Attached files

| file | filename |

|---|---|

| EX-99.4 - EXHIBIT 99.4 - HERTZ GLOBAL HOLDINGS, INC | a994noticeofconditionalred.htm |

| EX-99.3 - EXHIBIT 99.3 - HERTZ GLOBAL HOLDINGS, INC | a993noticeofconditionalred.htm |

| EX-99.2 - EXHIBIT 99.2 - HERTZ GLOBAL HOLDINGS, INC | a992pressrelease-proposedp.htm |

| 8-K - 8-K - HERTZ GLOBAL HOLDINGS, INC | a2017securednotesoffering8.htm |

The Hertz Corporation

May 30, 2017

2

Forward-Looking Statements

Certain statements contained in this presentation are “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements give our current expectations or forecasts of future events and

our future performance and do not relate directly to historical or current events or our historical or current performance.

Most of these statements contain words that identify them as forward looking, such as “anticipate”, “estimate”, “expect”,

“project”, “intend”, “plan”, “believe”, “seek”, “will”, “may”, “opportunity”, “target” or other words that relate to future events,

as opposed to past or current events.

Forward-looking statements are based on the expectations, forecasts and assumptions of our management as of the date

made and involve risks and uncertainties, some of which are outside of our control, that could cause actual outcomes and

results to differ materially from current expectations. For some of the factors that could cause such differences, please

see the sections of our annual report on Form 10-K for the year ended December 31, 2016 entitled “Risk Factors” and

“Cautionary Note Regarding Forward-Looking Statements.” Copies of this report are available from the Securities and

Exchange Commission (“SEC”), on our website or through our Investor Relations department.

We cannot assure you that the assumptions under any of the forward-looking statements will prove accurate or that any

projections will be realized. We expect that there will be differences between projected and actual results. These forward-

looking statements speak only as of the date made, and we do not undertake any obligation to update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise. We caution prospective

lenders not to place undue reliance on forward-looking statements. All forward-looking statements attributable to us are

expressly qualified in their entirety by the cautionary statements contained herein and in our annual report described

above.

3

Disclosure on Financials in Presentation

Hertz Global Holdings, Inc. (“HGH”) is the ultimate parent company of The Hertz Corporation (“Hertz”, “Company,” “we,” “us” and “our”). GAAP

and non-GAAP profitability metrics for Hertz, the wholly owned operating subsidiary, are materially the same as those for HGH.

The Company has three reportable segments as follows:

U.S. Rental Car (“U.S. RAC”) – rental of vehicles (cars, crossovers and light trucks), as well as sales of ancillary products and services, in the

United States and consists of the Company’s United States operating segment;

International Rental Car (“International RAC”) – rental and leasing of vehicles (cars, vans, crossovers and light trucks), as well as sales of

ancillary products and services, internationally and consists of the Company’s Europe and Other International operating segments, which are

aggregated into a reportable segment based primarily upon similar economic characteristics, products and services, customers, delivery

methods and general regulatory environments;

All Other Operations – primarily consists of the Company’s Donlen business which provides vehicle leasing and fleet management services,

together with other business activities, which represents less than 2% of revenues and expenses of the segment.

In addition to the above reportable segments, the Company has corporate operations (“Corporate”) which includes general corporate assets and

expenses and certain interest expense (including net interest on non-vehicle debt).

Adjusted Corporate EBITDA, Adjusted Corporate EBITDA Margin, Gross EBITDA, Corporate EBITDA and Credit Agreement Adjusted Corporate

EBITDA are non-GAAP measures within the meaning of Regulation G. A reconciliation of income (loss) from continuing operations before income

taxes to Adjusted Corporate EBITDA is included in the appendix of this presentation. Adjusted Corporate EBITDA margin is calculated as the ratio

of Adjusted Corporate EBITDA to total revenues. Reconciliations of Income (loss) from continuing operations before income taxes to Adjusted

Corporate EBITDA on a segment basis for HGH are included in schedules to HGH’s earnings releases, and with respect to 2013 in HGH’s Form 8-

K filed on November 9, 2015, which amounts are the same for the Company as for HGH.

We regularly borrow amounts available to us under our credit facilities and use the proceeds thereof to invest in our business and to manage our

working capital and liquidity needs. Except as otherwise described herein, the information set forth in this presentation does not reflect changes

that have occurred in any outstanding balances, including our cash and cash equivalents or outstanding indebtedness, since March 31, 2017.

Amounts shown in this presentation, unless otherwise indicated, are for Hertz.

Business Overview

5

Hertz is Built on a Foundation of Strong Assets...

Top 10 Used Car Company in the United States

Iconic Business Operating through Distinguished Hertz, Dollar & Thrifty Brands

Strong Global Footprint with ~9,700 Corporate and Franchisee Locations Worldwide

Stable and Profitable International RAC Segment

Resilient Corporate and Affinity Partnerships and Consumer Loyalty Program

Industry Leading Large Company Leasing Business through Donlen

6

One of three major players in the North

American car rental industry with ~$9

billion in revenue in 2016

...That We Believe Will Drive Future Growth and Profitability…

Iconic Business &

Well-Recognized Brands

Strong Global Footprint

Stable & Profitable International

RAC Segment

Leading Donlen Leasing Business

Resilient Partnerships & Consumer

Loyalty Program

Top 10 Used Car Company in the

United States

International

Revenue

24%

U.S. Revenue

76%

~9,700 locations in the United States,

Australia, New Zealand as well as all

major markets in Europe

Rental locations in ~150 countries

Fleet management expertise enables

Hertz to further participate in evolving

mobility landscape

As of year-end 2016, ~175,000 vehicles

at Donlen

$9.2 $9.5 $9.0 $8.8

2013 2014 2015 2016

International RAC Other Ops U.S. RAC

Announces long-term strategic

partnership with Localiza, South

America’s largest rental car company

Announces partnership with CAR Inc.

providing exposure to fast growing

market in China

Rapidly growing customer loyalty

program, with over 10 million members

globally

As measured by units sold, 9th largest

used car company in the United States

through 80 retail outlets

65% of re-marketing through higher-

yielding, non-auction channels

2016 Revenue by Geography

Historical Revenue Profile

($ in billions)

7

…With Int’l and Donlen Providing a Stable Earnings Base…

We believe we have a leading market share position in major European

airports2

Highly recurring franchisee revenue of over $117 million (Q1 2017 LTM)

58%3 program vehicles for International RAC

Less volatile used car market

International RAC

Revenue

All Other Operations (Includes Donlen)

$175 $188

$255

$228 $220

2013 2014 2015 2016 LTM Q1

2017

Adj. Corp. EBITDA

$527

$568 $583 $592 $600

2013 2014 2015 2016 LTM Q1

2017

Revenue

$53

$60

$66

$69

$72

2013 2014 2015 2016 LTM Q1

2017

Adj. Corp. EBITDA

U.S.

RAC

69%

Int'l

RAC

24%

Donlen

7%

Diversified blue-chip customer base with virtually zero credit losses over

last five years

Strong growth with additional opportunities in ride sharing

Highly recurring revenue and EBITDA

A leading technology innovator for services in the fleet leasing industry

U.S.

RAC

48%

Int'l

RAC

39%

Donlen

13%

Int’l RAC and Donlen represent ~50% of Q1 2017 LTM Adj. Corporate EBITDA

% Q1 2017 LTM Revenue By Segment % Q1 2017 LTM Adj. Corp. EBITDA By Segment1

$2,378 $2,436

$2,148 $2,097 $2,075

2013 2014 2015 2016 LTM Q1

2017

Note: $ in millions.

1 Excludes corporate operations, which includes general corporate assets and expenses and certain interest expense (including net interest on non-vehicle debt).

2 Based on locations where data regarding rental concessionaire activity is available.

3 Purchases for year-ended December 31, 2016.

Donlen

8

...and Successfully Navigate Industry Headwinds

Pricing

Pressures

Pricing has historically responded to changes in fleet costs, but typically lags ~9 months

Over-fleeting has created “high” pricing pressure environment

Hertz is positioning itself to capture quality demand through investments in revenue management

systems and improve pricing through fleet optimization

Fleet

Management

Hertz historically fleeted to an aspirational growth assumption resulting in overfleeting

Furthermore, oversupply of used cars entering the market is expected to continue pressuring residual

values

Hertz is actively resizing its fleet to reduce risk of overfleeting and intends to negotiate model year

2018 purchases at prices that reflect the residual market environment

Over time Hertz intends to optimize the mix of vehicles in a manner that maximizes RPD and

provides responsiveness to changing levels of car rental demand

Competitive Threat

From Ride Share

Operators

Ride share operators have emerged as alternative transportation under certain use cases

— We believe this reflects only a small percentage of our revenue base

Modest negative impact on shorter duration car rentals (1-3 days)

— Presents profitable partnership opportunities

Currently have agreements with Uber and Lyft to supply drivers with 1-week to monthly rentals

Despite their presence, top 100 U.S. airport industry revenue grew nearly 3% in 2016 vs. 2015

1

2

3

9

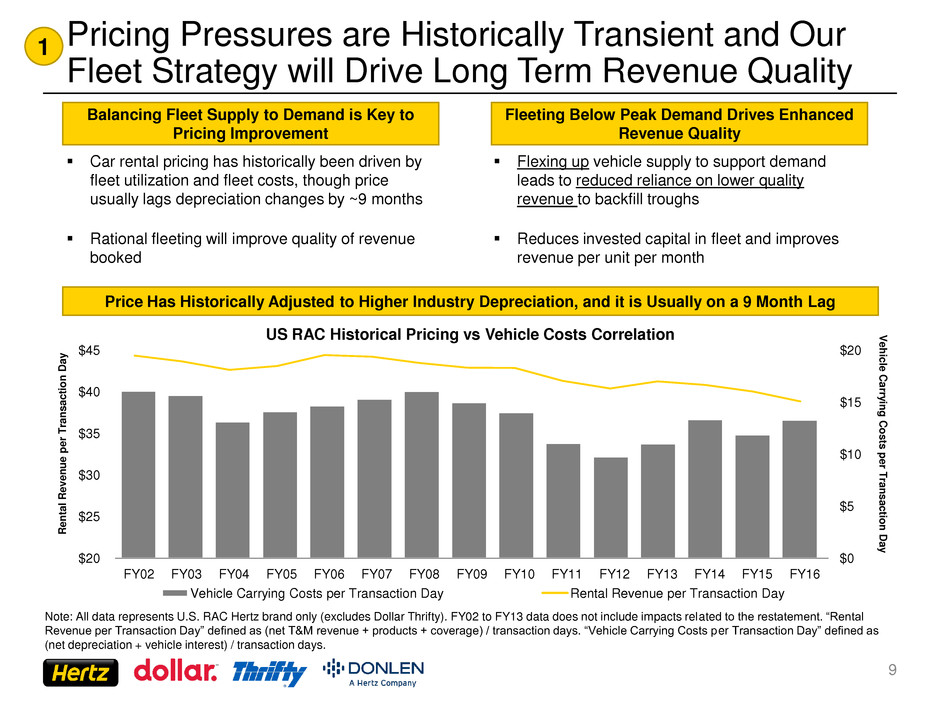

Pricing Pressures are Historically Transient and Our

Fleet Strategy will Drive Long Term Revenue Quality

Car rental pricing has historically been driven by

fleet utilization and fleet costs, though price

usually lags depreciation changes by ~9 months

Rational fleeting will improve quality of revenue

booked

1

Balancing Fleet Supply to Demand is Key to

Pricing Improvement

Fleeting Below Peak Demand Drives Enhanced

Revenue Quality

Flexing up vehicle supply to support demand

leads to reduced reliance on lower quality

revenue to backfill troughs

Reduces invested capital in fleet and improves

revenue per unit per month

Price Has Historically Adjusted to Higher Industry Depreciation, and it is Usually on a 9 Month Lag

Note: All data represents U.S. RAC Hertz brand only (excludes Dollar Thrifty). FY02 to FY13 data does not include impacts related to the restatement. “Rental

Revenue per Transaction Day” defined as (net T&M revenue + products + coverage) / transaction days. “Vehicle Carrying Costs per Transaction Day” defined as

(net depreciation + vehicle interest) / transaction days.

$0

$5

$10

$15

$20

$20

$25

$30

$35

$40

$45

FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16

US RAC Historical Pricing vs Vehicle Costs Correlation

Vehicle Carrying Costs per Transaction Day Rental Revenue per Transaction Day

R

e

n

ta

l

R

e

v

e

nue

pe

r

T

ra

ns

a

c

ti

on

D

a

y

V

e

h

ic

le

C

a

rr

y

ing

C

os

ts

pe

r T

ra

ns

a

c

tion

D

a

y

10

Fleet Optimization To Better Align with Industry Demands

Aggressively sold vehicles in 1Q

2017 to right size fleet capacity,

despite industry residual weakness

Expect fleet optimization initiatives

to be completed by end of 2Q 2017

2

490 499 490 485

161 167 169 173

170 173 164 175

821 839 823 833

2013 2014 2015 2016

U.S. RAC International RAC Donlen

Average Vehicle Fleet Over Time (000s)

Optimized fleet improves pricing,

reduces operational cost volatility,

and improves time of fleet

remarketing

Should allow for YoY utilization

improvements in back half 2017

11

Emergence of Ride Share Operators Presents

Potential Growth Opportunities

3

Proactively established partnerships with Uber and Lyft to supply U.S. drivers with cars under specified rental

agreement, turning ride-sharing into a revenue opportunity

Enhancing ease and speed of rental car service via mobile applications and “counter-less” checkout

Improves fleet utilization of off-airport, a

business that typically experiences lower

demand than on-airport as a result of

including a minimum one-week rental

Used as a sales channel for older vehicles

that are nearing rotation out of fleet

Enables Hertz to extend the useful life of a

revenue earning asset at a time when the

depreciation curve is less steep

Rental Period (Days)

0-1 2-3 4-5 6+

Miles

per Day

<10

4% of Total Revenue

10 – 30

30 – 60

60+

Revenue most vulnerable to ride-sharing

Limited U.S. RAC Revenue Vulnerability to Ride-Sharing Ride-Sharing Partnership Highlights

12

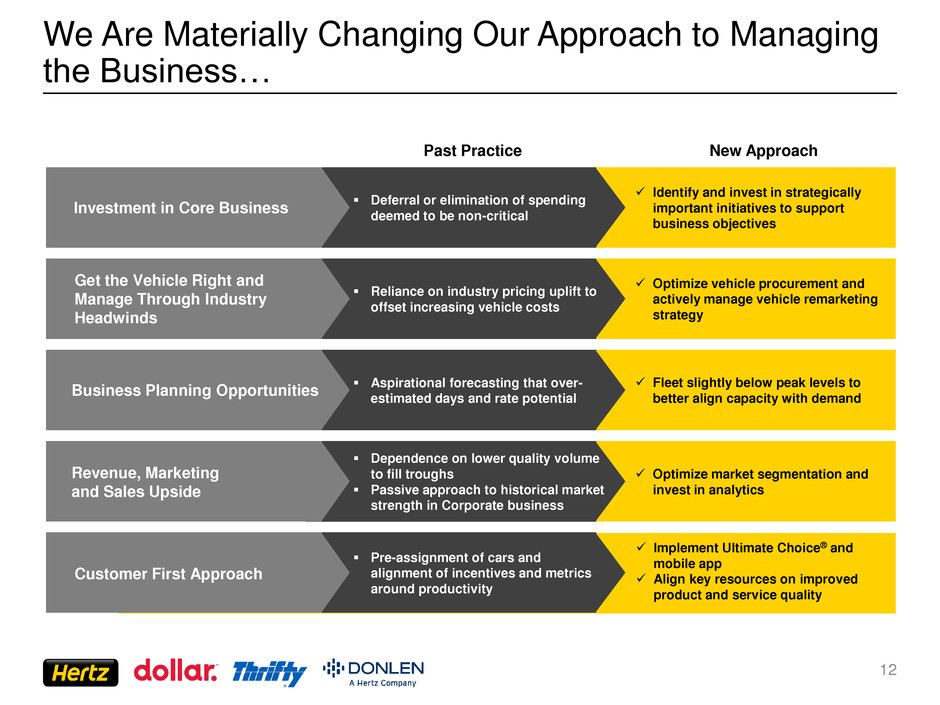

We Are Materially Changing Our Approach to Managing

the Business…

New Approach Past Practice

Investment in Core Business

Deferral or elimination of spending

deemed to be non-critical

Identify and invest in strategically

important initiatives to support

business objectives

Get the Vehicle Right and

Manage Through Industry

Headwinds

Reliance on industry pricing uplift to

offset increasing vehicle costs

Optimize vehicle procurement and

actively manage vehicle remarketing

strategy

Business Planning Opportunities

Aspirational forecasting that over-

estimated days and rate potential

Fleet slightly below peak levels to

better align capacity with demand

Revenue, Marketing

and Sales Upside

Dependence on lower quality volume

to fill troughs

Passive approach to historical market

strength in Corporate business

Optimize market segmentation and

invest in analytics

Customer First Approach

Pre-assignment of cars and

alignment of incentives and metrics

around productivity

Implement Ultimate Choice® and

mobile app

Align key resources on improved

product and service quality

13

… and Measurable Progress is Already Being Delivered…

Opportunity Current State

Vehicle

Fleet

Improve vehicle mix

Provide competitive trim and choice

Meet free upgrade performance

targets

Compact mix declined 400 basis points in Q1 2017 vs. Q1 2016

and was under 17% of fleet at the end of April 2017

Invested ~$70mm in trim and premium vehicles

Improved upgrades at top 20 U.S. airports from 45% in

September 2016 to currently near 80% for Platinum and

President’s Circle members

Operations

Update service delivery model and

improve speed and convenience

Improve agent training, incentive

design and service

Provide clean cars consistently

Ultimate Choice new service delivery model on track and

projected to be in 60% of total airport revenue markets by mid-

year 2017 and 80% by year-end 2017

Agent incentives adjusted to focus on service and productivity

Over 70 new car washes will be installed by mid-year 2017 and

new cleaner standards in place

Technology Modernize IT Platform

As of June 1, 2017, next generation revenue management

system live in 100% of U.S. markets

Modernized e-commerce platform scheduled for completion by

year-end 2017

New fleet accounting, management and reservation and rental

systems in process to be delivered in 2018 and early 2019

Brand &

Marketing

Invest in marketing and

e-commerce activities

Reposition brand and segment

customers with brands never

executed since Dollar Thrifty

acquisition

Investing incremental dollars in partnerships and e-commerce

activities

Brand repositioning and market segmentation work-in-progress

14

IT Platform / Cost of Delivery

• IT outsourcing

• Customer relationship

management system

• Global fleet management

system

US RAC Direct Operations

Expenses

Back Office Optimization and

General Overhead

• Vehicle damage collections

process

• Labor productivity

improvements

• Improved sourcing

• Outsourced accounts payable operations

• Outsourced US claims processing

• Reduced strategic consulting spend

• Streamlined vehicle administrative operations

Consolidated Cost Savings

• FY:17E expected savings of ~$160M

• FY:16 realized savings of ~$350M

• FY:15 realized savings of $229M

… With Improved Cost Structure and Investments to Drive

Further Cost Take-outs

Note: Consolidated Unit Costs Metrics Reflect Initiative Progress.

Cost Efficiency Remains a Priority

15

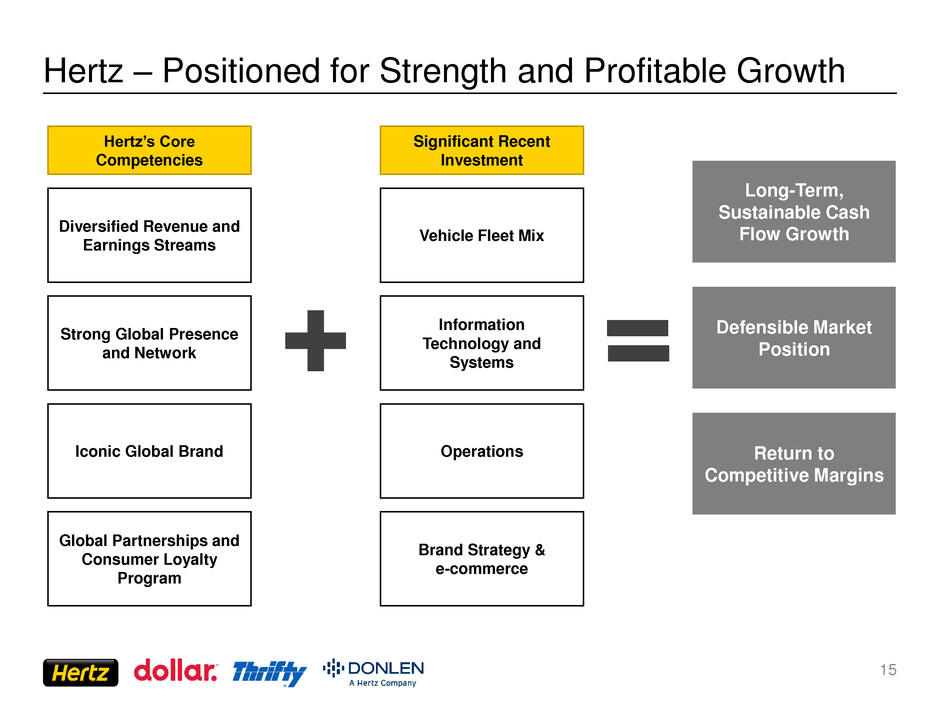

Significant Recent

Investment

Hertz’s Core

Competencies

Diversified Revenue and

Earnings Streams

Strong Global Presence

and Network

Iconic Global Brand

Global Partnerships and

Consumer Loyalty

Program

Vehicle Fleet Mix

Information

Technology and

Systems

Operations

Brand Strategy &

e-commerce

Long-Term,

Sustainable Cash

Flow Growth

Defensible Market

Position

Return to

Competitive Margins

Hertz – Positioned for Strength and Profitable Growth

16

Key Credit Highlights

Flexible Pro Forma Capital Structure & Attractive Maturity Profile 7

Significant Structural Protection for Notes 6

Diversified Business Mix 1

Major Player in Consolidated Rental Car Industry 2

Recent Investments are Expected to Improve Profitability 3

Limited Vulnerability & Role to Play in Evolving Mobility Landscape 5

Liquid Asset Base & Variable Cost Structure Provides Cyclical Durability 4

Financial Overview

18

Attractive Financial Attributes

Strong Free Cash Flow Generation

Largely Discretionary Non-fleet Capex

Significant Tax Assets (NOLs) Resulting in Low Cash Taxes

Strong Liquidity Position with No Significant Near-

Term Corporate Maturities

Highly Variable Cost Structure

Liquid Fleet Assets with Embedded Equity

No Structural Reasons Why Hertz Cannot Achieve Competitive Industry Margins

19

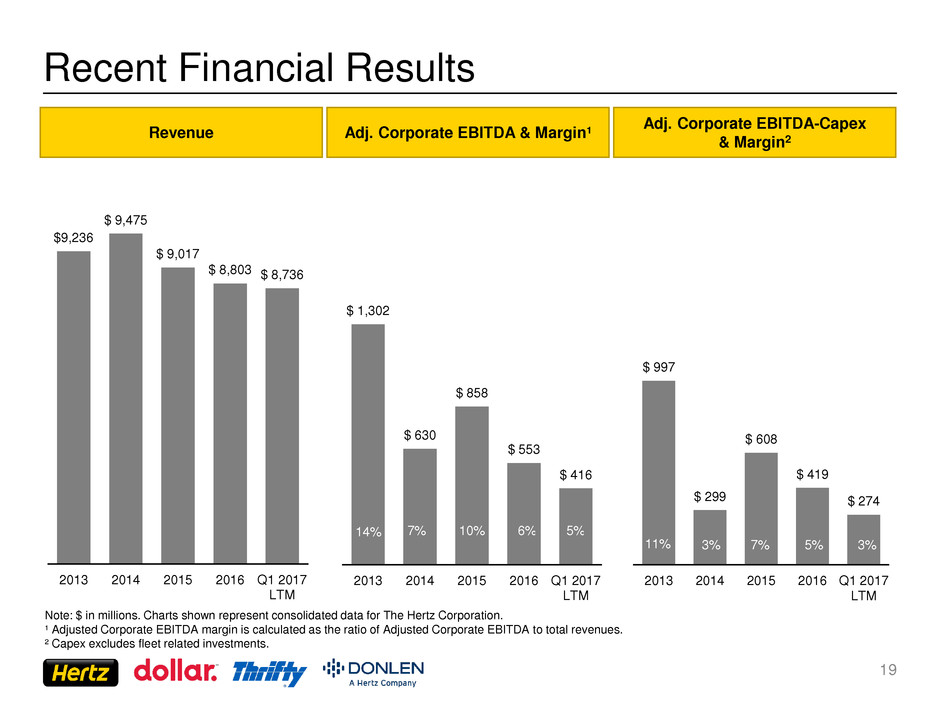

Recent Financial Results

$9,236

$ 9,475

$ 9,017

$ 8,803 $ 8,736

2013 2014 2015 2016 Q1 2017

LTM

$ 1,302

$ 630

$ 858

$ 553

$ 416

2013 2014 2015 2016 Q1 2017

LTM

7% 10% 5% 6% 14%

$ 997

$ 299

$ 608

$ 419

$ 274

2013 2014 2015 2016 Q1 2017

LTM

3% 7% 5% 3% 11%

Note: $ in millions. Charts shown represent consolidated data for The Hertz Corporation.

¹ Adjusted Corporate EBITDA margin is calculated as the ratio of Adjusted Corporate EBITDA to total revenues.

² Capex excludes fleet related investments.

Revenue Adj. Corporate EBITDA & Margin¹

Adj. Corporate EBITDA-Capex

& Margin2

20

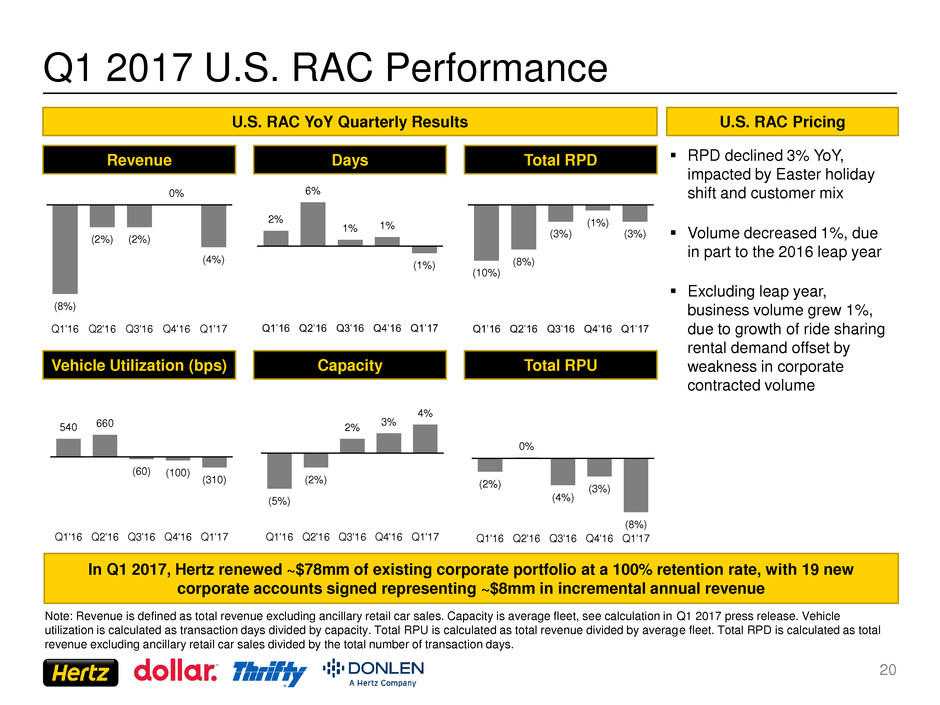

In Q1 2017, Hertz renewed ~$78mm of existing corporate portfolio at a 100% retention rate, with 19 new

corporate accounts signed representing ~$8mm in incremental annual revenue

Q1 2017 U.S. RAC Performance

Note: Revenue is defined as total revenue excluding ancillary retail car sales. Capacity is average fleet, see calculation in Q1 2017 press release. Vehicle

utilization is calculated as transaction days divided by capacity. Total RPU is calculated as total revenue divided by average fleet. Total RPD is calculated as total

revenue excluding ancillary retail car sales divided by the total number of transaction days.

RPD declined 3% YoY,

impacted by Easter holiday

shift and customer mix

Volume decreased 1%, due

in part to the 2016 leap year

Excluding leap year,

business volume grew 1%,

due to growth of ride sharing

rental demand offset by

weakness in corporate

contracted volume

(8%)

(2%) (2%)

0%

(4%)

Q1'16 Q2'16 Q3'16 Q4'16 Q1'17

2%

6%

1% 1%

(1%)

Q1’16 Q2’16 Q3’16 Q4’16 Q1’17

(10%)

(8%)

(3%)

(1%)

(3%)

Q1’16 Q2’16 Q3’16 Q4’16 Q1’17

540 660

(60) (100)

(310)

Q1'16 Q2'16 Q3'16 Q4'16 Q1'17

(5%)

(2%)

2%

3%

4%

Q1'16 Q2'16 Q3'16 Q4'16 Q1'17

(2%)

0%

(4%)

(3%)

(8%)

Q1'16 Q2'16 Q3'16 Q4'16 Q1'17

U.S. RAC YoY Quarterly Results

Revenue Days Total RPD

Vehicle Utilization (bps) Capacity Total RPU

U.S. RAC Pricing

21

U.S. RAC Fleet Management

Note: Quarterly trends reflect seasonality. Rentable Vehicle Utilization is calculated by dividing transaction days by available car days, excluding fleet unavailable

for rent e.g.: recalled, out of service, and vehicle in onboarding and remarketing channels.

34%

24%

42%

35%

24%

41%

Auction Retail Dealer Direct

1Q:17

1Q:16

540

660

(60) (100)

(310)

240

380

(60) (50)

(170)

Vehicle UTE Rentable UTE

Q1’16 Q2’16 Q3’16 Q4’16 Q1’17

Rentable utilization 170 basis points lower 1Q

2017 vs 1Q 2016, as mild weather impacted

demand in certain segments such as Insurance

Replacement and certain sun destinations

Expect fleet optimization initiatives to be

completed by end of 2Q 2017

Should allow for YoY utilization improvements in

back half 2017

Aggressively sold Risk cars in 1Q 2017 to right

size capacity, despite industry residual weakness

Sold 21% more risk vehicles YoY

Outlook for FY17 residual decline adjusted from

-3% to -3.5%

Supply agreements with Uber / Lyft provide

drivers with rental cars the company rotates out

of its fleet

Non-Program Vehicle Disposition Channel Mix

Q1 2017 Vehicle Utilization YoY Basis Point Incr. / (Decr.)

22

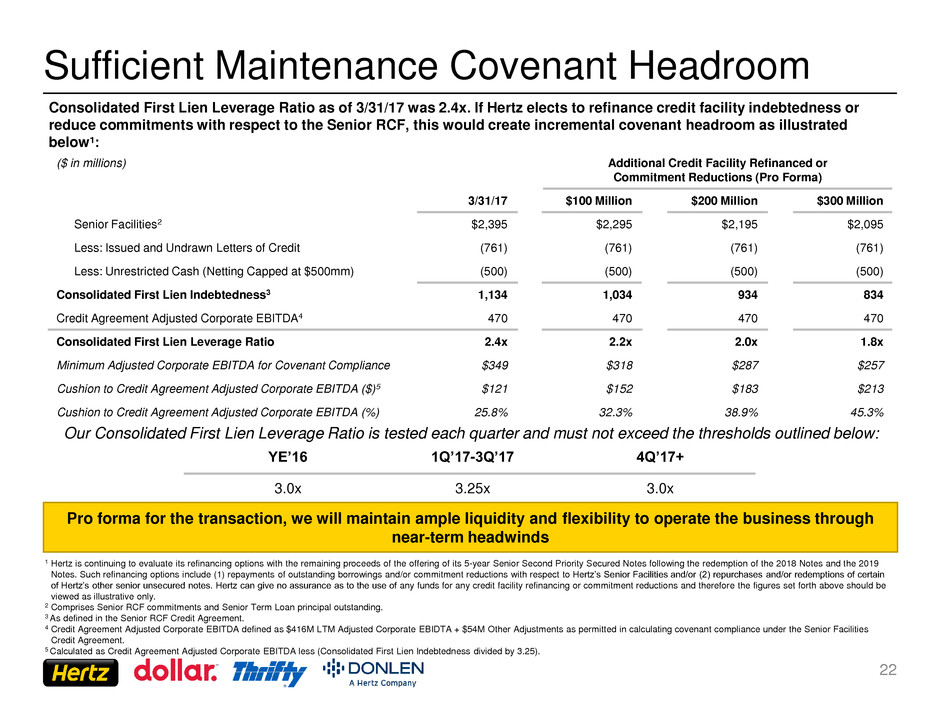

($ in millions) Additional Credit Facility Refinanced or

Commitment Reductions (Pro Forma)

3/31/17 $100 Million $200 Million $300 Million

Senior Facilities2 $2,395 $2,295 $2,195 $2,095

Less: Issued and Undrawn Letters of Credit (761) (761) (761) (761)

Less: Unrestricted Cash (Netting Capped at $500mm) (500) (500) (500) (500)

Consolidated First Lien Indebtedness3 1,134 1,034 934 834

Credit Agreement Adjusted Corporate EBITDA4 470 470 470 470

Consolidated First Lien Leverage Ratio 2.4x 2.2x 2.0x 1.8x

Minimum Adjusted Corporate EBITDA for Covenant Compliance $349 $318 $287 $257

Cushion to Credit Agreement Adjusted Corporate EBITDA ($)5 $121 $152 $183 $213

Cushion to Credit Agreement Adjusted Corporate EBITDA (%) 25.8% 32.3% 38.9% 45.3%

Consolidated First Lien Leverage Ratio as of 3/31/17 was 2.4x. If Hertz elects to refinance credit facility indebtedness or

reduce commitments with respect to the Senior RCF, this would create incremental covenant headroom as illustrated

below¹:

Our Consolidated First Lien Leverage Ratio is tested each quarter and must not exceed the thresholds outlined below:

YE’16 1Q’17-3Q’17 4Q’17+

3.0x 3.25x 3.0x

1 Hertz is continuing to evaluate its refinancing options with the remaining proceeds of the offering of its 5-year Senior Second Priority Secured Notes following the redemption of the 2018 Notes and the 2019

Notes. Such refinancing options include (1) repayments of outstanding borrowings and/or commitment reductions with respect to Hertz’s Senior Facilities and/or (2) repurchases and/or redemptions of certain

of Hertz’s other senior unsecured notes. Hertz can give no assurance as to the use of any funds for any credit facility refinancing or commitment reductions and therefore the figures set forth above should be

viewed as illustrative only.

2 Comprises Senior RCF commitments and Senior Term Loan principal outstanding.

3 As defined in the Senior RCF Credit Agreement.

4 Credit Agreement Adjusted Corporate EBITDA defined as $416M LTM Adjusted Corporate EBIDTA + $54M Other Adjustments as permitted in calculating covenant compliance under the Senior Facilities

Credit Agreement.

5 Calculated as Credit Agreement Adjusted Corporate EBITDA less (Consolidated First Lien Indebtedness divided by 3.25).

Pro forma for the transaction, we will maintain ample liquidity and flexibility to operate the business through

near-term headwinds

Sufficient Maintenance Covenant Headroom

Q&A

Appendix B: Supplemental Materials

25

Adjusted Corporate EBITDA Reconciliation

Note: Amounts for the twelve months ended March 31, 2017 are calculated as the corresponding amounts for the three months ended March 31, 2017 plus the corresponding amounts for the year ended

December 31, 2016 less the corresponding amounts for the three months ended March 31, 2016. $ in millions.

1. Represents debt-related charges relating to the amortization of deferred financing costs and debt discounts and premiums.

2. In 2016, amount represents $6 million of deferred financing costs written off as a result of terminating and refinancing various vehicle debt.

3. Represents expenses incurred under restructuring actions as defined in U.S. GAAP, excluding impairments and asset write-downs which are shown separately in the table. Also represents certain other

charges such as incremental costs incurred directly supporting business transformation initiatives. Such costs include transition costs incurred in connection with business process outsourcing arrangements

and incremental costs incurred to facilitate business process re-engineering initiatives that involve significant organization redesign and extensive operational process changes. Also includes consulting costs

and legal fees related to the previously disclosed accounting review and investigation.

4. For the first quarter 2017, excludes $2 million of stock-based compensation expenditures included in restructuring and restructuring related charges.

5. Represents the pre-tax gain on the sale of CAR Inc. common stock.

6. For the first quarter 2017, represents a $30 million impairment of an equity method investment. In 2016, primarily comprised of a $172 million impairment of goodwill associated with the Company's vehicle

rental operations in Europe, a $120 million impairment of the Dollar Thrifty tradename, a $25 million impairment of certain tangible assets used in the U.S. RAC segment in conjunction with a restructuring

program and an $18 million impairment of the net assets held for sale related to the Company's Brazil operations. In 2015, primarily comprised of a $40 million impairment of an international tradename

associated with the Company's former equipment rental business, a $6 million impairment of the former Dollar Thrifty headquarters, a $5 million impairment of a building in the U.S. RAC Segment and a $3

million impairment of a corporate asset. In 2014, primarily comprised of a $13 million impairment related to the Company's former corporate headquarters building in New Jersey and a $10 million

impairment of assets related to a contract termination.

7. Represents external costs associated with the Company’s finance and information technology transformation programs, both of which are multi-year initiatives that commenced in 2016 to upgrade and

modernize the Company’s systems and processes.

8. Includes miscellaneous, non-recurring and other non-cash items and, in the first quarter 2017, includes an adjustment to the carrying value of the Company's Brazil operations in connection with its

classification as held for sale. In 2016, also includes a $9 million settlement gain from an eminent domain case related to one of the Company's airport locations. For 2015, also includes a $23 million charge

recorded in relation to a French road tax matter, $5 million of costs related to the integration of Dollar Thrifty and $5 million in relocation expenses incurred in connection with the relocation of the Company's

corporate headquarters to Estero, Florida. In 2014, also includes $10 million in acquisition related costs and charges, $9 million of costs related to the integration of Dollar Thrifty, and $9 million in relocation

expenses incurred in connection with the relocation of the Company's corporate headquarters, partially offset by a $19 million settlement received in relation to a class action lawsuit filed against a vehicle

manufacturer. In 2013, also includes $29 million of premiums paid on debt to redeem our 8.50% former European Fleet Notes, $62 million of acquisition costs and integration charges primarily related with

our acquisition of Dollar Thrifty in 2012 and $6 million in costs associated with the relocation of our corporate headquarters.

9. LTM Adjusted Corporate EBIDTA. Excludes $54M add-back as permitted in calculating covenant compliance under the Senior RCF Credit Agreement.

Three Months Ended March 31, Year Ended December 31,

LTM 3/31/2017 2017 2016 2016 2015 2014 2013

Non-GAAP Reconciliation

Income (loss) from continuing operations before income taxes $(686) $(293) $(76) $(469) $132 $(231) $394

Depreciation and amortization 2,942 759 683 2,866 2,707 2,996 2,499

Interest, net of interest income 602 129 150 623 599 617 644

Gross EBITDA 2,858 595 757 3,020 3,438 3,382 3,537

Revenue earning vehicle depreciation and less charges, net (2,686) (701) (616) (2,601) (2,433) (2,705) (2,234)

Vehicle debt interest (282) (71) (69) (280) (253) (277) (302)

Vehicle debt‑related charges(1) 25 7 10 28 42 31 32

Loss on extinguishment of vehicle‑related debt(2) 6 – – 6 – – –

Corporate EBITDA (79) (170) 82 173 794 431 1,033

Non-cash and stock-based employee compensation charges 15 7 5 13 16 9 33

Restructuring and restructuring related charges

(3)(4)

47 6 12 53 84 157 88

Sale of CAR Inc. common stock

(5)

(12) (3) (75) (84) (133) – –

Impairment charges and asset write‑downs(6) 370 30 – 340 57 24 40

Finance and information technology transformation costs

(7)

64 19 8 53 – – –

Other

(8)

11 1 (5) 5 40 9 108

Adjusted Corporate EBITDA $416 $(110) $27 $553 $858 $630 $1,302

Capital Asset Expenditures, non-vehicle ("capex") (142) (54) (46) (134) (250) (331) (305)

Adjusted Corporate EBITDA less capex $274 $(164) $(19) $419 $608 $299 $997(9)