Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Cornerstone Building Brands, Inc. | ncs201706068-k.htm |

| EX-99.1 - EXHIBIT 99.1 - Cornerstone Building Brands, Inc. | q22017exhibit991.htm |

Our Mission & Vision

Q2 2017 Supplemental

Presentation

June 6, 2017

Our Mission & Vision

Forward-looking Statements

2

Certain statements and information in this presentation may constitute forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. The words “believe,” “anticipate,” “plan,” “intend,” “foresee,” “guidance,” “potential,”

“expect,” “should,” “will” “continue,” “could,” “estimate,” “forecast,” “goal,” “may,” “objective,” “predict,” “projection,” or similar

expressions are intended to identify forward-looking statements (including those contained in certain visual depictions) in this

presentation. These forward-looking statements reflect the Company's current expectations and/or beliefs concerning future events.

The Company believes the information, estimates, forecasts and assumptions on which these statements are based are current,

reasonable and complete. Our expectations with respect to the third and fourth quarter of fiscal 2017 and the full year fiscal 2017

that are contained in this presentation are forward looking statements based on management’s best estimates, as of the date of this

presentation. These estimates are unaudited, and reflect management’s current views with respect to future results. However, the

forward-looking statements in this presentation are subject to a number of risks and uncertainties that may cause the Company's

actual performance to differ materially from that projected in such statements. Among the factors that could cause actual results to

differ materially include, but are not limited to, industry cyclicality and seasonality and adverse weather conditions; challenging

economic conditions affecting the nonresidential construction industry; volatility in the U.S. economy and abroad, generally, and in

the credit markets; substantial indebtedness and our ability to incur substantially more indebtedness; our ability to generate

significant cash flow required to service or refinance our existing debt, including the 8.25% senior notes due 2023, and obtain future

financing; our ability to comply with the financial tests and covenants in our existing and future debt obligations; operational

limitations or restrictions in connection with our debt; increases in interest rates; recognition of asset impairment charges;

commodity price increases and/or limited availability of raw materials, including steel; interruptions in our supply chain; our ability to

make strategic acquisitions accretive to earnings; retention and replacement of key personnel; our ability to carry out our

restructuring plans and to fully realize the expected cost savings; enforcement and obsolescence of intellectual property rights;

fluctuations in customer demand; costs related to environmental clean-ups and liabilities; competitive activity and pricing pressure;

increases in energy prices; volatility of the Company's stock price; dilutive effect on the Company's common stockholders of potential

future sales of the Company's common stock held by our sponsor; substantial governance and other rights held by our sponsor;

breaches of our information system security measures and damage to our major information management systems; hazards that may

cause personal injury or property damage, thereby subjecting us to liabilities and possible losses, which may not be covered by

insurance; changes in laws or regulations, including the Dodd–Frank Act; the timing and amount of our stock repurchases; and costs

and other effects of legal and administrative proceedings, settlements, investigations, claims and other matters. See also the “Risk

Factors” in the Company's Annual Report on Form 10-K for the fiscal year ended October 30, 2016, which identifies other important

factors, though not necessarily all such factors, that could cause future outcomes to differ materially from those set forth in the

forward-looking statements. The Company expressly disclaims any obligation to release publicly any updates or revisions to these

forward-looking statements, whether as a result of new information, future events, or otherwise.

Our Mission & Vision

2Q 2017 Financial Overview (Page 1 of 2)

3

Sales were $420.5 million, an increase of $48.2 million or 13.0% from $372.2 million a

year ago

• Revenues for the quarter benefited from tonnage volume increases, particularly in the

Buildings and Components segments, and commercial pricing discipline in the pass-through

of higher costs in a rising steel price environment

Gross profit margins for the period and the comparable prior year period were each

24.0%. In the second quarter 2017, margins were affected by the following:

• 230 basis points improvement was from the overall product mix changes particularly in IMP

where sales of higher margin architectural panels increased during the period and company-

wide manufacturing efficiency improvements

• 200 basis points impact from rising steel input costs, compared to declining costs in 2Q 2016

Operating income was $32.5 million up from $10.6 million and Adjusted Operating

Income was $23.6 million up from $11.4 million in the respective prior year periods

Net income increased to $16.9 million, or $0.24 per diluted common share this quarter

compared to $2.4 million, or $0.03 per diluted common share in the prior year period.

On an adjusted basis, diluted earnings were $0.16 per share this quarter compared to

$0.04 in the prior year period

(1) Reconciliations of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 16

Our Mission & Vision

4

2Q 2017 Financial Overview (Page 2 of 2)

Adjusted EBITDA1 was $37.0 million compared to $25.5 million in the prior year

period

Consolidated backlog grew 3.2% year-over-year to $552.3 million

On May 2, 2017, the Company amended and extended its Existing Term Loan

Facility. Benefits to NCI included the extension of the final maturity to June 24,

2022 and a 25 basis point reduction in the interest rate margin on LIBOR

borrowings from 3.25% to 3.00% (LIBOR, not less than 1.00%.)

(1) Reconciliations of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 16

Our Mission & Vision

5

Manufacturing

• In connection with its manufacturing cost rationalization plans, the Company completed

the consolidation of a small plant in the Eastern U.S. into an existing facility

Commercial

• Backlog in the Buildings segment at the end of the quarter increased 9.0% to $368.8

million, resulting in the highest April backlog since 2008

• The Buildings and Components legacy distribution channels continue to expand their

product offerings, leveraging products from the other business lines and recognizing the

following revenue growth

• IMP sales increased 81% year-over-year

• Door sales increased 84% year-over-year

Steel Costs

• Steel costs continue to be elevated by trade cases and the current regulatory environment

2Q 2017 Operational Overview

Our Mission & Vision

Steel Price Movements 2015 – 2017

6

[VALUE]

[VALUE]

113.3

173.8

145.0

180.6

100

110

120

130

140

150

160

170

180

190

Nov-14 Feb-15 May-15 Aug-15 Nov-15 Feb-16 May-16 Aug-16 Nov-16 Feb-17

CRU Steel Price Index North America

CRU

FY 2015 FY 2016 YTD 2017

Apr-17

Source: CRU Group

The graph above shows the monthly CRU Index data for the North American Steel Price Index. The

CRU North American Steel Price Index has been published by the CRU Group since 1994 and the

Company believes this index appropriately depicts the volatility it has experienced in steel prices. The

index is based on a CRU survey of industry participants of purchases for forward delivery, according to

mill lead time, which will vary. For example, the January index would likely approximate the Company’s

fiscal March steel purchase deliveries based on current lead-times and be representative of the steel

costs that would be recognize in April. The volatility in this steel price index is comparable to the

volatility the Company experiences in its average cost of steel.

Our Mission & Vision

2Q 2017 Financial Summary

7 (1) Reconciliations of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 16

(Dollars in millions, except per share amounts)

April 30,

2017

May 1,

2016 % Chg.

April 30,

2017

May 1,

2016 % Chg.

Sales 420.5$ 372.2$ 13.0% 812.2$ 742.3$ 9.4%

Gross Profit 100.8$ 89.4$ 12.8% 184.8$ 179.1$ 3.2%

Gross Profit Margin 24.0% 24.0% 0.0% 22.8% 24.1% -5.7%

Income from Operations 32.5$ 10.6$ 206.5% 42.4$ 25.9$ 63.8%

Net Income 17.0$ 2.4$ 601.4% 19.0$ 8.3$ 128.7%

Diluted EPS 0.24$ 0.03$ 629.8% 0.27$ 0.11$ 140.5%

Adjusted Operating Income

1

23.6$ 11.4$ 107.4% 36.1$ 28.1$ 28.5%

Adjusted EBITDA

1

37.0$ 25.5$ 45.2% 63.1$ 54.6$ 15.7%

Adjusted Diluted EPS

1

0.16$ 0.04$ 300.0% 0.21$ 0.11$ 90.9%

Fiscal Three Months Ended Six Months Ended

Our Mission & Vision

8

2Q 2017 Revenues and Volumes – by Segment

2Q-'17 2Q-'16 % Chg.

% Vol.

Chg.

1

2Q-'17 2Q-'16 % Chg.

% Vol.

Chg.

1

2Q-'17 2Q-'16 % Chg.

% Vol.

Chg.

1

Third-Party 26.4$ 26.1$ 1.1% -6.0% Third-Party 239.6$ 211.7$ 13.2% 1.3% Third-Party 154.5$ 134.5$ 14.9% 13.6%

Internal 36.9 29.0 27.0% 14.3% Internal 31.0 23.0 35.1% 30.8% Internal 8.2 3.6 128.9% 118.8%

Total Sales 63.3$ 55.1$ 14.8% 3.5% Total Sales 270.6$ 234.6$ 15.3% 4.8% Total Sales 162.6$ 138.0$ 17.8% 17.9%

Metal Coil Coating Metal Components Engineered Building Systems

$-

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

2Q-'17 2Q-'16

Metal Coil Coating

Third-Party Internal

$-

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

2Q-'17 2Q-'16

Metal Components

Third-Party Internal

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

2Q-'17 2Q-'16

Engineered Building Systems

Third-Party Internal

Metal Coil

Coating

6%

Metal

Components

57%

Consolidated 3rd Party Revenue

2Q 2017

Metal Coil

Coating

7%

Metal

Components

57%

Consolidated 3rd Party Revenue

2Q 2016

(Dollars in millions)

Engineered Building

Systems

37%

Engineered Building

Systems

36%

(1) Calculated as the year-over-year change in the tonnage volumes shipped

Our Mission & Vision

2Q 2017 Business Segment Results1

9

(Dollars in millions)

$26.4

$239.6

$154.5

$420.5

$26.1

$211.7

$134.5

$372.2

Coatings Components Buildings Consolidated

(1) Consolidated segments results do not include intersegment sales

(2) Reconciliation of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 16

Revenue

$5.5

$40.1

$6.9

$32.5

$4.7

$17.8

$7.2

$10.6

Coatings Components Buildings Consolidated

Operating Income

Adjusted Operating Income2

$6.7

$37.6

$9.4

$37.0

$5.9

$24.9

$9.8

$25.5

Coatings Components Buildings Consolidated

2017

2016

Adjusted EBITDA2

$5.5

$30.8

$7.2

$23.6

$4.7

$18.5

$6.4

$11.4

Coatings Components Buildings Consolidated

Our Mission & Vision

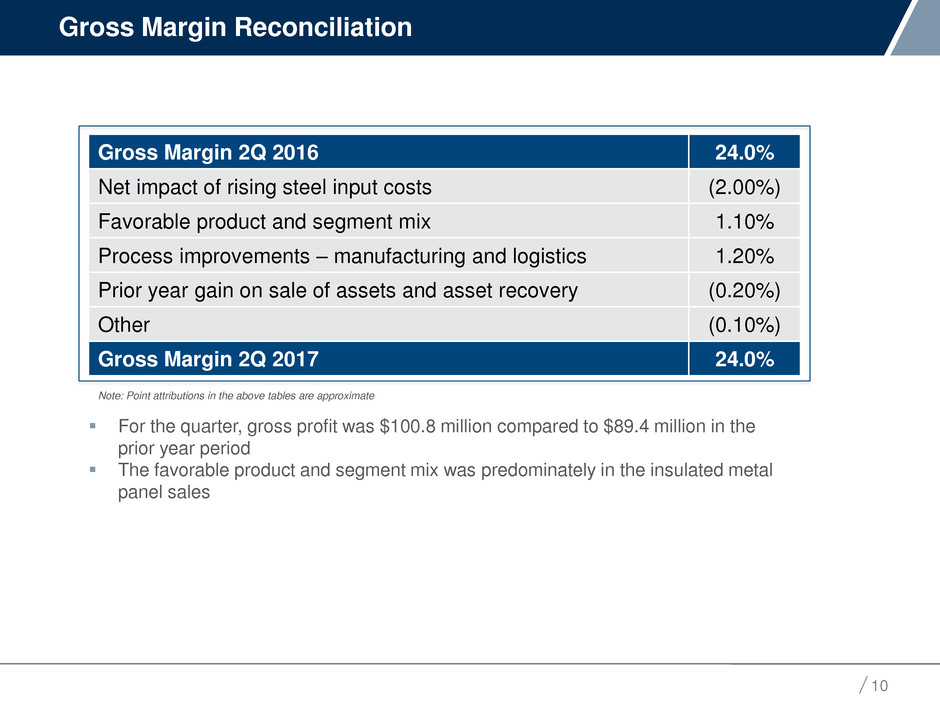

Gross Margin Reconciliation

10

Gross Margin 2Q 2016 24.0%

Net impact of rising steel input costs (2.00%)

Favorable product and segment mix 1.10%

Process improvements – manufacturing and logistics 1.20%

Prior year gain on sale of assets and asset recovery (0.20%)

Other (0.10%)

Gross Margin 2Q 2017 24.0%

For the quarter, gross profit was $100.8 million compared to $89.4 million in the

prior year period

The favorable product and segment mix was predominately in the insulated metal

panel sales

Note: Point attributions in the above tables are approximate

Our Mission & Vision

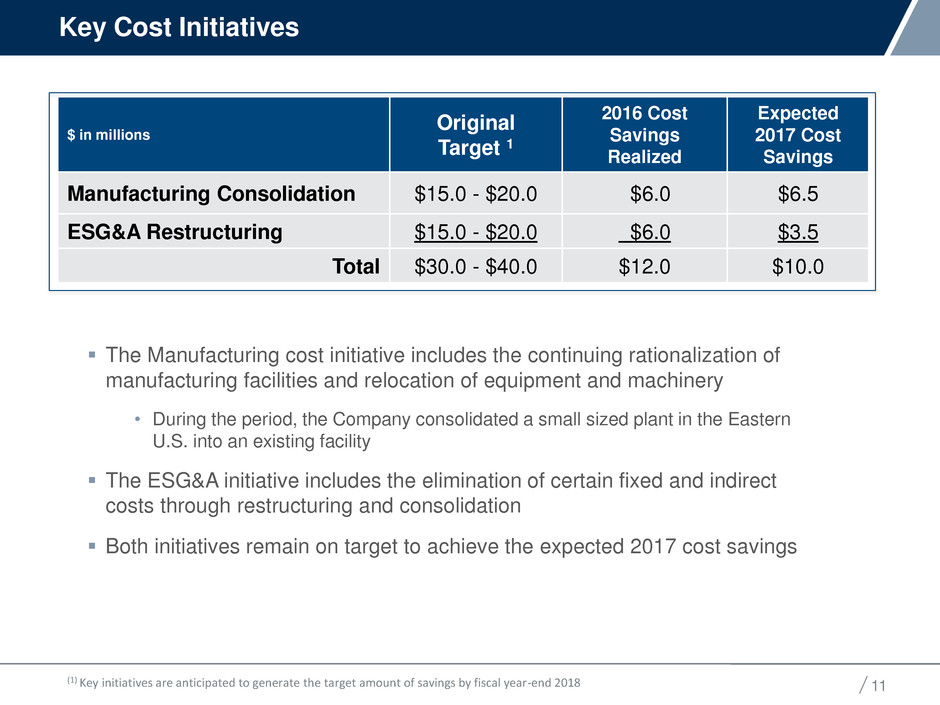

Key Cost Initiatives

11

$ in millions

Original

Target 1

2016 Cost

Savings

Realized

Expected

2017 Cost

Savings

Manufacturing Consolidation $15.0 - $20.0 $6.0 $6.5

ESG&A Restructuring $15.0 - $20.0 $6.0 $3.5

Total $30.0 - $40.0 $12.0 $10.0

The Manufacturing cost initiative includes the continuing rationalization of

manufacturing facilities and relocation of equipment and machinery

• During the period, the Company consolidated a small sized plant in the Eastern

U.S. into an existing facility

The ESG&A initiative includes the elimination of certain fixed and indirect

costs through restructuring and consolidation

Both initiatives remain on target to achieve the expected 2017 cost savings

(1) Key initiatives are anticipated to generate the target amount of savings by fiscal year-end 2018

Our Mission & Vision

12

Net Income:

Net income increased to $17.0 million in 2Q from $2.4 million in the prior year’s second quarter

Adjusted EBITDA1:

(Dollars in millions)

2Q Net Income and Adjusted EBITDA

(1) Reconciliations of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 16

$25.5

$37.0

$2.1

$4.5

$5.9

$(1.0)

$-

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

Adjusted EBITDA 2Q

2016

Volume ESG&A Cost Reductions Product Mix and Margin

Expansion

Other Adjusted EBITDA 2Q

2017

Our Mission & Vision

2Q 2017 Cash Flow Summary

13

Cash and Restricted Cash, as of 2Q 2017 1Q 2017 4Q 2016 3Q 2016

Beginning balance $ 15,789 $ 65,403 $ 50,710 $ 77,916

Cash provided by (used in) operating activities 38,254 (31,878) 28,169 20,586

Cash (provide by) used in investing activities (4,483) (4,120) 4,054 (4,044)

Cash used in financing activities 271 (13,702) (17,254) (43,547)

Exchange rate effects (149) 86 (276) (201)

Ending balance $ 49,682 $ 15,789 $ 65,403 $ 50,710

Refinancing

• On May 2, 2017, the Company amended and extended its Existing Term Loan Facility. Benefits

to NCI included the extension of the final maturity by three years to June 24, 2022 and 25 basis

point reduction in the interest rate margin on LIBOR borrowings from 3.25% to 3.00% (LIBOR,

not less than 1.00%)

• As part of the refinancing, the Company agreed to a prepayment premium for a six month

period. As a result of the timing of the refinancing and the prepayment penalty, the Company

plans to delay any repayments of the Term Loan Facility until fiscal 2018

Stock Repurchase

• During the quarter, the Company did not have any stock repurchase activity. As of the end of

the quarter $39.9 million remains available for stock repurchases under the September 2016

program

(Dollars in thousands)

Our Mission & Vision

2Q 2017 Results Compared to Guidance

14

$ in Millions

Range

Low High 2Q Actuals

Revenues $400.0 $425.0 $420.5

Gross Profit Margin 22.5% 24.5% 24.0%

ESG&A Expenses $72.5 $76.5 $75.1

Intangible Asset Amortization $2.3 $2.5 $2.4

Total Depreciation & Amortization

(inclusive of Intangibles above)

$10.0 $11.0 $10.1

Interest Expense $7.2 $7.5 $7.5

Effective Tax Rate 36.0% 38.0% 34.2%

Revenues increased with sales in higher margin products in IMP and the strength of the

legacy Components segment

Gross profit margins were toward the higher end of the range as a result of the mix and

volume in the IMP products and the legacy Components segment

The effective tax rate was favorably affected by intercompany foreign currency gains/losses

and the utilization of the China tax asset valuation allowance

Our Mission & Vision

3Q, 4Q and FY 2017 Guidance

15

$ in million

3Q Range

Low High

Revenues $480.0 $505.0

Gross Profit Margin 24.00% 26.25%

ESG&A Expenses $79.0 $83.0

Intangible Asset Amortization $2.3 $2.5

Total Depreciation & Amortization

(inclusive of Intangible Asset Amortization above)

$10.0 $11.0

Interest Expense $7.0 $7.4

Effective Tax Rate 34.00% 37.00%

Adjusted EBITDA $48.0 $58.0

On a year-over-year basis, revenues are expected to grow approximately 6.8% to 11.0% during the third quarter

based on current backlog and order rates

Guidance for ESG&A excludes the amortization of intangible assets, which is shown as a separate line item above

Total Depreciation & Amortization includes the intangible amortization and is reported on the Company’s Statements

of Operations within Cost of Goods Sold, ESG&A Expense and Intangible Asset Amortization

Weighted average diluted common shares is expected to be 71.1 million for 3Q 2017

Total capital expenditures for fiscal 2017 are expected to be in the range of $25.0 million to $30.0 million

For the 4Q, revenues are expected to be in the range of $510 - $545 million and Adjusted EBITDA in the range of

$69 – $79 million

Full year 2017 guidance is expected to reflect the normal quarterly patterns with the second half of fiscal 2017

expected to be stronger than the first half. Revenues are expected to be in the range of $1.80 - $1.86 billion and

Adjusted EBITDA is expected to be in the range of $180 - $200 million

Our Mission & Vision

Reconciliation of Net Income (Loss) and Adjusted Net Income (Loss) per

Diluted Common Share

16

(Dollars in thousands, except per share amounts)

April 30, May 1, April 30, May 1,

2017 2016 2017 2016

Net income per diluted common share, GAAP basis 0.24$ 0.03$ 0.86$ 0.46$

Restructuring and impairment charges 0.00 0.02 0.06 0.15

Strategic development and acquisition related costs 0.00 0.01 0.03 0.04

(Gain) on sale of assets 0.00 (0.01) 0.00 (0.02)

(Gain) on insurance recovery (0.13) - (0.13) -

Unreimbursed business interruption costs 0.00 - - -

(Gain) from bargain purchase - - - (0.03)

(Gain) on legal settlements - - - (0.05)

Fair value adjustment of acquired inventory - - - 0.01

Amortization of short lived acquired intangibles - - - 0.08

Tax effect of applicable non-GAAP adjustments

(2)

0.05 (0.01) 0.02 (0.08)

Adjusted net income per diluted common share

(1)

0.16$ 0.04$ 0.84$ 0.56$

April 30, May 1, April 30, May 1,

2017 2016 2017 2016

Net income applicable to common shares, GAAP basis 16,859$ 2,397$ 61,336$ 33,578$

Restructuring and impairment charges 315 1,149 4,172 11,020

Strategic development and acquisition related costs 124 579 1,890 3,104

Loss (gain) on sale of assets 137 (927) 147 (1,652)

(Gain) on insurance recovery (9,601) - (9,601) -

Unreimbursed business interruption costs 191 - 191 -

(Gain) from bargain purchase - - - (1,864)

(Gain) on legal settlements - - - (3,765)

Fair value adjustment of acquired inventory - - - 1,000

Amortization of short lived acquired intangibles - - - 5,733

Tax effect of applicable non-GAAP adjustments

(2)

3,445 (312) 1,248 (5,986)

Adjusted net income applicable to common shares

(1)

11,470$ 2,886$ 59,383$ 41,168$

0.051063

0

(1) The Company discloses a tabular comparison of Adjusted net income per diluted common share and Adjusted net income applicable to common shares, which are non-GAAP measures,

because they are referred to in the text of our press releases and are instrumental in comparing the results from period to period. Adjusted net income per diluted common share

and Adjusted net income applicable to common shares should not be considered in isolation or as a substitute for net income per diluted common share and net income applicable to common

shares as reported on the face of our consolidated statements of operations.

(2) The Company calculated the tax effect of non-GAAP adjustments by applying the applicable statutory tax rate for the period to each applicable non-GAAP item.

Fiscal Three Months Ended

Trailing 12 Months

Trailing 12 Months

Fiscal Three Months Ended

Our Mission & Vision

Reconciliation of 2Q 2017 Operating Income(Loss) to Adjusted

Operating Income (Loss) by Segment

17

(Dollars in thousands)

Trailing 12

Months

Engineered

Building

Systems

Metal

Components

Metal Coil

Coating Corporate Consolidated Consolidated

Operating income (loss), GAAP basis 6,894$ 40,087$ 5,514$ (20,023)$ 32,472$ 125,285$

Restructuring and impairment charges 186 129 - - 315 4,172

Strategic development and acquisition related costs - - - 124 124 1,890

(Gain) on insurance recovery - (9,601) - - (9,601) (9,601)

Loss on sale of assets 137 - - - 137 137

Amortization of short lived acquired intangibles - - - - - 10

Unreimbursed business interruption costs - 191 - - 191 191

Adjusted operating income (loss)

(1)

7,217$ 30,806$ 5,514$ (19,899)$ 23,638$ 122,084$

Trailing 12

Months

Engineered

Building

Systems

Metal

Components

Metal Coil

Coating Corporate Consolidated Consolidated

Operating income (loss), GAAP basis # 7,193$ 17,835$ 4,704$ (19,138)$ 10,594$ 81,730$

Restructuring and impairment charges 149 608 39 353 1,149 11,020

Strategic development and acquisition related costs - 28 - 551 579 3,104

Fair value adjustment of acquired inventory - - - - - 1,000

Gain o ale of assets (927) - - - (927) (5,417)

Amortization of short lived acquired intangible - - - - - 5,677

Adjusted operating income (loss)

(1)

6,415$ 18,471$ 4,743$ (18,234)$ 11,395$ 97,114$

(1) The Company discloses a tabular comparison of Adjusted operating income (loss), which is a non-GAAP measure, because it is instrumental in comparing the results from period

to period. Adjusted operating income (loss) should not be considered in isolation or as a substitute for operating income (loss) as reported on the face of our statements of operations.

Fiscal Three Months Ended April 30, 2017

Fiscal Three Months Ended May 1, 2016

Our Mission & Vision

Reconciliation of 2Q 2017 Net Income (Loss) to Adjusted EBITDA by

Segment

18

(Dollars in thousands)

Trailing 12

Months

Engineered

Building

Systems

Metal

Components

Metal Coil

Coating Corporate Consolidated Consolidated

Net income (loss) 4,991$ 40,571$ 5,514$ (34,102)$ 16,974$ 61,729$

Add:

Depreciation and amortization 2,285 6,414 1,155 208 10,062 40,789

Consolidated interest expense, net (9) (92) - 7,442 7,341 29,455

Provision for income taxes 1,787 - - 6,819 8,606 34,157

Restructuring and impairment charges 186 129 - - 315 4,172

(Gain) on insurance recovery - (9,601) - - (9,601) (9,601)

(Gain) loss on sale of assets 137 - - - 137 147

Strategic development and acquisition related costs - - - 124 124 1,890

Unreimbursed business interruption costs - 191 - - 191 191

Share-based compensation - - - 2,820 2,820 11,704

Adjusted EBITDA

(1)

9,377$ 37,612$ 6,669$ (16,689)$ 36,969$ 174,633$

-$

Trailing 12

Months

Engineered

Building

Systems

Metal

Components

Metal Coil

Coating Corporate Consolidated Consolidated

Net income (loss) 7,013$ 17,457$ 4,687$ (26,737)$ 2,420$ 33,939$

Add:

Depreciation and amortization 2,436 6,853 1,146 330 10,765 49,407

Consolidated interest expense, net (48) 2 17 7,821 7,792 31,767

Provision (benefit) for income taxes 1,166 0 - 43 1,209 17,211

Restructuring and impairment charges 149 608 39 353 1,149 10,774

(Gain) on sale of assets (927) - - - (927) (3,516)

Strategic development and acquisition related costs 0 28 - 551 579 3,104

(Gain) on legal settlements - - - - - (3,765)

Fair value adjustment of acquired inventory - - - - - 1,000

Share-based compensation - - - 2,468 2,468 9,295

Adjusted EBITDA

(1)

9,789$ 24,948$ 5,889$ (15,171)$ 25,455$ 149,216$

(1) - 1 1 -

(1) The Company's Credit Agreement defines Adjusted EBITDA. Adjusted EBITDA excludes non-cash charges for goodwill and other asset impairments and stock compensation as well as certain special

charges. As such, the historical information is presented in accordance with the definition above. Concurrent with the amendment and restatement of the Term Loan facility, the Company entered

into an Asset-Based Lending facility which has substantially the same definition of Adjusted EBITDA except that the ABL facility caps certain non-recurring charges. The Company is disclosing Adjusted

EBITDA, which is a non-GAAP measure, because it is used by management and provided to investors to provide comparability of underlying operational results.

Fiscal Three Months Ended April 30, 2017

Fiscal Three Months Ended May 1, 2016

Our Mission & Vision

K. DARCEY MATTHEWS

Vice President, Investor Relations

E: darcey.matthews@ncigroup.com

281.897.7785

ncibuildingsystems.com