Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KEMET CORP | fy2017_q4x8kxinvestorpres.htm |

Stifel

2017 Technology, Internet & Media Conference

June 6, 2017

Presenters: Per Loof – Chief Executive Officer

William M. Lowe, Jr. – EVP & Chief

Financial Officer

Cautionary Statement

Certain statements included herein contain forward-looking statements within the meaning of federal securities laws about KEMET Corporation's (the "Company") financial

condition and results of operations that are based on management's current expectations, estimates and projections about the markets in which the Company operates, as

well as management's beliefs and assumptions. Words such as "expects," "anticipates," "believes," "estimates," variations of such words and other similar expressions are

intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions,

which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in, or implied by, such forward-looking

statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management's judgment only as of the date hereof. The

Company undertakes no obligation to update publicly any of these forward-looking statements to reflect new information, future events or otherwise.

Factors that may cause actual outcomes and results to differ materially from those expressed in, or implied by, these forward-looking statements include, but are not

necessarily limited to, the following: (i) adverse economic conditions could impact our ability to realize operating plans if the demand for our products declines, and such

conditions could adversely affect our liquidity and ability to continue to operate and cause a write down of long-lived assets or goodwill; (ii) an increase in the cost or a

decrease in the availability of our principal or single-sourced purchased raw materials; (iii) changes in the competitive environment; (iv) uncertainty of the timing of customer

product qualifications in heavily regulated industries; (v) economic, political, or regulatory changes in the countries in which we operate; (vi) difficulties, delays or unexpected

costs in completing the restructuring plans; (vii) acquisitions and other strategic transactions expose us to a variety of risks; (viii) acquisition of TOKIN may not achieve all of

the anticipated results; (ix) our business could be negatively impacted by increased regulatory scrutiny and litigation; (x) difficulties associated with retaining, attracting and

training effective employees and management; (xi) the need to develop innovative products to maintain customer relationships and offset potential price erosion in older

products; (xii) exposure to claims alleging product defects; (xiii) the impact of laws and regulations that apply to our business, including those relating to environmental

matters; (xiv) the impact of international laws relating to trade, export controls and foreign corrupt practices; (xv) changes impacting international trade and corporate tax

provisions related to the global manufacturing and sales of our products may have an adverse effect on our financial condition and results of operations; (xvi) volatility of

financial and credit markets affecting our access to capital; (xvii) the need to reduce the total costs of our products to remain competitive; (xviii) potential limitation on the use

of net operating losses to offset possible future taxable income; (xix) restrictions in our debt agreements that could limit our flexibility in operating our business; (xx) disruption

to our information technology systems to function properly or control unauthorized access to our systems may cause business disruptions; (xxi) additional exercise of the

warrant by K Equity, LLC which could potentially result in the existence of a significant stockholder who could seek to influence our corporate decisions; (xxii) fluctuation in

distributor sales could adversely affect our results of operations, (xxiii) earthquakes and other natural disasters could disrupt our operations and have a material adverse

effect on our financial condition and results of operations.

2

TOKIN Acquisition Closure

4

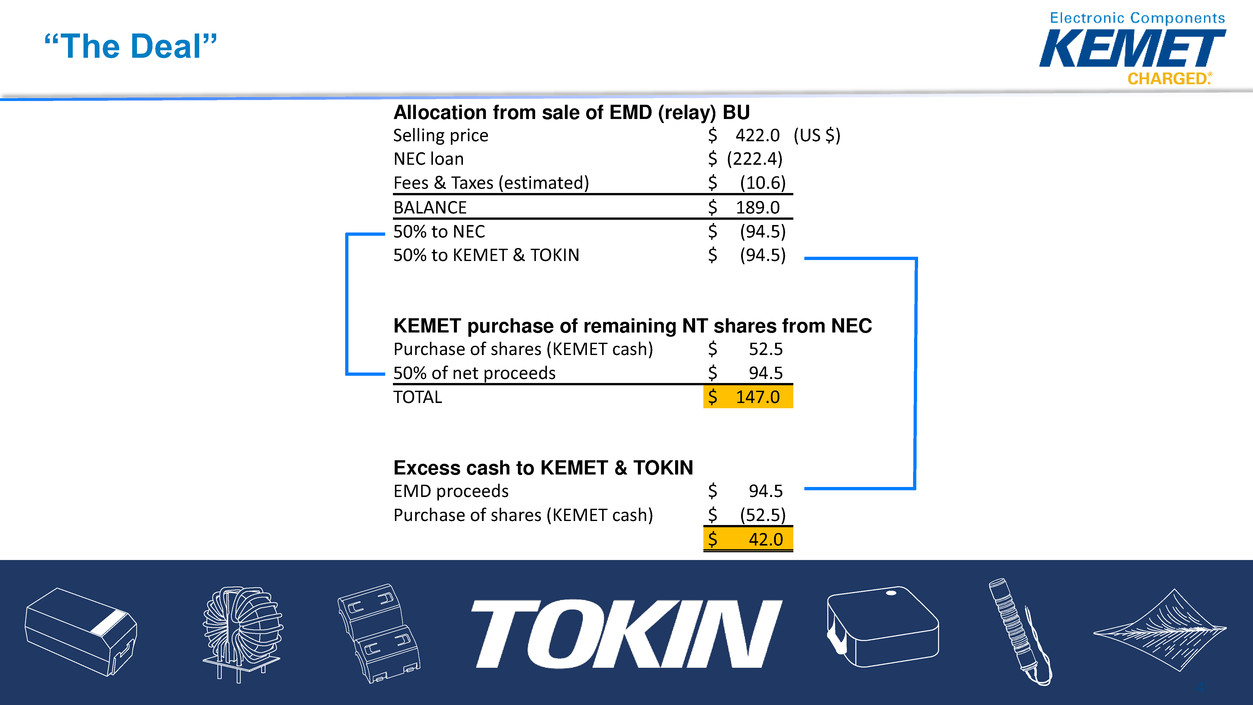

Allocation from sale of EMD (relay) BU

Selling price $ 422.0 (US $)

NEC loan $ (222.4)

Fees & Taxes (estimated) $ (10.6)

BALANCE $ 189.0

50% to NEC $ (94.5)

50% to KEMET & TOKIN $ (94.5)

KEMET purchase of remaining NT shares from NEC

Purchase of shares (KEMET cash) $ 52.5

50% of net proceeds $ 94.5

TOTAL $ 147.0

Excess cash to KEMET & TOKIN

EMD proceeds $ 94.5

Purchase of shares (KEMET cash) $ (52.5)

$ 42.0

“The Deal”

Cost of acquiring TOKIN

$104M

o $50M in 2013

o $54M now

100% of TOKIN cash

$165M

Used $52.5 to pay down debt post closing

Combined cash after closing, refinance & debt reduction

$217M

“The Deal”

6

“So on a net basis, it basically

seems like it’s costing you nothing

to acquire the company”

Matt Sheerin, Stifel Analyst

Deal of

the Century?

“The Deal”

Founded

April 8, 1938

Employee

5,257 Worldwide

880 in Japan

Manufacturing locations

• Japan (3)

• Thailand

• Vietnam

• China

Capacitors

Tantalum Polymer (NeoCap)

Supercapacitors

Electromagnetic Compatibility (EMC)

Power Inductors

Ferrite Cores

Transformers

Chokes & Filters

Noise Suppression sheets

Sensors & Actuators

Piezoelectric Actuators

Current & Temperature Sensors

TOKIN overview

High-Yield Bonds

Refinanced

1) Fund redemption of all outstanding $353

million 10.5% Senior notes due 2018

2) Repaid outstanding amount on revolver of

$34 million

3) New Term Loan:

$345M US$

Rate = LIBOR + 600 bps

$13M / year interest savings

5% annual principal amortization

Matures April 28, 2024

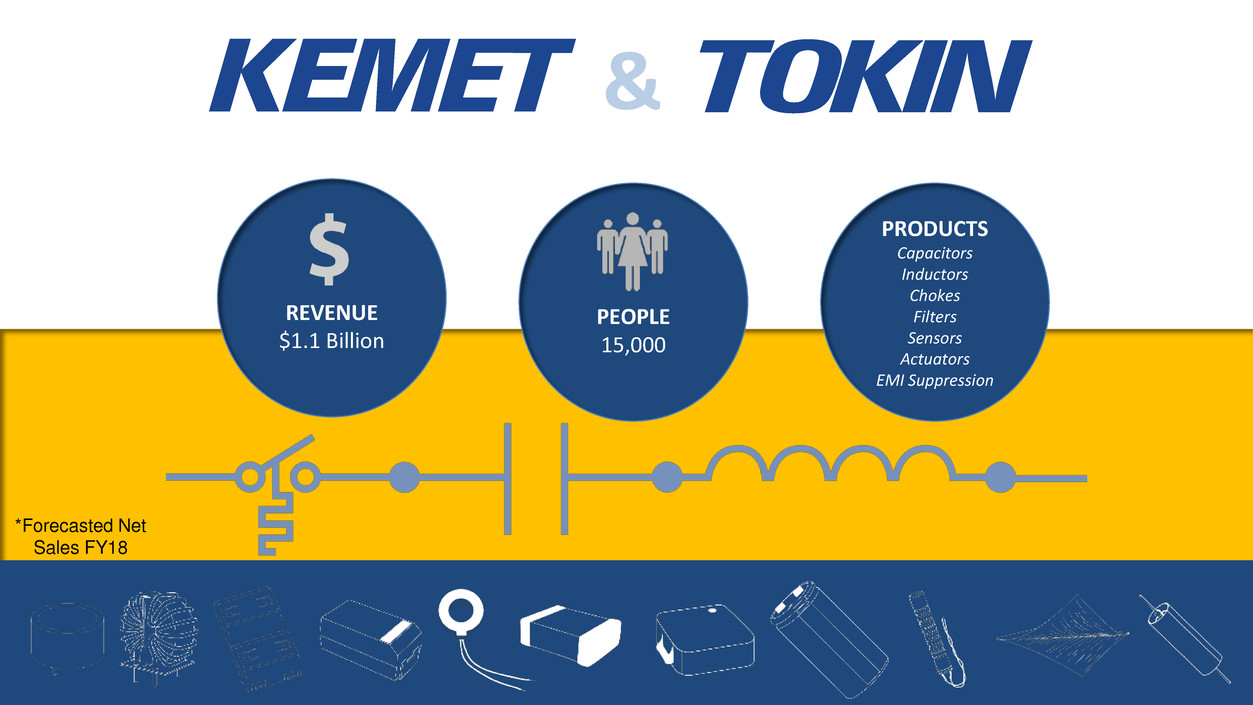

PRODUCTS

Capacitors

Inductors

Chokes

Filters

Sensors

Actuators

EMI Suppression

PEOPLE

15,000

REVENUE

$1.1 Billion

&

*Forecasted Net

Sales FY18

Dist / Agent

41%

OEM

44%

EMS

15%

Japan

15%

Asia

41%

Americas

22%

EMEA

22%

Telecom

14%

Computer

19%

Consumer

10%

Ind/Light

26%

Automotive

17%

Def/Med

9%

Other

4%

KEMET/TOKIN by segment, region, channel

(Est. Q1FY18 sales)

ChannelSegment

Region Product

Film and

Electrolytics

16.8%

Ceramics

21.5%

Tantalum/Polymer

42.3%

EMC

15.2%

S&A

4.2%

KEMET/TOKIN Market Share

Tantalum / Polymer (est. $1.3B)*

KEMET

27.2%

TOKIN

7.6%

AVX

30.0%

Sanyo

12.0%

Others

23.2%

34.8%

* Management estimates

Market Trends

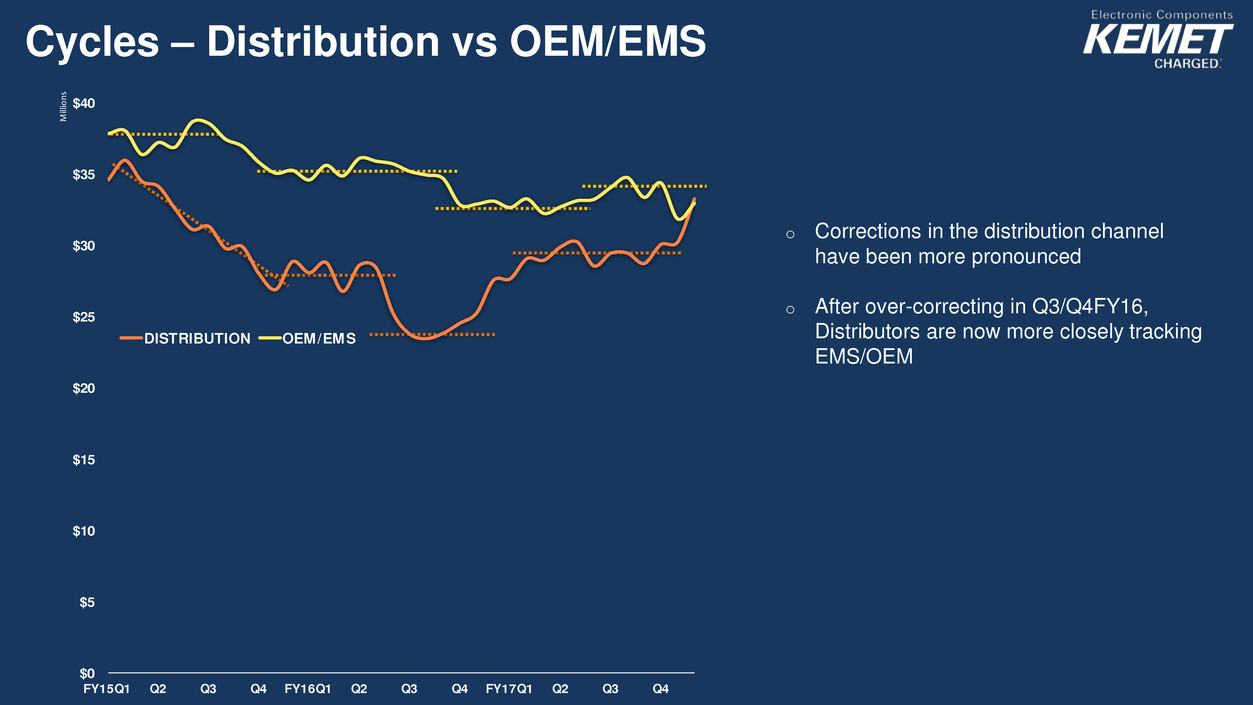

o Corrections in the distribution channel

have been more pronounced

o After over-correcting in Q3/Q4FY16,

Distributors are now more closely tracking

EMS/OEM

Cycles – Distribution vs OEM/EMS

Cycles – Distribution vs OEM/EMS

$0

$5

$10

$15

$20

$25

$30

$35

$40

FY15Q1 Q2 Q3 Q4 FY16Q1 Q2 Q3 Q4 FY17Q1 Q2 Q3 Q4

M

ill

io

n

s

DISTRIBUTION OEM/EMS

o Inventory over correction in Q2/Q3 FY16

- Stable since

o Inventories are Lean vs. POS and Industry

Lead Times

Distribution

$60

$70

$80

$90

$100

$110

$120

$130

$140

$150

FY15Q1 Q2 Q3 Q4 FY16Q1 Q2 Q3 Q4 FY17Q1 Q2 Q3 Q4

M

illi

on

s

POA Support

(POS – DIST MGN)

Actual POA

(3 Month)

Inventory

Inventory / POS = 3.6

3.6

3.4 3.3 3.2

o POS is trending up since Q4FY16

o POS/POA now closely matched

o - KEMET’s order entry and planning

systems adjusted to actual POS

and Distributor needs

Sales Strategy

Head

50% of Revenue

~ 1,000 Customers

Long Tail

50% of Revenue

~ 180,000 Customers

• Direct engagement

• Solution selling

• Design-in

Sales Strategy

Head

Long Tail

Pipeline

Growth

Head

Long Tail

• Make more products available and

easy to find

• Channel Focus

• ”Use bits to sell atoms”

Sales Strategy

Digital

Engagement

Platform

Sales Strategy

Discovery Decision Close

SearchResearch Pricing

Apps

Digital Engagement Platform

Simulation Tools

Video

Designed by Engineers

for Engineers

Chat

Digital Engagement

Platform

Innovative Search Engine

& Part Selection Tool

6.2M part

numbers

5.7M CAD

models

115 competitors for

cross referencing

Live distributor

pricing and inventory

Data sheets

& Spec sheets

Digital Engagement

Platform

Integrated

BI Software

Multiple

Data Sources

Part

Crossing

SMART

COLLABORATIVE

Flexible

Communication

Smart

Workflows

Chat &

Messaging

Pricing

Assistance

1000x FASTER

1,000 Part Numbers Processed in < 5 Minutes

(>3 PN / Sec)

Digital Engagement

Platform

In Beta Test

Next 10 years

Major Drivers

Computers that Listen and Talk Computers that See

Virtual/Augmented Reality Internet of Things

More Personal

• GaN (Gallium Nitride) • SiC (Silicon Carbide)

Computer Assisted Health Care Autonomous Vehicles

New Semiconductor TechnologiesAutonomous Drones

Smarter Technologies

400 million

servers to support

our 2020 IoT and

technology

demands.

Energy Efficiency & State of the Art

Looking Ahead

TOKIN

Integrate with elegance &

appreciation

• Improve profitability

• Synergy activities

PEOPLE

Creative & globally connected

• Pride & loyalty

• Philanthropic

• Career engagement

• Work-life balance

ADJACENCY 2.0

Technology relevance

Investing in components to

support:

• Green energy

• E-Cars

• Internet of Things

• Wearable medical devices

• Wide Band Gap

• Omnipresent digitalization

M&A

• Not necessarily capacitors

• Relevant technology with

a sustainable revenue

stream

• Asia

ATOMS & BITS

• Using digital to sell physical

• “Creative Disruption”

PEOPLE

ADJACENCY 2.0

M&A

ATOMS & BITS

Summary Financial

Information

Income Statement Highlights

U.S. GAAP (Unaudited)

Fiscal Year

(Amounts in thousands, except percentages and per share data) 2017 2016

Net sales $ 757,791 $ 734,823

Gross margin $ 186,112 $ 163,280

Gross margin as a percentage of net sales 24.6% 22.2%

Selling, general and administrative $ 107,868 $ 101,446

SG&A as a percentage of net sales 14.2% 13.8%

Operating income (loss) $ 34,540 $ 32,326

Net income (loss) $ 47,989 $ (53,629)

Per share data:

Adjusted net income (loss) - basic $ 1.03 $ (1.17)

Adjusted net income (loss) - diluted $ 0.87 $ (1.17)

Weighted avg. shares - basic 46,552 46,004

Weighted avg. shares - diluted 55,389 46,004

35

Income Statement Highlights

Non-GAAP (Unaudited)

Fiscal Year

(Amounts in thousands, except percentages and per share data) 2017 2016

Net sales $ 757,791 $ 734,823

Adjusted Gross margin $ 187,923 $ 165,931

Adjusted gross margin as a percentage of net sales 24.8% 22.6%

Adjusted selling, general and administrative $ 93,952 $ 88,354

Adjusted SG&A as a percentage of net sales 12.4% 12.0%

Adjusted operating income (loss) $ 66,548 $ 52,816

Adjusted net income (loss) $ 23,916 $ 8,917

Adjusted EBITDA $ 105,255 $ 91,144

Per share data:

Adjusted net income (loss) - basic $ 0.51 $ 0.19

Adjusted net income (loss) - diluted $ 0.43 $ 0.17

Weighted avg. shares - basic 46,552 46,004

Weighted avg. shares - diluted 55,389 51,436

36

Quarterly Financial Summary – Net Sales

U.S. GAAP (Unaudited)

$185 $187 $188

$198

$78 $84 $82

$85

JUN 2016 SEP 2016 DEC 2016 MAR 2017

KEMET TOKIN

1. TOKIN results exclude the EMD business which was sold on April 14, 2017.

2. Net sales include sales between KEMET and TOKIN of $5.0 million, $7.0 million, $7.2 million and $6.2 million for the quarters ended June 30, 2016,

September 30, 2016, December 31, 2016 and March 31, 2017, respectively. Upon acquisition, inter-company sales will be eliminated.

Million

37

Financial Trends

Cash and Cash Equivalents (Unaudited)

$33 $39

$45

$65

$53

$75

$87

$110

$92 $88

$92

$92

$97

$100

$107

$107

$200

Q1FY16 Q2 Q3 Q4 Q1FY17 Q2 Q3 Q4 Q1FY18

KEMET TOKIN KEMET/TOKIN

1. TOKIN results exclude the EMD business which was sold on April 14, 2017.

Million

38

Forecast Assumptions

Net Sales l Total Net Sales projected to grow at a 2.2% CAGR from FY 2017 to FY 2022Forecast does not include increase potential market synergies from cross selling

Gross Margin l Combined Gross Margin projected to expand from 23.6% in FY 2017 to 26.5% in FY 2022

Adjusted

EBITDA

l Total Adjusted EBITDA (excluding unrealized synergies) projected to grow at a 7.8% CAGR from

FY 2017 to FY 2022. Depreciation expense approximately $57 million prior to purchase

accounting effects.

Synergies

l Synergies of $11.3 million, $11.0 million and $8.4 million projected for FY 2018, FY 2019 and

FY 2020, respectively

l One-time equivalent cash costs to achieve projected overhead reductions of $9 million, $7 million

and $4 million in FY 2018, FY 2019 and FY 2020, respectively

Other Cash

Flow Items

l Capital expenditures projected to increase to support increased production capacity to meet

additional demand, primarily for polymer products

l Working capital projected to remain consistent as a percentage of Net Sales

39

Forecasted Financials

KEMET + TOKIN

$1,109

$1,152

$1,207

FY18 FY19 FY20

Net Sales

Sales includes ~ $25M/year of intercompany sales.

Million

40

Forecasted Financials

KEMET + TOKIN

$150

$161

$182

FY18 FY19 FY20

Adjusted EBITDA

Million

41

Forecasted Financials

KEMET + TOKIN

$44 $44 $44

FY18 FY19 FY20

Forecasted CAPEX

Million $

42

Forecasted Credit Statistics

Including TOKIN

43

QUESTIONS?

Appendix

Adjusted Gross Margin

Non-GAAP (Unaudited)

Fiscal Year

(Amounts in thousands, except percentages) 2017 2016

Net sales $ 757,791 $ 734,823

Cost of sales $ 571,679 $ 571,543

Gross margin (U.S. GAAP) $ 186,112 $ 163,280

Gross margin as a percentage of net sales 24.6% 22.2%

Adjustments:

Stock-based compensation expense 1,384 1,418

Plant start-up costs 427 861

Plant shut-down costs — 372

Adjusted gross margin (non-GAAP) $ 187,923 $ 165,931

Adjusted gross margin as a percentage of net sales 24.8% 22.6%

46

Adjusted Selling, General & Administrative Expenses

Non-GAAP (Unaudited)

Fiscal Year

(Amounts in thousands, except percentages) 2017 2016

Net sales $ 757,791 $ 734,823

Selling, general and administrative expenses (U.S. GAAP) $ 107,868 $ 101,446

Selling, general, and administrative as a percentage of net sales 14.2% 13.8%

Less adjustments:

ERP integration costs/IT transition costs 7,045 5,677

Stock-based compensation expense 3,130 3,162

Legal expenses related to antitrust class actions 2,640 3,041

NEC TOKIN investment related expenses 1,101 900

Pension plan adjustment — 312

Adjusted selling, general and administrative expenses (non-GAAP) $ 93,952 $ 88,354

Adjusted selling, general, and administrative as a percentage of net sales 12.4% 12.0%

47

Adjusted Operating Income

Non-GAAP (Unaudited)

Fiscal Year

(Amounts in thousands) 2017 2016

Operating income (loss) (U.S. GAAP) $ 34,540 $ 32,326

Adjustments:

ERP integration costs/IT transition costs 7,045 5,677

Stock-based compensation expense 4,720 4,774

Restructuring charges 5,404 4,178

Legal expenses related to antitrust class actions 2,640 3,041

NEC TOKIN investment related expenses 1,101 900

Net (gain) loss on sales and disposals of assets 392 375

Plant start-up costs 427 861

Plant shut-down costs — 372

Pension plan adjustment — 312

Write down of long-lived assets 10,279 —

Adjusted operating income (loss) (non-GAAP) $ 66,548 $ 52,816

48

Adjusted Net Income (Loss) and Adjusted EBITDA

Non-GAAP (Unaudited)

Fiscal Year

(Amounts in thousands) 2017 2016

Net income (loss) (U.S. GAAP) $ 47,989 $ (53,629)

Adjustments:

Change in value of TOKIN options (10,700) 26,300

Net foreign exchange (gain) loss (3,758) (3,036)

ERP integration costs/IT transition costs 7,045 5,677

Stock-based compensation 4,720 4,774

Income tax effect of non-GAAP adjustments (741) 652

Restructuring charges 5,404 4,178

Legal expenses related to antitrust class actions 2,640 3,041

TOKIN investment related expenses 1,101 900

Amortization included in interest expense 761 859

Equity (gain) loss from TOKIN (41,643) 16,406

Net (gain) loss on sales and disposals of assets 392 375

Write down of long-lived assets 10,279 —

Income tax effect of pension curtailment — 875

Plant start-up costs 427 861

Plant shut-down costs — 372

Pension plan adjustment — 312

Adjusted net income (loss) (non-GAAP) $ 23,916 $ 8,917

Adjusted net income (loss) per share - basic $ 0.51 $ 0.19

Adjusted net income (loss) per share - diluted $ 0.43 $ 0.17

Adjusted EBITDA (non-GAAP) $ 105,255 $ 91,144

Weighted avg. shares - basic 46,552 46,004

Weighted avg. shares - diluted 55,389 51,43649

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

Fiscal Year

(Amounts in thousands) 2017 2016

Net income (loss) (U.S. GAAP) $ 47,989 $ (53,629)

Interest expense, net 39,731 39,591

Income tax expense (benefit) 4,290 6,006

Depreciation and amortization 37,338 39,016

EBITDA (non-GAAP) 129,348 30,984

Excluding the following items

Change in value of TOKIN options (10,700) 26,300

Net foreign exchange (gain) loss (3,758) (3,036)

ERP integration costs/IT transition costs 7,045 5,677

Stock-based compensation 4,720 4,774

Restructuring charges 5,404 4,178

Legal expenses related to antitrust class actions 2,640 3,041

TOKIN investment related expenses 1,101 900

Equity (gain) loss from TOKIN (41,643) 16,406

Net (gain) loss on sales and disposals of assets 392 375

Write down of long-lived assets 10,279 —

Plant start-up costs 427 861

Plant shut-down costs — 372

Pension plan adjustment — 312

Adjusted EBITDA (non-GAAP) $ 105,255 $ 91,144

50

Forecast: Non-GAAP Reconciliation

A reconciliation of net income to Adjusted EBITDA as projected for 2018, 2019 and 2020 is not provided.

KEMET does not forecast net income as we cannot, without unreasonable effort, estimate or predict with

certainty various components of net income. These components include net foreign exchange (gain) loss,

further restructuring and other income or charges incurred in 2018, 2019 or 2020 as well as the related tax

impacts of these items. Additionally, discrete tax items could drive variability in our projected effective tax

rate. All of these components could significantly impact such financial measures. Further, in the future, other

items with similar characteristics to those currently included in Adjusted EBITDA that have a similar impact on

comparability of periods, and which are not known at this time, may exist and impact adjusted EBITDA.

51