Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - DermTech, Inc. | v468982_ex23-1.htm |

| EX-10.5.1 - EXHIBIT 10.5.1 - DermTech, Inc. | v468982_ex10-5x1.htm |

| EX-3.2 - EXHIBIT 3.2 - DermTech, Inc. | v468982_ex3-2.htm |

| S-1/A - S-1/A - DermTech, Inc. | v468982_s1a.htm |

Exhibit 10.6.1

AMENDED AND RESTATED

UNIT SUBSCRIPTION AGREEMENT

This AMENDED AND RESTATED UNIT SUBSCRIPTION AGREEMENT (this “Agreement”) is made as of this ____ day of June 2017, by and between Constellation Alpha Capital Corp., a British Virgin Islands business company (the “Company”), having its principal place of business at Emerald View, Suite 400, 2054 Vista Parkway, West Palm Beach, FL 33411, and Cowen Investments LLC (the “Purchaser”).

WHEREAS, the Company and the Purchaser entered into that certain Unit Subscription Agreement, dated as of May 17, 2017 (the "Initial Agreement"), pursuant to which the Purchaser agreed to purchase on a private placement basis (the "Offering"), an aggregate of 100,000 units of the Company, each such unit comprised of one ordinary share of the Company, no par value per share (the “Ordinary Shares”), one right to receive one-tenth (1/10) of one share of common stock (the “Right”), and one warrant (the “Warrant”) to purchase one-half of one Ordinary Share (the “Warrant Shares”), for an aggregate purchase price of $1,000,000, or $10.00 per unit; and, in conjunction therewith, the Company agreed to issue to the Purchaser 100,000 Ordinary Shares (the "Private Shares") for no additional consideration (which Ordinary Shares shall be identical to the Ordinary Shares (the "Founder Shares") purchased by Centripetal, LLC (the "Sponsor") prior to the Company’s initial public offering ("IPO")) and, in connection therewith, the Sponsor agreed to forfeit by surrendering without consideration to the Company 100,000 Founder Shares;

WHEREAS, simultaneously with the consummation of the Company’s IPO of 12,500,000 units (the “Public Units”) consisting of Ordinary Shares, the Rights and Warrants, the Sponsor agreed to purchase on a private placement basis an aggregate of 280,000 units (or 317,500 units if the over-allotment option is exercised in full) that are identical to the units to be purchased by the Purchaser, for an aggregate purchase price of $2,800,000 (or $3,175,000 if the over-allotment option is exercised in full), or $10.00 per unit;

WHEREAS, the Sponsor has now agreed to purchase an additional 88,750 units (or 107,500 units if the over-allotment option is exercised in full) for a total of 368,750 units (or a total of 425,000 units if the over-allotment option is exercised in full) (the “Founder Units”) for an aggregate purchase price of $3,687,500 (or $4,250,000 if the over-allotment option is exercised in full), or $10.00 per Founder Unit;

WHEREAS, as a result of the purchase by the Sponsor of additional Founder Units, the Company and the Purchaser desire to amend and restate the Initial Agreement to provide for the purchase by the Purchaser of an additional 36,250 units for a total of 136,250 units (the "Private Units") for an aggregate purchase price of $1,362,500, or $10.00 per Private Unit;

WHEREAS, concurrently with the issuance of the Private Units, the Company agrees to issue to the Purchaser 136,250 Ordinary Shares (the "Private Shares") for no additional consideration, which Ordinary Shares shall be identical to the Ordinary Shares (the "Founder Shares") purchased by the Sponsor prior to the Company’s IPO and, in connection therewith, the Sponsor shall forfeit by surrendering without consideration to the Company 136,250 Founder Shares; and

WHEREAS, the Purchaser desires to purchase the Private Units and the Company wishes to accept such subscription.

| 1 |

NOW, THEREFORE, in consideration of the promises and the mutual covenants hereinafter set forth and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Company and the Purchaser hereby agree as follows:

1. Agreement to Subscribe

1.1. Purchase and Issuance of the Private Units; Issuance of Private Shares. For the aggregate sum of $1,362,500 (the “Purchase Price”), or $10.00 per Private Unit, upon the terms and subject to the conditions of this Agreement, the Purchaser hereby agrees to purchase from the Company, and the Company hereby agrees to sell to the Purchaser, on the Closing Date (as defined in Section 1.2) 136,250 Private Units, free and clear of any and all liens, claims, options, charges, pledges, security interests, voting agreements, voting trusts, encumbrances, or restrictions of any nature (“Liens”) (other than restrictions under applicable securities laws and the restrictions contained herein). Concurrently with the purchase of the Private Units by the Purchaser, the Company agrees to issue to the Purchaser 136,250 Ordinary Shares, free and clear of any and all Liens (other than restrictions under applicable securities laws and the restrictions contained herein).

1.2. Closing. The closing (the “Closing”) of the subscription of the Private Units and the issuance of the Private Shares shall take place at the offices of Ellenoff Grossman & Schole LLP, 1345 Avenue of the Americas, New York, New York, 10105 simultaneously with the consummation of the Company’s IPO (such date, the “Closing Date”).

1.3. Delivery of the Purchase Price. On the Closing Date, the Purchaser agrees to deliver the Purchase Price by certified bank check or wire transfer of immediately available funds denominated in United States Dollars to Continental Stock Transfer & Trust Company, which funds shall be deposited on the Closing Date to the trust account established for the benefit of the Company’s public shareholders, managed pursuant to that certain Investment Management Trust Agreement to be entered into by and between the Company and Continental Stock Transfer & Trust Company, as trustee, and into which substantially all of the proceeds of the IPO will be deposited (the “Trust Account”). For the avoidance of doubt, if the size of the IPO is reduced after the date hereof, this Agreement shall become null and void and be of no further force and effect.

1.4. Delivery of Securities; Forfeiture of Founder Shares. Upon the Closing Date after delivery of the Purchase Price in accordance with Section 1.3, the Company shall (ii) issue to the Purchaser, and the Purchaser shall become irrevocably entitled to receive, a unit certificate representing the Private Units purchased hereunder and a certificate representing the Private Shares, and (ii) cause the forfeiture by the Sponsor of 136,250 Founder Shares. In furtherance of the foregoing, the Company shall register the Purchaser as the owner of the Private Units and the Private Shares in the register of members of the Company and with the Company’s transfer agent by book entry on or promptly after the Closing Date.

1.5 Closing Conditions.

(a) The obligation of the Purchaser to purchase the Private Units at the Closing under this Agreement shall be subject to the fulfillment, at or prior to the Closing of each of the following conditions, any of which, to the extent permitted by applicable laws, may be waived by the Purchaser:

(i) The representations and warranties of the Company set forth in Section 3 of this Agreement shall have been true and correct as of the date hereof and shall be true and correct as of the Closing, with the same effect as though such representations and warranties had been made on and as of such date (other than any such representation or warranty that is made by its terms as of a specified date, which shall be true and correct as of such specified date), except where the failure to be so true and correct would not have a material adverse effect on the Company or its ability to consummate the transactions contemplated by this Agreement;

| 2 |

(ii) The Company shall have performed, satisfied and complied in all material respects with the covenants, agreements and conditions required by this Agreement to be performed, satisfied or complied with by the Company or the Sponsor at or prior to the Closing;

(iii) No order, writ, judgment, injunction, decree, determination, or award shall have been entered by or with any governmental, regulatory, or administrative authority or any court, tribunal, or judicial, or arbitral body, and no other legal restraint or prohibition shall be in effect, preventing the purchase by the Purchaser of the Securities.

(iv) The Company shall have duly executed and delivered the Underwriting Agreement relating to the IPO.

(v) The Sponsor shall have forfeited by surrendering without consideration to the Company 136,250 Founder Shares.

(vi) The Company shall have furnished opinions of Ellenoff Grossman & Schole LLP, counsel for the Company, and Ogier, British Virgin Islands counsel for the Company, each addressed to the Purchaser, and dated the Closing Date, and each in form and substance satisfactory to the Purchaser.

(b) The obligation of the Company to sell the Private Units at the Closing under this Agreement shall be subject to the fulfillment, at or prior to the Closing of each of the following conditions, any of which, to the extent permitted by applicable laws, may be waived by the Company;

(i) The representations and warranties of the Purchaser set forth in Section 2 of this Agreement shall have been true and correct as of the date hereof and shall be true and correct as of the Closing, with the same effect as though such representations and warranties had been made on and as of such date (other than any such representation or warranty that is made by its terms as of a specified date, which shall be true and correct as of such specified date), except where the failure to be so true and correct would not have a material adverse effect on the Purchaser or its ability to consummate the transactions contemplated by this Agreement;

(ii) The Purchaser shall have performed, satisfied and complied in all material respects with the covenants, agreements and conditions required by this Agreement to be performed, satisfied or complied with by the Purchaser at or prior to the Closing; and

(iii) No order, writ, judgment, injunction, decree, determination, or award shall have been entered by or with any governmental, regulatory, or administrative authority or any court, tribunal, or judicial, or arbitral body, and no other legal restraint or prohibition shall be in effect, preventing the purchase by the Purchaser of the Private Units.

2. Representations and Warranties of the Purchaser

The Purchaser represents and warrants to the Company that:

| 3 |

2.1. No Government Recommendation or Approval. It understands that no United States federal or state agency or similar agency of any other country has passed upon or made any recommendation or endorsement of the Company, the Private Units, the Rights, the Warrants, or Warrant Shares, the Ordinary Shares underlying the Private Units or the Ordinary Shares issuable upon conversion of the Rights (excluding the Warrant Shares, the “Private Unit Shares” and, collectively with the Private Units and Warrant Shares, the “Securities”) or the Private Shares.

2.2. Organization. It is a limited liability company, validly existing and in good standing under the laws of its jurisdiction and possesses all requisite power and authority necessary to carry out the transactions contemplated by this Agreement.

2.3. Private Offering. It is an “accredited investor” as such term is defined in Rule 501(a) of Regulation D under the Securities Act of 1933, as amended (the “Securities Act”). It acknowledges that the sale contemplated hereby is being made in reliance on a private placement exemption to “accredited investors” within the meaning of Section 501(a) of Regulation D under the Securities Act and similar exemptions under state law.

2.4. Authority. This Agreement has been validly authorized, executed and delivered by the Purchaser and is a valid and binding agreement enforceable in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, fraudulent conveyance or similar laws affecting the enforcement of creditors’ rights generally and subject to general principles of equity (regardless of whether enforcement is sought in a proceeding at law or in equity).

2.5. No Conflicts. The execution, delivery and performance of this Agreement and the consummation by the Purchaser of the transactions contemplated hereby do not violate, conflict with or constitute a default under (i) the Purchaser’s organizational documents, (ii) any agreement, indenture or instrument to which the Purchaser is a party or (iii) any law, statute, rule or regulation to which the Purchaser is subject, or any agreement, order, judgment or decree to which the Purchaser is subject.

2.6. No Legal Advice from Company. It acknowledges it has had the opportunity to review this Agreement and the transactions contemplated by this Agreement and the other agreements entered into between the parties hereto with its own legal counsel and investment and tax advisors. Except for any statements or representations of the Company made in this Agreement and the other agreements entered into between the parties hereto, it is relying solely on such counsel and advisors and not on any statements or representations of the Company or any of its representatives or agents for legal, tax or investment advice with respect to this investment, the transactions contemplated by this Agreement or the securities laws of any jurisdiction.

2.7. Access to Information; Independent Investigation. Prior to the execution of this Agreement, it has had the opportunity to ask questions of and receive answers from representatives of the Company concerning an investment in the Company, as well as the finances, operations, business and prospects of the Company, and the opportunity to obtain additional information to verify the accuracy of all information so obtained. In determining whether to make this investment, it has relied solely on its own knowledge and understanding of the Company and its business based upon its own due diligence investigation and the information furnished pursuant to this paragraph. It understands that no person has been authorized to give any information or to make any representations which were not furnished pursuant to this Section 2 and it has not relied on any other representations or information in making its investment decision, whether written or oral, relating to the Company, its operations and/or its prospects.

| 4 |

2.8. Reliance on Representations and Warranties. It understands the Private Units are being offered and sold to it in reliance on exemptions from the registration requirements under the Securities Act, and analogous provisions in the laws and regulations of various states, and that the Company is relying upon the truth and accuracy of the representations, warranties, agreements, acknowledgments and understandings of the Purchaser set forth in this Agreement in order to determine the applicability of such provisions.

2.9. No Advertisements. It is not subscribing for the Private Units as a result of or subsequent to any advertisement, article, notice or other communication published in any newspaper, magazine, or similar media or broadcast over television or radio, or presented at any seminar or meeting.

2.10. Legend. It acknowledges and agrees the certificates (if any) evidencing (i) the Private Units and the Ordinary Shares, the Rights and Warrants underlying the Private Units and (ii) the Private Shares shall bear a restrictive legend (the “Legend”), in form and substance as set forth in Section 4.1 hereof, prohibiting the offer, sale, pledge or transfer of the securities, except (1) pursuant to an effective registration statement covering these securities under the Securities Act or (2) pursuant to any other exemptions from the registration requirements under the Securities Act and such laws which, in the opinion of counsel for the Company, is available.

2.11. Experience, Financial Capability and Suitability. It is (i) sophisticated in financial matters and is able to evaluate the risks and benefits of the investment in the Securities and the Private Shares and (ii) able to bear the economic risk of its investment in the Securities and the Private Shares for an indefinite period of time because the Securities and the Private Shares have not been registered under the Securities Act and therefore cannot be sold unless subsequently registered under the Securities Act or an exemption from such registration is available. It has substantial experience in evaluating and investing in transactions of securities in companies similar to the Company so that it is capable of evaluating the merits and risks of its investment in the Company and has the capacity to protect its own interests.

2.12. Investment Purposes. It is acquiring the Securities and the Private Shares solely for investment purposes, for its own account and not for the account or benefit of any other person, and not with a view towards the distribution or dissemination thereof and it has no present arrangement to sell the interest in the Securities or the Private Shares to or through any person or entity.

2.13. Restrictions on Transfer. It acknowledges and understands the Private Units and the Private Shares are being offered in a transaction not involving a public offering in the United States within the meaning of the Securities Act. The Securities and the Private Shares have not been registered under the Securities Act, and, if in the future, it decides to offer, resell, pledge or otherwise transfer the Securities or the Private Shares, such Securities or such Private Shares, as applicable, may be offered, resold, pledged or otherwise transferred only (A) pursuant to an effective registration statement filed under the Securities Act, (B) pursuant to an exemption from registration under Rule 144 promulgated under the Securities Act (“Rule 144”), if available, or (C) pursuant to any other available exemption from the registration requirements of the Securities Act, and in each case in accordance with any applicable securities laws of any state or any other jurisdiction. It agrees that if any transfer of its Securities or Private Shares or any interest therein is proposed to be made, as a condition precedent to any such transfer, it may be required to deliver to the Company an opinion of counsel satisfactory to the Company. Absent registration or another available exemption from registration, it agrees it will not resell the Securities or the Private Shares. It further acknowledges that because the Company is a shell company, Rule 144 may not be available to it for the resale of the Securities or the Private Shares until the one year anniversary following consummation of the initial Business Combination (defined below) of the Company, despite technical compliance with the requirements of Rule 144 and the release or waiver of any contractual transfer restrictions.

| 5 |

3. Representations and Warranties of the Company

The Company represents and warrants to the Purchaser that:

3.1. Valid Issuance of Share Capital. The total number of all classes of share capital which the Company has authority to issue is (i) an unlimited number of Ordinary Shares and (ii) an unlimited number of preferred shares. As of the date hereof, the Company has issued 3,593,750 Ordinary Shares (of which 468,750 Ordinary Shares are subject to forfeiture as described in the registration statement related to the IPO), and no preferred shares issued and outstanding. All of the issued share capital of the Company has been duly authorized, validly issued, and are fully paid and non-assessable.

3.2. Title to Securities. Upon issuance in accordance with, and payment pursuant to, the terms hereof, the warrant agreement to be entered into with a mutually agreeable warrant agent on or prior to the closing of the IPO (“Warrant Agreement”) and the rights agreement to be entered into with a mutually agreeable rights agent on or prior to the closing of the IPO (the “Rights Agreement”), as the case may be, each of the Warrants, the Rights, the Ordinary Shares and the Private Shares will be duly and validly issued, fully paid and non-assessable, free and clear of any Liens (other than restrictions under applicable securities laws and the restrictions contained herein). On the date of issuance of the Private Units, the Warrant Shares shall have been reserved for issuance. Upon issuance in accordance with the terms hereof and the Warrant Agreement, the Purchaser will have or receive good title to the Warrant Shares, free and clear of any and all Liens (other than restrictions under applicable securities laws and the restrictions contained herein). Upon issuance in accordance with the terms hereof and the Rights Agreement, the Purchaser will have or receive good title to the Ordinary Shares issuable upon conversion of the Rights, free and clear of any and all Liens (other than restrictions under applicable securities laws and the restrictions contained herein).

3.3. Organization and Qualification. The Company has been duly incorporated and is validly existing as a British Virgin Islands business company and has the requisite corporate power to own its properties and assets and to carry on its business as now being conducted.

3.4. Authorization; Enforcement. (i) The Company has the requisite corporate power and authority to enter into and perform its obligations under this Agreement and to issue the Securities in accordance with the terms hereof, (ii) the execution, delivery and performance of this Agreement by the Company and the consummation by it of the transactions contemplated hereby have been duly authorized by all necessary corporate action and no further consent or authorization of the Company or its Board of Directors or shareholders is required, and (iii) this Agreement constitutes, and upon the execution and delivery thereof, each of the Rights, the Rights Agreement, the Warrants and the Warrant Agreement will constitute, valid and binding obligations of the Company enforceable against the Company in accordance with their respective terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, fraudulent conveyance, moratorium, reorganization, or similar laws relating to, or affecting generally the enforcement of, creditors’ rights and remedies or by equitable principles of general application and except as enforcement of rights to indemnity and contribution may be limited by federal and state securities laws or principles of public policy.

| 6 |

3.5. No Conflicts. The execution, delivery and performance of this Agreement and the consummation by the Company of the transactions contemplated hereby do not (i) result in a violation of the Company’s Memorandum and Articles of Association, (ii) conflict with, or constitute a default under any agreement, indenture or instrument to which the Company is a party or (iii) conflict with any law statute, rule or regulation to which the Company is subject or any agreement, order, judgment or decree to which the Company is subject. Other than any federal, state or foreign securities filings which may be required to be made by the Company subsequent to the Closing, and any registration statement which may be filed pursuant thereto, the Company is not required under federal, state or local law, rule or regulation to obtain any consent, authorization or order of, or make any filing or registration with, any court or governmental agency or self-regulatory entity in order for it to perform any of its obligations under this Agreement or issue (1) the Private Units, the Rights, the Warrants or the Ordinary Shares underlying the Private Units, the Rights or Warrants or (2) the Private Shares, in each case, in accordance with the terms hereof.

3.6. Operations. As of the date hereof, the Company has not conducted, and prior to the IPO Closing the Company will not conduct, any operations other than organizational activities and activities in connection with offerings of the Securities.

3.7 Foreign Corrupt Practices. Neither the Company, nor any director, officer, agent, employee or other Person acting on behalf of the Company has, in the course of its actions for, or on behalf of, the Company (i) used any corporate funds for any unlawful contribution, gift, entertainment or other unlawful expenses relating to political activity; (ii) made any direct or indirect unlawful payment to any foreign or domestic government official or employee from corporate funds; (iii) violated or is in violation of any provision of the U.S. Foreign Corrupt Practices Act of 1977, as amended; or (iv) made any unlawful bribe, rebate, payoff, influence payment, kickback or other unlawful payment to any foreign or domestic government official or employee.

3.8 Compliance with Anti-Money Laundering Laws. The operations of the Company are and have been conducted at all times in compliance with applicable financial recordkeeping and reporting requirements and all other applicable U.S. and non-U.S. anti-money laundering laws and regulations, including, but not limited to, those of the Currency and Foreign Transactions Reporting Act of 1970, as amended, the USA Patriot Act of 2001 and the applicable money laundering statutes of all applicable jurisdictions, the rules and regulations thereunder and any related or similar rules, regulations or guidelines, issued, administered or enforced by any governmental agency (collectively, the “Anti-Money Laundering Laws”), and no action, suit or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving the Company with respect to the Anti-Money Laundering Laws is pending or, to the knowledge of the Company, threatened.

3.9 Absence of Litigation. There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the Company, threatened against or affecting the Company or any of the Company’s officers or directors, whether of a civil or criminal nature or otherwise, in their capacities as such.

3.10 Choice of Law. The Company has the power to submit, legally, validly, effectively and irrevocably, to the jurisdiction of any state courts in the State of New York or the United States District Court for the Southern District of New York.

4. Legends

4.1. Legend. The Company will issue (i) the Private Units, the Rights, the Warrants and the Private Unit Shares, and when issued, the Warrant Shares and the Ordinary Shares issuable upon conversion of the Rights, purchased by the Purchaser, and (ii) the Private Shares, in each case, in the name of the Purchaser. Each register and book entry for each of the Securities and the Private Shares shall contain a notation, and each certificate (if any) evidencing the Securities and the Private Shares shall be stamped or otherwise imprinted with a legend, in substantially the following form

| 7 |

THESE SECURITIES (i) HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND THESE SECURITIES MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT (A) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT FILED UNDER THE SECURITIES ACT, (B) PURSUANT TO AN EXEMPTION FROM REGISTRATION PROVIDED BY RULE 144 UNDER THE SECURITIES ACT (IF AVAILABLE) OR (C) PURSUANT TO ANY OTHER EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT, IN EACH CASE IN ACCORDANCE WITH ANY APPLICABLE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES OR ANY OTHER JURISDICTION. HEDGING TRANSACTIONS INVOLVING THESE SECURITIES MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE SECURITIES ACT.

“THE SECURITIES REPRESENTED BY THIS CERTIFICATE ARE SUBJECT TO AN AGREEMENT BETWEEN CONSTELLATION ALPHA CAPITAL CORP. AND COWEN INVESTMENTS LLC AND MAY ONLY BE OFFERED, SOLD, TRANSFERRED, PLEDGED OR OTHERWISE DISPOSED DURING THE TERM OF THE LOCKUP PURSUANT TO THE TERMS SET FORTH THEREIN.”

4.2. Purchaser’s Compliance. Nothing in this Section 4 shall affect in any way the Purchaser’s obligations and agreements to comply with all applicable securities laws upon resale of the Securities.

4.3. Company’s Refusal to Register Transfer of the Securities and the Private Shares. The Company shall refuse to register any transfer of the Securities or the Private Shares, if in the reasonable judgment of the Company such purported transfer would not be made (i) pursuant to an effective registration statement filed under the Securities Act, or (ii) pursuant to an available exemption from the registration requirements of the Securities Act.

4.4. Registration Rights. The Purchaser will be entitled to certain registration rights which will be governed by a registration rights agreement (“Registration Rights Agreement”) to be entered into with the Company on or prior to the closing of the IPO; provided, however, that the Purchaser may not exercise its demand and “piggy back” registration rights pursuant to such Registration Rights Agreement after five (5) and seven (7) years after the effective date of the Registration Statement, respectively, and the Purchaser may not exercise its demand registration rights thereunder more than one time.

4.5 Removal of Legend. Following the expiration of the transfer restrictions set forth herein, if any of the Securities or the Private Shares are eligible to be sold without restriction under, and without the Company being in compliance with the current public information requirements of, Rule 144 under the Securities Act, then at the Purchaser’s request, the Company will cause the Company’s transfer agent to remove the legend set forth in Section 4.1. In connection therewith, if required by the Company’s transfer agent, the Company will promptly cause an opinion of counsel to be delivered to and maintained with its transfer agent, together with any other authorizations, certificates and directions required by the transfer agent that authorize and direct the transfer agent to issue such Securities without any such legend.

| 8 |

5. Transfer Restrictions

5.1 FINRA Lock-up. The Purchaser acknowledges and agrees that the Private Units, the Warrants, the Private Unit Shares and the Warrant Shares shall not be transferable, saleable or assignable until after the consummation of an acquisition, share exchange, purchase of all or substantially all of the assets of, or any other similar business combination with one or more businesses or entities (a “Business Combination”), except to permitted transferees. The Private Units, the Rights, the Warrants, the Private Unit Shares, the Warrant Shares, the Ordinary Shares issuable upon conversion of the Rights, and the Private Shares will be deemed compensation by the Financial Industry Regulatory Authority (“FINRA”) and will therefore be subject to lock-up for a period of 180 days immediately following the date of effectiveness of the Registration Statement or commencement of sales of the IPO, subject to certain limited exceptions, pursuant to Rule 5110(g)(1) of the FINRA Manual. Accordingly, the Private Units, the Rights, the Warrants, the Private Unit Shares, the Warrant Shares, the Ordinary Shares issuable upon conversion of the Rights, and the Private Shares may not be sold, transferred, assigned, pledged or hypothecated for 180 days immediately following the effective date of the Registration Statement except to any underwriter or selected dealer participating in the IPO and the bona fide officers or partners of the Purchaser and any such participating underwriter or selected dealer nor may they be the subject of any hedging, short sale, derivative, put or call transaction that would result in the economic disposition of the securities by any person during such 180-day period.

5.2 Transfer Restrictions.

(i) Subject to Section 5.1, the Purchaser shall not Transfer (as defined below) any Private Shares until, with respect to 50% of the Private Shares, the earlier of (1) one year after the consummation of a Business Combination or earlier if, subsequent to such Business Combination, and (2) the date on which the closing sale price of the Ordinary Shares equals or exceeds $12.50 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) for any 20 trading days within any 30-trading day period commencing after such Business Combination and, with respect to the remaining 50% of the Private Shares, upon one year after the consummation of a Business Combination or earlier if, subsequent to such Business Combination, the Company consummates a subsequent liquidation, merger, stock exchange or other similar transaction that results in all of the Company’s shareholders having the right to exchange their Ordinary Shares for cash, securities or other property. For purposes of this Agreement, “Transfer” shall mean the (x) sale of, offer to sell, contract or agreement to sell, hypothecate, pledge, grant of any option to purchase or otherwise dispose of or agreement to dispose of, directly or indirectly, or establishment or increase of a put equivalent position or liquidation with respect to or decrease of a call equivalent position within the meaning of Section 16 of the Securities Exchange Act of 1934, as amended, and the rules and regulations of the Securities and Exchange Commission (the “Commission”) promulgated thereunder with respect to, any security, (y) entry into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of any security, whether any such transaction is to be settled by delivery of such securities, in cash or otherwise, or (z) public announcement of any intention to effect any transaction specified in clause (x) or (y).

(iii) Notwithstanding the provisions set forth in paragraph 5.2(i), Transfers of the Private Shares and any Securities are permitted to (a) to any members of the Purchaser or any affiliates of the Purchaser or any of its members; (b) by private sales or transfers made in connection with the consummation of a Business Combination at prices no greater than the price at which the securities were originally purchased; (c) in the event of the Company’s liquidation prior to the completion of a Business Combination; or (d) by virtue of the laws of the State of Delaware or the Purchaser’s limited liability company agreement upon dissolution of the Purchaser; provided, however, that in the case of clauses (a) through (c), these permitted transferees must enter into a written agreement agreeing to be bound by the transfer restrictions described herein.

| 9 |

6. Securities Laws Restrictions

The Purchaser agrees not to sell, transfer, pledge, hypothecate or otherwise dispose of all or any part of the Securities unless, prior thereto (a) a registration statement on the appropriate form under the Securities Act and applicable state securities laws with respect to the Securities proposed to be transferred shall then be effective or (b) the Company shall have received an opinion from counsel reasonably satisfactory to the Company, that such registration is not required because such transaction complies with the Securities Act and the rules promulgated by the Commission thereunder and with all applicable state securities laws.

7. Partial Forfeiture in Connection with Business Combination Closing

If, in connection with the closing of the Business Combination, the Sponsor agrees to forfeit any Founder Shares and/or Founder Units to the Company at no cost or subject its Founder Shares and/or Founder Units to contractual terms or restrictions, convert its Founder Shares and/or Founder Units (including the Ordinary Shares and Warrants comprising such Founder Units) into other securities or contractual rights or otherwise modify the terms of its Founder Shares and/or Founder Units, then, provided that the Sponsor is not being issued any other equity or equity-related securities in the Business Combination not also being issued to the Purchaser on a pro rata basis, the Purchaser agrees to forfeit, subject, convert or modify its Private Shares and/or Private Units, as applicable, on a pro rata basis and on the same terms as the Sponsor and any other holders of Founder Shares and/or Founder Units. Any forfeiture under this Agreement shall take effect as a surrender for no consideration as a matter of British Virgin Islands law.

8. Waiver of Distributions from Trust Account

In connection with the Securities and the Private Shares acquired pursuant to this Agreement, the Purchaser hereby waives any and all right, title, interest or claim of any kind in or to any distributions from the Trust Account.

9. Rescission Right Waiver

9.1. Rescission Waiver. The Purchaser understands and acknowledges that an exemption from the registration requirements of the Securities Act requires there be no general solicitation of purchasers of the Private Units or the Private Shares. In this regard, if the Offering were deemed to be a general solicitation with respect to the Private Units, the offer and sale of such Private Units may not be exempt from registration and, if not, the Purchaser may have a right to rescind its purchase of the Private Units. In order to facilitate the completion of the Offering and in order to protect the Company, its shareholders and the Trust Account from claims that may adversely affect the Company or the interests of its shareholders, the Purchaser hereby agrees to waive, to the maximum extent permitted by applicable law, any claims, right to sue or rights in law or arbitration, as the case may be, to seek rescission of its purchase of the Private Units as a result of the issuance of the Private Units being deemed to be in violation of Section 5 of the Securities Act. The Purchaser acknowledges and agrees this waiver is being made in order to induce the Company to sell the Private Units to the Purchaser. The Purchaser agrees the foregoing waiver of rescission rights shall apply to any and all known or unknown actions, causes of action, suits, claims or proceedings (collectively, “Claims”) and related losses, costs, penalties, fees, liabilities and damages, whether compensatory, consequential or exemplary, and expenses in connection therewith, including reasonable attorneys’ and expert witness fees and disbursements and all other expenses reasonably incurred in investigating, preparing or defending against any Claims, whether pending or threatened, in connection with any present or future actual or asserted right to rescind the purchase of the Units hereunder or relating to the purchase of the Private Units and the transactions contemplated hereby.

| 10 |

9.2. No Recourse Against Trust Account. The Purchaser agrees not to seek recourse against the Trust Account for any reason whatsoever in connection with its acquisition of the Private Units or the Private Shares or any Claim that may arise now or in the future.

9.3. Section 8 Waiver. The Purchaser agrees that to the extent any waiver of rights under this Section 9 is ineffective as a matter of law, the Purchaser has offered such waiver for the benefit of the Company as an equitable right that shall survive any statutory disqualification or bar that applies to a legal right. The Purchaser acknowledges the receipt and sufficiency of consideration received from the Company hereunder in this regard.

10. Terms of the Private Units and Private Shares; Voting

10.1 Terms of the Private Units and Private Shares. The Private Units shall be substantially identical to the Public Units, except the Private Units: (i) will be subject to the transfer restrictions described herein; (ii) are being purchased pursuant to an exemption from the registration requirements of the Securities Act and will become freely tradable only after certain conditions are met or the resale of the Private Units is registered under the Securities Act; and (iii) the Warrants underlying the Private Units are not redeemable by the Company, provided the Private Units are held by the Purchaser or its permitted transferees. The Private Shares shall be identical to the Founder Shares, and the Private Shares shall be identical to the Ordinary Shares comprising the Public Units, except that the Private Shares: (i) will be subject to the transfer restrictions described herein; (ii) are being purchased pursuant to an exemption from the registration requirements of the Securities Act and will become freely tradable only after certain conditions are met or the resale of the Private Units is registered under the Securities Act.

10.2 Voting. The Purchaser agrees that if the Company seeks shareholder approval of a proposed Business Combination, then in connection with such proposed Business Combination, the Purchaser shall vote the Private Shares and any other Ordinary Shares owned by it in favor of such proposed Business Combination. The Purchaser agrees: (i) not to propose an amendment to the Company’s Memorandum and Articles of Association with respect to its pre-Business Combination activities prior to the consummation of such a Business Combination unless the Company provides dissenting public shareholders with the opportunity to redeem their Ordinary Shares in conjunction with any such amendment; and (ii) not to redeem any Ordinary Shares owned by it (including the Private Shares) into the right to receive cash from the Trust Account in connection with a shareholder vote to approve the Company’s proposed initial Business Combination (or to sell any Ordinary Shares in a tender offer in connection with a proposed Business Combination if the Company does not seek shareholder approval in connection therewith) or a vote to amend the provisions of the Company’s Memorandum and Articles of Association relating to shareholders’ rights or pre-Business Combination activity.

11. Governing Law; Jurisdiction; Waiver of Jury Trial

11.1 Governing Law. This Agreement, the entire relationship of the parties hereto, and any litigation between the parties (whether grounded in contract, tort, statute, law or equity) shall be governed by, construed in accordance with, and interpreted pursuant to the laws of the State of New York, including, without limitation, Sections 5-1401 and 5-1402 of the New York General Obligations Law and New York Civil Practice Laws and Rules 327(b).

| 11 |

11.2 Jurisdiction. The parties (i) hereby irrevocably and unconditionally submit to the jurisdiction of the state courts of New York and to the jurisdiction of the United States District Court for the Southern District of New York for the purpose of any suit, action or other proceeding arising out of or based upon this Agreement, (b) agree not to commence any suit, action or other proceeding arising out of or based upon this Agreement except in state courts of New York or the United States District Court for the Southern District of New York, and (c) hereby waive, and agree not to assert, by way of motion, as a defense, or otherwise, in any such suit, action or proceeding, any claim that it is not subject personally to the jurisdiction of the above-named courts, that its property is exempt or immune from attachment or execution, that the suit, action or proceeding is brought in an inconvenient forum, that the venue of the suit, action or proceeding is improper or that this Agreement or the subject matter hereof may not be enforced in or by such court.

11.3 Waiver of Jury Trial. The parties hereto hereby waive any right to a jury trial in connection with any litigation pursuant to this agreement and the transactions contemplated hereby.

12. Assignment; Entire Agreement; Amendment

12.1. Assignment. Neither this Agreement nor any rights hereunder may be assigned by any party to any other person other than by the Purchaser, without the prior consent of the Company, to one or more persons agreeing to be bound by the terms hereof. Upon such assignment by a Purchaser, the assignee(s) shall become Purchaser hereunder and have the rights and obligations provided for herein to the extent of such assignment.

12.2. Entire Agreement. This Agreement, together with any documents, instruments and writings that are delivered pursuant hereto or referenced herein, constitutes the entire agreement and understanding between the parties as to the subject matter hereof and supersedes any and all prior discussions, agreements and understandings of any and every nature.

12.3. Amendment. Except as expressly provided in this Agreement, neither this Agreement nor any term hereof may be amended, waived, discharged or terminated other than by a written instrument signed by the party against whom enforcement of any such amendment, waiver, discharge or termination is sought.

12.4. Binding upon Successors. This Agreement shall be binding upon and inure to the benefit of the parties hereto and to their respective heirs, legal representatives, successors and permitted assigns.

13. Notices

All notices, requests, consents and other communications hereunder shall be in writing, shall be addressed to the receiving party’s address set forth herein or to such other address as a party may designate by notice hereunder, and shall be either (a) delivered by hand, (b) sent by overnight courier, or (c) sent by certified mail, return receipt requested, postage prepaid. All notices, requests, consents and other communications hereunder shall be deemed to have been given either (i) if by hand, at the time of the delivery thereof to the receiving party at the address of such party set forth above, (ii) if sent by overnight courier, on the next business day following the day such notice is delivered to the courier service, or (iii) if sent by certified mail, on the fifth business day following the day such mailing is made.

| 12 |

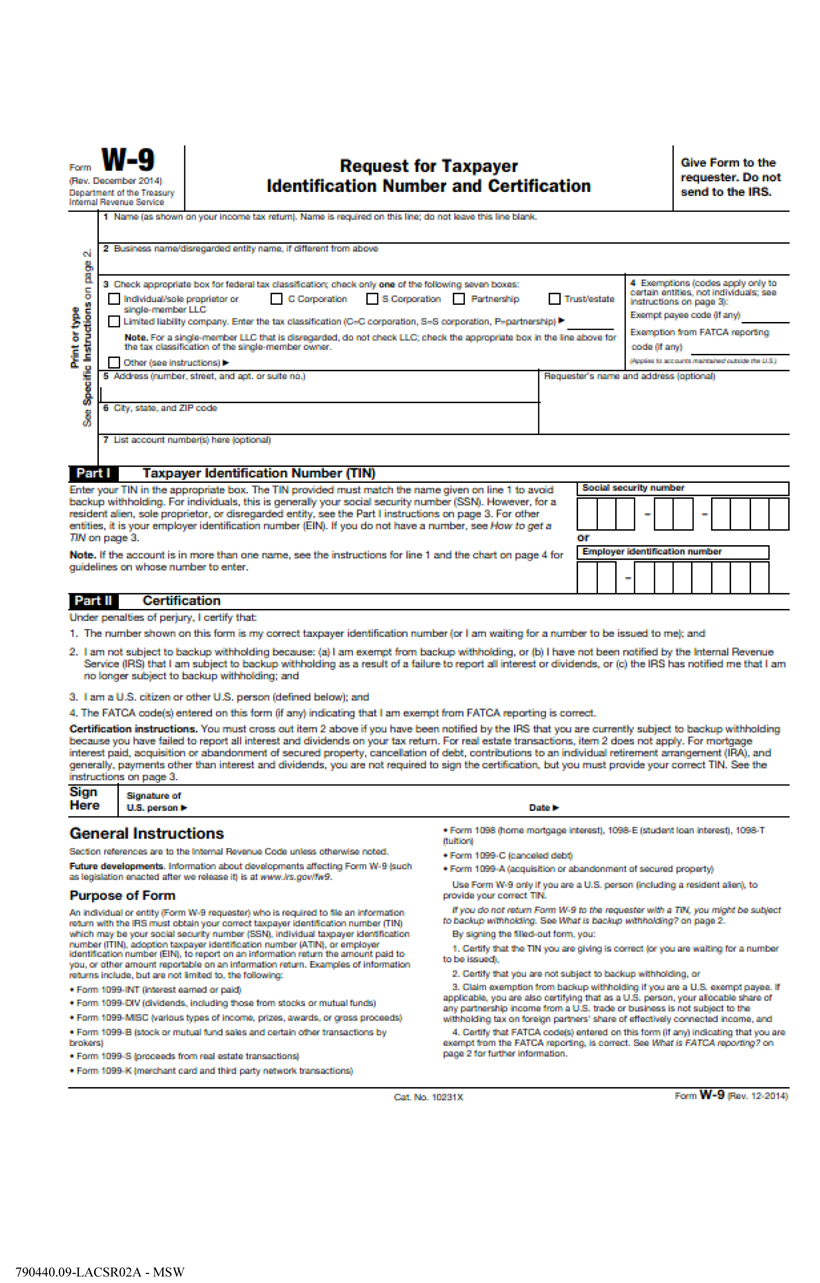

14. Tax Information

14.1 Form W-9. The Purchaser has, concurrently with the execution of this Agreement, executed and delivered the Internal Revenue Service Form W-9 attached hereto as Exhibit A.

14.2 QEF Election Information. As soon as practicable following the close of each taxable year of the Company, the Company shall determine whether the Company is or was deemed to be a “passive foreign investment company” (a “PFIC”) within the meaning of U.S. Internal Revenue Code of 1986, as amended, and the regulations promulgated thereunder (collectively, the “Code”) for such taxable year. If the Company determines that the Company is or was a PFIC in any year, for the year of determination and for each year thereafter during which the Purchaser holds an equity interest in the Company, including Warrants, the Company shall (i) make available to the Purchaser the information that may be required to make or maintain a “qualified electing fund” election under the Code with respect to the Company and (ii) furnish the information required to be reported under Section 1298(f) of the Code.

15. Counterparts

This Agreement may be executed in one or more counterparts, all of which when taken together shall be considered one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to the other party, it being understood that both parties need not sign the same counterpart. In the event that any signature is delivered by facsimile transmission or any other form of electronic delivery, such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such signature page were an original thereof.

16. Survival; Severability

16.1. Survival. The representations and warranties of the parties hereto shall survive the Closing until one (1) year following the consummation of an initial Business Combination.

16.2. Severability. In the event that any provision of this Agreement becomes or is declared by a court of competent jurisdiction to be illegal, unenforceable or void, this Agreement shall continue in full force and effect without said provision; provided that no such severability shall be effective if it materially changes the economic benefit of this Agreement to any party.

17. Headings

The titles and subtitles used in this Agreement are used for convenience only and are not to be considered in construing or interpreting this Agreement.

18. Construction

The parties hereto have participated jointly in the negotiation and drafting of this Agreement. If an ambiguity or question of intent or interpretation arises, this Agreement will be construed as if drafted jointly by the parties hereto and no presumption or burden of proof will arise favoring or disfavoring any party hereto because of the authorship of any provision of this Agreement. The words “include,” “includes,” and “including” will be deemed to be followed by “without limitation.” Pronouns in masculine, feminine, and neuter genders will be construed to include any other gender, and words in the singular form will be construed to include the plural and vice versa, unless the context otherwise requires. The words “this Agreement,” “herein,” “hereof,” “hereby,” “hereunder,” and words of similar import refer to this Agreement as a whole and not to any particular subdivision unless expressly so limited. The parties hereto intend that each representation, warranty, and covenant contained herein will have independent significance. If any party hereto has breached any representation, warranty, or covenant contained herein in any respect, the fact that there exists another representation, warranty or covenant relating to the same subject matter (regardless of the relative levels of specificity) which such party hereto has not breached will not detract from or mitigate the fact that such party hereto is in breach of the first representation, warranty, or covenant.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

| 13 |

This subscription is accepted by the Company as of the date first written above.

| CONSTELLATION ALPHA CAPITAL CORP. | ||

| By: | ||

| Name: | Rajiv Shukla | |

| Title: | Chief Executive Officer | |

Accepted and agreed this

____ day of June, 2017

COWEN INVESTMENTS LLC

| By: | ||

| Name: | ||

| Title: |

[Signature Page to Unit Subscription Agreement]

Exhibit A

FORM W-9

[Attached]