Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HomeStreet, Inc. | a8-kproxyresults.htm |

Annual Meeting of

Shareholders

Seattle, WA

May 25, 2017

NASDAQ:HMST

Welcome

• Introductory Remarks

• Notice

• Appointment of Inspector of Election &

confirmation of quorum

• Description of proposals

• Proceed to voting

• Report on 2016

• Results of voting

• Adjournment

2

Proposals

I. To elect three (3) Class III directors to serve until the 2020 annual meeting of

shareholders, or until their successors are elected, and qualified

• David A. Ederer

• Thomas E. King

• George “Judd” Kirk

II. To ratify on an advisory basis (non-binding) the appointment of Deloitte &

Touche LLP as the Company’s independent registered public accounting firm for

the fiscal year ending December 31, 2017

III. To approve an amendment to the 2014 Equity Incentive Plan to increase the

number of shares available for issuance by 975,000 shares and approve certain

additional performance measures for purposes of Section 280G of the Internal

Revenue Code

IV. To transact such other business that may properly come before the Annual

Meeting or any adjournment or postponement thereto

Preliminary results will be announced following the vote

3

Presentation by Mark K. Mason

Chairman, President, & CEO

HomeStreet, Inc.

4

Report on 2015

Important Disclosures

Forward-Looking Statements

This presentation includes forward-looking statements, as that term is defined for purposes of applicable securities laws, about our industry, our future financial performance, and our business

plans and expectations. These statements are, in essence, attempts to anticipate or forecast future events, and thus subject to many risks and uncertainties. These forward-looking statements

are based on our management's current expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not

historical facts, as well as a number of assumptions concerning future events. Forward-looking statements in this release include, among other matters, statements regarding our business plans

and strategies (including our expansion strategies) and the expected effects of those initiatives, general economic trends (particularly those that affect mortgage origination and refinance

activity) and growth scenarios and performance targets. Readers should note, however, that all statements in this presentation other than assertions of historical fact are forward-looking in

nature. These statements are subject to risks, uncertainties, assumptions and other important factors set forth in our SEC filings, including but not limited to our Annual Report on Form 10-K for

the year ended December 31, 2016 and our quarterly report on Form 10-Q for the quarter ended March 31, 2107, which we filed on May 5, 2017. Many of these factors and events that affect

the volatility in our stock price and shareholders’ response to those events and factors are beyond our control. Such factors could cause actual results to differ materially from the results

discussed or implied in the forward-looking statements. These limitations and risks include without limitation changes in general political and economic conditions that impact our markets and

our business, actions by the Federal Reserve Board and financial market conditions that affect monetary and fiscal policy, regulatory and legislative findings or actions that may increase capital

requirements or otherwise constrain our ability to do business, including restrictions that could be imposed by our regulators on certain aspects of our operations or on our growth initiatives and

acquisition activities, risks related to our ability to realize the expected value of our recent acquisitions, continue to expand our banking operations geographically and across market sectors,

grow our franchise and capitalize on market opportunities, manage our growth efforts cost-effectively and attain the desired operational and financial outcomes, manage the losses inherent in

our loan portfolio, and make accurate estimates of the value of our non-cash assets and liabilities, maintain electronic and physical security of customer data, respond to restrictive and complex

regulatory environment, and attract and retain key personnel. In addition, the ratio of loan lock to closed loan volume may fluctuate due to challenges our customers may face in meeting current

underwriting standards, a change in interest rates, an increase in competition for such loans, changes in general economic conditions, including housing prices and inventory levels, the job

market, consumer confidence and spending habits either nationally or in the regional and local market areas in which the Company does business, and legislative or regulatory actions or reform

that may affect our business or the banking or mortgage industries more generally. Actual results may fall materially short of our expectations and projections, and we may change our plans or

take additional actions that differ in material ways from our current intentions. Accordingly, we can give no assurance of future performance, and you should not rely unduly on forward-looking

statements. All forward-looking statements are based on information available to the Company as of the date hereof, and we do not undertake to update or revise any forward-looking

statements, for any reason.

Basis of Presentation of Financial Data

Unless noted otherwise in this presentation, all reported financial data is being presented as of the period ending March 31, 2017, and is unaudited, although certain information related to the

year ended December 31, 2016, has been derived from our audited financial statements. All financial data should be read in conjunction with the notes in our consolidated financial statements.

Non-GAAP Financial Measures

Information on any non-GAAP financial measures such as core measures or tangible measures referenced in this presentation, including a reconciliation of those measures to GAAP measures,

may also be found in the appendix, our SEC filings, and in the earnings release available on our web site.

5

Growing Western U.S. Franchise

• Seattle-based diversified

commercial bank -

company founded in

1921

• Growing commercial &

consumer bank with

concentrations in major

metropolitan areas of the

West Coast and Hawaii

• Leading West Coast

mortgage lender

• 111 primary offices (1) in

the Western United

States and Hawaii

• Total assets $6.4 billion

6

(1) The number of offices listed above does not include satellite offices with a limited number of staff who report to a manager located

in a separate primary office.

2016 Growth Activity

Organic Growth Activity

• Orange County Business Bank

• Branches and related assets and liabilities from The Bank of Oswego

• Two branches from Boston Private Bank & Trust

• Total asset growth – 27%

• Total loans held for investment – 19%

• Commercial real estate and commercial loans – 36%

• Total deposit growth – 37%

• Noninterest bearing checking account growth – 45%

• Total transaction and savings account growth – 31%

• Total business deposit growth – 51%

• Hired California commercial lending market president

• Bay Area market president

• San Diego & Orange Counties market president

• De-Novo openings

• 6 retail deposit branches

• 3 primary home loan centers

• 1 primary commercial lending center

• Opened Bay Area commercial lending center in San Jose, CA – Branch to follow

• Opened 15th California retail deposit branch in Baldwin Park

Strategic Growth Activity

Recent Developments

7

Strategy

Optimize Single Family

Mortgage Banking &

Servicing Segment

• Organic growth opportunities

• Focused on increased Commercial Lending

• Increase density of commercial and consumer deposits via existing market penetration and de-novo branch expansion

• Growth via acquisition of smaller institutions and branches, focus on Washington, Oregon,

and California

• Optimize investments in mortgage banking personnel, offices, and technology

• Focus on full utilization of mortgage banking capacity and geographic footprint

• Drive operating leverage through disciplined expense control

• Target consolidated efficiency ratio of less than 70%

• Commercial and Consumer segment <65% and Mortgage Banking segment <80%

• Target long-term 15%+ ROTE

Expand Commercial &

Consumer Banking

Segment

Disciplined expense

management

Efficient use of capital

Grow and diversify earnings with the goal of becoming a leading West Coast

regional bank

8

Results of Operations

For the three months ended

(1) Includes eleven months of OCBB’s results of operations.

(2) Includes ten months of Simplicity’s results of operations.

(3) Includes two months of OCBB’s results of operations.

(4) Excludes pre-tax acquisition-related expenses and bargain purchase gain. See appendix for reconciliation of non-GAAP financial measures.

For the nine months ended

9

($ in thousands) Dec. 30, 2016

(1)

Dec. 30, 2015

(2) Mar. 31, 2017 Dec. 31, 2016 Mar. 31, 2016

(3)

Net interest income $ 180,049 $ 148,338 $ 45,651 $ 48,074 $ 40,691

Provision for loan losses 4,100 6,100 - 350 1,400

Noninterest income 359,150 281,237 74,461 73,221 71,708

Noninterest expense 444,322 366,568 106,874 117,539 101,353

Net income before taxes 90,777 56,907 13,238 3,406 9,646

Income taxes 32,626 15,588 4,255 1,112 3,239

Net income $ 58,151 $ 41,319 $ 8,983 $ 2,294 $ 6,407

Diluted EPS $ 2.34 $ 1.96 $ 0.33 $ 0.09 $ 0.27

Core net income

(4) $ 62,789 $ 44,337 $ 8,983 $ 2,555 $ 9,785

Core EPS

(4) $ 2.53 $ 2.11 $ 0.33 $ 0.10 $ 0.41

Core ROAA (4) 1.09% 0.97% 0.57% 0.16% 0.78%

Core ROAE (4) 11.09% 10.03% 5.53% 1.67% 7.66%

Core ROATE (4) 11.68% 10.50% 5.81% 1.74% 8.08%

Net Interest Margin 3.45% 3.63% 3.23% 3.42% 3.55%

Core efficiency ratio (4) 81.1% 83.0% 89.0% 96.6% 85.6%

For the year ended For the three months ended

Diversification

Growth in our Commercial & Consumer Banking Segment is diversifying earnings,

and reducing earnings volatility

10

(1) Excludes acquisition-related expenses. See appendix for reconciliation of non-GAAP financial measures.

$8.9

$16.7

$21.0

$35.4

$39.8

33%

69%

47%

56%

64%

0%

10%

20%

30%

40%

50%

60%

70%

80%

$-

$10

$20

$30

$40

$50

$60

2013 2014 2015 2016 3/31/2017

LTM

$ in millions

C&CB Core Net Income (1) C&CB % of Total Core Net Income (1)

Segment Overview

Commercial & Consumer Banking

• Regional Single Family mortgage

origination and servicing platform

• 100% direct retail origination

• Majority of production sold into secondary

market

• Fannie Mae, Freddie Mac, FHA, VA lender

since programs’ inceptions

• Portfolio products: jumbo, HELOC and

custom home construction

• Servicing retained on majority of originated

loans sold to secondary markets

Mortgage Banking

Overview

• Commercial Banking

Commercial lending, including SBA

All CRE property types with multifamily focus

FNMA DUS lender / servicer

Residential and commercial construction

Commercial deposit, treasury and cash

management services

• Consumer Banking

Consumer loan and deposit products

Consumer investment, insurance and private

banking products and services

11

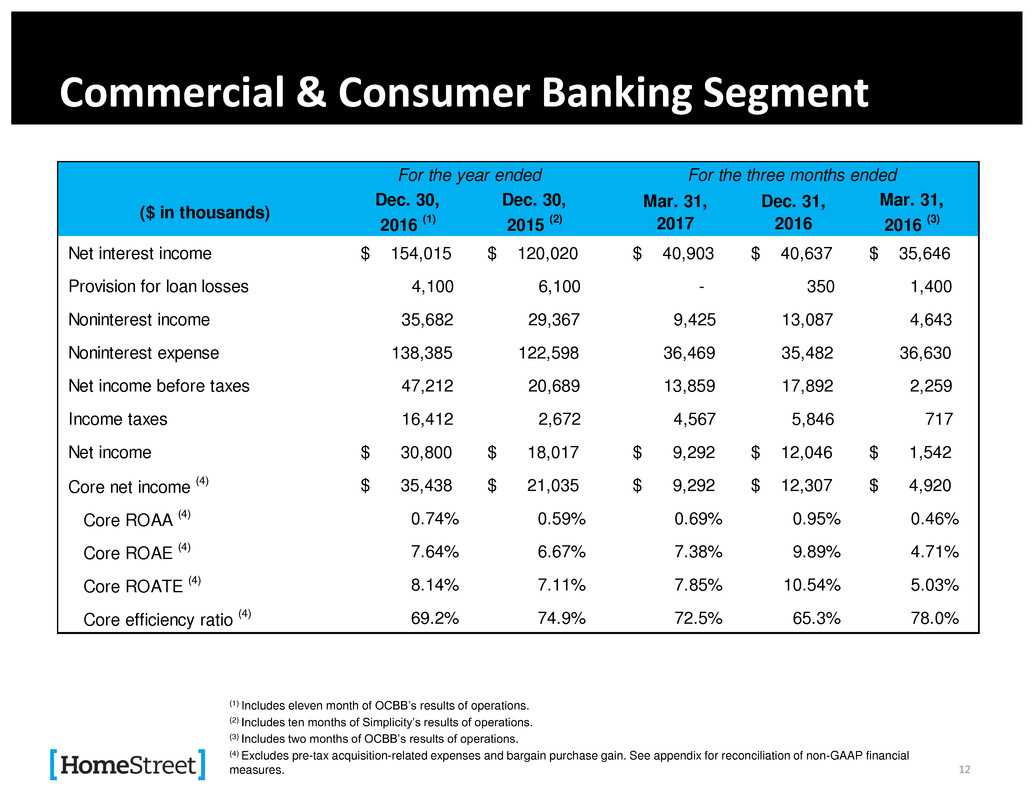

Commercial & Consumer Banking Segment

12

(1) Includes eleven month of OCBB’s results of operations.

(2) Includes ten months of Simplicity’s results of operations.

(3) Includes two months of OCBB’s results of operations.

(4) Excludes pre-tax acquisition-related expenses and bargain purchase gain. See appendix for reconciliation of non-GAAP financial

measures.

($ in thousands)

Dec. 30,

2016

(1)

Dec. 30,

2015

(2)

Mar. 31,

2017

Dec. 31,

2016

Mar. 31,

2016

(3)

Net interest income $ 154,015 $ 120,020 $ 40,903 $ 40,637 $ 35,646

Provision for loan losses 4,100 6,100 - 350 1,400

Noninterest income 35,682 29,367 9,425 13,087 4,643

Noninterest expense 138,385 122,598 36,469 35,482 36,630

Net income before taxes 47,212 20,689 13,859 17,892 2,259

Income taxes 16,412 2,672 4,567 5,846 717

Net income $ 30,800 $ 18,017 $ 9,292 $ 12,046 $ 1,542

Core net income

(4) $ 35,438 $ 21,035 $ 9,292 $ 12,307 $ 4,920

Core ROAA

(4) 0.74% 0.59% 0.69% 0.95% 0.46%

Core ROAE

(4) 7.64% 6.67% 7.38% 9.89% 4.71%

Core ROATE

(4) 8.14% 7.11% 7.85% 10.54% 5.03%

Core efficiency ratio

(4) 69.2% 74.9% 72.5% 65.3% 78.0%

For the year ended For the three months ended

Mortgage Banking Segment

13

($ in thousands)

Dec. 31,

2016

Dec. 31,

2015

Mar. 31,

2017

Dec. 31,

2016

Mar. 31,

2016

Net interest income $ 26,034 $ 28,318 $ 4,747 $ 7,437 $ 5,045

Noninterest income 323,468 251,870 65,036 60,134 67,065

Noninterest expense 305,937 243,970 70,404 82,057 64,723

Net income before taxes 43,565 36,218 (621) (14,486) 7,387

Income taxes 16,214 12,916 (312) (4,734) 2,522

Net income $ 27,351 $ 23,302 $ (309) $ (9,752) $ 4,865

ROAA 2.79% 2.36% (0.14)% (3.55)% 2.50%

ROAE / ROATE 26.78% 18.81% (0.90)% (31.91)% 21.74%

Efficiency Ratio 87.5% 87.1% 100.9% 121.4% 89.8%

For the year ended For the three months ended

-20%

0%

20%

40%

60%

80%

100%

120%

140%

160%

180%

200%

2/10/2012 8/10/2012 2/10/2013 8/10/2013 2/10/2014 8/10/2014 2/10/2015 8/10/2015 2/10/2016 8/10/2016 2/10/2017

HMST KBW Nasdaq Regional Bank

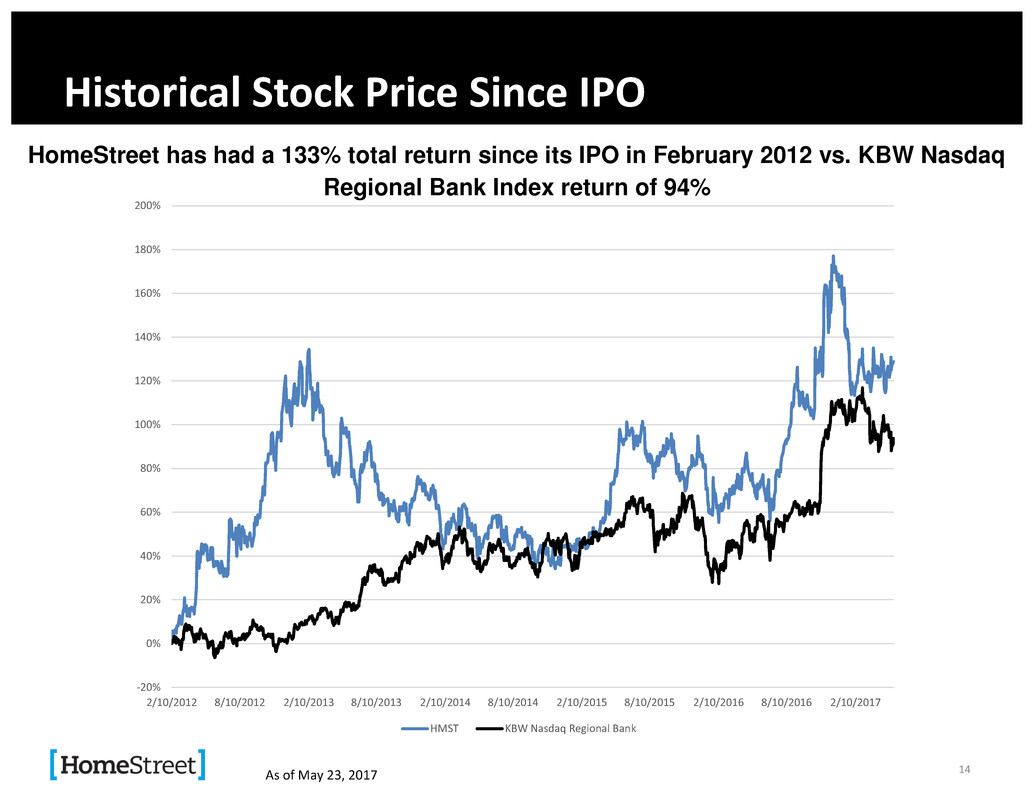

Historical Stock Price Since IPO

14

HomeStreet has had a 133% total return since its IPO in February 2012 vs. KBW Nasdaq

Regional Bank Index return of 94%

As of May 23, 2017

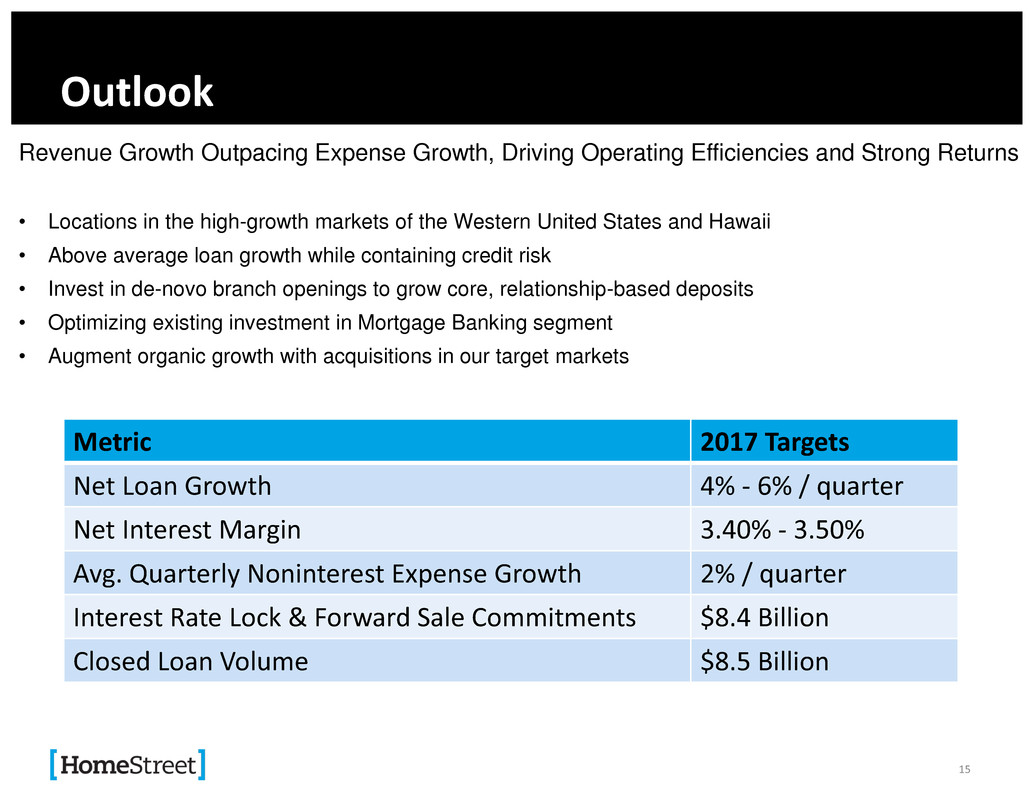

Outlook

15

Revenue Growth Outpacing Expense Growth, Driving Operating Efficiencies and Strong Returns

• Locations in the high-growth markets of the Western United States and Hawaii

• Above average loan growth while containing credit risk

• Invest in de-novo branch openings to grow core, relationship-based deposits

• Optimizing existing investment in Mortgage Banking segment

• Augment organic growth with acquisitions in our target markets

Metric 2017 Targets

Net Loan Growth 4% - 6% / quarter

Net Interest Margin 3.40% - 3.50%

Avg. Quarterly Noninterest Expense Growth 2% / quarter

Interest Rate Lock & Forward Sale Commitments $8.4 Billion

Closed Loan Volume $8.5 Billion

.

Questions?

16

Results of Votes

17

Final Tally of Vote (if available)

.

Thank you for attending

18

HomeStreet, Inc.

NASDAQ:HMST

http://ir.homestreet.com

(Electronic copies of this presentation available upon request)

.

Appendix

19

Non-GAAP Financial Measures

Tangible Book Value:

20

Dec. 31, Dec. 31, Mar. 31, Dec. 31, Mar. 31,

(dollars in thousands, except share data) 2016 2015 2017 2016 2016

Shareholders' equity $629,284 $465,275 $640,919 $629,284 $529,132

Less: Goodwill and other intangibles (30,789) (20,266) (30,275) (30,789) (29,126)

Tangible shareholders' equity $598,495 $445,009 $610,644 $598,495 $500,006

Common shares outstanding 26,800,183 22,076,534 26,862,744 26,800,183 24,550,219

Book value per share $23.48 $21.08 $23.86 $23.48 $21.55

Impact of goodwill and other intangibles (1.15) (0.92) (1.13) (1.15) (1.18)

Tangible book value per share $22.33 $20.16 $22.73 $22.33 $20.37

Average hareholders' equity $566,148 $442,105 $649,439 $616,497 $510,883

Less: Average goodwill and other intangibles (28,580) (19,668) (30,611) (29,943) (26,645)

Average tangible shareholders' equity $537,568 $422,437 $618,828 $586,554 $484,238

Return on average shareholders’ equity 10.27% 9.35% 5.53% 1.49% 5.02%

Impact of goodwill and other intangibles 0.55% 0.43% 0.28% 0.07% 0.27%

Return on average tangible shareholders' equity 10.82% 9.78% 5.81% 1.56% 5.29%

Three Months EndedYear Ended

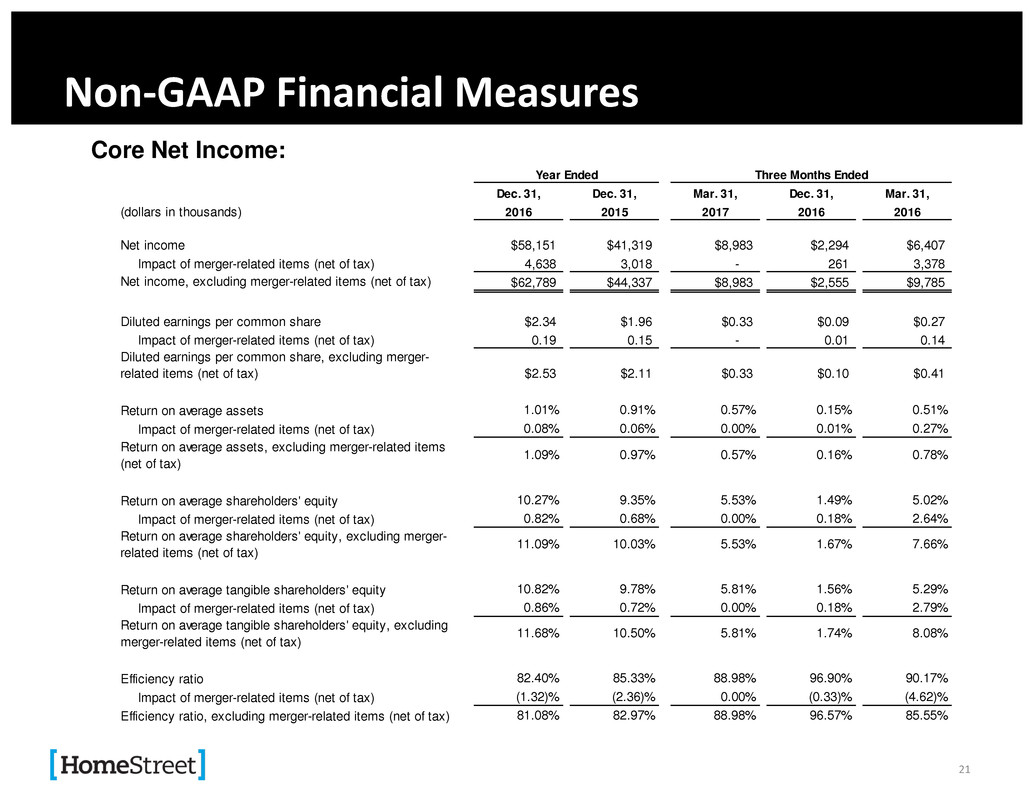

Non-GAAP Financial Measures

Core Net Income:

21

Dec. 31, Dec. 31, Mar. 31, Dec. 31, Mar. 31,

(dollars in thousands) 2016 2015 2017 2016 2016

Net income $58,151 $41,319 $8,983 $2,294 $6,407

Impact of merger-related items (net of tax) 4,638 3,018 - 261 3,378

Net income, excluding merger-related items (net of tax) $62,789 $44,337 $8,983 $2,555 $9,785

Diluted earnings per common share $2.34 $1.96 $0.33 $0.09 $0.27

Impact of merger-related items (net of tax) 0.19 0.15 - 0.01 0.14

Diluted earnings per common share, excluding merger-

related items (net of tax) $2.53 $2.11 $0.33 $0.10 $0.41

Return on average assets 1.01% 0.91% 0.57% 0.15% 0.51%

Impact of merger-related items (net of tax) 0.08% 0.06% 0.00% 0.01% 0.27%

Return on average assets, excluding merger-related items

(net of tax)

1.09% 0.97% 0.57% 0.16% 0.78%

Return on average shareholders' equity 10.27% 9.35% 5.53% 1.49% 5.02%

Impact of merger-related items (net of tax) 0.82% 0.68% 0.00% 0.18% 2.64%

Return on average shareholders' equity, excluding merger-

related items (net of tax)

11.09% 10.03% 5.53% 1.67% 7.66%

Return on average tangible shareholders' equity 10.82% 9.78% 5.81% 1.56% 5.29%

Impact of merger-related items (net of tax) 0.86% 0.72% 0.00% 0.18% 2.79%

Return on average tangible shareholders' equity, excluding

merger-related items (net of tax)

11.68% 10.50% 5.81% 1.74% 8.08%

Efficiency ratio 82.40% 85.33% 88.98% 96.90% 90.17%

Impact of merger-related items (net of tax) (1.32)% (2.36)% 0.00% (0.33)% (4.62)%

Efficiency ratio, excluding merger-related items (net of tax) 81.08% 82.97% 88.98% 96.57% 85.55%

Three Months EndedYear Ended

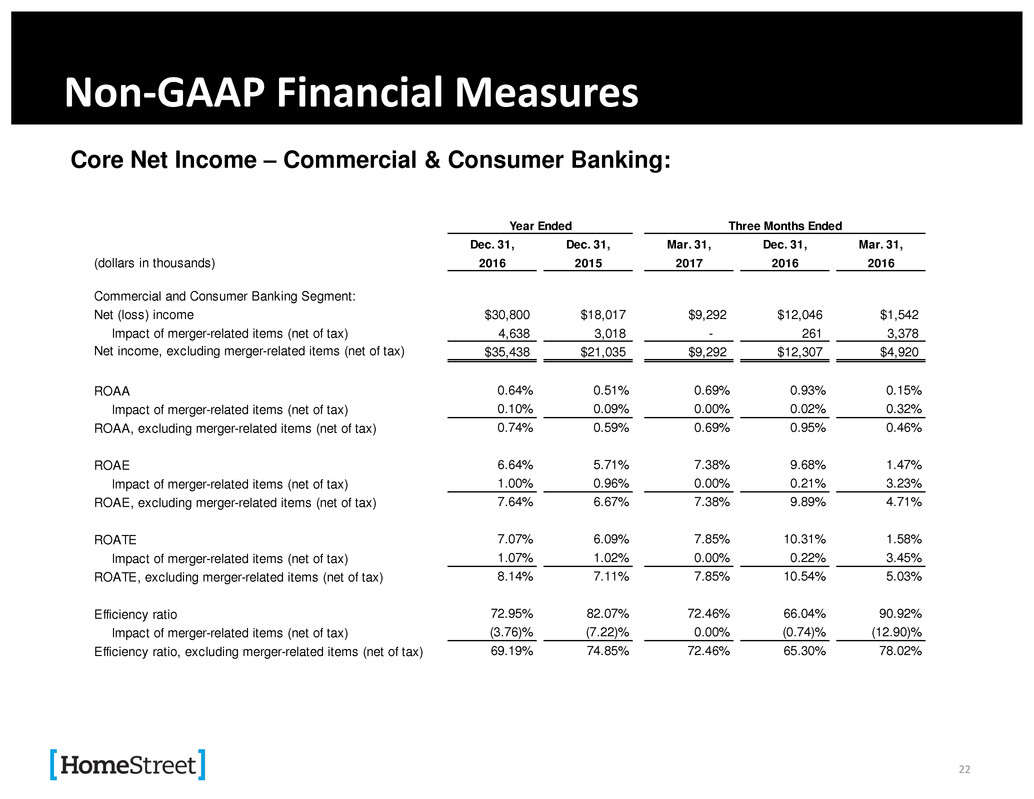

Non-GAAP Financial Measures

Core Net Income – Commercial & Consumer Banking:

22

Dec. 31, Dec. 31, Mar. 31, Dec. 31, Mar. 31,

(dollars in thousands) 2016 2015 2017 2016 2016

Commercial and Consumer Banking Segment:

Net (loss) income $30,800 $18,017 $9,292 $12,046 $1,542

Impact of merger-related items (net of tax) 4,638 3,018 - 261 3,378

Net income, excluding merger-related items (net of tax) $35,438 $21,035 $9,292 $12,307 $4,920

ROAA 0.64% 0.51% 0.69% 0.93% 0.15%

Impact of merger-related items (net of tax) 0.10% 0.09% 0.00% 0.02% 0.32%

ROAA, excluding merger-related items (net of tax) 0.74% 0.59% 0.69% 0.95% 0.46%

ROAE 6.64% 5.71% 7.38% 9.68% 1.47%

Impact of merger-related items (net of tax) 1.00% 0.96% 0.00% 0.21% 3.23%

ROAE, excluding merger-related items (net of tax) 7.64% 6.67% 7.38% 9.89% 4.71%

ROATE 7.07% 6.09% 7.85% 10.31% 1.58%

Impact of merger-related items (net of tax) 1.07% 1.02% 0.00% 0.22% 3.45%

ROATE, excluding merger-related items (net of tax) 8.14% 7.11% 7.85% 10.54% 5.03%

Efficiency ratio 72.95% 82.07% 72.46% 66.04% 90.92%

Impact of merger-related items (net of tax) (3.76)% (7.22)% 0.00% (0.74)% (12.90)%

Efficiency ratio, excluding merger-related items (net of tax) 69.19% 74.85% 72.46% 65.30% 78.02%

Three Months EndedYear Ended