Attached files

| file | filename |

|---|---|

| 8-K - AEROJET ROCKETDYNE HOLDINGS, INC. | form8k07319001_06082017.htm |

Exhibit 99.1

INVESTOR MEETING & FACILITY TOUR June 8, 2017

Certain information contained in this presentation should be considered “forward - looking statements” as defined by Section 21 E of the Private Securities Litigation Reform Act of 1995 . All statements in this report other than historical information may be deemed forward - looking statements . These statements present (without limitation) the expectations, beliefs, plans and objectives of management and future financial performance and assumptions underlying, or judgments concerning, the matters discussed in the statements . The words “believe,” “estimate,” “anticipate,” “future,” “goal,” “could,” “will,” “continue,” “can,” “potential,” “should,” “project,” and “expect,” and similar expressions, are intended to identify forward - looking statements . Forward - looking statements involve certain risks, estimates, assumptions and uncertainties, including with respect to future sales and activity levels, cash flows, contract performance, future reductions or changes in U . S . government spending, achieving anticipated costs savings and other benefits of the Company’s Competitive Improvement Program, failure to secure contracts, the outcome of litigation and contingencies, environmental remediation and anticipated costs of capital . A variety of factors could cause actual results or outcomes to differ materially from those expected and expressed in our forward - looking statements . Important risk factors that could cause actual results or outcomes to differ from those expressed in the forward - looking statements are described in the section “Risk Factors” in Item 1 A of our Annual Report to the Securities Exchange Commission on Form 10 - K for the fiscal year ended December 31 , 2016 and on our Quarterly Report on Form 10 Q for the period ended March 31 , 2017 . Additional risk factors may be described from time to time in our future filings with the Securities and Exchange Commission . Any forward - looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made . We undertake no obligation to publicly update any forward - looking statement, whether as a result of new information, future developments or otherwise . Financial data presented is derived from audited financial statements and/or unaudited quarterly reports on Form 10 - Q . This presentation also contains non - GAAP financial measures . A reconciliation of these financial measures to the nearest GAAP measure is included in this presentation . Any financial numbers provided that are not historical do not represent guidance or projections . Such figures are merely aspirational in nature and should not be relied upon . Forward Looking Statements and Non - GAAP Measures 2

Lunch Company Presentation Eileen Drake, CEO & President; Paul Lundstrom, CFO Facility Tour Mark Tucker, COO; John Schneider, VP of Quality & Mission Assurance Today’s Agenda 3

• NYSE: AJRD • Revenue: $ 1.76 billion • Adjusted EBITDAP (1) : $202 million • Contract backlog: $ 4.5 billion (~38% expected to be filled within one year) • Diversified portfolio of programs and markets served • Strongly aligned with customers’ priorities • Significant real estate holdings (Year ended 12/31/16) At a Glance Tactical Systems Advanced Programs Space and Launch Systems Missile Defense and Strategic Systems In - space Propulsion Technology - based manufacturing company providing innovative solutions to aerospace and defense customers 4 (1) Non - GAAP Measure. See reconciliation in Appendix.

• Decades of industry leadership with deep capabilities • Critical national asset • Supporting strategic priorities of NASA and U.S. DoD Who We Are Proven leader in space and defense propulsion, advancing rocket science and bringing value and ingenuity to every customer 5 Standard Missile Delta IV Orion THAAD

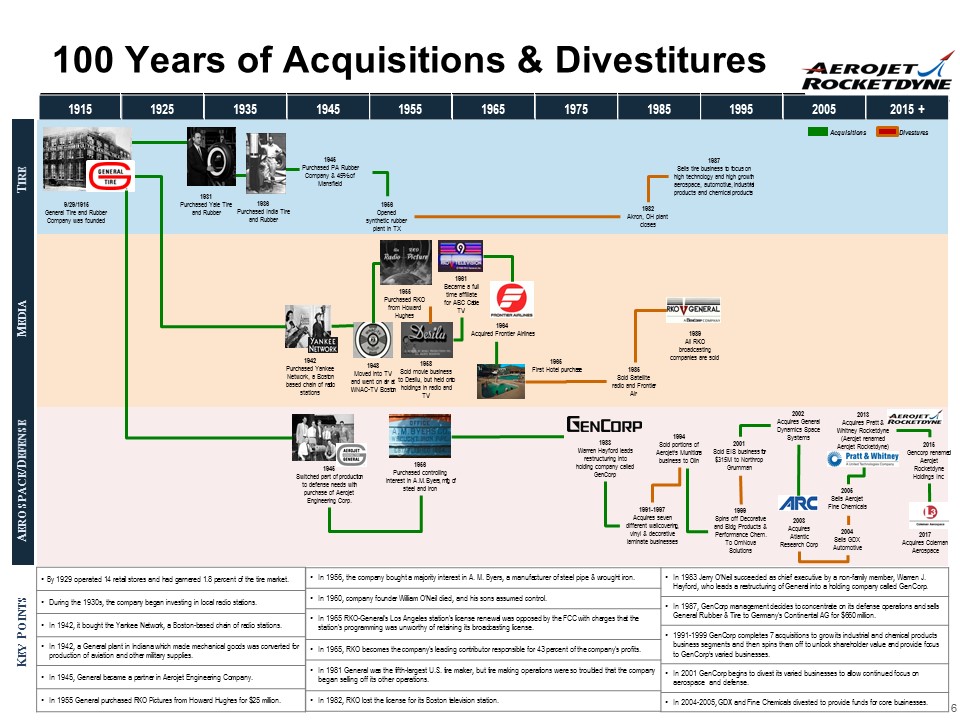

1915 1925 1935 1945 1955 1965 1975 1985 1995 2005 2015 + 100 Years of Acquisitions & Divestitures 9/29/1915 General Tire and Rubber Company was founded 1931 Purchased Yale Tire and Rubber 1936 Purchased India Tire and Rubber 1942 Purchased Yankee Network, a Boston based chain of radio stations 1945 Switched part of production to defense needs with purchase of Aerojet Engineering Corp. 1948 Moved into TV and went on air at WNAC - TV Boston 1955 Purchased RKO from Howard Hughes 1958 Sold movie business to Desilu , but held onto holdings in radio and TV 1956 Purchased controlling interest in A.M. Byers, mfg of steel and iron 1961 Became a full time affiliate for ABC Cable TV 1964 Acquired Frontier Airlines 1965 First Hotel purchase 1985 Sold Satellite radio and Frontier Air 1989 All RKO broadcasting companies are sold T IRE M EDIA A EROSPACE /D EFENSE 1945 Purchased PA Rubber Company & 45% of Mansfield 1956 Opened synthetic rubber plant in TX 1982 Akron, OH plant closes 1987 Sells tire business to focus on high technology and high growth aerospace, automotive, industrial products and chemical products 1983 Warren Hayford leads restructuring into holding company called GenCorp 1994 Sold portions of Aerojet’s Munitions business to Olin 1999 Spins off Decorative and Bldg Products & Performance Chem. To OmNova Solutions 2002 Acquires General Dynamics Space Systems 2003 Acquires Atlantic Research Corp 2013 Acquires Pratt & Whitney Rocketdyne (Aerojet renamed Aerojet Rocketdyne) 2001 Sold EIS business for $315M to Northrop Grumman 2004 Sells GDX Automotive 2005 Sells Aerojet Fine Chemicals Acquisitions Divestures 1991 - 1997 Acquires seven different wallcovering , vinyl & decorative laminate businesses K EY P OINTS • By 1929 operated 14 retail stores and had garnered 1.8 percent of the tire market. • During the 1930s, the company began investing in local radio stations. • In 1942, it bought the Yankee Network, a Boston - based chain of radio stations. • In 1942, a General plant in Indiana which made mechanical goods was converted for production of aviation and other military supplies. • In 1945, General became a partner in Aerojet Engineering Company. • In 1955 General purchased RKO Pictures from Howard Hughes for $25 million. • In 1983 Jerry O'Neil succeeded as chief executive by a non - family member, Warren J. Hayford , who leads a restructuring of General into a holding company called GenCorp. • In 1987, GenCorp management decides to concentrate on its defense operations and sells General Rubber & Tire to Germany's Continental AG for $660 million. • 1991 - 1999 GenCorp completes 7 acquisitions to grow its industrial and chemical products business segments and then spins them off to unlock shareholder value and provide focus to GenCorp’s varied businesses. • In 2001 GenCorp begins to divest its varied businesses to allow continued focus on aerospace and defense. • In 2004 - 2005, GDX and Fine Chemicals divested to provide funds for core businesses. • In 1956, the company bought a majority interest in A. M. Byers, a manufacturer of steel pipe & wrought iron. • In 1960, company founder William O'Neil died, and his sons assumed control. • In 1965 RKO - General's Los Angeles station's license renewal was opposed by the FCC with charges that the station's programming was unworthy of retaining its broadcasting license. • In 1965, RKO becomes the company's leading contributor responsible for 43 percent of the company's profits. • In 1981 General was the fifth - largest U.S. tire maker, but tire making operations were so troubled that the company began selling off its other operations. • In 1982, RKO lost the license for its Boston television station. 6 2017 Acquires Coleman Aerospace 2015 Gencorp renamed Aerojet Rocketdyne Holdings Inc

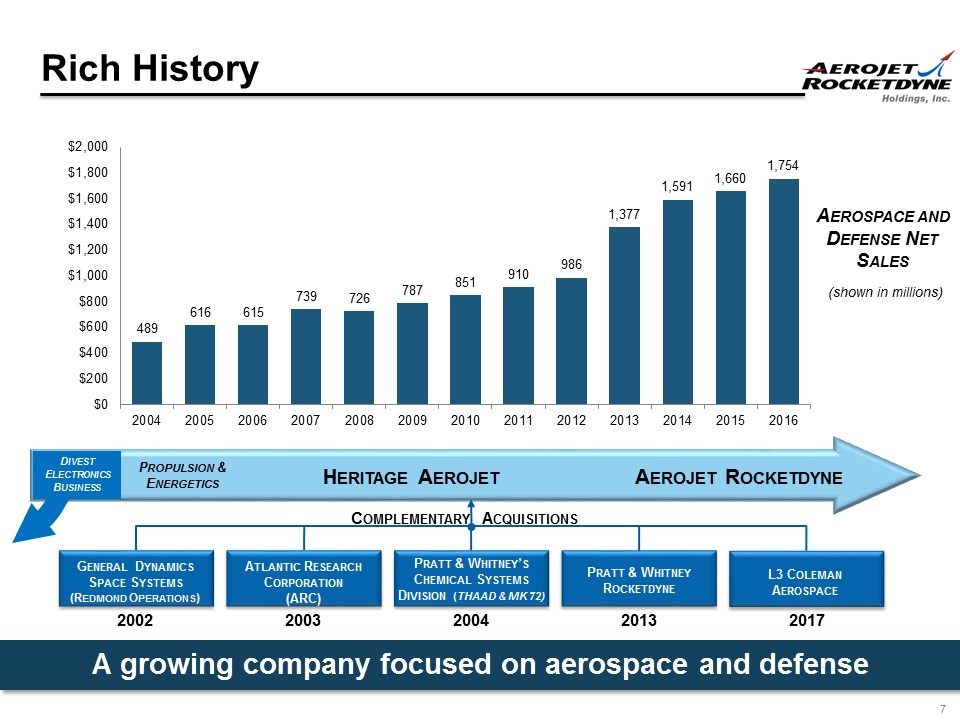

Rich History 7 P ROPULSION & E NERGETICS H ERITAGE A EROJET C OMPLEMENTARY A CQUISITIONS G ENERAL D YNAMICS S PACE S YSTEMS (R EDMOND O PERATIONS ) A TLANTIC R ESEARCH C ORPORATION (ARC) P RATT & W HITNEY ’ S C HEMICAL S YSTEMS D IVISION ( THAAD & MK 72) P RATT & W HITNEY R OCKETDYNE A EROSPACE AND D EFENSE N ET S ALES (shown in millions) D IVEST E LECTRONICS B USINESS L3 C OLEMAN A EROSPACE A growing company focused on aerospace and defense 2002 2003 2004 2013 2017 A EROJET R OCKETDYNE 489 616 615 739 726 787 851 910 986 1,377 1,591 1,660 1,754 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Significant Operational Improvements to Drive New and Existing Programs New Management Team Refining Path to Success Diversified, Well - Balanced Portfolio to Compete Effectively in Today’s Market Solid Industry Foundation and Technical Leadership Focused on Revenue and Profitability Growth to Enhance Shareholder Value Investing in Today’s Aerojet Rocketdyne 8

Jim Simpson SVP Strategy & BD 09/2015 Mohammed Khan SVP Defense 4/2017 Arjun Kampani General Counsel 04/2016 Huntsville, AL HQ for Defense Business Unit El Segundo, CA HQ for Aerojet Rocketdyne Holdings Organizational Changes: Refining Path to Success • Bolstered Senior Leadership Team with key appointments • Established new corporate headquarters for Aerojet Rocketdyne Holdings, Inc. in El Segundo, CA • Streamlined organization by consolidating six business units into two: Space and Defense; Established headquarters in Canoga Park, CA and Huntsville, AL respectively Mark Tucker COO 06/2015 Paul Lundstrom CFO 11/2016 Jerry Tarnacki SVP Space 2/2017 Canoga Park, CA HQ for Space Business Unit 9 Eileen Drake CEO & President 06/2015 Strong leadership team with vast industry experience John Schumacher VP Washington 04/2013

Primary Operations Sites 10 Product - focused m anufacturing centers AR Coleman Aerospace Orlando (FL) Carlstadt – ARDÉ (NJ) Huntsville (AL) & Marshall Space Flight Center West Palm Beach (FL) Stennis Space Center (MS) Canoga Park (CA) Redmond (WA ) Sacramento (CA) AOT Jonesborough (TN) (TN) Camden (AR) Sacramento Operations Employees: 1,645 Acres: 13,322 Owned 438 Leased Square Feet: 3,903,000 Owned Congressional District: 5th ISO 9000 Certified Information As Of: 6/97 Sacramento, California Orange (VA) In - Space (Chemical and Electric) Propulsion Mfg., Assembly & Test High pressure Composite Over - wrapped Pressure Vessels (COPVs ) Solid Propellant R&D Products Hypersonic Testing Specialty Metals Large Liquid Engine Assembly & Test, Component Assembly & Test High Rate Solid Rocket Motor Production Upper Stage Engine Fabrication, Assembly &Test; Hypersonics; Turbomachinery Space Sector HQ Liquid Engine Design Center Boost Engine Fabrication Defense Sector HQ Future Advanced Mfg . Site Large SRM Production Corporate Shared Services Ballistic Missile Targets for the DoD

Continuous Improvement 11 Focused productivity and process discipline

Defense Space Warheads & Advanced Structural Systems High - Speed Propulsion Systems Strategic Missile Boosters Launch Vehicle Propulsion and Subsystems Power Management Systems Spacecraft Components & Subsystems Human Space Exploration Satellite & Spacecraft Propulsion Upper Stage Subsystems Missile Defense Boosters Tactical Missile Boosters Propulsive Control Systems A Leader in A&D Sector Superior program execution and affordable product innovation enables attractive shareholder returns over time Broadest scope of propulsion systems in the U.S. Industry innovator Balanced portfolio 12

• Ensuring continued access to space • Helping keep troops, country and allies safe • Products aligned with current administration’s focus on deep space exploration and increased defense procurement • Targeted investments (internal and external) create portfolio well - aligned with civil, defense and foreign military priorities — Missile defense — Force projection — Protection of orbiting space assets — Assured access to space — Near - earth missions — Discovery missions — Deep space human & robotic exploration Strongly Aligned with Customers; Critical National Asset 13

Space 14

• Largest domestic portfolio of space propulsion and power systems • U.S. manned space launches resuming in 2019 (first time since 2011) • NASA’s new Space Launch System and Orion programs will restore U.S. deep space exploration Space Launch System In - Space Propulsion Hall Thruster RS - 25 Supporting re - establishment of U.S. manned space and emerging space war - fighting capabilities Strong Space Portfolio 15

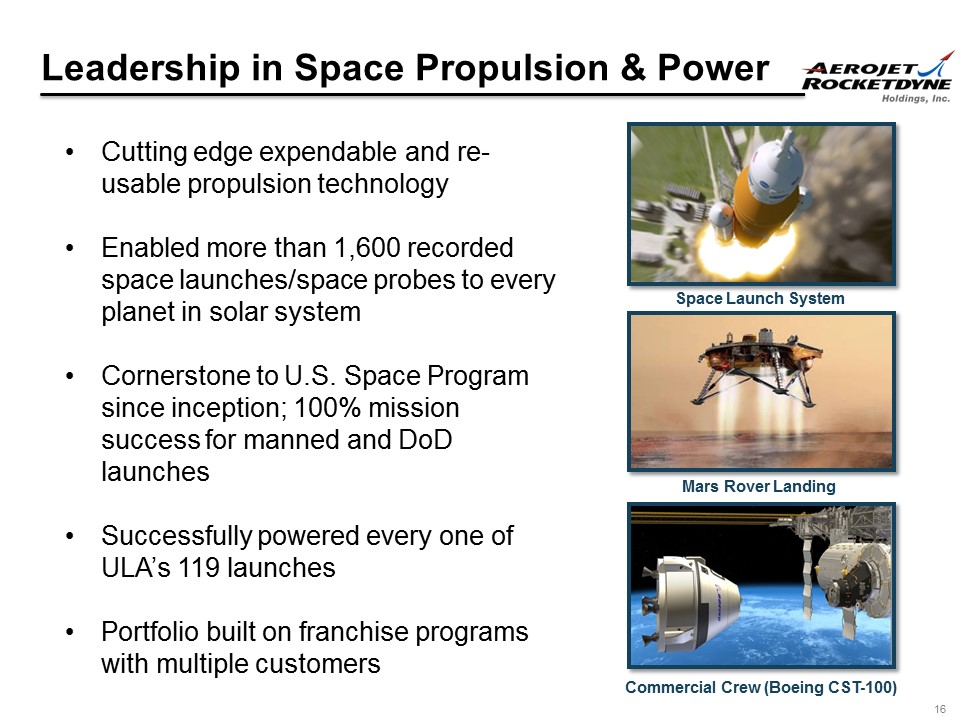

• Cutting edge expendable and re - usable propulsion technology • Enabled more than 1,600 recorded space launches/space probes to every planet in solar system • Cornerstone to U.S. Space Program since inception; 100% mission success for manned and DoD launches • Successfully powered every one of ULA’s 119 launches • Portfolio built on franchise programs with multiple customers Leadership in Space Propulsion & Power 16 Space Launch System Mars Rover Landing Commercial Crew (Boeing CST - 100)

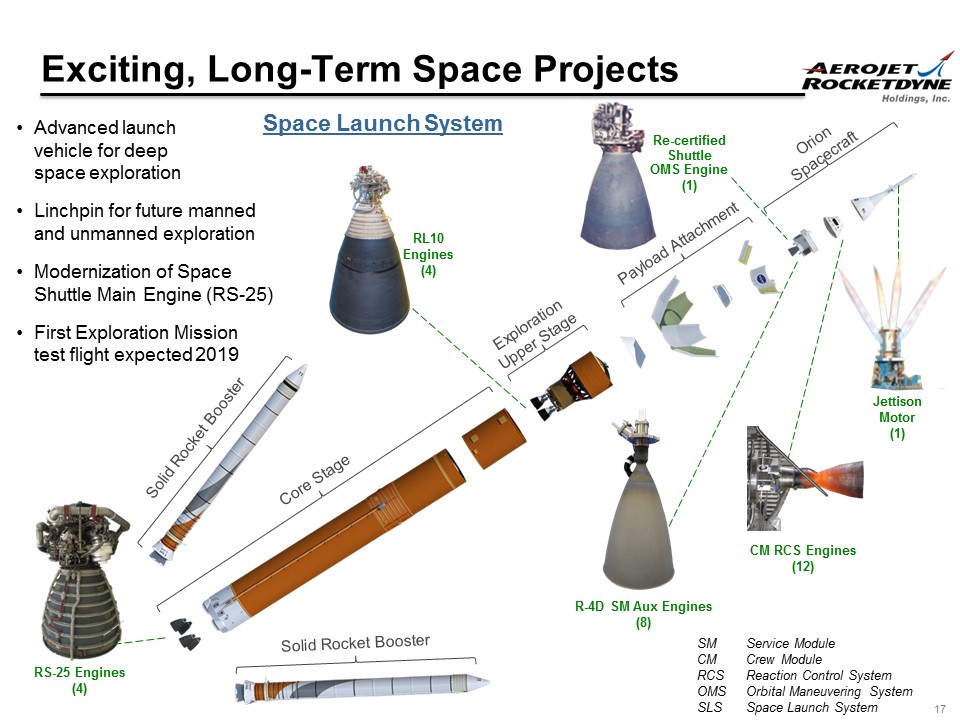

RS - 25 Engines (4) RL10 Engines (4) R - 4D SM Aux Engines (8) Re - certified Shuttle OMS Engine (1) CM RCS Engines (12) Jettison Motor (1) SM Service Module CM Crew Module RCS Reaction Control System OMS Orbital Maneuvering System SLS Space Launch System • Advanced launch vehicle for deep space exploration • Linchpin for future manned and unmanned exploration • Modernization of Space Shuttle Main Engine (RS - 25) • First Exploration Mission test flight expected 2019 Space Launch System Exciting, Long - Term Space Projects 17

Defense

• Liquid, solid, air - breathing propulsion systems and components for strategic, tactical and precision missile strikes, missile defense systems, maneuvering propulsion systems, precision warfighting systems • Geopolitical instability ; medium and long - range missiles proliferating; threats to U.S . and allied freedom • Success in maintaining national security inextricably linked to robust missile defense; assured access to space; and effective global force projection Standard Missile Tomahawk THAAD Patriot Our products play a major role in providing national and global security Strong Defense Portfolio 19

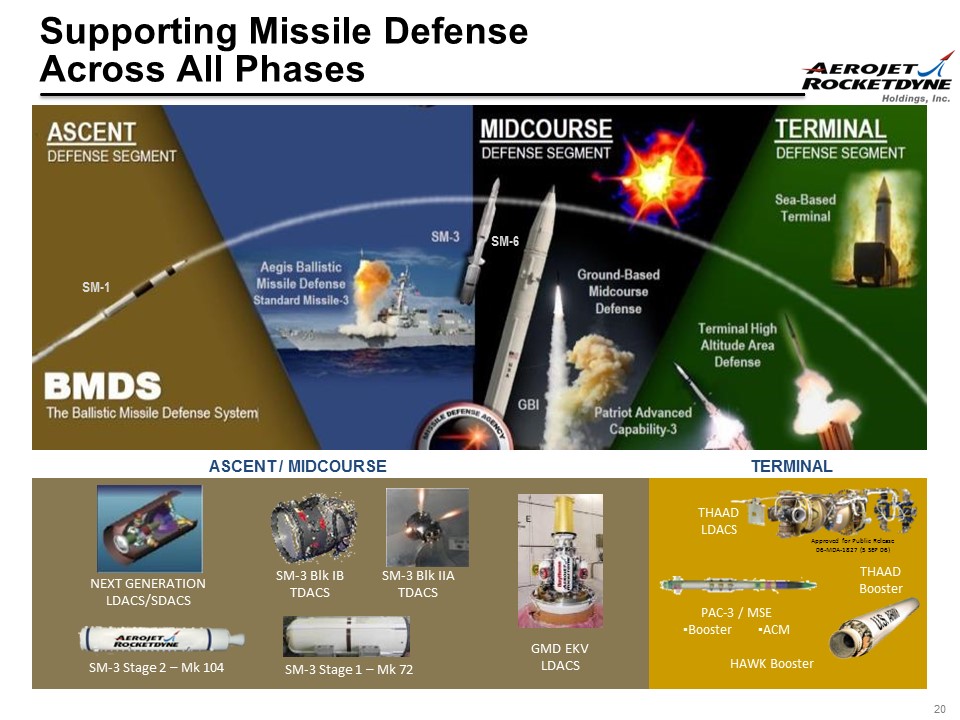

SM - 3 Blk IB TDACS SM - 3 Blk IIA TDACS GMD EKV LDACS NEXT GENERATION LDACS/SDACS SM - 3 Stage 2 – Mk 104 SM - 3 Stage 1 – Mk 72 THAAD Booster PAC - 3 / MSE ▪ Booster ▪ ACM ASCENT / MIDCOURSE TERMINAL THAAD LDACS Approved for Public Release 06 - MDA - 1827 (5 SEP 06) SM - 1 HAWK Booster Supporting Missile Defense Across All Phases 20 SM - 6

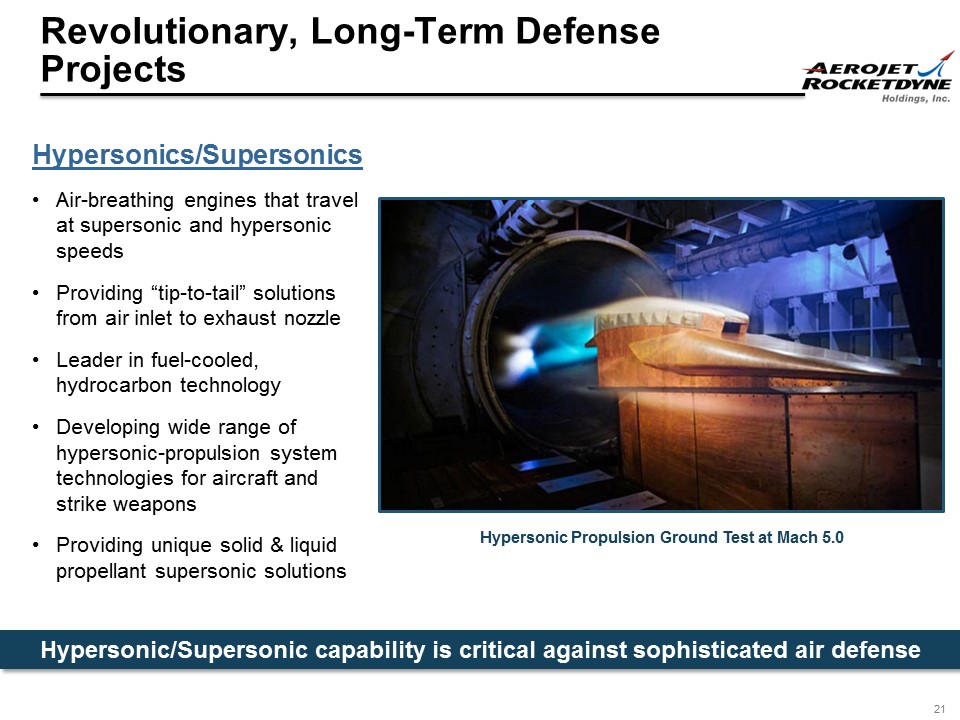

Hypersonics /Supersonics • A ir - breathing engines that travel at supersonic and hypersonic speeds • Providing “tip - to - tail” solutions from air inlet to exhaust nozzle • Leader in fuel - cooled, hydrocarbon technology • Developing wide range of hypersonic - propulsion system technologies for aircraft and strike weapons • Providing unique solid & liquid propellant supersonic solutions Revolutionary, Long - Term Defense Projects Hypersonic Propulsion Ground Test at Mach 5.0 21 Hypersonic/Supersonic capability is critical against sophisticated air defense

Positioned for Growth

• Advanced technology base, aligned with our nation’s critical needs • Strong and growing backlog in a diverse set of products • Proven manufacturing capability and expertise Competitive Positioning THAAD 23 Well positioned for next generation franchise programs Hypersonics /Supersonics THAAD XS - 1 GBSD RS - 25

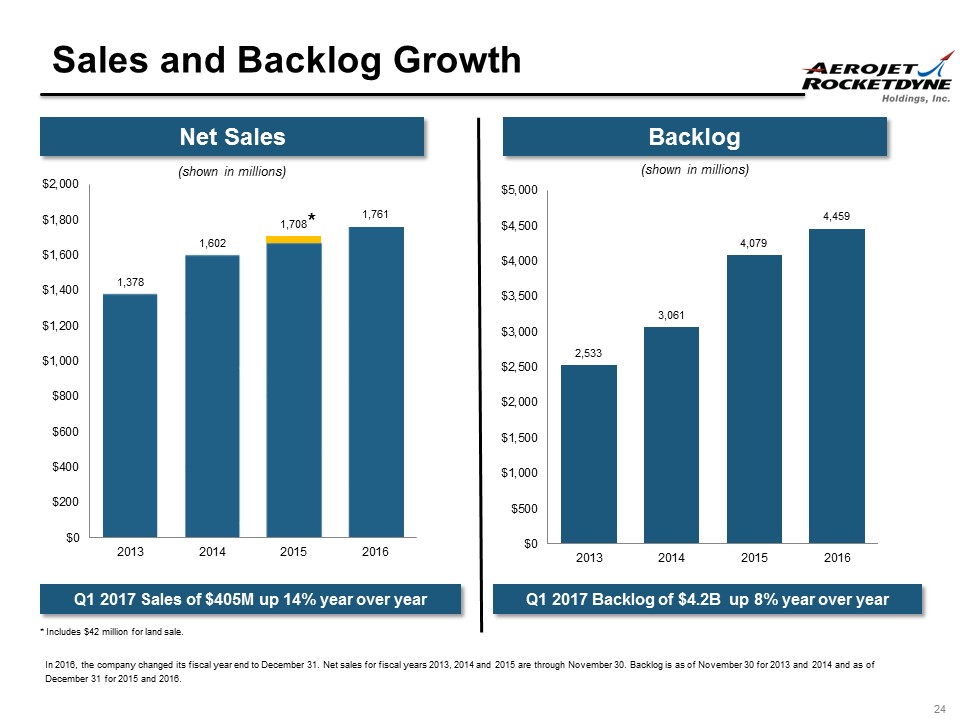

Sales and Backlog Growth 24 1,378 1,602 1,708 1,761 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 2013 2014 2015 2016 Q1 2017 Sales of $405M up 14% year over year Net Sales Backlog 2,533 3,061 4,079 4,459 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 2013 2014 2015 2016 Q1 2017 Backlog of $4.2B up 8% year over year In 2016, the company changed its fiscal year end to December 31. Net sales for fiscal years 2013, 2014 and 2015 are through N ove mber 30. Backlog is as of November 30 for 2013 and 2014 and as of December 31 for 2015 and 2016. * * Includes $42 million for land sale. (shown in millions) (shown in millions)

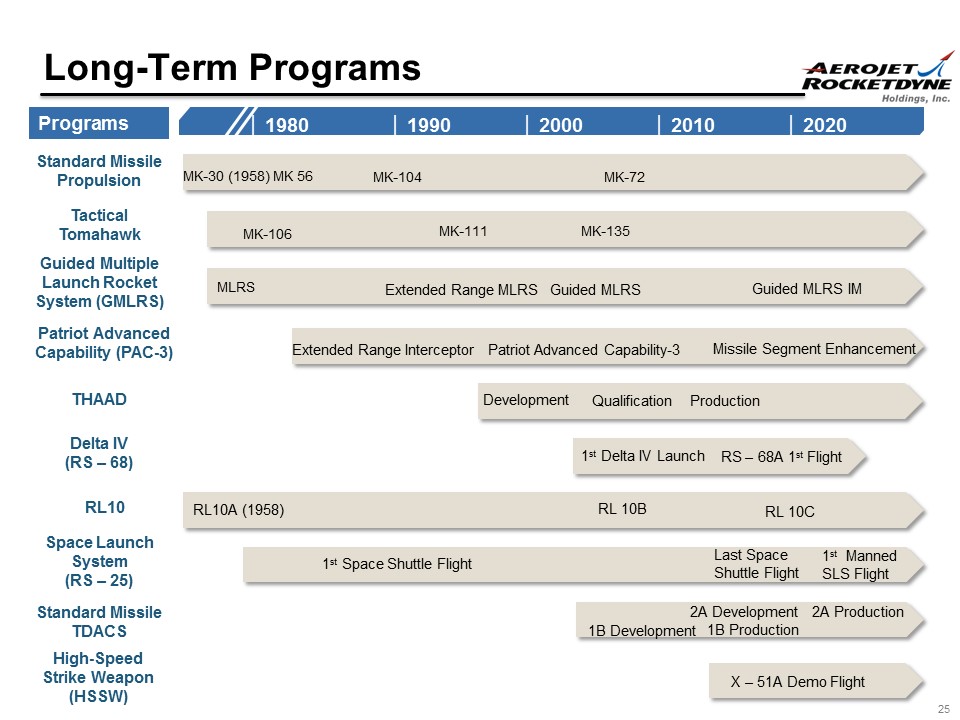

Long - Term Programs 25 1 st Delta IV Launch RS – 68A 1 st Flight MLRS Programs │ 1980 │ 1990 │ 2000 │ 2010 │ 2020 Standard Missile Propulsion MK - 30 (1958) MK 56 MK - 104 RL10A (1958) Tactical Tomahawk Guided Multiple Launch Rocket System (GMLRS ) Patriot Advanced Capability (PAC - 3) Delta IV (RS – 68) RL10 Space Launch System (RS – 25) Standard Missile TDACS MK - 72 MK - 106 MK - 111 MK - 135 Extended Range MLRS Guided MLRS Extended Range Interceptor Patriot Advanced Capability - 3 Missile Segment Enhancement 1 st Space Shuttle Flight RL 10B Last Space Shuttle Flight 1 st Manned SLS Flight 1B Development RL 10C High - Speed Strike Weapon (HSSW) X – 51A Demo Flight THAAD Qualification Production 2A Development Guided MLRS IM 1B Production 2A Production Development

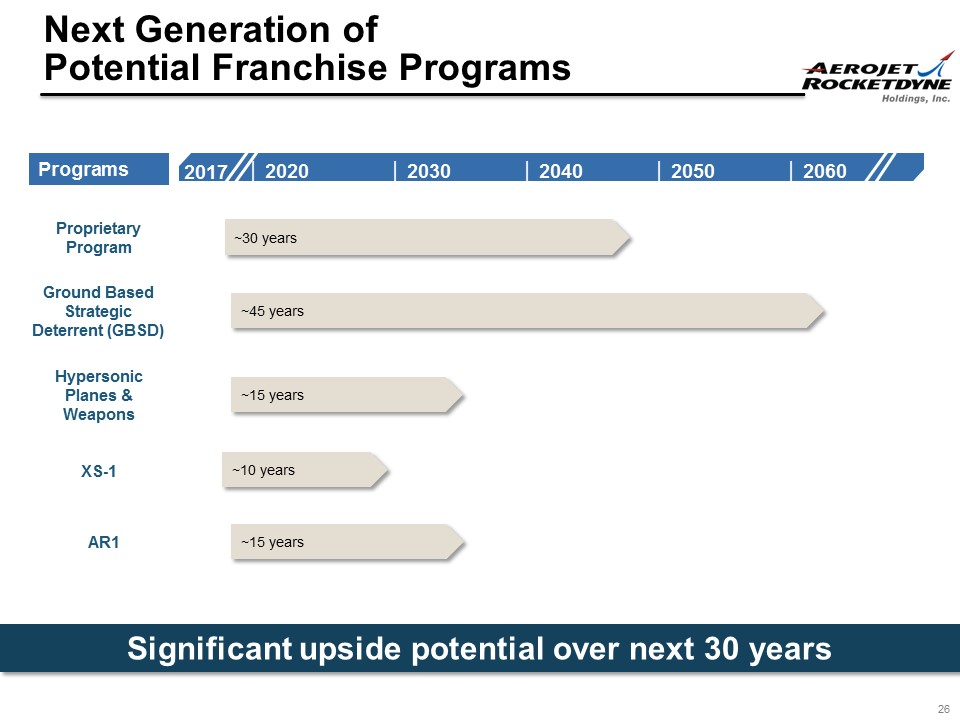

Next Generation of Potential Franchise Programs 26 Programs │ 2020 │ 2030 │ 2040 │ 2050 │ 2060 Proprietary Program ~30 years ~45 years Ground Based Strategic Deterrent (GBSD) ~15 years Hypersonic Planes & Weapons AR1 ~15 years ~10 years XS - 1 Significant upside potential over next 30 years │ 2017

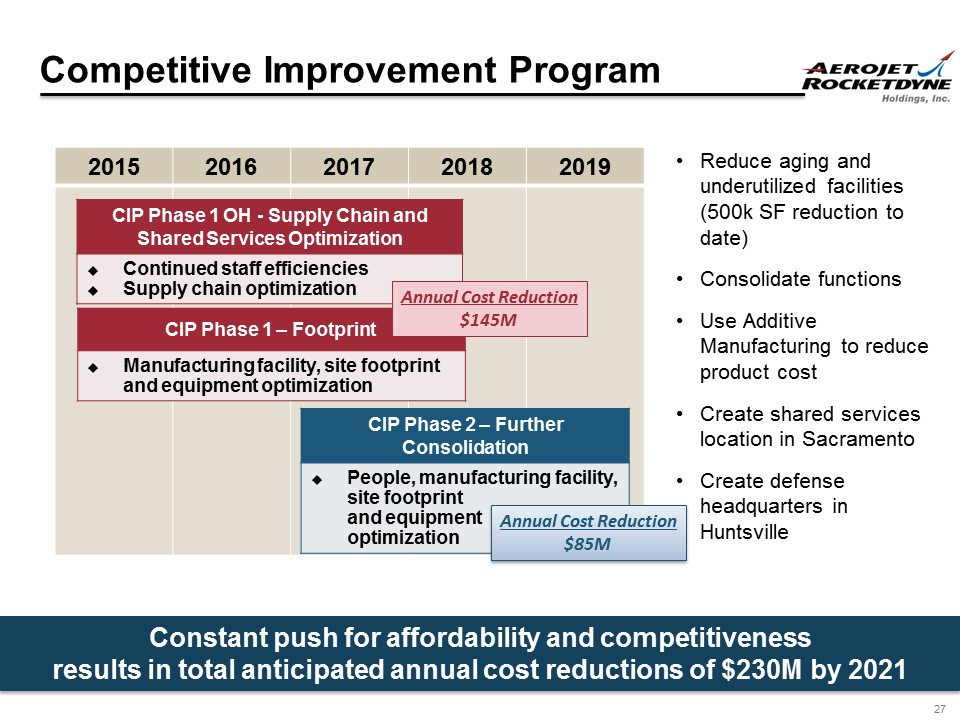

2015 2016 2017 2018 2019 CIP Phase 1 OH - Supply Chain and Shared Services Optimization Continued staff efficiencies Supply chain optimization CIP Phase 1 – Footprint Manufacturing facility, site footprint and equipment optimization Constant push for affordability and competitiveness results in total anticipated annual cost reductions of $ 230M by 2021 Annual Cost Reduction $145M CIP Phase 2 – Further Consolidation People, manufacturing facility, site footprint and equipment optimization Annual Cost Reduction $85M • Reduce aging and underutilized facilities (500k SF reduction to date) • Consolidate functions • Use Additive Manufacturing to reduce product cost • Create shared services location in Sacramento • Create defense headquarters in Huntsville Competitive Improvement Program 27

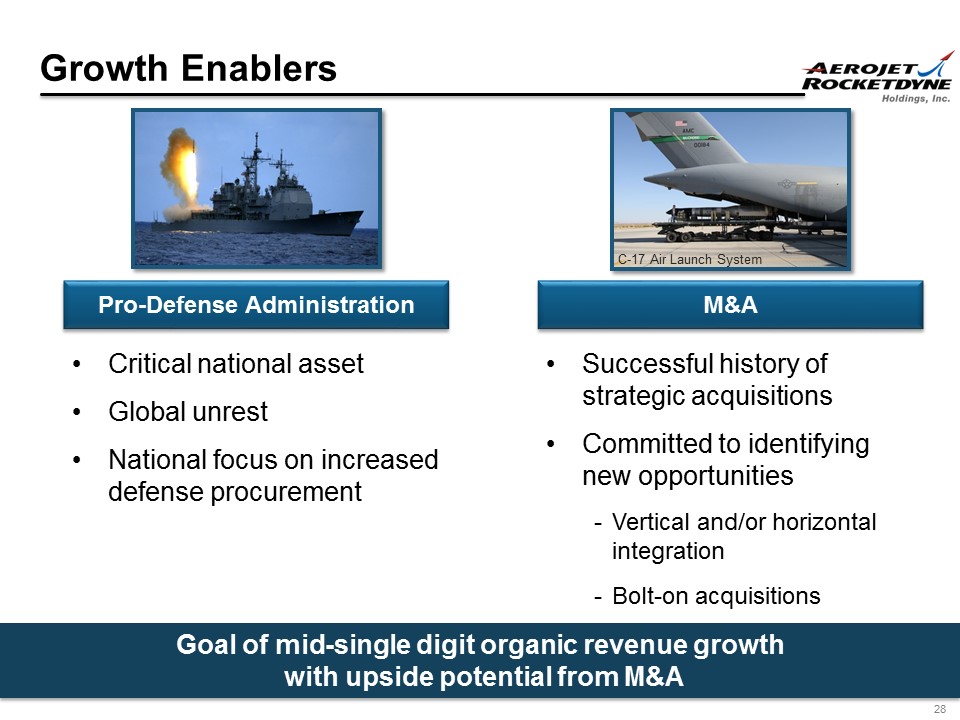

Growth Enablers 28 • Critical national asset • Global unrest • National focus on increased defense procurement • Successful history of strategic acquisitions • Committed to identifying new opportunities - Vertical and/or horizontal integration - Bolt - on acquisitions Pro - Defense Administration M&A Long Range Air Launch Target Coleman Aerospace Goal of mid - single d igit organic revenue growth with upside potential from M&A C - 17 Air Launch System

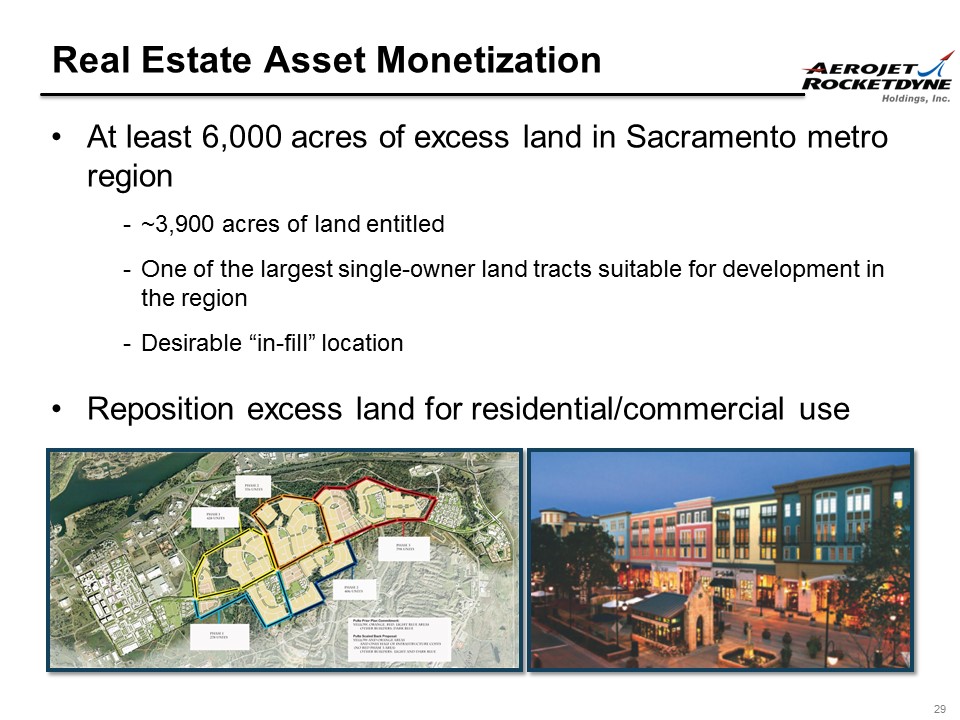

• At least 6,000 acres of excess land in Sacramento metro region - ~3,900 acres of land entitled - One of the largest single - owner land tracts suitable for development in the region - Desirable “in - fill” location • Reposition excess land for residential/commercial use Real Estate Asset Monetization 29

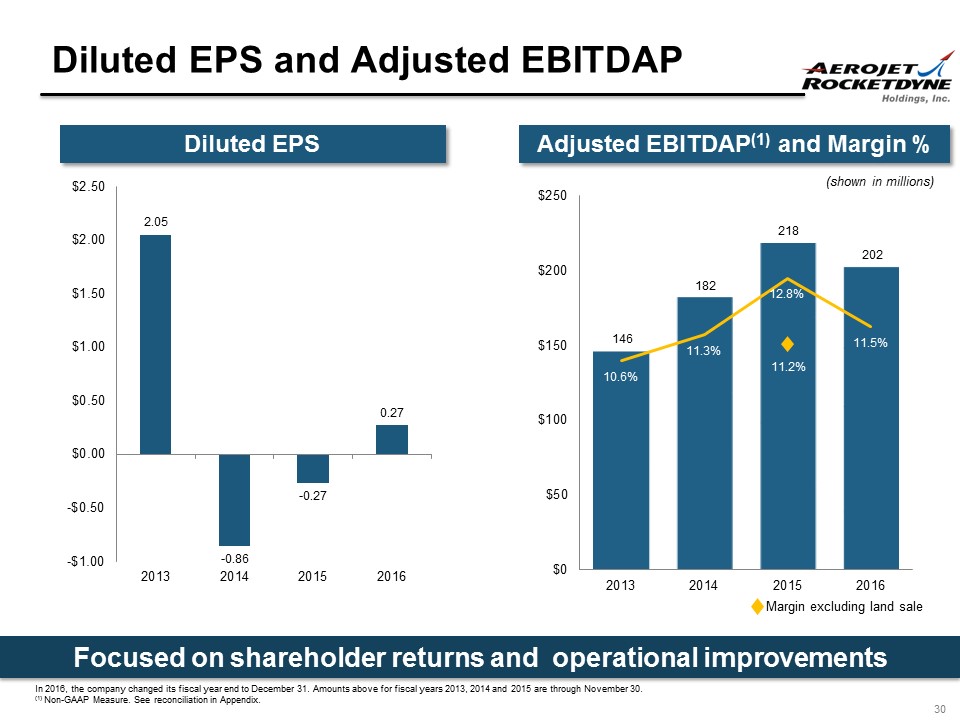

Diluted EPS and Adjusted EBITDAP 30 146 182 218 202 10.6% 11.3% 12.8% 11.5% $0 $50 $100 $150 $200 $250 2013 2014 2015 2016 2.05 - 0.86 - 0.27 0.27 -$1.00 -$0.50 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 2013 2014 2015 2016 Diluted EPS Adjusted EBITDAP (1) and Margin % Focused on shareholder returns and operational improvements 11.2% Margin excluding land sale (1) Non - GAAP Measure. See reconciliation in Appendix. (shown in millions) In 2016, the company changed its fiscal year end to December 31. Amounts above for fiscal years 2013, 2014 and 2015 are throu gh November 30.

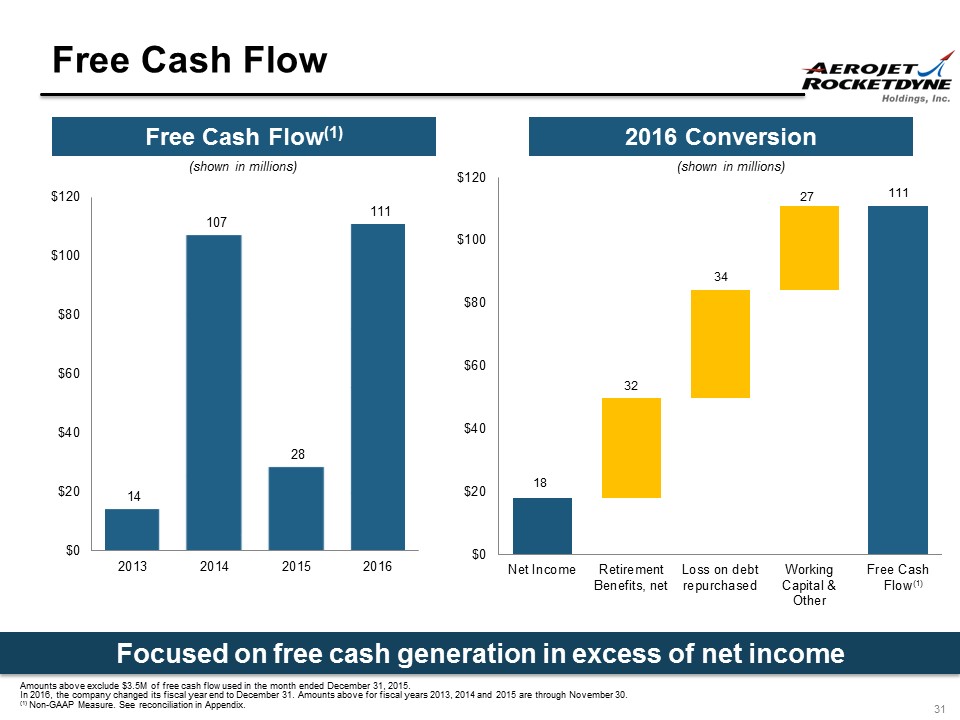

Free Cash Flow (1) Focused on free cash generation in excess of net income 18 32 34 27 111 $0 $20 $40 $60 $80 $100 $120 Net Income Retirement Benefits, net Loss on debt repurchased Working Capital & Other Free Cash Flow Free Cash Flow 31 14 107 28 111 $0 $20 $40 $60 $80 $100 $120 2013 2014 2015 2016 2016 Conversion Amounts above exclude $3.5M of free cash flow used in the month ended December 31, 2015. (1) Non - GAAP Measure. See reconciliation in Appendix. (shown in millions) (shown in millions) In 2016, the company changed its fiscal year end to December 31. Amounts above for fiscal years 2013, 2014 and 2015 are throu gh November 30. (1)

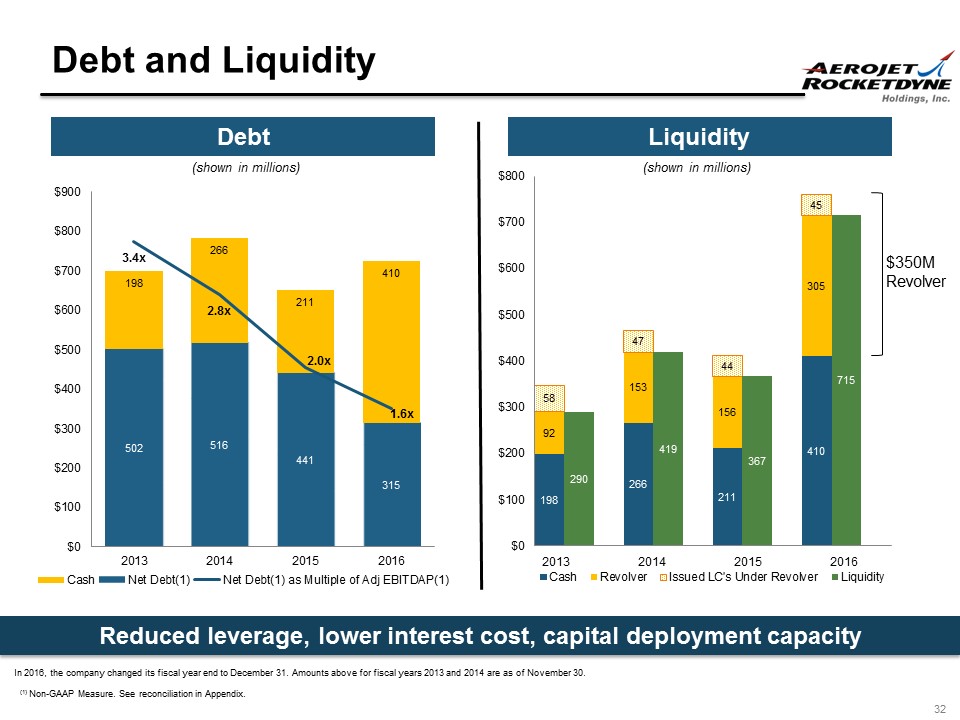

198 266 211 410 92 153 156 305 58 47 44 45 290 419 367 715 $0 $100 $200 $300 $400 $500 $600 $700 $800 Cash Revolver Issued LC's Under Revolver Liquidity Debt and Liquidity 32 Liquidity Reduced leverage, lower interest cost, capital deployment capacity Debt $350M Revolver 502 516 441 315 198 266 211 410 3.4x 2.8x 2.0x 1.6x $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 2013 2014 2015 2016 Cash Net Debt(1) Net Debt(1) as Multiple of Adj EBITDAP(1) (1) Non - GAAP Measure. See reconciliation in Appendix. (shown in millions) (shown in millions) In 2016, the company changed its fiscal year end to December 31. Amounts above for fiscal years 2013 and 2014 are as of Novem ber 30. 2013 2014 2015 2016

Investing in Today’s Aerojet Rocketdyne 33 Significant Operational Improvements to Drive New and Existing Programs New Management Team Refining Path to Success Diversified, Well - Balanced Portfolio to Compete Effectively in Today’s Market Solid Industry Foundation and Technical Leadership Focused on Revenue and Profitability Growth to Enhance Shareholder Value

APPENDIX 34

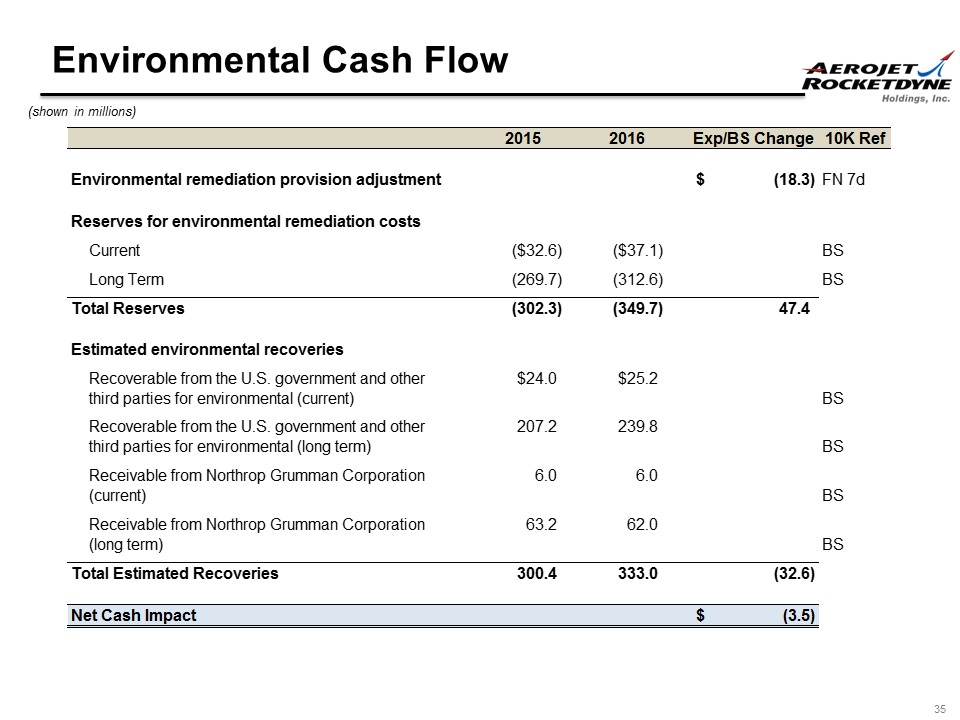

Environmental Cash Flow 35 (shown in millions) 2015 2016 Exp/BS Change 10K Ref Environmental remediation provision adjustment (18.3)$ FN 7d Reserves for environmental remediation costs Current ($32.6) ($37.1) BS Long Term (269.7) (312.6) BS Total Reserves (302.3) (349.7) 47.4 Estimated environmental recoveries Recoverable from the U.S. government and other third parties for environmental (current) $24.0 $25.2 BS Recoverable from the U.S. government and other third parties for environmental (long term) 207.2 239.8 BS Receivable from Northrop Grumman Corporation (current) 6.0 6.0 BS Receivable from Northrop Grumman Corporation (long term) 63.2 62.0 BS Total Estimated Recoveries 300.4 333.0 (32.6) Net Cash Impact (3.5)$

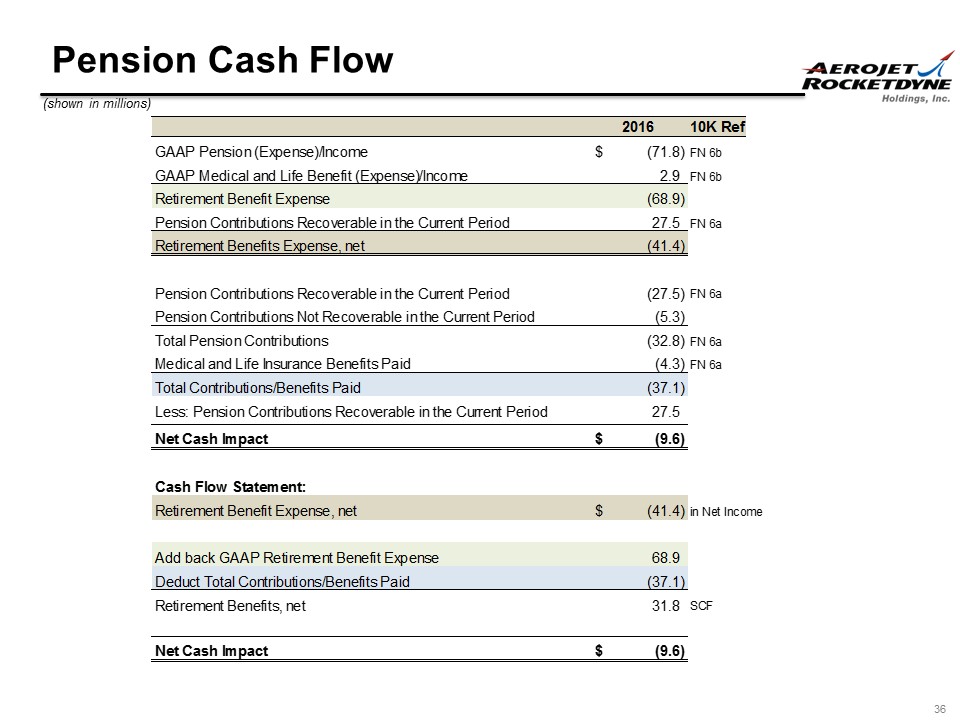

Pension Cash Flow 36 (shown in millions) 2016 10K Ref GAAP Pension (Expense)/Income (71.8)$ FN 6b GAAP Medical and Life Benefit (Expense)/Income 2.9 FN 6b Retirement Benefit Expense (68.9) Pension Contributions Recoverable in the Current Period 27.5 FN 6a Retirement Benefits Expense, net (41.4) Pension Contributions Recoverable in the Current Period (27.5) FN 6a Pension Contributions Not Recoverable in the Current Period (5.3) Total Pension Contributions (32.8) FN 6a Medical and Life Insurance Benefits Paid (4.3) FN 6a Total Contributions/Benefits Paid (37.1) Less: Pension Contributions Recoverable in the Current Period 27.5 Net Cash Impact (9.6)$ Cash Flow Statement: Retirement Benefit Expense, net (41.4)$ in Net Income Add back GAAP Retirement Benefit Expense 68.9 Deduct Total Contributions/Benefits Paid (37.1) Retirement Benefits, net 31.8 SCF Net Cash Impact (9.6)$

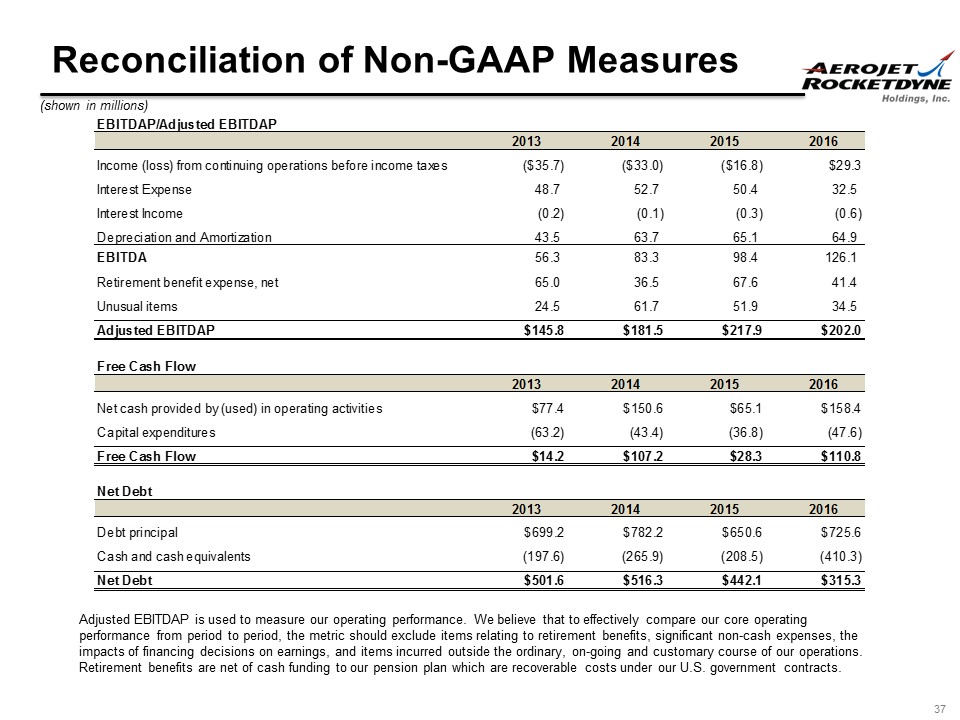

Reconciliation of Non - GAAP Measures 37 Adjusted EBITDAP is used to measure our operating performance. We believe that to effectively compare our core operating performance from period to period, the metric should exclude items relating to retirement benefits, significant non - cash expense s, the impacts of financing decisions on earnings, and items incurred outside the ordinary, on - going and customary course of our operat ions. Retirement benefits are net of cash funding to our pension plan which are recoverable costs under our U.S. government contrac ts. EBITDAP/Adjusted EBITDAP 2013 2014 2015 2016 Income (loss) from continuing operations before income taxes ($35.7) ($33.0) ($16.8) $29.3 Interest Expense 48.7 52.7 50.4 32.5 Interest Income (0.2) (0.1) (0.3) (0.6) Depreciation and Amortization 43.5 63.7 65.1 64.9 EBITDA 56.3 83.3 98.4 126.1 Retirement benefit expense, net 65.0 36.5 67.6 41.4 Unusual items 24.5 61.7 51.9 34.5 Adjusted EBITDAP $145.8 $181.5 $217.9 $202.0 Free Cash Flow 2013 2014 2015 2016 Net cash provided by (used) in operating activities $77.4 $150.6 $65.1 $158.4 Capital expenditures (63.2) (43.4) (36.8) (47.6) Free Cash Flow $14.2 $107.2 $28.3 $110.8 Net Debt 2013 2014 2015 2016 Debt principal $699.2 $782.2 $650.6 $725.6 Cash and cash equivalents (197.6) (265.9) (208.5) (410.3) Net Debt $501.6 $516.3 $442.1 $315.3 (shown in millions)