Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - BGSF, INC. | exhibit99306-15x17.htm |

| EX-23.1 - EXHIBIT 23.1 - BGSF, INC. | exhibit23106-15x17.htm |

| 8-K/A - 8-K/A - BGSF, INC. | form8-ka06x15x17.htm |

INDEPENDENT AUDITORS’ REPORT

The Board of Directors

Zycron, Inc.

Report on the Financial Statements

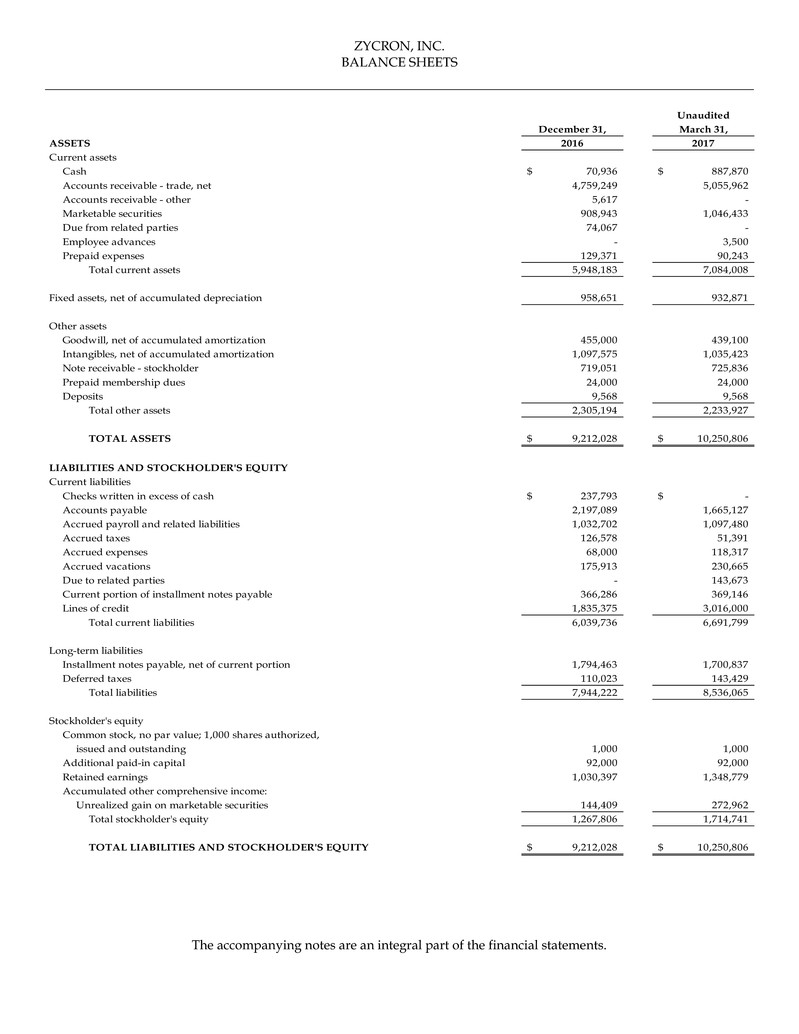

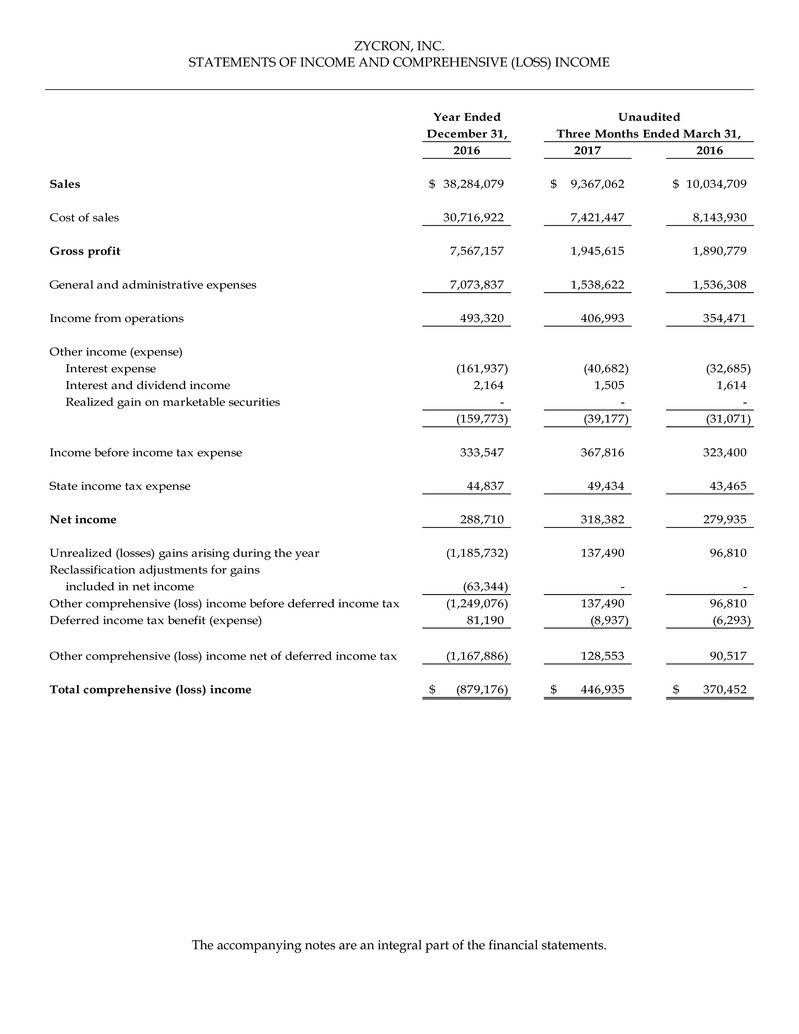

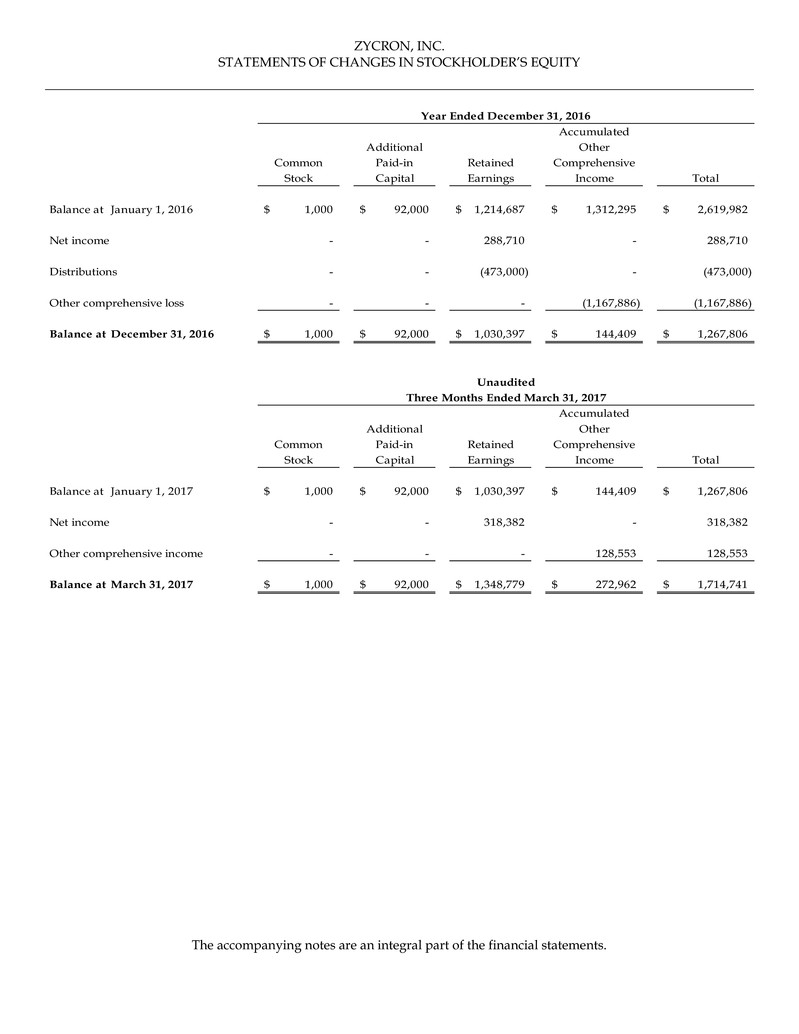

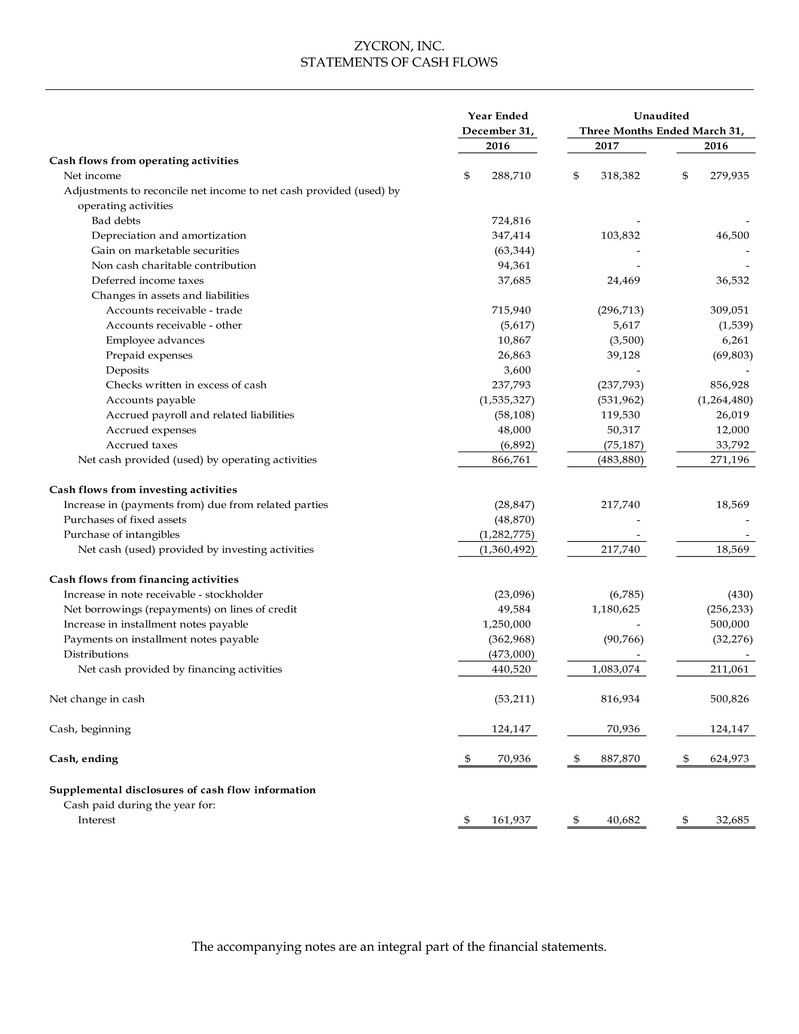

We have audited the accompanying financial statements of Zycron, Inc. (a Tennessee corporation), which comprise the balance sheet as of December 31, 2016, and the related statements of income and comprehensive loss, changes in stockholder’s equity, and cash flows for the year then ended, and the related notes to the financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Zycron, Inc. as of December 31, 2016, and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America.

INDEPENDENT AUDITORS’ REPORT (CONTINUED)

Report on Summarized Comparative Information

The summarized comparative information presented herein as of and for the three month periods ended March 31, 2017 and 2016, derived from those unaudited financial statements, has not been audited, reviewed or compiled and, accordingly, we express no opinion on it.

/s/ Blankenship CPA Group, PLLC

Nashville, Tennessee

June 13, 2017

NOTE 11 - RELATED PARTY TRANSACTIONS

The Company and its stockholder are invested in the financial institution that holds several of the Company’s cash accounts, all lines of credit and two installment notes payable. The stockholder is also on the Board of Directors of this financial institution.

During the year ended December 31, 2016, the Company made advances to companies related by common ownership for various purposes; the outstanding advances totaled $74,067. The Company wrote off advances deemed uncollectable in the amount of $323,916 during the year ended December 31, 2016.

The Company has an uncollateralized note receivable from its stockholder totaling $719,051 at December 31, 2016 and $725,836 at March 31, 2017. The note bears interest at 1.00%.

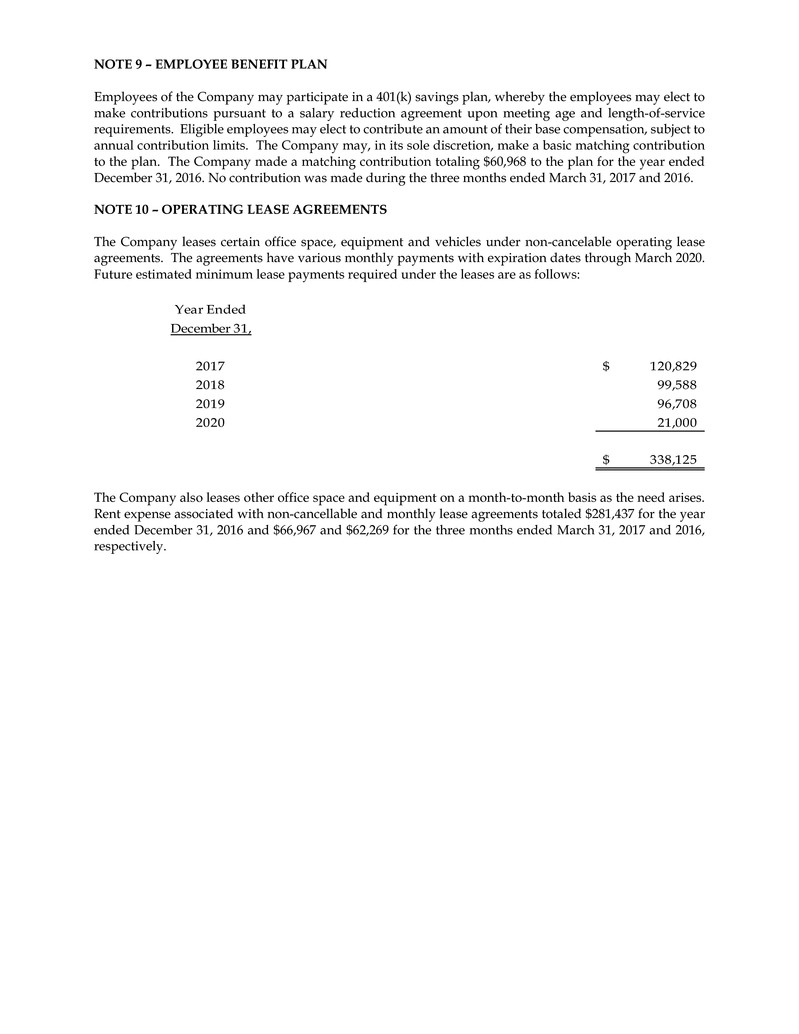

The Company has an operating lease agreement for office space with a related party expiring March 2020. Rental expense associated with this agreement totaled $84,000 for the year ended December 31, 2016 and $21,000 and $21,000 for the three months ended March 31, 2017 and 2016, respectively. The lease is included in future estimated minimum lease payments disclosed in Note 10.

The Company leases other space from its stockholder on a month-to-month basis. Rental expense paid to the stockholder for this lease totaled $42,000 for the year ended December 31, 2016 and $10,500 and $10,500 for the three months ended March 31, 2017 and 2016, respectively.

Aviation expense paid to related parties totaled $233,925 for the year ended December 31, 2016 and $42,854 and $50,987 for the three months ended March 31, 2017 and 2016, respectively. That amount was paid to a company related by common ownership for business aircraft use. The Company is not obligated, but expects to continue renting the aircraft regularly as needed.

NOTE 12 - SUBSEQUENT EVENTS

On April 3, 2017, BG Staffing, Inc. (“BG”) acquired substantially all of the assets, and assumed certain of the liabilities, of the Company, for an initial cash consideration paid of $18.5 million and issued $1 million (70,670 shares privately placed) of BG's common stock at closing. An additional $500,000 was held back as partial security for post-closing purchase price adjustments and indemnification obligations. The purchase agreement further provides for contingent earn-out consideration payments of up to $3 million, based on the performance for the two years following the date of acquisition. As part of the transaction, both lines of credit and two installment loans were paid in full.

Management has performed an analysis of the activities and transactions subsequent to December 31, 2016 to determine the need for any adjustments to and/or disclosures within the audited financial statements for the year ended December 31, 2016. Management has performed their analysis through June 13, 2017, the date the financial statements were available to be issued.

NOTE 13 - RECENT ACCOUNTING PRONOUNCEMENTS

In May 2014, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Updates ("ASU") ASU 2014-09, Revenue from Contracts with Customers. Since May 2014, the FASB has issued additional and amended authoritative guidance regarding revenue from contracts with customers in order to clarify and improve the understanding of the implementation guidance. As amended, the new guidance requires a company to recognize revenue to depict the transfer of goods or services to a customer at an amount that reflects the consideration a company expects to receive in exchange for those goods or services. The new standard is effective for annual and interim periods beginning after December 15, 2017. Based on our preliminary analysis, the Company does not believe the adoption of this accounting guidance will have a material impact on the Company's financial condition or results of operations. The Company will continue to evaluate the impact of this guidance on the financial statements and the preliminary assessments are subject to change.

NOTE 13 - RECENT ACCOUNTING PRONOUNCEMENTS (Continued)

In February 2016, the FASB issued ASU 2016-02 Leases, which applies to lease transactions. Under the new guidance, lessees will be required to recognize a lease liability, measured on a discounted basis; and a right-of-use asset, for the lease term. The new guidance is effective for annual and interim periods beginning after December 15, 2019. Early application is permitted for all entities upon issuance. Lessees and lessors must apply a modified retrospective transition approach for leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements. The Company is currently evaluating the impact of the adoption of this accounting guidance will have on the financial statements.

In March 2016, the FASB issued ASU 2016-09, Improvements to Employee Share-Based Payment Accounting, which simplifies several aspects of the accounting for employee share-based payment transactions including the accounting for income taxes, forfeitures, and statutory tax withholding requirements, as well as classification of related amounts within the statement of cash flows. The new guidance is effective for annual and interim periods beginning after December 15, 2017, with early adoption permitted. The Company does not anticipate the adoption of ASU 2016-09 will have a material impact on the Company's financial condition or results of operations.

In June 2016, the FASB issued ASU 2016-13, which amends how entities will measure credit losses for most financial assets and certain other instruments that are not measured at fair value through net income, which applies to trade accounts receivable and the calculation of the allowance for uncollectible accounts receivable. The new standard will become effective for the Company for annual and interim periods beginning after December 15, 2020, with early adoption permitted. The Company is currently evaluating the impact of the adoption of this accounting guidance will have on the financial statements.

In August 2016, the FASB issued ASU 2016-15, Classification of Certain Cash Receipts and Cash Payments, which provides guidance on how certain transactions are classified in the statement of cash flows. The standard will become effective for annual and interim periods beginning after December 15, 2018. The Company does anticipate the adoption of ASU 2016-15 will have a material impact on the Company's statement of cash flows.

In January 2017, the FASB issued ASU 2017-01, Business Combinations (Topic 805) Clarifying the Definition of a Business. The amendments in this Update is to clarify the definition of a business with the objective of adding guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses. The definition of a business affects many areas of accounting including acquisitions, disposals, goodwill, and consolidation. The guidance is effective for annual periods beginning after December 15, 2018, including interim periods within those periods. The Company does not anticipate the adoption of ASU 2017-01 will have a material impact on the Company's financial condition or results of operations.