Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AVISTA CORP | investorpresentation05-31x.htm |

Positioned for performance:

An overview of Q1 2017 and beyond

UBS West Coast Power/Utilities/Solar 1x1 Mini Conference

San Francisco

June 1, 2017

NYSE: AVA www.avistacorp.com

Exhibit 99.1

All forward-looking statements are Avista management’s present expectations of future

events and are subject to a number of factors and uncertainties that could cause actual

results to differ materially from those described in the forward-looking statements.

For more information on such factors and uncertainties, consult Avista’s most recent form

10-K and 10-Q, which are available on our website at www.avistacorp.com

Disclaimer

2

3

Strong and stable utility core

Regulated electric and natural gas operations

Serves customers in Washington, Idaho and Oregon

Contributes about 95% of earnings

Regulated electric operations

Serves customers in City and Borough of Juneau

Avista Utilities

Alaska Electric Light

& Power Company

(AEL&P)

Long history of service, trust,

innovation and collaboration

Photo: Spokane River Upper Falls

4

Steadily building long-term value

Reliably building value for our customers,

investors, communities and employees

Projecting long-term earnings and dividend growth of 4% to 5%

Avista Utilities

AEL&P

Strategic

Investments

5% to 6% rate base growth through utility capital investments

Upgrading infrastructure; grid modernization

Customer growth ~1%

Near-term earnings are challenged due to 2016 Washington rate order

Committed to reducing timing lag and align our earned returns with those

authorized by 2019-2020

Strong near-term rate base growth through investment in generation

Customer and load growth ~1%

Developing platforms for future growth

□ Targeting expanded natural gas services via LNG*

□ Exploring data science and advanced analytics

□ Investing in emerging technologies

*LNG: Liquefied natural gas

Avista Utilities

Investments in utility infrastructure

5

6

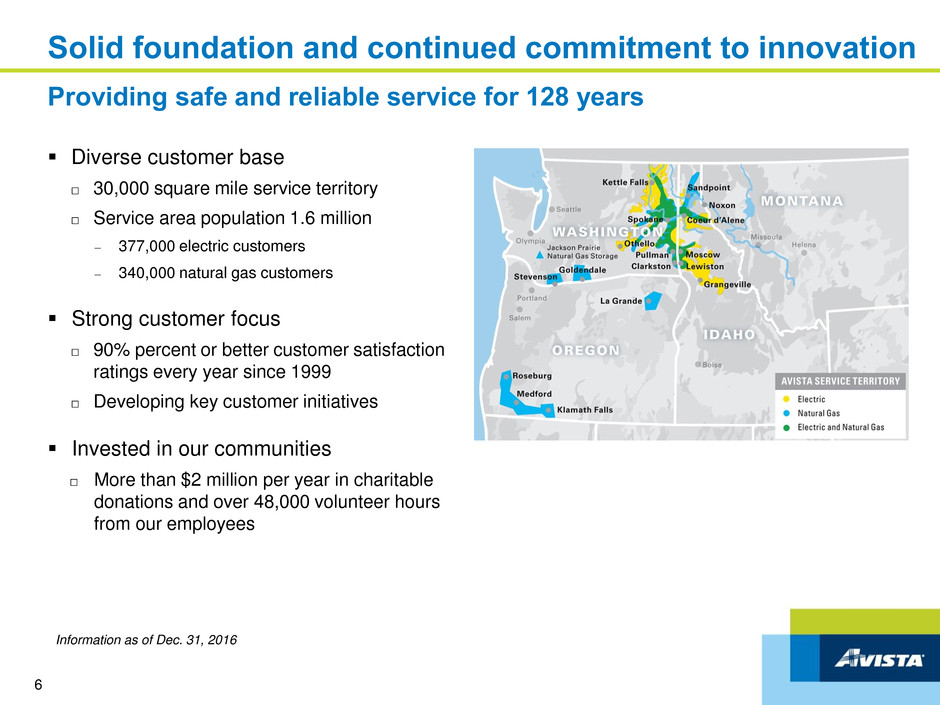

Diverse customer base

□ 30,000 square mile service territory

□ Service area population 1.6 million

– 377,000 electric customers

– 340,000 natural gas customers

Strong customer focus

□ 90% percent or better customer satisfaction

ratings every year since 1999

□ Developing key customer initiatives

Invested in our communities

□ More than $2 million per year in charitable

donations and over 48,000 volunteer hours

from our employees

Providing safe and reliable service for 128 years

Solid foundation and continued commitment to innovation

Information as of Dec. 31, 2016

7

A responsible mix of generation

Hydro

49%

Biomass

2% Wind

4.5%

Coal

9.5%

Natural Gas

35%

Avista Utilities Electricity Generation Resource Mix*

Dec. 31, 2016

Strategy is to control a portfolio of resources that responsibly meet our long-term

energy needs

Long resources through 2021; evaluating preferred resource strategy and will file an

electric Integrated Resource Plan in August

Exceeds Washington state’s 15% Renewable Portfolio Standard for the next 20 years

Founded on clean, renewable hydropower

*Based on maximum capacity

Excludes AEL&P Post Falls Dam, Idaho

8

Projected

Investments to upgrade our systems

* Other includes Facilities and Fleet

** Excludes capital expenditures at AEL&P of $16 million in 2016, and projected capital

expenditures of $7 million in 2017, $7 million 2018 and $13 million in 2019

5% to 6% rate base growth

$139 $137

$164 $157

$55 $59

$48 $47

$53 $50

$47 $46

$50 $47

$43

$42

$46

$49

$46 $52

$36 $42 $40

$48

$17 $21 $14

$9

$403 $405 $405 $405

2016 2017 2018 2019

Avista Utilities Capital Expenditures**

($ millions)

Environmental

Other*

Gas

Customer Growth

Enterprise Technology

Generation

T&D

9

Investing in our utility

Little Falls Plant Upgrade

Grid Modernization

Aldyl A Natural Gas

Pipe Replacement

Advanced Metering

Infrastructure (AMI)

Preserving and enhancing service reliability

Electric Vehicle Pilot

Program

10

Washington

May 26, 2017, filed two requests with the Washington Utilities and Transportation Commission.

POWER COST RATE ADJUSTMENT FILING

Designed to increase revenue by $15.0 million or 2.9%.

Effective Sept. 1, 2017.

Adjustment will expire at the conclusion of the general rate case.

GENERAL RATE CASE FILING

Designed to increase annual electric revenues by $61.4 million and annual natural gas revenues by $8.3 million, effective May 1, 2018.

Requests based on a 9.9% return on equity with a 50% common equity ratio.

Three-Year Rate Plan

New rates will take effect May 1, 2018, with annual increases in May 2019 and May 2020.

Power supply costs would be updated each year.

No new general rate cases would be filed with new rates effective

prior to May 1, 2021.

Driving Effective Regulatory Outcomes

Recovery of costs and capital investments

ELECTRIC NATURAL GAS

Proposed Revenue

Increase

Base %

Increase

Proposed Revenue

Increase

Base %

Increase

May 1, 2018 $61.4M 12.5% $8.3M 9.3%

May 1, 2019 $14.0M* 2.5% $4.2M 4.4%

May 1, 2020 $14.4M* 2.5% $4.4M 4.4%

*Excludes power supply adjustment

11

Driving Effective Regulatory Outcomes

Recovery of costs and capital investments

Idaho

Dec. 28, 2016, received approval of all-party settlement agreement designed to increase annual electric base revenues by 2.6% or

$6.3 million, plus continued recovery of $4.1 million of costs related to Palouse Wind Project through the PCA mechanism.

Based on a 9.5% return on equity with a 50.0% common equity ratio.

New rates took effect Jan. 1, 2017.

Plan to file electric and natural gas general rate case in Q2 2017.

Alaska

Sept. 16, 2016, filed an electric general rate request to increase base revenues by 8.1% or $2.8 million.

An interim rate increase of 3.86% or $1.3 million was effective Nov. 23, 2016.

An additional $2.9 million annually from interruptible service was approved to reduce overall revenue requirement from $5.7 million to $2.8 million.

Request based on a 58% equity ratio and a 13.8% return on equity.

The RCA has approximately 15 months to rule on the permanent rate increase.

The statutory timeline for the AEL&P GRC, with the consent of the parties, has been extended to Feb. 8, 2018.

Oregon

May 16, 2017, filed an all-party settlement agreement designed to increase annual natural gas base revenues by 5.9% or $3.5 million.

Based on 50% equity ratio and 9.4% return on equity.

If the settlement agreement is approved by the Public Utility Commission of Oregon, new rates would take effect on Oct. 1, 2017.

Alaska Electric Light & Power Company

(AEL&P)

Growing the utility core

12

Oldest regulated electric utility in Alaska, founded in 1893

13

Serves 17,000 electric customers in the City and Borough of

Juneau, meeting nearly all of its energy needs with hydropower

One of the lowest-cost electric utilities in the state

Approved capital structure of 53.8% equity and an authorized

return on equity of 12.875%

Diversifying our utility footprint

Juneau, Alaska

14

Strategic Investments

Developing platforms for future growth

Expand natural gas services via LNG

□ Salix (subsidiary)

– Generation – substitution for diesel

– Marine and rail fueling

□ Plum Energy

– Small LNG project investments

Targeted investments

□ Energy Impact Partners

– Private equity fund that invests in emerging technologies,

services, and business models throughout electricity supply

chain with a collaborative, strategic investment approach

□ TROVE

– Leverage AMI, consumer and other data through predictive

analytics to create utility value

□ Spirae

– Microgrid and distributed energy resource management

platform

Creating new growth platforms

15

16

Financial

Performance Metrics

Prudent Balance Sheet and Liquidity

Debt

52.2%

Equity

47.8%

Consolidated Capital Structure

March 31, 2017

17

Additional long-term debt maturities beyond 2027 not shown

*Excludes debt maturities of $15 million at Alaska Energy and Resources Company in 2019

$252.9 million of available liquidity at Avista Corp. as of March 31, 2017

In second half of 2017, expect to issue up to $110.0 million of long-term debt and up to

$70.0 million of common stock in order to fund planned capital expenditures and

maintain an appropriate capital structure

$273

$90

$52

$250

$14

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027

No significant maturities until 2018

($ millions)

*

$1.85

$3.10

$1.97

$2.15

2013 2014 2015 2016 2017

Guidance *

Continuing Operations Ecova (DiscOp)

$1.80-$2.00

18

Continued long-term earnings growth

Total Earnings per Diluted Share

Attributable to Avista Corporation

Business Segments Q1 2017 Q1 2016

Avista Utilities $0.90 $0.88

AEL&P $0.06 $0.05

Other - $(0.01)

Diluted EPS $0.96 $0.92

* 2017 earnings negatively impacted by Washington order

19

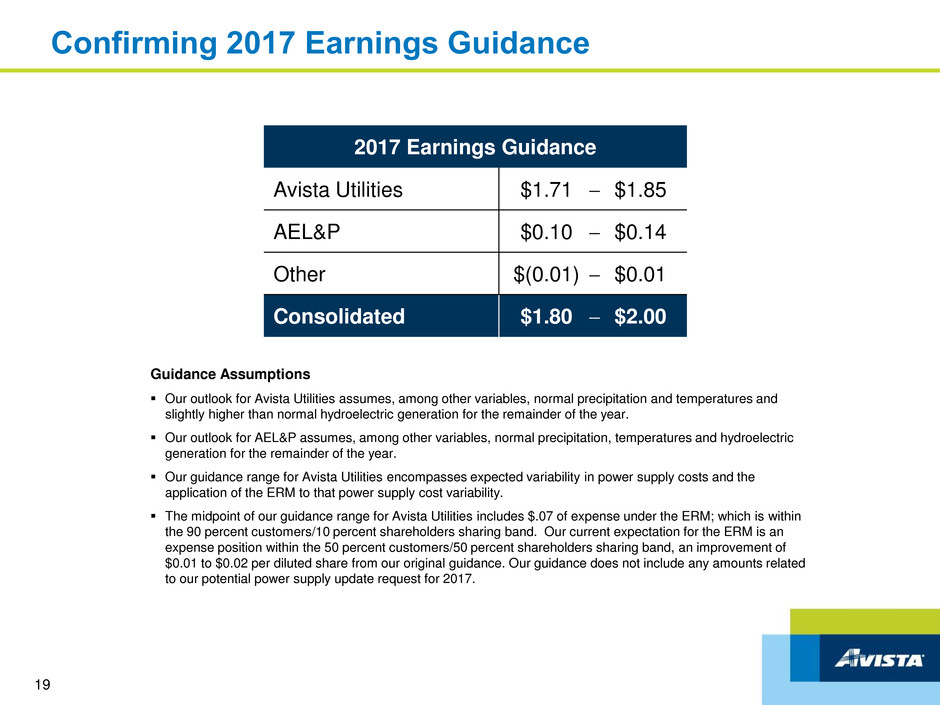

2017 Earnings Guidance

Avista Utilities $1.71 $1.85

AEL&P $0.10 $0.14

Other $(0.01) $0.01

Consolidated $1.80 $2.00

Guidance Assumptions

Our outlook for Avista Utilities assumes, among other variables, normal precipitation and temperatures and

slightly higher than normal hydroelectric generation for the remainder of the year.

Our outlook for AEL&P assumes, among other variables, normal precipitation, temperatures and hydroelectric

generation for the remainder of the year.

Our guidance range for Avista Utilities encompasses expected variability in power supply costs and the

application of the ERM to that power supply cost variability.

The midpoint of our guidance range for Avista Utilities includes $.07 of expense under the ERM; which is within

the 90 percent customers/10 percent shareholders sharing band. Our current expectation for the ERM is an

expense position within the 50 percent customers/50 percent shareholders sharing band, an improvement of

$0.01 to $0.02 per diluted share from our original guidance. Our guidance does not include any amounts related

to our potential power supply update request for 2017.

Confirming 2017 Earnings Guidance

*Current quarterly dividend of $0.3575 annualized

20

Dividend growth expected to keep pace with long-term earnings growth

Attractive and growing dividend

$1.22

$1.27

$1.32

$1.37

$1.43*

2013 2014 2015 2016 2017*

21

An attractive investment

Strong and responsible core utility

□ Investing substantially to modernize infrastructure and

upgrade systems

□ Steady returns and attractive dividend yield

□ One of the greenest utilities in the U.S.*

□ Committed to reducing current regulatory timing lag of

100-120 bps by 2019-2020

Focus on utility growth

□ Selective acquisitions

□ Developing new products and services and supporting

economic development throughout service area

Positioning for the future

□ Strategically investing in ways to extend access to

natural gas via LNG, leverage AMI data through

applied analytics, gain insight into leading-edge

energy solutions

□ Track record of innovation (e.g. Itron, ReliOn, Ecova)

*Source: Benchmarking Air Emissions of the 100 Largest Power Producers in the United States,

NRDC, July 2016

Photo: Cabinet Gorge Dam

Reliably building value for

our customers, investors,

communities and employees

We welcome your questions

Company Contact

Jason Lang, Investor Relations Manager

509-495-2930

Jason.Lang@avistacorp.com

www.avistacorp.com

Photo: Huntington Park, Spokane, Wash.

22