Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION - ANTARES PHARMA, INC. | atrs-8k_20170608.htm |

NASDAQ: ATRS Jefferies 2017 Healthcare Conference June 8, 2017 Robert F. Apple President and Chief Executive Officer Exhibit 99.1

This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to certain risks and uncertainties that can cause actual results to differ materially from those described. Factors that may cause such differences include, but are not limited to: the timing and outcome of the U.S. Food and Drug Administration (“FDA”) review of the XYOSTED™ NDA, FDA approval of the XYOSTED™ NDA and future market acceptance and revenue for QST; FDA approval of the sNDA submitted by AMAG Pharmaceuticals for an auto injector for Makena and future market acceptance and revenue of the same; the outcome of the pending patent litigation between Teva Pharmaceutical Industries, Ltd. (Teva) and Eli Lilly and Company regarding the Teriparatide multi-dose pen; FDA action with respect to Teva’s Abbreviated New Drug Application (“ANDA”) for the Teriparatide multi-dose pen and the timing and approval, if any, by the FDA of the same; Teva’s ability to adequately and timely respond to the Complete Response Letter received from the FDA for the VIBEX® epinephrine pen ANDA and approval by the FDA of the same, the timing and therapeutic equivalence rating thereof, and any future purchase orders and revenue pre or post FDA approval; Teva’s ability to successfully commercialize VIBEX® Sumatriptan Injection USP and the amount of revenue from the same; FDA action with respect to Teva’s ANDA filed for the Exenatide pen and future revenue from the same; continued growth of prescriptions and sales of OTREXUP®; the timing of AMAG Pharmaceuticals sNDA filing for an auto injector for Makena and FDA approval of the same; the timing and results of research projects, clinical trials, and product candidates in development; actions by the FDA or other regulatory agencies with the respect to the Company’s products or product candidates of its partners; continued growth in product, development, licensing and royalty revenue; the Company’s ability to obtain financial and other resources for its research, development, clinical, and commercial activities and other statements regarding matters that are not historical facts, and involve predictions; and the results of fully audited 2016 financial statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance, achievements or prospects to be materially different from any future results, performance, achievements or prospects expressed in or implied by such forward-looking statements. In some cases you can identify forward-looking statements by terminology such as ''may'', ''will'', ''should'', ''would'', ''expect'', ''intend'', ''plan'', ''anticipate'', ''believe'', ''estimate'', ''predict'', ''potential'', ''seem'', ''seek'', ''future'', ''continue'', or ''appear'' or the negative of these terms or similar expressions, although not all forward-looking statements contain these identifying words. Additional information concerning these and other factors that may cause actual results to differ materially from those anticipated in the forward-looking statements is contained in the "Risk Factors" section of the Company's Annual Report on Form 10-K for the year ended December 31, 2016, and in the Company's other periodic reports and filings with the Securities and Exchange Commission. The Company cautions investors not to place undue reliance on the forward-looking statements contained in this presentation. All forward-looking statements are based on information currently available to the Company on the date hereof, and the Company undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date of this presentation, except as required by law. ©2017 Copyright Antares Pharma, Inc. All Rights Reserved. Safe Harbor Statement

Antares Pharma A Growing, Revenue Generating State-of-the-Art Specialty Pharmaceutical Company An Innovative Leader in Self-Administered Injection Technology Two combination products approved and on the U.S. market (OTREXUP®, Sumatriptan) and one combination product approved in Europe awaiting marketing authorizations and patent clearance (Teriparatide) Three ANDA drug device combination products submitted by Teva and under U.S. FDA review with first to file status (Exenatide, Epinephrine pen, Teriparatide) One NDA for a Drug Device Combination Product under active review at the FDA (XYOSTED™) One sNDA for a Drug Device Combination Product under active review at the FDA submitted by AMAG (Makena®) Novel Drug Delivery Technology Can Provide Life Cycle Management Solutions Auto-injector platform and Multi-dose pen platform

QuickShot® Testosterone = XYOSTED™

XYOSTED™ NDA filing accepted February – PDUFA date 10/20/17 Possible launch in late 2017 / early 2018 Launch plan: ~60 Sales Representatives focusing on high decile prescribers Hiring of reps to commence Q417 (assuming FDA approval) – DM interviews underway Third party payer discussions have begun to determine pricing and positioning Testosterone therapy thought leaders focus on positive PK data and safety profile XYOSTED™ 2016 Testosterone Replacement Market Retail Prescriptions ~ Six Million

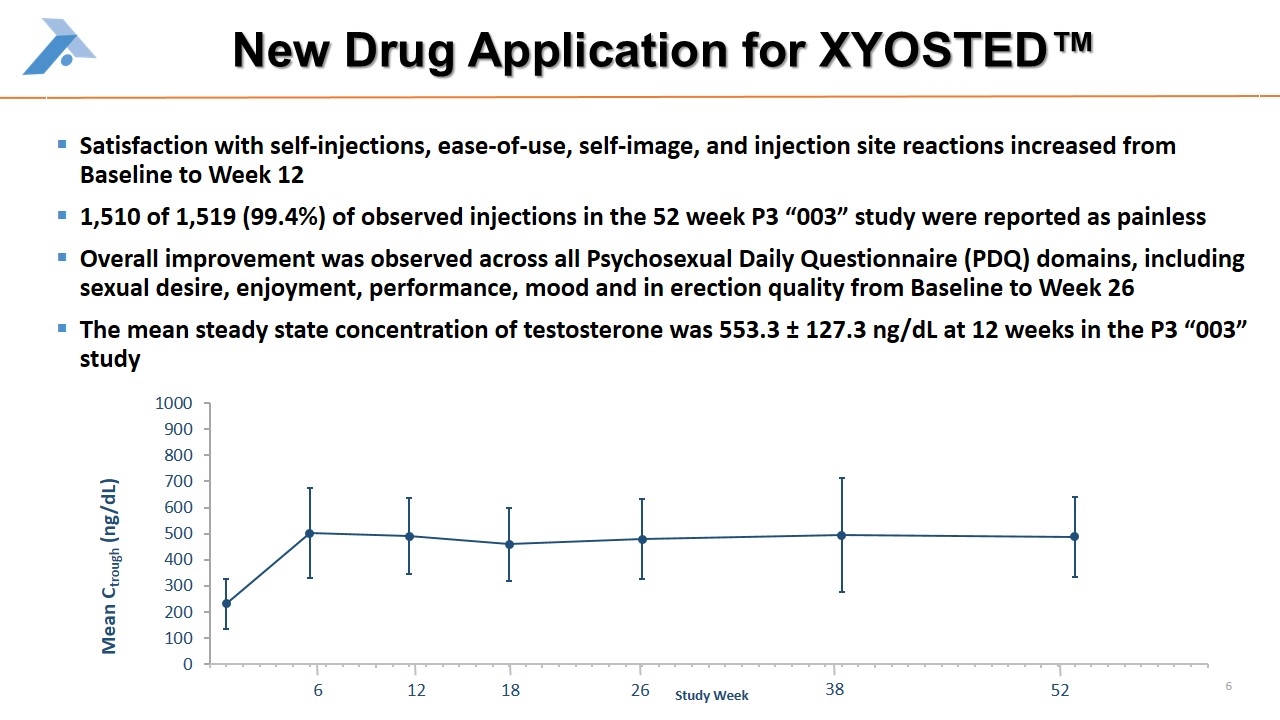

New Drug Application for XYOSTED™ Satisfaction with self-injections, ease-of-use, self-image, and injection site reactions increased from Baseline to Week 12 1,510 of 1,519 (99.4%) of observed injections in the 52 week P3 “003” study were reported as painless Overall improvement was observed across all Psychosexual Daily Questionnaire (PDQ) domains, including sexual desire, enjoyment, performance, mood and in erection quality from Baseline to Week 26 The mean steady state concentration of testosterone was 553.3 ± 127.3 ng/dL at 12 weeks in the P3 “003” study 6 12 18 26 38 52

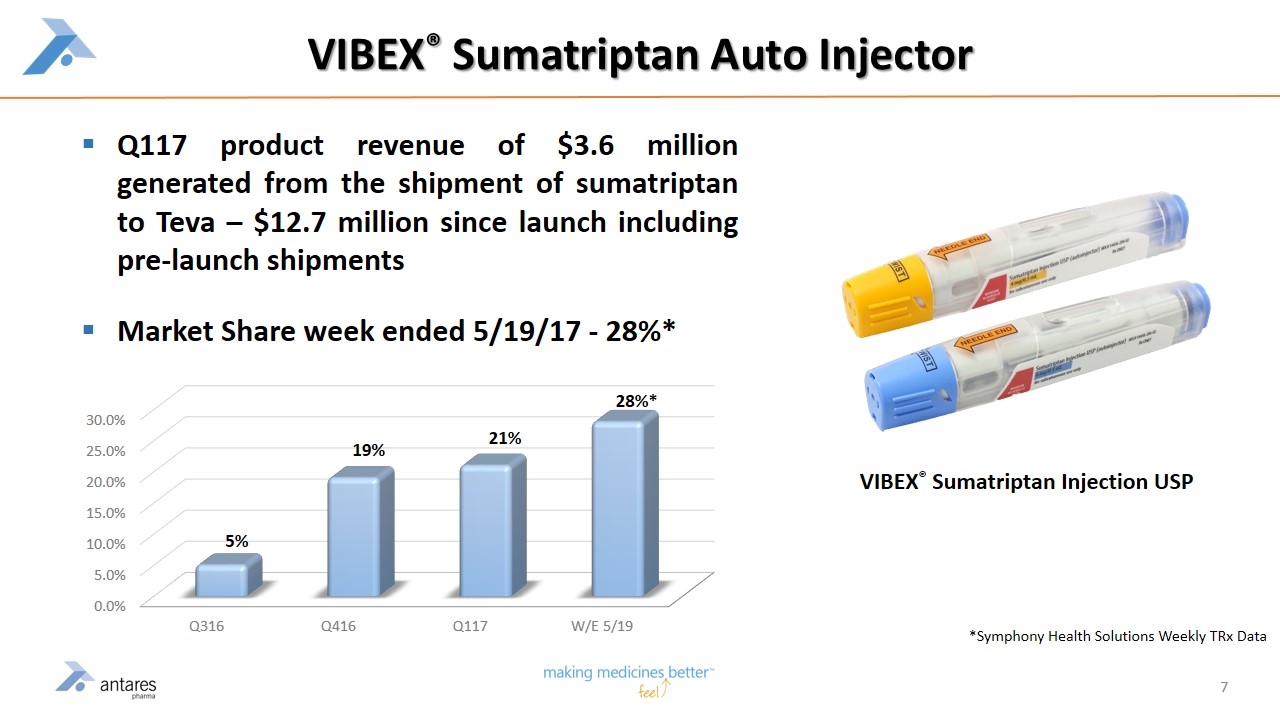

VIBEX® Sumatriptan Auto Injector Q117 product revenue of $3.6 million generated from the shipment of sumatriptan to Teva – $12.7 million since launch including pre-launch shipments Market Share week ended 5/19/17 - 28%* VIBEX® Sumatriptan Injection USP *Symphony Health Solutions Weekly TRx Data 28%*

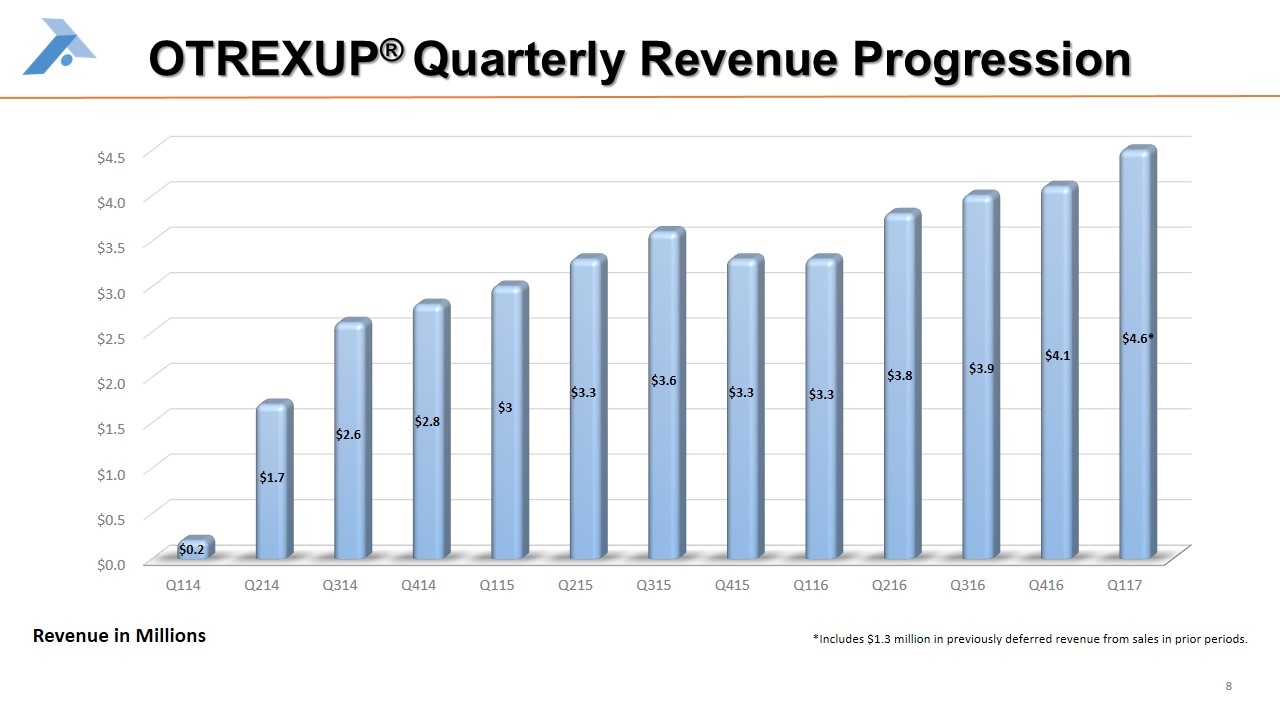

OTREXUP® Quarterly Revenue Progression Revenue in Millions $3.8 $3.3 $3.3 $3.6 $3.3 $3 $2.8 $2.6 $1.7 $0.2 *Includes $1.3 million in previously deferred revenue from sales in prior periods.

Generic Byetta® (exenatide) Multi-Dose Pen Teva announced settlement with AstraZeneca and Amylin which allows Teva to launch on October 15, 2017, pending FDA approval Teva filed ANDA in December 2014 and it is under FDA review – Antares believes Teva has first to file status and 180 days of marketing exclusivity Symphony retail sales of Byetta in 2016 ~$284 million Managed care plans may require Bydureon patients (extended release Byetta) to step through generic Byetta; Symphony 2016 retail sales of Bydureon ~$890 million ATRS will supply devices at reasonable margin plus receive high single digit to mid-teens royalty on Teva end sales

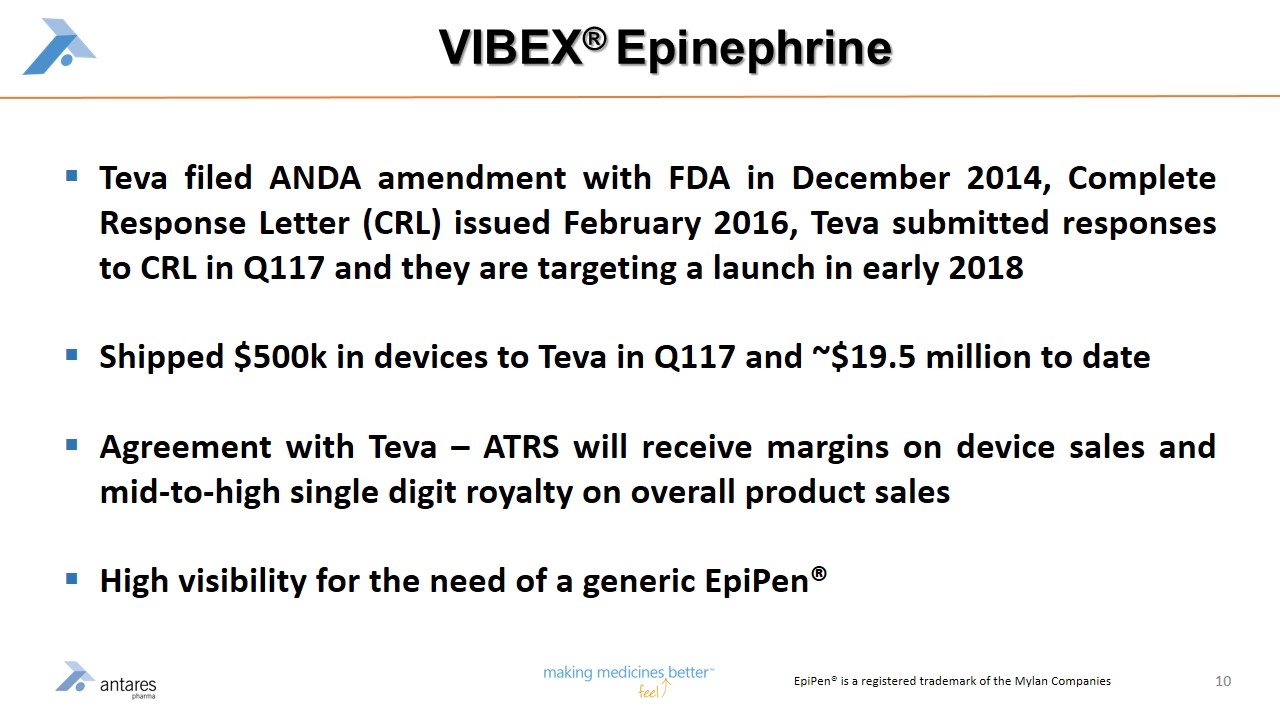

VIBEX® Epinephrine Teva filed ANDA amendment with FDA in December 2014, Complete Response Letter (CRL) issued February 2016, Teva submitted responses to CRL in Q117 and they are targeting a launch in early 2018 Shipped $500k in devices to Teva in Q117 and ~$19.5 million to date Agreement with Teva – ATRS will receive margins on device sales and mid-to-high single digit royalty on overall product sales High visibility for the need of a generic EpiPen® EpiPen® is a registered trademark of the Mylan Companies

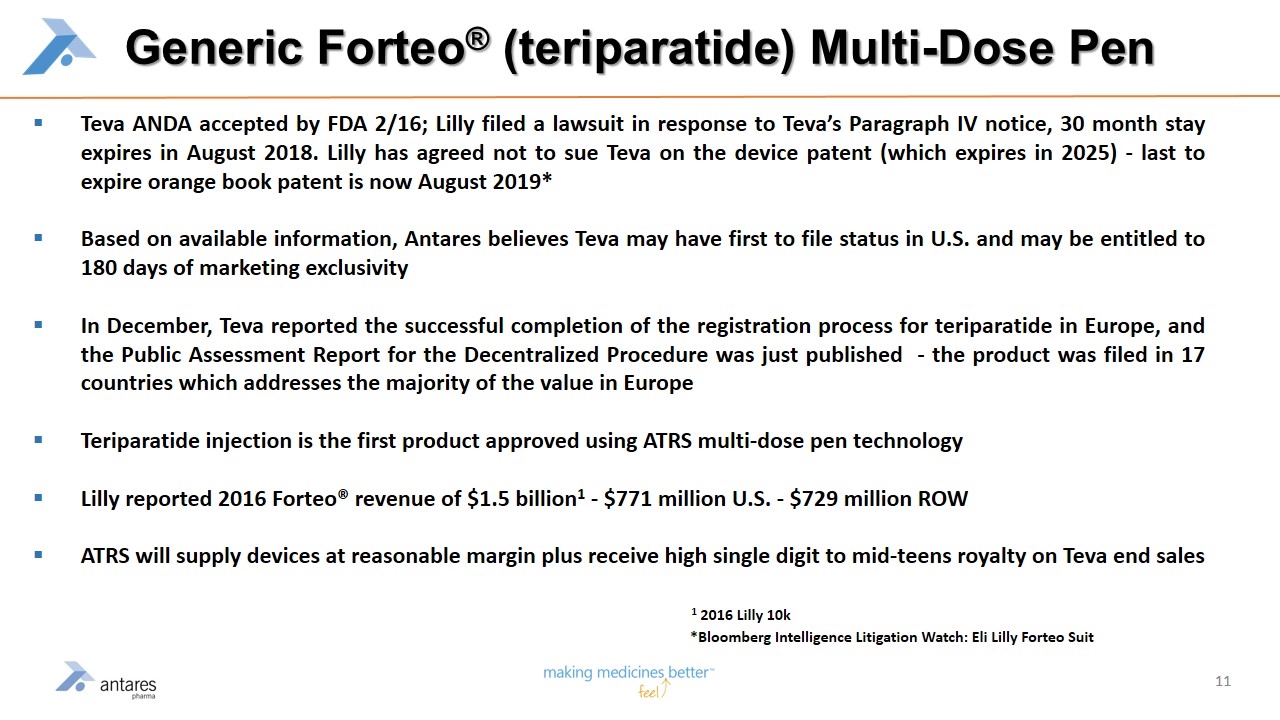

Generic Forteo® (teriparatide) Multi-Dose Pen Teva ANDA accepted by FDA 2/16; Lilly filed a lawsuit in response to Teva’s Paragraph IV notice, 30 month stay expires in August 2018. Lilly has agreed not to sue Teva on the device patent (which expires in 2025) - last to expire orange book patent is now August 2019* Based on available information, Antares believes Teva may have first to file status in U.S. and may be entitled to 180 days of marketing exclusivity In December, Teva reported the successful completion of the registration process for teriparatide in Europe, and the Public Assessment Report for the Decentralized Procedure was just published - the product was filed in 17 countries which addresses the majority of the value in Europe Teriparatide injection is the first product approved using ATRS multi-dose pen technology Lilly reported 2016 Forteo® revenue of $1.5 billion1 - $771 million U.S. - $729 million ROW ATRS will supply devices at reasonable margin plus receive high single digit to mid-teens royalty on Teva end sales 1 2016 Lilly 10k *Bloomberg Intelligence Litigation Watch: Eli Lilly Forteo Suit

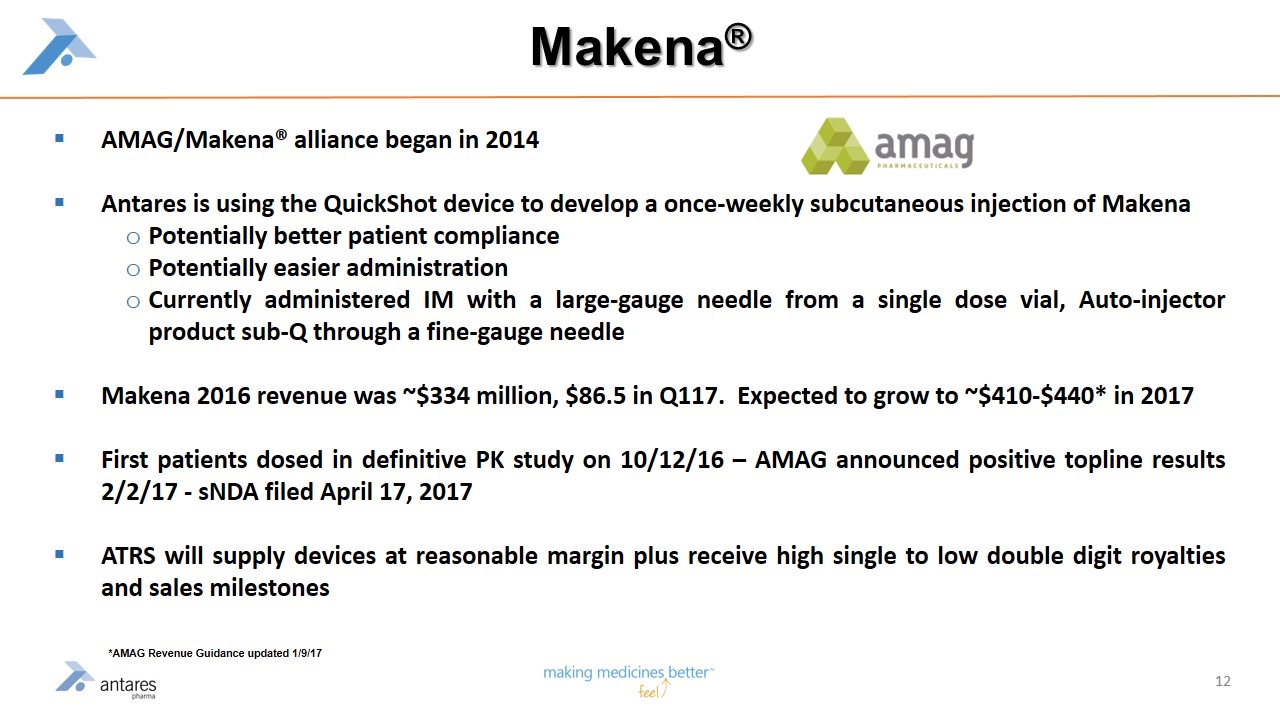

Makena® AMAG/Makena® alliance began in 2014 Antares is using the QuickShot device to develop a once-weekly subcutaneous injection of Makena Potentially better patient compliance Potentially easier administration Currently administered IM with a large-gauge needle from a single dose vial, Auto-injector product sub-Q through a fine-gauge needle Makena 2016 revenue was ~$334 million, $86.5 in Q117. Expected to grow to ~$410-$440* in 2017 First patients dosed in definitive PK study on 10/12/16 – AMAG announced positive topline results 2/2/17 - sNDA filed April 17, 2017 ATRS will supply devices at reasonable margin plus receive high single to low double digit royalties and sales milestones *AMAG Revenue Guidance updated 1/9/17

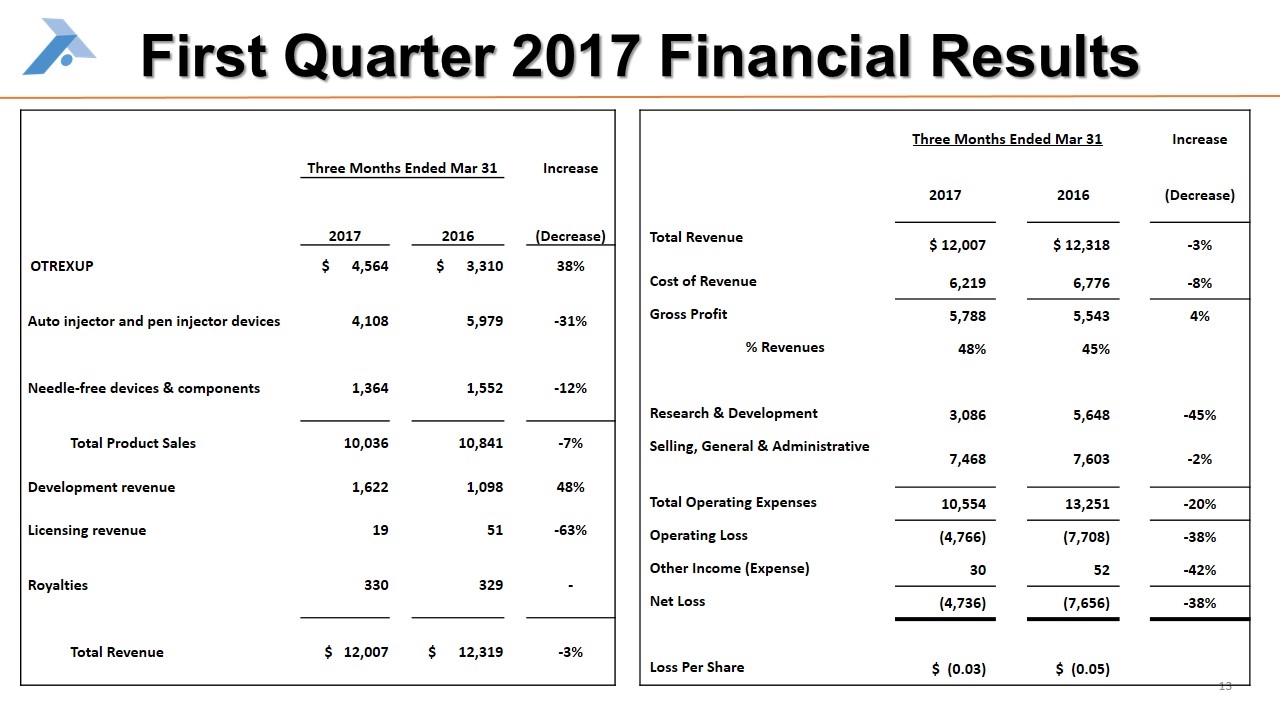

First Quarter 2017 Financial Results Three Months Ended Mar 31 Increase 2017 2016 (Decrease) OTREXUP $ 4,564 $ 3,310 38% Auto injector and pen injector devices 4,108 5,979 -31% Needle-free devices & components 1,364 1,552 -12% Total Product Sales 10,036 10,841 -7% Development revenue 1,622 1,098 48% Licensing revenue 19 51 -63% Royalties 330 329 - Total Revenue $ 12,007 $ 12,319 -3% Three Months Ended Mar 31 Increase 2017 2016 (Decrease) Total Revenue $ 12,007 $ 12,318 -3% Cost of Revenue 6,219 6,776 -8% Gross Profit 5,788 5,543 4% % Revenues 48% 45% Research & Development 3,086 5,648 -45% Selling, General & Administrative 7,468 7,603 -2% Total Operating Expenses 10,554 13,251 -20% Operating Loss (4,766) (7,708) -38% Other Income (Expense) 30 52 -42% Net Loss (4,736) (7,656) -38% Loss Per Share $ (0.03) $ (0.05)

Debt Financing From Hercules Capital Five year term loan agreement provides up to $35 million First tranche of $25 million was funded upon execution of the loan agreement Antares has an option to draw up to an additional $10 million upon achievement of a certain milestone Payments under the loan are interest only for the initial 24-month period, followed by equal monthly installments of principal and interest until the end of the five year term The interest rate on the loan is 8.5% with a maximum rate of 9.5% This non-dilutive financing further strengthens our cash position and gives us the ability to properly invest in the launch of XYOSTED™

ATRS Investment Considerations A revenue generating Specialty Pharmaceutical Company poised for growth Ongoing Catalysts: XYOSTED™ NDA under active review at FDA – October 20, 2017 PDUFA date Sumatriptan Injection USP launched – TRx share after 9 months – ~28% and growing per latest TRx data Continued TRx Growth of OTREXUP™ Q117 vs. Q116 +7.5% Progress in Alliance Business – Building and shipping device inventories for potential approvals (Exenatide, Teriparatide, Epinephrine, Makena®) Expect to add strategic new drug/device R&D combination products in the next 12 months Potential for five regulatory approvals of pending FDA applications over next 18 months: 2017 – XYOSTED™ (NDA), Exenatide (ANDA), Epinephrine (ANDA) and Makena (sNDA) 2018 – Teriparatide (ANDA) (approved in Europe 12/16) Strong balance sheet – $23.7 million in cash and cash equivalents at 3/31/17 – Up to $35 million in structured debt financing announced June 2017, $25 million funded at closing

NASDAQ: ATRS Jefferies 2017 Healthcare Conference June 8, 2017 Robert F. Apple President and Chief Executive Officer