Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Atkore Inc. | form8kjune2017.htm |

1

Cautionary statements

This presentation does not constitute an offer or invitation for the sale or purchase of securities and has been prepared solely for informational purposes. This presentation contains

forward-looking statements that are subject to known and unknown risks and uncertainties, many of which are beyond our control. All statements other than statements of historical fact

included in this presentation are forward-looking statements. Forward-looking statements appearing throughout this presentation include, without limitation, statements regarding our

intentions, beliefs, assumptions or current expectations concerning, among other things, financial position; results of operations; cash flows; prospects; growth strategies or

expectations; customer retention; the outcome (by judgment or settlement) and costs of legal, administrative or regulatory proceedings, investigations or inspections, including, without

limitation, collective, representative or class action litigation; and the impact of prevailing economic conditions. You can identify forward-looking statements by the fact that they do not

relate strictly to historical or current facts. These statements may include words such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,”

“is optimistic,” “intends,” “plans,” “estimates,” “anticipates” and other comparable terms. We caution you that forward-looking statements are not guarantees of future performance or

outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of the market in

which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if our results of operations,

financial condition and cash flows, and the development of the market in which we operate, are consistent with the forward-looking statements contained in this presentation, those

results or developments may not be indicative of results or developments in subsequent periods. A number of important factors, including, without limitation, the risks and uncertainties

discussed under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the registration statement on Form S-1/A

that the issuer has filed with the SEC on February 15, 2017 (Registration No. 333-215970), could cause actual results and outcomes to differ materially from those reflected in the

forward-looking statements.

Because of these risks, we caution that you should not place undue reliance on any of our forward-looking statements. New risks and uncertainties arise from time to time, and it is

impossible for us to predict those events or how they may affect us. Further, any forward-looking statement speaks only as of the date on which it is made. We undertake no obligation

to revise the forward-looking statements in this presentation after the date of this presentation.

Market data and industry information used throughout this presentation are based on management’s knowledge of the industry and the good faith estimates of management. We also

relied, to the extent available, upon management’s review of independent industry surveys, forecasts and publications and other publicly available information prepared by a number of

third party sources. All of the market data and industry information used in this presentation involves a number of assumptions and limitations which we believe to be reasonable, and

you are cautioned not to give undue weight to such estimates. Although we believe that these sources are reliable, we cannot guarantee the accuracy or completeness of this

information, and we have not independently verified this information. While we believe the estimated market position, market opportunity and market size information included in this

presentation are generally reliable, such information, which is derived in part from management’s estimates and beliefs, is inherently uncertain and imprecise. Projections, assumptions

and estimates of our future performance and the future performance of the industry in which we operate are subject to a high degree of uncertainty and risk due to a variety of factors,

including those described above. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by

independent parties.

We present Adjusted net sales, Adjusted EBITDA, Adjusted EBITDA margin, and Net Debt to help us describe our operating and financial performance. Adjusted net sales, Adjusted

EBITDA and Adjusted EBITDA margin are non-GAAP financial measures commonly used in our industry and have certain limitations and should not be construed as alternatives to net

income, net sales and other income data measures (as determined in accordance with generally accepted accounting principles in the United States, or GAAP), or as better indicators of

operating performance. Adjusted net sales, Adjusted EBITDA and Adjusted EBITDA margin as defined by us may not be comparable to similar non-GAAP measures presented by other

issuers. Our presentation of such measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Reconciliations of non-

GAAP measures to GAAP are provided in the appendix.

We have a fiscal year that ends on September 30. It is the Company’s practice to establish quarterly closings using a 4-5-4 calendar. Our fiscal quarters end on the last Friday in

December, March and June. Prior to fiscal 2016, the fiscal year ended on the last Friday in September. Fiscal 2016 was a 53-week fiscal year, which ended on September 30, 2016.

Fiscal 2015 and 2014 were 52-week fiscal years, which ended on September 25, 2015 and September 26, 2014, respectively.

2

Today’s presenters

Name Position Experience

John

Williamson

President, Chief Executive Officer and Director of Atkore

Member of Board of Governors; National Electrical Manufacturers

Association (NEMA)

Joined the Company in 2011

Jim Mallak

Vice President and Chief Financial Officer of Atkore

Joined the Company in 2012

3

$106 $106

1st Half

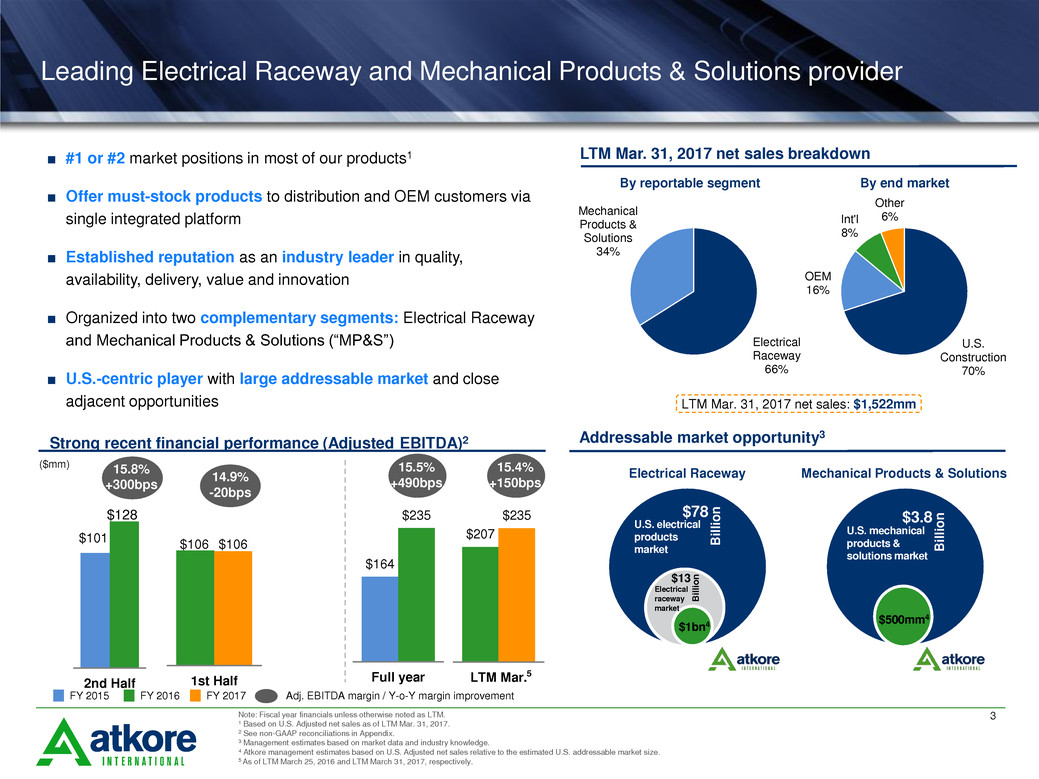

Leading Electrical Raceway and Mechanical Products & Solutions provider

■ #1 or #2 market positions in most of our products1

■ Offer must-stock products to distribution and OEM customers via

single integrated platform

■ Established reputation as an industry leader in quality,

availability, delivery, value and innovation

■ Organized into two complementary segments: Electrical Raceway

and Mechanical Products & Solutions (“MP&S”)

■ U.S.-centric player with large addressable market and close

adjacent opportunities

LTM Mar. 31, 2017 net sales breakdown

By reportable segment By end market

Addressable market opportunity3

$1bn4

$13

Bil

li

o

n

Electrical

raceway

market

$78

Billio

n

U.S. electrical

products

market

$500mm4

$3.8

Billio

n

U.S. mechanical

products &

solutions market

Electrical Raceway Mechanical Products & Solutions

Note: Fiscal year financials unless otherwise noted as LTM.

1 Based on U.S. Adjusted net sales as of LTM Mar. 31, 2017.

2 See non-GAAP reconciliations in Appendix.

3 Management estimates based on market data and industry knowledge.

4 Atkore management estimates based on U.S. Adjusted net sales relative to the estimated U.S. addressable market size.

5 As of LTM March 25, 2016 and LTM March 31, 2017, respectively.

U.S.

Construction

70%

OEM

16%

Int'l

8%

Other

6%

Electrical

Raceway

66%

Mechanical

Products &

Solutions

34%

$101

$128

2nd Half

$164

$235

Full year

Strong recent financial performance (Adjusted EBITDA)2

Adj. EBITDA margin / Y-o-Y margin improvement

($mm)

LTM Mar. 31, 2017 net sales: $1,522mm

$207

$235

LTM Mar.

15.8%

+300bps

15.5%

+490bps

15.4%

+150bps

FY 2015 FY 2016 FY 2017

5

14.9%

-20bps

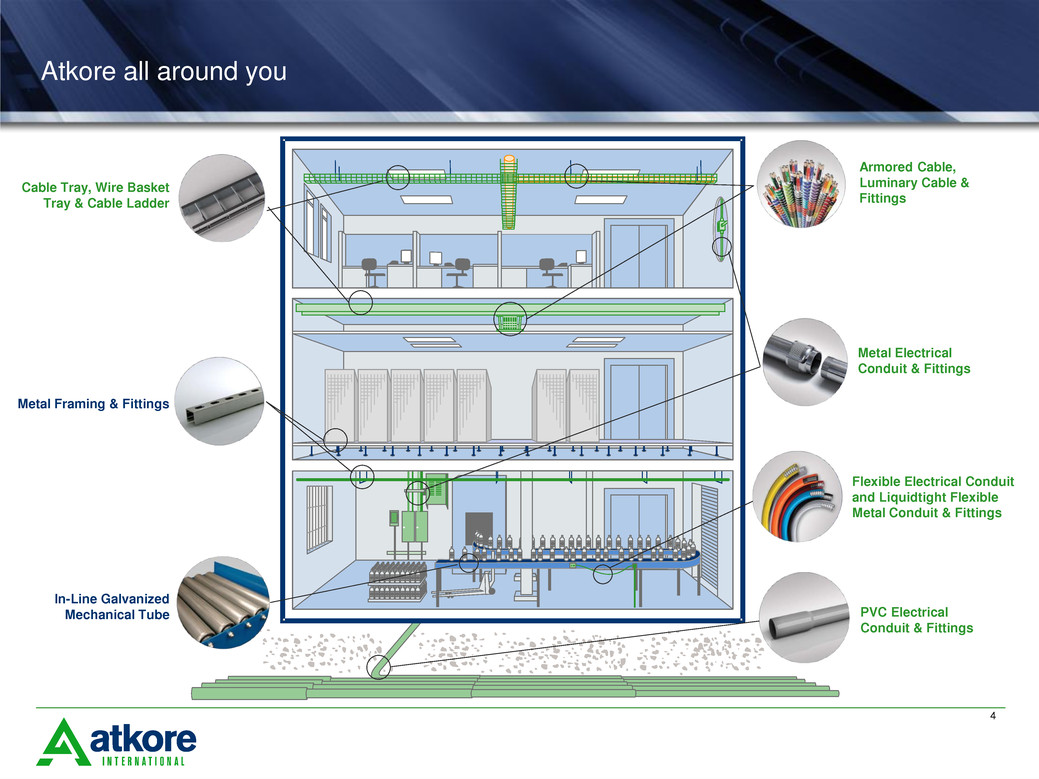

4

Cable Tray, Wire Basket

Tray & Cable Ladder

Armored Cable,

Luminary Cable &

Fittings

Metal Framing & Fittings

Flexible Electrical Conduit

and Liquidtight Flexible

Metal Conduit & Fittings

PVC Electrical

Conduit & Fittings

Metal Electrical

Conduit & Fittings

In-Line Galvanized

Mechanical Tube

Atkore all around you

5

$86

$107

$175

$183

9%

11%

18% 18%

6%

8%

10%

12%

14%

16%

18%

20%

FY 2014 FY 2015 FY 2016 LTM Mar. 31,

2017

Adjusted EBITDA ($mm) Adjusted EBITDA Margin

PVC Electrical

Conduit & Fittings

24%

Armored Cable &

Fittings

35%

Other

6%

Metal Electrical

Conduit & Fittings

35%

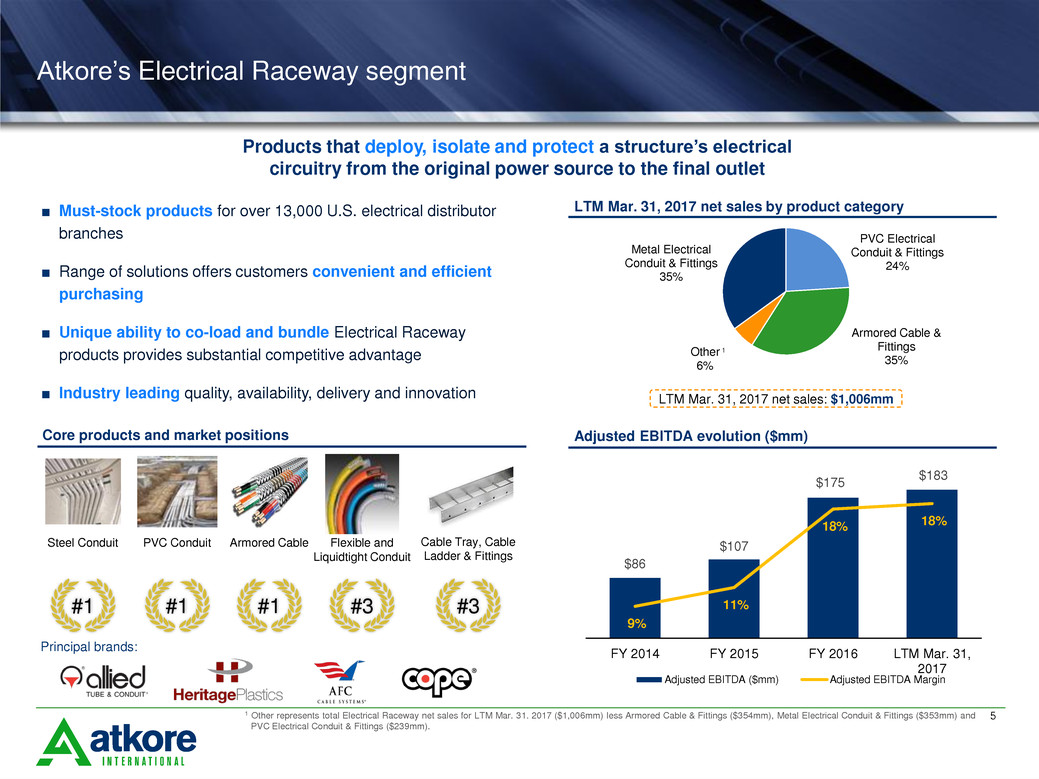

Atkore’s Electrical Raceway segment

LTM Mar. 31, 2017 net sales by product category

Adjusted EBITDA evolution ($mm)

Products that deploy, isolate and protect a structure’s electrical

circuitry from the original power source to the final outlet

■ Must-stock products for over 13,000 U.S. electrical distributor

branches

■ Range of solutions offers customers convenient and efficient

purchasing

■ Unique ability to co-load and bundle Electrical Raceway

products provides substantial competitive advantage

■ Industry leading quality, availability, delivery and innovation

Core products and market positions

Principal brands:

Armored CablePVC ConduitSteel Conduit

#1 #1#1

Flexible and

Liquidtight Conduit

Cable Tray, Cable

Ladder & Fittings

#3 #3

1

1 Other represents total Electrical Raceway net sales for LTM Mar. 31. 2017 ($1,006mm) less Armored Cable & Fittings ($354mm), Metal Electrical Conduit & Fittings ($353mm) and

PVC Electrical Conduit & Fittings ($239mm).

LTM Mar. 31, 2017 net sales: $1,006mm

6

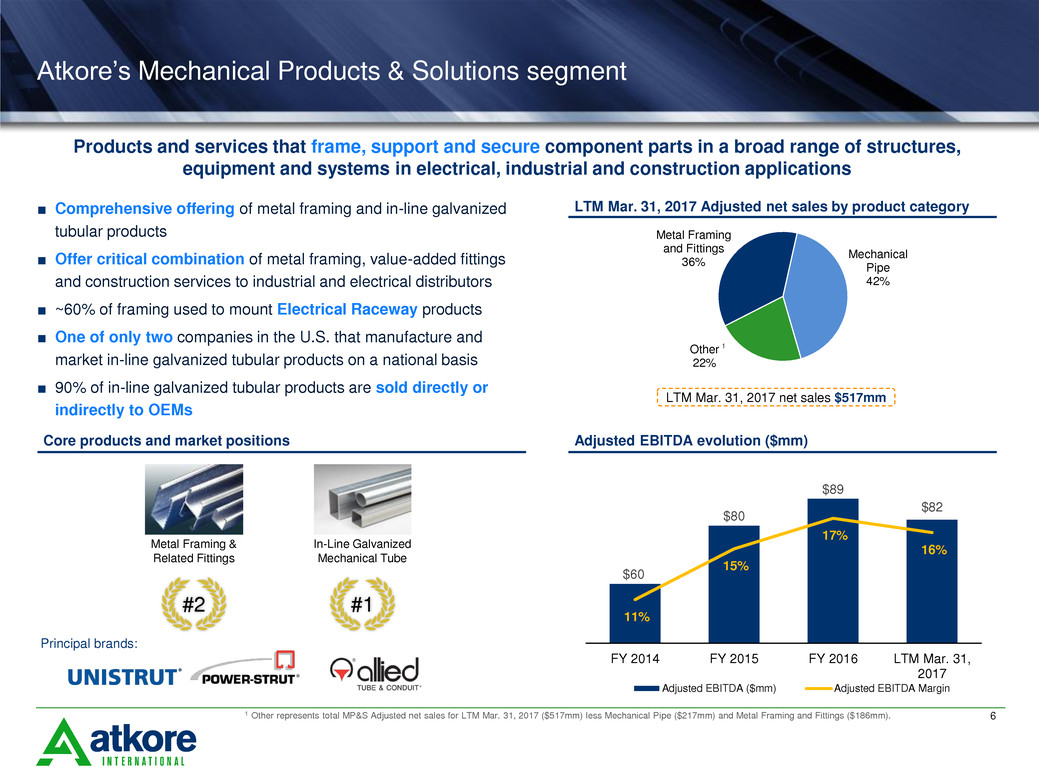

Metal Framing

and Fittings

36%

Mechanical

Pipe

42%

Other

22%

■ Comprehensive offering of metal framing and in-line galvanized

tubular products

■ Offer critical combination of metal framing, value-added fittings

and construction services to industrial and electrical distributors

■ ~60% of framing used to mount Electrical Raceway products

■ One of only two companies in the U.S. that manufacture and

market in-line galvanized tubular products on a national basis

■ 90% of in-line galvanized tubular products are sold directly or

indirectly to OEMs

Atkore’s Mechanical Products & Solutions segment

LTM Mar. 31, 2017 Adjusted net sales by product category

Products and services that frame, support and secure component parts in a broad range of structures,

equipment and systems in electrical, industrial and construction applications

Core products and market positions

Principal brands:

Metal Framing &

Related Fittings

In-Line Galvanized

Mechanical Tube

#1#2

Adjusted EBITDA evolution ($mm)

$60

$80

$89

$82

11%

15%

17%

16%

8%

10%

12%

14%

16%

18%

20%

FY 2014 FY 2015 FY 2016 LTM Mar. 31,

2017

Adjusted EBITDA ($mm) Adjusted EBITDA Margin

1

1 Other represents total MP&S Adjusted net sales for LTM Mar. 31, 2017 ($517mm) less Mechanical Pipe ($217mm) and Metal Framing and Fittings ($186mm).

LTM Mar. 31, 2017 net sales $517mm

7

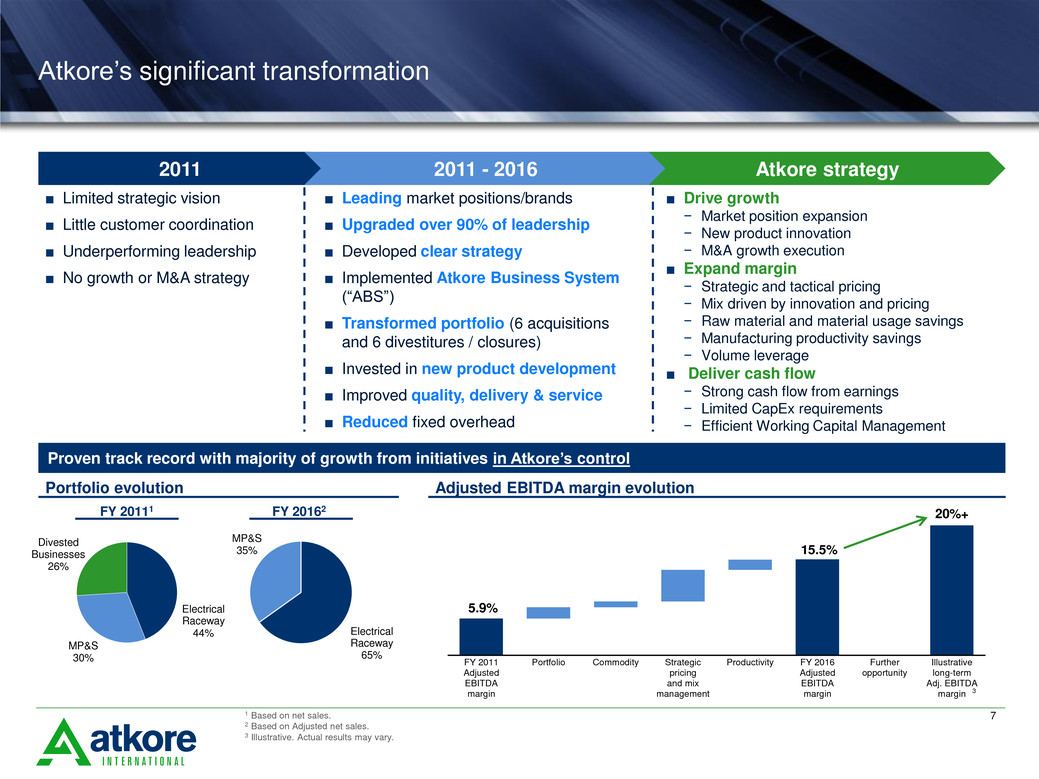

Atkore’s significant transformation

■ Limited strategic vision

■ Little customer coordination

■ Underperforming leadership

■ No growth or M&A strategy

2011 2011 - 2016 Atkore strategy

■ Leading market positions/brands

■ Upgraded over 90% of leadership

■ Developed clear strategy

■ Implemented Atkore Business System

(“ABS”)

■ Transformed portfolio (6 acquisitions

and 6 divestitures / closures)

■ Invested in new product development

■ Improved quality, delivery & service

■ Reduced fixed overhead

■ Drive growth

− Market position expansion

− New product innovation

− M&A growth execution

■ Expand margin

− Strategic and tactical pricing

− Mix driven by innovation and pricing

− Raw material and material usage savings

− Manufacturing productivity savings

− Volume leverage

■ Deliver cash flow

− Strong cash flow from earnings

− Limited CapEx requirements

− Efficient Working Capital Management

Electrical

Raceway

44%

MP&S

30%

Divested

Businesses

26%

Proven track record with majority of growth from initiatives in Atkore’s control

Portfolio evolution

FY 20111 FY 20162

1 Based on net sales.

2 Based on Adjusted net sales.

3 Illustrative. Actual results may vary.

Electrical

Raceway

65%

MP&S

35%

Adjusted EBITDA margin evolution

5.9%

15.5%

20%+

FY 2011

Adjusted

EBITDA

margin

Portfolio Commodity Strategic

pricing

and mix

management

Productivity FY 2016

Adjusted

EBITDA

margin

Further

opportunity

Illustrative

long-term

Adj. EBITDA

margin 3

8

The foundation for our improvement...

■ Market Intelligence and analysis

■ Portfolio analysis

■ Business development

■ “Evergreen” strategy

■ Product management

■ Culture of innovation

■ Talent assessment and

acquisition

■ Talent engagement

and development

■ Aligned incentives and

compensation

■ Resource deployment

and allocation analysis

■ Lean production system

■ Lean transactional

process excellence

■ Commercial excellence

■ Supply chain excellence

Strategy

Process

People

Adjusted EBITDA margin increased 920bps1

Defective parts per million down 83%1

Perfect order rate increased from 81% to 96%1

ABS driving performance

1 From FY 2011 to LTM Mar. 31, 2017.

9

Name / Position

Relevant

Experience

Electrical Industry

Experience Experience Gained With

John P. Williamson

President & Chief Executive Officer

30 years 16 years

James A. Mallak

Chief Financial Officer

30 years 4 years

Peter Lariviere

President, Cable Solutions

25 years 10 years

Bill Waltz

President, Conduit & Fittings

27 years 2 years

Mike Schulte

President, Mechanical Products & Solutions 20 years 2 years

Rodney Long

Senior Vice President of Sales 26 years 29 years

Gary Uren

Vice President,

Business Development & Strategy

29 years 35 years

Kevin Fitzpatrick

Vice President, Global Human Resources 25 years 5 years

Lisa Winter

Director, Corporate Communications 22 years 10 years

Dan Kelly

Vice President, General Counsel & Secretary 29 years 2 years

Steve Robins

Vice President, Strategic Sourcing 22 years 7 years

Keith Whisenand

Vice President, Investor Relations 20 years 1 year

...supported by a team built to outperform

Investment highlights

11

Investment highlights

Leading market positions and strong brands

Superior customer value proposition with a compelling portfolio

Significant scale providing barriers to entry

Focused growth strategy to attack substantial market opportunity

a. Capitalize on attractive end-market growth dynamics

b. Grow market share with new and existing customers

c. Execute on strategic pricing and mix opportunities

d. Expand product offering through innovation

e. Pursue M&A to deliver incremental growth

Strong profitability with clear runway for further improvement

1

2

3

4

a

5

Strong company

Growth upside

Momentum &

runway for results

12

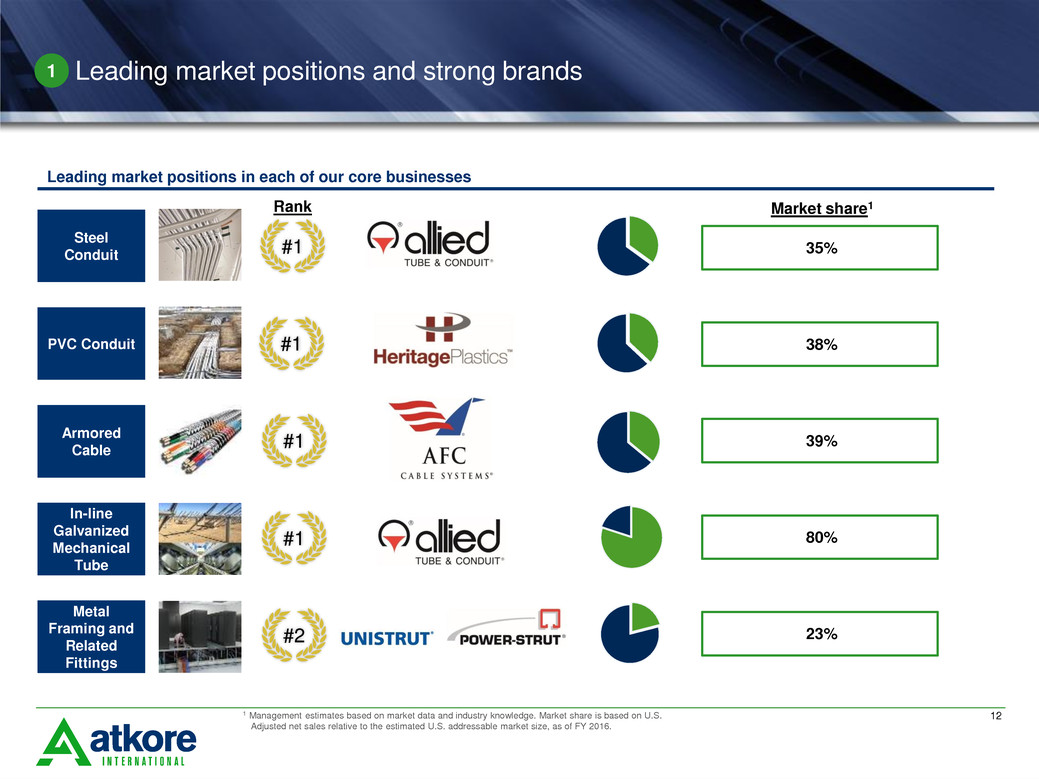

Leading market positions and strong brands1

Leading market positions in each of our core businesses

#1

#1

#1

#1

#2

Rank

35%

38%

39%

80%

23%

Market share1

Steel

Conduit

PVC Conduit

Armored

Cable

In-line

Galvanized

Mechanical

Tube

Metal

Framing and

Related

Fittings

1 Management estimates based on market data and industry knowledge. Market share is based on U.S.

Adjusted net sales relative to the estimated U.S. addressable market size, as of FY 2016.

13

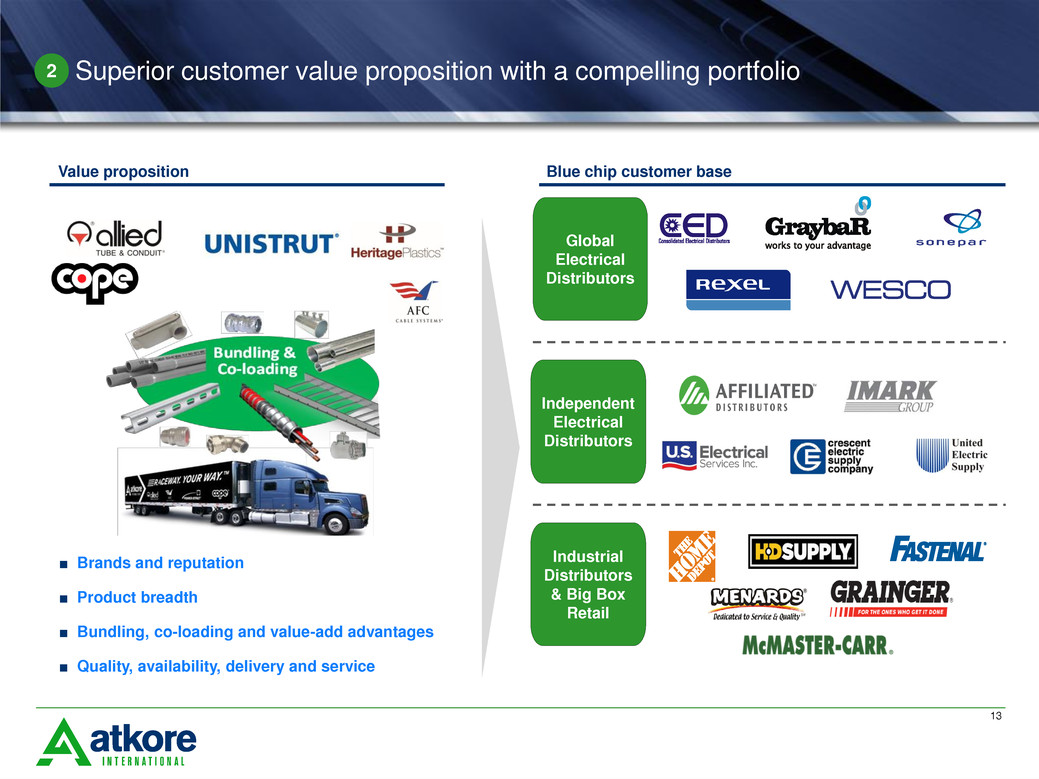

Global

Electrical

Distributors

Independent

Electrical

Distributors

Industrial

Distributors

& Big Box

Retail

■ Brands and reputation

■ Product breadth

■ Bundling, co-loading and value-add advantages

■ Quality, availability, delivery and service

2

Value proposition Blue chip customer base

Superior customer value proposition with a compelling portfolio

14

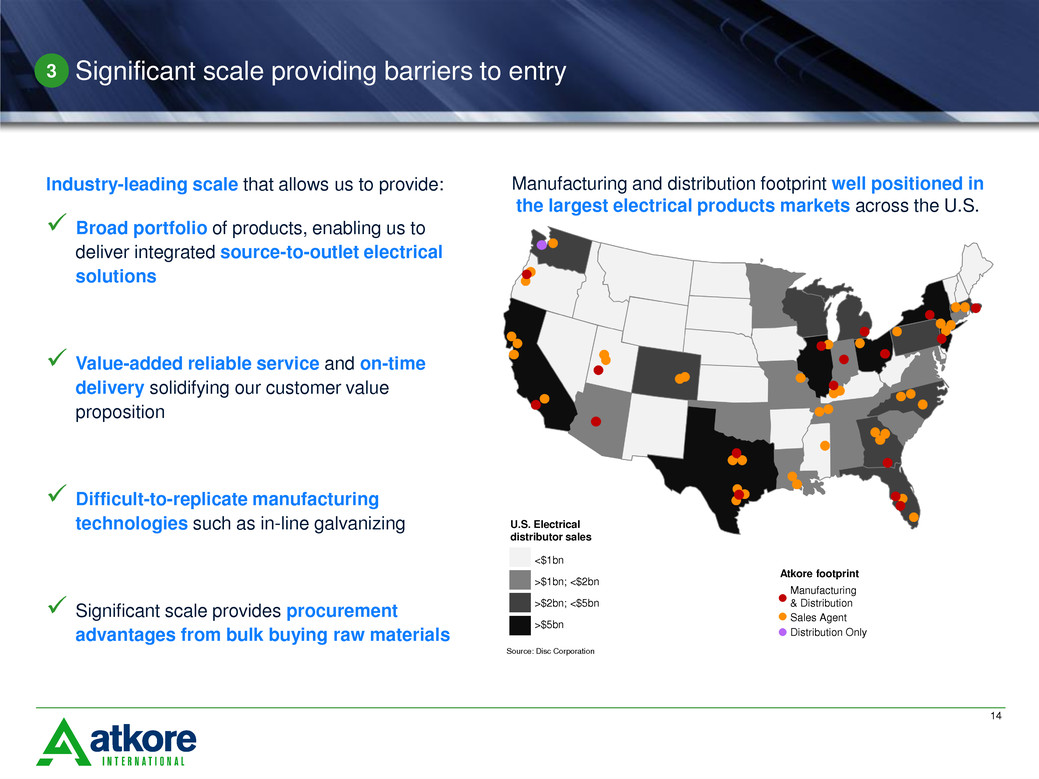

3

Industry-leading scale that allows us to provide:

Broad portfolio of products, enabling us to

deliver integrated source-to-outlet electrical

solutions

Value-added reliable service and on-time

delivery solidifying our customer value

proposition

Difficult-to-replicate manufacturing

technologies such as in-line galvanizing

Significant scale provides procurement

advantages from bulk buying raw materials

Manufacturing and distribution footprint well positioned in

the largest electrical products markets across the U.S.

Source: Disc Corporation

Manufacturing

& Distribution

Sales Agent

Distribution Only

Atkore footprint

>$5bn

>$1bn; <$2bn

>$2bn; <$5bn

<$1bn

U.S. Electrical

distributor sales

Significant scale providing barriers to entry

15

4

a) Capitalize on attractive end-market growth

dynamics

b) Grow market share with new and existing

customers

c) Execute on strategic pricing and mix

opportunities

d) Expand product offering through innovation

e) Pursue M&A to deliver incremental growth

Focused growth strategy to attack substantial market opportunity

$0.5bn2

$3.8bn

U.S. Mechanical

Products &Solutions

market

Electrical Raceway

Mechanical Products & Solutions

$1bn2

$13bn

U.S. Electrical Raceway

market

Substantial addressable market opportunity1

1 Management estimates based on market data and industry knowledge.

2 Atkore management estimates based on U.S. Adjusted net sales relative to the estimated U.S. addressable market size, as of LTM Mar. 31, 2017.

16

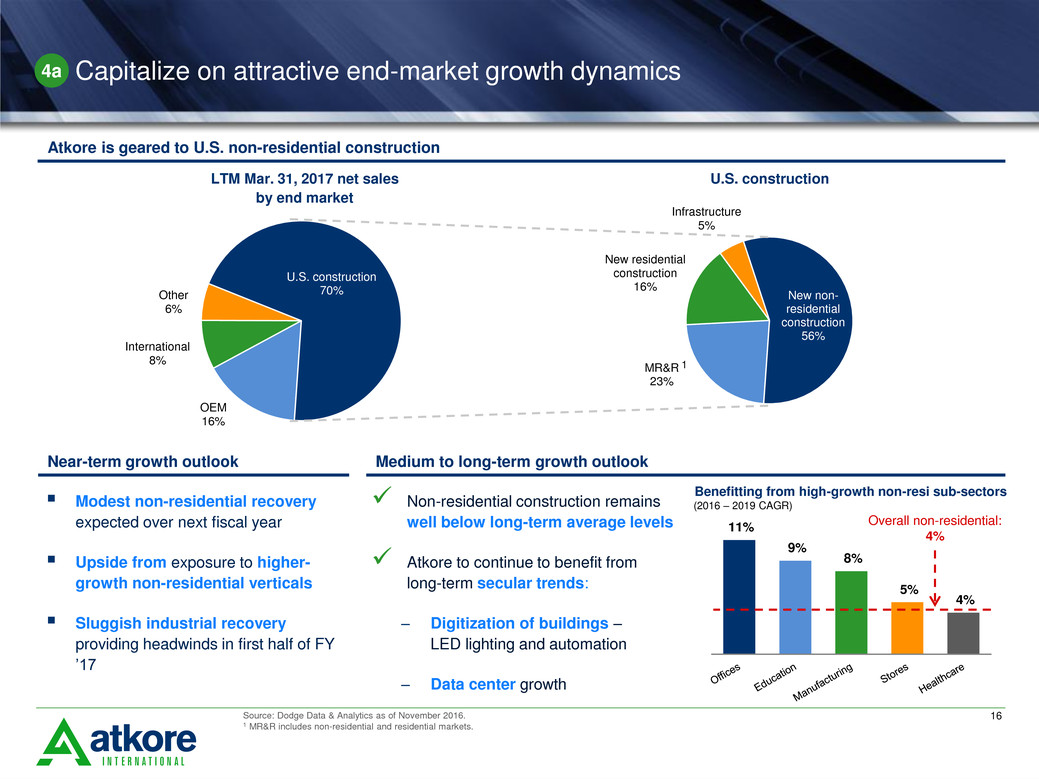

OEM

16%

International

8%

Other

6%

U.S. construction

70%

MR&R

23%

New residential

construction

16%

Infrastructure

5%

New non-

residential

construction

56%

Atkore is geared to U.S. non-residential construction

11%

9%

8%

5%

4%

Source: Dodge Data & Analytics as of November 2016.

1 MR&R includes non-residential and residential markets.

4a

LTM Mar. 31, 2017 net sales

by end market

U.S. construction

1

Capitalize on attractive end-market growth dynamics

Non-residential construction remains

well below long-term average levels

Atkore to continue to benefit from

long-term secular trends:

‒ Digitization of buildings –

LED lighting and automation

‒ Data center growth

Near-term growth outlook

Overall non-residential:

4%

Medium to long-term growth outlook

Modest non-residential recovery

expected over next fiscal year

Upside from exposure to higher-

growth non-residential verticals

Sluggish industrial recovery

providing headwinds in first half of FY

’17

Benefitting from high-growth non-resi sub-sectors

(2016 – 2019 CAGR)

17

Grow market share with new and existing customers4b

A

ll

st

rate

g

ic

b

u

s

in

ess

u

n

it

s

E

lect

ri

c

a

l

R

ace

w

a

y

i

n

f

o

c

u

s

All customers

Large national

accounts

Regional and

smaller

independent

distributors

Segment by 13 SBUs

Incentivize each SBU General

Manager to serve and grow

with top customers

Provide each SBU with

necessary resourcesCo

n

st

a

n

t

im

p

ro

v

e

m

e

n

t

e

n

a

bl

e

d

b

y

A

B

S

Strategy Impact

Adjusted EBITDA growth

in 12 of 13 SBUs

in FY 2016

Disproportionately grow with

largest Electrical Distributors

that value our entire offering

One supplier across broad

product offering

Bundle rebates to drive

outcomes

Op

e

ra

tiona

l

s

upe

rior

it

y

–

q

u

a

lit

y,

d

e

liv

e

ry

,

a

v

a

ila

b

ilit

y

a

n

d

e

a

s

e

14% sales CAGR with

top 5 customers

from FY 2014 – FY 2016

24% increase in

Atkore Atvantage sales

from FY 2015 – FY 2016

Atkore Atvantage – penetrate

independents that value our

bundling and co-loading

Price and new products in

exchange for entire full product

portfolio

18

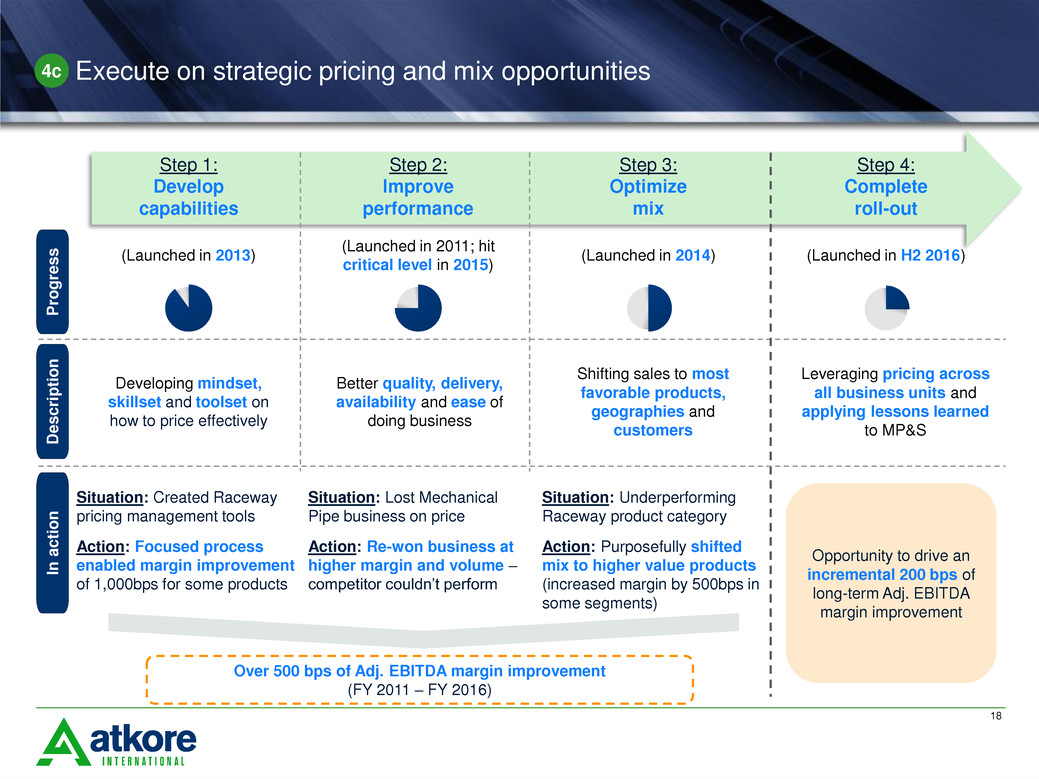

Execute on strategic pricing and mix opportunities 4c

Step 2:

Improve

performance

Step 1:

Develop

capabilities

Step 3:

Optimize

mix

Step 4:

Complete

roll-out

Developing mindset,

skillset and toolset on

how to price effectively

Better quality, delivery,

availability and ease of

doing business

Shifting sales to most

favorable products,

geographies and

customers

Leveraging pricing across

all business units and

applying lessons learned

to MP&S

P

rogr

e

s

s

De

s

c

riptio

n

(Launched in 2013)

(Launched in 2011; hit

critical level in 2015)

(Launched in 2014)

Situation: Underperforming

Raceway product category

Action: Purposefully shifted

mix to higher value products

(increased margin by 500bps in

some segments)

In

a

c

tio

n

Situation: Created Raceway

pricing management tools

Action: Focused process

enabled margin improvement

of 1,000bps for some products

Situation: Lost Mechanical

Pipe business on price

Action: Re-won business at

higher margin and volume –

competitor couldn’t perform

Over 500 bps of Adj. EBITDA margin improvement

(FY 2011 – FY 2016)

Opportunity to drive an

incremental 200 bps of

long-term Adj. EBITDA

margin improvement

(Launched in H2 2016)

19

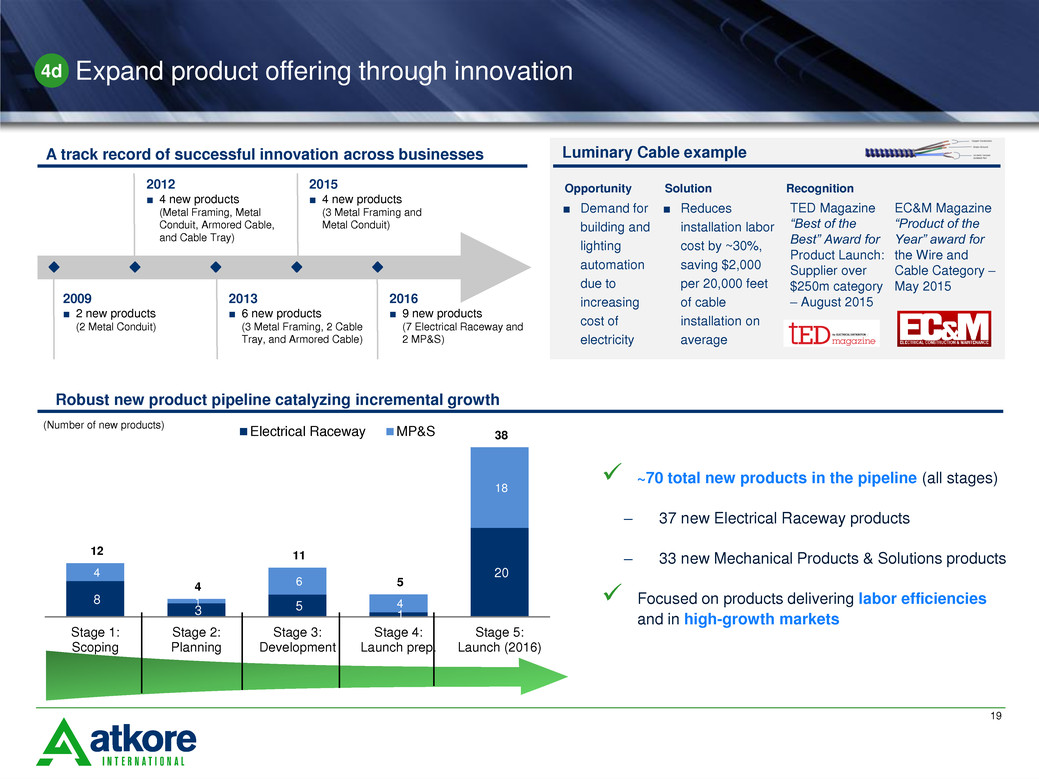

2016

■ 9 new products

(7 Electrical Raceway and

2 MP&S)

A track record of successful innovation across businesses Luminary Cable example

Opportunity RecognitionSolution

■ Demand for

building and

lighting

automation

due to

increasing

cost of

electricity

EC&M Magazine

“Product of the

Year” award for

the Wire and

Cable Category –

May 2015

TED Magazine

“Best of the

Best” Award for

Product Launch:

Supplier over

$250m category

– August 2015

■ Reduces

installation labor

cost by ~30%,

saving $2,000

per 20,000 feet

of cable

installation on

average

2009

■ 2 new products

(2 Metal Conduit)

2012

■ 4 new products

(Metal Framing, Metal

Conduit, Armored Cable,

and Cable Tray)

2013

■ 6 new products

(3 Metal Framing, 2 Cable

Tray, and Armored Cable)

2015

■ 4 new products

(3 Metal Framing and

Metal Conduit)

Expand product offering through innovation

Robust new product pipeline catalyzing incremental growth

~70 total new products in the pipeline (all stages)

‒ 37 new Electrical Raceway products

‒ 33 new Mechanical Products & Solutions products

Focused on products delivering labor efficiencies

and in high-growth markets

8

3 5 1

20 4

1

6

4

18

12

4

11

5

38

Stage 1:

Scoping

Stage 2:

Planning

Stage 3:

Development

Stage 4:

Launch prep.

Stage 5:

Launch (2016)

Electrical Raceway MP&S

(Number of new products)

4d

20

2011

2012

Pursue M&A to deliver incremental growth

■ Focused effort to build out our Raceway and MP&S

positions

- Strengthening our value proposition by continued

development of our existing portfolio

- Expanding into higher margin adjacencies

■ Leverage our manufacturing technology and capabilities

to expand into new markets

■ Leverage ABS, talent, culture & balance sheet

- Add a new platform

Market size

Current

Atkore

Presence

New

Category

Electrical and Flexible

Conduit

$4bn

Armored Cable

Electrical Fittings

Cable Management

Cable Accessories

$9bn

Electrical Enclosures

Raceway Tools

...with substantial market opportunitiesThree-pronged M&A strategy...

■ 8 acquisitions and 6 divestitures / closures completed

since 2011

■ Proven ability to integrate acquisitions

- Strong track record of identifying and realizing

meaningful synergies through seamless integration

■ Strong balance sheet with capacity for M&A

■ Substantial M&A pipeline

- More than 50 total opportunities (all stages)

Robust M&A capability...

4e

...developed through a history of successful acquisitions

2013

2014

Q3 2017

21

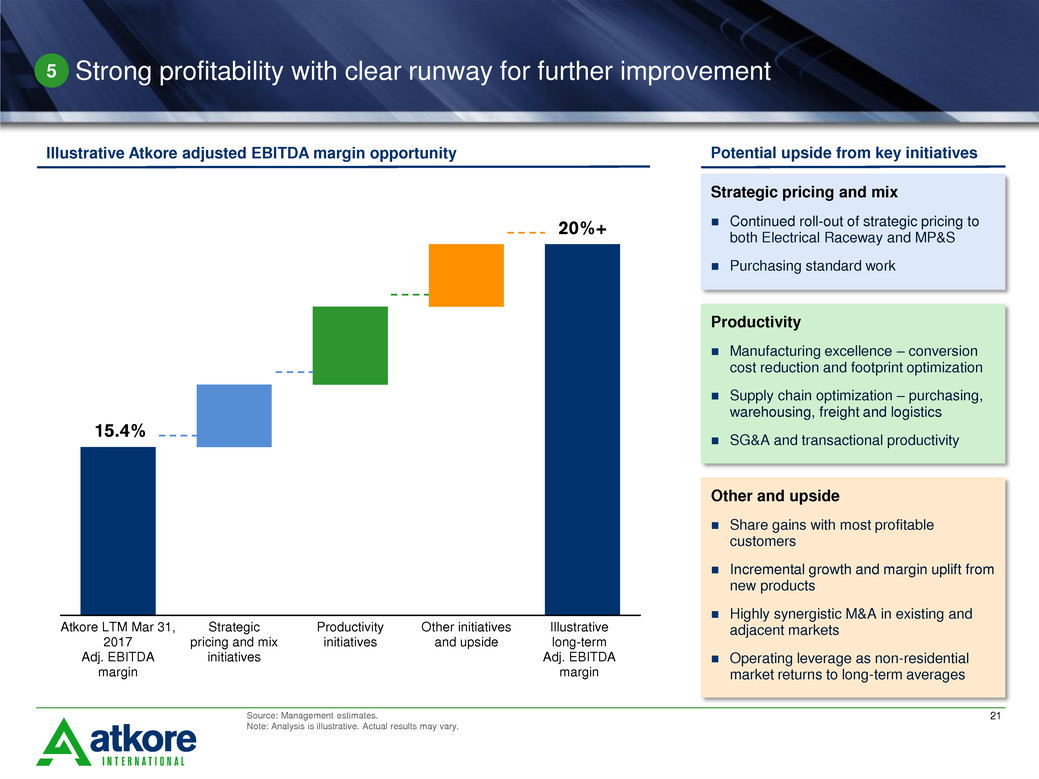

15.4%

20%+

Atkore LTM Mar 31,

2017

Adj. EBITDA

margin

Strategic

pricing and mix

initiatives

Productivity

initiatives

Other initiatives

and upside

Illustrative

long-term

Adj. EBITDA

margin

Strategic pricing and mix

Continued roll-out of strategic pricing to

both Electrical Raceway and MP&S

Purchasing standard work

Illustrative Atkore adjusted EBITDA margin opportunity Potential upside from key initiatives

Productivity

Manufacturing excellence – conversion

cost reduction and footprint optimization

Supply chain optimization – purchasing,

warehousing, freight and logistics

SG&A and transactional productivity

Other and upside

Share gains with most profitable

customers

Incremental growth and margin uplift from

new products

Highly synergistic M&A in existing and

adjacent markets

Operating leverage as non-residential

market returns to long-term averages

Source: Management estimates.

Note: Analysis is illustrative. Actual results may vary.

Strong profitability with clear runway for further improvement5

Financial overview

23

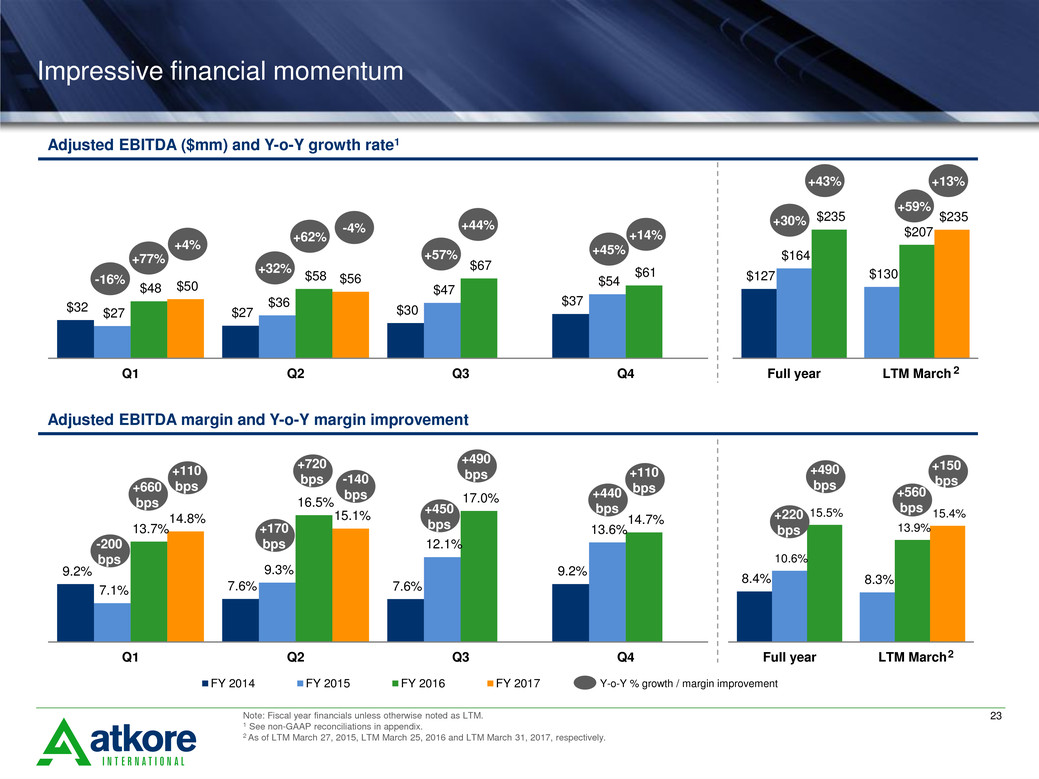

Impressive financial momentum

Adjusted EBITDA ($mm) and Y-o-Y growth rate1

$32 $27 $30

$37

$27

$36

$47

$54

$48

$58

$67

$61

$50

$56

Q1 Q2 Q3 Q4

-4%

Adjusted EBITDA margin and Y-o-Y margin improvement

9.2%

7.6% 7.6%

9.2%

7.1%

9.3%

12.1%

13.6% 13.7%

16.5% 17.0%

14.7% 14.8% 15.1%

Q1 Q2 Q3 Q4

FY 2014 FY 2015 FY 2016 FY 2017

-140

bps

Y-o-Y % growth / margin improvement

8.4% 8.3%

10.6%

13.9%

15.5% 15.4%

Full year LTM March

$127 $130

$164

$207

$235 $235

Full year LTM March

Note: Fiscal year financials unless otherwise noted as LTM.

1 See non-GAAP reconciliations in appendix.

2 As of LTM March 27, 2015, LTM March 25, 2016 and LTM March 31, 2017, respectively.

-16%

+77%

+4%

+32%

+62%

+57%

+44%

+45%

+14%

+30%

+43%

+59%

+13%

-200

bps

+660

bps

+110

bps

+170

bps

+720

bps

+450

bps

+490

bps

+440

bps

+110

bps

+220

bps

+490

bps

+560

bps

+150

bps

2

2

24

Key Market Influences by Segment Growth Outlook

Electrical

Raceway

(65% of FY 2016

Adjusted net sales)

Mechanical

Products &

Solutions

(35% of FY 2016

Adjusted net sales)

FY 2017

Healthcare

Industrial

Residential Construction

Sluggish

recovery

Low to Mid

Single Digit

New non-

residential

39%

Industrial (OEM)

16%

MR&R

16%

New residential

11%

Other

18%

LTM Mar. 31, 2017 net sales by end market

Outlook for Atkore’s key end markets

Non-Residential Construction

Offices

Commercial Stores

Education

Low single

digit

Less

exposure

More

exposure

1 MR&R includes non-residential and residential markets.

2 Based on 2016 – 2019 CAGR.

1

Represents a majority of Electrical Raceway and almost all of

our MP&S new non-residential exposure

High single

digit2

Manufacturing

25

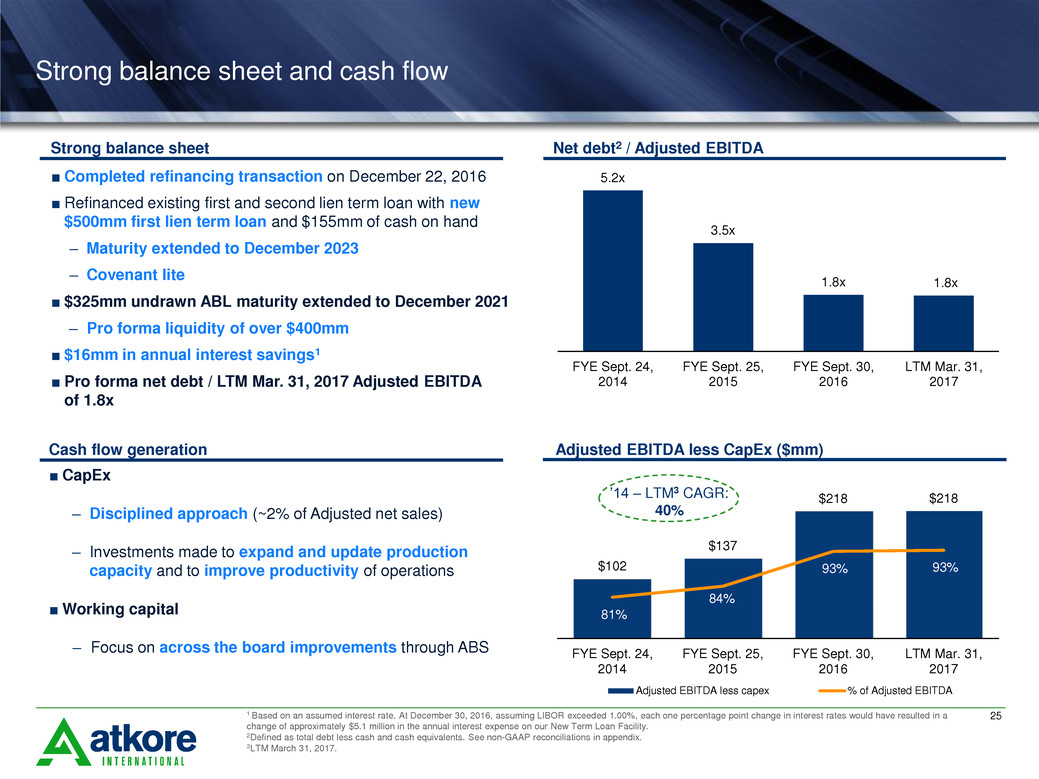

Strong balance sheet and cash flow

1 Based on an assumed interest rate. At December 30, 2016, assuming LIBOR exceeded 1.00%, each one percentage point change in interest rates would have resulted in a

change of approximately $5.1 million in the annual interest expense on our New Term Loan Facility.

2Defined as total debt less cash and cash equivalents. See non-GAAP reconciliations in appendix.

3LTM March 31, 2017.

$102

$137

$218 $218

81%

84%

93% 93%

FYE Sept. 24,

2014

FYE Sept. 25,

2015

FYE Sept. 30,

2016

LTM Mar. 31,

2017

Adjusted EBITDA less capex % of Adjusted EBITDA

Adjusted EBITDA less CapEx ($mm) Cash flow generation

■ CapEx

‒ Disciplined approach (~2% of Adjusted net sales)

‒ Investments made to expand and update production

capacity and to improve productivity of operations

■Working capital

‒ Focus on across the board improvements through ABS

Strong balance sheet

■ Completed refinancing transaction on December 22, 2016

■ Refinanced existing first and second lien term loan with new

$500mm first lien term loan and $155mm of cash on hand

‒ Maturity extended to December 2023

‒ Covenant lite

■ $325mm undrawn ABL maturity extended to December 2021

‒ Pro forma liquidity of over $400mm

■ $16mm in annual interest savings1

■ Pro forma net debt / LTM Mar. 31, 2017 Adjusted EBITDA

of 1.8x

5.2x

3.5x

1.8x 1.8x

FYE Sept. 24,

2014

FYE Sept. 25,

2015

FYE Sept. 30,

2016

LTM Mar. 31,

2017

Net debt2 / Adjusted EBITDA

’14 – LTM3 CAGR:

40%

Appendix

27

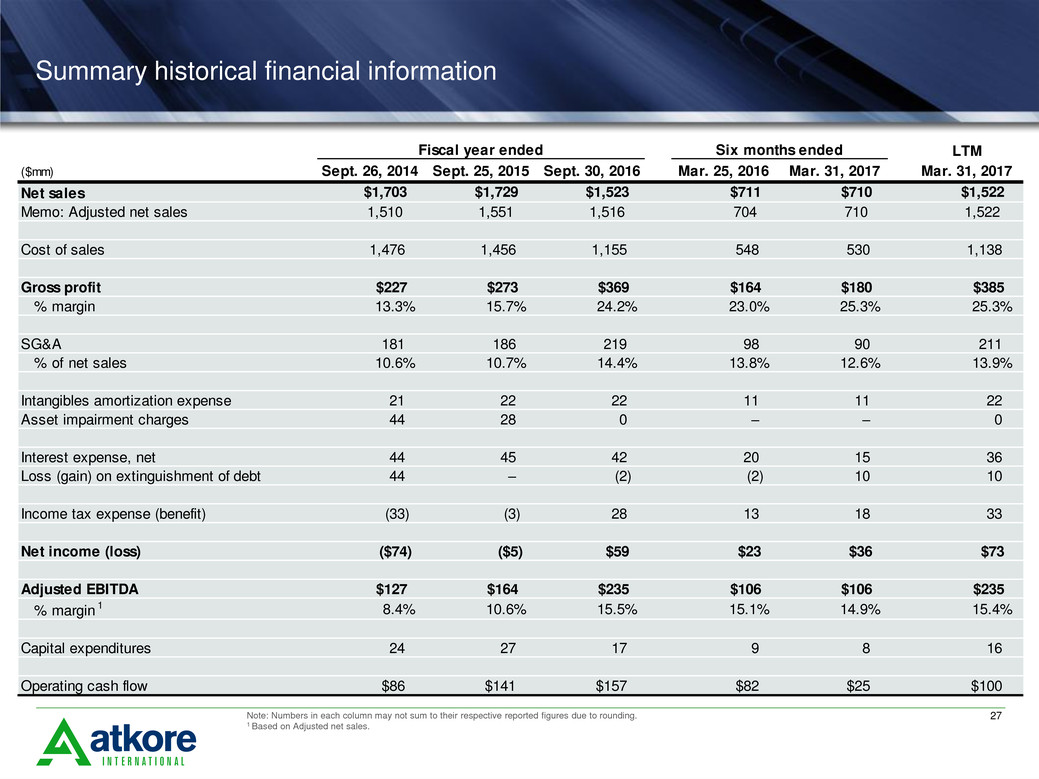

Summary historical financial information

Note: Numbers in each column may not sum to their respective reported figures due to rounding.

1 Based on Adjusted net sales.

Fiscal year ended Six months ended LTM

($mm) Sept. 26, 2014 Sept. 25, 2015 Sept. 30, 2016 Mar. 25, 2016 Mar. 31, 2017 Mar. 31, 2017

Net sales $1,703 $1,729 $1,523 $711 $710 $1,522

Memo: Adjusted net sales 1,510 1,551 1,516 704 710 1,522

Cost of sales 1,476 1,456 1,155 548 530 1,138

Gross profit $227 $273 $369 $164 $180 $385

% margin 13.3% 15.7% 24.2% 23.0% 25.3% 25.3%

SG&A 181 186 219 98 90 211

% of net sales 10.6% 10.7% 14.4% 13.8% 12.6% 13.9%

Intangibles amortization expense 21 22 22 11 11 22

Asset impairment charges 44 28 0 – – 0

Interest expense, net 44 45 42 20 15 36

Loss (gain) on extinguishment of debt 44 – (2) (2) 10 10

Income tax expense (benefit) (33) (3) 28 13 18 33

Net income (loss) ($74) ($5) $59 $23 $36 $73

Adjusted EBITDA $127 $164 $235 $106 $106 $235

% margin 1 8.4% 10.6% 15.5% 15.1% 14.9% 15.4%

Capital expenditures 24 27 17 9 8 16

Operating cash flow $86 $141 $157 $82 $25 $100

28

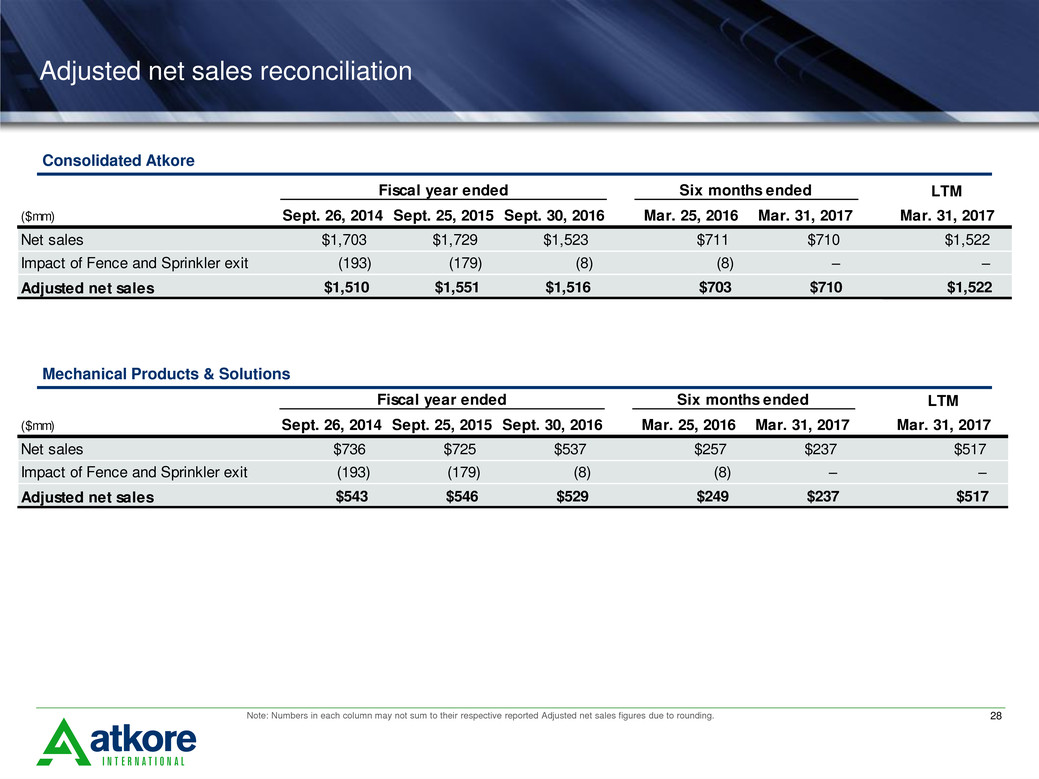

Adjusted net sales reconciliation

Note: Numbers in each column may not sum to their respective reported Adjusted net sales figures due to rounding.

Consolidated Atkore

Fiscal year ended Six months ended LTM

($mm) Sept. 26, 2014 Sept. 25, 2015 Sept. 30, 2016 Mar. 25, 2016 Mar. 31, 2017 Mar. 31, 2017

Net sales $1,703 $1,729 $1,523 $711 $710 $1,522

Impact of Fence and Sprinkler exit (193) (179) (8) (8) – –

Adjusted net sales $1,510 $1,551 $1,516 $703 $710 $1,522

Mechanical Products & Solutions

Fiscal year ended Six months ended LTM

($mm) Sept. 26, 2014 Sept. 25, 2015 Sept. 30, 2016 Mar. 25, 2016 Mar. 31, 2017 Mar. 31, 2017

Net sales $736 $725 $537 $257 $237 $517

Impact of Fence and Sprinkler exit (193) (179) (8) (8) – –

Adjusted net sales $543 $546 $529 $249 $237 $517

29

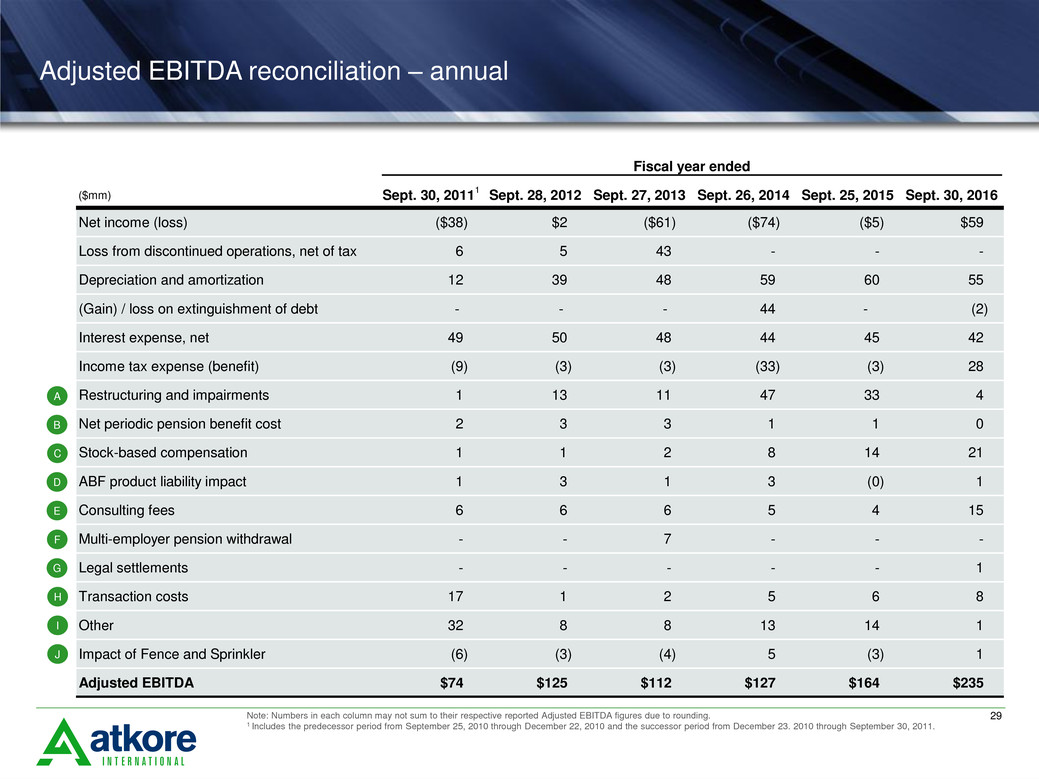

Adjusted EBITDA reconciliation – annual

A

B

C

D

E

F

G

H

Note: Numbers in each column may not sum to their respective reported Adjusted EBITDA figures due to rounding.

1 Includes the predecessor period from September 25, 2010 through December 22, 2010 and the successor period from December 23. 2010 through September 30, 2011.

J

I

Fiscal year ended

($mm) Sept. 30, 2011

1

Sept. 28, 2012 Sept. 27, 2013 Sept. 26, 2014 Sept. 25, 2015 Sept. 30, 2016

Net income (loss) ($38) $2 ($61) ($74) ($5) $59

Loss from discontinued operations, net of tax 6 5 43 - - -

Depreciation and amortization 12 39 48 59 60 55

(Gain) / loss on extinguishment of debt - - - 44 - (2)

Interest expense, net 49 50 48 44 45 42

Income tax expense (benefit) (9) (3) (3) (33) (3) 28

Restructuring and impairments 1 13 11 47 33 4

Net periodic pension benefit cost 2 3 3 1 1 0

Stock-based compensation 1 1 2 8 14 21

ABF product liability impact 1 3 1 3 (0) 1

Consulting fees 6 6 6 5 4 15

Multi-employer pension withdrawal - - 7 - - -

Legal settlements - - - - - 1

Transaction costs 17 1 2 5 6 8

Other 32 8 8 13 14 1

Impact of Fence and Sprinkler (6) (3) (4) 5 (3) 1

Adjusted EBITDA $74 $125 $112 $127 $164 $235

30

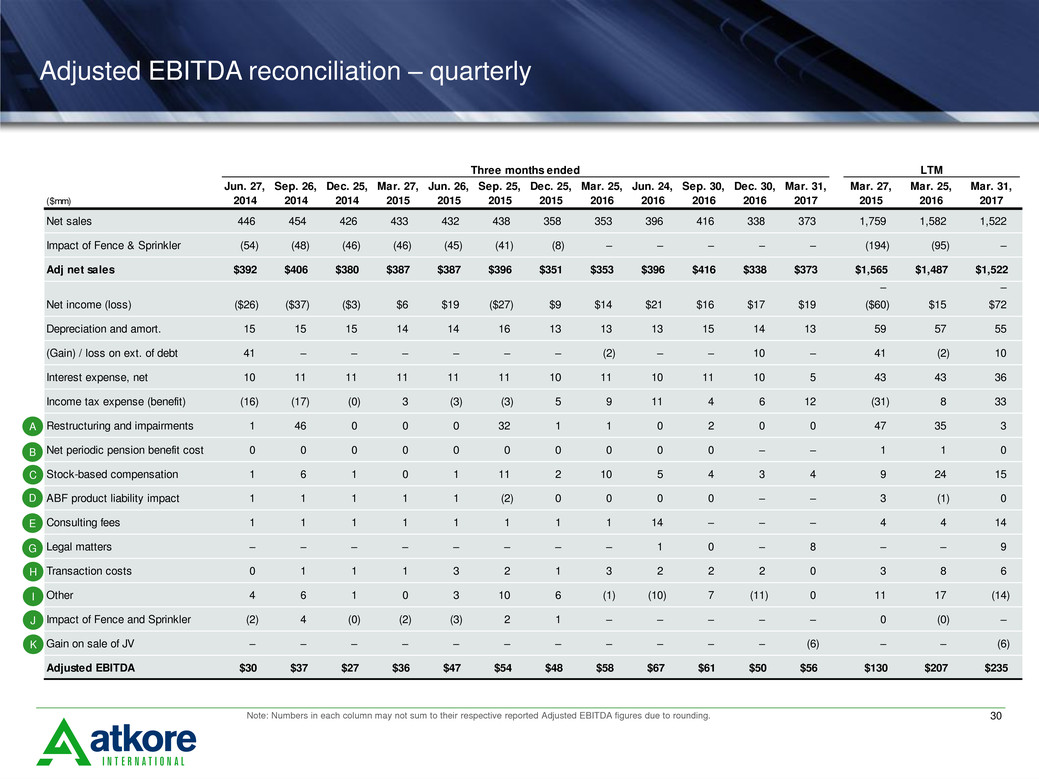

Adjusted EBITDA reconciliation – quarterly

Note: Numbers in each column may not sum to their respective reported Adjusted EBITDA figures due to rounding.

A

B

C

D

E

G

H

J

I

Three months ended LTM

($mm)

Jun. 27,

2014

Sep. 26,

2014

Dec. 25,

2014

Mar. 27,

2015

Jun. 26,

2015

Sep. 25,

2015

Dec. 25,

2015

Mar. 25,

2016

Jun. 24,

2016

Sep. 30,

2016

Dec. 30,

2016

Mar. 31,

2017

Mar. 27,

2015

Mar. 25,

2016

Mar. 31,

2017

Net sales 446 454 426 433 432 438 358 353 396 416 338 373 1,759 1,582 1,522

Impact of Fence & Sprinkler (54) (48) (46) (46) (45) (41) (8) – – – – – (194) (95) –

Adj net sales $392 $406 $380 $387 $387 $396 $351 $353 $396 $416 $338 $373 $1,565 $1,487 $1,522

– –

Net income (loss) ($26) ($37) ($3) $6 $19 ($27) $9 $14 $21 $16 $17 $19 ($60) $15 $72

Depreciation and amort. 15 15 15 14 14 16 13 13 13 15 14 13 59 57 55

(Gain) / loss on ext. of debt 41 – – – – – – (2) – – 10 – 41 (2) 10

Interest expense, net 10 11 11 11 11 11 10 11 10 11 10 5 43 43 36

Income tax expense (benefit) (16) (17) (0) 3 (3) (3) 5 9 11 4 6 12 (31) 8 33

Restructuring and impairments 1 46 0 0 0 32 1 1 0 2 0 0 47 35 3

Net periodic pension benefit cost 0 0 0 0 0 0 0 0 0 0 – – 1 1 0

Stock-based compensation 1 6 1 0 1 11 2 10 5 4 3 4 9 24 15

ABF product liability impact 1 1 1 1 1 (2) 0 0 0 0 – – 3 (1) 0

Consulting fees 1 1 1 1 1 1 1 1 14 – – – 4 4 14

Legal matters – – – – – – – – 1 0 – 8 – – 9

Transaction costs 0 1 1 1 3 2 1 3 2 2 2 0 3 8 6

Other 4 6 1 0 3 10 6 (1) (10) 7 (11) 0 11 17 (14)

Impact of Fence and Sprinkler (2) 4 (0) (2) (3) 2 1 – – – – – 0 (0) –

Gain on sale of JV – – – – – – – – – – – (6) – – (6)

Adjusted EBITDA $30 $37 $27 $36 $47 $54 $48 $58 $67 $61 $50 $56 $130 $207 $235

K

31

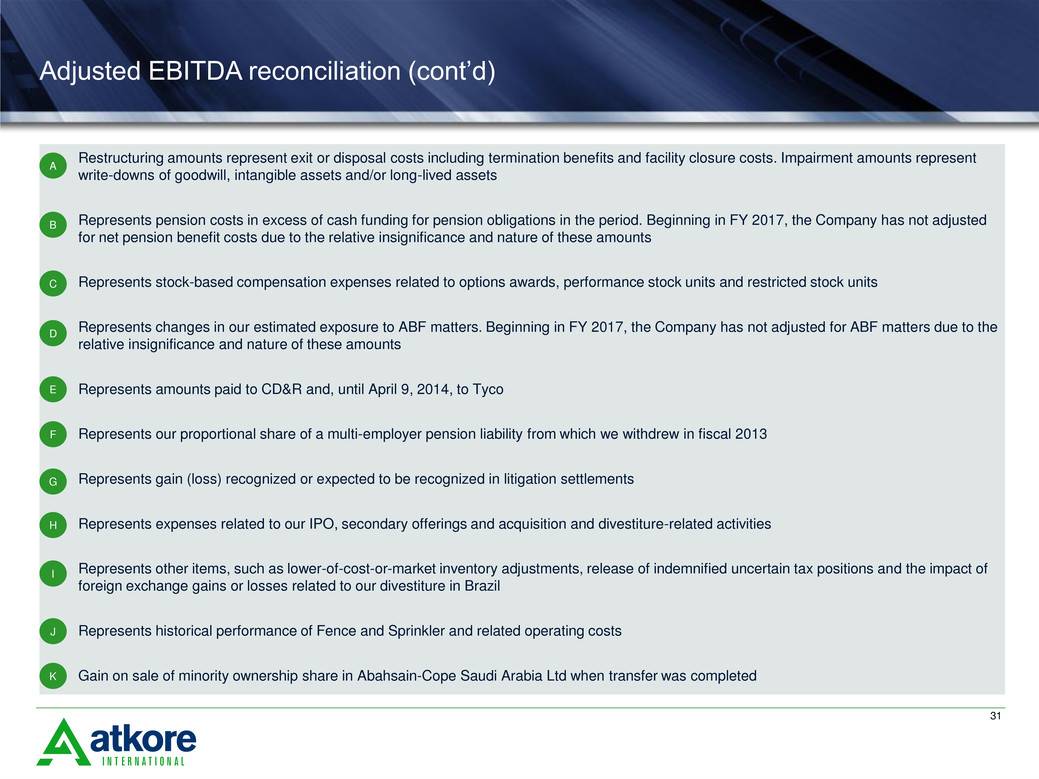

Adjusted EBITDA reconciliation (cont’d)

Restructuring amounts represent exit or disposal costs including termination benefits and facility closure costs. Impairment amounts represent

write-downs of goodwill, intangible assets and/or long-lived assets

Represents pension costs in excess of cash funding for pension obligations in the period. Beginning in FY 2017, the Company has not adjusted

for net pension benefit costs due to the relative insignificance and nature of these amounts

Represents stock-based compensation expenses related to options awards, performance stock units and restricted stock units

Represents changes in our estimated exposure to ABF matters. Beginning in FY 2017, the Company has not adjusted for ABF matters due to the

relative insignificance and nature of these amounts

Represents amounts paid to CD&R and, until April 9, 2014, to Tyco

Represents our proportional share of a multi-employer pension liability from which we withdrew in fiscal 2013

Represents gain (loss) recognized or expected to be recognized in litigation settlements

Represents expenses related to our IPO, secondary offerings and acquisition and divestiture-related activities

Represents other items, such as lower-of-cost-or-market inventory adjustments, release of indemnified uncertain tax positions and the impact of

foreign exchange gains or losses related to our divestiture in Brazil

Represents historical performance of Fence and Sprinkler and related operating costs

Gain on sale of minority ownership share in Abahsain-Cope Saudi Arabia Ltd when transfer was completed

A

B

C

D

E

F

G

H

I

J

K

32

Segment information

Fiscal year ended

September 30, 2016 September 25, 2015

($mm) Net sales

Impact of

Fence &

Sprinkler

exit

Adjusted

net sales

Adjusted

EBITDA

Adjusted

EBITDA

margin Net sales

Impact of

Fence &

Sprinkler

exit

Adjusted

net sales

Adjusted

EBITDA

Adjusted

EBITDA

margin

Electrical Raceway $988 – $988 $175 17.7% $1,006 – $1,006 $107 10.6%

Mechanical Products & Solutions 537 (8) 529 89 16.7% 725 (179) 546 80 14.6%

Eliminations (2) – (2) (1) – (1)

Consolidated operations $1,523 ($8) $1,516 $1,729 ($179) $1,551

Six months ended

March 31, 2017 March 25, 2016

($mm) Net sales

Adjusted

EBITDA

Adjusted

EBITDA

margin Net sales

Impact of

Fence &

Sprinkler

exit

Adjusted

net sales

Adjusted

EBITDA

Adjusted

EBITDA

margin

Electrical Raceway $474 $85 18.0% $455 – $455 $77 16.9%

Mechanical Products & Solutions 237 35 14.7% 258 (8) 250 42 16.6%

Eliminations (1) (1) – (1)

Consolidated operations $710 $711 ($8) $704

33

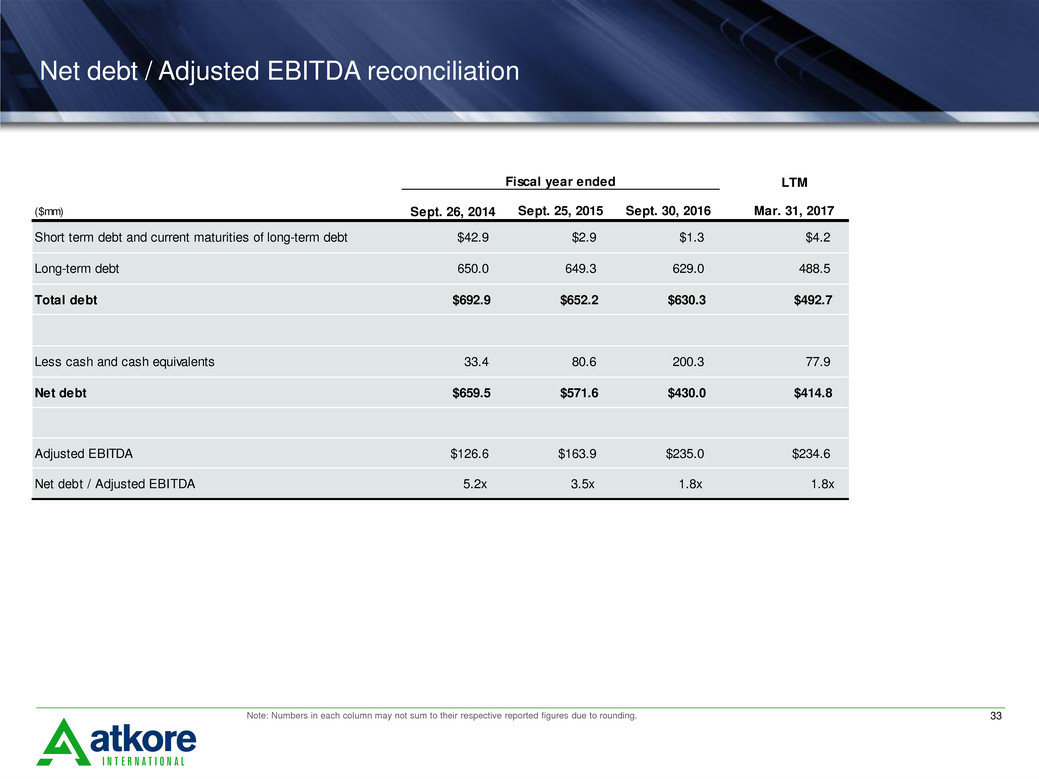

Net debt / Adjusted EBITDA reconciliation

Fiscal year ended LTM

($mm) Sept. 26, 2014 Sept. 25, 2015 Sept. 30, 2016 Mar. 31, 2017

Short term debt and current maturities of long-term debt $42.9 $2.9 $1.3 $4.2

Long-term debt 650.0 649.3 629.0 488.5

Total debt $692.9 $652.2 $630.3 $492.7

Less cash and cash equivalents 33.4 80.6 200.3 77.9

Net debt $659.5 $571.6 $430.0 $414.8

Adjusted EBITDA $126.6 $163.9 $235.0 $234.6

Net debt / Adjusted EBITDA 5.2x 3.5x 1.8x 1.8x

Note: Numbers in each column may not sum to their respective reported figures due to rounding.