Attached files

| file | filename |

|---|---|

| EX-10.1 - U.S. GOLD CORP. | ex10-1.htm |

| EX-99.5 - U.S. GOLD CORP. | ex99-5.htm |

| EX-99.4 - U.S. GOLD CORP. | ex99-4.htm |

| EX-99.3 - U.S. GOLD CORP. | ex99-3.htm |

| EX-99.2 - U.S. GOLD CORP. | ex99-2.htm |

| EX-99.1 - U.S. GOLD CORP. | ex99-1.htm |

| EX-10.3 - U.S. GOLD CORP. | ex10-3.htm |

| EX-10.2 - U.S. GOLD CORP. | ex10-2.htm |

| EX-3.2 - U.S. GOLD CORP. | ex3-2.htm |

| EX-3.1 - U.S. GOLD CORP. | ex3-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 23, 2017

DATARAM CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | 1-8266 | 22-18314-09 | ||

| (State

or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS

Employer Identification No.) |

777 Alexander Road, Suite 100, Princeton, NJ 08540

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (609) 799-0071

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

There are statements in this Current Report on Form 8-K that are not historical facts. These “forward-looking statements” can be identified by use of terminology such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control. For a discussion of these risks, you should read this entire Current Report on Form 8-K carefully, especially the risks discussed under the section entitled “Risk Factors.” Although management believes that the assumptions underlying the forward looking statements included in this Current Report on Form 8-K are reasonable, they do not guarantee our future performance, and actual results could differ from those contemplated by these forward looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. In light of these risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking statements contained in this Current Report on Form 8-K will in fact transpire. You are cautioned to not place undue reliance on these forward-looking statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking statements.

Reverse Stock Split

On May 3, 2017, Dataram Corporation (the “Company” or “Dataram”) filed a certificate of amendment to its Articles of Incorporation, as amended, with the Secretary of State of the State of Nevada in order to effectuate a reverse stock split of the Company’s issued and outstanding Common Stock on a one for four basis. The reverse stock split became effective with NASDAQ at the open of business on May 8, 2017. The par value and other terms of the Company’s common stock were not affected by the reverse stock split. As a result of the reverse stock split, every four shares of the Company’s pre-reverse stock split common stock were combined and reclassified into one share of the Company’s common stock. No fractional shares of common stock were issued as a result of the reverse stock split.

All common stock and per share amounts have been retroactively restated herein to give effect to the reverse stock split.

Item 2.01 Completion of Acquisition or Disposition of Assets.

Agreement and Plan of Merger

On June 13, 2016, the Company entered into an Agreement and Plan of Merger, as amended and restated on July 29, 2016, and further amended and restated on September 14, 2016 and November 28, 2016 (as so amended, the “Merger Agreement”), with Dataram Acquisition Sub, Inc., a Nevada corporation and our wholly-owned subsidiary (“DAS”), U.S. Gold Corp., a Nevada corporation (“USG”) and Copper King LLC, the principal shareholder of USG (“Copper King”).

On May 23, 2017 (the “Closing Date”), the Company closed the transactions contemplated under the Merger Agreement (the “Closing”) and filed Articles of Merger with the State of Nevada, a copy of which is attached hereto as Exhibit 3.1, pursuant to which USG was merged with and into DAS, with USG surviving the merger as the surviving corporation and wholly-owned subsidiary of the Company (the “Merger”). In addition, pursuant to the terms of the Merger Agreement and as consideration for the acquisition of USG, on the Closing Date, outstanding shares of USG’s common stock, Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock as well as outstanding options and warrants of USG were converted into the following:

| ● | 395,833 shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”) were issued to certain holders of USG common stock; | |

| ● | 37,879 shares of the Company’s Common Stock were issued to certain members of USG management; |

| 2 |

| ● | 1,083,543 shares of the Company’s Common Stock were issued to holders of USG’s Series A Preferred Stock; | |

| ● | 466,678 shares of the Company’s Common Stock were issued to holders of USG’s Series B Preferred Stock; | |

| ● | of the 45,000.18 shares of the Company’s newly designated Series C Convertible Preferred Stock, par value $0.001 per share (the “Series C Preferred Stock”), convertible into an aggregate of 4,500,180 shares of the Company’s Common Stock that were to be issued to Copper King, 45,500.17 shares of Series C Preferred Stock were issued to Copper King on the Closing and 4,500.01 shares of Series C Preferred Stock are to be held in escrow pursuant to the terms of the Escrow Agreement as further discussed below; | |

| ● | 452,359 five-year cashless warrants with an exercise price of $2.64 per share were issued to Laidlaw & Company (UK) Ltd.; | |

| ● | 462,500 shares of Common Stock were issued to holders of USG common stock issued in connection with the closing of the Keystone acquisition; and | |

| ● | 231,458 five-year options with an exercise price of $3.60 per share, which vest in 24 equal monthly installments commencing on the date of issuance were issued to holders of options issued in connection with the closing of the Keystone acquisition (collectively, the “Merger Consideration”). |

The Company registered the shares of Common Stock issued to holders of outstanding shares of USG’s common stock, Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock together with the shares of Common Stock underlying the Company’s newly designated Series C Preferred Stock on a Registration Statement on Form S-4 (file number 333-215385) which Registration Statement was declared effective on March 7, 2017.

Following the Closing of the Merger, the Company had 8,174,605 shares of Common Stock and 45,000.18 shares of Series C Preferred Stock issued and outstanding.

Lock-up Agreements

As a condition to the Closing of the Merger, certain USG security holders have entered into lock-up agreements pursuant to which such parties have agreed not to, except in limited circumstances, sell or transfer, or engage in swap or similar transactions with respect to, shares of the Company’s Common Stock, including, as applicable, shares received in the Merger from the effective time of the Merger until one or two years following the closing of the Merger.

Specifically, (i) 395,833 shares of the Company’s Common Stock were issued to certain holders of USG common stock conditioned upon the receipt of a two year lock-up agreement, (ii) 37,879 shares of the Company’s Common Stock were issued to certain members of USG management conditioned upon the receipt of a one year lock-up agreement and (ii) 462,500 shares of Common Stock were issued to holders of USG common stock in connection with the closing of the Keystone acquisition conditioned upon the receipt of a two year lock-up agreement from each Keystone holder. The Company issued 466,678 shares of Common Stock to holders of USG Series B Preferred Stock; however, the Company waived receipt of one year lock up agreements from each holder of USG Series B Preferred Stock.

The foregoing description of the one year lock-up agreements and two year lock-up agreements is qualified in its entirety by reference to the one and two year lock-up agreements, copies of which are attached hereto as Exhibit 10.1 and 10.2, respectively, and are hereby incorporated by reference into this Item 2.01.

Escrow Agreement

On May 23, 2017, the Company together with DAS, USG and Copper King entered into an escrow agreement (the “Escrow Agreement”) with Equity Stock Transfer LLC (the “Escrow Agent”) pursuant to which the Company delivered 4,500.01 shares of the Company’s newly designated Series C Preferred Stock (collectively, the “Escrow Shares”) to the Escrow Agent. The Escrow Shares will be available to secure any claims that may arise with respect to the representations, warranties, covenants or indemnification obligations of Copper King and USG pursuant to the Merger Agreement as well as against the failure to deliver a new economic preliminary report upon the Copper King Project (defined below) during the period of 12 months following the Closing in which case the Escrow Shares will serve to reimburse the Company, by the forfeiture of such shares, in accordance with the valuation of such Escrow Shares as set forth in the Escrow Agreement. The Escrow Agreement will terminate on May 23, 2018, at which time the Escrow Agent will disburse the Escrow Shares pursuant to the terms of the Escrow Agreement.

| 3 |

The foregoing description of the Escrow Agreement is qualified in its entirety by reference to the Escrow Agreement, a copy of which attached hereto as Exhibit 10.3 and is hereby incorporated by reference into this Item 2.01.

Changes to Business

Following the Closing of the Merger, the Company operates as a single entity with two reporting businesses – a junior mining business and a memory business.

USG

Through the Company’s wholly-owned subsidiary, USG, the Company owns certain mining leases and other mineral rights and will engage in gold exploration.

Dataram Memory

Through the Company’s new, wholly-owned Nevada subsidiary, Dataram Memory, the Company will continue its legacy business, consisting of, among other things, manufacture, distribution, design, development and sale of memory modules, software products, and technical services (the “Legacy Business”).

While each of these businesses will be operated and managed independent of one another, they will share common resources and functions to include, but not limited to, human resources, legal, facilities, back office operations and administrative support. The sharing of common functions and resources will be of mutual operational and financial benefit.

Distribution of Net Proceeds of Legacy Business

While the Company has no current plans to divest assets of the Legacy Business, if such assets are divested within 18 months of the Closing Date, shareholders of record as of the close on business on May 8, 2017 may be entitled to a distribution, if any, of an interest in the Company’s assets related to its Legacy Business. The Company’s Board of Directors intends to create an irrevocable liquidating trust pursuant to which Dataram Memory will, immediately prior to the divestiture of the assets related to the Legacy Business, place such assets or proceeds therefrom into such trust to be held for the benefit of the shareholders of record as of May 8, 2017. Shareholders as of the record date will receive a non-transferable beneficial interest in proportion to such shareholder’s pro rata ownership interest in the Company’s Common Stock as of the close of business on the record date, after giving effect to the authorized 1-for-4 reverse split of the Company’s Common Stock which became effective at the market open on May 8, 2017; provided, however, there can be no assurance that the Company will enter into any transaction, that any net proceeds will become available, or that the trust will be created.

Accounting Treatment

The Merger is being accounted for as a “reverse merger,” and USG is deemed to be the acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements prior to the Merger will be those of USG, and the consolidated financial statements after completion of the Merger will include the assets and liabilities of USG, historical operations of USG and operations of the Company from the Closing Date of the Merger.

| 4 |

Tax Treatment

Generally

The following discussion summarizes the material U.S. federal income tax consequences of the Merger to U.S. holders (as defined below) of USG capital stock. This discussion is based on the Internal Revenue Code of 1986, as amended (the “Code”), U.S. Treasury Regulations, administrative pronouncements and judicial decisions currently in effect, all of which are subject to change, possibly with retroactive effect. Any such change could affect the accuracy of this discussion.

This discussion assumes you hold your shares of USG capital stock as capital assets within the meaning of Section 1221 of the Code. This discussion does not address all aspects of U.S. federal income taxation that may be relevant to you in light of your particular circumstances or to U.S. holders of USG capital stock subject to special treatment under the federal income tax laws such as:

| ● | insurance companies; | |

| ● | investment companies; | |

| ● | tax-exempt organizations; | |

| ● | financial institutions; | |

| ● | dealers in securities or foreign currency; | |

| ● | banks or trusts; | |

| ● | persons that hold USG capital stock as part of a straddle, hedge, constructive sale or other integrated security transaction; | |

| ● | persons that have a functional currency other than the U.S. dollar; | |

| ● | investors in pass-through entities; or | |

| ● | persons who acquired their USG capital stock through the exercise of options or otherwise as compensation or through a tax-qualified retirement plan. |

Further, this discussion does not consider the potential effects of any state, local or foreign tax laws or U.S. federal tax laws other than federal income tax laws.

This discussion is not intended to be tax advice to any particular holder of USG capital stock. Tax matters regarding the Merger are complicated, and the tax consequences of the Merger to you will depend on your particular situation. You should consult your own tax advisor regarding the specific tax consequences to you of the Merger, including the applicability and effect of federal, state, local and foreign income and other tax laws.

For purposes of this discussion, you are a “U.S. holder” if you beneficially own USG capital stock and you are:

| ● | a citizen or resident of the United States for federal income tax purposes; | |

| ● | a corporation, or other entity taxable as a corporation for U.S. federal income tax purposes, created or organized under the laws of the United States or any of its political subdivisions; | |

| ● | a trust, if (i) a U.S. court is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have the authority to control all substantial decisions of the trust or (ii) the trust has a valid election in effect under applicable Treasury regulations to be treated as a U.S. person; or | |

| ● | an estate that is subject to U.S. federal income tax on its income regardless of its source. |

| 5 |

If an entity classified as a partnership for U.S. federal income tax purposes holds USG capital stock, the tax treatment of a partner generally will depend upon the status of the partner and the activities of the partnership. Partners of partnerships holding USG capital stock are urged to consult their own tax advisors.

Neither the Company nor USG have requested a ruling from the Internal Revenue Service (“IRS”) with respect to any of the U.S. federal income tax consequences of the Merger and, as a result, there can be no assurance that the IRS will not disagree with any of the conclusions described below. It is the Company’s understanding that the Merger will, under current law, constitute a tax-free reorganization under Section 368(a) of the Code, and the Company and USG will each be a party to the reorganization within the meaning of Section 368(b) of the Code. This understanding is not binding on the IRS or any court.

The discussion below summarizes the material U.S. federal income tax consequences to a U.S. holder of USG capital stock resulting from the qualification of the Merger as reorganization within the meaning of Section 368(a) of the Code.

U.S. Federal Income Tax Consequences of the Merger to U.S. Holders

As a tax-free reorganization, it is the understanding of the Company that the Merger will have the following federal income tax consequences for U.S. holders of USG capital stock:

| ● | No gain or loss will be recognized by U.S. holders of USG capital stock as a result of the exchange of such shares for the Merger Consideration pursuant to the Merger. | |

| ● | The tax basis of the Merger Consideration received by each U.S. holder of USG capital stock will equal the tax basis of such U.S. holder’s shares of USG capital stock exchanged in the Merger | |

| ● | The holding period for the Merger Consideration received by each U.S. holder of USG capital stock will include the holding period for the shares of USG capital stock of such U.S. holder exchanged in the Merger. |

Reporting and Retention Requirements

If you receive the Merger Consideration as a result of the Merger, you are required to retain certain records pertaining to the Merger pursuant to the Treasury Regulations under the Code. If you are a “significant holder” (as defined in the Treasury Regulations under the Code) of USG capital stock, you must file with your U.S. federal income tax return for the year in which the Merger takes place a statement setting forth certain facts relating to the Merger. You are urged to consult your tax advisors concerning potential reporting requirements.

SHAREHOLDERS AND INVESTORS SHOULD CONSULT THEIR TAX ADVISORS WITH RESPECT TO THE APPLICATION OF THE U.S. FEDERAL INCOME TAX LAWS TO THEIR PARTICULAR SITUATIONS AS WELL AS ANY TAX CONSEQUENCES OF THE MERGER ARISING UNDER THE U.S. FEDERAL ESTATE OR GIFT TAX LAWS OR UNDER THE LAWS OF ANY STATE, LOCAL OR NON-U.S. TAXING JURISDICTION OR UNDER ANY APPLICABLE INCOME TAX TREATY.

No ruling from the IRS has been or will be requested in connection with the Merger. In addition, shareholders of the Company should be aware that the tax opinions discussed in this section are not binding on the IRS, and the IRS could adopt a contrary position and a contrary position could be sustained by a court.

THE PRECEDING DISCUSSION DOES NOT PURPORT TO BE A COMPLETE ANALYSIS OR DISCUSSION OF ALL OF THE MERGER’S POTENTIAL TAX EFFECTS. U.S. HOLDERS OF USG STOCK SHOULD CONSULT THEIR TAX ADVISORS AS TO THE SPECIFIC TAX CONSEQUENCES TO THEM OF THE MERGER, INCLUDING TAX RETURN REPORTING REQUIREMENTS, AND THE APPLICABILITY AND EFFECT OF FEDERAL, STATE, LOCAL AND OTHER APPLICABLE TAX LAWS.

| 6 |

Corporate Information

U.S. Gold Corp. was formed in the State of Nevada on February 14, 2014. As used in this Current Report on Form 8-K, all references to “we”, “our” and “us” for periods prior to the Closing Date refer to USG as a privately owned company, and for periods subsequent to the Closing Date, refer to the Company and its subsidiaries (including USG).

BUSINESS OF U.S. GOLD CORP.

USG is an exploration stage company that owns certain mining leases and other mineral rights comprising the Copper King Project.

Copper King Project

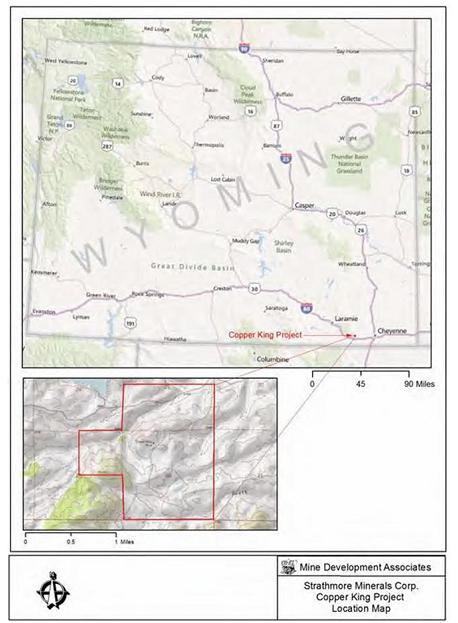

The Copper King project (the “Copper King Project”) consists of certain mining leases and other mineral rights comprising the Copper King gold and copper development project located in the Silver Crown Mining District of southeast Wyoming.

Location and Access

The Copper King Project is located in southeastern Wyoming, approximately 32km west of the city of Cheyenne, on the southeastern margin of the Laramie Range. The property covers about five square kilometers that include the S½ Section 25, NE¼ Section 35, and all of Section 36, T.14N., R.70W.,Sixth Principal Meridian. Access to within 1.5km of the property is provided by paved and maintained gravel roads. An easement agreement providing access for exploration and other minimal impact activities has been negotiated with Ferguson Ranch Inc. on the S½ Section 25, T14N, R70W, and the W½ Section 30, T14N, R69W. The fee for this easement is $10,000 per year, renewable each year prior to July 11.

The Copper King property covers 453 contiguous hectares (approximately five square kilometers) that include the S½ of Section 25, NE¼ Section 35, and all of Section 36, T.14N., R.70W. The project is entirely located on land owned and administered by the State of Wyoming. There are no federal lands within or adjoining the Copper King land position. Curt Gowdy State Park lies northwest of the property, partially within Section 26. The state park’s southeastern boundary is approximately 300m northwest of the property and approximately 900m northwest of the mineralized area. The Copper King property position consists of two State of Wyoming Metallic and Non-metallic Rocks and Minerals Mining Leases.

| 7 |

Figure 1 – Copper King Project Location and Boundaries

Title to Copper King Project

USG’s rights to the Copper King Project arise under two State of Wyoming mineral leases:

1) State of Wyoming Mining Lease No. 0-40828

Township 14 North, Range 70 West, 6th P.M., Laramie County, Wyoming:

Section 36: All

2) State of Wyoming Mining Lease No. 0-40858

Township 14 North, Range 70 West, 6th P.M., Laramie County, Wyoming:

Section 25: S/2

Section 35: NE/4

| 8 |

Ownership of the mineral rights remains in the possession of the State of Wyoming as conveyed to the State by the United States, evidenced by 1942 patents for Section 36, and 1989 Order confirming title to Section 25 and 35. The State of Wyoming issued Mineral Leases for the mineral rights to Wyoming Gold Mining Company, Inc. (“Wyoming Gold”) in 2013 and 2014. These leases were assigned to USG on June 23, 2014.

Lease 0-40828 was renewed in February 2013 for a second ten-year term and Lease 0-40858 was renewed for its second ten-year term in February 2014. Each lease requires an annual payment of $2.00 per acre.

The following production royalties must be paid to the State of Wyoming, although once the project is in operation, the Board of Land Commissioners has the authority to reduce the royalty payable to the State:

| FOB Mine Value per Ton | Percentage Royalty | |||

| $00.00 to $50.00 | 5 | % | ||

| $50.01 to $100.00 | 7 | % | ||

| $100.01 to $150.00 | 9 | % | ||

| $150.01 and up | 10 | % | ||

History of Prior Operations and Exploration on the Copper King Project

Limited exploration and mining were conducted on the Copper King property in the late 1880s and early 1900s. Approximately 300 tons of material was reported to have been produced from a now inaccessible 160 foot-deep shaft with two levels of cross-cuts. A few small adits and prospect pits with no significant production are scattered throughout the property.

Since 1938, at least nine historic (pre- Strathmore Minerals Corp.) drilling campaigns by at least seven companies plus the U.S. Bureau of Mines have been conducted at Copper King. The current project database contains 91 drill holes totaling 37,500 feet that were drilled before Wyoming Gold acquired the property. All but six of the drill holes are within the current resource area. Other work conducted at Copper King by previous companies has included ground and aeromagnetic surveys as well as induced polarization surveys along with geochemical sampling, geologic mapping, and a number of metallurgical studies.

Wyoming Gold conducted an exploration drill program in 2007 and 2008. Thirty-five diamond core drill holes were completed for a total of 25,500 feet. The exploration permit, 360DN, has been terminated and the bond released. The focus of that work was to confirm and potentially expand the mineralized body outlined in the previous drill campaigns, increase the geologic and geochemical database leading to the creation of the current geologic model and resource estimate, and to provide material for further metallurgical testing. The Copper King assay database for some 120 holes contains 8,357 gold assays and 8,225 copper assays. At least 10 different organizations or individuals conducted metallurgical studies on the gold-copper mineralization at the request of prior operators between 1973 and 2009. It was concluded that the process with the highest potential to yield good extractions of gold and copper would likely be flotation, followed by cyanidation of the flotation tailings. Core is stored in two public storage facilities; one is AAA in Cheyenne, Wyoming and the other is Absaroka in Dubois, Wyoming.

Geological Summary of the Copper King Project

The Copper King Project is underlain by Proterozoic rocks that make up the southern end of the Precambrian core of the Laramie Range. Metavolcanic and metasedimentary rocks of amphibolite-grade metamorphism are intruded by the 1.4 billion year old Sherman Granite and related felsic rocks. Within the project area, foliated granodiorite is intruded by aplitic quartz monzonite dikes, thin mafic dikes and younger pegmatite dikes. Shear zones with cataclastic foliation striking N60°E to N60°W are found in the southern part of the Silver Crown district, including at Copper King. The granodiorite typically shows potassium enrichment, particularly near contacts with quartz monzonite. Copper and gold mineralization occurs primarily in unfoliated to mylonitic granodiorite. The mineralization is associated with a N60°W-trending shear zone and disseminated and stockwork gold-copper deposits in the intrusive rocks. Some authors have categorized it as a Proterozoic porphyry gold-copper deposit. Hydrothermal alteration is overprinted on retrograde greenschist alteration and includes a central zone of silicification, followed outward by a narrow potassic zone, surrounded by propylitic alteration. Higher-grade mineralization occurs within a central core of thin quartz veining and stockwork mineralization that is surrounded by a zone of lower-grade disseminated mineralization. Disseminated sulfides and native copper with stockwork malachite and chrysocolla are present at the surface, and chalcopyrite, pyrite, minor bornite, primary chalcocite, pyrrhotite, and native copper are present at depth. Gold occurs as free gold.

| 9 |

Estimated Resources from the Technical Report dated June 20, 2012

The Copper King resource contains oxide, mixed oxide-sulfide, and sulfide rock types. At the stated cutoff grade 0.015oz AuEq/ton, approximately 80% of the resource is sulfide material with the remaining 20% split evenly between the oxide and mixed rock types. There is consistent distribution of gold and copper, albeit generally low-grade, throughout this potential open-pit deposit.

Table 1.1 Summary Tables of Copper King Resources 1

Total Measured and Indicated Resource:

| Au-equiv. Cutoff | tons | tonnes | oz Au/ton | g Au/t | oz Au | % Cu | lbs Cu | |

| oz AuEq/ton | g AuEq/t | |||||||

| 0.015 | 0.51 | 59,750,000 | 54,200,000 | 0.015 | 0.53 | 926,000 | 0.187 | 223,000,000 |

Total Inferred Resource:

| Au-equiv. Cutoff | tons | tonnes | oz Au/ton | g Au/t | oz Au | % Cu | lbs Cu | |

| oz AuEq/ton | g AuEq/t | |||||||

| 0.015 | 0.51 | 15,620,000 | 14,170,000 | 0.011 | 0.38 | 174,000 | 0.200 | 62,530,000 |

Using the individual metal grades of each block, the AuEq grade is calculated using the following formula: g AuEq/t = g Au/t + (2.057143 * %Cu). This formula is based on prices of US$1,000.00 per ounce gold, and US$3.00 per pound copper.

1 Technical Report on the Copper King Project Laramie County, Wyoming, Effective Date June 20, 2012, prepared for Strathmore Minerals Corp. by Mine Development Associates, authors Paul Tietz and Neil Prenn.

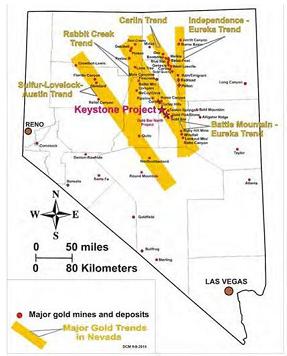

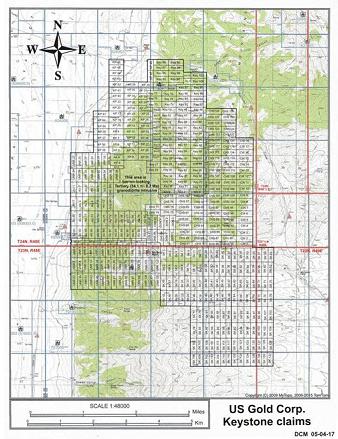

Keystone Project

Location

The Keystone Project consists of 479 unpatented lode mining claims situated in Eureka County, Nevada. The claims making up the Keystone Project are situated in Eureka County, Nevada in Sections 2-4 and 9-11, Township 23 North, Range 48 East, and Sections 22-28, and 33-36 Township 24 North, all Range 48 East of the Mount Diablo Meridian.

| 10 |

Figure 2 – Location of Keystone Project and Major Gold Trends in Nevada

| 11 |

Figure 3 – Keystone Project Claim Boundaries

The Keystone Project may be accessed by improved roads. Navigation through the interior of the project is by off-road vehicle.

Title and Ownership for Keystone Project

The Keystone Project consists of unpatented mining claims located on federal land administered by the U.S. Bureau of Land Management (“BLM”). An annual maintenance fee of $155.00 per claim per year must be paid to the Nevada BLM by September 1 of each year, and failure to make the payment on time renders the claims void.

In addition, the State of Nevada requires the claimant to file an Affidavit and Notice of Intent to Hold in the appropriate county by November 1 of each year. However, the failure to timely record an Affidavit does not affect a forfeiture of the claims, as does the failure to pay the federal claim maintenance fees by September 1. Instead, in the event of a conflict with a junior locator, the senior claimant must prove his intent to maintain the claims. This can generally be accomplished by producing a receipt showing payment of the federal claim maintenance fees to the BLM.

The federal claim maintenance fees are prospective and are paid for the ensuing assessment year. For example, the payments made on June 29, 2015 relate to the 2015-2016 assessment year running from September 1, 2015 to September 1, 2016. By comparison, the Nevada filings are retrospective, describing the assessment year just ended or about to end.

Congress has extended the claim maintenance requirements through 2016. It will therefore be necessary for USG to perform the following acts in order to maintain the claims in 2016-2017 and each year thereafter: (1) on or before September 1 of each year, USG must pay a maintenance fee of $155.00 per claim to the Nevada BLM, and (2) on or before November 1 of each year USG must record an Affidavit and Notice of Intent to Hold in Eureka County.

USG acquired the mining claims comprising the Keystone Project on May 27, 2016 from Nevada Gold Ventures, LLC (“Nevada Gold”) and Americas Gold Exploration, Inc. (“Americas Gold”) under the terms of the Purchase and Sale Agreement. Some of the Keystone claims are subject to pre-existing net smelter royalty (“NSR”) obligations. In addition, under the terms of the Purchase and Sale Agreement, Nevada Gold retained additional NSR rights of 0.5% with regard to certain claims and 3.5% with regard to certain other claims. The unpatented mining claims comprising the Keystone Project, with applicable NSR obligations, are as follows:

| 1. | Acquired 100% from Americas Gold; subject to a one percent (1%) NSR held by Wolfpack Gold Nevada Corp.; a two percent (2.0%) NSR with respect to precious metals and one percent (1.0%) NSR with respect to all other metals and minerals held by Orion Royalty Company, LLC; and a one-half percent (0.5%) NSR to Nevada Gold. |

27 unpatented lode mining claims situated in Eureka County, Nevada, in Sections 33 and 34, Township 24 North, Range 48 East, and Sections 3, 4, 9, and 10, Township 23 North, Range 48 East, Mount Diablo Base Line and Meridian.

| Claim Name | No. claims | BLM NMC Serial Number | ||

| UNR 5-8 | 4 | 861839-861842 | ||

| UNR 9-18 | 10 | 858729-858738 | ||

| UNR 19-22 | 4 | 875010-875013 | ||

| UNR 37 | 1 | 861857 | ||

| UNR 39 | 1 | 861859 | ||

| UNR 41 | 1 | 861861 | ||

| UNR 43 | 1 | 861863 | ||

| UNR 45 | 1 | 861865 | ||

| UNR 47 | 1 | 861867 | ||

| UNR 79 | 1 | 875020 | ||

| UNR 81 | 1 | 875022 | ||

| UNR 83 | 1 | 875024 | ||

| Total Claims | 27 |

| 12 |

| 2. | Acquired 100% from Americas Gold; subject to a three and one-half percent (3.5%) NSR to Nevada Gold |

13 unpatented lode mining claims situated in Eureka County, Nevada, in Sections 27, 28 and 35, Township 24 North, Range 48 East, and Sections 2 and 3, Township 23 North, Range 48 East, Mount Diablo Base Line and Meridian.

| Claim Name | No. claims | BLM NMC Serial Number | ||

| UNR 73-77 | 5 | 1102663-110266 | ||

| UNR 117 | 1 | 1102668 | ||

| UNR 119 | 1 | 1102669 | ||

| UNR 121 | 1 | 1102670 | ||

| DON 1-5 | 5 | 1102658-1102662 | ||

| Total Claims | 13 |

| 3. | Acquired 100% from Nevada Gold; subject to a three and one-half percent (3.5%) NSR to Nevada Gold |

28 unpatented lode mining claims situated in Eureka County, Nevada, in Sections 2 & 11, Township 23 North, Range 48 East, Mount Diablo Base Line and Meridian.

| Claim Name | No. claims | BLM NMC Serial Number | ||

| SK 1-28 | 28 | 865573-865600 | ||

| Total Claims | 28 |

| 4. | Acquired 50% from Nevada Gold, 50% from Americas Gold, subject to a three and one-half percent (3.5%) NSR to Nevada Gold |

216 unpatented lode mining claims, alphabetically ordered, situated in Eureka County, Nevada, in Sections 22, 23, 24, 25, 26, 27, 28, 33, 34, 35 & 36, Township 24 North, Range 48 East, Mount Diablo Base Line and Meridian.

| Claim Name | No. claims | BLM NMC Serial Numbers | ||

| AU 1-12 | 12 | 1116231-1116242 | ||

| AU 68-93 | 26 | 1116243-1116268 | ||

| CHS 54-72 | 19 | 1116269-1116287 | ||

| CHS 74 | 1 | 1116288 | ||

| CHS 76-120 | 45 | 1116289-1116333 | ||

| CHS 121-130 | 10 | 1118512-1118521 | ||

| CHS 265-266 | 2 | 1116334-1116335 | ||

| KEY 9-30 | 22 | 1116336-1116357 | ||

| KEY 32 | 1 | 1116358 | ||

| KEY 34 | 1 | 1116359 | ||

| KEY 36 | 1 | 1116360 | ||

| KEY 45-72 | 28 | 1116361-1116388 | ||

| KEY #73 - #78 | 6 | 1118480-1118485 | ||

| KP #4 - #8 | 5 | 1118496-1118500 | ||

| KP 9-14 | 6 | 1116389-1116394 | ||

| KP 18-19 | 2 | 1116395-1116396 | ||

| KP 21 | 1 | 1116397 | ||

| KP 23-29 | 7 | 1116398-1116404 | ||

| KP #30 - #39 | 10 | 1118486-1118495 | ||

| UNR 25-35 | 11 | 1118501-1118511 | ||

| Total Claims | 216 |

Under the terms of the Purchase and Sale Agreement, USG may buy down 1% of the NSR owed to Nevada Gold at any time through the fifth anniversary of the closing date for $2,000,000. In addition, USG may buy down an additional 1% of the NSR owed to Nevada Gold anytime through the eighth anniversary of the closing date for $5,000,000.

| 13 |

History of Prior Operations and Exploration on the Keystone Project

No comprehensive, modern-era, model-driven exploration has ever been conducted on the Keystone Project. Newmont drilled 6 holes in the old base metal and silver Keystone mine area in 1967, and encountered low grade (+/- 0.02 opt) gold intercepts. Chevron staked the property in 1981-1983 and drilled 27 shallow drill holes, continued by an agreement with USMX that drilled an additional 19 shallow holes; significant amounts of low grade and anomalous gold were intersected, but results were considered uneconomic, and the project dropped. In 1988 and 1989, Phelps Dodge acquired a southern portion of the district and drilled 6 holes, one of which total depth in gold mineralization, and was subsequently deepened in 1990 resulting in over 200’ of low grade gold mineralization. About this time Coral Resources acquired a northern portion of the property and drilled 21 shallow holes to follow-up previous drill intercepts. 1995-1997, Golden Glacier, a junior company, acquired the north end of the district, and Uranerz a portion of the southern area; 6 holes were drilled in the north and only 2 holes in the south, respectively. The entire district was dropped by all parties.

In 2004 with the discovery of Cortez Hills and escalating gold prices, Nevada Pacific Gold, Great American Minerals (Don McDowell), and Tone Resources (Dave Mathewson) competed in claim staking the entire district. Subsequently, Don McDowell, founder of Great American Minerals approached Placer Dome (prior to Barrick acquisition) who discovered Pipeline and Cortez Hills, and who correctly recognized the Keystone district potential. Placer Dome entered into separate joint venture agreements with Nevada Pacific and Great American. The following year Barrick Gold bought Placer Dome and dropped all Placer Dome’s Nevada exploration projects and joint ventures, including Keystone. In 2006, Nevada Pacific and Tone were purchased by USG. USG, now McEwen Mining, drilled 35 holes mostly near the north end of the district; targeting the range front pediment and the historic Keystone Mine.

Geological Potential of the Keystone Project

To date, a technical report has not been prepared on the Keystone Project. Keystone is positioned on the prolific Cortez gold trend, one of the world’s leading gold producing regions. The Keystone Project is centered on a granitic intrusion that warped the local Paleozoic stratigraphy into a dome, allowing for exposure of highly favorable Devonian, Carboniferous (Mississippian-Pennsylvania) and Permo-Triassic rocks including key likely host rocks for mineralization, the silty carbonate strata of the Horse Creek Formation and the Wenban limestone, as well as possible sandy clastic units of the Diamond Peak Formation. The Horse Canyon and Wenban rocks are the primary host rocks at the nearby Cortez Hills Mine and Gold Rush deposit currently operated by Barrick Gold.

Competition

USG does not compete directly with anyone for the exploration or removal of minerals from its property as USG holds all interest and rights to the claims. Readily available commodities markets exist in the U.S. and around the world for the sale of minerals. Therefore, USG will likely be able to sell minerals that it is able to recover. USG will be subject to competition and unforeseen limited sources of supplies in the industry in the event spot shortages arise for supplies such as explosives or large equipment tires, and certain equipment such as bulldozers and excavators and services, such as contract drilling that USG will need to conduct exploration. If USG is unsuccessful in securing the products, equipment and services it needs, it may have to suspend its exploration plans until it is able to secure them.

Compliance with Government Regulation

USG will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the United States generally. USG will also be subject to the regulations of the BLM with respect to mining claims on federal lands.

Future exploration drilling on any of USG’s properties that consist of BLM land will require USG to either file a Notice of Intent or a Plan of Operations with the BLM, depending upon the amount of new surface disturbance that is planned. A Notice of Intent is required for planned surface activities that anticipate less than 5.0 acres of surface disturbance, and usually can be obtained within a 30 to 60 day time period. A Plan of Operations will be required if there is greater than 5.0 acres of new surface disturbance involved with the planned exploration work. A Plan of Operations can take several months to be approved, depending on the nature of the intended work, the level of reclamation bonding required, the need for archeological surveys and other factors as may be determined by the BLM.

| 14 |

Environmental Permitting Requirements

Various levels of governmental controls and regulations address, among other things, the environmental impact of mineral mining and exploration operations and establish requirements for reclamation of mineral mining and exploration properties after exploration operations have ceased. With respect to the regulation of mineral mining and exploration, legislation and regulations in various jurisdictions establish performance standards, air and water quality emission limits and other design or operational requirements for various aspects of the operations, including health and safety standards. Legislation and regulations also establish requirements for reclamation and rehabilitation of mining properties following the cessation of operations and may require that some former mining properties be managed for long periods of time after mining activities have ceased.

USG’s activities are subject to various levels of federal and state laws and regulations relating to protection of the environment, including requirements for closure and reclamation of mineral exploration properties. Some of the laws and regulations include the Clean Air Act, the Clean Water Act, the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), the Emergency Planning and Community Right-to-Know Act, the Endangered Species Act, the Federal Land Policy and Management Act, the National Environmental Policy Act, the Resource Conservation and Recovery Act, and related state laws in Nevada. Additionally, much of USG’s property is subject to the federal General Mining Law of 1872, which regulates how mining claims on federal lands are located and maintained.

The State of Nevada, where USG focuses its mineral exploration efforts, requires mining projects to obtain a Nevada State Reclamation Permit pursuant to the Mined Land Reclamation Act (the “Nevada MLR Act”), which establishes reclamation and financial assurance requirements for all mining operations in the state. New and expanding facilities are required to provide a reclamation plan and financial assurance to ensure that the reclamation plan is implemented upon completion of operations. The Nevada MLR Act also requires reclamation plans and permits for exploration projects that will result in more than five acres of surface disturbance on private lands.

Employees

As of May 23, 2017, USG has 4 full-time employees and no part-time employees.

Legal Proceedings

USG is not currently subject to any legal proceedings, and to the best of its knowledge, no such proceeding is threatened, the results of which would have a material impact on USG’s properties, results of operation, or financial condition, nor to the best of USG’s knowledge, are any of its officers or directors involved in any legal proceedings in which USG is an adverse party.

Corporate Background

USG was incorporated in 2014 in the state of Nevada. USG’s principal executive office is located at Suite 102, Box 604, 1910 East Idaho Street, Elko, Nevada 89801, its telephone number is (800-557-4550), and its website is located at http://usgoldcorp.gold

CERTAIN RISK FACTORS RELATING TO U.S. GOLD CORP.

USG is a new company with a short operating history and has a history of losses.

USG was formed in February 2014. Its operating history consists of starting its preliminary exploration activities. USG has no income-producing activities from mining or exploration and has already incurred losses because of the expenses it has incurred in acquiring the rights to explore its properties and starting its preliminary exploration activities. USG incurred a net loss of approximately $407,000 for the year ended April 30, 2016 and approximately $3,685,000 for the nine months ended January 31, 2017 and has not generated any revenue. USG expects that its operating expenses and net losses will increase dramatically as it proceeds with exploration and development of the Copper King and Keystone mining projects. Exploring for gold and other minerals or resources is an inherently speculative activity. There is a strong possibility that USG will not find any commercially exploitable gold or other deposits on its properties. Because USG is an exploration company, it may never achieve any meaningful revenue.

| 15 |

Since USG has a limited operating history, it is difficult for potential investors to evaluate its business.

USG’s limited operating history makes it difficult for potential investors to evaluate its business or prospective operations. Since its formation, USG has not generated any revenues. As an early stage company, USG is subject to all the risks inherent in the initial organization, financing, expenditures, complications and delays inherent in a new business. Investors should evaluate an investment in USG in light of the uncertainties encountered by developing companies in a competitive environment. USG’s business is dependent upon the implementation of its business plan. There can be no assurance that its efforts will be successful or that USG will ultimately be able to attain profitability.

Exploring for gold is an inherently speculative business.

Natural resource exploration and exploring for gold in particular is a business that by its nature is very speculative. There is a strong possibility that USG will not discover gold or any other resources which can be mined or extracted at a profit. Although the Copper King Project has known gold deposits, the deposits may not be of the quality or size necessary for it to make a profit from actually mining it. Few properties that are explored are ultimately developed into producing mines. Unusual or unexpected geological formations, geological formation pressures, fires, power outages, labor disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labor are just some of the many risks involved in mineral exploration programs and the subsequent development of gold deposits.

USG will need to obtain additional financing to fund its Copper King and Keystone exploration programs.

USG does not have sufficient capital to fund its exploration programs for the Copper King Project or the Keystone Project as they are currently planned or to fund the acquisition and exploration of new properties. USG will require additional funding to continue its planned exploration programs. Its management estimates that USG will require up to $500,000 in order to fund the first year of planned exploration and development of the Keystone Project, with up to $2,000,000 required in order to fund plans for the second year. In addition, USG will require up to $500,000 per year for maintenance and development of the Copper King Project. Its inability to raise additional funds on a timely basis could prevent USG from achieving its business objectives and could have a negative impact on its business, financial condition, results of operations and the value of its securities.

USG does not know if its properties contain any gold or other minerals that can be mined at a profit.

Although the properties on which USG has the right to explore for gold are known to have deposits of gold, there can be no assurance such deposits which can be mined at a profit. Whether a gold deposit can be mined at a profit depends upon many factors. Some but not all of these factors include: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; operating costs and capital expenditures required to start mining a deposit; the availability and cost of financing; the price of gold, which is highly volatile and cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land use, importing and exporting of minerals and environmental protection.

USG is a junior gold exploration company with no mining operations and it may never have any mining operations in the future.

USG’S business is exploring for gold and other minerals. In the event that USG discovers commercially exploitable gold or other deposits, it will not be able to make any money from them unless the gold or other minerals are actually mined or all or a part of its interest is sold. Accordingly, USG will need to find some other entity to mine its properties on its behalf, mine them itself or sell the rights to mine to third parties.

| 16 |

USG’s financial statements have been prepared assuming that USG will continue as a going concern

USG’s financial statements have been prepared assuming that USG will continue as a going concern. The ability to continue as a going concern is dependent upon USG generating profitable operations in the future and/or its ability to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. USG’s ability to raise additional capital through the future issuances of equity or debt is unknown and there can be no assurances that any such financing can be obtained on favorable terms, if at all.. The obtainment of additional financing, the successful development of USG’s contemplated plan of operations and its transition, ultimately, to the attainment of profitable operations are necessary for USG to continue its operations.

USG’s business is subject to extensive environmental regulations which may make exploring for or mining prohibitively expensive, and which may change at any time.

All of USG’s operations are subject to extensive environmental regulations which can make exploration expensive or prohibit it altogether. USG may be subject to potential liabilities associated with the pollution of the environment and the disposal of waste products that may occur as the result of exploring and other related activities on its properties. USG may have to pay to remedy environmental pollution, which may reduce the amount of money that USG has available to use for exploration. This may adversely affect its financial position. If USG is unable to fully remedy an environmental problem, it might be required to suspend operations or to enter into interim compliance measures pending the completion of the required remedy. If a decision is made to mine its properties and it retains any operational responsibility for doing so, its potential exposure for remediation may be significant, and this may have a material adverse effect upon its business and financial position. USG has not purchased insurance for potential environmental risks (including potential liability for pollution or other hazards associated with the disposal of waste products from its exploration activities). However, if USG mines one or more of its properties and retains operational responsibility for mining, then such insurance may not be available to it on reasonable terms or at a reasonable price. All of its exploration and, if warranted, development activities may be subject to regulation under one or more local, state and federal environmental impact analyses and public review processes. It is possible that future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have significant impact on some portion of USG’s business, which may require its business to be economically re-evaluated from time to time. These risks include, but are not limited to, the risk that regulatory authorities may increase bonding requirements beyond its financial capability. Inasmuch as posting of bonding in accordance with regulatory determinations is a condition to the right to operate under all material operating permits, increases in bonding requirements could prevent operations even if USG is in full compliance with all substantive environmental laws.

USG may be denied the government licenses and permits which it needs to explore on its properties. In the event that USG discovers commercially exploitable deposits, USG may be denied the additional government licenses and permits which it will need to mine its properties.

Exploration activities usually require the granting of permits from various governmental agencies. For example, exploration drilling on unpatented mineral claims requires a permit to be obtained from the United States BLM, which may take several months or longer to grant the requested permit. Depending on the size, location and scope of the exploration program, additional permits may also be required before exploration activities can be undertaken. Prehistoric or Indian grave yards, threatened or endangered species, archeological sites or the possibility thereof, difficult access, excessive dust and important nearby water resources may all result in the need for additional permits before exploration activities can commence. As with all permitting processes, there is the risk that unexpected delays and excessive costs may be experienced in obtaining required permits. The needed permits may not be granted at all. Delays in or USG’s inability to obtain necessary permits will result in unanticipated costs, which may result in serious adverse effects upon its business.

The values of USG’s properties are subject to volatility in the price of gold and any other deposits USG may seek or locate.

USG’s ability to obtain additional and continuing funding, and its profitability in the unlikely event it ever commences mining operations or sells the rights to mine, will be significantly affected by changes in the market price of gold. Gold prices fluctuate widely and are affected by numerous factors, all of which are beyond USG’s control. Some of these factors include the sale or purchase of gold by central banks and financial institutions; interest rates; currency exchange rates; inflation or deflation; fluctuation in the value of the United States dollar and other currencies; speculation; global and regional supply and demand, including investment, industrial and jewelry demand; and the political and economic conditions of major gold or other mineral producing countries throughout the world, such as Russia and South Africa. The price of gold or other minerals have fluctuated widely in recent years, and a decline in the price of gold could cause a significant decrease in the value of USG’s properties, limit USG’s ability to raise money, and render continued exploration and development of its properties impracticable. If that happens, then USG could lose its rights to its properties and be compelled to sell some or all of these rights. Additionally, the future development of its properties beyond the exploration stage is heavily dependent upon the level of gold prices remaining sufficiently high to make the development of USG’s properties economically viable. You may lose your investment if the price of gold decreases. The greater the decrease in the price of gold, the more likely it is that you will lose money.

| 17 |

USG’s property titles may be challenged and it is not insured against any challenges, impairments or defects to its mineral claims or property titles. USG has not fully verified title to its properties.

USG’s unpatented Keystone claims were created and maintained in accordance with the federal General Mining Law of 1872. Unpatented claims are unique U.S. property interests and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented claims is often uncertain. This uncertainty arises, in part, out of the complex federal and state laws and regulations under the General Mining Law. USG has obtained a title report on its Keystone claims, but cannot be certain that all defects or conflicts with its title to those claims have been identified. Further, USG has not obtained title insurance regarding its purchase and ownership of the Keystone claims. Defending any challenges to its property titles may be costly, and may divert funds that could otherwise be used for exploration activities and other purposes. In addition, unpatented claims are always subject to possible challenges by third parties or contests by the federal government, which, if successful, may prevent us from exploiting its discovery of commercially extractable gold. Challenges to its title may increase its costs of operation or limit its ability to explore on certain portions of its properties. USG is not insured against challenges, impairments or defects to its property titles, nor does USG intend to carry extensive title insurance in the future.

Possible amendments to the General Mining Law could make it more difficult or impossible for USG to execute its business plan.

U.S. Congress has considered proposals to amend the General Mining Law of 1872 that would have, among other things, permanently banned the sale of public land for mining. The proposed amendment would have expanded the environmental regulations to which USG is subject and would have given Indian tribes the ability to hinder or prohibit mining operations near tribal lands. The proposed amendment would also have imposed a royalty of 8% of gross revenue on new mining operations located on federal public land, which would have applied to substantial portions of its properties. The proposed amendment would have made it more expensive or perhaps too expensive to recover any otherwise commercially exploitable gold deposits which USG may find on its properties. While at this time the proposed amendment is no longer pending, this or similar changes to the law in the future could have a significant impact on USG’s business model.

Market forces or unforeseen developments may prevent USG from obtaining the supplies and equipment necessary to explore for gold and other resources.

Gold exploration, and resource exploration in general, has demands for contractors and unforeseen shortages of supplies and/or equipment could result in the disruption of USG’s planned exploration activities. Current demand for exploration drilling services, equipment and supplies is robust and could result in suitable equipment and skilled manpower being unavailable at scheduled times for its exploration program. Fuel prices are extremely volatile as well. USG will attempt to locate suitable equipment, materials, manpower and fuel if sufficient funds are available. If USG cannot find the equipment and supplies needed for its various exploration programs, it may have to suspend some or all of them until equipment, supplies, funds and/or skilled manpower become available. Any such disruption in its activities may adversely affect its exploration activities and financial condition.

USG may not be able to maintain the infrastructure necessary to conduct exploration activities.

USG’s exploration activities depend upon adequate infrastructure. Reliable roads, bridges, power sources and water supply are important factors which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect USG’s exploration activities and financial condition.

USG does not carry any property or casualty insurance, however it intends to carry such insurance in the future.

USG’s business is subject to a number of risks and hazards generally, including but not limited to adverse environmental conditions, industrial accidents, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to its properties, equipment, infrastructure, personal injury or death, environmental damage, delays, monetary losses and possible legal liability. Investors could lose all or part of their investment if any such catastrophic event occurs. USG does not carry any property or casualty insurance at this time, however USG intends to carry this type of insurance in the future. Even if USG does obtain insurance, it may not cover all of the risks associated with its operations. Insurance against risks such as environmental pollution or other hazards as a result of exploration and operations are often not available to it or to other companies in its business on acceptable terms. Should any events against which USG is not insured actually occur, USG may become subject to substantial losses, costs and liabilities which will adversely affect its financial condition.

| 18 |

USG MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion and analysis of USG’S financial condition and results of operations together with “Selected Historical and Unaudited Pro Forma Condensed Combined Financial Data—Selected Historical Financial Data of USG” and USG’s financial statements and the related notes included elsewhere in this Current Report. In addition to historical information, this discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. USG’s actual results may differ materially from those results described in or implied by the forward-looking statements discussed below. Factors that could cause or contribute to such differences include, but are not limited to, those identified below, and those discussed in the section titled “Risk Factors” included elsewhere in this Current Report.

Overview

U.S. Gold Corp. (“USG”) is an exploration stage company that owns certain mining leases and other mineral rights. On July 2, 2014, USG entered into an asset purchase agreement with Wyoming Gold Mining Company, Inc. (“Wyoming Gold”) for the purchase of the Copper King gold and copper development project located in the Silver Crown Mining district of southwest Wyoming (the “Copper King Project”). On May 27, 2016, USG acquired certain unpatented mining claims related to a gold development project in Eureka County, Nevada from Nevada Gold Ventures, LLC (“Nevada Gold”) and Americas Gold Exploration, Inc. (the “Keystone Project”).

Copper King Project

The Copper King Project is located in southeastern Wyoming. USG’s rights to the Copper King Project are derived from two mineral leases from the State of Wyoming. Ownership of the mineral rights remains in the possession of the State of Wyoming as conveyed to the state by the United States. The State of Wyoming issued the mineral leases to Wyoming Gold in 2013 and 2014 and Wyoming Gold assigned both leases to USG on June 23, 2014. Limited exploration and mining were conducted on the Copper King property in the late 1880s and early 1900s. Since 1938, at least nine historic (pre-Strathmore) drilling campaigns by at least seven companies and the U. S. Bureau of Mines have been conducted at Copper King property. Wyoming Gold conducted an exploration drill program in 2007 and 2008. The focus of Wyoming Gold’s work was to confirm and potentially expand the mineralized body outlined in the previous drill campaigns, increase the geologic and geochemical database leading to the creation of the current geologic model and resource estimate, and to provide material for further metallurgical testing.

Keystone Project

On May 25, 2016, USG entered into a purchase and sale agreement (“Purchase and Sale Agreement”), as amended and restated, with Nevada Gold and Americas Gold Exploration, Inc. pursuant to which USG acquired certain mining claims related to a gold development project in Nevada. At the time of purchase, the Keystone Project consisted of 284 unpatented lode mining claims situated in Eureka County, Nevada. Subsequent to the acquisition, USG acquired 71 additional unpatented lode mining claims. No comprehensive, modern-era, model-driven exploration has ever been conducted on the Keystone Project. Previously, significant amounts of low grade (+/- 0.02 opt) and anomalous gold were intersected, but results were considered uneconomic, and prior projects were terminated.

Recent Events

On June 13, 2016, USG, Dataram Corporation (“Dataram”), Dataram Acquisition Sub, Inc. (“DAS”), and Copper King LLC, the principal shareholder of USG (“Copper King”) entered into an Agreement and Plan of Merger as amended and restated (“the “Merger Agreement”), pursuant to which, subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement, DAS will merge with and into USG, with USG surviving the Merger as the wholly-owned subsidiary of the Company.

On November 28, 2016, USG, Dataram, DAS, and Copper King, amended and restated (the “Third Amended and Restated Merger Agreement”) that certain merger agreement between the parties dated as of June 13, 2016 which was amended and restated on July 29, 2016 and September 14, 2016.

| 19 |

On May 23, 2017 the Merger was consummated pursuant to the terms of the Merger Agreement. The Merger consideration set forth below does not reflect Dataram’s 1 for 4 reverse stock split which became effective on May 8, 2017.

The parties agreed to execute the Third Amended and Restated Merger Agreement in order to, among other things:

| ● | Increase the Merger Consideration for the USG’s holders of record, in the aggregate and on an “as converted” and fully diluted basis, to 48,616,089 shares of Common Stock and equivalents from 46,241,868 shares of Common Stock and equivalents. This includes: |

| ● | Reducing the number of shares issuable to holders of the USG’s Series C Preferred Stock issued in connection with the USG’s holders private placement (the “Financing”) to 18,094,362 from 18,181,817; | |

| ● | Increasing the maximum number of warrants to purchase Dataram’s Common Stock issuable to the placement agent in the Financing to 1,809,436 five-year cashless warrants from 400,000 warrants; | |

| ● | Adding a provision to issue 925,833 five-year options which vest 1/24 each month over the 2 years from the original date of issue to the holders of options issued in connection with the closing of the Keystone Acquisition; |

| ● | Eliminate a covenant that certain officers and directors of Dataram be issued an aggregate of 820,000 shares of restricted stock pursuant to a shareholder approved equity incentive plan, subject to the execution of a two year lockup agreement; and | |

| ● | Reduce the maximum number of shares Dataram shall have outstanding at the closing of the Merger, on a fully diluted basis, to 4,945,182 shares of Common Stock and equivalents from 5,579,031 shares of Common Stock and equivalents. |

Immediately following the effective time of the Merger, USG shareholders are expected to own approximately 90.5% of the outstanding capital stock of the Company.

Series C Financing

Between July 2016 and October 2016, USG entered into subscription agreements with accredited investors pursuant to which USG sold an aggregate of 5,428,293 shares of Series C Preferred Stock (the “Series C Shares”) for a purchase price of $2.20 per share, for aggregate gross proceeds of approximately $11.9 million (the “Series C Closing”). Subject to certain limitations, each Series C Share is convertible into 10 shares of USG’s common stock.

In connection with the Series C Closing, USG paid a placement agent an aggregate of approximately (i) $1.5M ($1.2M in commissions, equal to approximately 10% of the gross proceeds received by USG from the sale of securities sold by the placement agent and $240,000 in expense reimbursement representing approximately 2% of the gross in expenses), and (ii) issued the placement agents warrants to purchase up to 1,809,436 shares of USG’s common stock (equal to 10% of the number of shares of common stock sold in the offering on an as-converted basis with respect to any Series C Shares sold by the placement agent). The warrants issued to the placement agent terminate five years from the date of issuance and are exercisable at a price equal to $0.66 per share and may be exercised on a cashless basis.

| 20 |

Results of Operations

Nine Months Ended January 31, 2017 and 2016

Net Revenues

USG is an exploration stage company with no operations, and we generated no revenues for the years ended January 31, 2017 and 2016.

Operating Expenses

Total operating expenses for the nine months ended January 31, 2017 as compared to the nine months ended January 31, 2016, were approximately $3,680,000 and $25,000, respectively. The $3,655,000 increase in operating expenses for the nine months ended January 31, 2017 is comprised of an increase of $914,000 in compensation as a result of the employment of USG officers and hiring of an additional employee during the nine months ended January 31, 2017, a $1,225,000 increase in exploration expenses on our mineral properties due to an increase in exploration activities during the current nine months ended, an increase of $1,328,000 in professional fees primarily due to an increased legal, accounting and consulting fees as a result of increase investor relations and business advisory services, and an increase of $189,000 in general and administrative expenses primarily attributable to an increase in travel related expenses.

Total operating expenses for the three months ended January 31, 2017 as compared to the three months ended January 31, 2016, were approximately $1,648,000 and $17,000, respectively. The $1,631,000 increase in operating expenses for the three months ended January 31, 2017 is comprised of an increase of $463,000 in compensation as a result of the employment of USG officers and hiring of an additional employee during the three months ended January 31, 2017, a $988,000 increase in exploration expenses on our mineral properties due to an increase in exploration activities during the current three month period, an increase of $148,000 in professional fees primarily due to an increased legal, accounting and consulting fees as a result of increase investor relations and business advisory services, and an increase of $32,000 in general and administrative expenses primarily attributable to an increase in travel related expenses.

Loss from Operations

USG reported loss from operations of approximately $3,681,000 and $25,000 for the nine months ended January 31, 2017 and 2016, respectively. USG reported loss from operations of approximately $1,648,000 and $17,000 for the three months ended January 31, 2017 and 2016, respectively. The increase in operating loss was due primarily to the increase in operating expenses described above.

Other Expenses

Total other expense was approximately $4,200 and $0 for the nine months ended January 31, 2017 and 2016, respectively. The change in other expense is primarily attributable to an increase in interest expense to a related party.

Net Loss

As a result of the operating expense and other expense discussed above, we reported a net loss of approximately $3,685,000 for the nine months ended January 31, 2017 as compared to a net loss of $25,000 for the nine months ended January 31, 2016. As a result of the operating expense and other expense discussed above, we reported a net loss of approximately $1,648,000 for the three months ended January 31, 2017 as compared to a net loss of $17,000 for the three months ended January 31, 2016.

| 21 |

Year ended April 30, 2016 and Year ended April 30, 2015

Net Revenues

USG is an exploration stage company with no operations, and we generated no revenues for the years ended April 30, 2016 and 2015.

Operating Expenses

Total operating expenses for the year ended April 30, 2016 as compared to the year ended April 30, 2015, were approximately $407,000 and $14,000, respectively. The $393,000 increase in operating expenses for the year ended April 30, 2016 is primarily attributable to an increase in compensation expenses of $260,000 primarily related to stock based compensation to our CEO, increased professional fees of $80,600 related to legal expenses and an increase in general and administrative expenses of $51,000 primarily attributable to an increase in travel related expenses.

Loss from Operations

USG reported loss from operations of approximately $407,000 and $14,000 for the year ended April 30, 2016 and 2015, respectively. The increase in operating loss was due primarily to the increase in operating expenses described above.

Net Loss

As a result of the operating expense and other expense discussed above, we reported a net loss of approximately $407,000 for the year ended April 30, 2016 as compared to a net loss of $14,000 for the year ended April 30, 2015.

Liquidity and Capital Resources

As of January 31, 2017, USG had cash totaling approximately $7,544,000. Net cash used in operating activities totaled approximately $2,930,000 and $19,000 for the nine months ended January 31, 2017 and 2016, respectively. Net loss for the nine months ended January 31, 2017 and 2016 totaled approximately $3,685,000 and $25,000, respectively. Stock based compensation expense for the nine months ended January 31, 2017 was approximately $875,000. Prepaid expenses and reclamation bond deposit for the nine months ended January 31, 2017 and 2016 increased by approximately $113,000 and $32,000, respectively. Total accounts payable and accrued liabilities from unrelated and related parties decreased by approximately $25,000 during the nine months ended January 31, 2017.

Net cash used in investing activities totaled approximately $289,000 which is primarily attributable to the acquisition of mineral rights related to the Keystone Project during the nine months ended January 31, 2017.

Net cash provided by financing activities totaled approximately $10,457,000 and $10,000 for the nine months ended January 31, 2017 and 2016, respectively. During the nine months ended January 31, 2017, financing activities consisted of net proceeds of $10,866,000 from the sale of preferred shares and $285,000 from the payment of note payable and $124,000 repayment of advances to a related party. During the nine months ended January 31, 2016, financing activities were primarily attributable to shareholder’s capital contribution of approximately $12,000.

As of April 30, 2016, USG had cash totaling approximately $306,000. Net cash used in operating activities totaled approximately $34,000 and $17,000 for the year ended April 30, 2016 and 2015, respectively. Net loss for the year ended April 30, 2016 and 2015 totaled approximately $407,000 and $14,000 respectively. Total prepaid expenses, and accounts payable and accrued liabilities, for the year ended April 30, 2016 and April 30, 2015 increased by approximately $ 12,000 and $136,000, respectively.

Net cash used in investing activities totaled approximately $0 and $1,592,000 for the year ended April 30, 2016 and 2015, respectively. During the year ended April 30, 2015, investing activity is primarily attributable to the acquisition of mineral rights related to the Copper King Project.

| 22 |

Net cash provided by financing activities totaled approximately $297,000 and $1,651,000 for the year ended April 30, 2016 and 2015, respectively. During the year ended April 30, 2016, financing activities consisted of shareholder’s capital contribution of approximately $12,000 and $285,000 of proceeds received from issuance of a note payable – related party. During the year ended April 30, 2015, financing activities consisted of net proceeds of $1,525,000 from the sale of common stock to a related party, $124,000 advances from a related party and shareholder’s capital contribution of approximately $2,000.

Based on the above, there is substantial doubt about USG’s ability to continue as a going concern. The consolidated financial statements do not include adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event USG cannot continue in existence.

Off-Balance Sheet Arrangements

USG does not have any present plans to implement, any off-balance sheet arrangements.

Recently Issued Accounting Pronouncements

See Notes to Audited Financial Statements (Note 2).

Critical Accounting Policies

The discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with U.S. generally accepted accounting principles. The preparation of our financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.