Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ATWOOD OCEANICS INC | d405186dex991.htm |

| EX-2.1 - EX-2.1 - ATWOOD OCEANICS INC | d405186dex21.htm |

| 8-K - FORM 8-K - ATWOOD OCEANICS INC | d405186d8k.htm |

Atwood Oceanics to be Acquired by Ensco Employee Presentation Presented May 30, 2017 Exhibit 99.2

Important Disclaimers Cautionary Note Regarding Forward-Looking Statements Statements included in this communication regarding Atwood Oceanics, Inc. (the “Company”) and Ensco plc (“Ensco”) and the proposed merger and statements that are not historical facts are forward-looking statements (including within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended). Forward-looking statements include words or phrases such as “anticipate,” “believe,” “contemplate,” “estimate,” “expect,” “intend,” “plan,” “project,” “could,” “may,” “might,” “should,” “will” and words and phrases of similar import. These statements involve risks and uncertainties including, but not limited to, actions by regulatory authorities, rating agencies or other third parties, actions by the respective companies’ security holders, costs and difficulties related to integration of the Company, delays, costs and difficulties related to the transaction, market conditions and Ensco’s financial results and performance following the completion of the merger, satisfaction of closing conditions, ability to repay debt and timing thereof, availability and terms of any financing and other factors detailed in the risk factors section and elsewhere in the Company’s and Ensco’s Annual Report on Form 10-K for the year ended September 30, 2016 and December 31, 2016, respectively, and their respective other filings with the SEC, which are available on the SEC’s website at www.sec.gov. Should one or more of these risks or uncertainties materialize (or the other consequences of such a development worsen), or should underlying assumptions prove incorrect, actual outcomes may vary materially from those forecasted or expected. All information in this document is as of today. Except as required by law, both the Company and Ensco disclaim any intention or obligation to update publicly or revise such statements, whether as a result of new information, future events or otherwise. Additional Information and Where You Can Find It In connection with the proposed merger, the Company will file a registration statement on Form S-4, including a joint proxy statement/prospectus of the Company and Ensco, with the SEC. INVESTORS AND SECURITY HOLDERS OF THE COMPANY AND ENSCO ARE ADVISED TO CAREFULLY READ THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER, THE PARTIES TO THE MERGER AND THE RISKS ASSOCIATED WITH THE MERGER. A definitive joint proxy statement/prospectus will be sent to security holders of the Company and Ensco seeking their approval of the proposed merger connection with the Company and Ensco shareholder meetings. Investors and security holders may obtain a free copy of the joint proxy statement/prospectus (when available) and other relevant documents filed by the Company and Ensco with the SEC from the SEC’s website at www.sec.gov. Security holders and other interested parties will also be able to obtain, without charge, a copy of the joint proxy statement/prospectus and other relevant documents (when available) by directing a request by mail or telephone to either Investor Relations, Atwood Oceanics, Inc., 15011 Katy Freeway, Suite 800, Houston, Texas 77094, telephone 281-749-7840, or Investor Relations, Ensco plc, 5847 San Felipe, Suite 3300, Houston, Texas 77057, telephone 713-430-4607. Copies of the documents filed by the Company with the SEC will be available free of charge on Atwood’s website at www.atwd.com under the tab “Investor Relations.” Copies of the documents filed by Ensco with the SEC will be available free of charge on Ensco’s website at www.enscoplc.com under the tab “Investors.” Security holders may also read and copy any reports, statements and other information filed with the SEC at the SEC public reference room at 100 F Street N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at (800) 732-0330 or visit the SEC’s website for further information on its public reference room.

Important Disclaimers Participants in the Solicitation The Company and Ensco and their respective directors, executive officers and certain other members of management may be deemed to be participants in the solicitation of proxies from their respective security holders with respect to the transaction. Information about these persons is set forth in the Company’s proxy statement relating to its 2017 Annual Meeting of Shareholders and Ensco’s proxy statement relating to its 2017 General Meeting of Shareholders, as filed with the SEC on January 9, 2017 and March 31, 2017, respectively, and subsequent statements of changes in beneficial ownership on file with the SEC. Security holders and investors may obtain additional information regarding the interests of such persons, which may be different than those of the respective companies’ security holders generally, by reading the joint proxy statement/prospectus and other relevant documents regarding the transaction, which will be filed with the SEC. No Offer or Solicitation This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

Ensco to Acquire Atwood Oceanics Message from the President and CEO What was announced? Today, we announced that we have entered into a definitive agreement under which Ensco will acquire Atwood. The boards of directors of both companies have approved the transaction. The transaction was finalized over the past few days. We expect the acquisition to close before the end of the calendar year. Who is Ensco? Ensco is a major global provider of offshore drilling services to the petroleum industry. For more than 29 years, Ensco has focused on operating safely and exceeding customer expectations. Ensco operates drillships, dynamically-positioned semisubmersibles, moored semisubmersibles and premium jackups.

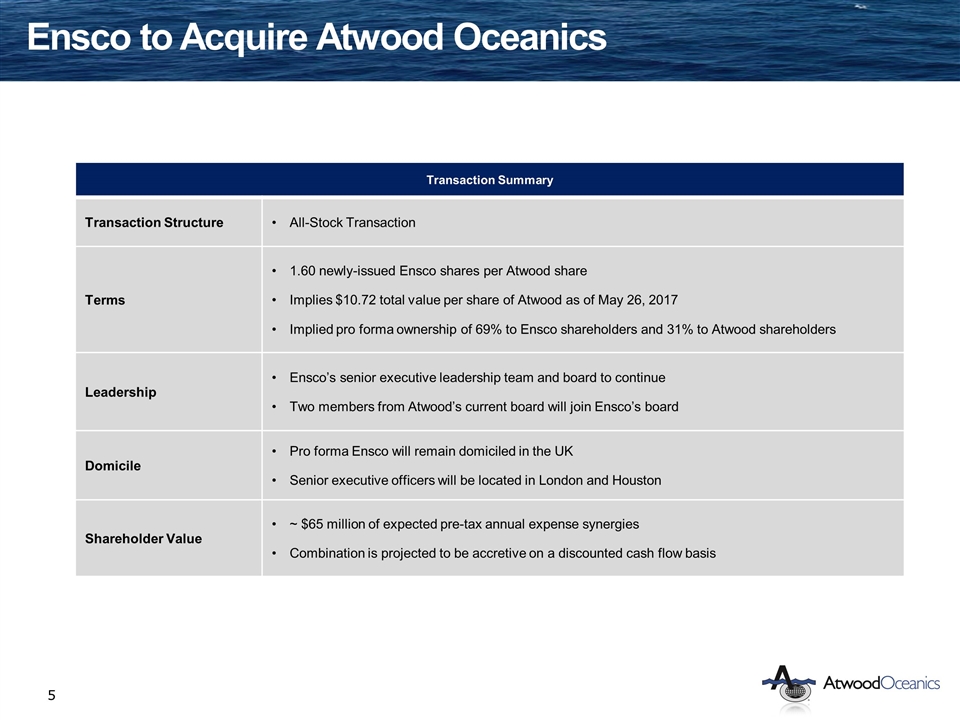

Ensco to Acquire Atwood Oceanics Transaction Summary Transaction Structure All-Stock Transaction Terms 1.60 newly-issued Ensco shares per Atwood share Implies $10.72 total value per share of Atwood as of May 26, 2017 Implied pro forma ownership of 69% to Ensco shareholders and 31% to Atwood shareholders Leadership Ensco’s senior executive leadership team and board to continue Two members from Atwood’s current board will join Ensco’s board Domicile Pro forma Ensco will remain domiciled in the UK Senior executive officers will be located in London and Houston Shareholder Value ~ $65 million of expected pre-tax annual expense synergies Combination is projected to be accretive on a discounted cash flow basis

Ensco to Acquire Atwood Oceanics 4.Why has this occurred now? Current industry downturn has significantly changed the competitive landscape and the economics of offshore drilling. Offshore drillers with scale, high-specification assets and strong balance sheets are in best position for the market recovery. This acquisition is consistent with these changes. Why Atwood? Atwood has a modern rig fleet and an excellent reputation for safety, operational excellence and client satisfaction. This makes Atwood Oceanics an attractive acquisition target. By successfully completing the acquisition, Ensco expects to: enhance their fleet; maintain their balanced exposure to deep- and shallow-water markets; expand their customer base; and increase their presence in key geographies.

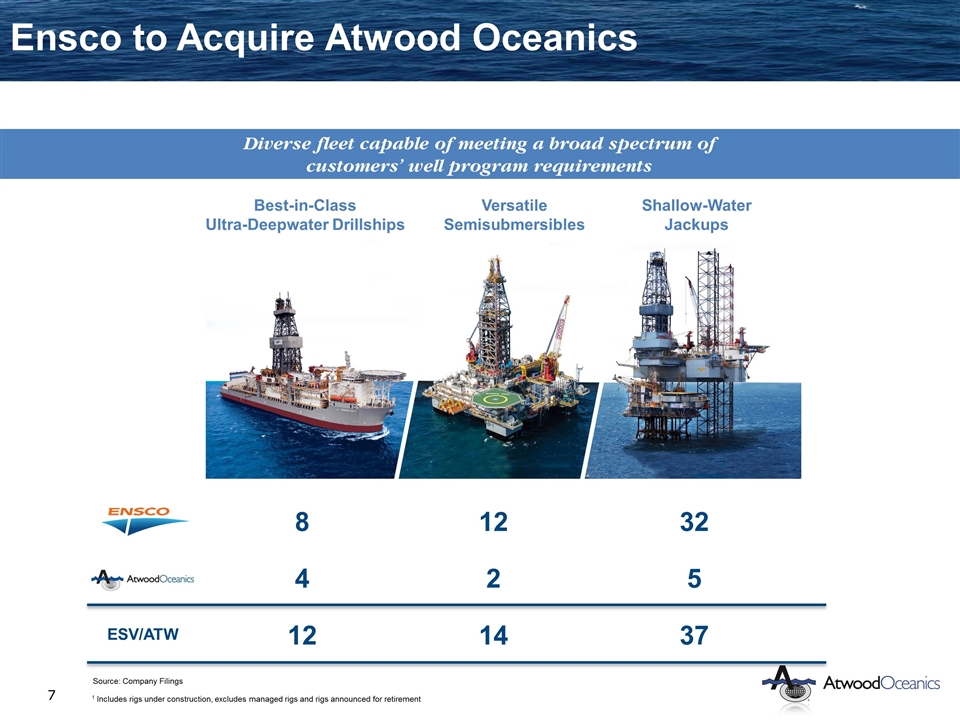

Ensco to Acquire Atwood Oceanics Diverse fleet capable of meeting a broad spectrum of customers’ well program requirements Best-in-Class Ultra-Deepwater Drillships Versatile Semisubmersibles Shallow-Water Jackups 8 4 12 2 12 14 32 5 37 ESV/ATW 1 Includes rigs under construction, excludes managed rigs and rigs announced for retirement Source: Company Filings

Ensco to Acquire Atwood Oceanics What does this mean for me? The acquisition is still subject to regulatory and shareholder approvals. Expect normal course of business until the closing of the transaction. We expect closing to occur before the end of the calendar year. The majority of offshore crews will not be materially affected. Many headquarters and shore-based positions will be consolidated. Employment will continue following closing until such time as you are notified of termination. We do not plan to carry out any further layoffs at Atwood between today and closing.

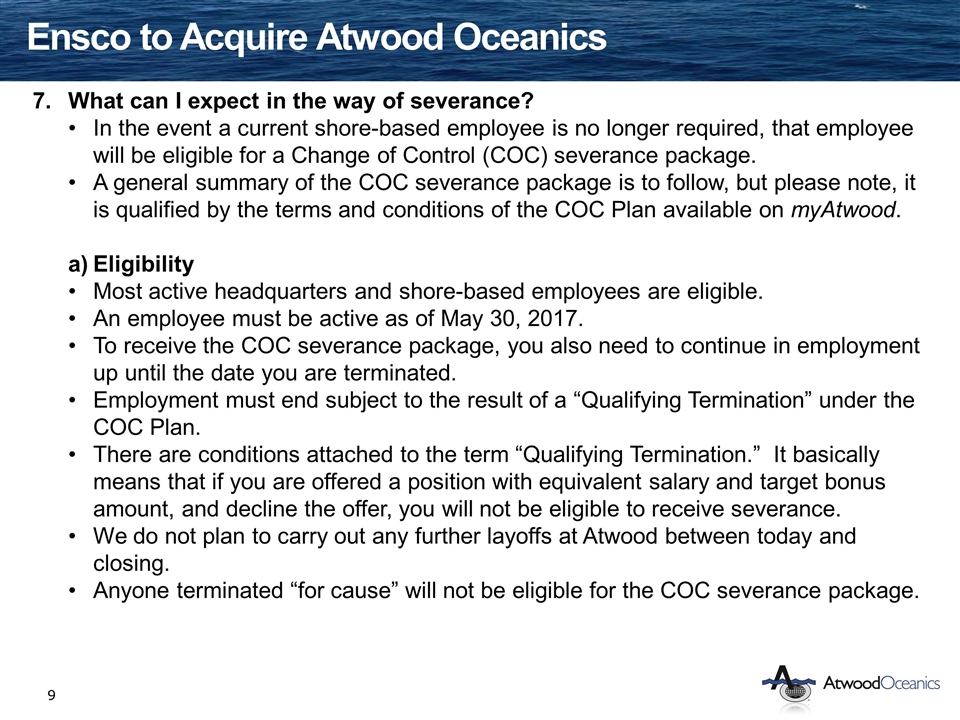

Ensco to Acquire Atwood Oceanics 7.What can I expect in the way of severance? In the event a current shore-based employee is no longer required, that employee will be eligible for a Change of Control (COC) severance package. A general summary of the COC severance package is to follow, but please note, it is qualified by the terms and conditions of the COC Plan available on myAtwood. a)Eligibility Most active headquarters and shore-based employees are eligible. An employee must be active as of May 30, 2017. To receive the COC severance package, you also need to continue in employment up until the date you are terminated. Employment must end subject to the result of a “Qualifying Termination” under the COC Plan. There are conditions attached to the term “Qualifying Termination.” It basically means that if you are offered a position with equivalent salary and target bonus amount, and decline the offer, you will not be eligible to receive severance. We do not plan to carry out any further layoffs at Atwood between today and closing. Anyone terminated “for cause” will not be eligible for the COC severance package.

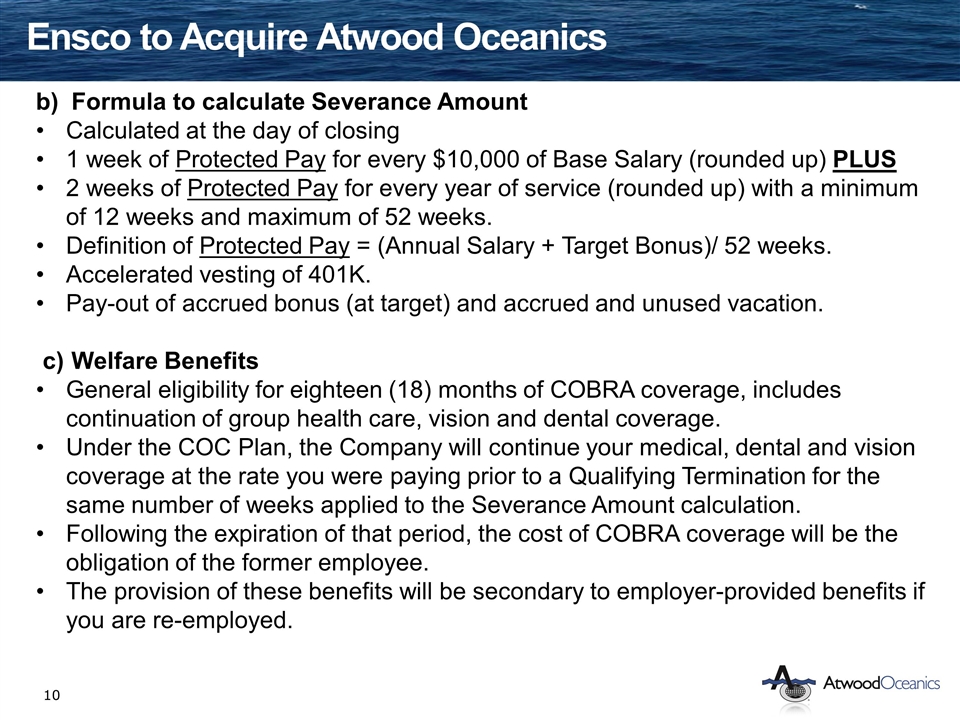

Ensco to Acquire Atwood Oceanics b)Formula to calculate Severance Amount Calculated at the day of closing 1 week of Protected Pay for every $10,000 of Base Salary (rounded up) PLUS 2 weeks of Protected Pay for every year of service (rounded up) with a minimum of 12 weeks and maximum of 52 weeks. Definition of Protected Pay = (Annual Salary + Target Bonus)/ 52 weeks. Accelerated vesting of 401K. Pay-out of accrued bonus (at target) and accrued and unused vacation. c)Welfare Benefits General eligibility for eighteen (18) months of COBRA coverage, includes continuation of group health care, vision and dental coverage. Under the COC Plan, the Company will continue your medical, dental and vision coverage at the rate you were paying prior to a Qualifying Termination for the same number of weeks applied to the Severance Amount calculation. Following the expiration of that period, the cost of COBRA coverage will be the obligation of the former employee. The provision of these benefits will be secondary to employer-provided benefits if you are re-employed.

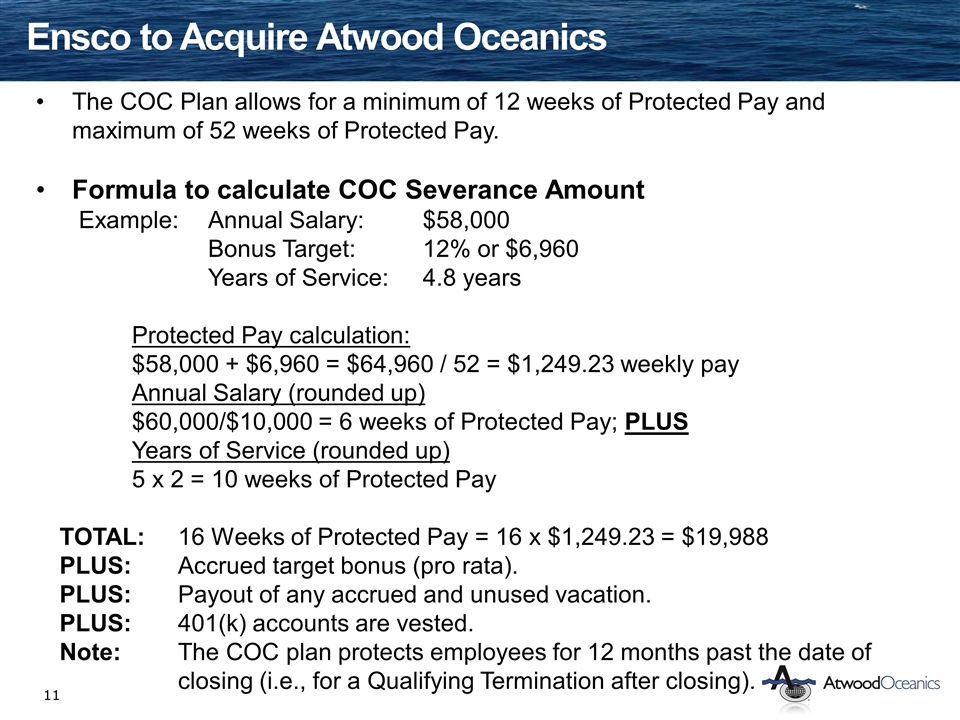

Ensco to Acquire Atwood Oceanics The COC Plan allows for a minimum of 12 weeks of Protected Pay and maximum of 52 weeks of Protected Pay. Formula to calculate COC Severance Amount Example:Annual Salary: $58,000 Bonus Target: 12% or $6,960 Years of Service: 4.8 years Protected Pay calculation: $58,000 + $6,960 = $64,960 / 52 = $1,249.23 weekly pay Annual Salary (rounded up) $60,000/$10,000 = 6 weeks of Protected Pay; PLUS Years of Service (rounded up) 5 x 2 = 10 weeks of Protected Pay TOTAL:16 Weeks of Protected Pay = 16 x $1,249.23 = $19,988 PLUS:Accrued target bonus (pro rata). PLUS: Payout of any accrued and unused vacation. PLUS:401(k) accounts are vested. Note:The COC plan protects employees for 12 months past the date of closing (i.e., for a Qualifying Termination after closing).

Ensco to Acquire Atwood Oceanics 8.When can I expect to be paid severance? Subject to waiver and release requirements, the COC severance benefit is paid within 60 days following the termination date. 9.What happens between now and closing? Atwood and Ensco will continue operations as separate entities until the acquisition is finalized. You are not to contact employees at Ensco unless specifically authorized by your supervisor. 10.What should I do if I receive questions from customers or vendors? Managers will be communicating with customers and vendors regarding our announcement. Should you receive questions from other outside parties, such as the media or analysts, please contact our Legal department.

Ensco to Acquire Atwood Oceanics What happens next? It is very much “Business as Usual” at Atwood Oceanics. We need to continue our focus on safe operations, operational excellence, client satisfaction and adherence to our “Guiding Principles”. Remember, the transaction is still subject to regulatory and shareholder approval (at both Atwood and Ensco). We must maintain our high level of professional standards. We still have a company to run and we need to “Finish Strong”! We will provide periodic updates on the progress to closing. We intend to set up a schedule for employees to meet with HR and discuss their individual circumstances.