 | Share Exchange Agreement among IPLO, Yibaoccyb and Xiuhua Song dated July 1, 2016 (Incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on July 8, 2016.) | |

| 10.1 | Stock Purchase Agreement between IPLO and Xiuhua Song dated May 15, 2016. (Incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on July 8, 2016.) | |

| 10.2 | Stock Purchase Agreement among IPLO, Standard Resources Ltd., and H&H Glass Inc. dated July 1, 2016. (Incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on July 8, 2016.) | |

| 10.3 | Consulting Services Agreement between YibaoHK and Shandong Confucian Biologics Co. Ltd dated August 31, 2016 (Incorporated by reference to Exhibit 99.6 to the Current Report on Form 8-K/A filed with the Securities and Exchange Commission on September 6, 2016.) | |

| 10.4 | Equity Pledge Agreement between YibaoHK, Shandong Confucian Biologics Co. Ltd and the owners of Shandong Confucian Biologics Co. Ltd dated August 31, 2016 (Incorporated by reference to Exhibit 99.7 to the Current Report on Form 8-K/A filed with the Securities and Exchange Commission on September 6, 2016.) | |

| 10.5 | Operating Agreement between YibaoHK, Shandong Confucian Biologics Co. Ltd and the owners of Shandong Confucian Biologics Co. Ltd dated August 31, 2016 (Incorporated by reference to Exhibit 99.8 to the Current Report on Form 8-K/A filed with the Securities and Exchange Commission on September 6, 2016.) | |

| 10.6 | Voting Rights and Proxy Agreement between YibaoHK, Shandong Confucian Biologics Co. Ltd and the owners of Shandong Confucian Biologics Co. Ltd dated August 31, 2016 (Incorporated by reference to Exhibit 99.9 to the Current Report on Form 8-K/A filed with the Securities and Exchange Commission on September 6, 2016.) | |

| 10.7 | Option Agreement between YibaoHK, Shandong Confucian Biologics Co. Ltd and the owners of Shandong Confucian Biologics Co. Ltd dated August 31, 2016 (Incorporated by reference to Exhibit 99.10 to the Current Report on Form 8-K/A filed with the Securities and Exchange Commission on September 6, 2016.) | |

| 31.1 | Certification of the Chief Executive Officer pursuant to Rule 13a-14(a) (Section 302 of the Sarbanes-Oxley Act of 2002) | |

| 31.2 | Certification of the Chief Financial Officer pursuant to Rule 13a-14(a) (Section 302 of the Sarbanes-Oxley Act of 2002) | |

| 32.1 | Certification of the Chief Executive Officer pursuant to 18 U.S.C.ss.1350 (Section 906 of the Sarbanes-Oxley Act of 2002) | |

| 32.2 | Certification of the Chief Financial Officer pursuant to 18 U.S.C.ss.1350 (Section 906 of the Sarbanes-Oxley Act of 2002) | |

| 101.INS | XBRL Instance Document | |

| 101.SCH | XBRL Schema Document | |

| 101.CAL | XBRL Calculation Linkbase Document | |

| 101.DEF | XBRL Definition Linkbase Document* | |

| 101.LAB | XBRL Label Linkbase Document | |

| 101.PRE | XBRL Presentation Linkbase Document |

| 21 |

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| YBCC, INC. | ||||

| (Registrant) | ||||

| Dated: June 16, 2017 | By: | /s/ Xiuhua song | ||

| Xiuhua Song | ||||

| Chief Executive Officer | ||||

| Principal Financial Officer and Director | ||||

| 22 |