Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Booz Allen Hamilton Holding Corp | d409059d8k.htm |

901 15th St. NW, Washington, DC 20005 INVESTOR DAY June 5, 2017 Exhibit 99.1

Forward-looking statements Forward Looking Safe Harbor Statement Certain statements contained in this presentation and in related comments by our management include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “could,” “should,” “forecasts,” “expects,” “intends,” “plans,” “anticipates,” “projects,” “outlook,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “preliminary,” or the negative of these terms or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we can give you no assurance these expectations will prove to have been correct. These forward-looking statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. A number of important factors could cause actual results to differ materially from those contained in or implied by these forward-looking statements, including those factors discussed in our filings with the Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K for the fiscal year ended March 31, 2017, which can be found at the SEC’s website at www.sec.gov. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Note Regarding Non-GAAP Financial Data Information Booz Allen discloses in the following information Revenue, Excluding Billable Expenses, Adjusted EBITDA, Adjusted Net Income, and Adjusted Diluted EPS, which are not recognized measurements under GAAP, and when analyzing Booz Allen’s performance or liquidity as applicable, investors (i) evaluate each adjustment in our reconciliation of revenue to Revenue Excluding Billable Expenses, net income to Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted Earnings Per Share, and the explanatory footnotes regarding those adjustments, each as defined under GAAP, and (ii) use Revenue, Excluding Billable Expenses, Adjusted EBITDA, Adjusted Net Income, and Adjusted Diluted EPS in addition to, and not as an alternative to revenue, net income or diluted EPS as measures of operating results, each as defined under GAAP. The Financial Appendix includes a reconciliation of Revenue, Excluding Billable Expenses, Adjusted EBITDA, Adjusted Net Income, and Adjusted Diluted EPS to the most directly comparable financial measure calculated and presented in accordance with GAAP. Booz Allen presents these supplemental performance measures because it believes that these measures provide investors and securities analysts with important supplemental information with which to evaluate Booz Allen’s performance, long term earnings potential, or liquidity, as applicable and to enable them to assess Booz Allen’s performance on the same basis as management. These supplemental performance and liquidity measurements may vary from and may not be comparable to similarly titled measures by other companies in Booz Allen’s industry. With respect to our expectations under “Fiscal 2018 Full Year Outlook” on slide 19, reconciliation of Adjusted Diluted EPS guidance to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward-looking basis due to our inability to predict our stock price, equity grants and dividend declarations during the course of fiscal 2018. Projecting future stock price, equity grants and dividends to be declared would be necessary to accurately calculate the difference between Adjusted Diluted EPS and GAAP EPS as a result of the effects of the two-class method and related possible dilution used in the calculation of EPS. Consequently, any attempt to disclose such reconciliation would imply a degree of precision that could be confusing or misleading to investors. We expect the variability of the above charges to have an unpredictable, and potentially significant, impact on our future GAAP financial results.

A leader with a proud history Company Overview We are a global firm of approximately 23,300 diverse, passionate, and exceptional people driven to excel, do right, and realize positive change in everything we do. We bring bold thinking and a desire to be the best in our work in consulting, analytics, digital solutions, engineering, and cyber and with industries ranging from defense to health, energy, and international development. Over 100 years in business HQ in McLean, VA 97% of FY17 revenue derived from government agencies, including Department of Defense, Department of Homeland Security, and the U.S. Armed Forces Key client relationships at a high level of the U.S. Government Approximately 4,800 contracts and task orders; 91% of our FY17 revenue is derived from engagements on which we acted as the prime contractor Unique organization and culture Built on collaboration One P&L and single bonus pool for partners, vice presidents, principals, and senior associates Equity incentives broadly distributed to leadership to ensure long-term success and alignment with shareholders Approximately 70% of staff with security clearances

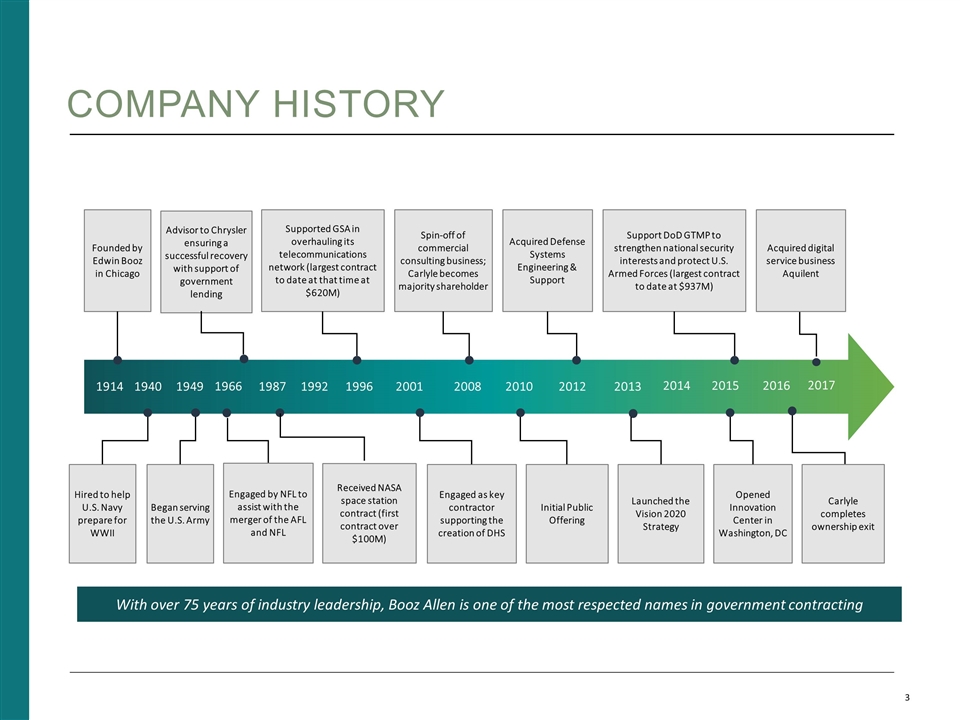

Company History With over 75 years of industry leadership, Booz Allen is one of the most respected names in government contracting 1914 1940 1949 1987 1992 1996 2001 2008 2010 2012 2013 2014 2015 2016 Founded by Edwin Booz in Chicago Received NASA space station contract (first contract over $100M) Supported GSA in overhauling its telecommunications network (largest contract to date at that time at $620M) Spin-off of commercial consulting business; Carlyle becomes majority shareholder Acquired Defense Systems Engineering & Support Support DoD GTMP to strengthen national security interests and protect U.S. Armed Forces (largest contract to date at $937M) Acquired digital service business Aquilent Hired to help U.S. Navy prepare for WWII Began serving the U.S. Army Advisor to Chrysler ensuring a successful recovery with support of government lending Engaged as key contractor supporting the creation of DHS Initial Public Offering Launched the Vision 2020 Strategy Opened Innovation Center in Washington, DC Carlyle completes ownership exit 2017 Engaged by NFL to assist with the merger of the AFL and NFL 1966

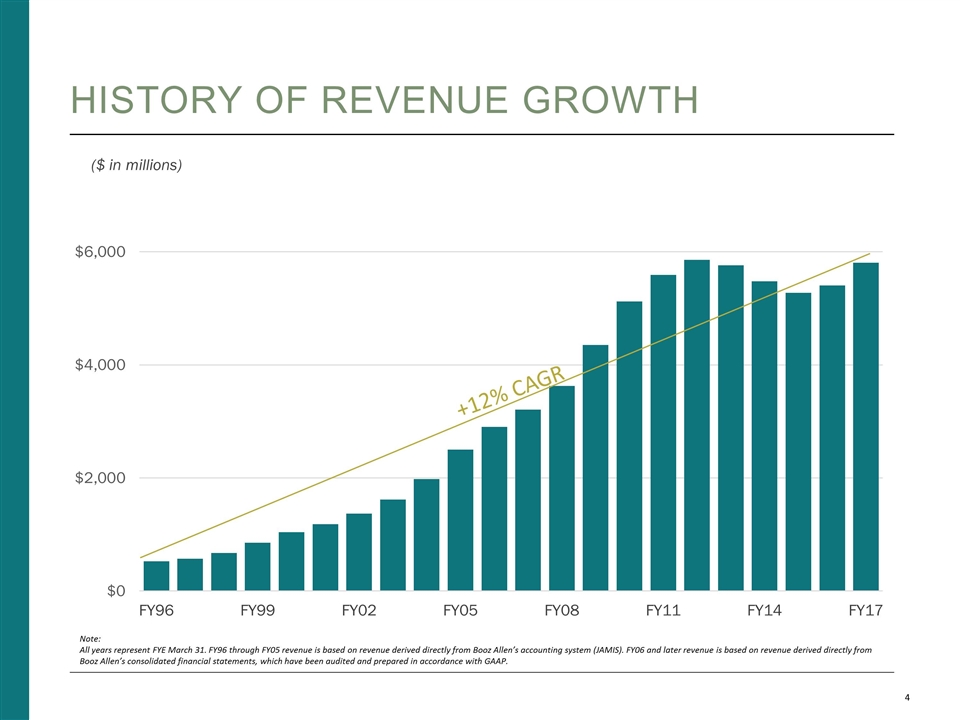

History of revenue growth Note: All years represent FYE March 31. FY96 through FY05 revenue is based on revenue derived directly from Booz Allen’s accounting system (JAMIS). FY06 and later revenue is based on revenue derived directly from Booz Allen’s consolidated financial statements, which have been audited and prepared in accordance with GAAP.

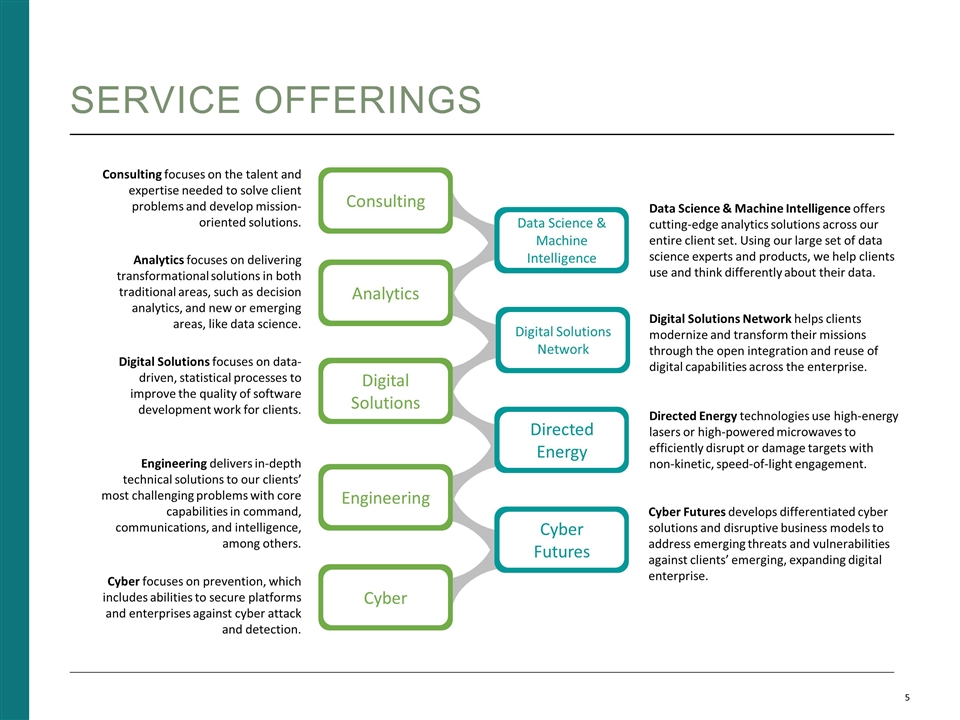

Service offerings Digital Solutions Engineering Cyber Analytics Directed Energy Digital Solutions Network Cyber Futures Data Science & Machine Intelligence Engineering delivers in-depth technical solutions to our clients’ most challenging problems with core capabilities in command, communications, and intelligence, among others. Cyber focuses on prevention, which includes abilities to secure platforms and enterprises against cyber attack and detection. Analytics focuses on delivering transformational solutions in both traditional areas, such as decision analytics, and new or emerging areas, like data science. Directed Energy technologies use high-energy lasers or high-powered microwaves to efficiently disrupt or damage targets with non-kinetic, speed-of-light engagement. Digital Solutions Network helps clients modernize and transform their missions through the open integration and reuse of digital capabilities across the enterprise. Cyber Futures develops differentiated cyber solutions and disruptive business models to address emerging threats and vulnerabilities against clients’ emerging, expanding digital enterprise. Data Science & Machine Intelligence offers cutting-edge analytics solutions across our entire client set. Using our large set of data science experts and products, we help clients use and think differently about their data. Consulting Consulting focuses on the talent and expertise needed to solve client problems and develop mission-oriented solutions. Digital Solutions focuses on data-driven, statistical processes to improve the quality of software development work for clients.

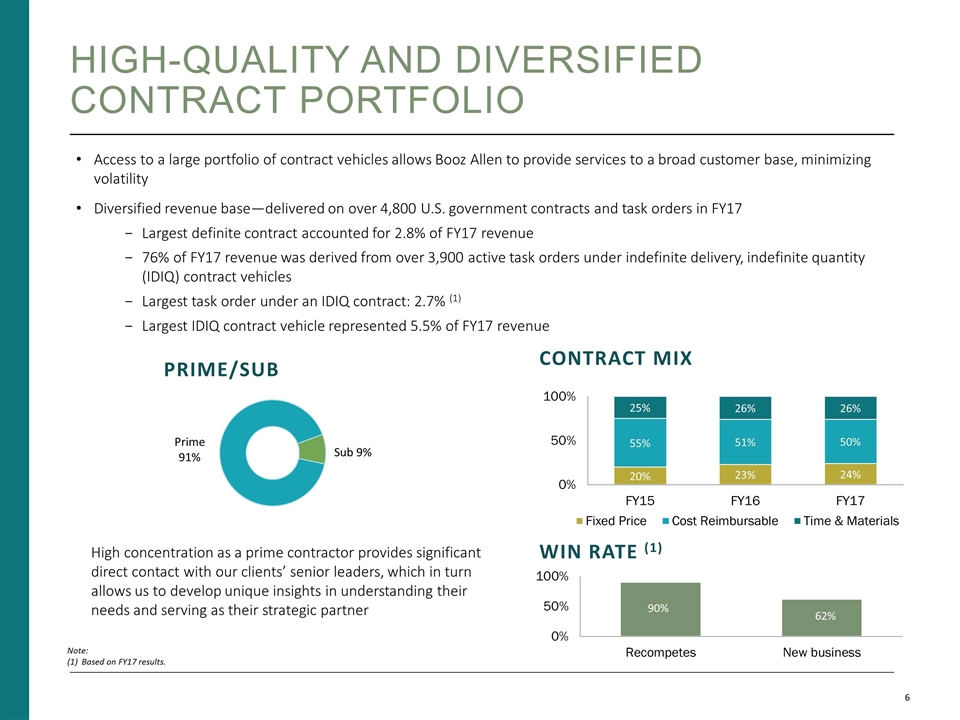

High-Quality and Diversified Contract Portfolio Access to a large portfolio of contract vehicles allows Booz Allen to provide services to a broad customer base, minimizing volatility Diversified revenue base—delivered on over 4,800 U.S. government contracts and task orders in FY17 Largest definite contract accounted for 2.8% of FY17 revenue 76% of FY17 revenue was derived from over 3,900 active task orders under indefinite delivery, indefinite quantity (IDIQ) contract vehicles Largest task order under an IDIQ contract: 2.7% (1) Largest IDIQ contract vehicle represented 5.5% of FY17 revenue Contract mix Note: Based on FY17 results. Win rate (1) High concentration as a prime contractor provides significant direct contact with our clients’ senior leaders, which in turn allows us to develop unique insights in understanding their needs and serving as their strategic partner Prime/Sub

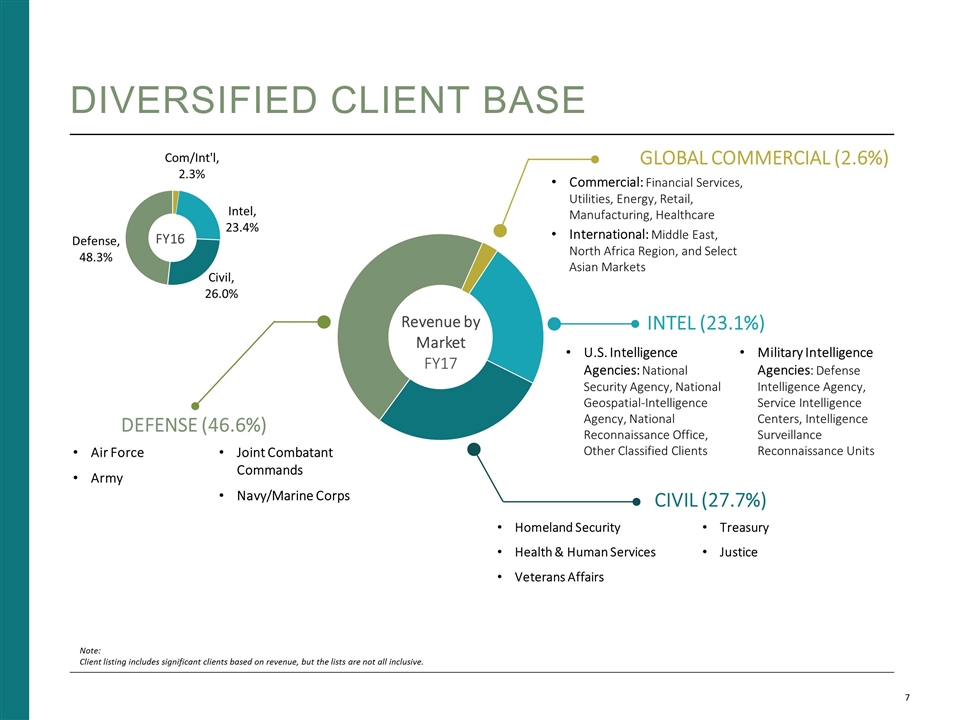

Diversified client base Commercial: Financial Services, Utilities, Energy, Retail, Manufacturing, Healthcare International: Middle East, North Africa Region, and Select Asian Markets GLOBAL COMMERCIAL (2.6%) U.S. Intelligence Agencies: National Security Agency, National Geospatial-Intelligence Agency, National Reconnaissance Office, Other Classified Clients Military Intelligence Agencies: Defense Intelligence Agency, Service Intelligence Centers, Intelligence Surveillance Reconnaissance Units INTEL (23.1%) CIVIL (27.7%) Air Force Army Joint Combatant Commands Navy/Marine Corps DEFENSE (46.6%) FY16 Homeland Security Health & Human Services Veterans Affairs Treasury Justice Revenue by Market FY17 Note: Client listing includes significant clients based on revenue, but the lists are not all inclusive.

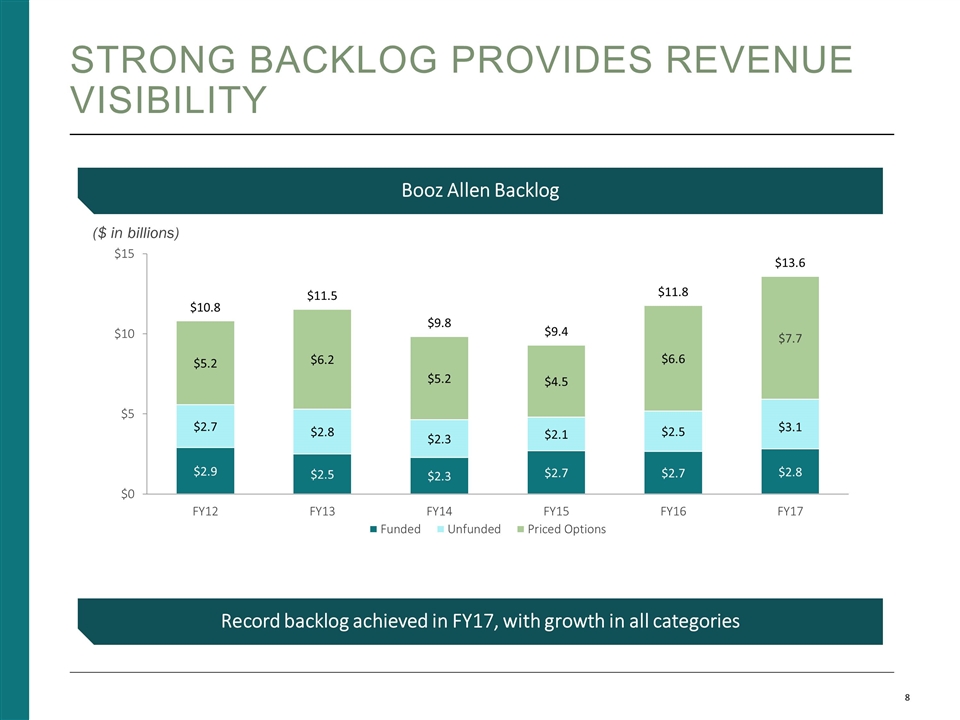

Strong Backlog Provides Revenue Visibility Booz Allen Backlog Record backlog achieved in FY17, with growth in all categories ($ in billions)

Key areas of differentiation We attribute our business and financial success to five key features Our culture Our purpose, as a firm, is to empower people to change the world, and we are committed to our employees Our strategy Successful execution of Vision 2020 reflects our ability to reinvent ourselves Our channels Our mature, large-scale channels enable us to shape future growth Our ability to integrate We merge our consulting expertise with advanced technical capabilities and mission knowledge to create integrated capabilities Our agility We anticipate the needs of the market and quickly move capabilities and talent to respond to client demands

Sources of Differentiation: our culture We are a values-driven organization with a unifying purpose We are defined and motivated by a unifying purpose and shared set of values Our inclusive culture champions diversity of perspective and experience Our people are passionate about their service to our clients, our clients’ missions, and the communities in which we live and work We operate as a single P&L and a single bonus pool Our organization aligns our leaders and teams with our clients to respond to emerging trends and shape our growth We share insights across our organization and deliver those insights to clients Our operating model allows us to be integrated and agile, moving leadership and talent to where the demand is going to be Our compensation model encourages and rewards collaboration and horizontal integration

Sources of Differentiation: our strategy Key Elements Moving closer to the center of our clients’ core mission Increasing the technical content of our work Attracting and retaining superior talent in diverse areas of expertise Leveraging innovation to deliver complex, differentiated, end-to-end solutions Creating a broad network of external partners and alliances Expanding into commercial and international markets Our vision 2020 strategy is in its fifth year of implementation

Sources of Differentiation: our Channels Our people fuel our growth through our channels Our people fuel our growth though the breadth of our client base, our long-standing relationships, and our understanding and commitment to their missions Our channels are central to our growth - who we serve and the vehicles through which we grow and expand these relationships to drive high margin / high quality work We have launched a set of targeted actions to help ensure we have the right vehicles at the right price point to support high margin work Contract vehicles to support the challenges clients are facing today and in the future Contract vehicles that provide clients with the scope to tackle their most pressing problems Benefits to the business as a result: Higher price point Supports our employee value proposition – doing important work attracts talent Doing this important work is the precursor to large procurements in the future – shaping their approaches and planting seeds to improve our probability of future success Our contract channel strategy supports this deliberate shape-capture plan, and is a primary mechanism to drive growth

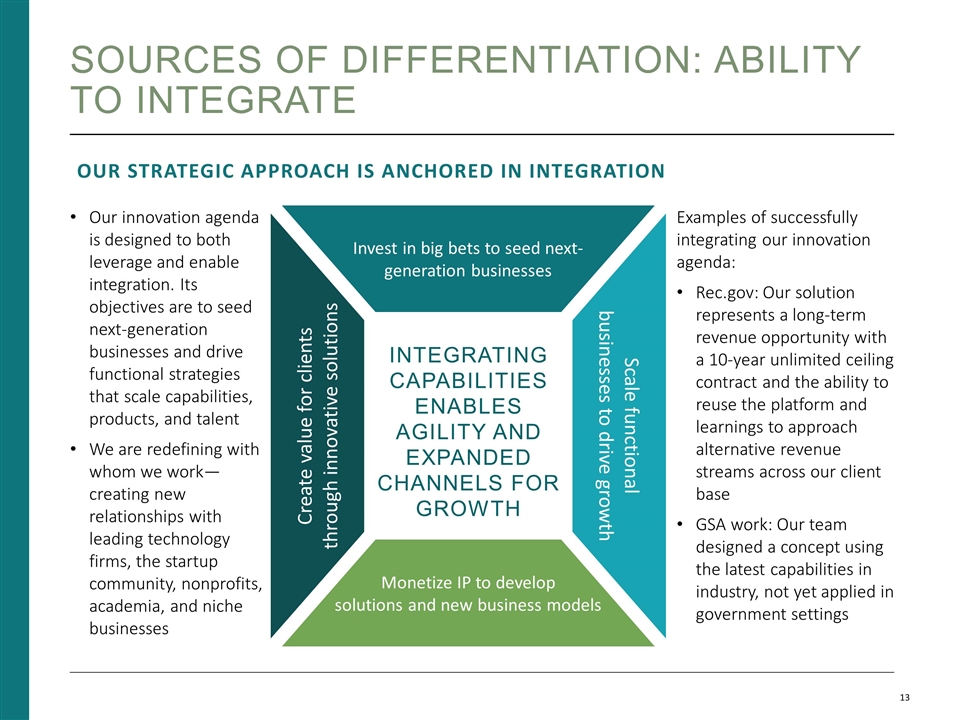

Sources of Differentiation: Ability to integrate Our innovation agenda is designed to both leverage and enable integration. Its objectives are to seed next-generation businesses and drive functional strategies that scale capabilities, products, and talent We are redefining with whom we work— creating new relationships with leading technology firms, the startup community, nonprofits, academia, and niche businesses Examples of successfully integrating our innovation agenda: Rec.gov: Our solution represents a long-term revenue opportunity with a 10-year unlimited ceiling contract and the ability to reuse the platform and learnings to approach alternative revenue streams across our client base GSA work: Our team designed a concept using the latest capabilities in industry, not yet applied in government settings Monetize IP to develop solutions and new business models Invest in big bets to seed next- generation businesses Scale functional businesses to drive growth Create value for clients through innovative solutions Integrating capabilities enables agility and expanded channels for growth Our strategic approach is anchored in Integration

Sources of Differentiation: agility We are differentiated by our ability to anticipate and react to the market A client-driven mindset, winning value proposition, and agility across our portfolio is a powerful combination that we believe positions us well for today and for sustained year-over-year growth Ability to swarm opportunities—functional and technical, across groups and accounts—and be resource efficient Client intimacy, capabilities, and insights allow us to position ourselves in areas unlikely influenced by budget cuts Examples of our success with agility Commercial: We are applying our military-grade cyber expertise to our commercial client base; rotating team members directly to our commercial clients provides employees the opportunity to stretch and grow new skills and missions SPARC: We are leveraging SPARC’s distributed digital delivery experience to form a firmwide Digital Solutions Network comprising geographically dispersed, but fully integrated, hubs Aquilent: We are quickly integrating Aquilent’s digital experience and expertise implementing over 100 GovCloud implementations across our broad market channels

Client mission support Case studies Global Threat Mitigation Program (GTMP) The nature of the 21st century physical and cybersecurity threats facing the US continues to evolve GTMP is a program to better share threat assessments, best practices and lessons learned to help ensure that our forces and those of our partner nations are well prepared to respond Booz Allen is supporting GTMP with threat identification and assessments and then provides training and expertise to combat these global threats Through our work, we build synergies, drive efficiencies, lower costs, and enhance collaboration and innovation Our agile teams have the ability to integrate, as they work with different partners across interrelated areas Our culture of collaboration is also important as we collaborate on best practices and share lessons learned with GTMP partners across tasks, organizations, and geographies. Our innovative contributions at GTMP are creating tangible results that help nations be better prepared to combat emerging and evolving threats

Client mission support Case studies Department of Veterans Affairs (VA) For over 60 years, Booz Allen has supported the Department of Veterans Affairs in serving the needs of America’s veterans – We’ve supported virtually every department of the VA, visiting every hospital and VA work location Our most recent experience is in modernizing VA IT systems, infrastructure and overall user experience for the delivery of benefits and services Booz Allen’s ability to integrate our technology expertise with our consulting culture allows us to serve as trusted advisors to the VA We believe that through our high-quality delivery, we have an essential partner of the VA in serving the needs of our nation’s veterans Where others have tried and failed, Booz Allen delivers success for Veterans through a number of integrated programs including: Automating the process for how veterans receive their benefits Transforming the way veterans interact with and communicate with the VA Creating an infrastructure where veterans and caregivers connect to mobile applications at any time We believe this work represents a quantum step forward for the VA and Booz Allen

Client mission support Case studies Platform Cyber Our capabilities are the result of deep roots in Defense and Intel Community Today, our cyber capabilities span: Enterprise technology Operational technology (Platforms) including vehicles, critical infrastructure, weapon systems, satellites, and health care devices In the federal space, there has been a new wave of attention and funding Civil agencies are more focused on it – as an example, we hold the Continuous Diagnostics and Mitigation (CDM) contract with DHS Presidential Executive Order last month With transition to operational technology, the client set changes – from one that is traditionally overhead, to a broader set of mission-focused and revenue-focused clients who manage the extended enterprise Booz Allen’s differentiation results from our knowledge of the threats and our understanding of the products, which allows us to fuse mission knowledge, services, and products to create a web that anticipates and protects against threats

Appendix

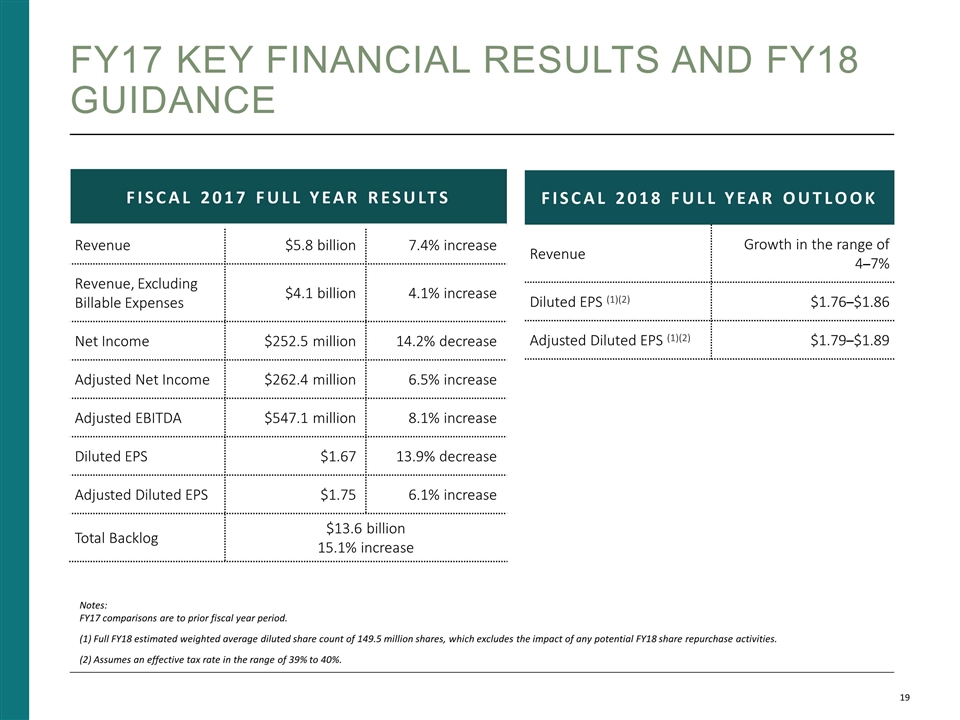

FY17 Key Financial Results and FY18 Guidance Notes: FY17 comparisons are to prior fiscal year period. (1) Full FY18 estimated weighted average diluted share count of 149.5 million shares, which excludes the impact of any potential FY18 share repurchase activities. (2) Assumes an effective tax rate in the range of 39% to 40%. Fiscal 2017 Full year Results Revenue $5.8 billion 7.4% increase Revenue, Excluding Billable Expenses $4.1 billion 4.1% increase Net Income $252.5 million 14.2% decrease Adjusted Net Income $262.4 million 6.5% increase Adjusted EBITDA $547.1 million 8.1% increase Diluted EPS $1.67 13.9% decrease Adjusted Diluted EPS $1.75 6.1% increase Total Backlog $13.6 billion 15.1% increase FISCAL 2018 FULL YEAR Outlook Revenue Growth in the range of 4–7% Diluted EPS (1)(2) $1.76–$1.86 Adjusted Diluted EPS (1)(2) $1.79–$1.89

Non-gaap financial information “Revenue, Excluding Billable Expenses" represents revenue less billable expenses. We use Revenue, Excluding Billable Expenses because it provides management useful information about the company's operating performance by excluding the impact of costs that are not indicative of the level of productivity of our consulting staff headcount and our overall direct labor, which management believes provides useful information to our investors about our core operations. "Adjusted EBITDA” represents net income before income taxes, net interest and other expense and depreciation and amortization and before certain other items, including transaction costs, fees, losses, and expenses, including fees associated with debt prepayments. Booz Allen prepares Adjusted EBITDA to eliminate the impact of items it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non-recurring nature or because they result from an event of a similar nature. "Adjusted Net Income" represents net income before: (i) adjustments related to the amortization of intangible assets resulting from the acquisition of our Company by the Carlyle Group, (ii) transaction costs, fees, losses, and expenses, including fees associated with debt prepayments, (iii) amortization or write-off of debt issuance costs and write-off of original issue discount, and (iv) release of income tax reserves, in each case net of the tax effect where appropriate calculated using an assumed marginal tax rate. We prepare Adjusted Net Income to eliminate the impact of items, net of tax, we do not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary, or non-recurring nature or because they result from an event of a similar nature. "Adjusted Diluted EPS" represents diluted EPS calculated using Adjusted Net Income as opposed to net income. Additionally, Adjusted Diluted EPS does not contemplate any adjustments to net income as required under the two-class method as disclosed in the footnotes to the financial statements. 9

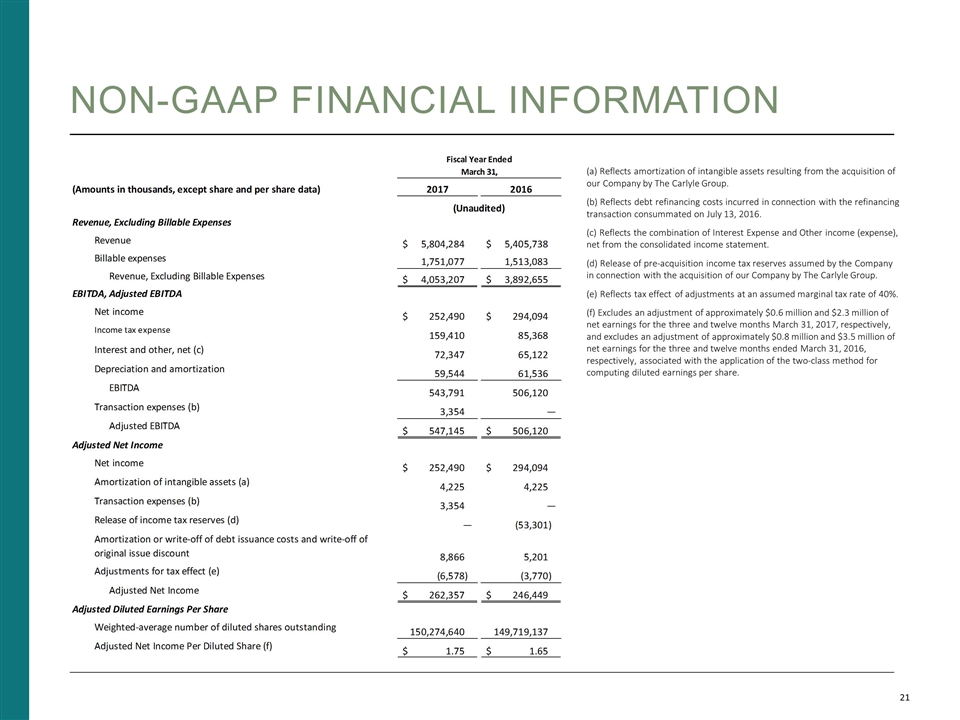

Non-gaap financial information (a) Reflects amortization of intangible assets resulting from the acquisition of our Company by The Carlyle Group. (b) Reflects debt refinancing costs incurred in connection with the refinancing transaction consummated on July 13, 2016. (c) Reflects the combination of Interest Expense and Other income (expense), net from the consolidated income statement. (d) Release of pre-acquisition income tax reserves assumed by the Company in connection with the acquisition of our Company by The Carlyle Group. (e) Reflects tax effect of adjustments at an assumed marginal tax rate of 40%. (f) Excludes an adjustment of approximately $0.6 million and $2.3 million of net earnings for the three and twelve months March 31, 2017, respectively, and excludes an adjustment of approximately $0.8 million and $3.5 million of net earnings for the three and twelve months ended March 31, 2016, respectively, associated with the application of the two-class method for computing diluted earnings per share.