Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SEALED AIR CORP/DE | d385475d8k.htm |

Exhibit 99.1

SealedAir

Re-imagineTM

Revised 2016 Financial

Results, Continuing Operations

June 8, 2017

(Unaudited Results)

Safe Harbor and Regulation G Statement

This presentation contains “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995

concerning our business, consolidated financial condition and results of operations. Forward-looking statements are subject to risks and uncertainties, many of which are outside our control, which could cause actual results to differ materially from

these statements. Therefore, you should not rely on any of these forward-looking statements. Forward-looking statements can be identified by such words as “anticipates,” “believes,” “plan,” “assumes,”

“could,” “should,” “estimates,” “expects,” “intends,” “potential,” “seek,” “predict,” “may,” “will” and similar references to future periods. All

statements other than statements of historical facts included in this press release regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Examples of forward-looking

statements include, among others, statements we make regarding expected future operating results, expectations regarding the results of restructuring and other programs, anticipated levels of capital expenditures and expectations of the effect on

our financial condition of claims, litigation, environmental costs, contingent liabilities and governmental and regulatory investigations and proceedings. The following are important factors that we believe could cause actual results to differ

materially from those in our forward-looking statements: the tax benefits associated with the Settlement agreement (as defined in our 2016 Annual Report on Form 10-K), global economic and political conditions,

changes in our credit ratings, changes in raw material pricing and availability, changes in energy costs, competitive conditions, the success of the sale of the Diversey Care division and related food hygiene and cleaning business (together,

“Diversey”), the success of our restructuring activities, currency translation and devaluation effects, the success of our financial growth, profitability, cash generation and manufacturing strategies and our cost reduction and

productivity efforts, the success of new product offerings, the effects of animal and food-related health issues, pandemics, consumer preferences, environmental matters, regulatory actions and legal matters, and the other information referenced in

the “Risk Factors” section appearing in our most recent Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, and as revised and updated by our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Any forward-looking statement made by us is based only on information currently available to us and speaks only as of the date on which

it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Our management uses non-U.S. GAAP financial measures to evaluate the Company’s performance, which exclude items we consider unusual or

special items. We believe the use of such financial measures and information may be useful to investors. We believe that the use of non-U.S. GAAP measures helps investors to gain a better understanding of core

operating results and future prospects, consistent with how management measures and forecasts the Company’s performance, especially when comparing such results to previous periods or forecasts. Please see Sealed Air’s May 9, 2017

earnings press release for important information about the use of non-U.S. GAAP financial measures relevant to this presentation, including applicable reconciliations to U.S. GAAP financial measures.

Information reconciling forward-looking non-U.S. GAAP measures to U.S. GAAP measures is not available without unreasonable effort.

Website Information

We routinely post important information for investors on our website,

www.sealedair.com, in the “Investor Relations” section. We use this website as a means of disclosing material, non-public information and for complying with our disclosure obligations under

Regulation FD. Accordingly, investors should monitor the Investor Relations section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that

may be accessed through, our website is not incorporated by reference into, and is not a part of, this document.

2

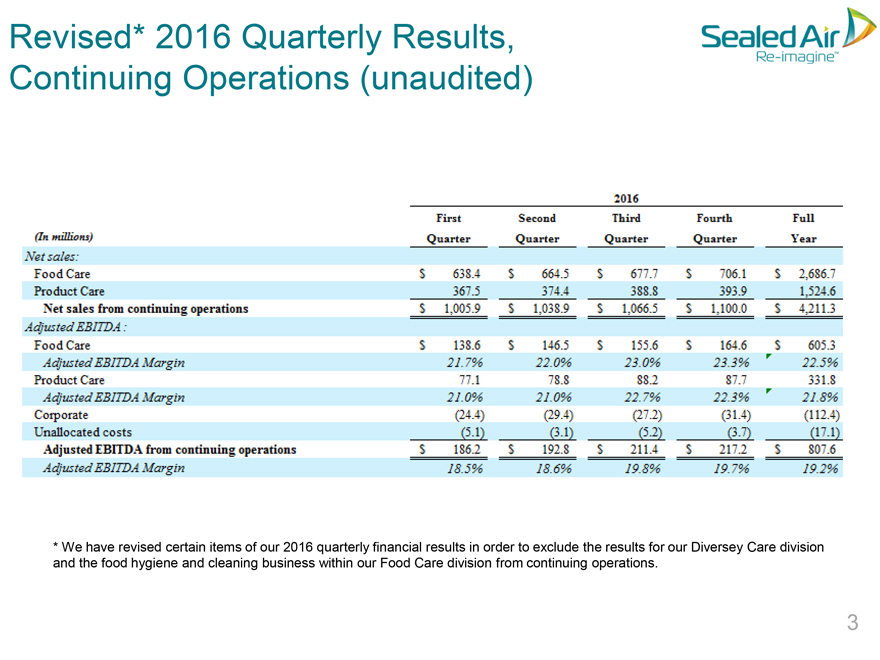

Revised* 2016 Quarterly Results, Continuing Operations (unaudited)

SealedAir

Re-imagineTM

2016

(In Millions) First Quarter Second Quarter Third Quarter Fourth Quarter Full Year

Net sales:

Food Care $638.4 $664.5 $677.7 $706.1 $2,686.7

Product Care 367.5 374.4 388.8 393.9 1,524.6

Net sales from continuing operations $1,005.9

$1,038.9 $1,066.5 $1,100.0 $4,211.3

Adjusted EBITDA:

Food Care $138.6 $146.5

$155.6 $164.6 $605.3

Adjusted EBITDA Margin 21.7% 22.0% 23.0% 23.3% 22.5%

Product Care 77.1 78.8 88.2 87.7 331.8

Adjusted EBITDA Margin 21.0% 21.0%

22.7% 22.3% 21.8%

Corporate (24.4) (29.4) (27.2) (31.4) (112.4)

Unallocated

costs (5.1) (3.1) (5.2) (3.7) (17.1)

Adjusted EBITDA from continuing operations $186.2 $192.8 $211.4 $217.2 $807.6

Adjusted EBITDA Margin 18.5% 18.6% 19.8% 19.7% 19.2%

* We have revised certain items of our

2016 quarterly financial results in order to exclude the results for our Diversey Care division and the food hygiene and cleaning business within our Food Care division from continuing operations.

3

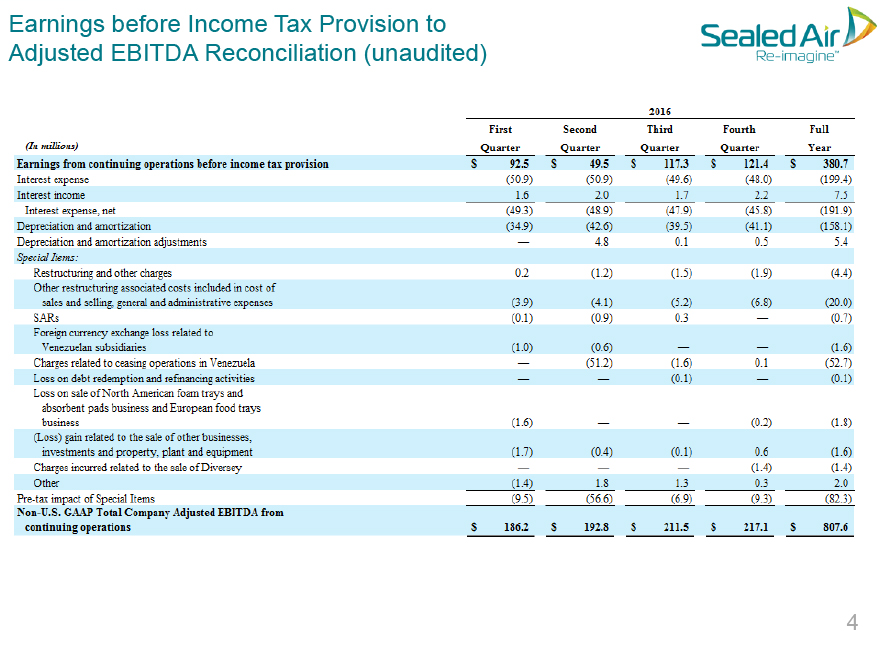

Earnings before Income Tax Provision to

Adjusted EBITDA Reconciliation (unaudited)

SealedAir

Re-imagineTM

2016

(In millions) First Quarter Second Quarter Third Quarter Fourth Quarter Full Year

Earnings

from continuing operations before income tax provision $92.5 $49.5 $117.3 $121.4 $380.7

Interest expense (50.9) (50.9) (496) (48.0) (199.4)

Interest income 1.6 2.0 1.7 2.2 7.5

Interest expense, net (49.3) (48.9) (47.9) (45.8) (191.9)

Depreciation and amortization (34.9) (42.6) (39.5) (41.1) (158.1)

Depreciation and amortization adjustments — 4.8 0.1 0.5 5.4

Special

Items:

Restructuring and other charges 0.2 (1.2) (1.5) (1.9) (4.4)

Other

restructuring associated costs included in cost of sales and selling, general and administrative expenses (3.9) (4.1) (5.2) (6.8) (20.0)

SARs (0.1) (0.9) 0.3

— (0.7)

Foreign currency exchange loss related to

Venezuelan

subsidiaries (10) (06) — — (1.6)

Charges related to ceasing operations in Venezuela — (51.2) (1.6) 0.1 (52.7)

Loss on debt redemption and refinancing activities — — (0.1) — (0.1)

Loss on

sals of North American foam trays and absorbent pads business and European food trays business (1.6) — — (0.2) (1.8)

(Loss) gain related to the sale of

other businesses, investments and property, plant and equipment (1.7) (0.4) (0.1) 0.6 (1.6)

Charges incurred related to the sale of Diversey — — —

(1.4) (1.4)

Other (1.4) 1.8 1.3 0.3 2.0

Pre-tax impact of Special Items (9.5) (56.6) (6.9) (9.3) (82.3)

Non-U.S. GAAP Total Company Adjusted EBITDA from continuing operations $186.2 $192.8 $211.5 $217.1 $807.6

4