Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SITE Centers Corp. | d290070d8k.htm |

Exhibit 99.1

Exhibit 99.1

NAREIT

– JUNE 2017DDR CORP.

INVESTOR PRESENTATIONS

DDR considers portions of this information to be forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, both as amended, with respect to the Company’s expectations for future periods. Although the Company believes that the expectations

reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved. For this purpose, any statements contained herein that are not historical fact may be deemed to be

forward-looking statements. There are a number of important factors that could cause our results to differ materially from those indicated by such forward-looking statements, including among other factors, local conditions such as supply of space or

a reduction in demand for real estate in the area; competition from other available space; dependence on rental income from real property; the loss of, significant downsizing of or bankruptcy of a major tenant; redevelopment and construction

activities may not achieve a desired return on investment; our ability to buy or sell assets on commercially reasonable terms; our ability to complete acquisitions or dispositions of assets under contract; our ability to secure equity or debt

financing on commercially acceptable terms or at all; our ability to enter into definitive agreements with regard to our financing and joint venture arrangements or our failure to satisfy conditions to the completion of these arrangements; and the

success of our deleveraging strategy; any impact or results from the Company’s portfolio transition or any change in strategy. For additional factors that could cause the results of the Company to differ materially from these indicated in the

forward-looking statements, please refer to the Company’s Form 10-K for the year ended December 31, 2016. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that

arise after the date hereof.

SAFE HARBOR STATEMENT

2

SUMMARY

Three Month

Progress Report

Short-Term Strategy Update

Portfolio review and dispositions

plan

Balance sheet

Leasing

Actively Managing DDR Real Estate

Measuring Tenant Risks

Best Buy (BBY) case study

Sears/Kmart and mall proximity analysis

Occupancy cost analysis

Long-Term Strategy Summary

2017 Guidance Summary

Evolution of DDR Leased Rate

Significant Portfolio Pruning to Date

Portfolio Diversity

3

THREE MONTH PROGRESS REPORT

MONTH 1: ORGANIZATIONAL STREAMLINING

Quickly right-sized organization to

match smaller operating base

12% head count reduction (65 positions), expected $6MM annual reduction in G&A

MONTH 2: INITIAL PORTFOLIO REVIEW AND STRATEGY PLANNING

Assessed and sustained disposition

pipeline

Began in-depth analysis of portfolio (Puerto Rico focus)

Formulated

short- and long-term strategies

MONTH 3: BALANCE SHEET EXECUTION AND DISPOSITION PLANNING

Balance sheet execution: lengthened average maturity to 7.9 years from

5.9 years including

perpetual preferred*

Finalized disposition list

* Assumes 30-year maturity

4

SHORT-TERM STRATEGY UPDATE

PORTFOLIO REVIEW AND DISPOSITION PLAN

Completed initial portfolio review

Relatively consistent quality across portfolio with small proportion

of

assets “in the tail”

DDR has aggressively disposed of lower quality assets since the GFC

Dispositions now motivated by deleveraging goal, not asset quality

Expected 12 month

disposition/deleveraging process

REIT peer group provides reasonable target leverage boundaries

Expect $300MM of proceeds from gradual liquidation of Blackstone

JVs in coming 2-3 years

Puerto Rico strategic review completed, progress announced upon execution

5

SHORT-TERM STRATEGY UPDATE

BALANCE SHEET

Recently completed $625MM of capital markets transactions

10yr Unsecured Notes: $450MM, 4.7% all-in rate, T+245

(minimal new-issue

concession)

Perpetual Preferred: $175MM, 6.375% (negative new-issue concession)

Increase weighted-average maturity

4.0 years as of 1Q17

5.1 years pro forma for 2Q deals, in-line with the peer group, or

7.9 years including

perpetual preferred stock*

Dispositions to move DDR balance sheet to top quartile of peer group

comprehensive leverage

Dispositions to further increase WA maturity

Additional opportunities to increase unencumbered pool via repayment of

secured term loan and

2017/2018 mortgage maturities

* Assumes 30-year maturity

6

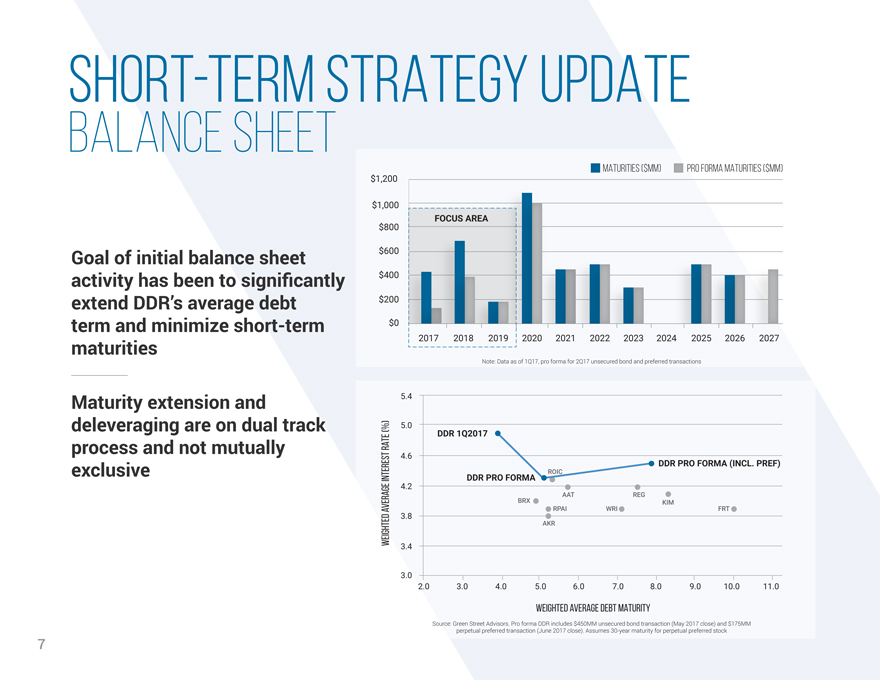

SHORT-TERM STRATEGY UPDATE

BALANCE SHEET

MATURITIES ($MM) PRO FORMA MATURITIES ($MM) $1,200

$1,000

FOCUS AREA $800

Goal of initial balance sheet $600 activity has been to significantly $400 extend DDR’s average debt $200 term and minimize short-term $0 maturities 202

Note: Data as of 1Q17, pro forma for 2Q17 unsecured bond and preferred transactions

Maturity

extension and 5.4 deleveraging are on dual track (%) 5.0

RATE DDR 1Q2017

process and not mutually 4.6

DDR PRO FORMA (INCL. PREF)

exclusive ROIC

INTEREST DDR PRO FORMA

4.2

AAT REG BRX KIM

AVERAGE RPAI WRI FRT

3.8

WEIGHTED AKR

3.4

3.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 11.0 WEIGHTED AVERAGE DEBT MATURITY

Source: Green

Street Advisors. Pro forma DDR includes $450MM unsecured bond transaction (May 2017 close) and $175MM perpetual preferred transaction (June 2017 close). Assumes 30-year maturity for perpetual preferred stock

7

SHORT-TERM STRATEGY UPDATE

LEASING

Currently running ahead of 1Q17 budgeted percentage leased guidance

Expect to sign 475k SF of anchor leases in next 2-3 months vs. 2yr total

quarterly leasing average of 400k SF of new leases

Reaffirming expectation to

complete TSA releasing by mid-2018

Healthy list of high-quality replacement anchors looking for new space

Expect healthy leasing spreads on comparable space

8

ACTIVELY MANAGING DDR REAL ESTATE

9

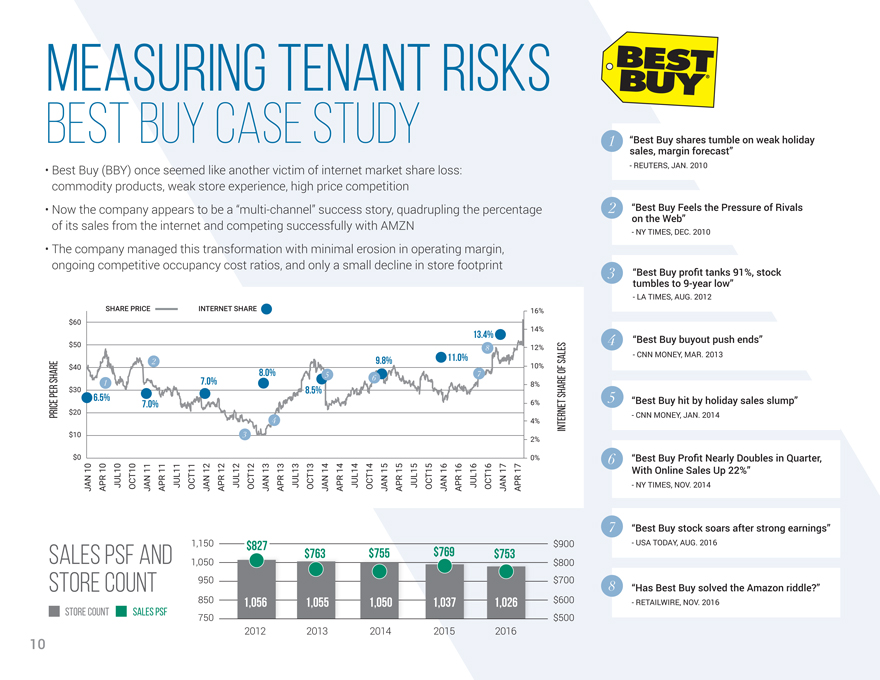

MEASURING TENANT RISKS

BEST BUY CASE STUDY

Best Buy (BBY) once seemed like another victim of

internet market share loss:

commodity products, weak store experience, high price competition

Now the company appears to be a “multi-channel” success story, quadrupling the percentage

of its sales from the internet and competing successfully with AMZN

The company managed this

transformation with minimal erosion in operating margin,

ongoing competitive occupancy cost ratios, and only a small decline in store footprint

PRICE PER SHARE

INTERNET SHARE OF SALES

SHARE PRICE INTERNET SHARE 16% $60 14%

13.4%

$50 12%

9.8% 11.0% 10%

$40

8.0%

$30 7.0% 8.5% 8%

6.5%

7.0% 6%

$20

4% $10 2%

$0 0%

JAN 10 APR 10 JUL10 OCT10 JAN 11 APR 11 JUL11 OCT11 JAN 12 APR 12 JUL12 OCT12 JAN 13 APR 13 JUL13 OCT13 JAN 14 APR 14 JUL14 OCT14 JAN 15 APR 15 JUL15 OCT15 JAN 16 APR 16 JUL16

OCT16 JAN 17 APR 17

“Best sales, Buy margin shares forecast” tumble on weak holiday

- REUTERS, JAN. 2010

“Best on the Buy Web” Feels the Pressure of Rivals

- NY TIMES, DEC. 2010

“Best tumbles Buy to profit 9-year tanks low” 91%, stock

- LA TIMES, AUG. 2012

“Best Buy buyout push ends”

- CNN MONEY, MAR. 2013

“Best Buy hit by holiday sales slump”

- CNN MONEY, JAN. 2014

“Best Buy Profit Nearly Doubles in Quarter, With Online Sales Up

22%”

- NY TIMES, NOV. 2014

“Best Buy stock soars after strong

earnings”

- USA TODAY, AUG. 2016

“Has Best Buy solved the Amazon

riddle?”

- RETAILWIRE, NOV. 2016

$827

SALES PSF AND $763 $755 $769 $753

STORE COUNT

1,056 1,055 1,050 1,037 1,026

STORE COUNT SALES PSF

10 2012 2013 2014 2015 2016

1,150, 1,050 950 850 750 $900 $800 $700 $600 $500 10

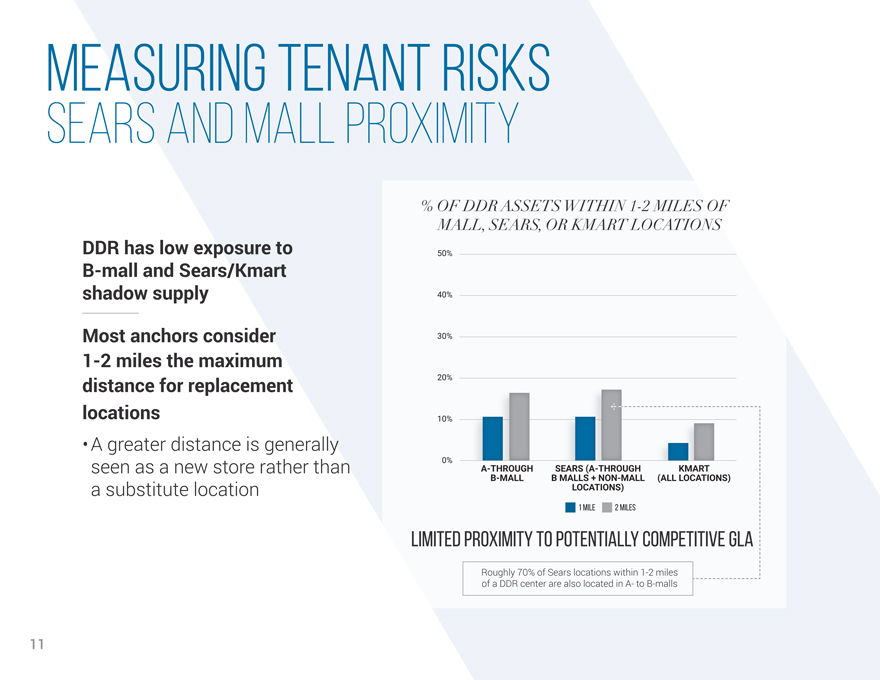

MEASURING TENANT RISKS

SEARS AND MALL PROXIMITY

DDR has low exposure to B-mall and Sears/Kmart

shadow supply Most anchors consider

1-2 miles the maximum distance for replacement locations

A greater distance is generally seen as a new store rather than a substitute location

% OF DDR

ASSETS WITHIN 1-2 MILES OF

MALL, SEARS, OR KMART LOCATIONS

50%

40%

30%

20%

10%

0%

A-THROUGH SEARS (A-THROUGH KMART

B-MALL B MALLS + NON-MALL (ALL LOCATIONS)

LOCATIONS)

1 MILE 2 MILES

Limited Proximity to Potentially Competitive GLA

Roughly 70% of Sears locations within 1-2 miles

of a DDR center are also located in A- to

B-malls

11

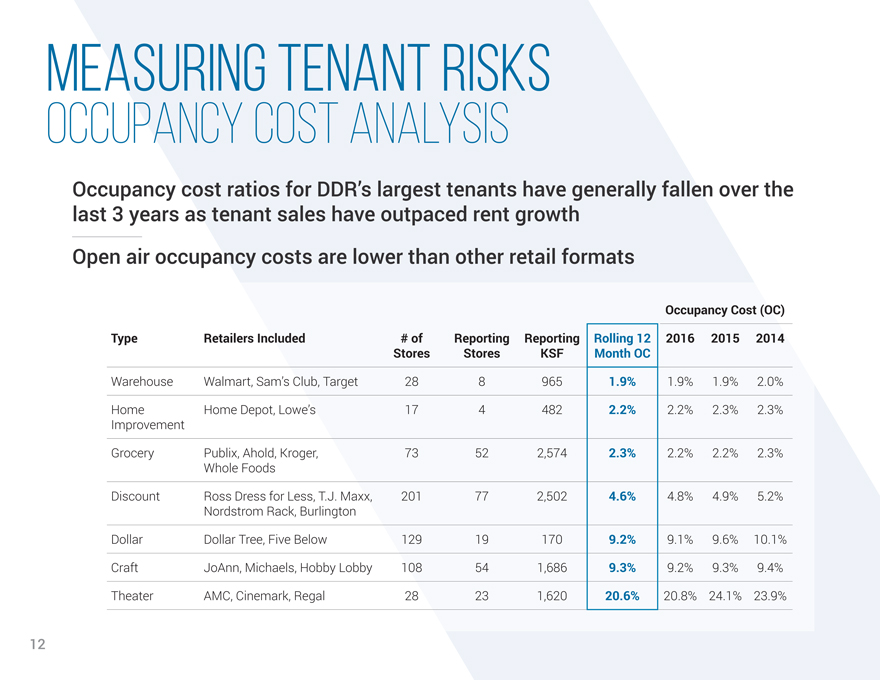

MEASURING TENANT RISKS

OCCUPANCY COST ANALYSIS

Occupancy cost ratios for DDR’s largest tenants

have generally fallen over the

last 3 years as tenant sales have outpaced rent growth

Open air occupancy costs are lower than other retail formats

Occupancy Cost (OC)

Type Retailers Included # of Reporting Reporting Rolling 12 2016 2015 2014

Stores Stores KSF

Month OC

Warehouse Walmart, Sam’s Club, Target 28 8 965 1.9% 1.9% 1.9% 2.0%

Home Home Depot, Lowe’s 17 4 482 2.2% 2.2% 2.3% 2.3%

Improvement

Grocery Publix, Ahold, Kroger, 73 52 2,574 2.3% 2.2% 2.2% 2.3%

Whole Foods

Discount Ross Dress for Less, T.J. Maxx, 201 77 2,502 4.6% 4.8% 4.9% 5.2%

Nordstrom Rack,

Burlington

Dollar Dollar Tree, Five Below 129 19 170 9.2% 9.1% 9.6% 10.1%

Craft JoAnn, Michaels, Hobby Lobby 108 54 1,686 9.3% 9.2% 9.3% 9.4%

Theater

AMC, Cinemark, Regal 28 23 1,620 20.6% 20.8% 24.1% 23.9%

12

LONG-TERM STRATEGY SUMMARY

Assets must fall into at least one of three categories:

1 2 3

DURABLE UNDERSERVING TRANSFORMATIONAL GROWTH THE 3-MILE RING REDEVELOPMENT POTENTIAL

NATURALLY

“DE-BOXING” POTENTIAL BELOW MARKET RENTS WITH GROWING NOI GLA EFFICIENCY UPSIDE

13

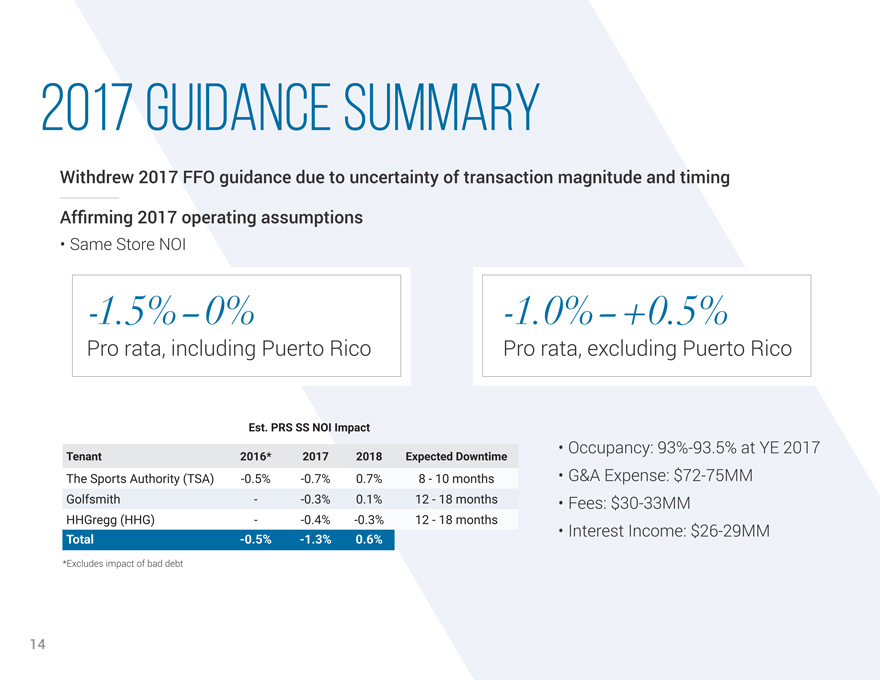

2017 GUIDANCE SUMMARY

Withdrew 2017 FFO guidance due to uncertainty of transaction magnitude and timing

Affirming 2017 operating assumptions

Same Store NOI

-1.5%-0% -1.0%-+0.5%

Pro rata, including Puerto Rico Pro rata, excluding Puerto Rico

Est. PRS SS NOI Impact

Tenant 2016* 2017 2018 Expected Downtime

The Sports Authority (TSA) -0.5% -0.7% 0.7% 8—10 months

Golfsmith —0.3% 0.1%

12—18 months

HHGregg (HHG) —0.4% -0.3% 12—18 months

Total

-0.5% -1.3% 0.6%

*Excludes impact of bad debt

Occupancy: 93%-93.5% at YE 2017

G&A Expense: $72-75MM

Fees: $30-33MM

Interest Income: $26-29MM

14

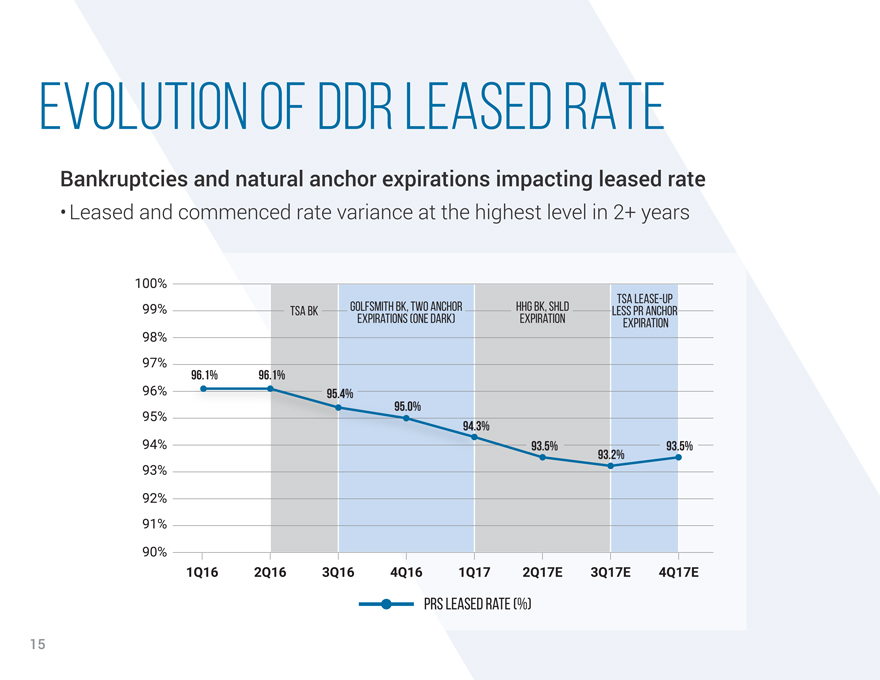

EVOLUTION OF DDR LEASED RATE

Bankruptcies and natural anchor expirations impacting leased rate

Leased and commenced rate

variance at the highest level in 2+ years

100%

TSA lease-up

99% TSA BK Golfsmith BK, two anchor HHG BK, SHLD less PR anchor

Expirations (one Dark)

Expiration expiration

98%

97%

96.1% 96.1%

96% 95.4%

95% 95.0%

94.3%

94% 93.5% 93.5%

93.2%

93%

92%

91%

90%

1Q16 2Q16 3Q16 4Q16 1Q17 2Q17E 3Q17E 4Q17E

Prs Leased Rate (%)

15

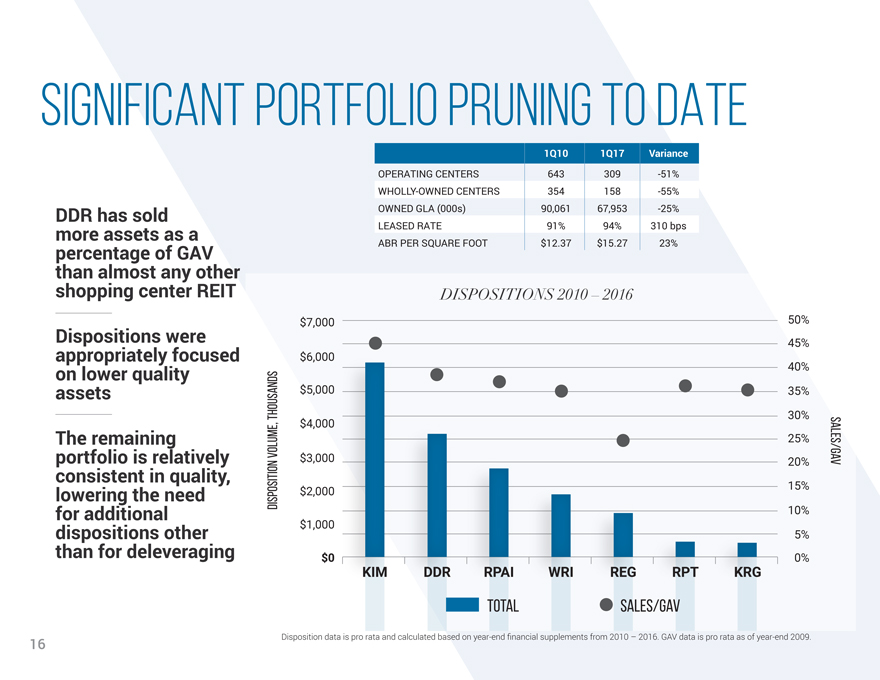

SIGNIFICANT PORTFOLIO PRUNING TO DATE

1Q10 1Q17 Variance

OPERATING CENTERS 643 309 -51%

WHOLLY-OWNED CENTERS 354 158 -55%

OWNED GLA (000s) 90,061 67,953 -25%

LEASED RATE 91% 94% 310 bps

ABR PER SQUARE FOOT $12.37 $15.27 23%

DDR has sold more assets as a percentage of GAV than almost any other shopping center REIT

Dispositions were appropriately focused on lower quality assets

The remaining

portfolio is relatively consistent in quality, lowering the need for additional dispositions other than for deleveraging

DISPOSITION VOLUME, THOUSANDS

SALES/GAV

DISPOSITIONS 2010 – 2016

$7,000 50% 45% $6,000 40% $5,000 35% 30% $4,000 25% $3,000 20% $2,000 15% 10% $1,000 5%

$0 KIM

DDR RPAI WRI REG RPT KRG 0%

TOTAL SALES/GAV

Disposition data is pro rata and

calculated based on year-end financial supplements from 2010 – 2016. GAV data is pro rata as of year-end 2009.

16

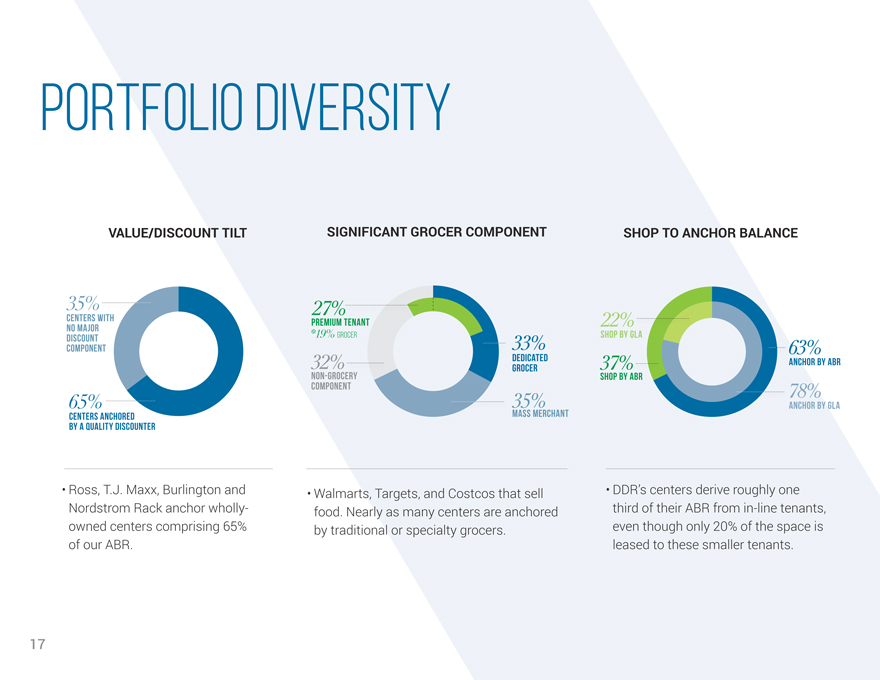

PORTFOLIO DIVERSITY

VALUE/DISCOUNT TILT SIGNIFICANT GROCER COMPONENT SHOP TO ANCHOR BALANCE

35%

CENTERS WITH NO MAJOR DISCOUNT COMPONENT 65% CENTERS ANCHORED BY A QUALITY DISCOUNTER

27% PREMIUM TENANT *19% GROCER 32% NON-GROCERY COMPONENT

33% DEDICATED GROCER 35% MASS MERCHANT

22% SHOP BY GLA 37% SHOP BY ABR

63% ANCHOR BY ABR 78% ANCHOR BY GLA

Ross, T.J. Maxx, Burlington and Nordstrom Rack anchor

wholly-owned centers comprising 65% of our ABR.

Walmarts, targets, and Costcos that sell food. Nearly as many centers are anchored by traditional or specialty

grocers.

DDR’s centers derive roughly one third of their ABR from in-line tenants, even though only 20% of the space is leased to these smaller tenants.17